Spread betting involves speculating whether the price of an instrument like currency pair, commodity, indices, etc. will rise or fall in the future. If you are correct then you will make a profit, but you will make a loss on your trade if you are wrong.

Spread Betting is a derivative product, and you can trade it legally in the UK via an FCA regulated Spread Betting platform.

This guide will give an insight into the basic things you need to know about these spread betting platforms in the UK & what you should consider in choosing them.

Let’s see the brief comparison first in the table below.

Comparison of Best Spread Betting Brokers UK

| Forex Trading App | Regulation | Minimum Deposit | EUR/USD Spread | Spread Betting Account | |

|---|---|---|---|---|---|

| Pepperstone UK |

ASIC, FCA, CySEC

|

No minimum deposit

|

0.79 pips (Spread Bet Account)

|

Yes

|

Visit Broker |

| City Index |

FCA

|

£100

|

0.8 pips

|

Yes

|

Visit Broker |

| CMC Markets |

FCA, ASIC

|

No minimum deposit

|

0.7 pips

|

Yes

|

Visit Broker |

| FXCM |

ASIC, FCA, FSCA

|

£50

|

1 pips

|

Yes

|

Visit Broker |

| OvalX(ETX Capital) |

FCA, CySEC, FSCA

|

£250

|

0.6 pips (Spread Betting Account on OvalX Platform)

|

Yes

|

Visit Broker |

| IG Markets |

FCA, ASIC, FSCA

|

£250

|

1.04 pips

|

Yes

|

Visit Broker |

List of Best Spread Betting Brokers in the UK

Here is the list of best spread betting brokers in the UK. We have ranked them based on various factors like regulation, trading fees, customer support, etc.

- Pepperstone UK – Best Spread Betting Platform UK

- City Index – MT4 Spread Betting Broker regulated in UK

- CMC Markets – Good Spread Betting platform for Beginners

- FXCM – Regulated Spread Betting Broker

- OvalX – Best Spread Betting Broker for Low Cost

- IG Markets – Reputed Broker for Spread Betting

The next section gives you a systematic comparison of the best spread betting platforms in the UK. With this, you will be able to compare these spread betting platforms to know the one that suits you.

#1 Pepperstone UK – Best Spread Betting Platform UK

Pepperstone is considered a low-risk platform for spread betting in terms of their regulation.

Regulation: They are regulated with the FCA as Pepperstone Limited. The company’s licence number is 648312. They are authorised to operate in the UK.

Fees: Pepperstone’s spread for EUR/USD, GBP/USD, and UK 100 are 0.79 pips, 1.49 pips and 1.0 pips respectively. They charge no commission on spread betting but there are overnight charges.

Trading conditions:

Minimum deposit: Pepperstone does not enforce a minimum deposit for traders. However, it is recommended that you deposit a minimum of £200 because of margin requirements.

Range of market: You place a spread bet on 60+ currency pairs, 50+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices.

Trading platforms: With Pepperstone, you can trade using these platforms: Metatrader 4, Metatrader 5, and cTrader. TradingView is also available. These platforms come with advanced trading tools, technical indicators, and customizable charts.

Deposit/withdrawal: You can deposit and withdraw your funds in Pounds (GBP). Deposit/Withdrawal methods available are Visa debit/credit card, Mastercard debit/credit card, bank transfer, and PayPal. Pepperstone does not charge deposit and withdrawal fees. Deposits transactions are executed immediately except for bank transfers. Withdrawal takes 1-3 days.

Support: We tested Pepperstone’s live chat feature and email. We had the best experience on live chat because responses came quickly, and there was low hold time while connecting to their chat. It took a few hours to get a response via their customer support email. A local phone number is also available for UK traders.

Risk Warning: 74.7% of retail traders lose their money trading with Pepperstone.

Pepperstone Pros

- No commission on spread betting

- Fast execution

- You can spread bet in GBP. This limits your currency risk exposure

Pepperstone Cons

- ETFs are not available for spread bet

#2 City Index- MT4 Spread Betting Broker Regulated in the UK

City Index are regulated with the FCA as StoneX Financial Limited. They are licenced to operate in the UK having been authorised since 24/03/2006.

Regulation: Their FCA license number is 446717. City Index are low-risk for UK traders.

Fees: City Index charge no commission on spread betting. The spread for EUR/USD, GBP/USD, and the UK 100 are 0.8 pips, 1.8 pips, and 1 pip respectively. Swaps are calculated based on your lot size, instrument closing price for the day, and the UK SONIA rate. Their Swap Rates are comparatively lower than other platforms.

Trading conditions:

Minimum deposit: You need a £100 minimum deposit to open a spread betting account with City Index. However, you should take note of your account’s margin requirements. If £100 will not be enough to sustain the margin, it is recommended you deposit more money.

Range of market: City Index offer a good range of instruments. You get access to 12+ indices, 4500+ stocks, 80+ currency pairs, 16 indices 4 commodities, 4 options, 4 bonds, 4 metals, and 3 interest rates.

Trading platforms: For trading platforms, you get to trade with City Index’s HTML5 Web Trader platform, MetaTrader 4, and City Index mobile trading app.

Deposit/Withdrawal: You can fund your account via Visa debit/credit card, Maestro debit/credit card, Electron debit/credit card, Master debit/credit card, bank transfer, and PayPal. Withdrawal might not be possible with some credit cards. If there is any issue with your card, you will be notified. You can fund your account in pounds.

Support: A local mobile number is available. There is also an extensive FAQs section. You can find commonly asked questions there. A menu-based live chat feature is also available. If the menu cannot answer your question, you will be referred to a customer support agent for help. We tested this and had no holding time with their live agent.

Risk Warning: 69% of retail investors lose money when trading with City Index.

City Index Pros

- 8000+ Markets

- There is a research portal on their platform. It gives actionable trading ideas.

- Zero commission on spread betting

- You can use GSLOs to limit your loss if a bet goes against you.

City Index Cons

- Extra charges for guaranteed stop loss

#3 CMC Markets – Good Spread Betting platform for Beginners

CMC Markets are registered with the FCA as CMC Markets UK plc. They have had an authorised status in the UK since 01/12/2001.

Regulation: The broker’s FCA licence number is 173370. CMC Markets are considered low-risk to trade with

Fees: CMC Markets charge no commission for spread betting. Spreads for EUR/USD, GBP/USD, and UK 100 are 0.7 pips, 0.9 pips, and 1 pip respectively. Forex swaps are calculated based on the tom-next rate of the currency pair’s underlying market.

For indices like the UK 100, overnight charges are based on the weighted average of the constituents of the index, plus and minus CMC’s fees for Buy & Sell positions respectively. Their overall Holding Costs are okay.

Trading Conditions:

Minimum deposit: CMC have no specified minimum deposit. However, there is a recommended deposit of at least £100.

Range of market: CMC’s spread betting account has over 11,000+ financial instruments. It includes 330+ currency pairs, 80+ indices, 19 cryptocurrencies, 100+ commodities, 9000+ shares, and 50+ treasuries. They have the widest market range among the spread betting platforms in this review.

Trading platforms: CMC Markets have three platforms. A web platform, a mobile app, and MetaTrader 4. You can trade your spread betting account on any of these platforms.

Deposit/Withdrawal: You have three deposit/withdrawal options with CMC Markets. You can deposit/withdraw funds via your credit/debit cards, Bank Transfer, and PayPal. These payment options are available on the CMC Markets trading app and web trading platform.

Support: Overall support is good. You can reach out to the company by calling the local mobile number on their website. You email them also. They respond in 20 minutes.

Risk Warning: 69% of retail investors lose money when trading with CMC Markets.

CMC Markets Pros

- 11500+ Markets

- You can spread bet on US stocks without currency conversion fees

- No extra commission on spread betting

- Some indices are available 24/5 for spread betting.

CMC Markets Cons

- Extra fees for GSLOs

#4 FXCM – Regulated Spread Betting Broker

FXCM has multiple trading platforms with low minimum deposits.

Regulation: FXCM is low-risk. They are regulated with the FCA as Forex Capital Markets Limited. FXCM have been authorised in the UK since 27/05/2002. Their FCA license number is 217689.

Fees: FXCM charge no commission for spread betting. They are compensated by spreads. For EUR/USD, GBP/USD, and UK 100, the spreads are 1 pip, 0.6 pips, and 1 pip respectively.

Trading conditions:

Minimum deposit: FXCM require a minimum deposit of £50 to open an account with FXCM.

Range of market: You get to trade 38 currency pairs, 15 indices, 12 commodities, 60+ shares

Trading platforms: FXCM offers five trading platforms. You can trade the markets using Trading Station, NinjaTrader, and MetaTrader 4.

Deposit/Withdrawal: You can deposit and withdraw your funds via debit/credit card, Skrill, Neteller, and bank transfer.

Support: FXCM can be reached via email and WhatsApp. They typically respond to WhatsApp messages within two minutes. Email response comes within a few hours. You can also call the UK mobile number on their website.

Risk Warning: 66% of retail investors lose money when trading with FXCM.

FXCM Pros

- No commissions on spread bets

FXCM Cons

- Slow email response

- Limited currency pairs

#5 OvalX – Best Spread Betting Broker for Low Cost

ETX Capital merged with OvalMoney in 2021. The merger led to a change of name so ETX Capital is now known as OvalX.

Important Update: OvalX has discontinued its trading services. As part of their closure, the broker has partnered with capital.com to enable their clients to continue their trading journey.

Regulation: OvalX is regulated with the FCA as Monecor (London) Ltd with FCA number 124721. Monecor(London) Ltd is a member firm of the London Stock Exchange so they are considered low-risk.

Fees: OvalX does not charge extra commission for spread betting. Their fee is calculated into the spread. The spread for EUR/USD, GBP/USD, and UK100 on their spread betting account are 0.6 pips, 1 pip, and 1 pip respectively. This is the spread on the OvalX trading platform.

Trading conditions:

Minimum deposit: £250 is the minimum deposit for a new account.

Range of market: OvalX offers 39 currency pairs. The following CFDs are also available:12 indices, shares, 4 commodities, 1 bond, and 12 cryptocurrencies.

Trading platforms:OvalX supports MT4 and the OvalX trading platform. They are available as mobile apps and on desktops.

Deposit/Withdrawal: You can deposit and withdraw your funds via debit/credit, Skrill, Neteller, and bank transfer.

Support: You can contact OvalX via email and the UK phone number on their website. We tested the email and got a response after 8 minutes.

Risk Warning: 76.76% of retail investors lose money when trading with OvalX.

OvalX Pros

- No commissions on spread bets

- Fast email response

OvalX Cons

- Limited number of currency pairs

- Minimum deposit is £250

#6 IG Markets – Reputed Broker for Spread Betting

IG Markets is reputable with multiple trading platforms. They support spread betting and offer essential risk management tools that you need.

Regulation: IG is licensed with the FCA in the UK as IG Markets Limited. The company’s reference number is 195355.

Fees: IG does not charge an extra commission for spread betting. They make their money from spreads. The average spread for EUR/USD, GBP/USD, and UK100 on IG are 1.04 pips, 1.83 pips, and 1 pip respectively. The average spreads for EUR/USD and GBP/USD might be lower between 00:00-21:00.

Trading conditions:

Minimum deposit: £250 is the minimum deposit for a new account via credit/debit cards and PayPal. No minimum deposit via bank transfer.

Range of market: IG Markets offers 99 currency pairs, 8 energies, 5 metals, 21 soft commodities, 34 indices, 16000+ shares, and 12 bonds.

Trading platforms:IG Markets supports MT4 and ProRealTime. You can also trade with the IG trading app.

Deposit/Withdrawal: You can deposit and withdraw your funds via debit/credit, PayPal, and bank transfer.

Support: You can contact IG Markets via email and the UK phone number on their website. We tested the email and got a response after 6 minutes.

Risk Warning: 75% of retail investors lose money when trading with IG Markets.

IG Markets Pros

- Over 16000 shares

- No minimum deposit via bank transfer

IG Markets Cons

- No MT5

- Minimum deposit is £250

What is Spread Betting?

Spread betting involves speculating the movement of financial instruments and making money off it. This however differs from CFD trading in some ways. Instead of trading in lots, you stake a certain amount for an increase or decrease in the spread of trading instruments.

Your profit or loss is calculated by multiplying your stake per unit of increase or decrease in spread.

How Does Spread Betting Work?

Let us assume the current price of Facebook shares is £100. By your analysis, you believe that the price of the share will rise so you opened a buy trade at £100. You placed this trade with a stake of £2 per point. Some days later, Facebook announced some news, and the price rallied from £100 to £120 (a 20-point rally).

Your profit is calculated as the number of points * stake=profit. In this case, we have 20*2= £40.

If this trade goes against you and the price of Facebook shares fell by 20 points, you will lose £40.

Benefits of Spread Betting

Opting for spread betting comes with certain advantages. Here are some of them:

Reduced costs: Trading fees work differently with spread betting. Unlike CFD trading, spread betting brokers do not charge commissions. They make their money from the spread of the instrument you are trading. This cost arrangement is considerably lesser than that of CFD trading.

Tax-free: This is the foremost benefit of spread betting. Your profits are not subjected to capital gains tax. They are also free from stamp duty. However, this rule only applies if spread betting is not your main source of income. Other than this, you do not need to report to the HMRC.

Leverage: This benefit applies to spread betting and CFD trading. You can use leverage to control more buying or selling positions in the market. Since you are in the UK, most spread betting brokers here are FCA regulated. This means you can get a max leverage of 30:1.

Spread Betting Tips for Beginners

To place your spread bets successfully, you need to have a strategy. If you are a beginner, here are some tips for you.

1. Begin with a demo account: A demo account is a risk-free trading account. Instead of using real money, you trade with virtual money. The essence of using a demo account is to test your spread betting strategies on your favorite instruments.

This will also help you gain valuable experience without the emotions that come with trading a live account. If you manage your virtual money well, you can then proceed to open a live spread betting account.

2. Place small bet sizes: Because of the psychological pressure that comes with losing real money, it is advisable you start with small bets. This will help you stay consistent in deploying your trading strategy. If it goes wrong, you lose small money.

3. Avoid highly volatile instruments: Volatile instruments usually have rapid fluctuations in their price. This can lead to much slippage, missed entries, etc. Also, it is difficult to predict price movement for these assets.

4. Avoid high leverage: Spread betting is risky. Trading with high leverage brokers only adds to that risk. The minimum leverage in the UK is 30:1. Only professional traders can leverage up to 500:1. To avoid the temptation of using high leverage, trade with FCA regulated brokers.

How to Select the Best Spread Betting Platform?

1) Regulation: The safety of your funds is important. The Financial Conduct Authority regulates forex brokers in the UK. Brokers clearly state this on their website with their FCA licence number. You can confirm the broker’s details on the FCA register using the link: https://register.fca.org.uk/s/.

Let us walk you through this in simple steps. We will be using City Index as an example. The first step is to check the broker’s regulation disclosure in the footnote of their website at cityindex.co.uk. Here, you must find the broker’s licence number and name in the FCA register. For City Index, it is Stone Financial Limited as shown below.

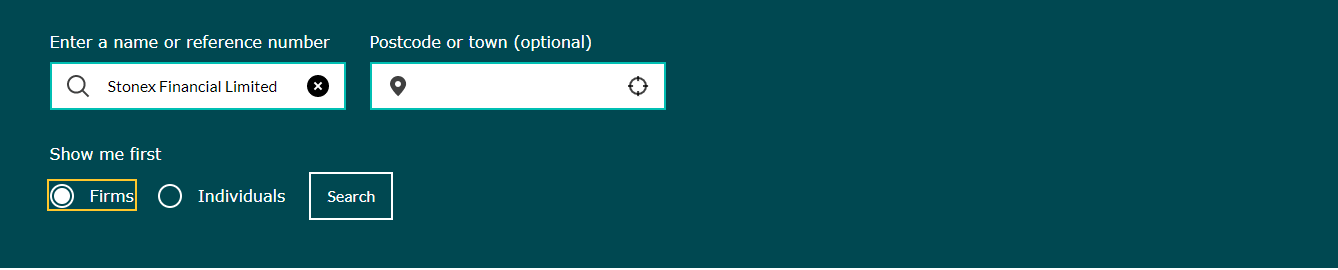

Since a spread betting broker’s word is not enough, the next step is to check the FCA register at https://register.fca.org.uk/s/. Once the page opens, scroll down to the part shown in the picture below. Fill in the spread betting broker’s registered name, select firms, and click on ” Search”.

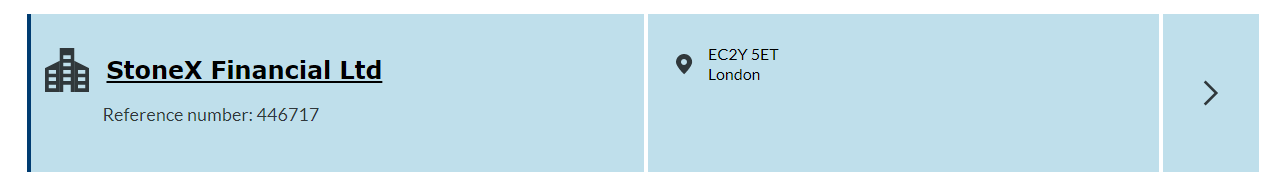

Your search result should look like the image below with the same reference number on the forex broker’s website

Remember you have to check the website first. This is quite important because some brokers can have similar names with another part of their parent company. These other parts might also be on the FCA website. If you do not check the broker’s website first, you might be confused when you get to the FCA website.

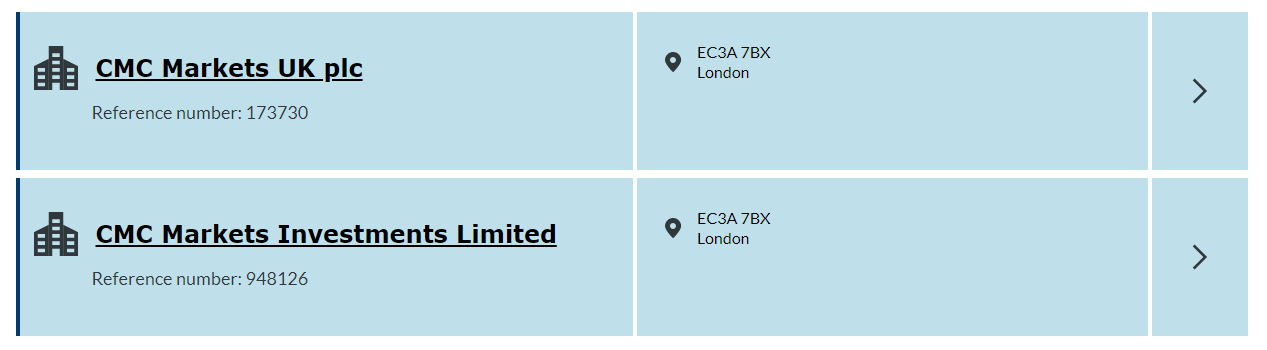

CMC Markets is one of those brokers. If you search for them as directed above, your initial result will look like this picture

You can see clearly that there are two entities here with similar names. The key difference is the reference number. It is your job to figure that out by going to the broker’s website before the FCA website. There, you will find the broker’s reference number so you can always differentiate.

Finally, you want to check if your chosen broker has fraudulent clone firms. These clone firms are put to scam unsuspecting traders by using similar names with UK licensed brokers. The FCA spots these brokers and make their info available publicly so you can avoid them.

Typically, you will find them as you research your broker’s regulation so they are easy to find. For example, we searched for FXCM’s on FCA’s register and we found the clone firms below.

Do you see why you must not downplay verifying your broker’s regulation?

Here is how our listed spread betting brokers compare by FCA regulation:

| Broker | FCA Regulation |

|---|---|

| Pepperstone UK | Yes |

| City Index | Yes |

| CMC Markets | Yes |

| FXCM | Yes |

| OvalX | Yes |

2) Cost: There are trading fees and non-trading fees at spread betting brokers. Trading fees include spreads, swaps, and commissions. Do not open a trading account without the knowledge of the costs attached to the financial instruments you want to trade.

Trading fees are deducted whether you win or lose a trade. They have a strong impact on your long term profits and losses so it is important you check them. Non-trading fees could be deposit/withdrawal fees, and inactivity fees.

Let us see the trading charges if you spread bet EUR/USD with Pepperstone. Assuming you go long on EUR/USD at 1.1150 with a £5 stake. After some hours, the price goes your way and went as high as 1.1200. You have gained 50 points.

Your profit is calculated as £5*50 points = £250.

So you have made your money but you had to hold this trade overnight. You will pay a holding cost (swap) from your profit. Pepperstone’s long rate swap for EUR/USD is -£11.49.

Therefore, your final profit is calculated as £250-£11.49= £238.51. No extra commissions.

The brokers in this review do not charge deposit/withdrawal fees. Here is how they compare for inactivity fees.

| Broker | Inactivity Fees |

|---|---|

| Pepperstone UK | No |

| City Index | £12 per month |

| CMC Markets | £10 per month |

| FXCM | £50 per year |

| OvalX | No |

Note: Inactivity fees are applied after 12 months of inactivity. After 12 months, the fee is charged monthly. Only FXCM charge their fee per year.

3) Trading Platforms: MetaTrader 4 and 5 are the most popular trading platforms. Your broker should have at least one of them.

Another common platform offered by brokers is the web trading platform. Your broker should have an app too, on both Android & iOS. You get to monitor your trades on the go via mobile apps. Some brokers also have their proprietary platforms too so it is good to always check the platform available.

Here is how you can check. We’ll use CMC Markets as our example. Go to CMC Markets’ homepage and click on trading platforms as shown below. In the options that show, click on ‘see all platforms’

Scroll down on the page that follows, you will see there is MT4, mobile apps, and web platforms. These are the basic things needed for spread betting.

As per our review, all the brokers in this list offer their platforms on multiple devices.

4) Risk Management: Though spread betting is different from CFD trading, it carries its own risks. You should check if your broker has proper risk management tools in place. The first tool to look out for is negative balance protection. Since leverage is involved in spread betting, you want to make sure you do not lose more money than you have in your account.

This next tool is very useful too but it is not free. It is the guaranteed stop loss order. This order type minimizes losses by making sure your stop loss order is executed at the price you want (mitigating slippage). You should check with your broker to know how much they charge for it.

5) Range of instruments: A good spread betting broker will offer a wide range of trading instruments at low fees, and you can choose which instrument you want to trade.

You should be able to trade currency pairs, metals, shares, commodities, and precious metals. The range of instruments offered by your broker can help you decide your market exposure to each asset class on your speculative bet.

Here is how the spread betting brokers in our list compare in terms of the range of instruments offered on their platforms:

| Broker | Forex | Indices | Shares | Commodities | Metals |

|---|---|---|---|---|---|

| Pepperstone UK | 60+ | 50+ | 900+ | 16 | 12 |

| City Index | 80+ | 16 | 4500+ | 4 | 4 |

| CMC Markets | 330+ | 80+ | 9000+ | 100+ | 5 |

| FXCM | 38 | 15+ | 60+ | 12 | 3 | OvalX | 39 | 12 | 60+ | 4 | 2 |

6) Demo Account: Spread betting is as risky as CFD trading. You should create a trading strategy and practice as much as possible. Not doing this increases the possibility of losing all of your trading capital.

Therefore, it is better to start with a demo account. A demo account allows you to trade with virtual money with zero risks. You can practice your strategy in a simulated market condition without the pressure of trading with real money.

To open a demo account, go to your broker’s website and click ‘Demo Account’. Follow the steps that show up and open an account for free.

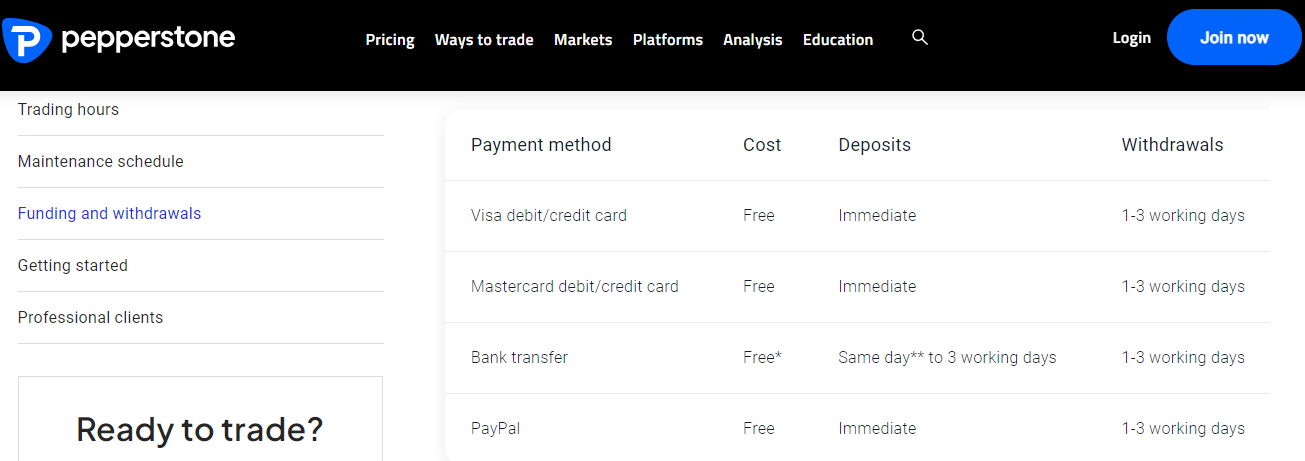

7) Payment Methods: You should know the payment methods supported by your broker. Can you deposit via your local bank? Do they accept credit/debit cards? E-wallets like Skrill and Neteller are also good. Beyond the methods, you should also check how fast deposits/withdrawals are processed.

Bank transfers typically take 1-3 business days so you might want to try methods that are quicker. This is why you need to check all of your broker’s payment methods so you can choose the most suitable.

Here is Pepperstone UK deposit/withdrawal methods for example.

With Pepperstone, all withdrawals take 1-3 days. However, only bank transfer deposits take a longer time. All other deposit methods are instant. In this kind of situation, you might want to choose instant deposit methods since all withdrawal methods have similar processing time.

8) Broker’s Support: Your spread betting broker should be easily accessible. You should be able to get support via email and live chat. A mobile number (preferably a UK number) should also be available for calls.

In addition, an FAQ section that answers general enquiries should also be available. Before signing up with the broker, test their live chat & phone support. Call the broker on the phone number listed on their website, and see how well they respond to your questions. If the broker’s support team is able to answer your questions, and there is not much of a hold time, then it is considered good.

Here is how our best spread betting brokers compare in terms of the kind of support they have.

| Broker | Live Chat | UK Mobile Number | Instant Messaging | |

|---|---|---|---|---|

| Pepperstone UK | Yes | No | Yes | None |

| City Index | Yes | Yes | Yes | None |

| CMC Markets | Yes | No | Yes | None |

| FXCM | Yes | Yes | Yes | OvalX | Yes | No | Yes | No |

From the table above, you can see that email and phone calls are the most common support available. They are the best way you can reach your spread being a broker.

How to Open a Spread Betting Account

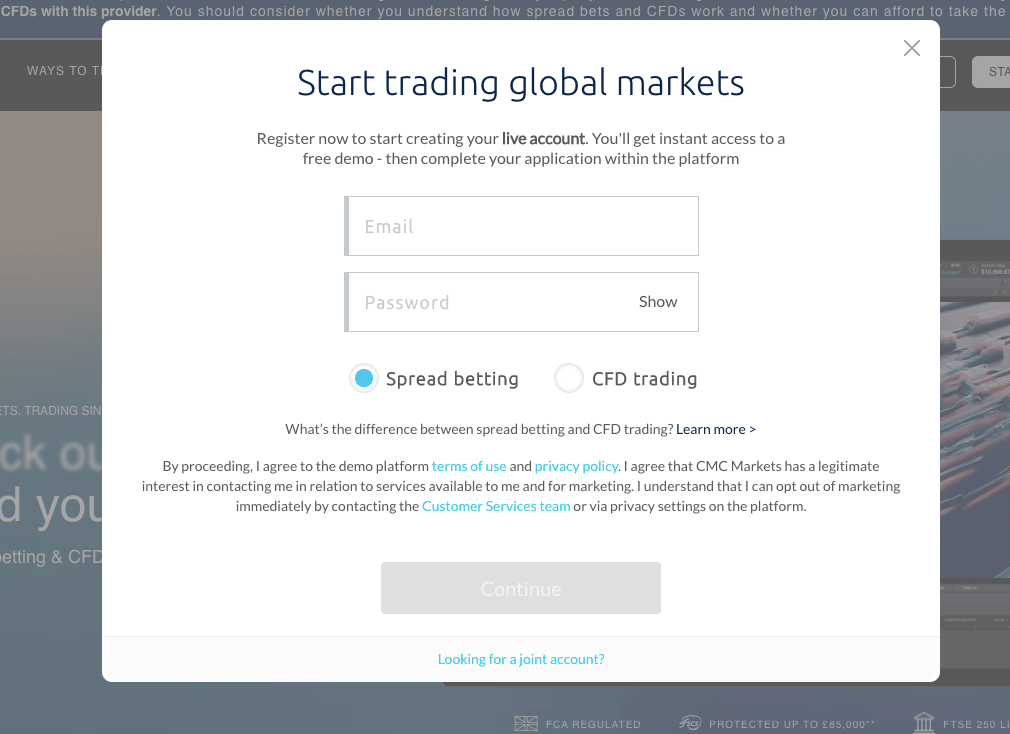

1) Go to the CMC Markets website and click ‘START TRADING’ at the top right corner of the homepage.

2) Enter your email, create a password, and select a Spread Betting Account, then click ‘Continue’.

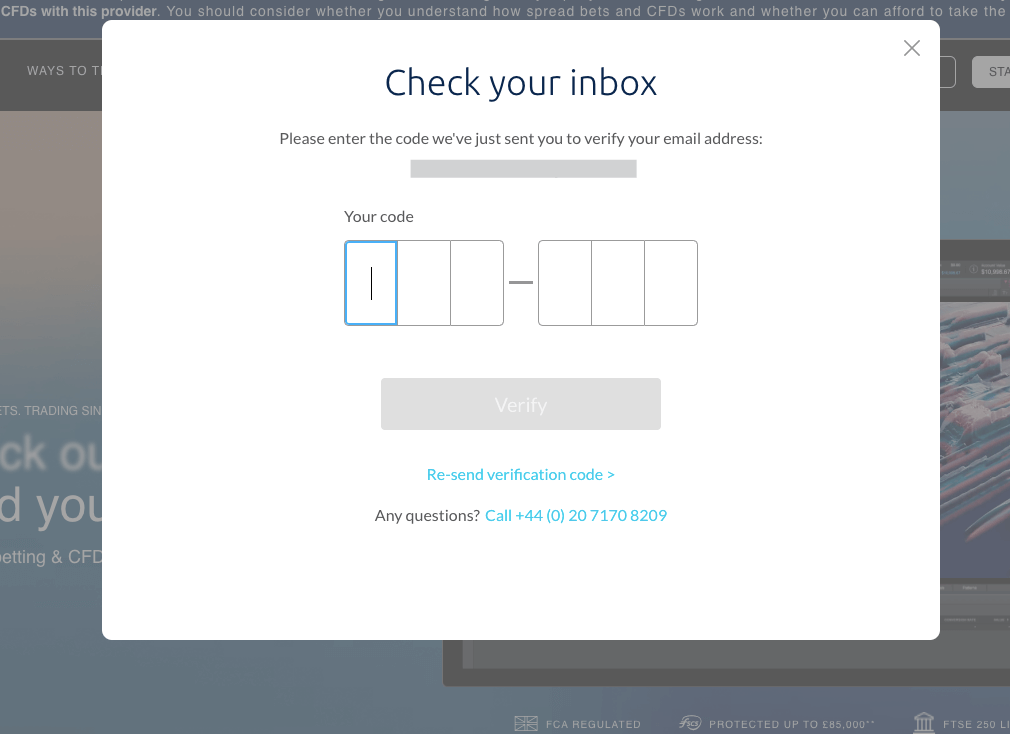

3) Verify your email by typing the verification code sent to your inbox.

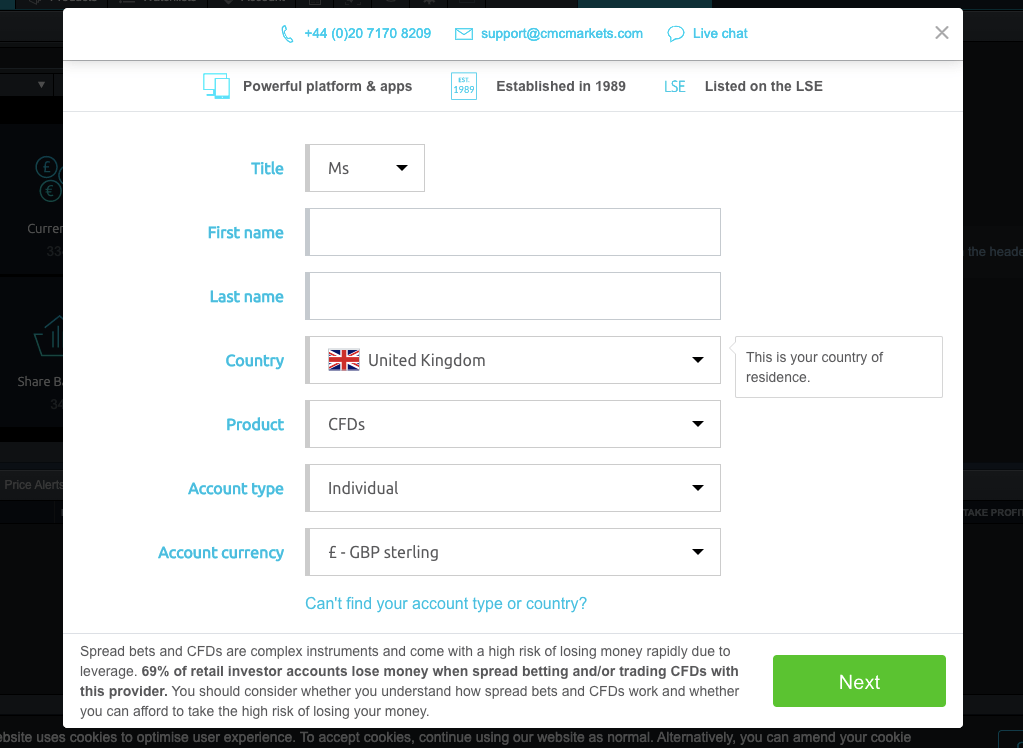

4) Enter your full name, select account base currency and click ‘NEXT’.

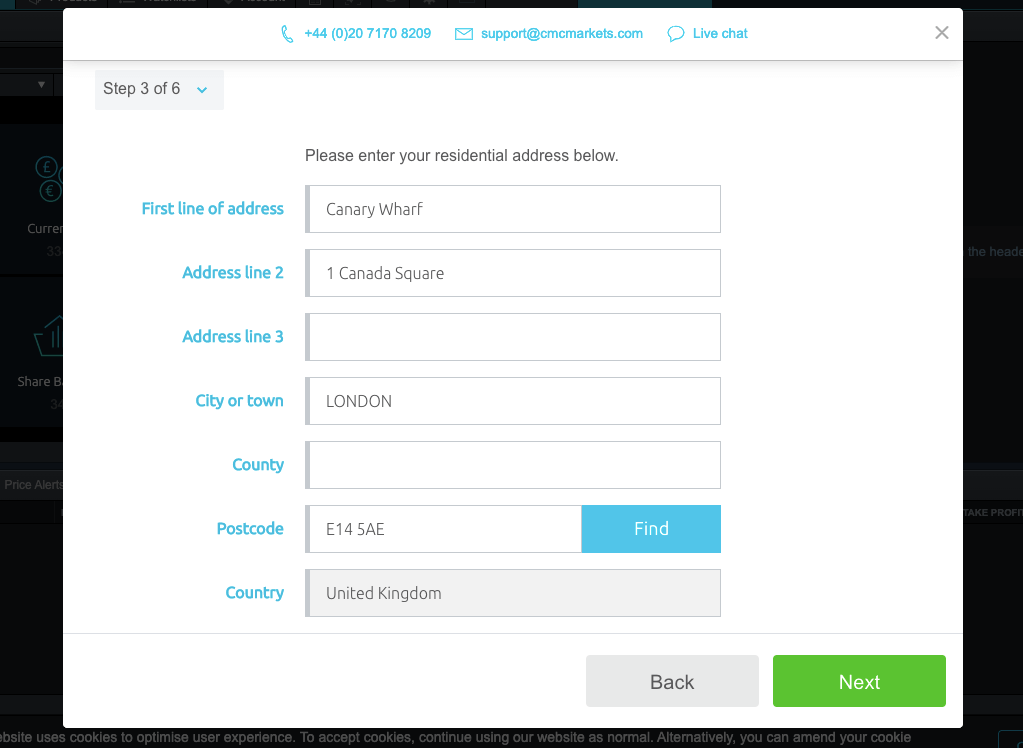

5)Enter accurately your residential address, click ‘Find’ then confirm it and click on ‘Continue’.

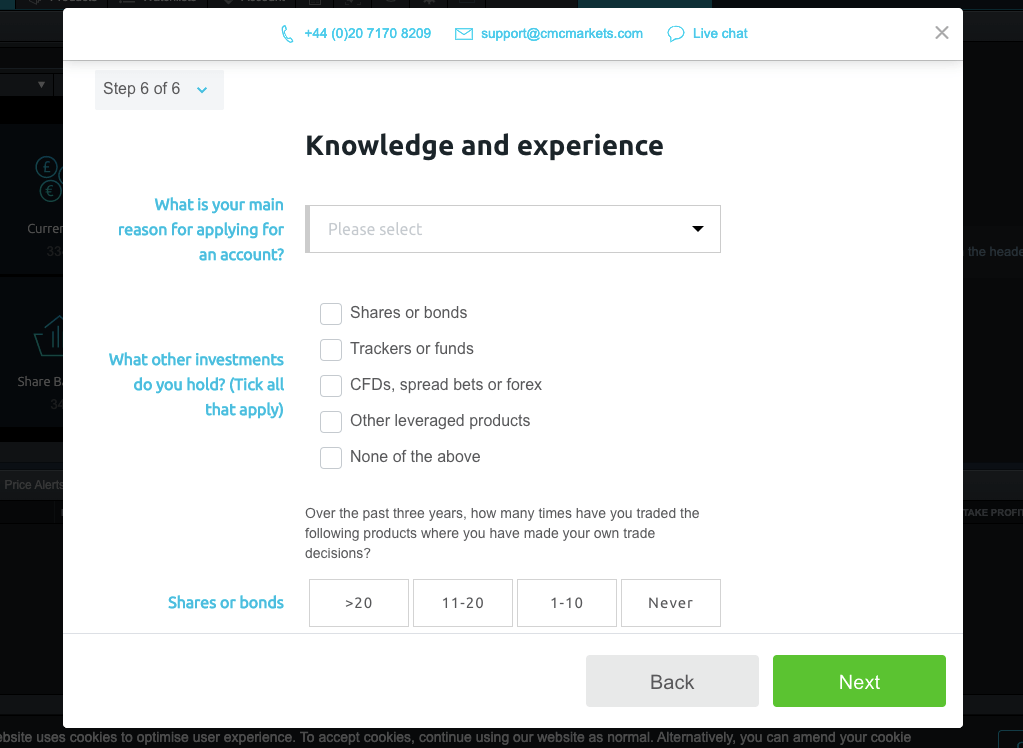

6) Answer questions about your employment status, financial background, and trading knowledge/experience. Click ‘NEXT’

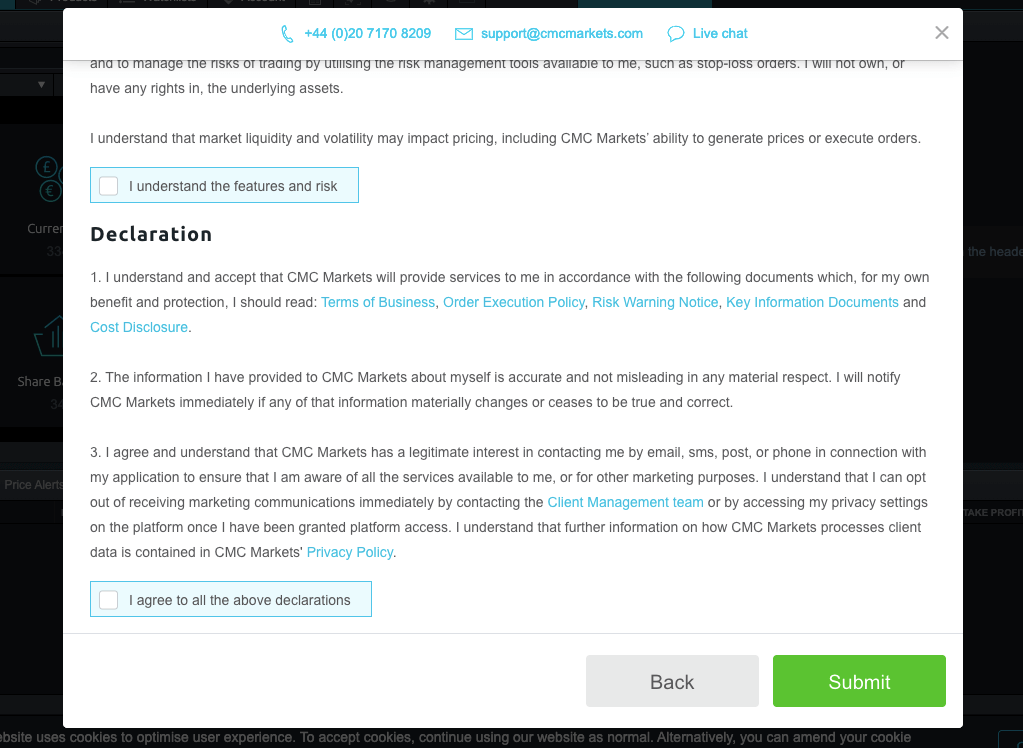

7) Read the terms and conditions, check the agreement box, then click ‘Submit’

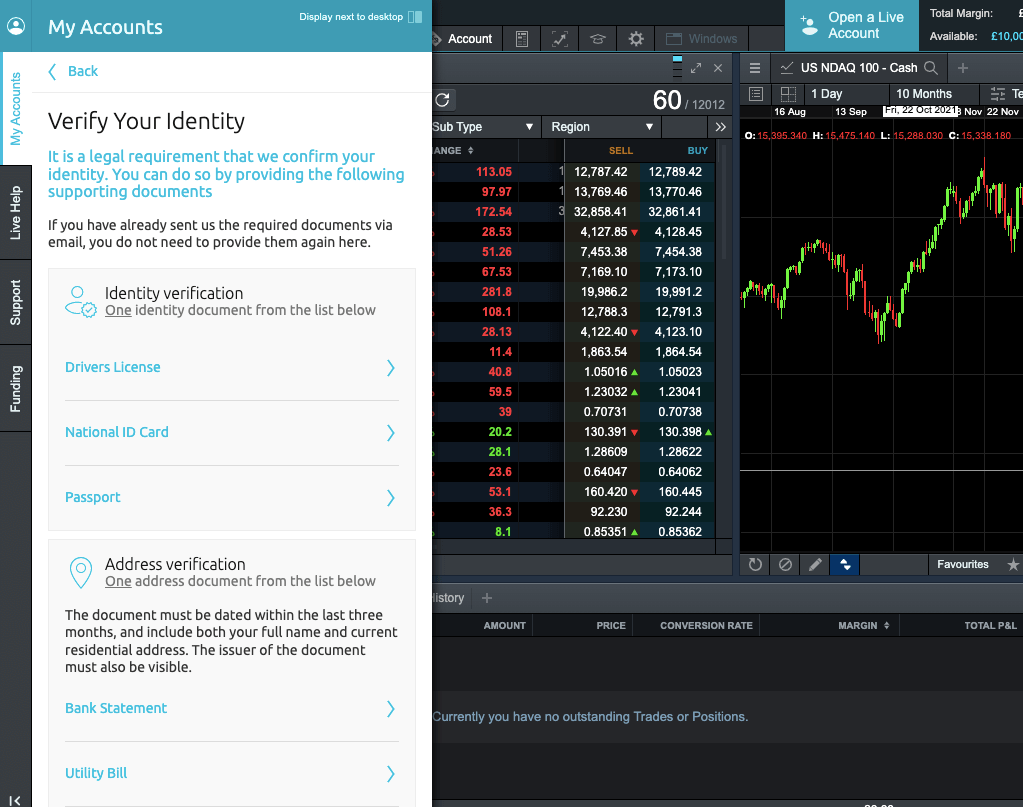

8) Verify your identity by uploading the required documents

9) Deposit your funds and start trading.

Is there Stamp Duty on Spread Betting?

Stamp duty is a form of payable tax. Unlike capital gains tax, it is expressed as a percentage of the value of your trade. In the United Kingdom, spread betting is exempt from stamp duty. This is one of the reasons spread betting is popular as CFD trading in the UK. Due to this exemption, you can stake a bet on the price movements of various financial instruments without paying taxes.

However, it is crucial you know that tax matters depend on the government. Therefore, tax regulations can change. It is advisable that you contact a financial advisor or your official tax authorities to stay updated. Furthermore, tax codes and laws may vary per jurisdiction within the UK so it is essential you stay informed always.

How is Spread Betting Different from CFD Trading?

For CFD trading, you are opening a buy or sell contract on CFD products. When you close the contract, you make your money off the difference between the opening and closing price of the contract. A practical example is opening a buy contract on EUR/USD at 1.1300. Your speculation is right and EUR/USD goes up by 100 points to 1.1400 and you close the contract at this price. Your profit is calculated as (the size of your contact*the difference between the opening and closing price).

For spread betting, there is no standardized contract. You make money off the stake you attach to a unit of price movement.

Spread betting is legal in the UK and Ireland only. But CFD trading is available & legal in many countries in the EU, Asia & Africa like Australia, South Africa, etc.

Another important difference between spread betting and CFD trading is how they are treated in terms of tax and capital gains. Your profits from spread betting are free from capital gains tax while your capital gains from CFDs are taxed.

What is the best spread betting platform in the UK?

There are different trading platforms available for spread betting in the UK. Your choice will mostly depend on your trading style and visual preference. However, there are tested and trusted platforms for spread betting that have a good track record.

Many traders use them because of their reliability and exceptional user interface. Here are the platforms you can use for spread betting.

MT4: MT4 is a popular trading software designed by MetaQuotes. Most UK spread betting brokers have MT4. Read more on Best MT4 brokers.

MT5: MT5 is also designed by MetaQuotes and it is more advanced than MT4. In addition, it gives you access to more trading instruments. Read more on Best MT5 brokers.

cTrader: cTrader is famous for advanced automated trading. Read more on Best cTrader brokers.

Your broker may have one or all of these platforms but you might also check for a propriety platform or trading app. This is an in-house trading platform designed and owned by brokers.

What is a spread betting UK example?

Spread betting is a form of trading financial instruments that is based on speculations. Basically, you bet on the price movement of a financial asset. With spread betting, you do not buy and own the asset. Instead, you are betting that the price of the asset will rise or fall.

Here’s a simple example of how spread betting works:

Let’s say you think the FTSE 100 index will rise. The current trading spread on the financial market (stock exchange) might be 70 points. This means if you buy at 7,070 you can sell at 7,140.

After buying at 7,070 if the index rises to 7,150, you would make a profit of 70 points per point bet. For example, if you bet £1 per point, you’d make £70.

If the index falls to 7,000, you would lose by 70 points per point bet.

Key points for you to remember about spread betting:

1) You are not directly buying or selling the financial asset; you are only betting on its price movement.

2)The profit or loss on a spread bet is calculated based on the number of points you bet and the direction of the price movement you bet on.

3)Spread betting involves significant risks and you can lose all your money, so be cautious.

Spread betting tips for beginners

If you are just entering into the world of trading (especially spread betting), here are some tips that will help you:

1) Risk free trading: You can trade with zero risk via demo accounts. Do your due diligence and open a demo account with a broker. You can the practice spread betting on that account with virtual money and zero risk.

2) Learn: You need to get yourself educated. Take advantage of educational resources provided by your broker. Get familiar with terminologies, chart patterns etc. You should never stop learning as a trader.

3) Control your emotions: When you open a live account, do not focus on making money. Your trades can result in losses too. So manage your emotions and don’t get greedy.

Can crypto traders spread bet?

The FCA does not permit spread betting on crypto. The crypto market is high risk for spread betting. The FCA consider crypto assets too risky and unregulated. Only professional traders are allowed to spread bet on cryptocurrencies.

Does negative balance protection cover spread betting?

Yes, you are protected by negative balance protection according to FCA rules. Just like with CFDs, you cannot lose more than the capital in your trading account. Therefore, you will not owe your broker if your account goes down to zero.

Best spread betting brokers for beginners

If you are a new spread bettor in the UK, you should take time to learn spread betting. You can choose a forex broker that has courses on spread betting so you can learn the basics.

After learning the basics, our recommendation is that you open a demo spread betting account. The importance of this is access to the market with virtual money. Once you have your trading strategy ready, it is important to test it. A spread betting demo account gives you a risk-free environment fort this.

You can tweak and practice your strategy repeatedly on this account until you get the hang of it. IG for example, have a spread betting course and a free demo account for practice.

Does negative balance protection cover spread betting?

Yes. As long as your spread betting broker is regulated with the FCA, they have to protect you from a negative account balance. So, you cannot lose more than your trading capital, and you will not owe your broker any money.

What is the difference between spread betting brokers and betting brokers?

Both brokers give access to different types of markets. Spread betting brokers focus on financial instruments like currency pairs, ETFs, indices, etc.

Betting brokers usually focus on the outcome or happenings in a sporting event. Also, these two are not regulated by the same bodies.

The Financial Conduct Authority regulates spread betting brokers. The UK’s Gambling Commission regulates betting brokers.

Should I open multiple spread betting accounts?

The trading industry is quite competitive. There are a number of UK forex brokers that offer spread betting. For these brokers to get their market share, they offer diverse trading conditions so that you (the trader) can sign up with them.

This can be advantageous because you can find favorable trading conditions for spread betting with more than one broker. However, opening multiple spread betting accounts means more risks. Therefore, it is better to stick and work with one trading account.

FAQs on Best Spread Betting Brokers UK

Is Spread Betting Tax free in the UK?

Spread betting is not taxed in the UK. Your profits are free from Stamp Duty and Capital Gains Tax. But if spread betting is your main source of income, then it is taxable.

Is spread betting allowed in UK?

Yes, spread betting is allowed in the United Kingdom and it is legal. It is regulated by the Financial Conduct Authority (FCA), which oversees the activities of businesses that offer financial services to ensure that spread betting brokers operate fairly and transparently.

However, it is important for you to note that spread betting carries significant risks and you can lose all your money, so you should avoid it unless you understand how it works or have experience.

How to Start Spread Betting in the UK?

Generally opening a spread betting account involves these steps:

1) Open an account with an FCA regulated spread betting broker.

2) Complete your KYC regulation.

3) Open a spread betting account and fund it.

4) Begin trading.

Is Spread Betting Profitable?

Spread betting, like, CFD trading is based on speculation. There are no guarantees and there is a high risk of losing your capital due to leverage. The majority of traders end up losing their money, so you must understand all the risks before you decide to place a spread betting trade.

Is CFD Better than Spread Betting?

Both CFD trading and spread betting are risky for retail traders. The only difference between them is that gains from spread betting are not taxed.

Can You Get Rich from Spread Betting?

Spread betting, like, CFD trading is risky. Most retail traders lose their money when spread betting. The CFD brokers with the lowest percentage in this review are City Index and CMC Markets at 66%. Spread betting involves using leverage which can amplify losses.