Best Forex Brokers UK 2026

We've compared the forex brokers that are regulated in the UK with FCA based on comparison of 10+ trust factors. See our comparison of fees, safety, trading conditions & more.

Editor

|

If you are a UK resident looking to trade forex, you should know a few things.

The first is that the Financial Conduct Authority (FCA) regulates forex trading in the UK. They regulate the operations of forex brokers in the UK. FCA’s regulation helps to ensure there is an oversight on the activities of these brokers, and this keeps clients’ funds safe.

Never trade with an unregulated broker. You could lose all of your money.

When you want to choose a broker, regulation is not the only factor to consider. You need to consider other factors like overall fees: is it high or low?, customer support: how quick and efficient are they?, trading conditions: what is the sum of the instruments they offer?, what trading platforms do they offer?, etc.

The brokers on our list were selected based on these criteria & other factors.

| Broker | FCA Firm Reference No. | EUR/USD Spread (pips) | Min. Deposit | Percentage of Losing Retail Traders | FSCS Insurance | Visit |

|---|---|---|---|---|---|---|

| Pepperstone |

648312

|

1.10 (Standard Account)

|

No minimum deposit

|

75.2%

|

Yes

|

Visit Broker |

| City Index |

446717

|

0.7

|

£100

|

69%

|

Yes

|

Visit Broker |

| XTB |

522157

|

0.9

|

No Minimum Deposit

|

76%

|

Yes

|

Visit Broker |

| CMC Markets |

173730

|

0.7

|

No Minimum deposit

|

71%

|

Yes

|

Visit Broker |

|

793714

|

0.6

|

£20

|

70.04%

|

Yes

|

Visit Broker | |

|

217689

|

0.6

|

£50

|

68%

|

Yes

|

Visit Broker | |

|

583263

|

1.0

|

£100

|

51%

|

Yes

|

Visit Broker | |

|

717270

|

0.1

|

£100

|

71%

|

Yes

|

Visit Broker | |

|

509956

|

1.30 (MT4 with Market Execution)

|

£100

|

74%

|

Yes

|

Visit Broker | |

|

Forex.com

|

446717

|

0.7

|

£100

|

69%

|

Yes

|

Visit Broker |

Note: The spread data & minimum deposit is the typical spread as per information on these brokers’ websites in May 2024. Please see our methodology below.

Here are the Best Forex Brokers in the UK that we have reviewed based on 10+ trust Factors:

If you need more information, we now cover below the detailed breakdown of features like safety, fees, trading conditions, support & more of each above listed broker one by one for comparison.

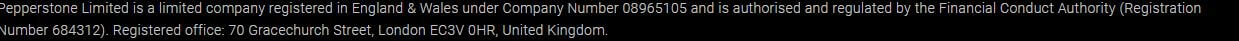

Pepperstone Limited is licensed in the UK. They are regulated by the FCA and are authorised to operate in the UK. They have been authorised since 2015. Their registration number with the FCA is 648312. Their website and the FCA website confirms these.

Total Fees: Pepperstone does not charge any fees for deposit, withdrawal, or account inactivity. The commission depends on your account type, platform, and account base currency. Spreads are low for major pairs except if you trade exotic pairs with high spreads. Overall, total fees are low.

Trading Conditions:

Account types: Pepperstone offers three account types – standard, spread Bet, and razor accounts. The minimum deposit for these accounts as recommended by the broker is £500. Spreads for major currency pairs are low.

| Major Currency Pairs | Spread |

|---|---|

| EUR/USD | 1.10 |

| USD/JPY | 1.30 |

| GBP/USD | 1.40 |

| USD/CHF | 1.40 |

| USD/CAD | 1.40 |

| AUD/USD | 1.20 |

| NZD/USD | 1.40 |

Please, note that these spreads (average) are for the standard account alone.

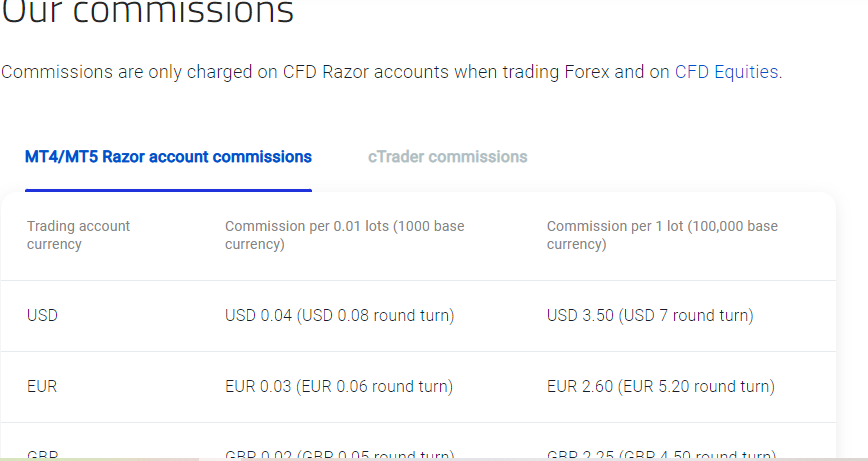

Commissions: Pepperstone’s commission depends on your account’s base currency and account type. Since your account will likely be in GBP, you will be charged £4.50 round-turn commission on every standard lot that you trade. Commissions are charged on razor accounts only.

Instruments: You get to trade 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices

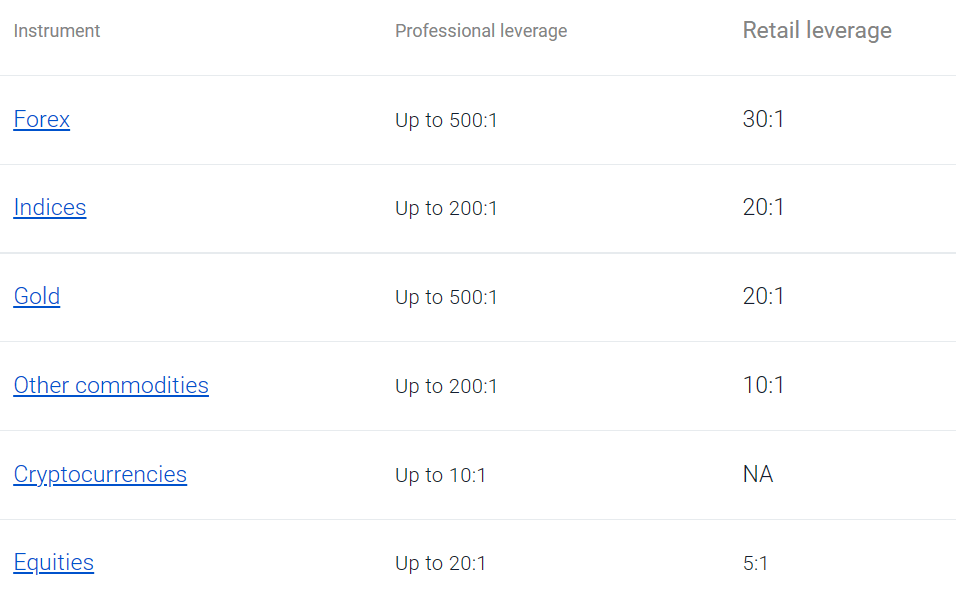

Leverage: These are the leverages for retail traders.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Index CFDs | 20:1 |

| Gold | 20:1 |

| Commodities | 10:1 |

Risk management tools: Pepperstone does not offer guaranteed stop loss orders.

Funding/Withdrawal methods: You can deposit via your debit/ credit card, PayPal, and local bank transfer. You can withdraw via these means too. Pepperstone accepts cards from Visa and Mastercard only. All deposits reflect in your account immediately. Except for bank transfers (can take up to 3 days).

Trading platforms: Metatrader 4, Metatrader 5, and cTrader are the platforms available with this broker. These platforms are available on different devices (Android, iOS, and Windows, and Mac). The cTrader is not available on Mac. However, you can still access it via the cTrader web app.

Support: UK residents can get support via the live chat feature on Pepperstone’s website. The replies are immediate. You can also chat with a live agent. We got a response to our email after an hour. You might have to wait longer on weekends though. There is also a UK phone number you can call.

You can also read our detailed Pepperstone Review. for more.

Pepperstone Pros

Pepperstone Cons

City Index has had an authorised status in the UK since 24/03/2006. The forex broker is regulated with the FCA as StoneX Financial Limited with FCA reference number is 446717.StoneX Group is City Index’s parent company. They are listed on US’ Nasdaq Exchange. We consider City Index low risk.

Total Fees: City index do not charge commissions for forex trading. They do not charge deposit/withdrawal charges too. However, you pay a premium price if your guaranteed stop-loss order is triggered. Overall, total fees are low.

Trading Conditions:

Account types: City Index offers two account types – spread betting and CFD trading accounts. Minimum deposit for all accounts is £100. Spreads for major currency pairs are shown below.

| Major Currency Pairs | Spread (Typical) |

|---|---|

| EUR/USD | 0.7 |

| USD/JPY | 60 |

| GBP/USD | 1.1 |

| USD/CHF | 1.8 |

| USD/CAD | 1.6 |

| AUD/USD | 0.5 |

| NZD/USD | 1.4 |

Commissions: City Index does not charge commissions for forex trading. The commission is built into the spread.

Instruments: City Index offer a good range of instruments. You get to trade 17 indices, 4500+ stocks, 84 currency pairs, 16 indices 4 commodities, 4 options, 4 bonds, 4 metals, and 3 interest rates.

Leverage: These are the leverages for retail traders.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Indices | 20:1 |

| Metals | 20:1 |

| Commodities | 10:1 |

| Shares | 5:1 |

Risk management tools: City Index offers guaranteed stop loss orders for a premium. If it is nit triggered, City Index will refund your money.

Funding/Withdrawal methods: City Index supports three deposit/withdrawal methods: credit/debit card, bank transfer, or PayPal. Credit/debit card transactions take 3-5 working days. Bank transfer takes up to 1-2 working days. Funding and withdrawing via PayPal can take up to 2 working days.

Trading platforms: You can trade with an HTML5 webtrader, MetaTrader 4 or their proprietary mobile trader. City Index MT4 is available on Mac and Windows. Also, you can download their mobile trader on Google Play Store and Apple App Store.

Support: You can get support via UK mobile number or email on their website. There is also a detailed FAQs section. It should answer any question you might have. We got no response when we tested their email support. We got a response from their live chat after 5 minutes.

Read our City Index Review to know more about this broker.

City Index Pros

City Index Cons

CMC Markets are regulated with the FCA as CMC Markets UK plc with reference number 173730. CMC Markets have over two decades of presence in the UK. In addition, their parent company is FTSE 250 listed so CMC Markets is a low risk broker.

Total Fees: CMC Markets do not charge commissions for forex trading. You also pay no fee for deposits/withdrawals. However, you are charged £10 monthly for inactivity fee after one year of not trading. There is also a premium fee for guaranteed stop-loss orders.

Trading Conditions:

Account types: CMC Markets offer three account types – spread betting, CFD and corprate accounts. Minimum deposit for all accounts is £0. Spreads for major currency pairs are shown below.

| Major Currency Pairs | Spread (Minimum) |

|---|---|

| EUR/USD | 0.7 |

| USD/JPY | 0.7 |

| GBP/USD | 0.9 |

| USD/CHF | 1.0 |

| USD/CAD | 1.3 |

| AUD/USD | 0.7 |

| NZD/USD | 1.5 |

Commissions: CMC Markets does not charge commissions for forex trading.

Instruments: CMC Markets offer a wide range of financial instruments. Opening an account with them exposes you to 11,000+ financial instruments. You get to trade 333 currency pairs, 80 indices, 19 cryptocurrencies, 100 commodities, 9000+ shares, and 50 treasuries.

Leverage: These are the leverages for retail traders.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Indices | 20:1 |

| Metals | 20:1 |

| Commodities | 10:1 |

| ETFs | 5:1 |

| Treasuries | 33:1 |

Risk management tools: CMC Markets offer guaranteed stop loss orders.

Funding/Withdrawal methods: You can deposit and withdraw funds via three channels. You can carry out your transactions via bank wire transfer, credit/debit card, and PayPal. Deposits and withdrawals are processed instantly but can take 2-3 business days for funds to reflect in your account.

Trading platforms: CMC Markets offer MetaTrader 4, and webtrader. They also offer their own mobile app. You can download the mobile app on Android and iOS

Support: According to our tests, overall customer support is good. We reached out to CMC Markets via e-mail and got a response after an hour. A local mobile number is also available.

You can find more on their trading conditions in our well-researched CMC Markets Review.

CMC Markets Pros

CMC Markets Cons

XTB Limited is regulated with the FCA. Their reference number is 522157. They are authorised to provide forex services in the UK. XTB Limited have been authorised since 17/01/2011.

Total Fees: XTB charges inactivity fee. This fee is charged when there is no trading activity on your account for 12 months. You are charged $10 monthly till you begin trading again. In addition, you are charged a 2% fee when depositing through e-wallets like Paysafe. Other e-wallets like Neteller and Safetypay also have their deposit charges

If your withdrawal is below £60, you are charged £12 for the transaction. Every withdrawal above £60 carries no charge.

There are no commissions on trades except for stock CFDs and ETF CFDs & the commission is 0.08% per standard lot for these instruments. There are also swap charges for holding trades overnight.

Account type: XTB offer just one account – standard account with low spreads.

| Major Currency Pairs | Spread (Minimum) |

|---|---|

| EUR/USD | 0.8 |

| USD/JPY | 1.1 |

| GBP/USD | 0.9 |

| USD/CHF | 1.2 |

| USD/CAD | 1.5 |

| AUD/USD | 1.1 |

| NZD/USD | 1.3 |

Minimum deposit: XTB has no minimum deposit for you to start trading.

Commission for major pairs: There are no commissions on currency pairs. The cost of trading currency pairs is in the spread.

Instruments: Over 2100 instruments are yours to trade. They offer 71 currency pairs, 32 indices, 27 commodities, 1995 stock CFDs, and 171 ETF CFDs.

Leverage by instruments: The maximum leverage across all instrument classes is 30:1.

Risk management tools: Your stop-loss price is not guaranteed here as well.

Funding/withdrawals: You can deposit and withdraw funds through your debit/credit card. XTB accepts MasterCard, Visa, and maestro. Local bank transfers and e-wallets are also available for withdrawal/deposits. Your withdrawals are processed the same day if you placed them before 1 pm.

Trading platforms: XTB do not offer the MetaTrader 4 and 5 platform. Their platforms are xStation 5 and xStation Mobile. xStation 5 is available on the web, mobile phones, and desktops. The xStation Mobile is only available on phones (Android only)

Support: XTB has great customer support. Their live chat features offer answers to FAQs and live agents reply promptly. Emails are replied typically within 20-30mins.

Read our full XTB Review for more on their trading conditions.

XTB Pros

XTB Cons

Capital.com is the trading name for Capital Com (UK) Limited. The company is regulated by the FCA. Their reference number is 793714, issued in 2018.

Fees: Capital.com does not charge extra fees for deposit and withdrawals. There is no inactivity fee as well. Swaps and spreads are the only trading fees charged.

Account type: Capital.com offers Retail and Professional accounts, as well as accounts for Corporate clients.

Minimum deposit: Capital.com have a minimum deposit for bank transfers of £250. Cards and e-wallets can deposit as little as £20.

Commission: Capital.com does not charge commissions for forex trading.

| Major Currency Pairs | Spread (Minimum) |

|---|---|

| EUR/USD | 0.6 |

| USD/JPY | 100 |

| GBP/USD | 1.3 |

| USD/CHF | 1.7 |

| USD/CAD | 2.0 |

| AUD/USD | 0.6 |

| NZD/USD |

Note: All spreads are for the Capital.com trading platform. Spreads on MT4 are higher

Instruments: Capital.com offers currency pairs and other CFDs like shares, indices, commodities, and bonds.

Leverage by instruments:

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Indices | 20:1 |

| Commodities (except gold) | 10:1 |

| Cryptocurrencies | 2:1 |

| Shares | 5:1 |

| Bonds | 5:1 |

Risk management tools:Capital.com offers guarantee stop loss orders

Funding/withdrawals: You can deposit and withdraw funds via debit/credit card and bank transfers

Trading platforms: Capital.com offers different trading platforms. There is MT4 and their proprietary Capital.com Mobile App, Capital.com Web Platform. They also support TradingView.

Support: Apart from FAQ, you can contact via live chat, email and a UK phone number. We tested their live chat and email and got a response within ten minutes.

Do you want to know more about Capital.com? Read our in-depth Capital.com Review for 2025.

Capital.com Pros

Capital Cons

Forex Capital Markets Limited is regulated with the FCA with registration number 217689. They have been authorised for operation in the UK since 27/05/2003.

Fees: FXCM charges the lowest inactivity fee on this list. You pay $50 (£37) yearly after a year of inactivity. There are no deposit charges. You are charged £15 if your withdrawal method is non-BACS (Bankers’ Automated Clearing System) wire transfer. It is free if you use the BACS wire transfer method to withdraw your funds.

Account type: FXCM offers you a single account type. It is called the standard account.

Minimum deposit: Your minimum deposit is £50.

Commission: FXCM is a spread only forex broker with their accounts. But certain trading accounts fall under the commission model. If your account does fall under FXCM’s commission structure, you will be notified. Here are FXCM’s commissions for major pairs. These commissions are charged per side for every standard lot.

| Major Currency Pairs | Spread (Minimum) |

|---|---|

| EUR/USD | £3.00 |

| USD/JPY | £3.00 |

| GBP/USD | £3.00 |

| USD/CHF | £3.00 |

| USD/CAD | £5.00 |

| AUD/USD | £5.00 |

| NZD/USD | £5.00 |

Instruments: You get to trade currency pairs, indices, commodities, and metals. The number of instruments available to you depends on your accounts.

Leverage by instruments:

| Instruments | Leverage |

|---|---|

| Major currency pairs | 30:1 |

| Minor currency pairs, gold, and major indices | 20:1 |

| Commodities (except gold) | 10:1 |

| Cryptocurrencies | 2:1 |

| Individual equities | 5:1 |

Risk management tools: FXCM does not offer guarantee stop loss orders

Funding/withdrawals: You can deposit and withdraw funds via debit/credit card, Skrill, Neteller, Klarna, Rapid Transfer, and EFT/bank transfer.

Trading platforms: FXCM has multiple trading platforms compared to other brokers. MetaTrader 4, NinjaTrader, Zulutrade, Tradingview, and Trading Station are all available for use.

Support: Support is not available 24/5. To reach them faster, there is a UK mobile number you can chat with on WhatsApp. Replies on WhatsApp were instant with few seconds of holding time. According to our test, email response can take up to an hour and some minutes.

Do you want to know more about FXCM? Read our in-depth FXCM Review for 2025.

FXCM Pros

FXCM Cons

eToro (UK) Ltd are regulated with the FCA with registration number 583263.They have been authorised in the UK since 09/05/2013. We consider eToro low risk for forex traders

Fees: eToro charges $10 inactivity fee monthly after 12 months of inactivity. Deposit of funds is free but there is a $5 withdrawal fee. You cannot withdraw below $30 from your account. Withdrawal and deposit in any currency other than USD attract conversion charges.

Trading currency pairs attract charges in spreads and swaps but there are no commissions.

Account type: You can open an investment or corporate account with eToro.

Minimum deposit: Minimum first deposit is $10. If you deposit via bank transfer, the minimum deposit is $500. You will require at least $10,000 to open a corporate account. Spreads for major currency pairs are shown below

| Major Currency Pairs | Spread (Minimum) |

|---|---|

| EUR/USD | 1.0 |

| USD/JPY | 1.0 |

| GBP/USD | 2.0 |

| USD/CHF | 1.5 |

| USD/CAD | 1.5 |

| AUD/USD | 1.0 |

| NZD/USD | 2.5 |

Commission: There is no commission listed on their website for currency pairs. There is no commission, rollover, or management fees for investing in stocks too.

Instruments: eToro offers a wide range of instruments. You will find on their platform 49 currency pairs, 2848 stocks, 32 commodities, 67 cryptocurrencies, 13 indices, and 264 ETFs.

Leverage by instrument:

| CFD Instruments | Leverage |

|---|---|

| Major Currency Pairs | 30:1 |

| Minor Currency Pairs | 20:1 |

| Commodities | 10:1 |

| CFD (Stocks and ETFs) | 5:1 |

Risk management tools: No guaranteed stop-loss protection. eToro executes your stop-loss order with the best available market price depending on market conditions.

Funding/withdrawals: You can deposit funds/withdraw funds via credit card PayPal, and bank transfer. Neteller, Skrill, Rapid Transfer, and online banking are also available for deposits.

Trading platforms: eToro have their own trading app for mobile and web trading platforms. There is no metatrader. You can download eToro’s trading app on Play Store and App Store.

Support: eToro’s live chat is only available to active clients. We got a response from their live agent in four minutes. They have an FAQs section with detailed answers. We tested their email and got a response after four minutes as well. There is a UK address but no local mobile number.

Read our full eToro Review for more on their trading conditions.

eToro Pros

eToro Cons

Tickmill is regulated with the FCA. Their reference number is 717270. They have an authorised status, which had been since 29/07/2016.

Total Fees: Tickmill will not charge you for deposits or withdrawals. They even cover your bank deposit fees if your deposit is above $5000 or its equivalent in pounds. There is a monthly £10 inactivity charge after 12 months of inactivity. There are also trading fees such as swaps and commissions.

Only their classic accounts have spreads beginning from 1.6 pips. You are also charged a swap and they are pretty high.

| Major Currency Pairs | Spread (Typical) |

|---|---|

| EUR/USD | 0.1 |

| USD/JPY | 0.1 |

| GBP/USD | 0.3 |

| USD/CHF | 0.4 |

| USD/CAD | 0.2 |

| AUD/USD | 0.1 |

| NZD/USD | 0.3 |

Account type: Tickmill offers three accounts – Pro, Classic, and VIP accounts.

Minimum deposit: You require a minimum of £100 to open a Pro or Classic Account. The VIP account has no minimum deposit.

Commission: You are charged commissions and spread based on your account type. Commissions are charged on the Pro and VIP accounts only. Commission totals £4 and £2 for trading a standard lot on Pro and VIP Accounts respectively. Commissions are not charged on the Classic Account

Instruments: Tickmill offers limited instruments compared to other brokers on this list. You get to trade 62 currency, CFDs on 3 cryptocurrencies, 20 stock indices, oil, 7 bonds, and 3 metals.

Leverage by instruments:

| CFD Instruments | Maximum Leverage |

|---|---|

| Forex | 30:1 |

| Stock Indices & Oil | 20:1 |

| CFDs on Metals | 20:1 |

| Bonds | 5:1 |

| Crypto CFDs | 1:2 (only for Professional Clients) |

Risk management tools: You can use a stop-loss order without limits across their three accounts. However, Tickmill does not offer guaranteed stop-loss orders.

Funding/withdrawals: You can deposit and withdraw funds through bank transfer, credit/debit card, Neteller, PayPal, and Skrill, sofort, dotpay, and paysafecard. For all of these channels, you cannot withdraw below £25.

Also, deposits are instant but your withdrawals can take up to one working day or more.

Trading platforms: Tickmill offers the MetaTrader 4 and 5 platforms. They also have a Metatrader Web platform. Tickmill’s MT4 & MT4 mobile platforms are available for Android & iOS.

Support: There is a UK phone number you can contact 24/5. You can also contact Tickmill via email. After sending them an email, we got a response in 15 minutes.

We also carried out an in-depth review of Tickmill. You can read it our Tickmill Review for more knowledge about them.

Tickmill Pros

Tickmill Cons

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell). Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

In order to trade CFDs on currencies like EUR/USD or GBP/USD, you need a forex broker. If you are a retail trader, you cannot trade forex (speculate on currencies) without using a CFD broker.

There are a few factors that you must consider before signing up with any forex broker. We have created this checklist of some important points and also covered examples of how you can check these points yourself for a broker.

Let’s go.

Regulation is a big deal in the UK. In fact, every broker regulated with the FCA states it on their website. They also add the reference number. However, you cannot be too careful.

You should go to https://register.fca.org.uk/s/ to verify the broker’s reference number, authorized status, and website. Do not overlook this process.

The safety of your funds is tied to your broker being regulated. Avoid offshore and unlicensed brokers totally.

So, how do you verify a broker? Assume you saw a Pepperstone ad on Facebook. You feel good about them but you want to do your due diligence.

The first thing to do is go to Pepperstone’s website. Scroll down to the bottom of the website and see if they are regulated with the FCA. You should also look out for their reference number.

The screenshot above shows that Pepperstone is regulated with the FCA and their registration number is 684312. For your next step, you have to verify these details on the FCA’s website. Only then can you be sure that your funds are safe with this broker.

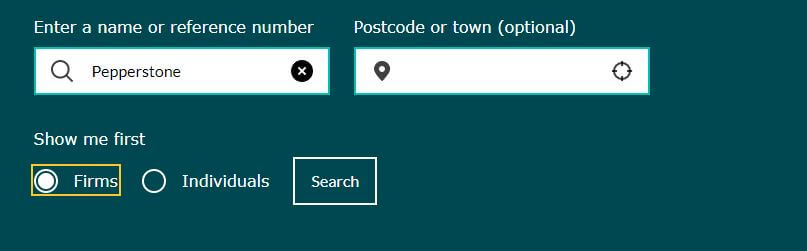

Go to the FCA website mentioned earlier.

Scroll down to this area and select firms. Enter the number 684312 or the company’s name and click on search. You should get the screenshot below.

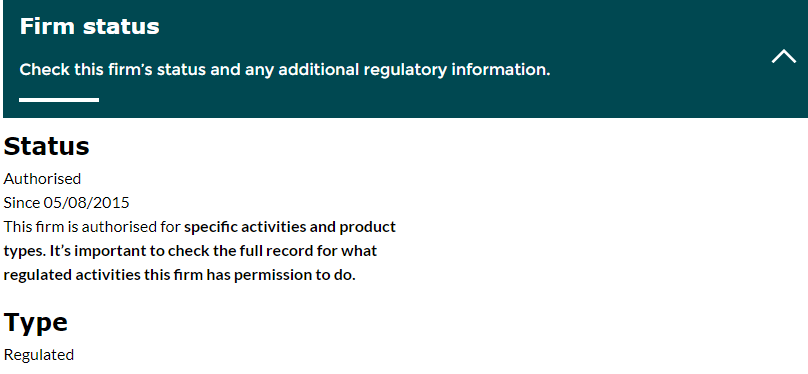

Clearly, you can see that the company name and reference number matched the broker’s website. But you don’t even stop here. Go ahead and click “Pepperstone Limited” and scroll down. To the right of your screen, you will determine if Pepperstone Limited is authorised in the UK and how long they have been authorised. Here is a screenshot of what it looks like.

This is how you know a broker that is safe to give your funds to. Finally, some brokers are regulated by offshore regulators such as FSC, BVI, etc. These regulators have low requirements. You should totally avoid brokers not regulated by tier-1 regulators like the FCA, ASIC, BaFin, etc.

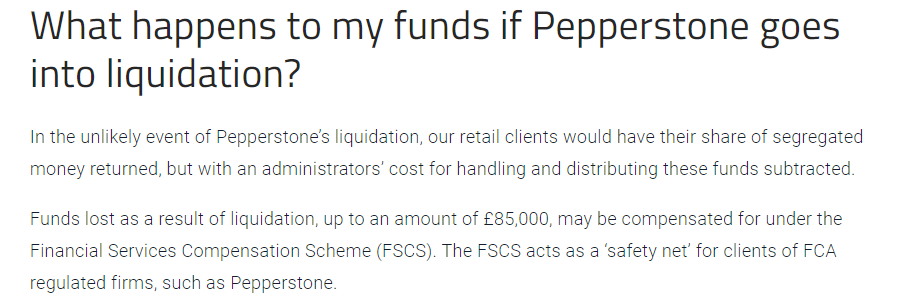

In addition, there is another way trading with a regulated broker benefits you. Apart from protecting you from fraud, you can get compensated if your forex broker goes into liquidation. This is a directive under the FCA’s Financial Services Compensation Scheme (FSCS). As a retail trader, your money is protected under this scheme.

FCA regulated brokers are transparent about this. You can even find it on their websites. Let us use Pepperstone as an example to confirm this

To confirm if a forex broker is under the FSCS, you can send them a mail or use their live chat. Make sure you verify these details always.

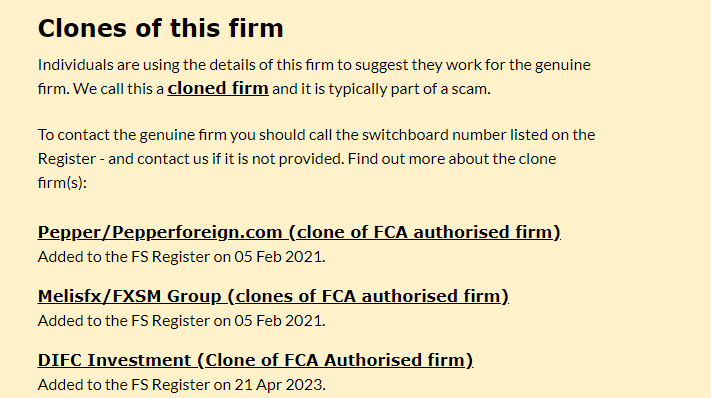

Seeing the advantage of trading with a broker that is legalized in the UK, you need to beware of clone firms. Clone firms are fraudulent. They try to fool traders by using company names similar to properly regulated brokers.

Their aim is to scam you off your money. So as you verify your broker’s regulation, check if they have any clones operating in the UK. You can find these clone firms on the FCA’s website too. In fact, they are part of the search result for legit brokers.

That is, if you search for Pepperstone for example, there is an obvious section on the result page that is for clones of Pepperstone. Here is a visual example.

Can you see the three clones of Pepperstone UK? Can you see how similar in name the first clone is? Thanks to the FCA, you are able to spot these brokers. This is why you should always trade with a licensed broker.

Fees are divided into non-trading and trading fees.

a. Non-Trading Fees: Non-trading fees include inactivity fees, withdrawal/deposit fees, and currency conversion charges. You can check the broker’s FAQ sections to check for non-trading fees. If you are not satisfied with what you find there, you can reach out to the broker via email, live chat, or a phone call. Here is how our brokers compare in terms of non-trading fees

| Broker | Deposit Fees | Withdrawal Fees | Inactivity Fees |

|---|---|---|---|

| Pepperstone | £0 | £0 | £0 |

| City Index | £0 | £0 | £12 |

| CMC Markets | £0 | £0 | £10 |

| XTB | £0 | £0 | £10 |

| Capital.com | £0 | £0 | £0 |

| FXCM | £0 | £0 | £50 |

| eToro | £0 | $5 | $10 |

| Tickmill | £0 | £0 | £0 |

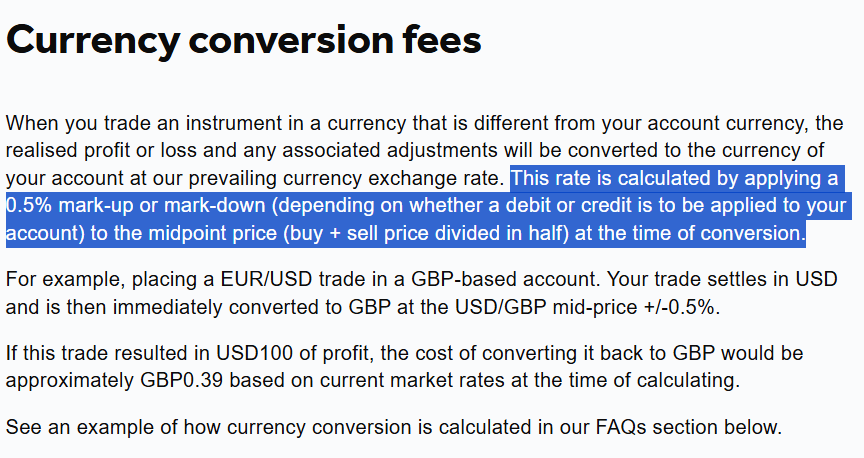

In the table above, we have not covered the currency conversion charge. How it works is, let us say that your trading account is in GBP (your account base currency), but you are depositing in USD or EUR for example, then your broker as well as your bank would charge you a markup for the currency conversion.

This fees can vary from broker to broker. Oanda for example charges are 0.5% currency conversion fees on trading. Refer to the below screenshot, where they have explained how this conversion fees will be charged.

When you are trading actively, all these non-trading charges can add up, without you even noticing the deductions in your account statement. This is because on the face of it, it will just be a minor charge, but over time (let us say over 1000 trades) the number can be significant enough.

b. Trading Fees: Trading fees include swaps, commissions, and spreads. How much of these you are charged depends on the type of account you choose to open with a broker. So you have to go to the broker’s website and determine the spreads and commissions attached to them. Some accounts even carry non-trading charges.

Most brokers give an overview of the different accounts they offer. Take your time to go through these accounts and see the fees attached to them.

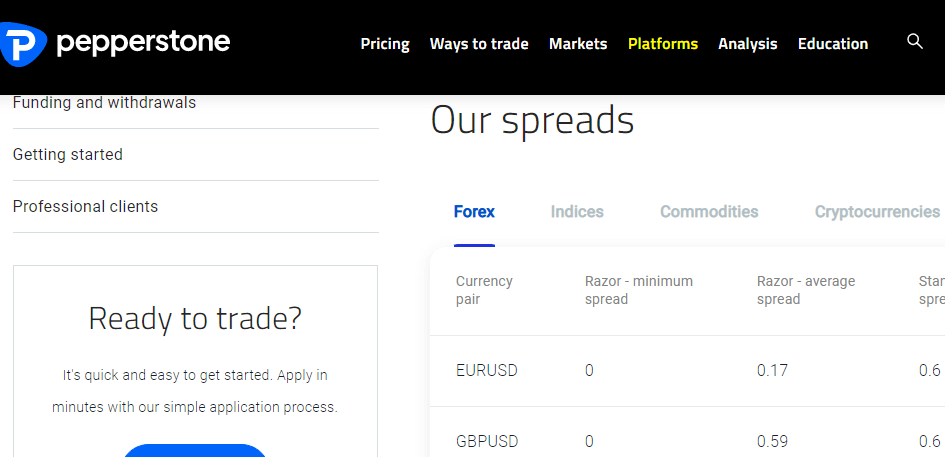

Let us use Pepperstone as an example again. Assuming you have chosen to trade with this broker, and you want to know about their trading charges.

The first thing to do is go to their website. You should arrive at the screenshot below

Click on pricing to view the fees page. Then scroll down to see the spreads, swaps, and commissions charged.

Below is an example from another broker City Index, where they mention their typical spreads for Forex CFDs on their Forex Trading page. You can see the contract specifications for all the currency pairs.

Here is a table showing spreads for currency pairs across different accounts on Pepperstone’s website. Remember we said that these fees are dependent on account type? Look at the screenshot below on the same page.

This means commissions are only charged on CFD Razor accounts. You cannot find these details if you do not go through the broker’s website.

The screenshot above shows commissions are not only account dependent. They can also depend on the trading platforms you choose.

This link shows you how swaps are calculated. All you have to do is click it to know more. By going through the broker’s pricing/fees page, you can get invaluable info about their trading charges.

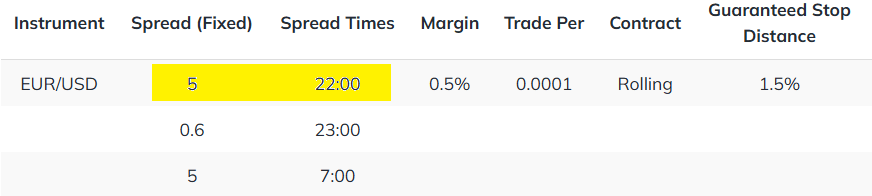

c. Floating Spreads or Fixed: When comparing the fees, you also have to very carefully consider if you want to trade with a fixed spread or a floating spread broker.

To put it simply, a fixed spread broker will charge you fixed spread per lot when trading. For example, if the broker says fixed spread of 0.3 pips on EUR/USD, it means it will not change, it will remain the same no matter when you are trading.

But most forex brokers have floating spreads. It means the spreads are not constant, they change according to market conditions. For example, your broker could have 0.5 pips spreads on EUR/USD during opening of London session but few minutes later it could be 0.7 pips. So, you don’t have any fixed idea of the cost you will have to pay for trading, it is ‘variable’.

Note that even with fixed spread brokers, it is possible that the spreads are fixed for particular hours. For example, in the screenshot below (from a reference broker’s website), the spreads in the Asian session are fixed at 5 pips for EUR/USD. Then during London & NY sessions, it is fixed at 0.6.

This is a major difference in trading cost for you if you trade during the Asian session. If you don’t take this into account, this could mean very high brokerage costs as a percentage of your overall trading volume.

Get a clear idea of the exact spreads, are their any terms applied on those spreads that would cause it to change, because these will be most of your trading fees & affect your overall costs.

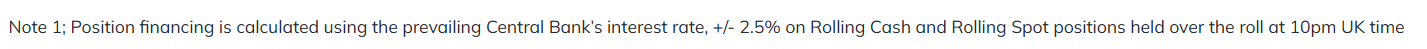

d. Overnight Trading Charges: If you are holding a position overnight, your broker may charge you swap fees or Rollover costs. Below is an example from a broker’s website.

Depending on which instrument you are trading & your account currency, the broker would charge you a markup on the current overnight lending rates, on your position size.

For example, if you are trading 10 Standard Lots of EUR/USD i.e. 1 million USD is your position size, and your broker charges you 5% swap fees, then the daily swap charge will be 0.0137% or USD 137.

If you are using very high leverage, then the swap fees can add up quickly against your P&L.

Before making a deposit to your broker, you need to know the number of instruments available for you to trade. As usual, you should go through the broker’s instrument page to see what they are offering you. Currency pairs, CFDs, indices, and commodities are important instruments for a broker to have.

Check the exact number of asset classes being offered & the total trading fees (spread, commission & swap fees) for each instruments under every asset class. For example, if you want to mainly trade major currencies like EUR/USD, GBP/USD etc. then you should look at the fees for these exact instruments.

But also in addition to this, check for the trading charges attached for trading other CFDs, stock indices, and commodities. This is because it will give you a general idea of the fees the broker is charging. They take up a portion of your profits and can add to your loss.

To check, you should visit the broker’s website & see the instruments page. Generally, you will find under sections like ‘markets’. Pepperstone for example mention their asset classes under this section & you can check every asset class like this.

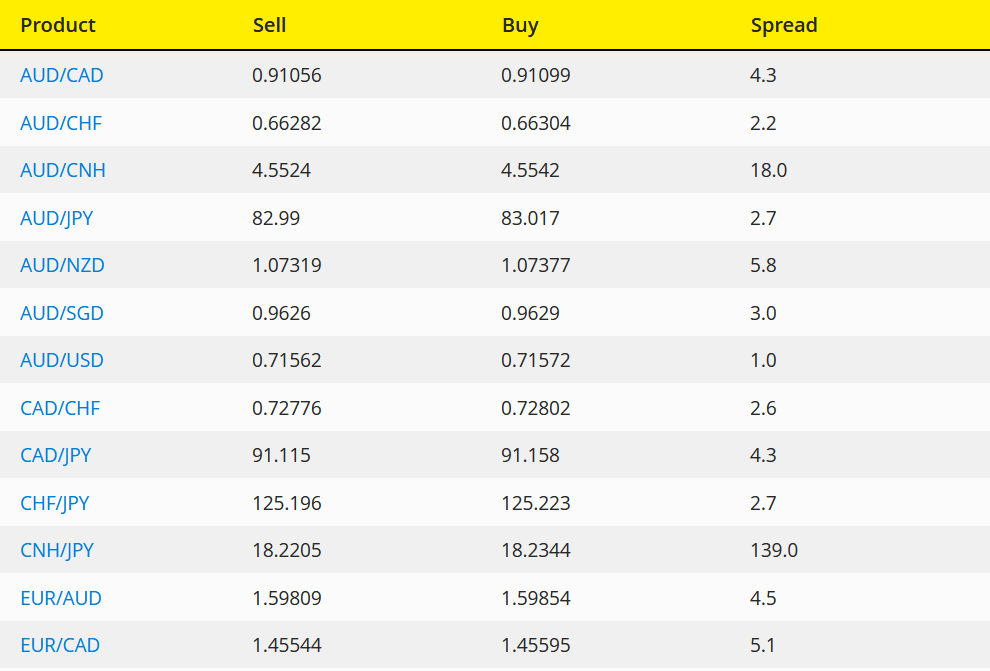

Here is a table showing spreads of certain CFDs on Pepperstone UK’s website.

Brokers usually give a breakdown of account types on their websites. You will also find in this breakdown key features of the accounts. You want to look for an account with low spreads and low commissions. This is a major factor to consider when choosing your trading account.

Having multiple account types can offer you the flexibility to trade, and generally brokers have different fees structures for different account types.

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large volume traders.

The Standard accounts are basic account types with standard fees structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, but some commission involved for each trade (depending on your lot size).

For example, below is the screenshot from Pepperstone UK’s website where they highlight the difference in leverage for Professional clients.

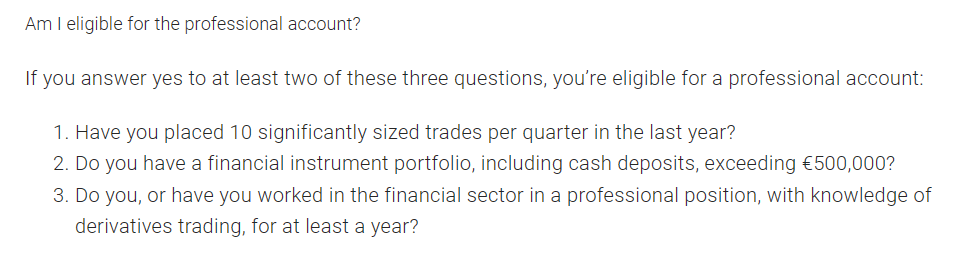

But the eligibility for opening Pro Account is much higher, including having large trading volume & adequate knowledge of derivatives trading.

So, if you are indeed a Professional trader with experience, then how do you choose your account?

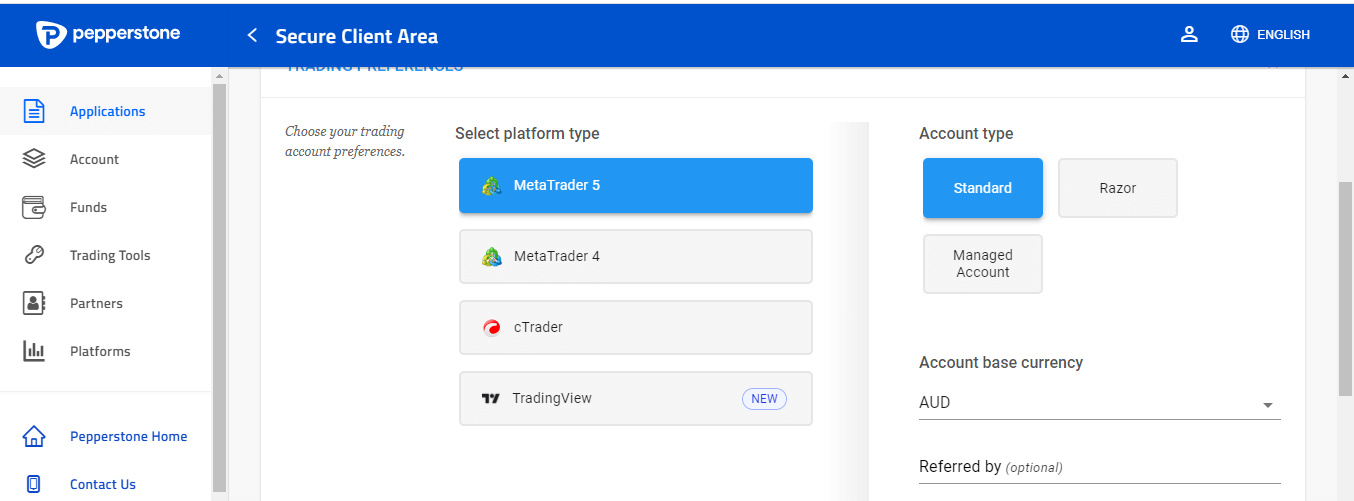

It is simple. As you continue your signing-up process, the account types available at the broker will be presented to you. All you have to do is select your choice with one click.

Let us see what it looks like at Pepperstone (example broker).

Here is a screenshot of Pepperstone UK’s account & platform selection.

At the top right of the page, you can see the account type section. You only need to select out of the three options there. You will find that section with every broker. It might not look like this exactly. But you will be the one to decide regardless.

You should also know that there are brokers with one single account type. There isn’t any choice to make here. You open an account and you are good to go.

Metatrader 4 (MT4) and Metatrader 5 (MT5) are the most popular trading platforms. Not all brokers have them though. What you want to pay attention to here are platform-specific features.

Some brokers have more instruments on their MT4 platform than MT5. There could even be differences in swaps and commissions across the two platforms. So make sure to look this up on the broker’s website.

The availability of copy trading is another important thing to check. You will find this on the broker’s website if it is available. On Pepperstone’s website, for example, it is referred to as social trading.

You can find it by clicking on the platforms tab on Pepperstone’s website.

Many forex brokers also support third-party trading platforms like MetaTrader, TradingView, and cTrader. For example, with FXCM Real account you get access to TradingView Pro.

Furthermore, some forex brokers also have their proprietary forex trading platforms. These platforms are developed by the company for the company. Traders hardly use these platforms for varying reasons. One of them is because of poor interface. However, brokers have greatly improved their platforms over the years with good trading conditions that may or may not be available on their third-party platforms

All FCA regulated forex brokers reveal the percentage of retail traders that lose money with them. The FCA made this compulsory. Why is this factor important? A regulated broker with a low percentage of losing retail traders indicates that more professional traders may be trading with that broker.

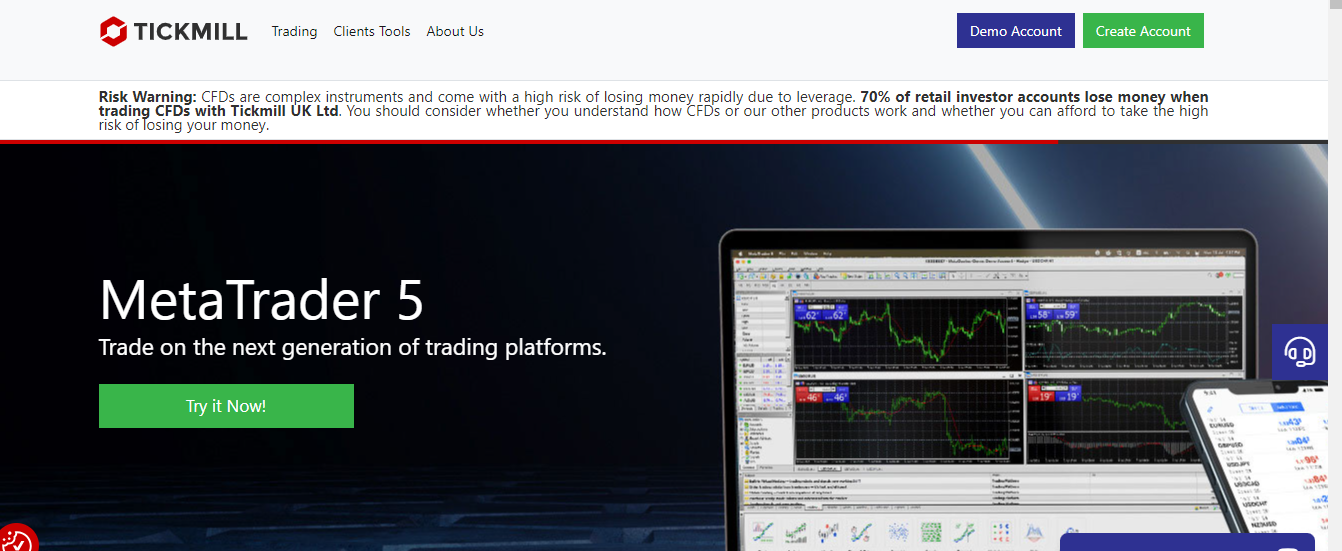

It is quite easy to find this data on the broker’s website. Most brokers put it at the top of their website. You only need to go to their homepage. Here is an example with Tickmill.

Few brokers like eToro and AvaTrade place this info at the footer of their websites. You will find it after scrolling down to the bottom of the website.

Here is the percentage of losing retail traders of each broker in our comparison.

| Broker | Percentage of Losing Retail Traders |

|---|---|

| Pepperstone | 77.6% |

| City Index | 75% |

| XTB | 82% |

| CMC Markets | 77% |

| Capital.com | 70.04% |

| FXCM | 71% |

| eToro | 79% |

| FxPro | 76.14% |

| Forex.com | 78.87% |

| Tickmill | 73% |

| AvaTrade | 71% |

As you can see, as per the latest data (December 2022) on the websites of these brokers, the percentage of losing traders was the highest at XTB & the lowest at FXCM and AvaTrade.

This is important information as this will tell you how many retail traders are losing with a broker. If the percentage of losing traders at a CFD broker is very high (much higher than the industry level of around 75%), then it is a warning sign that something could be wrong.

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. This is why the FCA required, in their 2019 publication on CFD rules, that brokers protect traders from experiencing this.

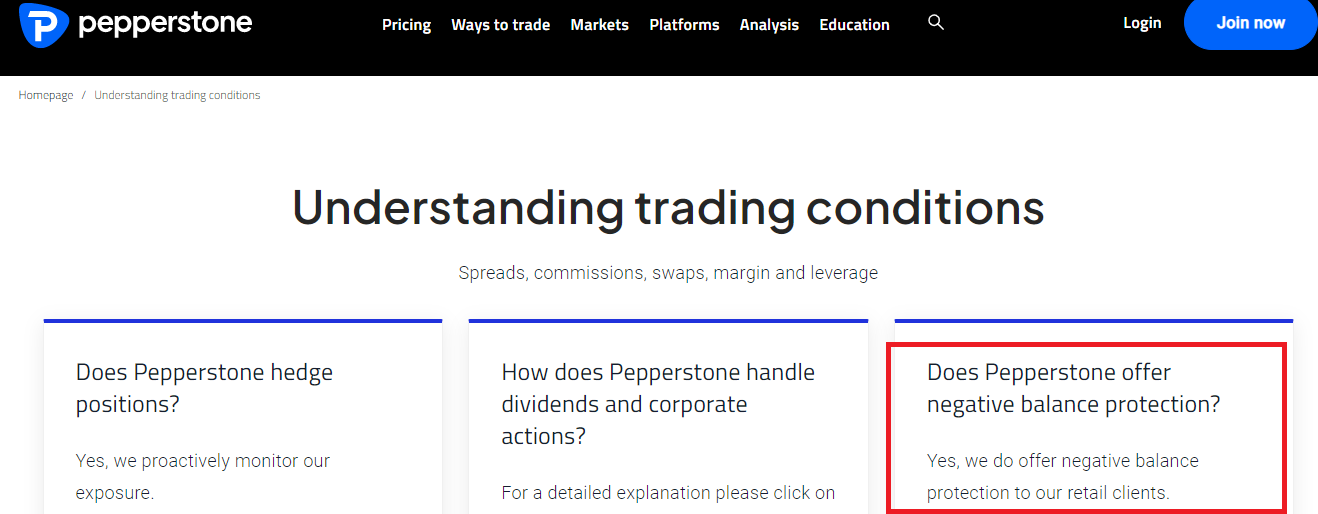

If your chosen broker is regulated with the FCA, you can be sure that they offer negative balance protection. Can you see why trading with a regulated broker is important?. You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on Pepperstone’s website

Finally, forex brokers are not mandated to provide negative balance protection if you are a professional trader. However, retail traders are guaranteed to get it.

c. Deposit/Withdrawals: Quick processing, multiple deposit/withdrawal methods, and low charges are the factors to keep a close eye on here. You should also be able to deposit and withdraw through your local bank. Most forex brokers do not charge extra fees for deposits/withdrawals. However, you can incur charges from your bank or e-wallet providers. Your broker does not receive any of these fees.

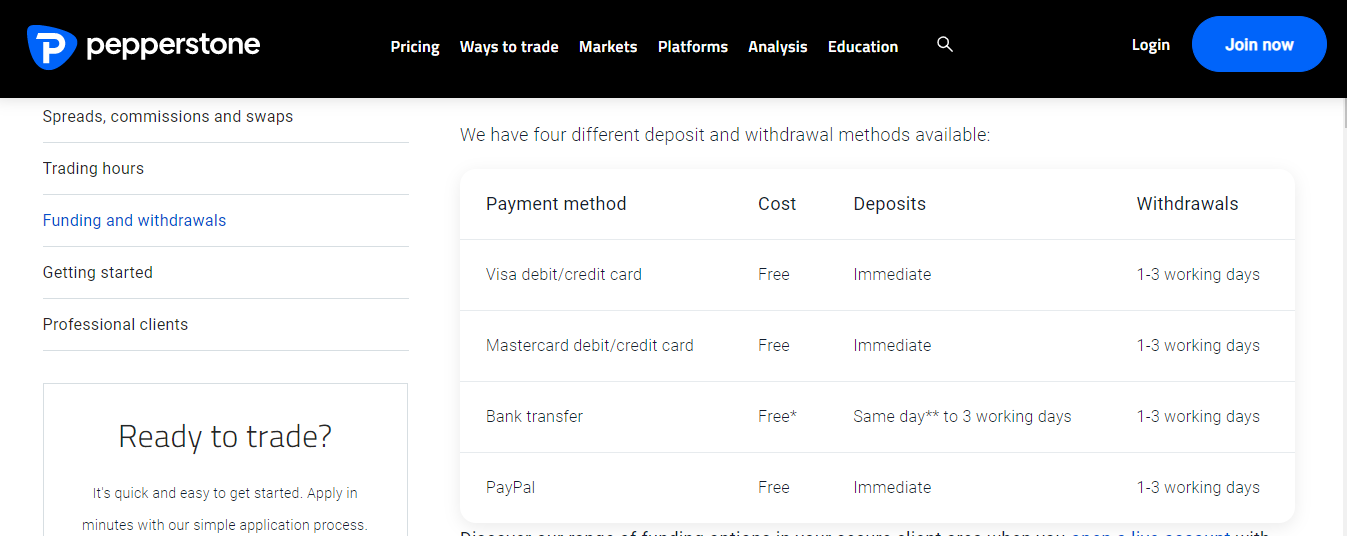

Summarily, what you want here is a broker with fast processing with little to no fees. Here is a screenshot of Pepperstone’s (example broker) deposit/withdrawal methods.

As you can see, Pepperstone combines low fees, multiple payment methods, and quick processing for deposits. Withdrawals can take 1-3 days.

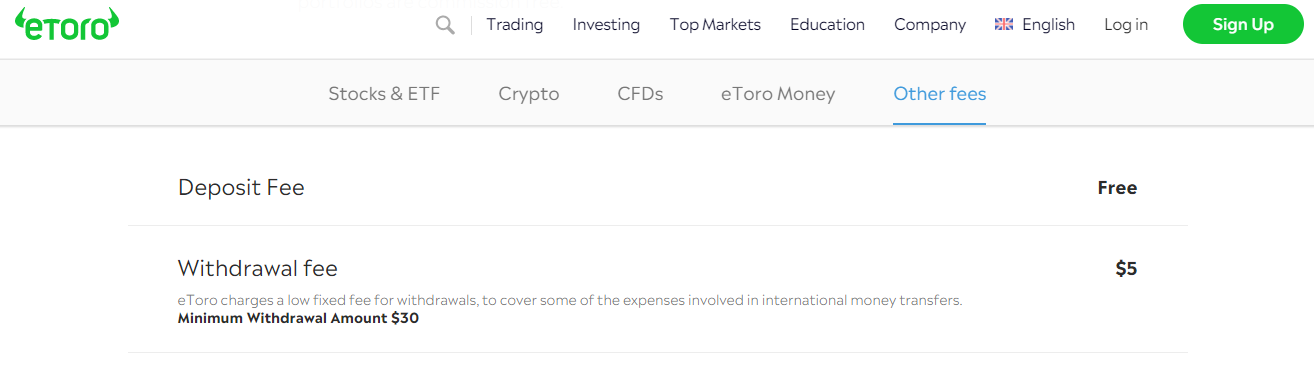

In this regard, eToro is an example of a broker that charges extra fees. They charge zero fees for deposits and $5 for withdrawals.

Another factor you might want to consider here is minimum withdrawals. This is not common but you should speak with your broker’s support to know if they have minimum withdrawals.

d. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs. You can read our best brokers for beginners to know the CFD brokers with the best education.

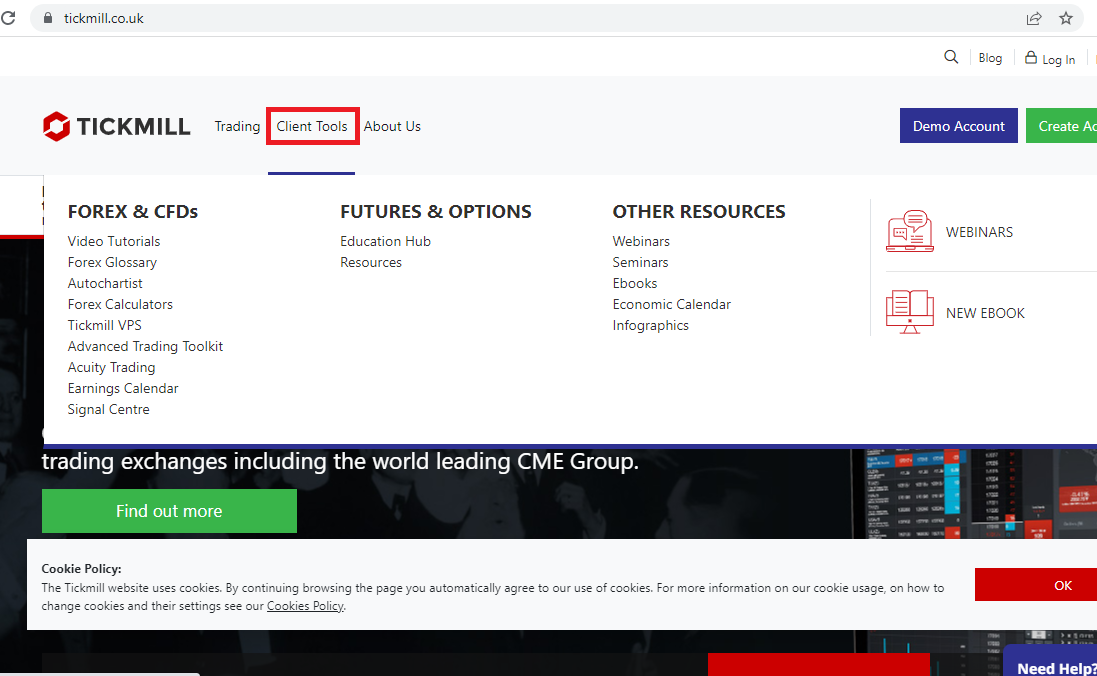

Finding a broker’s education is easy. It is usually on their homepage. With few clicks, you can access quality courses for your learning. Let us show you how you can do this (Tickmill is our example). On Tickmill’s homepage, click on ‘Client Tools’ (in the red box). Here is an illustration below.

From the image, you can see that Tickmill has webinars, seminars, e-books, infographics etc. You can use any of these tools to expand your knowledge about forex and CFD trading.

e. Customer support: Customer support is efficient if you can get a quick response. A live chat feature and a UK mobile number are also key. To know how quickly a broker responds to enquiry, send their customer support email.

In addition, you chat with them if they are on WhatsApp. Carrying out this test gives you good knowledge about a broker’s customer support.

Yes, you need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the interbank market where currencies are actually traded.

Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market.

Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders. For example, on the backend, the access different providers to get the prices.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

The Financial Conduct Authority (FCA) prioritizes the safety of your funds as a trader. Every forex broker in the UK are required to follow these two provisions to operate in the UK.

1) Segregation of Funds: Forex brokers are required to separate clients’ money from their own money. This means that they are not allowed to use your money for operational expenses. All funds deposited by clients are kept in a bank account separate from brokers’ bank account.

In addition, forex brokers cannot use clients’ fund to settle their debts. This is not allowed by the FCA.

The FCA ensures that forex brokers adhere to this rule. They require that all brokers that offer CFDs submit a compliance report. This report usually includes compliance with account segregation rules.

2) FSCS: This is an acronym for UK’s Financial Services Compensation Scheme. The aim of the scheme is to ensure that traders do not suffer total loss. The scheme comes into play only if your broker becomes bankrupt.

With FSCS, all traders will get their money back if their broker goes bankrupt. But there is a limit. The FSCS limit in the UK is £85,000. Compensation for traders does not pass this limit. Only UK-regulated brokers are covered by this scheme.

Yes, forex traders resident in the UK have to pay taxes on profits made from forex trading. You are free from tax obligations only if you trade forex via spread betting.

In summary, the profits you make from spread betting are not taxed. Your profits from standard forex trading are taxed as required. In addition, gains from forex trading are exempted from stamp duty. Stamp duty is a form of tax that applies to some transactions in the UK. Forex trader are exempted from this obligation.

Based on your situation, you might also be exempted from paying tax for gains up to £1000. This is a provision by the UK’s HRMC but it is not for everyone. If you do not make more than £1000 in a year, you might be eligible for this exemption.

Disclaimer: We are not a tax advisory organization. We advise that you contact tax professionals to know about taxation as it pertains to you and locality in the UK.

There is no specific amount that applies to every trader or forex brokers. The minimum deposit for forex trading is a decentralized phenomenon. No regulatory body enforces minimum deposit. It all depends on how each broker wants to operate. This is the first factor.

Some brokers have trading accounts with no minimum deposit. There could also be accounts with low minimum deposits requirement like £50. There are a few brokers with minimum deposits as high as £500 or more. So when it comes to the money you need to begin trading, your forex broker is a key factor.

The second factor is you. You need to consider your risk tolerance, trading goals, and financial state. How much are you willing to lose trading? How much is your gross monthly income? Why am I trading? These are pivotal questions you need to ask yourself. The answers to these questions will affect how much you put in your trading account.

How do you choose the amount to begin forex trading? A good consideration of the two factors above will help you make the right choice. After determining how much you are willing to risk in trading, then you need to choose your ideal broker.

If your risk tolerance is low, then you might have to choose brokers with zero minimum deposit account or low minimum deposit account like £5-£10. Though this little money, you can trade more positions with it using leverage. However, you should note that you can lose all of your money with leveraged CFD trading.

Even if your risk tolerance is high or you have enough money to trade CFDs, we caution that you do not put too much money in CFD trading because it is very risky.

Its best to trade with forex brokers that offer some form of safety for your funds. Here are some red flags to avoid when choosing a forex broker:

1) Unregulated Brokers: Do not trade with forex brokers that are not regulated. Only trade with brokers who are regulated by a reputable authority.

2) Hidden Fees: Another sign to avoid a broker is high fees or commissions. Make sure you know and understand all the costs associated with trading before you open an account with any broker.

3) Absence of risk management tools: Because the forex market is risky, you should avoid brokers that do not have risk management tools or features, such as stop loss order.

Since the United Kingdom is no longer part of the European Union (EU), there is no assurance that you can open a trading account with a UK broker.

If you are living in Europe, a UK broker can only accept you as a client if they have an EU entity. Most forex brokers have their EU entity registered with Cyprus Securities and Exchange Commission (CySEC).

So, if the trading conditions of a UK broker satisfies you. You can open an account with them if they are regulated with CySEC. However, trading conditions might differ for UK and EU clients so make sure you do your research.

Forex brokers have different account types. There are accounts that cater to retail traders and there are accounts for professional traders.

For retail traders, brokers have different names for their accounts. However, there are usually standard accounts. These accounts have high spreads with little or no commission. The next popular account is a trading account with raw spreads. The advantage of this account is that the spreads are low (almost zero).

Because the spreads are low, you will pay more in commission. So which account has the lowest fees? The truth is forex brokers will make money through trading fees. There is no way around that. It depends on your choice. Do you want a high spread/zero commission account or vice-versa.

You can also use a calculator to see your projected trading cost. There are forex brokers with trading calculator on their websites.

For professional traders, it is entirely different. You will hardly find the fees for professional accounts on your forex broker’s website. When you successfully open a professional account, you will have access to all the fee and other charges that come with it.

Please note that a Pro Account does not mean a professional trading account. There are many forex brokers who have retail accounts name Pro Account. Make sure you contact your broker for more details.

Leverage is one of the reasons traders are attracted to forex trading and CFDs. This is because leverage allows you to open trading positions beyond the money in your account. You get to borrow money from your broker in a bid to maximize profits on a trade. If you lose the trade, your loses will be higher because of leverage.

Forex trading is strictly regulated in the UK. Unlike loosely regulated environments, forex brokers cannot offer excessive leverage in the UK. Retail traders get a maximum leverage of 30:1. This means that with $2,000, you can open trade positions worth $60,000. While this is massive, it is very risky because of potential losses.

Professional traders in the UK have access to even higher leverage. Typically, the leverage for professional traders is 1:500. It might be lower for some brokers but the max is 1:500. However, you cannot open a professional account without a financial portfolio of over €500,000. You will also need to prove other work experiences.

In conclusion, 30:1 leverage is legal and permitted in the UK. That is still quite high and risky. If you can, try to trade with lower or no leverage.

Yes, copy trading is legal in the UK. It can only be offered by forex brokers that are regulated with the Financial Conduct Authority (FCA). In addition, the FCA has their own rules on copy trading which aligns with the EU’s MiFID

To protect users who copy trades. Here are some rules the FCA has put in place:

– Forex brokers must show clear risk warnings about losses associated with trading

– All copy trading services must operate under CFD and investment regulations

-Traders can choose to modify or stop copying trades at any time.

The conditions for professional traders are higher. There are three major criteria that is needed for all professional traders in the UK:

1) The first is that you must have carried out 10 substantial transactions per quarter over the past four quarters.

2) The second criteria is the size of your trading portfolio. It must be over £500,000 according to the FCA.

3) You must have at least one year of professional working experience in the financial sector.

You are required to meet only two of these three criteria to be designated a professional trader. You will also submit documents and paperwork that shows you meet the criteria.

Please note that there are certain privileges you might lose once you are designated a professional trader. You will not have access to the FSCS insurance and you might not have access to negative balance protection.

Speak to your broker to know their rules for professional traders.

On average, 85% of forex traders lose their money. The main reason this happen is because traders get emotional. As a trader, do not let greed and revenge trading dictate your trading. They lead to poor risk management, which eventually lead to losses.

Not all forex brokers operate the same way. There might be few similarities in some things. But when it comes to business models, the differences are usually clear.

Here are the most common forex business models:

DD: DD means dealing desk brokers. They are also known as market makers. This means they are counterparties to your trades. In other words, they take the opposite side of your trading positions. DD brokers can have different pricing models, some are fixed spread brokers, while others have variable spreads.

Also, some market market maker brokers offer instant order execution, but there may be slippage if the price is moving fast.

NDD: NDD means non-dealing desk brokers. Unlike DD brokers, NDD brokers are mediators. They connect their clients to interbank markets. Instead of a dealing desk, your trades are sent straight to banks and liquidity providers.

The direct market access offered by NDD brokers prevents requoting because prices are updated in real time. NDD brokers are further divided into ECN and STP brokers.

Here is a breakdown of the two:

ECN: ECN means Electronic Communication Network. ECN brokers are a liquidity hub. They have different liquidity providers, banks , and hedge funds that are connected. Your trades are sent electronically into this hub. There is no price manipulation and every participant has access to the price feed.

STP: STP means Straight-Through-Processing. STP brokers route your trades directly to liquidity providers who act as counterparties to your trades. STP brokers also add a mark up to spreads received by liquidity providers. That is one of the ways they make their money.

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

License: Your trading platform should be well regulated. The FCA license held by brokers in the UK is a tier-1 license. This gives you access to certain protections like FSCS insurance, negative balance protection, segregation of funds and so on.

GBP-base Account: Choosing a trading platform with your local currency account is good. As a beginner, you want to avoid excess charges like conversion fees. If you want to go the conventional way, you can open a USD trading account.

UK friendly payment methods: Bank wire transfers and debit/credit cards should be supported. More payment options like Skrill, Neteller, and other e-wallets help lets you enjoy a degree of flexibility. E-wallets are not available everywhere especially if you prefer a certain company.

So, the bare minimum is payment via your bank and your cards.

Diverse account types: A UK forex broker will likely have at least two trading accounts. There is usually a Standard Account, an ECN Account, and a Spread Betting Account. Not all account types are suitable for beginners. A Standard Account might be a good place to start.

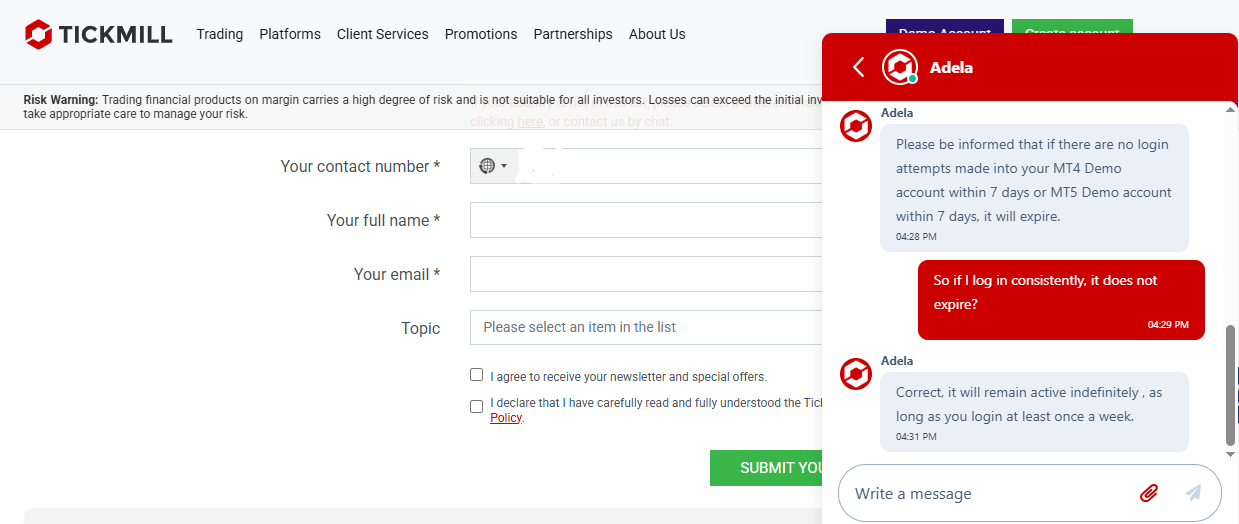

Free Demo account: Beginner traders need a demo account. An unlimited demo account that does not expire is preferable. This is helpful for practice of trading strategies. You are also able to trade objectively since there is no fear or greed to make money.

Tickmill is one of the UK brokers with a demo account that does not expire. We reached out to their customer care agent. Their response is displayed below:

You will find varying accounts with different forex brokers. Most of these accounts have a thing or two common to them.

This list is not executive by any means. However, you will find it helpful as you research forex brokers and choose a trading account.

1) Demo Account: The main property of this account is zero risk. You use virtual money on this account to practice trading and test your strategies. All forex brokers offer a demo account (whether for a limited or an unlimited period).

2) Islamic Account: The key attribute of this account is sharia-compliance. This ensures those of the Muslim faith can trade forex without violating the principles of Sharia Law in Islamic Finance. This account is usually swap-free.

3) Standard Accounts: Most Standard Accounts have a basic trading operation because the broker serves as a counterparty to your trade. The spreads for trading CFDs on this account is usually high but you will likely pay no commission.

4) ECN Accounts: ECN Accounts are for brokers looking for lower spread costs. The spread of CFDs on this account is tight but you will pay commissions as your trading fee. The commission can be as high as $3.5 per standard lot.

Note: The essence of this section is not necessarily about the names of the account. It is about the properties and that is what you should look out for. A forex broker might name their account a Pro Account but has ECN properties. So the properties of the account is superior to whatever the account is named.

The forex market is open 24 hours for 5 days in a week. This is possible due to a global network of trading centers. The market does not operate on Saturday and Sundays. There might be some partial operations on Sundays but there is usually not enough liquidity in the market.

The forex market opens at the beginning of every week in the Asian region and closes in the North American region. This allows you to take advantage of trading opportunities across different trading sessions.

Here are the most common trading sessions:

Asian session: The Asian session is also called the Tokyo session. This session kicks off trading for the day. Trading starts in Sydney (Australia) at 10 PM GMT. Tokyo opens for trading next by 12 AM GMT. Liquidity is very low during the Asian session. You can maximize this session by trading AUD and JPY pairs.

European Session: This session is also known as the London session. It opens 8 AM GMT and has the most liquidity because it overlaps with the Asian and North American session. Volatility is also very high. EUR, CHF, and GBP pairs are the best to trade in this session.

North American Session: Popularly known as the New York session, trading begins here at 1 PM GMT. It overlaps with the London session between 1 PM and 5 PM GMT. These four hours are usually very active because of the session going at once. The New York session is the best time to trade USD pairs.

Most strategic traders prefer to trade when there is a Tokyo-London or London-New York session.

N.B: There are other minor sessions within the sessions above. For example, Frankfurt session in Germany opens before London within the European session. However, these are the sessions discussed above are the most popular ones that traders work with.

There are a number of GBP pairs in the forex markets. They range from major pairs like GBP/USD to minor pairs (e.g. GBP/JPY), and exotic pairs like GBP/ZAR. In all, there are over 10 GBP pairs in the forex world. The ones you have access to depend on your forex broker’s offering.

All forex broker offer the GBP/USD because it is a major pair. The GBP/USD is also called the cable. It is the best GBP pair to trade in the UK. It is the most liquid with high volatility. In addition, the London and New York session overlap from 1 PM to 5 PM GMT. This is the best time to catch best trends and trade set-ups for GBP/USD.

Liquidity is also very high during this time. So, if you are considering GBP pairs, GBP/USD is a good pair to start with.

Any forex broker that is regulated with FCA is considered safe for trading. You should then compare factors like overall fees, trading conditions, platforms, number of instruments, support, withdrawals time, etc. As per our comparison City Index, Pepperstone & IG Markets are reputed forex & CFD brokers regulated in UK.

Yes, trading forex via a FCA regulated CFD & forex broker is legal. You must ensure that you are dealing with a licensed forex broker for the safety of your funds. So avoid any unlicensed brokers. Also, note that trading forex & CFDs is very risky & most retail traders lose money.

Make sure to verify that the broker that you are choosing is regulated with FCA. Then check the forex broker’s license no. You can also verify their website on FCA’s website. Carry out proper due diligence to make sure you are not trading with any unlicensed or fake broker.

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell).

A forex broker could be a market maker which means they could be taking the opposite sides of your trades or a No Dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

You can read our in-depth research on the best ECN brokers to understand this better.

Forex brokers are required if you want to trade forex & CFDs. They offer their trading platforms, market data, charting, tools, and the liquidity you need to buy or sell currencies. They are required by anyone who wants to trade forex (retail or professional).

According to our assessment, Tickmill offers competitive spreads and low round-turn commission. Looking at their pricing for EUR/USD for example, the typical spread is 0.1 pips (Pro and VIP Accounts). The total round turn commission for both accounts for a standard lot is £4 (Pro Account) and £2 (VIP Account), which is lower than most forex brokers.

For more on this, you can read our review on low spread brokers.

A dealing desk broker takes the opposite side of your trade & is also called a market maker broker.

When you buy a currency pair they sell. When you sell, they buy. On the other hand, non-dealing desk (NDD) brokers connect your trades to buyers/sellers in the market via computerized networks.

Some brokers like FxPro follow the hybrid model, so they can act as a dealer sometimes.