Pepperstone is a CFD broker with multiple tier-1 regulations. They offer currency pairs and other CFDs which include shares, indices, ETFs, commodities, and currency indices. Cryptocurrency CFDs are available for professional traders only.

Pepperstone is licensed with the Financial Conduct Authority (FCA) as Pepperstone (UK) Limited. The FCA is one of the top-tier regulators of financial services providers. We consider Pepperstone a low-risk broker because of this.

Traders in the UK can open a trading account and deposit/withdraw via bank transfer, PayPal, and credit/debit card. Pepperstone also has an office in London and offers a Great Britain Pound (GBP) base currency account. The forex broker also have a UK toll-free number for customer support.

| Pepperstone Summary | |

|---|---|

| Broker Name | Pepperstone |

| Establishment Date | 2010 |

| Website | www.pepperstone.com/en-gb |

| Address | Pepperstone Limited, 70 Gracechurch St London EC3V 0HR United Kingdom. |

| Minimum Deposit | No minimum deposit |

| Maximum Leverage | 30:1 (retail traders), 500:1 (professional traders) |

| Regulation | FCA, ASIC,CySec, CMA, BaFin, DFSA, and SCB |

| Trading Platforms | MT4, MT5, and cTrader for PC, Mac, Web, Android |

| Visit Pepperstone | |

Pepperstone Pros

- Pepperstone is licensed with FCA

- No account dormancy fee

- Good customer support

- Pepperstone supports MT4, MT5, and cTrader. These platforms are available on PC and mobile phones.

- Has negative balance protection.

Pepperstone Cons

- Pepperstone charges commission of GBP 4.50 per standard lot round turn with Razor Account

- No guaranteed stop loss order

Regulation and Safety of Funds

Pepperstone is considered low risk for traders in the United Kingdom because they are regulated in the region. In addition, they also have another top-tier regulator in the Australia Securities and Investments Commission (ASIC). Let us take you a little deeper into Pepperstone’s regulators.

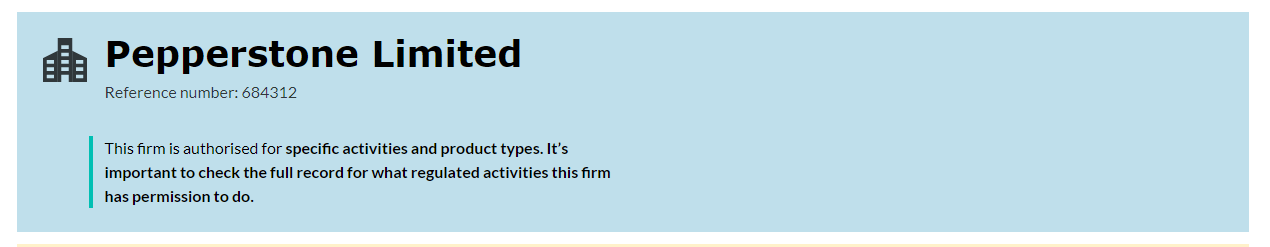

1) FCA: The Financial Conduct Authority (FCA) is the United Kingdom’s financial watchdog. Pepperstone is regulated with the FCA as Peperstone (UK) Limited. Their FCA reference number is 684312.

Apart from these regulations, Pepperstone is also mandated to compensate retail traders for up to £85,000 if they go into liquidation. This is according to the FCA’s directive to all the firms they regulate under the Financial Services Compensation Scheme (FSCS).

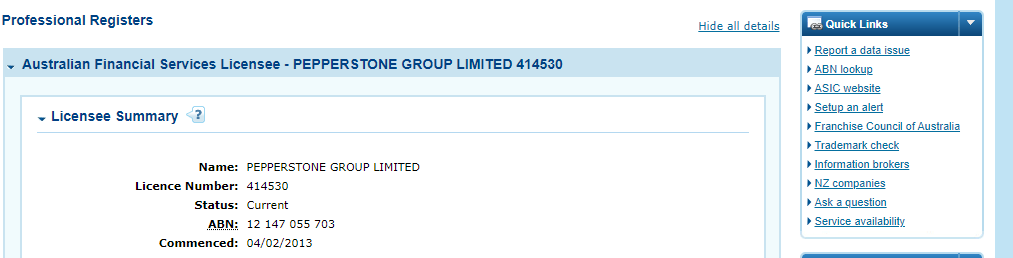

2) ASIC: Pepperstone’s registered name with ASIC is Pepperstone Group Limited. ASIC issues all financial service providers the Australian Financial Services License (AFSL) Number. 414530 is Pepperstone’s AFSL number.

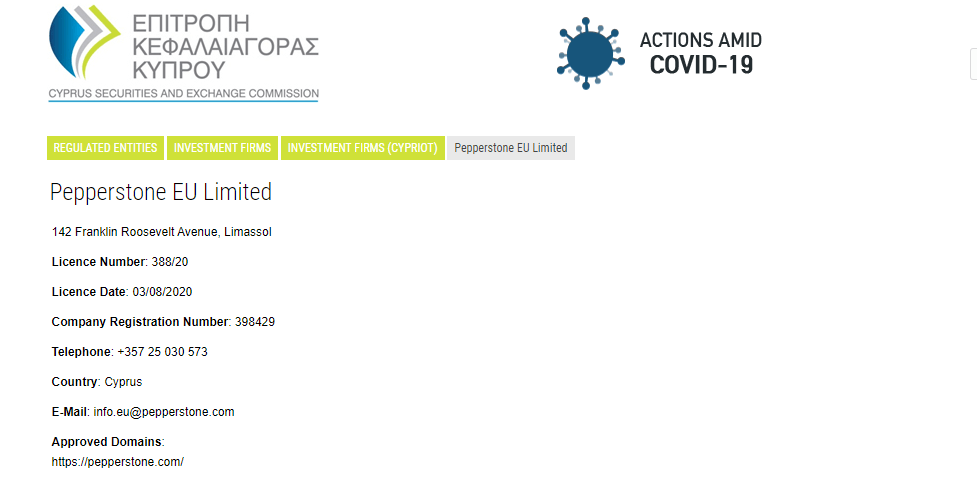

3) CySEC: Cyprus Securities and Exchange Commission is based in Cyprus. Pepperstone registers traders from other European regions under this regulator. Pepperstone is regulated with CySEC as Pepperstone (EU) Limited. Their company registration number is 398429 with license number 388/20.

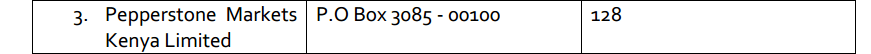

4) CMA: Capital Markets Authority is based in Kenya. Pepperstone is regulated with the CMA as Pepperstone Markets Kenya Limited. Their license number is 128.

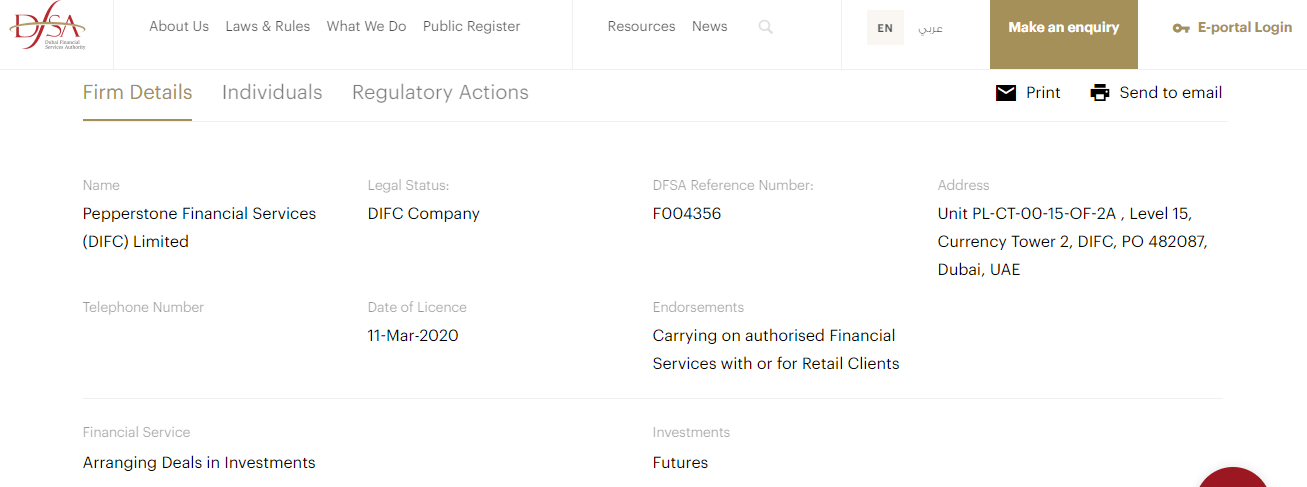

5) DFSA: DFSA is Dubai Financial Services Authority. Pepperstone is regulated with the DFSA as Pepperstone Financial Services Limited with license number F004356.

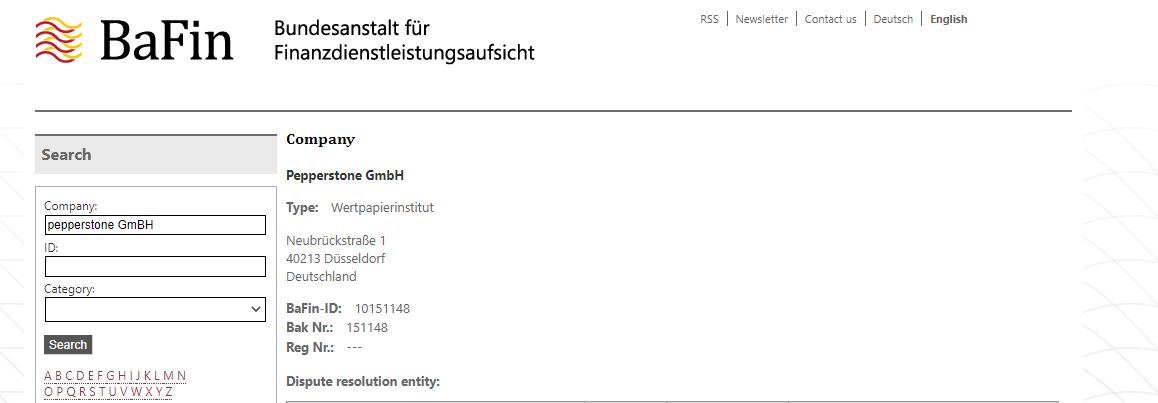

6) BaFin: BaFin is Germany’s financial watchdog. Pepperstone is regulated in Germany as Pepperstone GmBH with license number 151148.

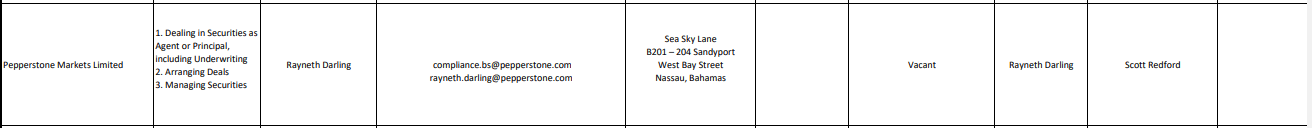

7) SCB: SCB is Securities Commission of The Bahamas. Pepperstone is regulated as an SIA company under the name Pepperstone Markets Limited. Their license number is 177174 B/SIA-F217.

Pepperstone Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Peperstone (UK) Limited |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Pepperstone (EU) Limited |

| Kenya | Ksh 50,000 | Capital Markets Authority (CMA) | Pepperstone Markets Kenya Limited |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Pepperstone Group Limited |

Pepperstone Leverage

Maximum leverage for fx pairs is 30:1 for retail traders. Professional traders can leverage up to 500:1 for fx pairs. Pepperstone’s leverage for other CFDs is shown below. We have compared the Professional and Retail Leverage for you

| Instruments | Professional Leverage | Retail Leverage | Forex | Up to 500:1 | 30:1 |

|---|---|---|

| Indices | Up to 200:1 | 20:1 |

| Gold | Up to 500:1 | 20:1 |

| Other Commodities | Up to 200:1 | 10:1 |

| Cryptocurrencies | Up to 10:1 | N/A |

| Equities | Up to 20:1 | 5:1 |

Note that trading leveraged products are risky, and you can lose your money. It is best to avoid it. Only trade if you have experience or understand them.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

Pepperstone Account Types

Pepperstone UK has three account types – a Razor Account, a Spread Bet Account, and a Standard Account. You can open either of the two accounts with GBP as your base currency.

Let’s take a deeper look at these accounts

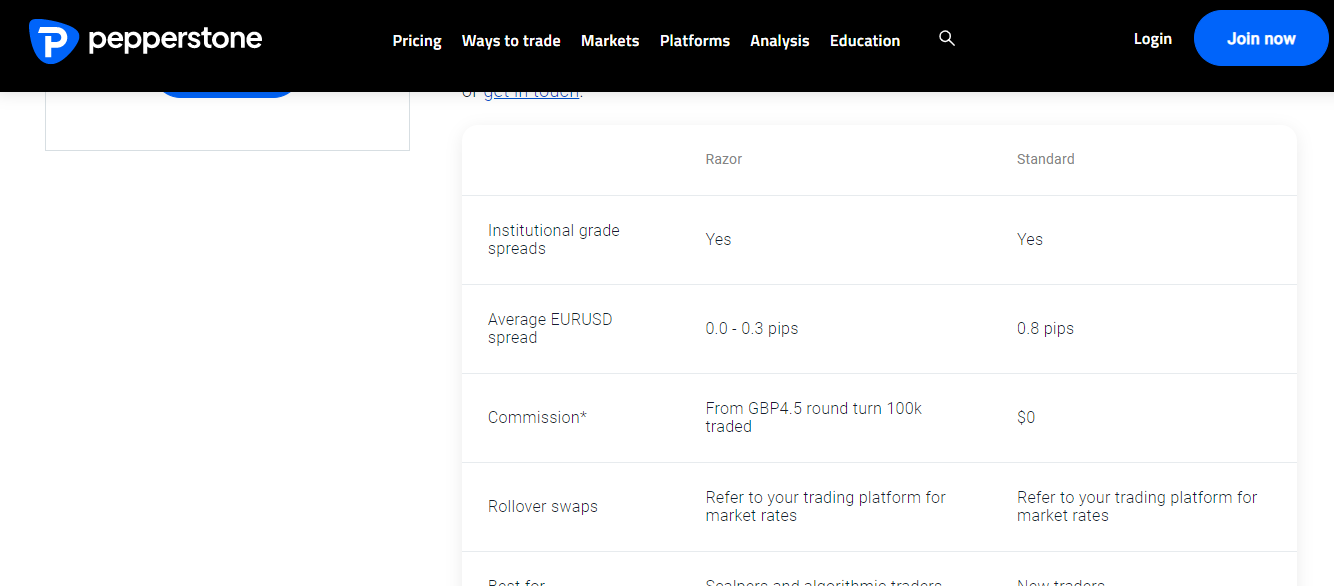

1) Razor Account: The Razor Account is a raw spread account with low average spreads. The minimum spread for most currency pairs is zero. In addition, there is an extra commission per standard lot.

2) Standard Account: This account type is different from the Razor Account. The spreads are not raw and the typical spread is high for major currency pairs. Pepperstone does not charge an extra commission per standard lot on this account.

3) Spread Bet Account: The Spread Bet Account is for traders that want to stake a fixed amount of money on a unit movement in the spread. Pepperstone offers a low spread for major currency pairs on this account and charges no extra commission per standard lot. Profits from this account are not subjected to capital gains tax.

You can open this account with any spread betting broker in the UK.

Pepperstone Fees

Pepperstone’s fees are on their website for potential clients to see. Here is a review of their fees below:

1) Spread: Pepperstone UK offer different spreads on their three accounts. The Razor Account has raw spread so they are typically low. The average spread on the Standard Account is higher. You can see the average spread for major currencies for the accounts in the table below:

2) Commissions: Pepperstone only charge commissions on their Razor Account. The commission differs based on the trading platform you choose. If you are using MT4/MT5, you pay a commission of £2.25 per standard lot. This means your round-turn commission is £4.50.

On the other hand, the commission on cTrader is $3 per standard lot ($6 round-turn).

Pepperstone Trading fees Table

Here is a summary of the average spread fees and commission Pepperstone charges on some instruments:

| CFD instrument | Spread (Standard Account) | Commission |

|---|---|---|

| EUR/USD | 1.1 pips | £2.25 |

| GBP/USD | 1.4 pips | £2.25 |

| EUR/GBP | 1.4 pips | £2.25 |

| XAU/USD (Gold) | 0.15 pips | None |

| Crude oil | 2.5 pips | None |

| UK 100 | 1.0 pips | None |

| US 30 | 2.0 pips | None |

*Commission stated here are for MT4 and MT5 platforms. Other platforms have different commission charges.

3) Swap fees: Anytime you keep a trade position open overnight (past market closing time), you pay swap fees. Pepperstone’s swaps are only accessible on their trading platforms. You can only find the formula to calculate the swap on their website. The average spread data is as per the data on Pepperstone’s website.

3) Non-Trading Fees: Non-trading fees refer to funding fees, withdrawal fees, and inactivity charges. Pepperstone charges low non-trading fees. See details below:

Pepperstone Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | None |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

How to Open a Trading Account with Pepperstone

You need a live account before you can start trading. Here are the basic steps for signing up with Pepperstone:

Step 1) Go to Pepperstone’s website at www.pepperstone.com/en-gb

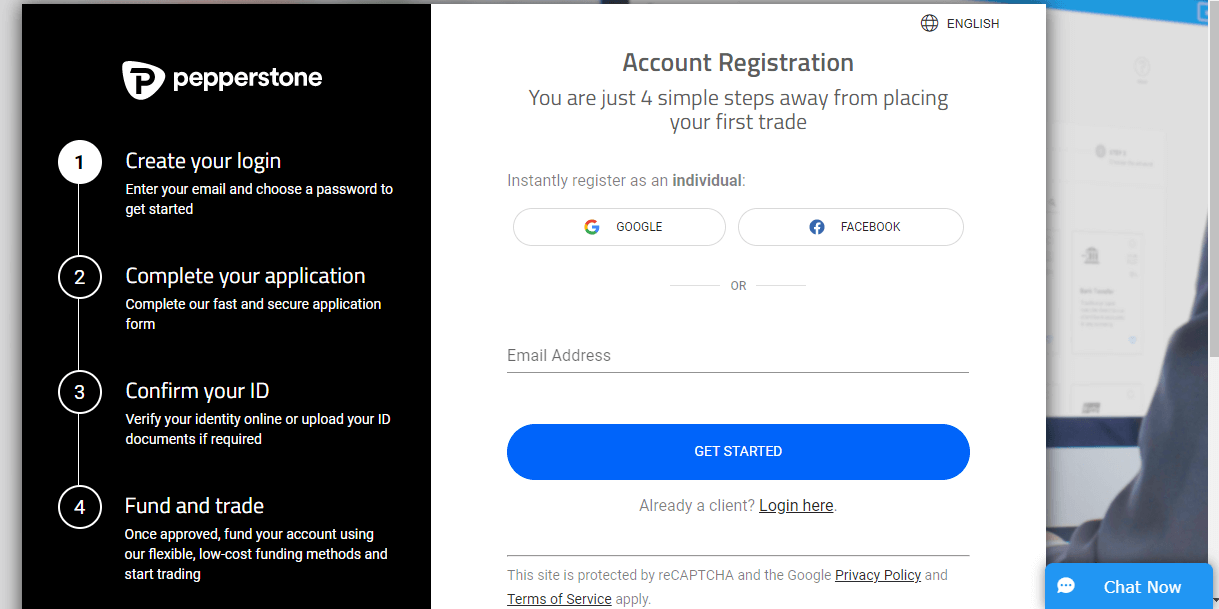

Step 2) Click on the ‘Join Now’ button, highlighted in the yellow box, at the top right side of the page.

Step 3) Enter your emai and click on “Get Started”.

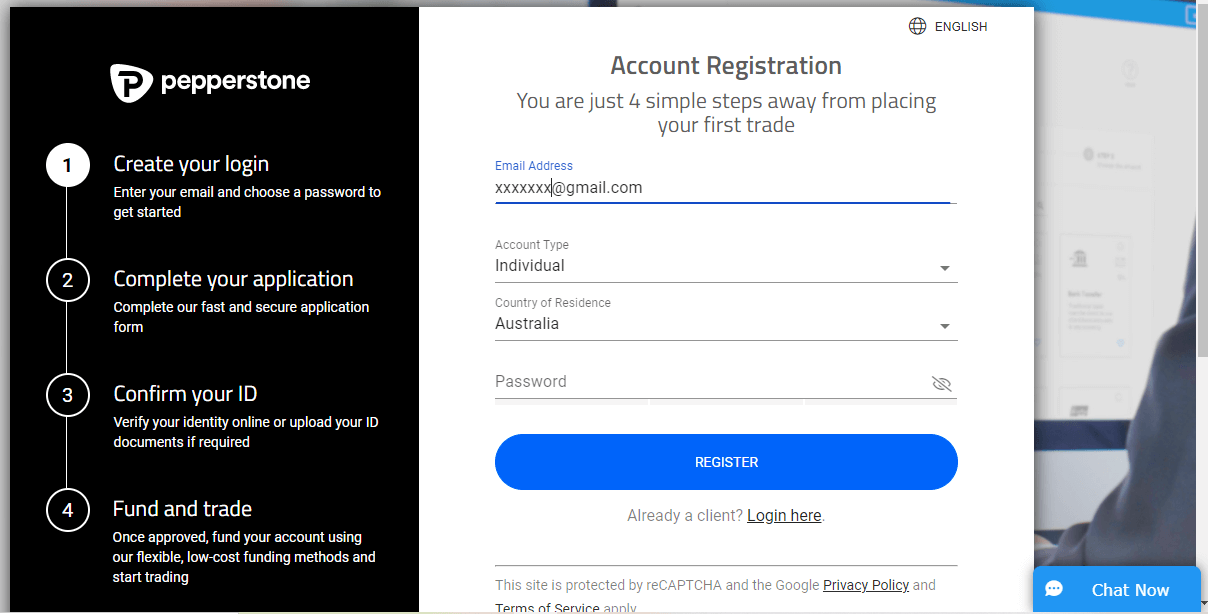

Step 4) You will enter your email again, and fill in your account type, country of residence, and preferred password.

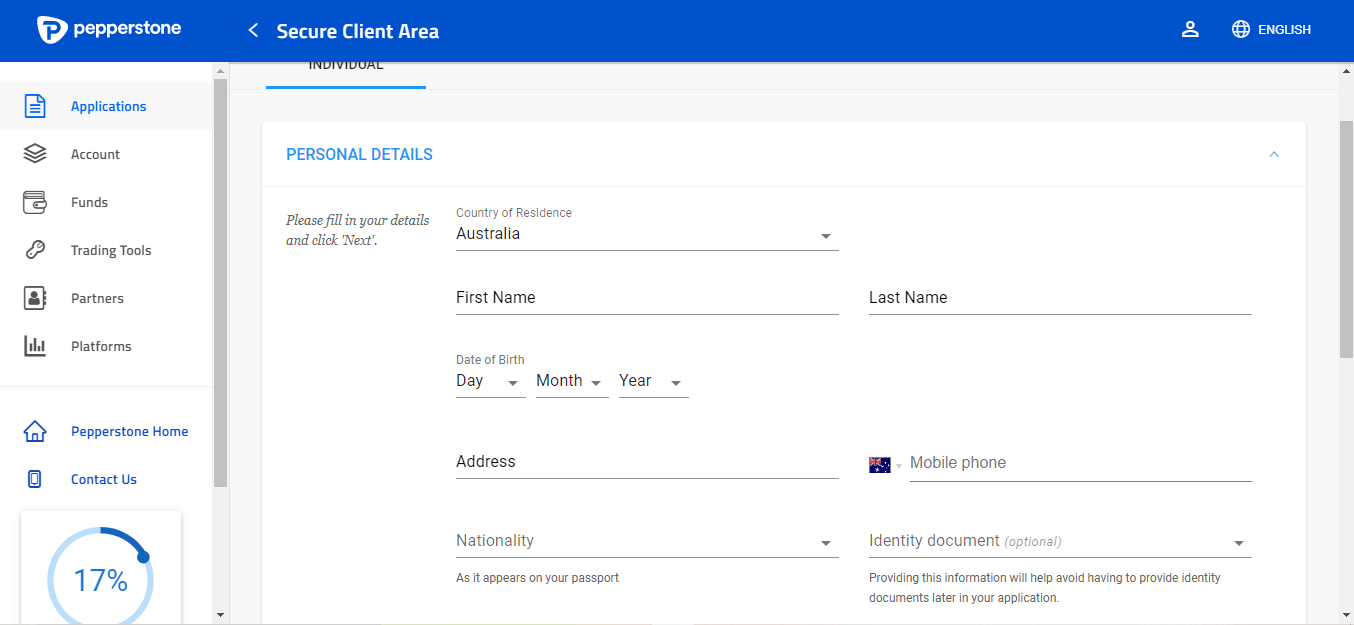

Step 5) At this point, you have access to your secure client area where you are required to fill in more details about yourself. Your date of birth, nationality, and identity document is required here.

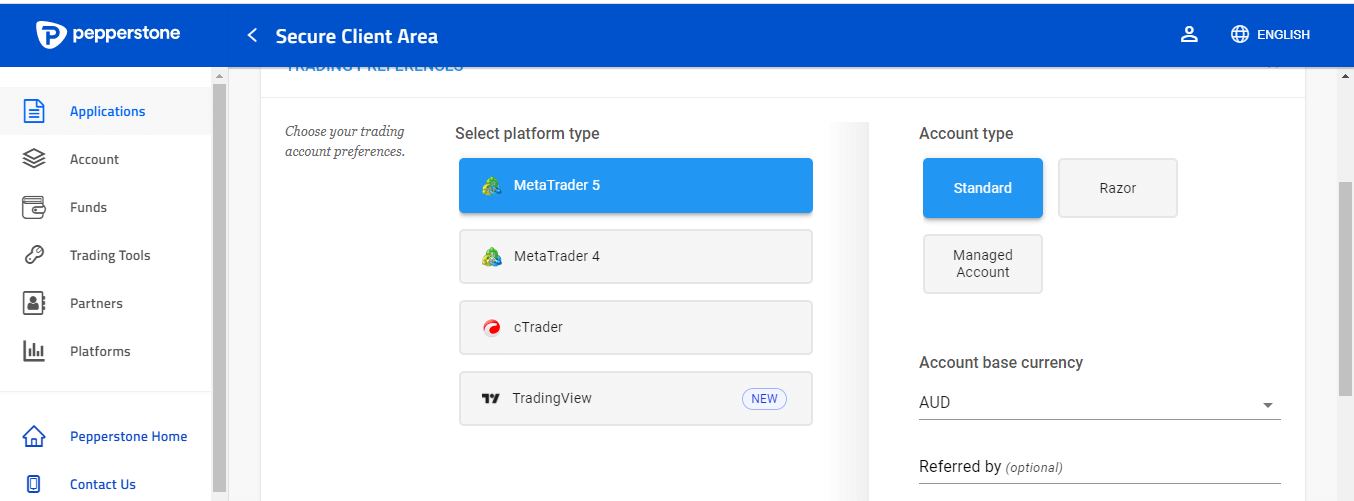

Step 6) Scroll down on your secure client area to choose your trading platform, account type, and base currency

Step 7) Next, you will be required to upload a valid ID document to verify your identity and a proof of residence to verify your address. You will also need to very your employment and income.

Step 8) After your documents have been approved, you should receive an email that contains your login details for your trading platform. You can proceed to fund your account and begin trading.

Pepperstone Deposits & Withdrawals

UK-based traders can fund their accounts or withdraw via multiple channels supported by Pepperstone. Bank transfer, credit/debit card (Visa or Mastercard), and PayPal are available for transactions.

By all means, avoid using third-party accounts. You might have issues withdrawing your money because Pepperstone will not remit to third-party accounts.

Below we have provided an overview of deposits and withdrawals on Pepperstone UK.

Pepperstone Deposit Methods

Here is a summary of payment methods accepted by Pepperstone for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | Same day |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (PayPal) | Free | Instant |

Pepperstone Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Pepperstone.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 1-2 working days |

| Cards | Yes | Free | 1-3 working days |

| E-wallets | Yes (Skrill, Neteller) | Free | 1-3 working days |

What is the Pepperstone Minimum Deposit?

Pepperstone does not enforce a minimum deposit. According to their customer support, traders usually deposit £200 for a start. However, Pepperstone recommends a minimum deposit of £500 because of margin requirements.

What is the Pepperstone Minimum Withdrawal?

There is no specific minimum withdrawal. It depends on your preferred withdrawal method. Your money might take 3-5 working days to arrive in your account if you are withdrawing via bank wire transfer

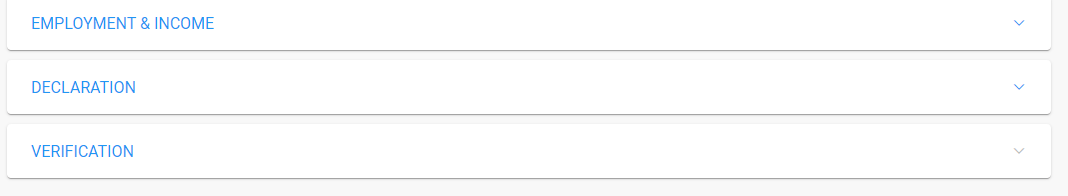

How do I Deposit/Withdraw Funds?

Deposit/withdrawal is easy. All you need to do is go to your secure client area and click on “Funds”. Right there you will see an option to “Add Funds” or “Withdraw Funds”. When you click on either of them, the funding/ withdrawal options will be shown.

Pick your preferred option and complete your transaction.

Trading Instruments at Pepperstone

Pepperstone offers over 1,200 trading instruments. All instruments are offered as CFDs. You can find their classification in the table below:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 62 |

| Indices CFDs | Yes | 23 |

| Commodities CFDs | Yes | 33 |

| ETFs CFDs | Yes | 97 |

| Shares CFDs | Yes | 600+ |

| Cryptocurrencies CFDs | Yes (Pro Traders Only) | 24 |

| Currency Index | Yes | 3 |

Pepperstone Trading Platforms

Pepperstone UK does not have a proprietary trading platform. They support third-party platforms in MT4, MT5, cTrader, and TradingView.

1) Pepperstone MT4: With this platform, you can customise the way you trade. It allows automated trading and you can your Expert Advisors using MQL4. It also comes with Autochartist, Smart Trader tools, and 85 pre-installed indicators. The downside, however, is that shares CFDs are not offered on it. Pepperstone MT4 is available on Android, iOS, and desktops.

2) Pepperstone MT5: Pepperstone MT5 is advanced and is available on Android, iOS, Windows, and Mac devices. Coding is more accessible in MQL5 and analysis is deeper with 21 timeframes. It has Autochartist and Smart Trader tools too. And shares CFDs are available on it.

3) cTrader cTrader is growing in popularity among traders. Pepperstone’s cTrader is optimized for indicators and EAs. You can customise your trades via cTrader Automate and enjoy advanced risk management. pepperstone cTrader is available on iOS, Android, and Windows. It is not available on Mac.

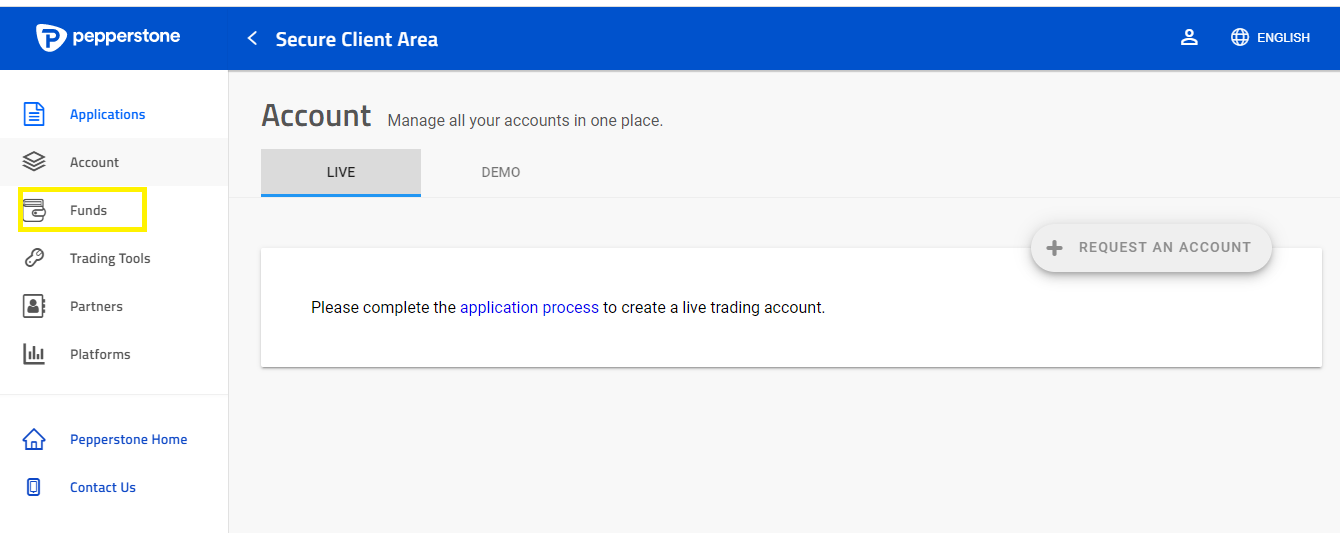

4) TradingView: TradingView is a third-party platform with advanced drawing and technical tools. You can connect your trading account to the platform and trade directly from there. Only Razor Accounts can get connected. TradingView is available on desktops and mobile devices.

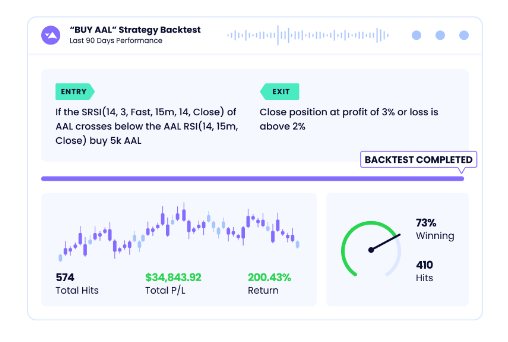

4) Capitalise.ai: Capitalise.ai is a third-party automation tool. It allows you to automate your trades without having to code. With Capitalise.ai, you can plan and execute your trades quickly without your emotions getting in the way.

Capitalise.ai can run 24/7, making sure you do not miss trading opportunities with timely entries and exits. Apart from automation, you can also improve your knowledge with Capitalise.ai’s strategy library and learning center. Pepperstone clients can access these and more via Pepperstone MT4 without extra costs.

Pepperstone UK Execution Policy

Pepperstone is an ECN broker. They do not take the opposite side of your trades or operate a dealing desk. As mentioned, the forex broker has a Razor Account with raw spreads typical of ECN conditions. Pepperstone strives to achieve the best execution for traders. They consider factors such as price, costs, speed, the likelihood of execution and settlement (liquidity), size, nature, type, characteristics of the financial product, and characteristics of the possible execution venues

if you don’t get the best prices, it will be because of one of these conditions. For example, in periods of low liquidity, spreads tend to widen, affecting the final price quoted. Execution venues also play an important role in execution. Pepperstone uses five execution venues according to our research. These venues are constantly reviewed to make sure the best prices are provided.

When executing your trade, Pepperstone takes into consideration price and cost as important factors in achieving the best results for you. However, other factors such as execution speed, nature of the order, etc, might be considered more important in certain conditions. These conditions include:

– your categorisation as a retail or professional trader. For retail traders, the important factors remain cost and price.

– order characteristics

– characteristics of the CFD you want to trade

– characteristics of execution venues

– specific instructions or objectives that relate to your trade.

How these conditions give you the best results is determined by Pepperstone.

Pepperstone Education and Research

Pepperstone UK has a comprehensive learning and research package. It is free and accessible to clients and non-client. Here is how Pepperstone helps you learn:

Learn to Trade: The ‘Learn to Trade’ section is divided into learn to trade CFDs, learn to trade shares, and learn to trade forex. Under learn to trade CFDs, the focus is on how to trade gold (XAU). It covers the best way to trade gold and key fundamental factors to consider.

Learn to trade shares deals with how to trade stocks as CFDs. The content in the section is introductory and good for beginners.

Learn to trade forex is divided into beginner, intermediate, and advanced content. It covers important concepts like pip value, technical analysis, trading terms, etc. All content in the learn to trade section is all text. No videos.

Trading Guides: The trading guides is a miscellaneous section. Different concepts of forex and CFD trading are explained here. Each topic is categorized as beginner, intermediate, and advanced. With this, you can know the topic to read at your level.

Webinars: You can register to join Pepperstone expert webinars. When you do, you will get a reminder so you can join live. Past webinars are also available so you can watch them. The webinars go back as far as 2019 and beyond so you can find and watch discussions that interest you.

Market Analysis: The Market Analysis section is to aid your research. It is divided into market news, daily fix, trading charts, and the economic calendar. The market news tracks economic events and important news that are relevant to the market. It is designed well and one news can focus on a single or multiple CFDs.

The daily fix and economic calendar are grouped together. The economic calendar helps you know the exact date and time important data or economic information will be released. The daily fix provides more details on the data and economic information to be released.

Trading charts are the final arm. Here, you get trade ideas based on technical analysis. Charts of CFDs are provided with indicators, trendlines, and analysis showing where the price may go. While this might be an easy way to avoid spending too much time on charts. We advice that you combine the trade ideas with your own analysis too.

Do not rely solely on trade ideas. Because Pepperstone will bear no responsibility for any loss incurred.

Pepperstone Talks: Pepperstone talks is a learning initiative. The company brought it forth in 2023 so it is pretty new. Pepperstone talks offer you deep insights and new perspectives in trading from market experts. The goal is to help you make sound trading decisions amidst increasing market unpredictability.

Pepprstone talks hold in webinar style. It is a live session so you will need to register to secure a spot.

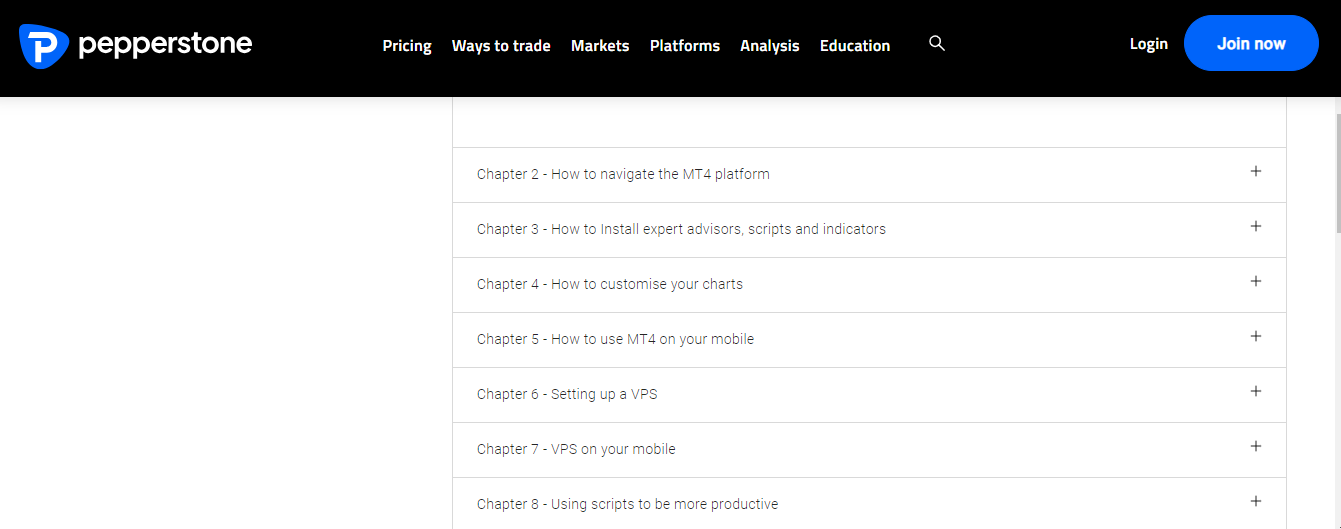

MT4 Course: This a new platform education package put together by Pepperstone. The course is presented by an expert and you will learn a lot of good stuff. This course is good for you if you are a beginner. You will learn how to automate your trades, maximize the featues on MT4, and MT4 shortcuts that will save you time.

Here is a breakdown of the course.

Learn Liquidity: Liquidity is an essential part of forex trading. Without high liquidity, trades do not get executed or they get executed at a very low speed. Pepperstone has a whole learning section on liquidity, illiquidity, pros & cons etc. As an extra, you will also know about the most liquid markets.

This section is full of helpful information. However, it is only in text format so you will be doing some reading.

Pepperstone UK Customer Service

Pepperstone has good customer support service. If you are a trader based in the UK, you can reach Pepperstone via

1) Live chat: Pepperstone gives fast replies on their live chat. Their chatbot named Pepper can transfer you to a live customer representative. We tested this and got a reply after four minutes. You do not need to open an account before you can use Pepperstone’s live chat. You only need to fill in your name and email.

2) Phone number support: Pepperstone have an UK toll-free number for UK traders. The number is +44 (800) 0465473. An international mobile number is also available (+44 203 807 4724). These numbers are available 24/5

3) Email Support: Email support is available on [email protected]. Pepperstone’s email support response is not as fast as the live chat. We got a response 23 minutes after we sent in an inquiry. The answers given were straight to the point and relevant to what we asked.

Do we Recommend Pepperstone for UK Traders?

Pepperstone is a low-risk broker for CFD traders in the UK because they have multiple tier-1 regulators including the FCA.

In addition, they have a Raw spread account with low spreads and moderate commission. They do not enforce a minimum deposit and offer negative balance protection. This means you cannot lose more than your trading capital.

Pepperstone’s trading fees may be on the high side for some instruments but they do not charge account inactivity fees or funding fees. They also offer a variety of CFD instruments in good numbers. Based on our review, we recommend Pepperstone as a reliable CFD broker.

FAQs on Pepperstone UK

Is Pepperstone UK a true ECN?

No, Pepperstone is technically not ECN but they have a raw spread account similar to that of ECN brokers. In addition, Pepperstone operates no dealing desk model.

Is Pepperstone regulated in the UK?

Yes, Pepperstone is regulated with the Financial Conduct Authority (FCA) under FRN 684312. Furthermore, they are regulated by the Australia Securities and Investments Commission, which is another tier-1 regulator. Pepperstone is safe and low-risk.

What is the minimum deposit at Pepperstone?

Pepperstone UK have no minimum deposit. They, however, recommend a minimum deposit of £500 for traders in the UK to cover margin costs.

Is my money safe with Pepperstone?

Pepperstone is regulated so your funds are safe. They have segregation of funds. And if they go bankrupt, your money is protected up to £85,000

How long does Pepperstone withdrawals take?

Pepperstone withdrawals take 1-3 working days. This applies to cards and e-wallets. Withdrawals to local bank transfers take 1-2 working days.

Can I use Pepperstone in UK?

Yes, you can use Pepperstone in the UK. The forex broker is regulated by the FCA and is a member of FSCS which insures your deposit for up to £85,000.

Does Pepperstone have GBP Account?

Pepperstone offers GBP base currency accounts to UK traders. All you need to do is select your base currency as GBP when signing up.

Note: Your capital is at risk