If you are a retail trader, you probably do not have a lot of money for your trading capital. This is why forex brokers allow you to deposit a small amount of money as your capital. Some will take between £100 – £200 while some will not even enforce a deposit.

Either way, the fact is your little capital as it is, is not enough to open trading positions. You need a substantial amount of money for that. This is where leverage comes in. So what exactly is leverage?

It is simply trading with borrowed money. Leverage allows you to borrow money from your broker so you can control larger positions. Without leverage, what you can do with your capital is limited. It is usually expressed in a ratio (like 10:1)

Leverage is a double-edged sword. It can amplify your gains or lead to a damaging loss. Why? Because the higher the leverage, the larger the positions you can control. This is why we have reviewed the CFD brokers with high leverage in the UK.

Warning: The leverage restriction for retail traders in the UK is 30:1. Avoid forex brokers with high leverage for retail traders. High leverage is for professional traders only.

Comparison of High Leverage Forex Brokers in the UK

| Broker | FCA Regulation | Max. Leverage (Retail) | Max. Leverage (Professional) | Visit |

|---|---|---|---|---|

| Pepperstone |

Yes

|

30:1

|

500:1

|

Visit Broker |

| CMC Markets |

Yes

|

30:1

|

500:1

|

Visit Broker |

| Forex.com |

Yes

|

30:1

|

500:1

|

Visit Broker |

| Tickmill |

Yes

|

30:1

|

500:1

|

Visit Broker |

| City Index |

Yes

|

30:1

|

400:1

|

Visit Broker |

Note: The leverage is as per information on these brokers’ websites in Jan. 2023.

Best High Leverage Brokers in the UK

Here is the list of best high leverage brokers in the UK as per our research:

- Pepperstone – High Leverage broker with Social Trading

- CMC Markets – CFD Broker with Most CFD Instruments

- Forex.com– High Leverage Broker with DMA Account

- Tickmill – High Leverage broker with Low spreads

- City Index – Forex Broker with FCA Regulation

Warning: High leverage is not an advantage. Only trade with regulated brokers that have a leverage cap or restriction.

#1 Pepperstone – High Leverage broker with Social Trading

Pepperstone is an FCA regulated broker. This means they are low-risk. Also, it means they have a leverage restriction on their CFD products. This restriction applies to both professional and retail traders.This also makes sure that retail traders are protected from huge losses.

Pepperstone offers three account types. There is the Razor Account with an ECN-like spread. This means the price of CFDs is gathered from a pool of liquidity providers. This account is good for you if you are a scalper or algorithmic trader. You incur a round-turn commission of £4.50 if you choose this account and the average spread ranges from 0.0-0.3 pips.

There is also the Standard Account. If you are a beginner or a new trader, this account is good for you. The spreads are institutional grade with an average spread of 0.6. No commissions are charged on this account.

Also, there is the spread betting account where you can stake money on an increase or decrease in the spread of trading instruments. There is no dealing desk on any of the accounts so execution is fast.

The base currencies available are GBP, USD, EUR, and CHF.

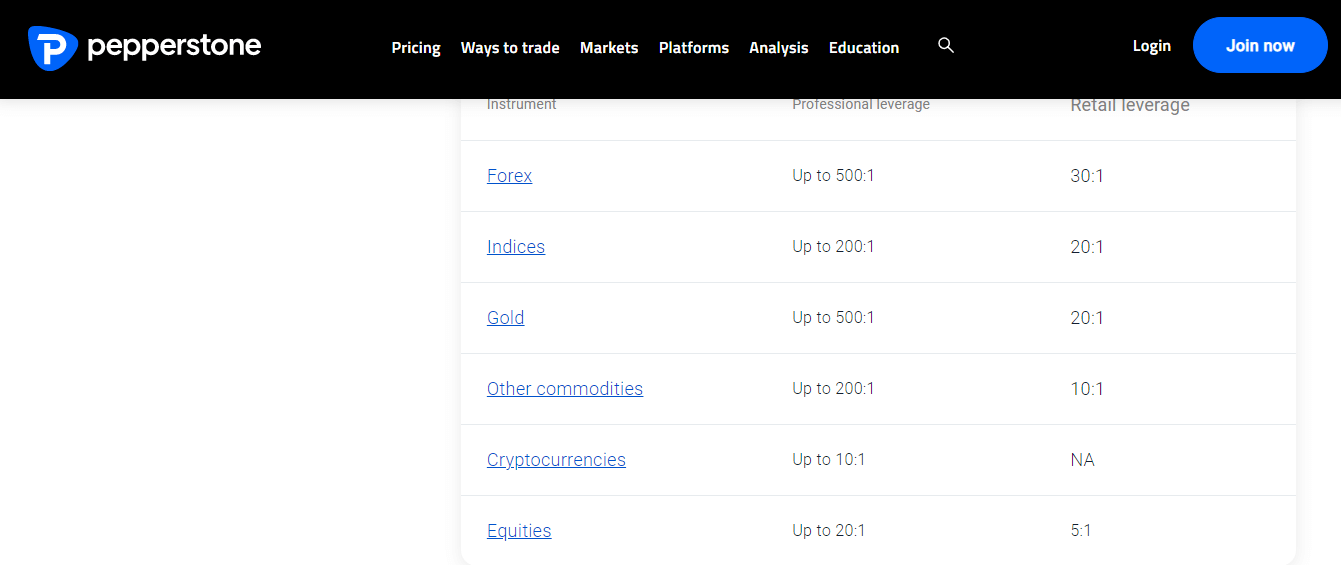

Pepperstone offers forex, indices, commodities, shares, and ETFs. The leverage for these products differs between retail and professional clients.

If you are a professional trader, your leverage for forex is 500:1, indices (200:1), gold (500:1), other commodities (200:1), cryptocurrencies (10:1), and equities (10:1).

But if you are a retail trader, your leverage for forex is 30:1, indices (20:1), gold (20:1), other commodities (10:1), and equities (5:1). You might be wondering why we did not include crypto CFDs for retail traders. Well, in the UK, Crypto CFDs are available to professional clients only.

You will have to open a Pro Account to access crypto CFDs.

Risk warning: 75.6% of retail traders lose their money when trading spread bets and CFDs with Pepperstone UK

#2 CMC Markets – CFD Broker with Most CFD Instruments

CMC Markets is another high leverage broker. They are regulated with the FCA so they are considered low risk. They accept retail and professional traders from the UK with different leverage for CFDs. This is in agreement with the FCA’s regulation.

Let us break down CMC Markets’ accounts. In the UK, CMC Markets offer a Spread Betting Account, CFD Account, and Corporate Account. According to their website, the Spread Betting Account is the most popular. There is no minimum deposit for all three accounts. However, only the spread betting account is exempted from capital gains tax.

Over 11,500 CFDs are available on all accounts with zero commission per standard lot. You incur a commission only when you trade shares CFDs (from $10 on CFD and Corporate Accounts only). There are also other fees for GSLOs and dormancy fees after one year of inactivity (£10).

You can also trade the markets with MT4 or their Next Generation trading platform. Different order execution types take profit, trailing stop-loss, and regular stop-loss is all available.

So, what leverage is offered to retail and professional traders?

For professional traders, the leverage for forex is 500:1, indices (500:1), commodities (200:1), shares (33:1), ETFs (10:1), treasuries (400:1), and cryptocurrencies (5:1).

If you choose to open a standard retail account, your leverage is 30:1 for forex, 20:1 for indices, 20:1 for metals, 10:1 for commodities, 5:1 for ETFs, and 33:1 for treasuries.

Like other FCA-regulated brokers, crypto CFDs are offered to professional clients only.

Risk warning: 67% of retail traders lose their money when trading spread bets and/or CFDs with CMC Markets

#3 Forex.com – High Leverage Broker with DMA Account

Forex.com is forex broker under StoneX Financial Ltd. The company is incorporated in the UK so they are regulated by the FCA. Forex.com are considered low-risk and operates under the FCA’s leverage cap rule.

Basically, you can open a Standard or MT4 Account. The difference between the two accounts is the trading platforms and their features.

The MT4 account lets you the popular MT4 to trade forex. On the Standard Account, you get access to a customizable web trader platform. Another extra feature that distinguishes the Standard Account is Chasing Returns. It is a tool that analyses your past trading behavior so you can make better trading decisions in the future.

Another thing is that shares CFDs are available on forex.com’s trading platform only. You cannot trade shares on their MT4.

Also, both accounts have variable spreads that are as low as 1 pip. Forex.com also offers a Corporate Account and a DMA Account but you probably won’t be needing those. Except you want to open an account for your business. Then you can open a corporate account.

No commissions are charged except for shares CFDs only. As per execution, Forex.com has a fast execution (0.05 seconds). 99.99% of trades are successfully executed.

Here are the leverages for the retail traders: for forex, it is 30:1, indices (20:1), gold (20:1), shares (5:1), and oil (10:1). Forex.com’s leverage differs by platform, market, trade size, and other factors. These figures might change as you trade.

Risk warning: 68% of retail traders lose their money when trading CFDs with Forex.com

#4 Tickmill – High Leverage broker with Low spreads

Tickmill has the lowest spreads compared to other high leverage brokers. They are regulated in the UK as Tickmill UK Limited so they are considered low risk.

Tickmill is a low spread broker. Their three accounts – Pro, Classic, and VIP are available for retail traders. The minimum deposit for the accounts is £100 except for the VIP Account (£0). Available base currencies include USD, EUR, GBP, and PLN with all strategies allowed.

Also, the typical spreads for major pairs are low. NZD/USD usually has the highest spread with forex brokers. For Tickmill, the typical spread for NZD/USD is 0.3 pips. This should give you an idea of how low their spreads are.

Tickmill supports MT4 and MT5 trading platforms. You can use them on your Mac, Android, iOS, Windows, or as a web platform. Pepperstone and Tickmill are the only forex brokers in this review that supports the MT5.

Tickmill offers stocks CFDs on their MT5 platform alone. You should consider this when choosing your trading platform.

You can find Tickmill’s maximum leverage below:

Professional clients: forex (500:1), stocks (20:1), indices (100:1), metals (300:1), bonds (100:1), cryptocurrencies (200:1).

.

Retail clients: forex (30:1), stocks (5:1), indices (20:1), metals 20:1), bonds (5:1).

Risk warning: 70% of retail traders lose their money when trading spread CFDs with Tickmill UK

#5 City Index – Forex Broker with FCA Regulation

City Index are is a market maker forex broker with FCA regulation. They are considered low risk and have been operating in the UK for decades. Like forex.com, City Index is also under StoneX Financial Limited.

If you sign up with City Index, you can open a CFD Trading or Spread Betting Account. You will be able to trade CFDs or spread bet on over 12000 markets. City Index is a market maker broker so no ECN pricing.

City Index supports their webtrader with HTML5 technology. Metatrader 4 is also available. The execution of trades is fast with pre-programmed orders. These orders give you flexibility in entering and exiting the markets.

One of these orders is the One Cancels Other (OCO). The OCO allows you to place a stop and limit order at the same time. When one of the orders is triggered, the other one is canceled. The remaining orders include the trailing stop-loss and GSLO.

You incur a premium fee if your GSLO gets triggered and there is a dormancy fee of £12. The dormancy fees vary depending on your account’s base currency. Except for shares CFDs, there’s no extra commission per standard lot.

Below is City Index’s leverage

Professional Clients: forex (400:1), indices (400:1), shares (33:1), cryptocurrencies (20:1), commodities (200:1)

Retail Clients: forex (30:1), indices (20:1), metals (20:1), commodities (10:1), shares (5:1).

Risk warning: 70% of retail traders lose their money when trading CFDs with City Index UK

What is a High Leverage Broker?

A high leverage broker is a broker that allows trading on high leverage. High leverage consequently means a low margin. Since a retail trader will need to control more volume of money than his capital, high leverage ensures he pays a small down payment.

This is why high leverage brokers are attractive to many retail traders. However, data shows many of them end up losing their money. Why so? Because leveraged trading is very risky. This is why the FCA has a leverage cap of 30:1 in the UK which can be considered high enough.

To reduce the risk of high leverage brokers, only trade with FCA regulated brokers.

Risks of High Leverage Brokers

As we have said earlier, only professional traders can access high leverage. However, there are some forex brokers that offer high leverage to retail traders. Most of these CFD brokers operate offshore where regulation is not strong. You should avoid such brokers

Signing up with such a broker puts your trading capital at risk. Why? You will be tempted to overleverage your trading account, which will lead to more losses. To make this clearer, we will look at two trade examples. One with 30:1 leverage, and one with 300:1 leverage.

For both examples, your trading capital is $50.

Example 1: After analyzing GBP/USD, you determine that the GBP will rise against the dollar. It is time to place your trade. Now, remember, your leverage is 1:30.

This means you can open a trade worth $1500 in volume

So, let’s break down the trade:

You are buying GBP/USD at 1.3500 with 0.01 lot size ($1000 volume) lot size. Your prediction is a rise in price by 50 pips (1.3550). You set your stop loss 20 pips below entry at 1.3480. After 4 hours, your stop loss was triggered.

Your total loss is calculated as 10 cents x 20 = 200 cents which equals $2.

That’s little right?. Next example.

Example 2: After analyzing GBP/USD, you determine that the GBP will rise against the dollar. It is time to place your trade. With 300:1 leverage, you can open a position worth $15000.

Because of this advantage, you chose to buy GBP/USD at 1.3500 with a 0.1 lot size ($10000 volume). Your guess is an increase in price by 50 (1.3550) pips with a stop loss of 20 pips (1.3480). The trade doesn’t go your way and your stop loss is triggered.

Your total loss is calculated as $1 x 20 = $20.

From these two examples, you can see how your loss increased 10 times when you open a bigger trading position because of high leverage.

High leverage amplifies losses. In our second example, you can see how the loss wiped out 40% of your trading capital in a single trade. This is why you must avoid forex brokers with high leverage.

How to Check a Forex Broker’s Leverage?

Every FCA regulated forex broker follows the leverage restriction for CFDs offered to retail traders. However, you cannot be too careful.

Even if a broker is regulated by the FCA, there is nothing wrong if you decide to confirm that they are not offering you high leverage. With Pepperstone as our example broker, here is a step-by-step guide for you to check a forex broker’s leverage:

Step 1) Go to pepperstone.com/en-gb. You should arrive at the homepage

Step 2) Click on “PROFESSIONAL” at the top left corner of the homepage (check the image in step 1). It will bring you to this page

Step 3) Scroll down till you arrive at the image below.

You can see how the leverage for retail and professional traders is clearly stated. Also, you can see how pro traders have access to higher leverage on all CFD instruments. Not all forex brokers have it like this on their websites.

For some brokers, you might find leverage under margin. Some brokers might even require you to click on the instrument before you can find the leverage. Summarily, the quickest way to get it done is to speak to the forex broker’s support.

They will likely send you a link where you can find all the leverage for their CFDs at once or answer you directly via email or live chat.

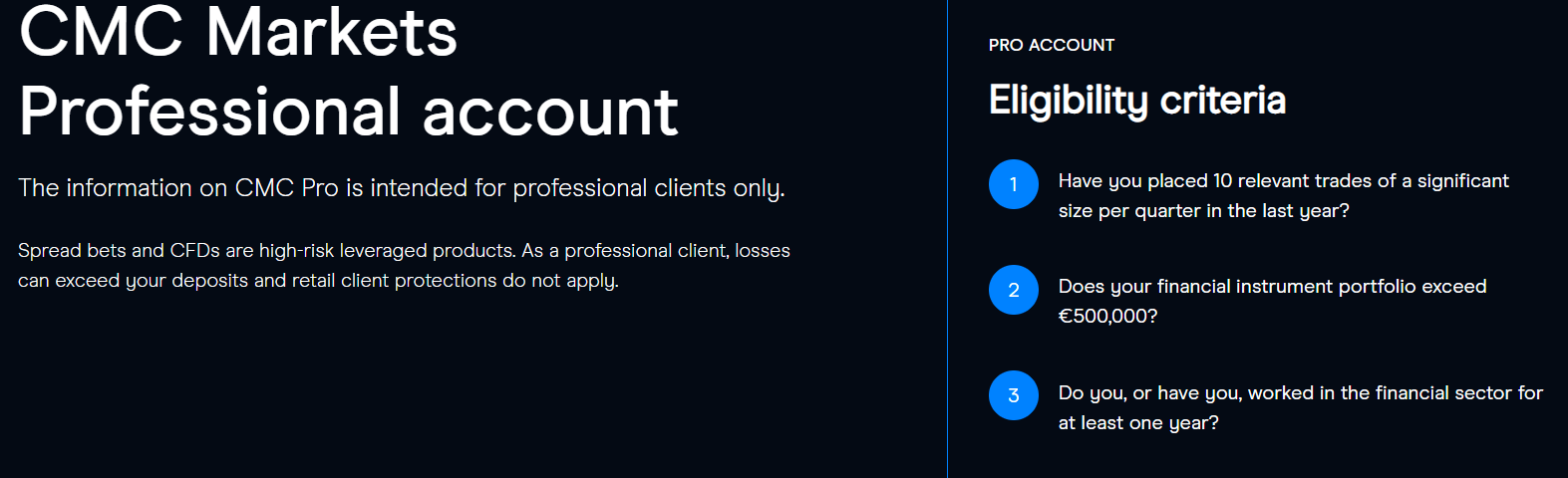

Before we end this section, you might be thinking, what does it take to be a pro trader? See, not all everybody is eligible to be a professional trader or open a Pro Account. There are three criteria you must meet.

Below are the criteria for Professional clients as seen on CMC Market’s website:

Generally, the following are the requirements.

1. Volume Requirements: You must carry out 10 trades per quarter of significant size.

2. Capital Requirements: Must have a financial instrument portfolio of €500,000 or higher.

3. Financial Adequacy: Must have a background in finance or at least 1-year of experience in the sector.

All forex brokers that offer a Pro Account demand that you meet these criteria. These requirements are the same for most brokers.

You will also have to submit documents that show that you meet these criteria when opening a Pro Account.

What is the Connection between Leverage and Margin?

Margin and leverage are connected. While leverage is being able to use little money to control larger trading positions. Margin is more like a down payment. It is a deposit your broker takes from your account to open your position.

The down payment is returned to your account when the trade is closed. Whether you win or lose, your margin is always refunded. The connection between leverage and margin is that one is expressed as a percentage of the other. For example, a 30:1 leverage equals to 3% margin (1/30 * 100).

What does this mean for your trade? It means when you open a position, 3% of your trading capital will be used as a margin to open the trade. Your broker supplies the remaining 97%. This is how leverage and margin connect.

What Leverage Ratio is Appropriate for Forex Trading?

In strictly regulated regions like the UK and Australia, there is a leverage cap so traders do not have much choice. However, you might find yourself in areas with low regulations where high leverage is offered. You might even be tempted to open an account with an offshore broker.

We advise against these. According to data, areas with excessively high leverage have a high number of traders that lose their money. We recommend that you stay with strictly regulate frameworks as much as possible. If you find yourself in a lightly regulated environment, leverage can be up to 1000:1. This increases the risk of losing all of your money. Therefore, we advise that you go for the lower and conservative leverage in these regions. Don’t let the emotion of greed expose you to risks.

Tips for Trading with High Leverage

Trading with high leverage is quite risky. However, there are useful tips that can help you limit losses and maximize profits. Here are some of the tips:

Trade with Regulated Brokers: This is not about trading with a broker that is regulated. It is about trading with a broker with top-tier regulations. There are brokers who are able to offer extremely high leverage because they do not have top-tier regulations.

These brokers are licensed with offshore regulators where supervision is not too stringent. You should avoid such brokers. Only sign up with brokers that are regulated with the FCA (UK), AISC (Australia), or CySEC (EEA). If your broker is regulated with one or more of these entities, then you will trade with a leverage cap and not be too exposed to the risk of losing your capital.

Demo Account: Demo accounts are zero risks accounts. Forex traders use them to practice their strategies. You can also use it to get acquainted with your broker and their leverage. A demo account lets you trade in a simulation so you do not lose any money.

Before trading with real money on a real account, practice trading your desired leverage on a demo account first. This way, you can measure the impact of the leverage on your trading capital, profit, or loss.

Stop Loss: To reduce losses that come with using high leverage, use a stop loss always. Do not leave your stop-loss position open. Using it will set the maximum amount you can lose. In addition, you can make your stop loss tighter than usual. Set it close to your opening price so you do not lose much money.

Risk Management Tools: Most forex brokers offer risk management tools that help reduce losses. It is important to ask your broker about their tools so you know how they can help. Guaranteed Stop Loss Order is one of the most popular risk management tools. Brokers charge a premium for traders that want to use it. GSLOs can be quite helpful when trading with high leverage. They make sure your stop loss is executed at the exact price you choose without slippage.

Money Management: Since high leverage allows you to control more positions with less money, it is important you make the right choice. You should not trade astronomically large lot sizes. That is how most traders lose their money. Try to trade at reasonable lot sizes that protect your capital and prevent a margin call. If you do the opposite, you will wreck your trading account.

Furthermore, you can also adopt the risk-to-reward (RR) approach. This approach measures how much you are likely to win against your loss in a trade. The rule of thumb is that your risk-to-reward ratio should be 1:2. This means for every trade you take, you should stand to gain at least twice the amount you might lose.

How does this help with high leverage? The advantage is that it helps you trade less. With proper RR calculation, you can weed out risky trades so you only trade when proper opportunities show up. The less you trade, the fewer the losses you are likely to incur.

FAQs on High Leverage Brokers in the UK

Which broker gives highest leverage in Forex?

All standard retail accounts in our review have the same leverage for forex (30:1). For Pro Accounts, Pepperstone, CMC Markets, Forex.com, and Tickmill give the highest leverage (500:1)

What leverage should I use for Forex Trading?

The best leverage is that which is offered by FCA regulated brokers, which is 30:1 for forex, and lower for other CFD instruments. However, it is even better if you can go lower to about 5:1 or lower for forex trading if you are new to trading

What leverage is best for newbies?

Newbie traders should never attempt to use high leverage. The standard 30:1 in the UK is the recommended leverage for newbies.

What leverage do professional traders use?

The maximum leverage for professional traders in the UK is 500:1. You can only use this leverage if you meet the criteria for professional traders set by UK-based forex brokers.

Does leverage increase profit?

Leverage increases the potential for profits from trade if the market moves in your direction. But it magnifies the potential for damaging losses that can make you lose all of your trading capital. It is important to know that most retail traders lose with high leverage.