Finding the best day trading platforms can be quite daunting. After all, there are a lot of brokers out there, and most of them have almost the same features.

The issue is beyond choosing a day trading platform. You should check if such platforms are regulated, how costly their fees are, the kind of instruments they offer, their minimum deposits, etc.

For this research, we reviewed over 42 regulated ‘CFD brokers’ in the UK that offer platforms for day trading. After reading this, you’ll have the relevant info you need to choose a day trading platform with low fees, good support & fair trading conditions.

Let’s go.

Below is a quick short summary for you if you don’t have a lot of time & want to quickly scan the day trading platforms in our list.

Comparison of Best Day Trading Platforms UK

| Broker | FCA Firm Reference No. | Commissions | Swaps | Visit |

|---|---|---|---|---|

|

509909

|

No commissions

|

Yes

|

Visit Broker | |

| CMC Markets |

173730

|

No commissions

|

Yes

|

Visit Broker |

| Capital.com |

793714

|

No commissions

|

Yes

|

Visit Broker |

| IG Markets |

195355

|

No commissions

|

Yes

|

Visit Broker |

Note: The swap and commissions are as per information on these brokers’ websites in May. 2023. Please see our methodology below.

Best Day Trading Platforms UK

Here is a list of the UK’s best day trading platforms for 2024

- Plus500 – Overall Best Day Trading Platform UK

- CMC Markets Mobile – Day Trading Platform with the Most Currency Pairs

- Capital.Com – Best Day Trading Platform for Beginners

- IG – Forex Trading Platform with Spread Betting

#1 Plus500 – Overall Best Day Trading Platform UK

Plus500 is regulated by the FCA in the UK. They offer an easy to use trading platform with biometric login. Their parent company (Plus500 Ltd) is an FTSE 250 company listed on the London Stock Exchange. They are on the main market for listed companies.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Account: There is just one account type at Plus500 for retail traders. This can be useful if you are a beginner trader as you don’t have to worry about different account features, and you have all the available features in a single account type. They also offer a demo account.

There is also no MT4, MT5, or cTrader. All trading instruments are on Plus500’s proprietary trading platform. CFDs such as indices, shares, commodities, and ETFs are available. Options are also supported. With Plus500, you can trade options on shares, indices, and commodities.

You should understand the importance of options relative to day trading. Since you won’t be holding your trades overnight in most cases, the availability of options can allow you to hedge the risks on your positions.

Other risk management tools include the trailing stop loss and the guaranteed stop loss. The latter helps you avoid slippage thereby reducing losses.

Warning: Using Options for hedging is not a perfect strategy, and you must fully understand it. Be careful how you use it.

Plus500’s trading platform has up 10 100 built-in indicators and drawing tools to aid your technical analysis. Also, there are features such as real-time price alerts that will help you time your entry and exit of the market. The platform is available as a mobile app for iOS and Android.

How much do you need to open a trading account with Plus500? Well, you can open a trading account with €100. This figure might differ with funding methods. There are no charges for deposit/withdrawal.

Refer to our Plus500 Review to see our detailed research.

Note that Plus500 is suitable for experienced traders only. It is best for beginners who lack knowledge and experience to start with a demo account.

Plus500 Pros

- Zero commissions

- Tight spreads

- Options are available for imperfect hedge

- Good market range

- Top-tier regulation with the FCA

Plus500 Cons

- No MT4. Only their proprietary platform

- They charge dormant account and currency conversion fees

#2 CMC Markets – Day Trading Platform with the Most Currency Pairs

CMC Markets is a day trading platform for UK traders, the broker is regulated by the FCA. The parent company is also listed on London Stock Exchange’s FTSE 250. This means there are even more layers of regulation apart from their financial services license.

Our major reason for choosing CMC Markets is because of zero minimum deposit.

You can carry out your day trading on a Spread Betting, CFD, or Corporate Account. There is no minimum deposit for any of the accounts. Please note that the Corporate Account is for your business (if you have one). No day trading platform in this guide has more currency pairs (333) than CMC Markets.

CMC Markets offer CFD Trading on shares, indices, commodities, ETFs, and treasuries. The sum of all CFD instruments totals 11,500. Because CMC Markets do not offer options trading, you cannot use the imperfect hedge strategy to manage risks.

CMC Markets also charge swaps but you will only be charged for commissions and spreads for day trading

The good thing about CMC Markets as a day trading platform is the wide market range. For example, if you do not want to trade a particular market (e.g currency pairs), you can trade CFDs on shares or any other alternative markets. Each market type available on their platform has a large number of CFD instruments.

MT4 is the only Metatrader available. But CMC Market’s ‘Next Generation’ trading platform might be a better option for you. It is also the only platform with shares CFDs. If you choose the MT4, you cannot day trade shares. The Next Generation platform has all the instruments.

The Next Generation platform is available on Android and iOS.

For more details on CMC Markets & their features, read our in-depth CMC Markets Review.

CMC Markets Pros

- FCA regulation

- Wide market range

- No minimum deposit

- Shares CFDs are available

CMC Markets Cons

- No shares CFDs on MT4

#3 Capital.com – Best Day Trading Platform for Beginners

Capital.com is regulated by the FCA. They are a day trading platform, they offer good conditions for day traders. They combine low fees with quality education on their CFD trading app. Capital.com is also licensed with ASIC in Australia.

With Capital.com, you can spread bet or trade CFDs. They give you access to over 5600 markets which include forex (138), indices (23), shares (4000+), and commodities(39). The shares are from different regions: some parts of Asia, Europe, and the USA.

With £20, you can open a trading account. There is no inactivity fee, trading ‘commissions’, or deposit/withdrawal fees. This is why we have Capital.com in this review. They are inexpensive

Different trading platforms are available. There is the MT4 which Capital.com has integrated into their system. Unlike other day trading platforms UK in this review, you can access all markets on Capital.com’s MT4. Yes, shares are also included. This removes the constraint you might have with other day trading platforms.

Another option available is the CFD Trading App. It is a dynamic mobile app suitable for day traders. You can set price alerts, use more than 70 indicators for technical analysis, and enjoy top educational content too. You can also open 10 demo accounts to test your day trading strategies. This is helpful for you so you can test different day trading strategies on multiple accounts.

Capital.com Pros

- Multiple tier-1 regulations

- No deposit/withdrawal fees

- Low minimum deposit

- Good for beginners

Capital.com Cons

- Limited number of currency pairs

#4 IG – Forex Trading Platform with Spread Betting

IG has been around for up to 48 years having been established in 1974. They are regulated with the FCA and have up to 5 decades of operation in the UK. They are publicly traded on the London Stock Exchange.

IG is a good fit for day traders. They do not offer CFDs only. Day traders who want to place spread bets can also sign up with IG. Spread betting profits are not taxed and you can place a spread bet on up to 17,000 markets.

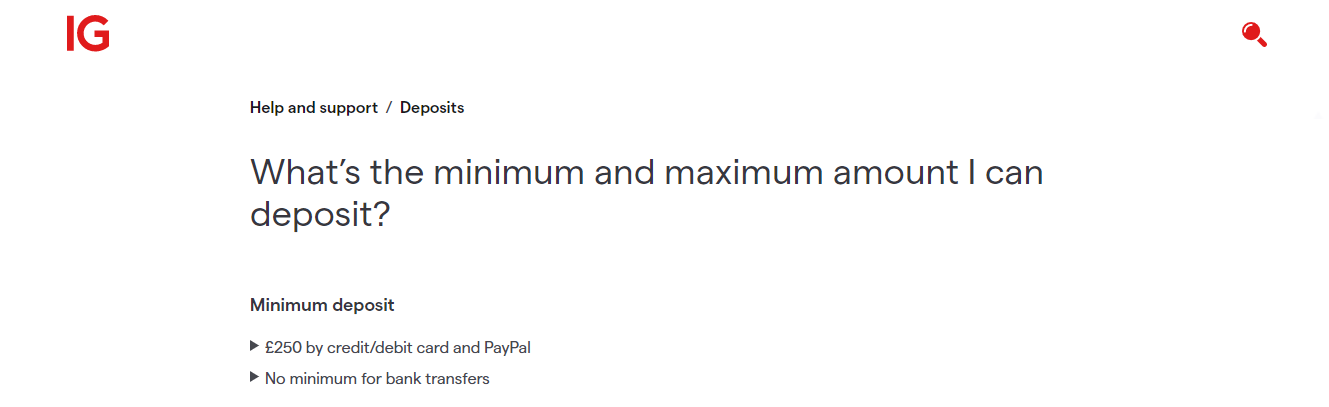

You can open an account with £250 if you are funding via credit/debit card and PayPal. For bank transfers, no minimum deposit. This is a flexible and hybrid funding system for day traders. A combination of a fixed amount and zero minimum deposit for you to choose from.

Here is the range of CFDs you can day trade: forex, indices, shares, commodities, options, and futures. The availability of options means you can use them as an imperfect hedge for your day trading positions.

For fees, you will be charged spreads and commissions. IG’s spreads are quite high. For example, the average spread for GBP/USD is 2.38.

IG Markets support multiple trading platforms. For day trading, however, the IG Online Platform and the IG Mobile app, and MT4 might be your best option. You can day trade on all markets including shares CFDs on them.

IG Pros

- Regulated with the FCA

- Zero minimum deposit for bank transfer

- Up to 17,000 markets

IG Cons

- IG is not ideal for beginners

- £250 minimum deposit via credit/debit card

What is Day Trading?

Day trading is a form of short-term trading. It involves opening a position with the intention to profit from small price movements. Traders that engage the market this way are called Day Traders.

Day traders normally do not hold their trades overnight. They open a position and close it by the end of a business/trading day. This kind of trading requires enough time to analyze and execute trades. You will also need enough time to monitor your trades.

How does Day Trading work?

The platforms listed above in this guide are CFD brokers that offer trading on different markets as CFDs.

It is important to know that day trading CFD instruments using leverage carries a lot of risks. If you are using excessive leverage then you can lose a lot of money very quickly.

For example, if you are day trading 1 Standard Lot (100,000 units) on EUR/USD, and are using 1:10 leverage, this means you will need a ‘margin’ of around $10,000 (100,000/10).

In a standard, the pip value would be $10 for this example trade. If the market goes against you by 100 pips, then you will lose $1000, which is 10% of your deposit. If you were to trade without leverage, then you would only have lost $100 on your trade, which is 1% of your capital.

Learn & understand this risk before you choose to day trade ‘CFD Instruments’.

Day Trading Strategies And Tips

Day traders deploy different trading strategies to take advantage of intraday price movements. Here is a short breakdown of some of these strategies.

Scalping: This strategy is used by scalpers who focus on short-term price movements. A day trader using this strategy can trade up to 50 times a day, raking in little pips by exiting trades quickly. You will need a lot of attention to maximize this strategy.

Trend trading: Sometimes, the direction of price may be strongly bullish or bearish depending on who is stronger (buyers and sellers) in the market. Day traders can wait for a strong trend to form. You can then ride the momentum, and close your trades within the day even if the trend continues.

Day Trading vs Swing Trading

As stated above, day trading strategies involve opening and closing positions within market hours. Day traders do not hold trades overnight regardless of the result (profit or loss). Because of this short-term approach, day trading does not give room for much flexibility. Furthermore, day trading is not effective when volatility is low. Day traders can open up to 50 positions a day. When price moves rapidly, it helps them capitalize on short-term price movements.

Swing trading has a different approach. Swing traders do not have a time limit to keep a trade open. A typical swing trader will keep his position open for a few days. Some swing traders can even keep their positions open for a month. Because swing trading strategy is long-term, it gives room for flexibility in terms of lot size and how often trading happens.

In addition, swing trading does not rely on rapid price movements like day trading. Patience is the key to this strategy. Experienced swing traders are able to stay through the rollercoaster of bullish and bearish price movements till they are ready to close their trades.

This is how these two strategies differ. One is not better than the other. It all depends on how you want to approach your trading journey.

How Do You Become a Day Trader in the UK?

When you have chosen a day trading platform that suits you, there are a few more steps you need to take. These steps are essential for a successful day trading experience.

1. Practice on a demo account: Day trading is not a thing to rush. There is a lot of price fluctuation because of market volatility. This makes short-term profitability a difficult task. Therefore, you need to have a plan for the long term and begin with a demo account.

With a demo account, you can test your skills and strategy. You should practice till the majority of your trades ends up as profit. If you can do this successfully, you can then go on to trade with real money. Do not be in haste to end demo trading, stay with it till you perfect your strategy.

2. Tax paperwork: Profits from trading are taxable in the UK. Make sure you file the necessary paperwork and keep a good record of your profits. This will be helpful when you have to pay your taxes at the end of the tax year.

Can you day trade with $100?

Yes, you can day trade with $100. It all depends on your trading goals, strategy, and the instruments you want to trade. Your choice of broker is also crucial. It is possible that your broker requires a minimum deposit that is more than a $100. In this case, you might need more than a $100.

Furthermore, some trading platforms do not have a specified minimum deposit. If you do not have more than a $100 for day trading, then you should consider such platforms.

Is day trading good for beginners?

Day trading involves the use of leverage so it is risky. Even the most advanced traders can suffer loss of money. Therefore, it is advisable that inexperienced trader avoid day trading. Even if you have some experience but lack the mental strength to withstand losses, it is better if you don’t day trade.

How to Start Day Trading

Since there is a number of day trading platforms, we will pick one as our example. These steps will guide you when opening your account. Capital.com is our example

1) On Capital.com’s homepage, click ‘Trade Now’ at the top right corner.

2) Enter your email address and create a password, then click ‘Continue’. You will be redirected to the Capital.com trading platform. On the platform, click ‘Complete registration’

3) Answer some basic questions on your trading experience, financial status, educational background, etc. You will also have to confirm you can bear the risks that come with trading.

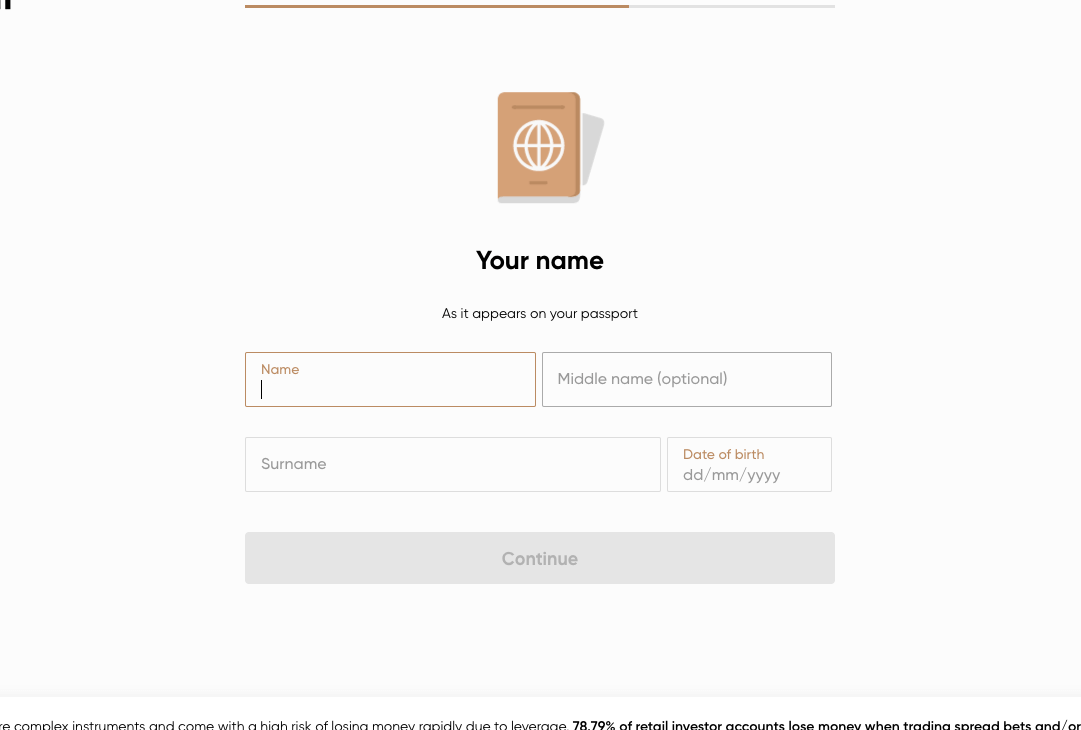

4) Fill in your name, date of birth, and click ‘Continue’

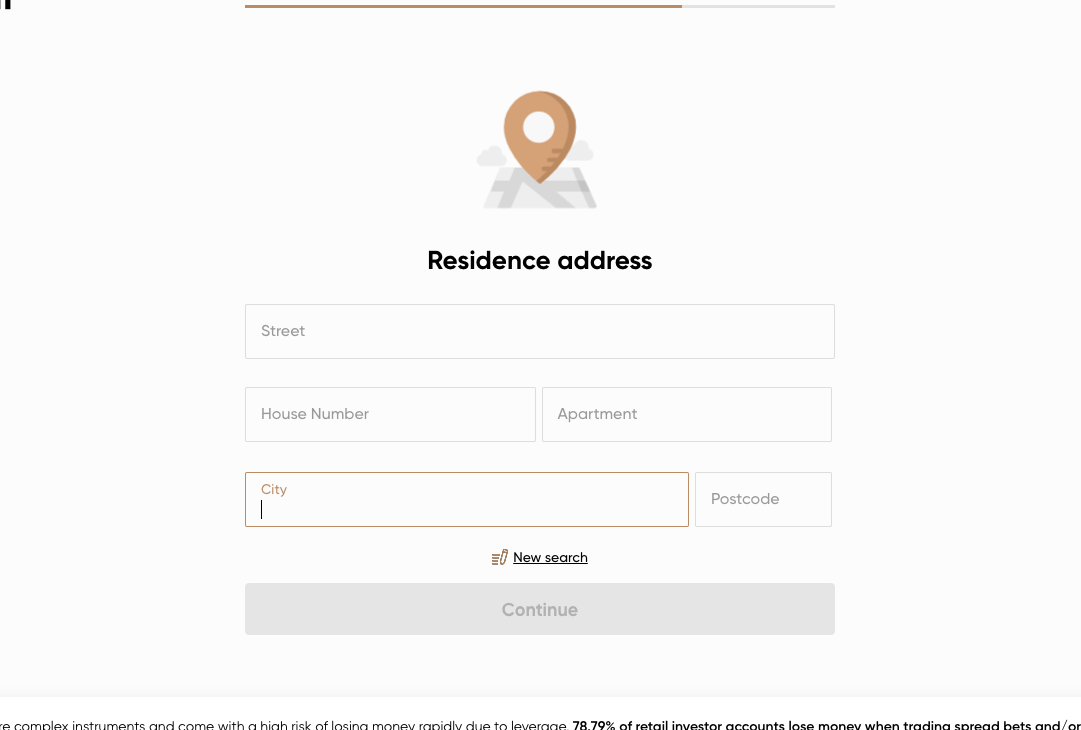

5) Supply your residential address, national insurance number, and mobile number. Click ‘Continue’

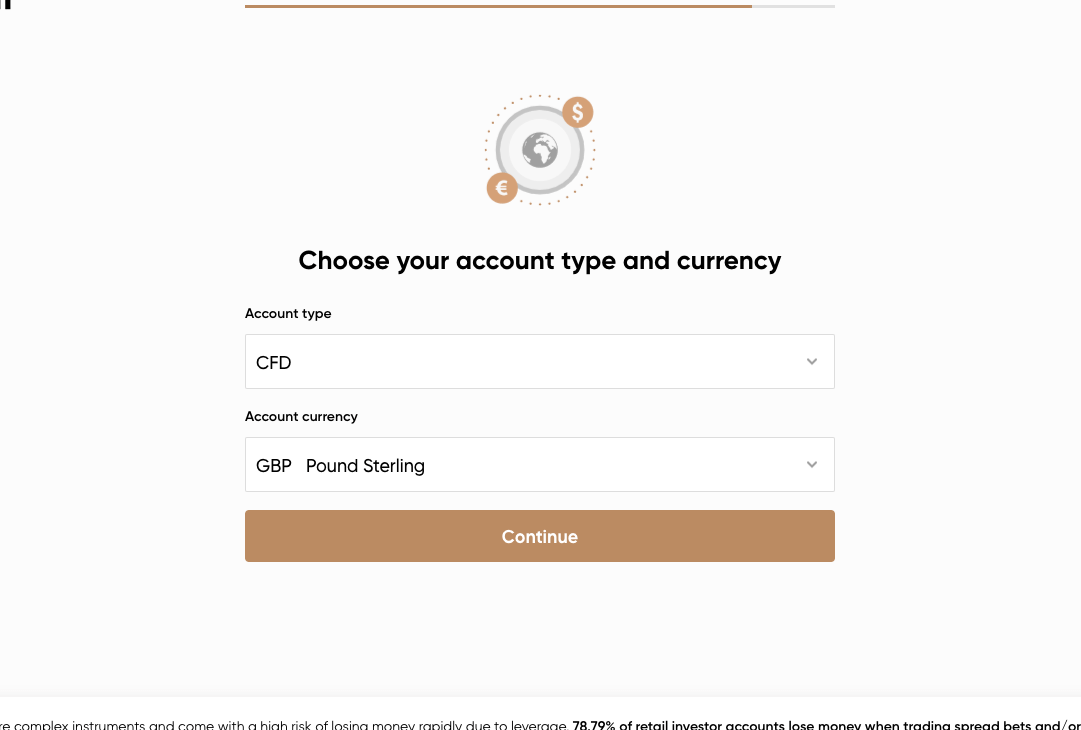

6) Select your preferred account type and account base currency

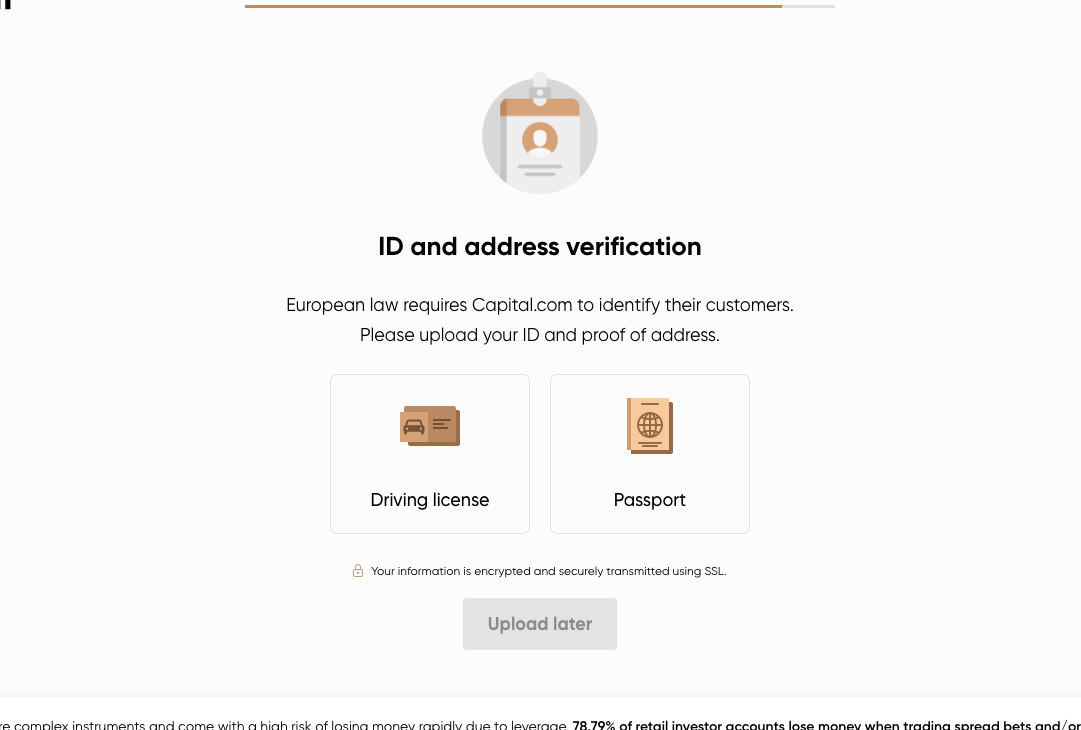

7) Verify your identity.

What Should You Consider When Choosing a Day Trading Platform?

If you are wondering how to check the factors which we considered for this guide & research, follow the checklist below. We will also try to explain how you can verify these points yourself on a platform.

Let’s start with the most important factors first.

1. Safety of your deposited Funds: This should be the ‘first’ factor on your mind.

Choosing a broker that is regulated with the FCA is the only way you can guarantee that your funds will be safe with the broker, that is the funds kept in your account on their platform. The FCA is a regulatory body that monitors the activities of day trading platforms in the UK. They assign a firm reference number to all CFD brokers that operate in the UK to distinguish them.

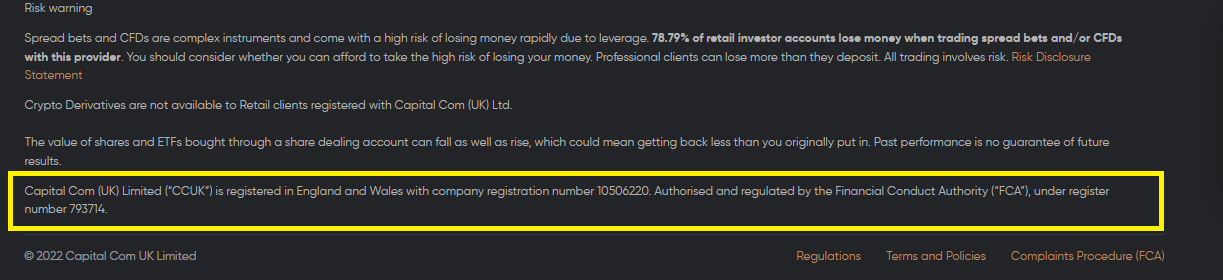

How do you know if a day trading platform is regulated with the FCA? The first thing to do is go to the footnote of the platform’s website. You can find their FCA regulation there. Here is a screenshot of Capital.com’s footnote

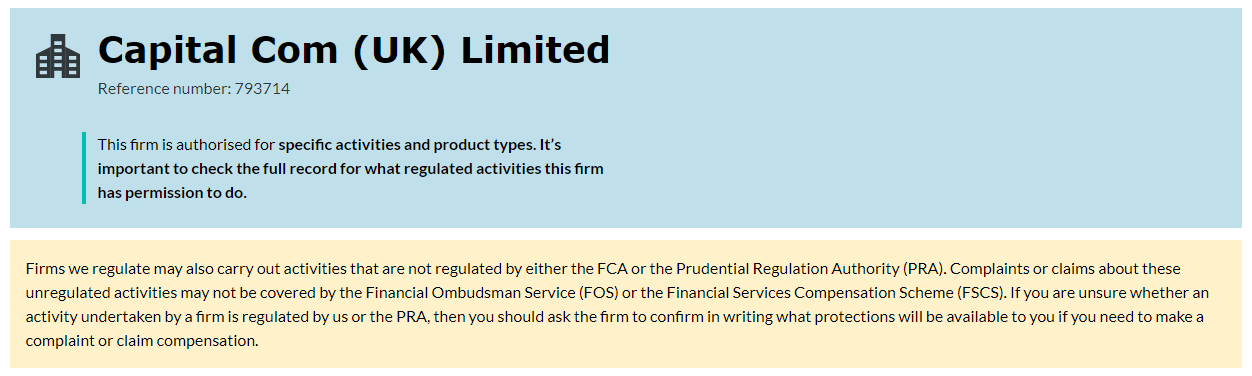

After this, you can go ahead to the FCA’s homepage and search for the day trading platform under firms. You will find the platform’s FCA regulation. It looks like the picture below:

Make sure the reference/registration number on the broker’s and FCA websites match.

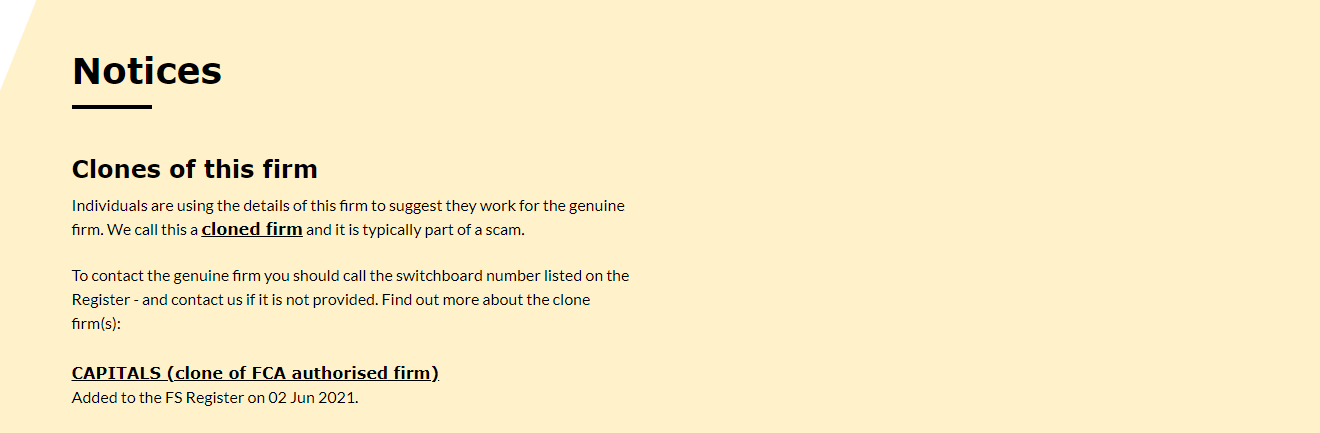

In addition, you should be wary of clone firms. Clone firms are fraudulent and try to imitate real FCA regulated firms to defraud potential clients. However, these firms can also be found on the FCA’s website as clones so you can avoid them.

Can you see the similarity between the name of the clone firm and our example broker? Can you see they are almost the same? This is why it is important to check the list of clone firms too. You will be able to spot them easily.

2. Trading Fees: Since you will not hold trades overnight, you might not have to consider swaps. The most important fees you should look at are the spreads and commissions. Average or typical spreads should be low and if possible, there should be no commissions.

Why?

With day trading, you are trying to accumulate small gains. Excessive trading fees will have an impact on your final profit or loss.

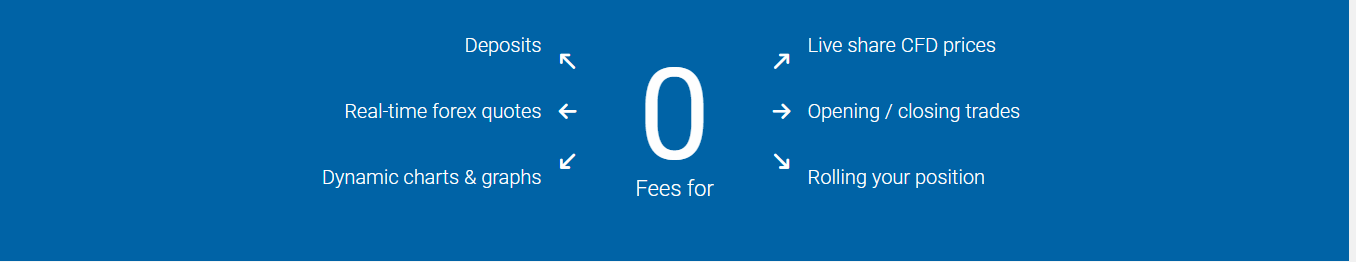

You should also check other non-trading fees like deposit and withdrawal fees. Here is a general outlook of low fees with Plus500 below:

3. Range of CFDs: Markets have different conditions per day. There are days when you might like the conditions on shares CFDs more than currency pairs. There will be times you want to do ETFs CFDs only. So there must be a wide market range. Forex, indices, shares, and commodities should all be available.

Also, options are also good for hedging your day trading positions so they should be available. Here is how to check the market range of your preferred day trading platform. We will use Plus500 as our example. The first step is to go to Plus500’s UK website.

Click on ‘Markets’. A dropdown appears listing all classes of trading instruments as shown below. Instead of ‘Markets’, some brokers might have it as instruments or a range of markets.

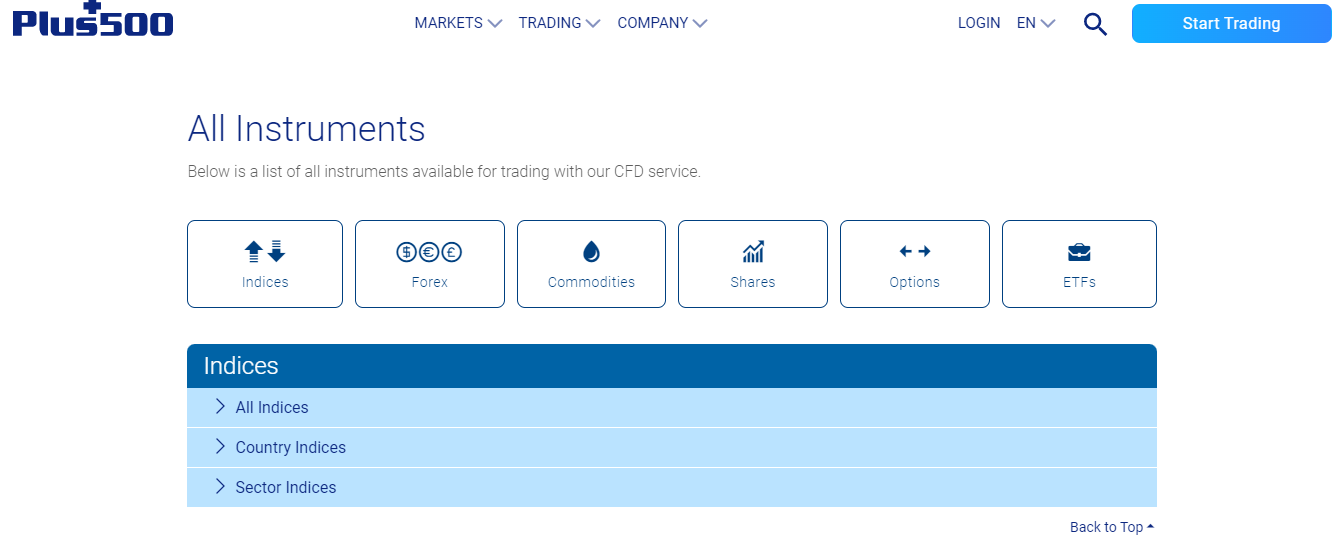

Go ahead and click on ‘All Instruments’. You will arrive at the page below.

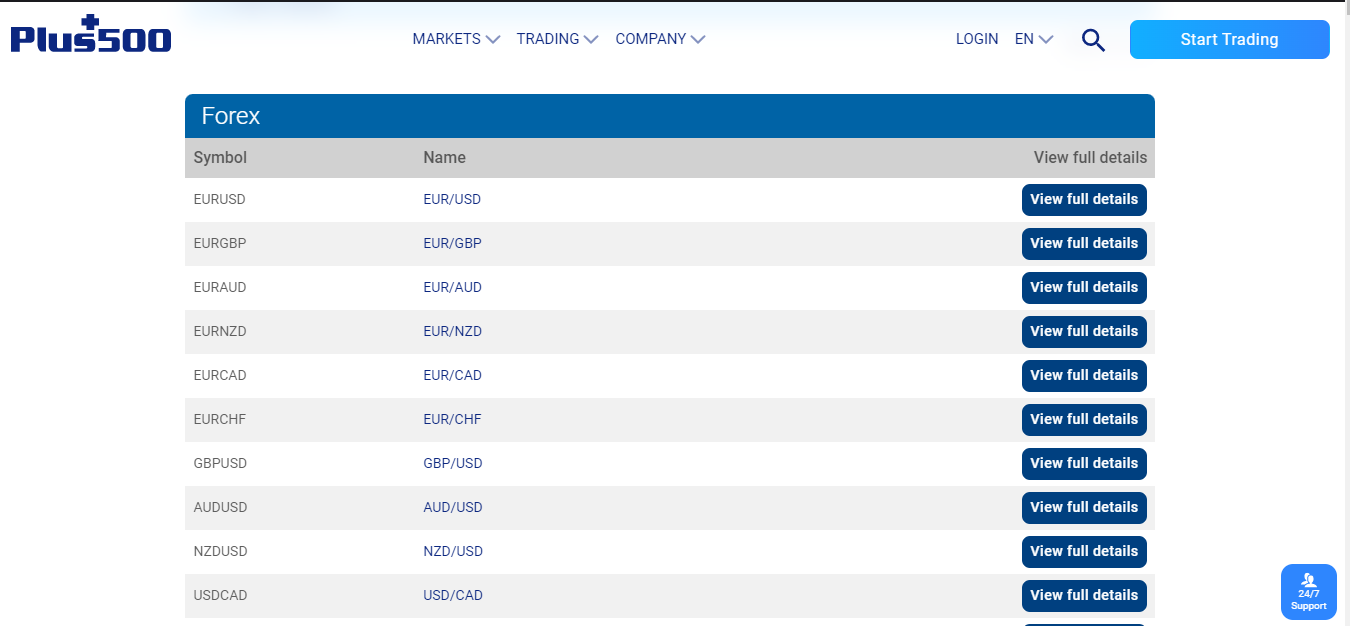

From there, all you need to do is scroll down the page. You will be able to view all the CFDs offered. The image below shows Plus500’s currency pairs

4. Demo Account: If you are going to be venturing into day trading. You will want to test out your strategies because day trading comes with its own risks too. Demo accounts allow you to have access to virtual balances.

A virtual balance enables you to practice your strategies with zero risks. Here is a screenshot of Capital.com’s CFD trading app with multiple demo accounts available

5. Trading Platform: The important factor to consider here is mobile app availability. Why is this important? You might not be able to sit down in a place to monitor your trades. You have to be able to monitor your trades on the go since you will be trading short-term movements. So trading apps should be available on Android and iOS. If your broker supports MT4, MT5, and/or cTrader, they will support the mobile version of these platforms. It is also possible that your broker has their own proprietary mobile app.

One more thing. You might not want to day trade manually. So trading platforms that allow automation will be good for you. Please note that this automation is not copy trading. We are talking about the kind of automation that allows you to program your day trading strategies (including entry and exits of trades).

6. Payment methods: Popular payment methods like debit/credit cards and local bank transfer are offered by most brokers. However, it is vital you check as conditions vary broker to broker. Some broker may support e-wallets like Neteller and Skrill.

Furthermore, you need to check this factor because some brokers have different minimum deposits for their payment methods. These deposits are usually higher than each other so you can choose a method that aligns with your trading plans. Let us consider IG Market as an example.

IG’s payment methods are credit/debit cards, PayPal and bank transfers. There is no stipulated minimum deposit for bank transfers so you can be flexible with your money. For other methods, you cannot deposit below £250 so there is no flexibility. Do you see why you need to understand how your broker operates their payments?

7. Trading Tools: Trading tools are extra perks offered by day trading platforms. These tools can be very helpful and are usually free. Personalized watchlist is a great tool for day traders. You can monitor a group of assets that you want to trade efficiently. CMC Markets has this feature on their platform.

Real-time price alerts are key too. This tool lets you know when the market price has reached a level you desire for entry and exit. This is possible without having to open your charts always. Some brokers like CMC Markets even have features that show market sentiments. With this tool, you can tell what direction traders are leaning towards.

Finally, risk management tools are also key. Negative balance protection is offered by all brokers in this review. However, you need to confirm if there are more advanced tools like the guaranteed stop loss order .

8. Customer Support: You need your forex broker to be available. You might have questions that are crucial to your account, trading, funding, etc. You should choose a broker with round the clock support. They should be available via phone calls or instant messaging. Emails are good as well but responses might be longer.

FAQs on Best Day Trading Platforms in the UK

Which is the best platform for day trading in the UK for beginners?

As per our research Capital.com is the best day trading platform for beginners. They have top educational content on their CFD trading app.

Is day trading legal in the UK?

Yes, day trading is legal in the UK. Just make sure you trade with only FCA regulated brokers.

How does day trading work?

Day trading involves opening and closing a trade in a day. Trades are not kept overnight and the goal is to capitalize on small price movements.

Which day trading platforms have no minimum deposit?

According to our review, only CMC Markets have no minimum deposits. IG also has no minimum deposits (for bank transfers only)