CFD, expanded, means contract for difference. CFD trading is one of the ways you can trade the financial markets. It is a speculative method of trading that allows you to open a buy or sell contract for a financial instrument. There is no possession of the financial instruments you trade. You make money based on the difference between the opening and closing price of your contract (more on this as you read further).

Trading the financial markets via CFDs is risky. This is because CFDs are leveraged products. Trading with leverage increases the chances of losing your trading capital. You should not trade CFDs except you are a professional trader. Most retail traders end up losing all of their money.

You need a broker to trade CFDs in the UK. In this review, we have selected the best six CFD brokers in the UK. We have selected these brokers based on factors such as regulation, range of market, and local deposit/withdrawal.

Comparison of Best CFD Brokers UK

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| eToro |

FCA, ASIC

|

1:30

|

$10

|

Visit Broker |

| City Index |

FCA, ASIC

|

1:30

|

£100

|

Visit Broker |

| Pepperstone |

FCA, ASIC

|

1:30

|

£200 (recommended)

|

Visit Broker |

| IC Markets |

ASIC, CySEC

|

1:30

|

£200

|

Visit Broker |

| XTB |

FCA, IFSC

|

1:30

|

No minimum deposit

|

Visit Broker |

| IG Markets |

FCA

|

1:30

|

$0 (for card payments)

|

Visit Broker |

Best CFD Brokers in the UK

Below is the list of best CFD brokers for traders based in the UK as per our research:

- eToro – Best CFD Broker with Low Spread

- City Index – CFD broker with low trading fees

- Pepperstone – Best CFD Trading Platform with ECN type account

- IC Markets – CFD broker with free deposit and withdrawal

- XTB – Good CFD Broker with fast funding methods

- IG Markets – Reputed CFD Broker with best trading platform

- Plus500 – Regulated CFD Trading Platform

- CMC Markets – CFD Broker with wide range of Instruments

Now we are going to explain all the listed best CFD brokers with complete their complete information like regulation, trading fees, support & many more.

#1 eToro – Best CFD Broker with Low Spread

eToro offers zero commission trading accounts to Traders. They have user firendly trading platforms and offer copy and social trading option to traders.

Regulation: eToro are regulated with the FCA as eToro (UK) Ltd. Their reference number is 583263 and they have been authorised in the UK since 09/05/2013. eToro are a safe broker because they are regulated.

Minimum deposit: eToro’s first minimum deposit is $50. If you are making your deposit through a bank transfer, $500 is required as the minimum deposit. For a corporate account, the minimum deposit is $10,000.

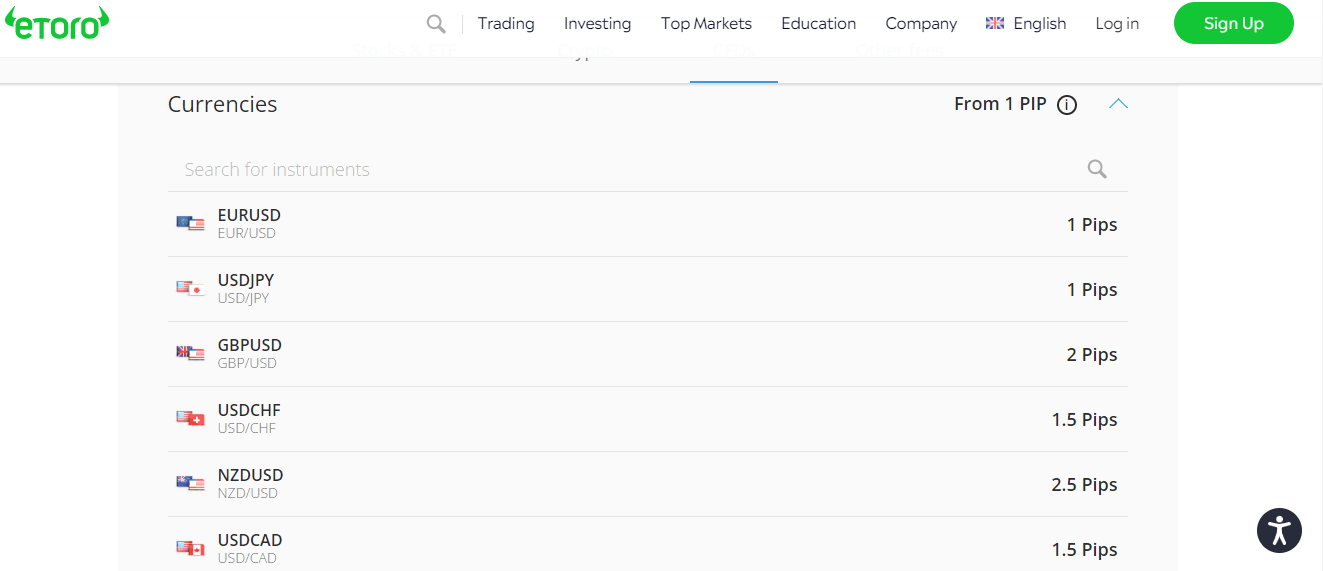

Spread for major pairs: eToro offers 2.0pips and 1.0pips as the spread for GBP/USD and EUR/USD.

Fees: eToro does not charge commissions for CFDs. However, there are other trading fees such as spreads and swaps. They also charge comparatively high non-trading fees. eToro charges a $10 inactivity fee monthly after 12 months of inactivity. Deposit of funds is free but there is a $5 withdrawal fee. Since you will likely be depositing your funds in pounds, you are also charged a currency conversion fee.

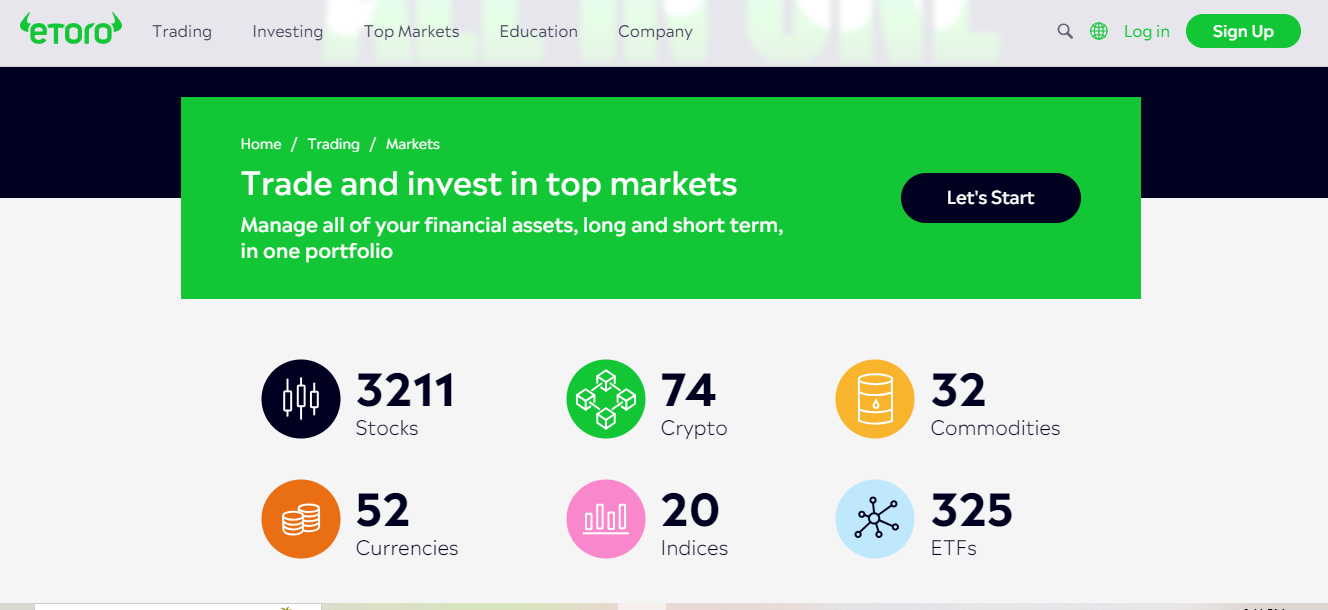

Range of markets: eToro offers 49 currency pairs, 2848 stocks CFDs, 32 commodities, 13 indices, and 264 ETFs CFDs.

Leverage for forex: Retail traders can leverage up to 30:1 for forex. Professional traders are offered higher leverage.

Deposit/withdrawal: You can deposit/withdraw your funds using a credit card, PayPal, and bank wire transfer. You cannot withdraw below $30. The easiest way to deposit is PayPal because transactions are completed in 2 business days. Bank transfers and credit card transactions take up to 10 business days.

eToro Pros

- User- friendly trading platform

- Forex trading is 100% commission free

- Thousands of assets available

- Multiple deposit methods

- Low minimum deposit

- Copy trading is available

eToro Cons

- eToro’s platform is not suitable for technical analysis

#2 City Index – Best CFD broker with low trading fees

City Index was established in 1983 and have around 15000 users. You can start trading with minimum deposit of just £100.

Regulation: City Index have had an authorised status in the UK since 24/03/2006. They are regulated with the FCA as StoneX Financial Limited and their FCA reference number is 446717. You can trade safely with City Index.

Minimum deposit: City Index do not enforce a minimum deposit but a recommend £100 deposit for retail traders.

Spread for major pairs: City Index’s typical spread for GBP/USD and EUR/USD are 1.8pips and 0.8pips respectively.

Fees: City Index charge no commission for CFD trading except for Shares CFD. You pay a £10 commission for trading UK shares. Swaps are charged at UK’s SONIA ±2.5%. Non-trading fees include a £12 monthly inactivity fee after 12 months of non-trading activities on your account. City Index charges no deposit/withdrawal commissions.

Range of market: City Index offer a good range of instruments. You get to trade 12+ indices, 4500 stocks, 80+ currency pairs, 16 indices 4 commodities, 4 options, 4 bonds, 4 metals, and 3 interest rates.

Leverage for forex: The leverage cap for retail traders is 30:1. Professional traders can leverage up to 400:1 for major forex pairs.

Deposit/withdrawal: City Index support deposit/withdrawal through credit/debit card, bank transfer, or PayPal. Credit/debit card transactions take 3-5 working days. Bank transfer takes up to 1-2 working days. Funding and withdrawing via PayPal can take up to 2 working days.

City Index Pros

- Regulated with the FCA

- Guaranteed stop loss order is available

- Good customer support

- 4500 global shares

- No commissions

- You can analyze your performance with Trading Central

City Index Cons

- Guaranteed stop loss order is not available on all platforms

- No smart signal service on MT4

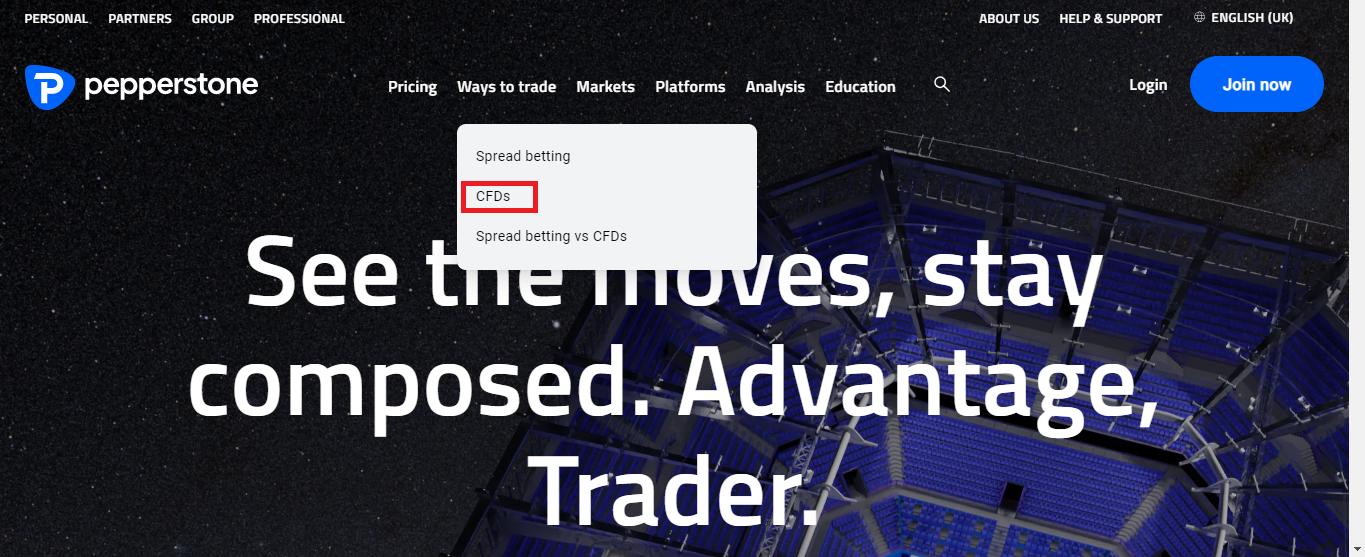

#3 Pepperstone – CFD Broker with ECN type accounts

Pepperstone does not charge inactivity fees and deposit/withdrawal fees from traders. They do not have any non-trading charges.

Regulation: They are regulated with the FCA as Pepperstone Limited. They are authorised to operate in the UK since 05/08/2015 and are still authorised. Their FCA reference number is 648312. Your money is safe with Pepperstone.

Minimum deposit: You can open a Pepperstone CFD trading account with a £200 minimum deposit. This is a recommended amount. Pepperstone does not enforce a minimum deposit.

Spread for major pairs: Pepperstone’s spread for GBP/USD and EUR/USD is relatively low, with standard averages at 1.1 pips and 1.4 pips respectively.

Fees: Apart from spreads and swaps, Pepperstone charges commission on trades as well. The round turn commission for GBP/USD and EUR/USD is £4.50. The CFD broker does not charge you for account inactivity.

Range of markets: Trading with Pepperstone gives you access to trade 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices

Leverage for forex: 30:1 is the maximum leverage for retail traders. Professional traders can leverage up to 500:1

Deposit/withdrawal: Pepperstone supports four deposit/withdrawal methods. You can use your Visa credit/debit card, Mastercard credit/debit card, bank transfer, and PayPal. Deposits reflect in your account immediately for card transactions and PayPal. Bank wire deposits take up to three working days. Withdrawals take 1-3 working days.

Pepperstone Pros

- Multiple tier-1 regulation

- Minimum deposit is low

- ECN account type

- Smart trader tools

- No commissions on the Standard Account

- Good education resources

- Social trading

Pepperstone Cons

- No guaranteed stop loss

#4 IC Markets – Best CFD broker with free deposit and withdrawal

IC Markets have temporary permission to operate in the UK. The reason is that they are licensed in another European Economic Area (Cyprus).

Regulation: The FCA reference number of IC Markets is 827935 with temporary permission.

Update: IC Markets have applied to cancel their temporary regulation with the FCA. This is according to the information on the FCA’s website in June 2022.

Minimum deposit: With £200, you can open an IC Markets trading account.

Spread for major pairs: IC Markets’ average spread for GBP/USD and EUR/USD is 1.03pips and 0.82pips respectively.

Fees: IC Markets charge through spread and commissions. Their round turn commission for a pound account is £5 per standard lot. There are no deposit/withdrawal charges or inactivity fees with IC Markets.

Range of markets: IC Markets offer a good range of financial instruments. You get to trade 61+ currency pairs, 22+commodities, 25+indices, 11+ bonds, 730+ stocks, and 4 global futures.

Leverage for forex: For retail traders, leverage for forex is 30:1

Deposit/withdrawal: IC Markets support four deposit/withdrawal methods: Visa credit/debit card, Mastercard credit/debit card, Neteller, Skrill, and bank wire transfer. Deposit transactions are instant. Withdrawals can take up to 2-5 business days to reflect in your account.

IC Markets Pros

- Regulated with ASIC (tier-1)

- MT4, MT5, and cTrader are available

- ECN account type

- Copy trading is available on cTrader

- Zero commissions on the Standard Account

IC Markets Cons

- High minimum deposit

- Not regulated with the FCA

#5 XTB – CFD Broker with fast funding methods

XTB does not charge any fees on bank transfers. They offer very low forex spread and negative balance protection. They are regulated with FCA so trading with them is safe.

Regulation: XTB are regulated with the FCA as XTB Limited. Their FCA reference number is 522157 and are authorized to provide financial services in the UK. They have held an authorized status since 17/01/2011. Your funds are safe with XTB.

Minimum deposit: XTB do not enforce minimum deposits. We however recommend that you deposit enough funds because of margin requirements.

Spread for major pairs: XTB offers minimum spreads of 0.9 pip and 0.8pip for GBP/USD and EUR/USD.

Fees: XTB charge relatively low trading fees. You only pay a commission for trading stock CFDs and ETF CFDs. You do not pay any commission for trading currency pairs. However, XTB charges you a host of non-trading fees. You pay £9 monthly after 12 months of inactivity on your trading account. You pay 2% commission when depositing funds via e-wallets. If you are withdrawing below £60 from your account, you pay £12 per transaction.

Range of markets: XTB offers over 2100 instruments. You get to trade 57 currency pairs, 36 indices, 21 commodities, 1849 stock CFDs, and 138 ETF CFDs.

Leverage for forex: UK retail traders are restricted to a 30:1 leverage cap.

Deposit/withdrawal: XTB supports three deposit/withdrawal methods. You can carry out your transactions using credit/debit cards (Visa, Mastercard, and Maestro). Bank transfers and e-wallets (Skrill) are also supported. Withdrawals are processed the same day if requested before 1 pm.

#6 IG Markets- Reputed CFD Broker with the best trading platform

IG Markets do not charge commissions for currency CFDs but commissions are charged for shares. Non-trading fees include a £12 monthly inactivity fee and currency conversion charge.

Regulation: IG Markets are regulated with the FCA. They are registered as IG Markets Limited with reference number 195355. They have been authorised in the UK since 01/12/2001 and are safe to trade with.

Minimum deposit: You can open an IG Markets trading account with £250.

Spread for major pairs: IG Markets’ average spread for GBP/USD and EUR/USD is 2.38pips and 1.13pips respectively

Fees: You can pay a premium to use a guaranteed stop-loss order. The premium cost for EUR/USD and GBP/USD guaranteed stop loss is £1.2 and £2 respectively.

Range of markets: IG Markets offer up to 17000 financial instruments. You get to trade

50+ currency pairs, 6 commodities, 8 stock indices, and a whopping 13000+ shares. Other markets include ETFs, bonds, options, and interest rates.

Leverage for forex: Retail traders are offered 30:1 leverage

Deposit/withdrawal: You can deposit your funds via credit/debit card, PayPal, and bank wire transfer. IG Markets support only two withdrawal methods: credit/debit card and bank transfer. Card transactions and bank transfers take up to 5 working days. PayPal transactions are immediate.

IG Markets Pros

- FCA regulated

- 17,000 markets

- Easy funding and withdrawal

- MT4 is supported

- No commissions

IG Markets Cons

- Minimum deposit is high for some funding methods

What is CFD Trading?

CFD trading simply means making money off the difference between the opening and closing price of a contract. The contract could be a buy or a sell depending on your analysis. If you speculate a financial instrument will rise in value, you open a buy contract. On the other hand, you open a sell contract if you speculate a financial instrument will fall in value.

You can lose money trading CFDs. CFD trading is purely speculative. If your speculation is wrong and a financial instrument rises in value when you have opened a sell contract, you lose money to your broker. Trading with leverage also increases the amount of money you can lose. This is why CFD trading is risky and should be left to experienced professional traders.

With CFD trading, there is no physical exchange or ownership of financial instruments. Your broker credits your profit into your trading account if you win a trade. If you lose, your broker debits the loss from your trading account.

Example of a CFD Trade

We will be looking at two trading outcomes: profit and loss. Let us assume you have a £200 trading account with 5:1 leverage.

1) You open your chart and see GBP/USD trading at 1.3591. After combining your technical and fundamental analysis, you speculate the value of GBP/USD to rise to 1.3641 (50pips rise). You opened a buy trade at 0.1 lot size (£1 per pip). For risk management, you set your stop-loss 20pips from entry at 1.3571. If this trade goes your way, your profit is calculated as (£1x50pips =£50).

2) Now, let us look at a trade that went south. In this case, we will use another instrument – EUR/USD. We assume the currency pair is currently trading at 1.1361. This time, it was an NFP week and you speculated the coming news will favour the US dollar. You place a sell trade at 0.1 lot (£1 per pip) size with the speculation that EUR/USD will fall by 60pips to 1.1301. You also set a stop loss at 1.1391 (30pips from entry).

The news came out but not as you expected. The US had an increase in the NFP, causing the price of EUR/USD to rise to1.4000 triggering your stop-loss order in the process. This trade ended in a loss and it is calculated as (£1x30pips=£30).

These two examples show the speculative nature of CFD trading. There are no guarantees of where your trade will end. You can win or lose. This is why you should always trade with a stop loss.

How to Open a CFD Trading Account in the UK

Opening a CFD trading account is simple. We will use eToro CFD broker as an example to explain the basic steps involved.

- Go to the website of the CFD broker that you want to trade with. Then as shown in the picture below, click sign in to open an account.

- Proceed to enter your details on the page below. You also set up your password on this page.

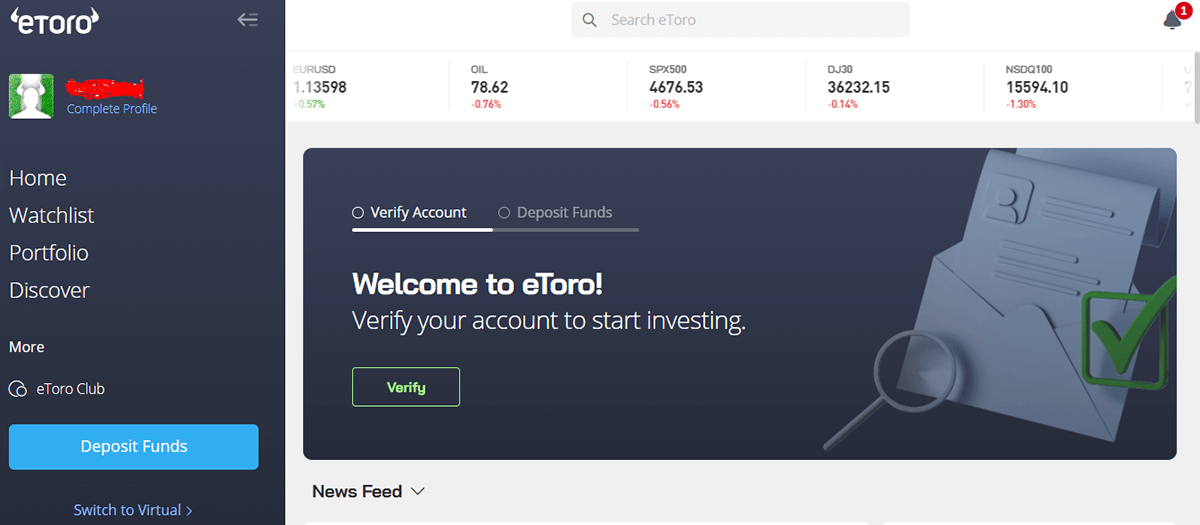

- Once you submit your account details, you have access to your personal dashboard. It looks like this.

As shown in the picture above, you cannot begin investing without verifying your ID. So click the ‘verify’ link to begin your KYC verification.

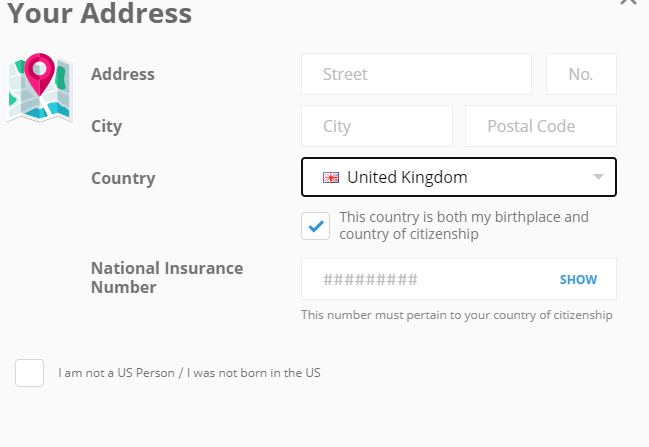

- For your KYC, you will be required to submit your personal details such as your name, date of birth, residential address, postal code, and national insurance number.

Also, make sure you check the “I am not a US Person/I was not born in the US” box. You will also be required to upload your passport, driver’s license, or government-issued ID to verify personal details.

- After completing your verification, you can then proceed to deposit funds in your account. You can choose from the different funding options available. The payment page is shown in the picture below

- You can start trading when your fund reflects in your trading account. eToro does not support the MetaTrader platforms. They have their mobile trading app and web-trading platform.

Risk warning: Trading CFDs is risky. 90% of retail traders lose their money trading CFDs. If you are not a professional trader, you should stay away from CFDs.

What is CFD leverage in the UK?

1:30 is the maximum leverage for CFDs trading in the United Kingdom, this limit is mandated by the Financial Conduct Authority (FCA) and all regulated forex brokers are required to follow this when dealing with retail forex traders.

The leverage limit of 1:30 means that you can borrow up to 30 times the amount of your deposit to enter a trade. If you deposit £100, you can open a trade position worth £3,000.

However, if you are an experienced forex trader that trade large volumes and want to access higher leverage for trading CFDs in the UK, you can apply for the professional trader account (after meeting certain criteria). Professional traders can access leverage of up to 1:500 or less, depending on the CFDs broker.

Note that the maximum leverage of 1:30 for retail traders apply to major forex pairs. Other instruments leverage limits are 1:20 for forex minors, major indices, ETFs and gold, 1:10 for minor indices, metals and other commodities, and 1:5 for shares and bonds.

For professional accounts, the maximum of 1:500 applies to forex majors, other instruments leverage limits are 1:200 for forex minors, major indices, and gold, 1:100 for minor indices, metals, bonds, FX Options, and other commodities, 1: 20 for ETFs, 1:10 for shares, and 1:2 for cryptocurrencies.

Before applying for a professional account, you are required to meet the following criteria:

- You must have placed at least 40 trades of significant sizes over the last 1 year

- You must have a financial instruments portfolio exceeding 500,000 EUR or GBP equivalent

- You must have at least one year of working experience in the financial sector, in a professional role that requires knowledge of trading CFDs

It is best that you do not use all the leverage available as this increases your risk and you can lose your money.

Can you lose money with CFD?

Yes, CFD trading involves using leverage to trade financial instruments, trading leveraged CFDs products involves risk and you can lose all your money. It is best to avoid trading leveraged products unless you understand how they work and have experience.

How to Choose the Best CFD Brokers

FCA Regulation: You do not want to fall victim to a fraudulent CFD broker and lose all of your funds. The only way to avoid this is to sign up with an FCA regulated CFD broker.

Doing this comes with its own advantages. One is that your funds are protected should your chosen broker enter insolvency. Furthermore, regulated CFD brokers are given fixed maximum leverage for the CFDs they offer. These fixed leverages are aimed at protecting your trading capital. It is because of these advantages that you should always check if a CFD broker is regulated.

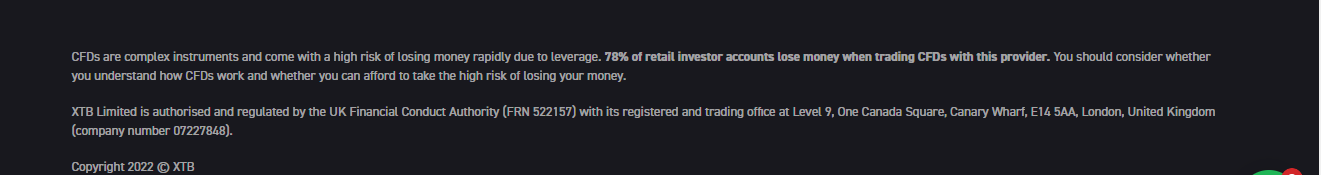

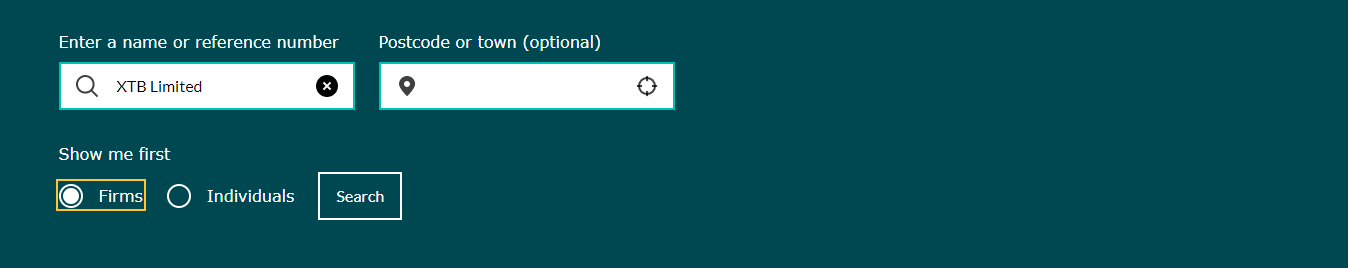

It is crucial that you check if your CFD broker is licensed with the FCA. You can check this in these simple steps. We will use XTB to explain. First, you need to go to XTB’s website and go down to the footer. There, you will find their regulation with the FCA. It includes their registered name and reference number.

From the image above, you can see that XTB’s registered name is XTB Limited with reference number 522157. These are the details you need to verify with the FCA. This brings us to the second step.

Go to the FCA’s website. Scroll down till you see the pane displayed below.

Enter the registered name from the broker’s website and select ‘firms’ (in the yellow box). Click on ‘search’. Your search result ends in the picture below.

The important detail to note here is how the company name and reference number match the one on XTB’s website. This is proof that XTB holds a valid FCA licence. You can repeat these steps for any broker and you will get the needed result.

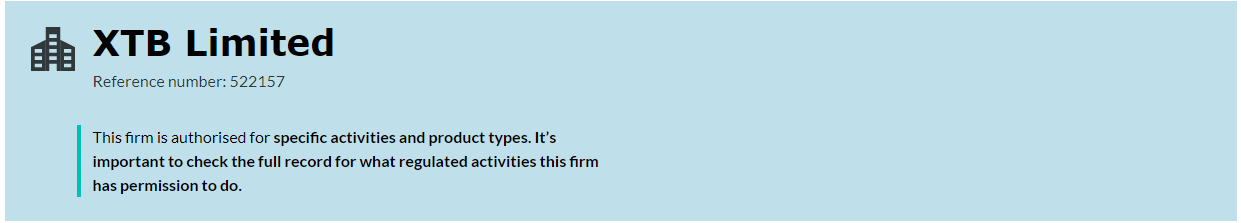

Furthermore, checking a forex broker’s regulation helps you detect and avoid clone firms. What are clone firms? Clone firms try to defraud traders and investors by offering financial services. They tend to use names similar to that of legally regulated brokers to fool traders.

With the help of the FCA, you can spot these firms. As you follow the steps we have listed above, you will find the list of these fraudulent firms on the same page. Here is an example of XTB’s clone firms as seen on the FCA’s website.

Finally, you should know that if XTB or any FCA regulated broker goes bankrupt, your money is protected. This is possible because of the UK’s Financial Services Compensation Scheme (FSCS). The scheme is designed to make sure traders’ money is protected to the tune of £85,000. If your broker goes bankrupt, you will get your money back.

This scheme covers retail and professional traders.

Account Type: CFD brokers usually offer at least one account. Most brokers have more than one. It is important to consider this factor for various reasons. First, there is flexibility in trading costs. Some accounts like ECN-type accounts have low spreads with an extra commission.

Also, there are also accounts with relatively high spreads with zero commission. Furthermore, some brokers might not have an equal distribution of CFDs on all of their accounts. Some accounts might have stock CFDs while some do not. All of these depend on the broker you choose so you have to check.

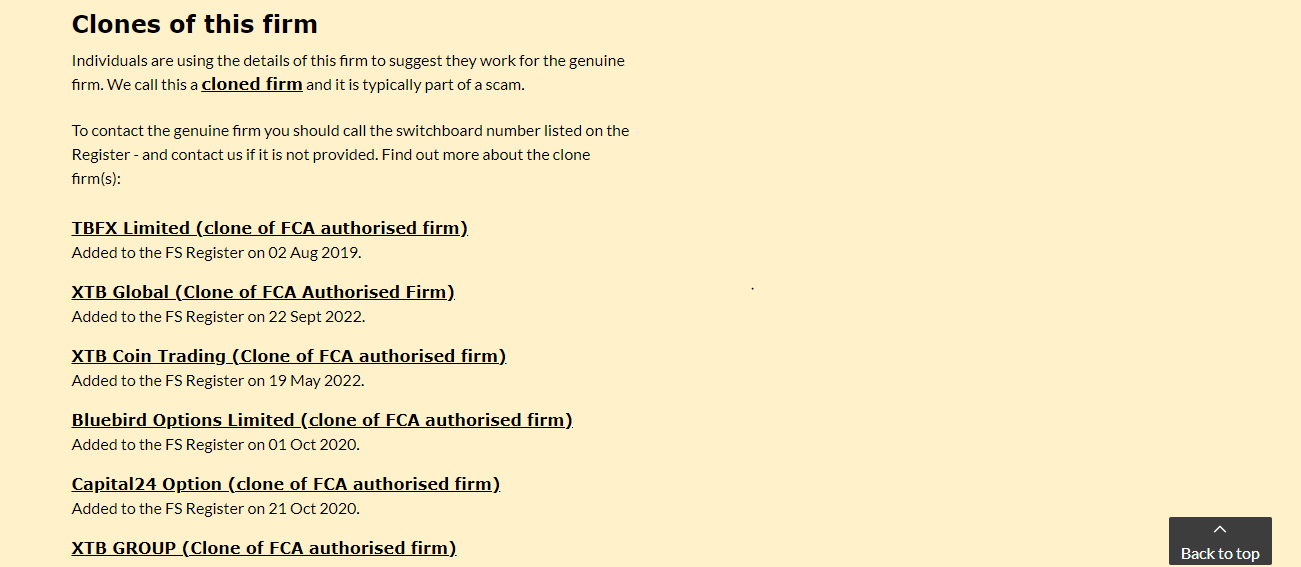

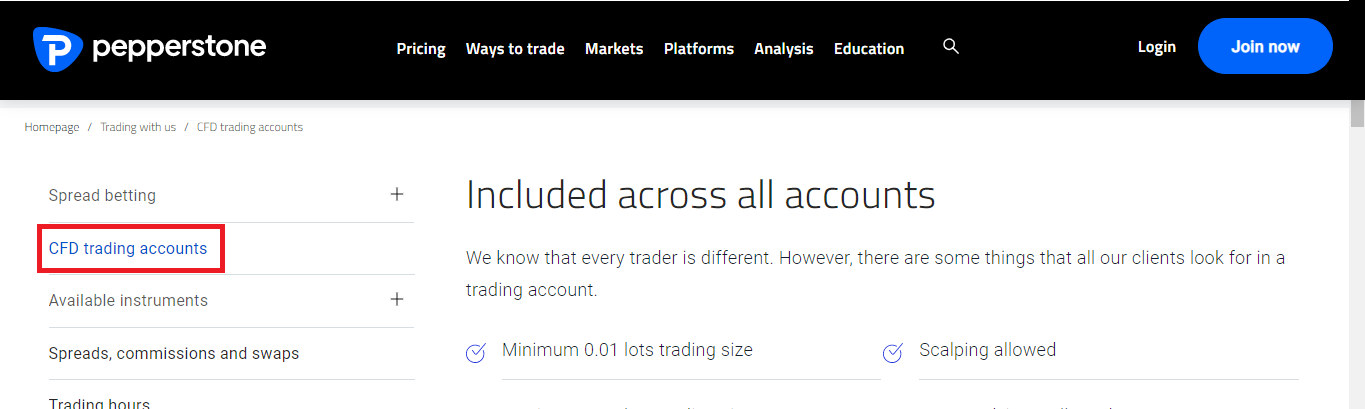

If you go to Pepperstone’s website, for example, move your cursor to ‘Ways to trade’ and then click on CFDs, you will easily find their account types

After clicking ‘CFDs’, click ‘CFD trading accounts’ (in the red box).

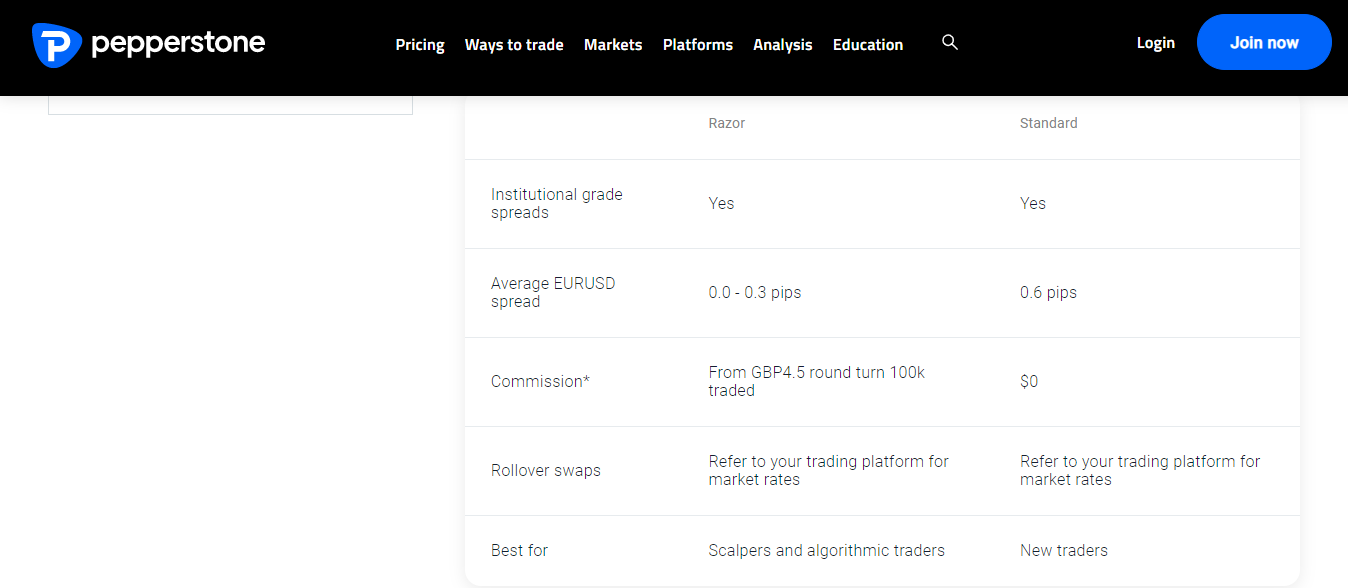

Scroll down, and you will find Pepperstone’s trading accounts as displayed.

From the image, you can see that there is a Razor Account and a Standard Account. You can see that spreads, commissions, and other factors vary between the two accounts. This is why you have to check to see the differences in trading conditions. You can then choose the one you want.

Low Overall Fees: Spreads, swaps, and commissions make up your trading fees. Non-trading fees might include deposit/withdrawal fees or currency conversion fees. Overall fees should be low. You should not be giving away too much money to your broker via high fees.

eToro for example has low fees. Their typical spread for currency pairs is moderate as shown below

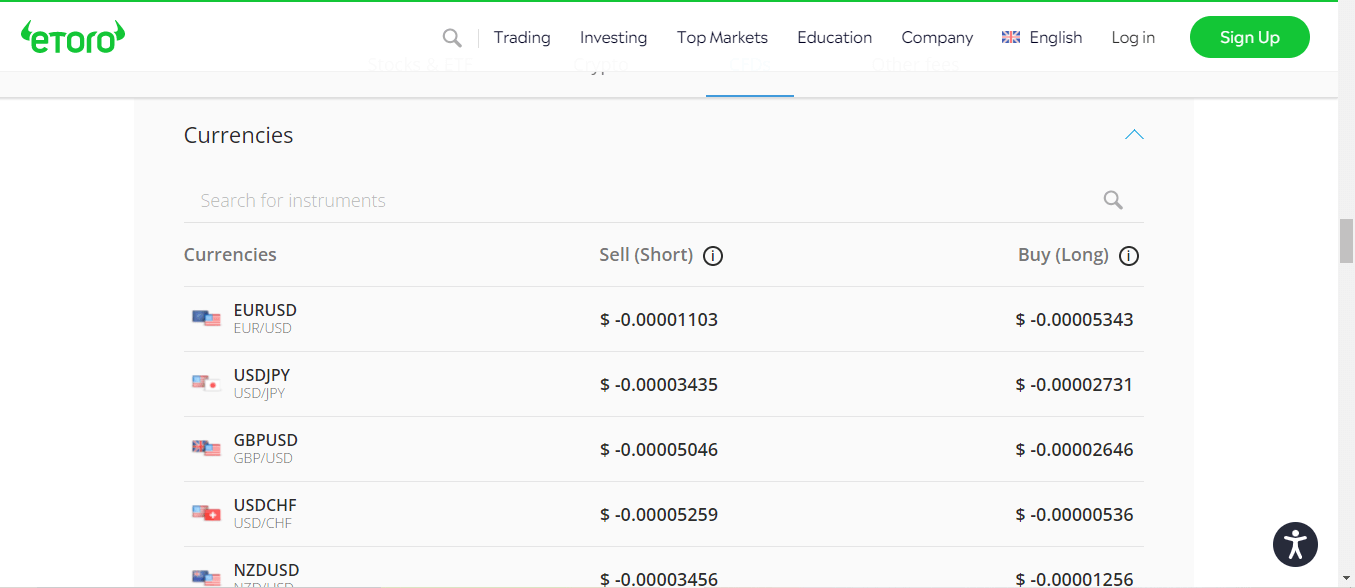

In addition, their swaps are low compared to other brokers and they do not charge commissions for trading currency pairs.

Range of CFDs: CFD brokers must have a wide range of instruments. Forex, commodities, metals, and stocks are the most common class of CFDs. Some CFD brokers might even have ETFs. Under these classes, there should be a good number of instruments.

For example, a broker’s forex pairs should not only include majors like EUR/USD, and GBP/USD. You should check if there is enough minor pairs, exotic pairs, and pairs from emerging companies.

A wide range of CFDs allows that you to explore the market more. Trading opportunities are not always available on all asset classes at the same time. So if the forex market is not looking good, you can trade other asset classes. This is another essential reason to check this factor.

Here are the different CFDs with eToro for example.

Can you see the different options available? You can click each CFD class to know about trading conditions like spreads, commissions, and rollover charges.

Ease of withdrawals: Withdrawing your profits should be easy. It should be as easy as sitting in the comfort of your couch and getting it done. Withdrawal methods such as credit/debit cards and bank transfers make this possible. E-wallets like PayPal, Skrill, and Neteller are also good. Your CFD broker should have at least two of these methods.

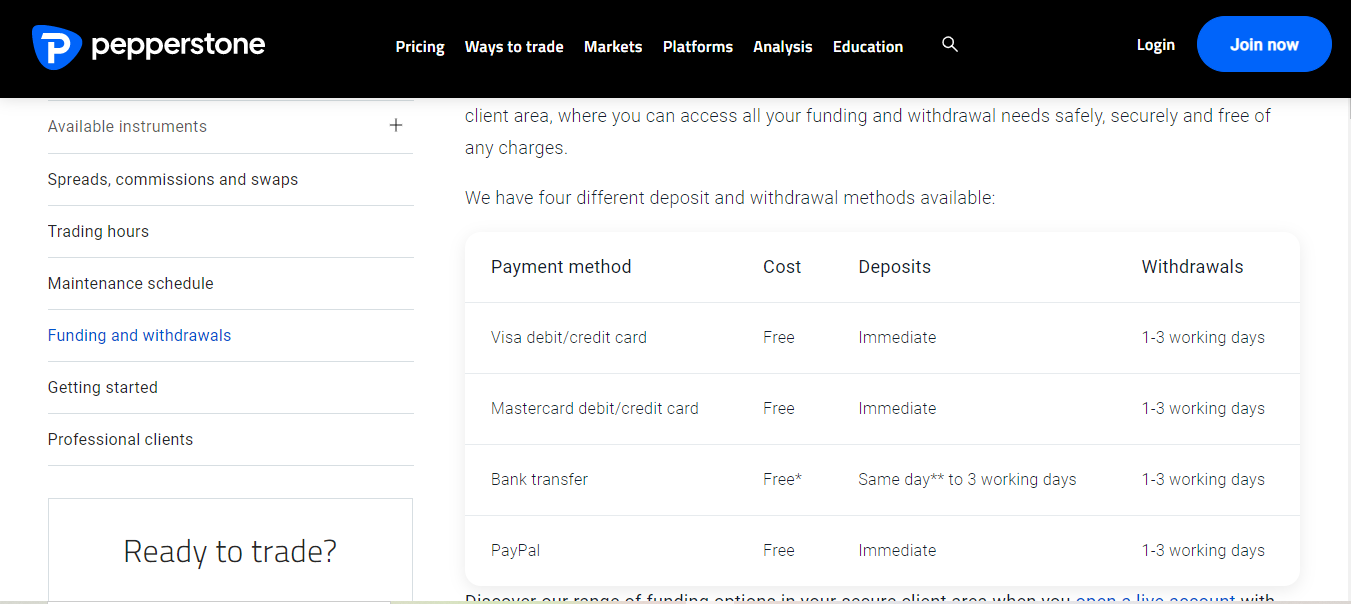

In addition, you also want to know if your broker charges extra fees on deposits/withdrawals. Your bank and e-wallet provider have their own independent charges. These are different from broker’s fees so you should always check. Here is how you can check using Pepperstone as an example.

On Pepperstone’s homepage, click on ‘Pricing’. A dropdown will appear. On the dropdown, click on ‘Funding and Withdrawals’

The result page will bring you to the image below.

As you can see, all of Pepperstone’s funding and payment methods carry no extra charge. You can also speak to your broker’s support for more details

Losing Traders: According to FCA regulations, it is compulsory for CFD brokers to disclose the level of risk associated with trading with them They are to do this by publicly revealing the percentage of traders that lose money trading CFDs with them.

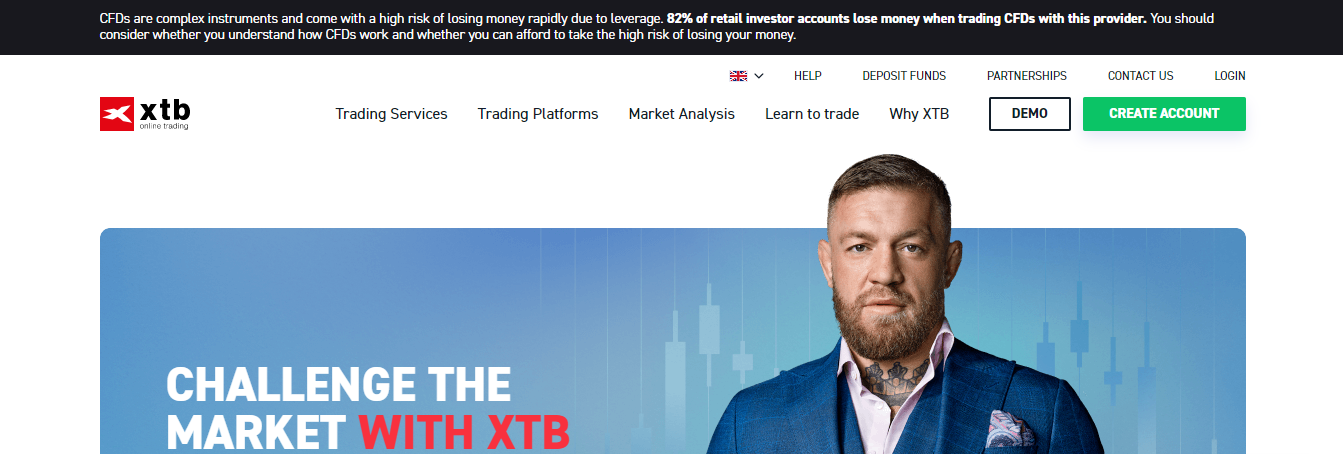

Most CFD brokers usually place this data at the top of their website so it can be visible. Here is a screenshot below from XTB’s website

From the image, you can see that 82% of traders lose their money when trading CFDs with XTB.

UK Customer Support: You might need your CFD broker to clarify some things for you. It could be trading conditions, their charges, or regulation. Most CFD brokers have an FAQs section but it might not suffice. Therefore, a CFD broker should be reachable via email, live chat, and mobile phone (preferably a UK number). Try and test a forex broker’s support to see how fast they answer before signing up with them.

Here is how you can check a CFD broker’s support (city index is our example). On the homepage, scroll down to the footnote and click on ‘Contact Us’

You will arrive at a page with FAQs as shown below

If you scroll down, you will also find a live chat tab. Click on ‘Let’s Chat’ and you are good to go.

What are the Risks of CFD Trading?

1) Risk of leverage

Leverage can make or mar your account. You can make more profit as much as more loss trading with leverage. See a practical example below

Let us assume you have a trading account with GBP 200 and 1:1 leverage (no leverage). If you buy Gold CFD (0.01 which is 10 cents per point) at the entry price of 1817.89 but the price falls and triggers your stop loss at 30 pips from entry (1817.59). Your loss is a paltry GBP 3.

If you take this same trade on an GBP 200 trading account with (1:5) leverage. The implication of this is that your account is 5 times stronger (GBP 1,000). You will be able to control more trade volume for a small margin.

So, you placed a buy trade on Gold CFD at 1817.89, with the same stop loss. This time, you can trade at 0.1 (GBP 1 per point) lot size because of your leverage. The trade goes against you but your loss is calculated as 1 x 30 = GBP 30.

The 1:5 leverage multiplied your loss 10 times the time you used no leverage. This is why CFDs are risky and should be left to professional traders.

2) You can lose your entire trading capital

This can happen if you overleverage your account and trade volatile instruments. If you do not have enough money in your account to meet up with margin requirement, you will not be able to trade. Negative balance protection ensures you do not lose more than your capital. However, it is possible to lose all of your trading capital

3) Risk of Fraud

There is a risk of trading with unregulated CFD brokers. These brokers can register you under loosely regulated entities and can defraud you. Also, there is no form of insurance if your money is lost. You can mitigate this risk by signing up with FCA regulated brokers only.

Another area the risk of fraud can affect you is clone firms. Clone firms try to deceive traders by trying to use similar names to FCA regulated brokers. Some even try to use a similar website name with licensed forex brokers. To avoid these clone firms, make sure to check the list of the clones of your preferred broker. This is the best way to avoid being a victim of fraud.

4) Gapping Risks

The reason you are able to open a contract (buy or sell) on a CFD is because of liquidity. Liquidity is when there is enough money volume involved in the trading of a CFD. However, there are rare occasions where your contract can become illiquid because of a low volume of money.

Illiquidity, coupled with volatility in the markets can cause your trade to be executed at unfavorable prices. In other words, the price of a CFD can drop before your trade is executed at your preferred price. This phenomenon is known as Gapping.

If gapping occurs when you have a trade open, it will negatively affect your profits.

5) Holding costs

Some CFD trades can take up days or weeks to reach your exit point. The longer you hold a trade, the more the holding costs you procure. Holding costs accumulated over a long period will make you pay a lot to your broker. For every day you do not close a trade, you will pay a swap for that day.

On specific days, the holding cost might be twice the normal fee (double swap). Holding costs can reduce your profit or amplify your loss when they accumulate.

Is there Capital Gains Tax on CFD Trading?

Also known as CGT, capital gains tax is the tax you pay on profits made from selling assets. These assets could be stocks, ETFs, or even currency assets. Though CFD trading involves buying and selling, it is speculative.

You buy and sell derivatives of currencies, shares, and other financial instruments without owning them physically.

Therefore, your profits or losses depend on the difference between your entry and exit price per trade.

In the UK, capital gains tax is charged on CFD trading. When you close a trade, the value of the trade is not taxed (CFDs are free from stamp duty). Rather, you pay capital gains tax on your profit.

How Do CFD Brokers Make Money?

CFD Brokers make money through different means like spreads, fees, and overnight financing. Though fee structures may differ per broker, all CFD brokers combine these various means to generate revenue.

The spread is the difference between the buying (ask) and selling (bid) prices of a CFD. Brokers typically charge traders this spread, and they make money regardless of your trade result (profit or loss). Some brokers may offer fixed spreads, while others provide variable spreads that can change based on market volatility.

Other than spreads, brokers may also charge commissions and inactivity fees.

Another fee charged by CFD brokers is overnight financing also known as swap. When you hold a trade overnight, a fee is charge that reflects the cost of maintaining your trade overnight.

In essence, you can say that CFD brokers have multiple streams of making money. However, it is important for you to research your broker’s fees structure. For example, some brokers do not charge inactivity fees. So it is important always that you do your research.

Is CFD trading profitable?

Yes, CFD trading can be profitable. Some traders (retail or professional) can make money sometime. However, 70-80% of forex traders lose their capital trading CFDs. This is due to the risk that comes with CFD trading. CFDs are leveraged products which further increases the risk of losses.

This is why CFD brokers licensed with tier-1 regulators are required to reveal potential risk disclosures to their clients. Brokers regulated in the UK will give you the exact percentage of their clients that lose their money. They also update this data as it changes.

CFD brokers in other jurisdictions might just let you know that your capital is at risk without any data. CFD trading is not a get-rich-quick-scheme. You need to have a clear trading strategy combined with risk management. This helps minimize your losses but that is still no guarantee.

Is CFD trading good for beginners?

CFD trading might not be the best for a beginner. There is an extra risk that comes CFD trading because of leverage. Leverage increases the potential for profit and loss. It goes both ways. This is why CFD trading is different from traditional investing.

If you want to go into CFD trading as a beginner, a demo account might be the best for you. With this account, you get virtual money that gets you acquainted with the CFD market. You can trade different instruments without losing real money.

If you have practiced long enough and have confidence in your strategy, you can then move to a real account. Otherwise, it is better to avoid the risk entirely.

FAQs on Best CFD Brokers in the UK

Is CFD trading legal in the UK?

CFD Trading is legal in the UK. UK traders are allowed to trade forex, stocks, and ETFs as CFDs. Crypto CFDs are illegal in the UK.

Which is the best CFD trading platform in the UK?

This depends on different factors. Safety is one of the most important. Do not trade with a broker that is not regulated with the FCA. In addition, the platform should also support local deposits and withdrawals. We have reviewed eToro, City Index, CMC Markets, and a few other brokers. These brokers are reputed as per our research.

Can you get rich from CFD trading?

CFD trading is risky. More than 70% of CFD traders lose their money. In addition, CFDs are leveraged products. Leverage amplifies your losses if a trade goes against you. This is why you should not trade CFDs if you are not a professional.

What are CFD brokers?

CFD brokers are middlemen.They allow traders to trade derivatives on various instruments. The profit or loss are cash settled in an account opened with the CFD broker.

Can I trade CFD in the UK?

You can trade CFDs in the UK via FCA licensed brokers. CFD trading is legal in the UK.

Is CFD trading risky?

CFD trading is very risky. 90% of retail traders lose all of their trading capital. CFD products are leveraged products. Trading with leverage increases projected profit and loss. This is why CFD trading is for professional traders. Professional traders are experienced in trading leveraged products.