Copy trading allows you to access the strategies & trades of other traders. You copy their strategies and get the same results as the traders you are following.

Copy trading platforms are offered by multiple forex & CFD brokers. With some brokers, it is called ‘Social trading’. Before you go ahead and sign up with any of these platforms, there are a few things you should consider.

Factors such as the safety of your funds, fees, trading platform, and copy trading features are important. We have reviewed some of the regulated copy trading platforms in the UK based on these factors. Below is our research.

Comparison of Best Low Spread Forex Brokers UK

| Broker | FCA Regulation | Copy Trading | GBP/USD Spread | Visit |

|---|---|---|---|---|

| eToro |

Yes

|

Yes

|

2 pips

|

Visit Broker |

| Pepperstone |

Yes

|

Yes

|

1.40 pips (Standard Account)

|

Visit Broker |

| AvaTrade |

Yes

|

Yes

|

1.5 pips

|

Visit Broker |

| Vantage FX |

Yes

|

Yes

|

0.5 pips (ECN Account)

|

Visit Broker |

Note: The spread data is as per information on these brokers’ websites in December 2023.

Best Copy Trading Platforms in the UK

Here is the list of best copy trading brokers in the UK for your review:

- eToro – Overall Best Copy Trading Platform in the UK

- Pepperstone – MT4 Copy Trading Platform

- AvaTrade – Copy Trading Platform with Temporary FCA Regulation

- Vantage FX – Copy Trading Platform with Pro ECN Account

Now that you know the platforms we are looking at, let us take them one after the other and show you our methodology.

#1 eToro – Overall Best Copy Trading Platform in the UK

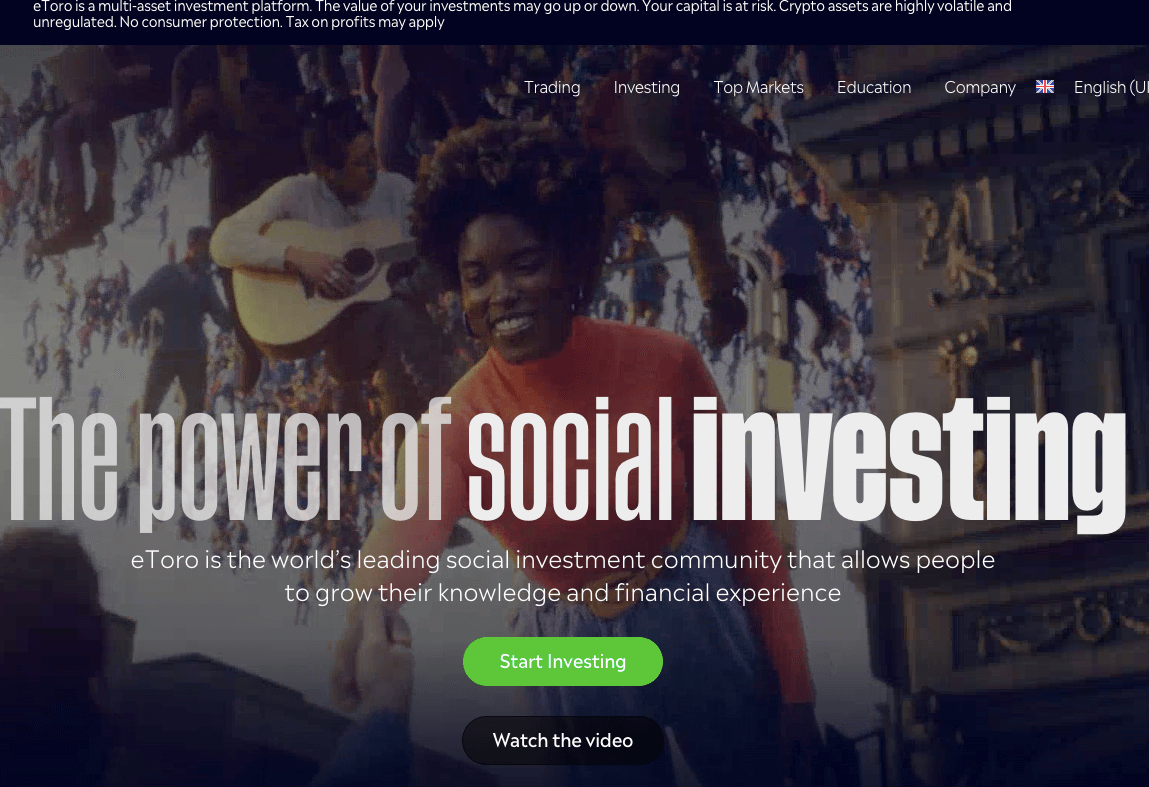

eToro has good conditions for copy trading as per our research. With their CopyTrader, you get access to successful traders that you can copy. eToro is regulated with the FCA so they are considered low risk.

So, how does eToro’s CopyTrader work? Simple. You choose a trader, choose the amount of money you want to invest, then you start copying.

There are no hidden costs or extra fees for copying successful traders. You don’t even pay any management fee to the traders you copy. The only fees you’ll incur are the spread and overnight charges.

No commissions for stock CFDs. Other CFDs offered include forex (48) commodities (15), and indices (13). The leverage for forex is 30:1.

The traders you copy get paid directly as part of eToro’s Popular Investor Program. You’ll have to meet certain criteria if you want to be a Popular Investor.

Beyond copying trades, the CopyTrader platform also gives you access to an interactive community of investors and traders. You can collaborate with fellow traders, learn from different investors, and view millions of portfolios.

In addition, when choosing the trader you want to copy, you will be able to see their risk score. This will help you judge their trading habits. This will help you choose a trader that matches your risk appetites.

The CopyTrader platform is suitable for both beginners and expert traders.

Our eToro Review covers everything about their trading conditions, you should check it out.

eToro Pros

- Thousands of verified traders are available

- No extra fees to use CopyTrader

- You can assess the risk appetites of traders you want to copy

- Wide range of instruments including ETF CFDs and stock CFDs

- Well regulated

- Interactive trader community

eToro Cons

- Third party platform like MT4 and cTrader are not available

#2 Pepperstone – MT4 Copy Trading Platform

Pepperstone offers copytrading through Duplitrade. It is referred to as social trading on their website. They are considered low risk because they are regulated with the FCA.

Pepperstone is a good trading platform for beginners. Their trading platforms work well on major devices like windows, android, and iOS. You can even use their WebTrader on your desktop.

This is the general condition of Pepperstone’s trading platforms. However, they go a step further by offering Social Trading. It works through a platform called DupliTrade.

DupliTrade is a social trading platform that allows for the automation of trades. This means that your copying of trades is not manual. You also have access to the signals of proprietary traders so you can take advantage of their expertise.

You get to trade the following: currency pairs, stock indices, stocks, ETFs, commodities, and currency indices. They are all CFDs.

The interesting thing is that DupliTrade works in conjunction with Pepperstone’s MT4. When you open a DupliTrade Account and deposit your funds, the strategies of top traders are automatically traded on your MT4 account.

There’s just one downside to using DupliTrade – the minimum deposit. According to Pepperstone’s website, you’ll need a minimum deposit of AUD$5,000 to join. This is a large sum of money and some traders might not have that much.

However, you can open a risk-free demo account and test the trades of these strategy providers. If you like what you see, you can proceed to use real money.

Check out our Pepperstone Review to know more about their trading platform and features.

Pepperstone Pros

- Regulated with the FCA

- No extra fees to use DupliTrade

- Copy trading is automated

- Good market range

- Trading simultor allows for bactesting of strategies

Pepperstone Cons

- Minimum deposit is too high

- DupliTrade has a limited number of strategies

#3 AvaTrade – Copy Trading Platform with Temporary FCA Regulation

AvaTrade is regulated with the FCA but their permission is temporary. However, they have an FCA firm number and they are considered low risk. AvaTrade offers copy trading via their three copy trading platforms. The presence of multiple platforms gives room for flexibility.

AvaTrade has multiple copy trading platforms. They offer good copy trading services because of their partnership with signal providers.

AvaTrade has good conditions for copy trading because of the flexibility its structure offers. Their three copy trading platforms are AvaSocial, DupliTrade, and ZuluTrade. They all operate differently.

The AvaSocial app works in tandem with the AvaTrade mobile app. It almost looks like an instant messaging app where you can create groups with like-minded traders and exchange messages with individual traders. Beyond these, you are able to copy the trades of different traders.

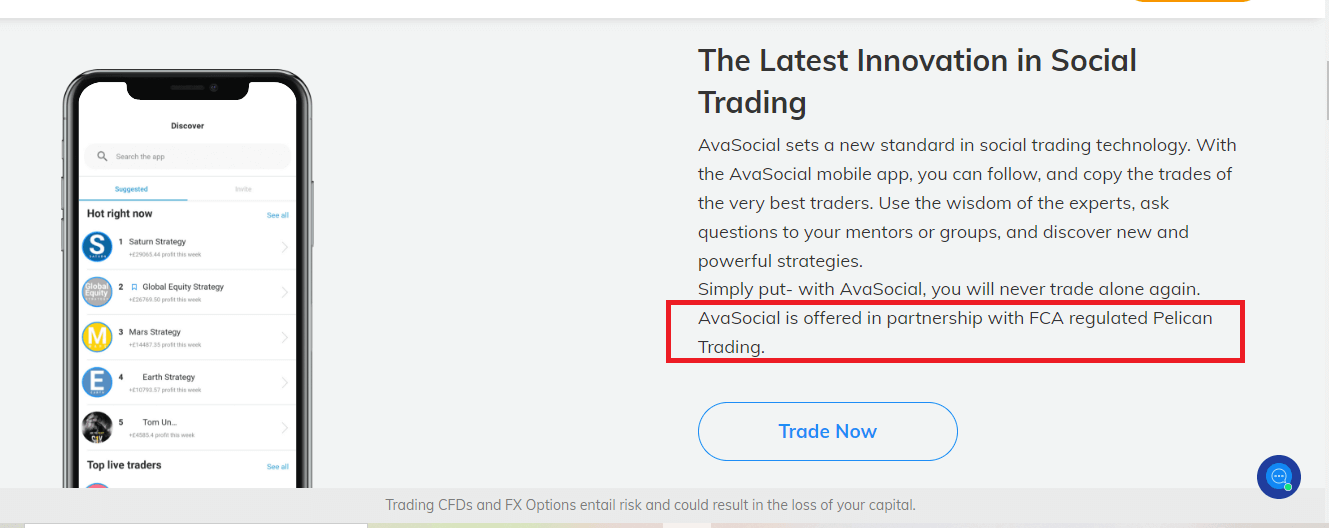

You should also know that you can also automate your trades on AvaSocial. You don’t have to do it manually. AvaTrade offers this platform via another FCA-regulated entity called Pelican Trading.

The next platform is DupliTrade. Like Pepperstone’s, it is easy to use and compatible with the MT4. With access to rich portfolios, you can copy the strategies of successful traders. Here, trading is also automated.

For registration, you only need to open a DupliTrade Account and the signals will get delivered to your AvaTrade Account. This is possible because you will be able to link the two accounts. With $2000, you can access the leading strategy providers on DupliTrade

Or you can always try the demo account with zero risks.

The last platform is ZuluTrade. You can access ZuluTrade with a minimum deposit of £500. ZuluTrade offers a wide variety of traders. These traders are not random. They have been ranked according to certain factors criteria like average profitability and maximum drawdown.

Trading is automated in connection with MT4 after you have funded your account. In addition, there is also the ZuluGuard. It can happen that the trader you are copying changes his strategy or begins to perform poorly. ZuluGuard protects your account when either of these happens.

Learn more about AvaTrade by reading our detailed AvaTrade UK Review.

AvaTrade Pros

- Well regulated

- Top mobile apps like AvaSocial and ZuluTrade

- You can asess traders’ profitability and max drawdowns

- Solid risk management with ZuluGuard

- It takes minutes to open an account

- ZuluTrade is available

AvaTrade Cons

- Temporary FCA regulation

- $2000 minimum deposit for DupliTrade

#4 Vantage FX – Copy Trading Platform with Temporary Pro ECN Account

Vantage FX or Vantage Markets are regulated with the FCA as Vantage Global Prime LLC. They offer copy trading on their three accounts with multiple deposit and withdrawal methods available.

Vantage FX supports social trading via their V-Social platform. The V-Social platform is powered by Pelican (regulated by the FCA). The platform is a mobile app that allows you to copy, trade, and chat on the go. It is basically a community.

The community is quite dynamic. You can trade smarter by auto-copying the most successful traders or get paid by helping other traders become successful. In other words, you can share your trade g ideas for a fee. Within the community, there are trading networks. You can follow/join anyone or create your own network. This way, you can build your own community within the community.

Since V-Social is powered by Pelican, they provide tools to help you analyse your trades and track your growth. Vantage FX has three accounts. A Standard Account with STP execution, a Pro and Raw Account with ECN execution. Copy trading is supported on the three accounts.

Read our Vantage FX review to know more about their trading conditions.

Vantage FX Pros

- Regulated with the FCA

- Solid mobile app with V-Social

- V-Social is powered by Pelican who is also regulated

- Account opening is easy

- ECN and STP execution

Vantage FX Cons

- Minimum deposit is £200

- V-Social is available on mobile phones only

What is Copy Trading?

Copy trading is literally what the name implies – copying another person’s trade. Without being an active trader, copy trading allows you access to strategies of successful traders that you can replicate in your own account. If they win, you win. If they experience losses, you experience the same. This is what copy trading means in simple terms.

Copy trading should not be confused with mirror trading. While copy trading involves human intervention, mirror trading copies strategies and trades without human intervention. The two are basically the same in operation but the human intervention factor is the difference.

Advantages of Copy Trading

- Inexperience is not a problem. Copy trading can be a good tool for beginners. Learning the basics of trading takes time. It is even believed in some quarters that a trader should demo trade for six months before opening a live account. Doing this might take too long. For copy trading, you can open an account today and begin trading today without much experience.

- Beginner traders can increase their knowledge via copy trading. Copy trading does not just give you access to expert trades. You also get access to the strategy that has made them profitable. You can use these strategies to improve yourself as a trader.

- Copy trading helps you diversify your investment portfolio. With access to different traders, strategies, and trading instruments, you can have exposure to varying market environments.

Risks of Copy Trading

- No trading strategy is 100% risk-free. Even if the trader or traders you copy have a good profit record, the risk attached to trading is still there. You can still lose a part of your trading capital if the markets do not go your master trader’s way. This is possible because you trade the same assets they trade.

- Current data might be deceptive. A master trader may have a short-term winning streak. This streak can be so hot that his gains are eye-watering. If you do not do your homework to assess his previous performances in the long term, you might sign up with such a trader. When the streak ends, you start losing money.

- In copy trading, you share your profits with your master trader(s). Most brokers fix the profit-sharing percentage. Some brokers do not. If you choose a broker that has no fixed profit-sharing percentage, then your money is at the mercy of master traders.

What CFDs are Available for Copy Trading?

Copy trading is literally copying another person’s trade. This means the only limitation to assets that can or cannot be copied depends on the platform you choose. In addition, it depends on the master trader you choose to copy. If he/she does not trade certain CFDs, you cannot copy them.

Currency pairs are the most copy traded instruments. However, other platforms allow you to copy trades on other CFDs. Here are the CFDs you can copy trade:

1. Currency Pairs: Currency pairs are the most prominent of CFDs. They are one of the few CFDs that are available on both MT4 and MT5. It is no surprise that most copy traders that prefer currency pairs prefer MT4 or MT5. You can use EA or a robot on these platforms. You can also copy trades manually if you want.

2. Shares CFDs: Not many trading platforms allow the trading of stocks directly. Only the derivatives are common. This is why most brokers have stock CFDs. Copy trading stocks is just like copying any other CFD. The upside is that commissions are less because of the stock market’s high liquidity.

3.ETF CFDs: ETFs are stock baskets. Literally, it is like a container that has multiple stocks in it. So copying a trade on ETF CFDs is like copying a trade on multiple stocks. ETF CFDs have high liquidity too.

4. Crypto CFDs: In the UK, crypto CFDs are available to professional traders only. Crypto copy trading is not as popular as currency pairs and stock CFDs.

Types of Copy Trading Systems

Copy trading is not carried out in a single way. There are different systems of copy trading available. Some brokers have a single system while some have multiple systems. For those with multiple systems, you can make a choice, selecting your preferred system. Here are the most common systems

1) All-round system: This system is an all-in-one system that combines conventional trading and copy trading. eToro is a typical example. It is a broker and a copy trading platform joined together. You don’t need to combine it with anything. You open your account and you are good to go. Other platforms like MT4, MT5, and cTrader require an external broker account before you can use them.

2) Copy trading signals: This system involves one or more traders spotting an opportunity in the market. The opportunity is then made available to other traders as a signal with opening, exit, and stop-loss positions. You will have to manually enter the signal on your trading platform. This system is common with unregulated online copy trading channels.

Regulated forex brokers who have this system do not give opening, exit, and stop-loss positions. Rather, they notify you if certain conditions have been met in the market. You can then analyze the conditions and see if there is a trading opportunity there.

3) Algorithm Software: This involves the use of EA (expert advisors) or bots to trade. These bots are preprogrammed and they trade based on an algorithm. EAs can trade 24 hours a day and they strictly follow the codes put in them.

Basically, the bot will go long or short on a CFD if it crosses major price zones or fulfill other on-chart parameters. However, there is a downside to using bots. Because bots cannot think for themselves, they only execute trades technically. They cannot track economic releases and events that have high impact on the price movement of CFDs.

Is Copy Trading Profitable?

Copy trading is not free of risk. However, losses or profits are determined by the trader you copy. Since their result is your result as well, if they win, you win. So you must be thorough when choosing the trader you want to copy.

Furthermore, previous performances do not guarantee future results. A trader might be profitable over a period, then a string of losses might follow. The fore market is volatile and there are cycles. If the trades you copy do not go with current cycle, you are at risk of losses.

How to Choose a Copy Trading Platform in the UK

Now that you have in-depth knowledge about copy trading platforms in the UK, how do you choose one? Which points were the basis of our research in choosing these platforms?

In these points listed below, you will find the factors that should serve as your checklist. Make sure your preferred copy trading platform passes these criteria.

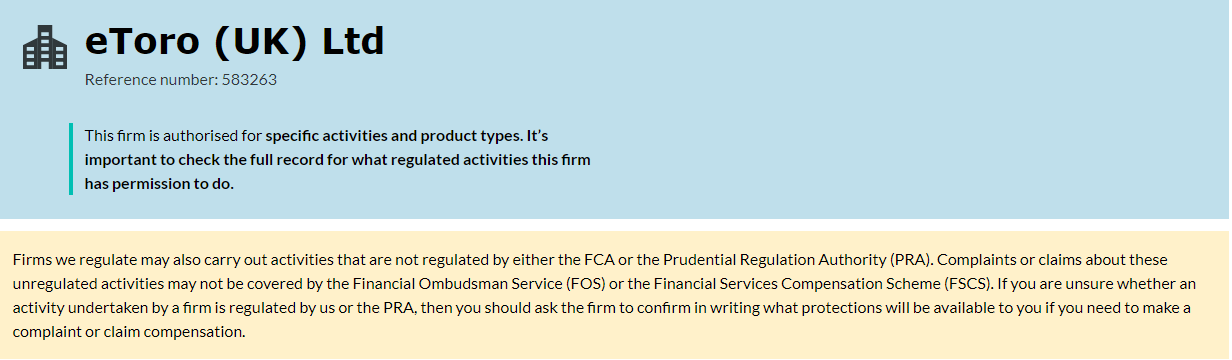

1) Safety of Funds: You can only guarantee the safety of your funds by choosing a regulated copy trading platform. The Financial Conduct Authority (FCA) is the regulator of copy trading platforms in the UK. They assign a firm reference number to all copy trading platforms. There are no platforms with the same number.

So, how do you check this regulation? First, copy trading platforms display it clearly in the footnote of their websites. Here is an example with eToro.

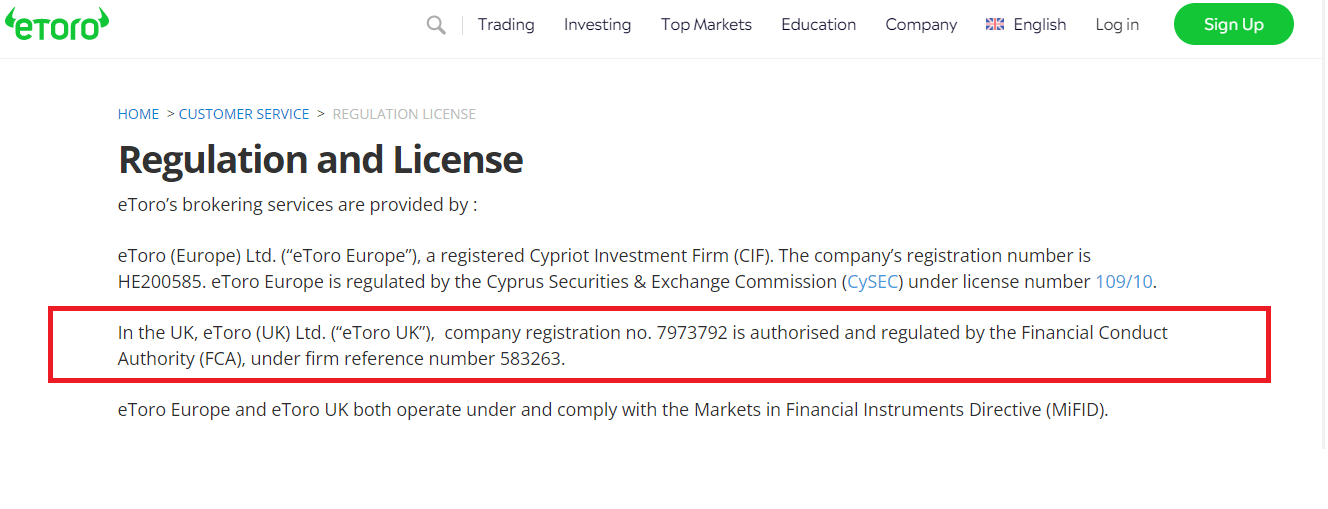

If you click on “Regulation & License” (in the yellow box). It will take you to the page showing eToro’s regulation with the FCA and their firm reference number. The page is shown below (FCA regulation in red)

For some copy trading platforms, you might not need to click and go to a page. They just spell out the regulation in the footnote. Also, it is possible for a forex broker to offer their copy trading platform in partnership with another regulated entity. Below is an example with AvaTrade’s AvaSocial app.

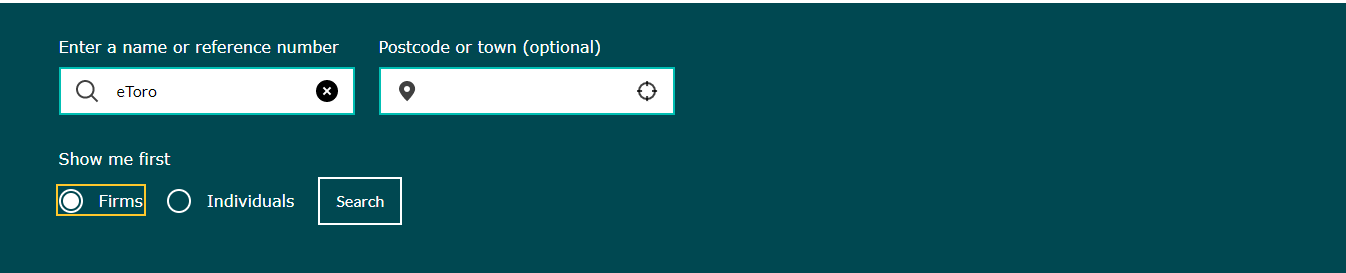

All we have done is talk about information from the forex brokers. You need to confirm their regulation on the FCA’s website as well. Just go to https://register.fca.org.uk/s/ and search for the firm. You should particularly check if the reference number on the forex broker’s website and that of the FCA match.

To do this, scroll down the FCA website homepage till you find the panel displayed below. Enter the broker’s name and select ‘firms’ to narrow the search to companies only. Then click on ‘search’.

When we searched for eToro, the result showed that the firm reference number was the same as the one on their website. The company name, eToro UK, matched as well.

Apart from these, there is a great advantage to copying trades with FCA regulated brokers. First, your funds are protected under the Financial Services Compensation Scheme (FSCS). This guarantees your money is not lost should the forex broker declare insolvency.

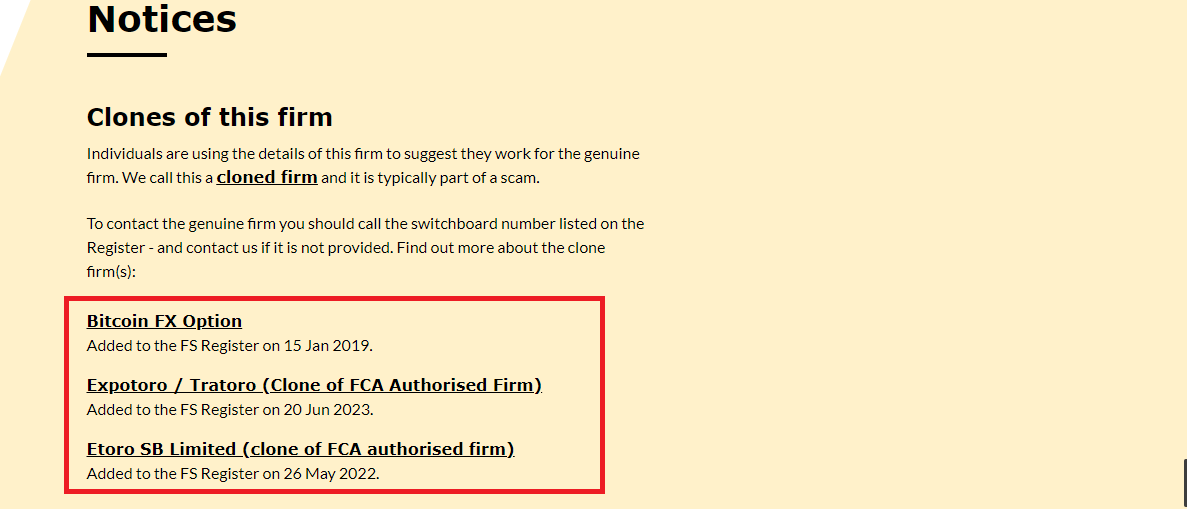

In addition, you get to avoid fraudulent clone firms. These brokers do have similar names to FCA licensed brokers and unsuspecting traders can easily become victims. As you try and verify your broker’s regulation, you will find their clones as well.

Here is an example with eToro.

The clone firms are in the red box. Do you see how close the names are? It is quite easy to be a victim. This is another advantage of trading with copy trading platforms that are licensed with the FCA.

Secondly, there is a 30:1 leverage restriction. With this, you cannot overleverage your account so you will avoid huge losses.

2) Total Fees: With copy trading, the total fees you are charged are important. Spreads, swaps, and commissions are the basic trading fees you will incur. The forex brokers in our review do not have different trading fees for copy trading.

You should check the trading fees to know the ones that are charged by your preferred copy trading platform. You will also be able to know if they are high, low, or moderate.

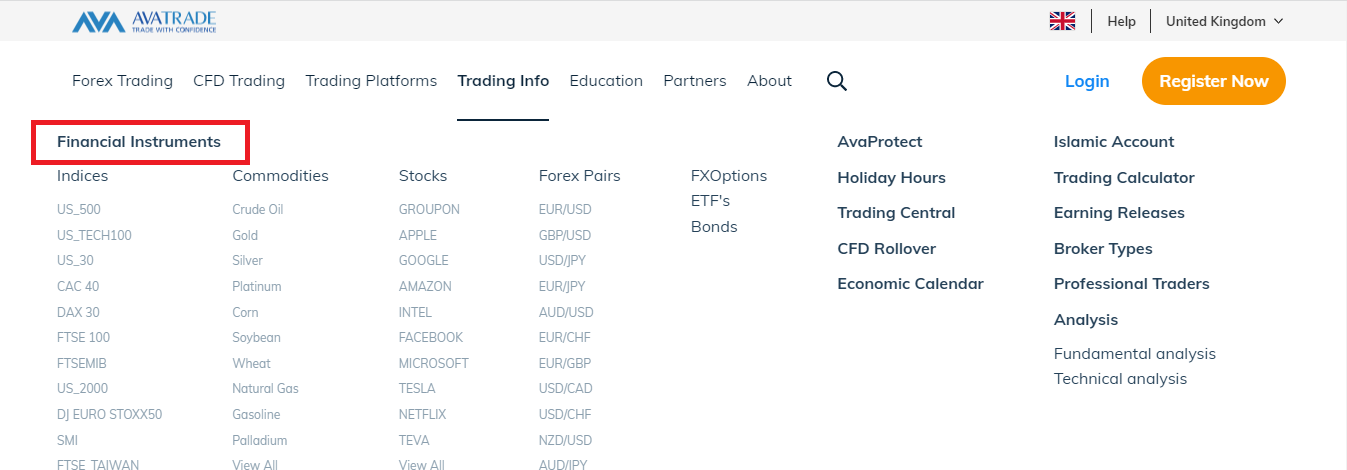

Just go to the broker’s website and navigate to spreads, fees, or charges. You will find all information you need about the total fees. Let us demonstrate how you can find AvaTrade’s spread for example. On their homepage, move your cursor to ‘Trading Info’. You will see a wide dropdown. In the dropdown click on financial instruments (in the red box). Here is an illustration below

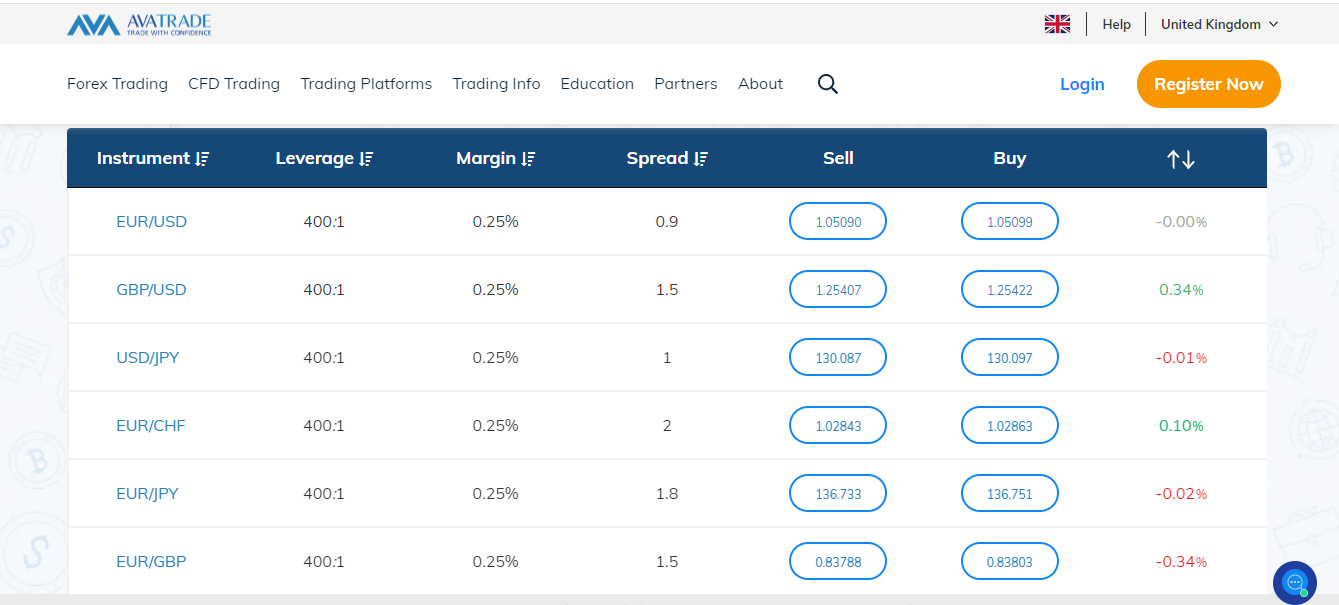

After selecting ‘Financial Instruments’, you page that follows will display a tab, naming all the CFDs offered. When you click on ‘forex’. You will be able to view AvaTrade’s spreads as displayed below.

Finally, you should also check if there are management fees or extra costs that come with copy trading. eToro, for example, pays the traders you copy via their Popular Investor Program. So there are no extra costs.

Beyond going through the website yourself, speak to your copy trading platform’s support for more information

3) Risk Scores: Risk scores let you know more about the trading habits of the traders you are copying. Traders with high scores are more conservative. Those with low scores are probably aggressive in their trading.

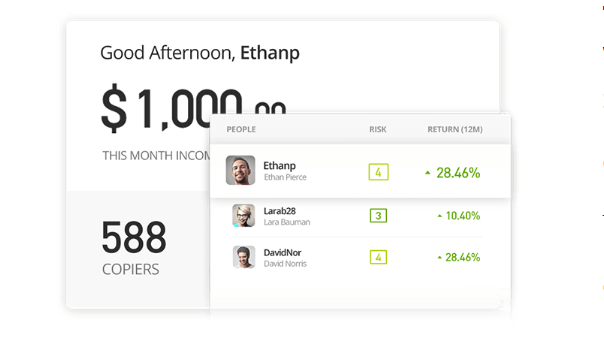

Any copy trading platform you choose should make sure you are not copying trades blindly. There should be enough transparency to help you make informed choices. eToro’s CopyTrader displays the risk scores of strategy providers. Here is a snapshot below:

AvaTrade also has something similar on their ZuluTrade copy trading platform. Strategy providers are ranked according to profitability, the number of followers, and the maximum drawdown.

Transparency is important. Never copy trade blindly.

4) Automation: You can copy trade manually. It’s all good. However, you might not be online always. Or there could be other things taking your time.

Your chosen copy trading platform should have automation with it. Such that when your chosen trader makes a trade, it is replicated automatically on your platform. It should not be 100% manual ‘copy and paste’.

All copy trading platforms in this review have automation.

But it is important to consider that by using automation, you are fully trusting the strategies of the traders you are copying, without doing your own analysis. This could result in losses.

5) Range of Markets: A wide range of markets is key to an excellent copy trading condition.

You cannot access CFDs on instruments that your chosen trader does not have access to. So, there should be a good number of trading instruments. Currency pairs, indices, stocks, and commodities (especially oil and gold) should be available.

Don’t bother about cryptocurrencies. They are only available for professional traders. For those that are available for retail traders, you need to check if your favorite CFDs are offered. For example, if you prefer to copy trades on GBP/USD to other currency pairs, you need to confirm your broker has that CFD before signing up.

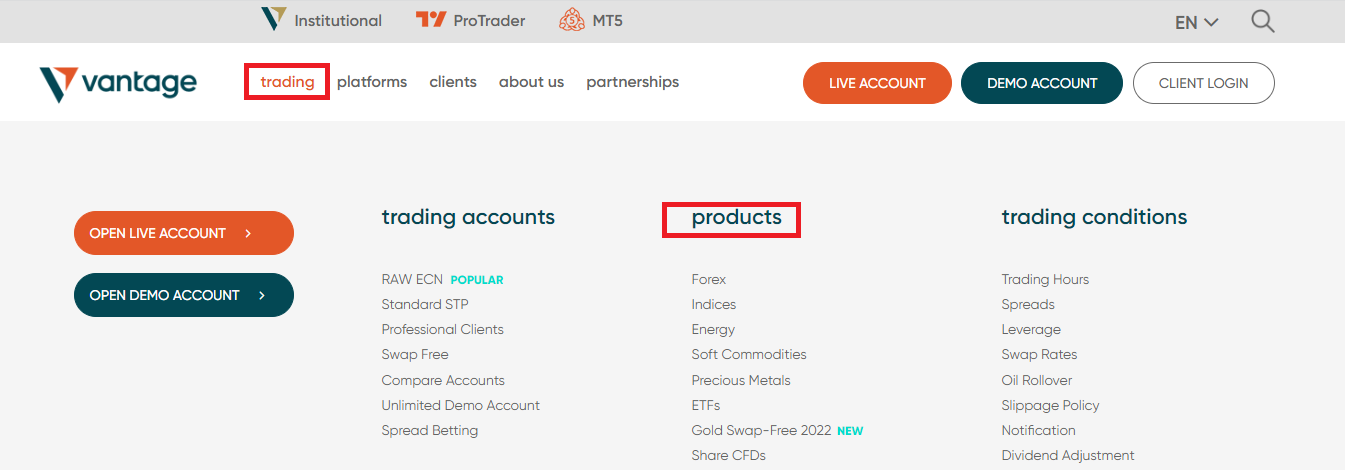

Here is a systematic guide to go about this with Vantage FX as an example. On their homepage, click trading (in the red box). You will see a dropdown that includes among other things the list of their products (in the red box) as shown below

You can see Vantage FX has forex, indices, energy, soft commodities, precious metals, ETFs, and shares. (Please note they are all CFDs). You could stop here in your search but there is an issue. The list does not show the specific CFDs within each instrument class. To see the specific CFDs, click any of the instrument classes.

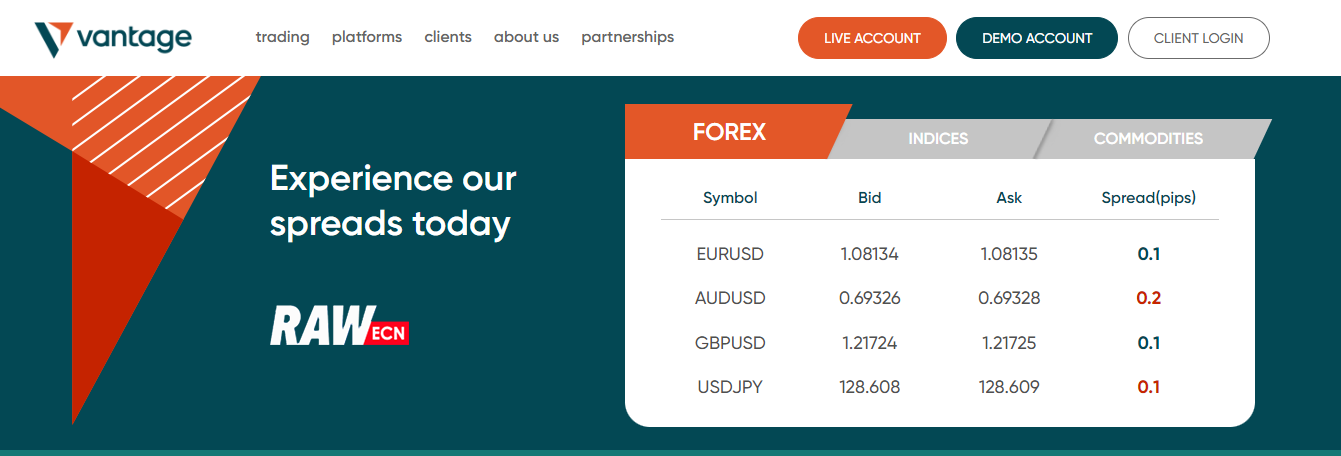

If you click ‘forex’ for example, you will find the individual currency pairs that make up the class.

6) Funding/Withdrawals: Most of the forex brokers that operate in the UK have a GBP account. So you should be able to deposit and withdraw your funds in pounds. So what you want to look out for are the payment methods available.

Can you deposit/withdraw via your bank? Are there e-wallets you can use anywhere?. In addition, you also need to know how long payment takes. Withdrawals should not be more than 2-3 days. Finally, you should check if there are deposit/withdrawal charges from your broker.

7) Customer Support: You might have some questions about your copy trading platforms. There is no better way to get the answers than direct contact. You should be able to reach the forex brokers that provide copy trading services.

Emails, phone calls, and live chats are the commonest channels. A UK mobile number should be available for calls. Email responses should arrive quickly.

Also, the live chat should not be menu-based only. Menu-based live chats only give you automated responses from chatbots. From the live chat, you should be able to access a live agent that can relate to more complex enquiries.

How to Begin with a Copy Trading Platform

1) On eToro’s homepage, click on ‘START INVESTING’

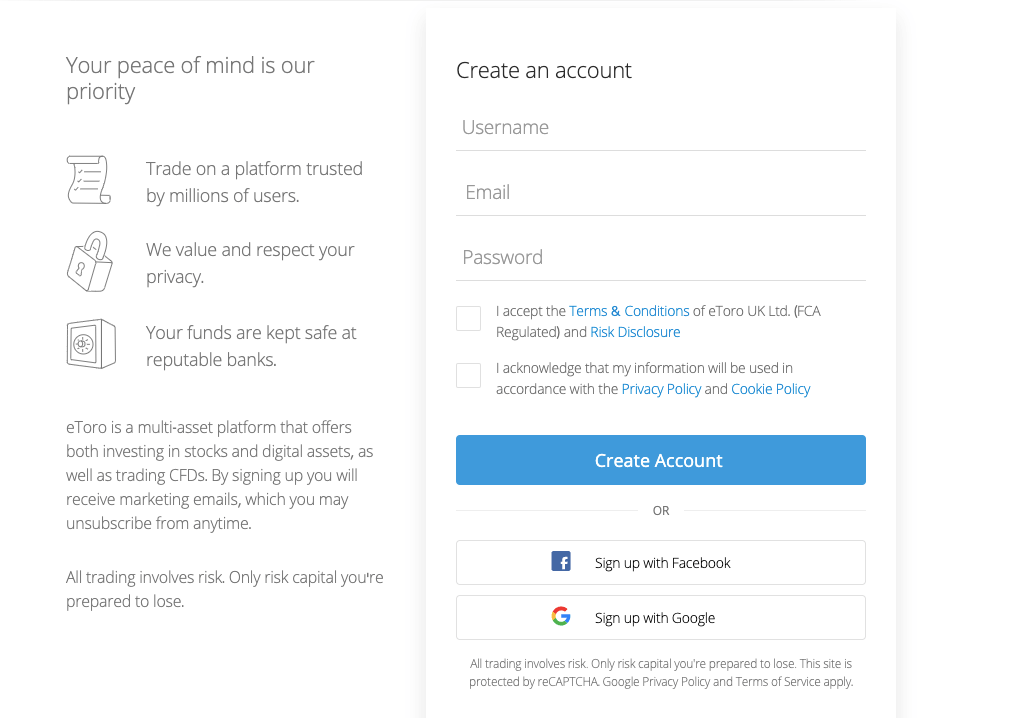

2) Create an account b filling in your username, email, and password. You should also check the privacy policy and terms & conditions boxes.

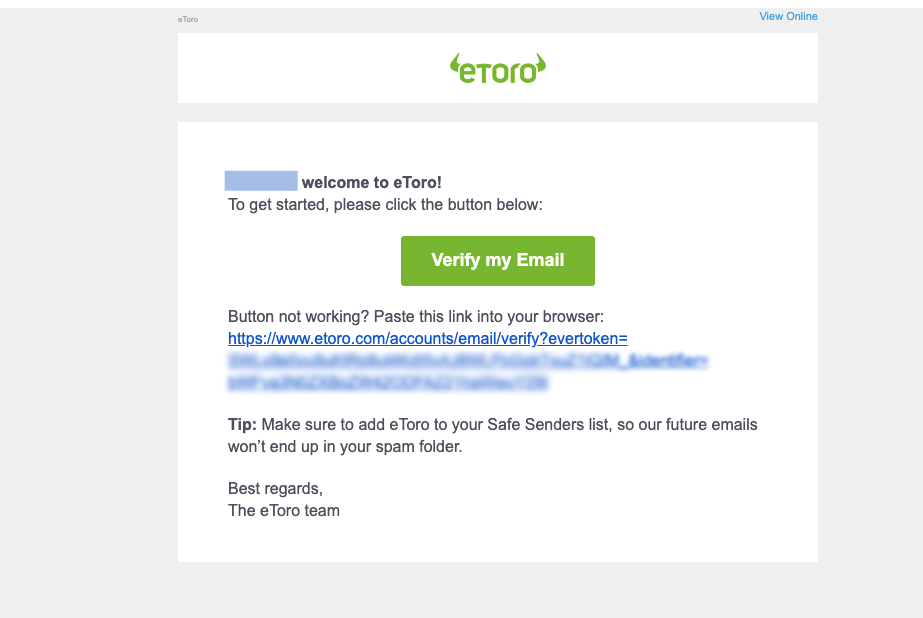

3) Check your email box and click on the link sent to verify your email. Once this is done, you will be redirected to your dashboard.

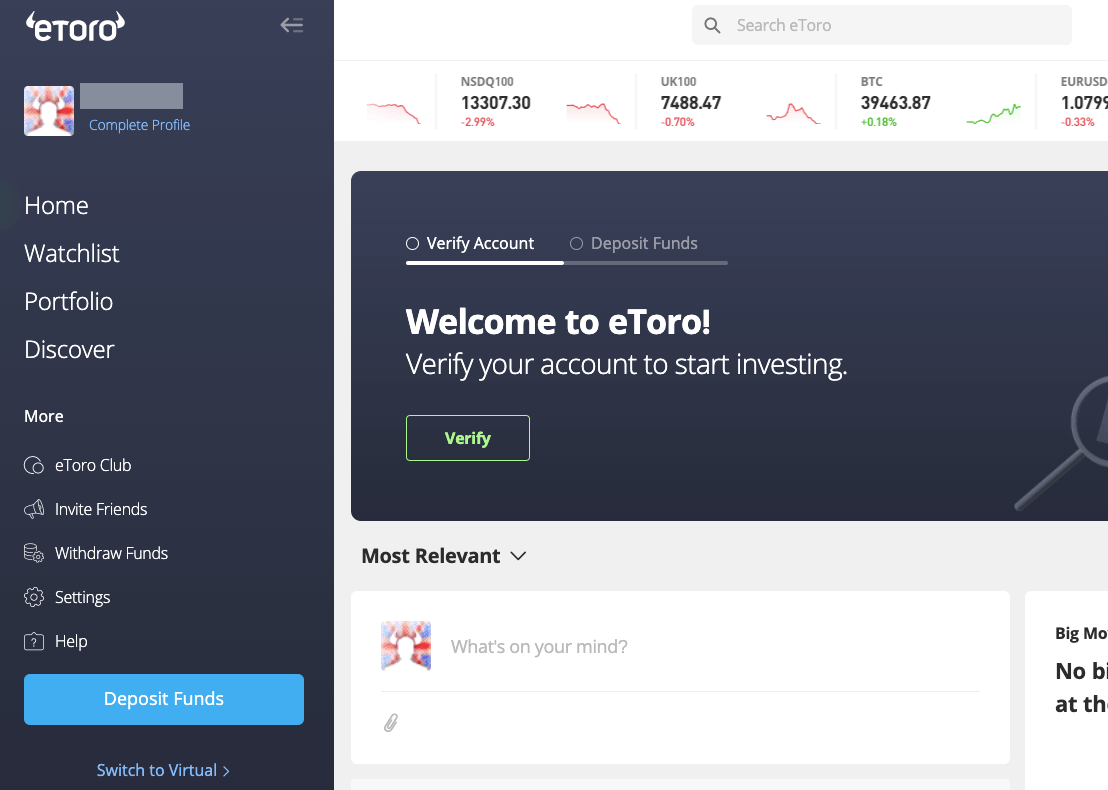

4) On the dashboard, you can proceed to verify your account by clicking on ‘Verify’

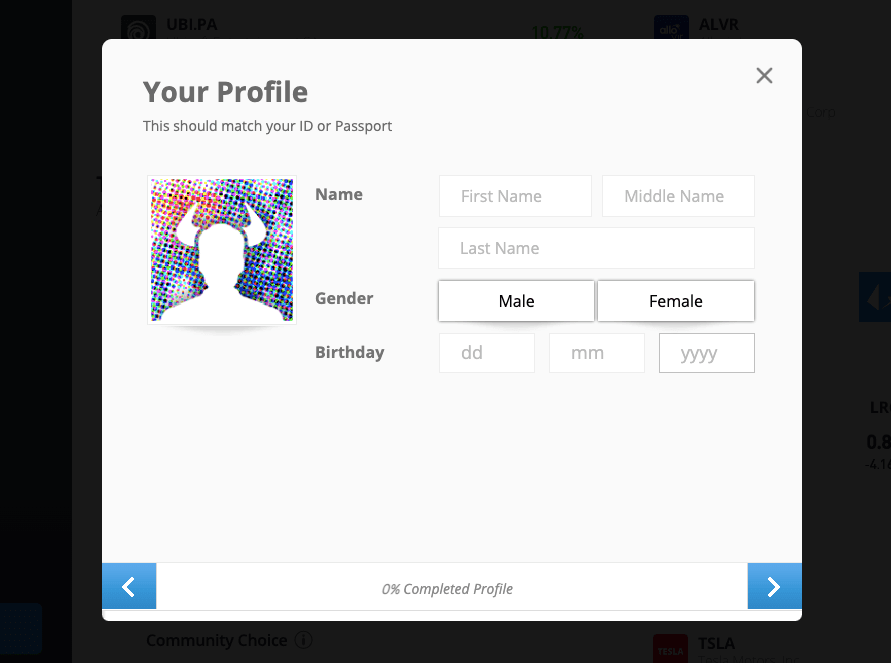

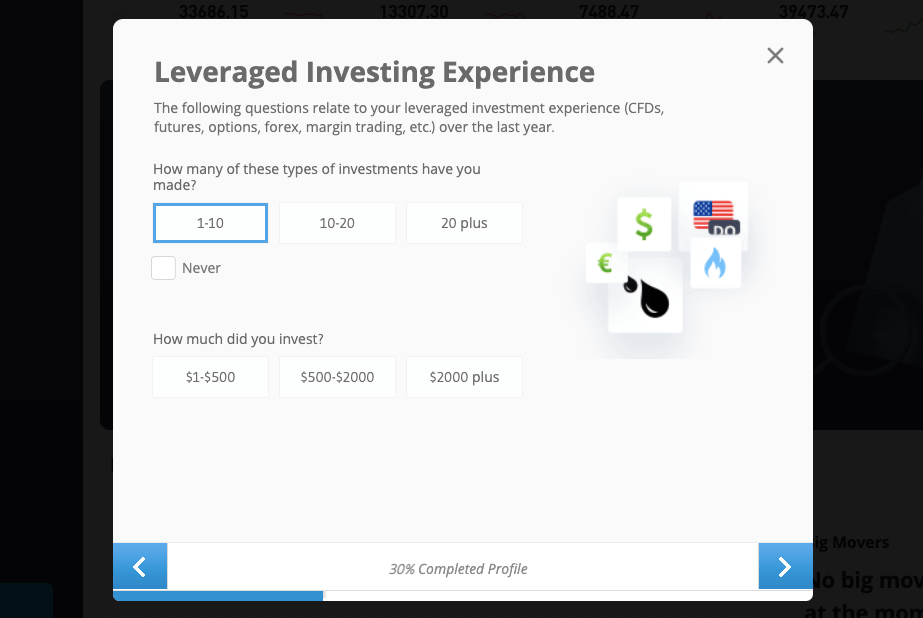

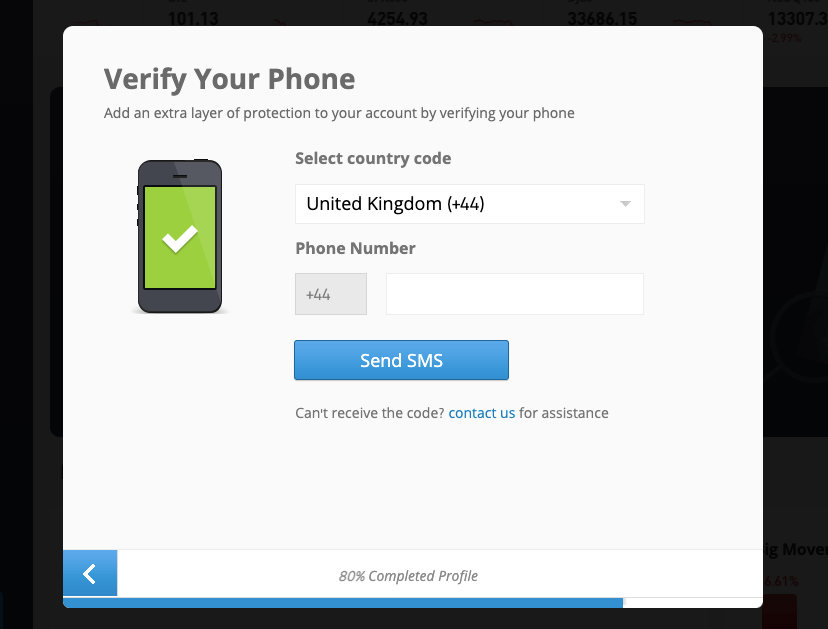

5) Proceed to complete your profile by answering questions on your trading experience, your phone number, and uploading your proof of ID.

6) After your KYC verification, you can start copy trading

What is the Difference between Social Trading and Copy Trading?

Social trading is not the same as copy trading. With social trading, it is all about community. You join other traders in communicating and sharing of trading ideas and strategies. The goal of social trading is learning.

You will find different levels of traders in a community. It could be a mix of beginners, intermediate, and expert traders. When you are active in this kind of community, you get to speed up your learning process. You make rapid progress because of the different ideas being shared by other traders. Your trading skills and knowledge improve.

Copy trading is like a service offered by your broker on their trading platform. Though it might involve other traders, the goal is not learning or sharing ideas. Rather, it is to copy the trades of successful traders that you choose.

The process could be manual or automatic. Analyzing and trading the financial markets takes a lot of time. Through copy trading, you can save time. You do not need a deep knowledge of the financial markets to use copy trading. Just few clicks on your trading platform and you are in.

In summary, social trading focuses on developing your skills while copy trading gives you a time-saving way into trading.

FAQs on Best Copy Trading Platforms in the UK

How does Copy trading work?

Opening a Copy trading account is a straightforward process. After you open an account and fund it, you then proceed to choose a trader to copy. When the trader opens a position, it is automatically replicated in your trading account.

Is copy trading legal in the UK?

Copy trading is legal in the UK and it is recognized by the FCA as portfolio or investment management. Sign up with FCA regulated copy trading platforms only to protect your funds.

What is the best forex platform with a low deposit and copy trade?

The platforms we have reviewed are the best in the UK. In terms of low deposit, eToro has a minimum deposit of $10 while Pepperstone does not enforce any minimum deposit.

How do I copy a successful trader?

You begin by picking a regulated broker with copy trading. Open an account and fund it. Check the most successful traders with good risk scores on the platform. You can then start copying.

Is copy trading profitable?

Copy Trading comes with its risk. It can lead to more losses. Since it is automated, you do not have control over how many times you trade. This might lead to trading more than usual, which then leads to more losses.