Most forex & CFD brokers in the UK support the MetaTrader 4 Trading Platform. It is the most popular trading platform in the world. It was developed in 2005 by MetaQuotes and is still one of the most popular platforms for charting & placing orders with traders after 15+ years.

In this guide, we will cover the MT4 brokers in the UK that we consider to be safe. In addition, we will answer some frequently asked questions about these MetaTrader-based brokers.

To gather the list of these MT4 brokers, we looked at different factors such as the number of instruments offered, execution speed, and trading costs. We also considered their regulation with FCA to know if they are safe to trade with or not.

Comparison of Best MT4 Brokers in the UK

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| City Index |

FCA, ASIC

|

1:30

|

£100

|

Visit Broker |

| IC Markets |

ASIC, CySEC

|

1:30

|

£200

|

Visit Broker |

| CMC Markets |

FCA

|

1:30

|

£0

|

Visit Broker |

| AvaTrade |

FSCA, FSA, FSC, ASIC

|

1:30

|

£100

|

Visit Broker |

| Pepperstone |

FCA, ASIC

|

1:30

|

£0

|

Visit Broker |

| IG Markets |

FCA

|

1:30

|

$0 (for card payments)

|

Visit Broker |

6 Best MT4 Brokers in the UK

Here are the six brokers that made our list of best MT4 brokers in the UK:

- City Index – Best MT4 Broker in the UK

- IC Markets – Regulated ECN Type Forex Broker with MT4 & low fees

- CMC Markets – Regulated MT4 broker with Guaranteed Stop Loss Order

- AvaTrade – Best MT4 Broker with Zero Commissions

- Pepperstone UK – MT4 Broker with Low Spreads

- IG Markets – Reputed CFD Broker with MetaTrader 4 platform

Let’s start with a brief explanation & description of the above-listed MT4 brokers one by one which will make it easy for you to compare them.

#1 City Index – Best MT4 Broker in the UK

They have been authorized to operate in the UK since 24/03/2006 and they are still authorized at the time of this writing.

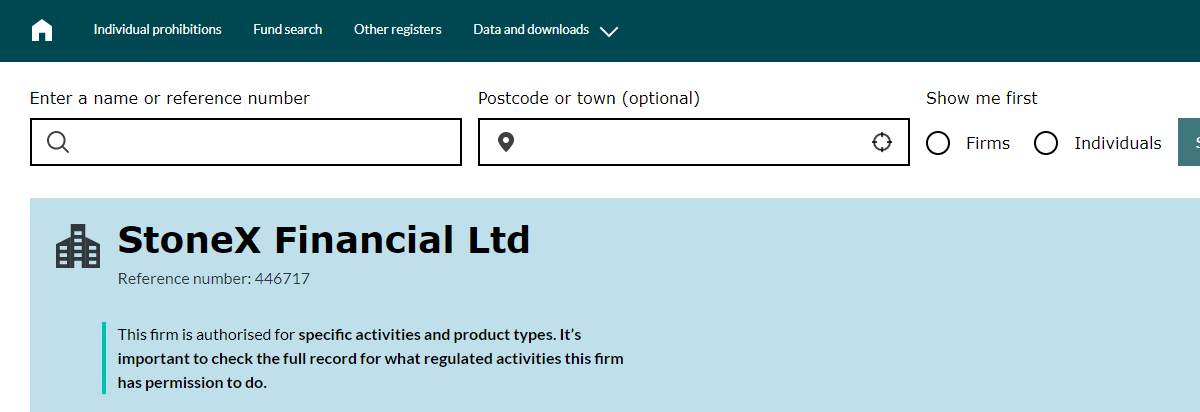

Regulation: City Index are regulated with UK’s Financial Conduct Authority (FCA) as StoneX Financial Limited. Their reference number is 446717. Your funds are therefore safe with City Index.

Minimum deposit: Generally, your minimum deposit must be enough to cover margin requirements and your trading style. City Index recommends a minimum deposit of £100.

Spreads for major pairs: City Index offers a typical spread of 1.8pips and 0.8 pips for GBP/USD and EUR/USD respectively.

The number of instruments: City Index offers a good range of instruments. You get access to 12+ indices, 100+ stocks, 80+ currency pairs, 16 indices 4 commodities, 4 options, 4 bonds, 4 metals, and 3 interest rates.

Leverage for forex: The maximum leverage for retail traders is 30:1. Professional traders can access higher levels of leverage.

Deposit/withdrawals: You can deposit/withdraw funds using a credit/debit card, bank transfer, or PayPal. Card transactions take 3-5 working days. Bank transfer takes up to 1-2 working days. Funding and withdrawing via PayPal can take up to 48 hours.

City Index Pros

- City Index MT4 is available on multiple devices

- Hedging toos are available

- Multiple trading orders

- You can scale out of trades partially

- There is a research portal that gives actionable trade ideas

City Index Cons

- Inactivty fee

#2 IC Markets – Regulated ECN Type Forex Broker with MT4 & low fees

IC Markts offer very low spread at low trading fees. They have also wide range of assets for trading.

Regulation: IC Markets are regulated in another European Economic Area country. They have temporary permission to operate in the UK. They have held this temporary permission status since 31/12/2020. Their reference number is 827935. Your funds for trading are considered safe with IC Markets.

Update: As of May 2022, IC Markets have applied to cancel their temporary FCA license according to the FCA website.

Minimum deposit: You can open an IC Markets trading account with a minimum of £200. Do not forget that you must have enough funds to cover for margin.

Spreads for major pairs: With IC Markets, you can trade GBP/USD and EUR/USD at low spreads of 0.83pips and 0.62pips respectively.

The number of instruments: IC Markets offers a gives you exposure to a range of financial instruments. You have access to 61+ currency pairs, 22+ commodities, 25+ indices, 11+ bonds, 730+ stocks, and 4 global futures.

Leverage for forex: Retail traders are offered maximum leverage of 30:1. Professional traders can leverage up to 500:1.

Deposit/Withdrawals: IC Markets offer four deposit/withdrawal channels: Visa credit/debit card, Mastercard credit/debit card, Neteller, Skrill, and bank wire transfer. All deposit transactions are processed instantly. Bank wire transfer takes up to 2-5 business days.

Withdrawals are processed in 24 hours and funds can take up to 2-5 business days to reach your account.

IC Markets Pros

- You can run MT4 on Windows or Mac

- Raw pricing with tight spreads

- No restrictions on trading. You can place your stop-loss at any price level.

- No dealing desk

- You can hedge your trades

IC Markets Cons

- Inactivty fee

- Stocks are not available on IC Markets MT4

#3 CMC Markets – Regulated MT4 broker with Guaranteed Stop Loss Order

CMC Markets have over two decades of presence in the UK having been authorized since 01/12/2001. You can safely trade the forex market with CMC Markets. We consider them low risk

Regulation: CMC Markets are regulated with the FCA as CMC Markets UK plc. They have an authorized status in the UK with reference number 173730.

Minimum deposit: CMC Markets have no minimum deposit. You should deposit enough money because of margin requirements.

Spread for major pairs: CMC Markets offer a minimum spread of 0.9 pips and 0.7 pips for GBP/USD and EUR/USD respectively.

The number of instruments: CMC Markets offers a wide range of financial instruments. Opening an account with them exposes you to 11,000+ financial instruments. You get to trade 330+ currency pairs, 80+ indices, 19 cryptocurrencies, 100+ commodities, 9000+ shares, and 50+ treasuries.

Leverage for forex: You can trade forex with CMC Markets at 30:1 leverage. This is the maximum leverage for retail traders.

Deposit/Withdrawals: You can deposit and withdraw funds via three channels. You can carry out your transactions via bank wire transfer, credit/debit card, and PayPal. These payment options can be used on their trading app and web-trading platform. Deposits and withdrawals are processed instantly but can take 2-3 business days for funds to reflect in your account.

CMC Markets Pros

- Good customer support

- You can automate your trades

- Trading signals are offered

- MT4 is available on Web, Android and iOS

CMC Markets Cons

- Inactivty fee (£10)

- Spread betting isn’t available on MT4

- Share CFDs are not available on MT4

#4 AvaTrade – Best MT4 Broker with Zero Commissions

AvaTrade processes withdrawals within 24-48 hours with cards and e-wallets. Bank transfer can take up to 10 business days to reflect in your account.

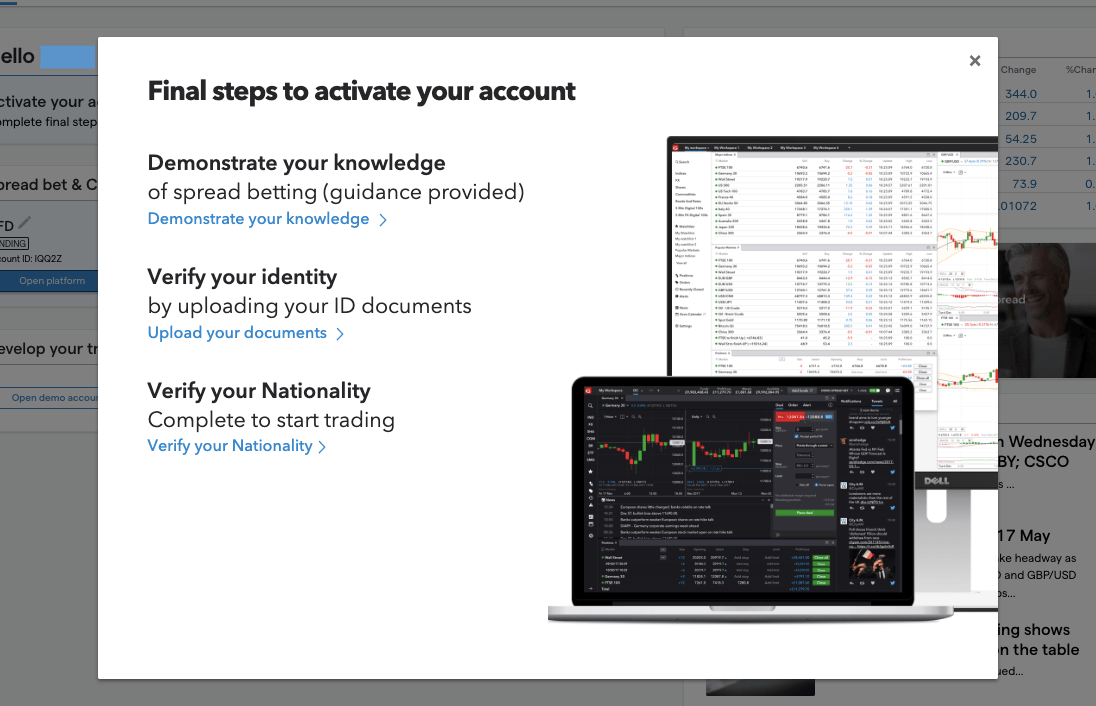

Regulation: Like IC Markets, AvaTrade is regulated in another European Economic Area but has temporary permission to operate in the UK. They have held the temporary permission status since 31/12/2020 with 504072 as their reference number. AvaTrade is moderately safe for UK brokers.

Minimum deposit: You can open an AvaTrade account with a minimum of £100.

Spreads for major pairs: AvaTrade’s spread for GBP/USD and EUR/USD are 1.6 pips and 0.9 pips respectively.

The number of instruments: You get to trade 50+ currency pairs, 5 precious metals CFDs, 5 energies, 7 commodities, 30+ stock indices.

Leverage for forex: Maximum leverage for forex trading is 30:1.

Deposit/withdrawals: AvaTrade allows deposit/withdrawal via credit/debit cards, Skrill, Neteller, and bank wire transfer. Deposits reflect in your accounts instantly except for bank transfers. It can take up to 7 business days for funds to reflect in your trading account via bank transfer.

AvaTrade Pros

- MT4 is available on multiple devices

- Algorithmic trading via Expert Advisors

- Hedging is permitted

- AvaTrade MT4 has Guardian Angel that helps improve your trading skills. It is free.

- MT4 is available on old windows versions like Vista.

AvaTrade Cons

- Inactivty fee

- Limited number of indicators

#5 Pepperstone – MT4 Broker with Low Spreads

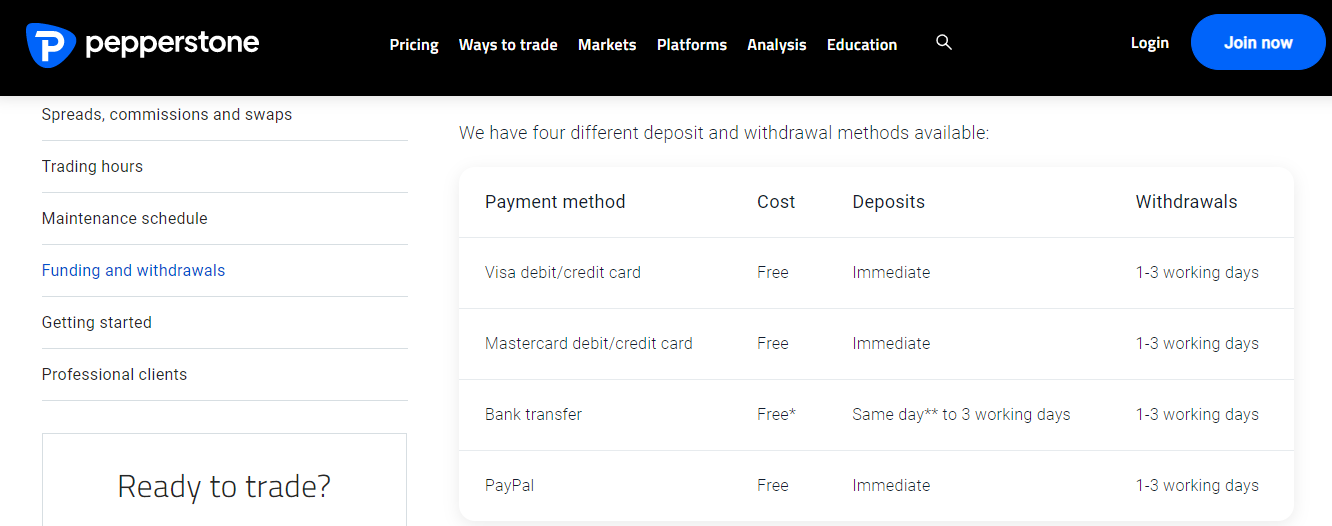

With Pepperstone deposits are immediate except for bank transfers, which can take up to 3 working days. All withdrawal methods take 1-3 working days.

Regulation: Pepperstone is regulated with the FCA as Pepperstone Limited with reference number 648312. They are currently authorized to operate in the UK. They have been authorized since 05/08/2015. Pepperstone is a low-risk broker.

Minimum deposit: Pepperstone recommends a minimum deposit of £200 for traders to open a forex trading account.

Spreads for major pairs: Pepperstone offers 1.19 pips average spread for GBP/USD. For EUR/USD, the average spread is 0.77 pips

The number of instruments: With Pepperstone, You get to trade 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices.

Leverage for forex: Retail traders get maximum leverage of 30:1 for forex trading. Professional traders are offered up to 500:1 leverage.

Deposit/Withdrawals: Pepperstone has four deposit methods: Visa credit/debit card, Mastercard credit/debit card, bank transfer, and PayPal. Deposits are immediate except for bank transfers, which can take up to 3 working days. All withdrawal methods take 1-3 working days.

Pepperstone Pros

- You can build and run your EAs on MQL4

- Autochartist is available. This tool helps you identify key price structures on your charts.

- Hedging is available

- Pepperstone’s Smart Trader Tools helps you access more indicators and EAs.

- No inactivity fees

Pepperstone Cons

- Shares CFDs are not offered on Pepperstone MT4

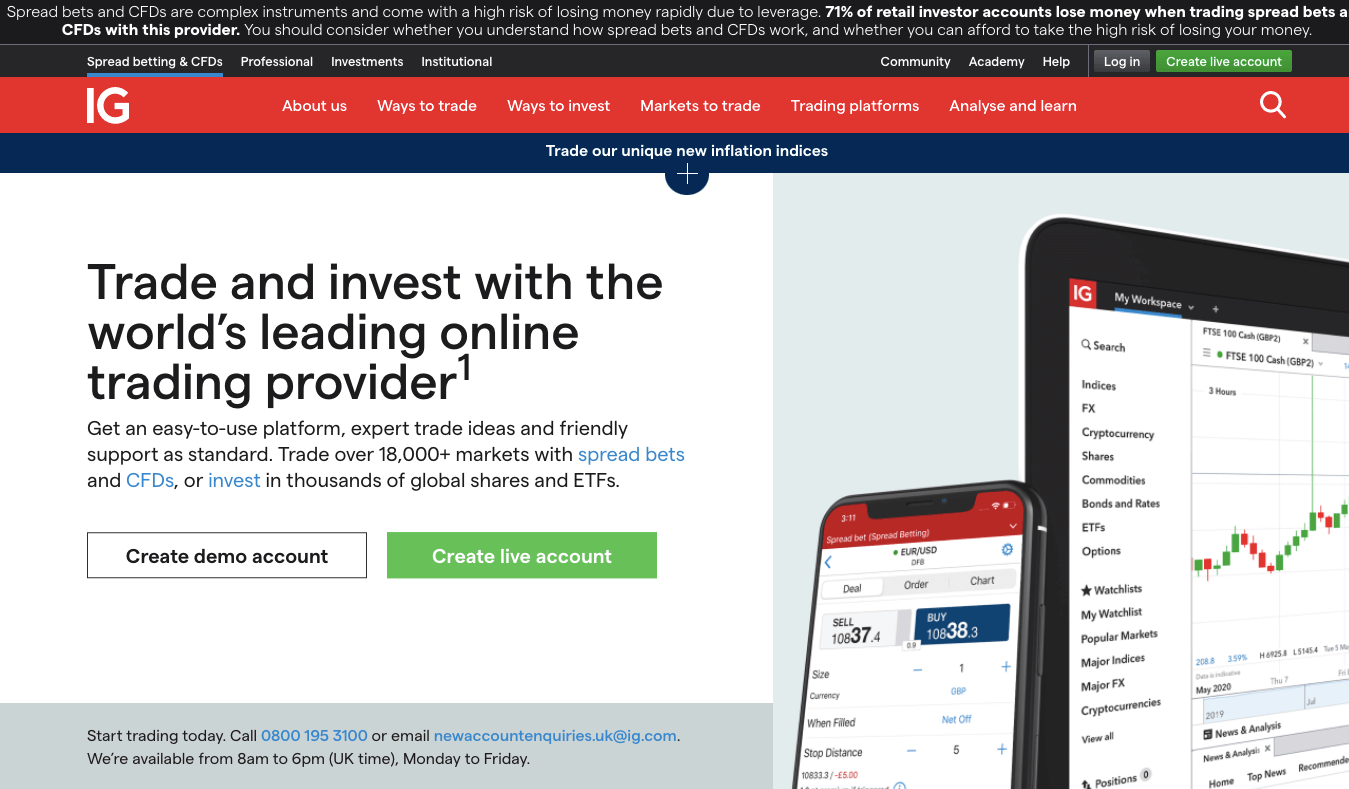

#6 IG Markets – Reputed CFD Broker with MetaTrader 4 platform

With IG Markets PayPal transactions are usually immediate. Card and bank transfers can take up to 5 working days.

Regulation: IG Markets are regulated with the FCA as IG Markets Limited. Their reference number is 195355 and they have been authorized since 01/12/2001. You can trade safely with IG Markets.

IG Group is also publicly listed on the LSE, so they are considered a safe CFD broker to deposit funds with.

Minimum deposit: You need a minimum of £250 to open a trading account with IG Markets.

Spreads for major pairs: IG Markets offer 2.38 pips and 1.13 pips as the average spreads for GBP/USD and EUR/USD respectively.

The number of instruments: IG Markets lets you trade up to 17000 markets. You get to trade

50+ currency pairs, 6 commodities, 8 stock indices, and a whopping 13000+ shares. Other markets include ETFs, bonds, options, and interest rates.

Leverage for forex: Maximum leverage for retail traders is 30:1.

Deposits/Withdrawals: You can deposit your funds using any of these three methods: credit/debit card, PayPal, and bank wire transfer. For withdrawals, only two methods are available: credit/debit card and bank wire transfer.

IG Markets Pros

- You can build and run your EAs on MQL4

- Spread betting is supported on IG Markets MT4

- Automated trading is available

- Autochartist is supported.

- 12 free add-ons

IG Markets Cons

- Complex pricing because of different executions on MT4

- Shares CFDs are not available

What is MetaTrader 4?

MetaQuotes developed the MetaTrader 4 in 2005. It is designed for futures and Forex trading. MetaTrader 4 allows a trader to analyze the financial markets and use expert advisors. It also supports copy trading.

The platform has a good trading system that supports instant execution and market orders. It also supports buy limit orders, sell limit orders, sell stop orders, buy stop orders, 2 stop orders, and trailing stop loss. The combination of these functions allows you to be flexible with your trading strategies.

MetaTrader 4 also supports tools that help your technical analysis. These tools, which include 30 indicators and 24 graphic objects, are built-in. You do not need to install them, Moving averages, relative strength index, stochastic, trendlines, Fibonacci tools, and more are available for thorough technical analysis.

Most MT4 brokers offer a trading platform across different devices and operating systems. You can download your broker’s MT4 platform and install it on your PC. You can also use the platform on your mobile phone (android or iOS). In addition to these, there is also the MT4 web trading platform that you can access via your broker’s website.

What are MetaTrader 4’s Best Features?

The platforms we have discussed above use MT4 as a third-party platform. They integrate well with it. However, it is important to know why most of these brokers chose to integrate with MT4.

Timeframes: MT4 has multiple timeframes. They range from 1 minute to a month. This makes it suitable for different traders and trading strategies (swing trading or day trading).

Multiple Devices: MT4 is available for use on desktops (software or web trader), mobile phones (as apps on Android or iOS), and tablets too. The advantage here is that you can be flexible. You can check your trade on the go via mobile apps. Furthermore, you can use the desktop version if you want a better view of the market for better analysis.

Indicators: MT4 is loaded with indicators that you can use for technical analysis. There are trend indicators and oscillators that help you predict future price movements. Even better, you can edit the properties of these indicators and customize them to your trading strategies.

Expert Advisors: Also known as EAs, expert advisors are trading robots. They were developed by MetaQuotes in MetaQuotes Language 4m(MQL4). You can use these robots to ultimate your analysis and opening/closing of your trades.

Price Alerts: You can adjust the settings on MT4 so you can receive price alerts. This feature comes in handy if you’d love to check your charts at a specific price point. The alert feature also helps you stay updated on latest happenings in the market.

How To Sign Up with an MT4 Broker

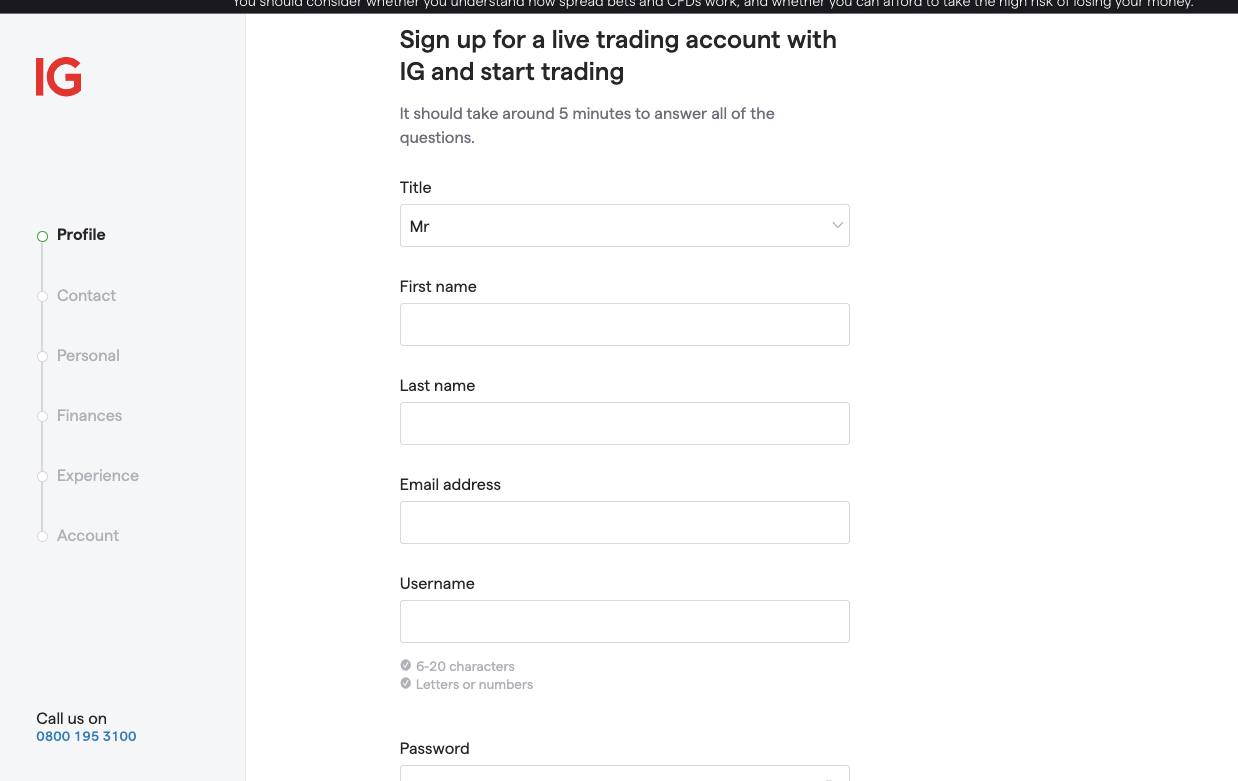

This section covers how you can start with an MT4 broker in easy and simple steps. We will be using IG Markets as our example. You can expect all MT4 brokers in the UK to have similar steps. Let’s go.

1. Go to IG’s website and click on ‘create live account’ at the top right corner of the homepage.

2. A form will appear on the next page. Enter your name and email address. You will also create your username and password. Click on ‘Next’ when you have done this.

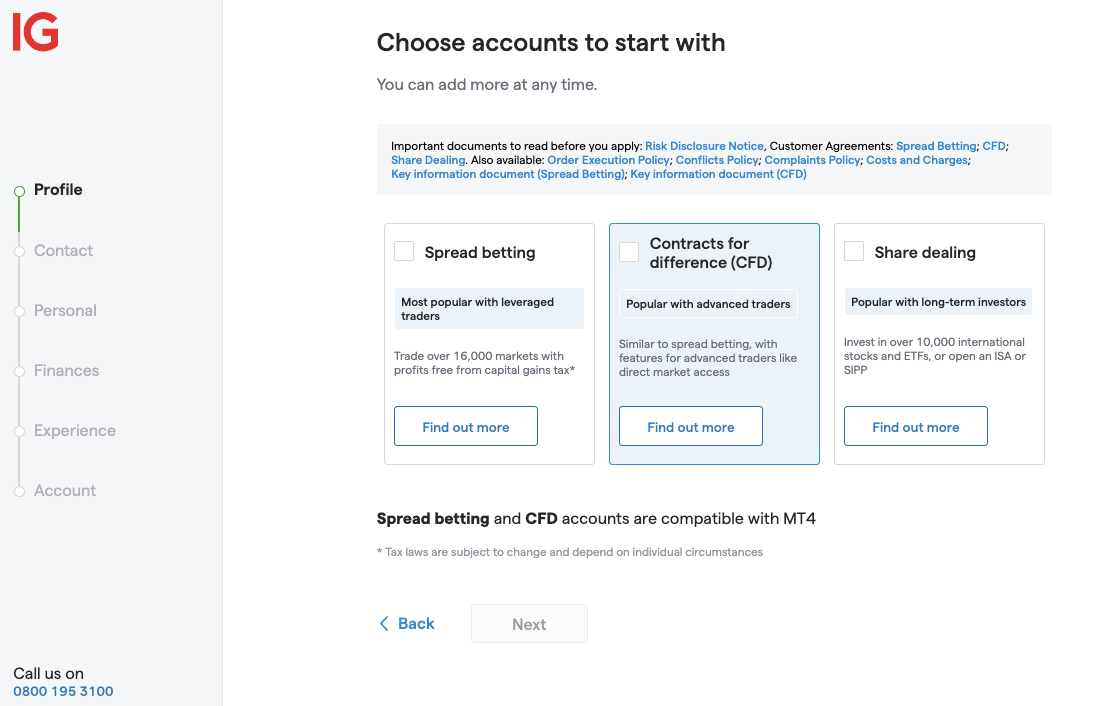

3. Select your account type and click on ‘Next’ to proceed

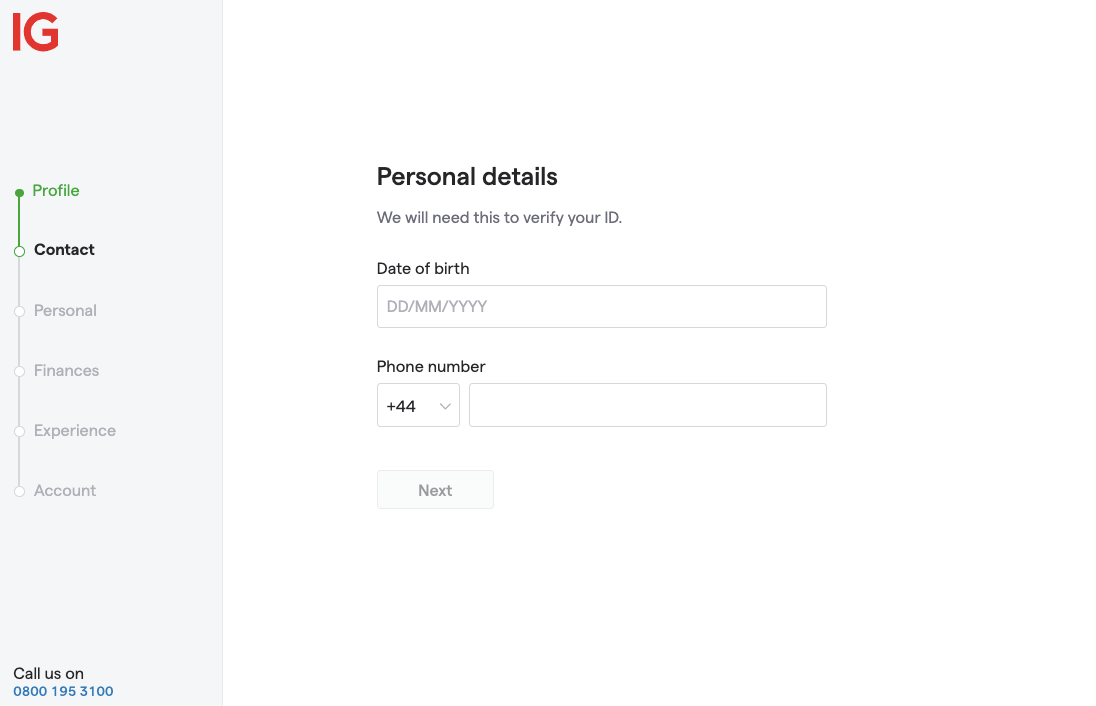

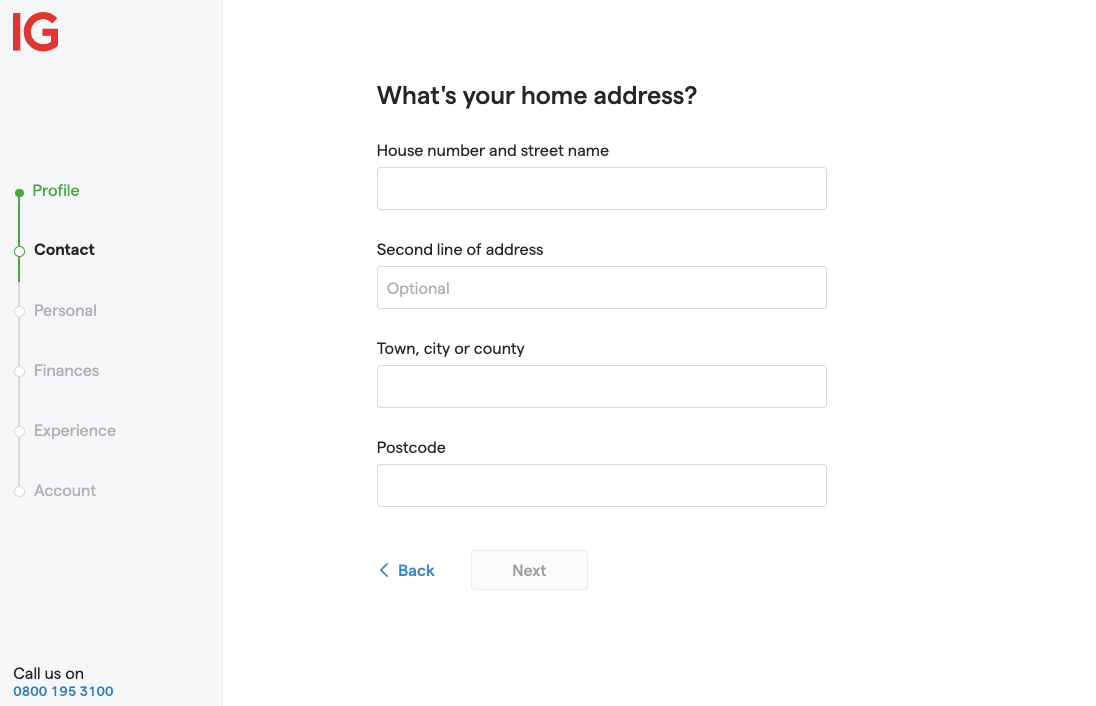

4. Supply more personal details. Your date of birth, address, nationality and national insurance number will be required here. Then click ‘Next’.

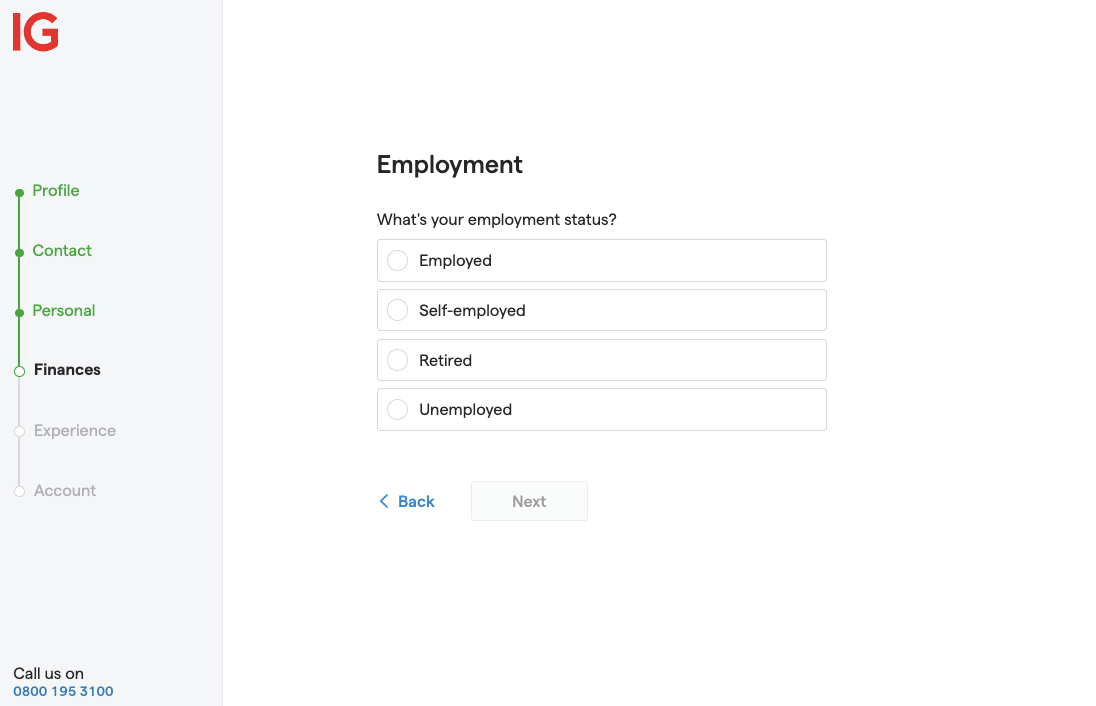

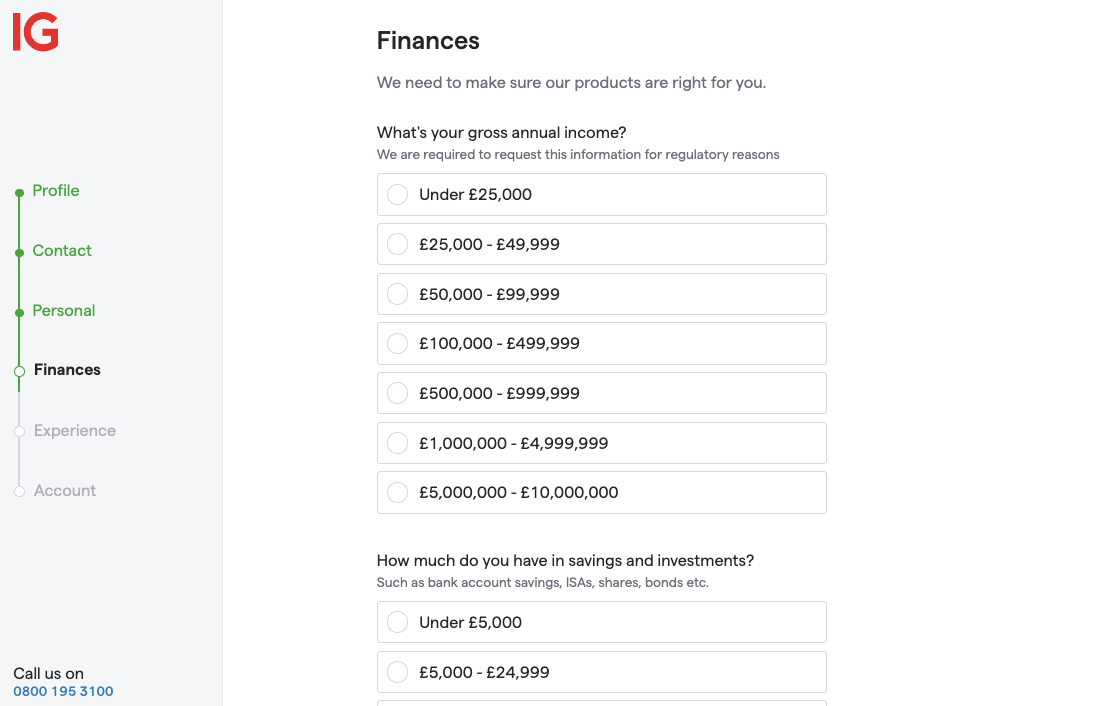

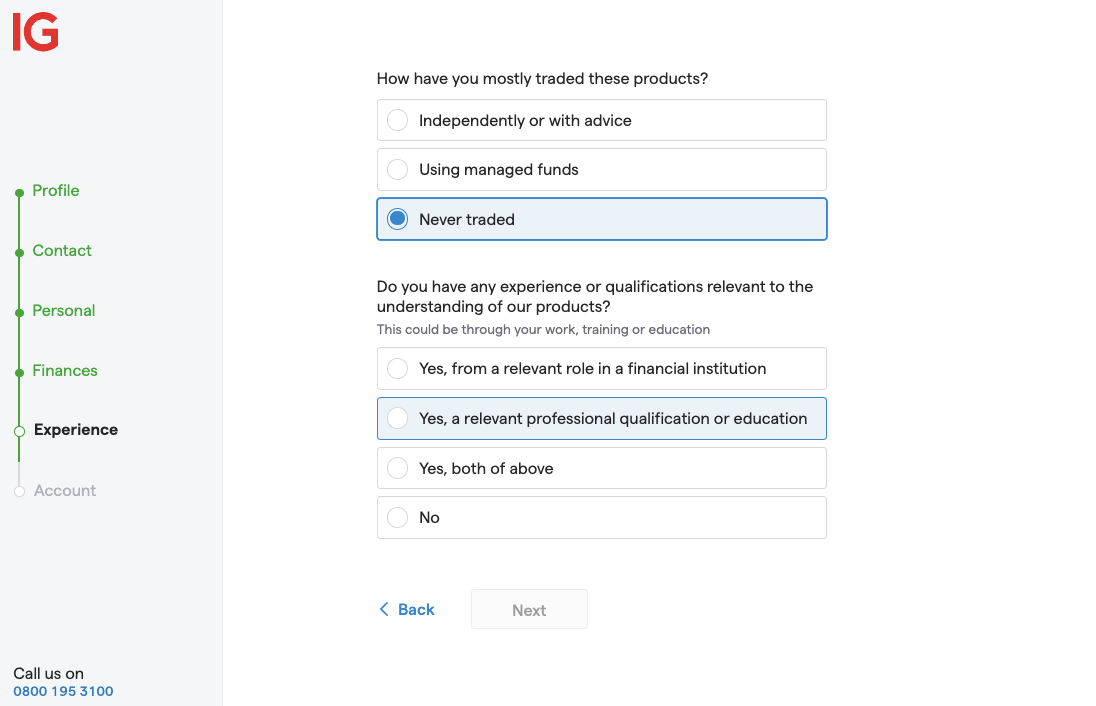

5. Answer all the questions that follow. They are based on your employment, financial status, and trading experience. Click on ‘Next’ when you have answered all questions.

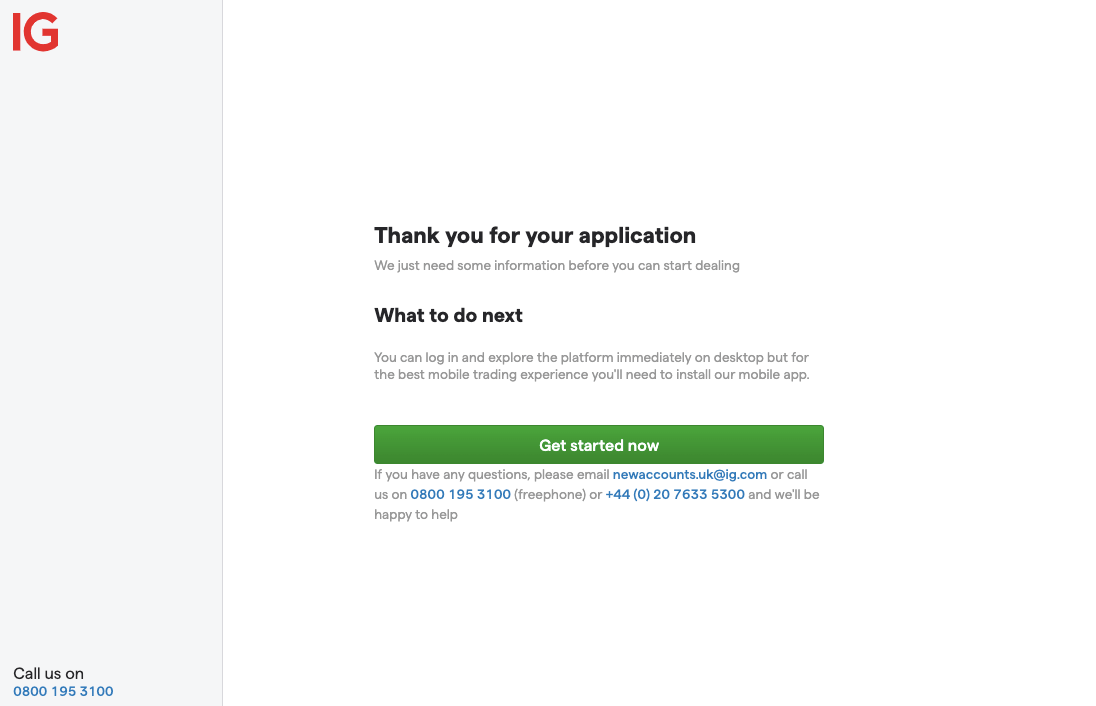

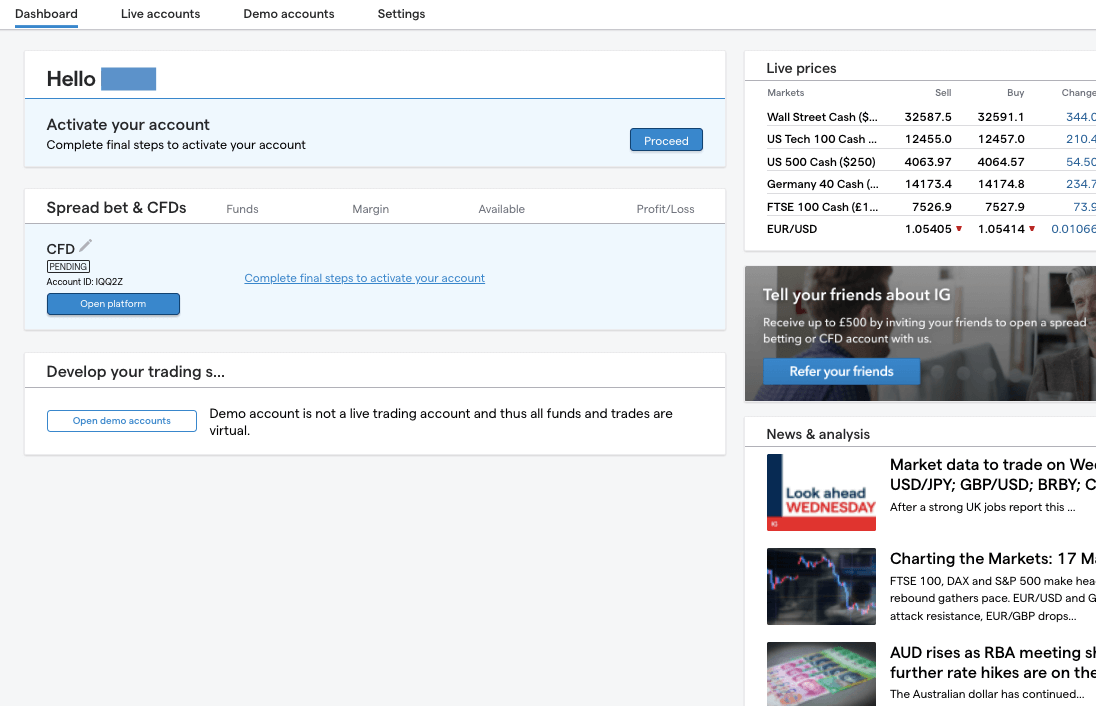

6. Check the terms and conditions box to confirm your agreement. Click on ‘Get Started Now’ on the next page. You will be redirected to the IG dashboard to proceed with your registration.

7. Click on ‘Proceed’ to complete the final steps and activate your account. Once, your account is activated, you can upload the required documents for your KYC verification.

How Do You Choose the Best MetaTrader 4 Brokers?

1) Is the broker licensed to accept UK-based traders?

The Financial Conduct Authority (FCA) licenses brokers that cater to UK traders. The FCA licenses some brokers in this review like Pepperstone, CMC Markets, IG Markets, and City Index.

IC Markets and AvaTrade are licensed in another European Economic Area. The two brokers are licensed in Cyprus and Ireland respectively but they have temporary permissions to operate in the UK. The screenshot below shows AvaTrade’s temporary permission on the FCA register.

Fully regulated brokers do not have the temporary permission tag. The picture below illustrates this

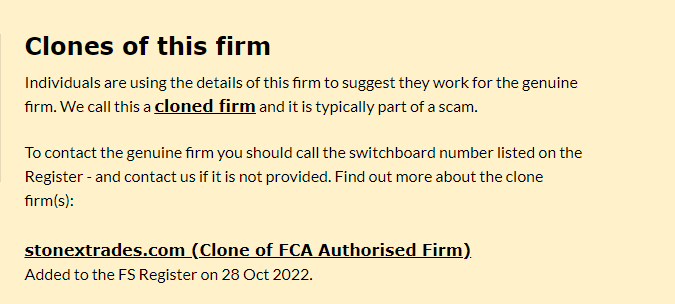

You can also avoid fraudulent brokers by looking out for clone firms. In the image below, you can see an example of such firms for StoneX Financial Ltd (City Index).

Can you see how the name ‘stonextrades’ looks similar to the original name? This is another reason why you should research your broker’s regulation. It will help you escape the fraudulent activities of clone firms.

Apart from offering MT4, FCA licensed brokers are mandated by the Financial Services Compensation Scheme to protect clients’ funds up to £85,000. This means your money is safe in case your broker goes bankrupt.

2) Trading fees

Brokers make money off commissions, swaps, and spreads. Some brokers charge commissions on trades while some do not. Spreads can be high or low. The same thing applies to rollover charges (swaps).

Do not choose an MT4 broker without knowing the trading costs attached to the instruments you want to trade.

Go to your broker’s website or contact their support to know about trading costs. Ask as many questions as possible about their different fee types.

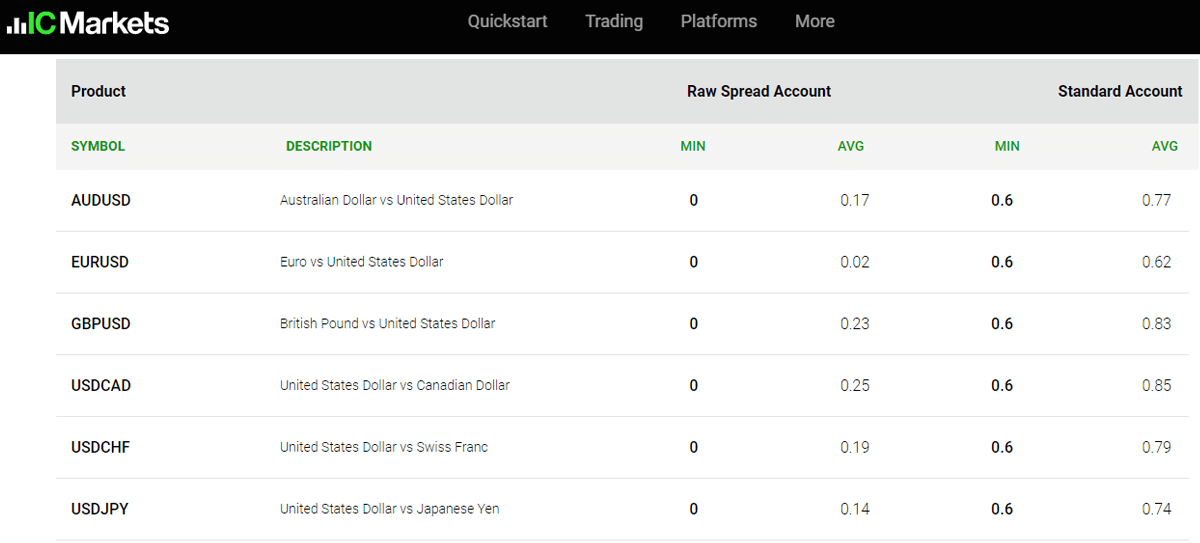

On the broker’s website, the trading costs of instruments are usually stated clearly. The table below shows IC Market’s spread for some currency pairs.

Similarly, other CFD brokers will have similar pages where they list their Spread, Swap (both Long & Short), Commission, and other fees for every Instrument.

3) Ease of Withdrawals & the Costs

It is important to consider the availability of local withdrawals with the attending costs. The MT4 brokers in this review allow you to withdraw funds to your account via bank transfer. Typically, you get your money between 3-5 business days. Only AvaTrade has a long duration (10 business days) for bank withdrawals.

In addition, they do not charge withdrawal fees. If you incur transaction fees when withdrawing, they will likely come from your bank or e-wallet vendor.

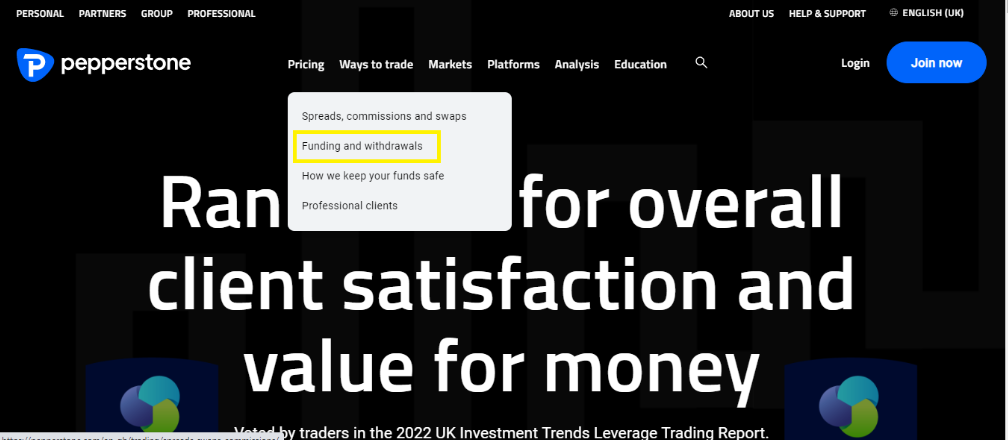

Here is how to check for an MT4 broker’s funding/payment method. Pepperstone UK is our example.

On their homepage, click ‘Pricing’, then ‘funding and withdrawals’. See the illustration below

The image shows a breakdown of Pepperstone’s deposits and withdrawal methods. There are about of them with no extra fees charged for transactions. Please note that it is the broker that does not charge. E-wallet providers and banks usually have their own charges for your transactions.

4) Range of Instruments

It is important that any currency pair or CFD you want to trade is available on MT4. A broker offering an instrument does not mean it is automatically on MT4. So it is important that you check the instruments available on your broker’s MT4.

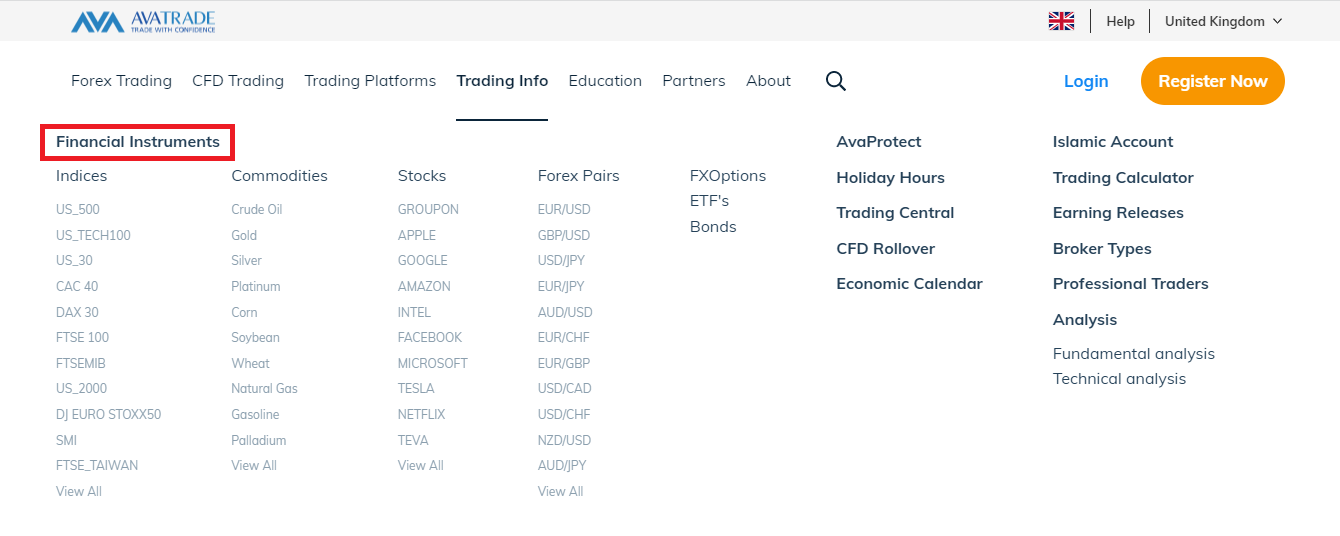

Let us show you how you can check this with AvaTrade as an example. On AvaTrade’s UK website, go to ‘trading info’ and click on ‘financial innstruments’.

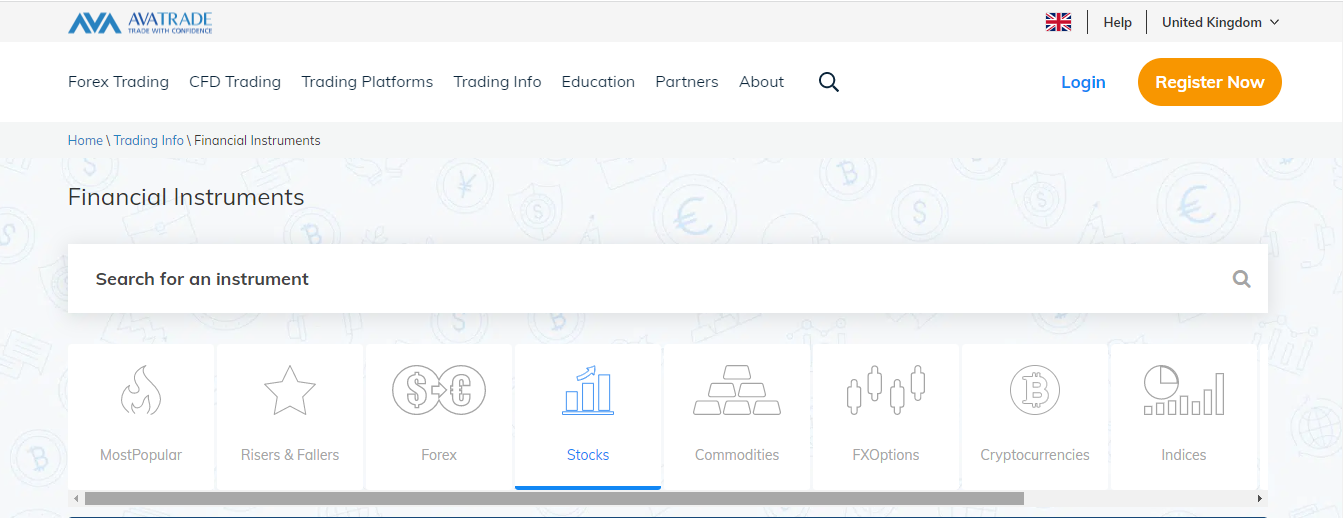

The first step will lead you to the page below. It is a tab displaying the range of CFDs offered by AvaTrade. On the tab, click on stocks.

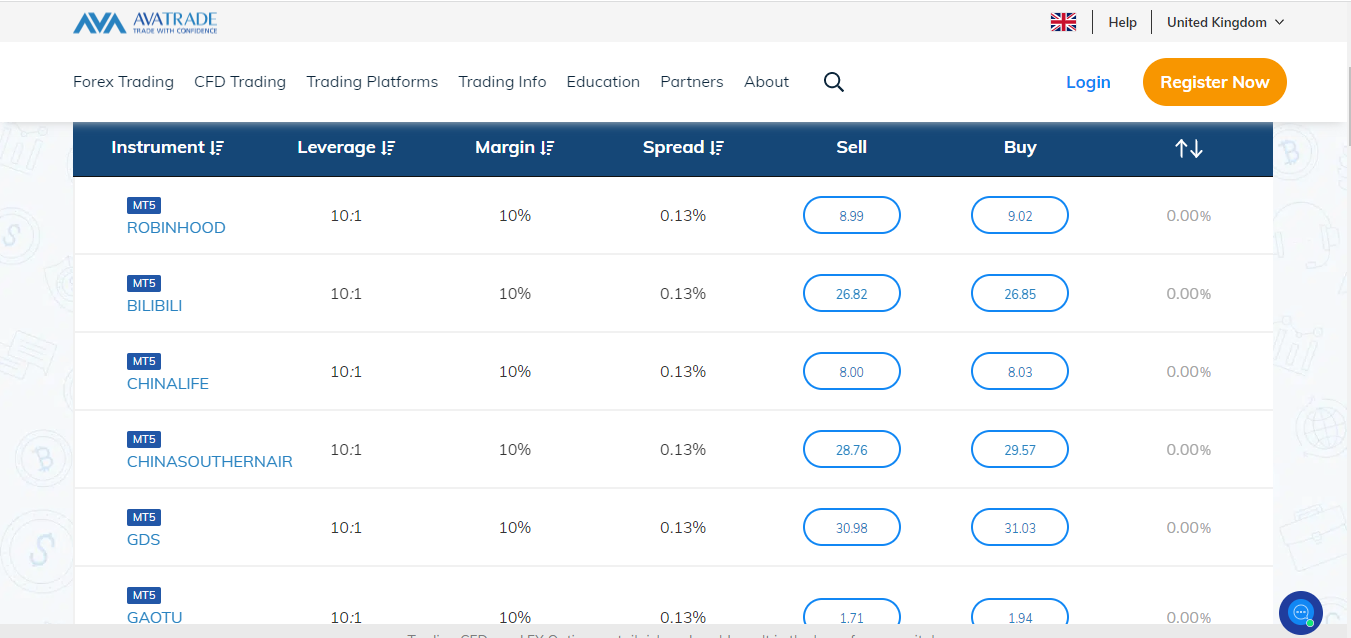

After clicking on stocks, scroll down the page and look through the shares CFDs offered. You will discover some of them are labeled as available on MT5 only. You will not be able to trade these stocks on MT4.

Some brokers have this info under their ‘trading platforms’ section or other parts on their websites. So it might be faster if you spoke to your customer’s support for more information about this.

In addition, most brokers tend to offer shares CFDs on MT5 only. You can read our review of UK’s best MT5 brokers to know more.

5) Execution

Execution method and speed are essential factors to consider. The execution speed sometimes depends on the execution method. If your preferred broker uses instant execution, the speed might be faster since you are likely trading against your broker.

On the other hand, market execution is slower because your broker will transmit your order to a third party. Because the execution method affects execution speed, it is important to check the kind of execution on your trading account.

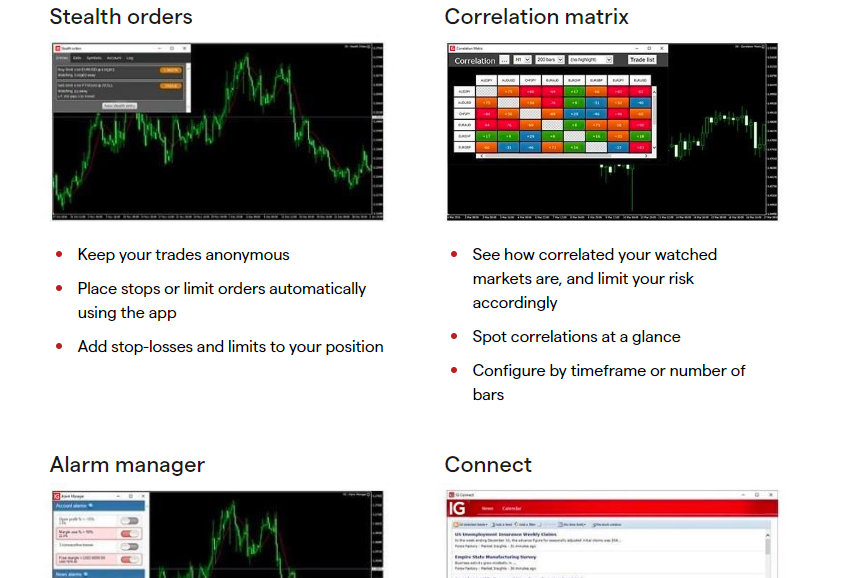

6) Plug ins

Some brokers occasionally offer extra plug-ins and tools that can help your trading experience. These tools are usually free. For example, Pepperstone MT4 has Autochartist that filters and scans the market for good trading opportunities. It also has Smart Trader Tools which contains 28 indicators and a number of expert advisors (EAs).

IG Markets’ MT4 has a good number of add-ons. One of them is the signal center. The signal center uses AI technology and in-depth market research to deliver concise trade ideas. Clear target levels and continuous updates from the signal center help you time the entry and exit of your trades.

Here is how you can find these plug-ins on IG’s website. Click ‘Trading Platform’, then click ‘MetaTrader 4’

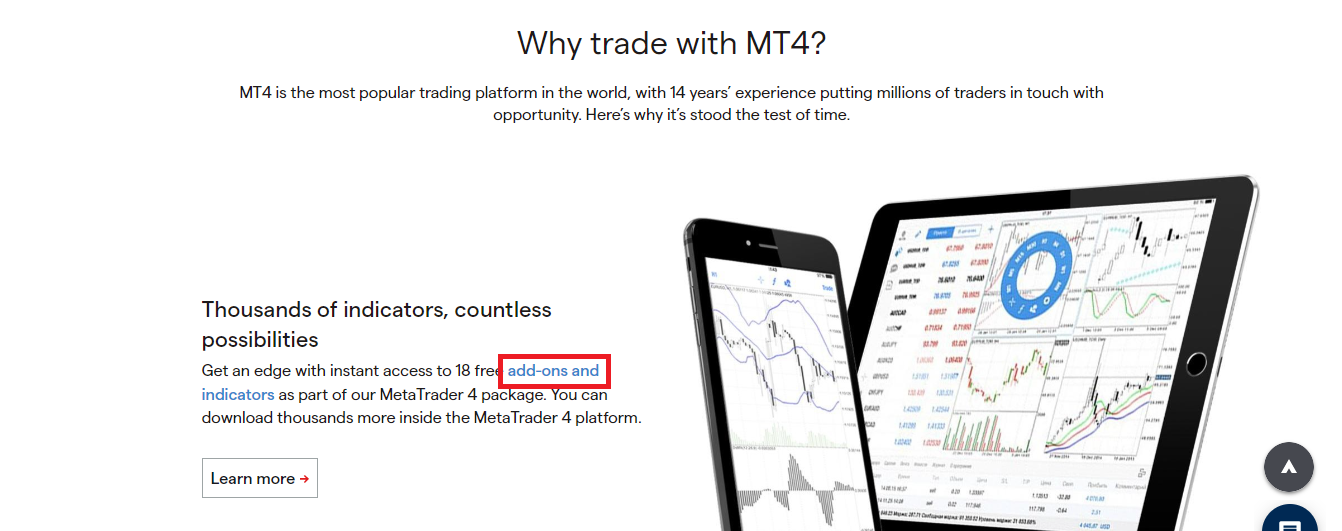

There is a lot of text on the page that follows. So you need to scroll down till you find the add-ons link displayed below. To find it quickly, focus on the left side of the page. When you find the link, click it.

Scroll down the page to find IG Markets’ free MT4 tools as shown below.

From the image, you can see the names of the tools and their respective functions. There are about 12 of them with their functions clearly listed. From the image, you can see the names of the tools and their respective functions. There are about 12 of them with their functions clearly listed. These tools and plug-ins are usually free. Most forex brokers do not charge an extra fee to use them. This makes them even more appealing to use because they can be quite helpful.

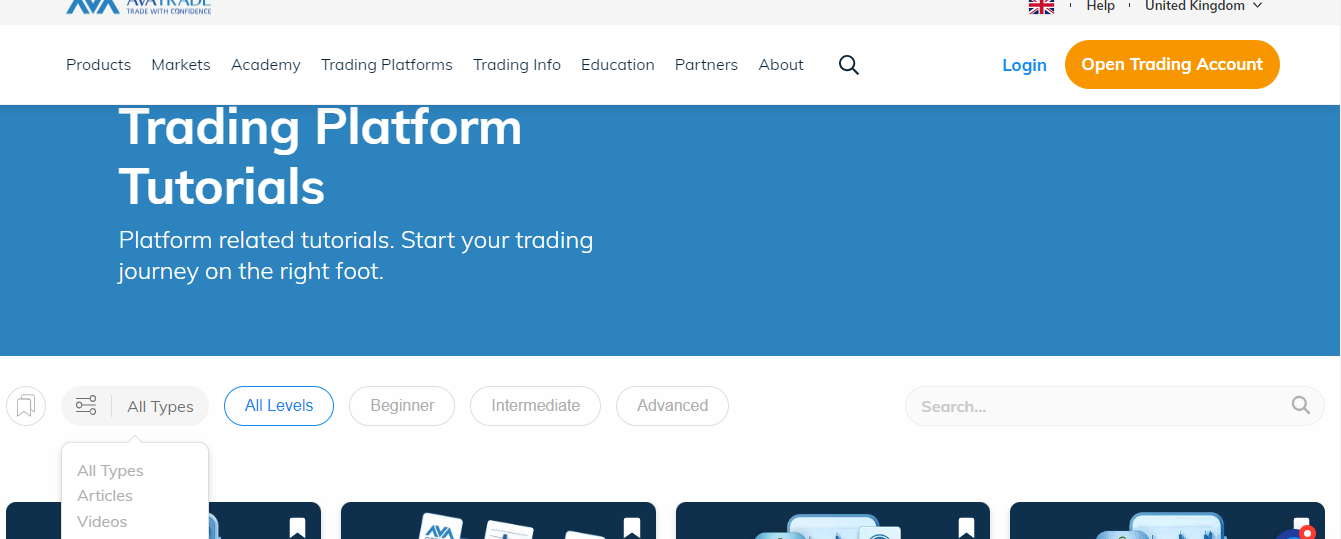

7) MT4-specific Education

Forex brokers generally have education materials. They are usually about trading basics, courses, and podcasts. However, it should not stop there. For beginners, installing MT4 and operating it can be daunting.

So you should check if your broker has tutorials about MT4. Preferably, they should be in video format. This makes it easier to learn because you can see what you are to do.

So you should check if your broker has tutorials about MT4. Preferably, they should be in video format. This makes it easier to learn because you can see how to use the platform. AvaTrade has one of the best MT4 education among of all the brokers in this review.

This how their platform tutorial page looks like.

You can see the tutorials are available in different media (articles and videos). You can also go through them systematically depending on your level (beginner, intermediate, or advanced). Here are some interesting topics available.

You might find tutorials on other AvaTrade platforms as well. But the MT4 tutorials stand out by topic.

8) Demo Account

MT4 has a number of good features that will help you trade better. With a demo account, you can use this features in a risk-free environment. Demo accounts are provided by brokers so traders can practice and experiment with zero risk.

You will not lose any money using a demo account. Instead, your broker gives you virtual money so you can trade in a simulation. You can explore MT4 as long as you want if your broker supports a demo account on the platform. Also, you need to ensure that the demo account is not one that expires permanently.

Once you verify these two factors, you can proceed to open an MT4 demo account with your broker.

9) Support

MetaQuotes have their own support for traders. However, the desktop versions of MT4 are tailored to different brokers. This makes your broker’s support more important. Check if they have a local phone number and a responsive e-mail.

You can even test a broker’s support before signing up so you can know how quick they respond and how well they respond to potential customers.

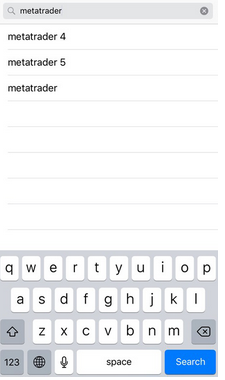

How to Get MT4 on iPhone After Ban

MT4 was removed from the Apple App store on September 23,2022. According to the company the app did not comply with review guidelines. After about six months, MT4 was reinstated on the App Store March 6, 2023. Now you can get MT4 on your iphone now that the ban is no longer in place.

How to Get MT4 on iPhone

1. Go to App store on your phone by clicking on the App store icon. (highlighted yellow)

2. Search for MetaTrader 4 in the search window. The App store will give show you an option to click.

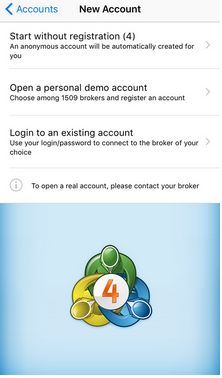

3. When you click the option, you will arrive at the MT4 page. It will look like the image below. Note the image and the logo of MT4. In addition, the name of the company is important. In the image, you can see the manufacturer’s name which is MetaQuotes Software Corp. Download the app by clicking ‘GET’.

5. When the download is complete, install the app on your iPhone.

6. Open the app when installation is complete. Find your broker’s server and enter log in details if you have an existing trading account. If you don’t have one, you can open a default MT4 demo account or a demo account from your broker.

7. If you follow this process, then you are ready to start using MT4 and trading CFDs. You can customize the colors and display on the chart if you want.

Do I Need a Broker for MT4

Yes, you need a forex broker to access live market rates and updates on MT4. If you download MT4 on your mobile phone, you can access a demo account offered by MetaQuotes. It is automatic and you do not need a broker for this demo account.

However, it is better that you sign up with a broker instead. This allows you open a demo account from your broker and assess their trading conditions. Then you can proceed to open a live account by searching for your broker’s server and entering your log in details.

For a more easy process, it is advisable that you download MT4 from your broker’s website. It will likely be customized and made for your broker. You will not have to carry out a long search to find your broker’s server.

FAQs on Best MT4 Brokers in the UK

What forex brokers are the best for MT4 in the UK?

Apart from offering the MT4 platform, the broker must be regulated by the FCA. Trading with unregulated brokers is risky. In addition, MT4 brokers must offer a range of different CFD Instruments with low to moderate trading fees, and low non-trading charges.

The broker must also support local deposits and withdrawals.

If a broker checks these boxes, then they are considered good for trading via MetaTrader 4 platform.

What are the fees for trading via MT4?

You do not incur any extra fees for using the MT4 trading platform. It is available for free download across different devices. However, your broker will charge you trading fees in swaps, spreads, and commissions, and non-trading fees in deposit/withdrawal charges, inactivity charges, etc.

Who owns MetaTrader 4?

MetaTrader 4 is a trading platform developed by MetaQuotes Software Corp. They hold the license for the product.

How can I trade via MT4?

You can trade via MT4 following these simple steps:

1. Sign up with a broker that offers MT4.

2. Complete your know-your-client (KYC). Here, you will be required to submit ID documents and proof of address documents. It could be your passport, utility bill, or driver’s license. It all depends on the MT4 broker’s requirements.

3. Download MT4: MT4 brokers usually supply a download link for their MT4 trading platform. For more flexibility, you can also download the mobile version of MT4 so you can check your trades on the go.

4. Fund your trading account.

5. Start trading.