You need a platform to trade the forex market. Most traders prefer to check the markets to use the desktop versions of software. Using popular trading software like MT4, MT5, and cTrader on desktops gives you a good view of the charts, especially past price movement.

However, you will not have your desktop or laptop with you always. The forex market is volatile, and you might need to check your trades on the go. This is where forex trading apps come in. They are usually available on smartphones and are offered by most brokers. Apart from MetaTrader apps, some forex brokers also provide their mobile trading apps.

Note: It is advised that you should not trade via your Smartphone only. Trading requires research & analysis. You should only use the app as an added feature with the actual platform. A mobile device should only be used as a secondary device for checking your position on the go.

Comparison of Best Forex Trading Apps UK

| Broker | FCA Regulated | Android App | Apple iOS App | Number of CFD Instruments | Visit |

|---|---|---|---|---|---|

| City Index | 446717 |

Yes

|

Yes

|

12,000 instruments for CFDs, currency pairs & spread betting

|

Visit Broker |

| CMC Markets | 522157 |

Yes

|

Yes

|

11500 instruments for CFD and spread betting accounts

|

Visit Broker |

| Capital.com | 793714 |

Yes

|

Yes

|

6086 CFDs with shares, commodities, indices, and forex

|

Visit Broker |

| 583263 |

Yes

|

Yes

|

3028 with currency pairs, shares, ETFs, commodities, indices, and cryptocurrencies

|

Visit Broker | |

|

504072

|

Yes

|

Yes

|

795 instruments with currency pairs, stocks, commodities, cryptocurrencies, and stock indices

|

Visit Broker | |

|

509909

|

Yes

|

Yes

|

2000+ instruments with currency pairs CFDs, commodities CFDs, ETFs CFDs, indices CFDs, and shares CFDs

|

Visit Broker | |

| XTB | 522157 |

Yes

|

Yes

|

2101 instruments with currency pairs, indices, commodities, shares, and ETFs

|

Visit Broker |

Note: The number of CFDs is as per information on these brokers’ websites in Feb. 2023. Please see our methodology below.

Best Forex Trading Apps UK

Here are 2024’s Best Forex Trading Apps in the UK that we have reviewed:

- City Index MT4 – Overall Best Forex Trading App UK for Beginners

- CMC Markets Mobile – Forex Trading App with most Currency Pairs

- Capital.Com – Forex Trading App with Zero Inactivity Fees

- eToro – Forex Trading App with Social Trading

- AvaTrade MetaTrader -Forex Trading App with Multiple Mobile Platforms

- Plus500 -Forex Trading App with Zero Commission

- XTB xStation – Forex Trading App with Low Spreads

- Pepperstone cTrader – Trading app with ECN Type Account

#1 City Index – Overall Best Forex Trading App UK for Beginners

City Index mobile trading app gives you access to trading on around 12,000 CFD, forex & spread betting instruments. The forex trading app is compatible with MT4. This means you can manage your MT4 account on the app. You can also sync the app with other devices. City Index are considered low-risk because they are regulated by the FCA.

Fees: The spreads at City Index are low. For example, the typical spread for a major like EUR/USD is 0.8 pips, 1.8 for GBP/USD. They do not charge any extra commissions per lot, and the only trading fee is their spreads.

The funding & withdrawals are free at City Index, but if your account currency is different from your deposit currency and you are depositing via Paypal, then you will have to bear conversion charges.

You are also charged an overnight fee (the swap) based on UK’s SONIA rate if you keep your forex & CFD position open overnight. In addition, you also pay a fee for account inactivity (£12) and guaranteed stop-loss orders

Trading conditions City Index have no minimum deposit

Up to 12,000 CFD instruments are available for trading on their app. This includes 84 currency pairs & 1000+ CFDs on indices, stocks, commodities, bonds, metals & interest rates.

Retail traders can trade forex at 30:1 max. leverage. And negative balance protection is available.

Also, a Guaranteed stop-loss order is available for a premium fee. You can find the information on GSLOs charges on their trading platform.

Platforms: City index supports MT4 which is also available as Webtrader. They also offer their mobile app on Google Play & App Store. The app does not support copy trading though.

Funding/withdrawals: The deposit & withdrawal methods at City Index are convenient including credit/debit card, bank transfer & PayPal for UK-based traders.

Customer Support: There is no local phone number for support on their website. The support email is not easily discoverable on their website. However, we were able to test their live chat. We got a response after four minutes. Our experience with their customer support was good.

City Index Pros

- City Index is regulated with FCA.

- Moderate typical spreads for majors & there are no extra commissions per lot.

- Their deposit requirements are not too high with every payment method.

- No extra charges on deposit or withdrawal

- Wide range of CFD trading instruments are available

City Index Cons

- They charge an Inactivity fee if you don’t operate your account

- Only MT4 platform is available. No MT5 or cTrader, or any other platform

- If your deposit currency is different from the account currency, then there are conversion charges.

#2 CMC Markets – Forex Trading App with Most Currency Pairs

CMC Markets mobile trading app is a new generation platform. The app supports technical tools, flexible analysis, and fundamental analysis. Market analysis is provided on the app by Reuters and Morningstar so you can always be up to date. There are 11,500 CFDs on the trading app. CMC Markets are a low risk broker because they are regulated.

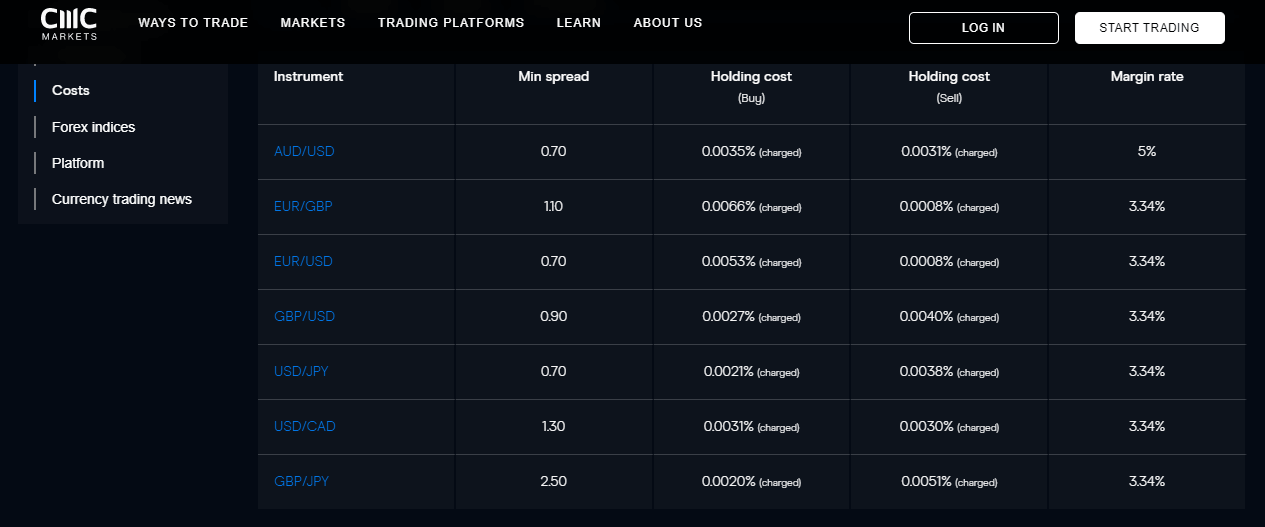

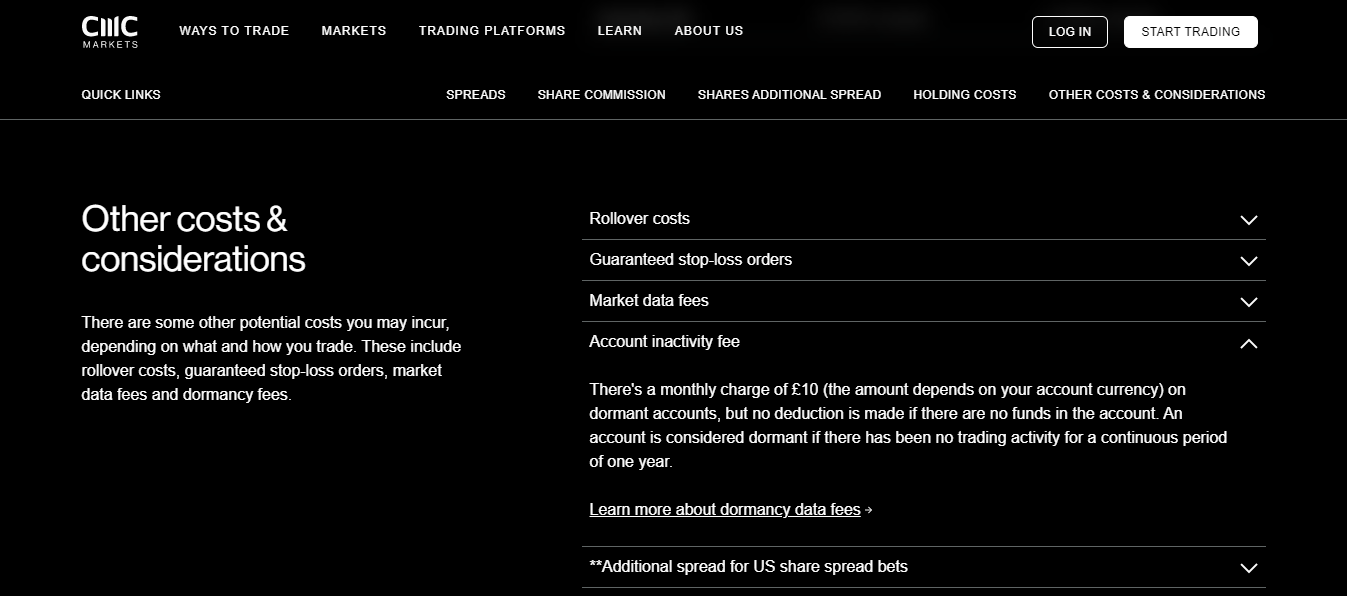

Fees: Minimum spreads for EUR/USD and GBP/USD are low (0.70 and 0.90). There is no extra commission per lot, and deposit and withdrawal are free as well. Rollover costs are also low. If there is no trading activity on your account for a year, you pay £10 monthly. There is also a fee for guaranteed stop-loss orders and market data for share CFDs.

Trading conditions

CMC Markets offer a wide range of CFDs, totaling up to 11500 on all of their accounts. The instruments include 333 currency pairs, 80 indices, 19 cryptocurrencies, 100 commodities, 9000 shares, and 50 treasuries. Maximum leverage for forex is 30:1, with guaranteed stop-loss order and negative balance protection.

Platforms: Apart from MT4 and webtrader, the CMC mobile trading app is also available for smartphones. You can download the app on Google Play and the App Store. MT5 and cTrader are not supported by CMC Markets. The forex trading app does not support copy trading too.

Funding/withdrawal: You can easily deposit and withdraw funds via three channels bank wire transfer, credit/debit card, and PayPal. There are no extra charges.

Customer support: We had a good customer support experience with this forex broker. We got an email after an hour. UK traders can also get support by calling the local mobile number on their website.

CMC Markets Pros

- Easy funding and withdrawals

- Minimum deposit is low for all accounts

- Customer support is good

- Wide range of instruments

- They are regulated by the FCA

CMC Markets Cons

- There is £10 inactivity fee

- There is additional spreads for US shares

- Copy trading is not supported

- Monthly market data fees for shares CFDs

#3 Capital.com – Forex Trading App with Zero Inactivity Fees

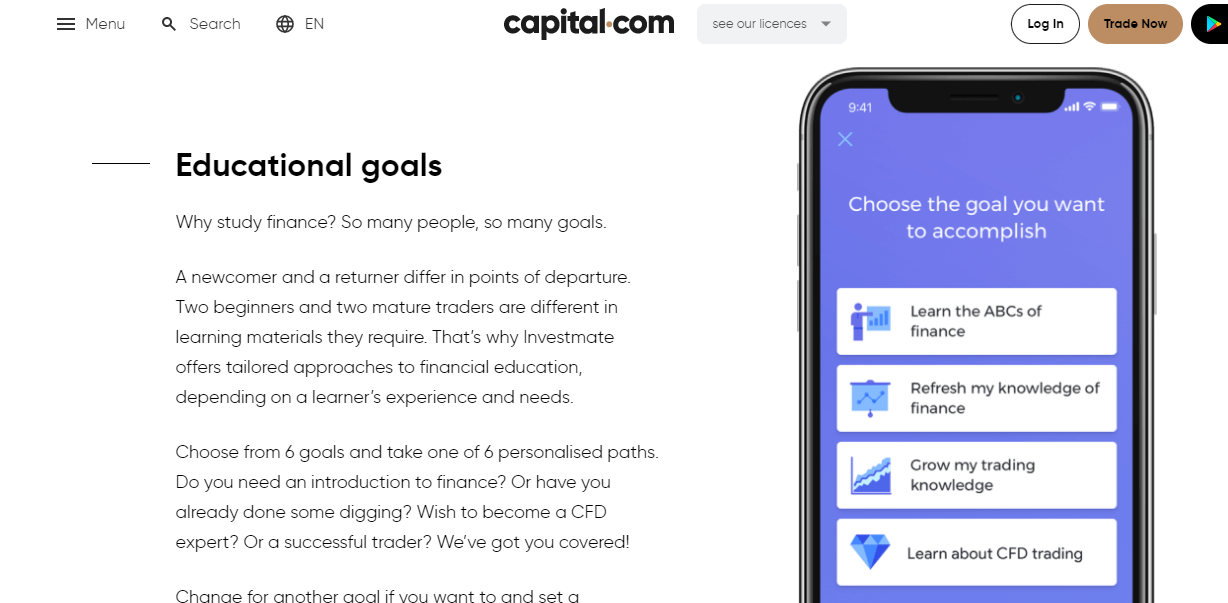

Capital Com CFD trading app functions like the typical smartphone application. It is dynamic, allowing you to open up to 10 accounts in different currencies. The forex trading app gives alerts about significant market events and price changes. Capital.com also have a mobile app solely dedicated to trading education. For safety, Capital Com is regulated with two tier-1 regulatory bodies so they are considered low-risk.

Fees: Trading fees are charged from the spreads. The typical spreads for major pairs are low. It is 0.6 pips for EUR/USD, and 1.3 pips for GBP/USD. Also, you pay a swap for overnight trades. Capital Com does not charge excessive fees. No commissions, no deposit/withdrawal charges, and no inactivity fee.

Trading conditions

You can open a trading account with £20. 138 currency pairs CFDs, 33 commodities CFDs, 37 indices CFDs, 115 ETFs CFDs, and 27 crypto CFDs are available. Leverage for forex is 30:1

Negative balance protection but no guaranteed stop-loss order. In addition, Capital Com covers your deposit/withdrawal fees.

Platforms: Capital Com does not support MetaTrader. However, they offer their Capital com trading platform. It is available for download on Google Play and the App Store. cTrader and copy trading are not available

Funding/withdrawals: You can deposit/withdraw funds via credit/debit cards, PayPal, Skrill, and Neteller. You can transact without difficulty.

Customer Support: Overall, customer support is good. We tested their email support. The response was quick, arriving after four minutes. In addition, we had no holding time during live chat.

Capital Com Pros

- They are regulated by the FCA

- Minimum deposit is £20

- Dedicated app for trading education

- There is no inactivity fee

- They cover deposit and withdrawal charges

Capital Com Cons

- Metatrader and other platforms are not supported

- Minimum deposit for bank wire deposits is £250

- No copy trading

#4 eToro – Forex Trading App with Social Trading

eToro (UK) Ltd offers a proprietary platform that is available on the web and smartphones. The forex trading app is user-friendly and intuitive. The platform has multiple CFDs with analysts from top financial institutions providing knowledge about the market. Social and Copy trading are also available. eToro is regulated in the UK so they are less risky.

Fees: Low spreads for major pairs. EUR/USD is 1 pip spread while GBP/USD is 2 pip spread. You also pay a swap but there is no commission per lot.

Non-trading fees are quite low as well. Deposit is free but you pay $5 for withdrawals. If you deposit or withdraw funds in any currency other than USD, you incur currency conversion charges.

Trading conditions

UK-based traders can open an account with $10. 3028 CFD instruments are available and you can trade forex at 30:1 leverage. eToro will absorb the loss and reset your equity to zero if your available balance becomes negative.

However, guaranteed stop-loss order is not available.

Platforms: No MT4, MT5, or cTrader. eToro offers their proprietary trading platform and it is available on smartphones. Copy trading and social trading are supported

Funding/withdrawal: Easy funding/withdrawal via credit card, PayPal, and bank transfer. Neteller, Skrill, Rapid Transfer, and online banking are also available for deposits. You cannot withdraw below $30 from your account

Customer support: We were able to test their email support and got a response after four minutes. You need to be an active client to use live chat. Overall, customer support is good.

eToro Pros

- They are regulated by the FCA

- Social trading and copy trading

- You incur zero fees for deposits

- A lot of stock CFDs is available

eToro Cons

- No MT4, MT5, or cTrader

- Only deposits in USD is free

- $5 for withdrawal xharges

- You cannot withdraw below $30

#5 AvaTrade – Forex Trading App with Multiple Mobile Apps

You can trade the forex broker on four mobile platforms- MT4, MT5, AvaTradeGO, and ZuluTrade. AvaTradeGO has a sophisticated dashboard with step-by-step instructions on opening and closing trades. The app also allows you gauge market sentiments so you know what other traders are buying or selling. AvaTrade is regulated in another European Economic Area (Ireland) but have temporary permission in the UK.

Fees: The spread for EUR/USD and GBP/USD is 0.9 pips and 1.6 pips respectively so the spread for majors is low.

The broker peculiarly charges their inactivity fee. After three months of inactivity, you pay £50 as an inactivity fee. If there is no trading activity on your account for a year, you pay an annual inactivity fee of £100. AvaTrade does not charge commissions for forex trading

Overall, fees are high

Trading conditions

The minimum deposit is high ($100). AvaTrade offers 795 CFDs. They include:55 currency pairs, 626 stocks, 18 commodities, 20 cryptocurrencies, and 32 stock indices.

Retail traders can leverage up to 400:1. AvaTrade is partially regulated in the UK so it is possible. Negative balance protection is available

No guaranteed stop-loss order

Platforms: AvaTrade supports MetaTrader, ZuluTrade, and DupliTrade but no cTrader. The three platforms are available on smartphones. However, their proprietary forex trading app is AvaTradeGO which can be downloaded on the Google Playstore and Apple App Store. Copy trading is available on DupliTrade alone.

Funding/withdrawals: Easy deposit/withdrawal via credit/debit cards, Skrill, Neteller, and bank wire transfer. A bank transfer takes a long time before it reflects in your account.

Customer Support: We had a good customer service experience. We contacted with AvaTrade via WhatsApp. We got instant replies with no holding time. We got no response via email.

AvaTrade Pros

- AvaTrade does not charge commissions

- Multiple mobile platforms

- Copy trading is available

- Up to 400:1 leverage (do not overleverage)

AvaTrade Cons

- No guaranteed stop loss order

- Inactivity fee is high

- Temporary permission in the UK

- Only DupliTrade supports copy trading

#6 Plus500 – Forex Trading App Zero Commission

The Plus500 mobile forex trading app is user friendly. The design is good and supports biometric login. You can place your trades with either market, limit, or stop order. Trailing stop order is also available. In addition, there is search function that allows you navigate their over 1500 CFDs. Plus500 are also regulated by the FCA and ASIC.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Fees: No commissions for trading forex, deposits/withdrawals, and live forex quotes. You pay £10 a month for account inactivity and currency conversion fee as well. For guaranteed stop loss, you are charged by wider spreads.

Trading conditions

Your minimum deposit depends on your deposit method. The following CFDs: 67 forex CFDs, 22 commodities CFDs, 96 ETFs CFDs, 27 indices, and 1000+ CFDs of shares are available

Plus 500 supports negative balance protection. They also offer guaranteed stop-loss orders. GSLOs fees are charged from wider spreads

You can trade with the Plus500 trading platform. You can use it on your desktop and smartphones. No MT4, MT5, and cTrader. Social trading and Copy trading are also not available.

You will find all deposit and withdrawal methods on the Plus500 trading app. From our research, we know Plus500 supports credit/debit cards and PayPal. They also cover your payment processing fees so no extra fees are incurred.

Customer Support: Overall, customer support is good. We reached them via WhatsApp and had a 13-minute holding time. When we contacted them via email, we got a response in five minutes.

Plus500 Pros

- They are regulated by the FCA

- Zero commissions

- Varying deposit methods

Plus500 Cons

- Inacitivity fee

- No meatrader or any other platform

- No copy trading or social trading

- Different minium deposits

- Wider spreads for GSLOs

#7 XTB – Best Forex Trading App with Low Fees

The xStation mobile offers you access to over 1500 instruments with its intuitive design. The forex trading app allows you to customize some of its default features like lighting mode. In addition, get access to xtb clients globally and gauge their sentiments to help your trading decisions. xtb are regulated by the FCA so they are low-risk.

Fees: Typical spreads for major pairs are low. No commission per lot. Trading fees are from spreads and swaps. The account inactivity fee is $10. In addition, there is a £60 threshold for withdrawal. You incur a £12 fee on every withdrawal below the threshold.

Also, you pay a 2% commission if you are funding your account via e-wallets.

Overall, fees are low

Trading conditions

XTB has no minimum deposit.

XTB offers a wide market range of 2101 CFDs. 57 currency pairs, 36 indices, 21 commodities, 1849 stock CFDs, and 138 ETF CFDs. The maximum leverage for forex is 30:1

XTB offers negative balance protection but no GSLOs

Platforms: XTB does not support MetaTrader 4,5 or cTrader. They offer xStation 5 and xStation mobile. The latter does not support copy trading or social trading. You can download the xStation mobile on your smartphone via Google Playstore or the App Store.

Funding/withdrawal: Convenient deposit and withdrawal methods through your debit/credit card. Local bank transfers and e-wallets are also available. XTB no longer charge fees for deposits made through credit/debit cards or bank transfer. However, there is a £12 withdrawal fee if you are withdrawing below £60. In addition, you are charged a 2% fee when depositing through e-wallets like Paysafe

Customer Support: Overall customer support is good. We tested their live chat feature and email support. We got an email response after 25mins. No response from live chat.

XTB Pros

- Good customer support

- XTB does not commission for forex

- Spread for major pairs are low

- They are regulated by the FCA

XTB Cons

- There is account inactivity fee

- There is minimum withdrawal threshold

- Stop loss is not guaranteed

- No metatrader or any other platform

- The forex trading app does not support copy trading

Types of Forex Trading Apps

There are two types of forex trading apps. Some forex brokers have both while some support just one type. Let us break them down:

1) Third-Party Trading Apps: These trading apps are developed by other companies for forex brokers. These companies allow CFD brokers to host their trading services on their trading apps. A prominent example is MetaTrader 4 and MetaTrader 5 mobile developed by MetaQuotes.

Another common third-party mobile trading app is cTrader mobile developed by Spotware Systems. These companies are not brokers. However, they partner with brokers globally so traders can use the app through their clients.

2) Proprietary Trading Apps: Proprietary trading apps are developed by forex brokers independently. This is not done in conjunction with third parties so the names of these trading apps vary from broker to broker.

For example, CMC Market’s app is called the ‘Next Generation Platform’ while other brokers just name their apps after their companies just name it after their company (like AvaTradeGO and XTB’s Station)). Because these apps are developed by brokers individually, their trading conditions and interface are never the same too.

Advantages of Using Forex Trading Apps

There are some pros that come with using forex trading apps. We look at a few in this section.

Ease: It is easier to trade forex with trading apps. In the past, traders needed an office and a desktop to analyze the market. To get key economic news, they have to read newspapers. In addition, access to industry experts was so difficult. They have to make a number of calls to get advice. A single proprietary trading app can perform all of these functions and much more.

Flexibility: Apart from the convenience that trading apps bring, they also offer flexibility. With mobile apps, you can trade on the go, analyze the market, and monitor your positions. You can do these while you are in a car, hanging out with friends, or taking a walk. This will not be possible if all that was available for trading are desktops.

Notifications: Price alerts and notifications are a major advantage of forex trading apps. You can set an alert that lets you know when prices have hit certain levels. This saves you a lot of time and allows you focus on other things.

Furthermore, you can set notifications for news releases as well. Instead of checking manually on websites. You can get an automated notification of key economic data, releases, and events.

Personalization: Most forex trading apps allows traders to arrange trading tools, charts, indicators, and colors in a way that suits them. Being able to customize your app makes you ‘feel at home’ with the app, making trading more convenient.

Efficiency: Placing trades on mobile phones is often efficient and quicker than desktop. This is not about execution speed. It is that with a few swipes, you can set your take profit and stop loss targets quickly. Because the desktop versions of trading platforms are designed differently, it often takes more than a few clicks to place your trade.

Disadvantages of Using Forex Trading Apps

Though forex trading apps are very useful, they also have some disadvantages. If you really want to be a proficient trader, you cannot use mobile apps alone. Here is why:

Size of the Screen: This is a major challenge with using mobile apps. They do not give a good view of past price movements, especially on higher timeframes. This experience is not so good. Many traders use up to two or more desktops to have a full view of the market. You cannot do this on mobile devices, not even a tablet.

Difficult to Focus: Mobile trading apps can lead to a lot of distractions. This could come from notifications from social media apps, a message, or a call. These interruptions are not good for traders and can affect long-term performance. Desktops do not have these issues.

Execution Speed: Forex trading apps have improved over the years. However, there could be risks of your app crashing when trading. In addition, mobile networks might not be very reliable. This affects execution speed and leads to latency.

Overtrading: Because it is easy to access charts on the go, mobile apps heighten the tendency to trade more. This in turn increases your chances of losing more money. To deal with this, you need to be disciplined and stick to your trading plan.

How to Choose the Best Forex Trading App in UK

Before choosing a forex trading app, there are a few things you should consider. The following factors should influence your decision-making.

1. Regulation of the Forex Trading App?

Forex brokers offer trading apps but that is not enough reason to give them your hard-earned money. The broker you choose must be regulated with the Financial Conduct Authority. This is the only way you can guarantee the safety of your funds. The FCA sees to it that forex brokers do not defraud their clients. Any forex broker regulated with them is safe and you can use their trading app.

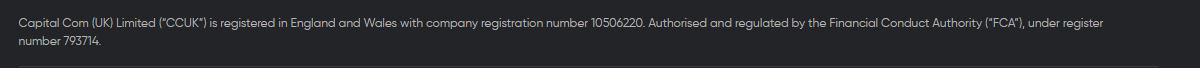

How do you verify a broker’s regulation? Forex brokers typically have their regulation statements as a footnote on their websites. That is the first place to check.

The picture above is from Capital.com’s website. You can see clearly that the FCA regulates them, with their reference number. However, the forex broker’s word is not enough. You need to confirm the information on the FCA register.

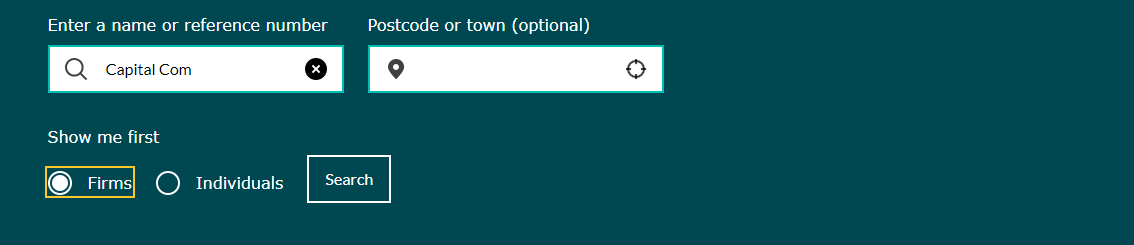

On your web browser, go to register.fca.org.uk/s/. When you scroll down, you should arrive at the picture below

Enter the broker’s name and select firms as shown here. Click on search.

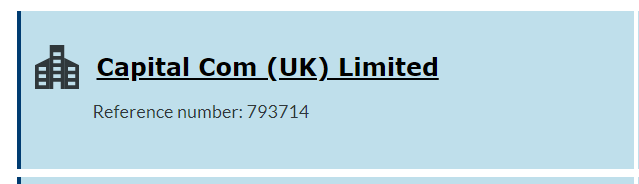

You should arrive at the pictures above, which show the same reference number on Capital.com’s website. With this simple step, you can verify any forex broker’s regulation. Having a trading app is not enough. Your broker must be licensed and authorized to operate in the UK.

Only FCA regulated brokers can guarantee the safety of your funds. Even if such brokers go bankrupt, you will be able to get your money back under the Financial Services Compensation Scheme (FSCS). Under the scheme, your money is protected for up to £85,000.

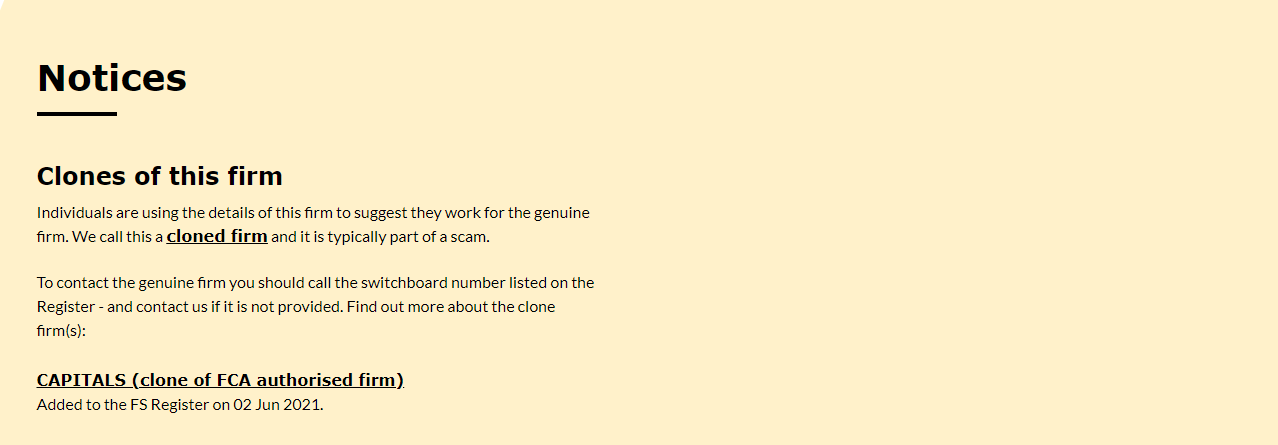

Finally, you should note the the clones of your regulated broker. Clone firms are usually part of a scam. They operate under similar names with regulate brokers and defraud unsuspecting traders. So beyond verifying your broker’s license, check the list of firms trying to clone your broker’s identity too.

Here is an example with Capital.com.

2. Total Fees Charged for Trading & Non-Trading

The total fees are divided into trading fees and non-trading fees.

The trading fees offered by a forex broker can be lower, but they may add up with their non-trading charges. You should always check the trading fees especially. They can increase your losses or lessen your profits. So make sure to always check them.

Broadly, trading fees include the broker’s spread, commission per lot, the swap charges, and currency conversion charges if your trading account is in a different currency.

Non-trading fees could be deposit/withdrawal charges or inactivity charges. Regulated Forex brokers are generally transparent about their fees and you can find them on their websites. The picture below shows minimum spreads and holding costs for currency pairs with CMC Markets.

Non-trading fees are important too. You should know how much your chosen forex broker charges for funding, withdrawal, and account dormancy. Here is how you can check that of CMC Markets (example broker). From the homepage, click on ‘costs’ under “ways to trade’

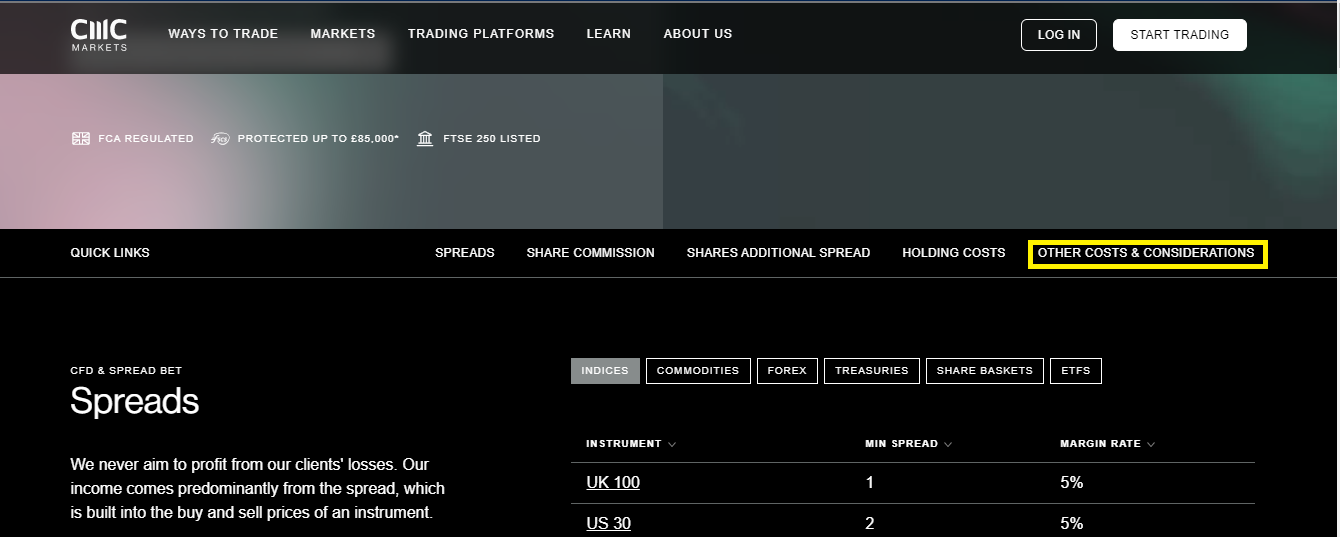

On the following page, click on ‘other costs and considerations’

Finally, you will arrive at the page where the non-trading fees are displayed. You only need to click on them to know more details.

If you feel personal research is cumbersome, you can speak to customer support to know more about their fees.

3. Total Instruments Available on the Broker’s App

On your forex trading app, you should be able to access and trade different CFDs.

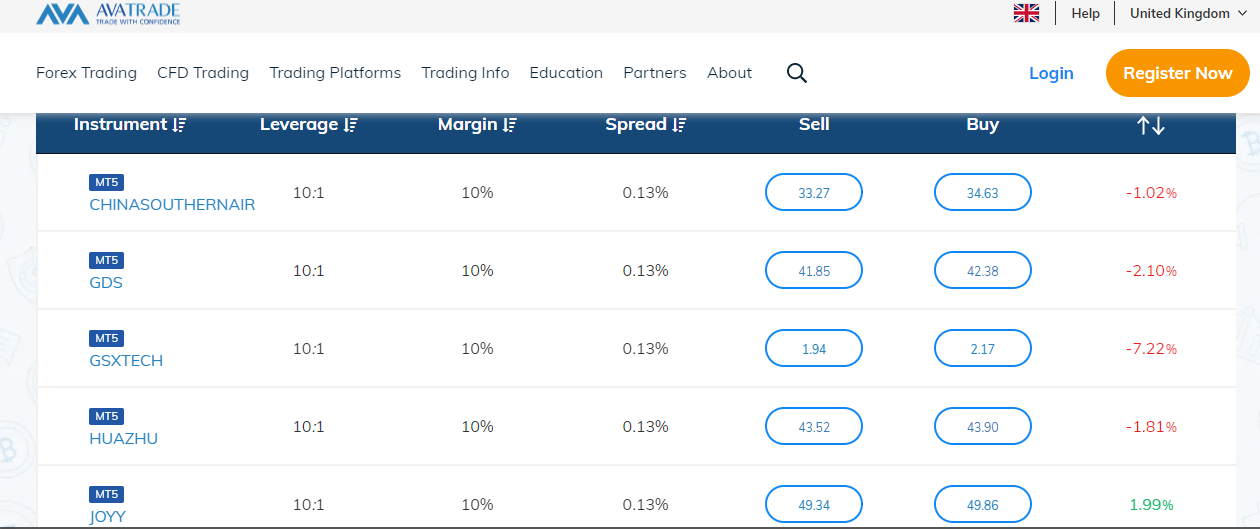

The broker must have currency pairs, and CFDs on commodities, and metals that you usually trade. In addition, some brokers do not offer the same number of instruments on all forex trading apps as their other platforms. AvaTrade is such a broker as shown in the picture below. The stocks displayed are available on MT5 alone.

As usual, you should speak to your preferred broker to confirm the availability of instruments on their trading platforms.

4. Available Trading Platforms

MetaTrader is the most popular trading platform but not all brokers offer it. This is why you must check to know the platforms your broker offers.

Furthermore, you have to make sure your broker’s platforms are available as smartphone apps. You should be able to download it on Google Playstore or the Apple App Store. Mobile trading apps help you monitor your trades on the go.

The picture below shows the summary of the CMC Markets mobile trading app.

Similarly, the brokers will have a page for their trading apps on their websites.

5. Execution Model

When using a mobile app for trading, there are some challenges that come with it on your end. The prominent one is a slow or poor internet connection. This can lead to your trade being executed at another price. If this is combined with choosing a broker with the least favorable execution model.

For the execution model, dealing desk brokers might not be the best option. Their manual intervention causes a little bit of delay in order execution. Non-dealing desk brokers are the best choice. They could have the STP, ECN model, or a hybrid of the two.

Regardless of the model, an electronic network is used in communicating orders which is faster and more effective.

6. Demo Account

Trading with mobile apps is a different situation compared to trading on desktops. Generally, a demo account is useful for practicing and perfecting your strategy. However, it is more important if you are trying to use trading apps.

Apart from practice, a demo account offers you a risk-free environment to get accustomed to the limitations of charting on trading apps due to the screen size. In addition, you also get used to drawing indicators and other charting tools in a limited space.

Furthermore, you must check if your broker supports a demo account on their proprietary trading app. You might prefer it compared to MT4, MT5, or cTrader. Using a demo account on proprietary mobile apps can help you utilize and maximize it better.

7. Other Features to Check on Trading Apps

There are a few other features that you should check in the app.

a. Ease of Funding/withdrawals: Funding and withdrawal should be easy. Your broker should support credit/debit cards and bank wire transfers. E-wallets such as PayPal, and Skrill should also be available. Finally, you should be able to deposit/withdraw in pounds without excessive charges.

b. Risk Management Tools: In unique situations, the market might execute your stop-loss order at an unfavorable price, leading to more losses. A guaranteed stop-loss order (GSLO) makes sure your stop-loss order is executed at your desired price. You should speak to your broker to know if they offer GSLO.

Negative balance protection is another important risk management tool. In a situation where you are likely to lose more than the money in your trading account, this tool makes sure you do not enter into debt. It automatically resets your account balance to zero and your broker bears responsibility for the negative balance. This tool is free and every broker is under obligation to provide it according to FCA regulations.

c. Is Customer Support Good or Bad: Your broker should be reachable via different means. Email, local mobile number(s), live chats, and instant messaging should be available. Quick response is the hallmark of good customer support so make sure to carry out a personal test.

d. Two Factor Auth: Does the platform support 2FA? This will provide added protection against hacking. Some forex brokers have 2FA for their accounts, and you should check this with the support of the broker that you intend to signup with.

Reputable forex brokers invest in high security measures to secure their trading apps. Authentication protocols protect your personal and financial information so you must make sure your broker has proper security measures in place.

e. Education: You want to choose a forex broker that allows you to learn. This is why education on trading apps should be key for you. The education content could be videos, written content, podcasts, or ebooks. Most of this content is usually on the broker’s websites. Few brokers like Capital.com have their educational content on their mobile app.

Capital.com is one of the best forex brokers for beginners that we reviewed for UK traders.

How to Get Started with a Forex Trading App?

Signing up with a forex trading app is easy. You can open an account and start trading the CFDs available on the broker’s App by following simple steps on the trading app.

Here is an example with the eToro app on Android.

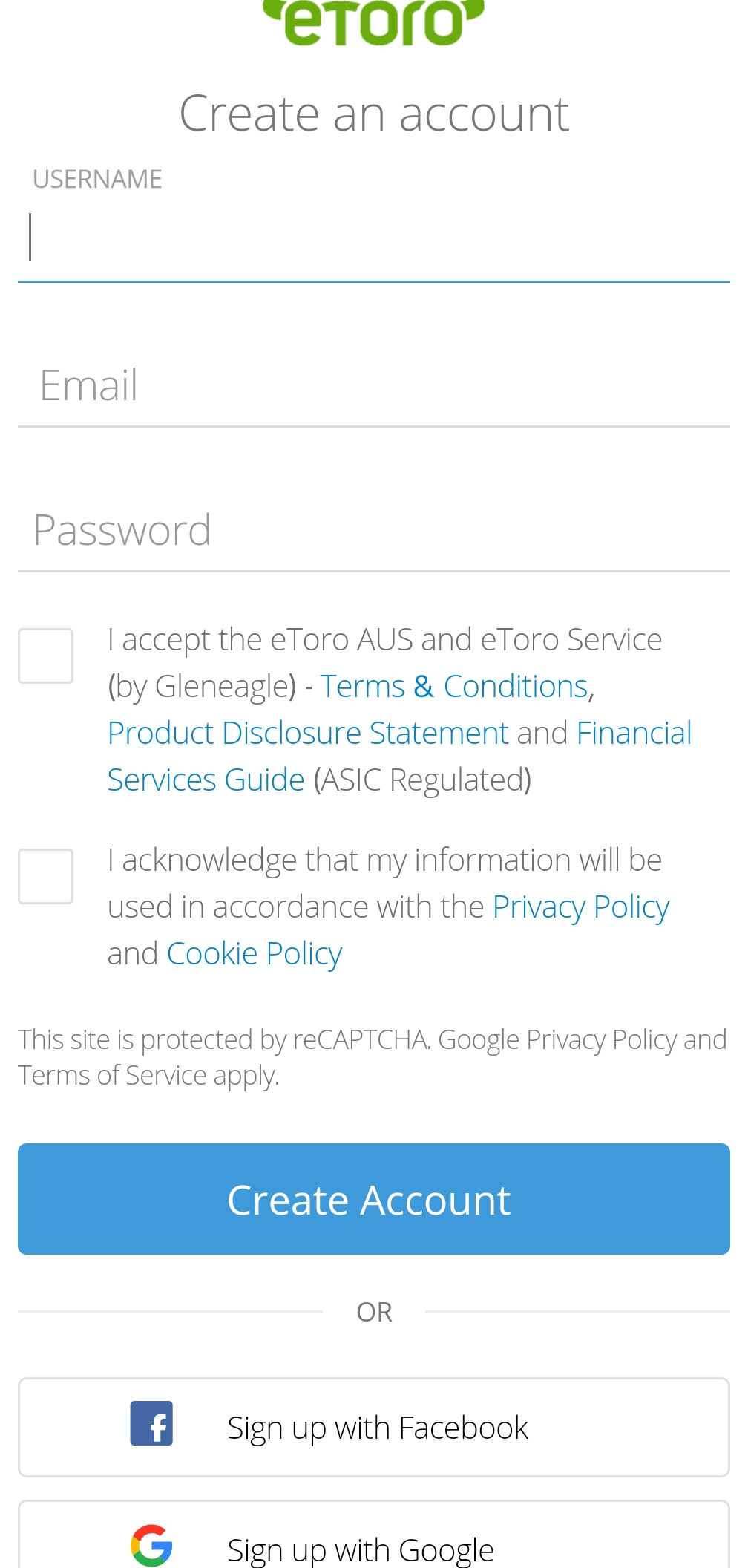

1) Go to Google Play or App Store and download the app (eToro in this example). When you install and open the app, you should see the option to ‘Continue’.

2) From the homepage, swipe through the images till “get started” shows up. When it shows, click on it.

3) On the next page, enter your name, email address, and password. In addition, accept the terms and conditions, and privacy policy. Finally, click on “Create Account”

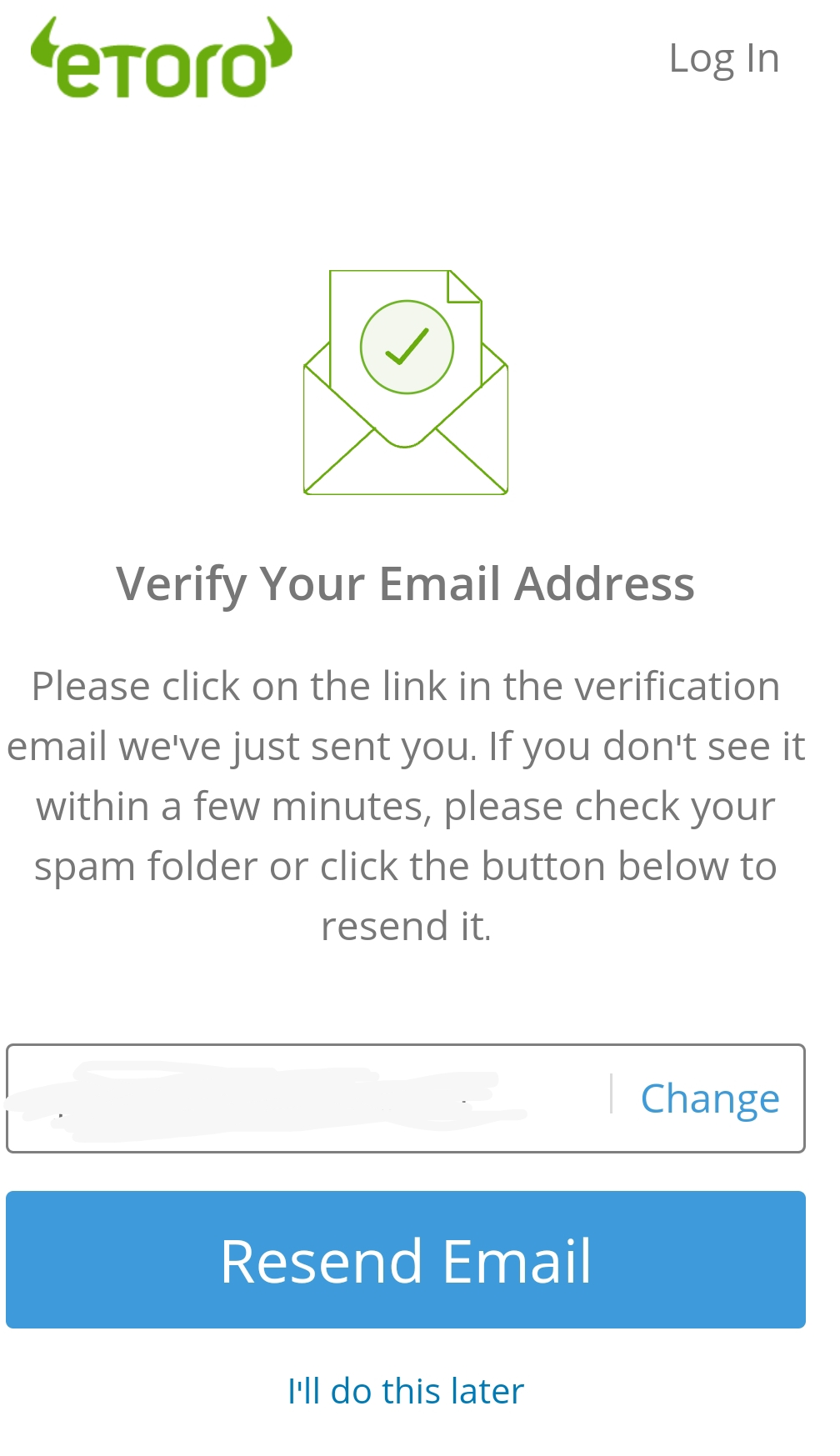

4) Verify your email. You will do this by clicking on the verification link that will be sent to your email address.

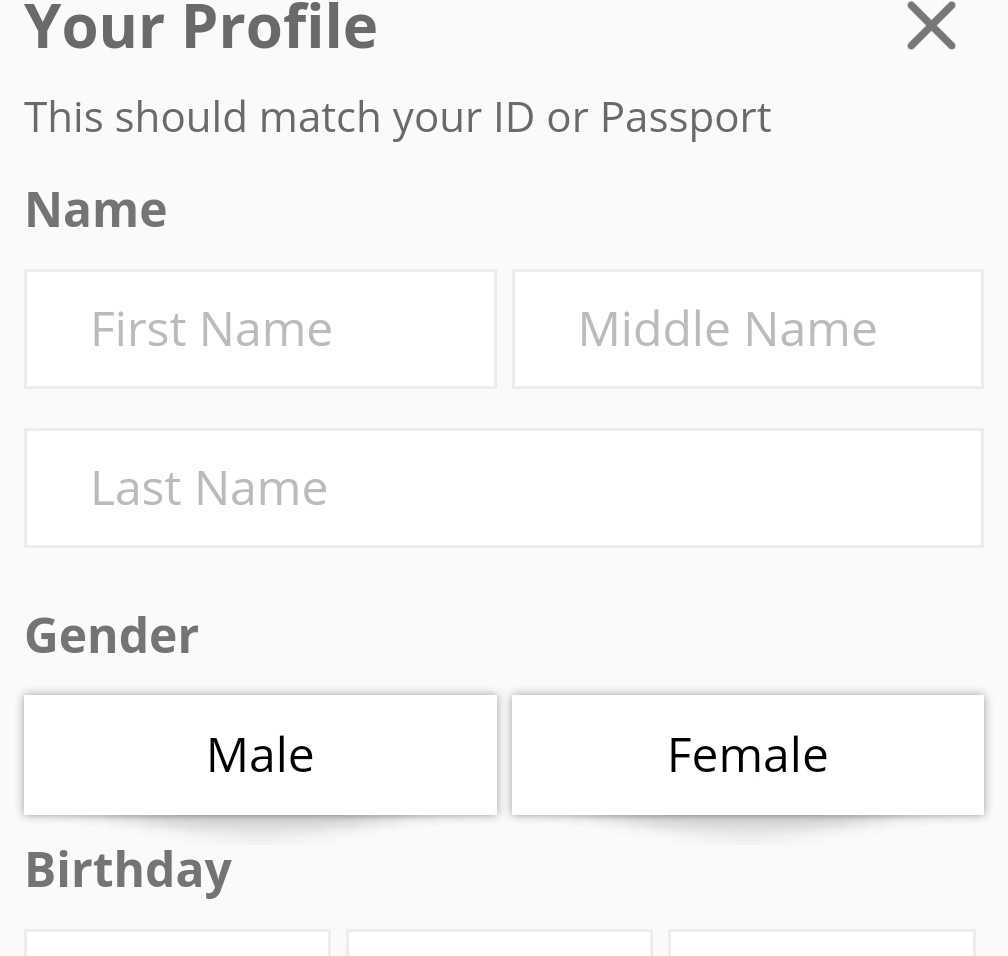

5) After you have successfully logged in, enter your name, select your gender, and fill in your date of birth.

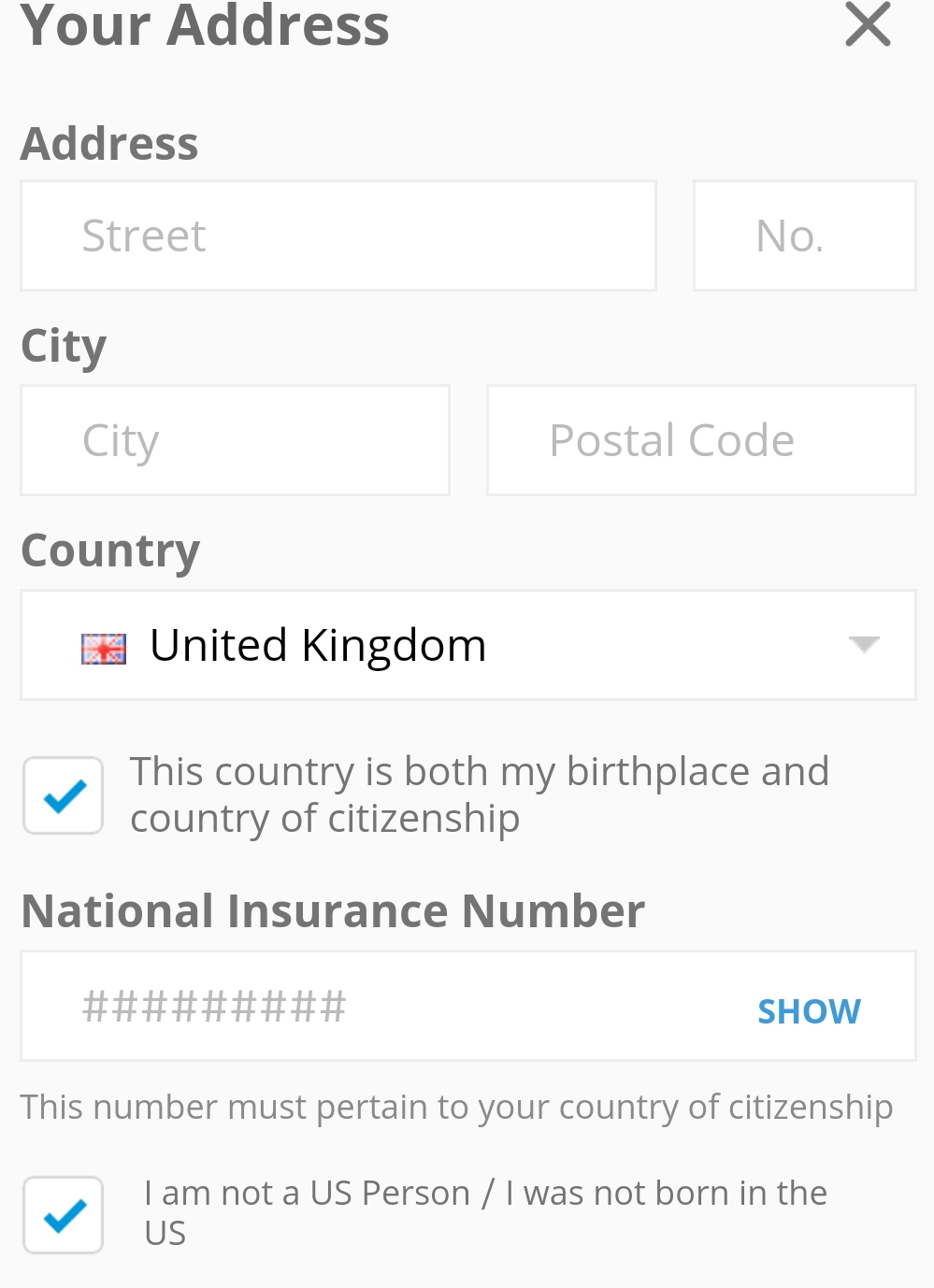

6) Enter your residential details where relevant and confirm that you were not born in the US.

7) Submit your KYC documents, deposit your funds, and begin trading.

The steps at other forex trading apps will also be similar. Using the example of eToro you can open an account on any trading app as most apps have an easy signup process.

How do forex trading apps make money?

Trading apps do not generate money independent of forex brokers. Most of the fees you will pay will go to your broker. It does not matter if the app is proprietary or from a third-party.

Brokers make money from trading apps in multiple ways. However, we can simplify all of them into trading and non-trading fees. Trading fees are the money you pay to your broker for every trade you make. It does not matter if you won the trade or lost. You will pay these fees.

Spreads, commissions, and swaps are the main trading fees charged by brokers on trading apps. Spread is the difference between the buy and sell price of the CFDs you are trading. Swap is the fee you pay for holding your trades overnight while commissions are usually charged where spread is low.

If you are trading on MT4/MT5 on your mobile device, you will see the amount commission and swap you are charged per trade. Non-trading fees are not connected to trading. They include account inactivity fees (if you don’t place a trade for a certain period), currency conversion fees, etc.

Finally, not all brokers have the same fee structure for their trading apps. A broker may have a low spread account on MetaTrader or offer a commission-free package on their proprietary trading app. Furthermore, inactivity fee is not the same too. Some brokers charge it, some don’t.

So make sure you research your broker’s fee structure before signing up on their trading app.

Is there a difference between forex trading apps and software?

Anything application has to do with mobile phones or tablets. So it is not difficult to understand what forex trading apps are. They are designed and tailored for mobile phones so you can have a smooth experience when trading.

Forex trading software are quite different. They are designed for your laptops, PCs, and desktops. A major advantage software have over apps is the clear view you get. You can see price movements are use charting tools more conveniently with forex trading software.

In addition, you have a better user experience with the advanced trading tools on the software. Tools like backtesting and automated trading are easier to use on trading software because of the view. In summary, forex trading apps are built for convenience and are user friendly. You can be on the move and monitor your trades.

For trading software, you need to be settled with a work station or an office space even especially if you are a full time trader. You cannot carry desktops about. Though some laptops are light enough to carry, they are not as easy to use on the go like trading apps.

So which is better for you? The answer depends on you, your preference, and how you want to trade.

Trading features to look for when choosing a forex trading app

Here are some of the trading features you should check for in your mobile trading app:

1) Watchlists: Watchlists allow you to customize your favorite CFDs into a list so you can track them easily. There is a lot of CFDs in the market. Being able to narrow your focus on a few of them might be helpful.

2) 1-click trading: You don’t always have to use the popup feature when placing your order. 1-click trading allows you to place your order faster. However, some trading apps have terms and conditions connected to using this feature.

Ensure you read and understand this conditions before agreeing to use 1-click trading.

Is there an official trading app for Forex

Forex trading does not have an official trading app. This is because the market has no central physical location. It is a decentralized market. Central banks, financial institutions, forex brokers, and large corporations make up the forex market.

Trading apps for forex are supplied by forex brokers. The app could be own by the broker or developed by a third-party company like MetaQuotes (MetaTrader 4 and MetaTrader 5 developer).

What are the risks of using forex trading apps?

Forex trading apps make on-the-go trading easy, but they also expose you to price volatility. The forex market is unpredictable, with prices changing quickly due to fundamental factors like news, geopolitical issues and economic releases. Traders using mobile apps need to be ready for sudden price changes that can hugely affect your loss or profit because of leverage.

In addition, unregulated mobile apps constitute a huge risk to you. This lack of regulatory oversight might allow forex brokers engage in unethical business practices such as price manipulation, stop hunting, or even denying withdrawal requests. It’s crucial for traders to do thorough research and sign up with mobile apps that are regulated with the UK’s Financial Conduct Authority. Doing this will also protect you from clone firms.

Cybersecurity threats are also a source of major concern. Trading through mobile apps can expose you to hacking and malware risks. Unauthorized access to your account can result in stolen funds or worse. To mitigate these risks, make sure your password is strong, enable 2FA, and avoid logging into your trading accounts over insecure connections like public Wi-Fi.

Is there a difference between forex trading apps and forex trading platforms?

Forex trading apps and forex trading platforms allow you to trade the financial markets and grants you access to your broker’s system.

Though they perform the same function, they are significantly different. A major difference is that forex trading platforms run on computers while forex trading apps run on mobile devices. In addition, forex trading apps are limited in terms of features and tools required for thorough analysis. Forex trading platforms have these tools in abundance. This is why professional traders prefer trading platforms.

Can I download forex trading apps for free?

Most forex trading apps are free to download. Whether they are proprietary trading apps or third party trading apps like cTrader and the MetaTrader duo (MT4 and MT5).

This should not be confused with trading fees like spreads, commissions, and swaps. They will be on the app just as they are on desktop versions.

Can I open a trading account on a trading app?

Yes, you can open a live or demo account on forex trading apps. If you download MT4 or MT5 for example, you get a demo account from MetaQuotes.

You can switch to your broker’s demo or live account by searching for their server. However, it will likely be more straightforward on your forex broker’s trading app.

You can open a demo or live account directly on the trading app.

What is the most popular forex trading app?

MT4 and MT5 are the most popular forex trading apps. On the Google Play Store alone, MT4 and MT5 have over 20 million downloads between them.

On the Apple App Store, the figure is the same. Some proprietary trading apps also come close to this number. But none beats MT4/MT5 in terms of popularity.

Can I fund my trading account directly from the app?

Yes, with forex trading apps, you can fund your trading account on the go. Some forex brokers might not have all payment methods available on their trading apps. But you should still be able to fund your account with the methods supported.

Note that funding and withdrawals are not possible on third-party trading apps like MT4 and MT5.

Do forex trading apps and desktop platforms have the same tradeable instruments?

This depends on your forex broker and how they operate. If your broker only offers third party trading apps like MT4/MT5, the apps and the desktop platforms will have the same tradeable instruments.

With in-house apps and desktop platforms, brokers have more liberty. They develop the apps and platforms so they may distribute their CFDs differently. Some forex brokers do not even have an in-house desktop platform.

The best way to confirm the availability any CFD is to check your broker’s website. If you cannot confirm this way, use the customer care channels. City Index, for example, have an FAQ section for mobile apps.

Is mobile trading safe?

Forex brokers do have security measures to protect traders that use their trading apps. The most common is the two-factor authentication. This makes sure no one can access your account without your permission.

In addition, some brokers add biometric verification to their security. But you can only use it if your phone has the function.

Is $100 enough to start forex?

$100 is more than enough to start forex trading. There are even brokers with no minimum deposit so you can start with $100.

FAQs on Best Forex Trading Apps UK

Which is the best forex trading app in UK?

If a forex broker is regulated with the FCA, then their app is considered safe. There is no best Forex App for all traders, as it depends on the requirements of a trader.

Never trade with an unlicensed broker. You might just be throwing away your hard-earned money. You also need to consider overall fees, deposit/withdrawal methods, etc. According to our review, City Index, CMC Markets, and eToro have some of the best forex trading apps in the UK.

Which is the most popular trading app?

MetaTrader is the most popular third party trading platform & app among forex traders. However, forex brokers also have their own trading apps that you can download from the Google Play Store or the App Store.

How much do you need to start trading forex in the UK?

The amount to start with depends on your forex broker. Some brokers require a minimum deposit while some do not.However, it is essential you have enough money in your account to cover margin costs. You can read our breakdown of forex trading for more.

Which forex trading App has low fees?

Brokers charge fees for spreads, commissions per lot & other non-trading charges like inactivity fees, deposit/withdrawal charges etc. As per our comparison Pepperstone, City Index, CMC Markets & few other regulated forex brokers have competitive overall fees. You can read our review of low spread forex brokers for more.

Which is best for forex trading app for beginners?

According to our review, Capital.com have the best education content for mobile apps. Their trading and Investmate apps are good for beginners. For more on this, you can read our in-depth review of the best brokers for beginners in the UK.

Which forex trading app is best for iPhone?

As per our research, there are few CFD brokers that have their apps on iPhones. For example, CMC Markets, Pepperstone cTrader, etc.

Most apps are easy to use & it takes a few minutes to sign up. The app should allow you access to technical indicators, and price alerts.