Forex trading is not legal in the Philippines as per SEC (Securities and Exchange Commission of the Philippines) and traders are advised to not trade until there is a regulation in place. All brokers accepting traders from the Philippines are doing so illegally, and traders are trading at their own risk.

All of the retail traders that are currently trading forex & CFDs in the Philippines are trading via foreign brokers. Therefore, there is a huge third-party risk involved.

To avoid a scam, do not trade with any FX brokers that are not regulated with any tier-1 regulations (even though traders from the Philippines will be registered by brokers under their entity which is regulated with offshore regulation, still it is important that your FX broker is regulated with multiple top-tier regulators to ensure that it is low-risk).

Show More

Comparison of Best Forex Brokers in the Philippines

| Broker |

Tier-1 regulation |

EUR/USD Spread (Pips) |

Other Regulators |

Visit |

| XM

|

FCA, ASIC |

1.6

|

FSC Belize, DFSA, CySEC

|

Visit Broker |

| Octa

|

None |

0.9

|

FSA (SVG), CySEC, FSCA

|

Visit Broker |

| FBS

|

FCA, ASIC |

0.9

|

FSC Belize, CySEC, FAIS

|

Visit Broker |

| HF Markets

|

FCA |

1.4

|

FSA (SVG), CMA, FSCA, DFSA

|

Visit Broker |

| FXTM

|

FCA |

2.1

|

FSC Mauritius, CMA, FSCA, CySEC

|

Visit Broker |

| IC Markets

|

FCA, ASIC |

0.8

|

FSA (Seychelles), CySEC, SC – Bahamas,

|

Visit Broker |

Note: The spread and regulation are as per information on these brokers’ websites in September 2024. Please see our methodology below.

Best Forex Brokers in the Philippines

Here are 2024’s Best Forex Brokers in the Philippines that we have reviewed:

- XM – Overall Best Forex Broker in the Philippines

- Octa – Forex Broker with Copy Trading

- FBS – Forex Broker with Crypto CFD Account

- HF Markets – Forex Broker with Tier-1 regulation

- FXTM – Forex Broker with Low Minimum Spreads

- IC Markets – Forex Broker with cTrader

#1 XM – Overall Best Forex Broker in the Philippines

EUR/USD Benchmark:

1.6 pips (Standard Account)

Trading Platforms:

MT4, MT5, XM Webtrader and the XM Mobile App

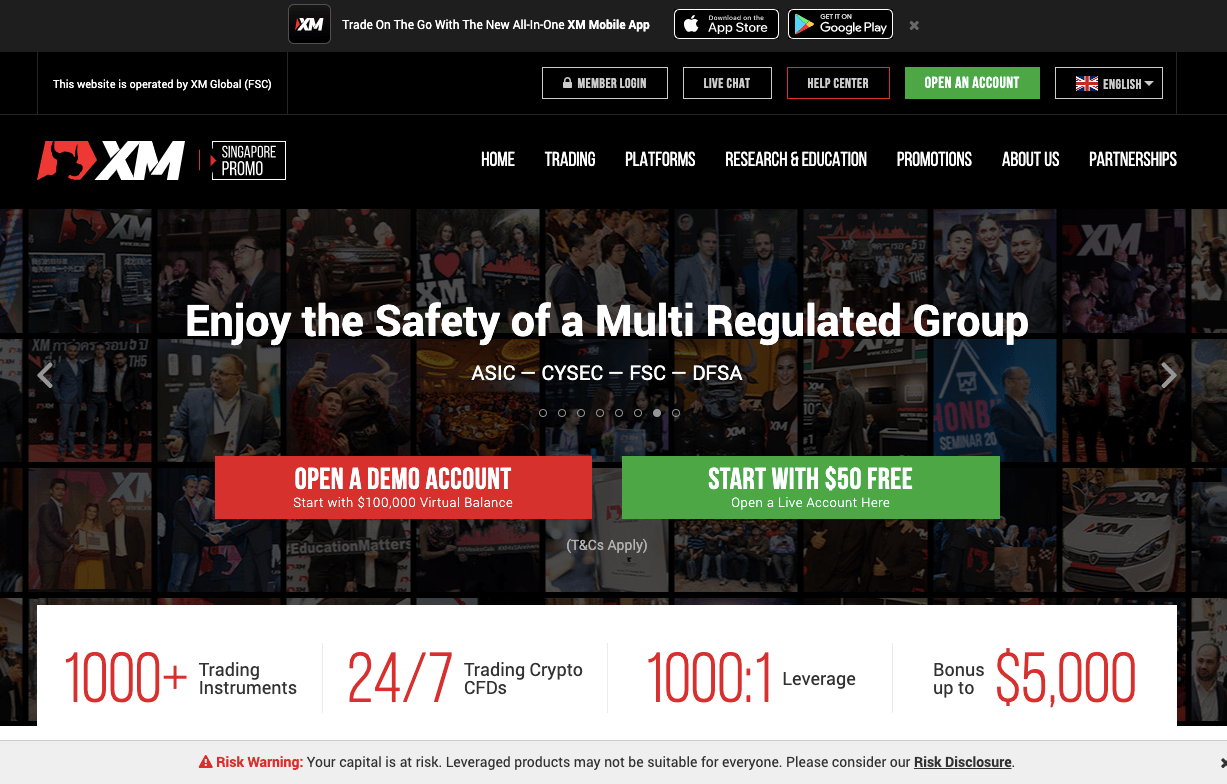

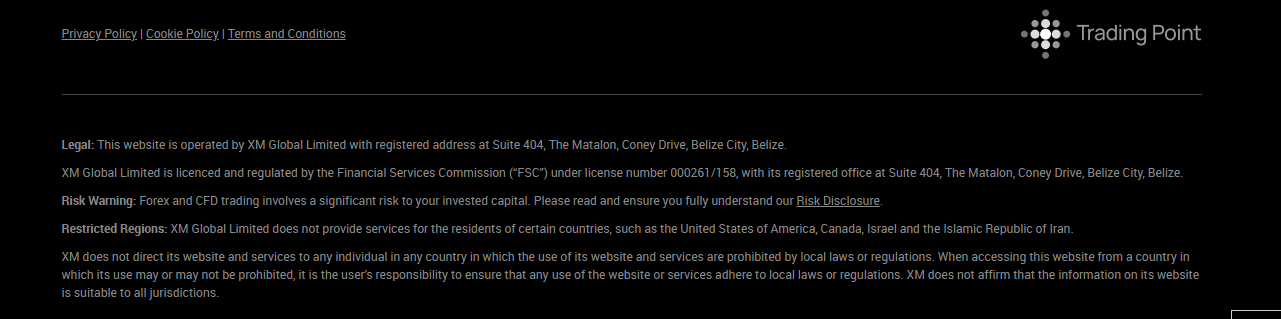

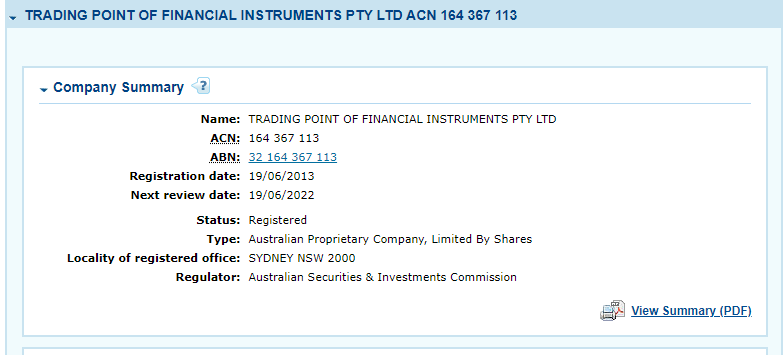

Philippines traders are registered under the Financial Services Commission (FSC) in Belize. Their parent company, Trading Points of Financial Instruments Limited, is regulated by the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC).

XM Pros

- Multiple tier-1 regulations

- You can deposit in Philippine Peso

- Minimum deposit is $5 (261 Philippine Pesos)

- Supports MT4 and MT5 trading platforms

- Offers free deposits and withdrawals

- XM does not charge commissions for forex trading. They make their money from the spread and the swap.

XM Cons

- The swap for major pairs is high.

- Few tradable instruments available

- Charges dormant account fees

#2 Octa – Forex Broker with Copy Trading

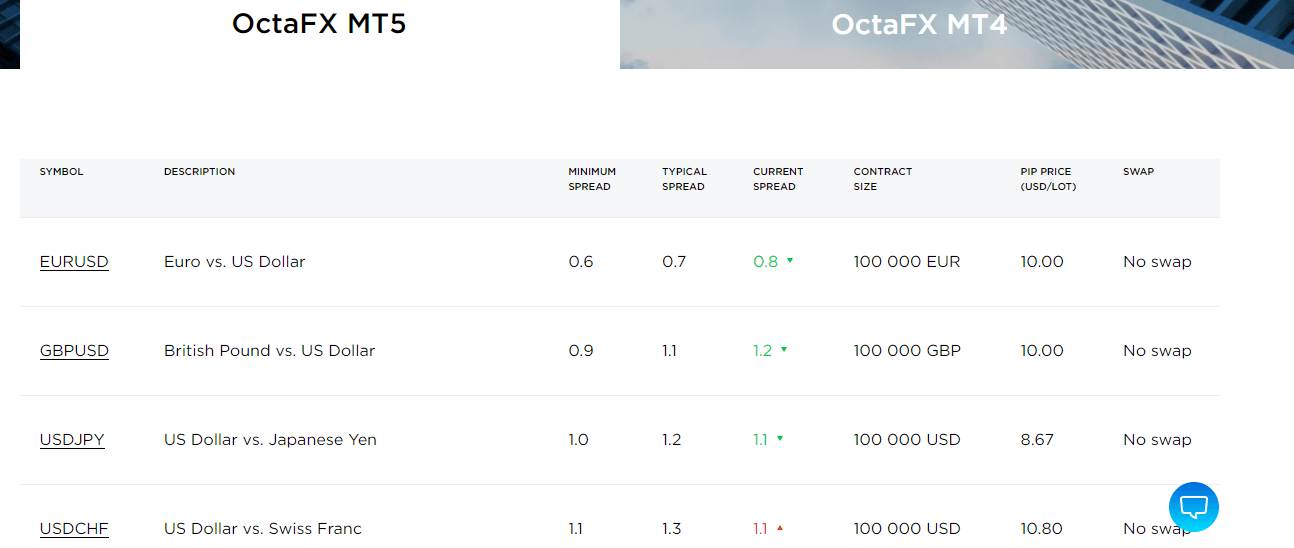

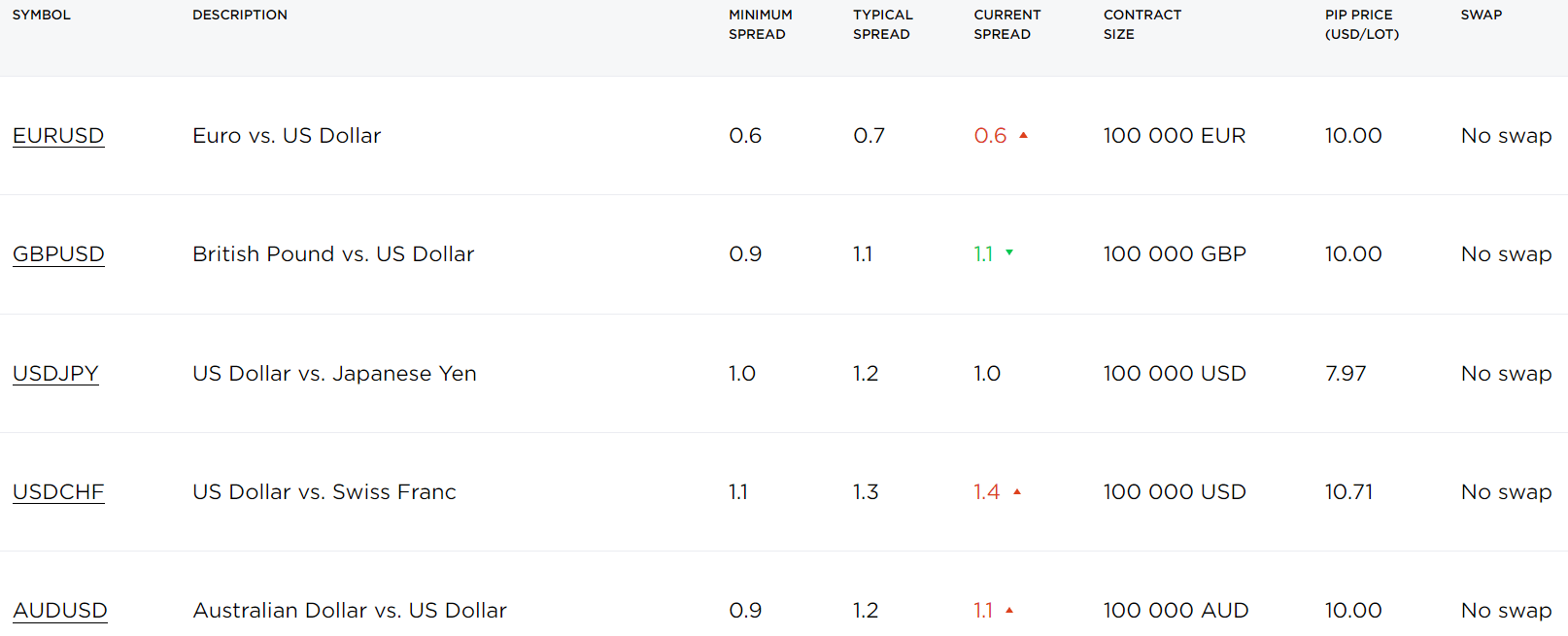

EUR/USD Benchmark:

0.9 pips (MT4 Account)

Trading Platforms:

MT4, MT5, Octa Trading App, and the Octa Copytrading App

Octa registers Philippines-based traders under the FSA-St-Vincent & Grenadines. They do not have tier-1 regulators like the FCA or ASIC. However, they are regulated by Cyprus Securities Exchange and Commission (CySEC).

Octa Pros

- Octa offers copytrading.

- Octa does not charge extra commission per lot

- Multiple trading platforms

- Octa offers swap-free trading

- Has auto trading robots, Expert Advisor (EA) and cBot

- Customer service is available 24/7

Octa Cons

- Recommended minimum deposit is $100 (5,223 Philippine Peso).

- Limited number of CFDs.

- No tier-1 regulation.

- Stock CFDs are not available on MT4.

#3 FBS – Forex Broker with Crypto CFD Account

EUR/USD Benchmark:

0.9 pips (Standard Account)

Trading Platforms:

MT4, MT5, FBS CopyTrade App, and the FBS Trader (mobile app)

FBS is regulated by top-tier bodies like ASIC and the FCA (temporary permission). They are also licensed with CySEC. Traders based in the Philippines are registered under the IFSC in Belize.

FBS Pros

- FBS offer multiple trading accounts with different minimum deposits

- You can deposit and withdraw funds via local exchangers. This means you can carry out your transactions in Pesos

- FBS offers multiple trading platforms and copy-trading

- Offers commission-free trading

- FBS does not charge dormant account fees

- Has 24/7 live chat support

FBS Cons

- Most deposit/withdrawal method is in USD and EUR

- Charges withdrawal fees on all payment methods

- You can leverage up to 3000:1. This puts your capital at high risk

#4 HF Markets – Forex Broker with Tier-1 regulation

EUR/USD Benchmark:

1.4 pips (Premium Account)

Trading Platforms:

MT4, MT 5, HFM webtrader, and the HF Markets mobile trading app.

HF Markets have just one tier-1 regulation – the Financial Conduct Authority (FCA). Philippine-based traders are registered under the FSA in St. Vincent & the Grenadines regulation.

HF Markets Pros

- Supports multiple trading platforms MT4, MT5

- Offers a wide range of tradable instruments

- The typical spread for major pairs is low

- Offers free deposits/withdrawals

- Has responsive 24/5 customer support via email and live chat

HF Markets Cons

- Extra commission per lot on Zero Account

- Customer service is not available 24/7

- Charges dormant account fees

#5 FXTM – Forex Broker with Low Minimum Spreads

EUR/USD Benchmark:

2.1 pips (Advantage Plus Account)

Trading Platforms:

MT4, MT5, and FXTM Trader.

The FCA (UK) and CySEC (Cyprus) regulate FXTM. Their Philippines clients are registered under the Financial Services Commission (FSC) in Belize.

FXTM Pros

- Fast processing of deposits and withdrawals

- No fees on deposits for all payment methods

- The customer care support of FXTM is good and available 24/5

- Copytrading is available

FXTM Cons

- Charges dormant account fees after 6 months of inactivity

- FXTM customer support is not available 24/7

- Charges withdrawal fees on some payment methods

#6 IC Markets – Forex Broker with cTrader

EUR/USD Benchmark:

0.8 pips (Standard Account) with $3.5 per lot commission on Raw Spread MetaTrader Account, $3.0 per lot commission on Raw Spread cTrader Account

Trading Platforms:

MT4, MT5, and cTrader

IC Markets are regulated with ASIC and have temporary permission from the FCA in the UK. Philippines-based traders are likely registered with the Financial Services Authority (FSA) in Seychelles.

IC Markets Pros

- No fees for deposit/withdrawals

- You can deposit your funds in Philippine Peso

- Spreads for major pairs are low

- No inactive account fees

- Offers commission-free trading with Standard Account

IC Markets Cons

- Few products available for trading

- Philippines-based traders are not registered under tier-1 regulation

- No copy-trading

How to Choose the Best Forex Broker in the Philippines

Since forex trading is not regulated in the Philippines, it is important to know what to check when choosing a foreign CFD broker. We have created this checklist of some important points and also covered examples of how you can check these points yourself for a broker.

Let’s go.

1. Safety

Check if your deposits are safe. Since forex trading is not regulated in the Philippines, there is no investor protection. Your broker could run away with all your money. All traders in the Philippines are trading at their own risk.

There are so many fraudulent brokers in the region who are promoting forex as a get-rich-quick scheme, even though trading forex & CFDs using leverage is very risky. Avoid any such brokers which offer promotions & promote forex as a way to get rich.

Make sure you verify that your broker is reputed, safe & well regulated. Check the tier-1 regulators the broker is regulated by.

Here is how you can do this using XM as an example (you can follow these steps using other brokers too).

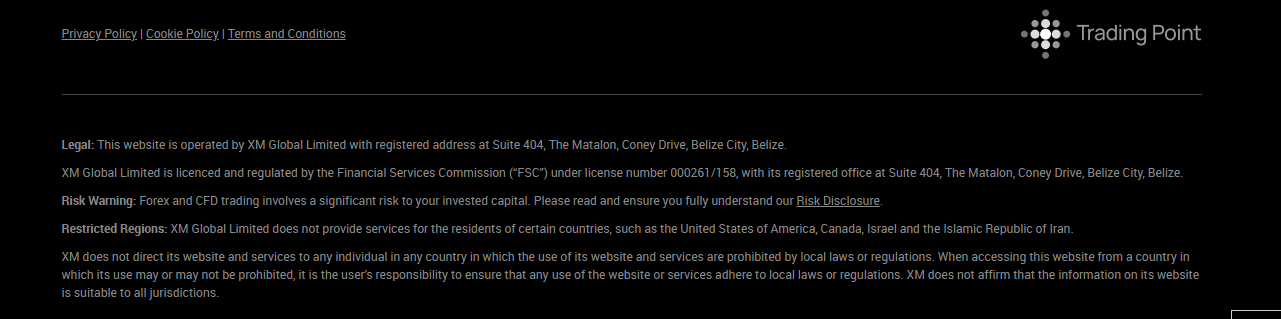

At the footnote of xm.com, you will see that the parent company for XM is Trading Points as shown below

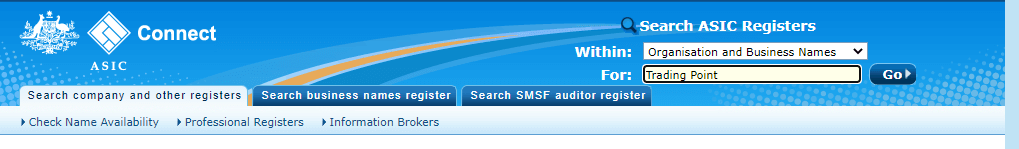

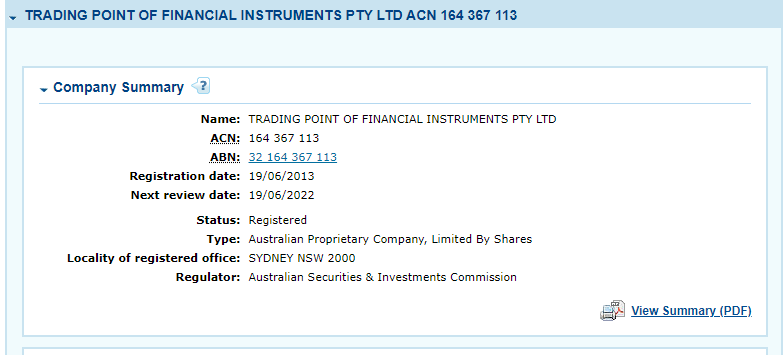

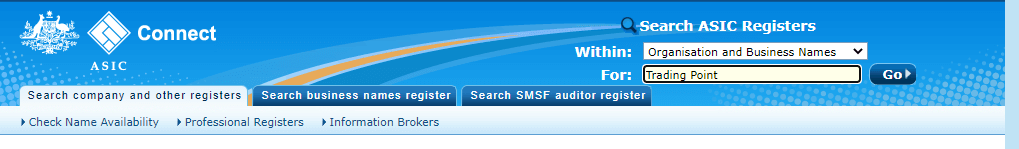

ASIC and the FCA are major tier-1 regulators. In this example, we will show you how to verify XM’s ASIC regulation. The first step is to go to asicconnect.asic.gov.au. On the home page, under search ASIC register, select organization and business name and input Trading Point. The illustration is shown below

Finally, click on go. You should have your final search result displayed as shown here

2. What are the Spreads, Commission & Other Non-Trading Charges

Overall fees should not be high. You lose money when you trade so giving extra money to your broker because of high fees is not helpful.

Floating Spreads or Fixed: When comparing the fees, you also have to very carefully consider if you want to trade with a fixed spread or a floating spread broker.

To put it simply, a fixed spread broker will charge you fixed spread per lot when trading. For example, if the broker says fixed spread of 0.3 pips on EUR/USD, it means it will not change, it will remain the same no matter when you are trading.

But most forex brokers have floating spreads. It means the spreads are not constant, they change according to market conditions. For example, your broker could have 0.5 pips spreads on EUR/USD during opening of London session but few minutes later it could be 0.7 pips. So, you don’t have any fixed idea of the cost you will have to pay for trading, it is ‘variable’.

Note that even with fixed spread brokers, it is possible that the spreads are fixed for particular hours.

Typical spreads should be low as well and if possible, no extra commission per lot. You have to check this yourself.

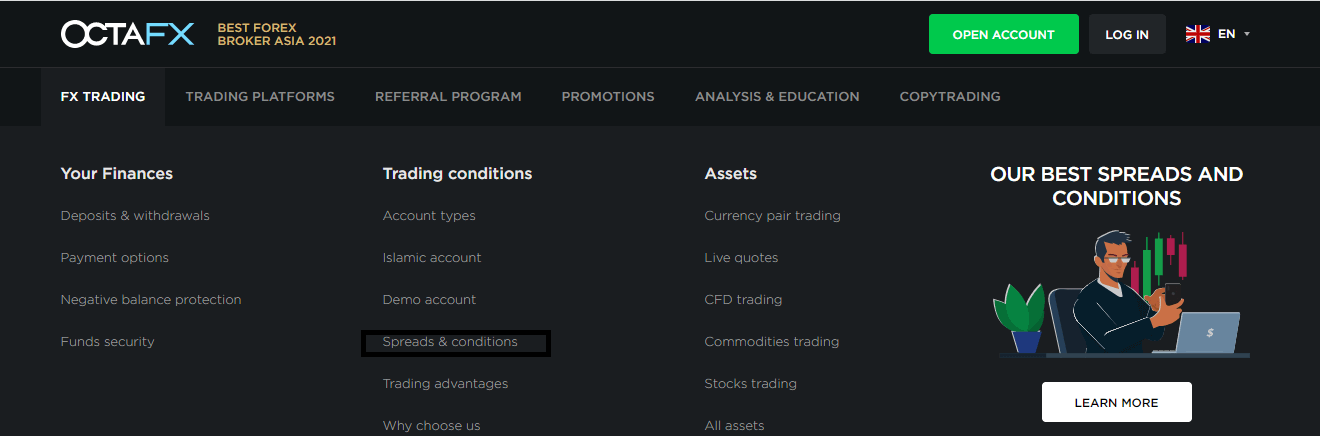

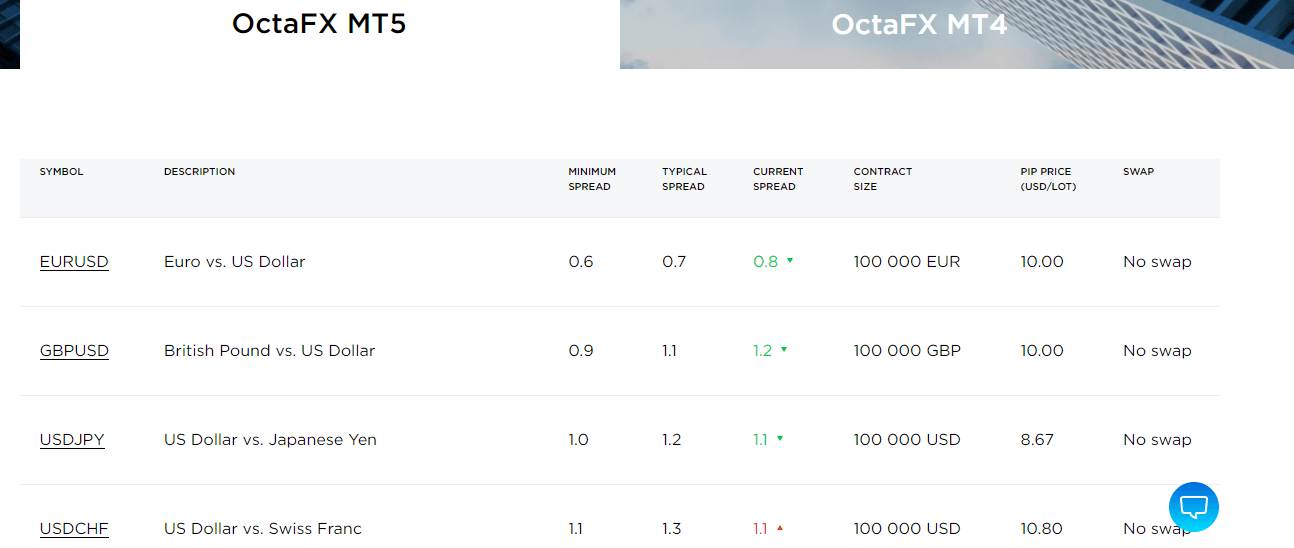

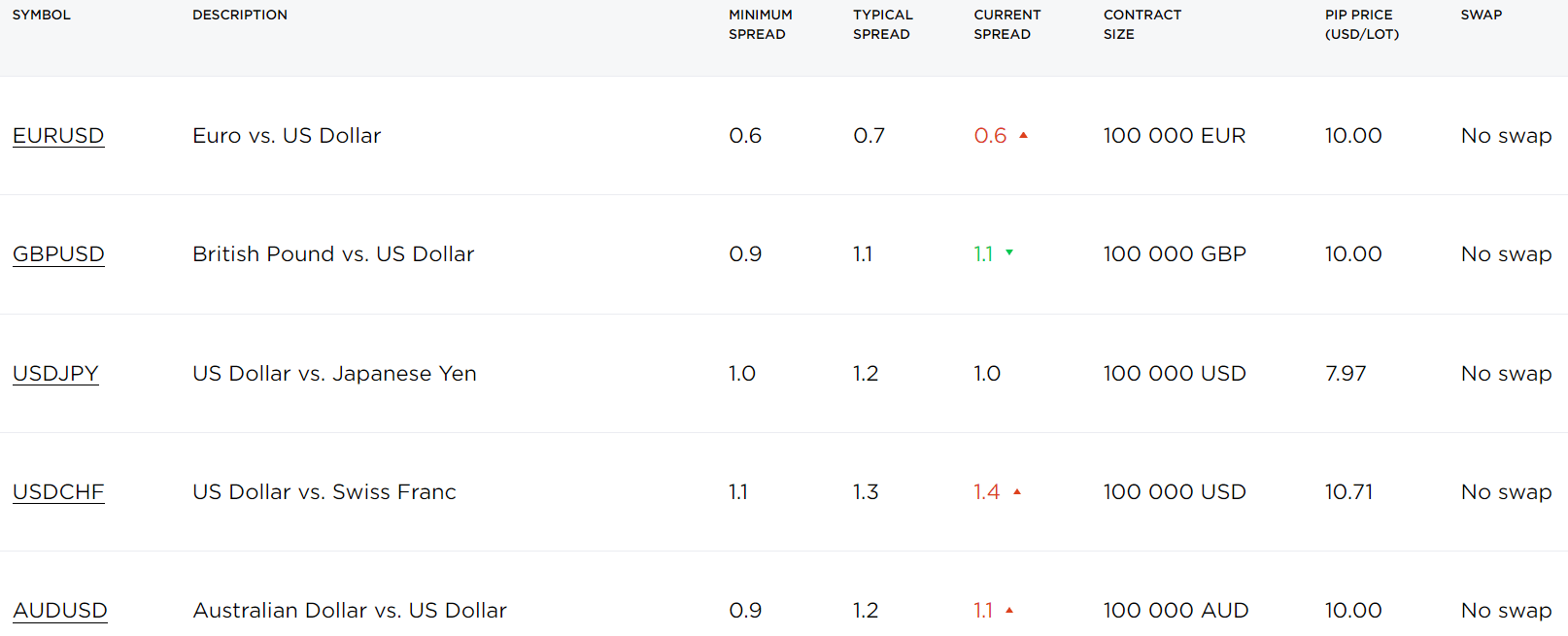

Here is a guide on how to go about it for Octa. Go to octafx.com and click on “FX TRADING”. Select “Spreads & Conditions as shown below

The page that follows will show you the spread for currency pairs.

In addition, there could be non-trading charges such as inactivity fees, currency conversion fees, deposit/withdrawal fees, etc. You can speak with the forex broker’s support to verify their non-trading charges.

3. How many CFD trading instruments are available?

A limited number of CFDs will limit the number of markets you can trade. Your CFD broker should not only offer a good range of CFDs. The number must also be substantial for a good trading experience.

You should make sure that your broker offers the trading instruments that you want to trade. The larger the range of trading instruments, the better it is. A lot of forex brokers have started to offer cryptocurrencies as well, and you should try to trade with a forex broker that does offer it since they are attractive trading instruments.

For example, Octa offers 32 currency pairs, 10 indices, 5 commodities, and 30 cryptocurrencies. The range of cryptocurrencies offered by Octa is very large, so you should consider it if you want to trade cryptocurrencies.

In contrast, HF Markets offers 53 currency pairs, 6 metals, 4 energies, 54 CFD stocks, 23 indices, 3 bonds, 5 commodities, 34 ETFs, 19 cryptocurrencies, and 945 DMA stocks. Hence, in comparison to Octa, HF Markets has a much wider range of trading instruments.

If you’re looking to trade a particular trading instrument such as GBP/USD, then you should also compare the fees associated with different forex brokers. For example, the spread that you’ll be charged for trading GBP/USD through Octa is 1.1 pips, and through HF Markets is 1.9 pips, and through Pepperstone is 0.6 pips.

Hence, if you’re looking to trade only GBP/USD, then you should trade with Pepperstone since they offer the lowest fees (spread).

4. Suitability of Trading Platforms

The user interface of the broker’s platform is also important when deciding on the broker to use. Some brokers’ platforms either web or app, have poor user interfaces, some come with ads, and so on. These can slow down the execution of trades.

Online trading is a fast-paced business where every second is important. Entering or leaving a trade one second late can be very costly. It is also important the platform is compatible with different devices such as Android, Mac, etc.

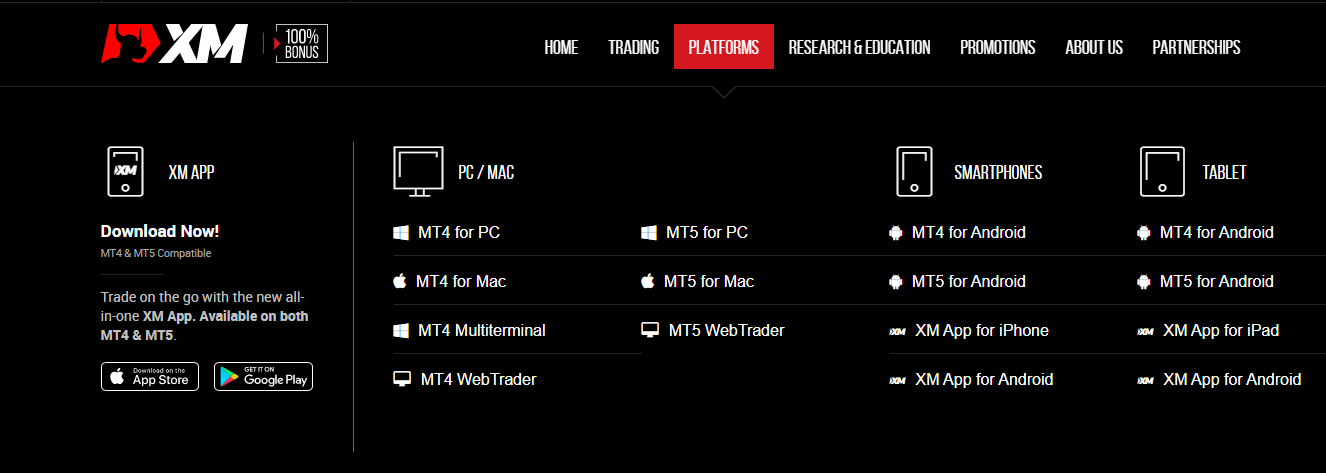

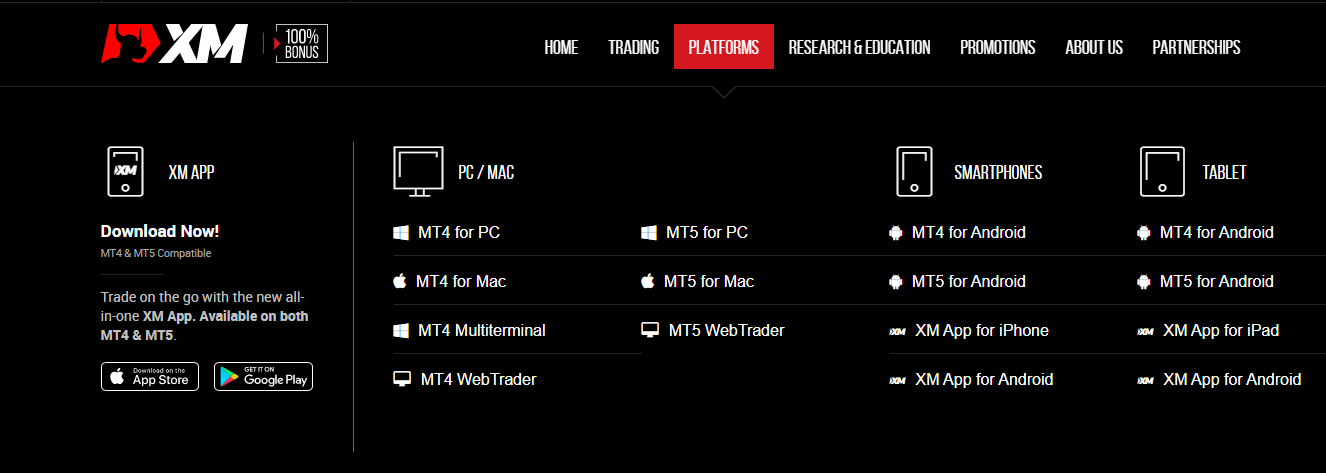

Here is how to check the platforms available with your forex broker. We will use XM as our example. First, you go to their homepage and click ‘PLATFORMS’ (highlighted red)

At a glance, you can see the different platforms with XM and the devices they support. You can see MT4 and MT5 which are available on PC (Mac and windows). The platforms are also available on smartphones, and tablets and work well on Android and iOS systems.

The XM trading app is also available on both systems. While MT4 and MT5 are third-party platforms, the XM trading app is owned by the broker. This is how most brokers operate, supporting their own app and third-party platforms.

Furthermore, some forex brokers also have their proprietary forex trading platforms. These platforms are developed by the company for the company. Traders hardly use these platforms for varying reasons. One of them is because of poor interface. However, brokers have greatly improved their platforms over the years with good trading conditions that may or may not be available on their third-party platforms

5. Customer Support

Customer support is an essential part of a brokerage. The better the customer support is, the better your trading experience will be. You should always check if the broker offers customer support in your language (Melayu or English or your preferred language). Before signing up with a broker, you should contact customer support and ask them to clarify any issues or doubts that you may have. This will give you an idea of the kind of customer support that the broker offers.

For example, Octa offers customer support through live chat and email. They do not offer customer support through phone calls. Their customer support is available in Melayu as well as in English.

We contacted Octa’s customer support team at the time of writing this review and received a response within 5 minutes. A response time which is under 5 minutes is usually considered to be good enough.

You may have to wait longer if you contact them through email.

This is how you check whether the customer support offered by a broker is good enough for your needs.

6. Leverage

As a trader, you have the option of using leverage on each of your trades. Leverage allows you to increase the size of your position without betting more money. Usually, CFD brokers operating in the Philippines offer very high leverage. You can use the leverage of up to a maximum of 1:3000 depending on the broker.

However, using leverage can greatly increase the risk associated with your trade. Leverage can multiply the loss that you face if your trade moves in an unfavourable direction. Hence, you should only use maximum leverage of 1:10 (for forex instruments) and even lower for other types of asset classes, despite the broker offering much higher leverage. This is to help you reduce the risk of your trade.

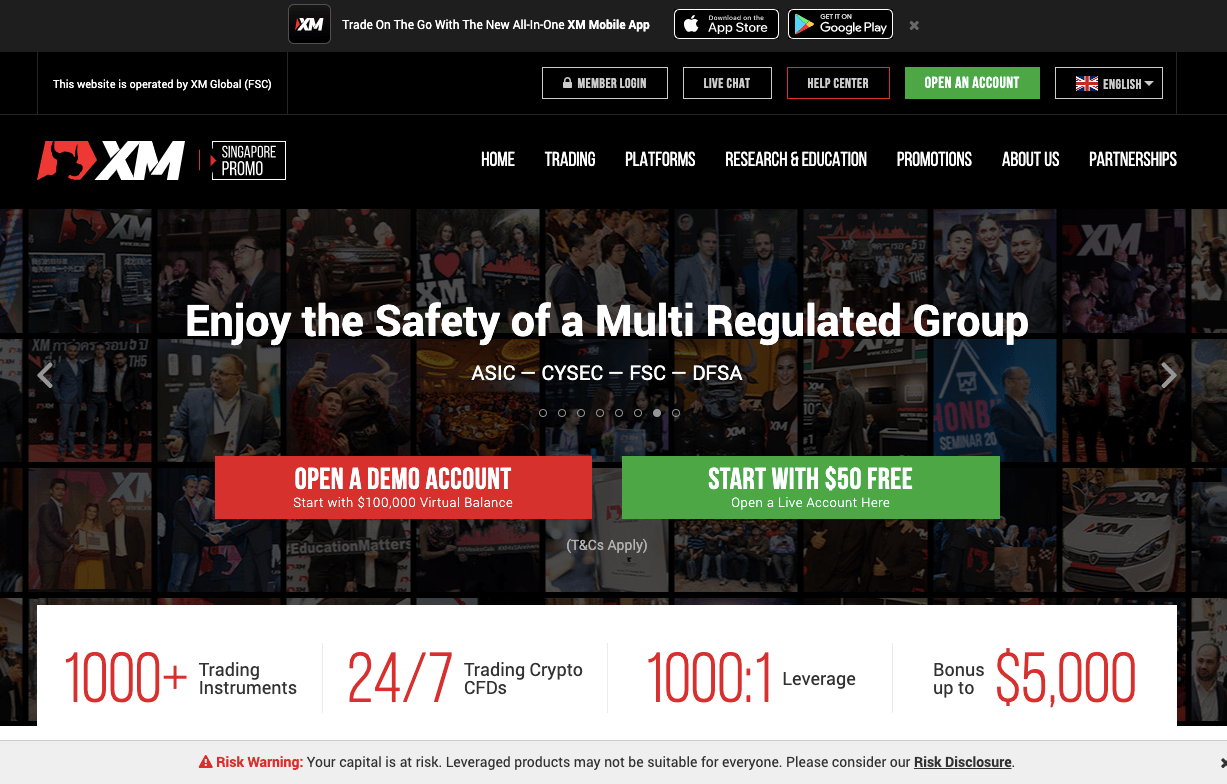

You can check the maximum leverage offered by a broker on their website. For example, below is a screenshot from XM’s website where they state that they leverage up to 1:1,000.

7. Account types

Brokers usually give a breakdown of account types on their websites. You will also find in this breakdown key features of the accounts. You want to look for an account with low spreads and low commissions. This is a major factor to consider when choosing your trading account.

Having multiple account types can offer you the flexibility to trade, and generally brokers have different fees structures for different account types.

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large volume traders.

Standard accounts are basic account types with standard fee structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, but some commission is involved for each trade (depending on your lot size).

8. Other trading conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

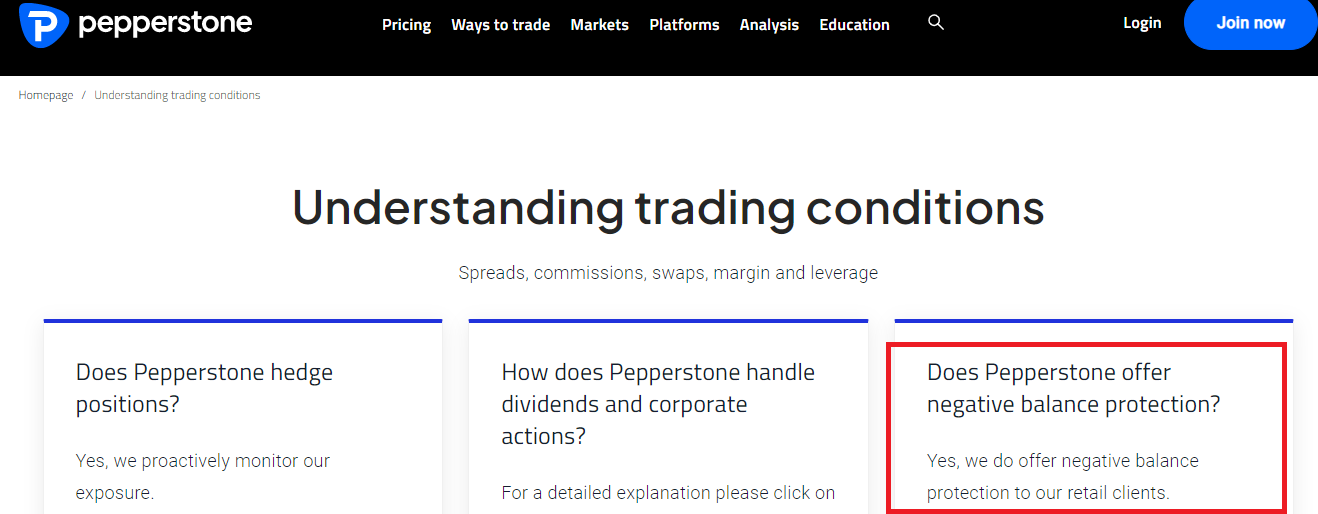

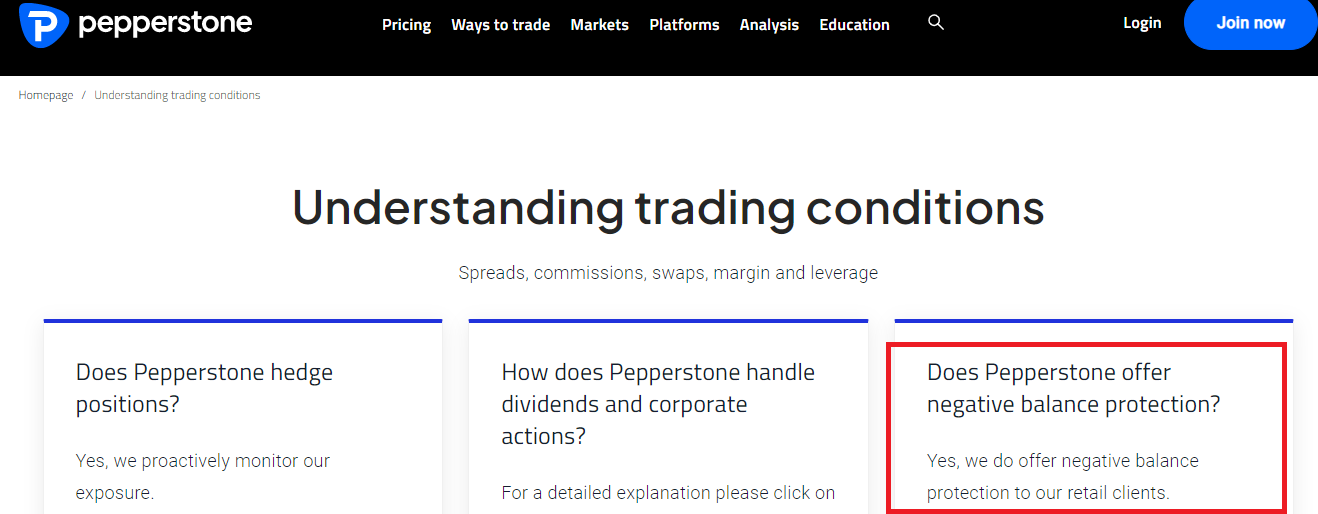

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. There is no local regulatory body that mandates forex brokers to offer negative balance protection in Nigeria. However, if the broker is regulated by African regulators like the FSCA (South Africa) and CMA (Kenya), they likely offer it.

You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on Pepperstone’s website

c. Deposit/Withdrawals: Quick processing, multiple deposit/withdrawal methods, and low charges are the factors to keep a close eye on here. You should also be able to deposit and withdraw through your local bank. Most forex brokers do not charge extra fees for deposits/withdrawals. However, you can incur charges from your bank or e-wallet providers. Your broker does not receive any of these fees.

Summarily, what you want here is a broker with fast processing with little to no fees. In conclusion, you should be able to deposit in Naira. A naira base currency account is not too popular in Nigeria so your money will be converted to the currency you choose. Most traders in Nigeria prefer the US dollar as their account’s base currency.

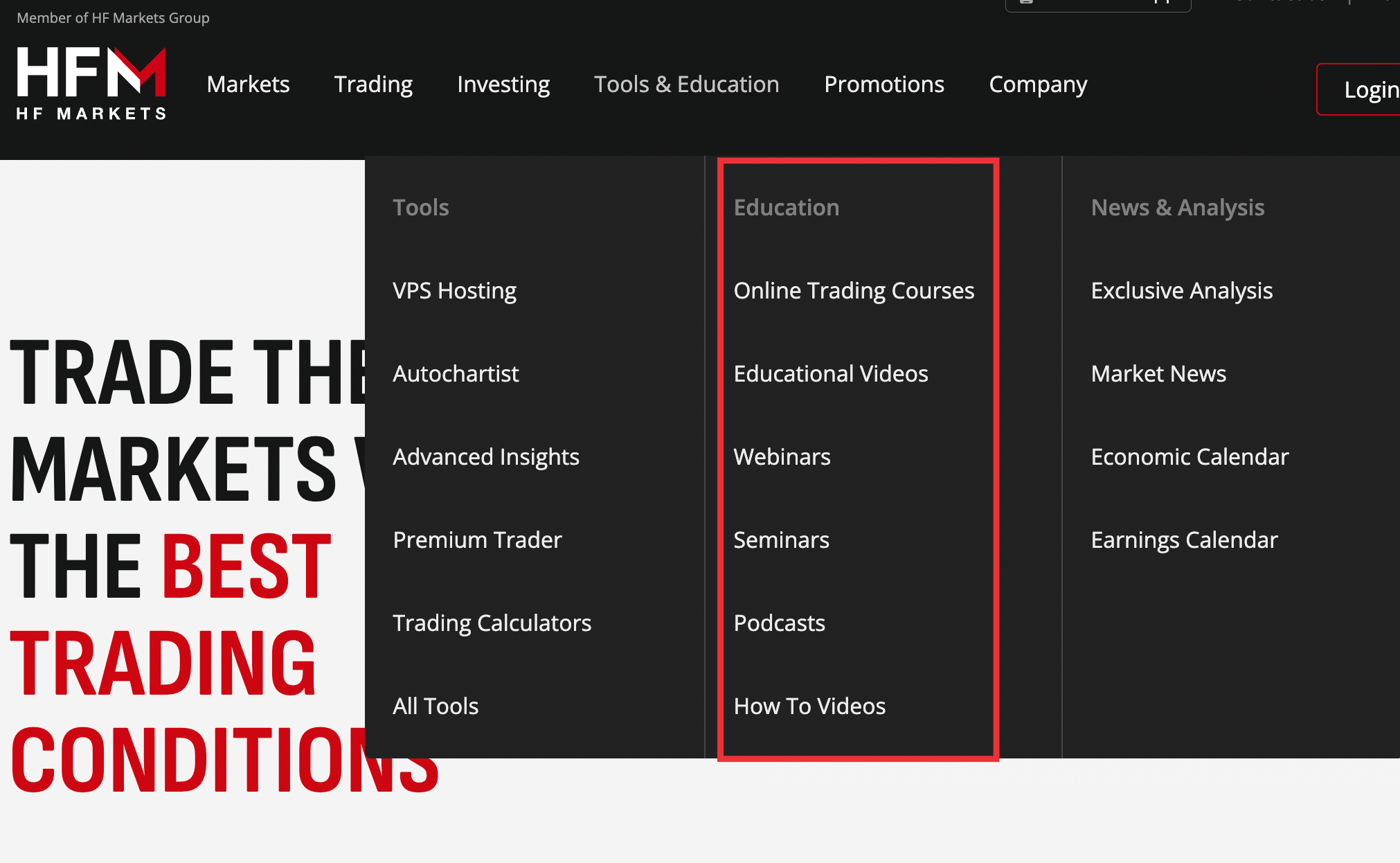

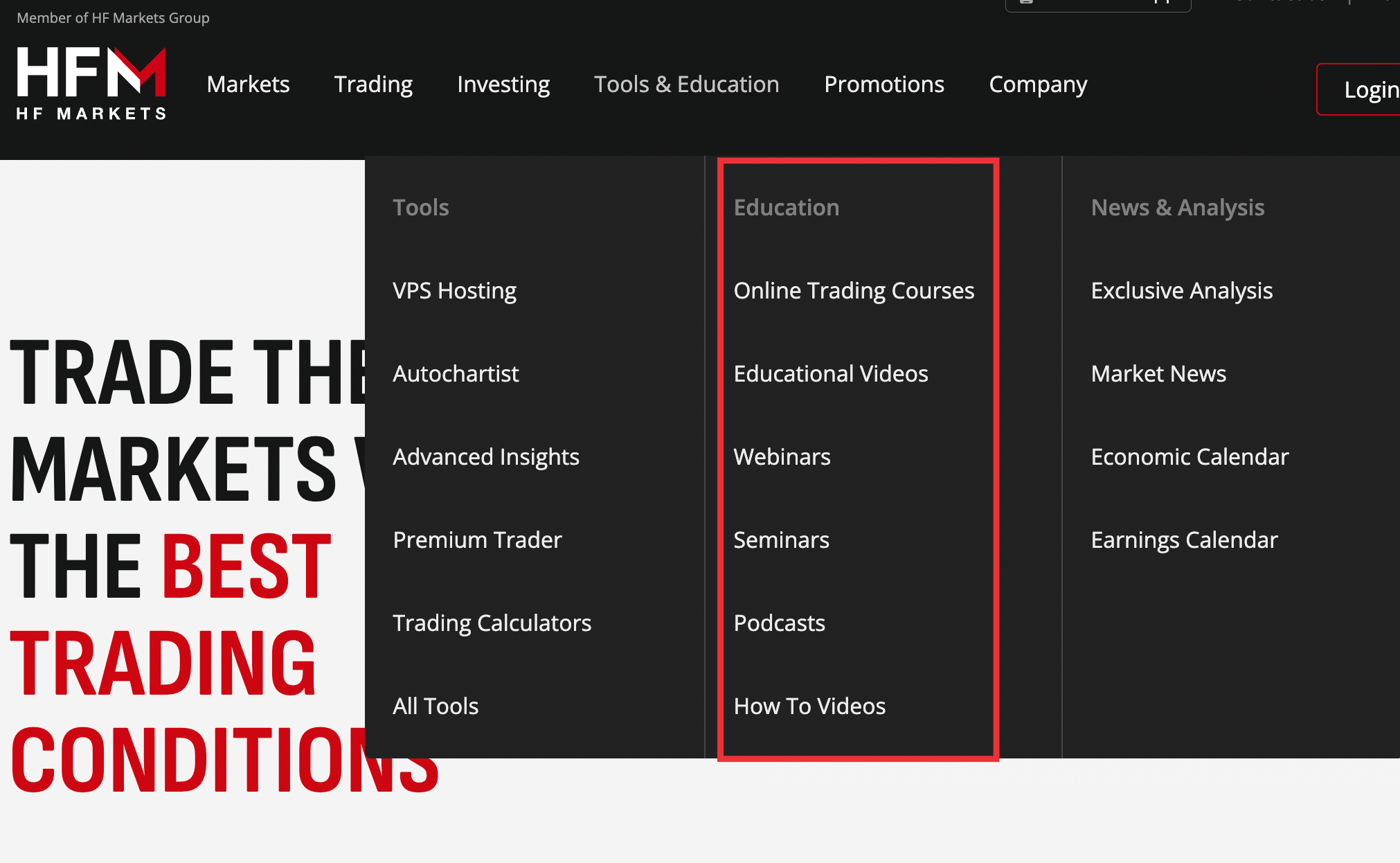

d. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

Finding a broker’s education is easy. It is usually on their homepage. With a few clicks, you can access quality courses for your learning. Let us show you how you can do this (HF Markets is our example). On HF Market’s homepage, click on ‘Education’ (underlined red). Here is an illustration below.

From the image, you can see that HF Markets has webinars, tutorials, podcasts, forex e-course, educational videos, etc. You can use any of these resources to expand your knowledge about forex and CFD trading.

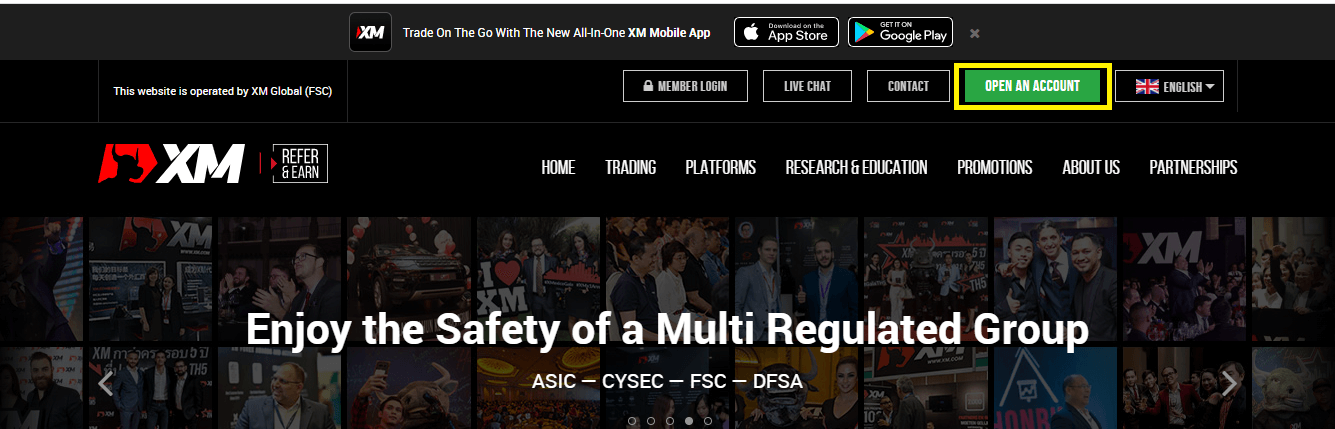

How to open forex account in The Philippines?

We will explain the steps using XM broker as an example.

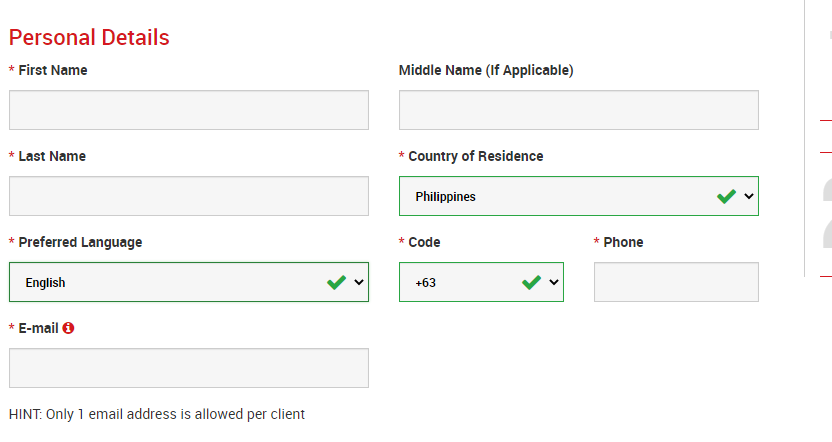

1. Go to xm.com and click on “Open Account”

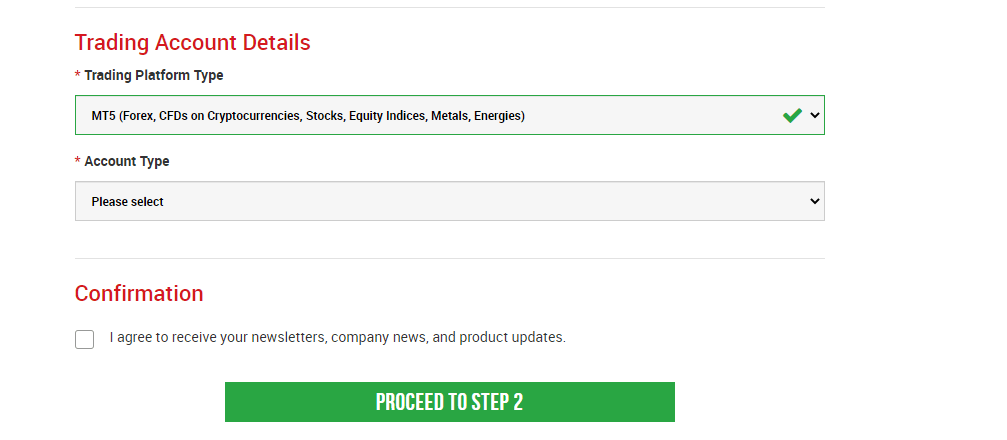

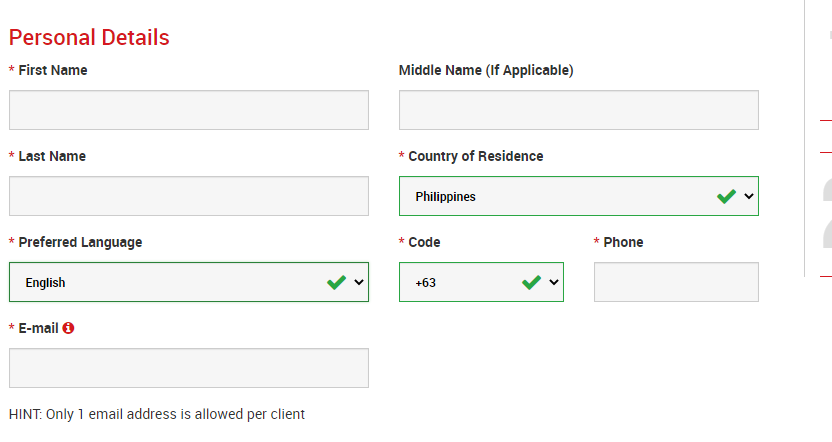

2. Fill in your personal details and trading account details, and proceed to the next step.

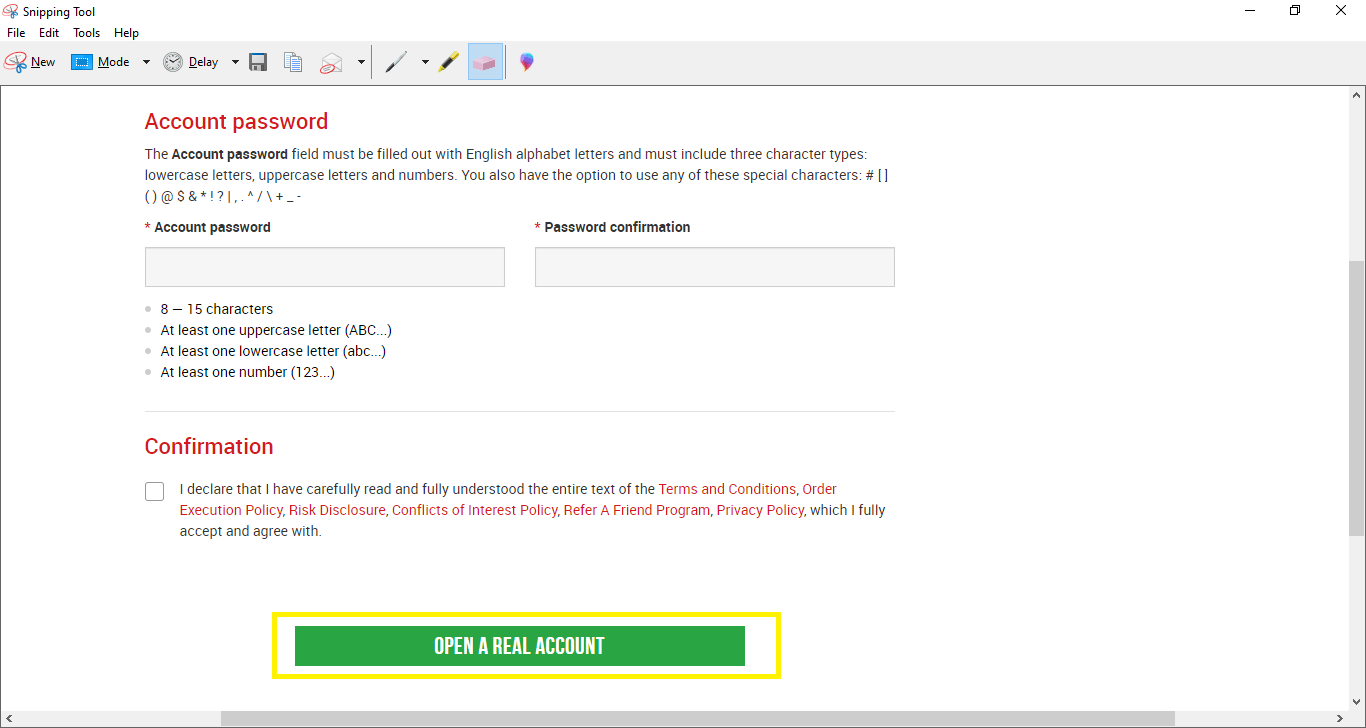

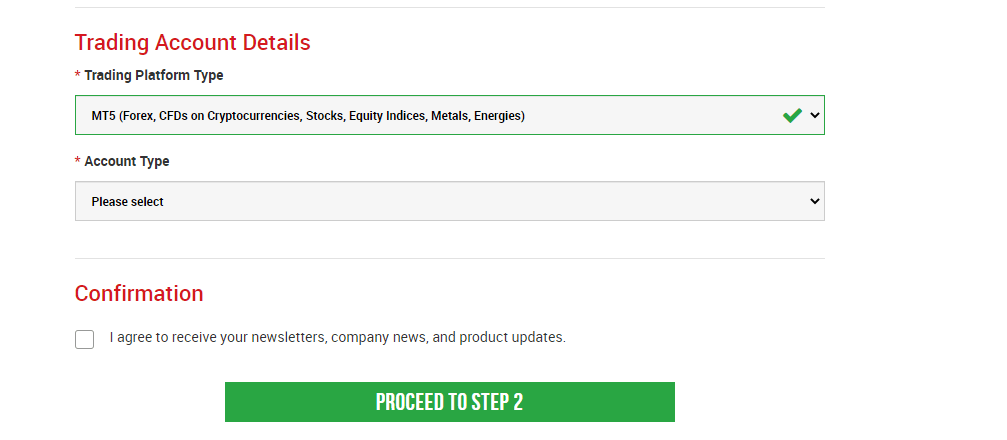

3. Fill in all the details in the next form and click on “Open a Real Account” as shown below. Do not forget to check the terms and conditions box

What is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading?

Yes, you generally need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the vast interbank market where currencies are actually traded. Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market. Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

What are some red flags to watch out for when choosing a forex broker?

Its best to trade with forex brokers that offer some form of safety for your funds. Here are some red flags to avoid when choosing a forex broker:

1) Unregulated Brokers: Do not trade with forex brokers that are not regulated. Only trade with brokers who are regulated by a reputable authority.

2) Hidden Fees: Another sign to avoid a broker is high fees or commissions. Make sure you know and understand all the costs associated with trading before you open an account with any broker.

3) Absence of risk management tools: Because the forex market is risky, you should avoid brokers that do not have risk management tools or features, such as stop loss order.

FAQs on Best Forex Brokers in the Philippines

Is Forex trading legal in the Philippines?

Forex trading is not legal in Philippines. Forex traders in the Philippines do so at their own risk because forex trading is not regulated in the region.

Which forex broker is the best in the Philippines?

No forex broker is the best. It all depends on individuals’ experiences. However, if you want to limit risk, only choose a forex broker with multiple tier-1 regulators.

Who are the top forex traders in the Philippines?

The top forex brokers for forex traders in the Philippines are HF Markets, Octa, IC Markets, and XM Trading. Although it is important for you to do your research to choose a forex broker that has trading conditions matching your trading needs.

Which is the Difference between a Dealing Desk and NDD broker?

A dealing desk broker takes the opposite side of your trade & is also called a market maker broker.

When you buy a currency pair they sell. When you sell, they buy. On the other hand, non-dealing desk (NDD) brokers connect your trades to buyers/sellers in the market via computerized networks.

Some brokers like FxPro follow the hybrid model, so they can act as a dealer sometimes.

Which forex broker charges the lowest fees?

According to our review, IC Markets and HF Markets charge the lowest fees. For example, HF Markets have Zero accounts which has Raw spreads, and there is an extra commission of up to $7/lot.