If you are looking to trade forex online from Malaysia then you need to open an account with a retail forex broker.

The role of brokers in forex trading cannot be overemphasized. A good broker must keep your deposited funds safe, execute your trades in a fair and cost-effective manner and provide a trading platform with the tools you need for analyzing the market.

There are many forex brokers that accept traders from Malaysia. The challenge, however, is that they are foreign brokers. These brokers are not locally regulated in Malaysia. Malaysia does not have any locally regulated forex broker. Most of the retail forex traders in Malaysia trade with foreign brokers that are not licensed by the Securities Commission Malaysia.

Note: Since there are no locally regulated retail forex brokers in Malaysia, it is best to not trade till there are locally regulated brokers.

The Securities Commission Malaysia (SCM) is the financial watchdog in the country. Trading with brokers not licensed with them puts your money at risk. You are responsible for whatever happens to your money and trading with unauthorized brokers at your own risk.

Comparison of Best Forex Brokers in Malaysia

| Broker |

Regulation |

EUR/USD Spread (pips) |

Min. Deposit |

Monthly Inactivity Fees |

Withdrawal Fees |

Visit |

| Octa

|

MISA, FSC, FSCA, CySEC

|

0.9

|

MYR 100

|

MYR 0

|

MYR 0

|

Visit Broker |

| HF Markets

|

FSA SVG, FCA, DFSA, CMA, CySEC & FSCA

|

1.4

|

MYR 50

|

MYR 23 after six months

|

MYR 0

|

Visit Broker |

| XM Trading

|

FSC Belize, CySEC,ASIC & FCA

|

1.6

|

MYR 23

|

MYR 23 after three months

|

MYR 0

|

Visit Broker |

| Tickmill

|

FSA (Seychelles), FCA, FSA (Labuan), CySEC, and FSCA

|

0.1

|

MYR 450

|

MYR 0

|

MYR 0

|

|

| FXTM

|

FCA, CMA, FSC, CySEC, and FSCA

|

2.1

|

MYR 2,374

|

MYR 26 after six months

|

MYR 13.4 for bank transfer

|

|

| Avatrade

|

ASIC, CySEC, CBI, PFSA, FSC, FFA, and FSCA.

|

0.9

|

MYR 450

|

MYR 230 after three months

|

MYR 0

|

|

CFDs are largely unregulated in many jurisdictions & it is extremely risky to trade forex as a CFD instrument. 62-91% of the traders lose money when trading CFDs at different brokers. The information on this page is for research only, please don’t trade forex in Malaysia, there is no legal or licensed forex broker in your region.

Best Forex Brokers in Malaysia

Here are our Best Forex Brokers for traders in Malaysia that have good trading conditions based on our research & editorial review. We tested the brokers that accept traders in this region, and tested them based on our comparison metrics.

- Octa – Overall Best Forex Broker Malaysia with Low spreads

- HF Markets – Forex Broker with Zero Spread Account

- XM Trading – Forex Broker with zero commission accounts

- Tickmill – Raw Spread Forex Broker

- FXTM – Well regulated Forex Broker with Micro Account

- AvaTrade – Forex Broker with Fixed spread Account

Now we are going to cover all these forex broker one by one using their features like trading conditions, regulation, fees support and many more.

#1 Octa – Best Forex Broker Malaysia

EUR/USD Benchmark:

0.9 pips

Trading Platforms:

MT4, MT5, OctaTrader

Octa is not licensed to operate in Malaysia. Octa offers commission-free trading and swap-free trading on all instruments. The broker also has 24/7 live chat support and a dedicated website for Malaysian clients in Melayu.

Regulation:Octa (formerly OctaFX) is not a regulated broker in Malaysia & they are dealing in derivatives without a local license, so you are trading with them at your own risk. They register traders under their foreign entity.

Octa is regulated with 2 tier-2 regulators i.e. CySEC (Cyprus) and FSCA (South Africa).

Fees: The typical spread for EURUSD and gold are 0.9 pips and 12.2 pips respectively with MetaTrader 4, MT5 & OctaTrader account types. There is no extra commission per lot on trades. So, their spread is quite low.

Trading conditions:

Islamic account: Octa offers Islamic trading account automatically to clients in Malaysia. No rollovers or swap fees for keeping a position open past the market closing time.

Number of instruments: Octa offer CFDs trading on 52 currency pairs, 16 indices, 2 metals, 3 energies, and 34 cryptocurrency pairs are the instruments offered by Octa. The number of forex pairs & other CFDs is much lower as compared to other CFD brokers.

Order Execution: Octa’s trading platform has market execution of orders.

Negative Balance Protection: Octa offers negative balance protection. If your balance becomes negative for any reason, they adjust it to zero. This way, you do not lose beyond your trading capital.

Support: Their website has a live chat feature. You can contact them via the live chat. The customer support email is also available. We got a response from them in 30 minutes when we tested it. Octa’s customer support is available 24/7.

You can read more on Octa trading conditions in our Octa review for Malaysian traders.

Octa Pros

- They offer an Islamic account

- Regulated with CySEC

- 24/7 customer support

- Website is available in Melayu

- Local bank transfer options available

- Supports copy trading

- Offers live chat support in Melayu

- No charges for deposit/withdrawal & local deposit & withdrawals are available

Octa Cons

- They are not regulated by any Tier-1 regulation

- You pay trading commissions with Copy Trading

- No local contact number in Malaysia

- Limited CFD instruments are available

#2 HF Markets – Forex Broker with Zero Spread Account

EUR/USD Benchmark:

1.4 pips on average with Premium Account

Trading Platforms:

MT4, MT5, HFM App

HF Markets fees are competitive but not the lowest. Their Swap fees if you don’t open an Islamic account are also low compared to XM. If you need lower spreads then you should open a Zero account.

Regulation: HF Markets is unregulated in Malaysia, so you are trading with them at your own risk if you are based in MY. HFN Group is regulated by 2 top-tier regulators i.e. the FCA (UK) and the CySEC (Cyprus).

Fees: The typical spread for EURUSD is 1.4 pips with the Premium Account & lower with Zero accounts but it includes extra commission per lot. While that of CFD on Gold is 0.28 pips, and this spread applies across all Retail account types for this CFD instrument.

Trading Conditions:

Islamic account: You can open an Islamic trading account with HF Markets. No swaps or rollovers but there is a carry charge applied on certain currency pairs for positions held beyond 7 days.

Number of instruments: HF Markets offers up to 3,500+ trading instruments. 53 currency pairs (forex CFDs), 6 metals CFDs, 4 energies CFDs, 95 stocks CFDs, 23 indices CFDs, 3 bonds CFDs, 5 commodities CFDs, 34 ETFs CFDs, and 40 cryptocurrencies pairs CFDs are all available for you to trade. They have recently started offering more than 1,951 physical stocks for trading as well.

Order execution: HF Markets offers market execution

Negative Balance Protection: HF Markets’ negative balance protection makes sure you don’t lose more than your capital under highly volatile conditions. According to the broker’s website, no client of theirs is responsible for paying back a negative balance, as it would be reset to zero.

Support: HF Markets support is 24/5. You can chat with a customer care agent via live chat on their website. They respond within a minute. You can also reach them via email. They responded within 20 minutes when we sent an email.

You can read more on HF Markets trading conditions in our HF Markets review.

HF Markets Pros

- Islamic account is available

- Has Tier-1 regulation

- Good overall customer support

- Wide market range

- Allows deposits/withdrawals of funds via Malaysian banks

HF Markets Cons

- No local mobile contact

- Customer service is not available 24/7.

- You are charged account inactivity fee after 6 months.

#3 XM Trading – Forex Broker with zero commission accounts

EUR/USD Benchmark:

1.6 with Micro and Standard account

Trading Platforms:

MT4, MT5, XM App

Account Minimum:

MYR 23 or $5

XM Trading is regulated with top-tier regulatory bodies, but they are not licensed to operate in Malaysia.

Regulation: XM is not regulated in Malaysia & they are registering clients under their offshore entity, so Malaysia traders who trade with XM are doing so at their own risk. Their entity is also listed on SC warning list for “Carrying out unlicensed capital market activities”, so please understand the risks.

Their parent company is licensed with the FSC of Belize, CySec (Cyprus), ASIC (Australia), and the FCA (UK).

Fees: The average spread attached to instruments depends on your account type. For EURUSD, XM’s average spread is 1.6 for their Standard and Micro accounts. For Gold, the average spread is 3.5 pips for both accounts.

Trading conditions:

Islamic account: XM Trading offers an Islamic trading account. You can trade on this account without swap, rollover interest, and spread widening.

Number of instruments: 55 currency pairs, 1,261 stocks, 8 commodities, 4 precious metals, 14 equity indices, 100 shares, 31 cryptocurrencies and 5 energies are all available for you to trade with XM trading. All of which are CFDs.

Order execution: You get real-time market execution with XM Trading. 99.35% of their trades are executed in less than 1 second. There is also no rejection of orders.

Negative balance: Trading CFDs is risky. You can lose all your money trading. Negative balance protection ensures you do not lose more than your initial trading capital in your trading account. XM Trading offers negative balance protection on all account types.

Support: There is no local phone number to call. However, there is a detailed FAQ section where you can find answers to your questions. If this is not enough, you can reach the broker via email. According to our test, you should get a response from them in about an hour. The broker also has live chat that is available 24/7 and you can chat in English or Malay.

You can read more on XM trading conditions in our XM Trading review.

XM Trading Pros

- Licensed by Top-Tier financial regulators

- Hedging is allowed

- Offers commission-free trading

- MT4/MT5 trading platform is available

- You can open an Islamic account

- Offer live chat in Malay

XM Trading Cons

- Charges dormant account fees

- You might be charged currency conversion fees

- There is no local mobile number or phone number on their contact page

#4 Tickmill – Raw Spread Forex Broker

EUR/USD Benchmark:

0.1 pips on Average Classic Account

Trading Platforms:

Tickmill Mobile App, MT4, MT5

Tickmill is not licensed to operate in Malaysia & are dealing in derivatives without a license (in Malaysia). They register clients under ‘Tickmill Ltd Seychelles’, which is regulated offshore.

Tickmill group is regulated by the FCA (UK), CySEC (Europe), and FSCA (South Africa).

Regulation: Please note that Tickmill is not regulated by regulator in Malaysia to offer forex trading.

On their Asian website, we discovered they are regulated by the Financial Services Authority of Labuan Malaysia with license number MB/18/0028, but this license does not allow them to accept Malaysia clients/traders. They are further regulated by the FCA, CySEC, FSCA, and FSA of Seychelles.

Fees: Tickmill offers low spread. The typical spread for trading EURUSD is as low as 0.1. It is also very low for gold CFDs. The spread for trading precious metals is as low as 0.09.

With this low fee, there is an extra commission per lot of MYR 16 for forex. But the fee is still low overall when compared to other forex brokers.

Trading Conditions:

Islamic account: Tickmill offers a swap-free Islamic trading account. All you need to do is request one by contacting customer support. According to their website, they process this request in one business day.

If you trade and hold certain instruments beyond three nights, then a swap applies. The charge ranges from MYR 0.01 to MYR 230 depending on the instrument you are trading. WTI (Oil) has the lowest swap with USDTRY being the highest at MYR 230.

Number of instruments: Tickmill offers a good range of instruments. You get to trade 62 currency pairs CFDs, 8 cryptocurrencies CFDs, 23 stock indices CFDs & energies (oil) CFDs, 4 bonds CFDs, and 2 metals CFDs.

Order execution: Tickmill’s order execution speed is 0.20seconds. This is the average as seen on the broker’s website.

Negative balance protection: All Tickmill clients are offered negative balance protection. However, the broker reserves the right not to, if the protection of your negative balance is due to fraud or market abuse.

Support: In our review, we can say the overall support is good. It is available 24/5. We tested their live chat feature but no response because customer support was closed. So you should reach them during business hours. They also responded to our emails within 25mins.

You can read more on Tickmill trading conditions in our Tickmill review.

Tickmill Pros

- Swap-free Islamic account is available

- Tier-1 regulation with FCA

- No deposit/withdrawal charges

- Does not charge dormant account fees

- Low trading fees with tight spreads

Tickmill Cons

- You need a minimum of MYR 450 to open a trading account.

- Negative balance protection is not guaranteed

- The market range is not wide.

- No local contact

#5 FXTM – Well regulated Forex Broker with Micro Account

EUR/USD Benchmark:

2.1 pips with Advantage Plus Account

Trading Platforms:

MT4, MT5, FXTM Trader

Account Minimum:

MYR 2,374 ($500)

Forextime is unlicensed to operate or accept clients in Malaysia. FXTM offers 40+ currency pairs. They also have a large number of stocks from the US, Europe, and Hong Kong.

Regulation: FXTM is not approved to offer forex trading or CFDs to traders in Malaysia, your account is registered under ‘Exinity Limited’ which is an entity based in Mauritius.

FXTM is regulated with the FCA (UK), CySec (Europe), CMA (Kenya), FSC (Mauritius), and the FSCA (South Africa).

Fees: FXTM’s trading fees for EURUSD is an average spread of 2.1 pips on the Advantage Plus Account. That of gold is relatively high at 45 pips.

Trading conditions:

Islamic account: FXTM offers a swap-free option on all their accounts. Although this option is not available in all countries. Our review shows that the swap option is available for Malaysian clients. According to our live chat with them, the broker stated that the swap-free option complies fully with the no-riba tenets of Sharia Law.

Number of instruments: You can trade 58 currency pairs CFDs, 5 metals CFDs, 3 commodities CFDs, 6 FX indices CFDs, 749 US stocks CFDs, 49 European stocks CFDs, 638 US stocks, 11 cryptocurrencies CFDs and 13 spot indices.

Order Execution: FXTM offers both instant and market execution. Market execution is available on their Advantage and Advantage Plus accounts only. We were able to access their performance statistics on order execution. FXTM executes trading orders speedily.

Negative balance protection: FXTM corrects negative balance as a usual practice but it is done with discretion. Requests for negative balance correction are usually evaluated.

Support: There is a live chat feature programmed to answer FAQs only, no live agent is available. For a quick response, reach FXTM via WhatsApp and email. It takes about 25mins to get a response via email.

You can read more on FXTM trading conditions in our FXTM review.

FXTM Pros

- You can access their website in Melayu

- Tier-1 regulation

- Islamic account is available

- Good overall customer support

- Fast processing of deposits and withdrawals

- Offer commission-free trading on 2 accounts

FXTM Cons

- You need MYR 2300 to open other account types

- No local contact

- You pay an inactivity fee on your trading account.

#6 AvaTrade – Forex Broker with Fixed spread Account

EUR/USD Benchmark:

0.9 Fixed Spread

Trading Platforms:

MT4, MT5, Web Trading, AvaTradeGO

Account Minimum:

MYR 450 ($100)

AvaTrade is CFD and Forex broker, but note that their are operating in Malaysia with any license. They are offering trading platforms like AvaTradeGo, MT5 and MT4.

Regulation: Avatrade is not authorized to offer forex trading activities in Malaysia.

The broker is regulated by ASIC (Australia), CySec (Europe), CBI (Ireland), PFSA (Poland), FSC (British Virgin Islands), FFA (Japan), and FSCA (South Africa).

Fees: Typical spread for EURUSD is 0.9 pips. That of gold is lower at 0.29 pips

Trading conditions:

Islamic account: AvaTrade offers swap-free Islamic account for Muslim clients. Islamic trading account requests are processed within 1-2 business days.

Number of instruments: AvaTrade grants you exposure to a wide range of instruments. They have 55 currency pairs, 18 commodities, 44 FX options, 612 stocks, and 31 indices. All instruments are CFDs.

Order execution: In a document about their order policy, it is stated that AvaTrade strives to offer high speed within the limitations of technology and communication links

Negative balance protection: You cannot lose more than the money in your trading account as AvaTrade offers negative balance protection.

Support: There is a local phone number to call. We tested the number and found it functional. You can also contact AvaTrade by sending an email. We got a response within 30 minutes. The broker also has a live chat option that is available 24/5.

You can read more on AvaTrade trading conditions in our AvaTrade review.

AvaTrade Pros

- Islamic account is available

- There is a local mobile contact

- Authorised by Top-Tier Regulators

- Offers commission-free trading

- Supports multiple trading platforms and EAs

- Does not charge any fees for deposits or Withdrawals

Avatrade Cons

- Minimum deposit is MYR 450

- The inactivity fee is high

- Slow processing of deposits and withdrawals

SCM’s CFD Licensing in Malaysia

The SCM (Securities Commission Malaysia) oversees financial regulation in Malaysia. They require brokers to register under their CFD regulations and report their transactions. The issue is that many foreign brokers do not find these regulations good for business & their profits. This is because any broker licensed under the SCM can only offer CFDs on indices, commodities, and equities. They cannot offer CFDs on forex. This is why these foreign brokers operate in Malaysia unauthorized locally.

There are only two locally licensed brokers in Malaysia – Phillip Futures and CGS-CIMB. They both do not offer forex CFDs.

This shows why traders in Malaysia trade with foreign forex brokers though it is risky. The brokers available locally do not provide the same range of instruments offered by foreign brokers.

In addition, foreign forex brokers run strong online advertising campaigns online that attract traders. They do not need to be in Malaysia to make traders aware of them.

Beyond prohibiting forex CFDs, here is more information for you about SCM’s CFD regulations. So, by trading with these unregulated brokers, you are doing so at your own risk.

1) Types of CFDs allowed

According to SCM’s guidelines for CFDs, chapter three of the documents states that a broker can only offer shares and indices CFDs. Forex CFDs are not allowed in Malaysia yet.

2) Financial requirements

Here are the financial requirements for a capital market service license (CMSL) holder restricted to offer CFDs only. These parameters are they are on SC’s document on guidelines on CFDs:

- Minimum paid-up capital and shareholders’ funds of RM10 million at all times.

- Minimum 50% of total shareholders’ funds in the form of liquid capital at all times.

For a CMSL holder who is licensed for both activities of dealing in derivatives and clearing, who wishes to offer CFDs? The financial requirements are as follows:

- Minimum paid-up capital and shareholders’ funds unimpaired by losses of RM10 million at all times.

- Minimum adjusted net capital: The higher of – RM500,000; or – 10% of aggregate margins at all times.

For a CMSL holder who is licensed for dealing in derivatives and wishes to offer CFDs? The financial requirements are as follows:

- Minimum paid-up capital and shareholders’ funds of RM10 million at all times.

- Minimum adjusted net capital: The higher of – RM500,000; or – 10% of aggregate margins.

3) Leverage restrictions: A maximum of 10:1 leverage is permitted for index shares CFD and 5:1 for non-index shares CFD. 20:1 is the maximum leverage index CFD.

4) Reporting requirements: CFD providers are required to submit a monthly report. They are required to submit this report on the 15th of every month or any day specified by the SC. These are the SC’s reporting requirements:

Where the CFD provider is a CMSL holder for dealing in derivatives

- A statement of financial condition;

- A statement of income or loss; and

- A statement of adjusted net capital.

Where the CFD provider is a CMSL holder for dealing in derivatives restricted to CFD –

- A statement of financial condition;

- A statement of income or loss; and 10

- Computation of liquid capital

The above requirements are a key part of the SC’s regulations for CFD providers.

Derivatives and Trading volume reported by the SC

According to the SC, the volume of derivatives traded in the year 2018, 2019, and 2020 are RM13.52 million, RM13.11 million, and RM18.03 million respectively.

Which are the regulated CFD brokers in Malaysia?

As stated earlier, there are only two locally regulated brokers in Malaysia. They are:

- CGS-CIMB Futures Sdn.Bhd: They are a licensed holder clearing and dealing in derivatives. Their license number is eCMSL/A0066/2007. They have been licensed since 28, September 2007. Their licensed status is valid and they have 98 representatives.

- Phillip Futures Sdn.Bhd: Phillip Futures are a licensed broker. Their regulated activities include clearing and dealing in derivatives. Their license number is eCMSL/A0233/2008. They have been licensed since 8, September 2008, and have 42 representatives.

How to choose the best Forex Broker in Malaysia

Please note that our research indicates that all forex brokers operating in Malaysia are foreign regulated entities, and they don’t have any license to offer CFDs or other derivative products to traders who are based in Malaysia.

Almost all the brokers, including ones in this list (which we created for research & education only after checking the brokers which are popular in the region), don’t have any legal authority to accept Malaysian traders.

Therefore, you must not trade with any forex broker. This guide is for general research only, and we have explained our methodology in detail below.

1) Tier-1 regulation

The brokers on this list are not regulated locally. Foreign bodies like the FCA (UK), CySec (Europe), ASIC (Australia), and the FSCA (South Africa) regulate them. While it is risky to trade with these foreign brokers, you are safer trading with a broker with tier-1 regulation, rather than trading with a broker that is only regulated with offshore regulations such as the Seychelles or the British Virgin Islands.

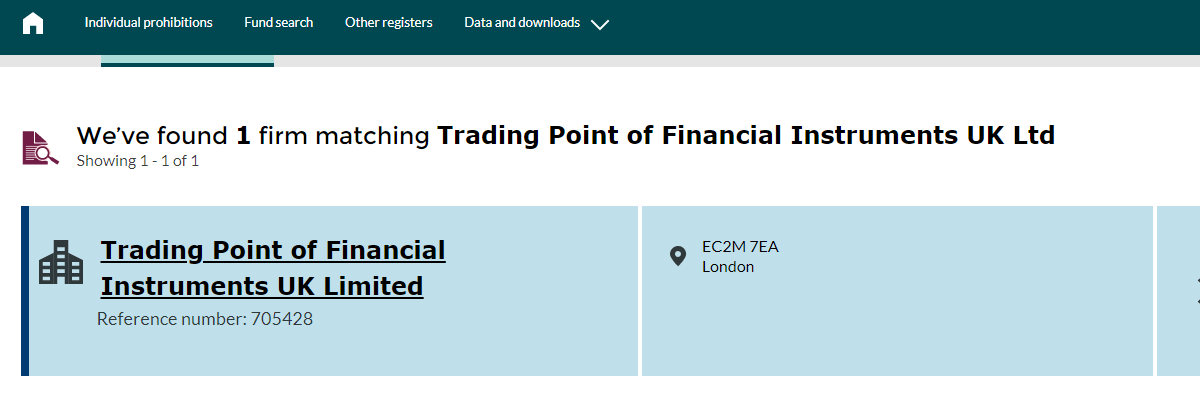

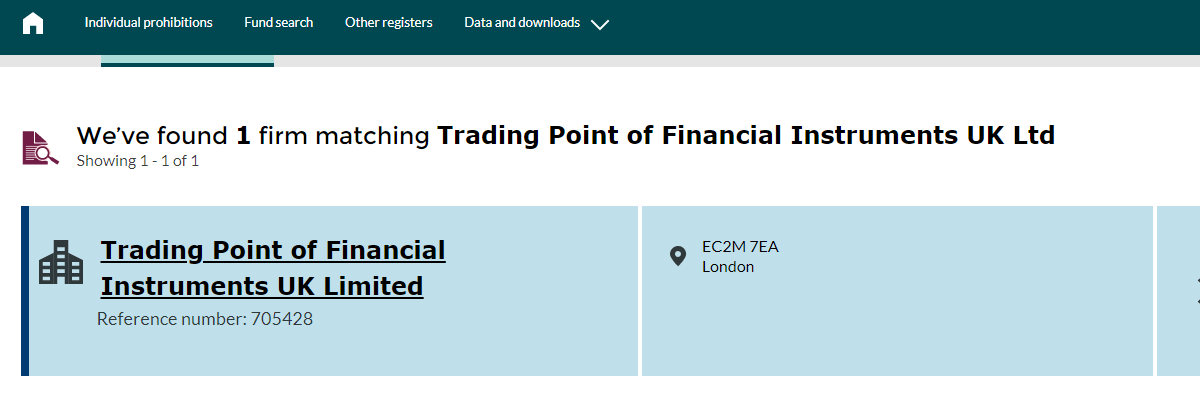

For example, the FCA page of XM broker has been pictured below. We can see that XM broker is licensed by the FCA under the name Trading Point of Financial Instruments UK.

Any foreign broker you will choose must be regulated by either the FCA or ASIC. They are tier-1 regulatory bodies so they can be trusted.

Also, you must note that because a broker is regulated with Tier-1 regulation does not mean that your account will be registered under FCA or ASIC for example. Your broker may register your account under Offshore regulations, and this is a common practice including with brokers like Octa, HF Markets, FXTM etc.

This comes with high risk because you will not get any investor protection in case the broker goes out of business.

For example, for brokers licensed with FCA, UK citizens can get investor protection for their funds with the broker if the broker goes bankrupt (this does not apply to traders who are based in Malaysia). But if your broker is registering your account under some foreign offshore entity, it does not have to offer any investor protection of funds, it is mostly grey area.

If the forex broker is licensed under multiple regulators, it can be considered lower risk. But if you are dealing with a broker that is unlicensed or one has offshore licenses, you should generally consider that broker as much higher risk to hold your funds with.

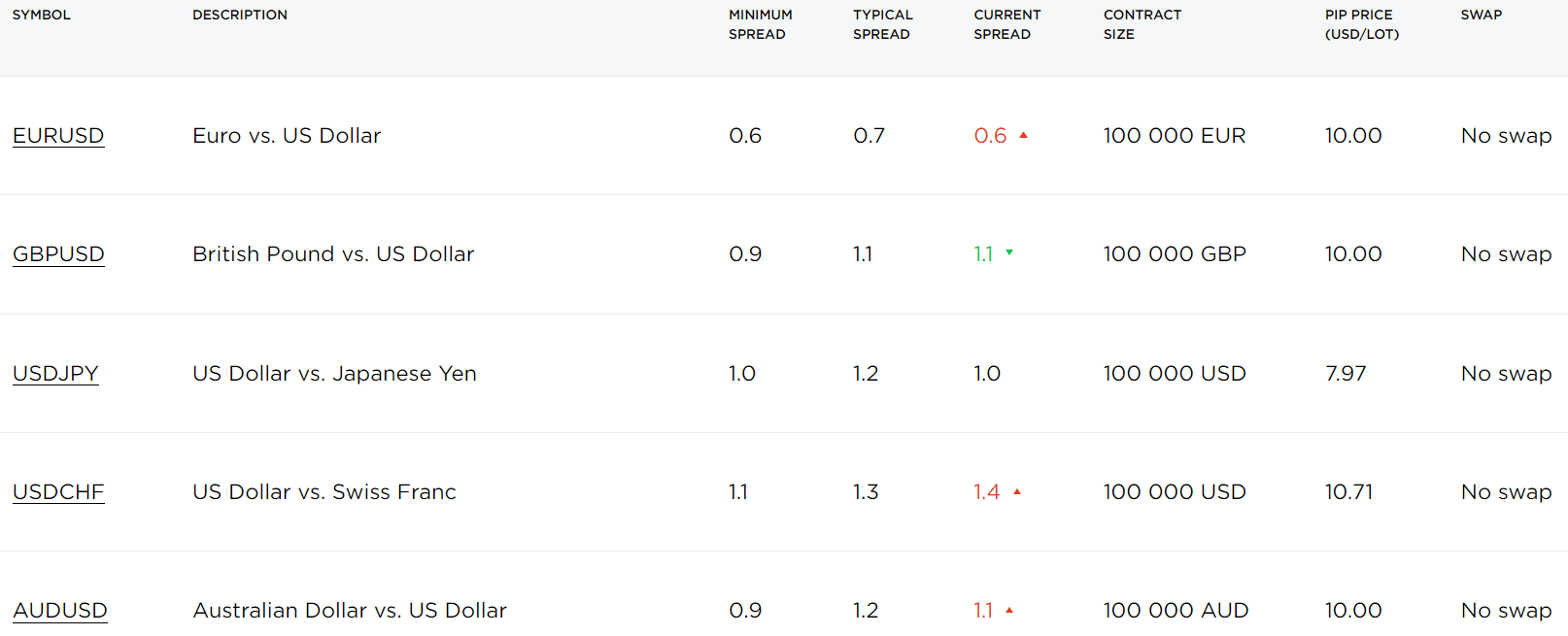

2) Overall Fees

Fees can be divided into trading and non-trading fees. Trading fees include spreads and commissions while non-trading fees could be deposit/withdrawal charges, inactivity fees, or currency conversion fees.

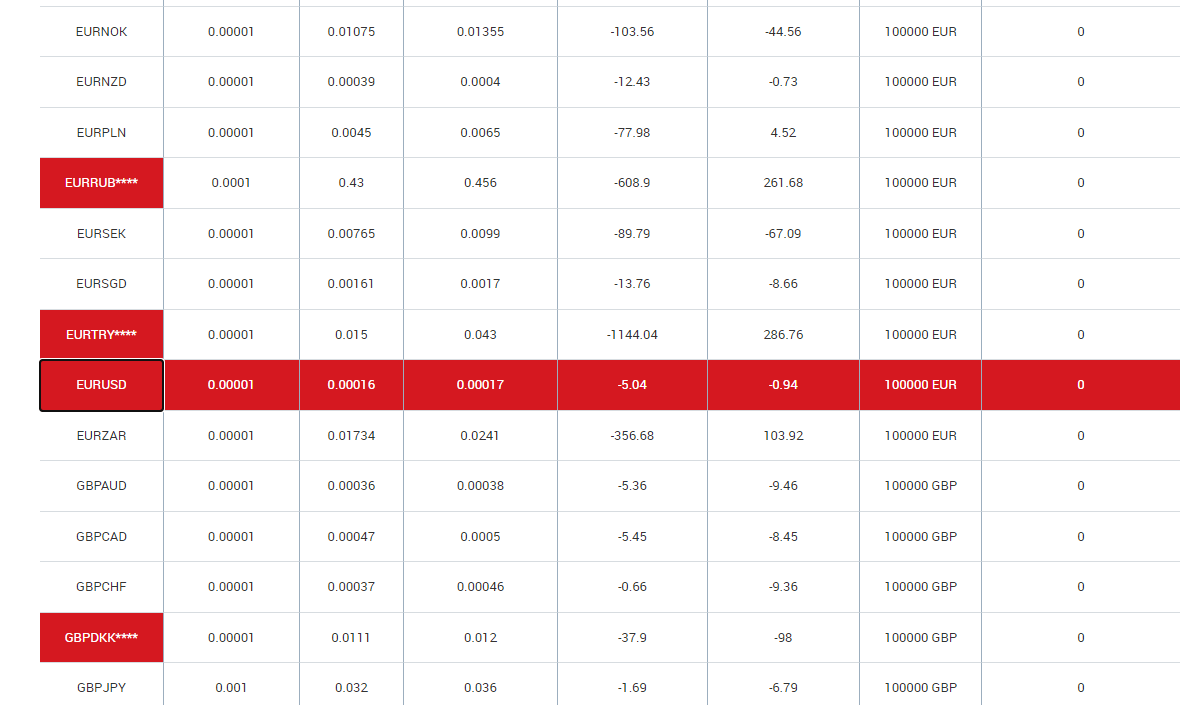

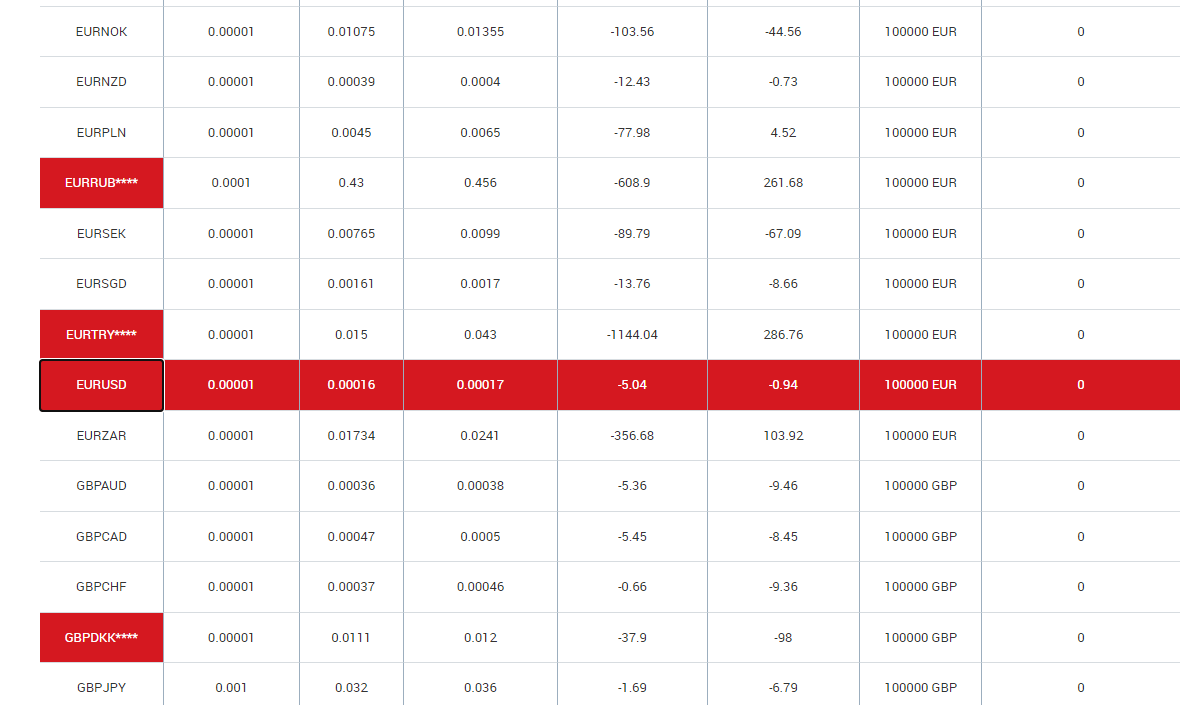

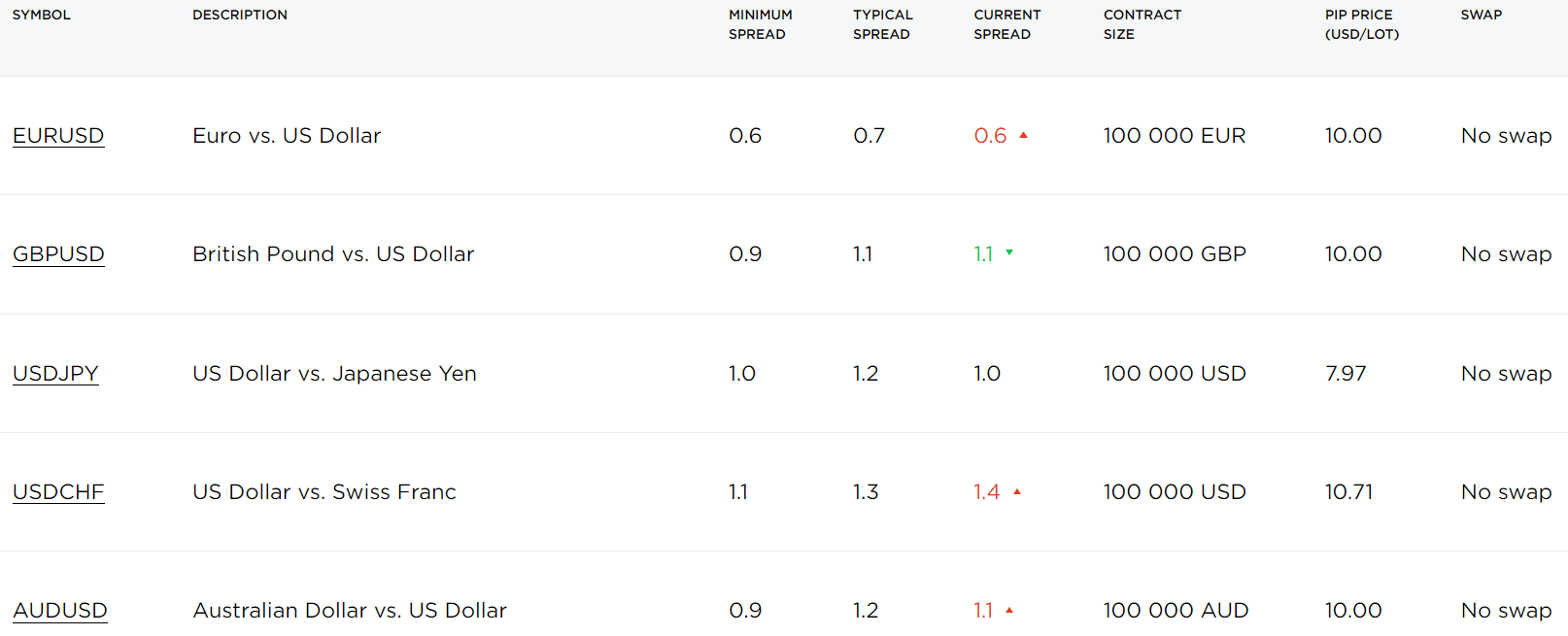

The combination of these two fees affects your final profit or loss. You must go through your broker’s website to know the spreads and commission charged on trading instruments. For example, a spread page looks like the picture below:

Before choosing a broker, you should always their spreads against other brokers. Here is a breakdown of the spreads charged by the brokers on this list:

Comparison of Typical Spreads of Best Forex Brokers in Malaysia

| Broker |

Stock CFDs (in pips) |

CFDs on Gold (in pips) |

Forex (EUR/USD)( in pips) |

Equities (in pips) |

| XM Trading |

0.5 |

3.5 |

1.6 |

0 for a selection of 100 shares |

| HF Markets |

0.3 |

0.28 |

1.4 |

0 for a selection of 901 shares |

| Octa |

NA |

12.5 |

0.9 |

NA |

| Tickmill |

0.45 |

0.09 |

0.1 |

NA |

| FXTM |

3 (Minimum) |

45 |

2.1 |

NA |

| Avatrade |

0.13 |

0.29 |

0.9 |

NA |

You can check the typical spread charged by a broker by going to their website. They will usually have a page which shows the typical spread charged by them for each instrument.

For example, here is a screenshot from XM’s website which shows their minimum spread as well as typical spread.

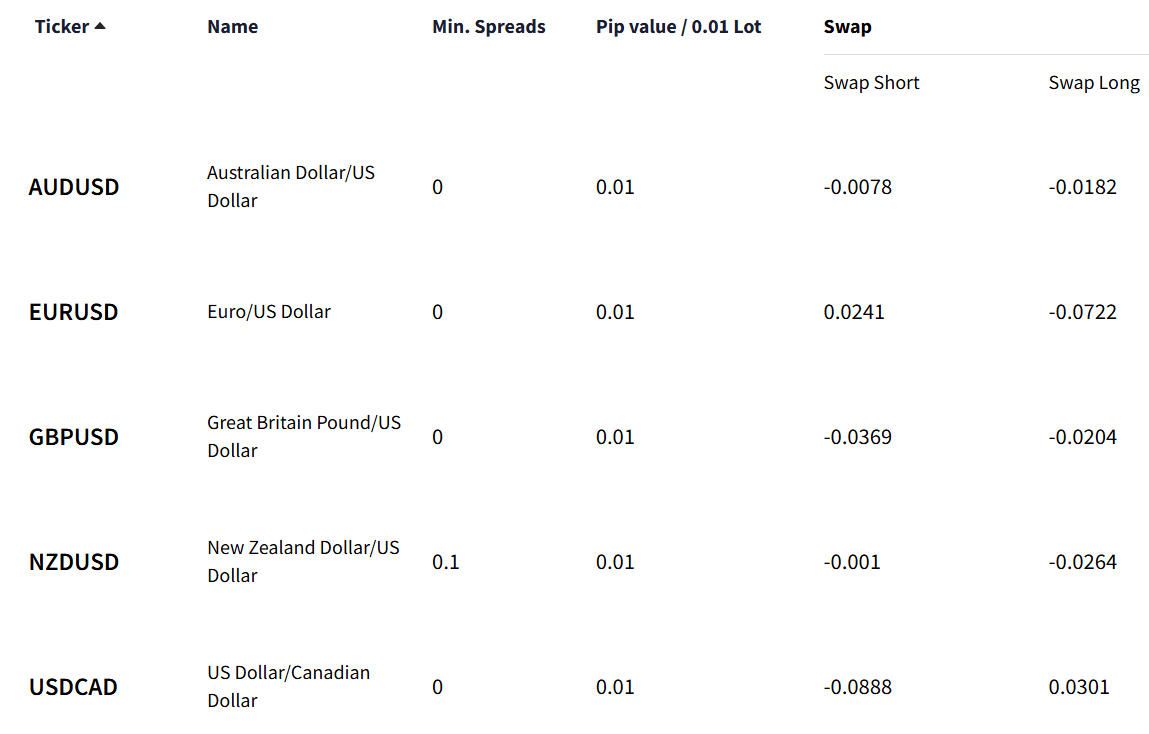

Swaps are not charged on Islamic accounts except for exotic currency pairs after a period of time. Timeframes and charges depend on your broker.

It is important to know the swap charges if you are a swing trader, because you will be actively holding overnight positions. Many brokers charge swap fees that is variable.

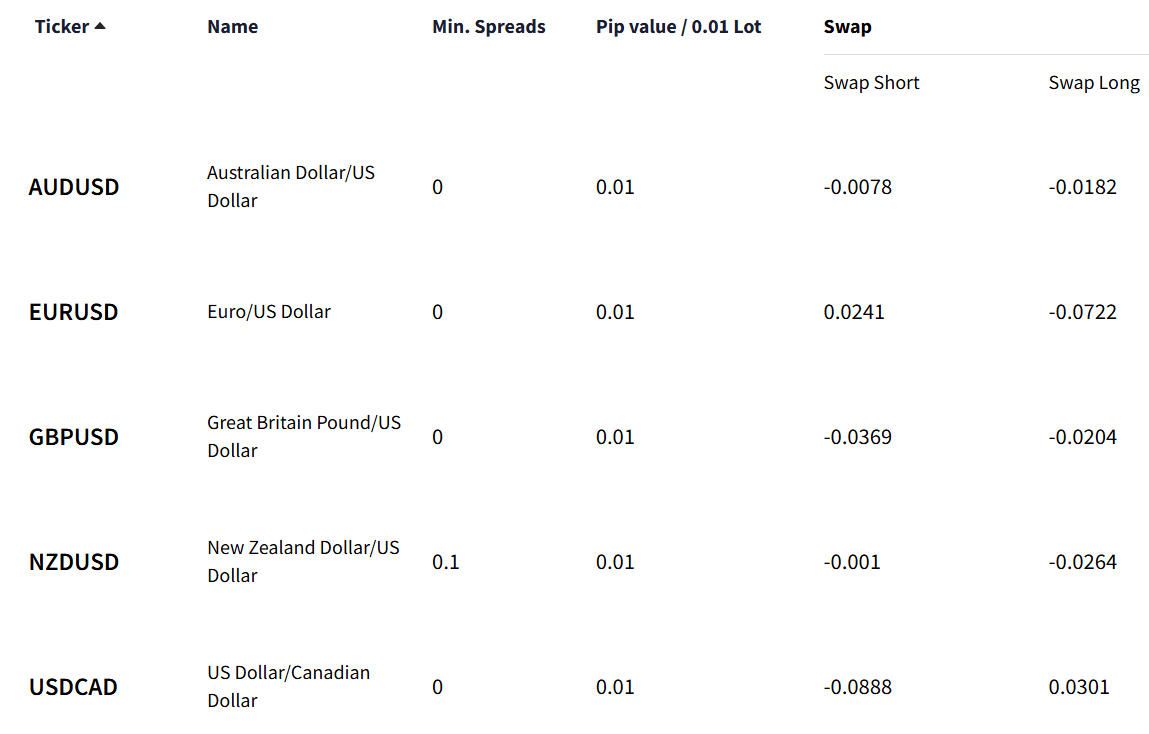

Refer to the below example from a broker’s instrument specifications.

Depending on which instrument you are trading & your account currency, the broker would charge you a markup on the current overnight lending rates, on your position size. The swap charges are different for long & short positions.

Let’s take an example of 1 Standard lot position on GBP/USD.

Now, take the above fees (in the screenshot) into account i.e. -0.0369 for long & -0.0204 for short, this means your broker will charge you 0.37 USD per night for holding long position, and 0.2 USD per night for holding a short position.

If you are trading a higher lot size, and holding the position for few weeks, you can notice how this fees will go against you. For example, if you are using 1:1000 leverage (which you should not), then with only 100 USD you are trading a Standard lot. On top of that, you will be paying your broker 0.37 USD per night or 0.037% of your equity.

If you actively take trades that you hold for few weeks & months, then choose a broker that offers you swap free trading accounts.

Most brokers do not charge for deposits/withdrawals but middlemen such as banks or alternative payment platforms may charge. Make sure to check with your payment platform to know how much they charge.

Finally, inactivity fees are charged when there is no trading activity on your account over a period of time.

Timeframes and charges differ from broker to broker so it is important to contact your broker’s customer support about their fees for each instrument that you want to trade.

Ask them about their spread with each account type, commissions, Swap, Inactivity charges, deposit & withdrawal fees with your method of choice.

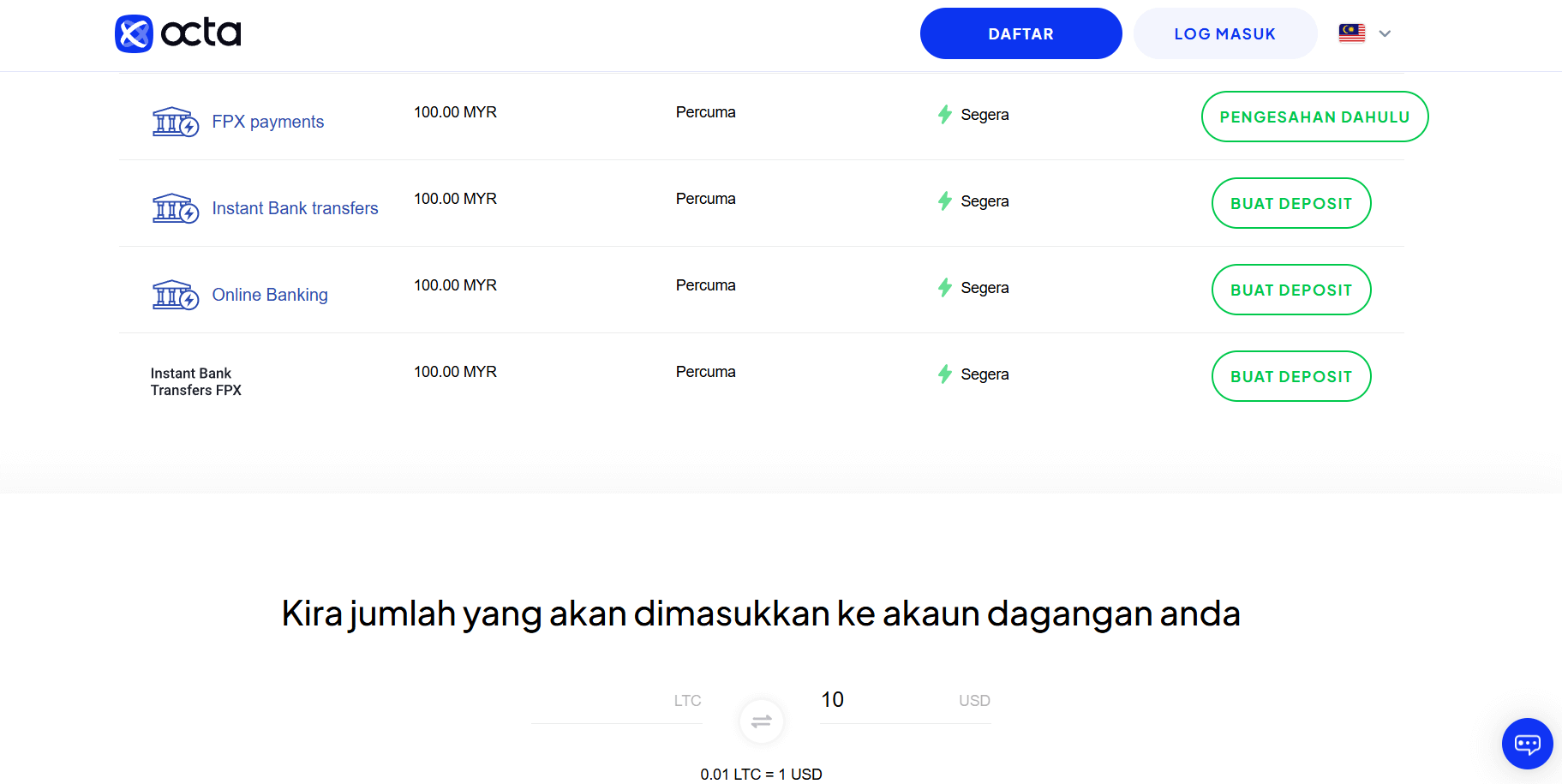

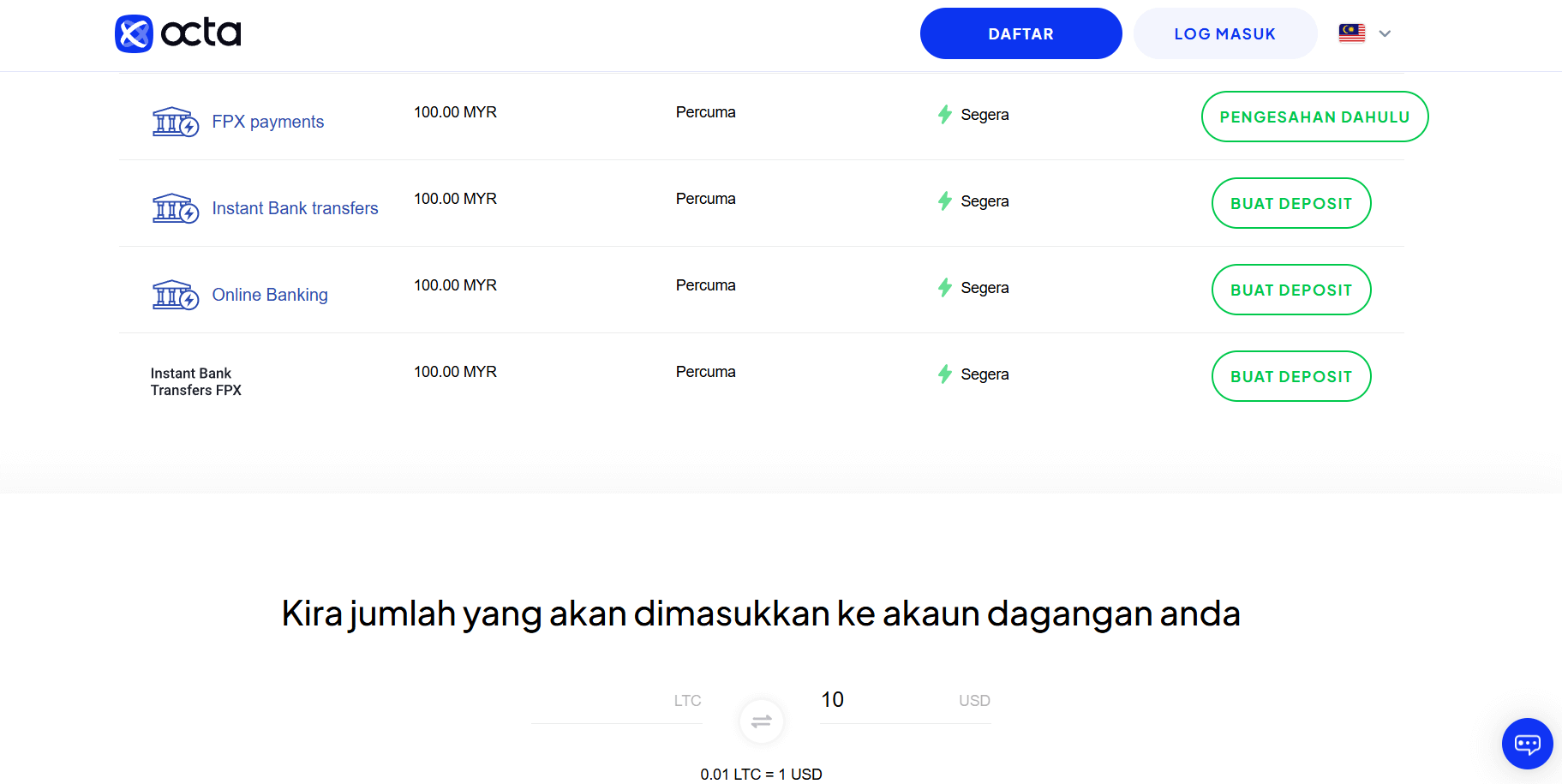

3) Deposits and Withdrawals

You need to pay more attention here. HF Markets, Octa, FXTM, and other brokers on this list may be popular. However, they are not regulated by the Securities Commission Malaysia (SCM). Due to this, they are not authorized to operate and are on SCM’s list of blacklisted investors. This is why deposits/withdrawals via your local bank might be risky & you may not be able to transfer via bank deposits.

For bank payments, foreign brokers in Malaysia like Octa generally accept payments via Online payment gateways where you can pay instantly.

These brokers in Malaysia offer alternative payment methods which many traders use other than bank transfer. It could be e-wallets like Skrill, Neteller, and PayPal. You could also use online payment channels like iPay88 and eGHL.

Contact your broker to know more about their payment methods if your preferred methods are unavailable.

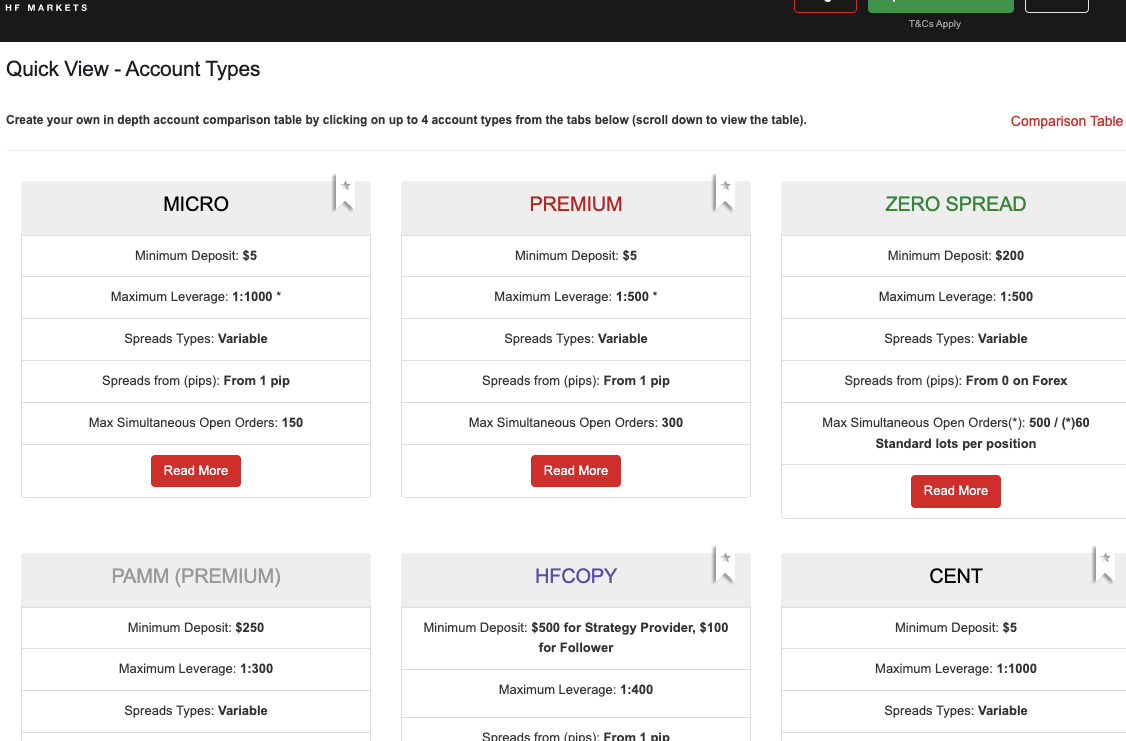

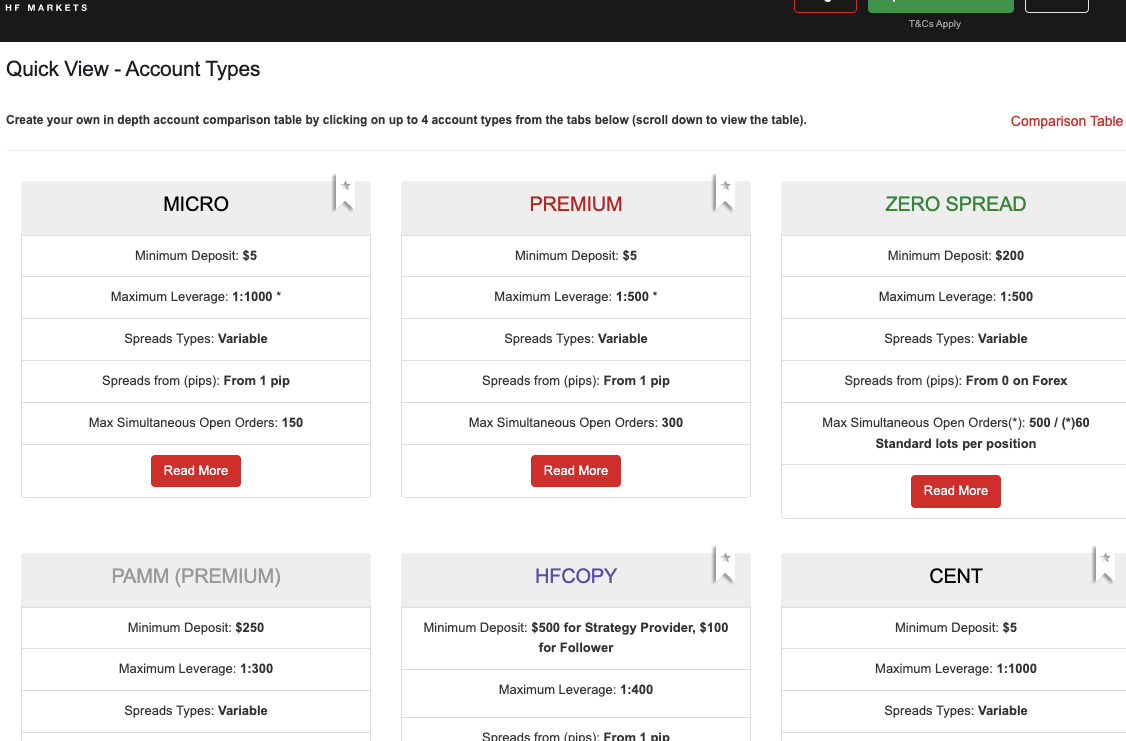

4) Account types

Brokers usually give a breakdown of account types on their websites. You will also find in this breakdown key features of the accounts. You want to look for an account with low spreads and low commissions. This is a major factor to consider when choosing your trading account.

Having multiple account types can offer you the flexibility to trade, and generally brokers have different fees structures for different account types.

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large volume traders.

The Standard accounts are basic account types with standard fees structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, but some commission involved for each trade (depending on your lot size).

For example, below is the screenshot from HF Markets’ website where they highlight the different features of several account types.

The overall difference may not be obvious when you look at the listed account types. But when you go into details of individual account, you will notice the difference in the spreads & commissions.

For example, the typical spreads with standard account at most brokers is around 1+ pips on average for EUR/USD & GBP/USD (most actively traded currency pairs). But the spreads with Pro account is around 0.6 pips at most brokers. That is 40% lower trading cost (at the minimum) compared to Standard account.

Moreover, the difference in deposit requirements between standard & pro account is also not that high. At some brokers the deposit required for both account types is the same. Therefore, you should check carefully the account type that you are choosing to open with a broker.

5) Range of Trading Instruments

You should make sure that your broker offers the trading instruments that you want to trade. The larger the range of trading instruments, the better it is. A lot of forex brokers have started to offer cryptocurrencies as well, and you should try to trade with a forex broker that does offer it since they are attractive trading instruments.

For example, Octa offers 32 currency pairs, 10 indices, 5 commodities, and 30 cryptocurrencies. The range of cryptocurrencies offered by Octa is very large, so you should consider it if you want to trade cryptocurrencies.

In contrast, HF Markets offers 53 currency pairs, 6 metals, 4 energies, 54 CFD stocks, 23 indices, 3 bonds, 5 commodities, 34 ETFs, 19 cryptocurrencies, and 945 DMA stocks. Hence, in comparison to Octa, HF Markets has a much wider range of trading instruments.

If you’re looking to trade a particular trading instrument such as GBP/USD, then you should also compare the fees associated with different forex brokers. For example, the spread that you’ll be charged for trading GBP/USD through Octa is 1.1 pips, and through HF Markets is 1.9 pips, and through Pepperstone is 0.6 pips.

Hence, if you’re looking to trade only GBP/USD, then you should trade with Pepperstone since they offer the lowest fees (spread).

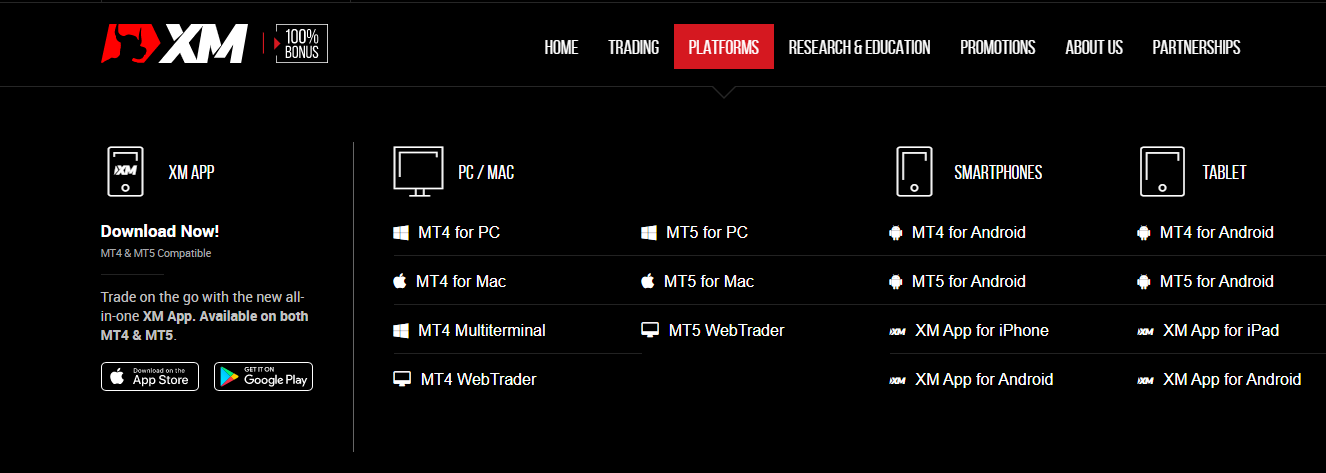

6) Suitability of Trading Platforms

The user interface of the broker’s platform is also important when deciding on the broker to use. Some brokers’ platforms either web or app, have poor user interfaces, some come with ads, and so on. These can slow down the execution of trades.

Online trading is a fast-paced business where every second is important. Entering or leaving a trade one second late can be very costly. It is also important the platform is compatible with different devices such as Android, Mac, etc.

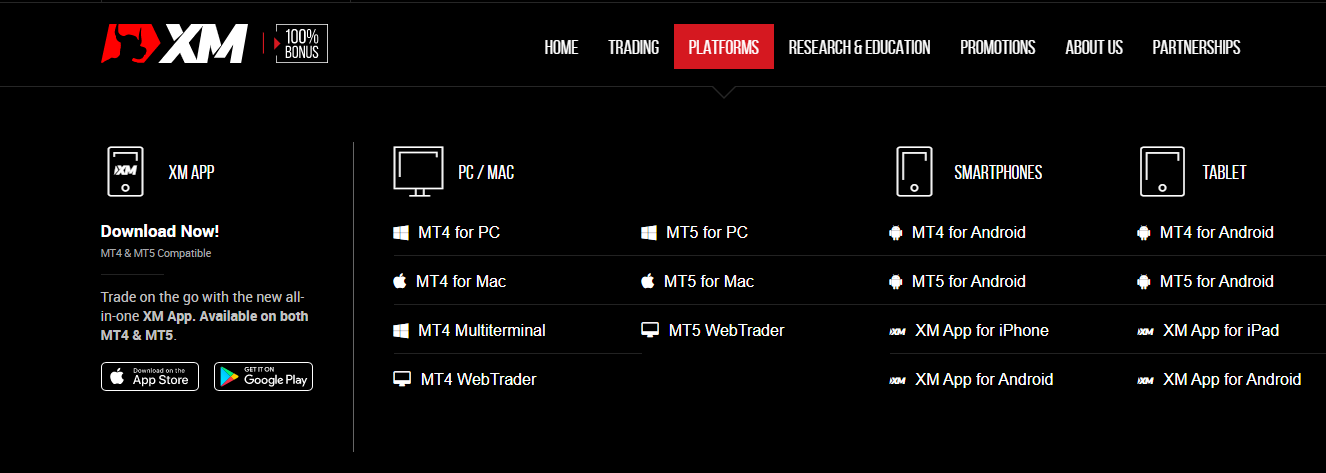

Here is how to check the platforms available with your forex broker. We will use XM as our example. First, you go to their homepage and click ‘PLATFORMS’ (highlighted red)

At a glance, you can see the different platforms with XM and the devices they support. You can see MT4 and MT5 which are available on PC (Mac and windows). The platforms are also available on smartphones, and tablets and work well on Android and iOS systems.

In addition, the XM trading app is also available on both systems. While MT4 and MT5 are third-party platforms, the XM trading app is owned by the broker. This is how most brokers operate, supporting their own app and third-party platforms.

7) Customer Support

Customer support is an essential part of a brokerage. The better the customer support is, the better your trading experience will be. You should always check if the broker offers customer support in your language (Melayu or English or your preferred language). Before signing up with a broker, you should contact customer support and ask them to clarify any issues or doubts that you may have. This will give you an idea of the kind of customer support that the broker offers.

For example, Octa offers customer support through live chat and email. They do not offer customer support through phone calls. Their customer support is available in Melayu as well as in English.

We contacted Octa’s customer support team at the time of writing this review and received a response within 5 minutes. A response time which is under 5 minutes is usually considered to be good enough.

You may have to wait longer if you contact them through email.

This is how you check whether the customer support offered by a broker is good enough for your needs.

8) Leverage

As a trader, you have the option of using leverage on each of your trades. Leverage allows you to increase the size of your position without betting more money. Usually, CFD brokers operating in Malaysia offer very leverage. You can use the leverage of up to a maximum of 1:3000 depending on the broker.

However, using leverage can greatly increase the risk associated with your trade. Leverage can multiply the loss that you face if your trade moves in an unfavourable direction. Hence, you should only use maximum leverage of 1:10 (for forex instruments) and even lower for other types of asset classes, despite the broker offering much higher leverage. This is to help you reduce the risk of your trade.

You can check the maximum leverage offered by a broker on their website. For example, below is a screenshot from XM’s website where they state that they leverage up to 1:1,000.

9) Other trading conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

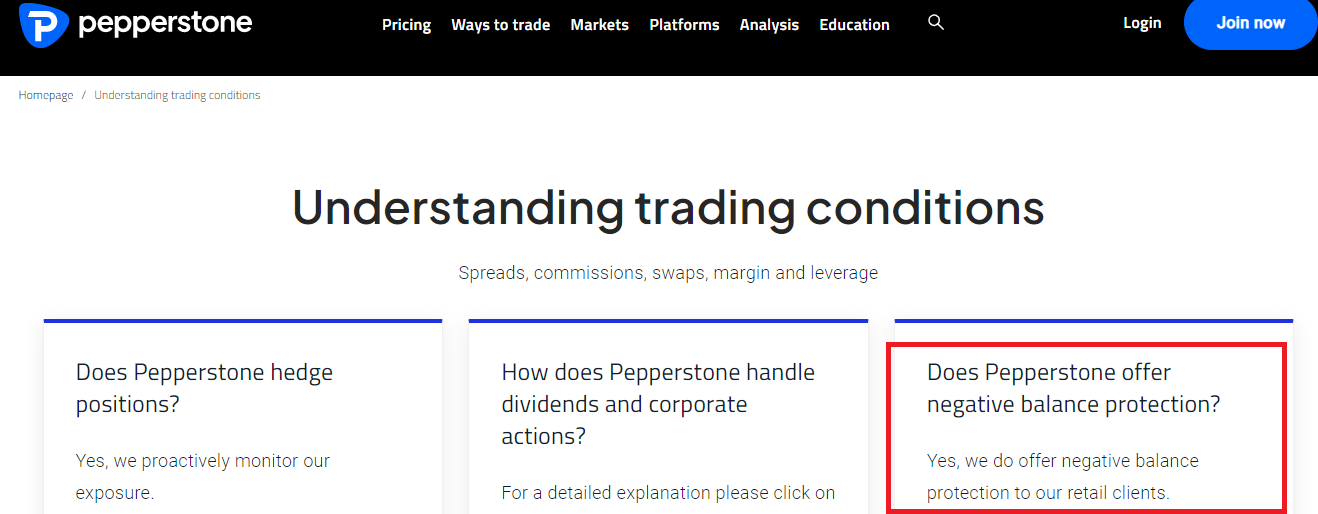

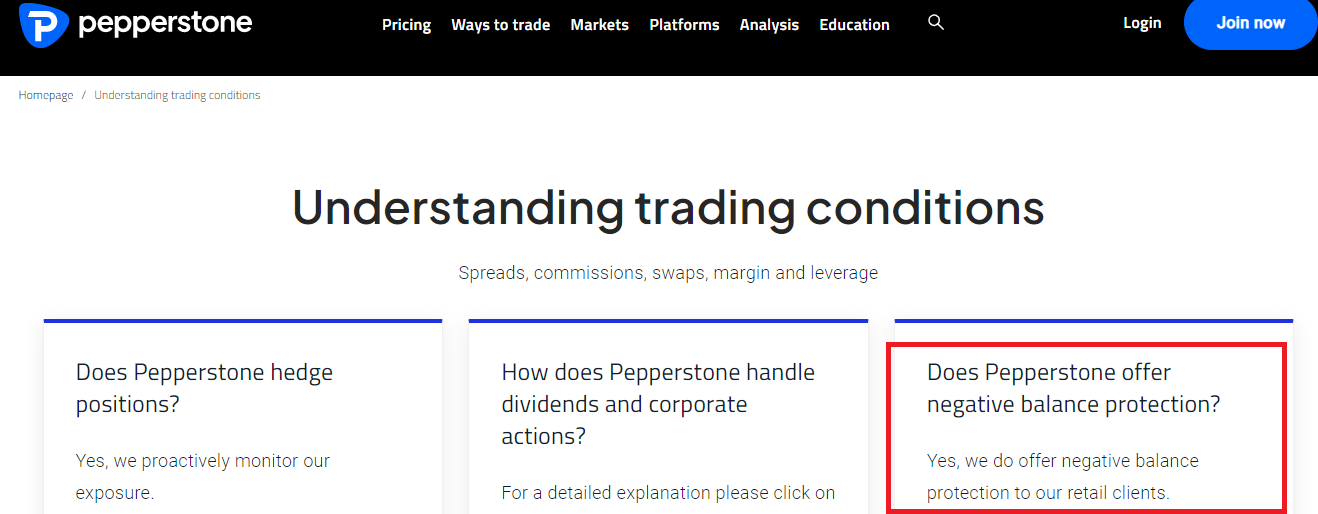

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. There is no local regulatory body that mandates forex brokers to offer negative balance protection in Malaysia. However, some brokers still offer it, even for traders they register under offshore jurisdictions.

You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify it. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on Pepperstone’s website. Please note that we are just using it as a reference, you can search ‘Broker Name’ FAQs on Google search to find the FAQs page of any broker you are choosing. Note: Replace broker name with the actual broker’s name.

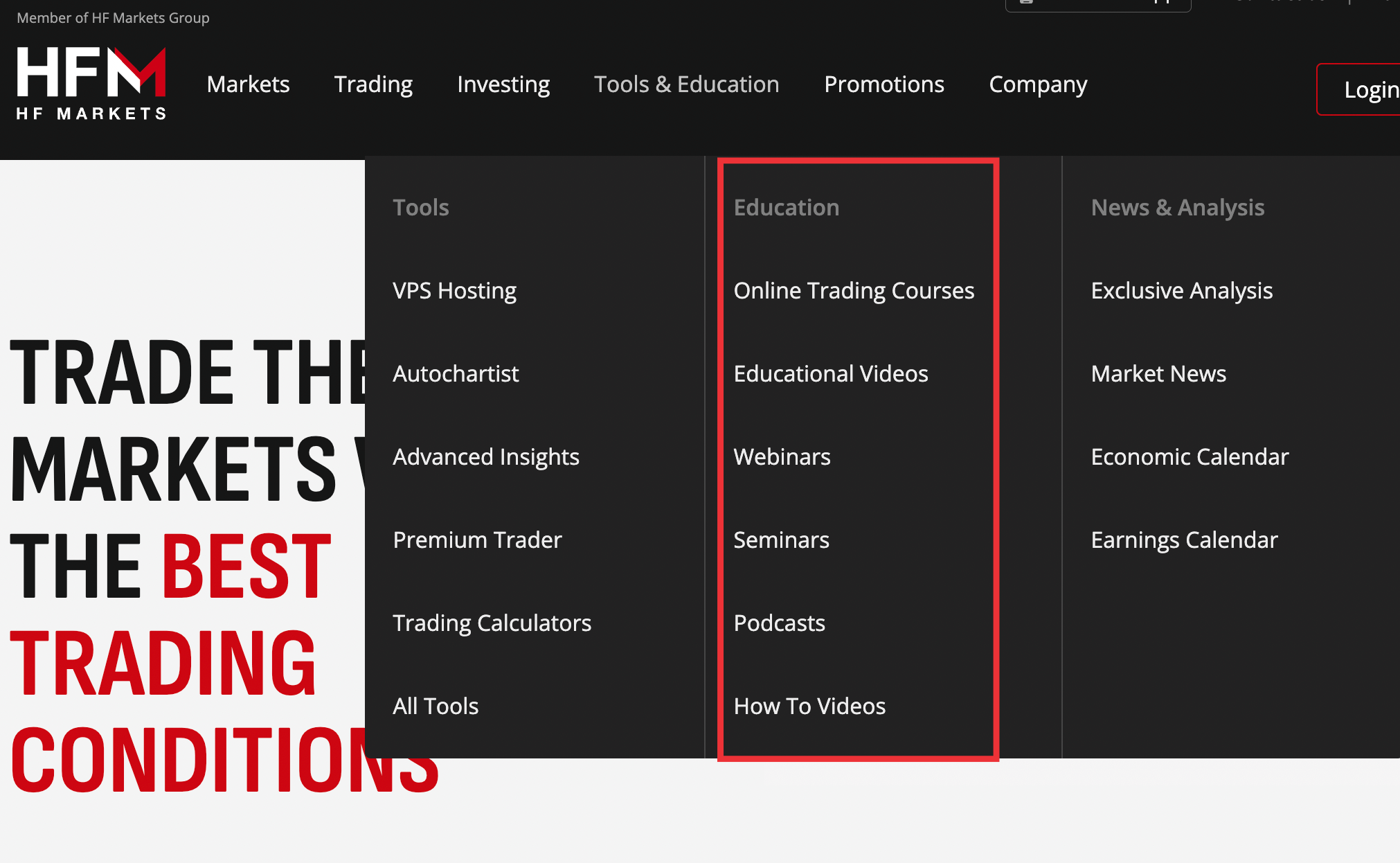

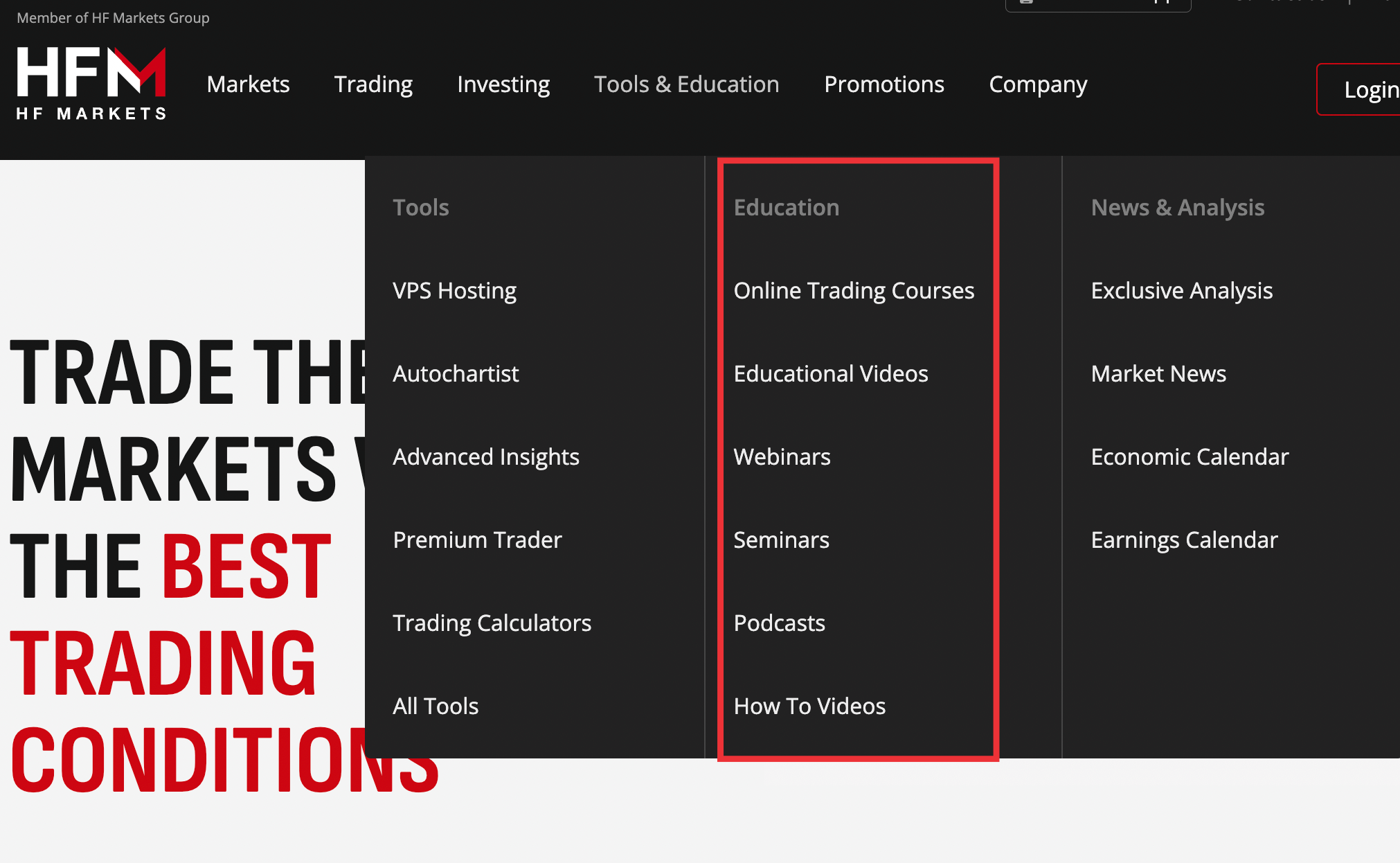

c. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

Finding a broker’s education is easy. It is usually on their homepage. With a few clicks, you can access quality courses for your learning. Let us show you how you can do this (HF Markets is our example). On HF Market’s homepage, click on ‘Education’ (underlined red). Here is an illustration below.

From the image, you can see that HF Markets has webinars, tutorials, podcasts, forex e-course, educational videos, etc. You can use any of these resources to expand your knowledge about forex and CFD trading.

How to open Account with a Forex Broker?

To start trading, you need to open a live trading account with a forex broker.

Follow the steps below to open an account with a forex broker in Malaysia, where we will use HF Markets (HotForex) as an example. Generally, the steps involved are the same with each broker, so you can follow these generic steps as references.

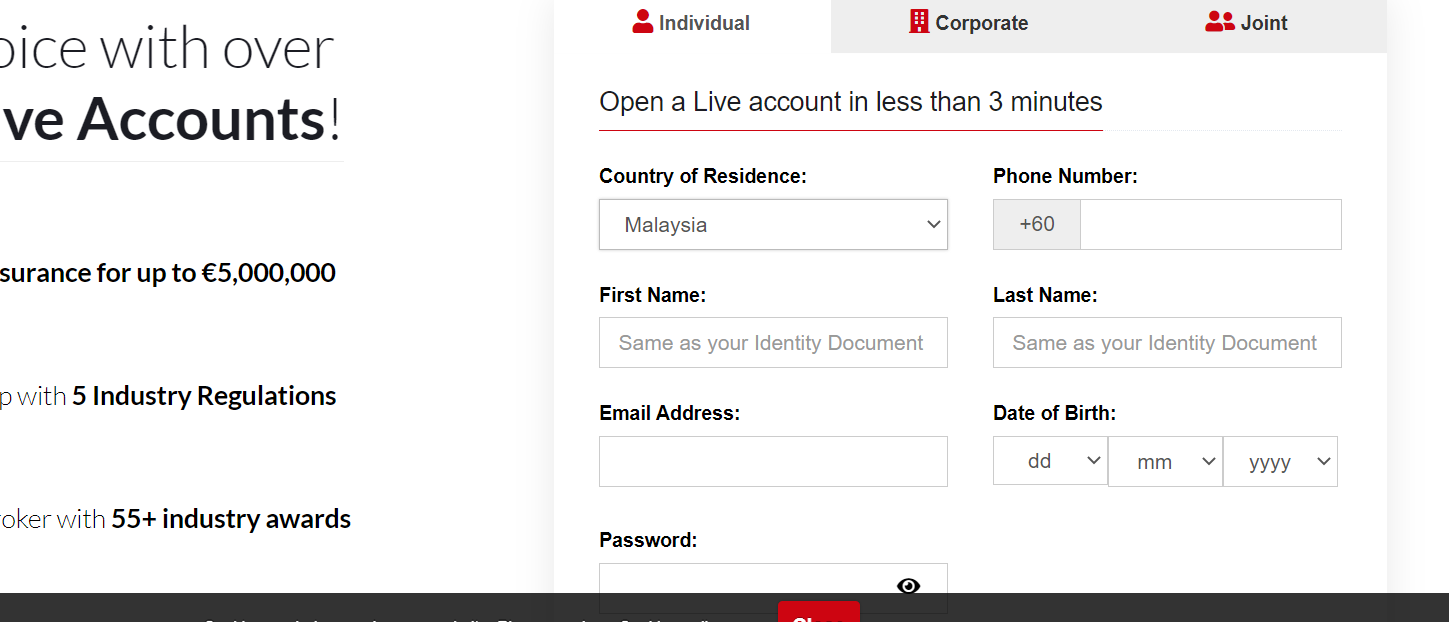

Step 1) Go to the HF Markets website for Malaysian traders at www.hfm.com and click on the ‘Open Live Account’ button, highlighted in green colour, at the top right side of the page.

Step 2) Select the client type, either as an individual, corporate or joint, then fill in your information, create a password, select Malaysia as country of residence, check the terms and conditions box after reading, and click on register.

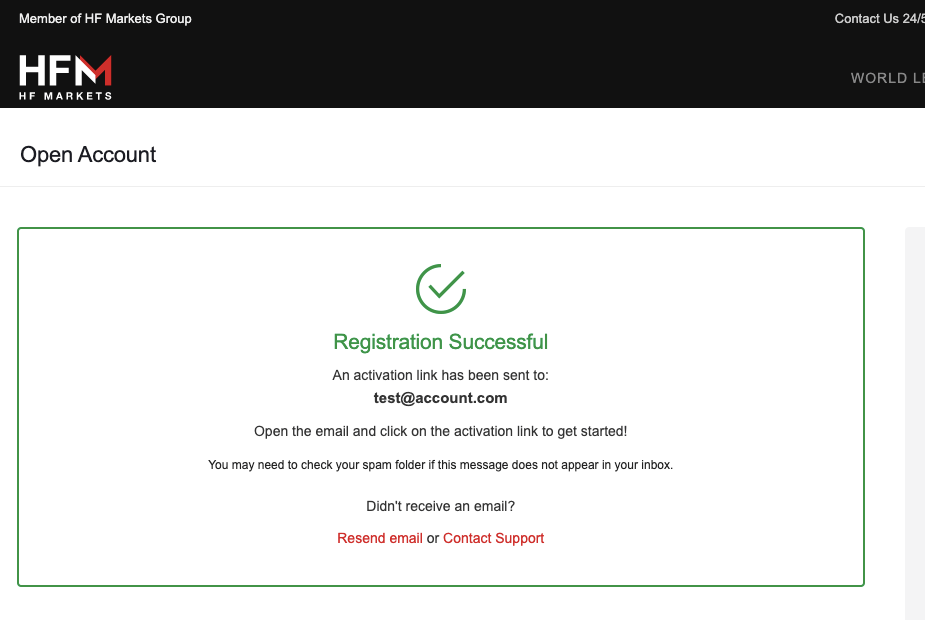

Step 3) A verification link will be sent to your email address. Go to your email inbox and click the ‘Activate Account’ link to continue with your registration.

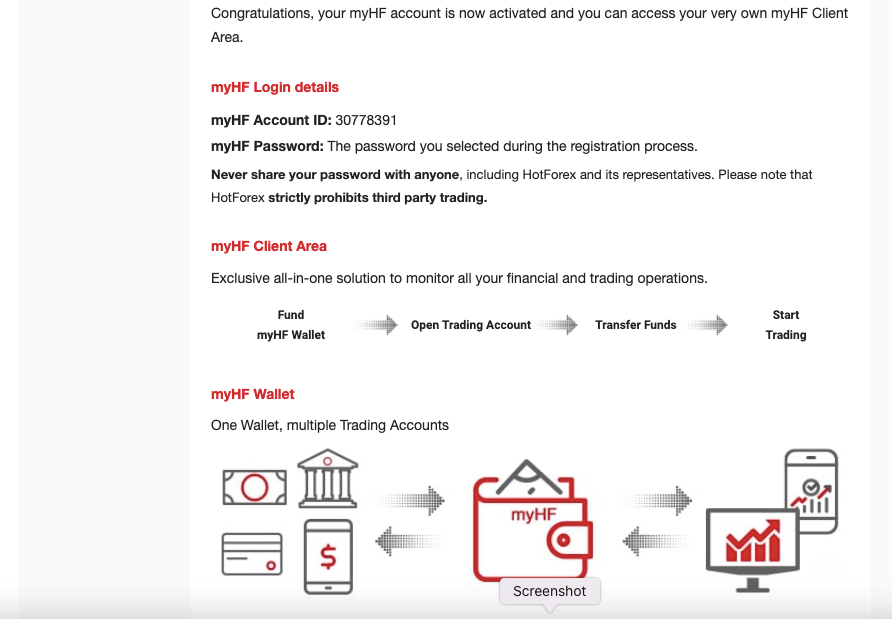

Step 4) You will get a confirmation email with your ‘myHF account ID’ after the account is activated.

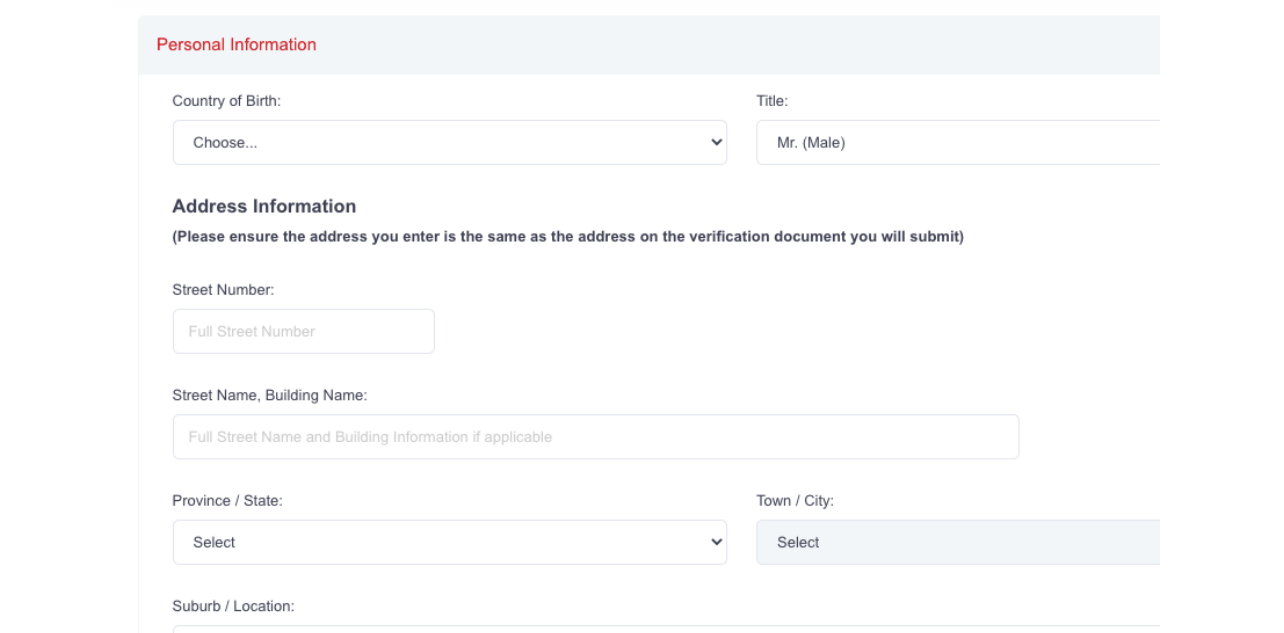

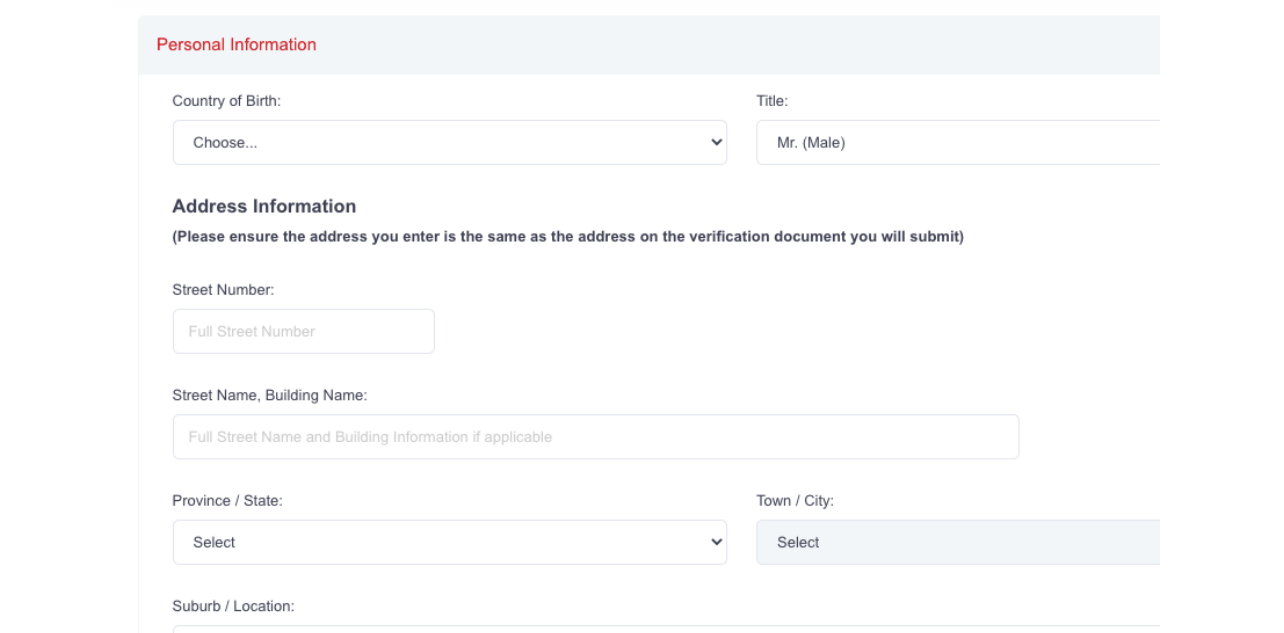

Step 5) Now you can proceed to log in, and on your dashboard, you will be required to complete registration/profile by supplying some personal and economic information, including your experience level with Forex trading.

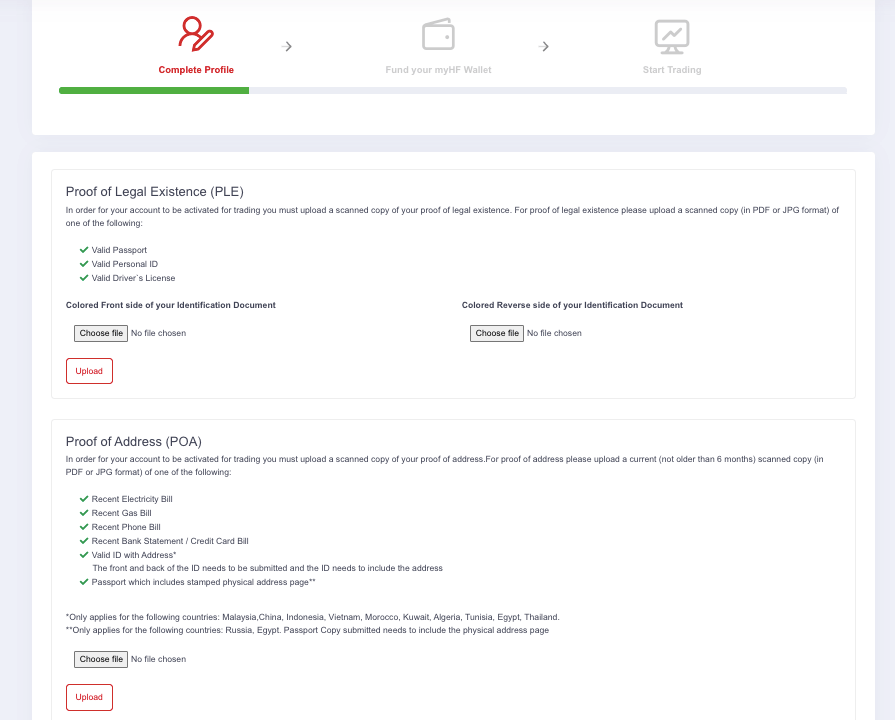

Step 6) Next, you will be required to upload a valid ID to verify your identity and a proof of address to verify your address. Then wait for the approval.

Step 7) After your account is approved, you can make deposits, start trading, make transfers and withdrawals.

What is a forex broker?

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Do I need a broker for Forex Trading?

Yes, you generally need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the vast interbank market where currencies are actually traded. Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market. Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

How much money do I need to open Account with Forex Broker in Malaysia?

There is no specific amount that applies to every trader or forex brokers.

The minimum deposit for forex trading is a decentralized phenomenon. No regulatory body enforces minimum deposit. It all depends on how each broker wants to operate. This is the first factor.

Some brokers have trading accounts with no minimum deposit. You don’t have to put any money in your account to open & verify the account. Note that it does not mean that you can trade without making any deposit.

You will still have to put capital in your account if you want to put on any trades, just that you don’t need any balance in your account per se to keep it open. And there is no restriction on how much money you have to put in your account in order to trade with it.

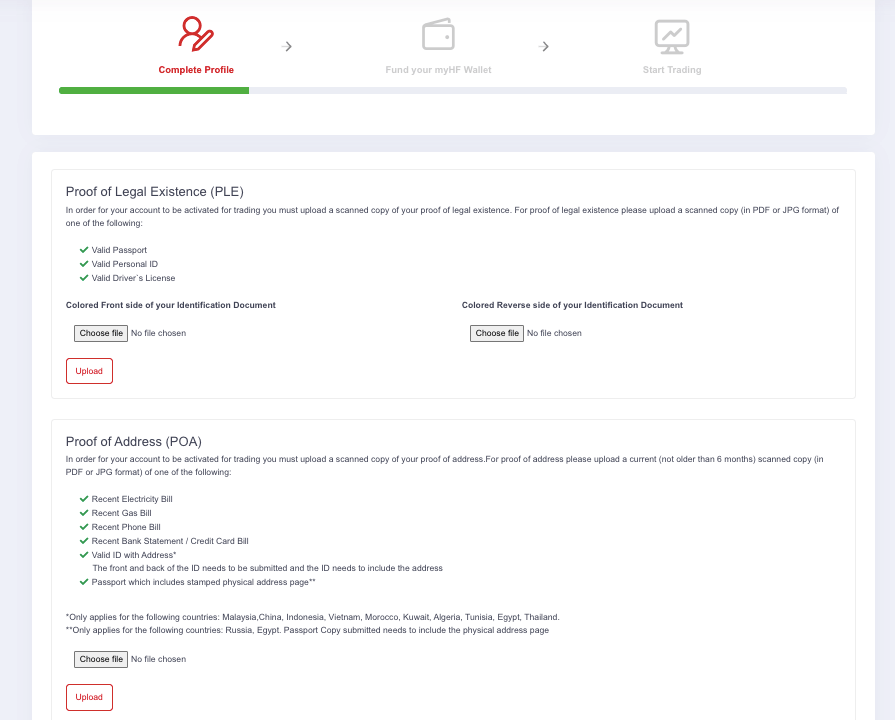

For example, refer to the below screenshot from a broker’s website where they explain their ‘no minimum account deposit requirements’.

Or there could also be trading accounts with low minimum deposits requirement like $50 (MYR 215), some even have $1 deposit requirements or 4.5 MYR. There are a few brokers with minimum deposits as high as $500 (MYR 2,150) or more. So when it comes to the money you need to begin trading, your forex broker is a key factor.

The second factor is you. You need to consider your risk tolerance, trading goals, and financial state. How much are you willing to lose trading? How much is your gross monthly income? Why am I trading? These are pivotal questions you need to ask yourself. The answers to these questions will affect how much you put in your trading account.

Take for example, if you are making a deposit of MYR 50, with the hope that you will turn it into millions from your trading, then you will likely lose the deposit very quickly. Forex & CFDs are leverage instruments & you can lose your money in few minutes if you are taking a position too large.

How do you choose the amount to begin forex trading? A good consideration of the two factors above will help you make the right choice. After determining how much you are willing to risk in trading (which should be based on factors including your risk tolerance & financial adequacy), then you need to choose your ideal broker.

If your risk tolerance is low, then you might have to choose brokers with zero minimum deposit account or low minimum deposit account like MYR 50-100. Though this is little money, you can trade larger positions with it using leverage (which you should avoid). However, you should note that you can lose all of your money with leveraged CFD trading.

Even if your risk tolerance is high or you have enough money to trade CFDs, we caution that you do not put too much money in CFD trading because it is very risky. Most of the CFD traders lose their money, it is very hard to make a profit from forex trading.

What are some red flags to watch out for when choosing a forex broker?

Its best to trade with forex brokers that offer some form of safety for your funds. Here are some red flags to avoid when choosing a forex broker:

1) Unregulated Brokers: Do not trade with forex brokers that are not regulated. To add to this, some brokers may claim to be regulated, but are actually only regulated by offshore regulators. You should only trade with a broker that is locally regulated by your local regulator and/or by tier-1 regulators.

2) Hidden Fees: Another sign to avoid a broker is high fees or commissions.

What account types have the lowest fees?

Forex brokers have different account types. There are accounts that cater to retail traders and there are accounts for professional traders.

For retail traders, brokers have different names for their accounts. However, there are usually standard accounts. These accounts have high spreads with little or no commission. The next popular account is a trading account with raw spreads. The advantage of this account is that the spreads are low (almost zero).

Because the spreads are low, you will pay more in commission. So which account has the lowest fees? The truth is forex brokers will make money through trading fees. There is no way around that. It depends on your choice. Do you want a high spread/zero commission account or vice-versa.

You can also use a calculator to see your projected trading cost. There are forex brokers with trading calculator on their websites.

For professional traders, it is entirely different. You will hardly find the fees for professional accounts on your forex broker’s website. When you successfully open a professional account, you will have access to all the fee and other charges that come with it.

Please note that a Pro Account does not mean a professional trading account. There are many forex brokers who have retail accounts name Pro Account. Make sure you contact your broker for more details.

Is there any legal forex broker in Malaysia?

All the popular forex brokers that Malaysian traders trade with are not legal in Malaysia.

These are foreign forex brokers, with offshore regulated entities & they are not legally licensed to operate in Malaysia. So, traders must be cautious when dealing with these offshore entities because you will not get any investor protection, you are trading at your own risk.

While some of the foreign brokers have good reputation & are licensed by tier-1 regulators (like the FCA (UK), ASIC in Australia), but they do not register Malaysian traders under any top-tier regulation. They register them under offshore jurisdictions like Mauritius or Belize.

These foreign brokers don’t comply with Malaysian regulations.

What are the most popular forex business models?

Not all forex brokers operate the same way. There might be few similarities in some things. But when it comes to business models, the differences are usually clear.

Here are the most common forex business models:

DD: DD means dealing desk brokers. They are also known as market makers. This means they are counterparties to your trades. In other words, they take the opposite side of your trading positions. DD brokers can have different pricing models, some are fixed spread brokers, while others have variable spreads.

Also, some market market maker brokers offer instant order execution, but there may be slippage if the price is moving fast.

NDD: NDD means non-dealing desk brokers. Unlike DD brokers, NDD brokers are mediators. They connect their clients to interbank markets. Instead of a dealing desk, your trades are sent straight to banks and liquidity providers.

The direct market access offered by NDD brokers prevents requoting because prices are updated in real time. NDD brokers are further divided into ECN and STP brokers.

Here is a breakdown of the two:

ECN: ECN means Electronic Communication Network. ECN brokers are a liquidity hub. They have different liquidity providers, banks , and hedge funds that are connected. Your trades are sent electronically into this hub. There is no price manipulation and every participant has access to the price feed.

STP: STP means Straight-Through-Processing. STP brokers route your trades directly to liquidity providers who act as counterparties to your trades. STP brokers also add a mark up to spreads received by liquidity providers. That is one of the ways they make their money.

Which forex brokers is best for beginners in Malaysia?

For beginners, you need to prioritize education and simple account structure. The following brokers are the best forex brokers for beginners in Malaysia: XM, Octa, HFM, Tickmill, FXTM, and AvaTrade.

These brokers have account structures that are easy to understand. They also have FAQs that will answer common questions. Furthermore, they have educational materials in written and video form for you to learn forex trading.

What is the best trading platform for beginners in Malaysia?

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

License: Your trading platform should be well regulated. Most of the brokers operating in Malaysia are foreign and not regulated locally. So, focus on brokers that have a top-tier regulation with the FCA in the UK or ASIC in Australia.

MYR-base Account: Choosing a trading platform with your local currency account is good. As a beginner, you want to avoid excess charges like conversion fees. If you want to go the conventional way, you can open a USD trading account.

Malaysia friendly payment methods: Bank wire transfers and debit/credit cards should be supported. More payment options like Skrill, Neteller, and other e-wallets help lets you enjoy a degree of flexibility. E-wallets are not available everywhere especially if you prefer a certain company.

So, the bare minimum is payment via your bank and your cards.

Diverse account types:A forex broker will likely have at least two trading accounts. There is usually a Standard Account, and an ECN Account. Not all account types are suitable for beginners. A Standard Account might be a good place to start.

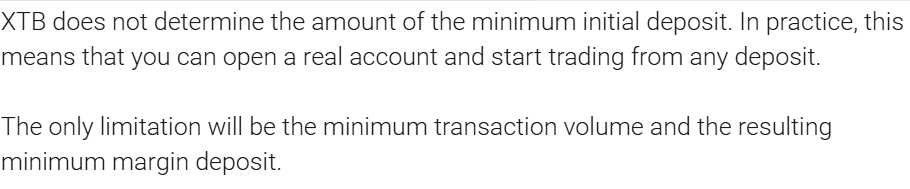

Free Demo account: Beginner traders need a demo account. An unlimited demo account that does not expire is preferable. This is helpful for practice of trading strategies. You are also able to trade objectively since there is no fear or greed to make money.

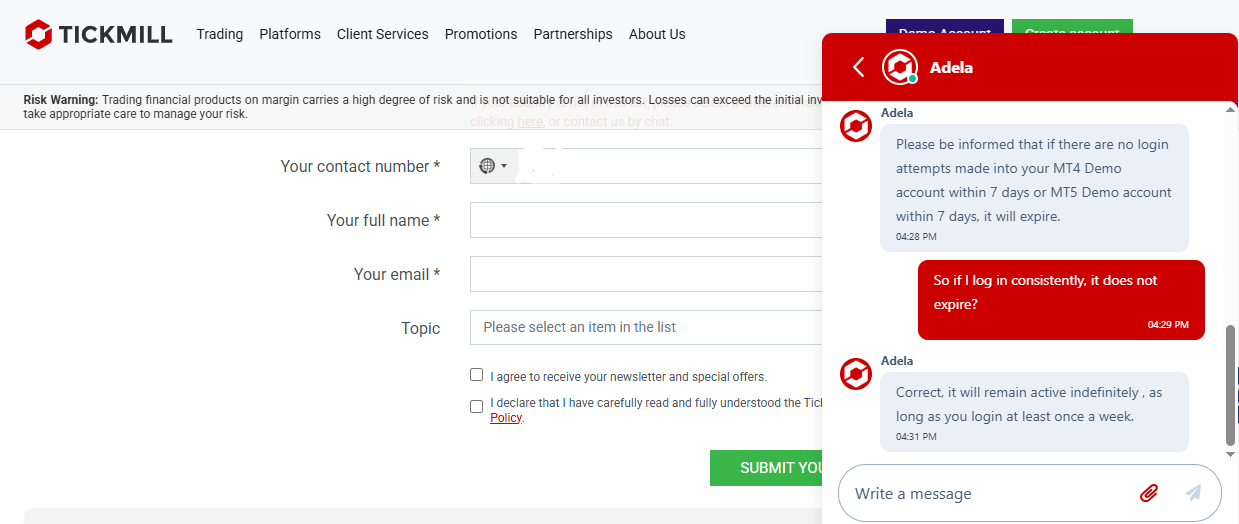

Tickmill is one of the brokers in Malaysia with a demo account that does not expire. We reached out to their customer care agent. Their response is displayed below:

FAQs on Best Forex Brokers in Malaysia

Which forex broker is regulated in Malaysia?

There are no legal forex brokers in Malaysia for retail traders. All the brokers are foreign brokers that are unregulated in Malaysia. So traders are trading with these brokers are their own risk.

Which Forex Broker is the best in Malaysia?

Please note that it is first important to know that there is not licensed forex broker in Malaysia. This means traders who engage in forex trading are dealing with foreign brokers unregulated only.

So, we can only point out that in general, any forex broker that is regulated by multiple tier-1 & tier-2 regulations are considered ‘lower’ risk (because there is no risk free broker). Then the comparison is based on fees, support, account features, withdrawals etc.

There are some brokers like HF Markets, FXTM etc. that are regulated under multiple regulations, but not in Malaysia. It should be noted that if you trade with any forex broker as a resident in Malaysia, you are doing so at your own risk. So all forex brokers should be considered high risk.

Which forex brokers have no deposit bonus?

HF Markets, Tickmill, XM, and FBS are forex brokers in Malaysia that offer no deposit bonus. No deposit bonus means the forex broker will give you a cash bonus, that is usually credited to your trading account and you can use it to trade financial instruments.

In Malaysia, the no deposit bonus amount vary from broker to broker, HF Markets, Tickmill and XM no deposit bonus amount is MYR 142 ($30), while, that of FBS is MYR 332 ($70).

Note that, usually, you are not allowed to withdraw such bonus received, you can only trade with it and withdraw any profits realised. You can find more information about the terms and conditions of such bonus on our post No Deposit Bonus Forex Brokers In Malaysia.

Are there brokers with zero or low commission fees?

Yes, most forex brokers in Malaysia offer commission-free trading on forex trades and other financial instruments. Forex brokers like Octa and AvaTrade do not charge commission fees on trades, this means that you will not pay any fees opening or closing trade positions.

HF Markets and Tickmill also offer commission free trading on some account types, like the HF Markets Premium Account and Tickmill Classic Account. Other account types by the brokers attract commission charges.

Which Forex Broker has low fees?

HF Markets, Tickmill & Octa have moderate to low trading fees as per our research. All three of them offer commission free trading on most trading instruments, Octa even offering swap-free trading for all accounts at all times. While HF Markets charge account inactivity fee, Tickmill and Octa do not charge those fees.