Forex brokers connect forex traders to the market. Their importance in trading cannot be overestimated. However, some brokers are high-risk and can scam traders. This is why regulation is important.

The Financial Conduct Authority is the watchdog in the UK. They regulate the activities of brokers and protect UK-based traders from fraudulent brokers. If you live in the UK, never register with a broker that is not FCA regulated. You are putting your money at risk by doing so.

In this review, we will be looking at some FCA regulated brokers and their general trading conditions.

Comparison of FCA Regulated Forex Brokers

| Broker | FCA License No | Authorised Since | Min. Deposit | Visit |

|---|---|---|---|---|

| Pepperstone | 648312 |

05/08/2015

|

No minimum deposit

|

Visit Broker |

| City Index | 446717 |

24/03/2006

|

£100

|

Visit Broker |

| CMC Markets | 173730 |

20/09/2005

|

No minimum deposit

|

Visit Broker |

| eToro | 583263 |

09/05/2013

|

$10

|

Visit Broker |

| OvalX | 124721 |

01/12/2001

|

£100

|

Visit Broker |

| Tickmill | 717270 |

29/07/2016

|

£100 (Pro and Classic Accounts)

|

Visit Broker |

Best FCA Regulated Forex Brokers

Here are 2022’s best FCA regulated forex brokers in the UK:

- Pepperstone – Overall Best FCA Regulated Forex Broker

- City Index – Regulated Broker with HTML5 Webtrader

- CMC Markets– FCA Regulated Broker with Most Currency Pairs

- eToro – FCA Regulated UK Broker with CopyTrading

- OvalX – Forex Broker with FCA Regulation

- Tickmill – FCA Regulated Broker with Low Fees

#1 Pepperstone- Overall Best FCA Regulated Forex Broker

Pepperstone is licensed with the FCA under the trading name Pepperstone Limited. They have been authorised since 05/08/2015 and are still authorised. Their reference number is 648312 and their registered company number is 08965105.

Pepperstone are considered low-risk because they are FCA regulated. They offer three account types (CFD Razor Account, Spread Bet Account, and CFD Standard Account). This allows you to trade in your preferred way, whether CFD trading or spread betting. There is no minimum deposit for any of the accounts.

The average spread for major forex pairs depends on your account type. They are generally lower on the CFD Razor Account with 0.10 pips for EUR/USD and 0.40 pips for GBP/USD. There is also an extra commission per lot and it depends on your account’s base currency. MetaTrader 4, MetaTrader 5, and cTrader are their available trading platforms and there is no inactivity fee.

You can deposit or withdraw your funds via three means: credit/debit card, bank transfer, and PayPal. Pepperstone supports Visa and Mastercard only. Finally, you can get support through email, live chat, and a UK toll-free mobile number.

#2 City Index- Regulated Broker with HTML5 Webtrader

City Index is one the trading names for StoneX Financial Limited. StoneX have been authorised in the UK since 24/03/2006 but the City Index trading name became effective 01/03/2021. Their FCA reference number is 446717.

You can trade the forex market via CFDs or spread betting. You can open a trading account with a £100 minimum deposit.

The typical spread for major pairs depending on your way of trading is low with 0.8 pips for EUR/USD and 1.8 pips for GBP/USD. For some instruments like shares, the spread depends on whether you are trading CFDs or spread betting. City Index charges no commissions except for shares CFDs. There is a monthly account inactivity fee of £12 and a premium fee for guaranteed stop loss orders.

There are no extra charges for deposits/withdrawals. You can fund your account via debit card (Mastercard, Visa, Maestro, and Electron), credit card (Visa and Mastercard), PayPal, and Bank transfer. Withdrawals are easy via bank transfer and other methods you will find once you are signed up.

You can trade with MT4, webtrader, and the City Index mobile app and support is available via live chat and FAQs.

#3 CMC Markets- FCA Regulated Broker with Most Currency Pairs

The forex broker is regulated with FCA as CMC Markets (UK) plc. This is also their trading name, which has been effective from 20/09/2005. They have been authorised in the UK since 01/12/2001 and are still authorized. Their firm reference number is 173730.

Three account types are available at CMC Markets – Spread Betting Account, CFD Account, and Corporate Account. There are no minimum deposits for these accounts.

Overall fees are low with no extra commission per lot or deposit/withdrawal charges. The minimum spread for GBP/USD and EUR/USD is 0.90 pips and 0.70 pips respectively. There are also holding costs (swap), account inactivity fee (£10), and a guaranteed stop loss premium.

Of all the FCA regulated brokers in this review, CMC Markets has the widest market range with over 11,000 trading instruments available. You can trade these instruments on Metatrader 4 and CMC’s Next Generation platform.

You can deposit/withdraw funds via bank wire transfer, credit/debit card, and PayPal without extra charges. Support is available via FAQs, email, and a UK mobile number.

#4 eToro – FCA Regulated UK Broker with CopyTrading

eToro is licensed with the FCA as eToro UK Limited. According to the FCA, the forex broker currently trades under three names: eToro (effective from 27 July, 2021), eToro UK (effective from 27 July, 2021), and eToro (UK) Ltd (effective from 21 June, 2012). eToro have been authorized in the UK since 09/05/2013 and are still authorized. Their reference number is 583263.

eToro operates differently compared to other FCA regulated brokers. Apart from opening a trading account, you can also invest. With a minimum deposit of $10, UK traders can open an account.

eToro’s fees are quite high. There is a monthly inactivity fee of $10 and a withdrawal fee of $5. In addition, there is a minimum withdrawal of $30. The spread for GBP/USD and EUR/USD is 1.0 pips and 2.0 pips respectively with no extra commission for currency pairs. eToro offers its own proprietary trading platforms. No MT4 or cTrader.

Deposit/withdrawal is easy via credit card, PayPal, and bank transfer. Neteller and Skrill are also available for deposits. There is no local mobile number but you can get support via FAQs, email, and live chat.

#5 OvalX- Forex Broker with FCA Regulation

OvalX is regulated with the FCA as Monecor (London) Ltd. They have been authorized since 01/12/2001 and are still authorized. Their trading name is Monecor (London) Ltd with FCA reference number 124721.

Update: OvalX have discontinued their forex trading services. They have now transferred clients’ live accounts to Capital.com. Clients can also withdraw their funds if they so desire. Read OvalX’s statement here.

You can open a CFD trading or Spread Betting Account with £100. OvalX does not charge an extra commission per lot but fees are built into the spread. The average spread for major pairs are high with 1.01 for EUR/USD and 1.85 for GBP/USD. There are also overnight charges.

You can trade forex, commodity CFDs, shares CFDs, and indices CFDs with ETX Capital. The trading platforms they support are the OvalX platform and MT4.

Deposit/withdrawal is easy with credit/debit cards, UnionPay, and Skrill with no extra charges. Support is available for UK traders via email, Facebook messenger, and a UK mobile number.

#6 Tickmill – FCA Regulated Broker with Low Fees

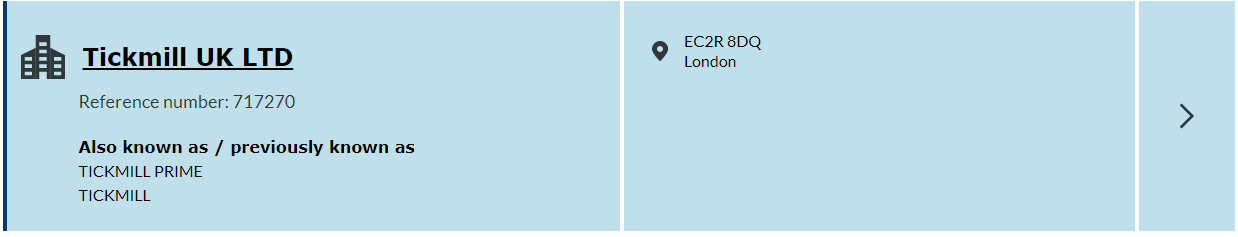

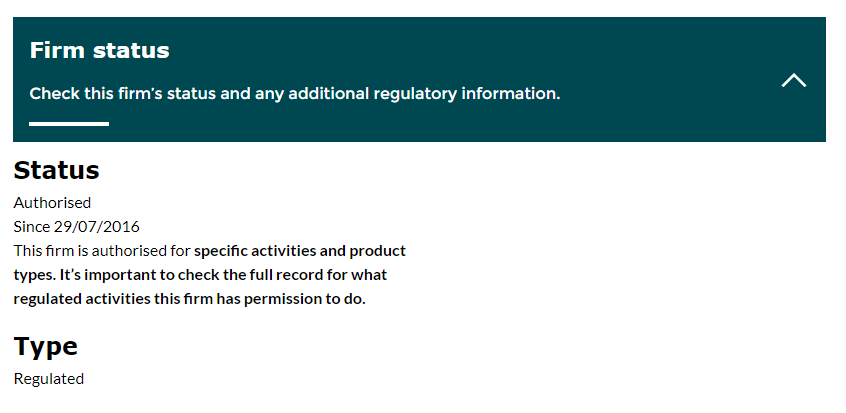

Tickmill is regulated with the FCA as Tickmill (UK) Ltd. They have been authorized in the UK since 29/07/2016 and are still authorized. They have three trading names currently – Tickmill, Tickmill Prime, and Tickmill UK Ltd. Their FCA reference number is 717270.

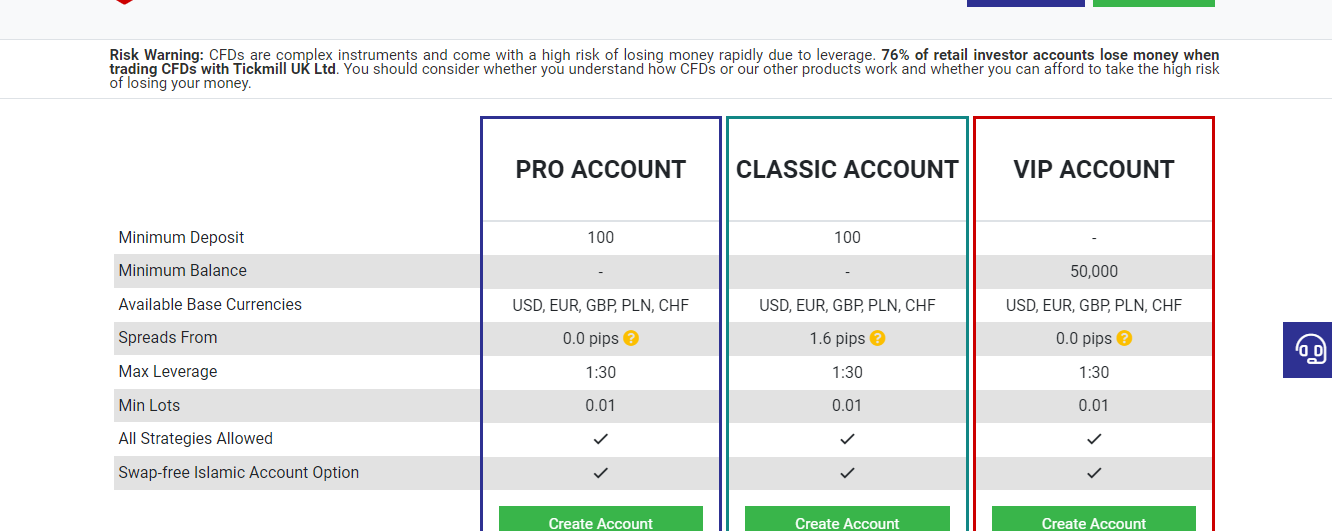

You can open a Pro, Classic, or VIP Account. The minimum deposit for Pro and Classic Accounts is £100. No minimum deposit if you are opening a VIP Account.

Tickmill has low fees with 0.1 pips and 0.3 pips minimum spread for EUR/USD and GBP/USD. You also pay extra commission per standard lot on Pro and VIP Accounts only. The commission is higher on Pro Account. In addition, there are holding costs and account inactivity fees too.

Metatrader 4 and 5 are supported.

Deposit/withdrawal methods are convenient with no extra charges. You can get support via email, live chat, and UK mobile number.

The History of the FCA

Before the FCA, there was the FSA (Financial Services Authority). The FSA ran from 2001-2023 as a semi-judicial body that regulates financial services and investments in the UK. Due to the failure of banks to comply with regulatory frameworks during the 2007/2008 financial crisis, the government decided to restructure financial regulation in the UK.

This decision led to the introduction of the Financial Services Act. The act received royal assent on 19 December 2012 which led to the abolition of the FSA on 1 April 2013. On the same day, the Financial Conduct Authority was established, being part of the two agencies that now share the responsibilities of the FSA.

Currently, the FCA makes sure that over 58,000 businesses conduct themselves appropriately in the UK.

What Are the FCA’s Notable Achievements?

The FCA’s achievements looking at their 9-year records are significant. Since 2013, while the FCA commenced regulating the United Kingdom’s financial markets, London has come to be extra mentioned as a primary global forex trading centre.

Before the FCA was set up in 2013, there has been no system within the UK to secure retail from forex brokers that promoted complex high-risk CFD instruments.

The instant success of the FCA is the improvement of the requirements that brokers have to adhere to. These requirements were designed to protect traders. In addition, the FCA also created systems to easily remedy the hurt some consumers have experienced due to weak regulations.

The FCA is likewise reworking the attitudes of the businesses that provide financial services in the UK. This has led to a marketing and advertising approach that focuses more on the customer. For example, FCA regulated brokers are not allowed to offer customers promos and promises of bonuses. With this, there is no pressure to begin forex trading without considering the risks.

How Does the FCA Protect You?

The FCA acts in the best interest of forex traders. As an authority over forex brokers, they make sure financial services providers are set up to reduce the risk traders are exposed to. In this section, we will be looking at the structures the FCA has put in place to protect you and your funds.

1) Leverage restriction: FCA regulated brokers have a leverage cap for CFDs. The maximum leverage for retail traders is 30:1 (currency pairs). There are leverage restrictions for commodities, indices, and stocks too. The restriction ensures that you do not abuse leverage. Leverage amplifies losses. Lower leverage ensures that traders are not exposed to damaging losses.

2) Negative balance protection: Negative balance protection was put in place to make sure trades do not lose more than their trading capital. Without this, your account balance can go into the negative. That means you will have to pay your broker.

However, FCA regulated brokers are under orders to make sure no traders lose more than their account balance. Instead of the trader paying, most brokers absorb the debt and take responsibility for it.

3) Financial Services Compensation Scheme: The FCA also mandates brokers to be part of the FSCS before they can operate in the UK. The aim of the FSCS is to ensure that traders get their money back should a forex broker go bankrupt. Under the scheme, your money is protected for up to 85,000. This is why only FCA regulated brokers can guarantee the safety of your funds.

4) Segregation of funds: The segregation of funds involves forex brokers keeping clients’ money in a separate account. That is, your money and the brokers’ money are not in the same account. This has good implications for forex traders. The implication is that the creditors of brokers cannot lay claim to traders’ money in case of bankruptcy. Also, traders’ money will not be used for hedging trades with counterparties.

Furthermore, the FCA also insists that that all brokers have at least 1 million GBP in operating capital. This is important so forex brokers can maintain the positions of their traders in the market. As the number of traders increase, brokers must increase their operating capital. All of this is put in place so brokers can meet their financial duties for their clients.

5) Financial Ombudsman Service: The Financial Ombudsman Service (FOS) was set up by the UK parliament in 2001. The main goal of the FOS is to settle disputes between forex traders and forex brokers. As a trader, you might not be able to take on your broker if a major dispute arises. The FOS evens the playing field and makes sure you are not at a disadvantage. If you have any complaints, you can go to the FOS website and lodge your complaint.

6) Risk Disclosure: Most traders are drawn to forex trading ignoring the risks. Even with all the restrictions put in place by top-tier regulatory bodies, more than 80% of forex traders lose their capital trading CFDs. For the sake of transparency, all FCA regulated brokers are required to display the percentage of their clients that lose money on their website. With this information made public, you are more aware of the risks that accompany trading CFDs.

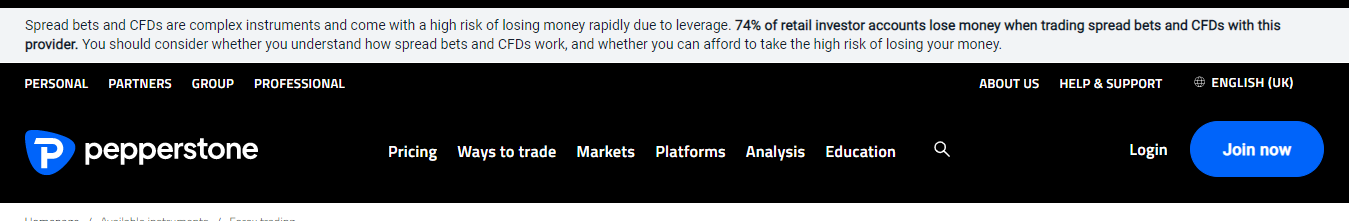

Typically, you will find it at the header or footer of the CFD broker’s website. Here is a screenshot showing Pepperstone’s risk disclosure as an example for you.

In conclusion, these benefits are enough reasons for you to choose an FCA regulated broker. In regions where these strict regulations are not in place, data show traders lose a lot of money.

How to Check a Forex Broker’s FCA Regulation?

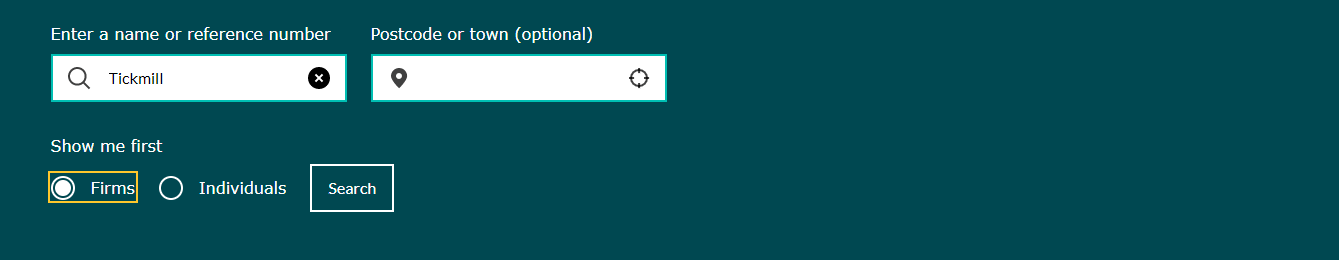

In simple steps, this is how to verify a forex broker’s FCA regulation. Tickmill is our example:

Step 1) Check Broker’s FCA Regulation: First, you need to know from the broker if the FCA regulates them. Forex brokers usually display this in the footnote of their website.

Step 2) Verify Broker Regulation at the FCA website: Once you find the regulation, on the forex broker’s website, go to https://register.fca.org.uk/s/ and scroll down. When you get to the part displayed below, enter the broker’s name, select firms, and click on search

Your search result will give you the image displayed below where the forex broker’s company name is displayed with the FCA reference number.

If the reference number matches the one on the broker’s website, then the broker is truly FCA regulated.

Step 3) Check Status & Type of Regulation: Furthermore if you click on the broker’s company name and scroll down, you will know when they got authorized in the UK and if they are still authorized.

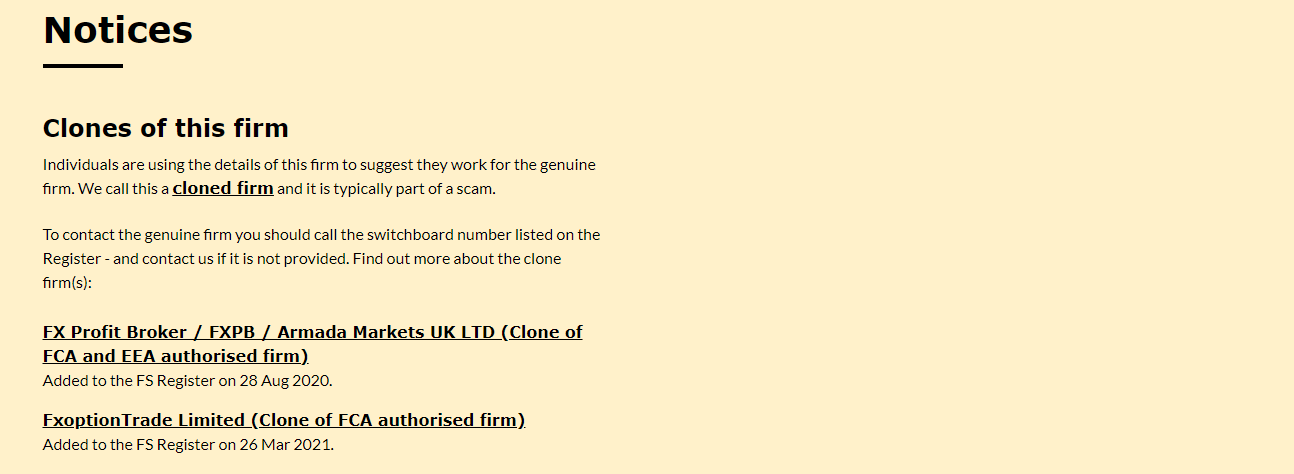

Step 4) Check the Clones of the Firm: This is a bit of an extra precaution. There might be individuals or companies using the name or details of a forex broker. This is usually a part of an attempt to defraud people. The FCA always reveals the details of these scams so you can avoid them. The image below shows the clones of Tickmill UK as shown on the FCA website.

Other Important Factors for FCA Regulated Brokers

Apart from FCA regulation, there are other trading conditions you should consider before choosing an FCA regulated broker. FCA regulation combined with good trading conditions gives you a complete trading experience. Here are other factors

Bonuses/Promotions: Bonuses and promotions are marketing strategies used by forex brokers to get traders to sign up with them. These promotions are usually monetary. They are usually tied to opening an account with a certain amount or trading a certain volume.

These leads to traders taking excessive risks and they end up losing money again and again. So the FCA mandated that all brokers that operate in the UK must not offer bonuses or promotions. If you see any forex broker offering bonuses in the UK, avoid them totally.

They are not FCA regulated.

Account type: Trading conditions vary by account. Some accounts have low spreads while some have higher spreads. Some brokers even offer just a single account so you do not have any choices. Another factor determined by account type is the commission. Most brokers with multiple accounts usually have an account that is commission-free. This is why it is important to check this factor so you can compare the account types and choose the one that fits you.

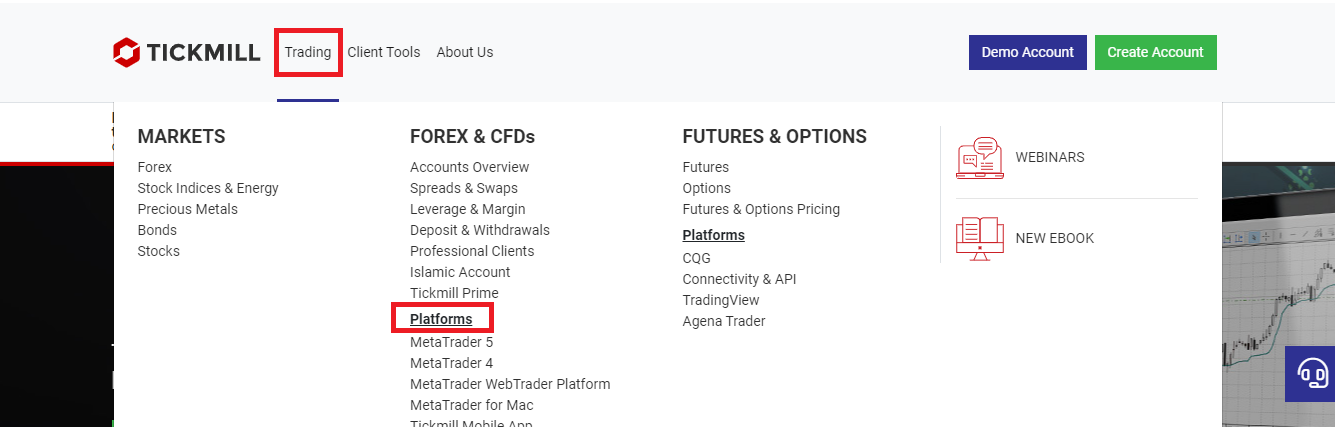

Let us check Tickmill’s account types for example. On their homepage, move your cursor to ‘Trading’ and click on ‘Accounts Overview’ (in the yellow box).

When you click on ‘Accounts Overview’, you will find Tickmill’s three accounts as displayed below.

As you can see, these accounts have similar features. But they also vary in a significant way. For example, the VIP account requires a minimum balance of £50,000. Not just that. You can also see that the spread for the Classic Account begins from 1.6 pips. The other accounts have their spreads from 0.0 pips. This means you will likely incur more trading fees on the Classic Account.

Do you see why it is important to compare accounts?

Trading Platforms: What you want to check here is the platform offered. Is it a proprietary platform developed by the broker? or a third-party platform like MT4, MT5, or cTrader. Most forex brokers tend to have more advanced features on their proprietary platform so you should check.

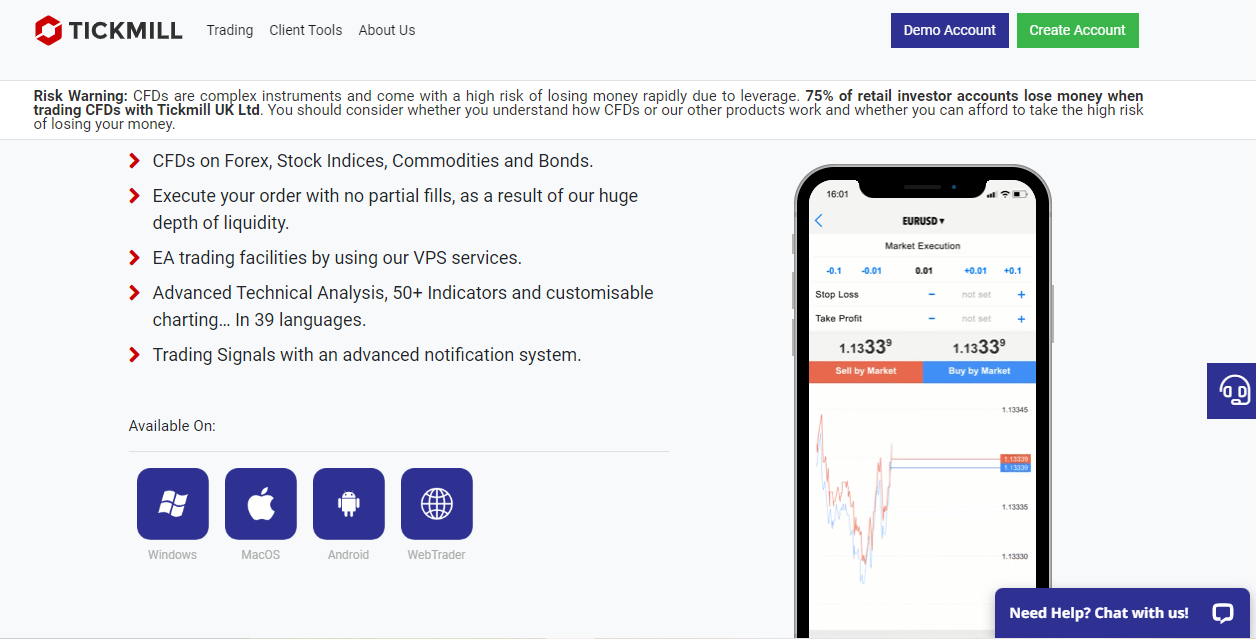

In addition, you want to check if the platforms are available on desktops and mobile phones. This helps you combine the full view that the desktop offers with the on-the-go feature of mobile apps. To check this factor, you can go through the platforms section on the broker’s website. Here s an example with Tickmill UK.

Under ‘Platforms’, you can see that Tickmill has MT4, MT5, and their proprietary app. To confirm they are available on multiple devices, click any of the platforms. Here is one of the images you will see if you click MT4.

Funding and Withdrawals: For UK traders, you need to be able to deposit/withdraw your funds via local banks or credit/debit cards. This is the bare minimum. After these, you can consider if your broker supports e-wallets like Skrill and Neteller.

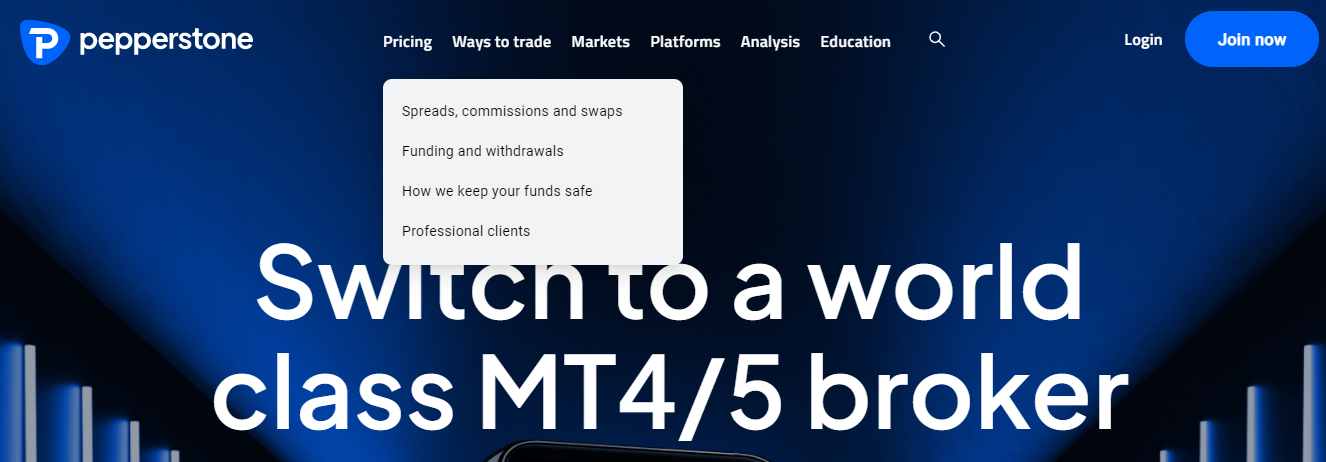

Beyond the payment methods, you should consider how fast funding/withdrawal is. Deposits should be processed quickly and reflected in your account instantly. Withdrawals should not be more than 3 business days. You can check this factor to make sure there is no delay in your transactions. Here is an example with Pepperstone UK.

On their homepage, click ‘Pricing’. You will see a dropdown with four options. One of them is ‘Funding and withdrawals’. Click it.

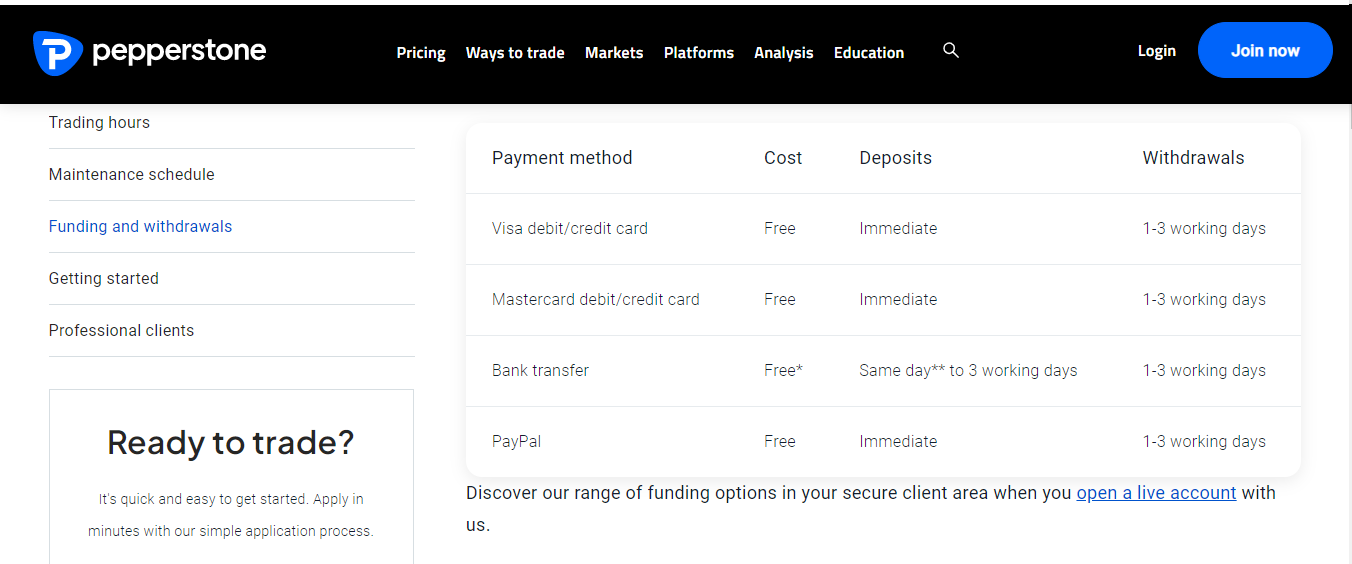

When you click ‘Funding and withdrawals’, you will be taken to Pepperstone’s funding page. Here is how the page looks

From the image, you can see that Pepperstone has 4 payment methods. The methods are valid for funding and withdrawals. In addition, there are no extra fees from Pepperstone for your transactions. Also, withdrawal takes 1-3 working days.

Customer Support: You want your forex broker to be reachable if you have any inquiries. Though FAQs are available, they might not have all the answers. So you need to check other support channels available. Emails and live chats are quite common. Some brokers also have a UK mobile number.

How to Manage Risks with Forex Trading

Forex trading involves risks and you could lose all your money, it is best that you avoid trading forex CFDs, unless you have experience and understand them.

In the UK, the FCA does not make it compulsory for forex brokers to offer negative balance protection, this means that you can lose more than the capital you invested and will be required to deposit additional money to clear the balance.

However, you can use the following strategies to manage the risks of trading:

1) Use lower leverage: FCA regulations limit leverage for retail traders in UK to 30:1 for retail traders

. While leverage can amplify profits, it can also increase your losses. It is advisable that you do not use all the leverage available to you, as this exposes you to more risks.

2) Use Stop Loss Orders: A stop-loss order automatically exits your trade position when the price reaches a level that you set, this helps to limit potential losses. Setting stop-loss orders helps to maintain discipline and prevents emotional trading decisions.

3) Position Sizing: Do not commit too much to a single trade. Allocate your capital in percentages for different trades, this ensures your account is diversified and can mitigate some risk if the market moves too fast against you.

4) Practice with a Demo Account: Ultimately, if you are starting out, before putting your real money and facing the risks, use demo accounts to learn more about the CFDs trading market and test your risk management strategies. This will allow you to experiment in a risk-free environment with risk-free virtual money.

5) Keep Learning and Stay Up-To-Date: The forex CFDs market is always changing due to several reasons and events. It is best to stay updated with recent economic news, central bank policies (of the currencies you are trading), and technical analysis techniques. This will help you to make informed decisions and change your risk management strategies as needed.

Types of FCA Broker License

All forex brokers who want to sign up UK-based clients must obtain an FCA license. There are three types of FCA licenses available:

Dealer license: This license is for market-making brokers that operate their own dealing desks to provide price quotes for traders.

Intermediary license: This is for brokers that acts as intermediaries that need third-party liquidity providers to fulfill their clients’ orders.

Limited broker license: This is for brokers who are not fully brokers. They sell and market relevant products but do not keep their clients’ funds.

Dealer and intermediary licenses enable approved brokerage firms to provide CFDs to UK traders legally.

What are the requirements for obtaining an FCA license?

Capital requirements: The FCA has different capital requirements depending on the type of license. The requirement for dealer and intermediary licenses is £750,000 and £150,000 respectively. Firms can obtain limited license broker for £75,000. This ensures brokers have sufficient funds to do business in the UK.

Physical Office: All FCA regulated brokers must set up physical offices in the UK. UK brokers usually have their addresses on their website. Here is an example from Vantage Markets’ website:

You can see their physical UK office address in the red box.

Personnel: The top executives and directors of the firms must also be UK residents. Other key personnel must have sufficient expertise and experience in the financial sector.

Taxes: According to FCA rules, all forex brokers in the UK are subjected to a corporate tax. The rate varies depending on the company’s profitability. As of April 2023, the tax rate for forex companies is 25%. This applies for taxable profits above £250,000. For taxable profits below £50,000, a lower 19% tax rate is applied.

KYC and AML Policies: Brokers are required to obtain know-your-client (KYC) data from their clients. Crucial questions must be asked to ensure that a client is ready to trade CFDs. Apart from names and address, documents that proof client identity and residence are also required.

Furthermore, client’s financial strength must also be strong enough to withstand losses common with CFD trading. There must also be a robust anti-money laundering (AML) policy.

Application fee: When forex brokers are ready to apply for the FCA license, they must submit their applications to the Companies House. This requires a registration fee of £10.

Business Plan: Brokerage firms must provide a clear business plan and their forecast for future revenues. In addition, the business plan must include their risk management, anti-money laundering and KYC policies.

All documents in the application for the license must be submitted in English. It takes about 6-12 months for the FCA to complete the assessment of applications.

Does the FCA regulate all online brokers?

No, the FCA does not regulate all online brokers. The FCA only regulates online brokers that operate from the UK. The FCA is UK-based and does not have authority over online brokers outside the UK.

In addition, their authority does not cover entities of brokers they regulate that are not in the UK. For example, Pepperstone is regulated with the FCA. However, they have entities in Australia and even Africa. If you open an account with any of these entities, you are not protected by the FCA.

You should only open an account with the UK entity of your broker. This is what guarantees FCA protection and access to the FSCS scheme.

What is the maximum leverage for FCA regulated brokers?

The maximum leverage for FCA regulated brokers is 30:1. However, this only applies to major currency pairs. Other CFDs have lower leverage.

| CFDs | Leverage |

|---|---|

| Non-major pairs, gold, and major indices | 20:1 |

| Commodities other than gold and non-major indices | 10:1 |

| Equities | 5:1 |

| Cryptocurrencies | 2:1 |

These leverage caps are very important. They help you trade safely by avoiding excess risks that can lead to huge losses.

What is Trading Regulation?

Regulatory bodies like the FCA are watchdogs. They supervise the operations of online brokers and financial markets. They also enforce rules and regulations should a broker break them.

The Markets in Financial Instruments Directive (MiFID) which was replaced by MiFID II was adopted in the UK 18 months ago. It is the foundation on which FCA regulations stand.

Do all forex brokers have the same level of protection?

No, all forex brokers have the same level of protection. This is why you cannot chose any broker just because they are regulated.

Licenses and regulations limited to jurisdictions. For example, FCA protections is only available if you sign up with a forex broker that operates in the UK. If you sign up with the same broker under a different regulation, UK laws do not protect you.

In addition, not all financial regulators have the same rules and regulations. With top-tier regulators like the FCA and ASIC, it is compulsory that all forex brokers maintain a segregated account. Trader’s funds cannot be mixed with the company’s fund.

However, most offshore regulators do not have this same rule.

Are there legal repercussions if I trade with offshore brokers?

Currently, you will not be prosecuted as a British trader if you trade with an offshore broker. However, we advice that you trade with FCA regulated brokers only. This is the only way you can enjoy legal protections in forex trading.

FAQs on Best FCA Regulated Forex Brokers

What is the FCA?

FCA means Financial Conduct Authority. They are UK’s financial watchdog. All the forex brokers that can accept clients from the UK must be regulated with the FCA. Trading via a regulated broker would ensure that your funds are kept safe.

Which FCA regulated broker has low fees?

Pepperstone and Tickmill have the lowest fees with low spreads for major pairs and no inactivity fees. They also have ECN-type trading accounts with raw spreads & low commissions per lot.

Do forex traders pay tax in the UK?

Gains from CFDs are not subjected to capital tax. Only gains from spread betting are taxed.

Which FCA regulated broker has the most instruments?

CMC Markets have the most instruments as per our research as they offer CFD trading on more than 11,000 instruments.

Which FCA regulated broker offers GSLOs?

According to our review, CMC Markets, City Index, and ETX Capital offer guaranteed stop-loss orders.

xt