Forex trading is legal in Canada. CIRO or the Canadian Investment Regulatory Organization is a self-regulatory non-profit body that governs and promulgates the rules by which forex brokers in Canada can operate.

Being regulated by the CIRO provides legitimacy to the forex broker. Any broker that wants to operate in Canada must be licensed by CIRO. If you’re a forex trader from Canada, then it is advisable that you only trade through forex brokers that are regulated by the CIRO. This is because such brokers are considered to be safe and you can have legal recourse against them in case of any fraudulent behavior.

In this article, we’ll cover some of the best forex brokers that hold licenses from CIRO.

Comparison of Best CIRO Regulated Forex Brokers Canada

| Broker | CIRO Regulated | USD/CAD Spread (Pips) | Min. Deposit | Visit |

|---|---|---|---|---|

| Forex.com | Yes |

2.8

|

100 CAD

|

Visit Broker |

| OANDA | Yes |

2.1

|

No minimum deposit (Standard Account)

|

Visit Broker |

| CMC Markets | Yes |

1.7

|

No minimum deposit

|

Visit Broker |

| FXCM | Yes |

0.7

|

50 CAD

|

Visit Broker |

| AvaTrade | Yes |

1.5

|

300 CAD

|

Visit Broker |

5 Best CIRO Regulated Forex Brokers

Here are the five brokers that made our list of best CIRO Regulated Forex Brokers:

- Forex.com – Best CIRO Regulated Broker

- Oanda – Reputable Forex Broker in Canada

- CMC Markets – CIRO Regulated Broker with Zero Commissions

- FXCM – CFD Broker with Social Trading

- AvaTrade – Forex Broker with CIRO Regulation

Now we’ll be talking about the regulation, the overall fees, the trading platform, and the customer support, along with the pros and cons.

#1 Forex.com – Best CIRO Regulated Broker

Forex.com has been operational since 2001 and has built a strong reputation.

Regulation: Forex.com is licensed by CIRO of Canada under the name Forex.com Canada Limited.

Further, group entities of Forex.com are also licensed by the Cayman Islands Monetary Authority (CIMA), the FCA of the UK, the FSA of Japan, the CFTC of the United States, and the ASIC of Australia.

It is worth noting that Forex.com holds a license from both top-tier financial regulators which are the FCA and the ASIC.

Forex.com also practices segregation of funds and negative balance protection.

Overall, we consider Forex.com to be low risk for traders from Canada.

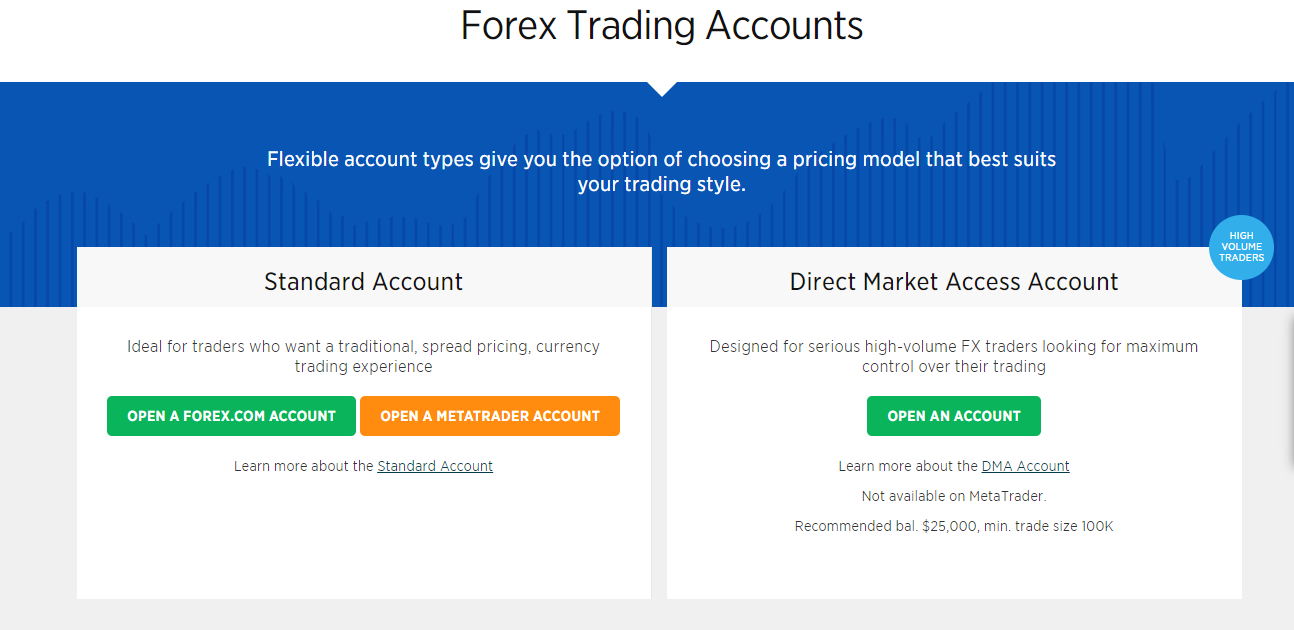

Overall Fees: Forex.com offers two different types of accounts for different types of traders. These are the Standard account and the Direct Market Access account. The Standard account is a spread-only account while the DMA account charges a spread as well as a commission (however, the spread is much lower).

Forex.com charges a typical spread of 1,3 pips for trading the benchmark EURUSD currency pair, which is a little higher than average. Usually, brokers charge in the range of 1 pip for trading the EURUSD currency pair.

If you’re using the DMA account, you will be charged a commission of $80 per $1 million worth of trade. (However, the spread will be much lower).

Trading Platforms: Forex.com provides the choice of trading with their own proprietary trading platform or using the ubiquitous and popular MetaTrader 4. Both of these trading platforms are available through mobile phones, web browsers, as well as desktop software.

You can use these trading platforms through iOS, Android, Windows, and MacOS.

Customer Support: Forex.com provides customer support through email, phone calls, as well as live chat. We tried to contact them through the live chat option and received a response within 3 minutes. We found the response to be helpful and the customer support executive seemed to have in-depth knowledge of the broker.

Forex.com Pros

- Traders from Canada can use Canadian Dollars as the base currency for their trading account

- They have a website dedicated to Canadian traders

- They have local offices in Canada

Forex.com Cons

- Their services are extremely expensive

- The structure of opening accounts may be complex for a beginner

#2 OANDA – Reputable Forex Broker in Canada

OANDA was founded in 1996 and has a strong reputation.

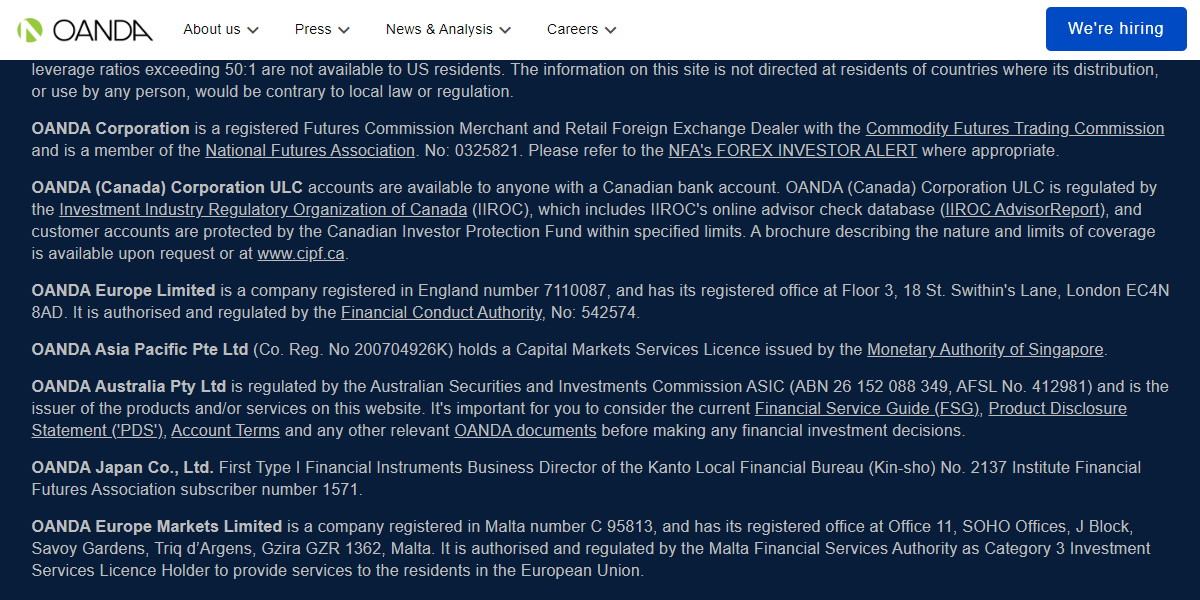

Regulation: Oanda is regulated by CIRO of Canada under the name Oanda (Canada) Corporation ULC. Anyone with a Canadian bank account can be registered under this regulation.

Further, different group entities of Oanda are regulated in the United States, the UK, Singapore, Australia, Japan, Malta, and the British Virgin Islands.

Oanda is one of the most highly regulated brokers that we have come across.

They provide negative balance protection and segregation of funds to their Canadian traders.

Overall, we consider them to be low risk for Canadian traders.

Overall Fees: The typical spread for trading the EUR/USD currency pair is 1.8 pips through the Standard account. They do not charge a commission when trading through the Standard account.

Oanda offers two different account types – Standard and Premium Accounts. No commissions are charged on both accounts. However, you should know that the minimum deposit for the premium account is 25,000 CAD.

Traders should also know that Oanda charges an inactivity fee after a trading account has been dormant for a period of over one year. Also, no deposit/withdrawal charges.

You will be charged a currency conversion fee if you deposit in any currency other than your account’s base currency.

Trading Platforms: Traders have the option of choosing between the MetaTrader 4, or the Oanda Trade platforms. The MetaTrader 4 trading platform is highly popular and is offered by most forex brokers around the world. The Oanda Trade platform is Oanda’s own proprietary trading platform.

Overall, we consider the range of platforms offered by Oanda to be excellent. While everyone is familiar with the MetaTrader platforms, we found the fxTrade platform to give close competition to those platforms.

You can use the platforms regardless of whether you have a Windows, Mac, Android, or iOS device. You can even access them through any web browser.

Customer Support: Oanda provides customer support through email or through the live chat option available on their website. They do not provide customer support through phone calls.

We contacted them through live chat and it took around 10 minutes for us to get a proper answer.

Overall, we consider the customer support provided by Oanda to be adequate.

OANDA Pros

- They have a local office in Canada (Toronto)

- They are highly regulated and considered to be safe

- They charge decent fees

- Competitive spreads

- No extra commission per standard lot

OANDA Cons

- You cannot reach them through phone call

- Their live chat option is slow

#3 CMC Markets – CIRO Regulated Broker with Zero Commissions

CMC Markets was founded in 1989 and is one of the first retail forex and CFD brokers in the world.

Regulation: CMC Markets is regulated by the CIRO and they have a local office in Toronto. Further, the group entities of the broker are regulated in the UK, Singapore, Germany, Australia, New Zealand, and Dubai.

Canadian traders can take advantage of negative balance protection and segregation of funds.

Overall Fees: The minimum spread for trading the benchmark EURUSD currency pair is 0.7 pips. This is slightly expensive considering that it is the minimum. Further, if you’re trading share CFDs, then you will have to pay a commission of CAD 8.00 (however, the spread will be lower).

CMC Markets does not charge any deposit or withdrawal fees, however, you may be charged a fee from your payment service provider.

CMC Markets does charge an inactivity fee if your account has been inactive for a period of more than one year.

Trading Platform – CMC Markets offers both their own proprietary trading platform as well as MetaTrader 4. Their own trading platform is called Next Generation and can support Windows, Mac, iOS, iPad, and Android. The trading platform comes with a range of charting features and uses technical indicators.

Customer Support: Traders from Canada can get in touch with CMC Markets through email or phone calls. The live chat option on their website was not working at the time of writing this review.

We sent them an email and got a reply within two hours. The response showed us that their support team is quick to respond and is knowledgeable about the services that CMC Markets provides. They were also quite polite.

CMC Markets Pros

- They have a local office in Toronto

- They are highly regulated and reputed

- They do not charge a deposit or withdrawal fee

- No commissions on currency CFDs

CMC Markets Cons

- They charge an inactivity fee

- The range of trading instruments is narrow

- Commissions are charged on Canadian shares

#4 FXCM – CFD Broker with Social Trading

FXCM has been operating since 1999. The company is known for its algorithmic and social trading features.

Regulation: FXCM is regulated by the CIRO under the name Friedberg Direct. Further, group entities of the company are regulated by the FCA of the UK, the ASIC of Australia, the CySEC of Cyprus, and the FSCA of South Africa.

Moreover, FXCM provides negative balance protection and segregation of funds to its traders.

Overall, we consider FXCM to be low-risk for Canadian traders.

Overall Fees: The average spread for trading the benchmark EURUSD currency pair is 0.3 pips. This is quite reasonable and one of the lowest spreads from the brokers that we have reviewed.

If you’re trading through the Active Trader account, then you’ll be charged an even lower spread along with a commission of $7 for a trade size of 100,000.

FXCM does not charge an account fee, deposit fee, or withdrawal fee. However, they do charge an inactivity fee.

Trading Platform – FXCM offers the choice between Trading Station (their own platform) or MetaTrader 4 (a popular third-party platform).

Users can download Trading Station on their Mac, iOS, or Android device. If you want to use MetaTrader, it is available on all popular devices.

Customer Support: You can contact FXCM through email, phone call, WhatsApp, or live chat. The live chat option is available on their website. They offer customer support on all weekdays at all times.

We contacted them through the live chat option available on their website and we received a response within seconds. We believe that FXCM offers decent customer support and their team is quite professional.

FXCM Pros

- They have a dedicated website for Canadian traders

- They offer social and algorithmic trading services

- Their fees are quite low

FXCM Cons

- They charge an inactivity fee

- They do not provide customer support on weekends

#5 AvaTrade – Best Trading Platforms

AvaTrade has been in business since 2006. The company is known for its modern approach to forex trading and innovative trading platforms.

Regulation: AvaTrade is licensed and regulated by the CIRO. Further, group entities of the company are regulated by the CBI of Ireland, the ASIC of Australia, the FSCA of South Africa, the FSA of Japan, and the ABDGM of Abu Dhabi.

AvaTrade also offers segregation of funds and negative balance protection to its traders.

Overall, AvaTrade is a safe broker to trade through.

Overall Fees: The typical spread for trading the benchmark EURUSD currency pair is 0.6 pips. AvaTrade does not charge a commission on trades.

AvaTrade does not charge a deposit or withdrawal fee, however, they charge an inactivity fee. (50 CAD). This inactivity fee is first charged after three months of inactivity. After which you then begin to incur a monthly fee

Overall, the fees charged by AvaTrade are quite reasonable and competitive.

Trading Platforms: AvaTrade offers a wide range of trading platforms including MetaTrader 4, MetaTrader 5, and AvaOptions.

While MetaTrader is a third-party software, all the other platforms have been built and maintained by AvaTrade.

AvaTrade offers one of the widest varieties of trading platforms for any broker operating in Canada.

Customer Support: AvaTrade’s customer support team can be contacted through live chat, email, and phone calls. While they do not provide a dedicated email handle, there is a contact form on their website which can be used to send them an email. You might find their FAQs helpful too.

We contacted them through live chat and found their responses to be insightful and helpful.

AvaTrade Pros

- They offer several different trading platforms

- The variety of trading instruments is high

- They are transparent about their fees

AvaTrade Cons

- Their educational materials are not extensive

- The account-opening process is slightly cumbersome

- 300 CAD minimum deposit

What is the CIRO?

CIRO is short for the Canadian Investment Regulation Organization. It is a self-regulatory organization established in 2008 and it is non-profit. It was formerly known as the Investment Industry Regulatory Organization of Canada (IIROC). The regulatory body was created to further strengthen the Investment Dealers Association of Canada. Canadian provinces have their own regulatory bodies. These provinces are 10 in number and are part of the Canadian Securities Administrators (CSA). Though they are independent, the CSA recognizes the CIRO as a regulatory body.

When a Canada-based broker gets their CIRO license, they automatically become a member of the Canadian Investor Protection Fund (CIPF). The CIPF protects traders’ funds that are held by brokers. This protection is limited as it does not cover losses incurred from trading activities. The protection only comes into play if a forex broker becomes insolvent or goes bankrupt. The CIPF ensures traders get their money back when this happens.

Other ways the CIRO protects traders include:

1) Segregation of funds: The segregation of funds involves forex brokers keeping clients’ money in a separate account. That is, your money and the broker’s money are not in the same account. This has good implications for forex traders. The implication is that the creditors of brokers cannot lay claim to traders’ money in case of bankruptcy. Also, traders’ money will not be used for hedging trades with counterparties.

2) Risk Disclosure: The leverage for CFDs in Canada is higher compared to other strictly regulated regions like the UK and Australia. To make sure that traders don’t abuse this, the CIRO requires all CFD brokers in Canada to provide a ‘risk disclosure’ statement or document. This document is to give full information on the risks that accompany trading leveraged products like CFDs.

3) Licensing Brokers: The CIRO gives licenses brokers. This is very important. Apart from getting a unique license number, the license ensures that brokers adhere to strict rules that protect traders. One of the rules is that brokers must meet certain capital requirements. A broker with sufficient capital is safe and will likely not be fraudulent. Brokers may find it hard to comply with these restrictions in a profitable manner. However, traders get a trading environment that is free of scams and malpractices.

4) Sanctions: As a regulatory body, one of the roles of the CIRO is to investigate any broker that goes against the agreement and restrictions of their license. Any broker that is guilty of this can be sanctioned by the CIRO (up to $5 million). This is why you should only trade with CIRO regulated brokers. This is the only way to ensure your funds are safe with brokers that operate in Canada.

5) Investor Recourse and Compensation: CIRO’s investor recourse and compensation is another layer of protection for you. It gives you access to the ombudsman. The ombudsman is an official that investigates your complaint against a forex broker or financial services provider.

Through the investor recourse and compensation ombudsman, you can access the Canadian Investor Protection Fund (CIPF), free legal advice, and settling of any dispute with your broker.

6) CIRO Advisor Report: CIRO places importance on the safety of investors and traders. So they regularly release advisor report. This is to help you navigate the market with relevant information. CIRO’s advisory committee include bodies like Financial and Operations Advisory Section (FOAS), the Conduct, Compliance, and Legal Advisory Section (CCLS), the Market Rules Advisory Committee (MRAC), etc.

What are the Duties of the CIRO?

Here are the general duties of the CIRO:

– The CIRO performs a regular review of the firms they regulate to make sure they are in line with CIRO rules.

– The CIRO determines the capital requirement of all regulated firms.

– If there is an act of misconduct, it is the duty of the CIRO to investigate and determine the appropriate punishment for the guilty firm

– The CIRO makes sure that the employees of regulated firms are well-trained for their roles. They also carry out background checks on staff of regulated firms.

How the CIRO Harmonized with Provincial Regulators in Canada

Canada operates a unique regulation structure. While the CIRO is the national regulatory body, provinces and regions within the country also have their regulatory bodies. Because of this, the two entities had different rules. The difference in the rules caused confusion for traders in Canada. CFD trading is complex as it is. These two sets of rules only made it more complicated.

The origin of this complication is the way provincial regulators classified trading instruments. Some provincial regulators classified them as OTC derivatives while regions like Montreal and British Columbia classified them as securities. This led to a disparity in rules because derivatives are subjected to trading rules. Securities, on the other hand, are subjected to investment rules.

Realizing this, the CIRO and provincial regulators created new harmonized rules. These rules used the same classification (trading instruments as derivatives). This step resolved all complications and changed the ways forex brokers operate in Canada. These new rules now guide the conduct of forex brokers in the country.

The Canadian Investment Regulation Organization gets funding from the regulated entities within it. In exchange for regulatory services, these entities fund CIRO. They pay an annual fee which is dependent on various factors. These factors include their revenues, capital, number of investment advisors, and trading activity.

How to Verify the CIRO License of Forex Broker?

You can easily verify a forex broker’s regulation with the CIRO. It is important to verify this information to protect yourself against scams and fraudulent brokers. In addition, CIRO regulated brokers have to adhere to strict policies that have been put in place to protect traders. You reduce risks to a level when you choose a regulated broker.

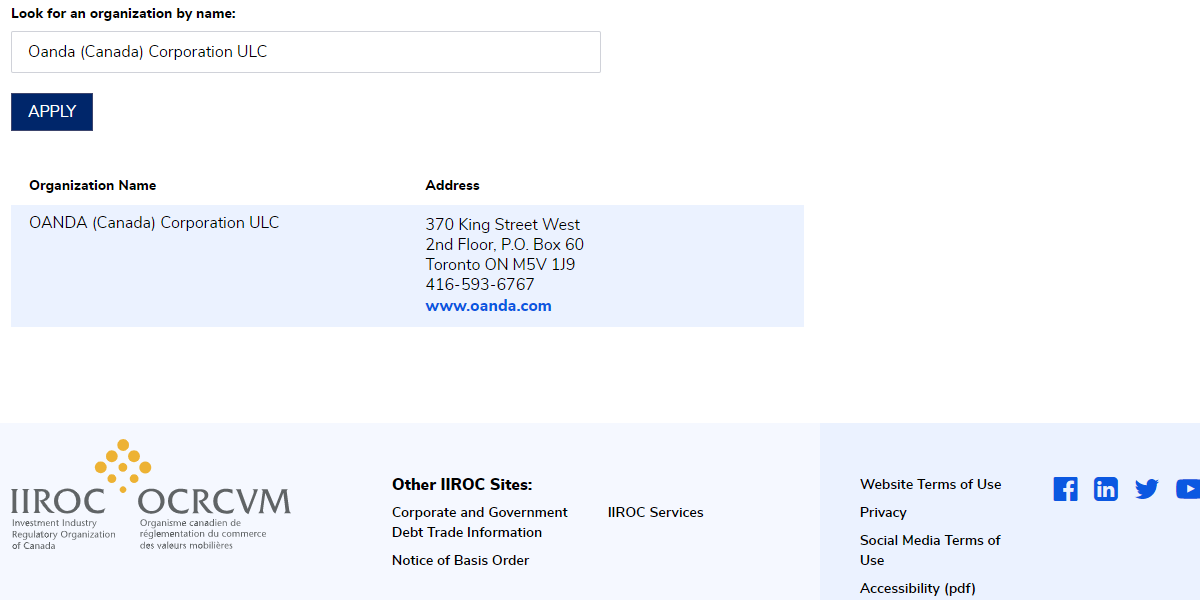

We’ll take you through the verification process using the example of Oanda.

Step 1) The first step is to visit Oanda’s Canadian website and check if they claim that they are verified by the CIRO. You can do this by typing “Oanda Canada” on Google and visiting the first website that shows up.

Step 2) Next, you go to the bottom of their “About Us” page where they have listed all the licenses that they have received from various regulators.

Step 3) As you can see, Oanda (Canada) Corporation ULC has been licensed by the CIRO according to the Oanda website. Now, we visit the CIRO website and search for the broker name “Oanda (Canada) Corporation ULC” on the website.

Step 4) We’ll get a search result that shows that the company is indeed licensed by the CIRO.

Step 5) Hence, we can be sure that the website is legitimate and Oanda is regulated by the CIRO, and safe to trade through for Canadian traders.

Factors To Consider When Choosing CIRO Regulated Broker

You should not consider CIRO regulation in isolation. There are other factors that make up an ideal trading condition. After you have confirmed that a broker is regulated with the CIRO, you should consider the following factors too.

Fees: For trading fees, you need to check the spreads, swaps, and commissions. Some brokers do not charge a commission per lot. But they all charge spreads and swaps. These charges are subtracted from your profit if you win a trade. If you lose, it is added to your loss thereby increasing it.

Since these fees affect your trading capital, it is important to check if they are low or excessive before signing up.

Non-trading fees usually vary and depend on how your broker operates. Common charges here include inactivity fees, currency conversion fees, and deposit/withdrawal fees. Make sure you speak with your broker to know the ones they charge.

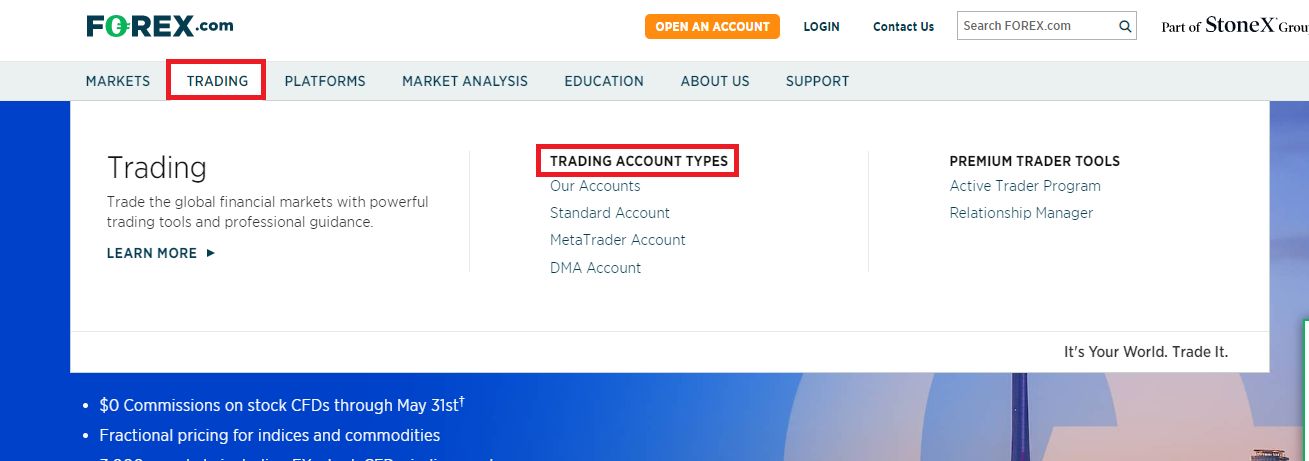

Account types: Account types is another crucial factor. Most brokers offer more than one account. These accounts usually differ by execution, fees, commissions, and number of CFDs sometimes. CIRO regulated brokers have their account types on their websites. You can check and compare so you can make your choice.

Apart from fees, trading accounts might actually vary by execution. A broker might have an account with a dealing desk execution, ECN execution, or STP execution. Most traders prefer ECN or STP models as there is no conflict of interest or trading against the broker.

Here is how you can check your broker’s account type with Forex.com as an example. Make sure you are on the Canadian version of their website. On the homepage, click ‘TRADING’. Under ‘Trading Account Types’, click ‘Our Accounts’. The step is illustrated below.

If you execute the first step correctly, you will arrive at this page

From the image, it is clear that Forex.com has two accounts. To explore the conditions within each account, you can click ‘Learn more’. You will find the link under the description of each account.

Wide range of CFDs:After choosing a regulated broker, you should verify if the broker has a wide range of CFDs. If their CFD range is wide, then there is a chance they have your favorite CFDs. So what should you look out for?

First, you want to know the classes of CFDs available. Apart from forex, are there indices, shares, commodities, and precious metals? The second thing to look out for is the number of CFDs in each asset class. It is possible for a broker to have all classes of CFDs with a limited number of tradeable instruments.

A wide range of CFDs with a high number of tradeable CFDs is the ideal trading condition

Trading Platforms: What you want to check here is the platform offered. Is it a proprietary platform developed by the broker? or a third-party platform like MT4, MT5, or cTrader?. Most forex brokers tend to have more advanced features on their proprietary platform so you should check.

In addition, you want to check if the platforms are available on desktops and mobile phones. This helps you combine the full view that the desktop offers with the on-the-go feature of mobile apps.

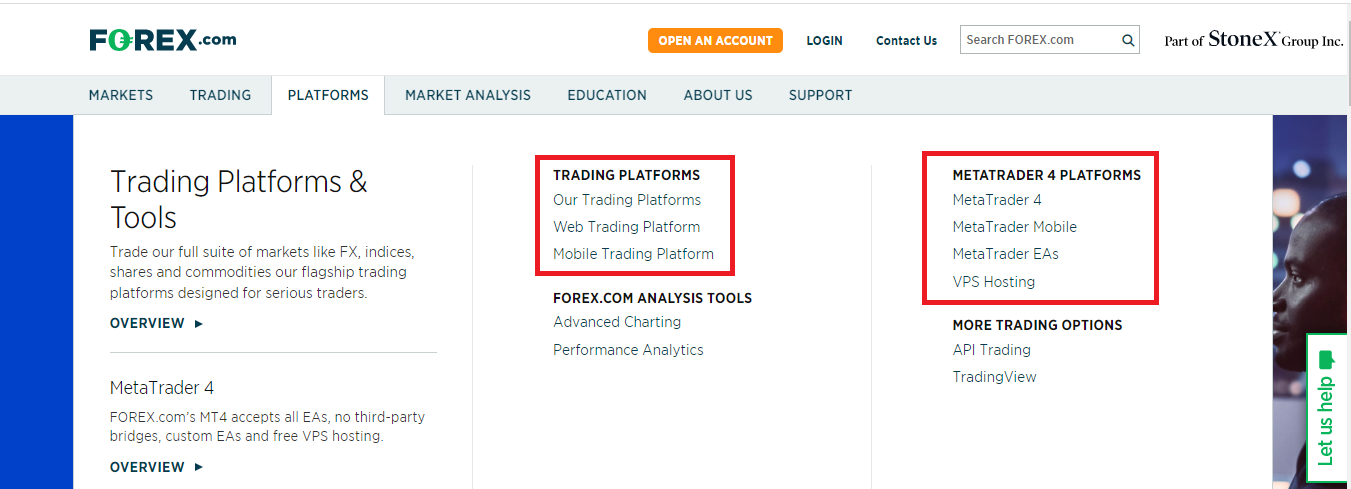

Here is how you can check your broker’s trading platforms ( We will use Forex. om as an example). To ensure you get the relevant information, go to forex.com’s Canadian website. On their homepage, click ‘PLATFORMS’. Check the illustration below

From the image, you can see the platforms are divided into two. The first section that says ‘Our Trading Platforms’ represents forex.com’s proprietary platforms. The second section is the third-party platform (MetaTrader 4). To know more about either, click the options below them.

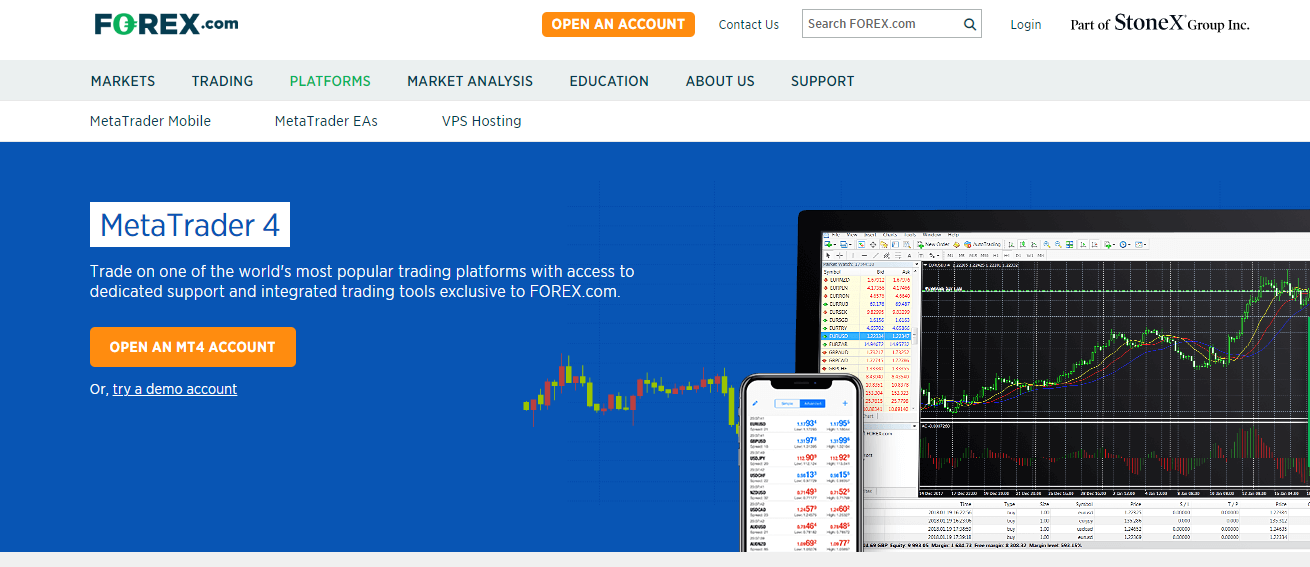

If you click MetaTrader 4 for example, you will find that it s available on desktop and mobile phones as shown below

Funding and Withdrawals:If you are in Canada, you need to be able to deposit/withdraw your funds via local banks or credit/debit cards. This is the bare minimum. After these, you can consider if your broker supports e-wallets like Skrill and Neteller or other means available locally. You can also check if PayPal is available.

Beyond the payment methods, you should consider how fast funding/withdrawal is. Deposits should be processed quickly and reflected in your account instantly. Withdrawals should not be more than 3 business days.

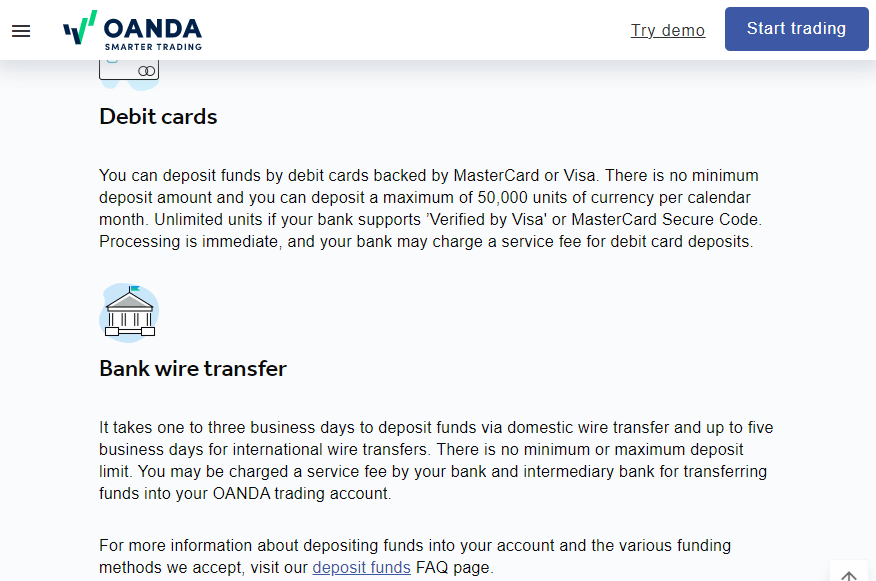

Here is an example from Oanda’s website for deposits.

The CIRO regulated broker supports credit/debit cards, bank transfers, and PayPal. If you deposit via cards, your funds are processed immediately. Bank wire transfers take up to 2-3 business days. It is longer for PayPal at 2-6 business days.

This is why is is crucial to check this factor. You want to choose a funding or withdrawal method that has no extra charges with quick processing time.

Customer Support: You want your forex broker to be reachable if you have any inquiries. Though FAQs are available, they might not have all the answers. So you need to check other support channels available. Emails and live chats are quite common. Some brokers also have a Canadian mobile number.

Are there assets prohibited by CIRO?

Countries are allowed to ban any CFD or trading asset they want. For example, retail CFD trading is not allow in the US. Furthermore, spread betting is only allowed in the UK and Ireland. However, tt is totally prohibited in the US and other countries in the EU.

Most CFDs are allowed by CIRO. Spread betting is also permitted. The only trading instruments prohibited by CIRO is binary options. Forex brokers in Canada are allowed to other trading instruments.

Do forex traders pay tax in Canada?

Yes, you will pay tax if you trade forex in Canada. Profits from trading are considered as capital gains. However, the tax rate depends on how much you make and how long you held your trading position. The tax rate can be as high as 50% in some cases.

CIRO is not in control of the taxation of forex traders.

FAQs on Best CIRO Regulated Forex Brokers

Who is the most trusted forex broker?

There are several forex brokers operating in Canada that are highly trustworthy. You should feel safe trading through any of the brokers on this list. Remember to only trade through a broker that is licensed by the CIRO.

Which brokers are allowed in Canada?

Canadian traders can safely trade through and forex and CFD broker that is licensed by the CIRo. CFD trading is legal in Canada, so there shouldn’t be any issues.

Is forex trading illegal in Canada?

Forex trading is legal in Canada and is overseen by the CIRO. However, Canada has a complex regulatory environment. There are regions with their own local regulator and requirements for forex trading.

In Alberta, for example, there is the Alberta Securities Commission (ASC). You should contact your local authorities to know how it works in your own region.

What are the factors I should check before trading with a broker?

You should check the regulations and licenses held by the broker, the overall fees that they charge, the trading instruments that they offer, and how good their customer support is.