Forex trading is risky. Apart from the risk of losing all of your capital trading currency pairs and CFDs, you could also fall prey to fraudulent brokers. This is why different countries, including Australia, have regulatory bodies that regulated CFD brokers. The Australian Securities and Investments Commission (ASIC) regulates forex brokers in Australia.

ASIC regulated forex brokers are considered low-risk because you can be sure of the safety of your deposit/funds. Do not make the mistake of signing up with a forex broker that is not licensed with ASIC. You could fall victim to fraud and lose all of your money.

To help you in your search for a regulated broker in Australia, we have reviewed six brokers and their trading conditions.

Comparison of ASIC Regulated Forex Brokers

| Broker | AFSL Number | Date licensed | Min. Deposit | Visit |

|---|---|---|---|---|

| Pepperstone | 414530 |

04/02/2013

|

No minimum deposit

|

Visit Broker |

| IC Markets | 335692 |

02/07/2009

|

AUD 200

|

Visit Broker |

| eToro | 491139 |

04/09/2017

|

$50

|

Visit Broker |

| FP Markets | 286354 |

31/05/2004

|

AUD 100

|

Visit Broker |

| CMC Markets | 238054 |

24/02/2004

|

No minimum deposit

|

Visit Broker |

| Plus500 | 417727 |

09/10/2012

|

AUD 200

|

Visit Broker |

Note: The minimum deposit is as per information on these brokers’ websites in May 2022. Please see the general trading conditions below.

Best ASIC Regulated Forex Brokers

Here are 2022’s best ASIC regulated forex brokers in Australia:

- Pepperstone – Overall Best ASIC Regulated Forex Broker

- IC Markets– ASIC Regulated Broker with Raw Spread Account

- eToro – Australian Forex Broker with Copy Trading

- FP Markets– Forex Broker with ASIC Regulation

- CMC Markets– ASIC Regulated Broker with Most CFD Instruments

- Plus500– Forex Broker with Zero Commission in Australia

#1 Pepperstone – Overall Best ASIC Regulated Forex Broker

Pepperstone is an ASIC regulated broker. They have a current license status having been licensed since 04/02/2013. They are licensed are Pepperstone Group Limited and are considered low-risk. Their AFSL number is 414530.

You can trade currency pairs and other CFDs on their Razor Account or Standard Account. No minimum deposit is enforced to open these accounts. However, it is recommended that you deposit a minimum of AUD 200 because of the margin.

Pepperstone’s spread for major pairs is low with a 0.24 pips average spread (Razor Account) for AUD/USD, and 0.84 pips average spread for their Standard Account. There is also no account inactivity fee. Commissions are charged on their Razor Account only (AUD 3.5 per standard lot). This means the round-turn commission is AUD 7. If you use their cTrader, the commission is fixed at $3 per standard lot ($6 round-turn).

Eight deposit methods are available which include: credit/debit card, POLi, Bpay, PayPal, Union Pay, Skrill, and Neteller. You can choose your preferred withdrawal method in your secure client area. No extra charges for deposit/withdrawal.

Australia-based traders can get support via email, live chat, and an AU toll-free mobile number.

We have an in-depth Pepperstone Review for Australia-based traders. You can read it for more on this broker.

Pepperstone Pros

- Regulated with ASIC

- Fast execution

- ECN type account is available

- Pepperstone supports cTrader

- No deposit and withdrawal charges

- Zero inactivity fee

Pepperstone Cons

- Recommended minimum deposit is high

- Extra commission on standard account

- No shares CFDs on MT4

#2 IC Markets – ASIC Regulated Broker with Raw Spread Account

IC Markets is licensed with ASIC as International Capital Markets Pty Limited with AFSL number 335692. Their license status is current and they have been licensed since 02/07/2009. IC Markets is a low-risk broker.

Two account types are available with IC Markets – Raw Spread Account and Standard Account. With AUD 200, you can start trading on either account type.

The average spread for AUD/USD is 0.17 pips (Raw Spread Account) and 0.77 pips (Standard Account). Other major pairs also have low spreads. IC Markets also charge AUD3.50 per standard lot on their MT4 Raw Spread Account. This brings the round-turn commission to AUD 7. cTrader commission is $3 per standard lot ($6 round-turn). There is no extra commission per lot on their Standard Account and there is no inactivity fee.

Furthermore, IC Markets support easy and convenient deposit methods like credit/debit cards, Neteller VIP, Broker-to-Broker, Skrill, Bpay, bank wire transfer, and PayPal. You can find withdrawal methods in your secure client area when you sign up. There are no extra fees for deposits/withdrawals.

Support is available via email, live chat, and AU mobile number. You will also find the FAQs section useful.

Read our complete IC markets review for more.

IC Markets Pros

- ASIC regulation

- Low spreads on Raw Account

- Good customer support

- Good educational materials

- No deposit and withdrawal charges

IC Markets Cons

- Minimum deposit is AUD 200

- You pay inactivity fee

- Rollover charges

#3 eToro – Australian Forex Broker with Social Trading

: eToro is licensed with ASIC as eToro AUS Capital Limited. They have been licensed since 04/09/2017 with current license status. eToro are low-risk to trade with. Their AFSL number is 491139.

eToro offers just one live trading account. The minimum deposit for traders in Australia is $50.

eToro’s overall fees are high. The spread for AUD/USD is 1 pip. Though there is no commission for trading currency pairs and CFDs, there are overnight charges and an account inactivity fee of $10 per month, and currency conversion fees.

Deposit/withdrawals are convenient through credit/debit cards, PayPal, and bank transfers. No extra charges for deposits but there is a withdrawal fee of $5.

eToro offers its proprietary trading platform. Metatrader, cTrader, or any other platforms are not available.

Australia-based traders can get support via email and live chat.

eToro is one of the brokers we have reviewed for Aussie traders. You can read the review here.

eToro Pros

- eToro is regulated in Australia

- Minimum deposit is low ($50)

- Copy trading is supported

- Low spreads for major currency pairs

eToro Cons

- $5 withdrawal charges

- Currency conversion charges

- No MT4/MT5 or any other platform

#4 FP Markets – Forex Broker with ASIC Regulation

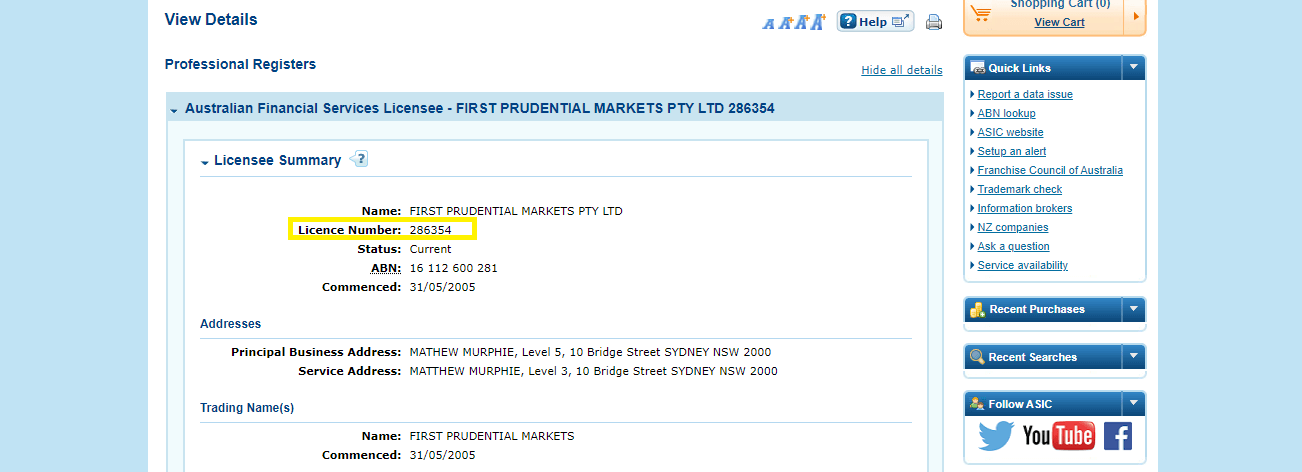

: FP Markets is an ASIC regulated broker. Their registered name is First Prudential Markets Pty Limited with AFSL number 286354. According to ASIC, FP markets have been licensed since 31/05/2005 and their license status is current.

You can open a Standard or Raw ECN Account with FP Markets. The minimum deposit for both accounts is AUD 100.

For fees, the average spread for AUD/USD is 0.3 pips on the Raw ECN Account and 1.4 pips on the Standard Account. The commission is built into the spread on Standard Account. On the Raw ECN Account, there is a round-turn commission of AUD 7 for standard lots. The swap for long and short positions for AUD/USD is AUD20.00 (charged). No inactivity fee.

Metatrader 4 and 5 are supported.

For AUD deposits/withdrawals, easy methods such as credit/debit cards, Skrill, Neteller, and bank transfers are available. No extra deposit/withdrawal charges.

Support is available for traders in Australia via email, live chat, and local mobile numbers. We experienced no holding time with their live chat support.

FP Markets Pros

- ASIC regulation

- Direct Market Access (DMA) is available

- Over 10,000 trading instruments

- ECN type account

FP Markets Cons

- High rollover charges

#5 CMC Markets – ASIC Regulated Broker with Most CFD Instruments

: They are licensed with ASIC as CMC Markets Asia Pacific Pty Ltd. Their AFSL number is 238054 and they hold a current license. Their regulation with ASIC commenced 24/02/2004 and are considered low-risk.

CMC Markets offer CFD Account and Corporate Account. No minimum deposit for both accounts.

The minimum spread for AUD/USD is 0.7 pips. CMC Markets do not charge an extra commission per standard lot but there are rollover charges. There is also a monthly AUD 15 inactivity fee. Total fees are low

CMC Markets have the widest market range in this review. They offer over 300 currency pairs and over 10,000 CFDs.

They support MT4 and offer their proprietary Next Generation trading platform.

Easy deposit/withdrawal via credit/debit card, POLi, PayPal, and bank transfer. CMC Markets do not charge extra fees for deposits/withdrawals. Customer support is good. You can reach CMC Markets via email and local mobile number.

Read our complete CMC Markets Review for more on this broker.

CMC Markets Pros

- No minimum deposit

- Guaranteed stop loss orders

- Over 10,000 trading instruments

- Good education through their Opto sessions

- Zero commission for forex pairs

CMC Markets Cons

- Inactivity fees

- No cTrader

#6 Plus500 – Forex Broker with Zero Commission in Australia

: Plus500 is regulated in Australia with ASIC as Plus500AU Pty Ltd. They hold a current license and have been regulated since 09/10/2012. Plus500’s AFSL number is 417727 and are considered low-risk.

Plus500 offers just one account type with AUD 200 minimum deposit.

No commission for currency pairs and the spread for AUD/USD is 0.8 pips. There are overnight charges as well. In addition, you pay a USD 10 inactivity fee after 12 months of no trading activity. There is also a premium fee for guaranteed stop-loss orders that are triggered.

Plus500 offers their proprietary trading platform. Deposit/withdrawals are easy via credit/debit card, Skrill, bank transfer, iDeal, BPay, etc. There are no extra deposit/withdrawal fees.

You can get support via email or WhatsApp chat.

Plus500 Pros

- Multiple tier-1 regulation

- Guaranteed stop loss orders

- Zero commission

- No deposit/withdrawal fees

Plus500 Cons

- No education contents for traders

- No metatrader 4/5

What is ASIC?

The main regulator of the financial sector in Australia is known as the Australian Securities and Investments Commission (ASIC). The organization oversees all of Australia’s financial markets, as well as the clearing and settlement of securities in the country. ASIC operates under the jurisdiction of the Australian Companies Act and the Market Integrity Rules. All forex brokers with offices in Australia must obtain an ASIC license to operate before they can start accepting clients there.

ASIC was formerly named Australian Securities Commission (ASC). The ASC was a replacement for National Companies and Securities Commission (NCSC) and the Corporate Affairs offices of the states and territories. NCSC became ASC in 1991. ASC was renamed ASIC in 1998, taking on the responsibility of consumer protection in insurance and deposit taking.

How Does ASIC Protect You?

The Australian Securities and Investments Commission acts in the best interest of forex traders. As an authority over forex brokers, they make sure financial services providers are set up to reduce the risk traders are exposed to. In this section, we will be looking at the structures ASIC has put in place to protect you and your funds.

1) Leverage restriction: ASIC regulated brokers have a leverage cap for CFDs. The maximum leverage for retail traders is 30:1 (currency pairs). There are leverage restrictions for commodities, indices, and stocks too. The restriction ensures that you do not abuse leverage. Leverage amplifies losses. Lower leverage ensures that traders are not exposed to damaging losses.

2) Negative balance protection: Negative balance protection was put in place to make sure trades do not lose more than their trading capital. Without this, your account balance can go into the negative. That means you will have to pay your broker.

However, ASIC regulated brokers are under orders to make sure no traders lose more than their account balance. Instead of the trader paying, most brokers absorb the debt and take responsibility for it.

3) Segregation of funds: The segregation of funds involves forex brokers keeping clients’ money in a separate account. That is, your money and the brokers’ money are not in the same account. This has good implications for forex traders. The implication is that the creditors of brokers cannot lay claim to traders’ money in case of bankruptcy. Also, traders’ money will not be used for hedging trades with counterparties.

4) Risk Disclosure: Most traders are drawn to forex trading ignoring the risks. Even with all the restrictions put in place by top-tier regulatory bodies, more than 80% of forex traders lose their capital trading CFDs. For the sake of transparency, all ASIC regulated brokers are required to state clearly that your capital is at risk when you trade CFDs. With this information made public, you are more aware of the risks of trading CFDs.

Typically, you will find it at the header or footer of the CFD broker’s website. Here is a screenshot showing CMC Market’s risk disclosure as an example for you.

5) Australian Financial Complaints Authority: The AFCA is an external dispute resolution provider. This body resolves any issue between traders and brokers. Retail and Professional traders have access to the AFCA. However, the latter might be treated differently because of their status as experienced wholesale investors. They might even be excluded at the AFCA’s discretion.

6) Financial Reporting: It is required by ASIC that all brokers they regulate must submit audited financial reports. This is to ensure that brokers are compliant and in a good place financially.

In conclusion, these benefits are enough reasons for you to choose an ASIC regulated broker. In regions where these strict regulations are not in place, data show traders lose a lot of money.

How to Check a Forex Broker’s ASIC Regulation?

Trading with an ASIC regulated forex broker is crucial to reducing the risk of fraud. This is why it is essential to know for sure if your preferred forex broker is licensed with them. You can follow this simple guide to check a forex broker’s ASIC regulation. Our example is FP Markets.

1) Find FP Markets’ regulation statement and AFSL number in the footnote of their website as shown below. Kindly note that their licensed name is First Prudential Markets and their AFSL Number is 286354

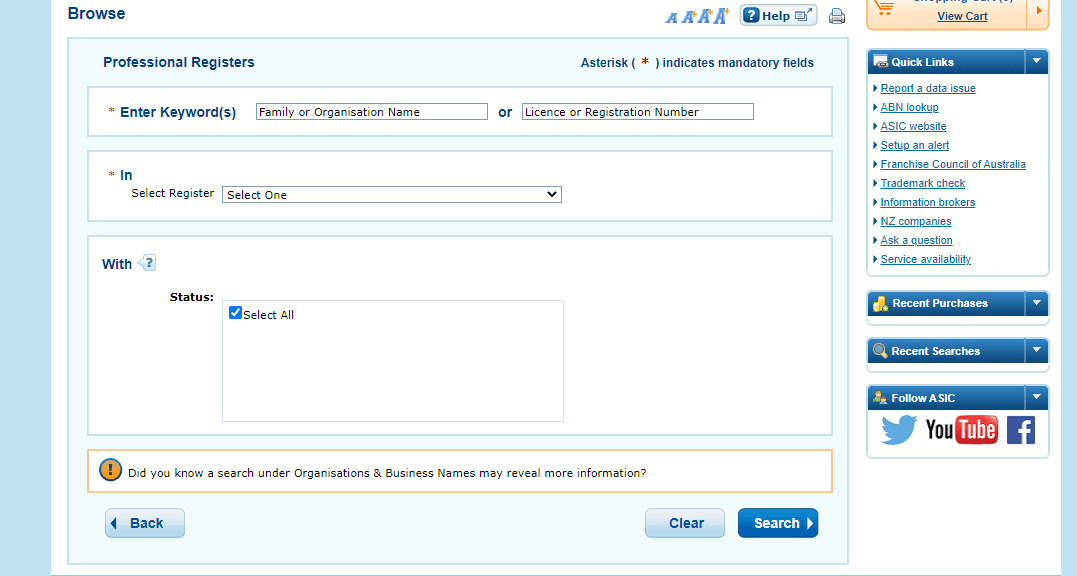

2) On your browser, go to ASIC Connect’s Professional Register Search. You should arrive at the image below:

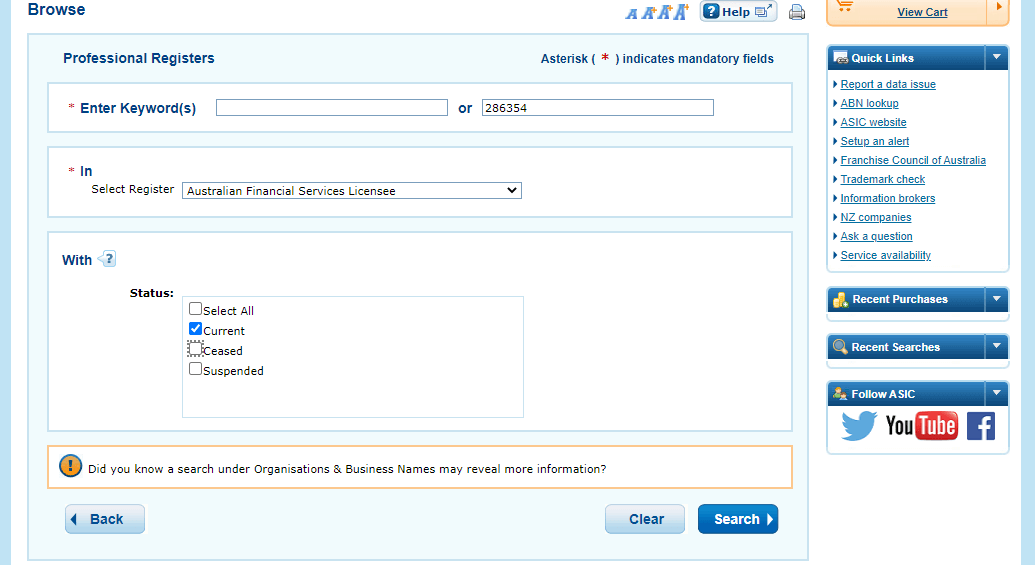

3) Fill in the broker’s AFSL number and select Australia Financial Services License. Under status, select current. Then click on search

4) Your search result should bring you here. You can see the broker’s licensed name and AFSL number (in the yellow box) matching the details in the footnote.

Other Important Factors for ASIC Regulated Brokers

Apart from ASIC regulation, you should consider other trading conditions before choosing an ASIC regulated broker. ASIC regulation combined with good trading conditions gives you a complete trading experience. Here are other factors

Bonuses/Promotions: Bonuses and promotions are marketing strategies used by forex brokers to get traders to sign up with them. These promotions are usually monetary. They are usually tied to opening an account with a certain amount or trading a certain volume.

These leads to traders taking excessive risks and they end up losing money again and again. So ASIC mandated that all brokers that operate in Australia must not offer bonuses or promotions. If you see any forex broker offering bonuses in Australia, avoid them totally.

They are not regulated with ASIC.

Account type: Trading conditions vary by account. Some accounts have low spreads while some have higher spreads. Some brokers even offer just a single account so you do not have any choices. Another factor determined by account type is the commission. Most brokers with multiple accounts usually have an account that is commission-free. This is why it is important to check this factor so you can compare the account types and choose the one that fits you.

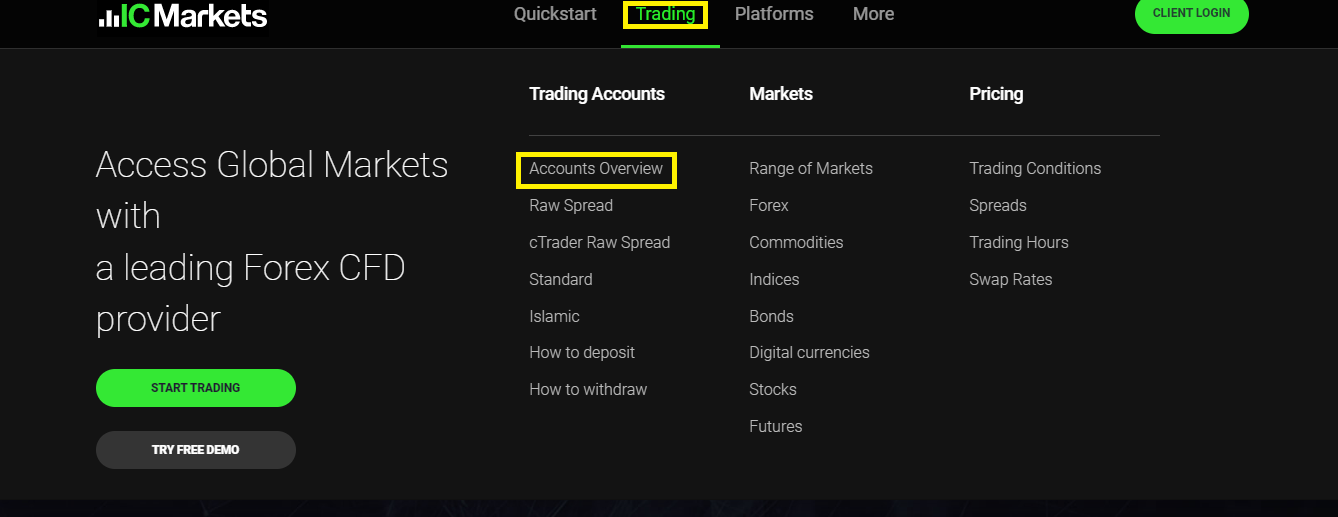

Let us see an example with IC Markets. Because forex brokers do not operate the same way across regions, it is important you go to their local website. This will ensure that you get information that is relevant.

So for this example, we will use IC Market’s Australian website . When you get to the homepage, click ‘Trading’, then ‘Accounts Overview’ (both in the yellow box). The image below illustrates this step

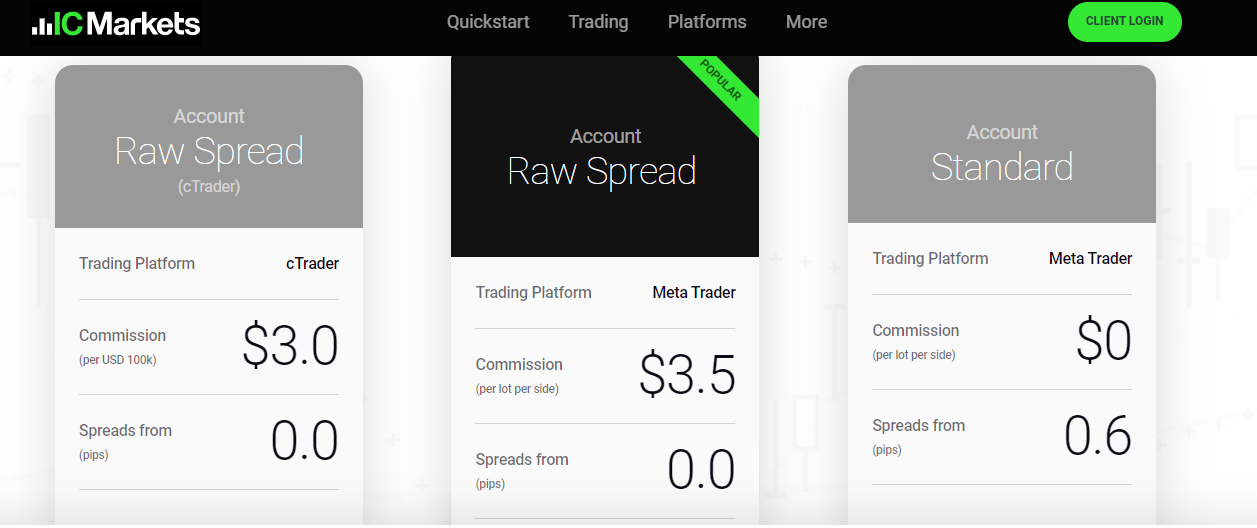

After the step above, you will see IC Markets Account types at a glance as shown below.

With IC Markets, you will observe that basic fees (spreads and commissions) can be seen for each account. In addition, the trading platforms that support each account can also be seen on a single tab. If you follow this step for ASIC regulated brokers, you can choose the ideal trading account for you.

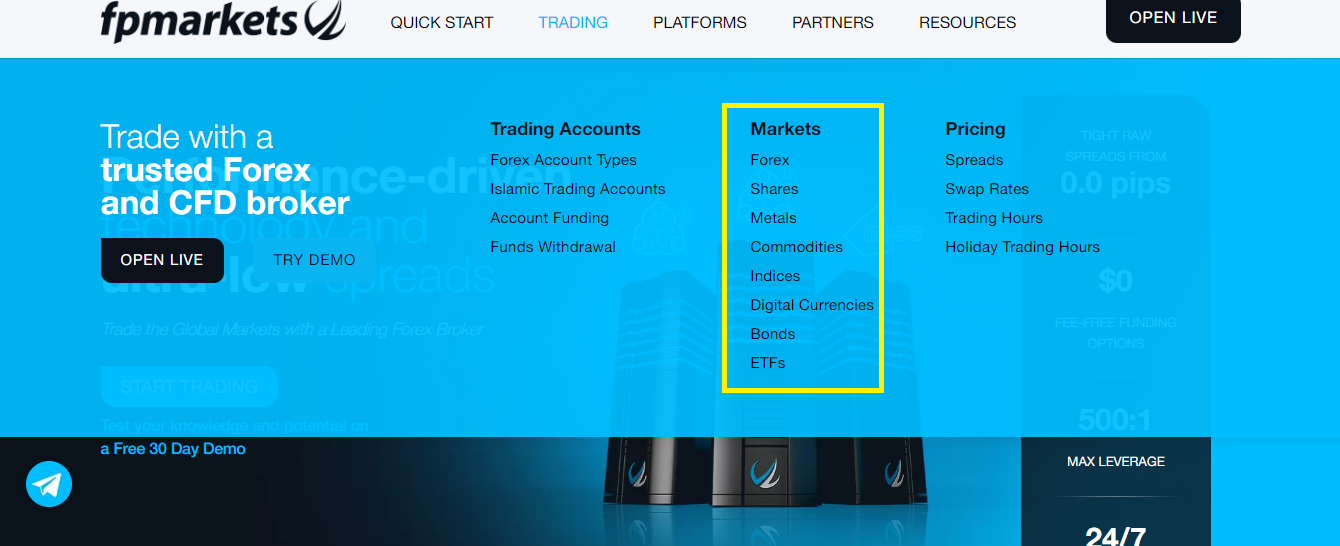

Wide range of CFDs: After choosing a regulated broker, you should verify if the broker has a wide range of CFDs. If their CFD range is wide, then there is a chance they have your favorite CFDs. So what should you look out for?

First, you want to know the classes of CFDs available. Apart from forex, are there indices, shares, commodities, and precious metals? The second thing to look out for is the number of CFDs in each asset class. It is possible for a broker to have all classes of CFDs with a limited number of tradeable instruments.

A wide range of CFDs with a high number of tradeable CFDs is the ideal trading condition. Here is an example with FP Markets. If you go to their homepage and click ‘TRADING’, you will see their market range as displayed below

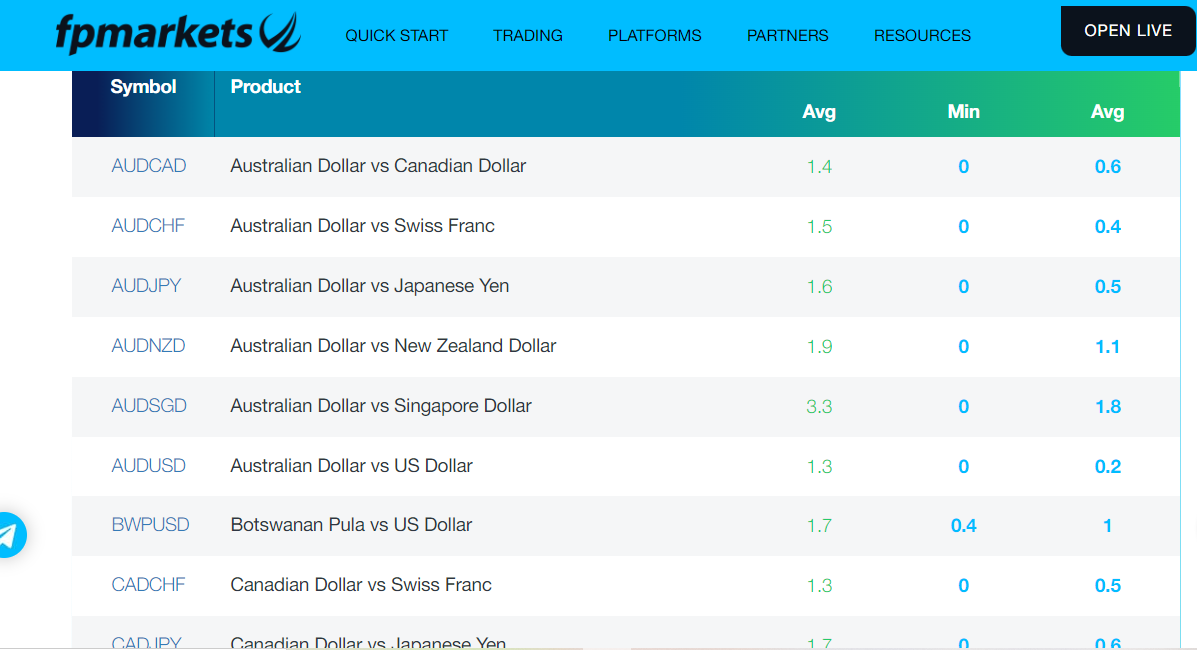

If you click any of the CFD classes under ‘MARKET’, you will find all the info you need including the spreads. If you click ‘Forex’, you will see more details on currency pairs as shown below

Funding and Withdrawals: For UK traders, you need to be able to deposit/withdraw your funds via local banks or credit/debit cards. This is the bare minimum. After these, you can consider if your broker supports e-wallets like Skrill and Neteller.

Beyond the payment methods, you should consider how fast funding/withdrawal is. Deposits should be processed quickly and reflected in your account instantly. Withdrawals should not be more than 3 business days. You can check this factor to make sure there is no delay in your transactions. Here is an example with Pepperstone Australia.

On their homepage, click ‘Pricing’. You will see a dropdown with four options. One of them is ‘Funding and withdrawals’. Click it.

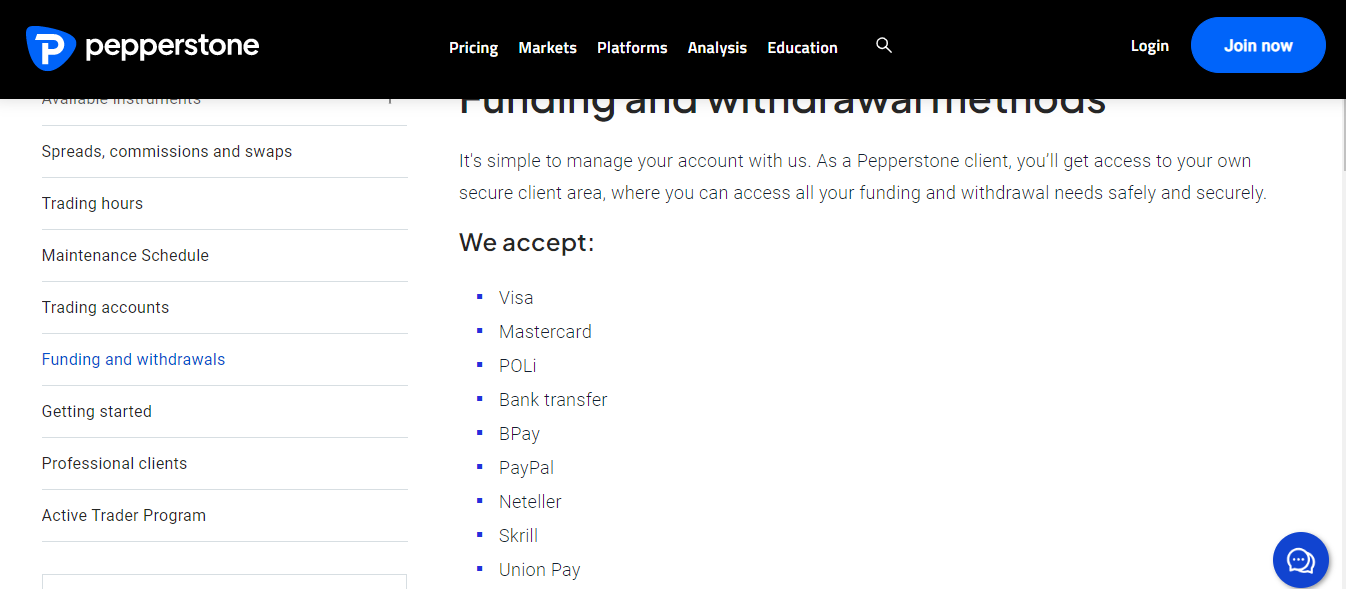

When you click ‘Funding and withdrawals’, you will be taken to Pepperstone’s funding page. Here is how the page looks

Pepperstone, like most Australian brokers, support local payment methods like UnionPay, BPay, and POLi. These methods plus popular means like credit/debit cards, bank transfer, and e-wallets makes payment easy for traders.

Trading Platforms: What you want to check here is the platform offered. Is it a proprietary platform developed by the broker? or a third-party platform like MT4, MT5, or cTrader?. Most forex brokers tend to have more advanced features on their proprietary platform so you should check.

In addition, you want to check if the platforms are available on desktops and mobile phones. This helps you combine the full view that the desktop offers with the on-the-go feature of mobile apps.

Customer Support: You want your forex broker to be reachable if you have any inquiries. Though FAQs are available, they might not have all the answers. So you need to check other support channels available. Emails and live chats are quite common. Some brokers also have a UK mobile number.

Does ASIC fine brokers?

ASIC has a track record of enforcement and moving against entities that breach their rules. While they may be to slow to act in some cases, it is advisable you do not see them as a figurehead. Here are some examples of brokers that have been fined by ASIC.

Forex Capital Trading: Forex CT was fined by ASIC in 2020. The reason for the fine include: conflicted remuneration for sales staff and failure to prioritize traders’ best interest. Forex CT paid AU$20 million in fine.

Interactive brokers: In 2021, ASIC reached out to Interactive brokers after a traders activities triggered ASIC’s alerts. The broker admitted negligent and reckless conduct due to suspicious trading. ASIC fined the company AU$832,500 in 2023.

Openmarkets: The broker was fined AU$4.5 million for not having their trading systems in place. Their systems was not suitably separating active trades from price-manipulating trades. This happened in 2023.

Does ASIC compensate retail traders?

As a body, ASIC does not compensate retail traders. If retail traders lose money due to breaches and negligence from forex brokers, ASIC will oversee the payment of compensations.

For example, ASIC over saw the payment of $17.4 million in compensation to over 2000 retail traders. The agreement to pay the fee began in 2021. A number of CFD brokers and crypto firms were involved.

What are the risks of using a non-ASIC regulated broker?

You will not have enough protection. ASIC is a tier-1 regulator so they hold CFD brokers to stringent standards. If these brokers breach any rule, they can be fined or banned by ASIC. In jurisdictions with loose regulations, this is not the case. You might end up being a victim of fraud and bad business practices.

FAQs on Best ASIC Regulated Forex Brokers

What forex brokers are regulated with ASIC?

According to our review, Pepperstone, IC Markets, eToro, CMC Markets, FP Markets, and Plus 500 are all regulated by ASIC. There are other forex brokers as well that are licensed with ASIC, but we have not reviewed them yet.

How do I find out if a forex broker is ASIC regulated?

To verify a forex broker’s ASIC regulation, search the professional register. Make sure you fill in the correct details for the broker. You can also check the footnote at the broker’s website to find the regulatory information. Also, be sure to properly check in order to avoid any fake & unregulated brokers.

Which ASIC regulated forex brokers have low spread?

Plus500, IC Markets, CMC Markets, and Pepperstone have low spreads for AUD/USD and other major currency pairs. IC Markets & Pepperstone also have a Raw spread ECN Type Trading accounts where they charge a commission per lot & offer Raw spreads from 0 pips with many currency pairs.

Is forex regulated in Australia?

Yes, forex is regulated in Australia. ASIC monitors the activities of forex brokers in Australia. They have been around for over 20 years. Any broker that seeks to accept Aussie traders must be licensed with ASIC.

What is ASIC Regulation?

ASIC, expanded, means Australian Securities and Investments Commission. ASIC regulation means a broker is licensed to operate in Australia. In some cases, they might also offer financial services. ASIC issues all Australia-based forex brokers the Australian Financial Service License (AFSL) number. This number distinguishes one broker from the other.