Forex brokers are middlemen who provide a platform for trading financial instruments. Their services connect traders to the financial market, making them crucial when it comes to trading.

It is important to note that while forex brokers play a vital role in financial instruments trading, there are some brokers who are fraudulent and scam traders of their money. To avoid this, you should only trade with regulated brokers as they are obliged by law to protect clients’ funds and provide transparent and fair trading services.

The Monetary Authority of Singapore (MAS) is the agency of the government of Singapore that regulates the activities of forex brokers in Singapore and sets out their rules for operations. The MAS rules are in place to protect traders based in Singapore, so you can complain to them at any time if a broker violates the rules, and they will help you get redress.

However, if you trade with a broker that is not regulated by MAS, the agency will not be able to protect you as the said broker is not in its jurisdiction and therefore not obliged to follow the MAS rules.

In this post, we will examine six forex brokers regulated by MAS in Singapore and compare their offerings as of September 2024. We will look at regulation dates, account types, minimum deposits, fees (trading & non-trading), available tradable instruments, trading platforms and customer support.

Comparison of MAS Regulated Forex Brokers

| Broker | MAS License No | Authorised Since | Min. Deposit | Visit |

|---|---|---|---|---|

| Plus500 | 201422211Z |

2014

|

SGD 200

|

Visit Broker |

| City Index | 201130598R |

2011

|

SGD 250

|

Visit Broker |

| Oanda | 200704926K |

2007

|

No minimum deposit

|

Visit Broker |

| CMC Markets | 200605050E |

2006

|

No minimum deposit

|

Visit Broker |

| IG Markets | 200510021K |

2005

|

S$250

|

Visit Broker |

Note: The spread and the minimum deposit is as per information on these brokers’ websites in September 2024. Please see the general trading conditions below.

Best MAS Regulated Forex Brokers

Here are 2024’s best MAS-regulated forex brokers in Singapore:

- Plus500 – MAS Regulated Forex Broker with 24/7 customer support

- City Index – MAS Regulated Broker with HTML5 Webtrader

- Oanda – Forex Broker with MAS Regulation

- CMC Markets– MAS Regulated Broker with Most Currency Pairs

- IG Markets – MAS Regulated Broker with Multiple Trading Platform

#1 Plus500 – MAS-Regulated Forex Broker with 24/7 customer support and negative balance protection

Plus500 is regulated in Singapore by MAS as Plus500SG Pte Ltd and licensed to offer Capital Markets Services with company registration number 201422211Z, issued in 2014.

Account types: Plus500 has only one account type for clients in Singapore, which is the Retail Account with maximum leverage of 1:20. You can only open individual accounts with this broker. Plus500 offers negative balance protection to traders, which means you cannot lose more than your deposits even if you suffer a loss.

Fees: Trading fees on Plus500 are spreads, currency conversion fees, and swap fees. Plus500 does not charge commissions on all instruments. Plus500 offers free deposits and withdrawals but charges dormant accounts after 3 months of inactivity.

Tradable Instruments: Financial instruments that you can trade on Plus500 Singapore are CFDs on forex currency pairs, shares, indices, commodities (oil, metals, and agriculture), cryptocurrencies, options, and ETFs.

Deposits/Withdrawals: You can deposit and withdraw from Plus500 with cards and bank transfers. Cards and e-wallets deposits are credited instantly and it takes up to 5 days. Withdrawals are processed within 1-3 business days and may take more days for you to receive funds.

Trading Platforms and Support: Plus500 supports a proprietary trading application – Plus500 Trader. The application is available on the web version, desktop or mobile devices. Plus500 offers 24/7 Customer support via live chat, email, WhatsApp and local phone numbers in Singapore.

#2 City Index- MAS Regulated Broker with HTML5 Webtrader

City Index is regulated in Singapore by MAS as StoneX Financial Pte. Ltd and licensed to offer Capital Markets Services with company registration number 201130598R, issued in 2011. City Index is the broker’s trading name.

Account types: Account types available on City Index are Standard Account and MT4 Account which has varying features. You can open an account as an individual or corporate entity on City Index. You can also choose to be a retail client with maximum leverage of 1:20 or an Accredited Investor (professional client) with maximum leverage of 1:50. City Index does not offer negative balance protection, which means you can lose more than your deposits.

Fees: Trading fees charged by City Index are spreads, commissions on shares, and swap fees. The broker does not charge commissions on other trading instruments asides from shares. Card deposits attract a fee, applied by the processor, while other deposit methods are free. City Index does not charge any fees for withdrawals, while the broker charges an account inactivity fee.

Tradable Instruments: Available financial instruments on City Index Singapore for trading are CFDs on forex currencies pairs, shares, indices, commodities, and metals.

Deposits/Withdrawals: Payment methods supported on City Index for deposits and withdrawals in Singapore are cards (debit/credits), e-wallets (PayNow & FAST), internet banking and bank wire transfer. Card and e-wallet deposits are credited instantly while it takes about 3 days for bank transfers. Withdrawals to cards take up to 10 business days and only 3 days for bank accounts.

Trading Platforms and Support: The broker supports the MT4 trading application and a proprietary WebTrader. You can access the platforms on the web, desktop or mobile devices. Customer support of City Index is available 24/5 via live chat, email and phone number in Singapore.

#3 Oanda – Forex Broker with MAS Regulation

Oanda is regulated by MAS as OANDA Asia Pacific Pte Ltd and licensed to offer Capital Markets Services in Singapore with company registration number 200704926K, issued in 2007.

Account types: The 2 account types offered by Oanda in Singapore are Standard Account and Premium Account. Accounts with retail status (which is the default) can trade with maximum leverage of 1:20. If you qualify as an Accredited Investor (professional client) you can trade with a leverage of up to 1:50. You can open an individual, corporate or joint account. Oanda does not offer negative balance protection for clients in Singapore.

Fees: Oanda fees include spreads, commissions, currency conversion fees, and swap fees. The broker charges a fee for deposits via PayPal, while other methods are free. Oanda also charges withdrawal fees depending on the payment method used. If your account becomes dormant for 12 months, the broker charges a monthly inactivity fee.

Tradable Instruments:Financial instruments on Oanda are CFDs on forex currency pairs, bonds, indices, commodities (oil and agriculture), cryptocurrencies and precious metals pairs.

Deposits/Withdrawals:Payment methods supported for deposits and withdrawals on Oanda Singapore are e-wallets (PayNow, DBS, PayPal, FAST, etc), cheques, internet banking and bank wire transfer. Deposits can take 1 to 5 business depending on the payment method. Withdrawals to PayPal take one business day, and up to 5 business days for cheques and bank accounts.

Trading Platforms and Support: The broker supports the MT4 trading application and a proprietary OandaTrader which are available on the web, desktop and mobile devices (Android & iOS). Oanda offers 24/5 customer services to clients via live chat, email and local phone numbers.

#4 CMC Markets- MAS Regulated Broker with Most Currency Pairs

CMC Markets is regulated in Singapore by MAS as CMC Markets Singapore Pte. Ltd and licensed to offer Capital Markets Services with company registration number and UEN (Unique Entity Number) 200605050E, issued in 2006.

Account types: Account types offered by CMC Markets are CFD Account and the Corporate Account. Retail clients can trade with maximum leverage of 1:20 or Accredited Investors (professional clients) with maximum leverage of 1:50. CMC Markets does not have negative balance protection for traders.

Fees: Trading fees charged by CMC Markets are spreads, swap fees and commissions. CMC Markets does not charge commission fees on other trading instruments. CMC markets charge fees on deposits made via cards, while other methods, including all withdrawals, are free of charge, although the broker charges a monthly inactive account fee after 12 months of dormancy.

Tradable Instruments: You can trade CFDs on forex currencies pairs, indices commodities (oil, metals, agriculture), cryptocurrencies, and treasuries (bonds) on CMC Markets Singapore.

Deposits/Withdrawals: Payment methods supported on CMC Markets are cards, e-wallets (PayNow, Bill Payment, etc.) and bank wire transfers. Cards deposits are credited instantly while it takes about 2 hours or 1 business day for bank transfers and e-wallets to be credited. Withdrawals can only be made to bank accounts which take about 1-2 working days to receive.

Trading Platforms and Support: The broker supports the MT4 trading application and a proprietary trading application – Next Generation. You can access the platforms on the web, desktop or mobile devices. CMC Markets offers customer support to traders in Singapore via live chat, email and phone which is available 24/5.

#5 IG Markets – MAS Regulated Broker with Multiple Trading Platform

IG Markets is regulated in Singapore by MAS as IG Asia Pte Ltd and licensed to offer Capital Markets Services with company registration number 200510021K, issued in 2005.

Account types: IG Markets offers accounts for retail and professional clients. You can also choose to be a retail client with maximum leverage of 1:20 or an Accredited Investor (professional client) with maximum leverage of 1:50. IG Markets does not offer negative balance protection, and you can lose more than your deposits.

Fees: IG Markets charges spreads, commissions on shares only, currency conversion fees, and swap fees. Deposits via cards attract a fee, applied by the processor, while other deposit methods have no fees. IG Markets charges zero fees for withdrawals, although the broker charges an account inactivity fee after 24 months of dormancy.

Tradable Instruments: Instruments you can trade on IG Markets are CFDs on forex currencies pairs, shares, indices, soft commodities, energies, ETFs, bonds, cryptocurrencies and metals pairs.

Deposits/Withdrawals: IG Markets supports cards, cheques, internet bank transfers(FAST) and e-wallets. While card deposits are credited instantly, it takes about 1 business day for bank transfers and up to 3 business days for cheques. Withdrawals to cards take up to 5 business days and withdrawals to bank accounts are received within 24 hours.

Trading Platforms and Support: IG Markets supports ProRealTime web-trader, L2 Dealer and MT4 trading applications available on the web, desktop, and mobile devices. IG Markets offers 24/5 customer support to traders via email and phone numbers in Singapore.

Why choose a MAS-regulated forex broker?

Choosing a MAS-regulated forex broker in Singapore has some benefits. The MAS regulation mandates forex brokers to protect your funds, ensure ethical practices, and offers clear channels for dispute resolution within Singapore in case you have an issue with a broker.

Forex brokers that are regulated in Singapore by MAS are subject to strict oversight, which promotes a safer and more reliable trading environment. While forex trading always has some risk, MAS regulation helps to minimize the risk associated with the forex broker practices.

Note that some forex brokers may be operating without regulation in Singapore, it is best to avoid such brokers as trading with them will be at your own risk with no protection from the Monetary Authority of Singapore (MAS).

How Does MAS Protect You?

The Monetary Authority of Singapore (MAS) is the financial regulator to issue licenses to forex brokers and other businesses in the financial sector. The aim of MAS is to protect investors and traders based in Singapore and ensure service providers treat them fairly. Here are some of the ways MAS regulations protect forex traders in Singapore.

1) Leverage restriction: Because leverage can amplify profits and also losses, MAS has set a limit of 1:20 for retail traders and 1:50 for professional traders (Accredited Investors). This leverage restriction is put in place to help minimise losses when you place a trade. Lower leverage reduces your risk exposure.

2) Segregation of funds: One of the MAS rules for forex brokers is for them to keep clients’ funds in a separate account different from the account used for running the operations of the company or broker. This means that the money you deposit into your trading account for investment is not saved in the same account the broker uses for operations. This is to ensure the safety of clients’ funds and prevent the broker from using your money for day to day running of their business.

3) Risk Disclosure: Because of the nature of forex trading and the volatility of the market over 70% of retail traders lose all their money when trading financial instruments. The forex brokers when marketing is likely to misrepresent reality because they want to get more customers. One of the ways MAS protects forex traders is by making it compulsory for forex brokers to disclose the risk involved in trading forex and other financial instruments.

They are required to display the risk and warning on their website and you may find it at the footer or header of the website. See a screenshot of such disclosure below.

These are some of the benefits of trading with MAS-regulated forex brokers in Singapore. In jurisdictions where forex is unregulated or the laws are not strict, traders tend to lose more money.

4) Singapore Deposit Insurance Corporation (SDIC): The SDIC is a compensation scheme provided by the Monetary Authority of Singapore (MAS).

The SDIC ensures that your money is protected through the Deposit Insurance Scheme. Though the MAS regulates forex brokers, they cannot guarantee the soundness of each broker.

Therefore, if your forex broker goes bankrupt, your money is protected. According to the SDIC website, your money is protected up to S$100,000.

You need to trade with MAS regulated brokers to enjoy this compensation scheme.

5) Financial Industry Disputes Resolution Center (FIDReC):MAS regulated brokers are required to attend to traders’ complaint promptly. However, it is possible that some forex brokers do not do this.

If you have a complaint about your broker, reach out to them first. If they do not respond, you can then reach out to FIDReC. Make sure you do this within six months of your last communication with your broker.

If you do not want to use FIDReC, you can also contact the Consumers Association of Singapore or the Singapore Mediation Center.

How to Check a Forex Broker’s MAS Regulation?

It is important to find out if a forex broker is regulated before you create an account and start using their platform.

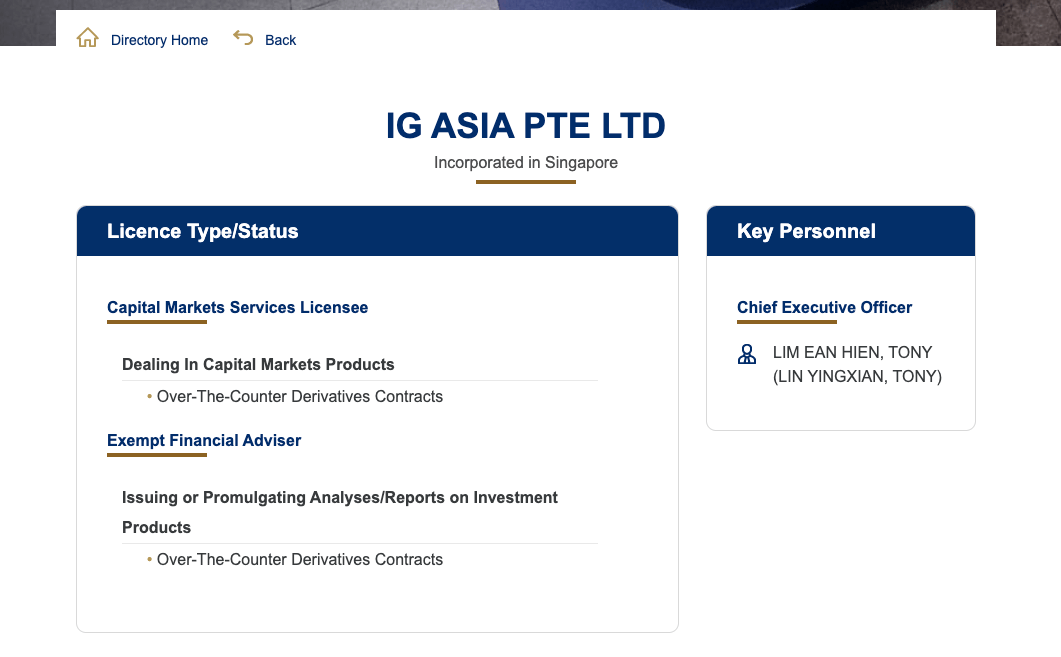

This is how to verify a forex broker’s MAS regulation in simple steps. Let’s use IG Markets for the example:

Step 1) On the broker’s website, you should scroll to the bottom of the page to know if they are regulated by MAS. All brokers usually state it. This is also important as their trading name may be different from the name they are regulated under. See an example with IG Markets below

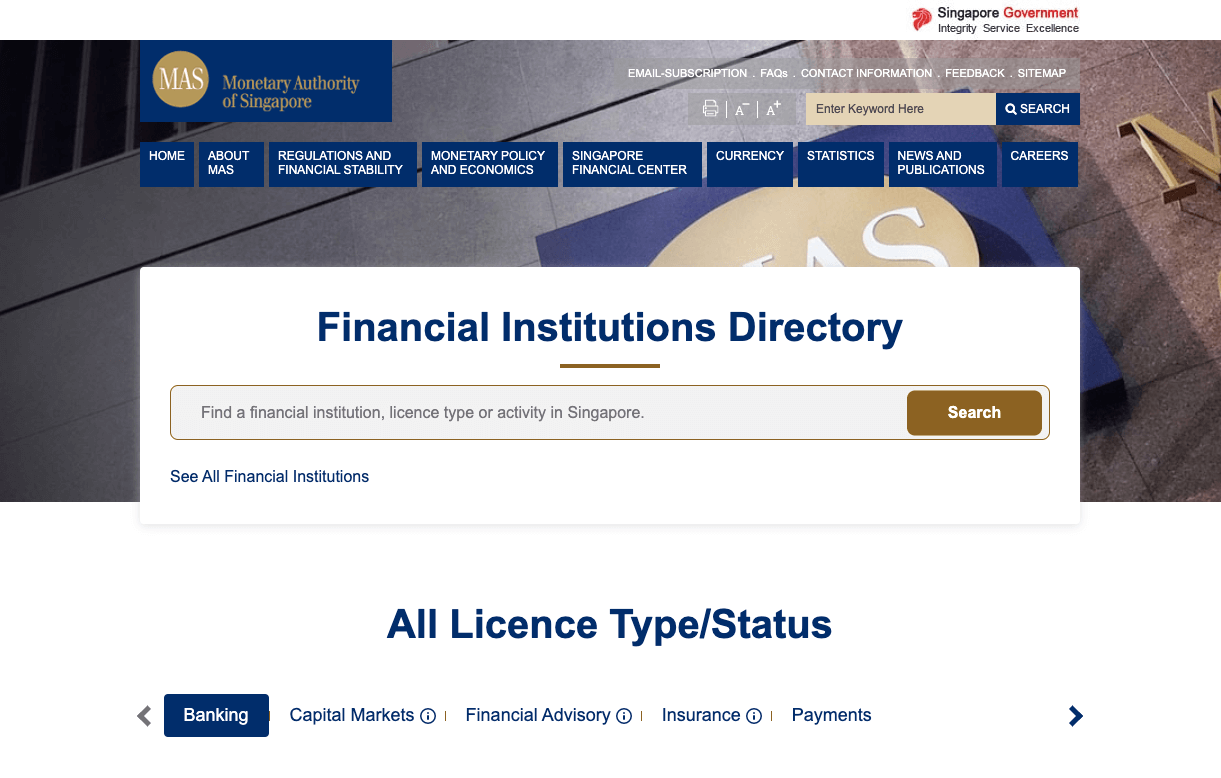

Step 2) Go to the MAS website at eservices.mas.gov.sg/fid/.

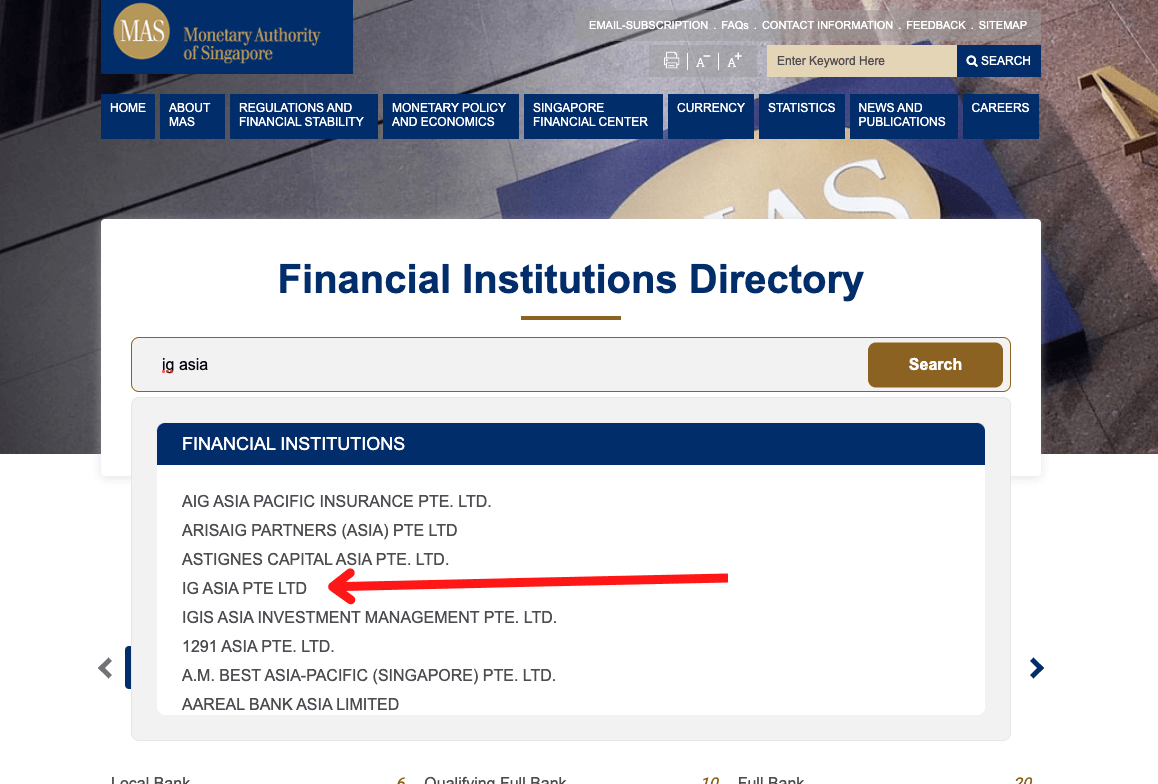

Step 3) Type in the name of the broker, as seen on their website footer, in the search box.

Step 4) Select the broker name from the results shown to see details about their license.

Other Important Factors for MAS Regulated Brokers

Apart from MAS regulation, there are other trading conditions you should consider before choosing an MAS regulated broker. MAS regulation combined with good trading conditions gives you a complete trading experience. Here are other factors

Trading Platforms: What you want to check here is the platform offered. Is it a proprietary platform developed by the broker? or a third-party platform like MT4, MT5, or cTrader. Most forex brokers tend to have more advanced features on their proprietary platform so you should check.

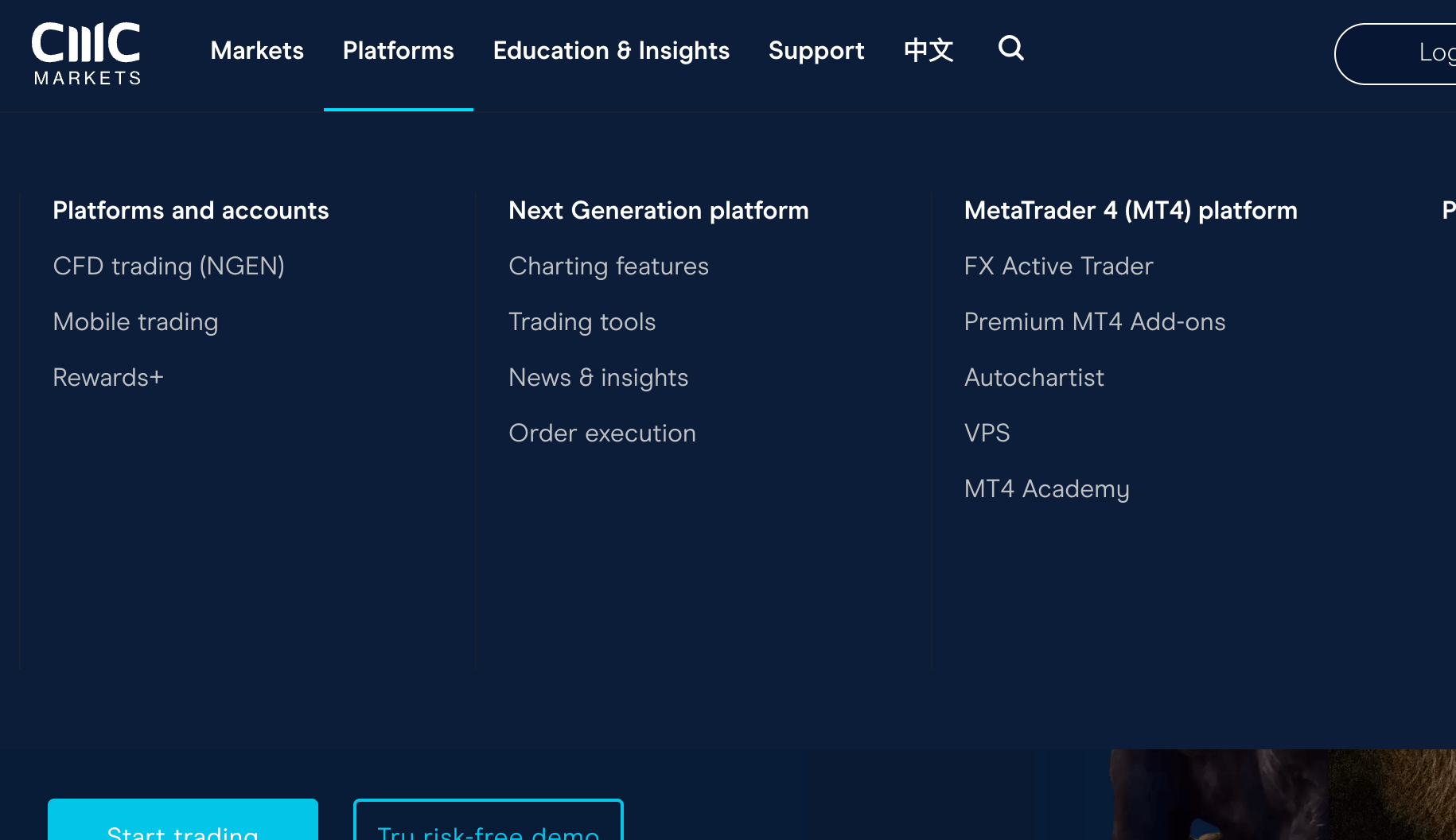

In addition, you want to check if the platforms are available on desktops and mobile phones. This helps you combine the full view that the desktop offers with the on-the-go feature of mobile apps. To check this factor, you can go through the platforms section on the broker’s website. Here s an example with CMC Markets.

Under ‘Platforms’, you can see that CMC Markets has MT4 and their proprietary application Next Generation (NGEN). To confirm they are available on multiple devices, click any of the platforms. Here is one of the images you will see if you click MT4.

How to Manage Risks with Forex Trading

Forex trading involves risks and you could lose all your money, it is best that you avoid trading forex CFDs, unless you have experience and understand them.

In Singapore, the MAS does not make it compulsory for forex brokers to offer negative balance protection, this means that you can lose more than the capital you invested and will be required to deposit additional money to clear the balance.

However, you can use the following strategies to manage the risks of trading:

1) Use lower leverage: MAS regulations limit leverage for retail traders in Singapore to 20:1. While leverage can amplify profits, it can also increase your losses. It is advisable that you do not use all the leverage available to you, as this exposes you to more risks.

2) Use Stop Loss Orders: A stop-loss order automatically exits your trade position when the price reaches a level that you set, this helps to limit potential losses. Setting stop-loss orders helps to maintain discipline and prevents emotional trading decisions.

3) Position Sizing: Do not commit too much to a single trade. Allocate your capital in percentages for different trades, this ensures your account is diversified and can mitigate some risk if the market moves too fast against you.

4) Practice with a Demo Account: Ultimately, if you are starting out, before putting your real money and facing the risks, use demo accounts to learn more about the CFDs trading market and test your risk management strategies. This will allow you to experiment in a risk-free environment with risk-free virtual money.

5) Keep Learning and Stay Up-To-Date: The forex CFDs market is always changing due to several reasons and events. It is best to stay updated with recent economic news, central bank policies (of the currencies you are trading), and technical analysis techniques. This will help you to make informed decisions and change your risk management strategies as needed.

Who regulates brokers in Singapore?

Monetary Authority of Singapore (MAS) is the government institution that regulates the activities of online forex and CFDs brokers. The MAS issues license to these brokers to offer Capital Market Services and sets the rules for how they will operate to protect traders and their money in Singapore. If you are a trader based in Singapore, it is best that you only trade through brokers that are regulated by MAS.

Does the MAS regulate all online brokers?

No, the MAS does not regulate all online brokers. The MAS only regulates online brokers that operate from Singapore. The MAS is Singapore-based and does not have authority over online brokers outside Singapore.

In addition, their authority does not cover entities of brokers they regulate that are not in Singapore. For example, CMC Markets is regulated by the MAS. However, they have entities in Australia and even Africa. If you open an account with any of these entities, you are not protected by the MAS.

You should only open an account with the Singapore entity of your broker. This is what guarantees MAS protection and access to redress if the broker defaults.

What is MoneySENSE in Singapore?

The MAS chairs MoneySENSE. It is an initiative launched in 2003. Its aim is to help consumers to become financially self-reliant. It is the MAS’ channel of educating the public and providing them with relevant information.

The importance of these is to help consumers make better trading decisions. For example, MoneySENSE issues alerts that help traders spot unregulated forex brokers. These brokers falsely claim MAS regulation. They even use names similar to MAS regulate brokers.

With MoneySENSE alerts, you can spot these fraudulent brokers and avoid being scammed.

FAQs on Best MAS Regulated Forex Brokers

Is forex and CFD trading regulated in Singapore?

CFDs and Forex trading is regulated in Singapore by the Monetary Association of Singapore (MAS). MAS issues the Capital Markets Services license to forex brokers in Singapore.

Which is the best MAS-regulated forex and CFD broker?

There are several well-performing brokers that are regulated by the MAS. The answer to this question depends on your needs as a trader. In our review, we’ve covered some of the best brokers that are regulated by the MAS along with the pros and cons for each.

Which broker is regulated by MAS?

Forex brokers regulated by MAS in Singapore are IG Markets, Plus500, CMC Markets, Oanda, City Index, and Saxo Markets, among others.

How do I trade FX in Singapore?

To trade FX in Singapore, you have to create a trading account with any of the regulated forex brokers in Singapore. Some of them are Plus500, CMC Markets, Oanda, etc.

Is forex regulated by MAS?

Yes, the Monetary Authority of Singapore (MAS) regulates forex (foreign exchange) trading in Singapore. Forex brokers in Singapore are required to be registered with MAS. It is best to trade with forex brokers that are regulated by MAS.

Which forex broker has high leverage in Singapore?

IG Markets, City Index, CMC Markets, and OANDA offer high leverage of 1:50 for accredited investors after meeting some criteria, this is the maximum regulated forex brokers can offer in Singapore.

Retail traders can only access maximum leverage of 1:20, but as an accredited investor (professional trader) you can access as higher as 1:50.

Do MAS-regulated brokers offer Islamic accounts?

Yes, brokers regulated in Singapore by MAS offer Islamic Accounts. Plus500, CMC Markets, and IG Markets are some of the forex brokers that offer Islamic Accounts to traders, such accounts are usually swap-free for a specific period.

Is OANDA regulated in Singapore?

Yes, OANDA is regulated by MAS (the Monetary Authority of Singapore) as ‘OANDA Asia Pacific Pte Ltd’. The broker is licensed to deal in capital market products in Singapore. You can create an account with OANDA if you are based in Singapore.

Is forex taxable in Singapore?

Profits from forex activities are taxable by the IRAS (Inland Revenue Authority of Singapore).