There are fees attached to forex trading. One of these charges is the spread. A currency pair or any CFD instruments usually have two price quotes for it – the bid price and the ask price. The spread is the difference between the two prices and is measured in pips.

The spread is the most important of all trading fees. Some forex brokers do not charge commissions or swaps. You will hardly find a forex broker without spreads. This is why you should know about this particular fee.

When the spread for a forex pair or CFD is high, you will pay more in terms of trading fees. This is why we have reviewed the best forex brokers with low spreads in the UK for you.

Comparison of Best Low Spread Forex Brokers UK

| Broker | FCA Firm Regulated | GBP/USD Spread (pips) | Round-turn Commission | Visit |

|---|---|---|---|---|

| Tickmill |

Yes

|

0.1

|

£4 per standard lot (Pro Account), £2 per standard lot (VIP Account)

|

Visit Broker |

| CMC Markets |

Yes

|

0.90

|

None

|

Visit Broker |

| Pepperstone |

Yes

|

1.19 (Standard Account)

|

£4.5 per standard lot (Razor Account)

|

Visit Broker |

| AvaTrade |

Yes

|

1.5

|

None

|

Visit Broker |

| City Index |

Yes

|

1.8

|

None

|

Visit Broker |

| ETX Capital |

Yes

|

1.41

|

None

|

Visit Broker |

Note: The spread data & commission is as per information on these brokers’ websites in Jan. 2023

Best Low Spread Brokers in the UK

Here is the list of best low spread brokers in the UK as per our research:

- Tickmill – Forex Broker with Lowest Spreads in the UK

- CMC Markets – Low Spread Broker with Most CFD Instruments

- Pepperstone – Forex Broker with Social Trading

- AvaTrade – CFD Broker with Temporary FCA Regulation

- City Index – Low Spread Broker with FCA Regulation

- ETX Capital – FCA Regulated Broker with Moderately High Spreads

Warning: Low spreads do not guarantee the safety of your funds. Make sure the CFD broker is regulated with the FCA to reduce the risk of fraud.

#1 Tickmill – Forex Broker with Lowest Spreads in the UK

Tickmill has the lowest spreads for major pairs compared to other brokers. The typical spread for EUR/USD and GBP/USD are 0.1 pips and 0.3 pips respectively. Tickmill is regulated with the FCA so they are low-risk.

The typical spread for other major pairs is low too. USD/CHF has the highest spread among the major pairs (0.4 pips). This shows how low the spreads are with Tickmill.

For other trading fees, Tickmill charges a swap on long and short positions and they are quite high. They also charge a commission on their Pro Account (£4 per standard lot) and VIP Account (£2 per standard lot). Their commission is one of the lowest compared to other brokers.

The spread for other major pairs is shown below

| Major Pairs | Spread |

|---|---|

| EUR/USD | 0.1 |

| USD/JPY | 0.1 |

| USD/CAD | 0.2 |

| AUD/USD | 0.1 |

| NZD/USD | 0.3 |

#2 CMC Markets – Low Spread Broker with Most CFD Instruments

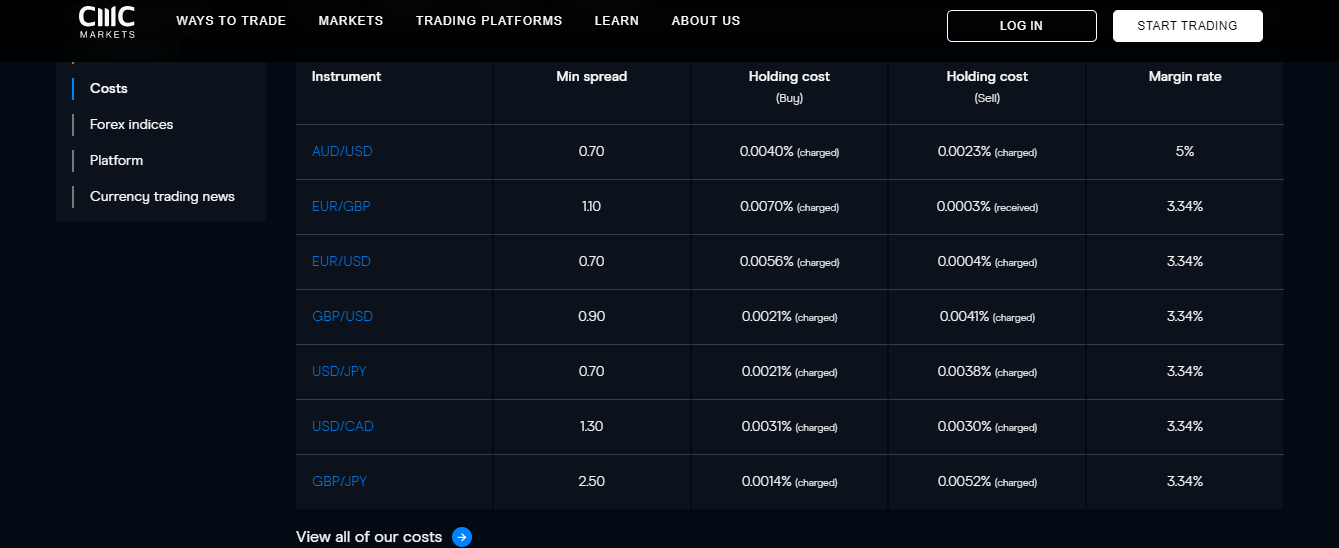

CMC Markets rank second in our review. They offer low minimum spread for major pairs at 0.70 pips for EUR/USD and 0.90 pips for GBP/USD. CMC Markets are considered low-risk because of FCA regulation.

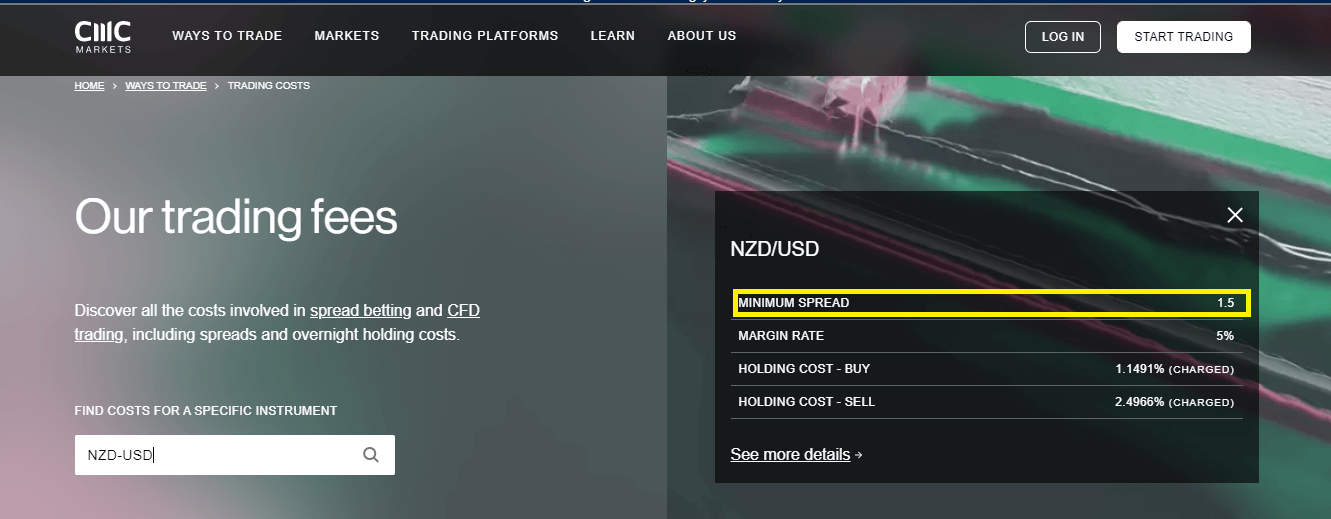

With a minimum spread of 1.5 pips, NZD/USD has the highest spread among the major pairs. It is closely followed by USD/CAD with a 1.3 pips minimum spread.

CMC Markets do not charge extra commissions per lot. Other trading fees include overnight charges for both long and short positions. This is the structure of trading fees on their CFD Account and Corporate Account.

For non-trading fees, CMC Markets charge a £10 monthly inactivity fee and a premium fee for guaranteed stop-loss orders.

Here are CMC Markets spreads for other major pairs

| Major Pairs | Spread |

|---|---|

| USD/CHF | 1.00 |

| USD/JPY | 0.70 |

| AUD/USD | 0.70 |

#3 Pepperstone – Forex Broker with Social Trading

Pepperstone offers three accounts with different spread for major pairs. For this review, our focus is the Standard Account. The average spread for EUR/USD and GBP/USD on this account is 0.77 pips and 1.19 pips respectively. Pepperstone are regulated with the FCA so they are low-risk to trade with..

NZD/USD has the highest spread among the major pairs (1.52 pips). It is followed by GBP/USD and USD/CAD (1.07 pips)

Pepperstone charges an extra commission per lot on their Razor Account alone. (£4.5 per standard lot). On cTrader, they charge $3 per standard lot. There are also overnight charges that you can find on their trading platform. No account inactivity fee.

The spread for other major pairs:

| Major Pairs | Spread |

|---|---|

| USD/CHF | 1.09 |

| USD/JPY | 0.86 |

| AUD/USD | 0.84 |

#4 AvaTrade – CFD Broker with Temporary FCA Regulation

The spread for EUR/USD and GBP/USD is 0.9 pips and 1.5 pips respectively. AvaTrade’s regulation with the FCA is temporary. Their regulation is in another European Economic Area. They are considered moderate-risk.

USD/ CAD is the major pair with the highest spread (2 pips). AvaTrade does not charge an extra commission per standard lot but you pay a swap for holding trades overnight. There is also an account inactivity fee

The spread offered by AvaTrade for other major pairs are shown below:

| Major Pairs | Spread |

|---|---|

| USD/CHF | 1.6 |

| USD/JPY | 1.0 |

| AUD/USD | 1.1 |

| NZD/USD | 1.8 |

#5 City Index – Low Spread Broker with Zero Commission

City Index rank fifth in our review. They offer EUR/USD and GBP/USD at 0.8 pips and 1.8 pips. City Index are regulated with the FCA so they are low-risk to trade with.

NZD/USD have the highest spread of their major pairs with 2.8 pips. USD/CAD follows at 2.6 pips.

City Index does not charge extra commission. Their fees are calculated with the spread. They also charge swaps and account inactivity fees.

The table below shows City Index’s spread for other major pairs:

| Major Pairs | Spread |

|---|---|

| USD/CHF | 2.3 |

| USD/JPY | 0.8 |

| AUD/USD | 0.9 |

#6 ETX Capital- FCA Regulated Broker with Moderately High Spreads

OvalX Capital offers EUR/USD and GBP/USD at 0.74 pips and 1.41 pips. These spreads are for their MT4 account only. ETX Capital is a low-risk broker because they are regulated.

Update: ETX Capital used to be the trading name of Monecor (London) Ltd. In May 2022, Monecor (London) Ltd changed its trading name from ETX Capital to OvalX .

Important Update: OvalX have shut down their trading services. They no longer offer forex trading services and have transferred all active accounts to capital.com. Their website also now automatically redirects to capital.com’s website.

OvalX has moderately low spreads compared to other brokers. USD/CAD has the highest spread at 2.01 pips. NZD/USD follows closely at 1.81 pips. A forex trader will likely incur more costs in spreads trading with OvalX.

OvalX does not charge an extra commission per lot but there are overnight charges

OvalX’s spread for other major pairs:

| Major Pairs | Spread |

|---|---|

| NZD/USD | 1.81 |

| USD/JPY | 0.97 |

| AUD/USD | 1.11 |

What are Forex Spreads?

Spread is one of the ways CFD brokers make their money. When you place a trade, there is a difference between the price you are willing to pay for a currency pair (bid price) and the price a seller is willing to sell (ask price).

The difference between these two prices is referred to as the spread. The spread is also the basis for a form of

trading known as spread betting.

The spread represents the broker’s fee for facilitating the trade. It’s usually expressed in pips, which is the smallest price movement for a particular currency pair. For example, a pip in EUR/USD is 0.0001.

Here’s an Example:

-Suppose the EUR/USD exchange rate is quoted at 1.1234/1.1238.

-The bid price is 1.1234 euros per US dollar.

-The ask price is 1.1238 euros per US dollar.

-The spread is 4 pips (1.1238 – 1.1234).

So, for every euro you buy at the ask price, you’re effectively paying 4 pips more than the price at which you could sell it (the bid price). This 4-pip spread represents the broker’s commission for executing the trade.

Here are the common spreads in forex trading

1) Variable spreads: A broker offers variable spreads if they pass on the best bid price at a certain time. The variability depends on the broker and the currency pair(s) or CFDs. Variable spreads are constantly changing and are cheaper when liquidity is high. However, they are subjected to high volatility due to economic news and macroeconomic events.

2) Fixed spreads: Fixed spreads are consistent. Most of the time, they remain unchanged regardless of market conditions. It is easier to plan your trading fees with fixed spreads because they are not constantly changing like variable spreads. It is important to note that fixed spreads can change dramatically during important news events. Other than this, they are constant.

What Should You Consider as a Low Spread?

There is not a specific figure that can be tagged as a low spread. However, there are factors you can consider to help you come to a conclusion. The first factor to consider is the currency pair or pairs you want to trade. Generally, major currency pairs have lower spreads compared to minor currency pairs. Exotic currency pairs have the highest spreads of all currency pairs.

Another factor you can consider, especially for major currency pairs, is the industry average. For example, the industry average spread for the EUR/USD 1 pip. Therefore, any forex broker that offers a spread below 1 pip for EUR/USD will be considered a low spread broker for EUR/USD. The only downside with this factor is that it does not apply to all currency pairs. A broker with a spread lower than the industry average for EUR/USD might have a spread higher than the industry average for GBP/USD. This is why you should take time to research the spreads of the brokers you want to choose.

Finally, you should consider the type of spread that your broker offers. It is essential to consider this factor because it helps you take advantage of low spreads and affect your trading time. If your broker offers a fixed spread. There is really nothing you can do than trade at any time. Variable spreads fluctuate and based on market conditions, they can be high or low. When there is no big news or huge macroeconomic events going on, variable spreads are usually low. This might be the best time for you to trade with low spreads.

How to Optimize Low Spreads

Low spreads are not a guarantee that conditions are favorable for trading. You have to combine your analysis with other minute details to take advantage of low spreads. Here is how you can do this:

1. Know the kind of spread offered by your broker (fixed or variable). If it is the latter, only trade when the spreads are low. That is, when there is no significant economic event going on.

2. Find out other trading fees. Especially commissions and swaps. They tend to increase your trading fees once they are added to the fees incurred from spreads.

3. Trade with low leverage. The higher your leverage, the higher your risk of a margin call. If the market moves against your trade, you will suffer a heavy loss to your capital.

4. Be flexible. Combine technical analysis and fundamental analysis. Every successful trader needs to work with both analysis. You might naturally prefer one to the other. However, you need to be aware of what is going on with both sides. As you use indicators and trendlines, also pay attention to economic events and releases that might have a strong impact on the market.

How to Check a Forex Broker’s Spread

Forex brokers are usually transparent with their spreads. There is always a section of the website dedicated to this. Spreads are part of your trading fees and every broker has them. They are charged regardless of the result of your trade (profit or loss). This is why you should always check a broker’s spreads before signing up.

Here is a systematic guide on how to go about it. Our example is CMC Markets.

1) Go to CMC Markets website (make sure that you are visiting their actual website that is listed on FCA Register, to avoid any clones). You should arrive at the homepage shown below

2) Move your cursor to markets and click on forex (in the yellow box)

3) When the page loads, you will find the spreads for currency pairs as shown in the image below.

4) The page in (3) does not display the spread for all currency pairs. To find the rest, click on “view all our costs”. It will take you to the page shown below. All you need to do is enter the currency pair in the box and click on search. The currency pair with its minimum spread, margin, and holding costs.

How to Calculate your Spread Cost

It is one thing to know the spread your CFD broker attaches to a currency pair. However, this value is of no use if you do not know how much it is costing you in real money. This is why you should learn to calculate your spread cost.

The simple formula to calculate your spread cost is (Lot size * Spread). Here is an example:

Let’s say you want to buy 1 standard lot GBP/USD at a bid-ask price of 1.2636/1.2634.

Remember that spread = bid price – ask price

1.2636-1.2634 =0.0002 (2 pips)

Spread Cost = 100,000 *0.0002 =$20.

So this trade will cost you $20.

How to Choose a Low Spread Broker in the UK

In the previous section, we covered how to check a broker’s spread. This is a major factor to consider when choosing a low spread broker. However, that is not the only factor you should look into. In this section, we cover the other important factors.

Regulation: Low spreads do not guarantee safety. Trading with a regulated broker only guarantees that. After confirming a forex broker has low spreads, you must confirm if your funds are safe. This is done by verifying if your broker is regulated with the FCA. Here is how you can go about this using pepperstone as an example.

1) Check your broker’s regulation in the footnote of their website. Pay attention to the company name and reference number.

From the image, you can see that the company name is Pepperstone Ltd with license number 648312. We need these details to correlate with the ones on FCA’s website.

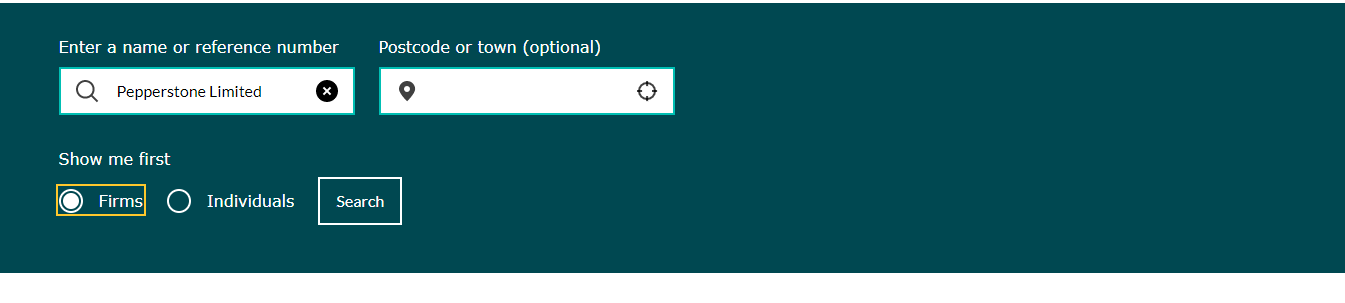

2) On the FCA’s website, scroll down to the search area and enter the broker’s name. Select ‘Firms’ and click on ‘Search’.

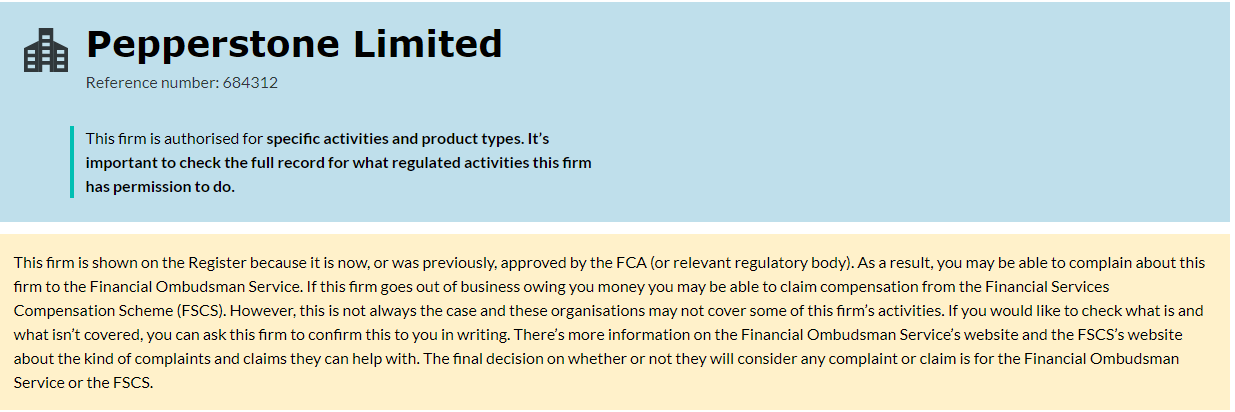

The image below shows the final result. You can see that the detail match the ones we saw on the broker’s website. This is the simple way to verify a low spread broker’s regulation.

Account type: It is common for a broker to have more than one account. Usually, the spreads on these accounts will differ. If one of the accounts is a raw ECN-type account, the typical spreads are usually low. Since you are looking to choose a low spread broker, you might as well go for the accounts with the lowest spreads.

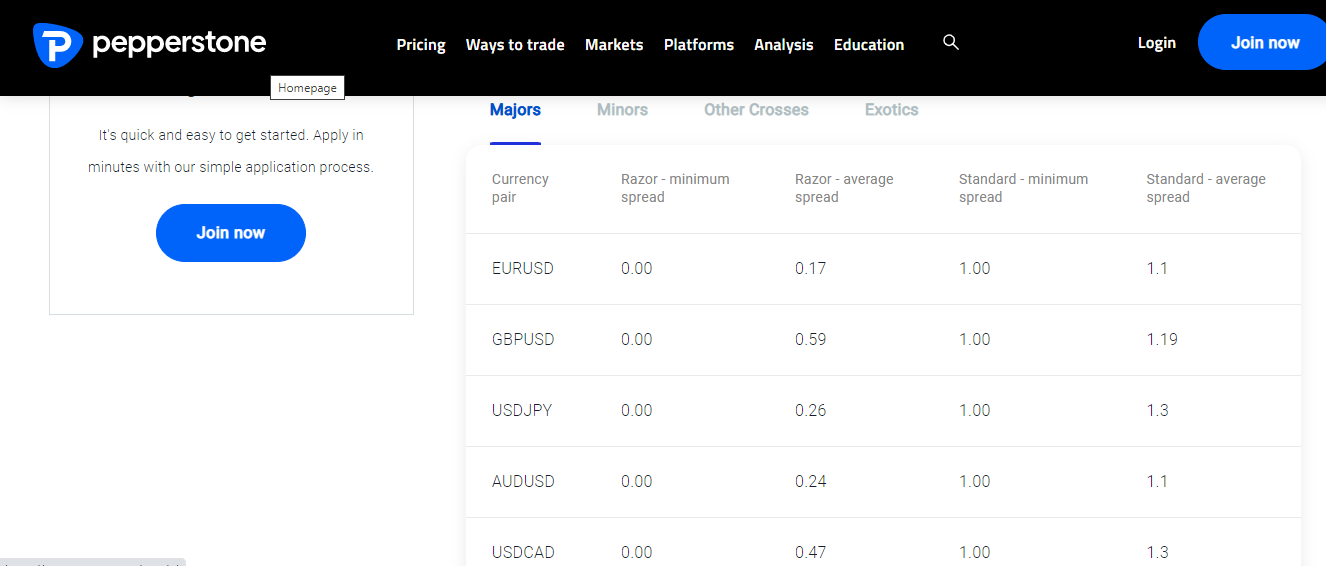

This is why you should check if your broker offers varying account types. Let us compare Pepperstone’s account as an example. Here is how their account looks.

If you compare the average spreads for major pairs on the Razor and Standard Accounts, you will see a significant difference in the spreads. Summarily, low spreads are available on the Razor Account only. For the Standard Account, the spreads are much higher though there is no extra commission.

Comparing different accounts offered by brokers help you identify the account with low spreads easily.

Other trading fees: We have covered how to calculated spread costs. But spreads are not the only trading fees you incur. There are commissions and overnight charges too. For brokers with multiple account types, their ECN accounts usually combine low spreads with extra commission charges. Some non-ECN accounts with low spread can also also have extra commissions.

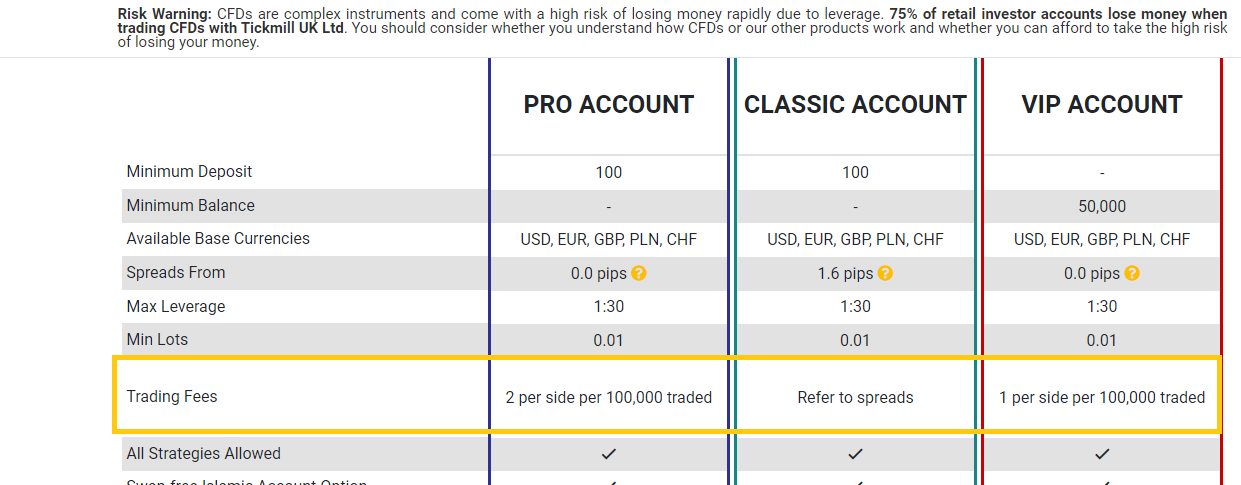

Let us explain this better with Tickmill’s account types from the image below

If you compare Tickmill’s Pro and VIP Accounts, you will see they are low spread accounts with spreads beginning from 0.0 pips. However, Tickmill charges $2 and $1 commission per standard lot respectively. On the Classic Account, the spreads are high, beginning from 1.6 pips without extra commissions per standard lot. They have been built into the spread.

Swaps can be high or low depending on the broker. These fees determine your total loss or profit per trade. This is why you have to check them to know if they are high or low.

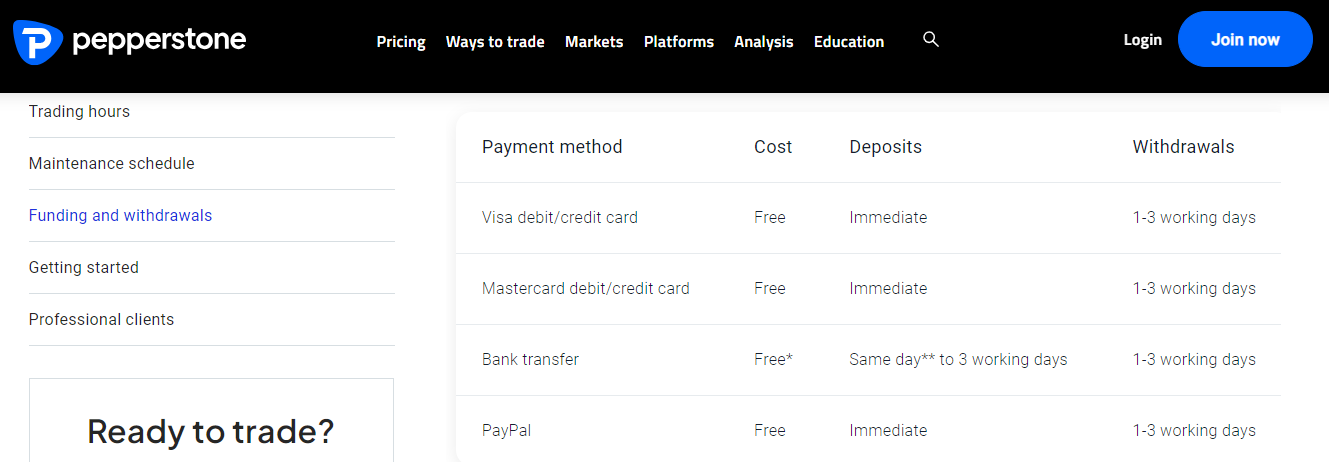

Deposit/Withdrawals: Quick payment methods are crucial to trading. You need to be able to deposit or withdraw your profit without hassle. Also, the payment methods available should be easily accessible. You should be able to carry out transactions with your debit/credit cards or e-wallets (if available).

Your broker should also support transactions via your local bank. Finally, it is good if your broker does not charge any commissions on your transactions. Let us see an example with Pepperstone.

From the image, you can observe that Pepperstone allows you deposit and withdraw via your local banks and e-wallets. Furthermore, there you do not have to pay extra charges or fees for transactions. If you incur any fees, it is from your payment service provider.

Customer Service: You want to make sure you are in good hands when dealing with a forex broker. You may have issue with your deposit/withdrawals. Or need more information about your broker’s trading conditions. So you need to know the channels of communication your broker supports.

Are the FAQs? Can you speak to a live customer support agent? Are email responses quick? These are the questions you should have in mind as you choose a low spread broker. You should also test all of their customer service channels to know how effective and fast they are.

What is a Zero Spread Trading Account?

A zero spread trading account is an account that has no significant difference between the bid (sell) and ask (buy) prices for certain currency pairs. Forex brokers do not offer zero spread on all of their currency pairs. It is easy to see why because forex brokers make money from spreads. In addition, some currency pairs do have enough liquidity that may allow for zero spread.

So, if a broker offers a zero account, it will usually be for major currency pairs like GBPUSD and EURUSD. These pairs have high trading volumes and are liquid. Since a zero account likely means zero spread cost, it does not mean you are not incurring other trading costs. Your forex broker might charge a commission or have other hidden fees.

Therefore, it is important you do your research if you see a forex broker offering a 0 spread account. Make sure you find out the structure of their trading costs before opening an account.

Here are some pros of opening a zero spread account:

Reduced trading costs: A zero spread account reduces your trading cost. Since there is no spread, your lot size is multiplied by a zero. Therefore, you do not pay trading fee in the form of spread.

This is good for you if you are a scalper. Frequent short-term trades can cause your trading fees (spread) to accumulate. With a zero spread account, this will not be an issue.

Easy cost calculation: Since there is no spread, it easy to calculate other costs associated with your trading. It makes it easier to forecast potential profits losses since there is will be little or no case of spread widening.

Here are some cons of opening a zero spread account:

Not suitable for long-term traders: Though there is no spread to pay, a zero spread account is not suitable for all traders. A standard account with fixed spreads might be the best option for long-term traders.

Commissions: No forex broker offers trading services without fees. If your account has zero spread, then you will likely pay high fees in the form of commissions. The amount you will pay in commissions depends on your broker.

Which Spread is Best for Forex Traders?

Forex trading is is a complex and diverse enterprise. The answer to this question is not that straightforward. The best spread for forex depends on your choices, your trading style, and strategies. Different forex trading strategies have different spreads that suits them.

Let us consider some of these strategies.

Scalping: Scalping involves opening and closing trades quickly to accumulate little profits over a period of time. Too high spreads defeats this purpose so low spreads are best for scalpers. Very low spreads positively impact their profitability.

Day trading: Day traders will definitely prefer lower spreads but can make do with slightly higher spreads. This is possible because of how long they hold their trades.

Swing trading: Swing traders do not mind wider spreads. They can have trades open for up to a month or more. Their trades will pass through periods of volatility including the widening of spreads during high impact economic news.

As long as a swing traders have an edge in their trading, they will likely not worry about these scenarios.

Position traders: Position traders are not too concerned with spreads. They have an investment approach that to trading, focusing on long-term, larger price movements. For these traders, spread is not a very strong factor.

What is the difference between a standard account and a raw spread account?

A standard account typically refers to the standard lot size (100,000 units). It indicates the smallest trade size.

Raw spread refers to the cost of trading without any mark up from your broker. This means the bid/ask price of the account comes directly from your broker’s liquidity providers.

What is the difference between zero commission and raw spread?

Zero commission brokers do not charge commission. However, they usually add a mar-up to the spreads they receive from liquidity providers.

Raw spread brokers offer spreads that are not marked up. However, they charge commissions per standard lot.

Are trading fees low with low spread brokers

It depends on the forex broker’s fee structure. If a broker has an account with low spread, that account is likely a raw spread or ECN type account. For these accounts, the commissions are usually high. They can be up to $3 per standard lot.

So what you have is a combination of low spread and commission as your trading fees? Whether the fees are high or low depends on you. It is more subjective than objective.

FAQs on Best Low Spread Forex Brokers in the UK

Which forex broker has a Low Spread?

As per our research Tickmill has a very low spread. They have Pro Account with which they have spread starting from 0 pips, and the commission is £4/lot round-turn.

What is a Low Spread Account?

With Low spread accounts brokers charge very low spread fees. This means the difference between the bid & the ask price is very low or close to zero. But such brokers charge fees in the form of commissions. But the overall trading fees is still low. It is important to note that the spreads may be higher depending on the market conditions.

Is there a broker with 0 Spread?

There are many brokers that advertise Raw spread or Zero spread, but the actual spread is likely to be higher than 0 pips most of the time. Take into account that the advertised 0 pips do not mean that you will get 0 pips spread on all instruments, these are typical spreads that are variable.

Which forex pair has the lowest spread?

Generally, forex brokers determine the spreads of forex pairs. If the broker is ECN broker or STP broker, their spreads are usually low. In addition, major and minor currency pairs have low spreads compared to exotic pairs.

Are low spreads good in Forex?

Low spreads only guarantee reduced trading fees (specifically, spread costs). However, low spreads should not be your sole reason for signing up with a broker. You need to consider other factors like FCA regulation, execution model, other trading fees, and their range of CFD instruments.