There are fees attached to forex trading. One of these charges is the spread. A currency pair or any CFD instruments usually have two price quotes for it – the bid price (buy price) and the ask price (sell price). The spread is the difference between the two prices and is measured in pips. It is basically a markup added by the broker to the ask price.

The spread is the most important of all trading fees. Some forex brokers do not charge commissions or swaps. But all brokers charge spreads on most instruments. This is why you should know about this particular fee.

When the spread for a forex pair or CFD is high, you will pay more in terms of trading fees. This is why we have reviewed the best forex brokers with low spreads in Canada for you.

Comparison of Forex Brokers with Lowest Spreads in Canada

| Broker | IIROC Regulated | USD/CAD Spread (pips) | Round-turn Commission | Visit |

|---|---|---|---|---|

| FXCM |

Yes

|

0.7

|

$14 per standard lot (100,000 units)

|

Visit Broker |

| CMC Markets |

Yes

|

1.3

|

$8 per trade on shares only

|

Visit Broker |

| AvaTrade |

Yes

|

1.5

|

None

|

Visit Broker |

| Forex.com |

Yes

|

2.8

|

$80 per USD million traded on shares only

|

Visit Broker |

Note: The spread data & commission is as per information on these brokers’ websites in September 2022.

Best Low Spread Brokers in Canada

Here is the list of low-spread brokers in Canada as per our research:

- FXCM – Forex Broker with Lowest Spreads in Canada

- CMC Markets – Low Spread Broker with Most CFD Instruments

- AvaTrade – IIROC-Regulated Forex Broker with Low Spread

- Forex.com – IIROC-Regulated Broker with Moderately High Spreads

Warning: Low spreads do not guarantee the safety of your funds. Make sure the CFD broker is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) to minimize the risk of fraud.

#1 FXCM – Forex Broker with Lowest Spreads in Canada

FXCM operates through Friedberg Direct which is regulated by the IIROC as Friedberg Mercantile Group Ltd, so they are considered low-risk.

FXCM has the lowest spreads for major pairs compared to other forex brokers in Canada. The average spread starts from 0.3 pips for majors like EUR/USD.

Along with the spreads, FXCM charges commission fees of $7 per side for a standard lot, which is 100,000 units of your base currency trade, making $14 per round turn for major currency pairs. Minor forex pairs on FXCM have commissions of $18 per round turn on a standard lot.

The average spread on FXCM Canada for major forex pairs:

| Major Pairs | Spread |

|---|---|

| USD/CAD | 0.7 pips |

| EUR/USD | 0.3 pips |

| GBP/USD | 0.8 pips |

| USD/JPY | 0.3 pips |

| USD/CHF | 0.6 pips |

#2 CMC Markets – Low Spread Broker with Most CFD Instruments

CMC Markets is member of IIROC and regulated as ‘CMC Markets (Canada) Inc.’ This makes CMC Markets a low-risk forex broker in Canada.

CMC Markets ranks second among forex brokers in Canada with low spreads for major pairs compared to other forex brokers in Canada. The minimum spread starts from 0.7 pips for majors like EUR/USD.

CMC Markets do not charge extra commissions per lot traded for other instruments except when trading shares, which attracts a commission of $8 per trade on shares only.

The minimum spread for major forex pairs on CMC Markets Canada are:

| Major Pairs | Spread |

|---|---|

| USD/CAD | 1.3 pips |

| EUR/USD | 0.7 pips |

| GBP/USD | 0.9 pips |

| USD/JPY pips | 0.7 |

| AUD/USD | 0.7 pips |

| NZD/USD | 1.5 pips |

| USD/CHF | 1.0 pips |

#3 AvaTrade – IIROC-Regulated Forex Broker with Low Spread

AvaTrade operates through Friedberg Direct which is regulated by the IIROC as ‘Friedberg Mercantile Group Ltd’, so they are considered low-risk for trading in Canada.

AvaTrade offers competitive spreads in Canada compared to other forex brokers, with lowest spread starting from 0.6 pips for the EUR/USD pair which is a major forex pair.

AvaTrade does not charge an extra commission per standard lot when you trade on the platform

The average offered by AvaTrade for major forex pairs are shown below:

| Major Pairs | Spread |

|---|---|

| USD/CAD | 1.3 pips |

| EUR/USD | 0.6 pips |

| GBP/USD | 1.0 pips |

| USD/JPY pips | 0.7 |

| AUD/USD | 0.8 pips |

| NZD/USD | 1.5 pips |

| USD/CHF | 2.1 pips |

#4 Forex.com- IIROC-Regulated Broker with Moderately High Spreads

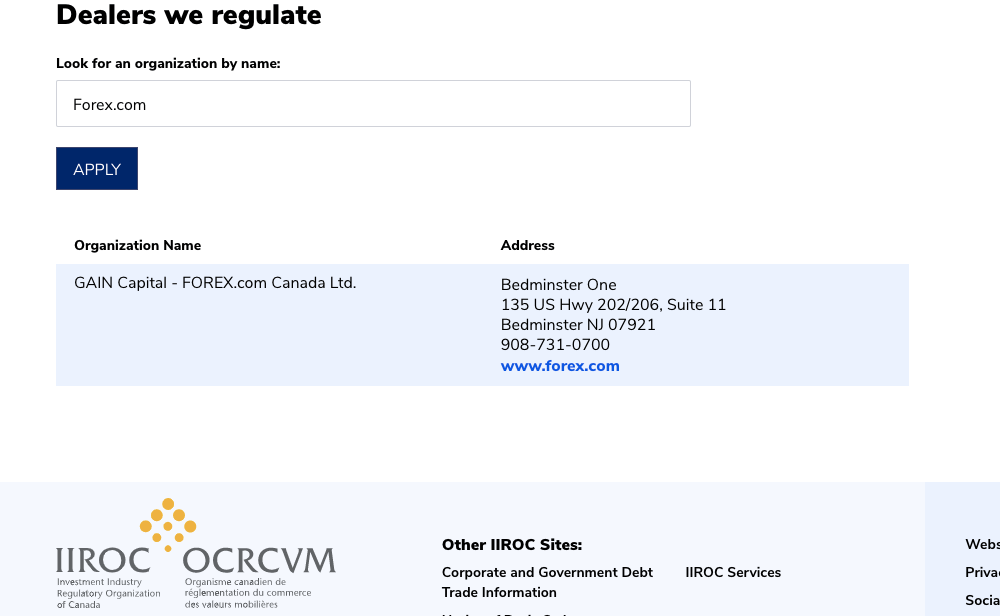

Forex.com is considered safe for trading in Canada with low risk. Forex.com is regulated by the IIROC as ‘GAIN Capital – FOREX.com Canada Ltd.’.

Forex.com offers relatively higher spreads among the regulated forex brokers in Canada. Spreads for majors like the EUR/USD start from as low as 0.8 pips with an average of 1.3.

Forex.com charges commission fees only when you are trading shares and it starts from $80 per USD million shares traded. Trading other instruments is commission-free.

The typical spread for major forex pairs on Forex.com in Canada are shown below:

| Major Pairs | Spread |

|---|---|

| USD/CAD | 2.8 pips |

| EUR/USD | 1.3 pips |

| GBP/USD | 1.7 pips |

| USD/JPY pips | 1.4 |

| AUD/USD | 1.4 pips |

| NZD/USD | 3.3 pips |

| USD/CHF | 2.2 pips |

What are Forex Spreads?

For every financial instrument, there is a market rate, which is the ask price or selling price. When you trade via a forex broker which connects you to the financial market, the broker adds a markup to the ask price to give you the bid price or selling price.

The difference between the ask price (sell price) and the bid price (buy price) is called a spread and measured in pips. It is the difference between the price you are willing to pay for a currency pair and the price a seller is willing to sell. Spreads go to the broker and are one of the ways CFD brokers make their money.

You may be wondering how the spread which is measured in pips translates to money. We have this covered in another section of this article.

Here are the common spreads forms of spread in forex trading.

1) Variable spreads: A broker offers variable spreads if they pass on the best bid price at a specific time. The variability depends on the broker and the currency pair(s) or CFDs. Variable spreads are constantly changing as the market moves, which means that if you open a trade position with a certain amount of spread, the spread can change before you close the trade.

Variable spreads are cheaper when liquidity is high. However, they are subjected to increased volatility due to economic news and macroeconomic events.

2) Fixed spreads: Fixed spreads are consistent forms of spread, which means that if you open a trade with a particular spread value, the spread amount will not change, but will remain the same until you close the trade.

Most of the time, they remain unchanged regardless of market conditions. It is easier to plan your trading fees with fixed spreads because they are not constantly changing like variable spreads. It is important to note that fixed spreads can change dramatically during important news events. Other than this, they are constant.

What Should You Consider as a Low Spread?

There is not a specific figure that can be tagged as a low spread. However, there are factors you can consider to help you come to a conclusion. The first factor to consider is the currency pair or pairs you want to trade. Generally, major currency pairs have lower spreads compared to minor currency pairs. Exotic currency pairs have the highest spreads of all currency pairs.

Another factor you can consider, especially for major currency pairs, is the industry average. For example, the industry average spread for the EUR/USD 1 pip. Therefore, any forex broker that offers a spread below 1 pip for EUR/USD will be considered a low spread broker for EUR/USD. The only downside with this factor is that it does not apply to all currency pairs. A broker with a spread lower than the industry average for EUR/USD might have a spread higher than the industry average for GBP/USD. This is why you should take time to research the spreads of the brokers you want to choose.

Finally, you should consider the type of spread that your broker offers. It is essential to consider this factor because it helps you take advantage of low spreads and affect your trading time. If your broker offers a fixed spread. There is really nothing you can do than trade at any time. Variable spreads fluctuate and based on market conditions, they can be high or low. When there is no big news or huge macroeconomic events going on, variable spreads are usually low. This might be the best time for you to trade with low spreads.

How to Check a Forex Broker’s Spread

Forex brokers are usually transparent with their spreads. There is always a section of the website dedicated to this. Spreads are part of your trading fees and every broker has them. They are charged regardless of the result of your trade (profit or loss). This is why you should always check a broker’s spreads before signing up.

Here is a systematic guide on how to go about it. Our example is CMC Markets.

1) Go to the CMC Markets website (make sure that you are visiting their actual website that is listed on IIROC database, to avoid any clones). You should arrive at the homepage shown below if you visit www.cmcmarkets.com.

2) Move your cursor to the Markets tab and under the Products segment click on Forex (in the yellow box)

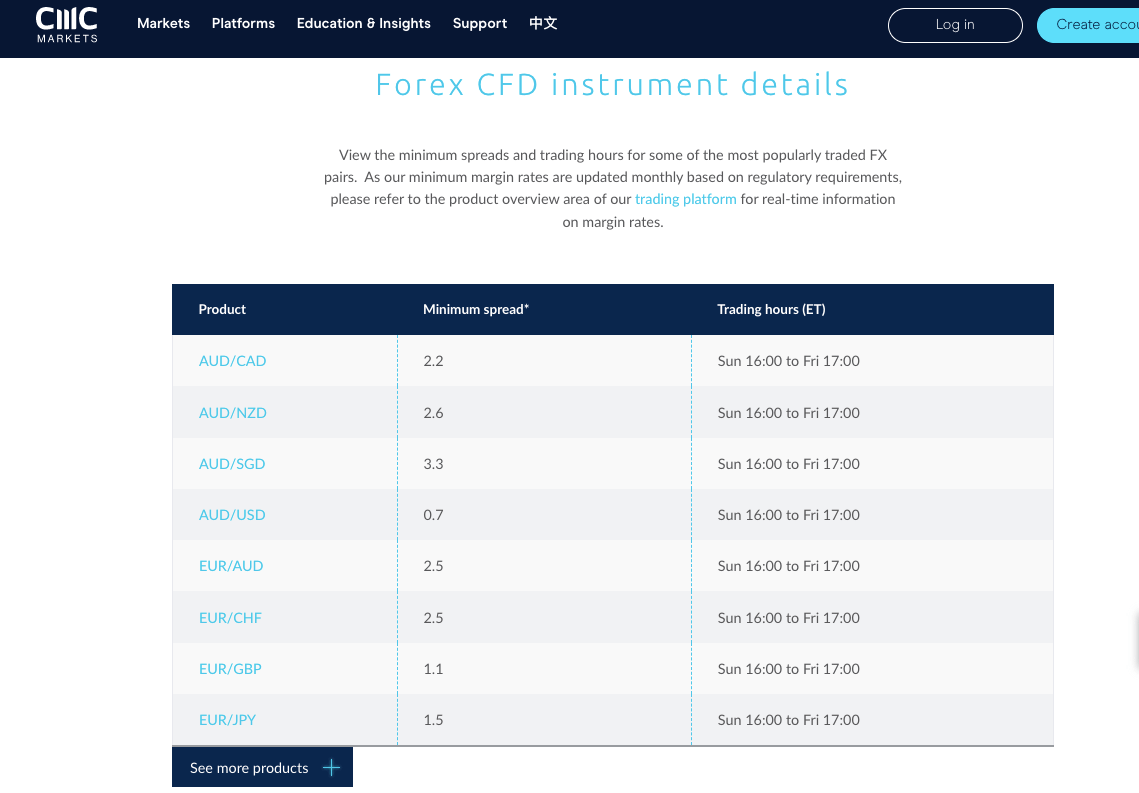

3) When the page loads, you will find the spreads for currency pairs as shown in the image below.

The page in (3) does not display the spread for all currency pairs. To find the rest, click on “See more products” and it will show you more currency pairs. To see the spread for other instruments, click the particular instruments under the Products segment as explained in step (2) above.

How to Calculate your Spread Cost

It is one thing to know the spread your preferred Forex broker attaches to a currency pair. However, this value is of no use if you do not know how much it is costing you in real money. This is why you should learn to calculate your spread cost.

The simple formula to calculate your spread cost is (Lot size * Spread). Here is an example:

Let’s say you want to buy 1 standard lot USD/CAD at a bid-ask price of 1.2636/1.2634.

Remember that spread = bid price – ask price

1.2636-1.2634 =0.0002 (2 pips)

Spread Cost = 100,000 *0.0002 =$20.

So this trade will cost you $20.

How to Optimize Low Spreads

Low spreads are not a guarantee that conditions are favorable for trading. You have to combine your analysis with other minute details to take advantage of low spreads. Here is how you can do this:

1. Know the kind of spread offered by your broker (fixed or variable). If it is the latter, only trade when the spreads are low. That is, when there is no significant economic event going on.

2. Find out other trading fees. Especially commissions and swaps. They tend to increase your trading fees once they are added to the fees incurred from spreads.

3. Trade with low leverage. The higher your leverage, the higher your risk of a margin call. If the market moves against your trade, you will suffer a heavy loss to your capital.

4. Be flexible. Combine technical analysis and fundamental analysis. Every successful trader needs to work with both analysis. You might naturally prefer one to the other. However, you need to be aware of what is going on with both sides. As you use indicators and trendlines, also pay attention to economic events and releases that might have a strong impact on the market.

How to Choose a Low Spread Broker in Canada

In the previous section, we covered how you can check a broker’s spread. This is a major factor to consider when choosing a low spread broker. However, that is not the only factor you should look into. In this section, we cover the other important factors.

Regulation: Low spreads do not guarantee safety. Trading with a regulated broker only guarantees that. After confirming a forex broker has low spreads, you have to confirm if your funds are safe with them. This is done by verifying if your broker is regulated by the IIROC. Here is how you can go about this using FOREX.com as an example.

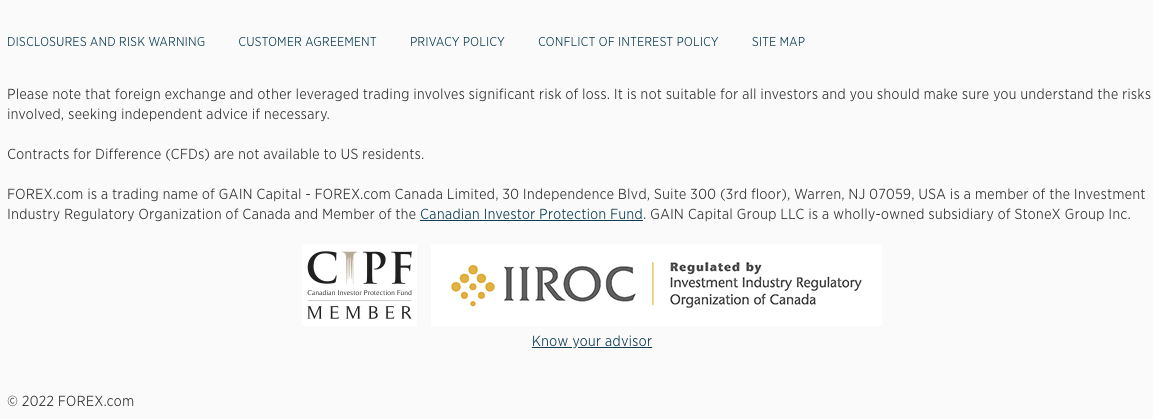

1) Check your broker’s regulation at the footnote of their website. Pay attention to the company. In this case visit forex.com.

From the image, you can see that the company name ‘FOREX.com is a trading name of GAIN Capital – FOREX.com Canada Limited’. We need these details to correlate with the one on IIROC’s website.

2) Go to IIROC website at www.iiroc.ca/investors/dealers-we-regulate, Scroll down until you arrive at the name search area as shown below..

3) Enter the broker’s name and click ‘APPLY’. Using FOREX.com for example, your search result should look like the screenshot below.

You can see that the detail match the ones we saw on the broker’s website. This is the simple way to verify a forex broker’s regulation.

Account type: It is common for a broker to have more than one account. Usually, the spreads on these accounts will differ. If one of the accounts is a raw ECN-type account, the typical spreads are usually low. Since you are looking to choose a low-spread broker, you might as well go for the accounts with the lowest spreads.

This is why you should check if your broker offers varying account types.

Other trading fees: We have covered how to calculate spread costs. But spreads are not the only trading fees you incur. There are commissions and overnight charges too. For brokers with multiple account types, their ECN accounts usually combine low spreads with extra commission charges.

Swaps can be high or low depending on the broker. These fees determine your total cost of trading and can affect loss or profit per trade. This is why you have to check them to know if they are high or low.

Customer Service: You want to make sure you are in good hands when dealing with a forex broker. You may have issue with your deposit/withdrawals. Or need more information about your broker’s trading conditions. So you need to know the channels of communication your broker supports.

Are there FAQs? Can you speak to a live customer support agent? Are email responses quick? These are the questions you should have in mind as you choose a low spread broker. You should also test all of their customer service channels to know how effective and fast they are.

What is a Zero Spread Trading Account?

A zero spread trading account is an account that has no significant difference between the bid (sell) and ask (buy) prices for certain currency pairs. Forex brokers do not offer zero spread on all of their currency pairs. It is easy to see why because forex brokers make money from spreads. In addition, some currency pairs do have enough liquidity that may allow for zero spread.

So, if a broker offers a zero account, it will usually be for major currency pairs like GBPUSD and EURUSD. These pairs have high trading volumes and are liquid. Since a zero account likely means zero spread cost, it does not mean you are not incurring other trading costs. Your forex broker might charge a commission or have other hidden fees.

Therefore, it is important you do your research if you see a forex broker offering a 0 spread account. Make sure you find out the structure of their trading costs before opening an account.

Which Spread is Best for Forex Traders?

Forex trading is is a complex and diverse enterprise. The answer to this question is not that straightforward. The best spread for forex depends on your choices, your trading style, and strategies. Different forex trading strategies have different spreads that suits them.

Let us consider some of these strategies.

Scalping: Scalping involves opening and closing trades quickly to accumulate little profits over a period of time. Too high spreads defeats this purpose so low spreads are best for scalpers. Very low spreads positively impact their profitability.

Day trading: Day traders will definitely prefer lower spreads but can make do with slightly higher spreads. This is possible because of how long they hold their trades.

Swing trading: Swing traders do not mind wider spreads. They can have trades open for up to a month or more. Their trades will pass through periods of volatility including the widening of spreads during high impact economic news.

As long as a swing traders have an edge in their trading, they will likely not worry about these scenarios.

Position traders: Position traders are not too concerned with spreads. They have an investment approach that to trading, focusing on long-term, larger price movements. For these traders, spread is not a very strong factor.

FAQs on Best Low Spread Forex Brokers in Canada

Which is the lowest spread forex broker?

As per our research FXCM is the forex broker with the lowest spread in Canada. Spreads start from 0.3 pips for majors forex pairs like the EUR/USD. The broker also charges commissions of $14 round turn per standard lot (100,000 units) traded.

Can you trade without spread?

There are many brokers that advertise Raw spread or Zero spread, but the actual spread are likely to be higher than 0 pips during most of the times. Take into account that the advertised 0 pips does not mean that you will get 0 pips spread on all instruments, these are typical spreads which are variable. Also note that brokers who offer 0 spreads usually charge commissions to compensate for the low spreads.

What type of broker has the lowest spreads?

Generally,forex brokers determine the spreads of forex pairs. If the broker is an ECN broker or STP broker, their spreads are usually low. In addition, major and minor currency pairs have low spreads compared to extoic pairs.

Is low spread good in forex?

Low spreads only guarantee reduced trading fees (specifically, spread costs). However, low spreads should not be your sole reason for signing up with a broker. You need to consider other factors like IIROC regulation, execution model, other trading fees, and their range of CFD instruments.