| AxiTrader Minimum Deposit Summary | |

|---|---|

| AxiTrader Minimum Deposit | £0 |

| Deposit Methods | Bank Transfer |

| Account Types | 5 trading accounts |

| Deposit Fees | No Fees |

| Account Base Currencies | AUD, CAD, GBP, EUR, CHF |

| Withdrawal Fees | Withdrawals are free if they are above US$50 or for the full balance of your Account. |

| Visit AxiTrader | |

AxiTrader is one of those brokers who has no stipulated minimum deposit. According to their website, the minimum deposit for AxiTrader is £0. Regardless of the trading account type you choose, that is the stated deposit required.

Apart from a demo account, there are five live trading accounts you can open with Axi. They are all on MT4 with varying trading conditions.

We researched these accounts and here is a summary of what we found.

How Much is AxiTrader’s Minimum Deposit in the UK?

Here is where we breakdown the account types, a summary of their trading conditions, and the minimum deposits.

Let’s go.

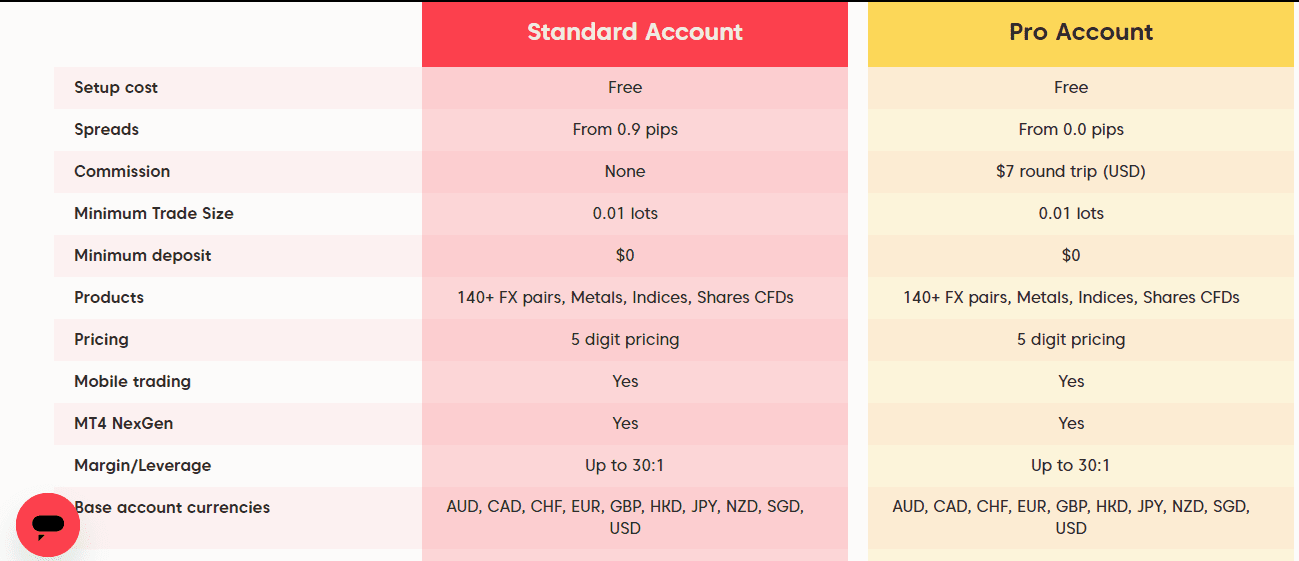

1) Standard Account

This is Axi’s first account. The minimum deposit for AxiTrader’s Standard Account is £0. Also, there is no fee required to set up the account.

In terms of trading fees, they are low for this account. You will pay a spread on every trade and that is all there is. The spread begins from 0.9 pips. The account is commission free so there will be no extra charges for every standard lot you trade.

Your lowest lot size is 0.01 and you can trade 140+ FX pairs, metals, indices, and Shares CFDs

2) Pro Account

The minimum deposit for Axi’s Pro Account is £0. Do not mistake this account for a professional account. It is just another retail trading account for retail traders.

The spread for this account is low, starting at 0.0 pips. The main trading fee for this account is the extra commission for every standard lot you trade. The commission is $3.5 per trip which brings your commission to $7 round trip.

You can trade 140+ FX pairs, metals, indices, and Shares CFDs on a 0.01 minimum lot size.

3) Axi’s Spread Betting Account

Axi also offers a spread betting account with £0 as minimum deposit. Axi’s spread betting account operates like a standard FX/CFD account.

Usually, spread betting operates on a point per move basis. But with Axi you will bet on spreads with lot sizes instead of bet sizes.

Forex, shares, indices, and commodities are offered as CFDs. The commission for this account is contained within the spreads so no extra charges.

No capital gains tax and no stamp duty on your profits.

4) Islamic Trading Account

As per our AxiTrader review, Axi’s Standard and Pro Accounts are also available as swap-free accounts. The minimum deposit remains the same.

You might not find it on their website. But as you go through the account application process, you will find the option of a swap-free account.

This account is for those who cannot pay or receive interest due to religious or cultural beliefs. Axi can revoke the swap-free status of your account. So make sure not to misuse the account or trade suspiciously.

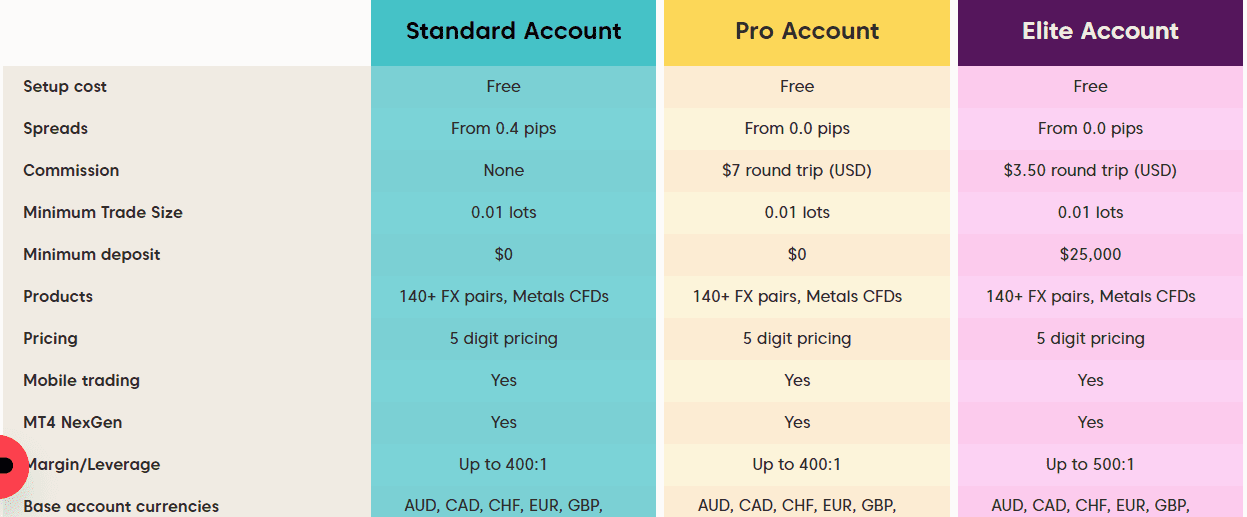

5) Elite Account

The elite account is a proper professional account. It is designed for wholesale clients, seasoned professionals, and institutions. The minimum deposit is £25,000.

Spreads begin from 0.0 pips with $3.50 round-turn commission. This is not an account you can just open. You have to meet some eligibility criteria. You will also show evidence that you meet these criteria.

The Standard and Pro Accounts also have their own professional version as shown below.

Note: 71% of traders lose money with this broker

6) MT4 Demo Account

This is an account you can use to practise trading without any risk. This account is 100% free and it only lasts for thirty days.

There is no minimum deposit for this account. Rather, Axi will give you virtual money in your demo account to trade a replica of live trading conditions.

If you do opt for a demo account, you get £50,000 as your virtual deposit.

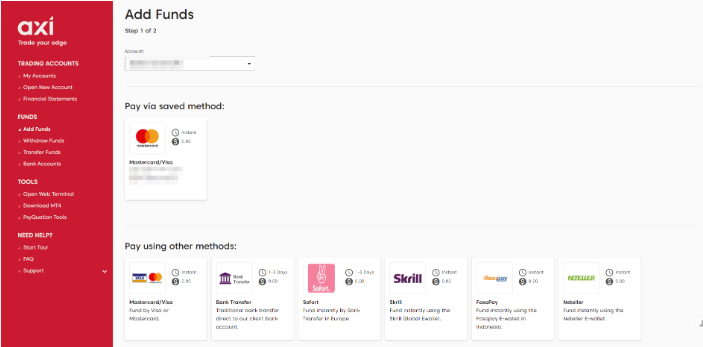

Axi Deposit Methods and Required Fees

Traders resident in the UK can fund their account in different ways. You might pay a fee or nothing for using these methods. It all depends on you meeting simple terms and conditions.

Any fee you have to pay can come from your bank or financial institution. Axi does not charge any fees for funding.

Let us have a look at these methods.

1) Bank transfers: You can fund your account via your local bank. There is no monthly limit to the amount you can deposit and no fees.

2) International Bank Transfer: International bank transfer can also be an easy means of funding your trading account. Axi charge no fees for using this method

3) Credit/Debit cards: Axi accepts cards from Visa and MasterCard only. There is no extra fee when you fund your account through this method.

Note: All of these payment methods have their monimum deposits. These minimum deposits are not from Axi but from the payment service providers.

You can withdraw your funds via these methods as well without extra commission or fees.

Axi Deposit Rules

1) Axi does not accept third party payments. If they suspect a third party payment, they reserve the right to return the funds to the remitter and retain the balance in your account, pending verification/proof of identity.

If Identity cannot be proven Axi reserves the right to retain the balance in your Account and you will not be permitted to withdraw the balance in your Account.

2) If funding exceeds monthly limits of $50,000 for card payments and other methods, Axi may charge a 3% fee. Only bank transfer is exempted from this rule because there is no monthly limit.

How to Deposit Funds Into Your Axi Account

1) Log in to your personal client area.

2) Click the ‘Deposit’ or ‘Funding menu’

3) Choose your preferred payment method

4) Provide necessary information and complete funding to your trading account.

Note: 71% of traders lose money with this broker

Comparison Of Axi Minimum Deposit With Other Brokers

Here is how Axi’s minimum deposit compares with a select UK brokers in the industry.

| Broker | Minimum Deposit |

|---|---|

| Admiral Markets | £250 |

| Axi | £0 |

| CMC Markets | £0 |

| FxPro | £100 |

| FXCM | £50 |

| Pepperstone | £0 |

What base currencies are accepted by Axi?

Axi accepts the following base currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD

Does Axi have a deposit bonus?

No, there is no deposit bonus for traders in the UK.

Frequently Asked Questions

How much is the Axi deposit fee?

Axi does not charge any fees for deposit. However, there is a 3% commission if you exceed a $50,000 monthly transaction for limit for some payment methods.

How long does it take to withdraw money from Axitrader?

It depends on the payment method you use. Credit/debit cards is instant. Other methods (bank transfer and international bank transfer) take 1-3 business days.

What is the minimum withdrawal from Axi?

There is no specific minimum withdrawal. Your payment method determines what your minimum withdrawal will be. If you are using a local bank it is £30, £5 for credit/debit cards, and £50 for international bank transfer.

Is Axi broker legit?

Axi is a forex broker licensed in the UK. They are registered in the UK under the trading name Axi Financial Services (UK) Limited.

Note: Your capital is at risk