Admiral Markets is an online Forex and CFDs broker that allows you to trade foreign exchange currency pairs, and CFDs (Contract For Difference) on metals, shares, energies, indices, bonds, ETFs (Exchange-Traded Fund), and agriculture commodities.

Admiral Markets was launched in 2001, they are registered in the UK and authorised by the FCA (Financial Conducts Authority).

Our Admiral Markets review looks at the trading conditions, leverage, fees, deposit/withdrawals, and customer support offered by the platform.

| Admiral Markets Review Summary | |

|---|---|

| Broker Name | Admiral Markets United Kingdom |

| Establishment Date | 2001 |

| Website | www.admiralmarkets.com |

| Address | Admiral Markets, 37th Floor, One Canada Square, Canary Wharf, London, E14 5AB, United Kingdom |

| Minimum Deposit | £250 |

| Maximum Leverage | 1:30 |

| Regulation | FCA, ASIC, CySEC, FSCA, EFSA, JSC |

| Trading Platforms | MT4, MT5 and Admirals Mobile App available on Android & iOS |

| Visit Admiral Markets | |

Admiral Markets Pros

- Admiral Markets is regulated in the UK

- Offers a wide range of trading instruments

- Supports MT4 and MT5 Platforms on multiple devices

- Low minimum deposit/withdrawals for bank transfers

- Negative balance protection for retail clients

- Fast deposit/withdrawal processing

Admiral Markets Cons

- Charges account inactivity fees

- Customer support is not available 24/7

- Charges deposit fees on some payment methods

- Offers only 1 free withdrawal per month for each payment method

Are Admiral Markets regulated?

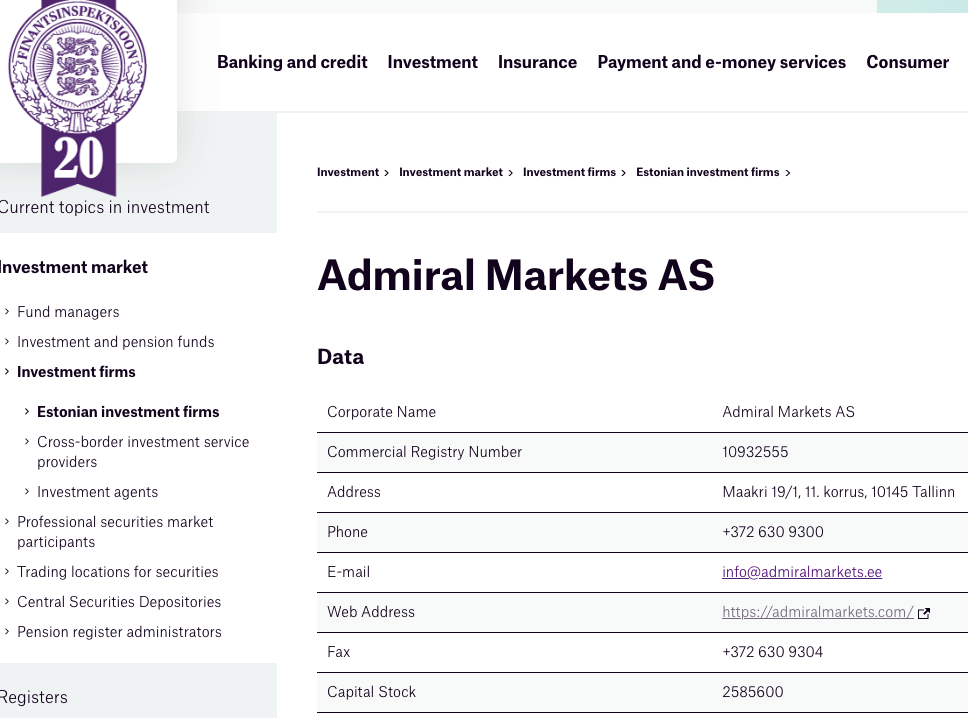

Admiral Markets is the trading name of Admiral Group AS, registered and regulated in the Republic of Estonia, where they have their headquarters. The company is currently on a rebranding campaign to change their trading name from ‘Admiral Markets’ to ‘Admirals’

The company is regulated in other jurisdictions by Top-Tier financial regulators. Find details of the various regulations of Admiral Markets below:

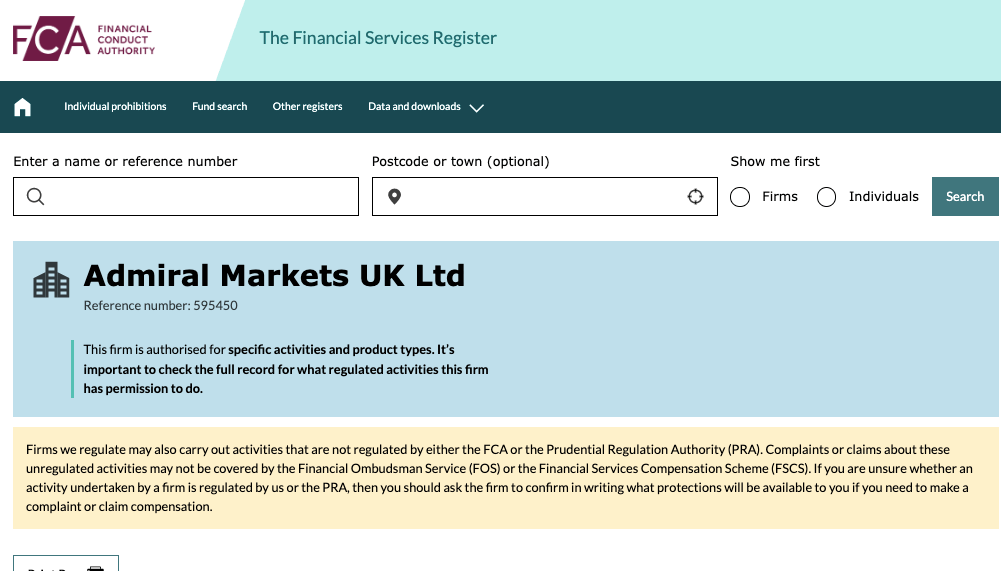

1) Financial Conduct Authority (FCA): Admiral Markets UK Ltd. is regulated by the FCA and authorized to offer financial services in the UK with reference number 595450, issued in 2013.

The company is also registered with the Financial Services Compensation Scheme (FSCS) in the UK, which protects clients of financial services firms and will compensate them up to £85,000 if the firm becomes bankrupt and cannot repay claims.

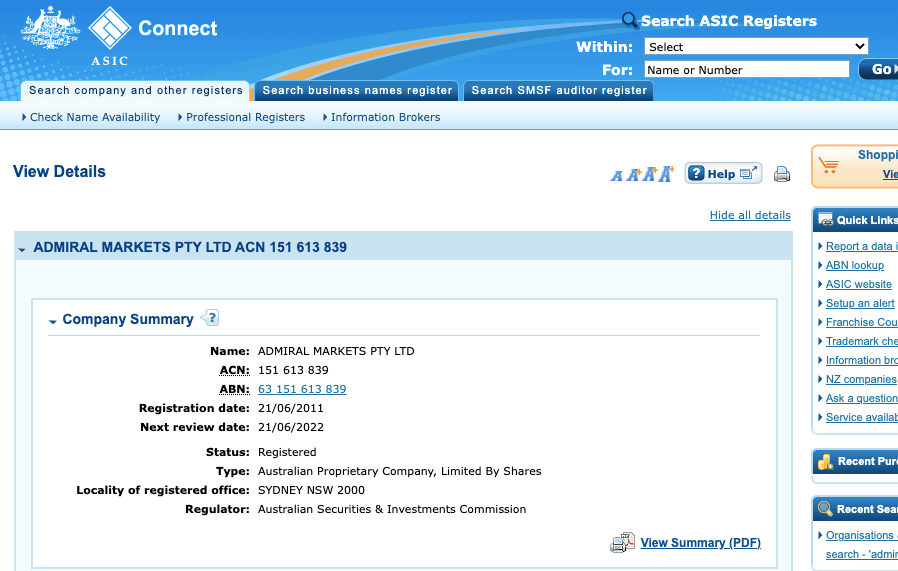

2) Australian Securities & Investments Commission (ASIC): Admiral Markets Pty Ltd is licensed in Australia by the ASIC to offer financial services, with ACN (Australian Company Number) 151613839, issued in 2011.

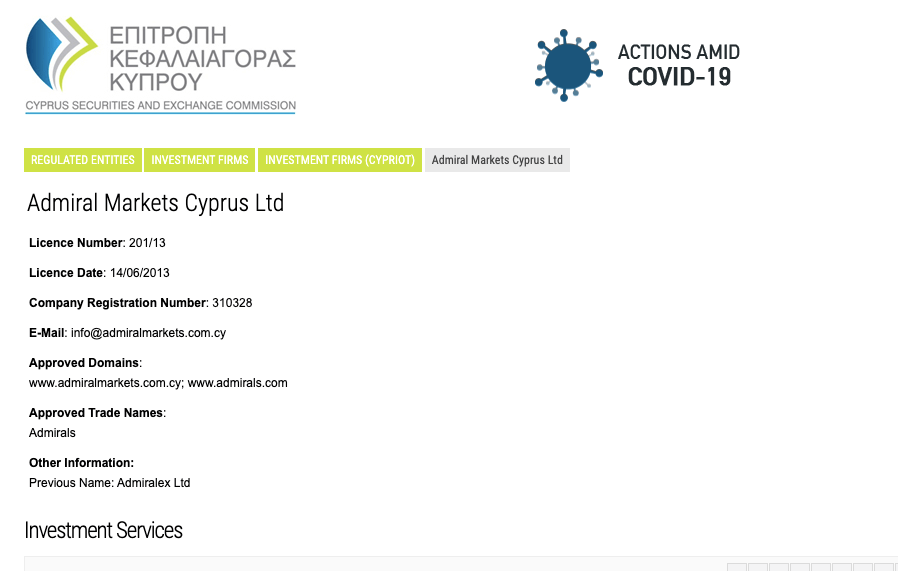

3) Cyprus Securities and Exchange Commission (CySEC): Admiral Markets Cyprus Ltd is licensed by CySEC to offer investment services in Cyprus, under the trading name Admirals, with license number 201/13, issued in 2013.

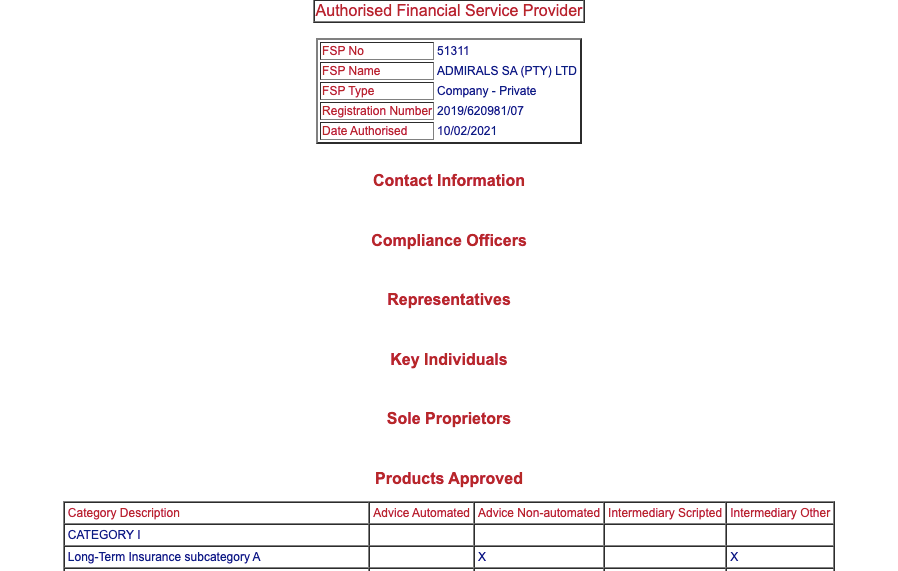

4) Financial Sector Conduct Authority (FSCA) in South Africa: Admirals SA (Pty) Ltd is authorized in South Africa by the FSCA to provide financial services with FSP (Financial Services Provider) Number 51311, issued in 2021.

5) Estonian Financial Supervision Authority (EFSA): Admiral Markets AS is licensed in Estonia as an investment firm by the EFSA. This license was issued in 2009 and permits them to offer their services to European Economic Area (EEA).

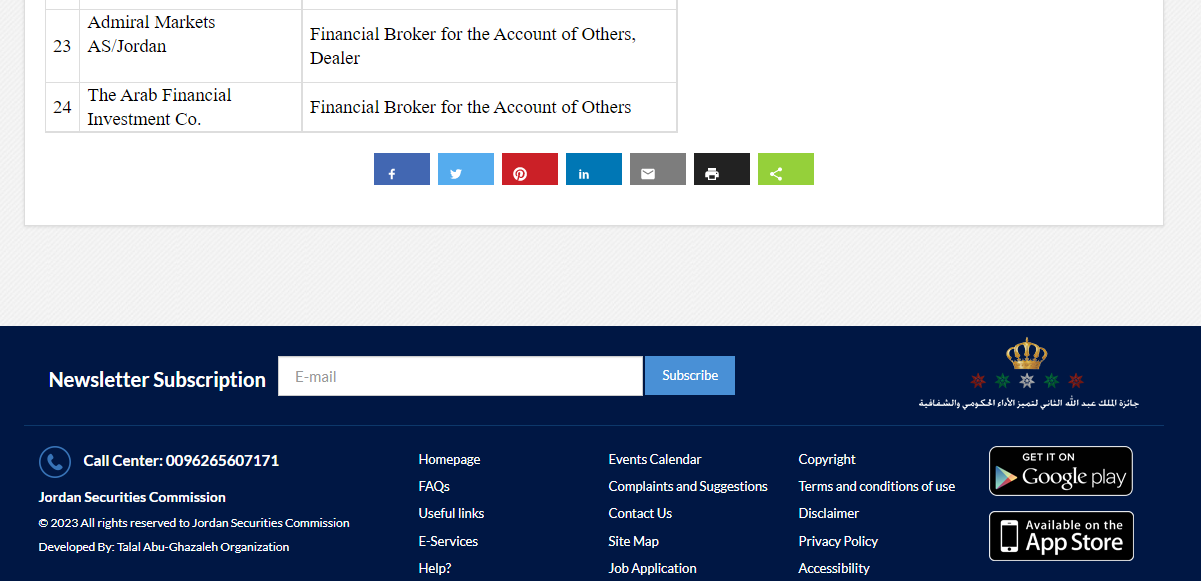

6) Jordan Securities Commission (JSC): Admiral Markets is also authorised and licensed to conduct business in Jordan as Admiral Markets AS Jordan Ltd. Their registration number is 57026 and the company is regulated in the Hashemite Kingdom of Jordan

7) Capital Markets Authority (CMA): Admiral Markets have also added CMA regulation to their license. This allows them to provide financial services to traders based in Kenya as non-dealing online foreign exchange broker. Their registered name is Admirals KE Ltd with license number 178.

Admiral Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | Admiral Markets UK Ltd |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | Admirals AU Pty Ltd |

| EEA Countries | €20,000 | St Vincent and the Grenadines Financial Services Authority (SVGFSA) | Admiral Markets Cyprus Ltd |

All clients of Admiral Markets have protection from negative balance as required by the FCA.

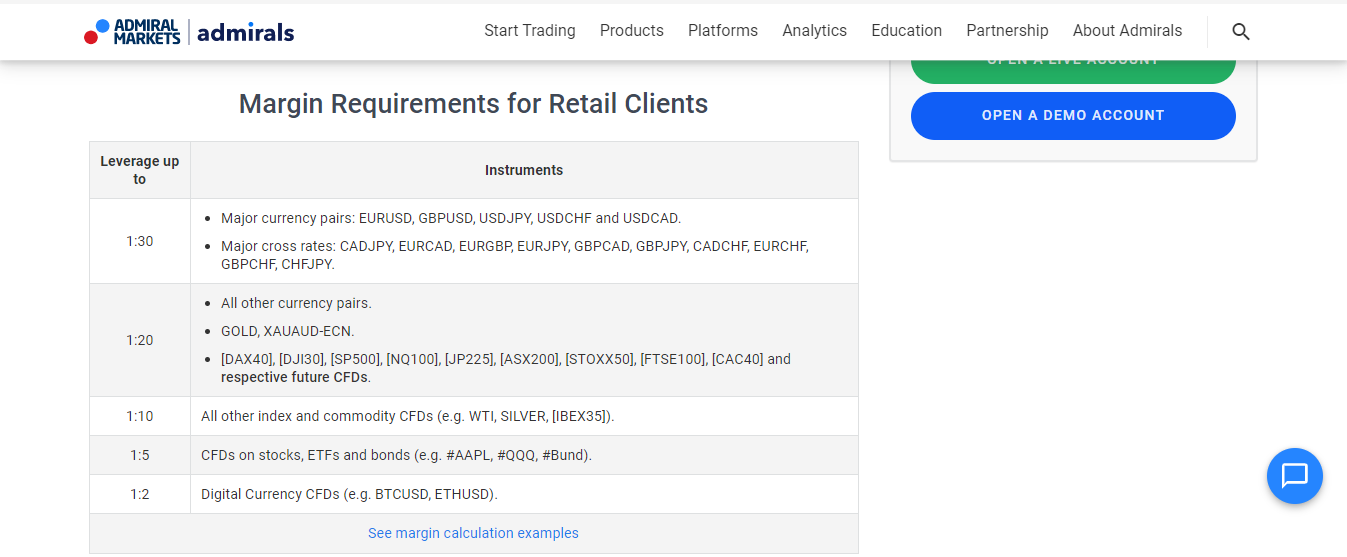

Admiral Markets Leverage

With a variable leverage system, the maximum leverage on Admiral Markets is 1:30 for retail clients, which means that you can open a position 30 times the size of your deposit.

For example, if you have a £1,000 deposit, you can open positions valued at up to £30,000 for Forex. The leverage is lower for other trading instruments.

If you want to trade with higher leverage, you can request to become a professional client and will be able to trade with higher leverage of up 1:500.

Admiral Markets Account Types

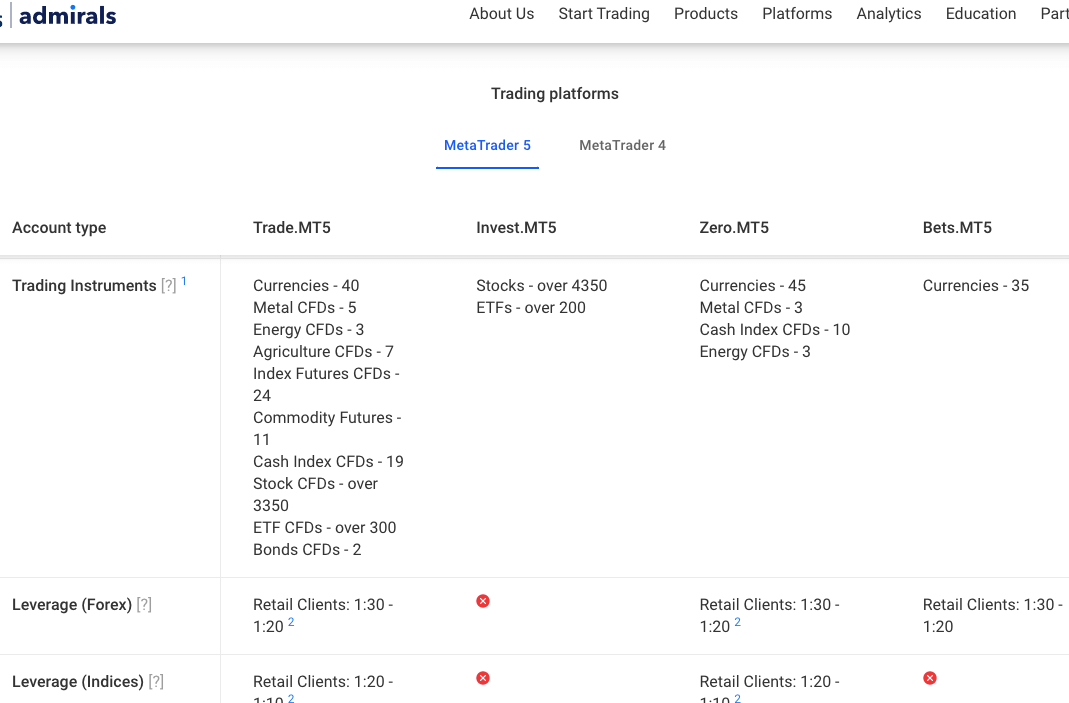

Admiral Markets offers 6 account types with varying features depending on the trading platform you use and whether you are a retail trader or a professional trader.

When you first create an account on Admirals, you get assigned a retail account status by default, except you meet the criteria for a professional account. After registration, you can apply for an account upgrade to professional account status.

They also offer Islamic Account features to Muslim traders, demo accounts for new traders who are not yet familiar with the trading platforms and Admirals spread betting account.

Here is an overview of the account types on Admirals and their features.

1) Trade.MT5 Account: The Admirals Trade.MT5 is designed for the MetaTrader 5 trading application and holders of this account can trade currency pairs and CFDs on indices, metals, ETFs, bonds, energies, and stocks.

This account does not pay any commission fees for opening or closing trade positions except when trading CFDs on shares and ETFs, in which case you will pay commission fees starting from $0.02.

Spreads on the Trade.MT5 Accounts start from 0.5 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £250, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

2) Zero.MT5 Account: The Admirals Zero.MT5 is designed for the MetaTrader 5 trading application. This account allows you to trade currency pairs and CFDs on cash indices, metals, and energies.

Commission fees for opening or closing trade positions start from $0.5 and up to $3. Spreads on the Zero.MT5 Accounts start from 0.0 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £250, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

3) Invest.MT5 Account: The Admirals Invest.MT5 Account is designed for the MetaTrader 5 trading application. With this account, you can only trade ETFs and stocks.

Commission fees for opening or closing trade start from $0.02 on Invest.MT5 Account spreads start from 0.0 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £1, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

4) Bets.MT5 Account: The Admirals Bets.MT5 is a spread betting account that is available only on the MetaTrader 5 trading application. You can only trade currencies on this account.

This account is commission-free, spreads start from 0.5 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £100, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

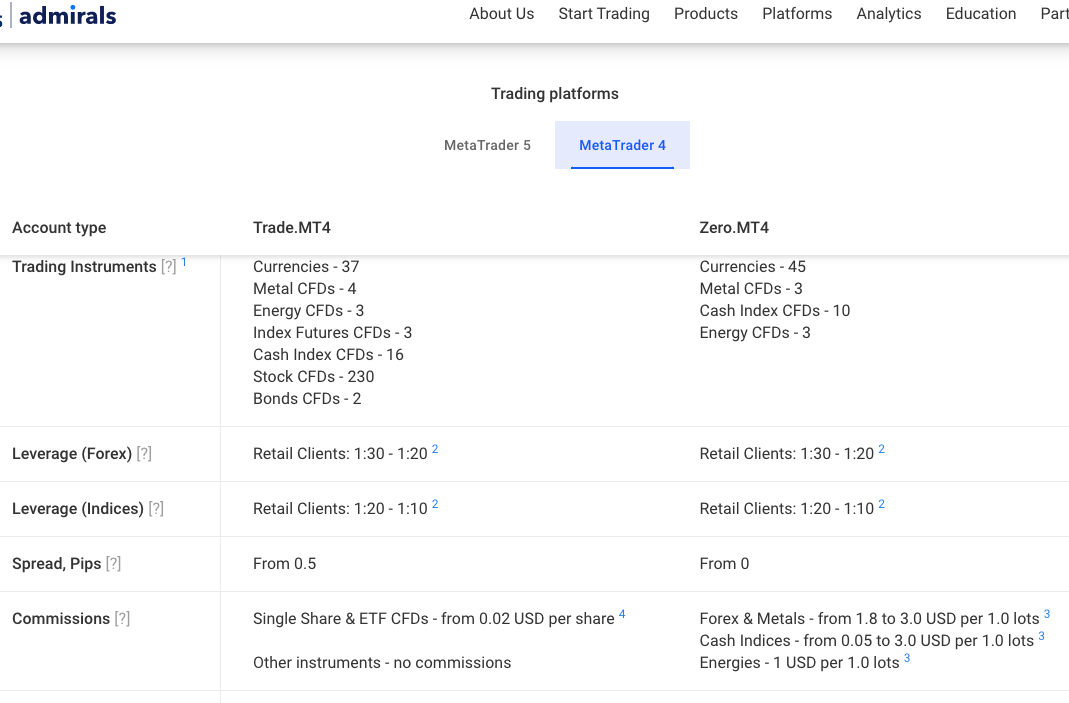

5) Trade.MT4 Account: The Admirals Trade.MT4 is designed for the MetaTrader 4 trading application and you can trade currency pairs and CFDs on indices, metals, ETFs, bonds, energies, and stocks with this account.

This account does not pay any commission fees for opening or closing trade positions except when trading CFDs on shares and ETFs, in which case you will pay commission fees starting from $0.02.

Spreads on the Trade.MT4 Accounts start from 0.5 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £250, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

6) Zero.MT4 Account: The Admirals Zero.MT4 is designed for the MetaTrader 4 trading application. This account allows you to trade currency pairs and CFDs on cash indices, metals, and energies.

Commission fees for opening or closing trade positions start from $0.5 and up to $3. Spreads on the Zero.MT4 Accounts start from 0.0 pips for major pairs and you pay swap fees for holding a position open overnight.

This account requires a minimum deposit of £250, with a minimum trade lot size of 0.01, and maximum leverage of 1:30 for retail clients.

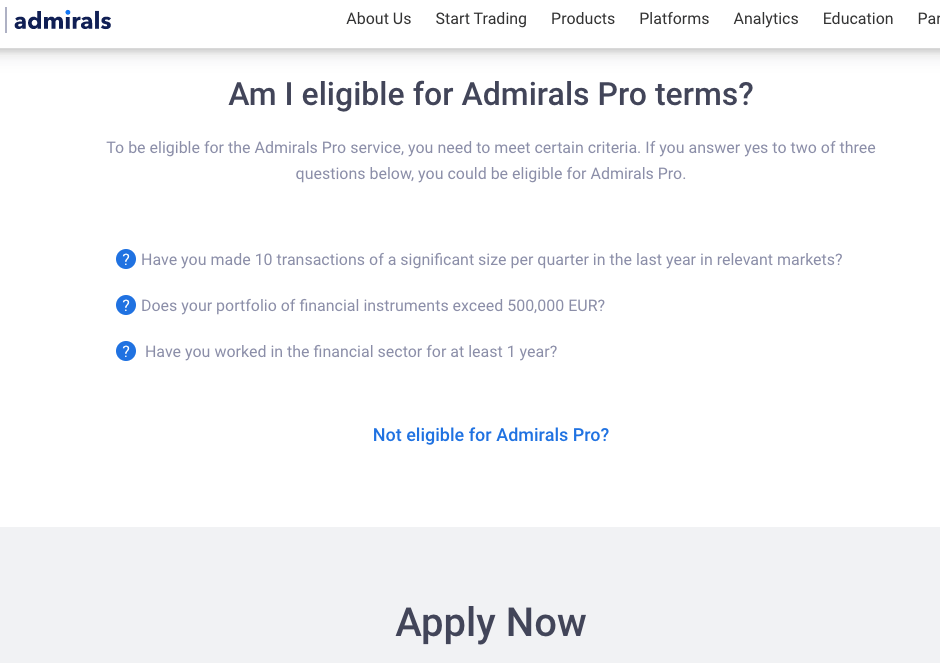

7) Admirals Pro Account: The Admirals Pro Account is designed for professional traders who have experience trading financial instruments and trade large size portfolios. You can signup for a Professional Account with Admirals during registration or request to have your retail account upgraded.

All account types offered on Admirals can be upgraded to professional status and you can access the professional traders’ features, such as higher leverage of up to 1:500. Leverage for some instruments is lower.

The Admiral Markets Professional Account does not have negative balance protection and you need to meet at least 2 of the 3 criteria below before applying.

- A minimum of 1 year of experience working in the financial sector is required.

- A minimum of 10 significant transactions size per quarter over the last 1 year.

- You have a portfolio of financial instruments with a value of more than €500,000 or its equivalent in GBP

8) Islamic Account: Admirals offers swap-free Islamic Accounts to Muslim traders who want to abide by the sharia law in their trading. The Islamic Forex Account is only available on Trade.MT5, accessible on the MetaTrader 5 application only.

Both retail and professional traders can have Islamic Accounts and will be able to trade all instruments available for the Trade.MT5 Account with no increased spreads or commission fees.

Admirals Islamic Account holders will not be required to pay any swap fees for keeping a position open overnight for up to 3 days, after which they will be charged a flat administration fee each day. The administration fees vary according to the instrument traded, starting from $0.01 and up to $113.

Note that digital and exotic currencies have only one-day swap-free before you start paying administrative fees.

To open an Islamic Account on Admiral Markets, first signup a standard Trade.MT5 Account, then contact support to apply for the Islamic Account status. You will be required to submit additional verification documents upon your application.

Admiral Markets Base Account Currency

When opening a trading account with Admirals, you choose from 10 account base currencies, they are British Pound Sterling-GBP, Euros-EUR, United States Dollars-USD, Swiss Franc-CHF, Bulgarian Lev-BGN, Czech Koruna-CZK, Croatian Kuna-HRK, Hungarian Forint-HUF, Poland złoty-PLN, and Romanian Leu-RON.

Your trades, deposits, withdrawals, and account balance will be measured in your chosen currency.

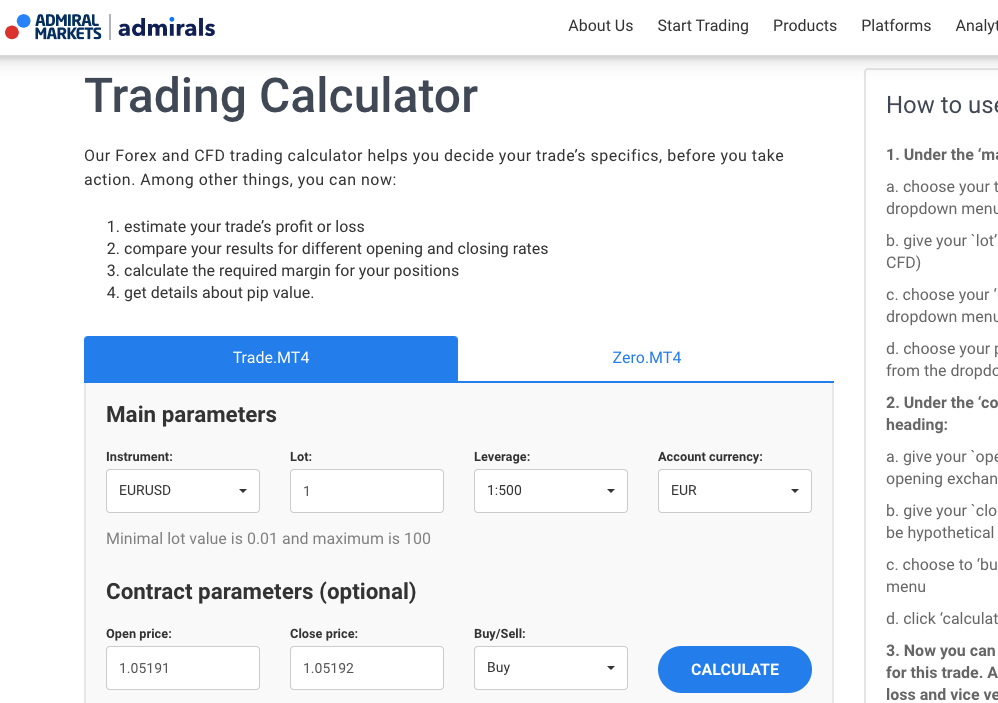

Admiral Markets Overall Fees

The fees on Admirals depend on the account type you have and the trading platforms. Find an overview of the trading and non-trading fees on Admiral Markets below:

Trading fees

1) Spreads: Admirals charge spread fees for trades which are the difference between the Ask and Bid price of instruments. Spreads are referred to as pips.

Spread fees vary depending on the instrument pair traded. Typical spreads on major pairs on Admirals are shown below:

| Instrument/Pair | Trade.MT5/MT4 Account | Zero.MT5/MT4 Accoun |

|---|---|---|

| EUR/USD | 0.8 pips | 0.1 pips |

| GBP/USD | 1 pip | 0.6 pips |

| EUR/GBP | 1 pip | 0.6 pips |

| Gold | 0.20 pips | 0.15 pips |

Note: The spread for gold might differ based on account type.

2) Commission fees: Admirals charge commission fees for opening and closing trade positions on all account types except the Bets.MT5. Although the Trade.MT5 and Trade.MT4 charges commission fees for only CFDs on shares and ETFs, while other instruments on the accounts are commission-free.

Commission fees on Admirals start from $0.02 to $3 per 1 standard lot of trade.

3) Swap fees: Whenever you hold a trade position open for more than 24 hours or overnight, that is 11:59 PM UK time, you are charged a swap fee which is added to your profit or loss on your trade whether a short (sell) position or you was long (buy) position.

Islamic Accounts do not pay any swap fees, and you can calculate your swap fees using the calculator on the Admirals website.

Non-trading fees

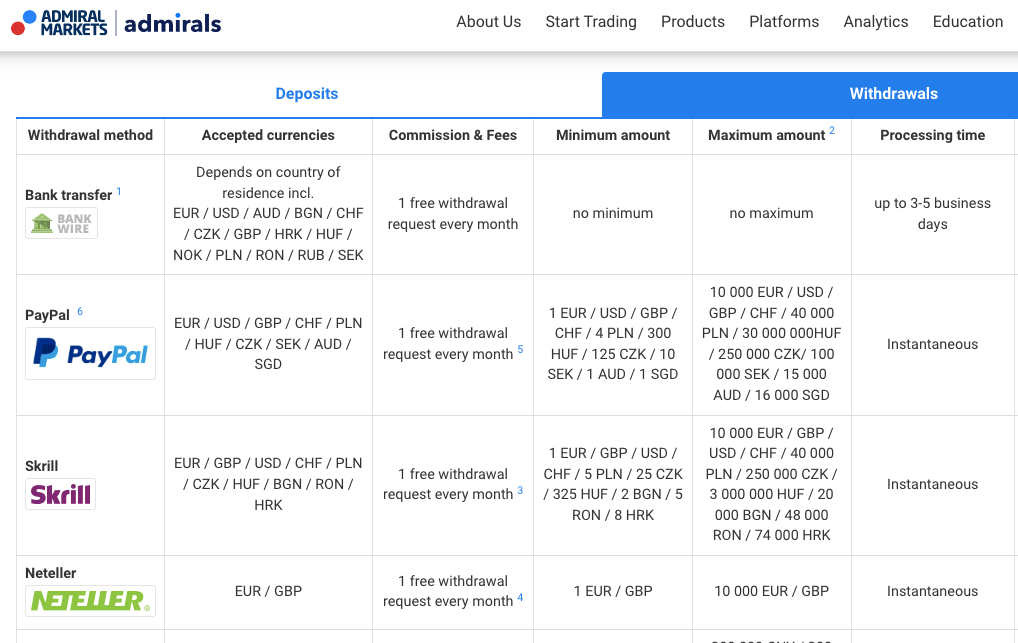

1) Deposit and Withdrawal fees: Admirals offers free deposits for most payment methods, except a 0.9% deposit fee for using Skrill and Nettler. Admirals offer 1 free withdrawal each month for all payment methods, after which subsequent withdrawals attract a 1% fee.

2) Account Inactivity charges: Admirals charge inactive account fees. If you do not trade or log in to your trading account for 24 months, a dormant account fee of €10 per month will apply.

| Fee | Amount |

|---|---|

| Inactivity fee | €10 |

| Deposit fee | None |

| Withdrawal fee | None* |

*After your first withdrawal in month, which is free, there is 1% commission for subsequent withdrawal requests. This applies to debit/credit card, PayPal, Skrill, and Neteller. For bank transfers, it is $10 for subsequent withdrawals.

How to Open Admiral Markets Account in UK?

Follow these steps to open a trading account on Admiral Markets.

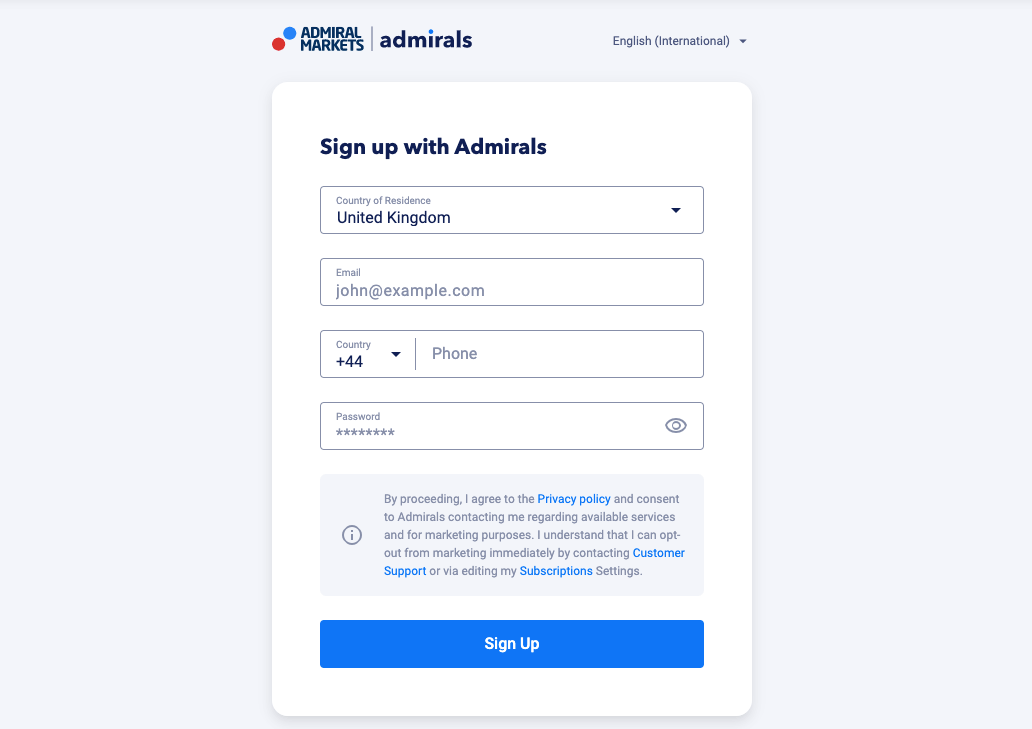

Step 1) Go to the Admiral Markets website homepage at www.admiralmarkets.com and click on the blue ‘GET STARTED’ button at the page centre or the green ‘REGISTER’ button at the top right corner of the page.

Step 2) Fill out your email address, and phone number, create a password then click on ‘Sign Up’.

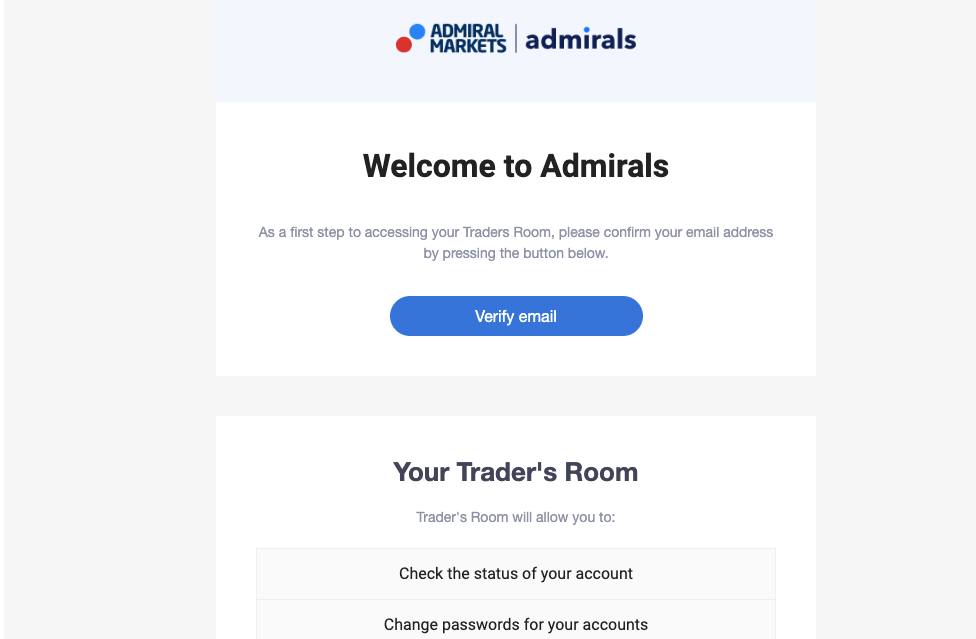

Step 3) Go to your email inbox and click on ‘Verify email’ in the email from Admirals.

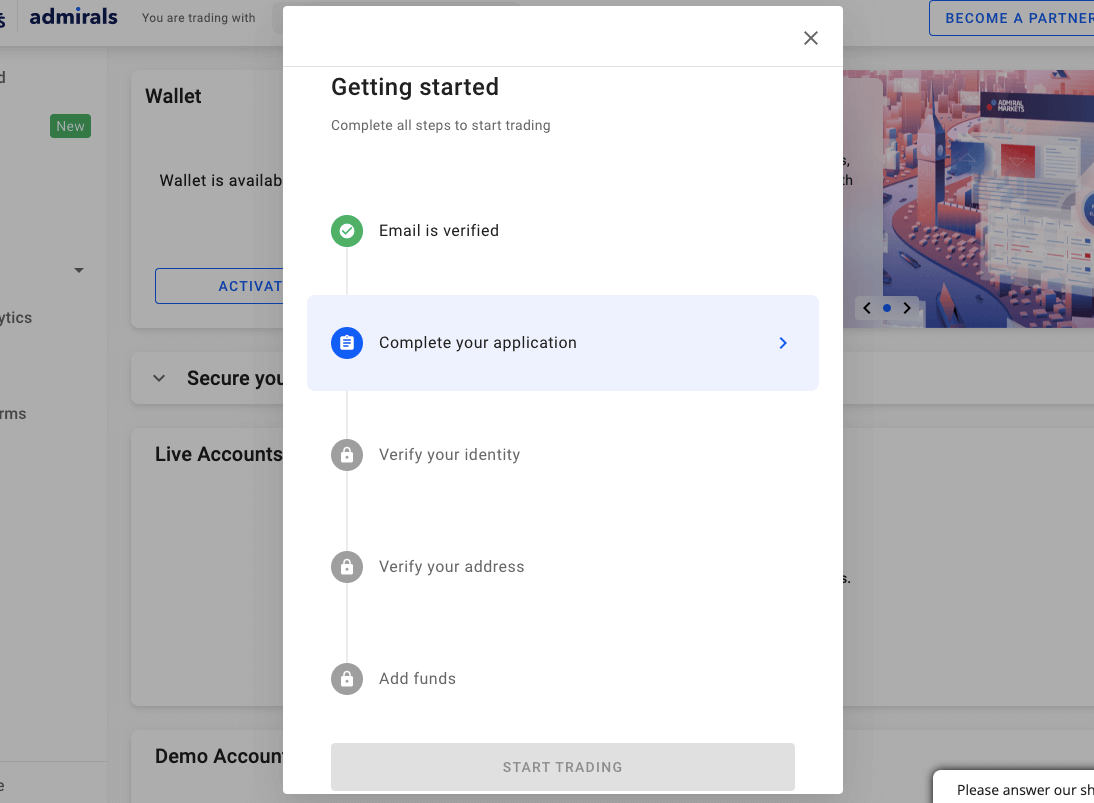

Step 4) Click on ‘Complete your application’, and select account individual account type.

Step 5) Confirm your phone number and fill out your full name, address, and date of birth.

Step 6) You will need to answer some questions about your trading experience, financial status and employment status.

Step 7) You will need to activate your wallet by uploading identity and address documents.

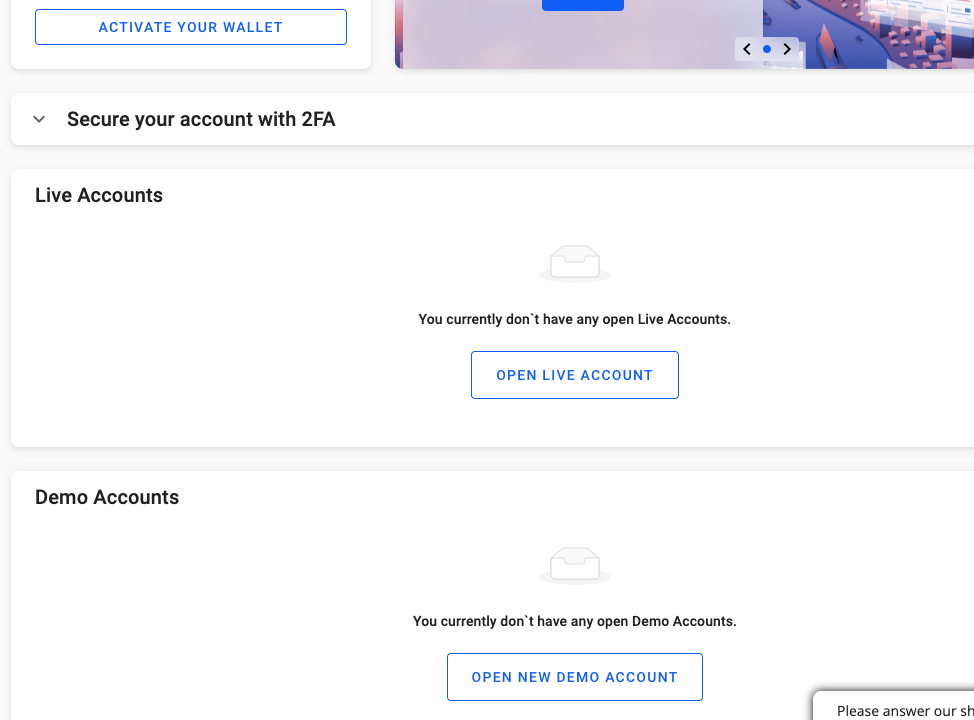

Step 8) Create a live trading account, then make deposits and you can start trading. You can also choose to create a demo account at this stage and get familiar with the trading platform.

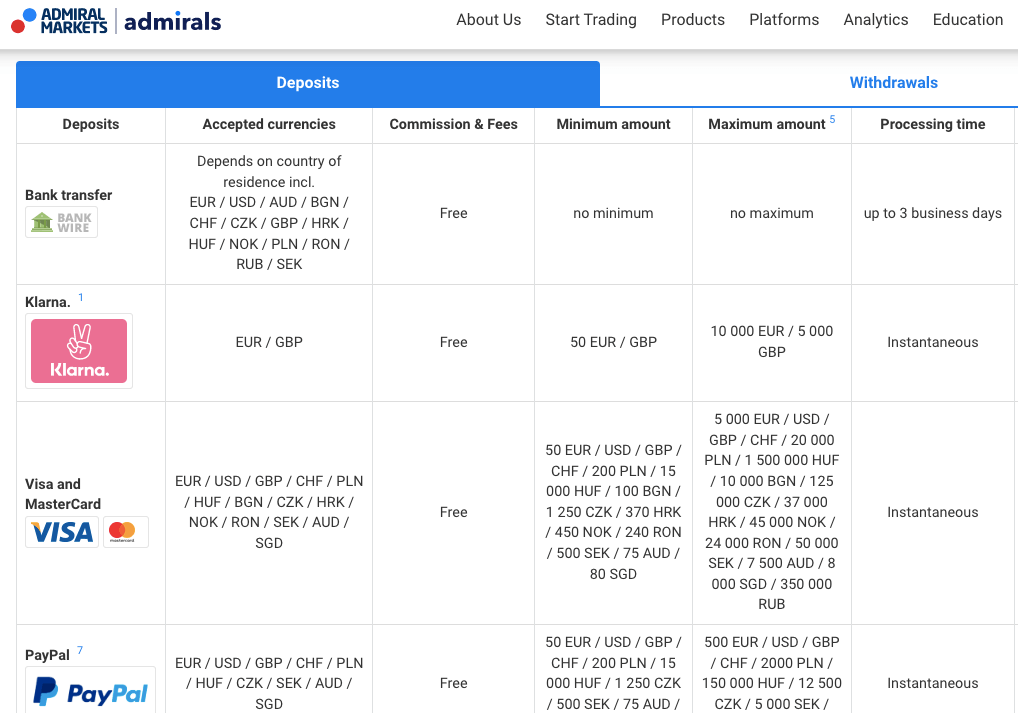

Admiral Markets Deposits & Withdrawals

Admirals’ payment methods for deposits and withdrawals are bank transfers, cards, and e-wallets (Skrill, Neteller, PayPal).

Find details of the deposits and withdrawals on Admiral Markets below.

Admiral Markets Minimum Deposit

The minimum deposit on Admirals is dependent on your account type and payment method. While bank transfers have no minimum deposit, the minimum deposit is £50 with cards and e-wallets which are credited instantly and it takes about 3 business days for bank transfers to be credited.

To deposit funds on Admirals, click on Transactions on the left side menu, then select ‘Deposit’ and follow the instructions to complete your deposit.

Admiral Markets Minimum Withdrawal

The minimum withdrawal amount on Admirals is £1 for cards and e-wallet withdrawals which are processed instantly. Bank transfers have no minimum amount, and withdrawals to a local bank account are processed within 3-5 business days.

To withdraw money from Admirals, click on ‘Transactions’ on the left side menu of your Admirals Trader’s Room (dashboard), select ‘Withdraw’ and follow the on-screen instructions to complete your withdrawal.

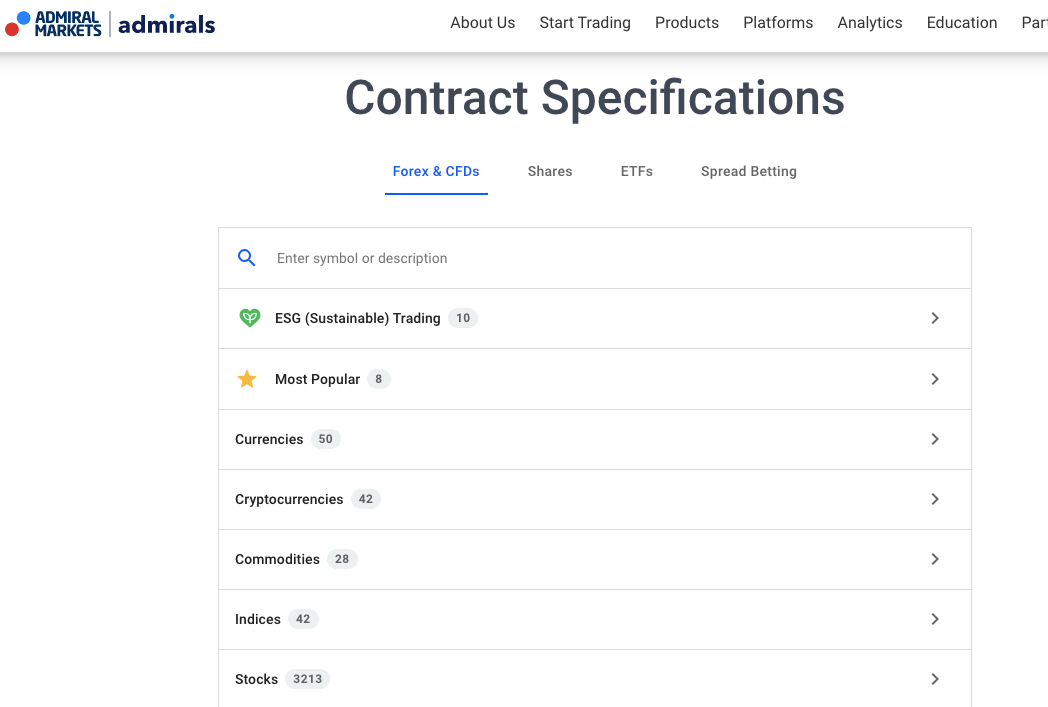

Admiral Markets Trading Instruments

You can trade over 3,000 instruments on Admiral Markets, depending on the account type and trading platform you choose. Here is a breakdown of the financial instruments on Admirals.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 50 currency pairs on Admiral Markets (5 majors, 23 minors, and 22 exotics) |

| Commodities | Yes | 28 commodities on Admiral Markets (Energies, Metals, Agricultures and futures) |

| ETFs | Yes | 371 ETFs on Admiral Markets (Germany (Xetra), UK (LSE), and others) |

| Indices | Yes | 42 cash and futures indices on Admiral Markets (DAX40, NQ100, SP500, UK100, and others) |

| Stocks | Yes | 3,213 stocks on Admiral Markets (US(NASDAQ), UK(LSE), France(Euronext), and others) |

| Bonds | Yes | 2 Bonds Futures on Admiral Markets (10-year Germany bund and US 10Yr T-Note) |

| ESG (Sustainable) Trading | Yes | 10 ESGs on Admiral Markets (Vanguard ESG, NVIDIA Corp, and others) |

| Cryptocurrencies | Yes | 42 cryptocurrency pairs on Admiral Markets (Including BTC, XRP, ETH, and others) |

Admiral Markets Trading Platforms

Trading platforms supported by Admirals are:

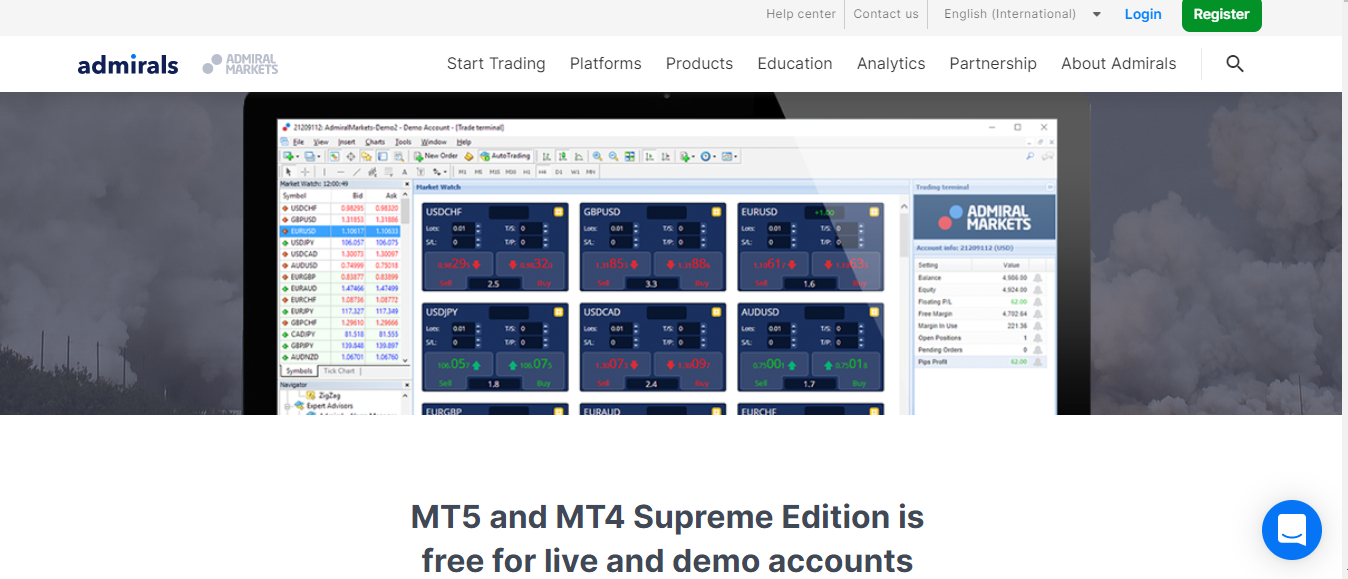

1) MetaTrader 4 and MetaTrader 5: Admirals support the MT4 and MT5 trading platforms and you can trade on them via webtrader, desktop, and mobile devices (android & ios). Admiral Markets also developed a MetaTrader Supreme Edition that is available for MT4 and MT5

This version of MetaTrader is indeed supreme because of the free trading tools added to it which are not available on the normal MT4 and MT5. These tools are very useful and can help your trading in different ways. For example, the Supreme Edition is connected to Trading Central which automatically identifies popular chart patterns.

There is also the global opinion widget that you can use to determine general market sentiment (bearish or bullish) in a glance.

2) Admirals Mobile App: Admirals has their own proprietary mobile app for trading Forex and CFDs that you can download from the Apple App Store, Google Play Store, or Huawei App Gallery.

3) StereoTrader: StereoTrader is a MetaTrader trading panel. It comes with advanced functions that increases trading efficiency. It accommodates all trading styles thereby making it cross-functional. Its tools are not limited to any trading strategy.

When you open a live account with Admiral Markets, you get monthly access to StereoTrader without extra charges.

Admiral Markets Copy Trading

You can join Admiral Market copy trading as a provider or a subscriber. Providers offer signal services to subscribers. As a subscriber, you get to follow the most profitable for a fee. You also get to join a community of traders and investors so you can get a lot of support.

Admirals also have a unique risk management in their copy trading service. You can set your stop loss, take profit, and copy ratio limits. With these, you do not have to worry about the risks that might come from the provider you are copying.

Admiral Markets’ Order Execution Policy

In obtaining the best outcome for traders, Admirals exercise their judgment based on different factors. The first factor is total consideration. This factor considers the sum of all the costs incurred in executing trades. The main thing to note here is that Admirals ensure that there is due regard to the market price of the underlying product of the CFDs you trade.

Another factor considered is the speed of execution. Admirals ensure that the speed of execution by their liquidity providers and other execution venues is consistent. Slow execution increases the probability of slippage beyond minimum levels. To tackle this, Admirals stop using any liquidity provider with persistently delayed execution.

Another factor connected to the speed of execution is price improvement and slippage symmetry. This factor involves you getting a better price even if the market has moved against your order at the requested price. To make sure that you benefit from this, Admirals make sure they only use liquidity providers that do not offer price improvement. Furthermore, liquidity providers with persistent asymmetric slippage(that is, the price that has moved against your order) problems are no longer considered for use.

The likelihood of execution is also a key factor in Admirals’ policy. This factor is about the rejection of trades. Execution venues and liquidity providers might not execute trades at the first request. This may lead to issues like requotes of price. Admirals stop using liquidity providers with high rejection rates that are not addressed in a timely manner.

Admirals are straight-through-processing (STP) brokers. They transmit your orders to third parties for execution. Though the conditions with the third party may not align with their execution policy, Admirals ensure the best execution of trades for their clients. However, the best execution is not guaranteed for every brokered trade.

Admiral Markets Education

Here are the learning channels provided by Admirals

1. Courses: Admirals offer two courses – Forex 101 and Zero to Hero. Forex 101 is the most recent of the two. It is divided into beginner, intermediate, and advanced levels. The training course contains videos, notes, and quizzes for effective learning.

Zero to Hero is a 20-day course. It contains 20 videos on forex trading that takes up from set-up to execution. It begins with technical and fundamental analysis and ends at application to real trade. There are also Q and A with live sessions.

These two courses are offered by Admirals free of charge.

2. Articles and Tutorials: This section contains articles for different levels of trading expertise and tutorials. Trading tips, psychological tricks, currency market analysis, strategies, etc can be found here. Forex basics, indicators, and ETFs are one of the many topics covered.

3. Glossary: Admirals have a glossary that is easy to navigate. The glossary is organized in alphabetical order with a search bar for easy navigation. It covers the definition of terms that you need to understand in forex trading.

4. Forex and CFD Webinars: Admirals’ webinar section is well structured. At first glance, you will see all the upcoming webinars, the topics, and when they will take place in your local time. Renowned and successful traders are the major speakers on these webinars.

5. E-book: Admiral Markets have one e-book under their education section. The book is titled ‘Blockchain Basis’ by Alexander Tsikhilov. He is the co-founder and President of the international Admiral Markets Group. The book explains blockchain technology in a clear and concise manner. The history and description of the technology are also covered. To get the book, you will need to have a real trading account with Admiral Markets.

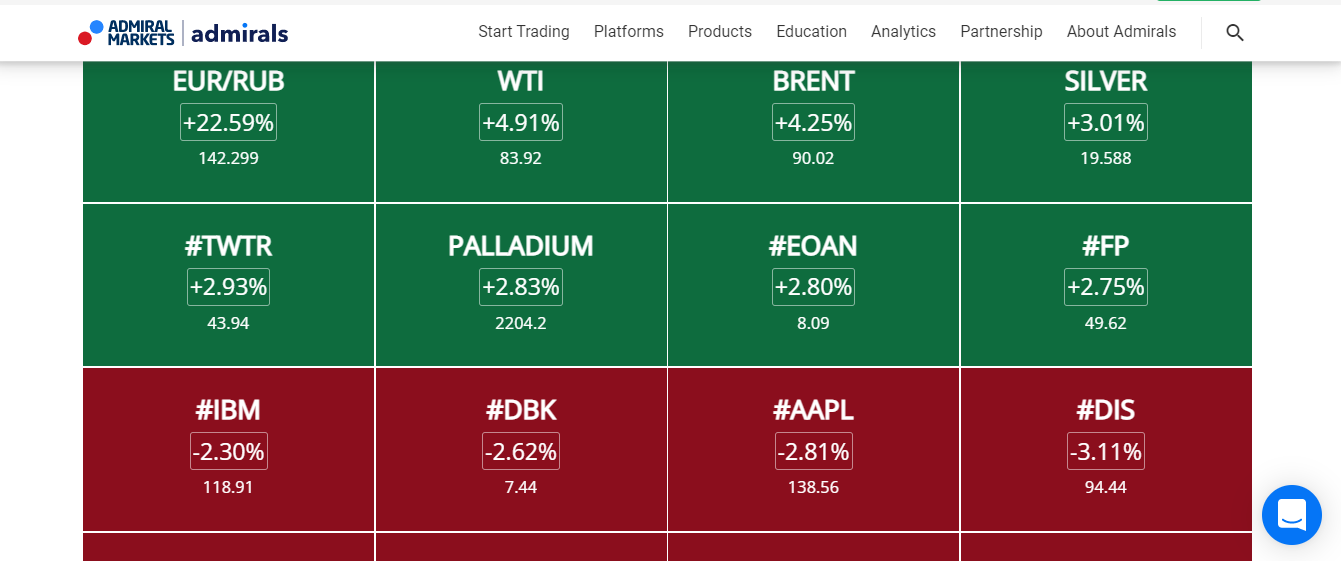

6. Analytics: Admirals Analytics aims to help traders in research. It contains a forex calendar for tracking fundamental events, weekly trading podcasts, and trading news. There are also helpful tools like the Market Heat Map displayed below. It shows the direction of financial instruments coupled with graphs and data analysis.

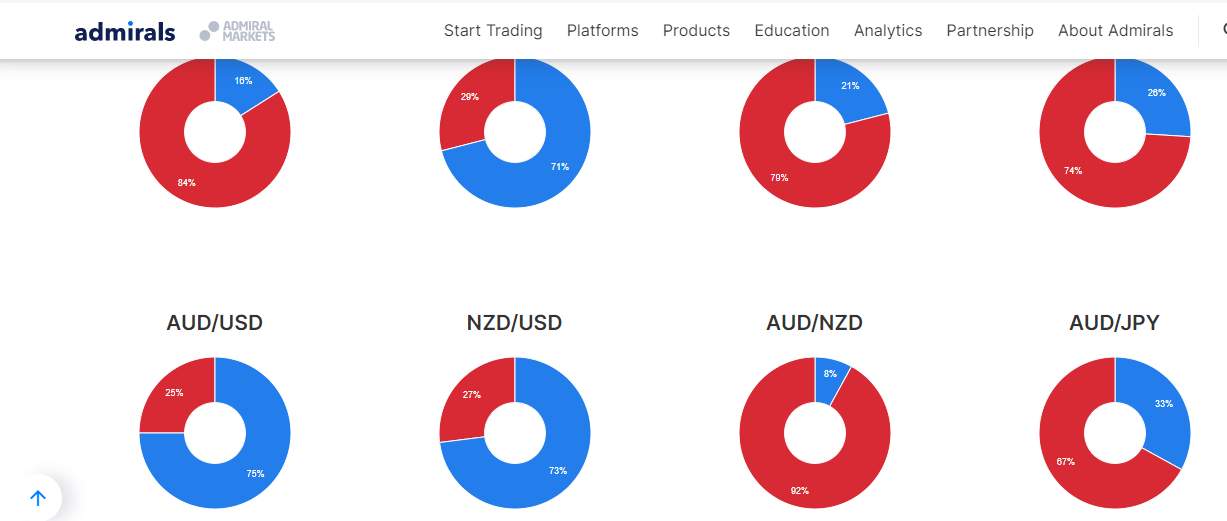

In addition, there is a tool that helps you monitor the bias of traders in the market. It is called Market Sentiment. Admiral Markets uses data gathered from multiple trading providers in partnership with FXBlue to create charts. These charts show if buyers or sellers are dominating a particular currency pair. Here is how it looks.

You can use this tool on major, commodities, and even minor currency pairs. However, you have to note that the sentiments are only indicative. They are not trading advice though they are updated in real-time.

7. Webinars: Admiral Markets webinars are designed by experts to develop your trading skills. The webinar library covers a wide range of forex trading topics that will make you a better trader. From Admiral Markets website, there is a link that leads to past webinars so you do not miss a thing. The link will lead you to Admiral Markets’ YouTube channel where past webinars are uploaded.

Admiral Markets UK Customer Service

Admirals UK offers online customer support to traders via the following channels:

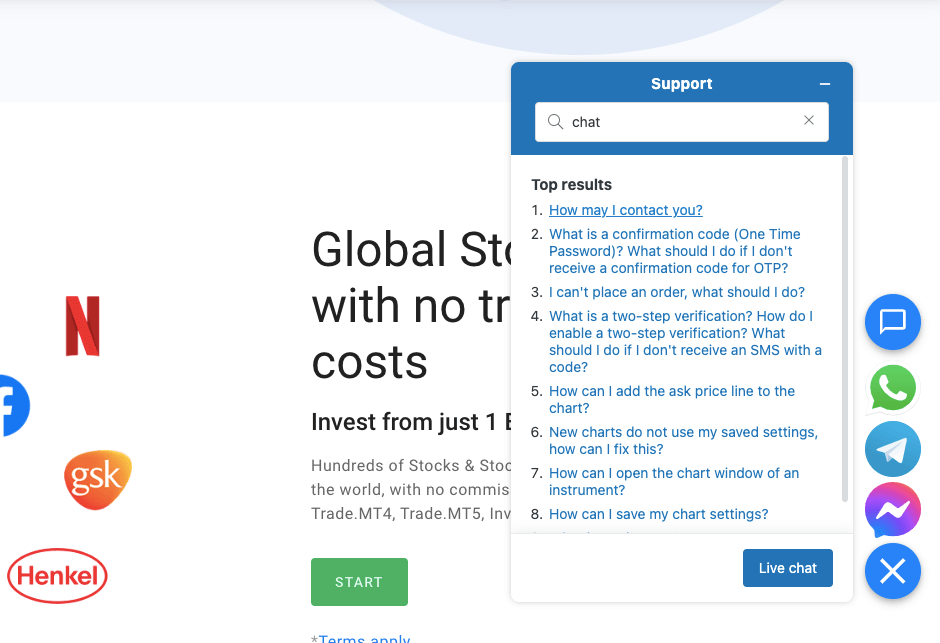

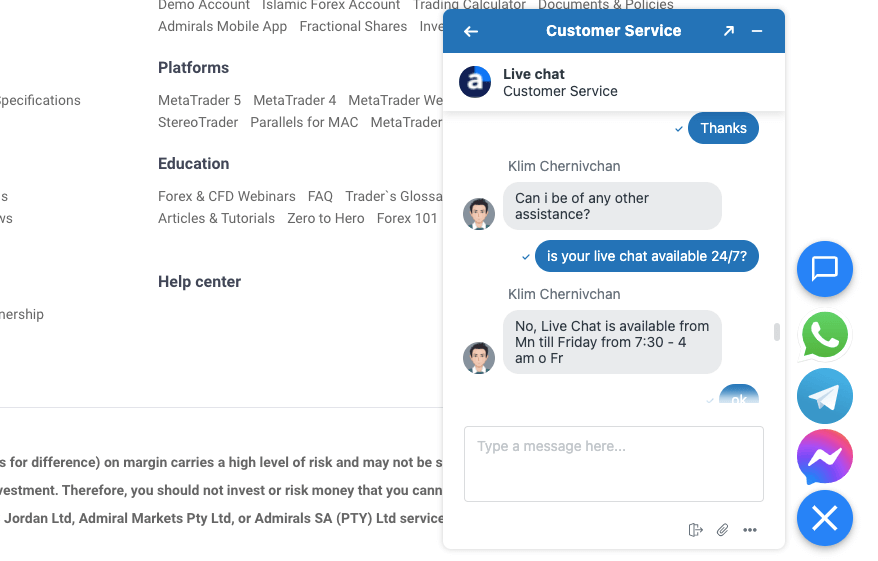

1) Live chat support: Admirals’ live chat support can be accessed via their website and is available during business hours from Monday to Friday.

When our team tested it, the wait time was under 2 minutes and the answers to our questions were relevant. When you first click on the live chat button, you can type in your question, and the chat will suggest related articles with possible answers.

To chat with a live agent, click on Live Chat, then supply your name and email to start chatting with a live agent.

Although the chat agent said they are available from Monday 7:30 AM to Friday 4:00 AM, when we sent them a message after working hours, there was no agent to respond.

2) Email support: Admirals offers email support to clients which is available during working hours. The email address for Admirals UK customer service is [email protected].

Our team tested the Admirals’ email support, and we got a response after more than 12 hours, although the answers to our questions were relevant.

3) Physical Office: Admirals has a physical office in London, located on the 37th Floor, One Canada Square, Canary Wharf, London, although the office is not open to client visits, as all inquiries are handled online.

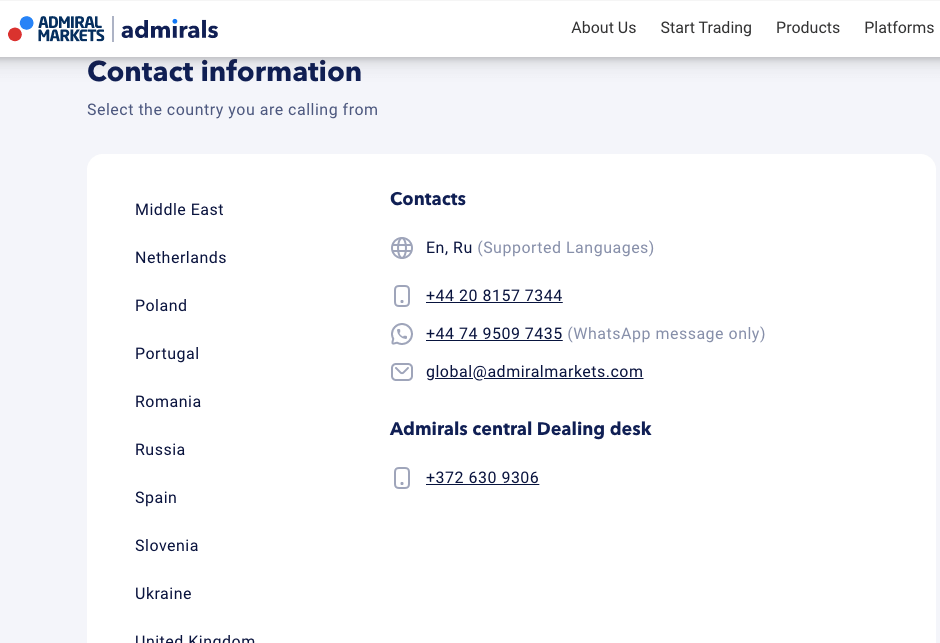

4) Phone support: Admirals offers phone support to UK traders, with a dedicated UK phone line which is available during working hours on business days. The Admirals UK phone number for customer support is +44 20 8157 7344.

You can also reach Admiral Markets WhatsApp support via +44 74 9509 7435.

Do we Recommend Admiral Markets UK?

Admiral Markets is regulated in the UK by the Financial Conducts Authority (FCA), which makes them low risk and safe for trading.

The fees on Admiral Markets are moderate, although there are some brokers that offer commission-free trading and unlimited free deposits and withdrawals.

The customer support of Admirals is not so good, as they are not available for 24 hours on any day, and their email support is slow. The account opening on Admirals is a bit complicated, although they make up for this with a detailed website and FAQ section that answers many questions through articles.

We recommend that you try Admiral Markets after reading this review and checking the website to see if it meets your trading needs.

Admiral Markets UK FAQs

Is Admiral Markets FCA regulated?

Admiral Markets is regulated by the FCA as ‘Admiral Markets UK Ltd.’ and authorised to offer financial services in the UK with reference number 595450, issued in 2013.

Can you trade stocks on Admiral Markets?

You can trade stocks on Admiral Markets, including 3,213 stocks of US (NASDAQ and NYSE), UK (LSE), France (Euronext), and others.

What is the minimum deposit for Admiral Markets?

The minimum deposit depends on your account type and base currency. UK-based traders can open a CFD trading account for £250. This figure might vary per account type.

Where is Admiral Markets from?

Admiral Markets (now known as Admirals) is a Talinn-based broker from Estonia. They are regulated by top-tier bodies.

Note: Your capital is at risk