| OANDA Minimum Deposit Summary | |

|---|---|

| OANDA Minimum Deposit | £0 |

| Deposit Methods | Credit/Debit Cards, Bank Transfer, Electronic Bank Transfer |

| Account Types | Standard Account, Spread Betting Account, Joint Account, Corporate Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, GBP |

| Withdrawal Fees | Yes |

| Visit OANDA | |

OANDA’s minimum deposit in the UK is £0. OANDA offers one retail account which is their Standard Account. However, there are sub-accounts under this account with unique trading conditions.

In this article, we cover OANDA’s different sub-accounts and their minimum deposits. You will also find all you need to know about funding methods and how much they cost. We will also show you how to fund your OANDA trading account.

How Much is OANDA’s Minimum Deposit in the UK?

Now we begin to breakdown OANDA’s Accounts. All of these accounts and important trading conditions are discussed in our OANDA review.

1) Standard Account

You need £0 minimum deposit for this account. It is an individual retail account that allows you trade CFDs like currency pairs, major indices, commodities, metals and bonds.

Spreads for this account begin from 1 pip for major FX pairs and you pay fees in commission per standard lot. However, you incur swap fees whenever you keep a trade position beyond official trading hours.

This account is available on OANDA Trade web platform, mobile and tablet apps, TradingView, and MT4. Minimum lot size is 0.01.

2) Spread Betting Account

Minimum deposit for OADNA’s Spread Betting Account is £0. It is the broker’s first sub-account that gives you access to over 100 trading instruments.

For major currency pairs, the spread begins from 0.8 pips. For major indices like UK 100 and Germany 30, the spread begins from 1 point.

The instrument class available for the account include forex pairs, indices, commodities, metals, and bonds. All profits made in spread betting are exempt from UK Capital Gains Tax and UK stamp duty (please note that laws might change).

Guaranteed stop loss orders are also available to manage your risks.

3) Joint Account

Minimum deposit for OADNA’s Joint Account is £0

If you and a partner or spouse are interested in co-owning a trading account, you can get this through the OANDA Joint Account. This way, two or more individuals can own one account collectively. Everyone involved will be able to log in on the account and place trades.

Spreads begin from 1 pip for major currency pairs and no extra commission per standard lot. But you will pay rollover charges for trading positions held overnight.

To fund a joint account, make sure the bank account or cards that will be used bear your name and your partner’s as well. This will ensure you have a smooth funding experience.

4) Corporate Account

You can open OANDA’s corporate account with £0. No mandatory minimum deposit. The corporate account is for businesses.

Your business can register with OANDA as an entity and trade CFDs. This account is not a professional account though it is owned by your business.

The trading conditions, CFD instruments available, and trading fees are that of a retail account. The account is also zero commission fees per standard lot. Spreads begin from 1 pip for major forex pairs.

5) Professional Account

Apart from the retail accounts we have reviewed, OANDA also have a Professional Account.

To open a Professional Account, you need to open a Personal, Joint, or Corporate Retail Account first. Then you can reach out to OANDA’s support team to upgrade your account.

However, there are certain criteria you need to meet before your account can be upgraded. The OANDA Professional Account does not have a required required minimum deposit.

Note: 73.8% of traders lose their money with this broker

OANDA Deposit Methods and Required Fees

You can fund your OANDA CFD trading account with a number of different methods. OANDA has GBP-based trading account so you can fund your account in Great Britain Pounds (GBP).

Here are the funding methods available for traders resident in the UK.

Credit/debit card: OANDA accept payments from credit and debit cards from MasterCard and Visa. Funds deposited via using a credit or debit card should show in your account within one business day.

Bank wire transfer: You can fund your account by transferring funds from your local bank. No charges from OANDA for this method but your bank might charge a fee.

Electronic bank transfer: Electronic bank transfer options are also supported. Faster Payment, BACS, CHAPS and SEPA are available for you. Processing time for these methods vary.

| Method | Processing Time |

|---|---|

| Faster Payments | 1-2 business days |

| BACS | 2-3 business days |

| CHAPS | 1-2 business days |

Note: All of these transaction times applies to deposits in GBP only. In addition, OANDA processes all withdrawals back to source. This means if you fund your account via a credit card, you can only withdraw your funds via that same credit card.

OANDA Deposit Terms

1) OANDA does not charge deposit fees. But your bank or card provider might charge you for offering you the payment service.

2) For Faster Payments, your bank might impose a maximum deposit of £10,000.

3) To ensure quick processing, make sure you add your OANDA account number in the reference field of your transaction.

4) OANDA does not accept deposits from other broker accounts. You should always transfer your funds from bank accounts in your name.

5) New bank sources will be verified before your payment is accepted. OANDA may ask you for a recent bank statement or transfer receipt for verification.

6) OANDA can contact you for any documents necessary to process your transaction.

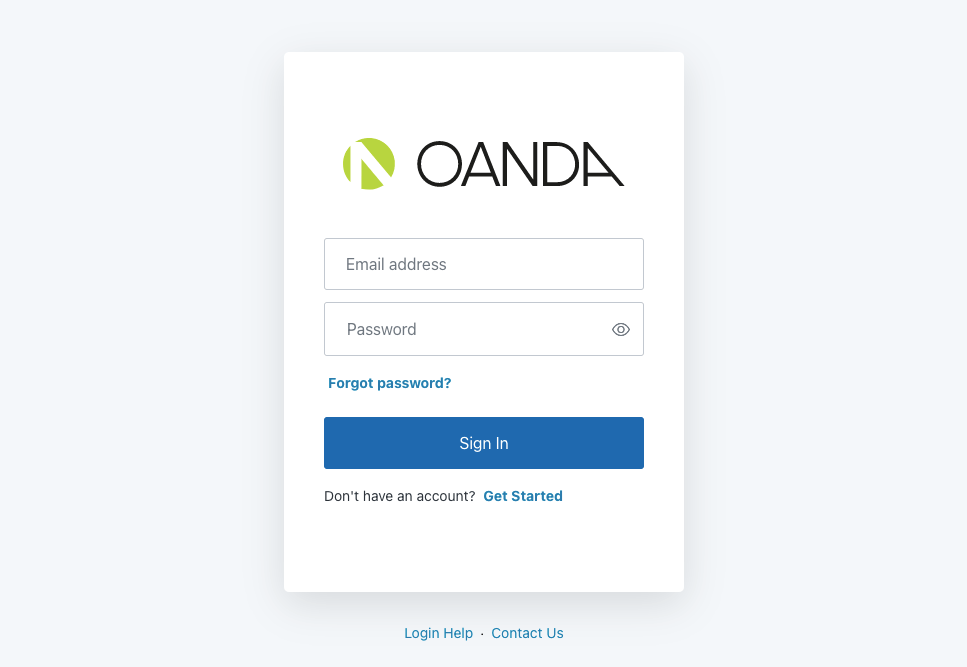

How to Deposit Money Into Your OANDA Account

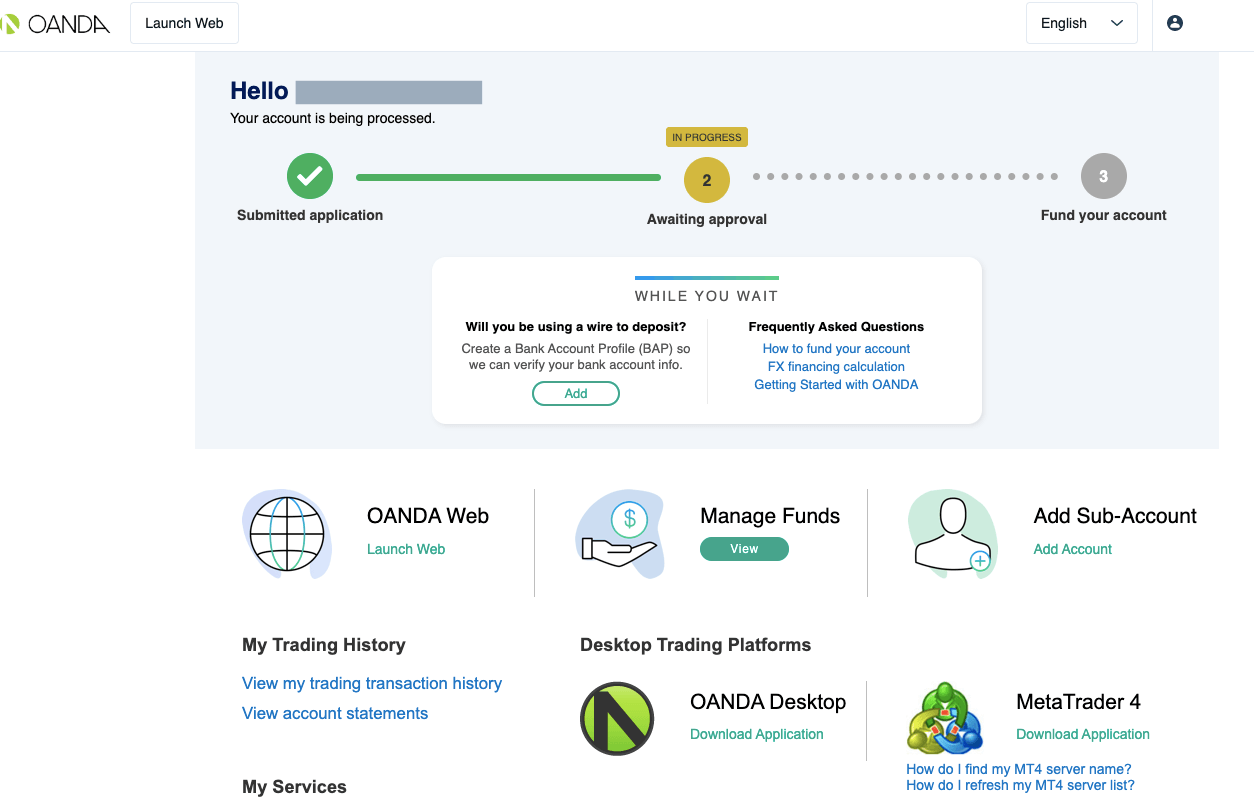

1) Log in to your OANDA client area.

2) Once your client area loads, click on ‘Manage Funds’.

3) Follow the on-screen prompts to complete your funding process.

Comparison Of OANDA Minimum Deposit With Other Brokers

| Broker | Minimum Deposit |

|---|---|

| OANDA | £0 |

| Pepperstone | £0 |

| CMC Markets | £0 |

| Vantage Markets | £200 |

| AvaTrade | £100 |

| Plus500 | £100 |

Note: 73.8% of traders lose their money with this broker

Frequently Asked Questions

What is the minimum order for OANDA?

The minimum order for OANDA is 0.01 micro lot size.

Can I use OANDA in the UK?

Yes, OANDA accepts traders resident in the UK. They are regulated with the UK’s Financial Conduct Authority (FCA). You must be 18 years old and a legal UK resident to sign up.

Is it easy to withdraw from OANDA?

Withdrawal from OANDA is simple and convenient. Just make sure you withdraw with the same method you used for deposits.

What is the deposit limit for OANDA?

OANDA does not have a deposit limit. But if you are using fast payments, your bank may impose a £10,000 maximum deposit.

What is the lowest spread on OANDA?

The lowest spread depends on your trading account and the CFD class you are trading.

Note: Your capital is at risk