City Index UK is forex broker & CFD broker, and their parent company is StoneX Group, which is listed on NASDAQ.

They are licensed with multiple Tier-1 & Tier-2 regulatory bodies and offer a good range of CFDs. Their CFD markets include indexes, shares, forex, oil, commodities, metals, and bonds. Apart from trading CFDs, City Index also offers spread betting on these instruments.

In the UK, City Index is regulated with the Financial Conduct Authority (FCA). On a global level, the FCA is a top-tier regulatory body. This is why we consider City Index as low-risk to trade with.

Traders from the UK can open a CFD trading account or spread betting account at City Index. You can fund your account via bank transfer, PayPal, and credit/debit card. You can also deposit in GBP. City Index is not just a CFD broker with an online presence. They have a physical office in London too.

| City Index Summary | |

|---|---|

| Broker Name | City Index |

| Establishment Date | 1983 |

| Website | www.cityindex.co.uk |

| Address | StoneX Financial Limited, 1st Floor, Moor House, 120 London Wall, London, EC2Y 5ET. |

| Minimum Deposit | £100 |

| Maximum Leverage | 30:1 (retail traders), 400:1 (professional traders) |

| Regulation | FCA, ASIC, CySec, and MAS |

| Trading Platforms | MT4, Webtrader, City Index Mobile App |

| Visit City Index | |

City Index Pros

- City Index is licensed with FCA

- Stop loss is guaranteed for a premium price

- You can deposit and withdraw your funds via bank transfer

- GBP-base currency account is available

- City Index do not charge extra commission for forex pairs.

- Good customer support via chat with little hold time

- City Index supports MT4 and offers a proprietary trading platform.

- Your account is protected against negative balance.

City Index Cons

- City index charges account inactivity fee.

- The forex broker does not offer MT5.

- Limited CFD range on MT4.

City Index Video Review

Regulation and Safety of Funds

As we said earlier, City Index is a low-risk broker because of their top-tier regulation in the UK. A forex broker with multiple tier-1 regulations has considerably lower risk. With their FCA regulation, City Index is also licensed with the Australian Securities and Investments Commission (ASIC). ASIC is another top-tier regulator for financial services providers. Here is a closer review of City Index’s regulations and licenses

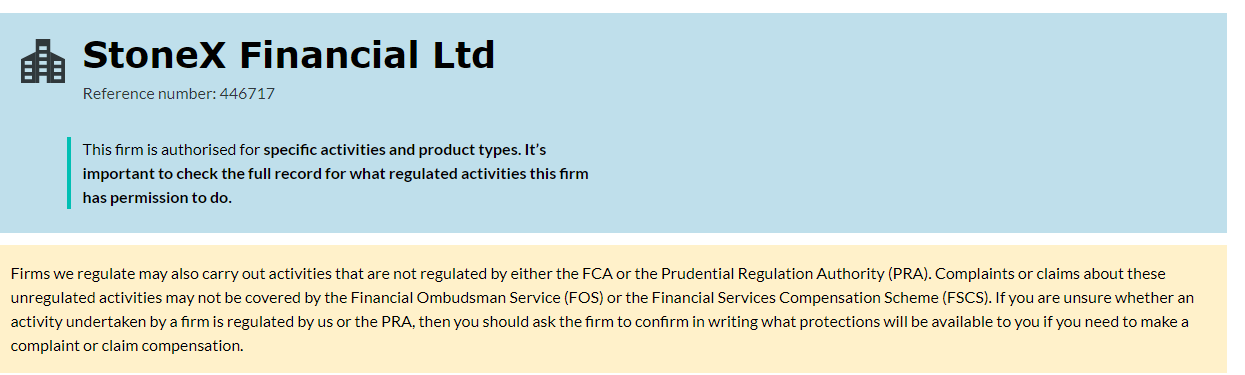

1) FCA: The Financial Conduct Authority (FCA) is the United Kingdom’s financial services regulator.City Index is licensed with the FCA as Stonex Financial Limited. Their FCA reference number is 446717

Because of FCA regulation, City Index also operates under the Financial Services Compensation Scheme (FSCS). The importance of the scheme is to protect the funds of retail traders should a broker goes into insolvency. UK clients can claim up to £85,000 under the scheme.

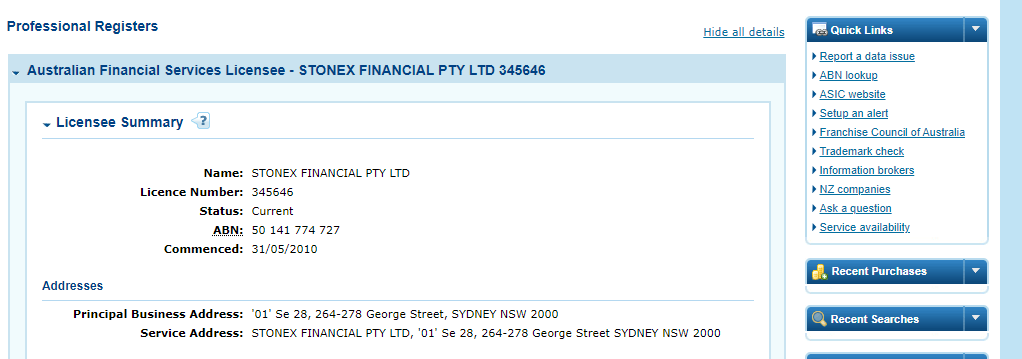

2) ASIC: City Index is licensed with ASIC as Sotnex Financial Pty.Ltd. All financial services providers in Australia are issued an Australian Financial Services License (AFSL) Number. City Index’s AFSL number as seen on ASIC’s website is 345646.

3) CySEC: CySec is Cyprus Securities and Exchange Commission. City Index is regulated with CySec as StoneX Europe Ltd. The company registration number is 409708 with license number 400/21.

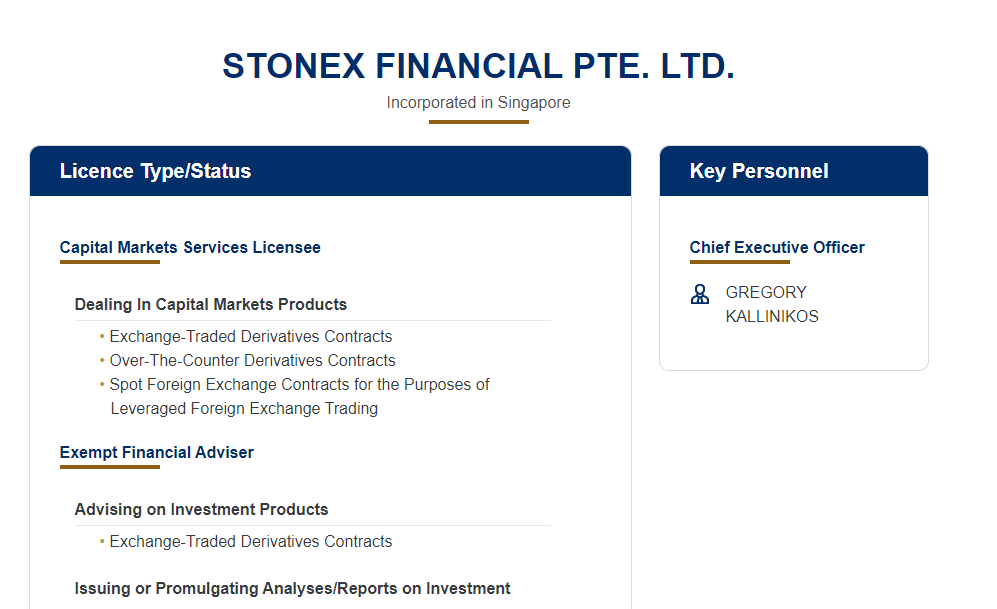

4) MAS: MAS is the Monetary Authority of Singapore. City Index is incorporated in Singapore as StoneX Financial Pte. Ltd.

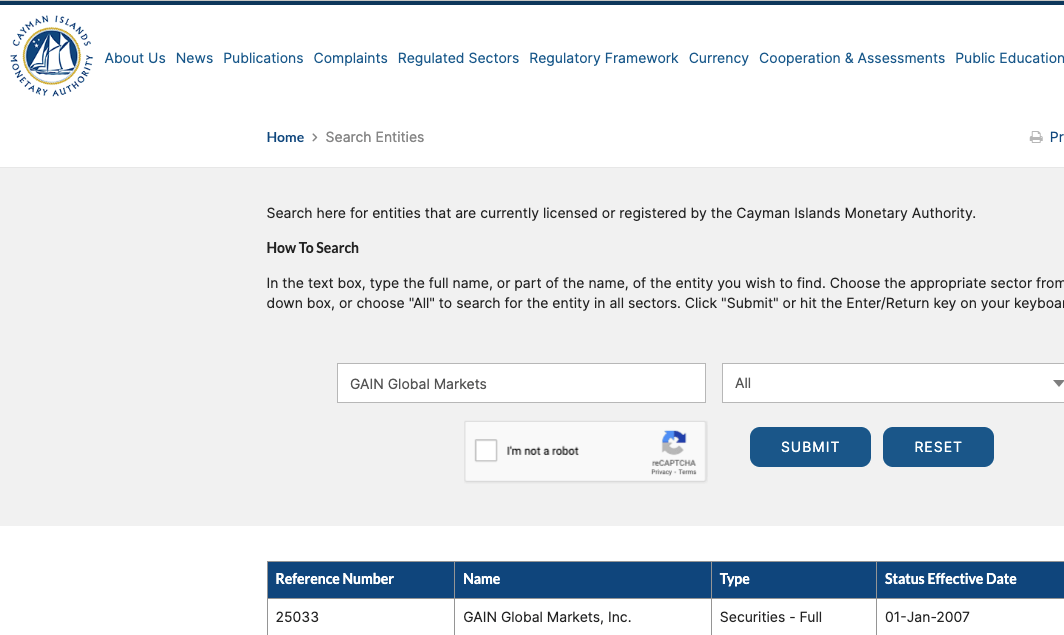

5) CIMA: City Index is licensed by the Cayman Islands Monetary Authority as GAIN Global Markets, Inc. with the trading name Forex.com. The broker was licensed in 2007 with reference number 25033.

City Index Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | StoneX Financial Limited |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | StoneX Europe Ltd |

| Singapore | No compensation | Monetary Authority of Singapore (MAS) | StoneX Financial Pte. Ltd. |

| Other countries | No protection | Cayman Islands Monetary Authority (CIMA) | GAIN Global Markets, Inc. |

City Index Leverage

The Maximum leverage at City Index for trading currency pairs is 30:1 for retail traders. Professional traders can access leverage of up to 400:1 on forex trading. The table below shows City Index’s range of instruments and their respective leverage.

| Instruments | Professional Leverage | Retail Leverage | Forex | 400:1 | 33:1 |

|---|---|---|

| Indices | 400:1 | 20:1 |

| Commodities | 200:1 | 20:1 |

| Shares | 33:1 | 5:1 |

| Cryptocurrencies | 20:1 | N/A |

Note that trading leveraged products are risky, and you can lose your money. It is best to avoid it. Only trade if you have experience or understand them.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

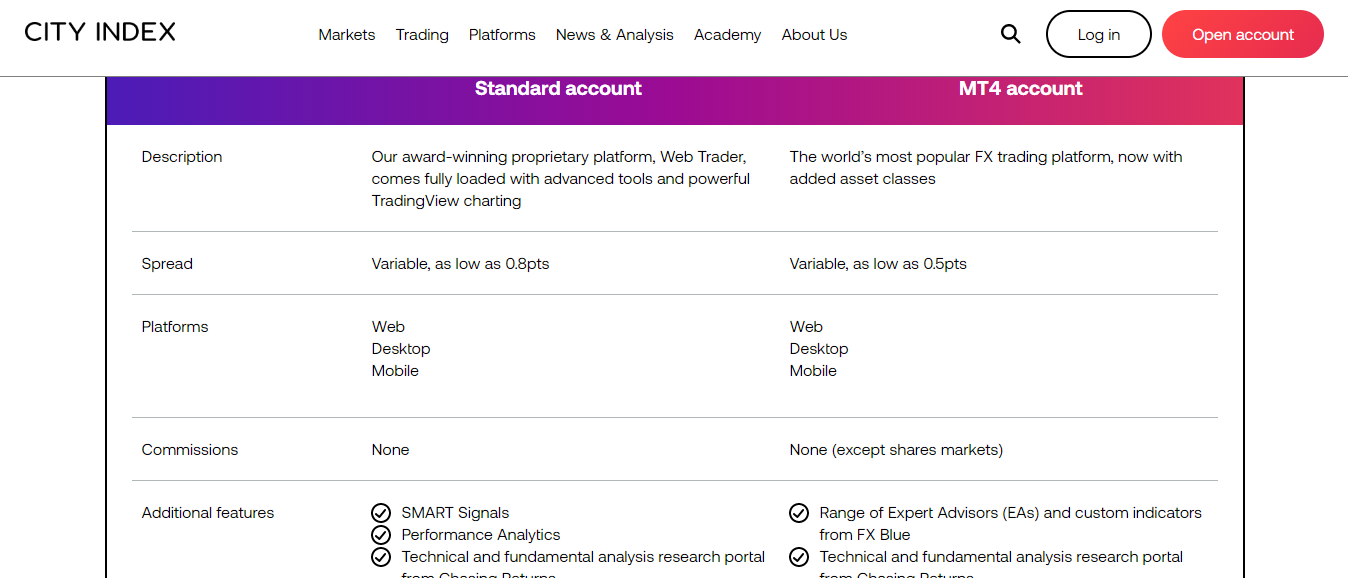

City Index Account Types

City Index offers two account types for UK traders – CFD Account and Spread Betting Account

Here is a breakdown of the two accounts:

1)Standard Account: The Standard Account has variable spreads (as low as 0.5 pips). Traders are able to access over 6300 markets on City Index’s proprietary trading platform. The platform has advanced analysis tools and TradingView charting. No extra commissions are charged on this account except for shares CFDs.

2) MT4 Account: MetaTrader 4 is the only trading platform available for this account. It has variable spreads (as low as 0.8 pips). You can use expert advisors (EA) and no extra commission is charged on all CFDs.

3) Spread Betting Account: The Spread Betting Account allows traders to stake money on an increase or decrease in the spread of an instrument. They make money based on a unit increase or decrease in the spread of instruments. Just like the CFD account, thousands of global markets including shares, indices, FX, and commodities are offered by City Index. No commissions are charged on this account but spread betting on equities is subjected to wider spreads.

In addition, gains from this account are not taxed. You can read our review of the UK’s best spread betting brokers.

4) Corporate Account: This account is for companies. With a corporate account, you will be able to trade in your company’s name using your company’s funds. This account also allows you to have multiple users. This means you can have more than one person trading the account.

5) Professional Account: This is for traders with experience and who trade in large volumes. This account does not have some pecks that come with retail accounts. For example, there is no negative balance protection. This means traders on this account can go into debt should they lose all of their money.

Therefore, there are certain criteria that must be met before you can open this account. They are

– You must have placed a minimum of 40 large-volume trades within the last year

– A financial instrument portfolio of €500,000 or equivalent

– A year minimum of professional experience in the financial sector.

If you meet these conditions, you are eligible for a Professional Account with City Index

City Index Fees

UK traders can find City Index’s spread, commissions, and other non-trading charges on their website. Here is a simplified view of their charges:

1) Spread: City Index offers the same spreads for their CFD and Spread Betting Accounts. The typical spread for major currency pairs is a little bit high. This is how much spread City Index charge for major fx pairs:

2) Swaps: Swaps are calculated based on the United Kingdom’s SONIA rate ±2.5%.

3) Commissions: City Index does not charge any commission when you spread bet. There is also zero commission for CFD trading except for shares CFDs.

City Index Trading fees Table

Here is a summary of the minimum spread fees and commission City Index charges on some instruments:

| CFD instrument | Spread (Standard Account) | Commission |

|---|---|---|

| EUR/USD | 0.7 pips | None |

| GBP/USD | 1.1 pips | None |

| EUR/GBP | 1.1 pips | None |

| XAU/USD (Gold) | 0.3 pips | None |

| Crude oil | 2.5 pips | None |

| UK 100 | 2.0 pips | None |

| US Tech 100 | 1.0 pips | None |

4) Non-Trading Fees: The Non-trading fees can be fees charged on deposits, withdrawal fees, and inactivity charges. City Index charges low non-trading fees compared to other CFD brokers. We’ve compared this in the table below.

| Deposit fees | Withdrawal fees | Inactivity charges | GSLO Fees | Currency Conversion Fees |

| No* | No* | Yes | Yes | Yes |

*Note that your payment processing company may charge some independent transaction fee.

How to Open a Trading Account with City Index

Here is how to sign up with City Index in basic steps:

Step 1) Go to City Index’s website at www.cityindex.co.uk.

Step 2) Click on the ‘OPEN ACCOUNT’ button, highlighted in the yellow box, at the top right side of the page.

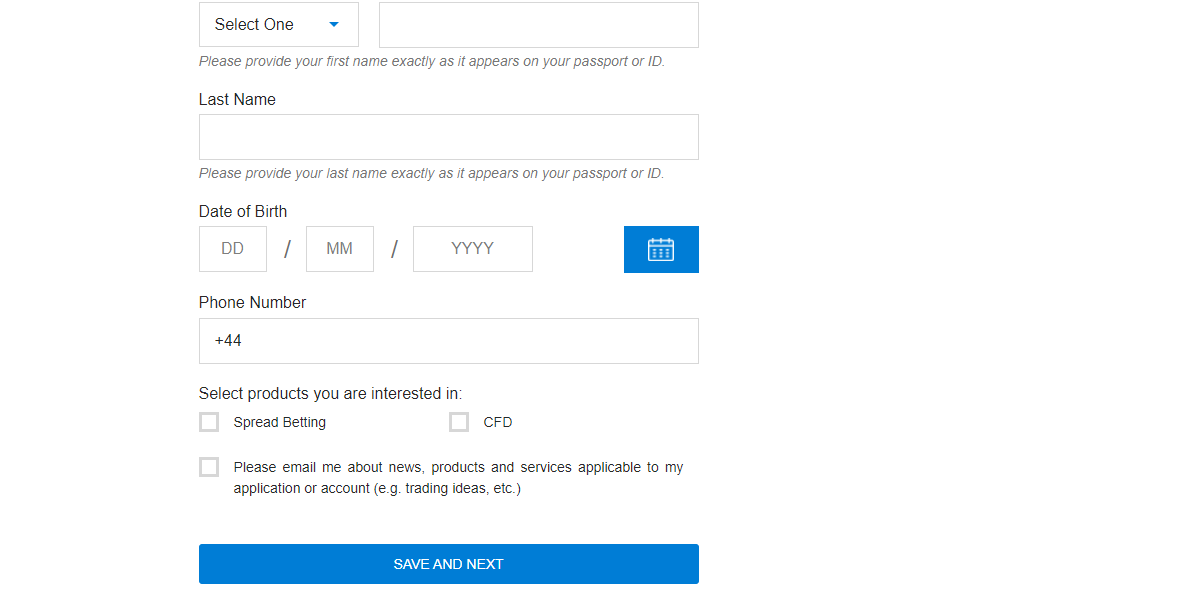

Step 3) On the next page, you will be asked to fill in your personal details, email, country of residence, etc. More importantly, you will have to choose your account type and set a login password. When you have filled in your details, click on ‘save and next’

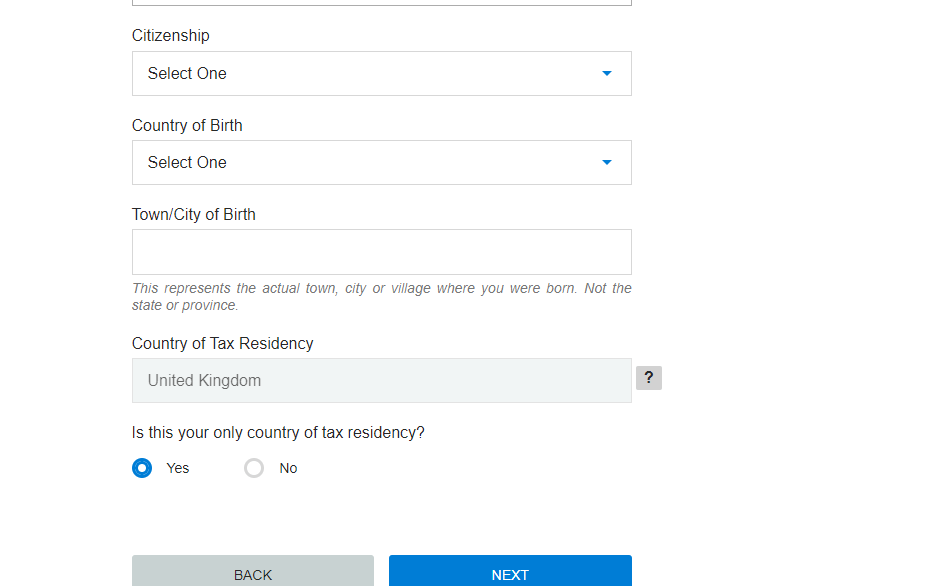

Step 4) On the next page, you will be entering your address, the region, you were born, and more personal details. A picture of this page is displayed below

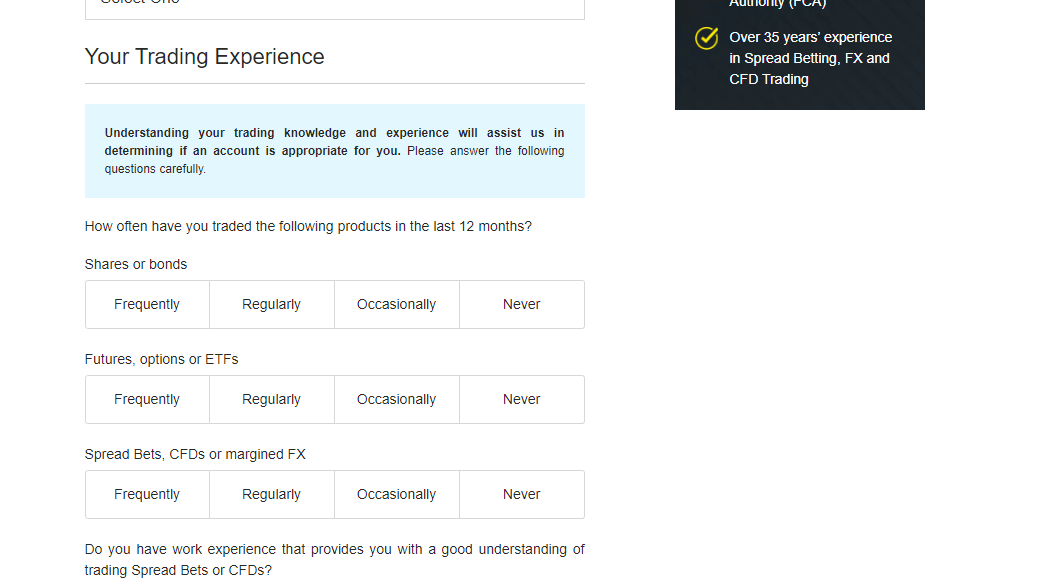

Step 5) At this point, City Index will be going deeper into what they want to know. Your employment details, your trading experience, and your annual income are key details required at this point.

Step 6) For the next step, you will basically be asked questions about your understanding of the risks attached to trading CFDs and Spread Betting. You will also choose your means of communication (email, SMS, phone call, or mail). Finally, you agree to the terms and conditions and click on ‘submit application’. It will take about 30 seconds for your application to be approved

Step 7) The final step is the KYC. You will submit documents to verify your nationality, identity, and address. Once your account is verified after you submit the documents, you can begin your trading with City Index

City Index Deposits & Withdrawals

Traders in the UK can deposit funds into their trading accounts via multiple means. City Index supports bank transfer, credit/debit cards (Visa, Electron, or Mastercard), and PayPal. The same methods are available for withdrawals. The only difference is that Electron credit/debit card cannot be used.

Furthermore, Citibank cards cannot be used for funding, and City Index does not accept cash payments directly into their bank account. Third-party deposits are also not accepted. The money will be returned to the source.

Below we have provided an overview of deposits and withdrawals on City Index UK.

City Index Deposit Methods

Here is a summary of payment methods accepted by City Index for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes | Free | Instant |

City Index Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on City Index.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | Up to 3 business days |

| Cards | Yes | Free | Up to 10 business days |

| E-wallets | No | N/A | N/A |

What is City Index’s Minimum Deposit?

You need a minimum deposit of £100 to open a CFD or Spread Betting Account with City Index. City Index also recommends you have more than enough money in your account to cover drawdowns and margin costs.

What is City Index’s Minimum Withdrawal?

The general minimum withdrawal is £100 or your current account balance. There are also minimum withdrawals that depend on how you choose to get your money out. If you are withdrawing online to your credit cards, the minimum withdrawal is £20,000 within 24 hours.

But if you are withdrawing online without credit cards, the minimum withdrawal is £20,000 in a single transaction. This means you can carry out multiple transactions but you cannot exceed the £20,000 limit per transaction.

How do I Deposit/Withdraw Funds?

The deposit & withdrawal of funds at City Index is easy and convenient. Simply click on the “Account” section on your dashboard or trading platform. You will be able to choose your preferred deposit/withdrawal method from there.

Trading Instruments at City Index

City Index offers over 12,000 CFD trading instruments. In the table below, we’ve listed the available CFD instruments at City Index & how they are classified.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 84 |

| Indices CFDs | Yes | 21 |

| Commodities CFDs | Yes | 25+ |

| Shares CFDs | Yes | 4500+ |

City Index Trading Platforms

MetaTrader 4: City Index supports MetaTrader 4. It is one of their third-party trading platforms. They even have an account dedicated to MT4 only. City Index MT4 is available as web trader, on desktop, and mobile phones (Android and iOS)

TradingView: TradingView is City Index’s second third-party platform. TradingView allows you to integrate your trading account with their platform. In addition, it comes with some of the best drawing tools in the industry.

Does City Index have a mobile app

City index has a proprietary mobile trading app. If you prefer City Index’s proprietary platform, you can use their mobile trading app or web trader. The web trader has 14 timeframes with advanced drawing tools. SMART signals and performance analytics make up a kit of the platform’s intelligent trading tools.

City Index mobile app is available on iOS and Android phones. It has 3/5 stars from 263 views on Google Play Store with over 10,000 downloads. On the App Store, it has 3.8/5 stars from 118 reviews.

City Index Trading Tools

City index have two trading tools. Here is a breakdown:

Economic Calendar: The economic calendar lets you monitor news and release that can move the prices of CFDs. Not all news move prices the same way. So there is a filter that allows you focus on only the most impactful news.

Performance Analytics: Performance analytics is like a digital mentor. It contains a variety of tools within it that helps you with discipline, knowledge, and skill. It helps you set realistic trading goals and track them.

This tool has within it four internal tools. There is the trading plan that help you measure and monitor your trading goals. Then there is the playmaker that make sure you stay on track. The next tool, called Review, analyses your trades to help you see how you can improve it.

The final tool is the GamePlan. It reveals the strength and weaknesses in your trade with advanced technology. Performance Analytics is free for city index live clients.

City Index Execution Policy

City Index UK is a hybrid broker. Their pricing and execution are a combination of ECN and market maker. They source their pricing and liquidity from exchanges, liquidity providers, and ECNs regularly. This is to ensure that you get the best prices. However, they do not offer variable spreads on all of their markets. Some of their CFDs have fixed spreads which is typical of a market maker. Also, they do not stream these prices directly to traders. They adjust it according to their own spreads.

City Index assumes that retail clients rely on them to get the best execution. The forex broker has a system to ensure this. However, it is possible that you do not get the best execution. According to City Index’s documents, it is possible that your orders are executed by a trading desk.

This trading desk is an in-house desk that carries out proprietary trading and pre-hedging against City Index’s capital. It is a pointer that City Index also has a market maker model. Under this condition, the best prices are not guaranteed.

Another provision made for improved pricing execution is what City Index calls aggregation of client orders. Under this provision, your orders can be aggregated with other clients’ transactions in City Index’s account. This is done only if there won’t be a disadvantage to you and the other clients.

City Index Education and Research

On City Index’s homepage, you can find the different ways to learn under ‘Academy’. Here are the channels of learning with City Index.

1. Demo Account: City Index offers a demo account for retail traders. The only issue is the account expires in 30 days. Traders can re-apply for another demo account. However, the account will be as good as new. All settings will go back to default and you might not be able to track how well you are doing in the long term.

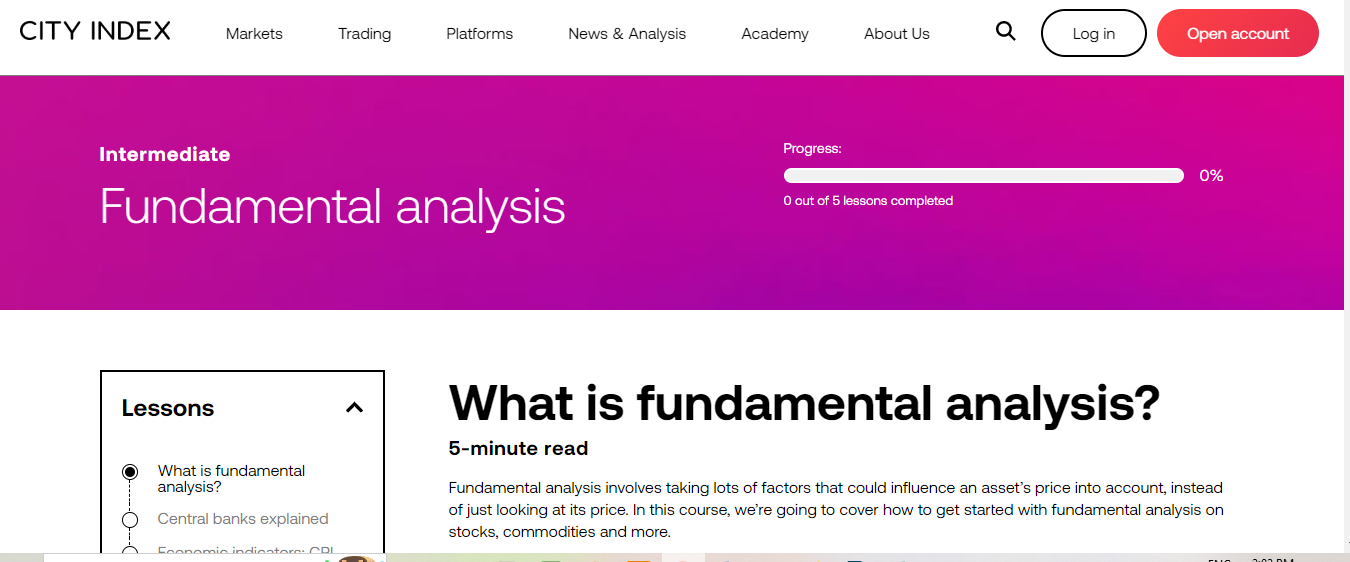

2. Courses: City Index’s courses are divided into basic, intermediate, and advanced levels. Each level has different courses and each course contains at least 3-4 lessons. The lessons are in text form and can take up to 5 minutes to read. There is also a progress bar that helps you track how far you have gone with the courses.

3. Glossary: Glossaries are good for getting the definition of terms quickly. City Index has a glossary for the definition of terms and some financial instruments. In addition, the glossary is easy to navigate and arranged in alphabetical order. This saves you time and helps you search quickly.

4. News: This section covers economic events and information that traders can use for research. Events or information that affects forex, commodities, shares, and indices are shared and analyzed by top professionals and market analysts.

There is quite a number of news covered in this section. But we discovered is that City Index made it possible to filter out old news and focus on latest research only. We found this feature to be time saving as we carried out this review.

4.Quick Lessons: If you are looking for a short explanation on various trading topics, City Index quick lessons is where to look. It is part of the forex broker’s academy and is not structured like the courses. It is more like a combination of different topics that you can access directly.

5. Webinars: Financial Markets experts are available on City Index’s webinar. They are certified by reputable financial bodies like the CFA. The webinars are well structured so you can track when they hold. If there is no webinar holding, you can watch the previous ones. There is also a filter you can use to know the most watched webinars. This is useful as it lets you know what other traders are watching.

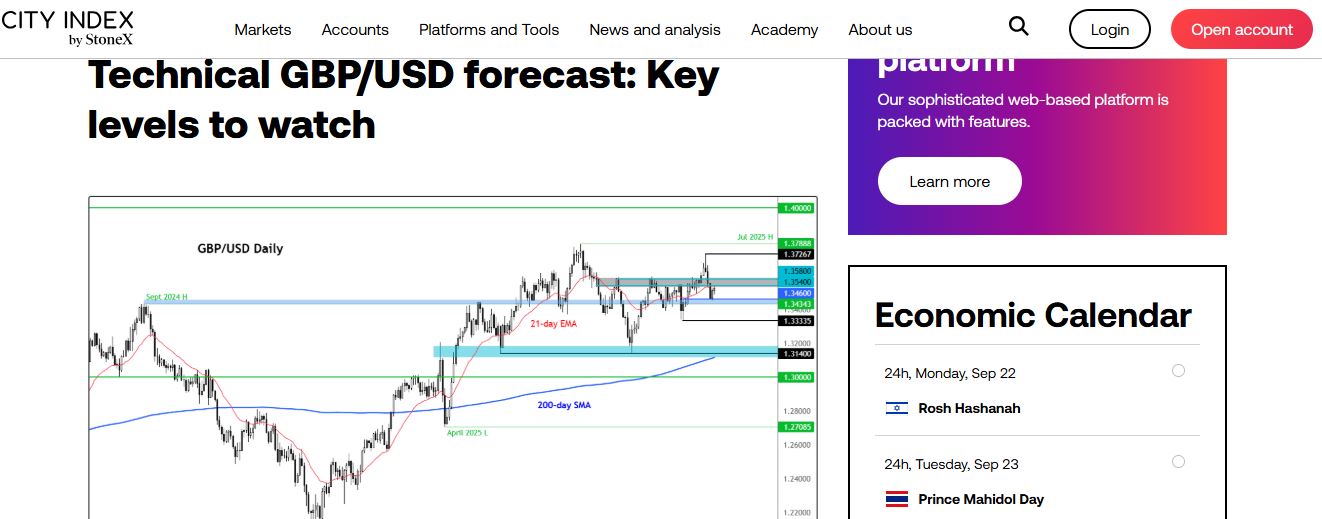

6. Trade Ideas: Trade ideas cover short-term outlooks of CFDs (whether price will increase or decrease). The content is in text format and is written by expert in multi-timeframe technical analysis, macroeconomics, price action, and trade education.

Here is an on-chart GBP/USD analysis from one of the experts:

City Index Customer Service

The support at City Index is good & we found it easy to talk to them via chat.

Good customer service is important. As a trader choosing a forex broker, you might have questions and inquiries. This is why we have reviewed City Index’s customer support in the UK.

1) Good Live chat: City Index has a live chatbot. It will be the first to respond to you on the live chat. When we got connected to the customer service representative, we had a few seconds of holding time. We got quick responses to our answers (within two minutes). The answers were simple and relevant to our questions.

2) Phone number support: City Index have a phone number on their website. It is under their ‘contact us section so clients change t support by calling this number – 0800 060 8609.

3) Email Support: It was difficult finding an email support address on City Index’s website. This is a bit of a downside as far as their customer support services are concerned.

4) Client Wellbeing: There are not many brokers that cater to their clients beyond business. Under city index wellbeing, the broker is willing to help if you are going through serious personal issues. Examples include losing a loved one, losing your job, retiring, mental health issues, physical disability, etc. City index encourages you to share these details with them so they can offer adequate help.

They also have a policy that protects all sensitive and private information you share with them. A form is provided for you to supply certain information like your name, email address, and account number. After this, you can go on to describe what you are going through (in a maximum of 10,000 characters) and submit the form.

Is City Index a Market Maker?

Yes, City index is a market maker. This means that City Index takes the opposite side of your trade, when you buy, City Index sells to you and when you sell, they buy from you.

As a market maker, City Index profits from the difference in the bid/ask price. On City Index trading platforms, you may notice that the ask price is always higher than the bid price. For example, they may display the bid/ask price of Tesla shares as 250/250.5

This means that City Index will buy Tesla shares at 250 from sellers but sell at 250.5 to buyers.

In the execution policy section above, we have explain City Index market model better.

Do we Recommend City Index for UK Traders?

City Index is low-risk CFD broker to trade with. They are regulated by the FCA and ASIC, and these are recognized, top-tier regulators. Also, the FSCS guarantees that your money is safe and protected upto a certain limit.

There are also risk management tools in place. Negative balance protection and guaranteed stop loss orders ensure that your losses are limited. You will also not fall into debt because you cannot lose more than your trading capital.

City Index offers over 12,000 CFD Markets without extra commission for currency pairs and typical low spreads. Considering the above, you can choose City Index as your broker.

FAQs on City Index UK

Is City Index an ECN broker?

No, City Index is a market maker, not an ECN broker. They also have a dealing desk.

Is City Index regulated in the UK?

Yes, City Index is regulated with the Financial Conduct Authority (FCA) under FRN 446717. Their registered company name is StoneX Financial Limited.

What is the minimum deposit at City Index?

City Index require traders deposit a minimum of £100 to open an account. Either CFD or Spread Betting Account, the minimum deposit is the same

What is the leverage at City Index?

City Index offers a 30:1 maximum leverage to retail traders. Professional traders can access leverage up to 400:1.

Is City Index a good broker?

City Index is a popular CFD broker in the UK and are regulated by the FCA. They provide CFD trading on various instruments and spread betting services with zero commission for currency pairs.

City Index offers negative balance protection and are a member of the Financial Services Compensation Scheme which protects your deposit and will compensate you for up to £85,000 in the event of insolvency by the broker.

Does City Index have GBP Account?

Yes, you can deposit in GBP and make also choose GBP as your account’s base currency.

Note: Your capital is at risk