Scalping is one of the many trading strategies used by forex traders. Though scalpers target little gains, this strategy has its own risks. Chiefly is that you are likely to trade more if you are scalping. And if you trade more, the more you are exposed to risks.

It is common knowledge that you cannot trade forex without a CFD broker. However, not all forex brokers support scalping. Finding a broker that supports scalping is quite tasking because there is a lot of them. Beyond finding one, you also want to make sure that the trading conditions are good for you.

This is why our team has reviewed the best scalping brokers in the UK with the best conditions. Our detailed research will guide you in choosing the best option.

Below is a table comparing the Best Forex Scalping brokers in this guide:

Comparison of Best Forex Scalping Brokers in the UK

| Broker | FCA Regulation | Trading Platforms | Commission | Visit |

|---|---|---|---|---|

| FP Markets |

Temporary Permission (EEA)

|

MT4, MT5, FP Markets Mobile App

|

$3 per standard lot (Raw Account)

|

Visit Broker |

| eToro |

Yes

|

eToro Proprietary Platform, CoyTrader

|

No commissions

|

Visit Broker |

| Pepperstone |

Yes

|

MT4, MT5, cTrader

|

£2.25 per standard lot (Standard Account)

|

Visit Broker |

| FxPro |

Yes

|

MT4, MT5, cTrader, FXPro Trading Platform

|

No commissions (except for cTrader)

|

Visit Broker |

| FXTM |

Yes

|

MT4, MT5, FXTM Mobile App

|

$0.4-$2 (Advantage Account)

|

Visit Broker |

Note: The commission is as per the data on these brokers’ websites at May 2022.

Best Forex Scalping Brokers in the UK

Here is the list of best forex scalping brokers in the UK that we have reviewed:

- FP Markets – Overall Best Scalping Broker in the UK

- eToro– Scalping Broker with CopyTrader

- Pepperstone – FCA Regulated Scalping Broker

- FxPro – Scalping Broker with cTrader

- FXTM – Scalping Broker with Advantage Account

Risk Warning: CFD Trading is risky. Only trade with FCA regulated brokers. Also, do not abuse leverage.

#1 FP Markets – Overall Best Scalping Broker in the UK

FP Markets is an Australian broker so their regulation is with ASIC. However, they are regulated in Europe with CySEC. They also have temporary permission with the FCA in the UK under the firm number 837633. FP Markets is low risk.

Before we show you why FP Markets tops this list, let us give a short review of their trading conditions. FP Market offers two accounts (Raw and Standard) with ECN pricing execution. You can open any of these accounts with £100.

The Raw Account is best if you are looking for low and raw spreads. The Standard Account has higher spreads. Also, there is no extra commission per lot on the Standard Account only.

There is also a good range of CFDs for you to scalp. Forex, shares, metals, commodities, indices, and bonds are all available as CFDs.

FP Markets support MT4, MT5, and the FP Markets Mobile App and they support scalping. The CFD broker tops this review because scalping is available on their MT4 and MT5. These two platforms are also available as WebTrader with ideal conditions for scalping too.

What else? FP Markets have an ECN account and an ECN pricing model. This is good for scalping because your trades will be executed quickly (under 40 milliseconds). In addition, there are no order restrictions so you can always exit trades on your own terms. It is difficult to scalp with order distance restriction.

Finally, you can open a demo account on any of their platforms to test their scalping conditions yourself.

FP Markets Pros

- Top-tier regulation with ASIC

- ECN pricing so trades are executed quicly

- ECN Account so spreads are tight

- Good range of CFDs

- Scalping is supported on MT4 and MT5

- No extra charges for scalping

FP Markets Cons

- Temporary permission with the FCA

- Scalping is probably not ideal on the FP Mobile App

- Minimum deposit is £100.

- Commissions are charged on the ECN Account

#2 eToro – Scalping Broker with CopyTrader

eToro is regulated with the FCA so they are low risk. Their FCA number is 583263 registered under the name eToro (UK) Ltd.

eToro has just one account. They have the lowest minimum deposit compared to other brokers in this review. Scalpers in the UK can open an account with $10. 49 currency pairs, 2631 stocks, 32 commodities, 40 cryptocurrencies, 13 indices, and 263 ETFs are offered as CFDs.

There are no commissions for CFDs. Your fees are built into the spreads and overnight charges.

According to eToro’s terms and conditions, scalping as a trading technique is not allowed. However, we spoke to their customer support for more details. We were told that eToro defines scalping as opening and closing a trade within a short time.

But the important info they gave to us is that they do not set a specific time within which a trade should not be closed. In addition, they allow the closing of trades within a short duration. Summarily, it means scalping is not totally disallowed.

You can read more on their trading conditions in our eToro review

eToro Pros

- FCA Regulation

- Low minimum deposit

- ECN Account so spreads are tight

- 2000+ stocks

- No extra fees for scalping

eToro Cons

- No MT4

- No ECN Pricing

- You are charged $5 for withdrawals

- No MT4, MT5, or cTrader

#3 Pepperstone – FCA Regulated Scalping Broker

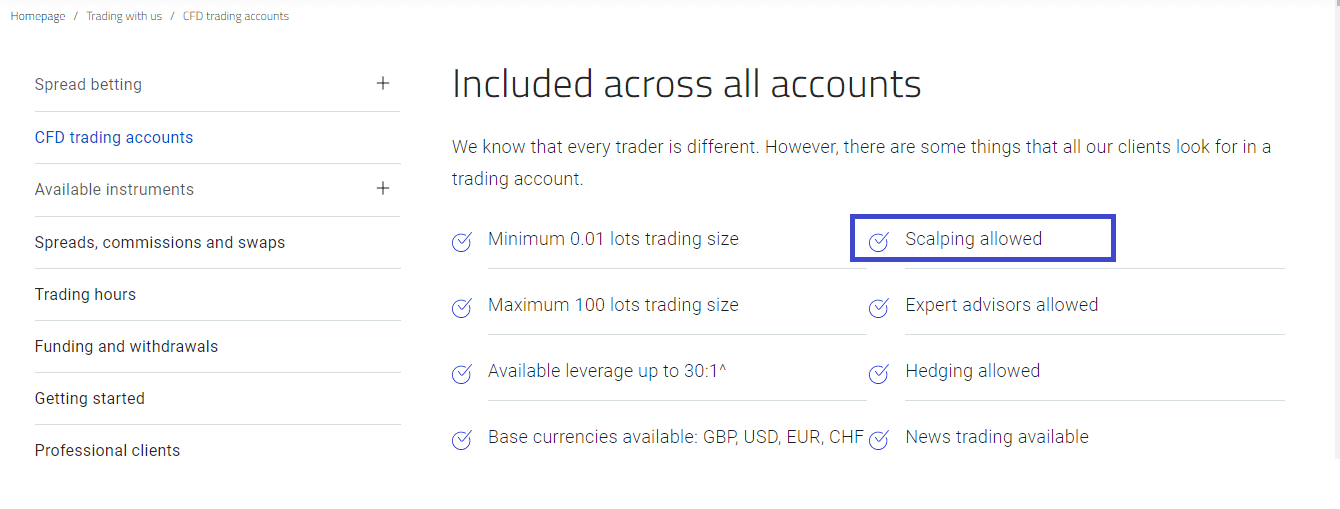

Pepperstone is a low risk scalping broker with FCA regulation. They are registered with the FCA under the name Pepperstone UK Limited with the firm number 648312. Pepperstone is also regulated in Australia with ASIC.

Scalpers in the UK can open three accounts – Razor, Standard, and Spread Bet. No minimum deposit is required for any of the accounts.

Pepperstone offers the following as CFDs: 60+ currency pairs, 20+ stock indices, 900+ stocks, 100+ ETF CFDs, 20+ commodities, and 3 currency indices. You can scalp on these instruments.

As per fees, Pepperstone only charges a commission on their Razor Account and it varies by trading platforms.

Read our Pepperstone review for in-depth info on their trading conditions.

Pepperstone’s trading platforms include MT4, MT5, and cTrader. However, scalping is connected to their account types. UK traders can scalp across Pepperstone’s three accounts. The account type you choose depends on you. But to further guide you, our research concludes that the Razor Account might be the best for scalping.

Why? The account is ECN type with fast execution so the spreads are low. As a scalper, you need quick execution to maximize small price movements. The only downside is that there is an extra commission per lot. If you prefer a zero-commission account, you can still choose the Standard Account.

Pepperstone Pros

- Top-tier regulations with the FCA and ASIC

- No minimum deposit

- ECN Account is available

- Scalping is supported across all accounts

- No charrges for scalping

Pepperstone Cons

- Extra commissions are charged on the ECN account

#4 FxPro – Scalping Broker with cTrader

FxPro is a low risk forex broker that supports scalping. They are registered with the FCA under the name FxPro UK Limited. Their license name is 509956.

FxPro supports four trading platforms: MT4, MT5, cTrader, and the FxPro Platform. Their accounts are also named after these platforms. Though FxPro recommends £1000 as minimum deposit, you can start with £100.

We chose FxPro in this review because they support scalping on all of their trading platforms. Because of this, scalping is available on all account types too. They also have a good range of CFDs (forex, indices, shares, metals, and energies). These CFDs are also available for spread betting.

FxPro also made this review because of their quick execution. Most of their orders are filled in less than 14 milliseconds which is good for scalpers.

According to our research, the MT4, MT5, and FxPro platforms are the best for scalpers. Though the spreads are high, there is no extra commission per lot. This is why they are the ideal platforms.

FxPro Pros

- Scalping is supported on all trading platforms

- Scalping is supported across all accounts

- No charges for scalping

- Regulated with the FCA

FxPro Cons

- Commissions are charged on cTrader

- No ECN Account

- Minimum deposit is £100

#5 FXTM – Scalping Broker with Advantage Account

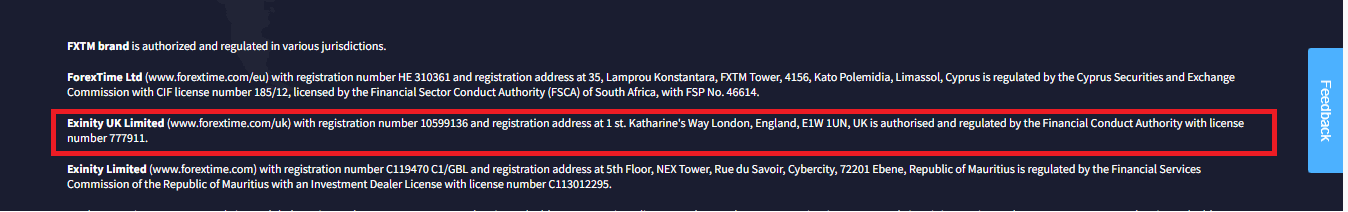

FXTM is regulated with the FCA as Exinity UK Ltd. Their FCA number 777911. They are also regulated with CySEC. FXTM is a low-risk broker.

FXTM offers three accounts – Micro, Advantage, and Advantage Plus Account. The minimum deposit for the Micro Account is £10. But you will need £500 for the other accounts. Commissions are charged on the Advantage Account only.

FXTM offers forex, FX indices, Stocks, Indices, Metals, and Commodities (all as CFDs). They support scalping on all of their accounts. This is one of the reasons we chose them. In addition, scalping is allowed across all of their trading platforms.

Because of FXTM’s competitive pricing, your choice of account for scalping depends on how you want to be charged. Also, we think their MT5 is more suitable for scalping because it has better conditions than their MT4. We also advise that you test the accounts on a demo account first.

FXTM Pros

- £10 minimum deposit for Micro Account

- Scalping is supported across all accounts

- Regulated with the FCA

FXTM Cons

- Commissions are charged on Advantage Account

- No ECN Account

- Minimum deposit is £500 for some accounts

What is Scalping?

Scalping is a trading strategy that involves opening and closing a trade within a short time. It is the shortest of all short-term trading strategies. Scalpers can trade between 10-100 times a day, accumulating small gains in the process. Scalpers take a number of low-profit trades instead of a few high-profit trades. This allows them to spread out their risk and reduce losses.

How is this done? Scalpers set certain conditions that determine if they will enter a trade. They also select a group of CFDs they want to trade. When one of the CFDs meets these conditions, they open a trade on it and close it after a short time.

The timeframe used differs from one scalper to the other. The 1-minute and 5-minute timeframes are very common. Also, scalpers tend to hold a trade for 1-15 minutes. Experienced traders can hold their trades for a few seconds.

Common Scalping Strategies

Independently, scalping itself is a trading strategy. It is aimed at maximizing profits and minimizing losses. However, there are several scalping strategies that are by beginner, intermediate, and expert scalpers. Here are some of the most popular scalping strategies:

The 1- minute strategy: This is a popular strategy among scalpers. As the name implies, it involves holding a trade for a maximum of 1 minute. Traders that employ this strategy open and close numerous trades in a day. They maximize profit this way, with the market having little time to move against them.

As solid as this strategy is, it is advisable that you employ it via automated trading so you can enter and exit trades quickly. The strategy is not really effective if your timing is not spot on.

The RSI strategy: The Relative Strength Index (RSI) is an indicator used by traders to know when CFDs are overbought and oversold. When a CFD is overbought, there will likely be a reversal in trend so you sell. If it is oversold, then it is time to buy.

A typical RSI scalping strategy will involve setting the upper and lower limits of the indicator to 70 and 30 respectively. When the indicator crosses the 70 mark, the CFD is overbought so you can open short-term sell orders on it.

When it is below 30-mark, the CFD is oversold and you can open short-term buy orders. More conservative traders set the RSI indicator to an upper limit of 80 and a lower limit of 20.

Majors Only Strategy: Major currency pairs are great for traders that want to scalp the forex market. EUR/USD, GBP/USD, and other majors have high liquidity. This means they are less volatile and their spreads are tight. So you get good price movement coupled with low spread cost. Trading majors only is also the most advisable strategy for beginners.

Key Support and Resistance Zones: Support is a zone where the price stops falling. Resistance is a zone where the price stops going up. Though these zones can be broken, the price usually goes up (support) or down (resistance) from them.

As a scalper, you can open positions at these zones on lower timeframes (e.g 1 minute and 5 minutes). This is the best way to maximize this strategy.

Is there an Ideal Time to Scalp?

The time period favored in scalping is determined by the technical strategy you prefer. Some scalpers opt for choppy market conditions, while others prefer to trade in strongly trending, highly liquid, and volatile markets. This selection primarily relies on personal preference, yet these two market types provide distinct environments where various strategies can yield profits.

So let us look at some of the ideal time to scalp and how your personal preference can fit each time. All times is UK time (non-daylight saving)

11:00am-12:00pm – European markets are usually choppy in this period as traders prepare for the opening of the New York session. Trading sessions in London and Frankfurt are also open in this period. However, there is reduced liquidity as trading desks monitors how the New York session affects the market.

So what do you do as a scalper? If you prefer trading a choppy market, you can consider this time. You get to take advantage of small changes in prices when price movement is a bit stable.

12:00pm-2:00pm – The New York, London, and Frankfurt sessions are opened in this period so this is the most volatile and liquid period. Therefore, this is one of the ideal times to deploy your scalping strategies.

Short- term trends are common in this period as market events and news causes quick changes in the direction of price. To maximize this window, a scalper must effectively combine fundamental and technical tools to trade profitably.

8:00pm-12:00am – You can break this time down into two phases. Between 8pm and 10pm, most banks in the US are open. However, they are rounding off the business day by this time. The last two hours (10pm-12am) is when most markets are closing. There is little liquidity and the market is quiet.

At this period, you can take advantage of the calmness of the market. Because of little liquidity, price movements on most CFDs are slow and you can scalp. You can use any strategy you prefer (automated or manual).

How to Choose the Best Scalping Broker in the UK

If you want to trade forex without a specific technique in mind, you can probably sign up with any regulated broker. However, you need to consider some points if you plan to be a scalper. This section will provide guidelines for choosing the best scalping broker.

We will also show you how to check these guidelines. Let’s go

1) Is the broker FCA Regulated?

FCA regulation is important. Trading with an FCA regulated broker is the only way to make sure your funds are safe. Though CFD trading is risky, regulated brokers are considered low risk. Checking a broker’s regulation is easy.

Go to the broker’s website and scroll down to the footnote. You will find their FCA regulation there with their registration number. The screenshot below is an example showing FXTMs regulation.

You can see their FCA regulation (in the red box), with their registration name as Exinity UK Ltd under the firm number 7779111.

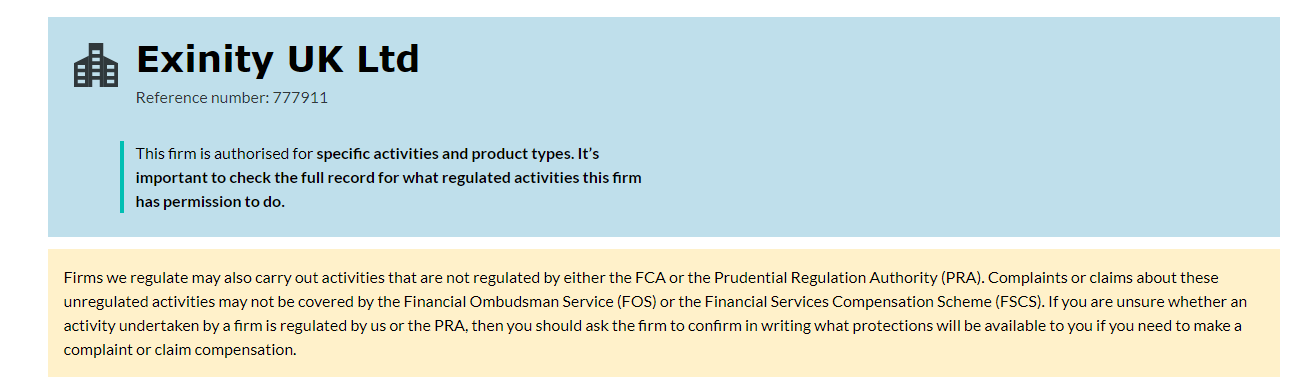

That is not all. There are brokers who claim they are regulated but they are not. So you need to cross-check the info on the broker’s website with the FCA. Go to the FCA’s website and search for the broker. Their registered name and reference number should display as shown below.

2) Does the broker allow scalping?

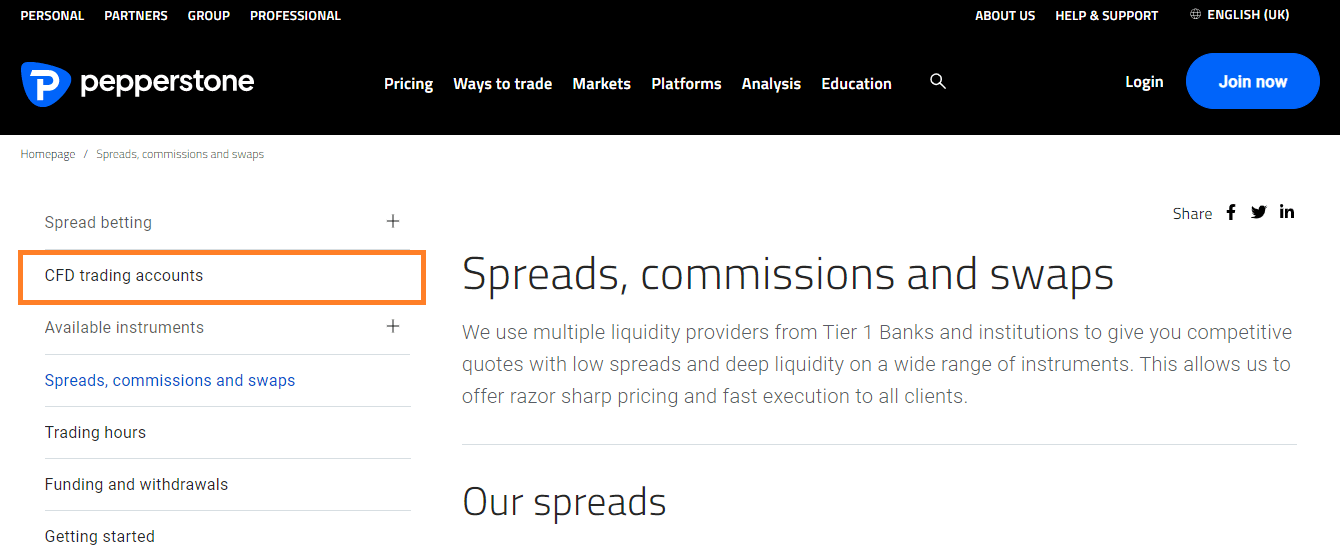

Here is another important point to consider. Not all brokers allow scalping so you cannot assume. You need to confirm. Let us walk you through it by using Pepperstone as an example.

Go to pepperstone.com/en-gb and click on ‘pricing. You will arrive at the page displayed below. Then click on ‘CFD trading accounts’ (in the orange box).

When you click on ‘CFD trading accounts’. You will arrive at the page below that shows that Pepperstone allows scalping across all of their accounts.

For some brokers, it is based on trading platforms. So make sure you read about the broker’s platforms to know if they allow scalping on all of their trading platforms. All of these can be checked on the broker’s website.

3) Are there any extra fees for scalping?

Trading fees are common with all brokers. Spreads, commissions, and swaps are all trading fees. The brokers in this review do not charge any extra fees for scalping. The best way to check this without any doubt is to speak to the broker’s support.

It could be via email, live chat, or phone call.

4) How fast is their execution?

As a scalper, you will be opening and closing your trades quickly. Since this is how you book profits, every second counts. Because of this, you have to choose a broker with speedy execution. This is why you should only sign up with an ECN or STP broker for scalping. Choosing brokers with these models limits the manual intervention of dealing desks. This lets you enter and exit your trades swiftly.

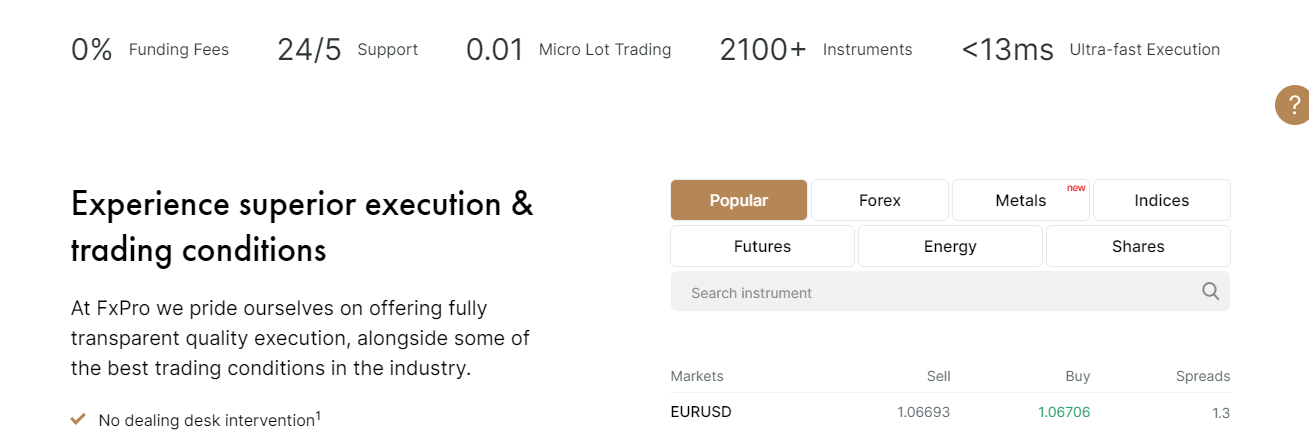

If you want to understand this deeper, you can seek to know your broker’s average execution speed. You can ask their customer support. Some brokers even state it on their website so you have an idea of what it is. FxPro is a good example of this. Here is a snapshot from their website

FxPro’s execution speed is less than 13 milliseconds as seen in the image. While there is no industry standard for execution speed, most forex brokers strive to have speedy execution

Apart from the info supplied by your broker, there is another way to verify their execution speed. This approach is more hands-on. You will have to open a demo trading account and place trades on your favorite CFDs. This gives you a practical first hand experience before opening a real account.

5) Is the broker ECN broker?

When you are scalping, you are closing trades at very short intervals. You need fast execution so your orders are filled speedily. This is why you should consider if the broker is ECN or not. Also, some brokers might not be ECN but have ECN conditions.

So you need to confirm this as well. You can do this by speaking to the broker’s customer support.

6) What is the leverage ratio?

Since scalping tries to take advantage of small price movements, leverage is very important. Because scalpers do not ride lengthy price movements, a high leverage ratio will let you control higher trading positions than the money in your trading account. With leverage, you can make more profit with small price movements if your trade goes your way.

For retail traders in the UK, the maximum leverage you can get from CF brokers is 30:1. This allows you to control positions worth 30 times more than your trading capital. This is sufficient. Do not trade with loosely regulated brokers that offer enormous leverage to retail traders. You might end up losing all of your money. Even worse, you could be in debt if such brokers do not offer negative balance protection.

Do all forex brokers support scalping?

No, not all forex brokers support scalping. Though the strategy is very popular, some forex brokers consider it high risk. Counterparty forex brokers do not allow scalping because successful scalping can affect their profit.

System overload is another reason some forex brokers do not support scalping. Scalpers tend to open hundreds of position every day. That is a lot of orders coming frequently coming on broker’s servers. This overload can slow down execution and system crash.

While some brokers are clear on whether they permit scalping or not, there are brokers who just put a limit on maximum daily orders and minimum hold times to manage system overload and excessive scalping.

FAQs on Best Scalping Brokers in the UK

What is scalping in forex trading?

Scalping is a short-term trading strategy that looks to accumulate small gains by trading more. It is a high-risk strategy.

What is the best broker for scalping?

If the broker is regulated with the FCA and allows scalping, they are good enough. If they have an ECN account, it’s even better.

Is scalping illegal in the UK?

Scalping is not illegal in the UK. Some brokers support it while some do not but scalping is legal.

Which timeframe is the best for scalping?

The one-minute time frame is considered the best for scalping.