There are different brokers you can register with to begin your trading journey. In this review, we have researched a list of brokers for you. Beyond offering you a trading account, the brokers in this review offer ECN (electronic communication network) accounts.

Some brokers claim to offer ECN accounts but they are false. In this review, we focused on brokers who operate the NDD (no dealing desk) model. This model is a key part of ECN accounts. Apart from operating the NDD model, we also made sure our brokers are regulated with at least one top-tier regulator.

Trading with regulated brokers is for your good. The Financial Conduct Authority (FCA) regulates brokers in the UK. Trading with regulated brokers guarantees the safety of your funds and compensation, should your broker declare insolvency. Make sure to verify your broker’s regulations before opening a trading account.

Comparison of ECN Brokers in UK 2024

| Forex Broker | Regulation | GBP/USD Spread | Minimum Deposit | |

|---|---|---|---|---|

| Pepperstone |

FCA, ASIC

|

0.91 pips

|

£0

|

Visit Broker |

| IC Markets |

ASIC, CySEC

|

0.23 pips

|

£200

|

Visit Broker |

| FxPro |

CySEC, FSCA, FCA

|

2.44 pips (Instant Execution on MT4)

|

£100

|

Visit Broker |

| FXCM |

FSCA, FCA, ASIC

|

1.4 pips

|

£50

|

Visit Broker |

| FP Markets |

FCA, ASIC, CySEC

|

0.3 pips

|

£100

|

Visit Broker |

| AxiTrader |

FCA, ASIC, DFSA, FMA

|

1.5 pips (Standard Account)

|

$0

|

Visit Broker |

List of Best ECN Brokers in the UK

Below is the list of best ECN brokers in the UK according to our testing & research.

- Pepperstone – Best ECN Broker with tight spread

- IC Markets – FCA Regulated ECN Broker

- FXPro – Multi regulated ECN Broker

- FXCM – ECN broker with low minimum deposit

- FP Markets – Forex broker with ECN Pricing

- AxiTrader – Best ECN Broker for Beginners

Now we are going to elaborate on these brokers one after the other so that you can compare them as per your requirements like low fees, high leverage, regulation, etc. Let’s start.

#1 Pepperstone- Best ECN Broker with Tight Spread

Pepperstone are regulated with FCA as Pepperstone Limited. They are licensed and authorized to offer forex trading services in the UK. Their FCA reference number is 648312.

ECN Trading Account Conditions:

Minimum deposit: Pepperstone do not enforce a minimum deposit for their ECN trading accounts. It is advisable you deposit at least £200 for the sake of margin.

GBP/USD Fees: Pepperstone’s average spread for trading GBPUSD is 0.59pips for their Razor Account. On their MT4/MT5, you pay a commission of £2.25 per turn for every standard lot traded. That totals £4.50 for a round turn. For a micro lot, you pay £0.05 round turn commission. cTrader round turn commissions are fixed per standard lot at $3.

Pepperstone’s swaps are indicative of current market volatility. This means they change as market volatility changes. You can find the latest swaps on their MetaTrader and cTrader platforms when you sign up to be a client.

Leverage: You can leverage up to 30:1 as a retail trader. Professional traders have access to higher leverage levels up to 500:1. The table below shows the leverage levels for retail traders.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Index CFDs | 20:1 |

| Gold | 20:1 |

| Commodities | 10:1 |

Trading platforms: Pepperstone offers MetaTrader 4 and MetaTrader 5 trading platforms. They also offer the cTrader platform. They offer ECN accounts on both MetaTrader and cTrader platforms.

Range of CFD trading instruments: Pepperstone offers 60+ currency pairs, 20+ stock indices, 100+ ETF CFDs, 20+ commodities, and 3 currency indices. These instruments are all yours to trade.

Withdrawal methods for UK traders: UK traders can withdraw their funds via Visa debit/credit card, Mastercard debit/credit card, bank transfer, and PayPal. Withdrawal takes 1-3 days across all payment methods.

Support for UK Traders: Overall customer support for UK traders is good. You can reach Pepperstone via a toll-free local mobile number. You can also contact them using email, WhatsApp, and the live chat feature on their website.

According to our tests, the live chat feature is the fastest. You get your response within a minute from the chatbot. You can also chat with a live agent and get quick responses too. They responded to emails within three hours.

#2 IC Markets- FCA Regulated ECN Broker

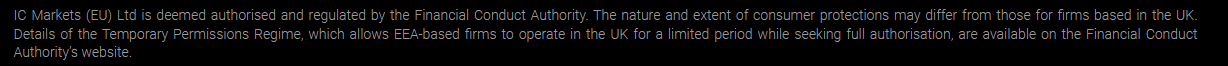

IC Markets are regulated in a European Economic Area country so they are authorized to operate in the UK. Their FCA reference number is 827935. It is also important you know that IC Markets’ permission to operate in the UK is temporary.

Update: According to the information on the FCA website in June 2022, IC Markets have applied to cancel their temporary FCA permission in the UK.

ECN Trading Account Conditions:

Minimum deposit: You need a minimum deposit of £200 to open an ECN trading account with IC Markets.

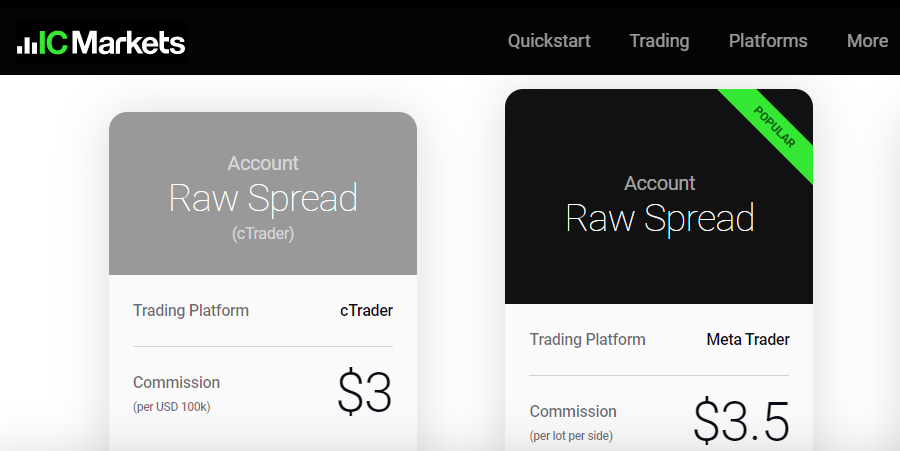

GBP/USD Fees: IC Markets offer 0.23pips average spread for GBP/USD on their Raw Spread Account. The trading commission is £3.50 per round turn for every standard lot traded. This brings your total commission to £7. On the cTrader platform, you pay £6 as a total commission at £3 per turn for every standard lot you trade. For swaps, you pay £3.30 for long positions and £2.35 for short positions.

Leverage: Traders in the UK can leverage up to 30:1 trading forex with IC Markets.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Indices | 20:1 |

| Commodities | 10:1 |

| Bonds | 5:1 |

| Futures | 5:1 |

Trading platforms: IC Markets offer MetaTrader 4 and MetaTrader 5 platforms. cTrader platform is also available. You can use these platforms on the web, mobile phones, and personal computers.

Range of CFD trading instruments: IC Markets offer a good range of trading instruments. You have access to 61+ currency pairs, 22+ commodities, 25+ indices, 11+ bonds, 730+ stocks, and 4 global futures. They also offer 18 crypto CFDs but you cannot trade them. Crypto CFDs are banned in the UK.

Withdrawal methods for UK traders: You can withdraw your funds via Visa debit/credit card, Mastercard debit/credit card, bank transfer, PayPal, Skrill, and Neteller.

Support for UK traders: You can reach IC Markets via email and the live chat feature on their website. A local mobile number is not available. We got a response to their email within three minutes. Live chat responses are even faster. We got responses within a minute. According to our tests, IC Markets have great customer support.

#3 FxPro- Multi Regulated ECN Broker

FxPro are regulated with the FCA. Their reference number as seen on FCA’s website is 509956. They have been authorized in the UK since 10/09/2010 and they have an office in London.

ECN Trading Account Conditions:

Minimum Deposit: With £100, you can begin your trading journey with FxPro.

GBP/USD Fees: The average spread for GBPUSD is 1.6pips. You pay a swap of £2.28 on long positions. If you are selling, the swap is £2.31. FxPro charges a commission of £2.25 per side for every standard lot GBPUSD that you trade. Your total charge for a round-turn trade is £4.50. This commission is charged on their cTrader platform only.

Leverage: You can leverage up to 30:1 trading with FxPro

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Stock CFDs | 5:1 |

| Stock Index CFDs | 20:1 |

| Commodities | 10:1 |

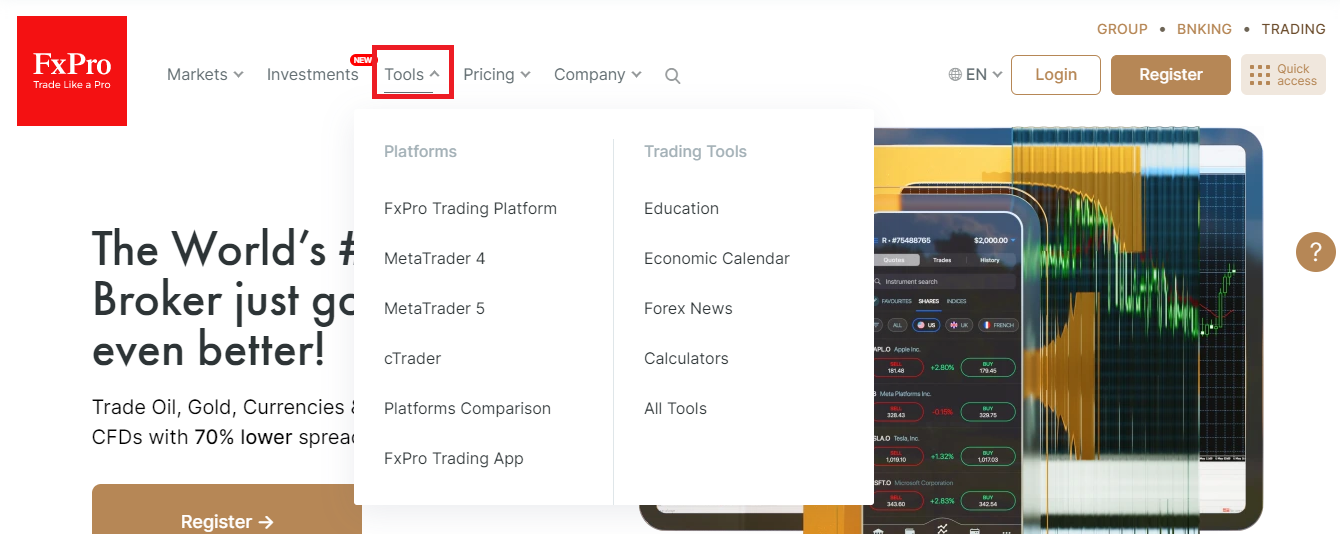

Platform: You can trade using FxPro trading platform, Metatrader 4, Metatrader 5, and cTrader. There is no dealing desk execution across all the platforms.

Range of CFD trading instruments: FxPro gives you exposure to 70+ currency pairs, 21 futures, 19 spot indices, 1000+ shares, 8 metals, and 3 energies.

Withdrawal methods for UK traders: You can withdraw your funds via bank wire transfer, debit/credit card, or through e-wallets like Skrill and Neteller.

Support for UK traders: A local mobile number is available. There is also a toll-free line for UK-based clients. A live chat feature is also available on their website. We got a response there within a minute. They responded to our email after four minutes.

Note: FxPro states on their website that they are not an ECN or STP broker but they do offer NDD execution on all of their trading platforms.

#4 FXCM- ECN Broker with Low Minimum Deposit

FXCM are regulated with the FCA as Forex Capital Markets Limited. They have been authorized to operate in the UK since 27/05/2003. Their FCA reference number is 217689.

ECN Trading Account Conditions:

Minimum deposit: You need only £50 to open a trading account with FXCM.

GBP/USD Fees: FXCM’s average spread for GBP/USD is 1.4pips. FXCM charges no swaps. However, you pay a commission for trading. You are charged £3 per turn for every standard lot of GBPUSD that you trade. This brings the total fees you pay to £6 for a round-turn trade.

Leverage: FXCM’s leverage by trading instrument is shown in the table below.

| Instruments | Leverage |

|---|---|

| Major currency pairs | 30:1 |

| Minor currency pairs, gold, and major indices | 20:1 |

| Commodities (except gold) | 10:1 |

| Cryptocurrencies | 2:1 |

| Individual equities | 5:1 |

Platform: FXCM offers four trading platforms namely Trading Station, MetaTrader 4, Ninjatrader, and Zulutrade. You can use any of these platforms to place your trades.

Range of CFD trading instruments: FXCM offers currency pairs, indices, commodities, and metals. The number of instruments available to you depends on the type of trading account you choose.

Withdrawal methods for UK traders: You can withdraw your funds via bank transfer, credit/debit card, Neteller, and Skrill.

Support for UK traders: Local mobile number is available for you to call. We tested their WhatsApp account as well. We got a response within a minute. Email response took some hours. Overall support is good.

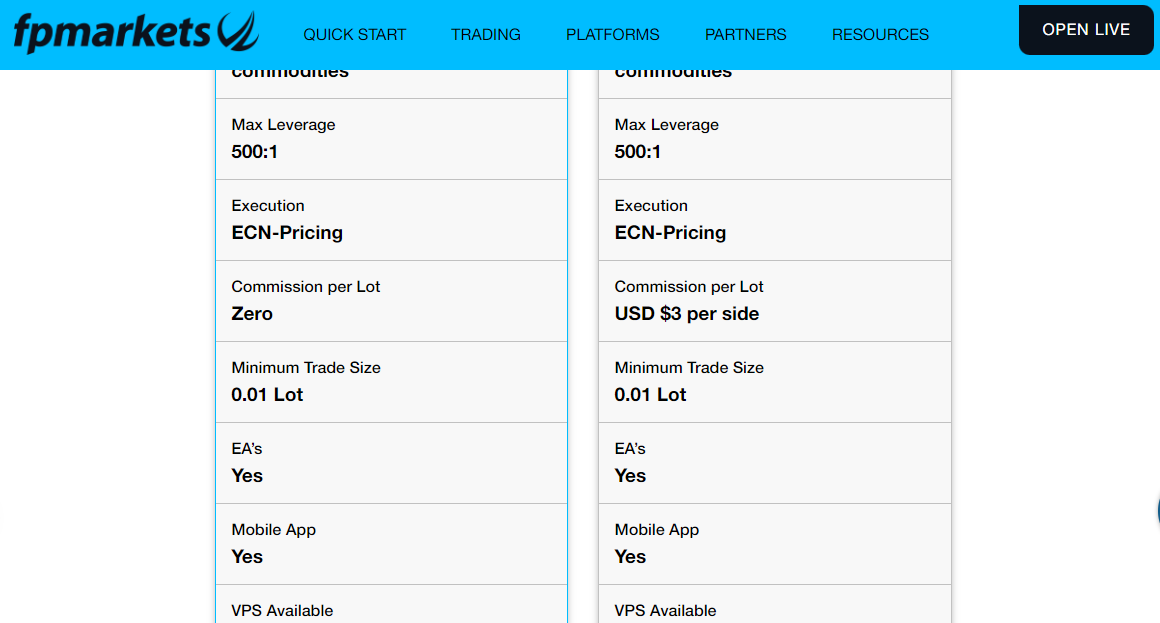

#5 FP Markets- Forex Broker with ECN Pricing

FP Markets operate in the UK because of their EEA license. Their FCA license number is 837633.

Update: According to the information on the FCA’s website, FP Markets is currently under a supervised run-off.

ECN Trading Account Conditions:

Minimum deposit: You need a minimum deposit of £100 to open FP Market’s ECN Account

GBP/USD Fees: FP Markets charge an average spread of 0.3 pips for GBP/USD. They also charge a high swap rate if you are going long (£4.01). If you are going short, your rollover fee is £0.37. This is according to the info on their website. However, live swap rates may differ.

Finally, you will pay a commission of £3 per standard lot of GBP/USD that you trade. This fee applies to the Raw ECN Account only.

Leverage: FP Markets’ leverage by trading instruments is shown in the table below.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Shares | 5:1 |

| Metals | 10:1 |

| Indices | 20:1 |

| Commodites | 10:1 |

| Bonds | 5:1 |

Platform: FP Markets supports MT4 and MT5. They are available as web trader, mobile apps, and desktop software. The Raw ECN Account is available on both platforms.

Range of CFD trading instruments: You can trade ETFs, shares, currency pairs, bonds, metals, and commodities with FP Markets.

Withdrawal methods for UK traders: Traders in the UK can deposit/withdraw funds via credit/debit cards, Skrill, and Neteller. Apart from these three, you can also use STICPAY and RAPID TRANSFER.

Support for UK traders: You can reach FP Markets via a phone call (locally), e-mail, and live chat. We tested their live chat and got a response within five minutes. FP Markets have good customer support.

#6 AxiTrader- Best ECN Broker for Beginners

AxiTrader offers retail trading via their Standard and Pro Accounts. They have a good education package for beginners with low ECN-type spreads on their Pro Account.

ECN Trading Account Conditions:

Minimum deposit: No stipulated minimum deposit. You can open an account with $0

GBP/USD Fees: AxiTrader charges 0.6 pips spread for GBP/USD on their Pro Account with a $7 round-turn commission. No extra commissions on the Standard Account.

Axi calculates your swap fees based on order size, the length of your trade, and your position in the market (buy/sell).

Leverage: Axi’s leverage by trading instruments is shown in the table below.

| Instruments | Leverage |

|---|---|

| Forex | 30:1 |

| Shares | 5:1 |

| Metals | 10:1 |

| Indices | 20:1 |

| Commodites | 10:1 |

Platform: Axi supports MT4 only. You can use Axi MT$ on your mobile phone and desktop. There is a WebTrader version also.

Range of CFD trading instruments: Axi offers currency pairs, shares, indices, commodities, and metals as CFDs

Withdrawal methods for UK traders: Traders in the UK can deposit/withdraw funds via credit/debit cards, and e-wallets (Skrill and Neteller).

Support for UK traders: You can reach Axi UK via +44 203 544 9646. You can chat with the broker on WhatsApp too.

What is an ECN Broker?

An ECN broker is a type of broker without a dealing desk. When you place a trade, you are either buying or selling. An ECN broker takes your trades and connects your order to buyers or sellers in the market. Computerized systems are used to connect your orders to buyers or sellers.

These systems also provide current ask and bid prices. They are programmed to show the highest bid prices and lower ask prices. This means you get to buy or sell a currency pair at the best prices available.

Dealing desk brokers are the opposite of ECN brokers. They typically take the opposite side of your trades. This means they sell to you when you place a buy order and vice-versa. If they do not do this, your trades are passed on to a market maker. This can lead to slow trade execution.

With an ECN broker, you get speedy trade executions, favorable spreads, and a flat commission rate.

History of ECN Brokers?

The roots of ECN technology go back to 1969, when Instinet was launched. It let institutions trade directly, bypassing traditional brokers. The term “ECN” became more common in the 1970s as the US Securities and Exchange Commission promoted electronic systems to share and execute orders, influencing NASDAQ, the first fully electronic stock market. Early players included Island and Archipelago.

While ECNs first transformed stock trading, they entered forex later. In 1999, Matchbook FX became the first ECN broker for online currency trading, letting banks and other users post prices and act as price makers.

By the early 2000s, ECNs had grown popular for their lower costs, faster trades, greater transparency, and anonymity. Today, many brokers use only ECN execution to link clients to the interbank market, while some dealing-desk brokers offer ECN accounts as an option.

ECN Broker vs Market Maker — What is the Difference?

A forex broker can be either an ECN or a market maker. The two are different. ECN brokers do not operate a dealing desk. They connect your trades directly to buyers and sellers in the market through computerized systems. These systems provide current and best bid and ask prices. They offer you the highest bid prices and lower ask prices so you buy or sell a currency pair at the best prices available.

Market makers operate a different system entirely. They purchase large positions from a liquidity provider and requote the bid and ask price to traders. Market makers quote these prices intending to make money off the bid-ask spread. Most times, the prices quoted are not favorable to traders.

In addition, Market Makers offer fixed spreads. Unlike ECN brokers, they control the bid and ask prices of trading instruments. So they are able to keep it fixed. ECN brokers give your direct market access (multiple buyers and sellers) via computerized networks so their spreads are variable.

Pros of ECN Brokers

1) There is no conflict of interest. ECN brokers do not make money from your losses. ECN brokers only act as intermediaries. They pass on wholesale prices directly to you without trading against you.

2) Overall low trading fees. ECN brokers connect you directly to the electronic communications network. The bid and ask price is determined by the market independent of your broker. Consequently, you get low spreads but you might still pay a commission which is not that high either.

3) Fast execution speed because of high liquidity. ECN is used by large financial institutions so you have access to premium liquidity. You will not have challenges opening and closing your trades even for exotic currency pairs.

4)Since ECN brokers make money via the size of transactions rather than your losses, they allow all trading methods including scalping.

5) Your trades are routed through liquidity providers so you can place big orders.

Cons of ECN Brokers

1) ECN brokers charge a commission for all of your transactions. These fees usually increase trading costs and affect profits.

2) You need a high minimum deposit for an ECN account. ECN brokers usually require these high deposits which maybe too much for you.

3) ECN offers direct market access (DMA) which has its own advantage. However, this type of access can expose you to high volatility and price swings which can bring losses.

4) Though ECN spreads are tight, they may widen significantly in times of low liquidity that can affect your trade execution.

ECN Broker vs STP Maker — What is the Difference?

ECN and STP brokers are the most common type of CFD brokers. While they both facilitate trades in the Forex market, there are distinct differences between them. As you already know, they connect you to liquidity providers like other banks and other traders.

On the other hand, STP brokers, while also connecting traders to liquidity providers, may use a dealing desk to execute trades. This might lead to conflict of interest because your broker might act as a counterparty. The only edge STP brokers might have over ECN brokers is faster execution speeds.

How to Identify If a Broker is a True ECN

A true ECN broker connects you to the market directly without acting as a middleman. To know if a broker is a true ECN, you should not take the word of the broker for it. A few pointers show that a broker is a true ECN. Here are some of them:

1) Disclosure: A true ECN broker is mandated to state clearly if they are a true ECN. You should find this clear disclosure in the broker’s terms and conditions or the FAQs section. The screenshot below is from Pepperstone’s FAQs page.

2) Variable spreads: A true ECN broker does not offer fixed spreads. This is because price quotes change in the open market regularly so spreads cannot be constant. In addition, true ECN brokers provide the best ask and bid prices per time. Their systems are programmed to constantly update the best prices from their liquidity providers. This is why a true ECN broker cannot offer fixed spreads.

The image below is from IC Market’s website. They offer variable spreads on all of their trading platforms. This is typical of other true ECN brokers. They are always clear on the kind of spreads they offer.

3) No dealing desks: This is a major litmus test for brokers who claim to be true ECN. True ECN brokers have no dealing desk. They do not take opposite sides of your trades or pass them on to a market maker. Again, this has to be clearly stated. Brokers without dealing desks show it clearly.

Here is a snapshot from Pepperstone’s website showing clearly that they operate the NDD model.

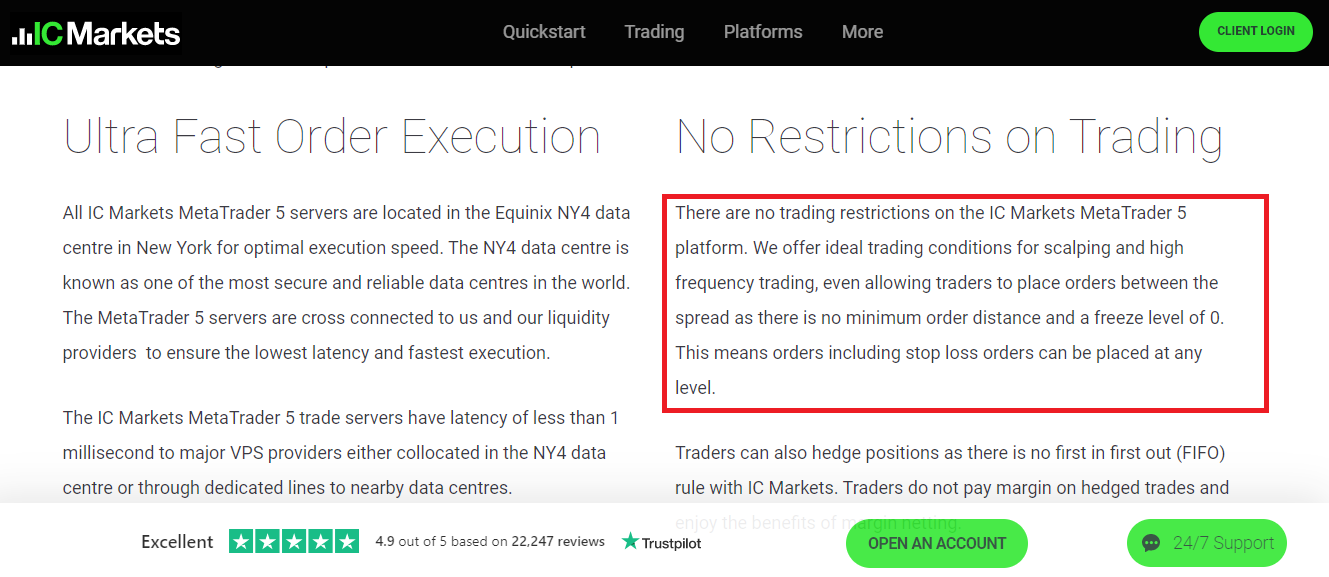

4) No stop loss/take profit restriction: True ECN brokers allow any trading style. This means you should be able to place your orders on your terms. If you want to know a true ECN broker, watch out for order distance restrictions. True ECN brokers do have order distance restrictions.

Below is another image on IC Markets’ website (example broker). They stated this in simple terms. You can place your stop loss and take profit orders at any price level.

5) Only negative slippages: Slippage is the difference between the price you placed a trade and the price it got executed. They are a common occurrence and can be positive or negative. If a broker gives you only negative slippage, that broker is not a true ECN. Why?

It is because, for ECN brokers, the system of executing your trades is computerized. The networks are programmed to make sure your trades are not executed at a worst price than your entry price. Due to this, true ECN brokers do not have high percentages of negative slippage. This is a key point you should note.

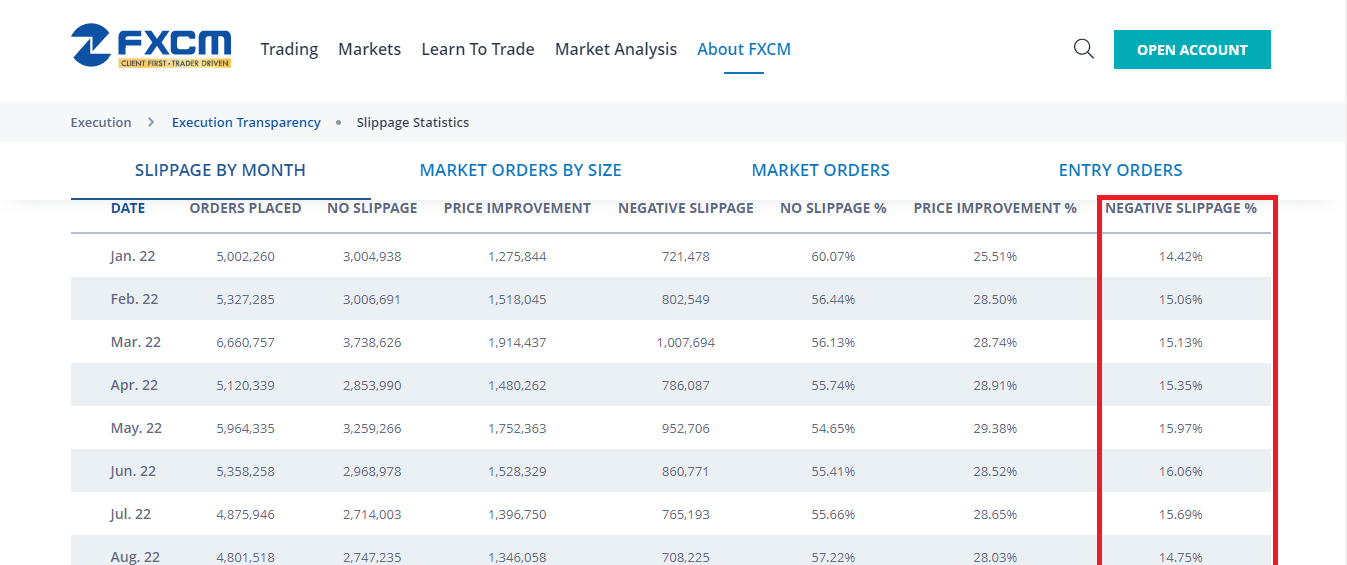

Some ECN brokers release their slippage statistics to the public. You can check it yourself and see how high traders have negative slippage with these brokers. Here is an example with FXCM UK.

This is FXCM’s data from the year 2022. You can see from the table that the percentage of negative slippage relative to orders placed is about 14%-15%. This is low but it can be lower for some brokers. The lower the negative slippage is, the better.

If your preferred broker does not publish their data publicly, you can speak to their customer support to know more about their slippage data.

6) No lot limitation: True ECN brokers allow you to place as many lots as you can. There is no restriction on lot sizes. If you want to test this, open a demo account with the broker and try to buy more than 6 standard lots of a currency pair. If the order is not filled or rejected, the broker is not a true ECN.

Furthermore, you should be able to trade any currency pair with the lowest lot size. The lowest lot size in forex trading is 0.01. A true ECN broker must allow flexibility in lot size.

This image is from FP Markets website showing their account types. You can see that the execution is ECN and you can trade minimum lot size.

7) No Promos: A true ECN broker will not promise you some bonus or discount for opening an ECN trading account. They make their money off commissions from your trade – whether you win or lose. To avoid brokers that bait with promos, sign up with FCA regulated brokers only. In the UK, it is illegal to use promos and bonus offers to convince traders according to FCA rules.

8) Constant price update: The computerized system in ECN scouts for prices and updates them on their platform every minute. You can test for this by opening a demo account. If prices are not updated every minute (or seconds most times), the broker is not a true ECN.

How Do ECN Brokers Make Money?

Here is how ECN brokers typically generate revenue:

1)Commission: ECN brokers will charge you a commission for each trade executed. This fee is usually a small amount per lot that you trade and can be found on your broker’s website. The commission model ensures that your broker makes money directly from your trades.

2)Spreads: ECN brokers offer tight spreads. This means that the difference between the bid and ask prices can be very low. Though it may be little, your broker will still make some money from the tight spreads.

3)Data Fees: As a retail trader, you will have access to real time market data. However, your broker might offer a premium data service for some traders that need the most recent data within a certain time period. This will come at an extra cost to such traders.

4)Private Server Fees: An ECN broker may offer VPS (Virtual Private Server). This server ensures that you trade with low latency. It also grants you a good connection with trading servers. Hosting your trading on VPS might attract some fees, generating money for your broker.

It’s important to note that the transparency and direct market access provided by ECN brokers align their interests with yours, since they do not profit from your losses. You should carefully review the fee structure of any ECN broker before opening an account.

How We Compared the Best ECN Brokers

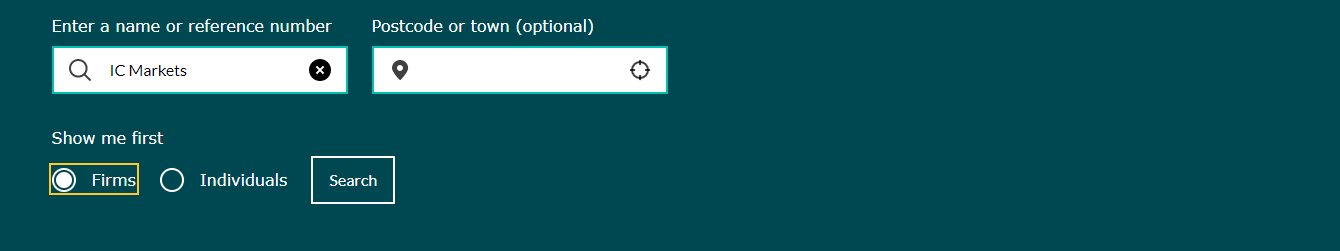

1) FCA Regulation: Before choosing an ECN broker, you need to be sure the broker is regulated with the FCA. The safety of your funds is only guaranteed if your broker is regulated. To verify your broker’s regulation, follow the following steps. We will use IC Markets to explain the how.

a) Find your broker’s FCA regulation and FCA reference number. You can find them in the footnote of their website. In IC Markets’ case, they have temporary permission with FCA and it is stated so on their website.

b) Once you find the information on your broker’s website, you must verify that the information is the same on the FCA’s website. So, enter on your browser the link: https://register.fca.org.uk/s/. You should arrive at the picture below. Enter the broker’s name, and select ‘firms’. The illustration is shown below

Click on the search button and select the broker from the list of options that come up. You will find the details you need on the page that follows as shown below.

You can see that the information on both websites (IC Markets’ and FCA’s) show the same details. This is how you verify a broker’s FCA regulation. If the details are not the same, something is wrong somewhere.

Trading with an FCA regulated ECN broker has its own benefit. If your broker becomes insolvent, you will not lose your capital. It will be refunded to you. All forex brokers licensed by the FCA are part of the Financial Services Compensation Scheme. The scheme ensures traders’ money can be refunded up to £85,000 if a broker goes bankrupt.

Do you see why this factor is essential?

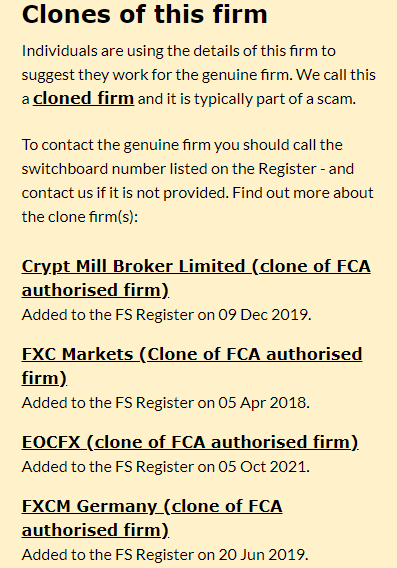

Finally, verifying your broker’s regulation helps you spot their clone firms. These are fraudulent firms that try to use similar names with regulated brokers to defraud traders. As you check your broker’s regulation, the FCA also lists these clone firms so you don’t become a victim.

FXCM is one of the best ECN brokers in the UK. If you try to verify their regulations, you will find these clone firms.

Can you see how familiar the names are? This is another key reason to check your broker’s regulation.

2) Overall fees with ECN account: You must know the total fees involved with a broker. Spreads, swaps, and commissions are trading fees you need to pay attention to. They affect your final profit and loss over a period of time. There could also be non-trading fees like currency conversion fees, deposit/withdrawal fees, and inactivity fees.

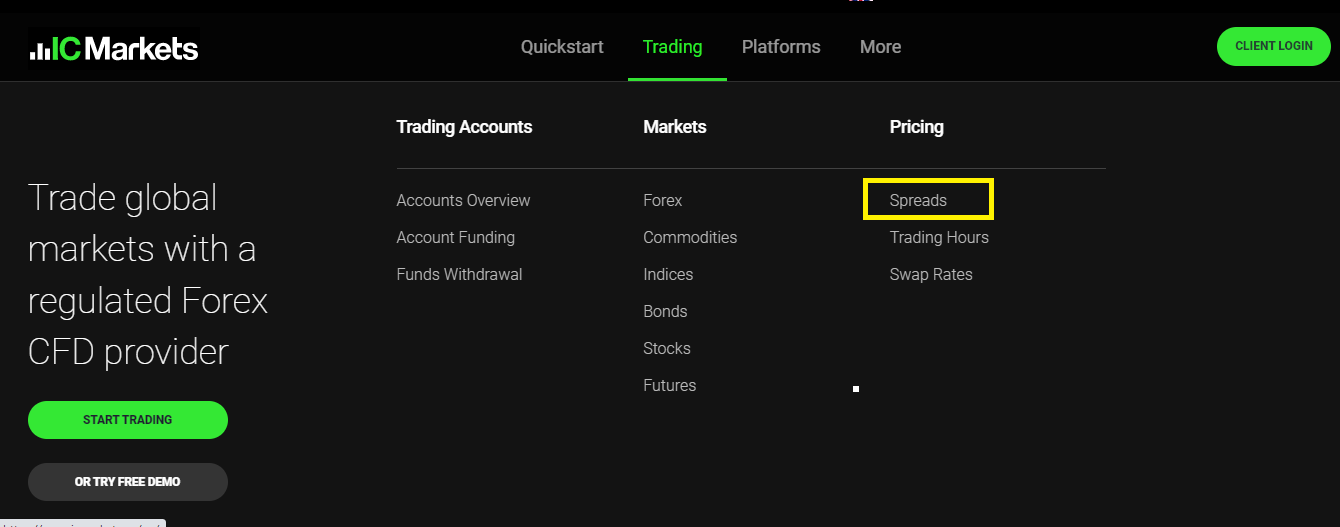

These fees vary for different brokers. Some brokers do not have them. Here is how you can check the trading fees on ECN Accounts. We’ll use IC Markets as our example. On the homepage, click on ‘Trading’. In the dropdown that shows up, click on ‘Spreads’

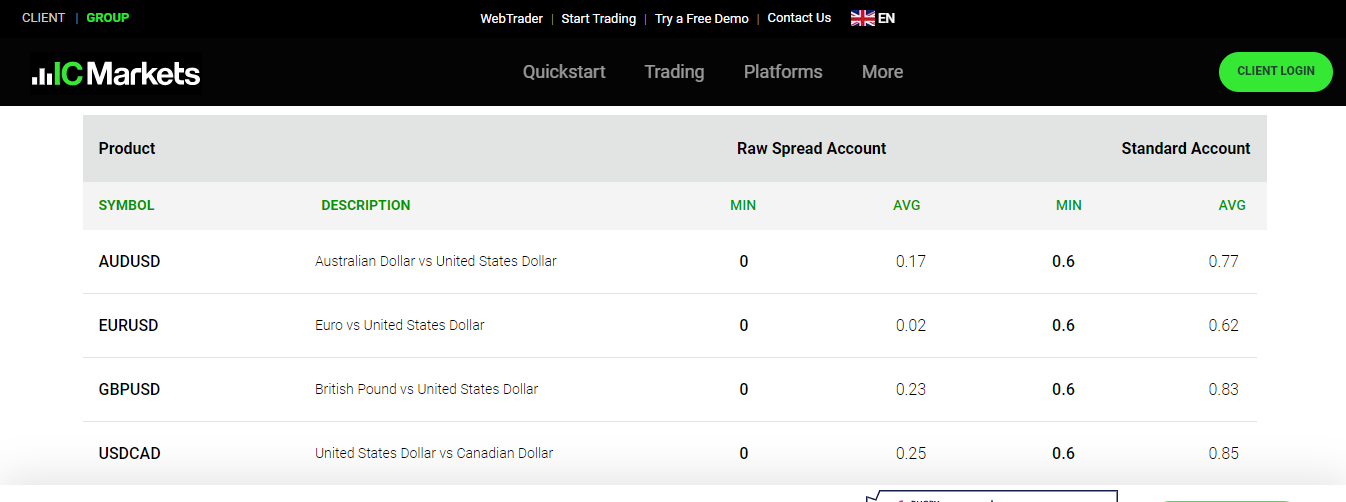

On the spread page, click on ‘Forex’. You will see that it displays the spread for two accounts. The Raw Spread Account is IC Markets’ ECN account and the spreads are considerably lower compared to the Standard Account.

ECN accounts typically have extra commissions per lot because of their low spreads. Because commission imparts your loss or profit, it is important to check them. If you scroll down on IC Markets’ spread page, you will find the commissions they charge for their ECN Account. Here is the image below.

You can see that a $3.5 commission is charged on MT4/MT5 while $3.0 is charged on cTrader. For other fees, you can reach out to your brokers instead of searching for yourself.

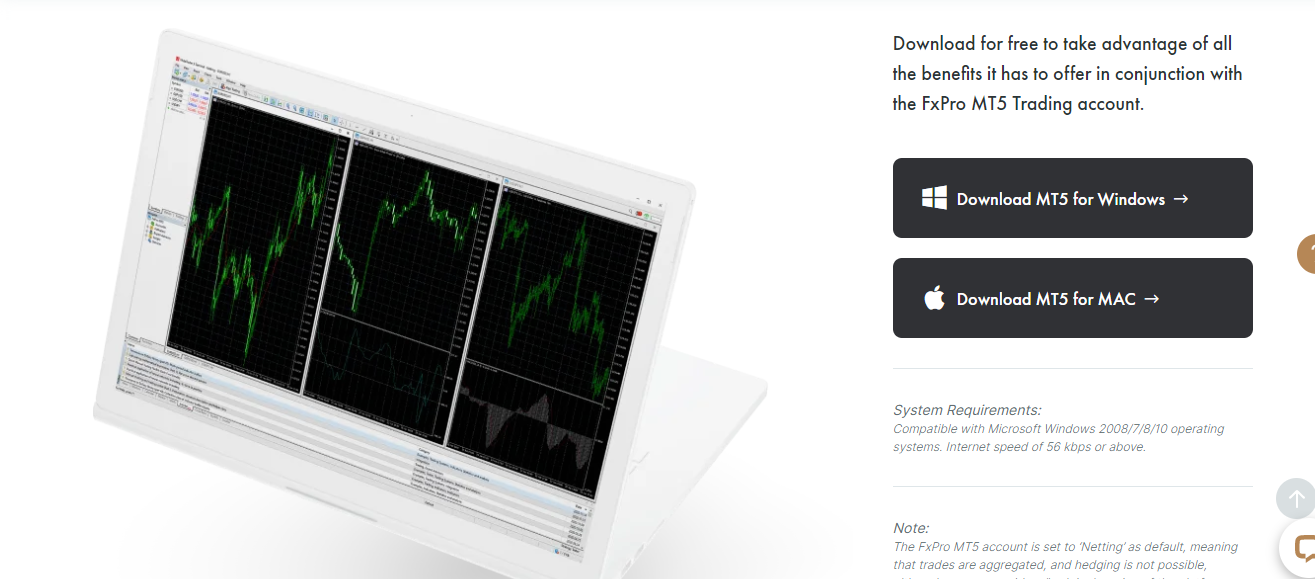

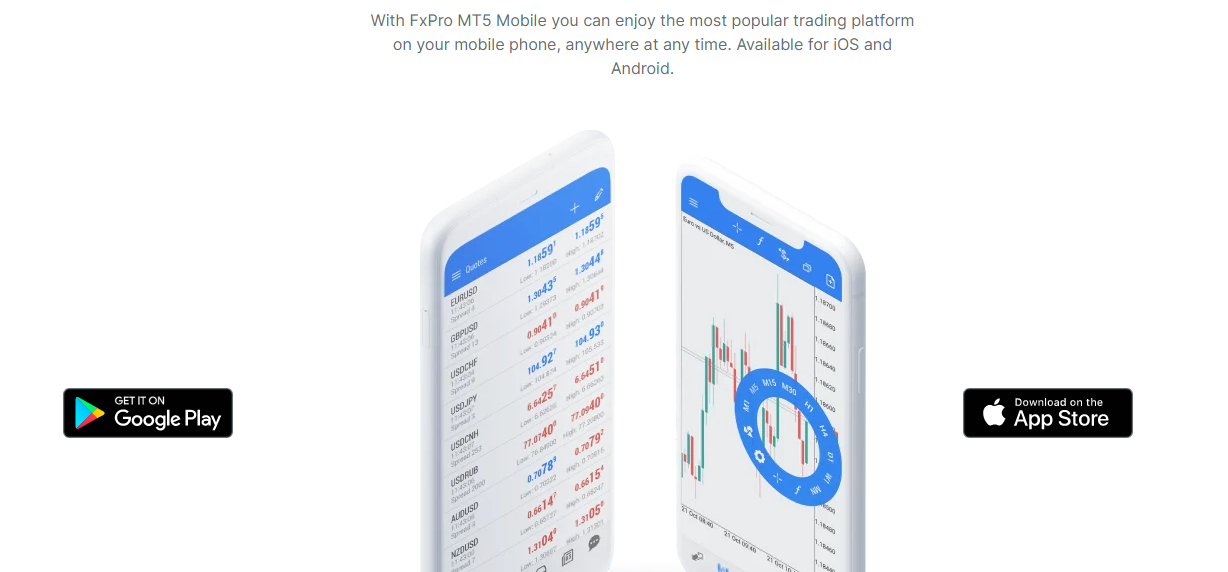

3) Platforms: Metatrader 4, Metatrader, and cTrader are popular trading platforms. Your preferred broker should offer them. It is important to check if these platforms are available as PC software and mobile phone apps.

PC software gives you a full outlay of price movements. However, you might have to check your trades on the go. This is why you must have these trading platforms as apps on your phone. You can check to make sure your ECN broker has their trading platforms on PC and mobile phones.

Here is an example with FxPro, If you click ‘Tools’ (in red box) on their homepage, you will find the list of their trading platforms displayed below

From the list, click any of the platforms to check if it is available on PC and mobile phones. Let us see an example with FxPro’s MetaTrader 5. If you click it, you will find your proof on the next page. The image below shows FxPro’s MT5 is available on PC (Windows and Mac)

While this confirms the availability of the platform on mobile phones an can be downloaded from Google Play and the App Store.

4) Range of CFD Instruments: You should be able to trade as many instruments as you desire. Beyond currency pairs, you should check if your broker offers commodities, metals, stocks, etc. You get exposed to different markets and trading instruments when your broker has a good range of markets. Crypto CFDs are not available for UK traders.

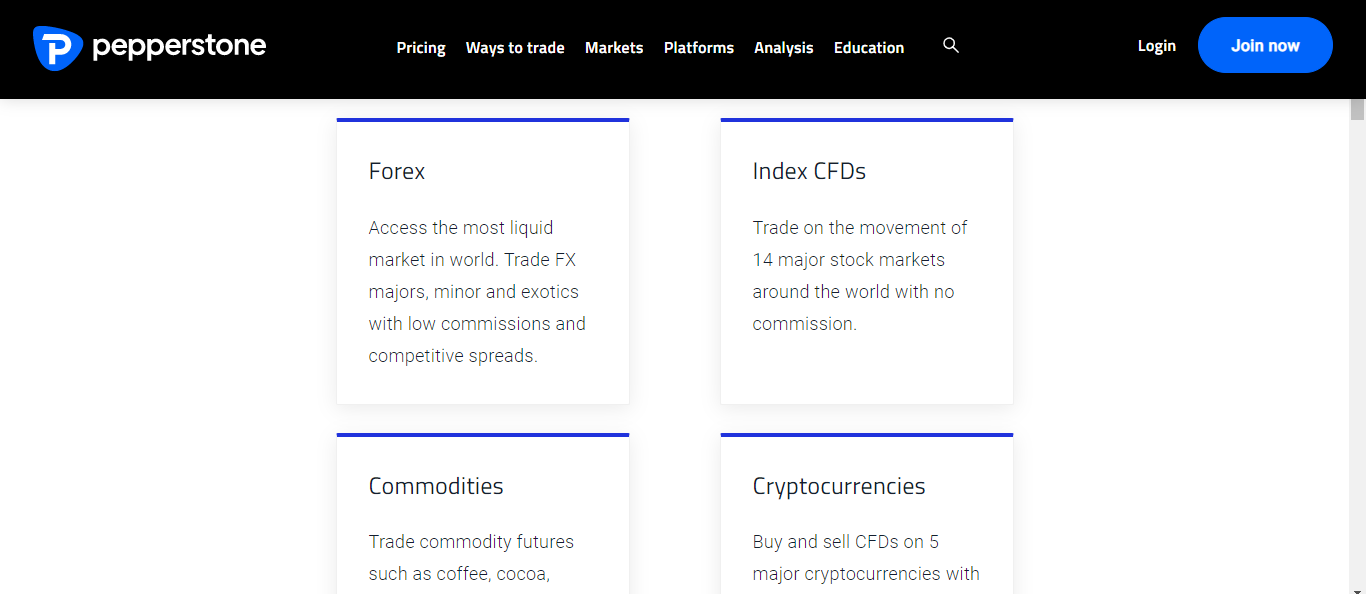

Here is how you can check an ECN’s broker range of trading instruments in the UK. We will use Pepperstone as an example.

First, go to Pepperstone’s UK website and click ‘Markets’ as shown below

On the page that follows, scroll down and you will see the instruments available at pepperstone. Here is how it looks.

If you click any of the instrument classes, you will find more details like spreads and commissions about individual CFDs in each class.

5) Deposit/Withdrawal methods: Transaction speed varies with deposit/withdrawal methods. Bank transfers usually take the most time. Deposit/withdrawals through Skrill and Neteller are faster. Transaction fees also vary. This is why your broker must give you various options for deposits/withdrawals.

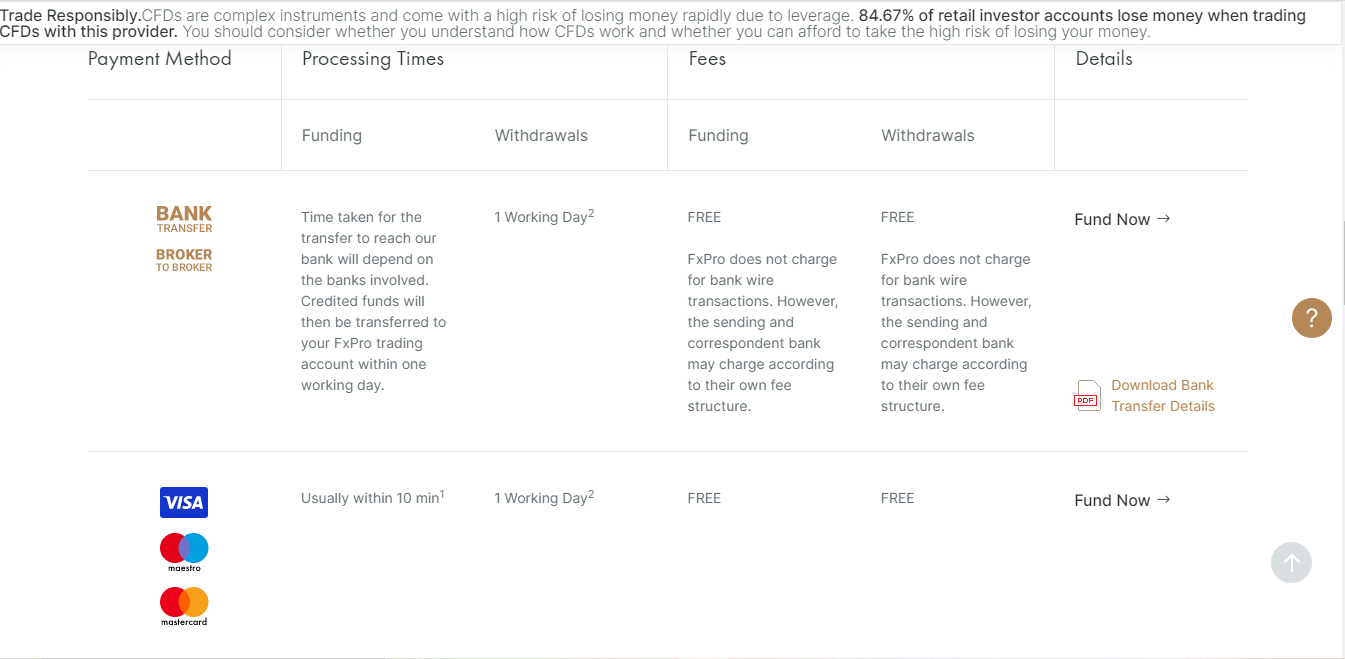

Before choosing a funding or payment method, you should check if there are extra fees that come with it. Banks and e-wallet providers have their own independent fees. However, your broker might also add their own fees so it is important you check it.

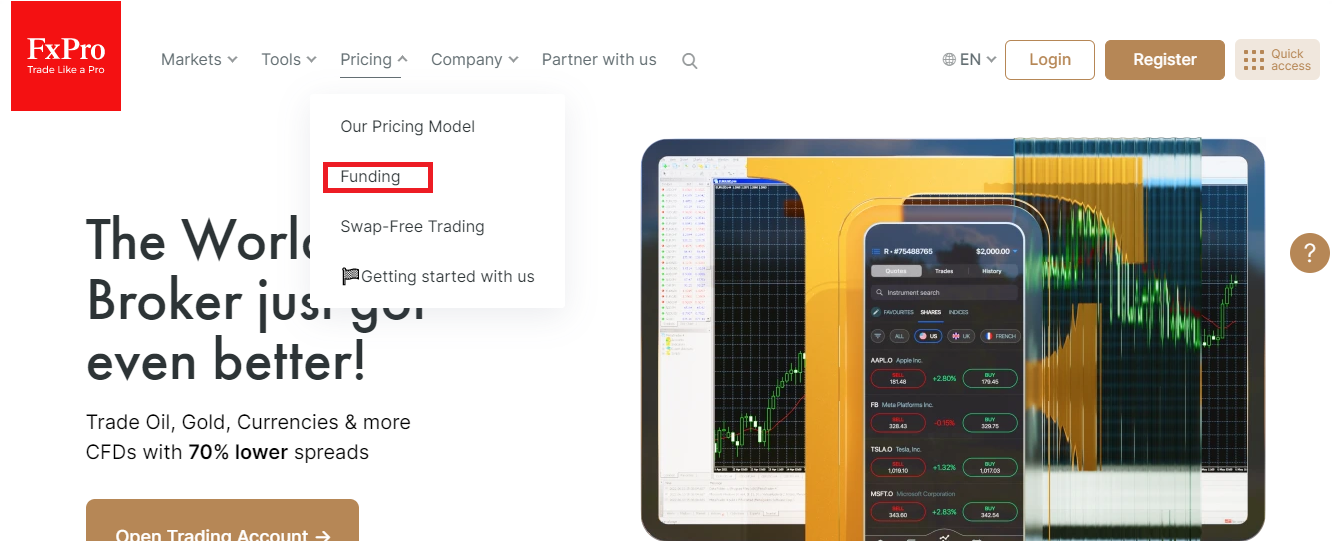

Here is how to check it with FxPro for example. On the homepage, click on ‘Pricing’. Then, click on ‘Funding’ in the dropdown as displayed below.

FxPro’s funding/withdrawal fees will be displayed when you click on ‘Funding’. You can see from the image below that the ECN broker has three payment methods. All the methods are free without extra costs from FxPro.

6) SSL Security: When you open a trading account, you have to give some sensitive details to your broker. Your address, utility bills, financial statement, etc. These are details you do not want in the wrong hands.

So you want to be sure your ECN broker is able to protect your data. The first thing to do is read your broker’s privacy policy. You want to be sure they are not sharing your data with third parties.

After that, you want to check if your broker has a secure sockets layer (SSL) encryption. The essence of this security apparatus is to make sure your hackers and illegal data brokers don’t get your information.

7) Customer Support: Good customer support guarantees speedy answers to enquiries and complaints. Your preferred broker should be easy to reach. Live chat features and emails are prominent these days. A local mobile phone number should also be available.

How Begin with an ECN Broker in the UK

We will use AxiTrader as our example broker.

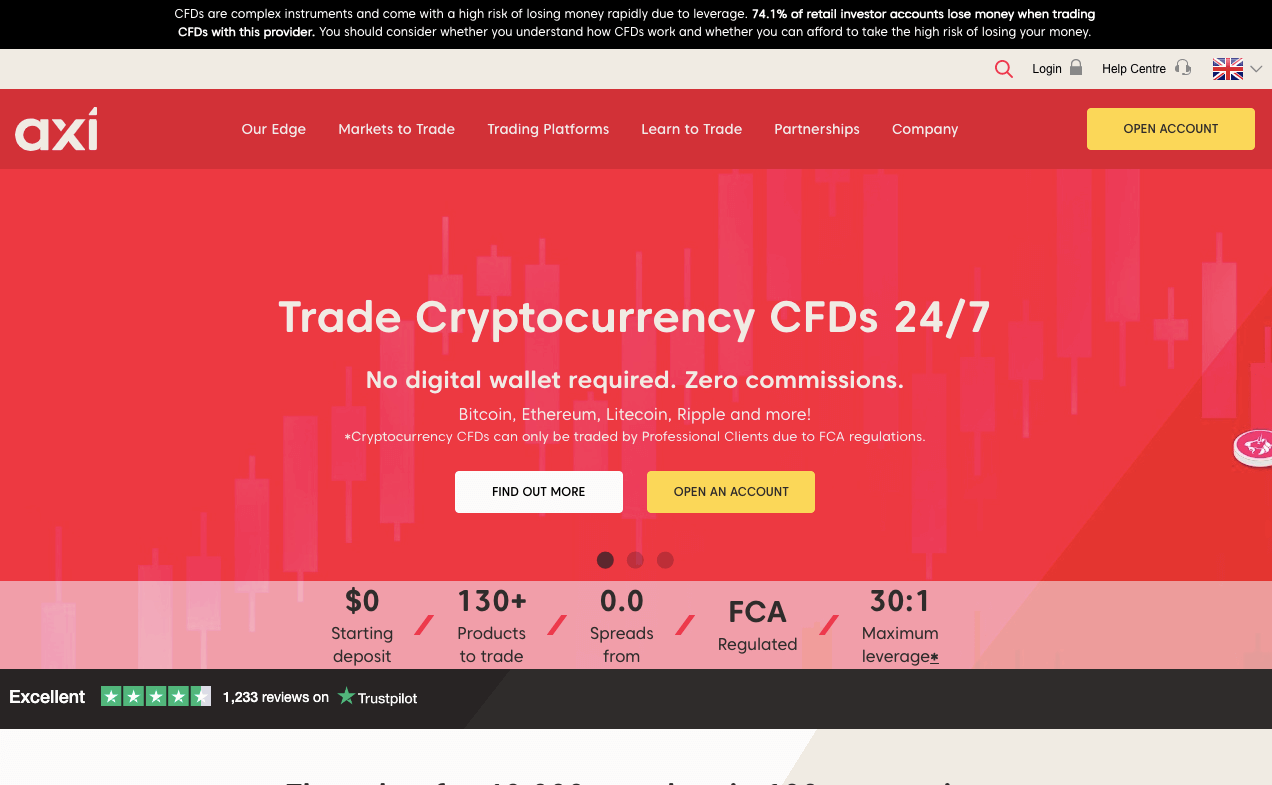

1) Go to Axi’s website and click ‘OPEN AN ACCOUNT’.

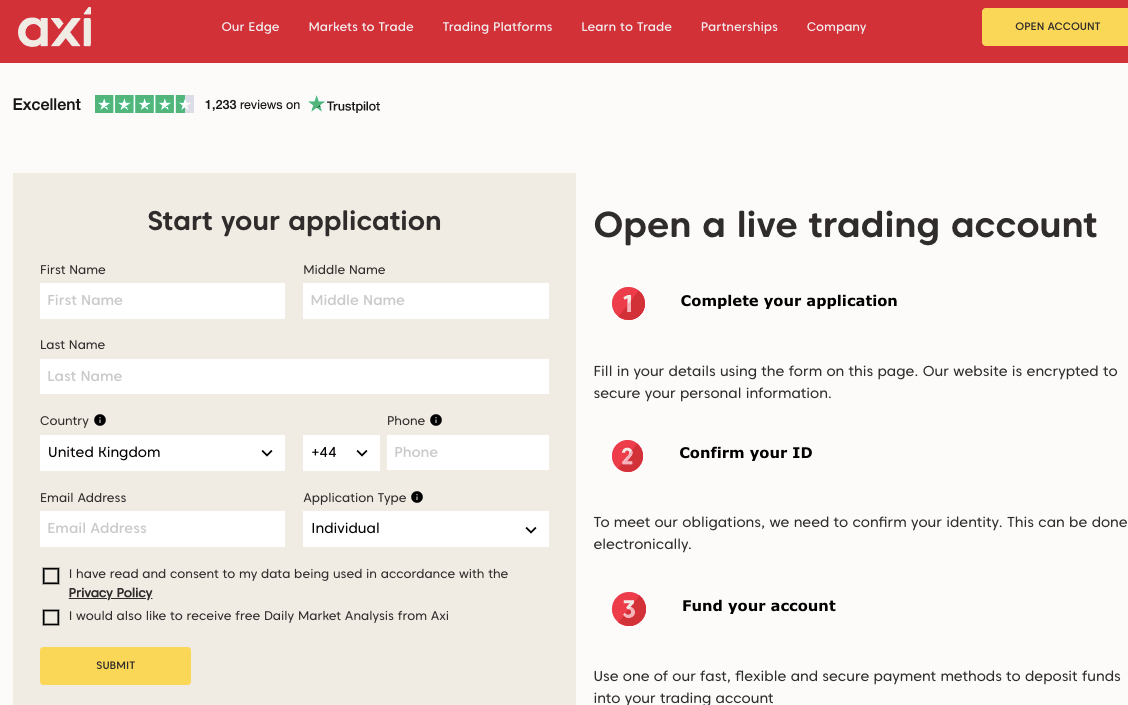

2) Fill out the registration displayed below. Your name, phone number, and email will be required. Agree to the privacy policy and click ‘SUBMIT’

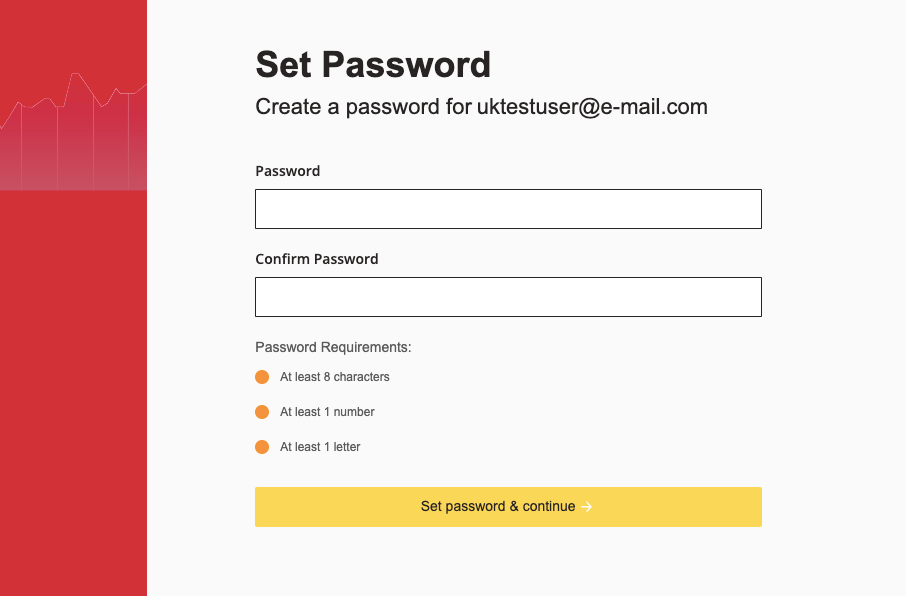

3) Create your password

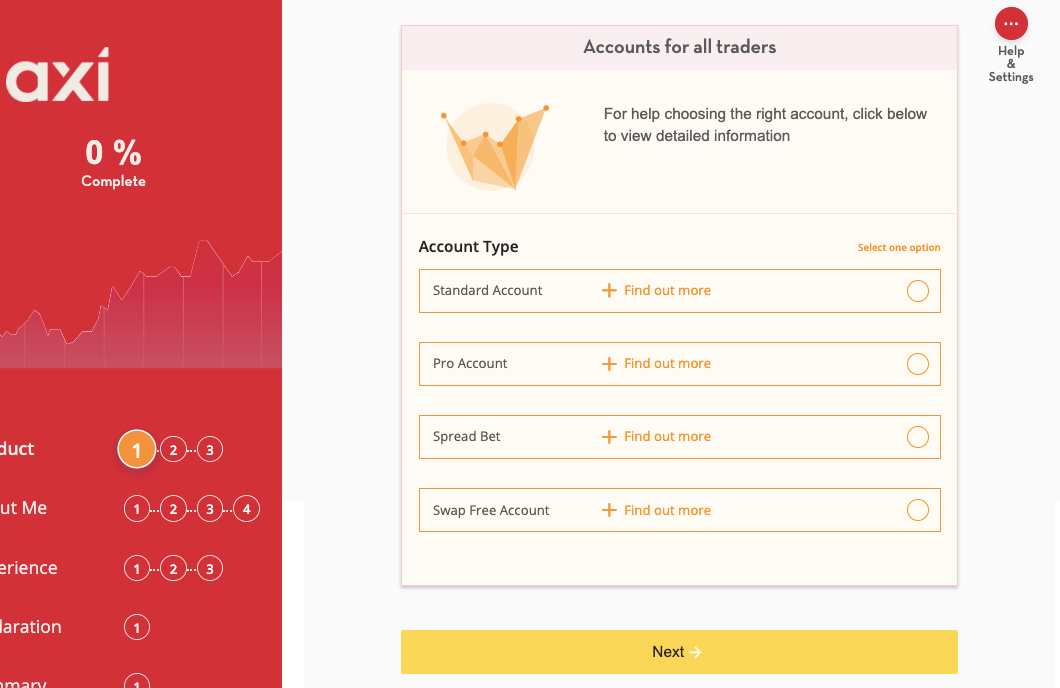

4) Choose your account type. For AxiTrader, their Pro Account is the one with ECN properties. So you will have to choose the Pro Account.

Once you choose your account, you can proceed to complete the other processes. You will choose your account’s base currency, initiate and complete your KYC, etc. You will also have to give info about your finances and trading experience.

When you have completed these, you can procced to fund your account and begin trading.

What are Execution Venues?

If you take time to read the execution policy of ECN brokers, you will find the phrase execution venue(s) appear a number of times. knowing what this mean will help you understand how ECN brokers work.

ECN brokers do not act as counterparty (that is, they do not trade against you). Instead, they use their electronic network to connect your trades to third parties. These third parties are your broker’s execution venues. They are the reason ECN brokers are able to offer competitive prices

How so?

ECN brokers usually have more than one execution venues. When you place a trade, the execution venues submit bid/ask price to your broker. Then your broker gives you the best price. Without multiple execution venues competing for your trades, you will not get the best prices for your trades.

Should I open an ECN Account as a beginner?

ECN Accounts can be good for beginners. With an ECN account, your trading fees are lower due to lower spreads, fast execution speed. This allows you to have more capital to trade with.

However, you will pay a commission on every trade. This might end up swallowing your profits, especially, if you are a beginner. Therefore, it is better you open a Standard Account. ECN Accounts are designed for frequent traders who have enough capital.

Are ECN brokers in the UK safe?

Before a forex broker can operate in the UK, they need to hold an FCA license. The process to obtain this license involves stringent compliance with FCA rules. These rules include:

– having a physical office in the UK

– cover losses of retail traders under the FSCS if the broker goes bankrupt

– their top managers and executives must be experienced and based in the UK

-traders money must be separated from the company’s money

This list is not exhaustive. It is to let you see that there is a framework for protection of traders in the UK

Can I use ECN Account on MT4?

MT4 is suitable for all kinds of brokers including ECN brokers. MT4 is popular among and it sis the go-to platform for most traders., It has 9 timeframes, 30 indicators, and 23 drawing tools. Expert advisors and automated trading are allowed as well,

FAQs on Best ECN Brokers in the UK

What is an ECN Broker?

ECN means Electronic Connection Network. Unlike Market marker brokers, STP & ECN type brokers don’t take the opposite side of your trades. Also, they can offer very low spreads, and charge commissions per lot with trading. There are other factors that you must check to ensure that the broker is actually a true ECN broker.

Which is the best ECN broker in the UK?

The core of ECN is access to raw spreads and no dealing desk model. A broker with a Raw Spread Account without dealing desk intervention is the ideal one to choose. In addition, the broker should be regulated by the Financial Conduct Authority (FCA).

Which ECN broker has the lowest fees in the UK?

IC Markets and Pepperstone have the lowest fees according to our review.

How much are ECN fees?

ECN brokers charge raw, low spreads. They also charge rollover fees, and an extra commission per standard lot.

Which is better between ECN or STP?

ECN accounts have raw and tight spreads. You are also connected directly to the market. STP brokers connect your trades to liquidity providers so they execute your trades on your behalf. You can read our review of STP brokers for more.

Which ECN broker has the lowest minimum deposit in the UK?

For ECN brokers with specified minimum deposit in our review, FXCM has the lowest minimum deposit (£50)