| Vantage Markets Minimum Deposit Summary | |

|---|---|

| Vantage Markets Minimum Deposit | £50 |

| Deposit Methods | Skrill, NETELLER, Credit/Debit card |

| Account Types | Raw ECN Account, Standard STP Account, Premium ECN Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, GBP, EUR |

| Withdrawal Fees | No Fees |

| Visit Vantage Markets | |

There is no fixed minimum deposit required to open a trading account with Vantage Markets. Your trading account will determine your minimum deposit. The lowest minimum deposit with Vantage Markets is £50.

Basically, there are four different accounts that you can open with Vantage Markets. They all have different trading conditions and importantly different minimum deposits. We have thoroughly researched these trading accounts and the various methods you can use to fund them.

Here is what we found out.

What is Vantage Markets’ Minimum Deposit in the UK?

This is where we show you the minimum deposits for all of Vantage Markets’ trading account as per our research.

Let’s go.

1) Raw ECN Account

Vantage Markets’ minimum deposit for their Raw ECN Account is £50.

This account with razor-sharp spreads starting from 0.0 pips. The largest banking institutions in the world provide liquidity. The ECN trading conditions are also cost effective. With prime FX liquidity, you will pay low fees in spreads and commissions.

With over 300 tradeable CFDs, all traders who open this account pay only $1 per standard lot in commissions (depending on base account currency).

2) Standard STP Account

This is a straight-through processing (STP) account. The minimum deposit for Vantage’s Standard STP Account is £50.

This trading account is similar to the RAW ECN Account in that the spreads are low. However, they do not begin from zero. Rather, they (spreads) are tight because they are institutional grade. You can access these spreads directly via the Standard STP Account.

Furthermore, the liquidity pool is deeper with consistent pricing and zero commissions. You will not incur any fee per standard lot. Finally, all trades on this account do not pass through a dealing desk. Vantage Markets does not take the opposite side of your trades. Only the biggest liquidity providers do.

3)Premium ECN Account

The Premium ECN Account has the highest minimum deposit – £25,000. Spreads are low starting from 0.0 and commission is $0.75 per standard lot.

4)Swap-fee ECN/STP Account

This account is a Shariah compliant trading account. It is for traders do cannot pay or receive swaps due to their religious persuasions. The minimum deposit for Vantage’s swap-free account is £50.

Vantage has structured this account in such a way that you do not miss out on good trading conditions. The swap-free account is available as Raw ECN Account or Standard STP Account.

So you get access to the trading conditions on the first two accounts without paying or receiving overnight charges.

5)Spread Betting Account

Traders resident in the UK can spread trade with Vantage Markets. With a £50 minimum deposit, you can open this trading account.

Like CFD trading, you do not own the instruments you spread trade on. Rather, you stake your bet on the increase or decrease in spread of the instruments.

Are there fees for this account? Yes, there are. You will pay the spread only. No commissions for spread betting. However, spread betting is not subjected to capital gains tax and stamp duty.

6)The Unlimited Demo Account

Most brokers provide a standard demo account that expires after thirty (30) days. It is not so with Vantage Markets. The broker provides a demo account that does not expire without extra cost.

You can take your time and practise without the pressure of time or a need to apply for a new demo account. No minimum deposit for demo accounts. Vantage Markets will you virtual money to trade with on your demo account without risk.

Note: 73.5% of traders lose money with this broker

Vantage Markets Subsequent Minimum Deposits

Now that you know the minimum deposits required for Vantage Markets’ live accounts, we feel it is essential you know how other deposits work.

For example, you need £200 to open the Standard STP Account. This only applies to your first deposit. Every deposit that follows is £50. This is applicable to all of Vantage Markets’ live trading account.

Read more about these accounts on our Vantage Markets review.

Vantage Markets Deposit Methods and Required Fees

In this section, we cover the methods that are available for you on Vantage Markets. We also cover the fees you might incur per method.

| Method | Commission/Fees |

|---|---|

| Domestic EFT | £0 |

| Domestic Fast Transfer | £0 |

| Neteller | £0 |

| Skrill | £0 |

| International EFT | £0 |

| Credit/Debit Card (Visa and MasterCard) | £0 |

| Broker-to-Broker Transfer | Subject to bank transfer fees |

You can fund your account in GBP with any of these methods. Your bank or e-wallet provider may have their own transaction fees. Vantage Markets does not charge any fee on their end. As a gesture of goodwill, Vantage Markets may reimburse your transaction fees.

You withdraw your funds via international bank transfer, Skrill, Neteller, and credit card only.

Vantage Markets Deposit Rules

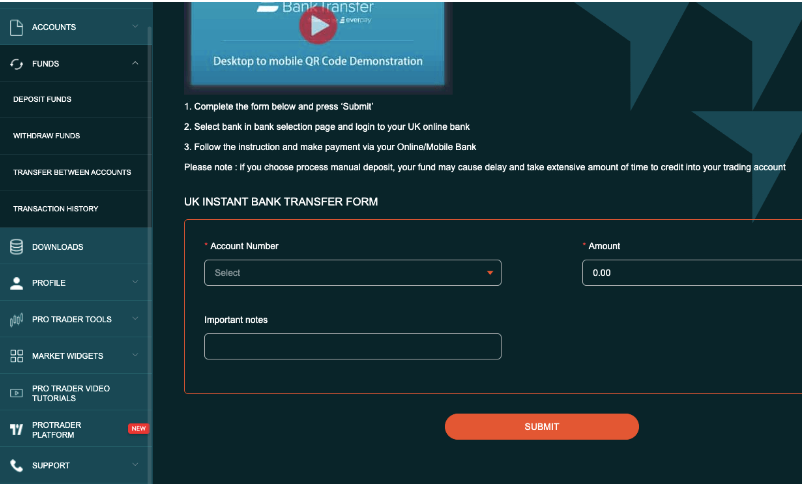

1) Vantage does not accept third-party payments. You must strictly adhere to this. Every fund you deposit in your account must have the same name as your Vantage Markets trading account.

2) Vantage will only cover fees they can see. You will cover fees from your bank, e-wallet provider or Vantage Markets’ bank.

3) Minimum deposit per day per transaction, per card, and trading account is £10,000.

4) Your funding method depends on your trading account’s base currency. You can easily find the method available to you in your client portal

How to Deposit Money Into Your Vantage Markets Account

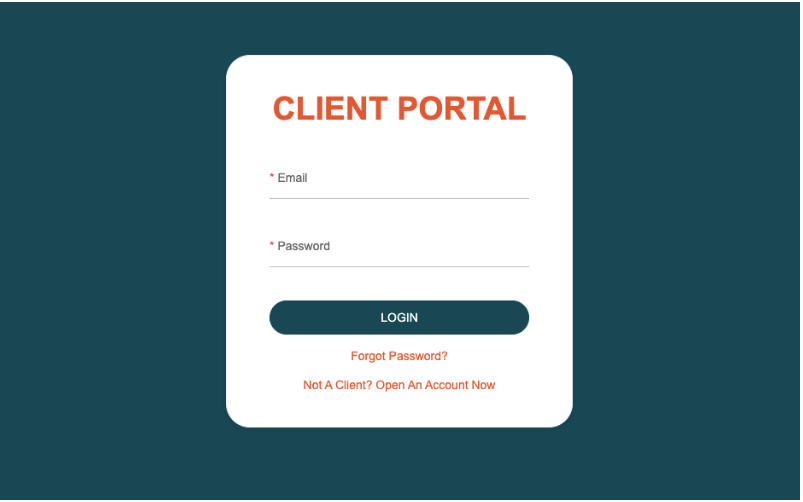

1) Log in to your client area by entering your email and password.

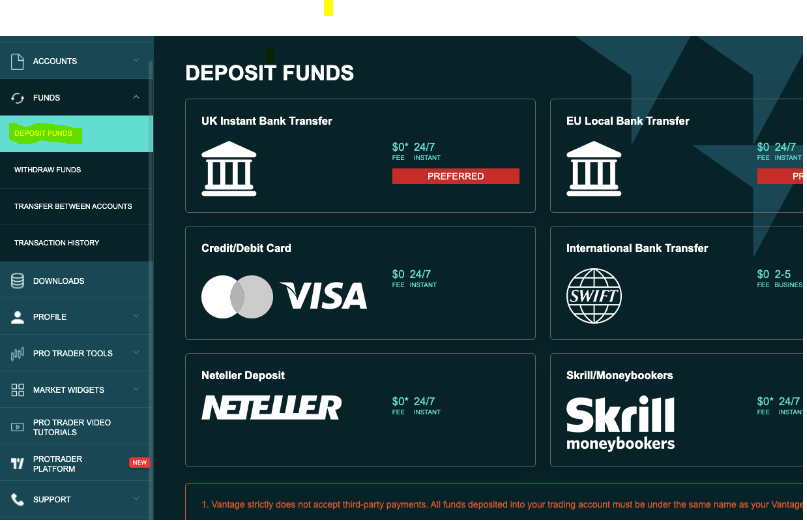

2) Click ‘FUNDS’, then ‘DEPOSIT FUNDS’ (highlighted yellow). You will see the different methods available to you. Here is how it should look.

3) Enter the minimum deposit required for your account and click ‘SUBMIT’. Follow subsequent on-screen prompts to complete your deposit.

Comparison Of Vantage Markets Minimum Deposit With Other Brokers

| Broker | Minimum Deposit |

|---|---|

| Vantage Markets | £50 |

| Tickmill | £100 |

| CMC Markets | £0 |

| City Index | £50* |

| AvaTrade | £100 |

| Pepperstone | £0 |

*City Index minimum deposit is for PayPal funding method only. Other funding methods might be higher.

Note: 68.4% of traders lose money with this broker

What base currencies are accepted by Vantage Markets

Here are the base currencies accepted by Vantage Markets: USD, GBP, EUR, HKD

Does Vantage Markets offer a Cent Account?

Yes, Vantage Markets offer a Cent Account with a low 0.01 lot size per trade. This account type is not available for UK residents. Only for traders in other regions.

Frequently Asked Questions

Is Vantage real or fake?

Vantage is a legit broker that is regulated in the UK with the Financial Conduct Authority (FCA).

What is the minimum withdrawal from Vantage Markets?

There is no minimum withdrawal required by Vantage Markets. All withdrawal methods have no lower limit transaction.

Can I close my Vantage account?

Yes, you can close your Vantage Account.

Can I make deposits on weekends?

Yes, you can initiate deposits on weekend via your client portal. However, weekends are not business days. Your transactions might be delayed till the next business day and subjected to banking opening hours.

What is the minimum deposit for Vantage UK?

Vantage UK’s minimum deposit is £200. Their Raw ECN Account has a £500 minimum deposit.

Note: Your capital is at risk