| AvaTrade Minimum Deposit Summary | |

|---|---|

| AvaTrade Minimum Deposit | £100 |

| Deposit Methods | Credit/Debit Card, Bank Wire Transfer, e-Wallets |

| Account Types | AvaTrade Retail Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, GBP |

| Withdrawal Fees | No Fees |

| Visit AvaTrade | |

AvaTrade’s minimum deposit in the UK is £100.

Here is a break down of AvaTrade minimum deposit requirements, accepted payment options, timelines for processing deposits/withdrawals, and other things you should know about deposit funds to your trading account on AvaTrade in the UK.

What is the minimum deposit for AvaTrade?

The minimum deposit to open a live trading account with AvaTrade in the UK is £100 (or your account currency equivalent). However, remember this minimum deposit is just the amount to unlock your account. If you want to execute big trades or use certain strategies, you’ll probably want a larger starting balance.

AvaTrade offers only the Retail Accounts and Professional Accounts. While the retail accounts require a minimum deposit of £100, you need to meet some criteria before getting an upgrade to a Professional Account.

These accounts are discussed further in our AvaTrade review.

Accepted Deposit Methods on AvaTrade UK

AvaTrade offers a range of ways to deposit into your trading account:

1) Credit/Debit Cards (Visa, MasterCard): You can use your credit or debit card to make a deposit on AvaTrade. You need to deposit a minimum of £100, and your account will usually get credited instantly.

You can also withdraw funds to your card – you need a minimum of £1 to withdraw, and while AvaTrade processes it within 24-48 hours, expect it to take up to 5 business days for the money to actually appear in your bank account.

AvaTrade generally won’t charge you fees for card transactions. But your card processor may charge an independent fee on their end.

2) Bank Wire Transfers: If you want to deposit larger sums, AvaTrade offers bank transfer option deposit. The minimums for both deposits and withdrawals are the same (£100).

It usually takes up to 10 business days for deposits to clear and appear in your trading account. It also takes about 10 business days for the money to hit your bank account after initiating a withdrawal.

AvaTrade typically offers free deposits and withdrawals but your bank might charge some independent fees for bank wire transfers.

3) E-wallets (Skrill, Neteller, and others): E-wallets are supported for deposits and withdrawals on AvaTrade.

The minimum deposit on AvaTrade is £100. Deposits are usually credited to your account within 24 hours.

If you are withdrawing, the minimum amount is £1 and AvaTrade processes it within 24-48 hours. The funds should then hit your e-wallet within a day or two. Your payment processor may charge an independent, but AvaTrade offers free deposits and withdrawals.

Note: 76% of traders lose money with this broker

AvaTrade Deposit Methods Table

Here is a summary of payment methods accepted by AvaTrade for deposits.

| Deposit Methods | Availability | Minimum Deposit | Charges | Processing time |

|---|---|---|---|---|

| Internet banking/bank transfers | Yes | £100 | Free | Up to 10 business days |

| Cards | Yes | £100 | Free | Instant |

| E-wallet | Yes (Skrill & Neteller) | £100 | Free | 24 hours |

AvaTrade Deposit Rules

1. Deposit Fees: While AvaTrade doesn’t usually charge deposit fees or withdrawal fees, you should double-check with your bank or payment provider in case they have their own separate costs.

2. Deposit Time: You can initiate deposits and withdrawals from your trading account at any time, on any day. However, in cases where instant processing is not feasible, you may experience a wait time of up to 24 hours for deposits and up to a few days for withdrawals.

3. Payment Source: Funds must come from bank accounts, cards, or e-wallets in your own name, that is the name that is on your trading account. Third-party deposits or withdrawals aren’t allowed.

Be prepared to verify your identity and address – this is required by regulators to prevent things like money laundering.

How do I deposit money into my AvaTrade account?

Step 1) Log in to your AvaTrade client area via myvip.avatrade.co.uk.

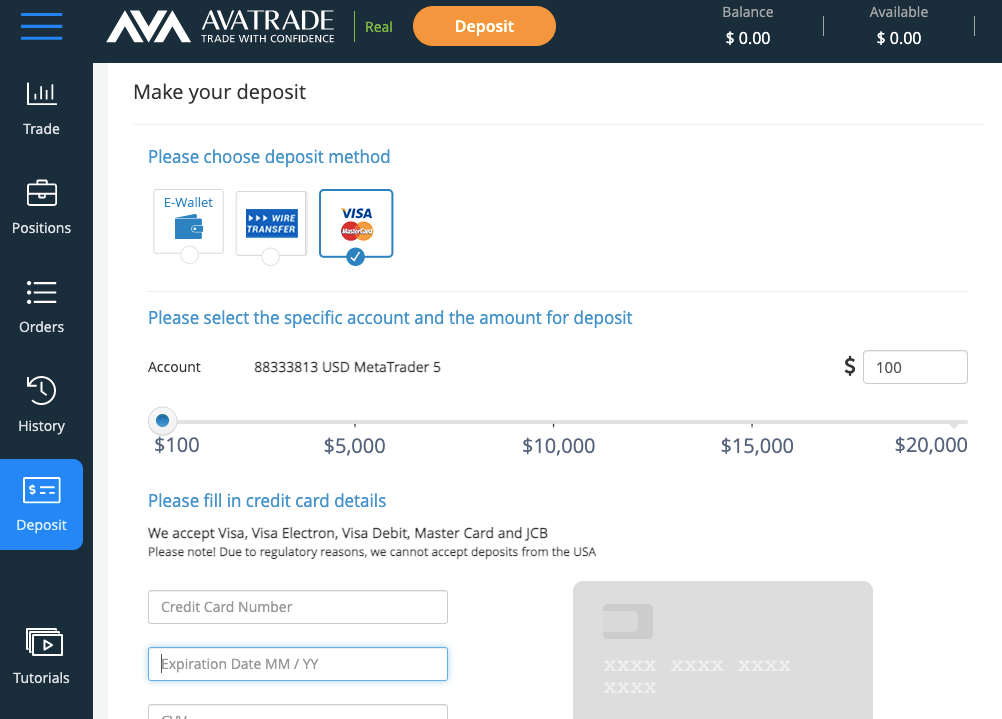

Step 2) On menu bar that is to the left, select ‘Deposits’, then select ‘Fund Your Account and choose preferred deposit method.

Step 3) Choose the preferred deposit method you want to use.

Step 4) Input the amount you want to deposit, then provide the required information (like your card number or e-wallet credentials).

Step 5) Review everything carefully and click the “Deposit” button.

Note: Please keep in mind that AvaTrade only approves deposits from accounts or payment methods that bear the same name as your AvaTrade trading account.

Comparison Of AvaTrade Minimum Deposit With Other Brokers

Here is a comparison of AvaTrade minimum deposit with that of their competitors.

| Broker | Minimum Deposit |

|---|---|

| AvaTrade | £100 |

| HF Markets | £0 |

| Capital.com | £20 |

| Vantage Markets | £200 |

| FxPro | £100 |

| AxiTrader | £0 |

Note: 76% of traders lose money with this broker

What base currencies are accepted by AvaTrade?

AvaTrade has trading accounts in the following base currencies: GBP, EUR, AUD, USD, and CAD.

AvaTrade Minimum Deposit FAQs UK

Is AvaTrade regulated in UK?

No, AvaTrade is not regulated in the UK by the Financial Conduct Authority (FCA). However, AvaTrade is regulated by the Central Bank of Ireland. Traders in the UK are registered under this regulation. This regulation offers a degree of security and protection for traders’ deposited funds.

Can I withdraw all my money on AvaTrade?

Yes, generally you should be able to withdraw all your available funds from your AvaTrade account, provided that you don’t have any open positions or margin requirements limiting it. It’s good practice to check your account balance and confirm any restrictions before initiating a full withdrawal.

How much does it cost to withdraw money from AvaTrade?

Generally, AvaTrade does not charge any deposit or withdrawal fee. So the amount you deposit is what you will see in your trading account and the amount you withdraw is what you get in your bank account or card. However, note that your bank or payment may charge an independent fee.

Is AvaTrade available in the UK?

Yes, AvaTrade offers its services to traders based in the United Kingdom. UK-based traders are registered under the regulation by the Central Bank of Ireland.

What is the minimum deposit with AvaTrade?

£100 is the standard minimum deposit to open a live trading account with AvaTrade in the UK or equivalent of your chosen account currency. This applies to all payment methods (cards, bank transfer and e-wallets).

Can I deposit $10 on AvaTrade?

No, the minimum deposit on AvaTrade is £100 and £10 deposits are not accepted.

How much does it cost to deposit on AvaTrade?

AvaTrade offers free deposits to traders. This means there are no charges and the amount of money you deposit is what you will be reflected in your trading account.

How long does it take for AvaTrade to deposit money?

The time varies for different payment methods. Card deposits are credited instantly, deposits via e-wallets are credited to your trading account within 24 hours and bank transfers can take up to 10 days for the funds to be added to your account.

Note: Your capital is at risk