AvaTrade is an online broker for trading Forex, CFDs on stocks, metals, energies, indices, bonds, and ETFs with no commission fees. AvaTrade also offers spread betting to clients in the UK.

AvaTrade was founded in 2006 and has temporary permission in the United Kingdom by the Financial Conduct Authority (FCA).

We will review the trading conditions, fees, deposit/withdrawals, trading platforms, and customer support of AvaTrade UK to see if this broker is right for you.

| AvaTrade Review Summary | |

|---|---|

| 🏢 Broker Name | Ava Trade EU Limited |

| 📅 Establishment Date | 2006 |

| 🌐 Website | www.avatrade.co.uk |

| 🏢 Address | AvaTrade Financial Centre, Five Lamps Place, Amiens Street, Dublin 1 Ireland |

| 🏦 Minimum Deposit | £100 |

| ⚙️ Maximum Leverage | 1:30 |

| 📋 Regulation | Central Bank of Ireland, ASIC, CySEC, FSCA, FRSA |

| 💻 Trading Platforms | AvaTrade WebTrader, MT4, MT5 and AvaTradeGo available on PC, Mac, Web, Android, & iOS |

| Visit AvaTrade | |

AvaTrade Pros

- Offers commission-free trading

- Offers negative balance protection

- Supports multiple trading platforms and EAs

- Supports copytrading

- Does not charge any fees for deposits or Withdrawals

AvaTrade Cons

- Not regulated by the FCA in the UK

- Charges dormant account fees

- Do not have 24/7 customer support

- Slow processing of deposits and withdrawals for bank transfers

Is AvaTrade Safe for Traders?

AvaTrade is licensed in multiple jurisdictions by top-tier financial regulators and this makes them score low on risk for traders in the UK. AvaTrade previously had a Temporary Permission to offer certain financial services in the UK as AVA Trade EU Limited which they applied to cancel in 2023.

However, as of January 2024, AvaTrade has ‘Supervised run-off’ status on the FCA site in the UK, which authorises them to offer certain financial services in the UK, but they are not a member of the Financial Services Compensation Scheme (FSCS), which means in the event of a default, there will be no compensation.

You can find details of AvaTrade’s regulatory status in the Europe, Africa and Asia below.

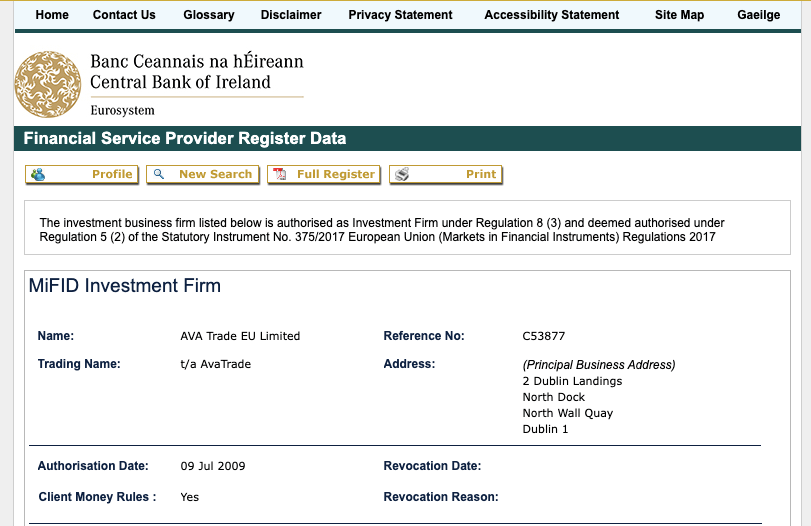

1) Central Bank of Ireland: AvaTrade is registered in Ireland as AVA Trade EU Limited, regulated by the Central Bank of Ireland, and authorized as an investment firm with reference number C53877 in 2009. Ireland serves as the headquarters for AvaTrade.

Traders in the UK are registered under this regulation. Note that is best to avoid trading with brokers not regulated in the UK by the FCA as the regulation consumer protection my not cover UK traders in the event of a dispute or default by the broker.

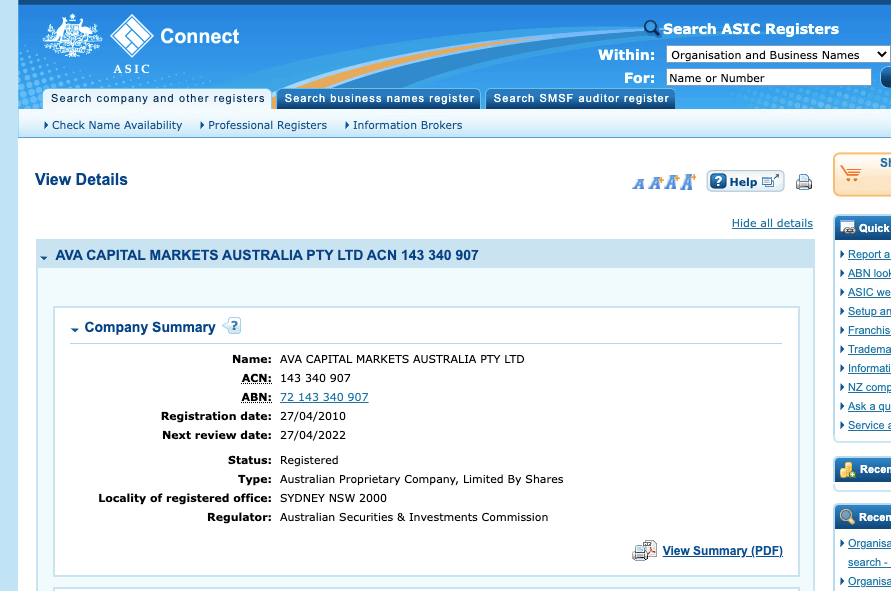

2) Australian Securities & Investments Commission (ASIC): AvaTrade is registered in Australia and regulated by ASIC as Ava Capital Markets Australia Pty Ltd with ACN 143 340 907, issued in 2010.

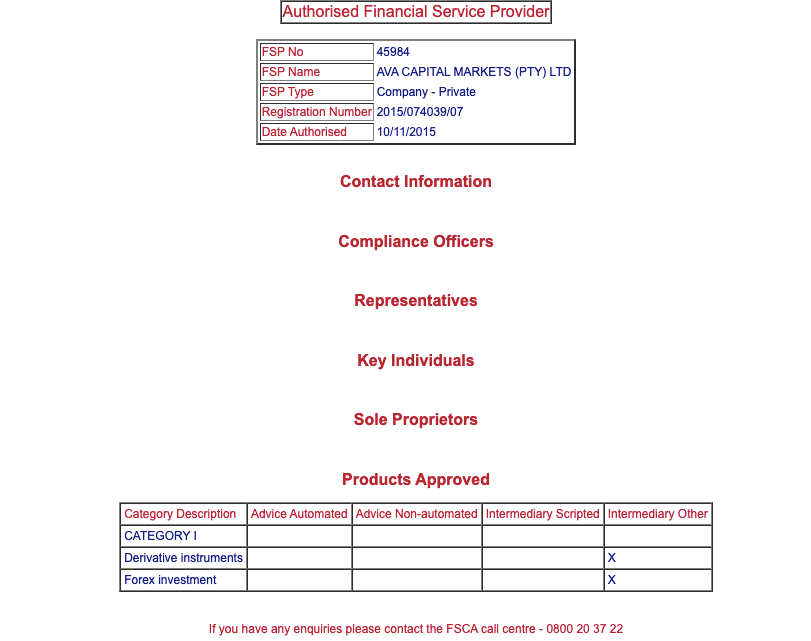

3) Financial Sector Conduct Authority (FSCA) in South Africa: AvaTrade is authorised by the FSCA to provide financial services in South Africa as Ava Capital Markets (Pty) Ltd with FSP number 45984, issued in 2015.

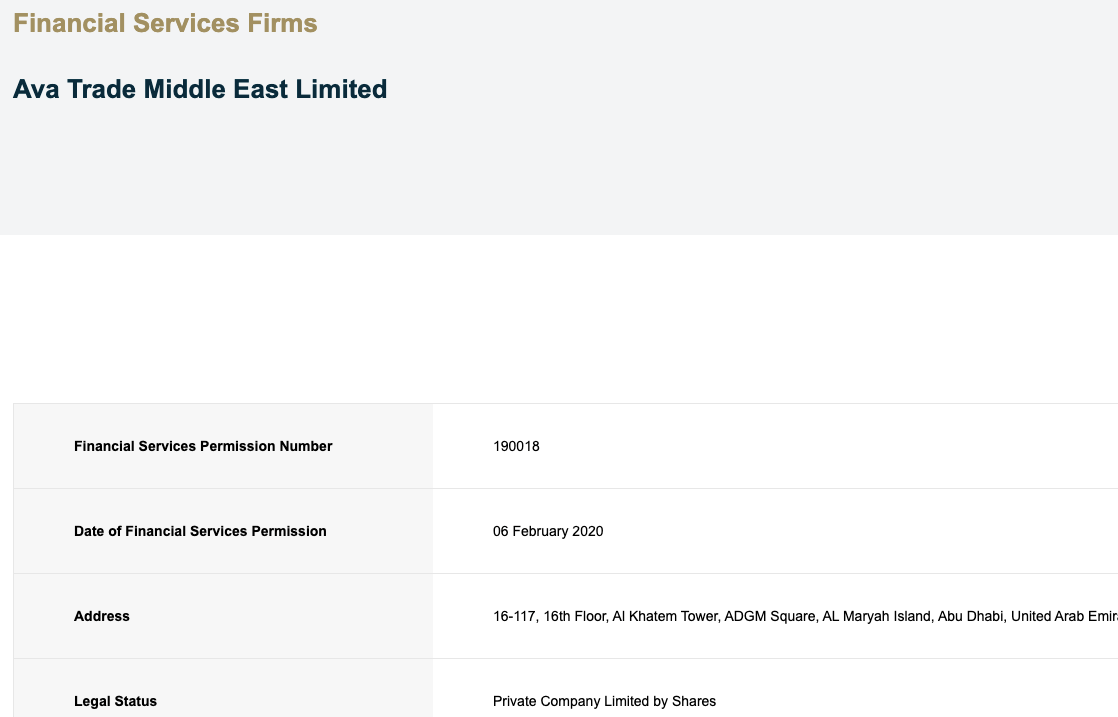

4) Financial Regulatory Services Authority (FRSA) of Abu Dhabi Global Markets (ADGM): AvaTrade also has authorization as an investment dealer in the UAE as Ava Trade Middle East Limited, regulated by the FRSA with permission number 190018 issued in 2020.

The AvaTrade brand is also authorised in Israel as Ava Trade Ltd., by the Israel Securities Authority, and in Japan as Ava Trade Japan K.K. authorised by the Financial Services Agency of Japan.

AvaTrade Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Ireland | €20,000 | Central Bank of Ireland | AVA Trade EU Limited |

| South Africa | No Compensation | Financial Sector Conduct Authority (FSCA) | Ava Capital Markets (Pty) Ltd |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Ava Capital Markets Australia Pty Ltd |

| United Kingdom | No Protection | Central Bank of Ireland | AVA Trade EU Limited |

AvaTrade Leverage

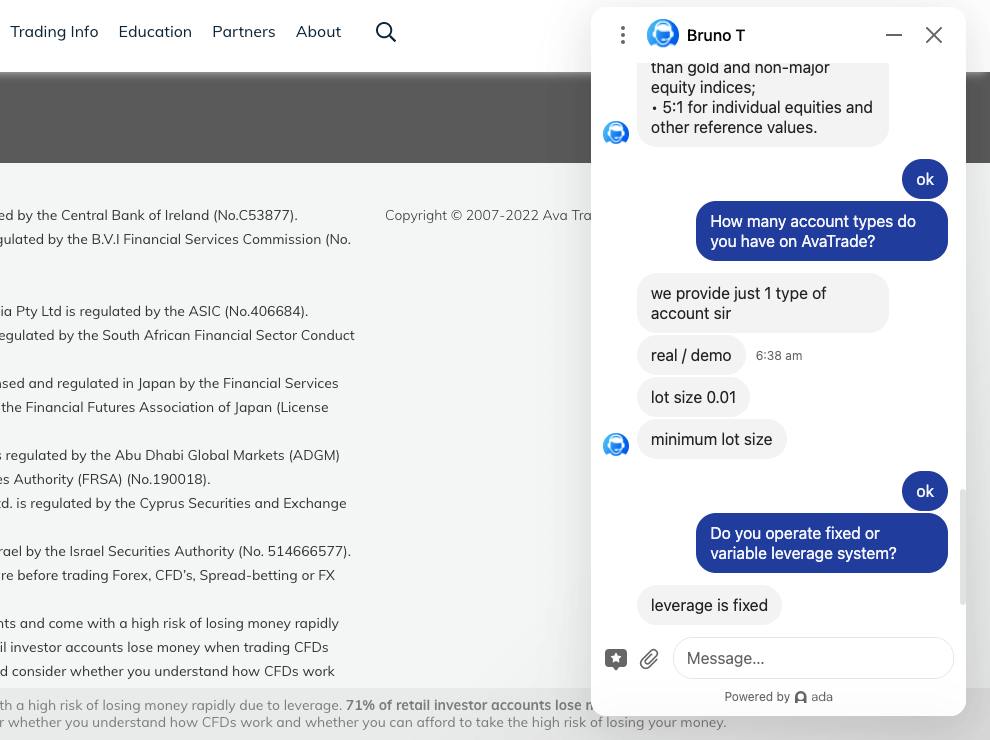

Under FCA and ESMA regulations, retail traders are subject to maximum leverage of 1:30 on AvaTrade. Professional account holders can access up to 1:400 leverage.

With leverage of 1:30, you open a trade position worth up to 30 times the size of your deposit. For example, if you deposit £1,000, you can place a trade of £30,000.

Note that some instruments have lower leverage ratios and AvaTrade operates a fixed leverage system.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

AvaTrade Account Types

AvaTrade offers two types of accounts for trading: the default retail account and the professional account designed for experienced and high-volume traders.

They also offer demo accounts for beginners and a no-swap Islamic account option upon request. You can also request for a spread betting account on AvaTrade.

Below, you’ll find information about the different account types at AvaTrade.

1) Retail Account: When you sign up with AvaTrade, you will automatically become a Retail Account trader. You can trade on a variety of financial instruments, including forex pairs and CFDs on bonds, stocks, commodities, precious metals, energies, FX Options, ETFs, and indices.

For the AvaTrade Retail Account, the maximum leverage is 1:30 for forex majors, 1:20 for forex minors, major indices, ETFs and gold, 1:10 for minor indices, metals and other commodities, and 1:5 for shares and bonds.

No commissions are charged for opening trades or closing trades with the Retail Account, swap fees are charged for maintaining a position that remains open overnight, and the spreads on majors like EURUSD start from 0.9 pips.

To start trading with the Retail Account, you must deposit a minimum of £100 and trade with a minimum of 0.01 lots.

You have negative balance protection with this account, which means that you will not lose more than the money deposited. If you suffer a loss from a trade, your account balance cannot be negative.

2) Professional Account: The AvaTrade Professional Account is for experienced traders who trade in significant volumes of financial instruments. You must meet certain requirements before you can apply to have a Professional Account.

To apply for a professional account, you must meet at least 2 of these 3 conditions:

- You have at least one year of working experience in the financial services sector.

- You have a financial portfolio valued at more than €500,000, including cash savings and financial instruments

- You must provide proof of at least 10 significant trades per quarter in the last 12 months.

With this account, you can trade forex pairs and CFDs on bonds, stocks, commodities, precious metals, energies, FX Options, ETFs, and indices with a maximum leverage of 1:400. Pro Accounts do not have negative balance protection.

For the AvaTrade Professional Account, the maximum leverage is 1:400 for forex majors, 1:200 for forex minors, major indices, and gold, 1:100 for minor indices, metals, bonds, FX Options, and other commodities, 1: 20 for ETFs, 1:10 for shares, and 1:2 for cryptocurrencies.

This account is spread only with commission-free trading and charges no fees when you deposit or withdraw funds.

Swaps fees are charged for holding a position overnight, and spread on major pairs like EURUSD starts from 0.6 pips on the Professional Account.

The minimum deposit on this account is £100, and you can trade with a minimum of 0.01 lots.

3) Islamic Account: AvaTrade offers swap-free Islamic Accounts to Muslims who want to adhere to sharia law in their trading.

If you want an Islamic Account, you need to first sign up for a Retail or Pro Account and then contact customer support so that they can convert your account to swap-free Islamic status. Such requests are processed within 2 days.

The leverage and fees for this account are the same as the Retail and Pro Account except that it does not charge a fee when you hold a position overnight for a grace period of 5 days, after which swap fees apply.

Note that AvaTrade Islamic Account holders are not allowed to trade FX currency pairs of ZAR, MXN, TRY, RUB, and any Cryptocurrencies. Additionally, Islamic customers pay increased spread fees on all trades.

AvaTrade Base Account Currency

While signing up for an AvaTrade account, you automatically get the British pound (GBP) as the base currency on your account and all your trades, deposits, and withdrawals will be measured in this currency.

Additionally, AvaTrade offers you the option to choose between CHF, EUR, and USD as your base currency. If you are planning to trade mainly in U.S. dollars (USD) or Euros (EUR), you can set your AvaTrade account to USD or EUR as the base currency and deposits in GBP will be converted to this currency.

AvaTrade Overall Fees

Fees on AvaTrade depend on several factors, including the type of account you have, the instruments you’re trading, and the volume of your transactions. An overview of trading and non-trading fees can be found below:

Trading fees

1) Spreads: When you trade any instruments on the platform, AvaTrade charges spread fees, which are the differences between the buy and sell prices of the financial instrument you are trading.

For example, if you’re buying EURUSD at 0.02250 and selling it at 0.02180, the difference of 0.0007 is the spread fee, also called pips.

The AvaTrade spreads are fixed. The typical spread fees for 1 lot size of major pairs are shown in the table below.

2) Commission fees: AvaTrade offers commission-free trading on all account types, a feature that allows you to enter and exit trades on any instrument without paying any fees.

AvaTrade Trading fees Table

Here is a summary of the typical fees AvaTrade charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 0.9 pips | None |

| GBP/USD | 1.3 pips | None |

| EUR/GBP | 1.2 pips | None |

| XAU/USD (Gold) | $0.27 over market | None |

| Crude oil | $0.03 over market | None |

| USTech100 | 1 pips | None |

| SPX500 | 0.25 pips | None |

3) Swap fees: Swap fees apply whenever you keep a trade position open on AvaTrade after midnight, which is the closing time of the market. The fee is based on the total volume of your positions and whether they are long (buy) or short (sell).

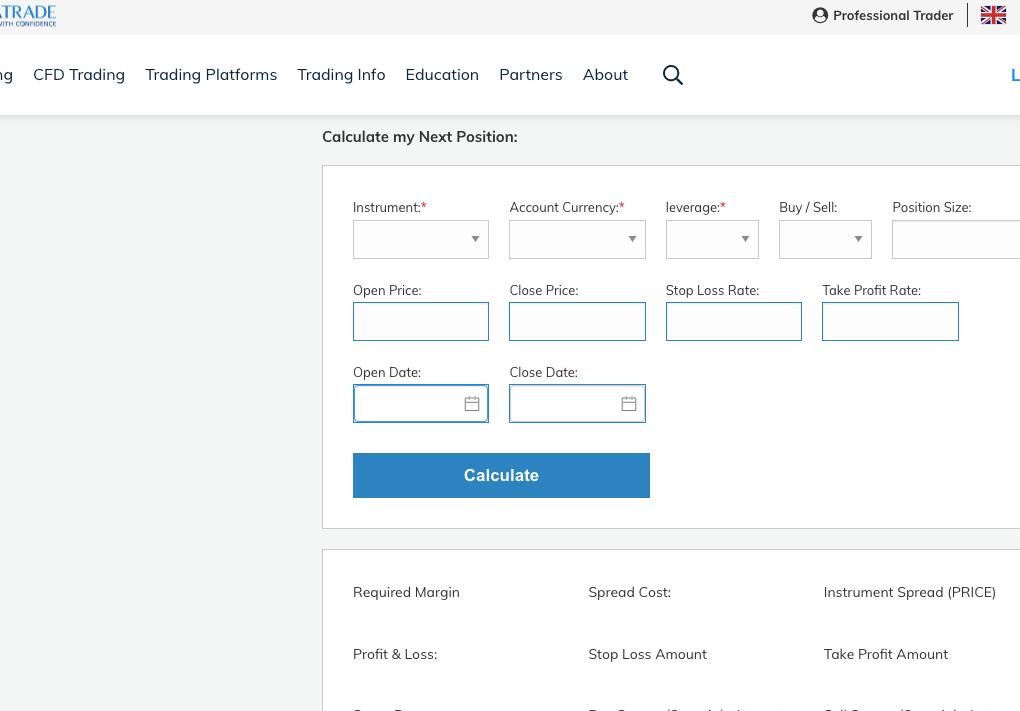

Your daily typical swap costs on AvaTrade for EURUSD on a trade size of 1,000 would be -0.0015% for selling, and -0.0060% for buying. You can calculate this with the AvaTrade Swap Calculator.

Since Islamic Accounts are swap-free, they do not pay any swap fees for a 5-day grace period.

Non-trading fees

1) Deposit and Withdrawal fees: AvaTrade does not charge you any fees when you deposit money into your trading account or withdraw money from it. This applies to all payment methods.

Your bank or payment processing company may charge some independent transaction fee.

2) Account Inactivity charges: If you don’t log in to your AvaTrade account for three consecutive months, a fixed monthly inactivity fee of £50 will be charged. After 12 months of inactivity, an additional administrative charge of £100 will be added. However, your account balance won’t become negative if it has no funds in it.

AvaTrade Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | $50 per month |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee.

How to Open AvaTrade Account in UK?

To start trading on AvaTrade, follow the basic steps below to open a trading account.

Step 1: Visit AvaTrade’s website, www.avatrade.co.uk, and click the ‘Register Now’ button highlighted in orange.

Step 2: Type in your email address and create a password on the form that appears. Then click ‘Create Account’ to continue.

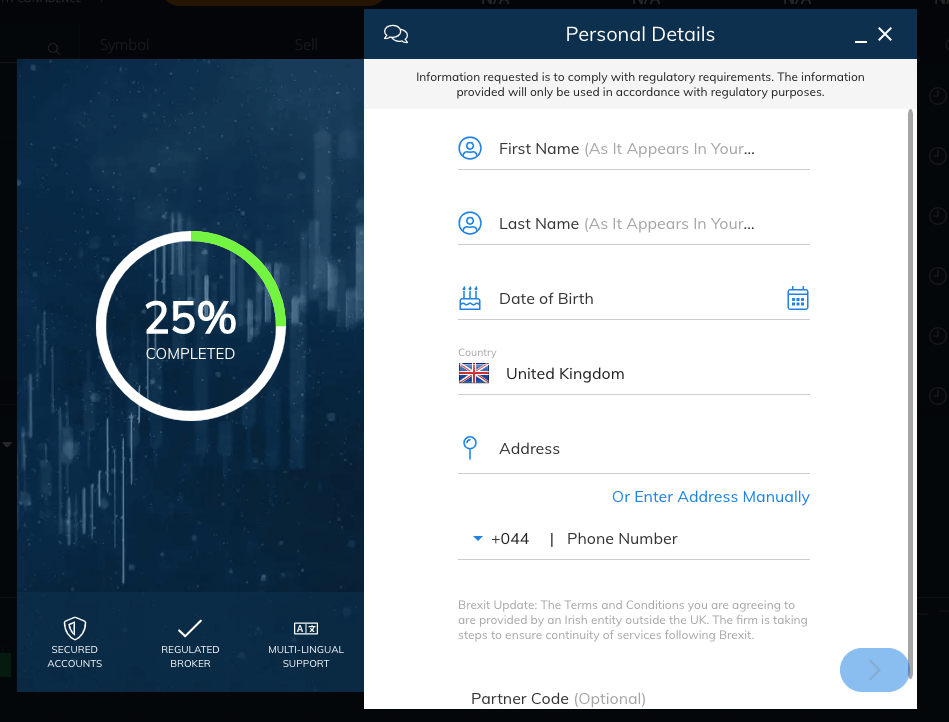

Step 3: After you click Create Account, you will be taken to the AvaTrade dashboard and asked to provide some personal details like date of birth, phone number, and full name.

Supply this information and then click the blue arrow button at the end of the form to go to the next page of the registration.

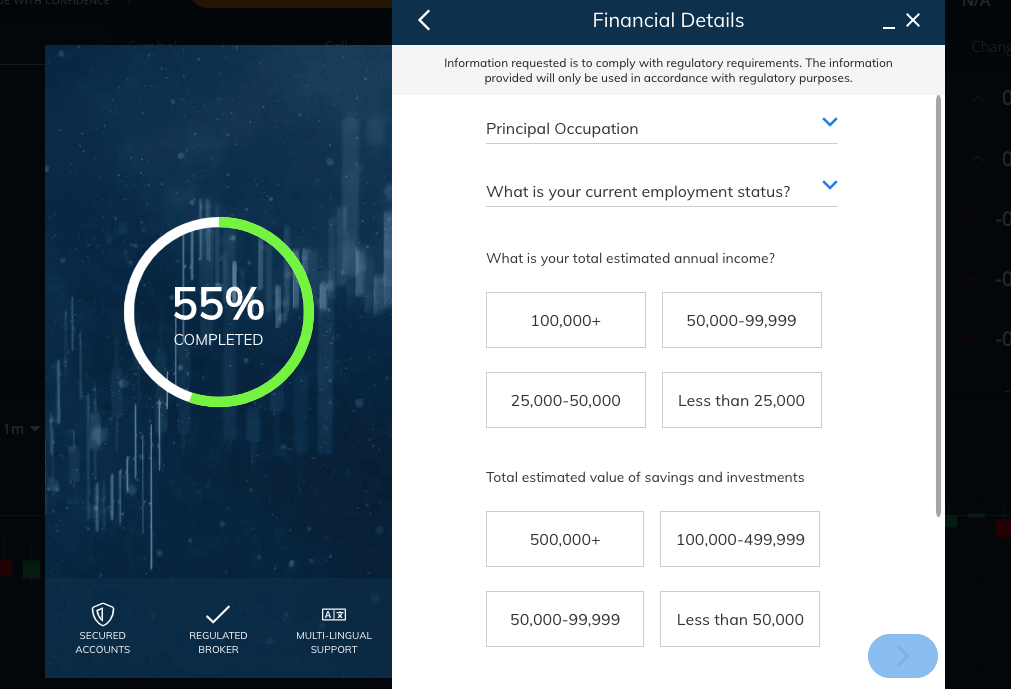

Step 4: Provide some personal information about your income and CFDs trading experience.

Select your preferred trading platform and base currency for your account. You can choose between the Swiss franc (CHF), Euro (EUR), Great Britain Pound (GBP), and the United States Dollar (USD).

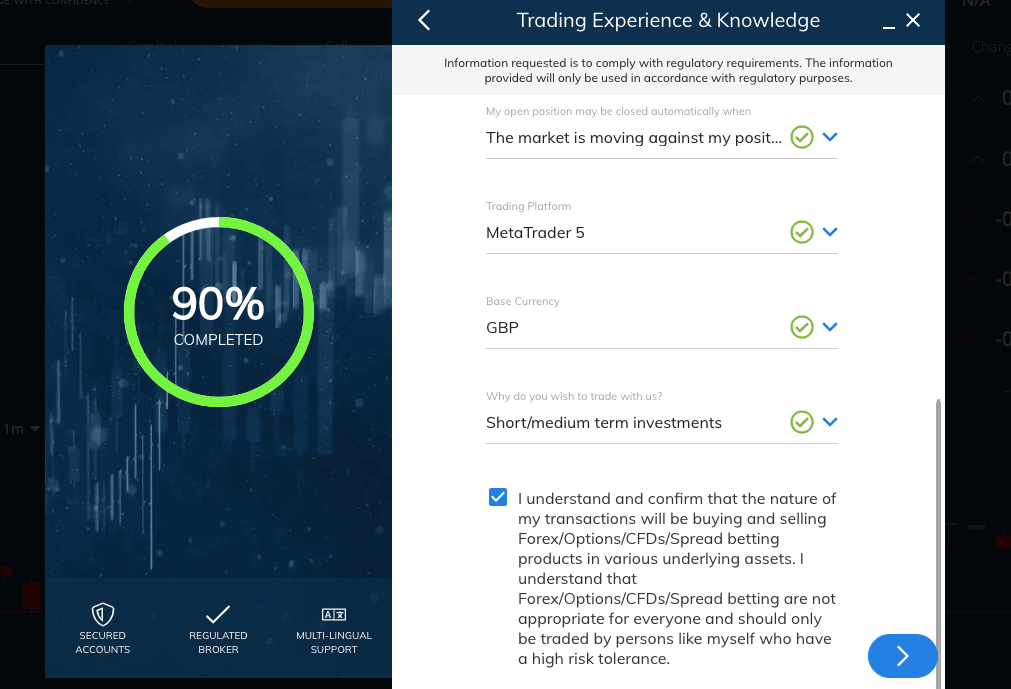

Next, check the box to confirm you understand the nature of trading on this platform and click on the blue arrow button

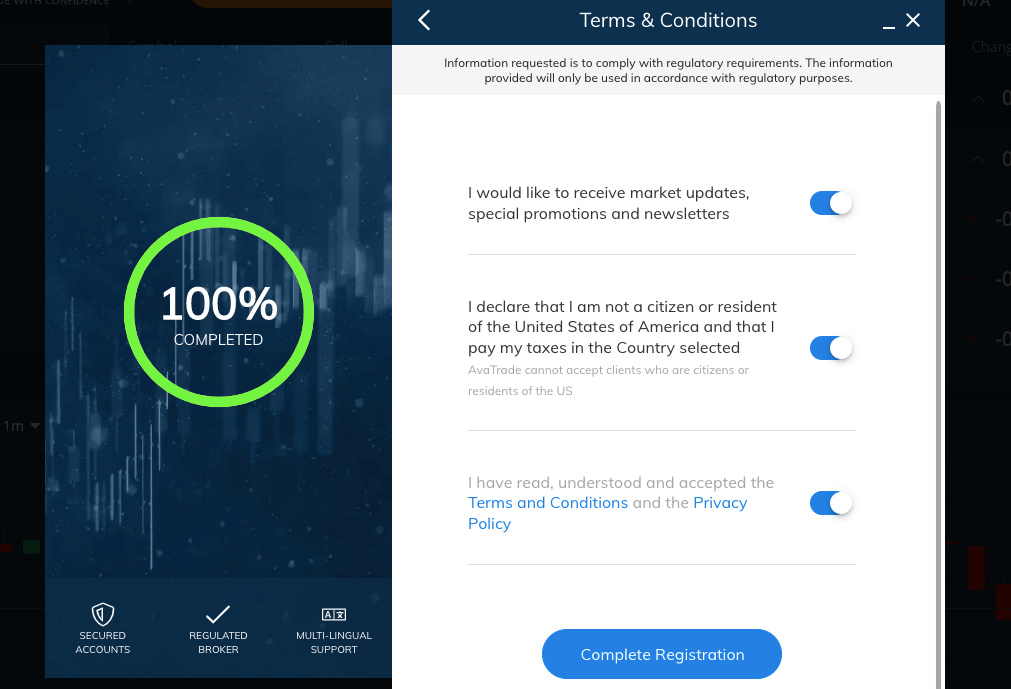

Step 5: Check the boxes to declare that you are not a US citizen, that you have read, understood, and agree to the terms, conditions, and privacy policy of the broker, and then click on ‘Complete Registration’.

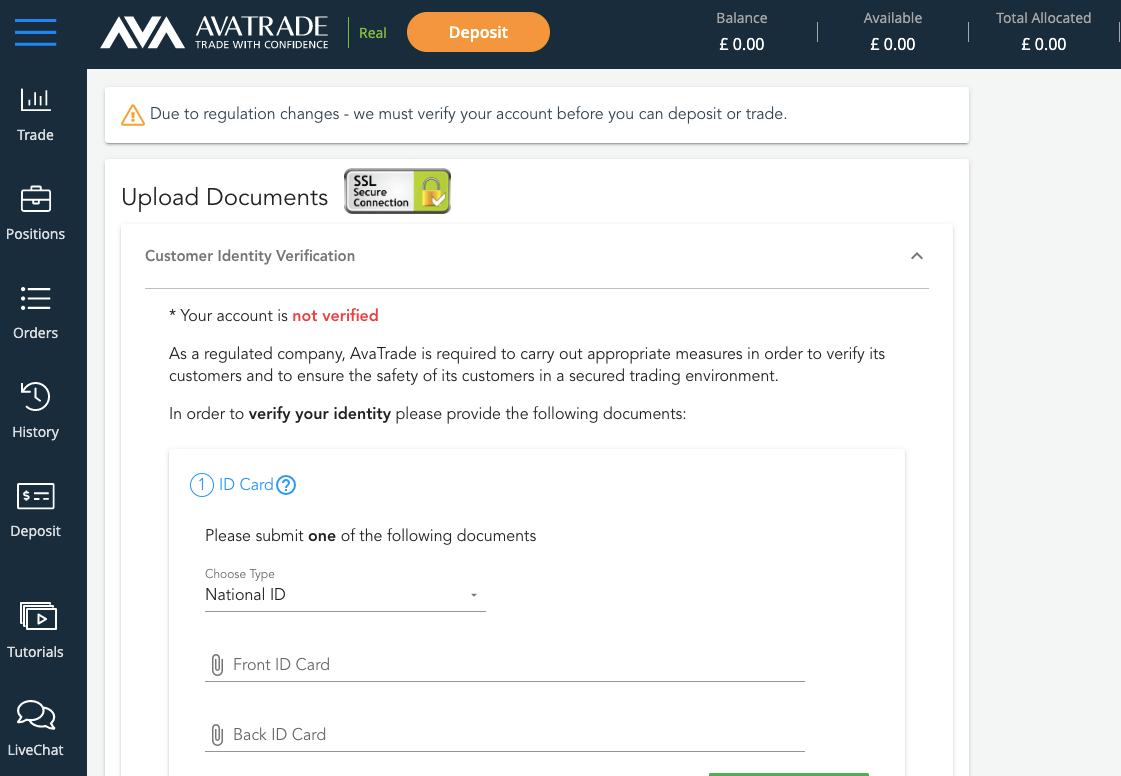

Step 6: Once you complete registration, you will be redirected to the AvaTrade dashboard.

Here you will upload identity and address verification documents to verify your account.

Once you verify your account, you can add money to your trading account, begin to trade, and withdraw funds.

AvaTrade Deposits & Withdrawals

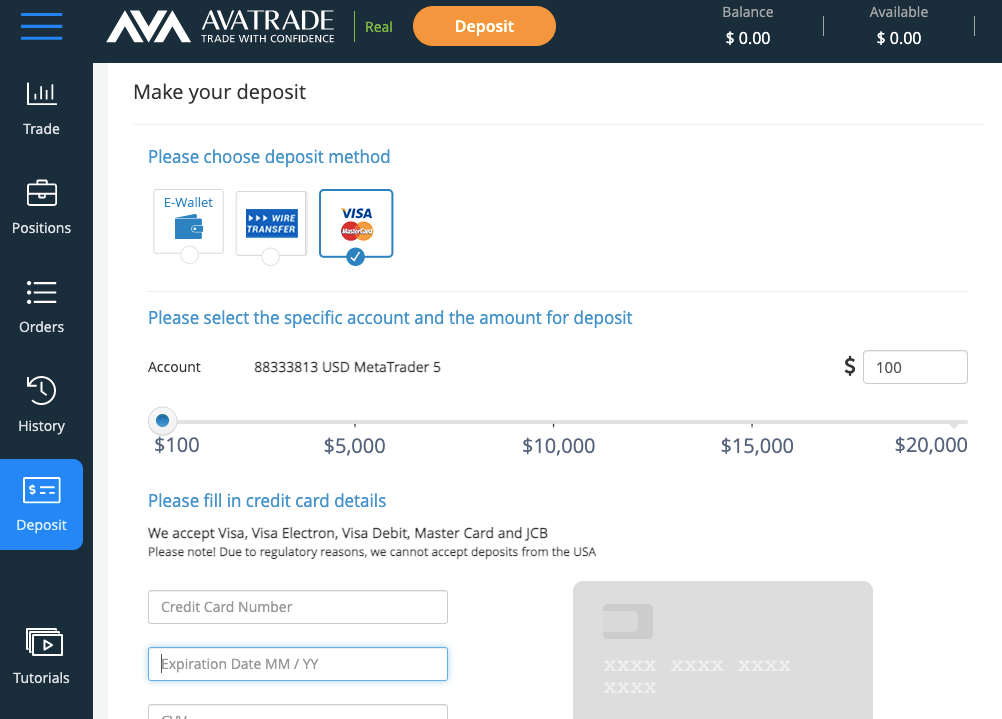

AvaTrade accepts the following payment methods for deposits and withdrawals: credit/debit cards, Skrill, Neteller, and bank wire transfers. These methods are visible on the deposit and withdrawal page of your account.

Below we have provided an overview of deposits and withdrawals on AvaTrade UK.

AvaTrade Deposit Methods

Here is a summary of payment methods accepted by AvaTrade for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | Up to 10 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | 24 hours |

AvaTrade Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on AvaTrade.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | up to 10 business days |

| Cards | Yes | Free | 24-48 hours |

| E-wallets | Yes (Skrill, Neteller) | Free | 24-48 hours |

What is AvaTrade minimum deposit?

AvaTrade’s minimum deposit is £100 or 100 units of your base account currency for all payment methods.

For faster bank transfer processing, you can contact support with your proof of payment.

When you deposit for the first time with a card, it can take up to 24 hours to be credited due to security checks.

How do I deposit money to AvaTrade?

Step 1) log in to your account via myvip.avatrade.co.uk.

Step 2) On the left side menu bar, click ‘Deposits’, then click ‘Fund Your Account and select a deposit method.

Step 3) Enter the amount you want to deposit then click on ‘Deposit’, then follow the on-screen instructions to complete the deposit.

What is AvaTrade minimum withdrawal?

On AvaTrade, there is a minimum withdrawal amount of £100 for wire transfers and £1 for other payment methods.

How do I withdraw from AvaTrade?

To withdraw your money from AvaTrade;

Step 1) log in to your account via myvip.avatrade.co.uk.

Step 2) Go to the Withdraw Funds section and select a payment method.

Step 3) Enter the amount you want to withdraw, fill out the required details then click on ‘Submit’, then follow the on-screen instructions to complete the withdrawal request on AvaTrade.

AvaTrade Trading Instruments

Below are financial instruments that can be traded on AvaTrade

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 53 currency pairs on AvaTrade |

| Commodities CFDs | Yes | 19 spot commodities on AvaTrade (Metals, Oil, Energies, Cocoa, and others) |

| FX Options CFDs | Yes | 54 pairs of FX Options on AvaTrade |

| Indices CFDs | Yes | 31 spot indices on AvaTrade |

| Stocks CFDs | Yes | 616 stocks on AvaTrade |

| ETFs CFDs | Yes | 61 ETFs on AvaTrade |

| Bonds CFDs | Yes | 2 Bonds on AvaTrade (Euro-Bund and Japan Govt Bond) |

| Spread Betting | Yes | 136 spread betting pairs on AvaTrade |

| Cryptocurrencies CFDs | Yes | 20 cryptocurrency pairs* |

*Note that AvaTrade does not currently offer cryptocurrency trading to UK retail customers.

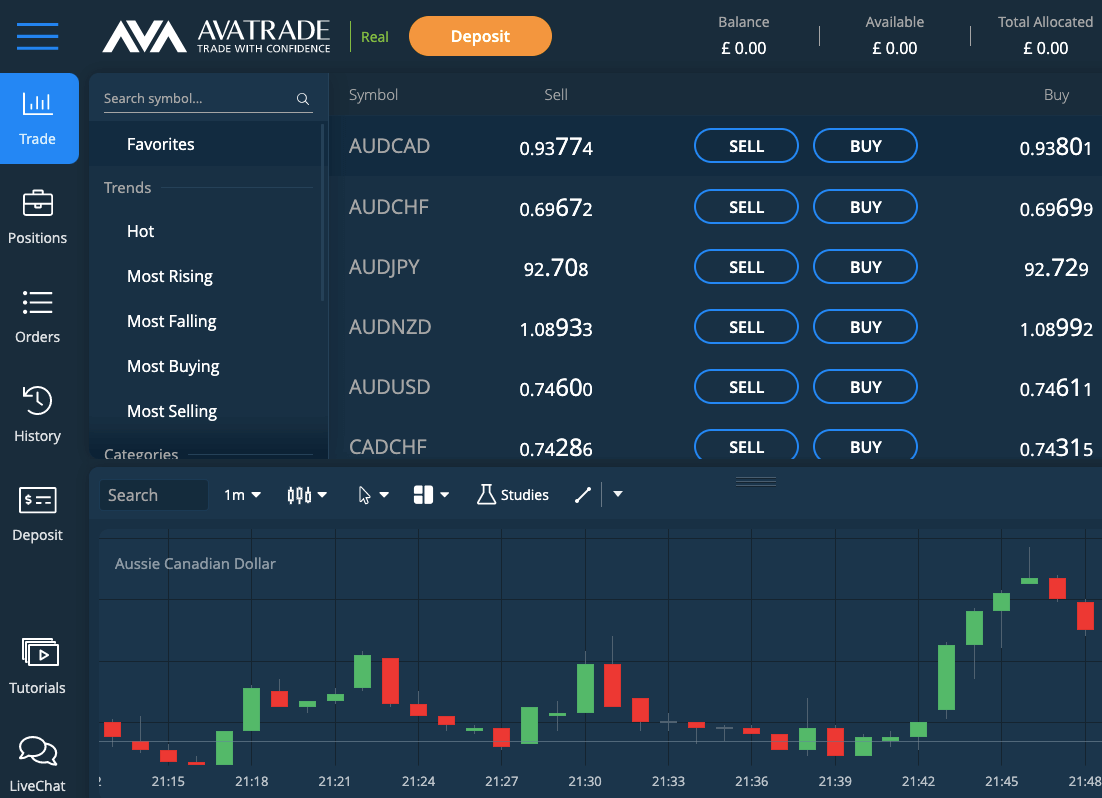

AvaTrade Trading Platforms

AvaTrade supports the following trading platforms:

1) MetaTrader 4 and MetaTrader 5: AvaTrade offers MT4 & MT5 trading applications that can be accessed on the web, desktop, and mobile devices (Android & iOS).

2) AvaTrade WebTrader: AvaTrade also offers its clients a proprietary web-based trading application, the AvaTrade WebTrader.

3) AvaTradeGo: AvaTradeGo is AvaTrade’s mobile trading application, available on both the App Store and Google Play Store.

4) AvaSocial: AvaSocial is a trading application by AvaTrade that lets you access the strategies of experts and successful traders. It is basically for copy trading. You can download AvaSocial on Google Play Store or Apple App Store. It is available on mobile phones alone.

AvaTrade Execution Policy

AvaTrade is a market maker. This is evidenced by their fixed spreads and in-house dealing desk. They determine the bid-ask prices of the CFDs they offer and fulfil all of your trades for you.

In a review of their legal document, we observe that there might be cases of delayed connectivity and latency. If the prices displayed during this delay are favourable to you, AvaTrade can block the trade, void it, revoke your profits or even widen the spread after you have placed the trade.

In addition, there are also price requotes. According to the document, if the initial bid-ask price offered to you does not reflect the ‘fair’ market rate, AvaTrade at their sole discretion can choose not to execute your order. Instead, they send you an amended quote for your consideration.

Furthermore, the document states that your Limit Orders will not be executed if the price moves to your advantage. This means AvaTrade does not have a system that seeks the best prices for traders.

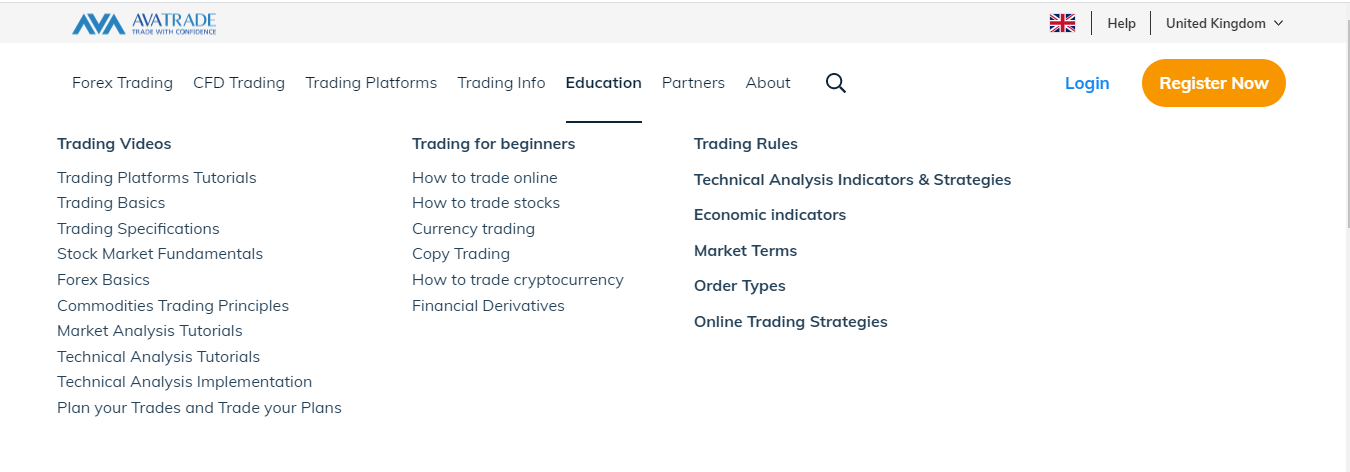

AvaTrade Education and Research

You can learn with AvaTrade in the following ways.

1. Demo Account: AvaTrade offers a free demo account with no risk. You can use the demo account for learning and practice. However, AvaTrade’s demo account has a downside. The demo account expires after three weeks. You will have to add another demo account. With this, it becomes difficult for traders to track their progress long-term.

2. Trading Videos: AvaTrade’s videos are extensive and structured well for traders to understand. Tutorials on trading platforms, currency pair trading, commodities trading, and stock trading are covered. Another important topic covered in this section is ‘stock market fundamentals’. This is key to understanding what moves the shares CFD market.

3. Educational Articles: These are extra articles for traders’ learning. They include random topics like trading rules, market terms, order types, etc.

What is AvaTrade copy trading?

AvaTrade copy trading allows you to automatically copy the trades of other successful traders on the platform. This means that when the trader you’re following opens or closes a position, the same position will be automatically opened or closed in your account.

How does it work?

AvaTrade offers copy trading through several integrated platforms, including ZuluTrade, DupliTrade, and AvaSocial. Each platform has its own features and interface, but the basic principle is the same:

1) Choose a trader to follow: You can browse through a list of traders based on their performance, trading style, and risk tolerance. You can also use filters to narrow down your choices.

2) Allocate an investment amount: Decide how much money you want to copy from the chosen trader.

3) Start copying: Once you’ve chosen a trader and allocated an amount, their trades will be automatically copied to your account.

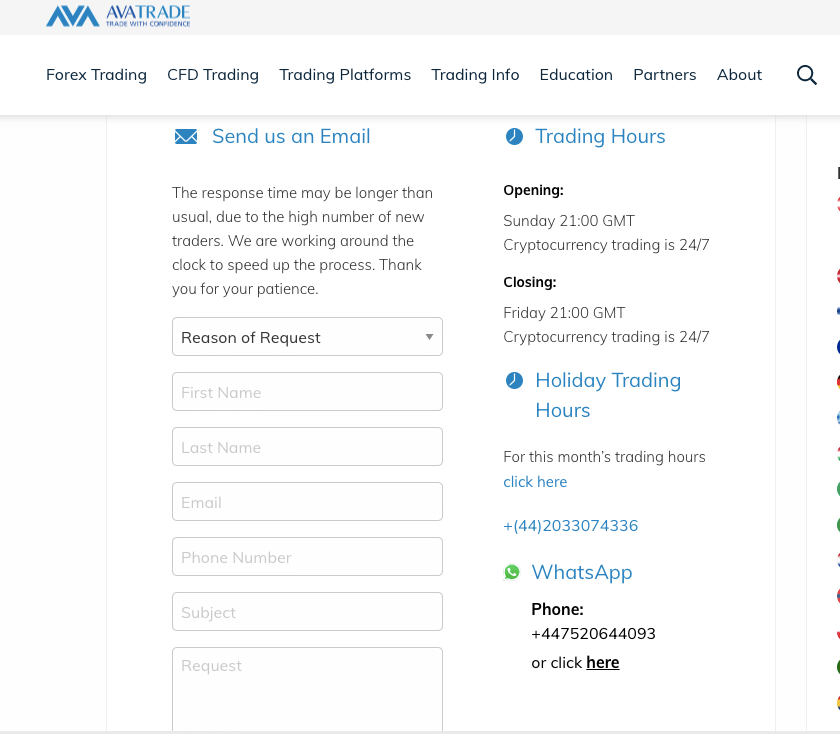

AvaTrade UK Customer Service

Avatrade customer support is available Monday through Friday via the following channels:

Live chat support: AvaTrade offers live chat support to traders via the website. The chatbot – AvaGuide – is available 24/5, but live agents are only available from 5:00 to 21:00 GMT, Monday to Friday.

The chatbot can answer a lot of questions about AvaTrade platforms, deposits/withdrawals, and more by prompting you with options when you ask a question.

In order to chat with a live agent, just send ‘chat agent’ as a message and the bot will give you a couple of options. Select ‘Chat With An Agent’ and it will take you to a live chat session. You will need to submit your email address and name for this.

The AvaTrade live chat customer support for us was prompt when we tested it, with a response time of about 1 minute. The answers provided were both accurate and relevant.

Email support: AvaTrade offers email support during business days, so you can send them an enquiry through their contact us form on their website.

Phone support: AvaTrade offers phone support to traders on the platform in different countries. Phone support on AvaTrade is available during business hours from Mondays to Fridays. The AvaTrade UK support phone number is +442033074336.

To reach AvaTrade WhatsApp support, you can send a message to the following number: +447520644093.

Do we Recommend AvaTrade UK?

Based on the safety of traders’ funds, AvaTrade is regulated by ASIC, which is a Tier-1 regulator, as well as other Top-Tier regulators like FSCA, CySEC, ISA, and FRSA, this means they are required to protect deposited client funds.

The fees on AvaTrade are moderate, with spreads starting from 0.9 pips for major currencies and the broker charges no commission fees for trading, although they charge inactive account fees.

AvaTrade supports trading on many platforms which is their proprietary trading app and MetaTrader that are accessible on web browsers and mobile devices, which makes it easy to create an account and make trades.

Customer support at AvaTrade is not so good, while their live chat has very little wait time, they cannot be reached 24 hours a day, which means that if you ever need to contact customer support, you may be waiting a while to get assistance. There are brokers who offer 24/7 customer support.

We recommend that you register with a broker that is regulated in the UK as it ensures the UK consumer protection laws will cover you. However, you can check out AvaTrade website to see the specific instruments they have and even chat with customer support and ask any questions you might have to help you make up your mind.

Does AvaTrade allow scalping??

Yes, AvaTrade support scalping. Scalping is a day trading strategy that involves leaving your trades open for only few seconds or minutes with the intention to profit from small price movement.

AvaTrade offers offer Major currency pairs (like EUR/USD and USD/JPY), Major stocks (eg. Amazon, and Facebook) and Indices (eg. S$P 500, and UK 100) that are usually of interest to scalpers who are looking to make profit from small movement in price.

They also offer trading platforms like MetaTrade4 and MetaTrader5 that support advanced technical indicators, and different types of charts for scalpers to conduct technical analysis. MT4 and MT5 also support buying and building of trading robots, which scalpers who wish to automate their trades will find helpful.

Is my money safe with AvaTrade?

AvaTrade segregates your money from their money. They do not combine clients money and business money. Though they are not regulated with the FCA, they hold a tier-1 license with ASIC and tier-2 license with CySEC. They also follow global best practices in terms of cybersecurity.

What countries is AvaTrade regulated in?

AvaTrade is regulated in several countries including Ireland, Cyprus, Japan, Canada South Africa, British Virgin Islands and Australia.

Does AvaTrade offer a good app?

Yes, AvaTrade offers a good number of trading apps. Their most popular forex trading app is the AvaTradeGO. Beyond trading, you also access investment and account management tools without a computer.

In addition, you get to access data and market trends that helps you see market sentiment on the go.

Is AvaTrade an ECN broker?

AvaTrade is not an ECN broker. They are a market maker. This means they act as counterparty to your trades. Their spreads are also wider than that of an ECN broker because they make money from spreads.

Is AvaTrade good for day traders?

Yes, AvaTrade is good for day traders. They have just one retail account. They also have MT4 and MT5 that allows automated trading strategies. They also have a reliable order execution.

Does AvaTrade work in the UK?

Yes, the FCA allows AvaTrade to provide forex trading services in the UK. It is important to know that AvaTrade does not hold an FCA license. But they are able to take on board UK client with their CySEC license.

AvaTrade UK FAQs

Is AvaTrade regulated in UK?

AvaTrade is not regulated in the UK. AvaTrade previously had a Temporary Permission to offer certain financial services in the UK, however, as of October 2023, AvaTrade had applied to cancel the license. In January 2024, the FCA website shows AvaTrade has ‘Supervised run-off’ status in the UK which authorises them to offer some services in the UK.

Does AvaTrade have Nasdaq?

You can trade NASDAQ on AvaTrade, the index can be found as US_TECH100 on AvaTrade.

How much does AvaTrade charge per trade?

AvaTrade does not charge commissions on CFDs. AvaTrade is commission-free.

What is the minimum deposit at AvaTrade?

£100 is the minimum deposit to start trading on AvaTrade. It is also 100 units of your base account currency, this applies to all payment methods.

Is AvaTrade good for beginners?

AvaTrade offers a Demo Account for new and prospective traders to try out the platform and its features.

The broker offers commission-free on all instruments along with competitive spreads which means low trading fees

AvaTrade’s negative balance protection means that traders do not lose more than the money in their account, making the broker a good choice for beginners. You can read our review of AvaTrade to know more about the broker.

Note: Your capital is at risk