Copy trading allows you to copy the trading strategies & orders of other traders. On a copy trading platform offered by brokers; you can access the strategies of other traders, and track their performance. You can copy these strategies to your trading account.

We have gathered a list of the copy trading platforms available in Malaysia. We assessed these brokers based on their Safety, Fees, Copy trading features & Trading conditions.

We also downloaded some of the copy-trading apps to see how they work.

Also, traders must note that copying the trades of other traders has its risks, which we will cover in this guide.

Comparison of Best Copy Trading Platforms in Malaysia

| Forex Trading App | Google Play Store Rating | EUR/USD Spread | |

|---|---|---|---|

| OctaFX Copytrading |

4.5

|

0.9 pips

|

Visit Broker |

| FBS Trader |

4.3

|

0.9 pips

|

Visit Broker |

| HFM APP |

3.9

|

1.4 pips

|

Visit Broker |

| FXTM Trader |

3.9

|

2.1 pips

|

Visit Broker |

| AvaTradeGo |

4.5

|

0.9 pips (fixed)

|

Visit Broker |

| Tickmill |

4.0

|

0.1 pips (plus commission)

|

Visit Broker |

Best Copy Trading Platforms in Malaysia

Here is the list of good Copy Trading platforms for traders based in Malaysia.

- Octa – Best Copy Trading Platform in Malaysia

- FBS – Good Copy Trading Broker

- HF Markets – Well Regulated Broker with Copy Trading Features

- FXTM – Good Copy Trading App

- AvaTrade – Fixed Fees Copy Trading App

- Tickmill – Reputed Forex Broker with Copy Trading

#1 Octa – Best Copy Trading Platform in Malaysia

Octa does not charge any extra commission for their copy trading platform.

1) Safety: Octa are regulated by CySec (Cyprus), and the FSA in Saint Vincent and the Grenadines. Octa is not regulated by any tier-1 regulatory body. Trading with them might carry a slightly higher risk because of this.

2) Fees: The master traders you copy charge a commission on your profits. This commission is usually a percentage of your gains and is charged in dollars. The commission is not the same for the master traders so there is no specific percentage in fees.

3) Copy trading features: Octa has a copy trading app (OctaFX Copytrading) that is available for download on Google play and Apple app store. You do not have access to Octa’s trading terminals if you are copy trading. All your trades are done on the app.

4) Trading Conditions:

- Minimum Deposit: This depends on your deposit method. If you are using Skrill or Neteller for example, the minimum deposit is $50 (MYR 230) but with a Visa Card, you can start copy trading with a minimum of $25 (MYR 112). You can deposit a minimum of MYR 100 with Malaysian banks.

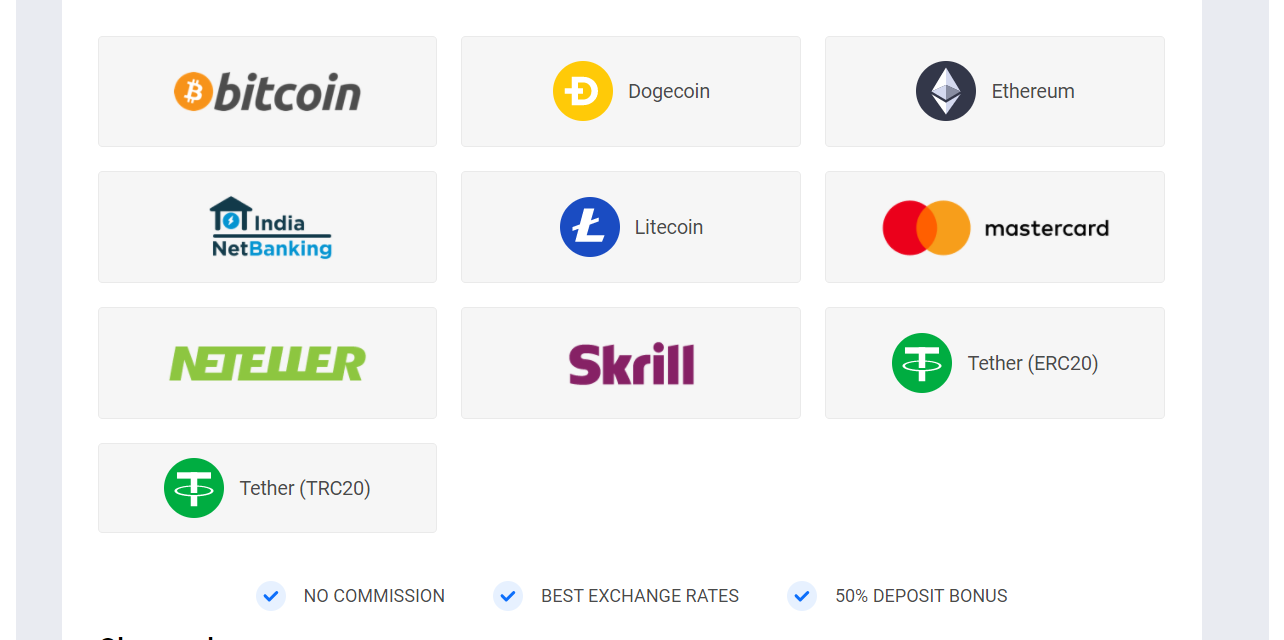

- Deposit/Withdrawal: The Octa trading platform offers a wide range of deposit and withdrawal options. You can deposit/withdraw funds via Malaysian Local Bank Transfer in MYR, cryptocurrencies such as Dogecoin, Ethereum, Litecoin, and USDT (either TRC20 or ERC20). You can also make deposits/withdrawals with your Master Card, Visa card, and e-wallets like Skrill and Neteller. Octa does not charge deposit/withdrawal fees. Charges may apply with your payment channel so make sure you find that out.

- Customer Support: We tested the live chat feature on OctaFX copy trading app. We got a response within a minute. The overall customer support is good.

Find more information about trading with Octa in Malaysia in our detailed Octa review.

#2 FBS – Good Copy Trading Broker

Malaysian traders are registered with the IFSC in Belize. The IFSC is not a tier-1 regulatory body so trading with FBS is considered risky.

1) Safety: FBS is regulated with the IFSC in Belize. In Europe, they are regulated with CySEC. They are also regulated with ASIC & FSCA.

2) Fees: FBS charges no extra commission. You only pay a 5% commission from your invested amount to the trader or traders you copy. The good thing with FBS is that this 5% is fixed for all traders. The traders you copy cannot charge beyond 5% of your trading capital for copy trading.

3) Copy trading Features: FBS offers a copy trading app for android and iOS systems. Copying, deposit, and withdrawals can be carried out on the app.

4) Trading Conditions:

- Minimum Deposit: Minimum deposit varies with the payment method. You can begin copy trading with FBS for $1 (RM 4.5).

- Deposit/Withdrawal: FBS offers varying deposit and withdrawal methods. Bank Transfer is available. E-wallets such as Skrill and Neteller are available. You can also deposit/withdraw with your MasterCard, Visa Card, and cryptocurrencies. Bitcoin Cash, Bitcoin, Litecoin, Ethereum, and USDT are the only cryptocurrencies allowed. In addition, there are deposit/withdrawal charges depending on the channel you choose. FBS does not charge for deposits and withdrawals.

- Customer Support: You can contact FBS via live chat on their copy trading app. It took an average of two minutes to get a response. Overall, customer support is good. You can also reach them via customer support email.

You can read more about the trading conditions at FBS in our FBS review for Malaysian traders.

#3 HF Markets – Well Regulated Broker with Copy Trading Features

HF Markets has a system in place that automatically calculates the performance fee based on the Service Provider’s profits and losses.

1) Safety: HF Markets is regulated with the FSCA (South Africa), CySEC (Europe), IBC (St. Vincent and Grenadine), DFSA (the United Arab Emirates), FSA (Seychelles), and the FCA (UK).

2) Fees: HF Markets charges no commission on their HFcopy account. However, a maximum of 50% of your profit goes to the strategy provider (SP) as a performance fee. The performance fee can vary depending on the high watermark regime. This means that the Service Provider you followed is paid based on the profits he makes. If he makes a string of losses, the performance fee is not paid until he has made profits that exceed the losses.

3) Copy trading features: Copy trading is executed on trading platforms like MT4 and the HFM App developed by HF Markets.

4) Trading Conditions:

- Minimum Deposit: HF Markets offers an HFcopy account for copy traders. You need a minimum deposit of $100 (MYR 450) to open the account.

- Deposit/Withdrawal: You can deposit with your debit/ credit card, bank transfer, or e-wallets like Skrill and Neteller. Deposit is also possible with cryptocurrencies. These channels are also available for withdrawal except Skrill. HF Markets does not charge deposit/withdrawal fees.

- Customer Support: Overall customer support is good. For a quick response, use the live chat feature on their website. Customer support agents are available to answer your questions within two minutes.

Learn more about the trading conditions with HF Markets in our HF Markets review for traders based in Malaysia.

#4 FXTM – Good Copy Trading App

This broker has tier-1 regulation.

1) Safety: FXTM is regulated with the FCA (UK), CySEC (Europe), FSC (Mauritius), and the FSCA (South Africa).

2) Fees: As a copy trader with FXTM, you pay between 0-30% of your profits to strategy managers. There are no extra fees attached to copy trading with the broker other than the 30%.

3) Copy trading Features: FXTM does not have a copy trading app. Copy trading features are linked to the trading terminal. FXTM offers automated copy trading.

4) Trading Conditions:

- Minimum Deposit: You cannot copy trade with FXTM without an FXTM Invest account. A minimum of $100 (MYR 450) is needed to open an FXTM Invest account.

- Deposit/Withdrawal: You can deposit/withdraw funds with Skrill/Neteller, MasterCard, or Visa card. If you prefer to deposit/withdraw in ringgit, FXTM allows you to do this via South East Asia Online Banking.

- Customer Support: Overall customer support is good. We contacted FXTM via WhatsApp and live chat. The latter was better as we got a response in a few minutes. WhatsApp response came after 40mins.

You can read more about FXTM trading conditions for Malaysian traders in our FXTM review.

#5 AvaTrade – Fixed Fees Copy Trading App

On their copy trading app, AVA Social is free of charge but this can change anytime.

1) Safety: AvaTrade is regulated by ASIC (Australia), CySEC (Europe), and FSCA (South Africa). Furthermore, AvaTrade is also regulated in the British Virgin Islands, Japan, and the UAE.

2) Fees: AvaTrade does not charge extra commissions for copy trading. Master traders are paid an average of $50 per month (MYR 230).

3) Copy trading features: AvaTrade has a copy trading app called AVA Social. It is available on Google playstore and Apple appstore. You will need your trading account to log in. You cannot use AVA Social without a trading account.

4) Trading Conditions:

- Minimum Deposit: You need a minimum deposit of $100 to copy trade with AvaTrade. That is RM420 in Malaysian local currency.

- Deposit/Withdrawal: You can deposit and withdraw your funds via different means. AvaTrade allows deposit/withdrawal through credit/debit card, bank wire transfer, and e-payment channels like Skrill and Neteller. E-payment is the most convenient way to go. The transaction is completed in 24 hours. Wire transfers can take up to seven days. AvaTrade does not charge any fees when funds are deposited or withdrawn.

- Customer Support: Local mobile number is available. You can also contact AvaTrade via email. We found the mobile number functional. We got a response via email in a few hours.

Find detailed information on AvaTrade trading conditions for traders based in Malaysia on our AvaTrade review.

#6 Tickmill – Reputed Forex Broker with Copy Trading

You are not charged any commission for copy trading with Tickmill.

1) Safety: Tickmill is regulated by the FCA (UK), CySec (Europe), FSA (Seychelles), Labuan FSA, and the FSCA (South Africa).

2) Fees: You only pay 10% of your profits to the expert traders you copy. This percentage is fixed for all expert traders.

3) Copy-trading features: Tickmill runs their copy trading services via Myfxbook. When you open your Tickmill trading account, you will have to link it to Autochartist or Myfxbook AutoTrade to start copy trading.

Tickmill does not have a copy trading app but Myfxbook does. It is available for download on the play store.

4) Trading Conditions:

- Minimum Deposit: With $100 (MYR 450), you can open a Tickmill trading account and begin copy trading.

- Deposit/Withdrawals: Tickmill offers bank wire transfers, credit/debit cards, Skrill, and Neteller for deposits and withdrawals. Transactions via Skrill and Neteller are instant. Bank transfers and card transactions can take up to seven working days.

- Customer Support: Overall customer support is good and there is a local mobile number. They responded to our emails within 30 minutes. You can also use the live chat feature on their website.

Learn more about the trading conditions of Tickmill in Malaysia by reading up on our AvaTrade review for Malaysia traders.

What is Copy Trading?

Copy trading is a technology that allows you to replicate the trades of expert or master traders in your trading account. It is also known as social trading or auto trade.

Copy Trading allows you to invest in the market passively. You do not analyze or create strategies. You simply replicate the trades of experts on a broker’s platform. Whatever they buy, you buy. Whatever they sell, you sell. This is how copy trading works.

Advantages of Copy Trading

- Inexperience is not a problem. Copy trading can be a good tool for beginners. Learning the basics of trading takes time. It is even believed in some quarters that a trader should demo trade for six months before opening a live account. Doing this might take too long. For copy trading, you can open an account today and begin trading today without much experience.

- Beginner traders can increase their knowledge via copy trading. Copy trading does not just give you access to expert trades. You also get access to the strategy that has made them profitable. You can use these strategies to improve yourself as a trader.

- Copy trading helps you diversify your investment portfolio. With access to different traders, strategies, and trading instruments, you can have exposure to varying market environments.

Risks of Copy Trading

- No trading strategy is 100% risk-free. Even if the trader or traders you copy have a good profit record, the risk attached to trading is still there. You can still lose a part of your trading capital if the markets do not go your master trader’s way. This is possible because you trade the same assets they trade.

- Current data might be deceptive. A master trader may have a short-term winning streak. This streak can be so hot that his gains are eye-watering. If you do not do your homework to assess his previous performances in the long term, you might sign up with such a trader. When the streak ends, you start losing money.

- In copy trading, you share your profits with your master trader(s). Most brokers fix the profit-sharing percentage. Some brokers do not. If you choose a broker that has no fixed profit-sharing percentage, then your money is at the mercy of master traders.

What CFDs are Available for Copy Trading?

Copy trading is literally copying another person’s trade. This means the only limitation to assets that can or cannot be copied depends on the platform you choose. In addition, it depends on the master trader you choose to copy. If he/she does not trade certain CFDs, you cannot copy them.

Currency pairs are the most copy traded instruments. However, other platforms allow you to copy trades on other CFDs. Here are the CFDs you can copy trade:

1. Currency Pairs: Currency pairs are the most prominent of CFDs. They are one of the few CFDs that are available on both MT4 and MT5. It is no surprise that most copy traders that prefer currency pairs prefer MT4 or MT5. You can use EA or a robot on these platforms. You can also copy trades manually if you want.

2. Shares CFDs: Not many trading platforms allow the trading of stocks directly. Only the derivatives are common. This is why most brokers have stock CFDs. Copy trading stocks is just like copying any other CFD. The upside is that commissions are less because of the stock market’s high liquidity.

3.ETF CFDs: ETFs are stock baskets. Literally, it is like a container that has multiple stocks in it. So copying a trade on ETF CFDs is like copying a trade on multiple stocks. ETF CFDs have high liquidity too.

4. Crypto CFDs: In the UK, crypto CFDs are available to professional traders only. Crypto copy trading is not as popular as currency pairs and stock CFDs.

Types of Copy Trading Systems

Copy trading is not carried out in a single way. There are different systems of copy trading available. Some brokers have a single system while some have multiple systems. For those with multiple systems, you can make a choice, selecting your preferred system. Here are the most common systems

1) All-round system: This system is an all-in-one system that combines conventional trading and copy trading. eToro is a typical example. It is a broker and a copy trading platform joined together. You don’t need to combine it with anything. You open your account and you are good to go. Other platforms like MT4, MT5, and cTrader require an external broker account before you can use them.

2) Copy trading signals: This system involves one or more traders spotting an opportunity in the market. The opportunity is then made available to other traders as a signal with opening, exit, and stop-loss positions. You will have to manually enter the signal on your trading platform. This system is common with unregulated online copy trading channels.

Regulated forex brokers who have this system do not give opening, exit, and stop-loss positions. Rather, they notify you if certain conditions have been met in the market. You can then analyze the conditions and see if there is a trading opportunity there.

3) Algorithm Software: This involves the use of EA (expert advisors) or bots to trade. These bots are preprogrammed and they trade based on an algorithm. EAs can trade 24 hours a day and they strictly follow the codes put in them.

Basically, the bot will go long or short on a CFD if it crosses major price zones or fulfill other on-chart parameters. However, there is a downside to using bots. Because bots cannot think for themselves, they only execute trades technically. They cannot track economic releases and events that have high impact on the price movement of CFDs.

What to do before choosing a Master Trader

You should not jump into copy trading because of master or expert traders. The presence of experienced traders does not mean you can copy any trader. You should check a few things before choosing a master trader.

Here are a few things I’d check:

1) Past Performance: One thing I have to avoid is choosing a trader based on short-term performances. If I am going to choose a trader to copy, I want to know how he has been doing long-term. His current performance is not an indicator of past or future performances. Going through past performances in detail will help me make a good choice. A master trader with a solid long-term performance is what I want.

2) Risk Profile: It is important I know the risk appetite of my master trader. I do not want to lose my trading capital because my master trader takes too much risk. So, what do I do? All I have to do is check his profit charts. Steady growth on the chart tells me that he has a strategy he sticks to. I will choose such a trader.

If I see a master trader with swing highs and swing low on his profit chart, chances are that he has no long-term working strategy.

3) Floating Profits: A master trader wants to rank higher. To achieve this, they do not close their losing trades. If the losing trades are not closed, they are not factored into their overall performance. To make sure I do not fall for this is why I check floating profits. I will be able to see the masters’ running trades and their performance.

How do you Copy Trade?

The steps required to begin copy trading are simple. To explain clearly, we will use Octa as an example.

-

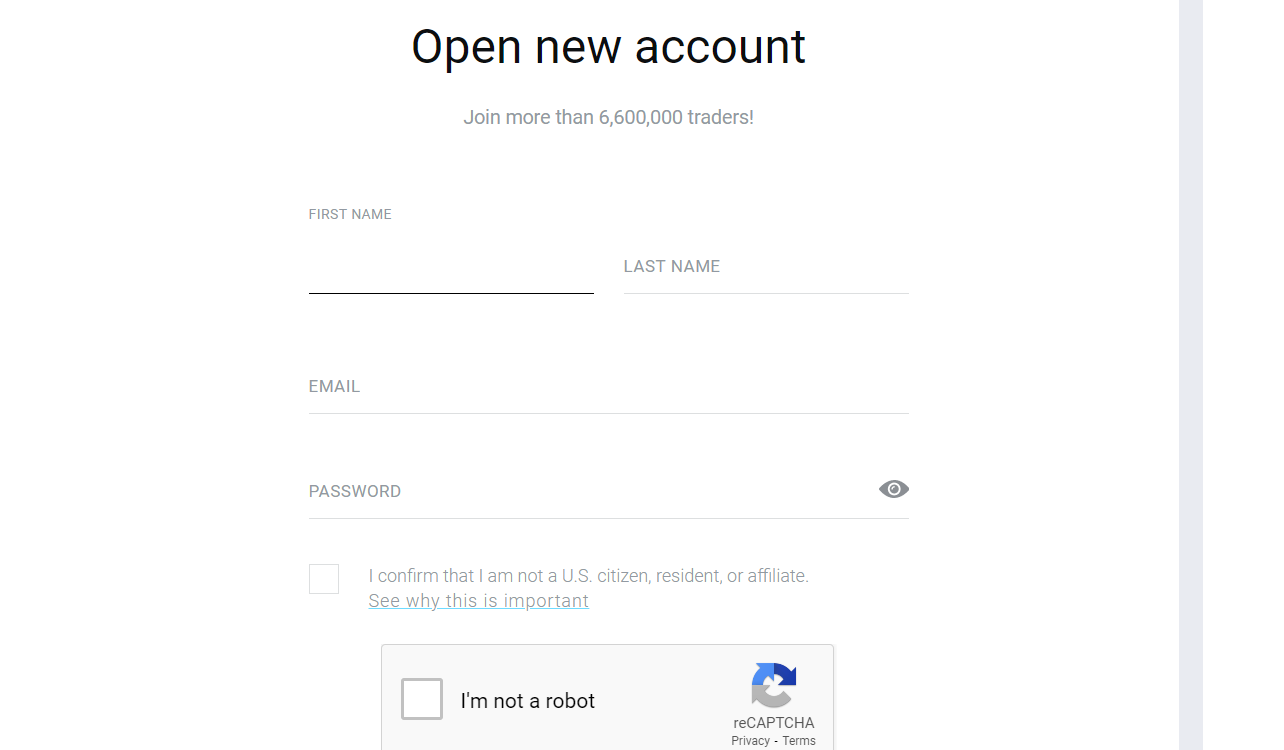

Open Account: In opening a copy trading account, you have to enter your name in full, a valid e-mail, and a password of your choice. A picture of the page is shown below. You can also do this on the copy trading app.

-

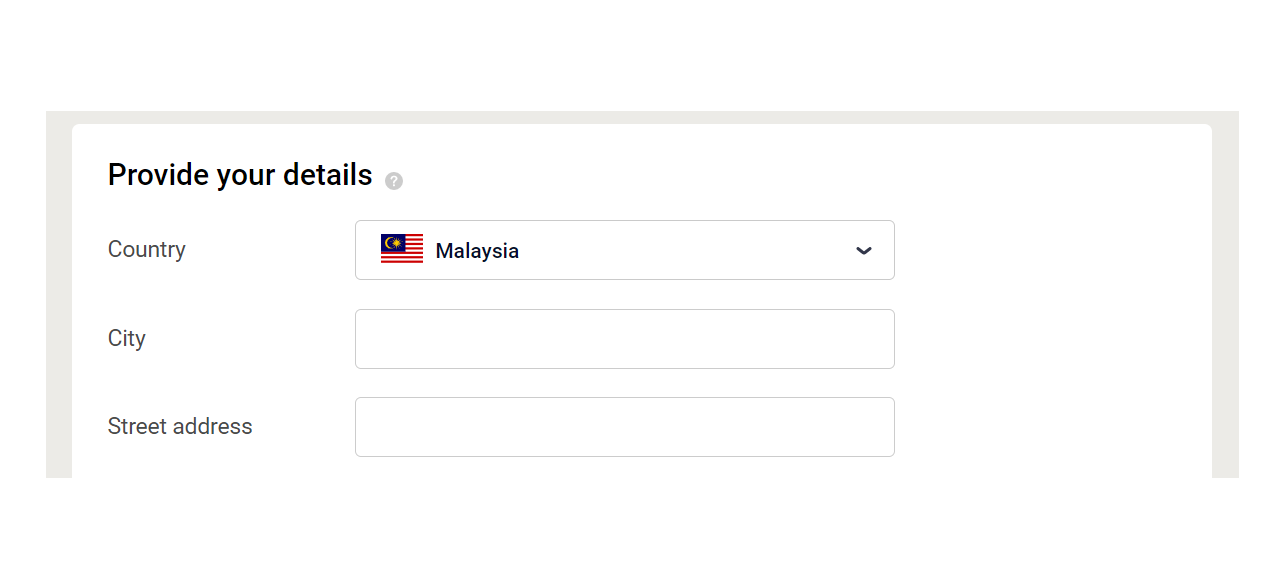

Complete KYC: KYC is short for know your client. All you need to do here is submit ID documents and your birth certificate. You must pay attention to the requirements on the broker’s website. You will complete your KYC quickly if you do. The documents required for your ID verification are ID documents, residence permit, driving permit, and passport. You are required to submit one of these for ID verification.

-

Fund your Copy trading account: Once your documents are verified, you can then proceed to fund your account. All you have to do is navigate to the payment page. Choose your payment method and fund your account. The deposit/withdrawal tab is shown in the picture below.

-

Choose the Traders to copy: Now that your account is funded, you can proceed to choose the traders you want to copy. Octa provides a list of Master traders you can copy. You will see clearly on the page the Master traders’ gain and the number of copiers. Here is a picture of how it looks like below.

Can I copy trade with Islamic accounts?

Yes, you can copy trade with Islamic accounts! Several popular platforms offer copy trading services compliant with Sharia law principles, making it possible for Muslim traders to participate in financial markets while adhering to their religious beliefs.

Here’s what you need to know about copy trading with Islamic accounts:

What are Islamic accounts?

Islamic accounts adhere to Sharia law, which prohibits earning or paying interest (riba). Traditional trading practices often involve rollover fees or interest charges on overnight positions, which are incompatible with Sharia principles.

How do Islamic copy trading accounts work?

Islamic copy trading accounts avoid interest-based charges through alternative fee structures. Some common methods include:

1) Fixed fees: A fixed fee is charged for each copied trade, regardless of the holding period.

2) Profit-sharing: Instead of interest, a platform or signal provider may share a portion of the profits generated from copied trades.

3) Mark-up fee: A small markup is added to the spread on copied trades to generate revenue.

Platforms for Islamic copy trading:

Several forex CFDs trading platforms in Malaysia cater specifically to Muslim traders, offering Islamic accounts and copy trading services. Some of the forex brokers that offer Islamic Accounts with swap-free trading on forex and CFDs are Octa, HF Markets, AvaTrade and XM Trading.

You can read more about trading with Islamic Forex brokers on our post Best Islamic Forex Brokers in Malaysia.

What features are important to consider when choosing a copy trading platform?

Picking a copy trading platform is important as your chosen platform will affect your trading and performance. Selecting a platform whose features and offerings align with your preferences is important. Here’s what to look out for when choosing a copy trading platform:

1) Regulation: First things first, is the platform legit? Make sure to choose a copy trading platform that is regulated – this adds a safety layer, as financial regulators usually mandate forex brokers to protect clients’ funds.

2) Available Instruments: Next, what kind of instruments would you be trading, stocks, forex or indices? You should choose a platform that offers a variety of assets to copy.

3) Master Trader: The person whose trade you will copy is equally important. You should check out their previous performances, risk profile and floating profits. A good platform will show performance history to help you pick someone who consistently delivers.

4) Fees: No one likes hidden charges. Make sure the platform is transparent about subscription fees, any performance fees taken from your profits, and regular trading commissions.

5) Interface: You should check out the platform interface to be sure it is easy to navigate. A user-friendly platform is key as it allows you to easily monitor trades and make adjustments without confusing menus.

6) Account Options: Some platforms might offer standard and Islamic accounts, for different clients with varying features. Make sure to pick a platform that fits your style. Plus, consider the minimum deposit/investment required – is it something you’re comfortable with?

7) Customer Support: Last but not least, Good customer support is key. The platform should offer reliable support channels in case you have questions. The best platforms will be those with 24/7 customer support.

What is the Difference between Social Trading and Copy Trading?

Social trading is not the same as copy trading. With social trading, it is all about community. You join other traders in communicating and sharing of trading ideas and strategies. The goal of social trading is learning.

You will find different levels of traders in a community. It could be a mix of beginners, intermediate, and expert traders. When you are active in this kind of community, you get to speed up your learning process. You make rapid progress because of the different ideas being shared by other traders. Your trading skills and knowledge improve.

Copy trading is like a service offered by your broker on their trading platform. Though it might involve other traders, the goal is not learning or sharing ideas. Rather, it is to copy the trades of successful traders that you choose.

The process could be manual or automatic. Analyzing and trading the financial markets takes a lot of time. Through copy trading, you can save time. You do not need a deep knowledge of the financial markets to use copy trading. Just few clicks on your trading platform and you are in.

In summary, social trading focuses on developing your skills while copy trading gives you a time-saving way into trading.

How to Create a Copy Trading Strategy

Here are some tips to help you develop your copy trading strategy:

1) Focus on consistency. It is important that you don’t focus on returns in terms of figures. You should avoid traders who name absolute returns like $100, $200 etc. This can make you think there it is possible to know make profit every time. Instead, focus on consistent returns over a long period of time.

2) Some copy trading platforms provide the statistics of signal providers. You should review these statistics so you can see how a provider performs. Check how many trades the enter. Also check how many they win or lose on average. You can also check how long they hold a trade. These will help you see a signal provider is a fit for you.

3) Work with your trading goals. Copy trading, like normal trading gives you access to different CFD markets. However, not all markets or CFDs will align with your trading goals. While it is good to diversify across markets, it is advisable that you diversify according to your goals.

4) Incorporate risk management. Greed is one of the emotions that cause forex traders to lose money. Do not allot the bulk of your capital to a single trade. Do not copy a signal provider with a poor risk score. Do not trade CFDs with high lot sizes.

Is Copy Trading Profitable?

Copy trading is not free of risk. However, losses or profits are determined by the trader you copy. Since their result is your result as well, if they win, you win. So you must be thorough when choosing the trader you want to copy.

Furthermore, previous performances do not guarantee future results. A trader might be profitable over a period, then a string of losses might follow. The fore market is volatile and there are cycles. If the trades you copy do not go with current cycle, you are at risk of losses.

FAQs on Copy Trading Brokers in Malaysia

Is copy trading a good idea?

It depends. You should be aware that copy trading does not necessarily mean that you will see a profit. Even top copy trading strategists may lose money. You should be very careful of who you’re following or copying. Hence, you should understand the strategy and the risk profile of the trader you’re copying. You can do this by checking the average drawdown, risk per trade, etc. of the trader.

How does Copy Trading work?

Copy trading allows you to view and copy the trades of more experienced traders.

Essentially, rather than make and follow your own trading strategy, you can make trades based on a different trader whom you trust. If you’re copy trading, then you will be charged additional fees by the broker and some parts of your profit will go to the trader whom you’re copying. There are several forex and CFD brokers that offer copy trading services.

Can you make money from Copy Trading?

Yes, it is possible to make money from copy trading. However, you should remember that copy trading is inherently risky and you could also lose money. You should never bet more money than you can afford to lose.

How Much Does it Cost to Start Copy Trading?

The cost of copy trading depends on the copy trading broker that you choose. The broker will ask for a minimum account deposit at the time of account opening, spreads, and commission. Further, some brokers charge an extra commission for copy trading services. You can start copy trading for as low as MYR 45.

Which Brokers is Best for Copy Trading?

According to our research, Octa is currently the best copy trading platform that accepts traders from Malaysia. They are a reputable broker and their copy trading services are cost-effective. They have a large pool of expert traders that can be copied and their platform is easy to use.