| Plus500 Minimum Deposit Summary | |

|---|---|

| Plus500 Minimum Deposit | RM500 |

| Deposit Methods | Credit/Debit Cards, Bank Wire transfer, PayPal |

| Account Types | Plus500 CFD Trading Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, MYR |

| Withdrawal Fees | No Fees |

| Visit Plus500 | |

Plus500 minimum deposit in Malaysia is RM500.

We have detailed everything you need to know about payment methods that are supported by the CFDs broker for deposits and withdrawals as well as the processing time, deposit fees and how you can add money to your account.

What is the minimum deposit on Plus500?

The minimum deposit amount on Plus500 in Malaysia is 500 MYR. This minimum deposit amount applies to cards and e-wallets (Skrill). The minimum deposit for bank transfers on Plus500 is 2,000 MYR.

Plus500 has only one account type, the Retail Account, however, if you are an experienced trader and you meet the criteria, you can be invited to operate a Premium Account, which is an invite only account with more support such as personal account manager. Once you become eligible, they send an invitation and you can choose to accept or reject the invitation.

Accepted Deposit Methods on Plus500 Malaysia

Plus500 offers a range of ways to deposit into your trading account:

1) Bank Wire Transfers: You can deposit on Plus500 through bank transfers. The minimum required amount is RM2,000 and it takes up to 5 business days for the funds to be reflected in your trading account. Plus500 does not charge any fees when deposit through your bank account.

Plus500 also allows you to withdraw funds to your bank account, the minimum you can withdraw to your bank account is RM400, this takes about 3 business days to process on Plus500 and can take between 3 to 7 business days for the funds to reach your bank account. Plus500 does not charge any withdrawal fee for this method.

2) Credit/Debit Cards (Visa, MasterCard): Bank cards are another accepted payment method on Plus500, with a minimum requirement of RM500. Deposits via cards are credited instantly to your trading and no deposit fees are charged.

You can also withdraw funds to your bank cards, the minimum amount supported is R4M00 and it takes about 3-7 business days for the funds to be added to your card after you initiate a withdrawal on the platform. Withdrawals are also free of charge as the broker charges no fees for this.

3) E-wallets (PayPal): Another popular method for making deposits on Plus500 are e-wallets, the minimum amount needed to deposit using this method is RM500 as well, the deposits are reflected instantly on your trading account, and no fees are charged.

You can also withdraw money to your e-wallets from Plus500, the minimum withdrawal amount on Plus500 for e-wallets such as PayPal is RM200. Withdrawals are processed within 3 business days and can take 3-7 business days before you receive the money in your e-wallet.

Note: CFD trading is risky

Plus500 Deposit Methods Table

Here is a summary of payment methods accepted by Plus500 for deposits.

| Deposit Methods | Availability | Minimum Deposit | Charges | Processing time |

|---|---|---|---|---|

| Internet banking/bank transfers | Yes | RM2,000 | Free | Up to 5 business days |

| Cards | Yes | RM500 | Free | Instant |

| E-wallet | Yes (PayPal) | RM500 | Free | Instant |

Plus500 Deposit Rules

1. Deposit Fees: Plus500 does not charge any fee on the deposits you make on the platform. This means that the full amount you deposited will be reflected in your trading account. However, your payment processor, bank or card issuer may charge an independent fee during deposit or withdrawal.

2. Deposit Time: While you can deposit funds to your account at any time, the deposit method used determines how soon the funds are added to your trading account for you to use. Deposits made via cards and e-wallets are reflected in your trading account immediately, while bank transfers can take up to 5 business days for the funds to be reflected.

3. Payment Source: Plus500 will only credit funds to your account if the depositing bank account, card or e-wallet has the same name as the name on your trading account. Third party deposits are not allowed.

You can deposit from a joint account you co-own with someone else, but you will need to provide documents to prove this, in addition to the standard identity and address verification required during registration.

How do I deposit money into my Plus500 account?

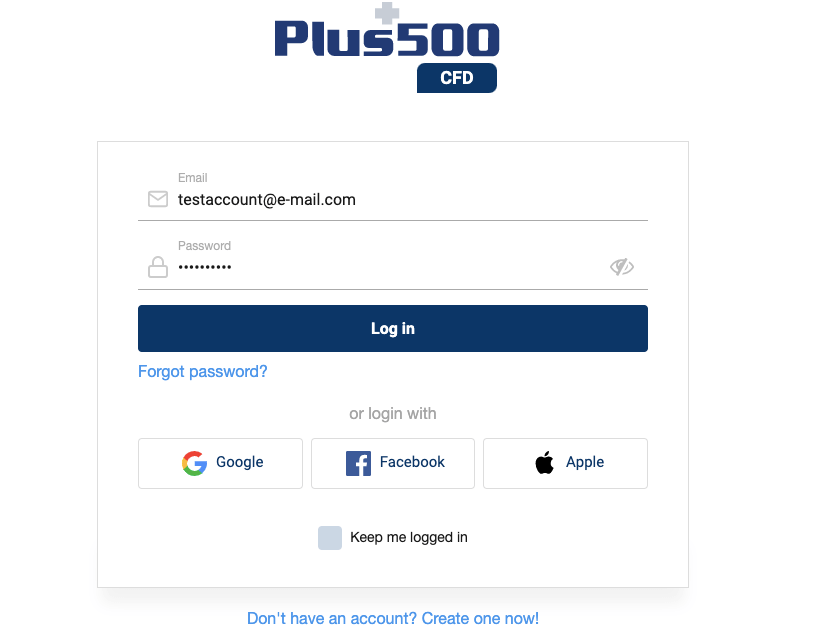

Step 1: Login to your Plus500 account dashboard via app.plus500.com.

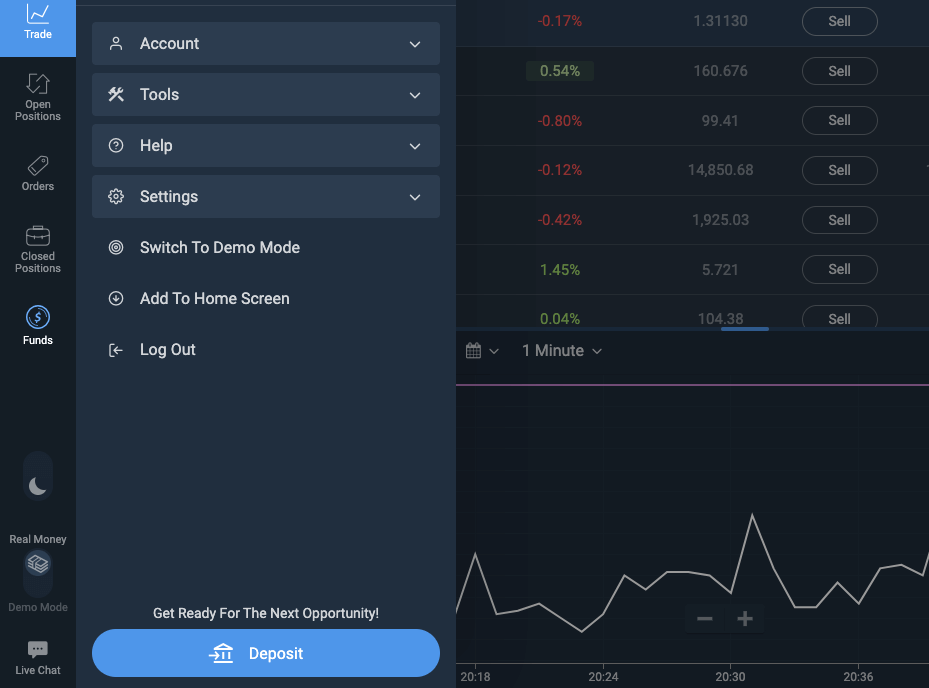

Step 2: Once logged in, click on the left-side menu tab and select the ‘Deposit’ link there.

Step 3: Select the payment method you want to use to deposit the funds.

Step 4: Enter the amount you want to deposit, then click on the ‘Deposit’ button under to complete the process.

Comparison Of Plus500 Minimum Deposit With Other Brokers

Here is a comparison of Plus500 minimum deposit with that of their competitors.

| Broker | Minimum Deposit |

|---|---|

| Plus500 | RM500 |

| Octa | RM100 |

| Exness | RM48 (US$10) |

| HF Markets | RM50 |

| AvaTrade | RM473 (US$100) |

Note: CFD trading is risky

What base currencies are accepted by Plus500?

The following tools are base currencies are available at Plus500: USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, ZAR, SGD.

How much does Plus500 charge for deposit?

Plus500 have zero deposit fees. They do not charge you for these transactions. Any charges you see is from your bank or from the company that issued your card.

Plus500 Minimum Deposit Malaysia FAQs

What is the minimum deposit for Plus500?

RM200 is the minimum deposit required to start trading on Plus500 in Malaysia. This amount applies to cards and e-wallets (PayPal) only. The minimum deposit for deposits via bank transfers or PayNow is RM500.

Can you use Plus500 in Malaysia?

Yes, Plus500 is available in Malaysia as per our Plus500 review. Malaysian traders are registered under Plus500SEY Ltd., which is regulated by the Financial Services Authority of Seychelles.

How long does it take to withdraw money from Plus500?

3-7 business days is the typical time it takes for all withdrawals initiated on the platform to get to your bank account, e-wallet or card. The internal team processes the withdrawal within 3 business days.

What is the minimum withdrawal from Plus500 Malaysia?

RM400 is the minimum withdrawal amount if you are withdrawing to cards or your Malaysian bank account or card. Withdrawals to e-wallets like Skrill require a minimum amount of RM200.

Does Plus500 have withdrawal fees?

No, Plus500 does not charge any withdrawal fees when taking out funds from your trading account. The amount you withdraw is what will sent to your chosen payment method (bank, card or e-wallet). However, not that your payment processor or bank may charge an independent fee.

How do I put money on Plus500?

To add money to your Plus500 account in Malaysia, simply log in to your dashboard, select the deposit link in the left side tab, then choose your preferred deposit method, enter the amount you want to deposit and click on the ‘Deposit’ button on the page to complete the process.

Does Plus500 have deposit fees?

No, Plus500 does not charge any fees when adding money to your account, all deposits are free, but your bank, card issuer or payment processor may charge their own separate fees.

Note: Your capital is at risk