| FxPro Minimum Deposit Summary | |

|---|---|

| FxPro Minimum Deposit | $50 (MYR 234) |

| Deposit Methods | Bank Transfer, Broker-to-Broker, Skrill, Credit/Debit cards |

| Account Types | Standard Account, Pro Account, Raw+ Account, Elite Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD |

| Withdrawal Fees | No Fees |

| Visit FxPro | |

FxPro’s minimum deposit is $50 (MYR 234). There are four live account types with FxPro Malaysia. These accounts are have a lot of differences. Essentially, they all vary by their initial deposits.

However, they differ by trading instruments and other important factors. In this article, we cover all of FxPro’s trading accounts, their minimum deposit for Malaysian traders, and how you can fund your account.

Beyond this, you will also know the costs/fess you might incur when funding your trading account.

How Much is FxPro’s Minimum Deposit in Malaysia?

Here, we will be showing you what our teams of researchers found on FxPro Malaysia’s account types. More peculiarities of these accounts are covered in our FxPro review

Let ‘s go.

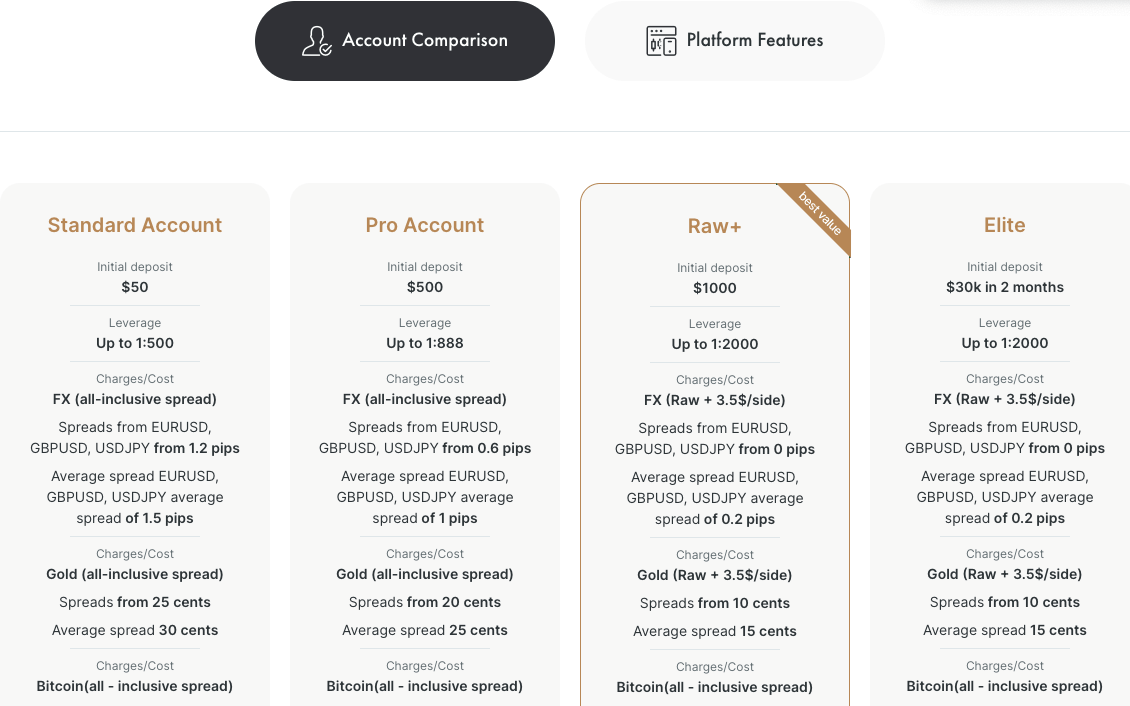

1) Standard Account

The minimum deposit for the Standard Account is $50 (MYR 234). The FxPro Standard Account caters to traders of all levels and is accessible through the MT4 & MT5 trading platforms.

It offers trading opportunities on CFDs like forex pairs, indices, futures, metals, energies, and shares.

With this account, you will not be charged commissions for opening or closing trade positions. Instead, it operates on spread-only basis. The spreads commence from 1.2 pips for major forex pairs.

2) Pro Account

The minimum deposit for the Pro Account is $500 (MYR 2,342). The FxPro Pro Account, tailored for retail traders, operates on the MT4 trading platform.

With trading opportunities across currency pairs, indices, futures, metals, and energies, cryptocurrencies, and shares. It has two asset classes more than the Standard Account.

It is a zero commission account. Instead, it features spreads starting at 0.6 pips for major forex pairs. Additionally, if you hold a trade position beyond the market’s closing time, rollover charges (swap) will be incurred.

3) Raw+ Account

You can open FxPro’s Raw+ Account with $1000 (MYR 4,684). The FxPro Raw+ Account is for you if you prefer MT4 and reduced spreads. All the CFDs on the Pro Account are supported on this account

Per standard lot of forex and metals you trade, you will pay a commission starting from $3.50 .Other instruments are commission-free. Spreads start from 0.0 pips for major forex pairs.

Additionally, swap fees are applicable if you maintain a trade position beyond the market’s closing time.

4) Elite Account

The minimum deposit for the Elite Account is $30,000 (MYR 140,535) in two months.

The FxPro Elite Account is for seasoned traders who trade in high volume. Accessible through the MT4 trading platform, you can trade CFDs on currency pairs, indices, futures, metals, energies, cryptocurrencies, and shares.

Under the Elite Account, commission fees amount to $3.50 per side lot for forex and metals trading, The remaining CFD instruments are commission-free.

Spreads are ow and they from 0.0 pips with. You will pay a rollover fee for holding trades past market closing time.

Note: CFD trading is risky

5) Swap-free Account

All of FxPro’s four live accounts are available as a swap-free account. This is an account for those that cannot pay or receive interests due to religious beliefs. It is an Islamic, Shariah compliant

The trading conditions and the minimum deposits remain the same. The only difference is that the account is interest free.

Does FxPro have a Recommended Minimum Deposit?

By recommendation, FxPro suggests you fund your account with a minimum deposit of $1000 (MYR 4,684). However, the minimum deposit for each account is enough for you to start trading.

FxPro Deposit Methods and Required Fees

FxPro’s funding methods depends on your region. In Malaysia, FxPro supports three deposit methods for CFD traders. None of these methods allow funding in Malaysian Ringgit (MYR). Here are the methods:

1) Bank transfer: FxPro supports deposits via local banks. No extra charges from the broker.

2) Broker-to-Broker: You can fund your FxPro Account with your funds held with another broker.

3) Credit/Debit Cards: FxPro accepts cards from Visa, MasterCard, and Maestro. There is no commission on your transactions with this method. Processing is within 10 minutes.

4) Skrill: FxPro supports Skrill as an e-wallet funding method.

Note: FxPro does not charge for funding. However, your may be subjected to fees from banks involved in the case of bank transfers.

FxPro Deposit Terms

1) You cannot hold FxPro liable for any delay of processing that is out of their control. Wait for one hour to see if your credit/debit card transaction was successful.

2) Length of processing are for indicative purposes only.

3) You will not incur a fee fir refunds if you request for a refund within six months of depositing money to your account.

4) FxPro does not accept payments from third party, Fund with cards or banks carrying your name only.

How to Deposit Money Into Your FxPro Account

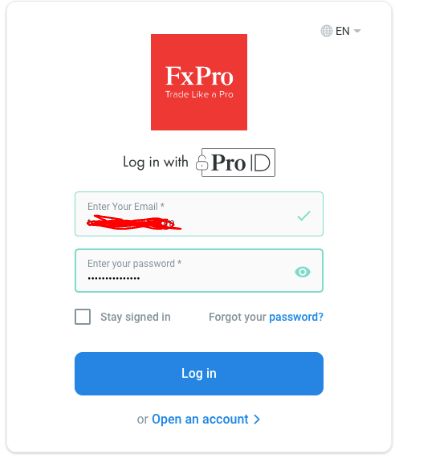

1) Log in to FxPro Direct with your email and password.

2) Click “Wallet” then click the ” Deposit” button.

3) Choose your the funding method that suits you.

4) Enter the amount you want to deposit. Fill out payment details and follow the prompts on screen to confirm payment.

5) When your transaction is approved, your fund will reflect in your trading account.

Comparison Of FxPro Minimum Deposit With Other Brokers

| Broker | Minimum Deposit |

|---|---|

| FxPro | $50 (MYR 234) |

| XM | $5 (MYR 23) |

| Plus500 | MYR 500 |

| HF Markets | $5 (MYR 23) |

| IC Markets | $200 (MYR 936) |

| FXTM | $10 (MYR 46) |

Note: CFD trading is risky

What base currencies are accepted by FxPro?

FxPro accepts the following currencies: EUR, GBP, USD, CHF, JPY, PLN, and AUD.

Frequently Asked Questions

What is the minimum account for FxPro?

FxPro supports five account types. You can choose the one you prefer via FxPro Direct.

What is the minimum trade size for FxPro?

All of FxPro’s accounts allow you trade 0.01 minimum lot size.

Can you withdraw from FxPro?

You can withdraw funds from FxPro by logging in to your wallet through FxPro Direct.

How long does it take for FxPro to deposit money?

The speed of your transaction depends on your funding method. Credit/debt card has the shortest indicative time at 10 minutes.

Note: Your capital is at risk