AvaTrade has partnered with Friedberg Direct to offer forex and CFD trading services in Canada. In this review, we’ll be referring to this broker as AvaTrade. AvaTrade has been in operation since 2006 and has a global presence along with being well-regulated.

AvaTrade is regulated in Canada by the CIRO which is the regulatory organisation in Canada that oversees investments. Further, group entities of the broker are licensed in the European Union, in Australia, in Japan, in the British Virgin Isles, and so on.

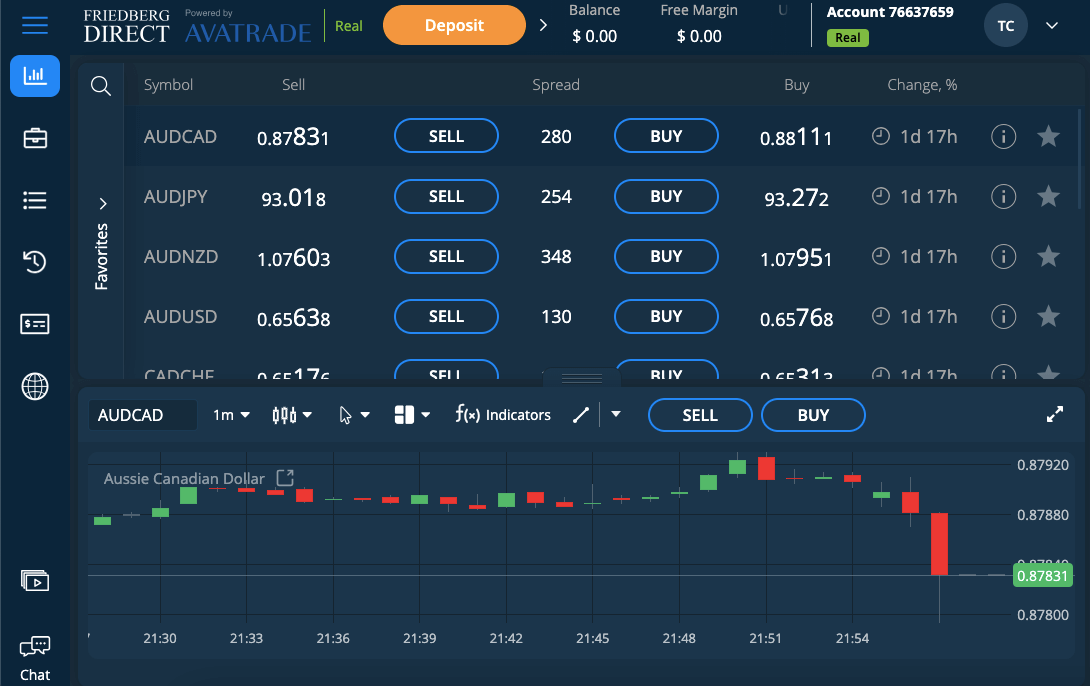

AvaTrade offers a wide range of trading platforms to choose from including the highly popular MetaTrader 4 and MetaTrader 5 platforms.

In this review, we’ll be covering everything you need to know about AvaTrader’s services in Canada along with pros and cons, customer support, safety, overall fees, and more.

| AvaTrade Review Summary | |

|---|---|

| 🏢 Broker Name | Friedberg Mercantile Group Limited |

| 📅 Establishment Date | 2006 |

| 🌐 Website | https://www.avatrade.ca/ |

| 🏢 Address | 220 Bay St., Suite 600, Toronto, Ontario, Canada M5J 2W4 |

| 🏦 Minimum Deposit | CAD 150 |

| ⚙️ Maximum Leverage | 1:33 |

| 📋 Regulation | CIRO, ASIC, Japan, DFSA, FSCA |

| 💻 Trading Platforms | MT4, MT5 for PC, Mac, Web, Android, & iOS |

| Visit AvaTrade | |

AvaTrade Pros

- Regulated in multiple jurisdictions including Canada

- Offers negative balance protection for retail clients

- Offers commission-free trading on all instruments

- Does not charge any fees for deposits or Withdrawals

AvaTrade Cons

- Does not offer ETFs or cryptos instruments

- Charges dormant account fees

- Slow processing of deposits & withdrawals via bank transfers

Is AvaTrade Safe for Traders from Canada?

AvaTrade has partnered with Friedberg Direct in Canada. Friedberg Direct is regulated by the Canadian Investment Regulatory Organization (CIRO). This means that they are mandated to follow the requirements of CIRO while offering their services to Canadians.

Any Canadian can start legal proceedings against the broker in case they do not follow the law or rules or regulations of the country. Hence, traders can hold the broker accountable for its actions, which means that they are protected against fraudulent practices.

Further, AvaTrade’s group entities are regulated around the world by reputed financial authorities which is a point in their credibility.

Here is a breakdown of the licenses held by AvaTrade:

1) Canadian Investment Regulatory Organization (CIRO): AvaTrade operates in Canada through a license of Friedberg Mercantile Group Limited, which is a member of the CIRO, which is the self-regulatory organisation in Canada that oversees investments and mutual fund dealings in the country. AvaTrade’s operations in Canada are subject to the rules and regulations promulgated by the CIRO.

Note that CIRO was formerly IIROC (Investment Industry Regulatory Organization of Canada).

Friedberg Mercantile Group Limited is also registered with the Canadian Investment Protection Fund (CIPF) that covers losses that is caused by the broker’s misconduct, up to $1 million.

2) Australian Securities and Investment Commission (ASIC): AVA Capital Markets Australia Pty Limited is licensed by the ASIC of Australia under the license number 143340907.

3) Financial Services Conduct Authority: Ava Capital Markets Pty Limited is licensed by the FSCA of South Africa and holds the license number 45984. This license was issued in 2015.

4) Financial Regulatory Services Authority (FRSA) of Abu Dhabi Global Markets (ADGM): Ava Trade Middle East Limited has been licensed by the FRSA of Abu Dhabi with the permission number 190018. They recently received the license in 2020.

Further, AvaTrade is also licensed in Japan (as Ava Trade Japan KK) and in Israel (as Ava Trade Limited).

Traders should know that AvaTrade implements safety practices in Canada such as negative balance protection and segregation of funds.

AvaTrade Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Canada | $1 million | Canadian Investment Regulatory Organization (CIRO) | Friedberg Mercantile Group Limited |

| Ireland | €20,000 | Central Bank of Ireland | AVA Trade EU Limited |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Ava Capital Markets Australia Pty Ltd |

| Other countries | No Protection | Financial Services Commission (FSC), British Virgin Islands (BVI) | Ava Trade Markets Ltd |

AvaTrade Leverage

The leverage offered by AvaTrade depends on the type of instrument being traded and the trading platform being used. Traders from Canada using the MetaTrader 4 or MetaTrader 5 trading platforms can experience a leverage of up to 1:33.

The leverage offered by AvaTrade is quite low due to the rules and regulations implemented by the CIRO of Canada. The low leverage means that traders operate in a relatively low-risk environment.

Leverage magnifies the potential profit or loss associated with a trade. With a leverage of 1:33, a trader can trade instruments worth $33,000 while just using $1,000 of their own money.

Note that the AvaTrade Maximum leverage of 1:33 applies to major pairs such EURUSD, other pairs and instruments have lower maximum leverage. The maximum leverage when trading on MetaTrader is 1:20.

It is important that you do not use all the available leverage, as this would increase your risk and you can lose all your money. Only engage in CFDs trading if you understand it and have experience.

AvaTrade Account Types

There are two types of accounts that traders can choose from: the Retail account and the Professional account.

Further, AvaTrade also offers demo account and Islamic accounts.

We will discuss all of them below:

1) Retail account: The default account type offered by AvaTrade is the Retail account. This account is meant for new traders and beginners and intermediate traders. The Retail account offers a wide variety of instruments such as currency pairs (forex), stock CFDs, commodities, metals, ETFs, and indices.

The maximum leverage that Canadian traders can use is 1:33, and it depends on the type of instrument being traded.

They do not charge any commission for trades. Traders only need to pay a spread and swap fees.

To start trading, a trader needs to deposit at least CAD 300 and trade a minimum of 0.01 lots.

2) Islamic account: An Islamic account is also known as a swap-free account. This type of account is meant for traders of the Islamic faith. An Islamic account allows traders to trade without paying any swap-fees (also called rollover interest).

This is because paying interest is forbidden in Islam. After creating and verifying your account get in touch with customer support in order to get convert your trading account to an Islamic status.

Only Muslims can open an Islamic account.

AvaTrade Base Account Currency

AvaTrade offers the CAD as a base account currency. Traders from Canada can choose the USD or CAD as their base account currency. This means that all trades, profits and losses will be in your choose account base currency.

AvaTrade Overall Fees

AvaTrade charges both trading fees and non-trading fees (similar to most other brokers). The fees charged by AvaTrade depends on a variety of factors such as type of account held by the trader and the instrument being traded.

Here is an overview of the overall fees a trader can expect to pay:

Trading fees

1) Tight Spreads – AvaTrade is very transparent about the spreads that they charge. They charge fixed spreads which means that the spreads do not vary depending on the timing of the trade. In order to trade the benchmark EUR/USD currency pair, a trader will be charged a spread of 0.6 pips. This spread is quite tight (cost-effective) compared to most other brokers (which charge an average spread of 1 pips).

2) No Commission – AvaTrade offers commission-free trading for all instruments. This means that the bulk of the trading fees is built into the spread. Hence, the overall trading fees charged by AvaTrade is quite reasonable. However, the commission-free approach may not be suitable for high-volume traders who are looking for minimal spreads and a low fixed commission per trade per lot.

AvaTrade Trading fees Table

Here is a summary of the typical fees AvaTrade charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 0.6 pips | None |

| GBP/USD | 1.0 pips | None |

| EUR/GBP | 1.0 pips | None |

| Gold | $0.21 over market | None |

| Crude oil | $0.02 over market | None |

| US_TECH100 | 1 pips | None |

| US_500 | 0.25 pips | None |

3) Swap Fees – Swap fees apply whenever you keep a trade position open on AvaTrade after midnight, which is the closing time of the market. The fee is based on the total volume of your positions and whether they are long (buy) or short (sell).

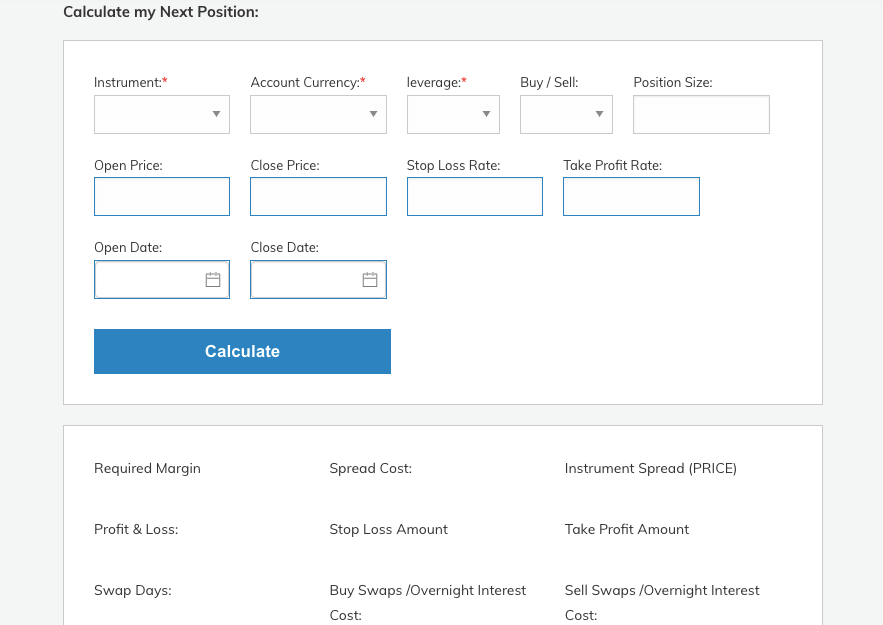

Your daily typical swap costs on AvaTrade for EURUSD on a trade size of 1,000 would be -0.0015% for selling, and -0.0060% for buying. You can calculate this with the AvaTrade Swap Calculator.

Since Islamic Accounts are swap-free, they do not pay any swap fees for a 5-day grace period.

Non-trading fees

1) No Deposit or Withdrawal Fees – AvaTrade does not charge any amount for making a deposit or withdrawal from your trading account. A trader may be charged a payment processing fee by the payment service provider such as the bank or payment wallet.

2) Low Inactivity Fee – AvaTrade does charge an inactivity fee if a trader does not trade for three consecutive months. After the first three months, the trader is charged a fee of around CAD 75 for every subsequent month of inactivity.

Overall, we consider the fees charged by AvaTrade to be reasonable and below average (when compared to other similar brokers).

AvaTrade Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | CAD 75 per month |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee during deposits or withdrawals.

How to Open AvaTrade Account in Canada?

To start trading on AvaTrade, follow the basic steps below to open a trading account.

Step 1: Visit AvaTrade’s website, www.avatrade.ca, and click the ‘Register Now’ or ‘Create Account’ buttons highlighted in orange.

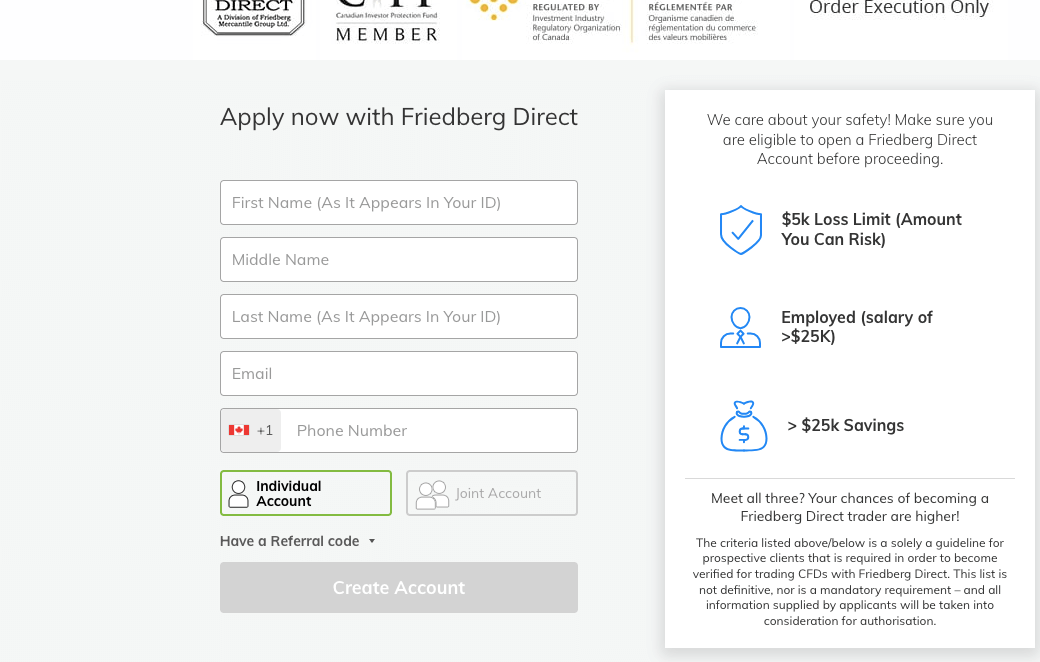

Step 2: Type in your name, email address and phone number on the form that appears. Then click ‘Create Account’ to continue.

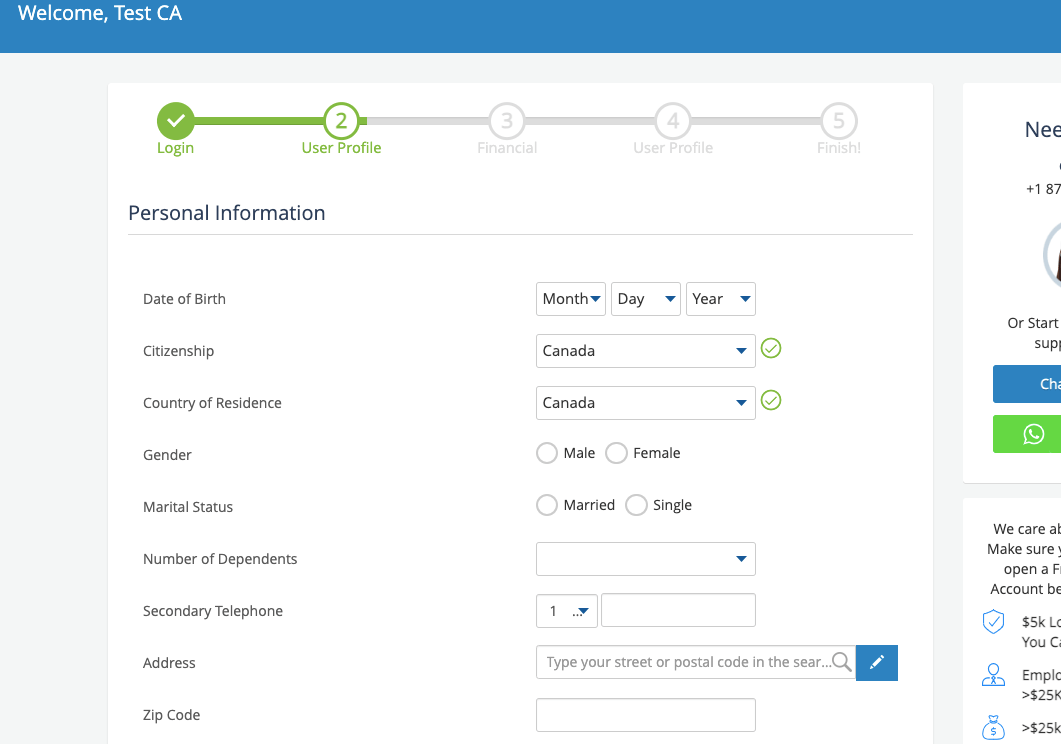

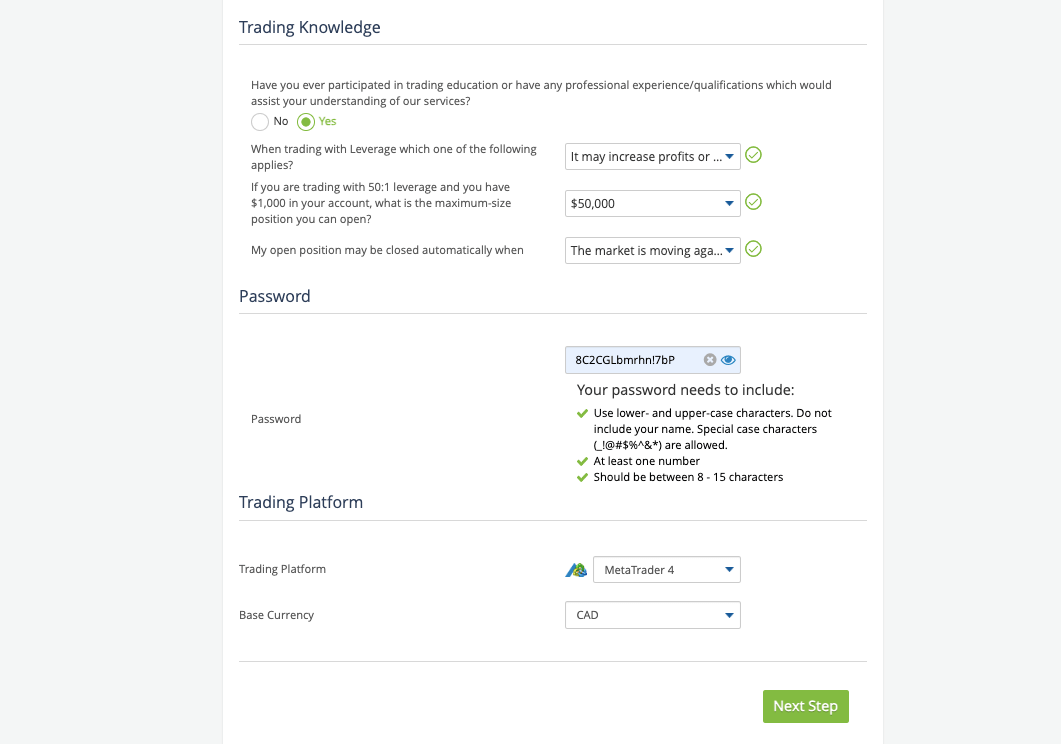

Step 3: Provide some personal details like date of birth, and address, answer questions about your trading experience, set your account password, choose your preferred currency and trading platform, then click ‘Next Step’

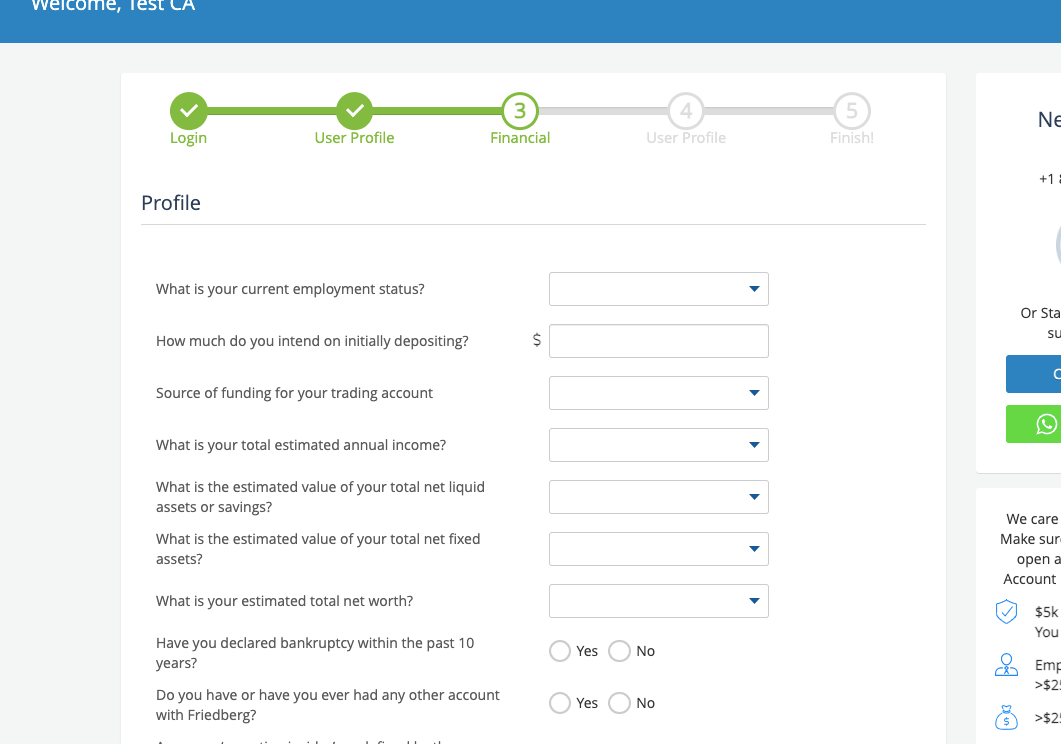

Step 4: Provide details about your employment and income then click ‘Next Step’.

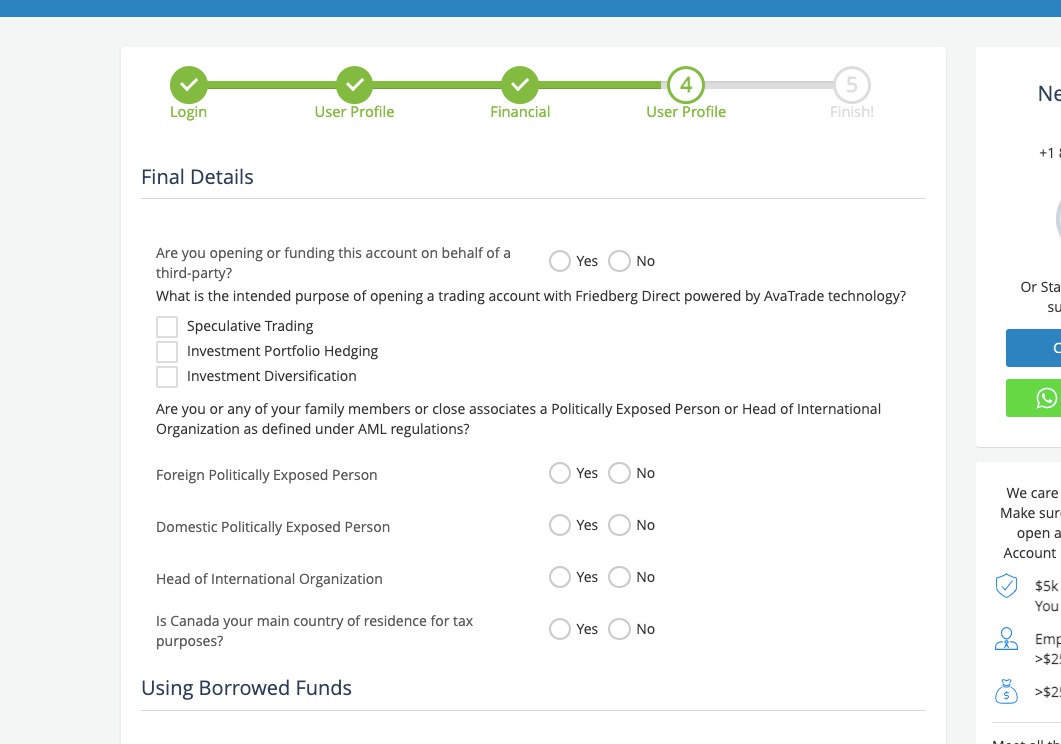

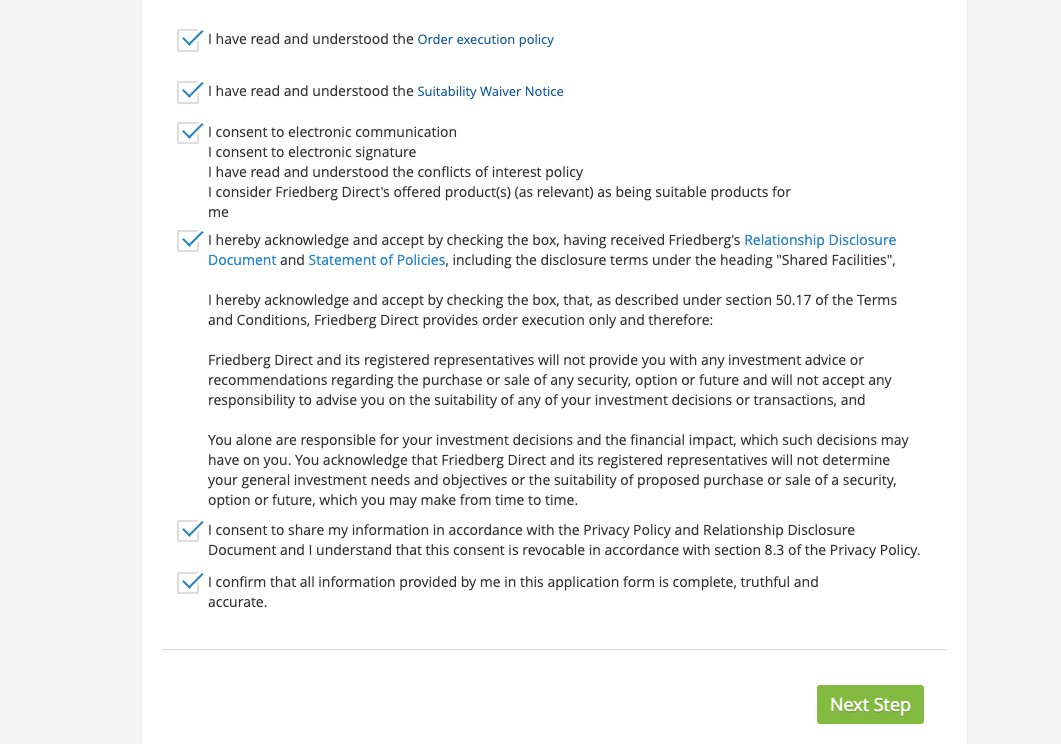

Step 5: Answer questions about your intended purpose for opening the account and how you will fund it, provide your social insurance number, check the boxes to accept the terms and conditions then click ‘Next Step’.

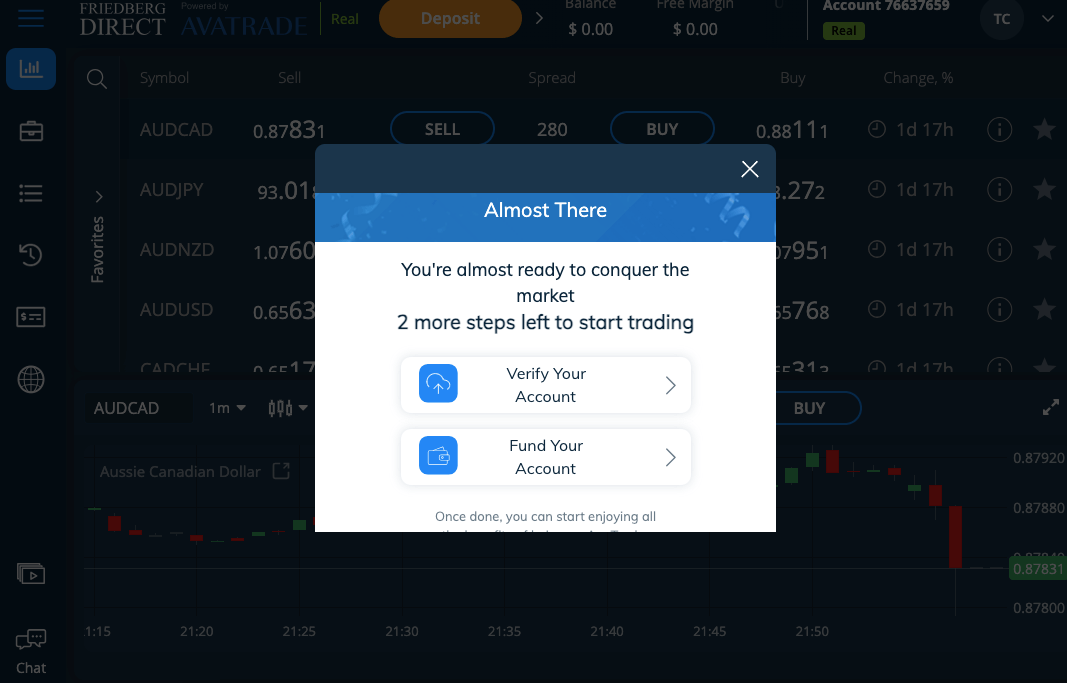

Step 6: Review the information you have provided then click on ‘Submit’. You will be redirected to AvaTrade account dashboard and required to verify your account.

Once you verify your account, you can add money to your trading account, begin to trade, and withdraw funds.

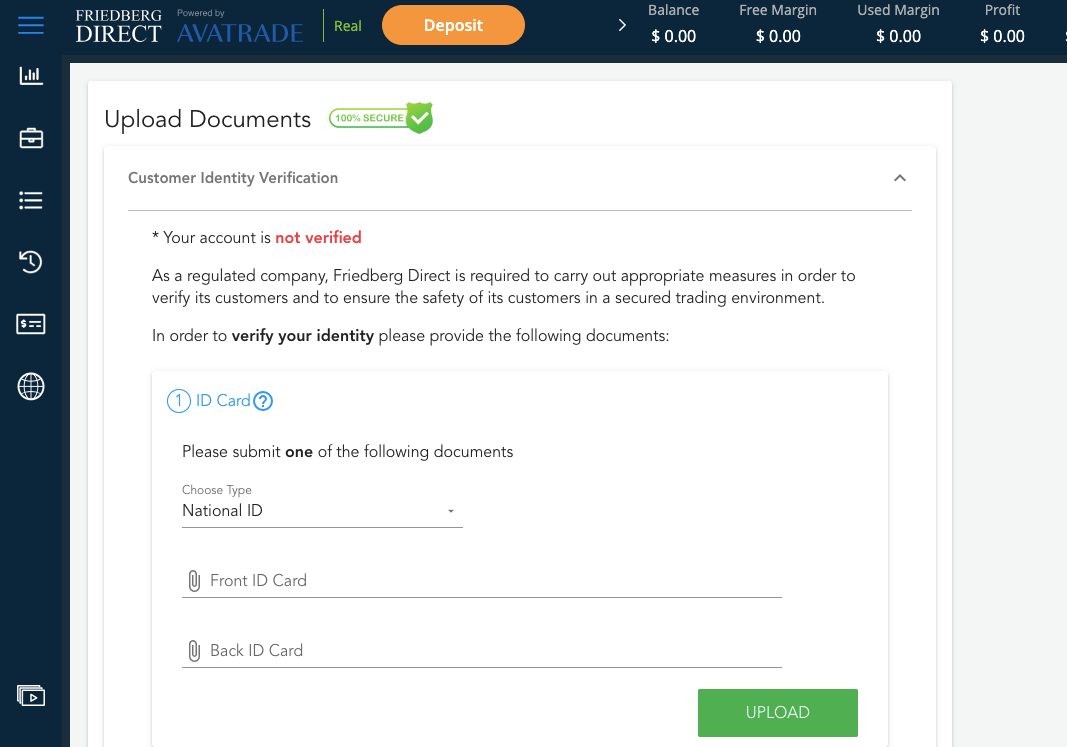

Step 7: Click on ‘Verify Your Account’, then upload an ID card, utility bill, financial related document and W8 BEN Form. After uploading these documents, the AvaTrade team will review them and activate your account.

Once you verify your account, you can add money to your trading account, begin to trade, and withdraw funds.

AvaTrade Deposits & Withdrawals

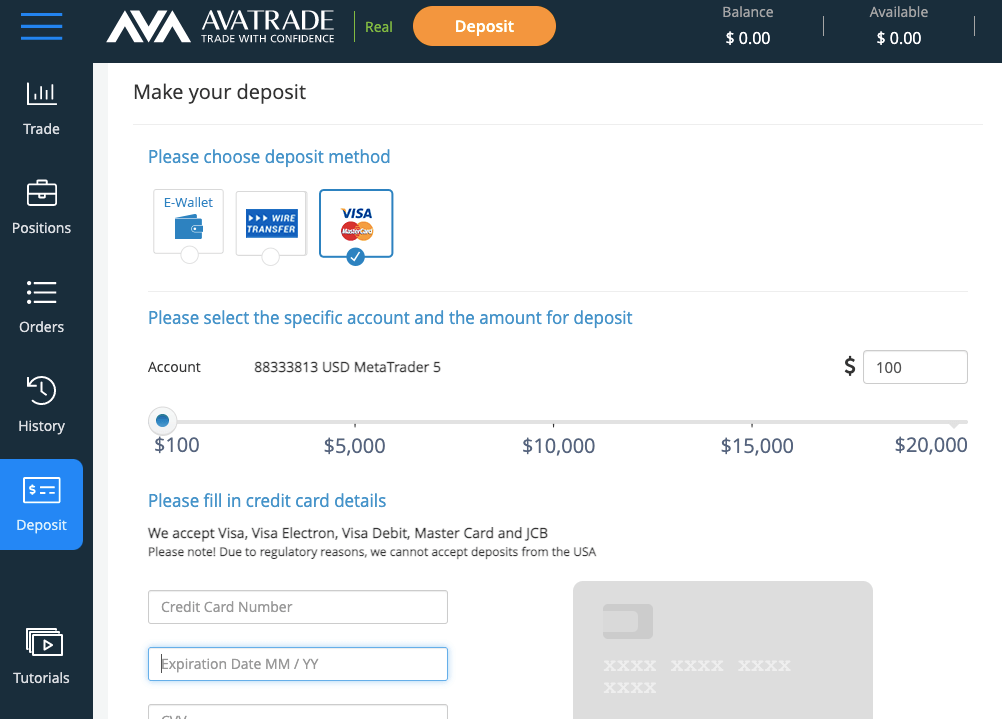

AvaTrade accepts the following payment methods for deposits and withdrawals: credit/debit cards, Skrill, Neteller, and bank wire transfers. These methods are visible on the deposit and withdrawal page of your account.

Below we have provided an overview of deposits and withdrawals on AvaTrade.

AvaTrade Deposit Methods

Here is a summary of payment methods accepted by AvaTrade for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | Up to 10 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | 24 hours |

AvaTrade Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on AvaTrade.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | up to 10 business days |

| Cards | Yes | Free | 24-48 hours |

| E-wallets | Yes (Skrill, Neteller) | Free | 24-48 hours |

What is AvaTrade minimum deposit?

AvaTrade’s minimum deposit is C$300 or 100 units of your base account currency for all payment methods.

For faster bank transfer processing, you can contact support with your proof of payment.

When you deposit for the first time with a card, it can take up to 24 hours to be credited due to security checks.

How do I deposit money to AvaTrade?

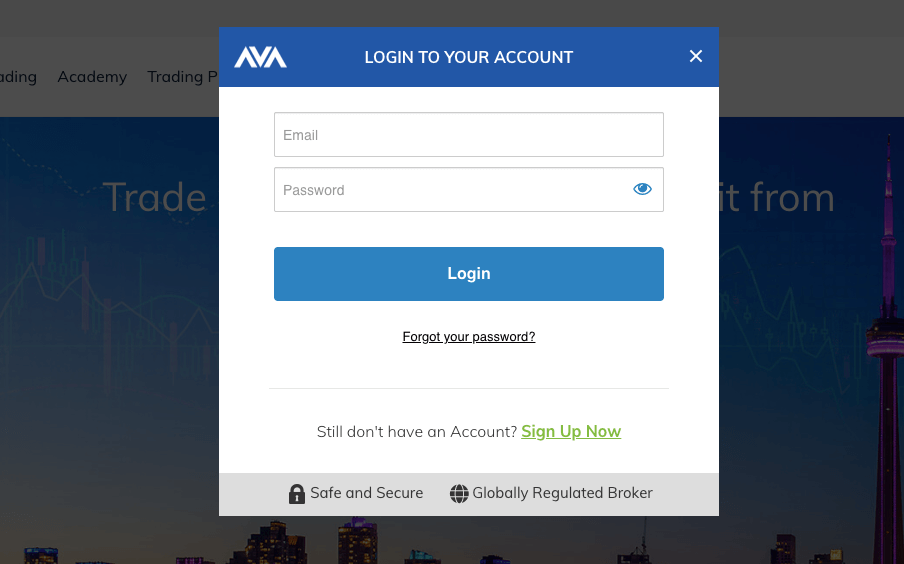

Step 1) log in to your account, by going to www.avatrade.ca and clicking on login.

Step 2) On the left side menu bar, click ‘Deposits’, then click ‘Fund Your Account and select a deposit method.

Step 3) Enter the amount you want to deposit then click on ‘Deposit’, then follow the on-screen instructions to complete the deposit.

What is AvaTrade minimum withdrawal?

On AvaTrade, there is a minimum withdrawal amount of C$100 for wire transfers and C$1 for other payment methods.

How do I withdraw from AvaTrade?

To withdraw your money from AvaTrade;

Step 1) log in to your account.

Step 2) Go to the Withdraw Funds section and select a payment method.

Step 3) Enter the amount you want to withdraw, fill out the required details then click on ‘Submit’, then follow the on-screen instructions to complete the withdrawal request on AvaTrade.

AvaTrade Trading Instruments

Below are financial instruments that can be traded on AvaTrade

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 37 currency pairs on AvaTrade |

| Commodities CFDs | Yes | 17 spot commodities on AvaTrade (Metals, Oil, Energies, Cocoa, and others) |

| FX Options CFDs | Yes | 55 pairs of FX Options on AvaTrade |

| Indices CFDs | Yes | 15 spot indices on AvaTrade |

| Stocks CFDs | Yes | 574 stocks on AvaTrade |

| Bonds CFDs | Yes | 2 Bonds on AvaTrade (Euro-Bund and Japan Govt Bond) |

AvaTrade Trading Platforms

AvaTrade offers a very wide range of trading platforms, each with their own strengths.

AvaTrade supports the following trading platforms:

1) MetaTrader 4 and MetaTrader 5: AvaTrade offers MT4 & MT5 trading applications that can be accessed on the web, desktop, and mobile devices (Android & iOS).

2) AvaTrade WebTrader: AvaTrade also offers its clients a proprietary web-based trading application, the AvaTrade WebTrader.

3) AvaTradeGo: AvaTradeGo is AvaTrade’s mobile trading application, available on both the App Store and Google Play Store.

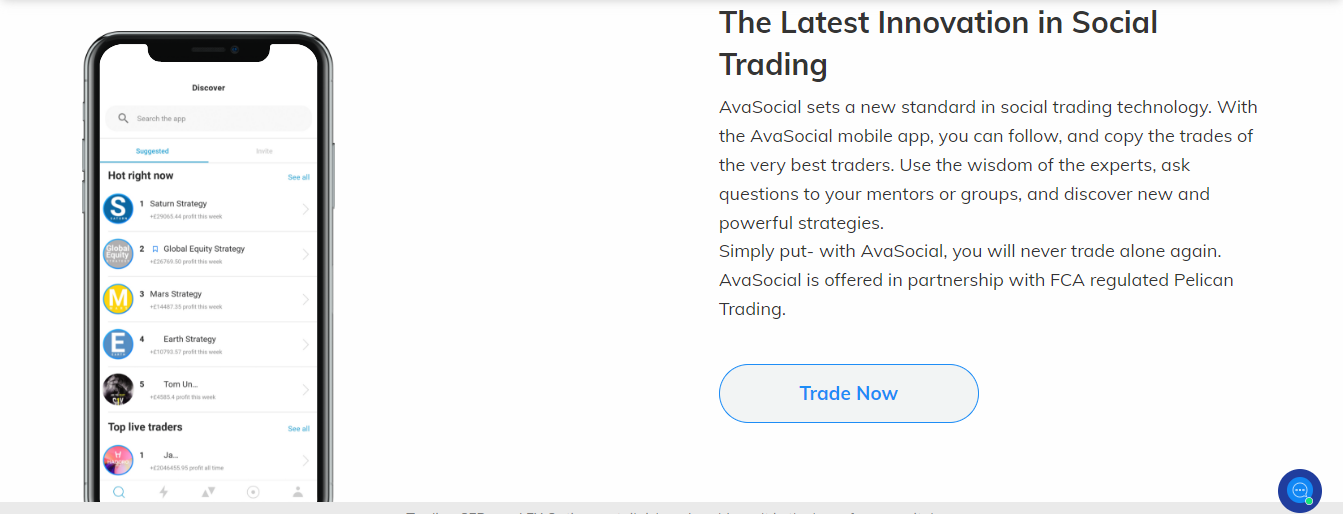

4) AvaSocial: AvaSocial is a trading application by AvaTrade that lets you access the strategies of experts and successful traders. It is basically for copy trading. You can download AvaSocial on Google Play Store or Apple App Store. It is available on mobile phones alone.

5) AvaOptions: AvaOptions is desktop trading platform by AvaTrade. You can also downnload it on Google Play Store. AvaOptions is a good choice for binary options traders who are looking for a reliable and user-friendly platform.

AvaTrade Execution Policy

AvaTrade is a market maker. This is evidenced by their fixed spreads and in-house dealing desk. They determine the bid-ask prices of the CFDs they offer and fulfil all of your trades for you.

In a review of their legal document, we observe that there might be cases of delayed connectivity and latency. If the prices displayed during this delay are favourable to you, AvaTrade can block the trade, void it, revoke your profits or even widen the spread after you have placed the trade.

In addition, there are also price requotes. According to the document, if the initial bid-ask price offered to you does not reflect the ‘fair’ market rate, AvaTrade at their sole discretion can choose not to execute your order. Instead, they send you an amended quote for your consideration.

Furthermore, the document states that your Limit Orders will not be executed if the price moves to your advantage. This means AvaTrade does not have a system that seeks the best prices for traders.

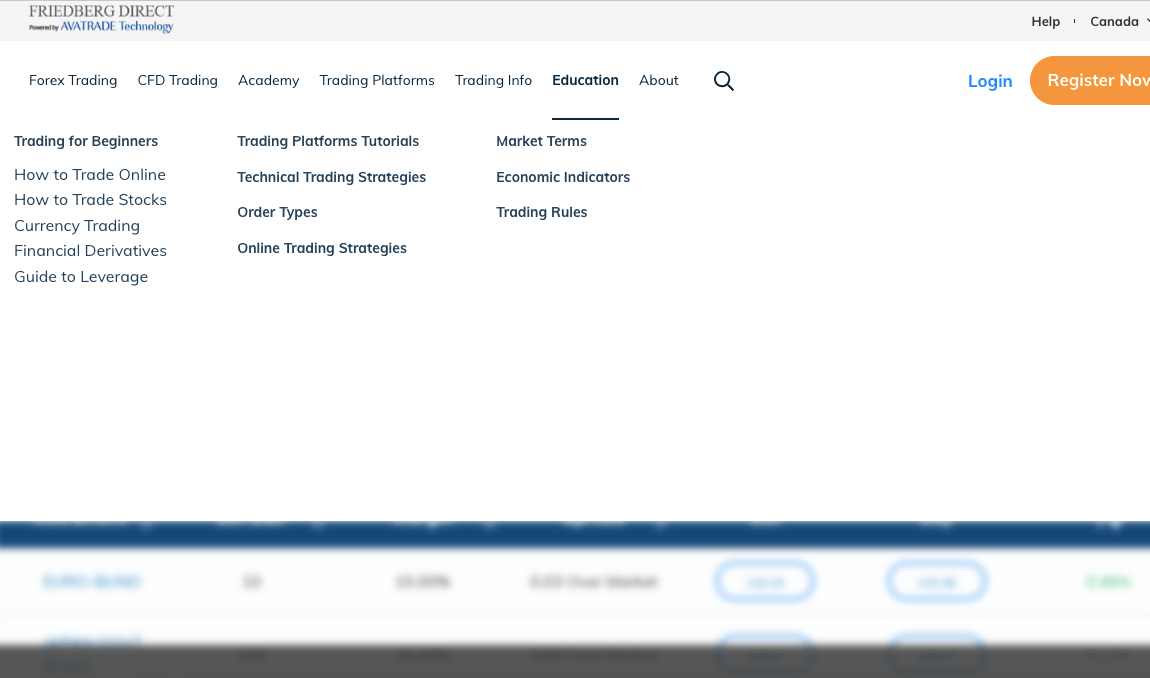

AvaTrade Education and Research

You can learn with AvaTrade in the following ways.

1. Demo Account: AvaTrade offers a free demo account with no risk. You can use the demo account for learning and practice. However, AvaTrade’s demo account has a downside. The demo account expires after three weeks. You will have to add another demo account. With this, it becomes difficult for traders to track their progress long-term.

2. Trading Videos: AvaTrade’s videos are extensive and structured well for traders to understand. Tutorials on trading platforms, currency pair trading, commodities trading, and stock trading are covered. Another important topic covered in this section is ‘stock market fundamentals’. This is key to understanding what moves the shares CFD market.

3. Educational Articles: These are extra articles for traders’ learning. They include random topics like trading rules, market terms, order types, etc.

4. E-book: AvaTrade’s ‘Ultimate Guide to CFD Trading” can help you on your trading journey. The content of the book will help you spot trading opportunities, make educated decision, anticipate when to take profit, and understand technical analysis.

Though the book is available for free, you will have to sign up on AvaTrade’s website before you can get it.

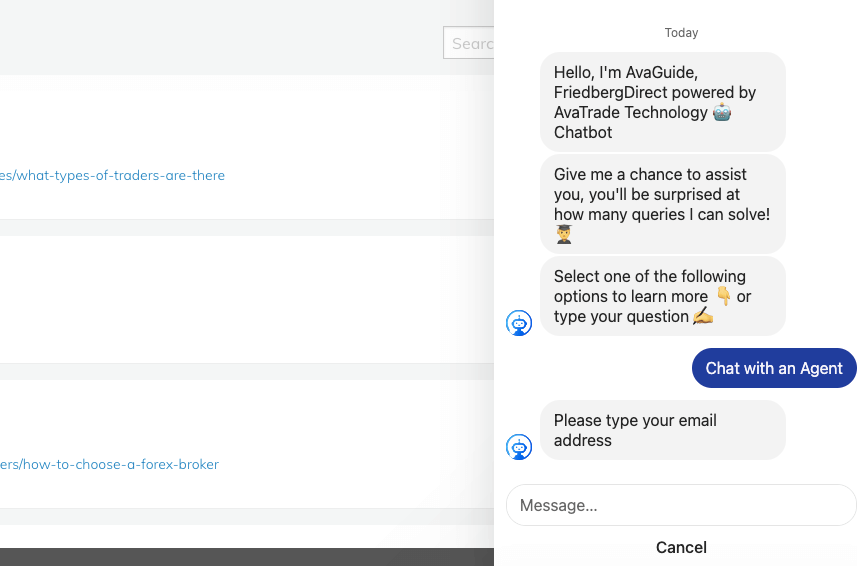

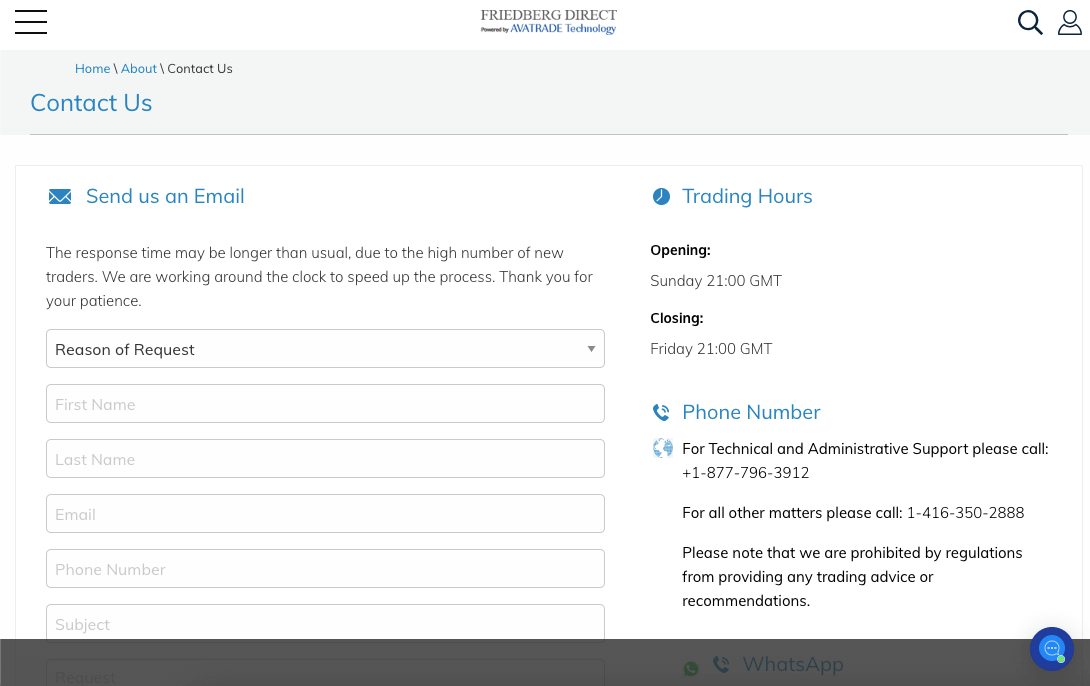

AvaTrade Canada Customer Support

AvaTrade customer support is available Monday through Friday via the following channels:

Live chat support: AvaTrade offers live chat support to traders via the website. The chatbot – AvaGuide – is available 24/5, but live agents are only available from 5:00 to 21:00 GMT, Monday to Friday.

The chatbot can answer a lot of questions about AvaTrade platforms, deposits/withdrawals, and more by prompting you with options when you ask a question.

In order to chat with a live agent, just send ‘chat agent’ as a message and the bot will give you a couple of options. Select ‘Chat With An Agent’ and it will take you to a live chat session. You will need to submit your email address and name for this.

The AvaTrade live chat customer support for us was prompt when we tested it, with a response time of about 1 minute. The answers provided were both accurate and relevant.

Email support: AvaTrade offers email support during business days, so you can send them an enquiry through their contact us form on their website.

Phone support: AvaTrade offers phone support to traders on the platform in different countries. Phone support on AvaTrade is available during business hours from Mondays to Fridays. The AvaTrade Canada support phone number is +1-877-796-3912.

To reach AvaTrade WhatsApp support, you can send a message to the following number: +447520644093.

What is AvaTrade copy trading?

AvaTrade copy trading allows you to automatically copy the trades of other successful traders on the platform. This means that when the trader you’re following opens or closes a position, the same position will be automatically opened or closed in your account.

How does it work?

AvaTrade offers copy trading through several integrated platforms, including ZuluTrade, DupliTrade, and AvaSocial. Each platform has its own features and interface, but the basic principle is the same:

1) Choose a trader to follow: You can browse through a list of traders based on their performance, trading style, and risk tolerance. You can also use filters to narrow down your choices.

2) Allocate an investment amount: Decide how much money you want to copy from the chosen trader.

3) Start copying: Once you’ve chosen a trader and allocated an amount, their trades will be automatically copied to your account.

Does AvaTrade allow scalping?

Yes, AvaTrade support scalping. Scalping is a day trading strategy that involves leaving your trades open for only few seconds or minutes with the intention to profit from small price movement.

AvaTrade offers offer Major currency pairs (like EUR/USD and USD/JPY), Major stocks (eg. Amazon, and Facebook) and Indices (eg. S$P 500, and UK 100) that are usually of interest to scalpers who are looking to make profit from small movement in price.

They also offer trading platforms like MetaTrade4 and MetaTrader5 that support advanced technical indicators, and different types of charts for scalpers to conduct technical analysis. MT4 and MT5 also support buying and building of trading robots, which scalpers who wish to automate their trades will find helpful.

Do We Recommend AvaTrade to Traders from Canada?

AvaTrade has partnered with Friedberg Direct which is a very reputable brand in Canada. This partnership means that AvaTrade is a member of the CIRO and is subject to their rules and regulations in protecting clients deposited funds.

Further, AvaTrade’s group entities are regulated by tier-1 financial authority which is the ASIC of Australia.

AvaTrade offers a decent variety of trading instruments a wide range of trading platforms to choose from. They offer commission-free services with tight spreads, hence, trading with them is quite cost-effective. Their overall fees is lower than most other brokers.

There are certain drawbacks when trading through AvaTrade as well. They do not offer bank transfers as a way to deposit funds. Further their minimum deposit requirement is quite high for new traders. They also do not offer any bonuses. Their customer support team is not available on weekends.

Is my money safe with AvaTrade?

AvaTrade segregates your money from their money. They do not combine clients money and business money. Though they are regulated with CIRO, they also hold a tier-1 license with ASIC and tier-2 license with CySEC. They also follow global best practices in terms of cybersecurity.

What countries is AvaTrade regulated in?

AvaTrade is regulated in several countries including Ireland, Cyprus, Japan, Canada South Africa, British Virgin Islands and Australia.

Does AvaTrade offer a good app?

Yes, AvaTrade offers a good number of trading apps. Their most popular forex trading app is the AvaTradeGO. Beyond trading, you also access investment and account management tools without a computer.

In addition, you get to access data and market trends that helps you see market sentiment on the go.

Is AvaTrade an ECN broker?

AvaTrade is not an ECN broker. They are a market maker. This means they act as counterparty to your trades. Their spreads are also wider than that of an ECN broker because they make money from spreads.

Is AvaTrade good for day traders?

Yes, AvaTrade is good for day traders. They have just one retail account. They also have MT4 and MT5 that allows automated trading strategies. They also have a reliable order execution.

AvaTrade Canada FAQs

Is AvaTrade a trusted broker?

AvaTrade is a relatively trusted broker for traders from Canada. They are a member of the CIRO and are regulated locally in Canada. Further, they are regulated by tier-1 financial authority which is the ASIC of Australia and tier-2 financial authority which FSCA of South Africa. The multiple regulation of AvaTrade means the broker is mandated to be fair in their dealings and consumers (traders) will be protected by the various authorities.

Does AvaTrade have an inactivity fee?

Yes, AvaTrade has an inactivity fee of CAD 75 for every month that a trader does not trade after three months.

Is AvaTrade any good?

Yes, AvaTrade is a good broker that offers forex and CFD trading services. They have won several awards for their services and cater to clients from across the world. They have a strong track record and offer cost-effective trading services.

Note: Your capital is at risk