CMC Markets is an online provider of and contract for difference (CFD) trading services. The company provides access to an electronic trading platform, through which customers can trade CFDs on forex, shares, indices, ETFs, bonds and commodities with competitive spreads.

CMC Markets was established in 1989 and operates across Australia, Europe, and Asia. They are regulated by the Canadian Investment Regulatory Organization (CIRO), the UK’s FCA and are listed on the London Stock Exchange.

Our review covers the information you need to know about trading instruments, trading fees, customer support and deposit/withdrawal options at CMC Markets.

| CMC Markets Review Summary | |

|---|---|

| 🏢 Broker Name | CMC Markets Canada Inc. |

| 📅 Establishment Date | 1989 |

| 🌐 Website | www.cmcmarkets.com |

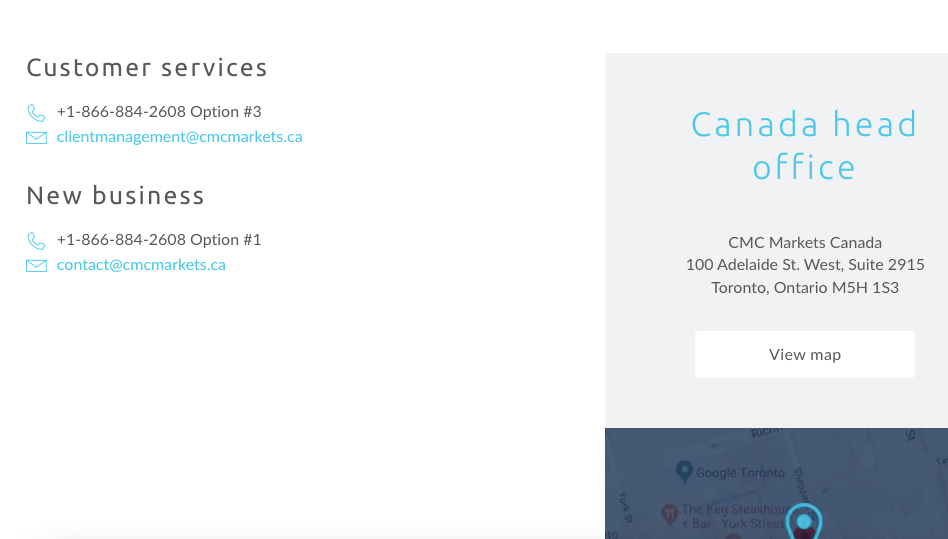

| 🏢 Address | CMC Markets Canada Inc., 100 Adelaide St. West, Suite 2915, Toronto, Ontario M5H 1S3 |

| 🏦 Minimum Deposit | $0 |

| ⚙️ Maximum Leverage | 1:33 |

| 📋 Regulation | CIRO, MAS, ASIC, FCA, BaFin |

| 💻 Trading Platforms | MT4 and CMC Markets Trader available on PC, Mac, Web, Android, & iOS |

| Visit CMC Markets | |

CMC Markets Pros

- Regulated by CIRO

- Offers a wide range of tradable instruments

- User friendly website and trader

- Fast processing of deposits and withdrawals

- No mandatory minimum deposit or withdrawal

- Offers commission-free trading for most instruments

CMC Markets Cons

- Customer support is not available 24/7

- Charges commission fees for shares trading

- Charges dormant account fees

- Does not support MT5 platform

- Does not payments with cards

Can I trust CMC Markets?

CMC Markets is regulated by top-tier financial regulators in multiple jurisdictions, including Singapore and the UK. The company is also listed on the London Stock Exchange (LSE) since 2016. These factors make CMC Markets trustworthy and have a low-risk rating.

CMC Markets is based in London. Some of their subsidiaries and the countries in which they are authorised are as follows:

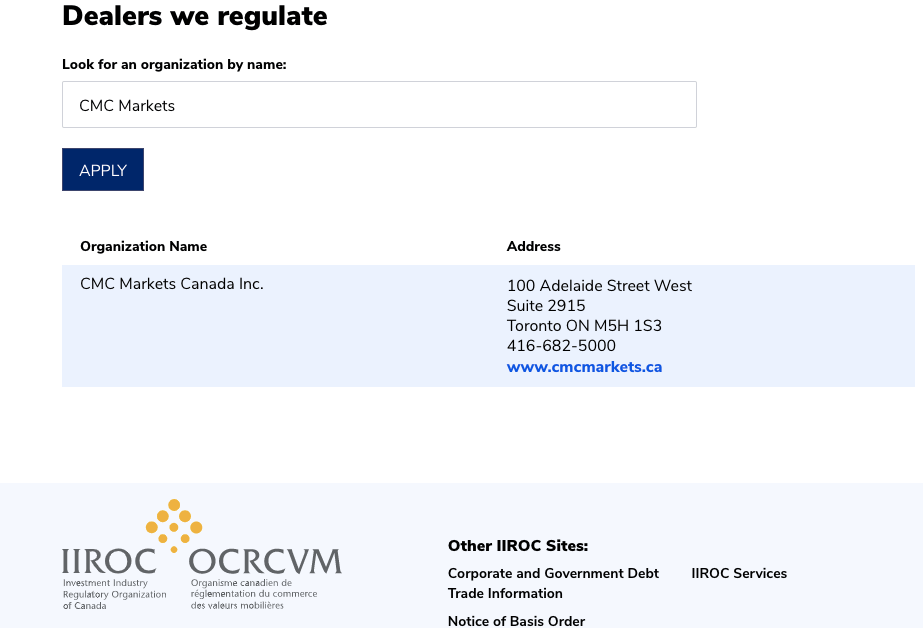

1) Canadian Investment Regulatory Organization (CIRO): CMC Markets is regulated in Canada by CIRO as ‘CMC Markets Canada Inc.’ as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 12570, issued in 2009.

CMC Markets is registered with the Canadian Investor Protection Fund (CIPF). The CIPF works to ensure that any asset or investment owed to you by a regulated broker is given back up to $1 million.

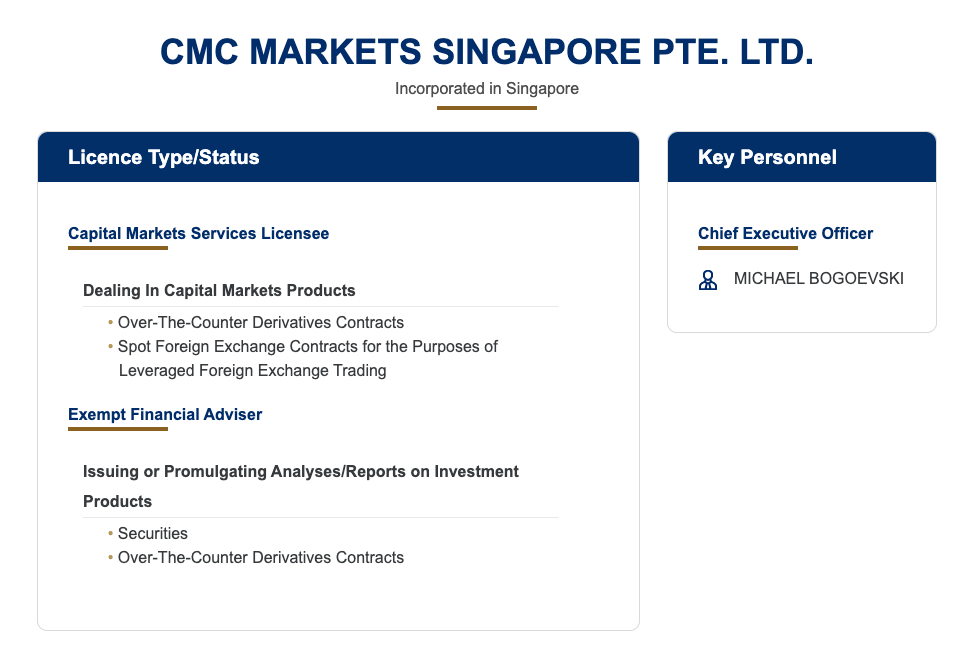

2) Monetary Authority of Singapore (MAS): CMC Markets is regulated in Singapore as ‘CMC Markets Singapore PTE. Ltd.’, and licensed to provide capital market services.

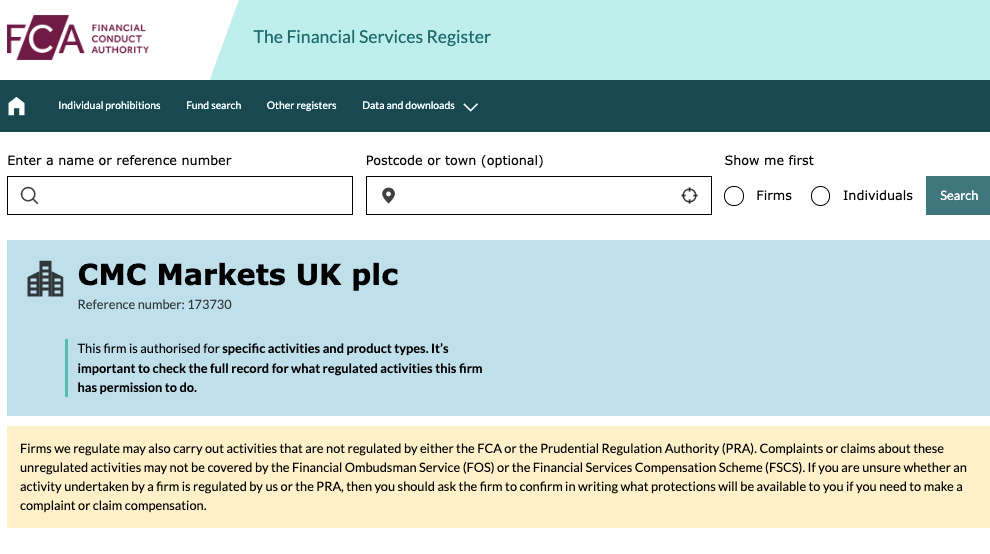

3) Financial Conduct Authority (FCA): CMC Markets is regulated by the FCA as ‘CMC Markets UK Plc’ and authorised to offer financial services in the UK with reference number 173730, issued in 2001.

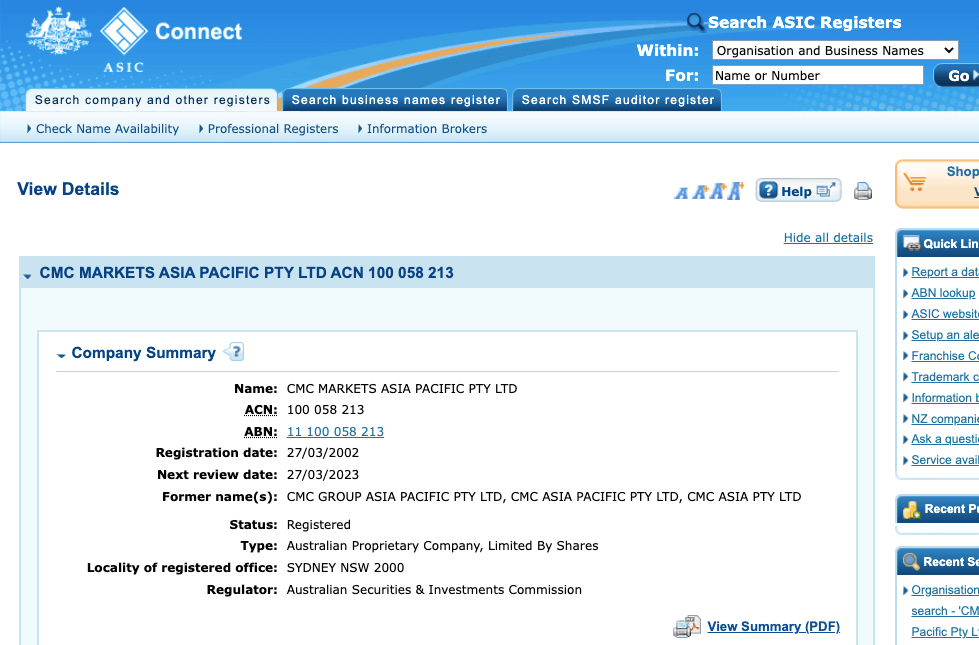

4) Australian Securities & Investments Commission (ASIC): CMC Markets is licensed in Australia by ASIC as ‘CMC Markets Asia Pacific Pty Ltd’ to offer financial services with ACN 100058213, issued in 2002.

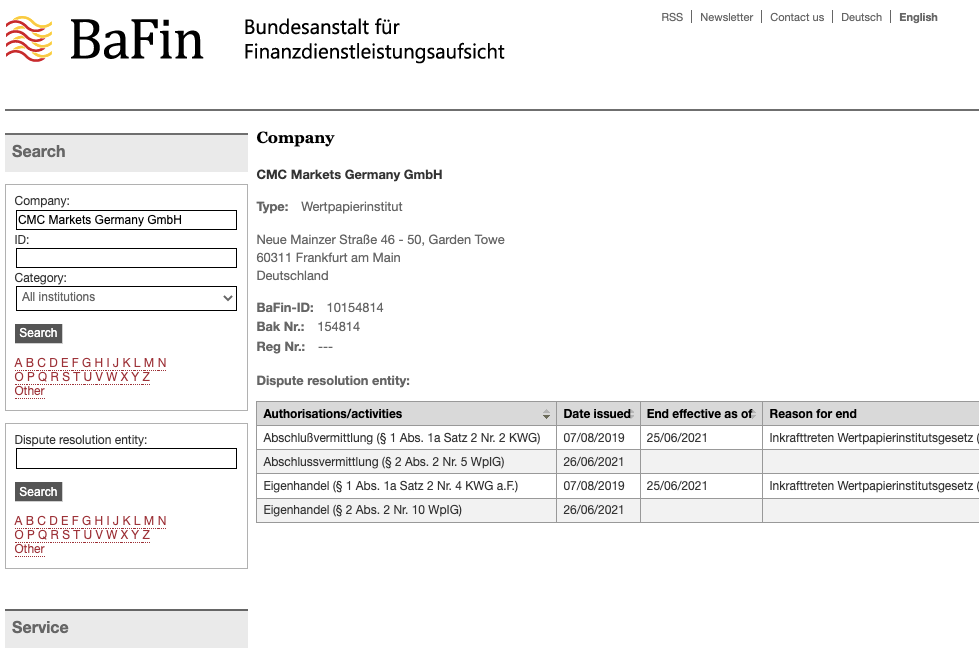

5) Federal Financial Supervisory Authority, Germany: CMC Markets is authorized in Germany as ‘CMC Markets Germany GmbH’, with an office in Frankfurt. They serve European clients through the license in the EEA.

6) Financial Markets Authority (FMA), New Zealand: CMC Markets also holds a license in New Zealand as CMC Markets NZ limited. They are authorised as a derivatives issuer with licence number FSP41187 active since 2014.

CMC Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | CMC Markets UK Plc |

| Australia | No Protection | Australian Securities and Investments Commission (ASIC) | CMC Markets Asia Pacific Pty Ltd |

| Singapore | No Protection | CMC Markets Singapore Pte. Ltd. | AxiTrader Limited |

| Canada | $1,000,000 | Canadian Investment Regulatory Organization (CIRO) | CMC Markets Canada Inc |

| New Zealand | No Protection | Financial Markets Authority (FMA) | CMC Markets NZ limited |

There is no negative balance protection for Canada-based traders.

CMC Markets Leverage

CMC Markets offer leverages of up to 33:1 to traders. This means you can open a position that is worth 33 times the amount of your deposit. If you deposit $100, you can open a $3,300 trade position.

This 33:1 maximum leverage on CMC Markets only applies to currency pairs. Other instrument pairs have lower leverage limits.

CMC Markets Account Types

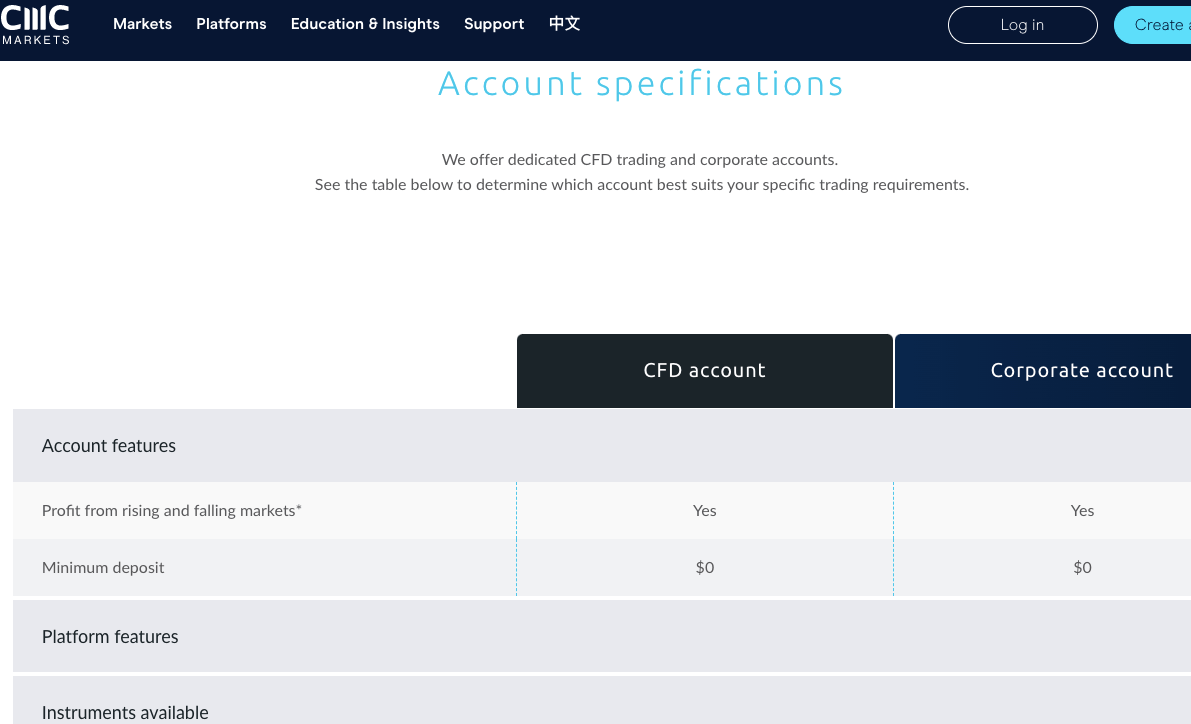

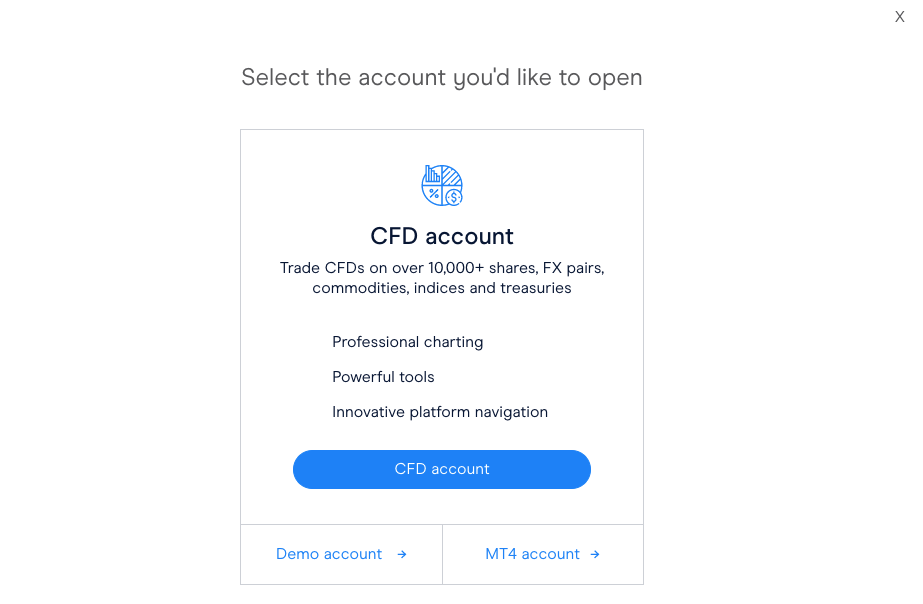

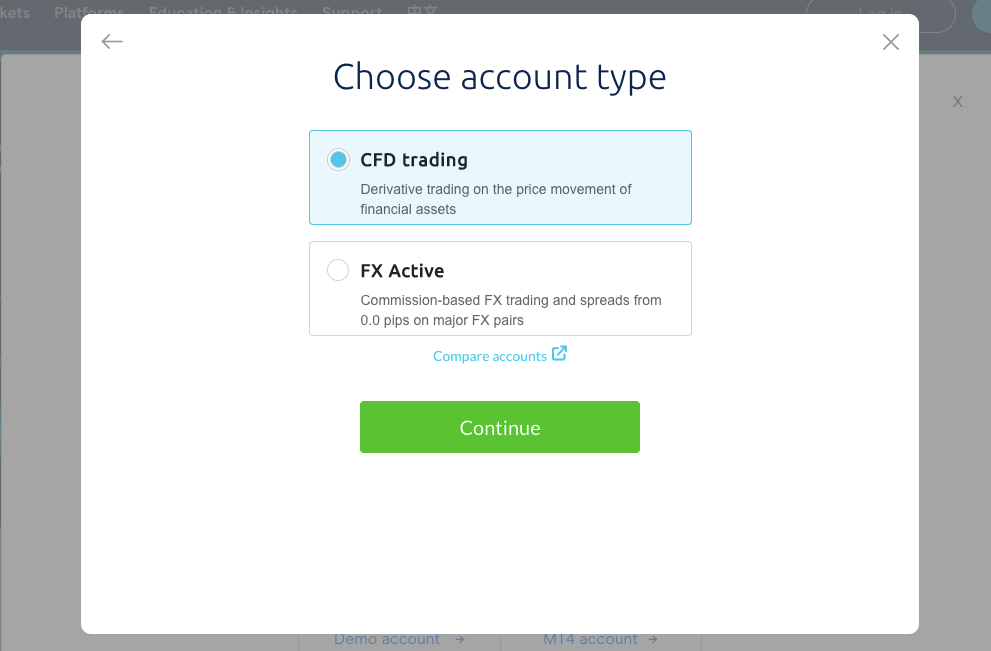

CMC Markets offers 2 main account types to traders, which are CFD & Corporate Accounts. These accounts are offered as standard accounts for retail traders.

CMC Markets also offers Alpha and FX Active Trader Account status to clients, which provides additional features, and you can apply for it after meeting certain requirements.

CMC Markets demo accounts allow new traders to get familiar with the trading platform using virtual money before they put in their real money. No Islamic account options are available on CMC Markets.

Read below to find out more about the features of the various types of accounts on CMC Markets:

1) CFD Account: CMC Markets CFD Account is designed for retail traders and allows you to trade CFDs on foreign exchange currency pairs, indices, shares, treasuries and commodities.

No commission fees are charged when you enter or exit a trade with this account, except for trading shares, in which charges starting from $8 apply.

Spread fees on this account start from 0.3 points and you pay swap fees for holding a position open for more than 24 hours.

This account has no minimum deposit requirement, with a maximum leverage of 33:1 and does not have negative balance protection, which means that you can lose more than your deposits.

For example, if a trade position is unsuccessful and you suffer a loss, you will be required to deposit more funds to clear any negative balance that accrues to your account.

2) Corporate Account: CMC Markets Corporate Account allows you to register your business and trade on the platform as a corporate entity. You can trade financial instruments such as forex, shares, indices, commodities and treasuries with this account.

This account is not required to pay commission fees for trades except when trading shares in which case commission fees apply starting from $8.

Spreads on the Corporate Account start from 0.3 points and the account incurs swap fees for holding a trade position open for more than 24 hours.

Corporate Accounts also have a maximum leverage of 1:33 and no negative balance protection, so you can lose more than the amount invested.

3) CMC Markets Alpha: CMC Alpha is CMC Markets Premium Account status reserved for clients who meet certain requirement. This account status gives you some extra benefits. You can get the Alpha status after meeting at least one of the following criteria.

- Your trade volume exceeds US$10 million in one month.

- You get an invitation from an Alpha Team member

The CMC Alpha offers a number of top-tier features, including priority customer support, rebates and a personal account manager. It also offers members access to a community of experts, invitation to exclusive seminars and discounts on spreads starting from 5% and up to 20%, depending on your sales volume.

4) FX Active Trader: CMC Markets Accredited Investor (AI) Account is designed for professional and experienced traders who trade large volumes of financial instruments and want lower fees.

The FX Active Account on CMC Markets offers lower spreads starting from 0.0 pips, no scalping restrictions, no stop-loss or take-profits restrictions, free premium EAs and indicators, free deposits and withdrawals, and commissions starting from US$2.50.

To get CMC Active Account, you can select it during the regular account opening process.

CMC Markets Base Account Currency

When opening an account on CMC Markets you can choose from 2 currencies to serve as your base account currency; they are the Canadian Dollar – CAD and the United States Dollar – USD.

All your trades, deposits/withdrawals will be measured in your base account currency.

CMC Markets Overall Fees

Fees on CMC Markets vary depending on your account type, tradable instruments and trade volume. Find an overview of the fees below:

Trading fees

1) Spreads: When you open trades on CMC Markets, you pay a spread fee, which is the difference between the bid (buy) and ask (sell) prices of instruments. Spreads are markups by brokers added to the selling price of the instruments and are measured in pips. Spreads on CMC Markets start from 0.3 pips for most accounts.

Here are the minimum spreads for major currency pairs on CMC Markets:

| Instrument/Pair | Spreads |

|---|---|

| EUR/USD | 0.7 pips |

| GBP/USD | 0.9 pip |

| EUR/GBP | 1.1 pip |

| Gold | 0.3 pips |

2) Commission fees: CMC Markets offers commission-free trading on all instruments, except shares. For opening/closing trades on shares, you will be charged a commission fee of $8 per round turn, which is subject to change based on the trade volume.

3) Swap fees: Whenever you keep a trade position past the market closing time (5 PM New York Time), you incur holding costs also known as swap fees. Swap fees on CMC Markets depend on the trade size and whether your trade position was long (buy) or short (sell).

Holding costs can also be gained as profits if you are holding a short (sell) position. Any holding costs you have paid to hold a position will be added to your profit or loss at the time you close the trade. Swap fees are usually based on an interbank rate and a percentage of the trade value.

Non-trading fees

1) Deposit and Withdrawal fees: CMC Markets does not charge any fees for depositing funds to your account or withdrawing from it via all methods except bank wire transfers which attracts a deposit fee of $15 and a withdrawal fee of $10.

2) Account Inactivity charges: If you do not place any trades on your account for a year, your account will be designated dormant and you will be charged $15 per month on any balance in the account. You will not incur any negative balance if you have no funds in your account.

| Fee | Amount |

|---|---|

| Inactivity fee | $15 |

| Deposit fee | None* |

| Withdrawal fee | None* |

Deposits via bank transfer attracts a $15 fee. Withdrawal via the same method attracts a $10 fee.

How to Open CMC Markets Account in Canada

Follow these steps to open a trading account on CMC Markets.

Step 1) Go to the CMC Markets website at www.cmcmarkets.ca and click on ‘Create account’ on the top right corner of the homepage.

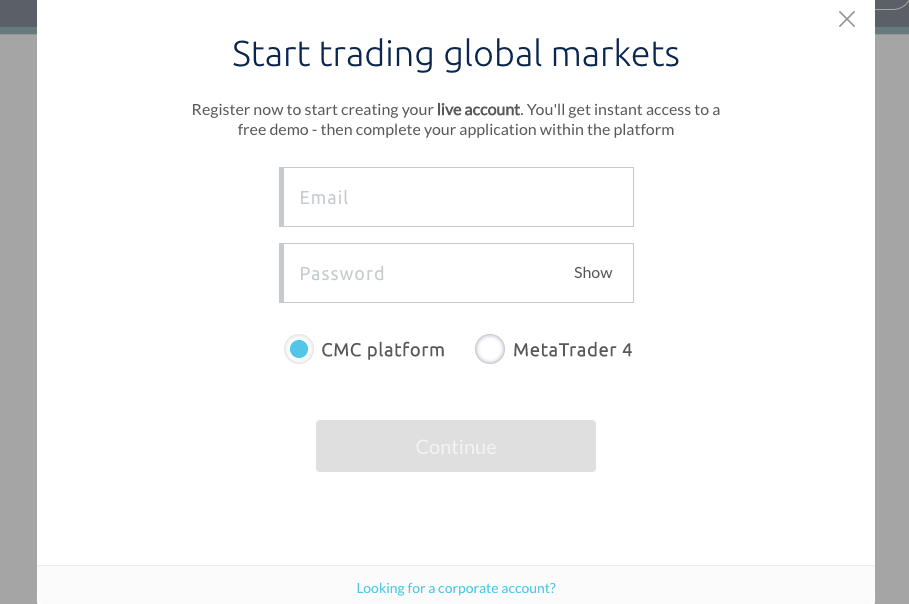

Step 2) Choose whether you want to open a demo account or a live CFD Account, then enter your email address, create a password, select the trading platform you prefer and then click ‘Continue’.

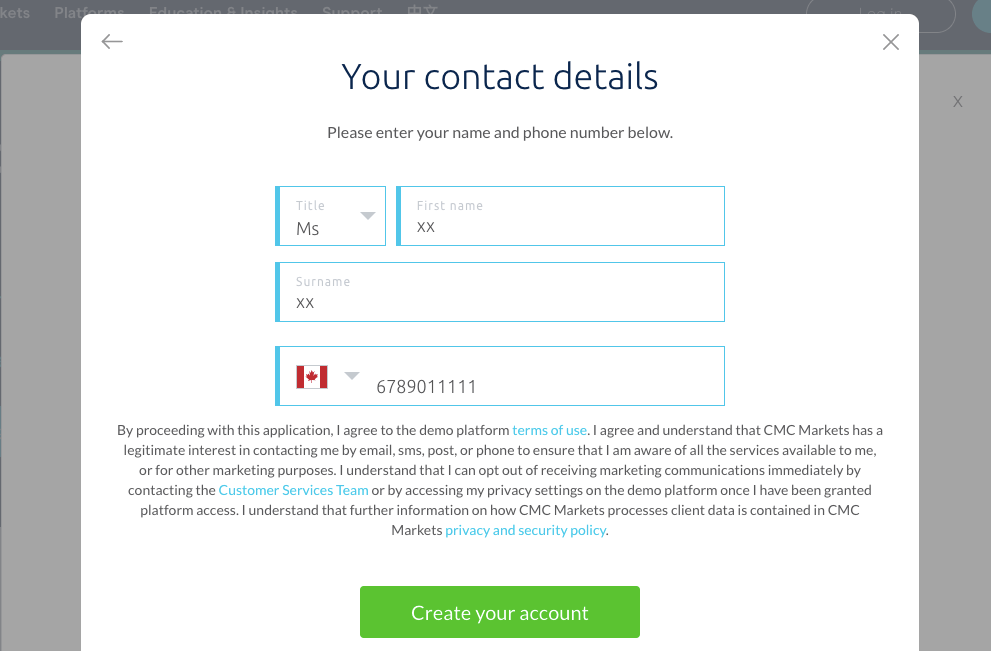

Step 3) Select an account type, where you live in Canada, and provide your full name and phone number then click on ‘Create account’.

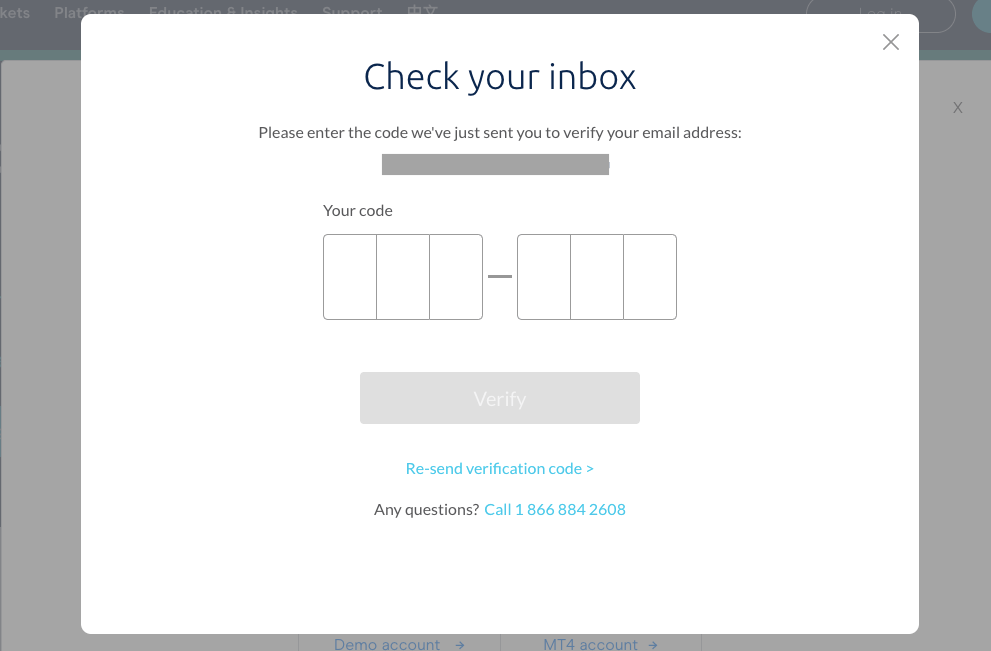

Step 4) Type in the verification code sent to your email and click verify to verify your email and proceed with the registration. You will be redirected to sign in to your CMC Trader platform.

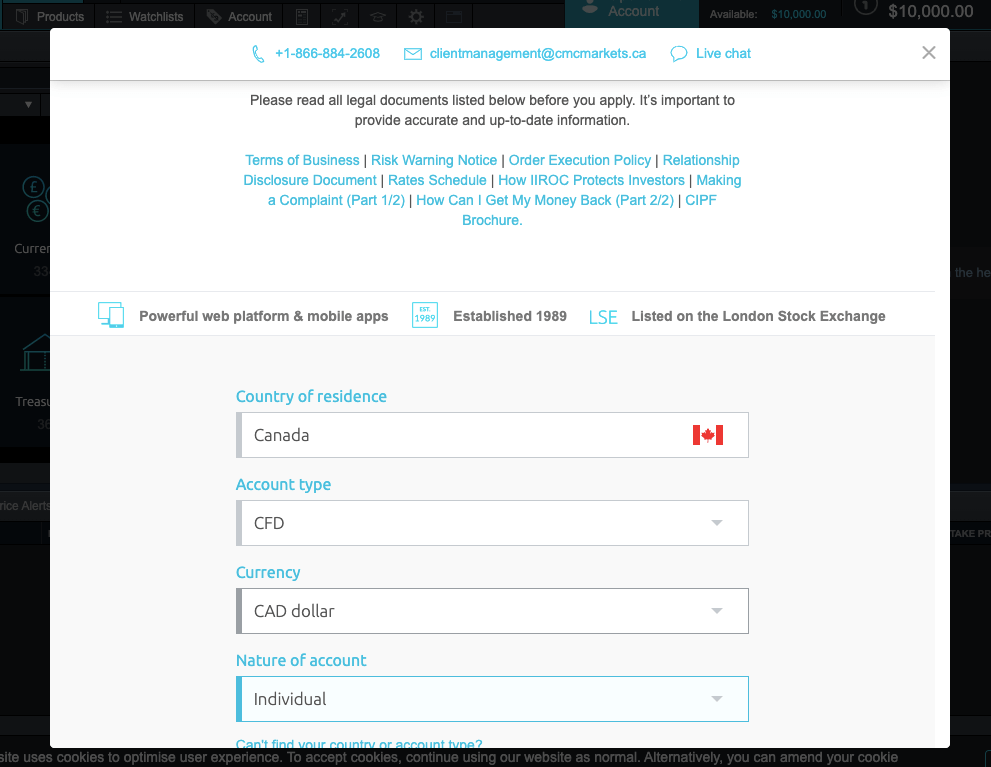

Step 5) When you first signup, you get a Demo Account, after you sign in to the Platform, select an account (individual or corporate) and account currency, then click ‘Get Started’

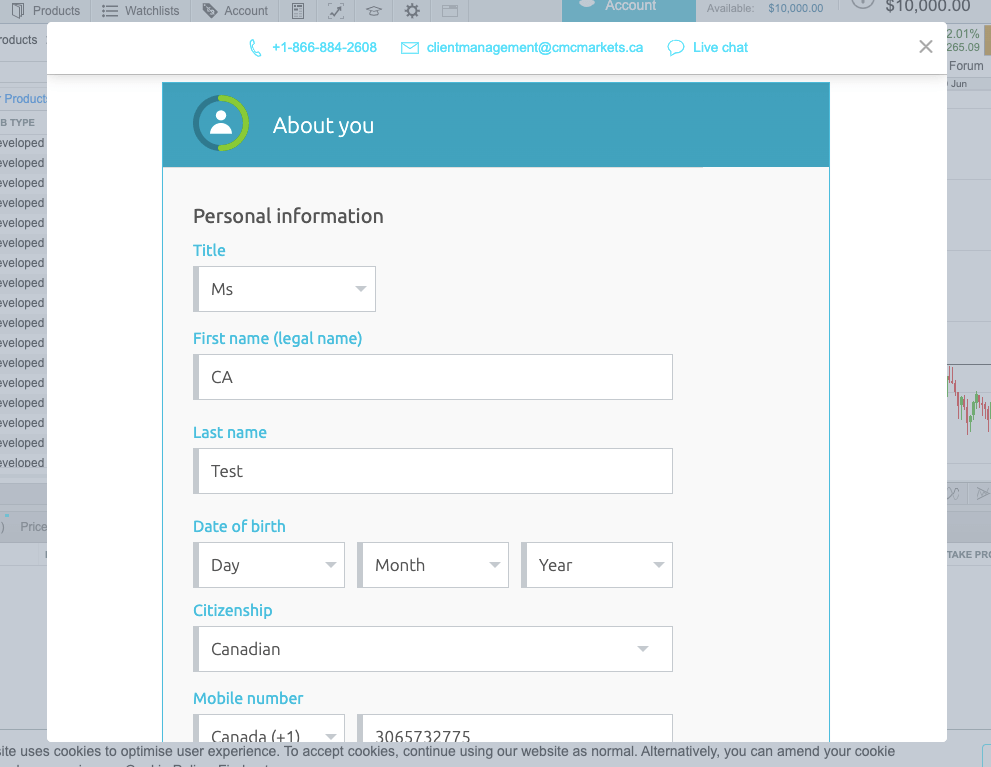

Step 6) Provide your date of birth, and answer the questions about your nationality, tax, and marital status. Provide your full address and social insurance number, and then click ‘Continue’.

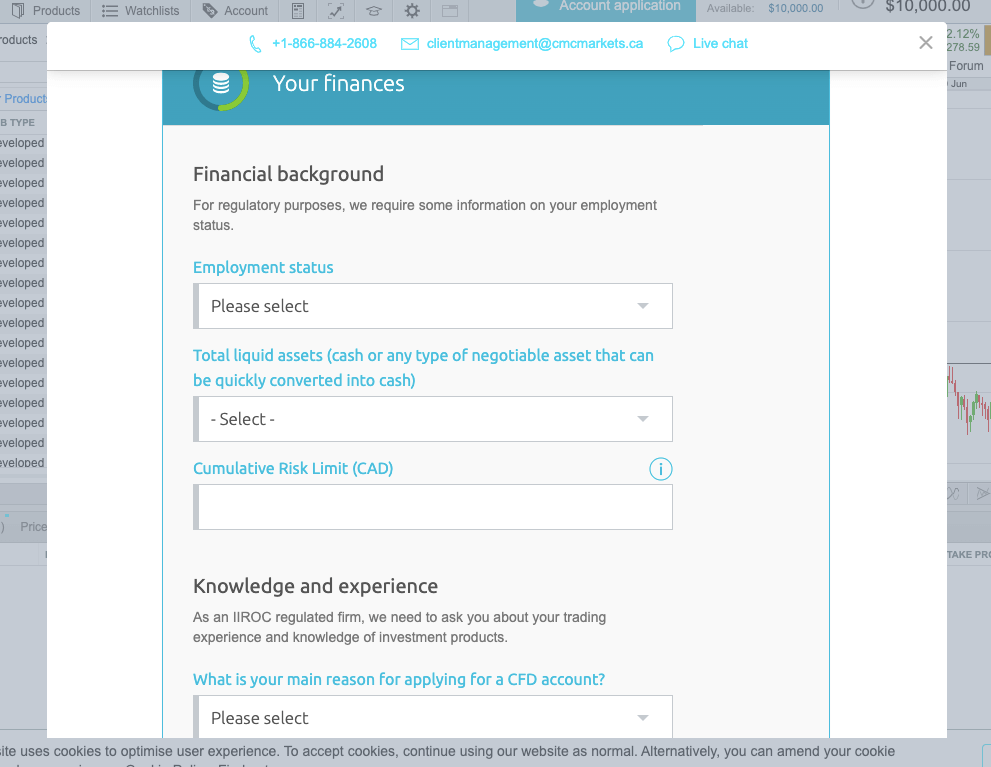

Step 7) Answer questions about your employment status, educational & financial background, and work & trading experience then click ‘Continue’.

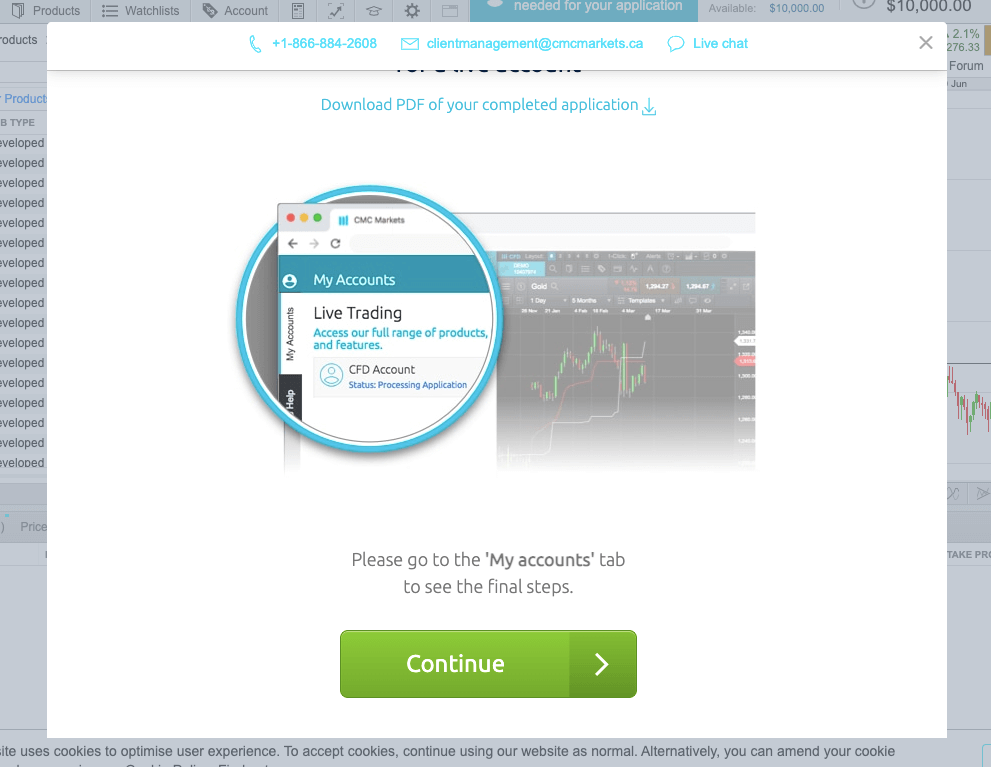

Step 8) Check the declaration box to agree with the Terms and Conditions and Privacy Policy then click ‘Submit’, and then ‘Continue’ on the ‘Thank you’ page that appears.

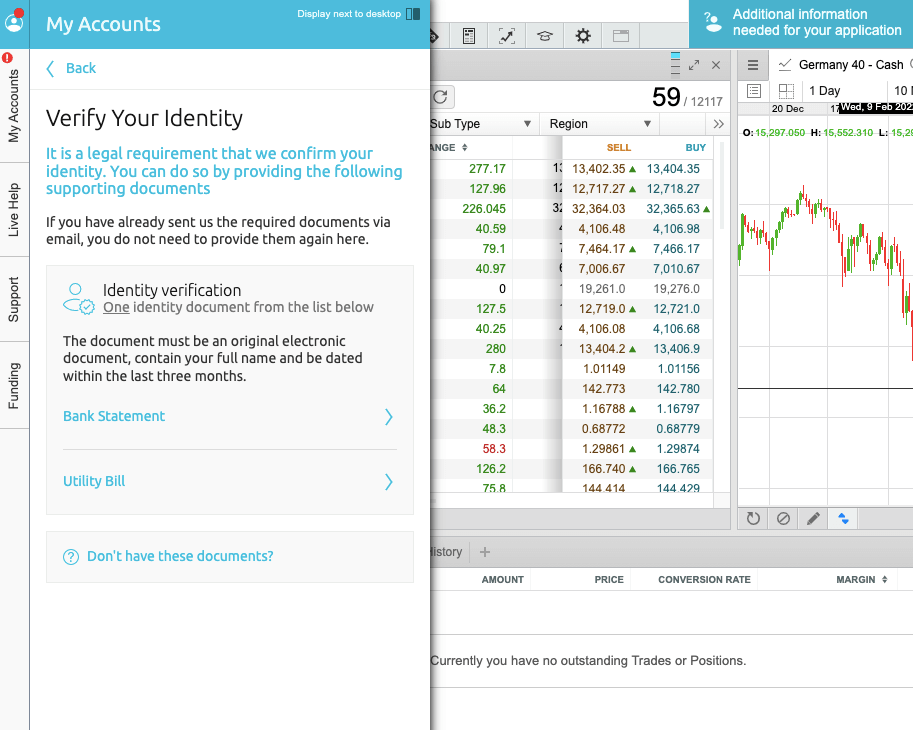

Step 9) Upload some documents to verify your identity and address and wait for your live account application to be approved. Note that your account application needs to be approved before you can access the full features of the app.

CMC Markets Deposits & Withdrawals

Payment methods supported by CMC Markets for deposits and withdrawals are bank wire transfers, cheques and Electronic Fund Transfers (EFT). Here is the summary of the deposits and withdrawal options on CMC Markets Canada.

CMC Markets Deposit Methods

Here is a summary of payment methods accepted by CMC Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | $15 | 24 hours |

| Cards | No | N/A | N/A |

| E-wallet | Yes (EFT, Online Bill Payment) | Free | 3 business days for EFTs, 24 hours for Online Bill Payment |

| Cheques | Yes | Free | 5 business days |

CMC Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on CMC Markets.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | $10 | 1-2 business days |

| Cards | No | N/A | N/A |

| E-wallet | Yes (EFT) | Free | 1-2 business days |

| Cheques | No | N/A | N/A |

What is the minimum deposit for CMC Markets?

The minimum deposit on CMC Markets is $0. This means that there is no mandatory minimum deposit amount, you can deposit any sum you want and start trading. Although the recommended minimum deposit is $100, it will allow you to place a sizable amount of trade.

How do I Deposit Funds to CMC Markets?

Step 1: Log in to your CMC Markets Dashboard, and click on the ‘Funding’ tab on the left side menu.

Step 2: Select ‘Add Funds’ and choose a payment method

Step 3: Enter the amount you want to deposit and follow the on-screen prompts to complete your deposit.

CMC Markets Minimum Withdrawal

There is also no minimum withdrawal sum required by the broker, you can withdraw any amount you want as long as you have funds in your trading account.

How do I withdraw from CMC market?

Step 1: Log in to your CMC Markets Dashboard, and click on the ‘Funding’ tab on the left side menu.

Step 2: Select ‘Withdrawal’, choose your preferred payment method and follow the on-screen prompts to complete your withdrawal.

CMC Markets Trading Instruments

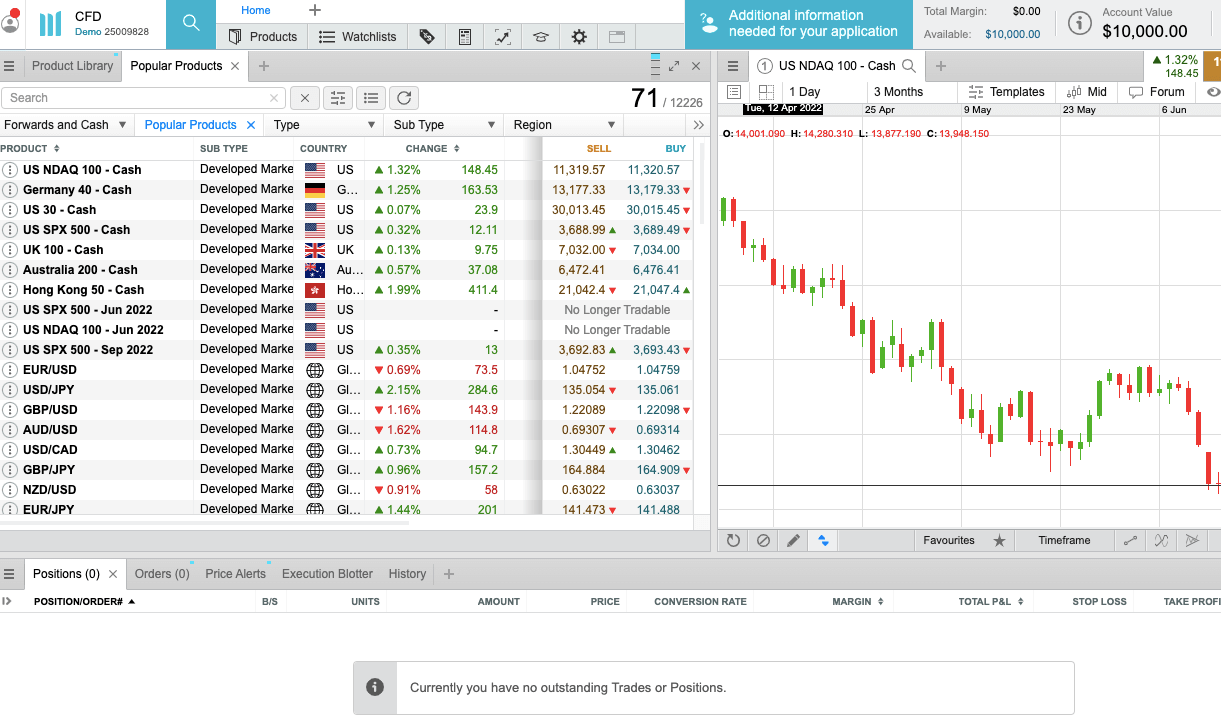

You can trade over 10,000 financial instruments on CMC Markets, find a breakdown of the instruments below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 339 currency pairs on CMC Markets (including majors, minors, exotics and forex indices) |

| Commodities | Yes | 111 spot commodities on CMC Markets (Metals, Energies, Agriculture, and Commodity Indices) |

| Indices | Yes | 95 indices on CMC Markets (UK 100, US NDAQ 100, Germany 40, Hong Kong 50 and others) |

| Shares | Yes | 9,451 shares on CMC Markets (including, Technology, Banking, ETFs, and Share baskets) |

| Bonds (Treasuries) | Yes | 46 Bonds on CMC Markets (US and European bonds) |

CMC Markets Trading Platforms

Trading platforms supported by CMC Markets are:

1) MetaTrader 4: You can access the CMC Markets instruments on the MT4 trading application, available on the web, desktop, and mobile devices (Android & iOS).

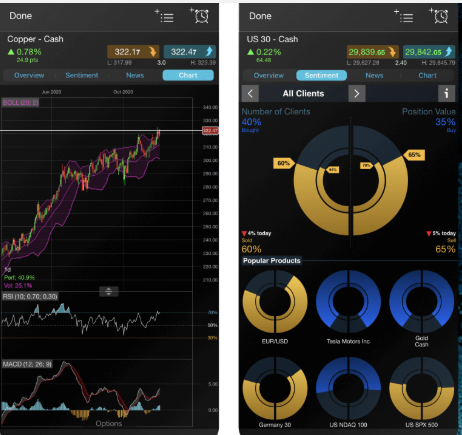

2) Next Generation CFD Platform: This is a CMC Markets’ owned trading platform, available for trading with the broker. The platform can be accessed on the web and downloaded from the App Store and Google Play Store.

CMC Markets Trading Tools

Pattern recognition scanner: In technical analysis, there are certain price patterns are crucial. Traders use these patterns to determine if a trend will continue or reverse. Head and shoulder, inverse head and shoulder, and rising wedge are some of these patterns. In fact, there are over 40 price patterns.

Recognizing them manually might be a difficult task. CMC Markets’ pattern recognition scanner scans your charts and shows you price patterns. You can combine this tool with other technical analysis tools to make trading decisions.

Client sentiment indicator: it reveals the behaviors of other traders on the CMC Markets’ trading platform. Beginner, intermediate, and expert traders, it doesn’t matter. You can know the CFDs they are buying or selling. You can also see the value of their positions.

Reuter news and analysis:This tool gives you access to a live feed of global news and the financial markets. You can use the filter settings to focus on the type of news you want to see. It could be a focus on a certain CFD, general market updates, or news around your CFD watchlists.

Does CMC Markets have a mobile app?

Yes, CMC Markets have a mobile app. It is available on the Google Play Store and has over 500,000 downloads. From 2,000 reviews, it is rated 3.6 stars out of 5. On the App store, it is rated 4.1 stars out of 5 from 218 reviews.

CMC Markets Execution Policy

After reviewing the broker’s documents, here is what we found on their execution policy. CMC Markets has processes in place that assess the quality of execution delivered to traders. The quality of execution depends on factors like price, cost, speed, and likelihood of execution. Execution quality is overseen by a committee known as TCF (Treating Customer Fairly).

Prices shown on the platform are generated electronically. They are sourced from top data vendors and liquidity providers in the industry. Data feeds and internal pricing mechanisms are continuously monitored by the support and dealing team to ensure quality pricing. In certain conditions, CMC Markets can generate price manually like a market maker. An example of this is when you try to trade an instrument outside market hours. CMC Markets will generate the price manually so you can have access to liquidity. However, the broker tries to provide a fair price when this is done.

For costs, CMC Markets keep trading costs low by sourcing the best prices from liquidity providers. They also review fees from their equities and futures brokers to make sure they are not too high. CMC Markets speedily executes all trades except on rare occasions when orders are rejected. The absence of manual intervention also makes your order execution faster.

Furthermore, there is a high likelihood that your trees will be executed. Why? Because your trades are executed against the broker’s liquidity. CMC Markets via their New Generation Platform provide more liquidity than the underlying market of a trading instrument. The higher volume of liquidity reduces the chances of your orders getting rejected.

CMC Markets Education and Research

CMC Markets have a good collection of learning channels that can help your trading and research. Let us look into them in detail

Trading Guides: It is a comprehensive section and is divided into trading strategies, essentials and definitions, trading tips, fundamental analysis, technical analysis, and asset classes. Each of these guides has content under them so you can explore them individually.

If you click trading strategies, for example, there are 35 guides in there (at the time of this writing). Topics like leveraged trading, day trading, and swing trading are covered here.

Webinars and Events: This is section is designed by CMC Markets for tailored learning. These webinars and events can help you learn trading concepts from the beginner level to the advanced level. Some of the topics covered include charting webinars, analysis of the US NFP, and trading platform tutorials. The schedule for their next webinar is on the website. You only need to book your spot without charges.

Learn Hub: CMC Markets’ learn hub contains free educative tools to help you develop your CFD trading and spread betting skills. You get to learn about the stock market first with four articles covering different topics.

Apart from the main trading guides, the learn hub also has trading guides. The guides cover CFD trading, forex trading (currency pairs), and spread betting. The following section is platform guides. Here, you will learn how to use CMC Markets’ Next Generation Platform and MT4. The guide covers how to trade, how to place orders, how to chart and use technical tools, etc

The last part of the learn hub is the glossary. This is a tool you can use to search for common trading terms so you can know their meaning. The glossary is arranged in alphabetical order so your search can be more precise.

Trading Library: CMC Market’s trading library contains trading-related articles. Beginner, intermediate, and advanced traders can benefit from the articles. You can systematically read the articles from basics to more advanced topics.

The library is divided into four categories: trading strategies, trading basics, fundamental analysis and technical analysis & charting. Here are the most popular articles in the library.

CMC Markets Canada Customer Service

CMC Markets Canada offers online customer support to traders via the following channels:

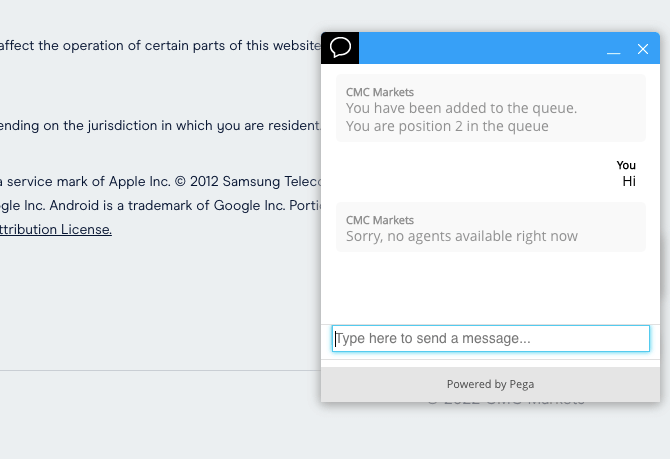

1) Live chat support: CMC Markets live chat is available during working hours from Monday to Friday. The live chat can be accessed from the website homepage or the support tab on your account dashboard.

When our team tested it, we did not get any response as it kept saying no agents were available.

2) Email support: CMC Markets also offers email support to traders which is available for 24 hours on business days. When we tested it, we received a response after 6 hours, and the answer was not satisfactory, as it conflicted with some information on the website.

The CMC Markets email address is [email protected].

3) Phone support: CMC Markets has phone support for clients that you can call on business days. The CMC Markets phone number for support is +1 866 884 2608.

Do we Recommend CMC Markets Canada?

CMC Markets are regulated in Canada by CIRO, in Australia by ASIC and in the UK by the FCA. This means your funds are safe and protected as they are required to follow strict rules and are also registered with the CIPF.

The trading fees on CMC Markets are moderate as you do not pay commission on all instruments except shares, so if you do not trade shares majorly, you will enjoy overall commission-free trading. Note that the broker charges dormant account fees after 12 months and offers no negative balance protection.

The website of CMC Markets has easy navigation and UI/UX for traders and you can easily find information. Although the registration process is a bit long and complicated.

The customer support of CMC Markets Canada is not so good. This is a downside as it means you cannot easily resolve issues or make enquiries. Only their email service is responsive and it is slow.

There are other brokers who are regulated in Canada that you can try out. We recommend that you check out the CMC Website to decide if they meet your trading needs.

CMC Markets Canada FAQs

Can I trust CMC Markets?

You can trust CMC Markets because they are regulated by the Canadian Investment Regulatory Organization (CIRO) and other top-tier regulators in the UK, Australia and Europe.

Is CMC Markets regulated in Canada?

CMC Markets is regulated in Canada as CMC Markets Canada Inc., by the Canadian Investment Regulatory Organization (CIRO).

How much commission does CMC Markets take?

CMC Markets charges a minimum commission of $8 whenever you trade shares and the amount can be lower, depending on the volume of your trade.

What can you trade on CMC Markets?

You can trade over 10,000 financial instruments on CMC Markets, including, forex, stocks, indices, bonds, cryptocurrencies, metals, energies, and agriculture commodities.

Note: Your capital is at risk