Forex.com is a CFDs broker that offers a platform for trading in the forex market, as well as other financial instruments like indices, metals, oil, agriculture commodities and stocks in Canada.

Forex.com was founded in 2001 and is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and other top-tier financial regulators in the UK and Australia.

In our Forex.com review, we look at their fees, deposit and withdrawal options, account opening process, customer support and regulations to help you decide if this broker is right for you.

| Forex.com Review Summary | |

|---|---|

| Broker Name | GAIN Capital – FOREX.com Canada Limited |

| Establishment Date | 2001 |

| Website | www.forex.com |

| Address | GAIN Capital – FOREX.com Canada Limited, GAIN Capital Group Bedminster One 135 US Highway 202/206 Suite 11 Bedminster, NJ 07921, USA |

| Minimum Deposit | C$100 |

| Maximum Leverage | 1:33 |

| Regulation | CIRO, FCA, ASIC, CySEC |

| Trading Platforms | MT4, Forex.com Mobile App, Forex.com Web Platform |

| Visit Forex.com | |

Forex.com Pros

- Regulated in Canada

- No deposit and withdrawal fees

- Offers commission-free trading

- Supports MT4 trading platform

- Fast execution

CMC Markets Cons

- Does not offer negative balance protection

- Does not support MT5 platform

- Does not offer deposits/withdrawals via e-wallets

- Charges inactive account fees.

- Customer support is not available 24/7.

Is FOREX.com safe?

Forex.com is the Trading name of GAIN Capital, which is a subsidiary of StoneX Group Inc. The company is regulated in multiple jurisdictions by Tier-1 and Tier-2 financial regulators.

Here are some of the countries in which Forex.com is regulated.

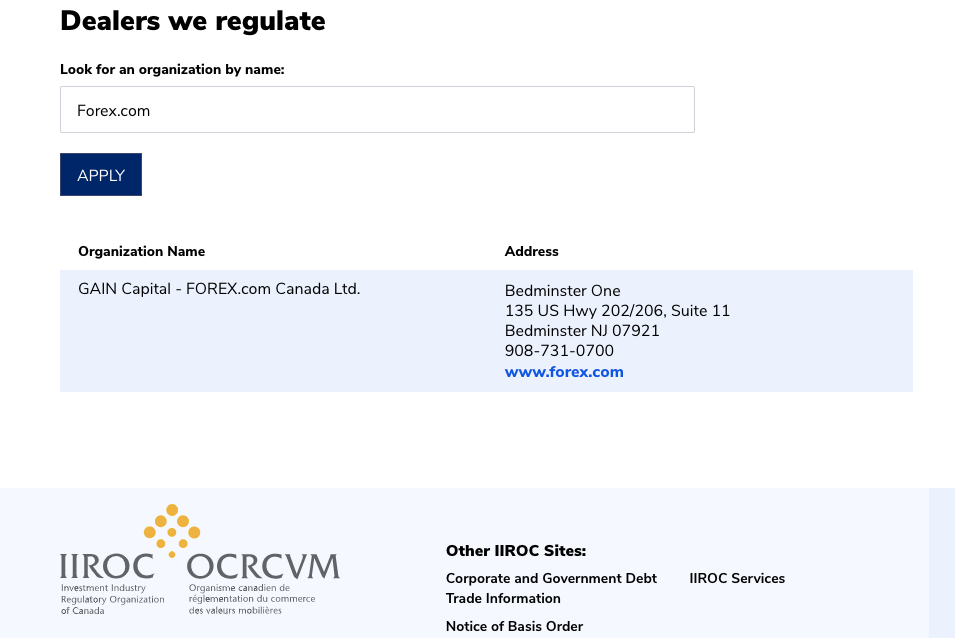

1) Canada Investment Regulatory Organization (CIRO): Forex.com is regulated in Canada by CIRO as ‘GAIN Capital – FOREX.com Canada Ltd.’ as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 38580, issued in 2012. CIRO was formerly called IIROC (Investment Industry Regulatory Organization of Canada)

Forex.com is registered with the Canadian Investor Protection Fund (CIPF). The CIPF works to ensure that any asset or investment owed to you by a regulated broker is given back, within some limits.

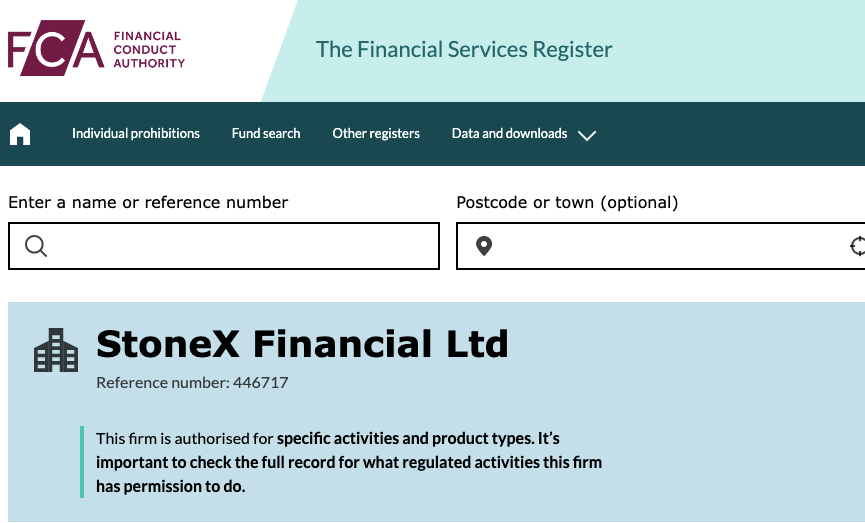

2) Financial Conduct Authority (FCA), UK: Forex.com is regulated by the FCA as ‘StoneX Financial Ltd’ and authorized to offer financial services in the UK with reference number 446717, issued in 2006.

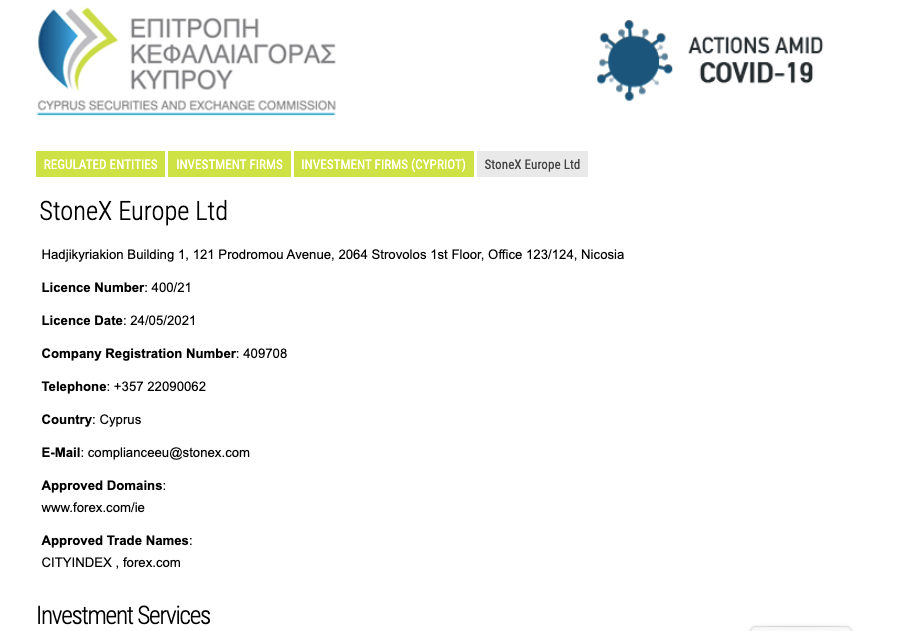

3) Cyprus Securities and Exchange Commission (CySEC): Forex.com is authorized in Europe by CySEC and licensed to offer investment services as ‘StoneX Europe Ltd’, with license number 400/21, issued in 2021.

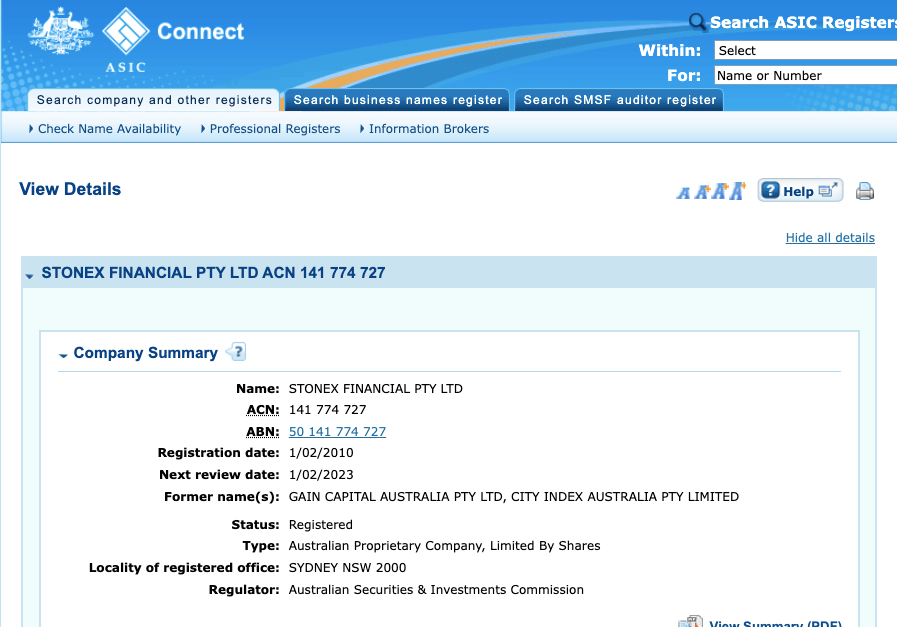

4) Australian Securities & Investments Commission (ASIC): Forex.com is licensed in Australia by ASIC as ‘StoneX Financial Pty Ltd’ to offer financial services, with Australian Company Number (ACN) 141 774 727, issued in 2010.

Forex.com Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Canada | $1 million | Canadian Investment Regulatory Organization (CIRO) | GAIN Capital – FOREX.com Canada Ltd |

| CyPrus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | StoneX Europe Ltd |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | StoneX Financial Pty Ltd |

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | StoneX Financial Ltd |

Forex.com Leverage

Leverage on Forex.com depends on the instrument you are trading. The maximum leverage on Forex.com in Canada is 1:33, which is a 3% margin requirement. This means that you can open a trade position worth up to 33 times your deposit. With a deposit of $1,000, you can open a $33,000 trade.

The 1:33 leverage applies to major forex pairs on the platform, other instruments have lower leverage limits such as 1:6 for indices, 1:3 for stocks, 1:4 for metals and 1:10 for some agriculture commodities.

It is best to avoid trading leveraged products as it involves risk, only trade if you understand them and have experience. It is important not to use all the available leverage as it increases your risk and the chance of losing your money.

Forex.com Account Types

Forex.com offers 3 main account types, Standard, Raw Pricing and DMA Accounts designed for different types of traders. The broker also offers Active Trader Status to clients that trade large volumes or maintain high account balances.

You can open a demo account to practice with virtual money and get familiar with the platforms before putting in your real money, but Forex.com does not offer Islamic Accounts in Canada.

You can open an account as an individual or corporate entity. Here is a summary of the features account types on Forex.com:

1) Standard Account: The Forex.com Standard Account is designed for regular traders who have experience or are new to trading. You can access the account via the Forex.com trading platform or MT5. It is the default account you get when you signup on to the platform.

This account allows you to trade forex pairs, metals, energies, stocks, agriculture commodities, and equities with a maximum leverage of 1:33.

This account does not charge commission fees when you open and close trade positions, spreads start from 0.8 pips for major pairs and you pay swap fees if you keep a trade position open for more than 24 hours.

The recommended balance for the Standard Account on forex.com is $1,000 and you do not have negative balance protection which means that if you suffer a loss on a trade, you can lose more than the money you deposited in your account and will be required to add more money to clear the negative balance.

2) Raw Pricing Account: The Forex.com Raw Pricing Account is designed for traders who want to pay low spreads on major forex pairs. You can access the account via the Forex.com trading platform or MT5.

This account allows you to trade forex pairs, metals, energies, stocks, agriculture commodities, and equities with a maximum leverage of 1:33.

This account charges commissions of $7 round-turn (when you open and close trade positions) per $100k USD traded, spreads start from 0.1 pips for major pairs and you pay swap fees if you keep a trade position open for more than 24 hours.

The recommended balance for the Raw Pricing Account on forex.com is $1,000 and you do not have negative balance protection which means that if you suffer a loss on a trade, you can lose more than the money you deposited in your account and will be required to add more money to clear the negative balance.

3) Corporate Account: The Forex.com Corporate Account Account is designed for retail or institutional client. The account allows you trade a Corporate Account via a corporate structure. The account comes with a dedicated support and effective trading platforms.

You can fund the account from your company’s cash supplies and trade in your business name. The account also have a unique feature that allows a team management of the account. That is, you can have multiple traders executing trades in the account.

The joint effort of these traders mirrors the culture of collaboration in a environment. If you want to test the account before opening it, then you can try the Corporate Demo Account.

4) Active Trader Account: The Forex.com Active Trader Program is an account status that Forex.com offers to high-volume currency traders, with a trading volume of $50 million in one month or with a minimum deposit of $10,000.

As an active trader on Forex.com, you get a dedicated account manager, professional guidance, and cash rebates on trades starting from US$8 per million volume traded and up to US$2,000 in a month.

Active Traders on Forex.com also get invited to exclusive events by the broker and receive a refund of any fees charged for wire transfers.

Other fees and features like trading platform depend on whether you had a Standard or DMA Account before becoming an Active Trader.

Note that you do not have to apply to become an Active Trader, your account will automatically be classified as Active Trader once you trade over $50 million in one month or open an account with $10,000.

Forex.com Base Account Currency

You can have the Canadian Dollar – CAD or the United States Dollar – USD as the base currency of your account on Forex.com. Your trades, deposits, withdrawals, and fees will be measured in the account currency you choose.

Forex.com Fees

Fees on Forex.com depend on your account type, the instrument you are trading, and your trade volume. Here is an overview of the trading and non-trading fees on Forex.com.

Trading fees

1) Spreads: Whenever you trade a financial instrument on Forex.com, you pay spreads, which is a markup added by the broker on the ask (sell) price. Spreads are the difference between the bid (buy) and ask (sell) price and go to the broker. Spread on Forex.com depend on the instrument you are trading, account type, and the volume of trade and can fluctuate throughout the trading day.

Find the minimum spread for major market pairs on the Forex.com Standard Account below:

2) Commission fees: While Forex.com offers commission-free trading for all instruments for the Standard Account which means that you will not pay any commissions for opening or closing trade positions, DMA Accounts on Forex.com pay commission fees starting from $80 per USD million traded and the commissions are discounted as the trade volume increases. Raw Pricing Account on Forex.com also pays a commission of $7 for every $100,000 lot traded.

Forex.com Trading fees Table

Here is a summary of the typical fees Forex.com charges on some instruments:

| CFD instrument | Spread | Commission on Raw Pricing Account |

|---|---|---|

| EUR/USD | 1 pip | $7/lot |

| GBP/USD | 1.1 pips | $7/lot |

| USD/CAD | 2.2 pips | $7/lot |

| Gold (XAU/USD) | 0.53 pips | $7/lot |

| US Crude oil | 1.5 pips | $7/lot |

| UK 100 | 3 pips | $7/lot |

| US S&P 500 | 0.6 pips | $7/lot |

3) Swap fees: If you open a trade position and leave it open past the market’s closing time which is 5:00 pm ET, the position rolls over to the next trading day and you incur a rollover fee (swap fee). This fee is dependent on the size of your trade that is open, whether your position was short (sell) or long (buy), the spread, the leverage, and how long it was kept open.

If your was a short (sell position), you gain interest instead of a charge. The swap fees will be added to your profit or loss when you close the trade.

Non-trading fees

1) Deposit and Withdrawal fees: Forex.com offers free deposits and withdrawals. You do not have to pay any fees when you deposit funds to your trading account or when you withdraw funds from it. This applies to all account types.

Note that your financial institution may charge an independent transaction fee during deposits or withdrawals.

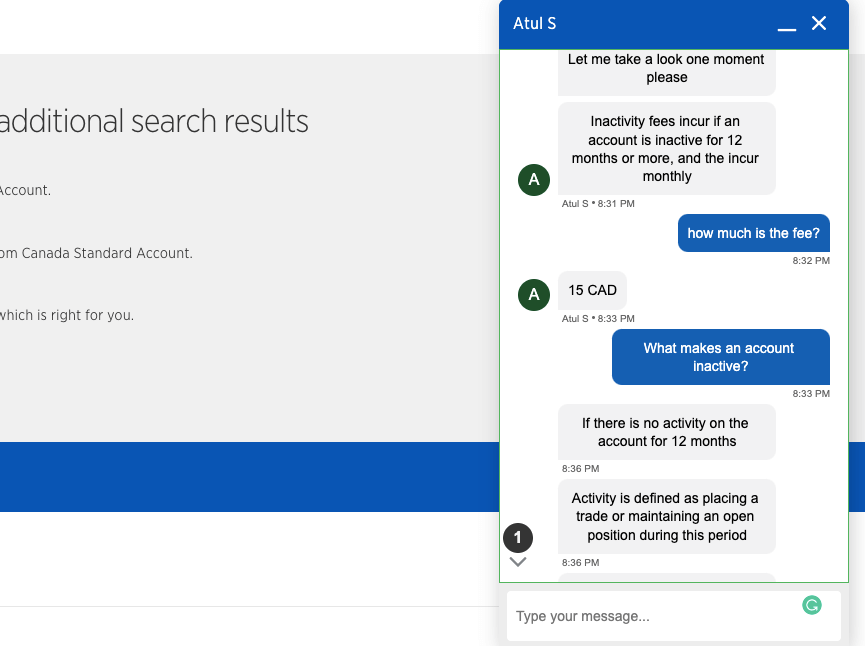

2) Account Inactivity charges: If you do not log in to your trading account or perform any trade on it for 12 months, the account will be classified as inactive and Forex.com will charge inactive account fees of C$15 monthly. If your account balance is zero, no negative balance will accrue.

Forex.com Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | CAD 15 per month after 1 year |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

*Note that your payment processing company may charge some independent transaction fee during deposits or withdrawals.

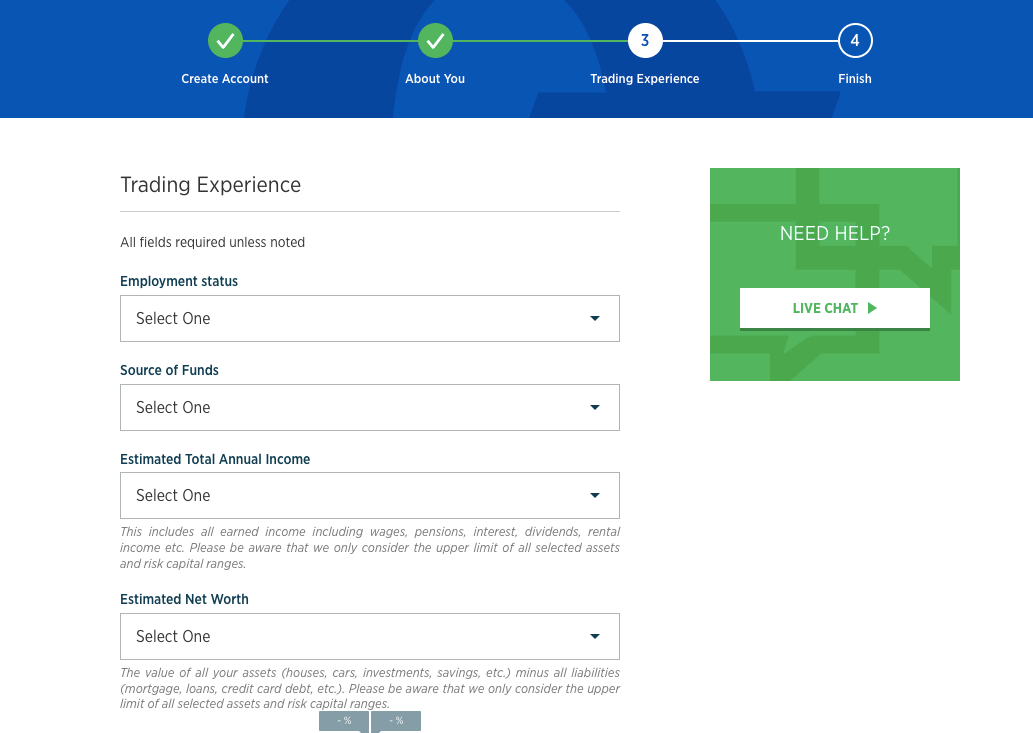

How to Open Forex.com Account in Canada?

Follow these steps to open a trading account on Forex.com.

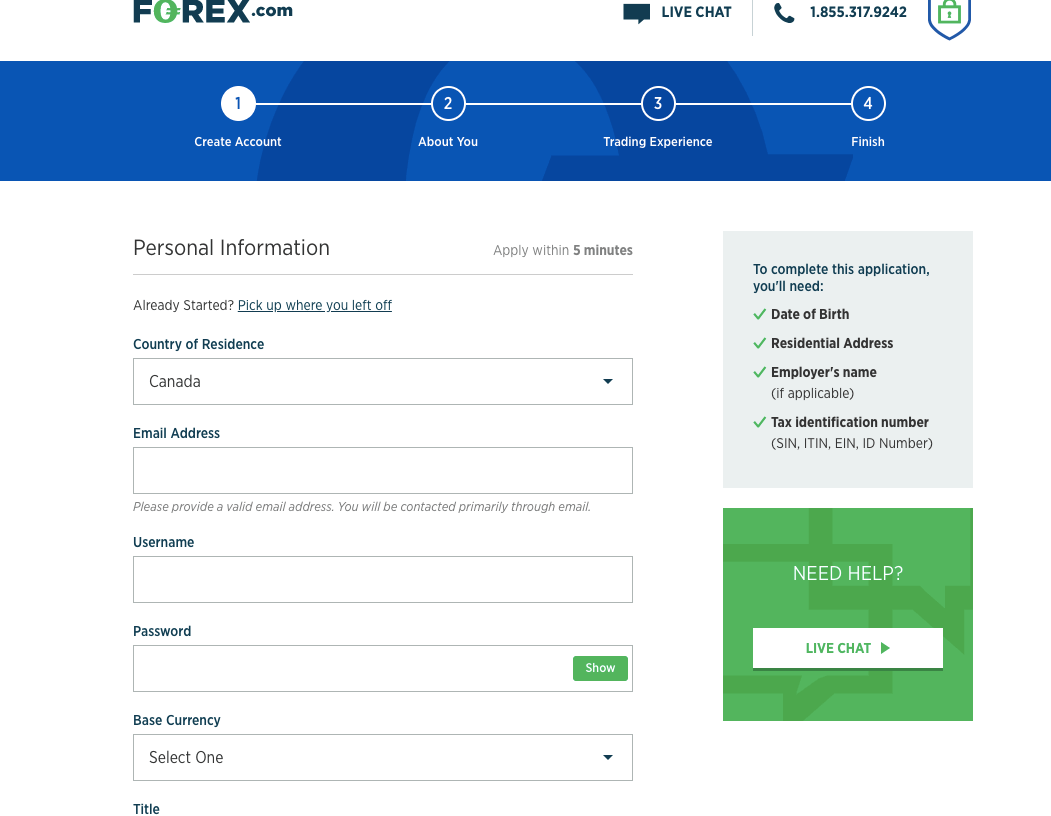

Step 1) Go to the Forex.com website at www.forex.com and click on the ‘OPEN AN ACCOUNT’ button, and you will be redirected to a page to choose your preferred trading platform to open the account with.

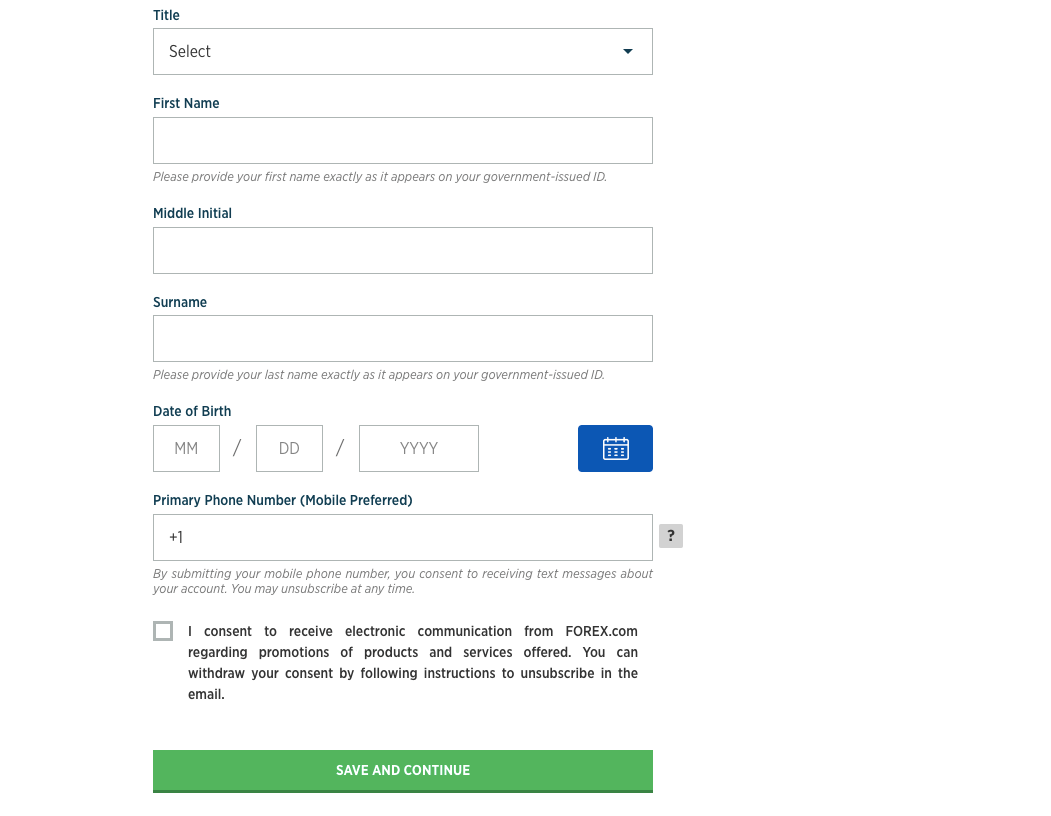

Step 2) Enter your email address, create username and password, select your preferred account currency, provide your full name, date of birth, and phone number, check the box to consent to the promotional emails then click ‘SAVE AND CONTINUE’.

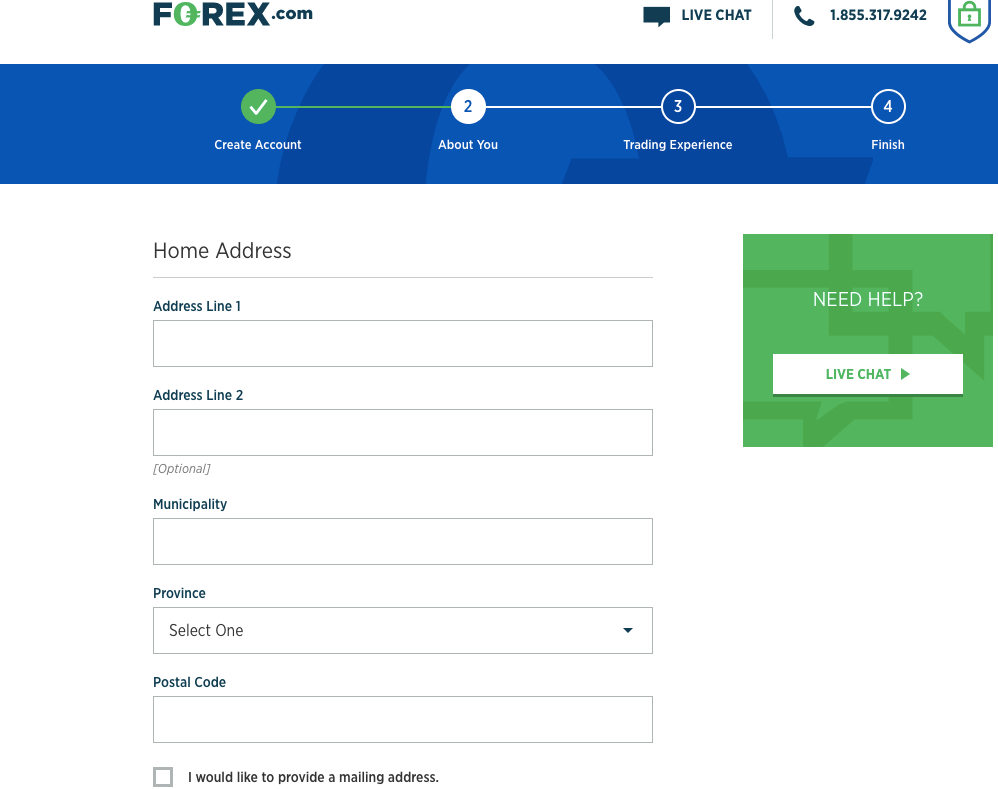

Step 3) Provide your address, information about citizenship and social insurance number then click ‘CONTINUE’.

Step 4) Answer questions about your trading experience, family background, employment, and financial status, then click ‘CONTINUE’.

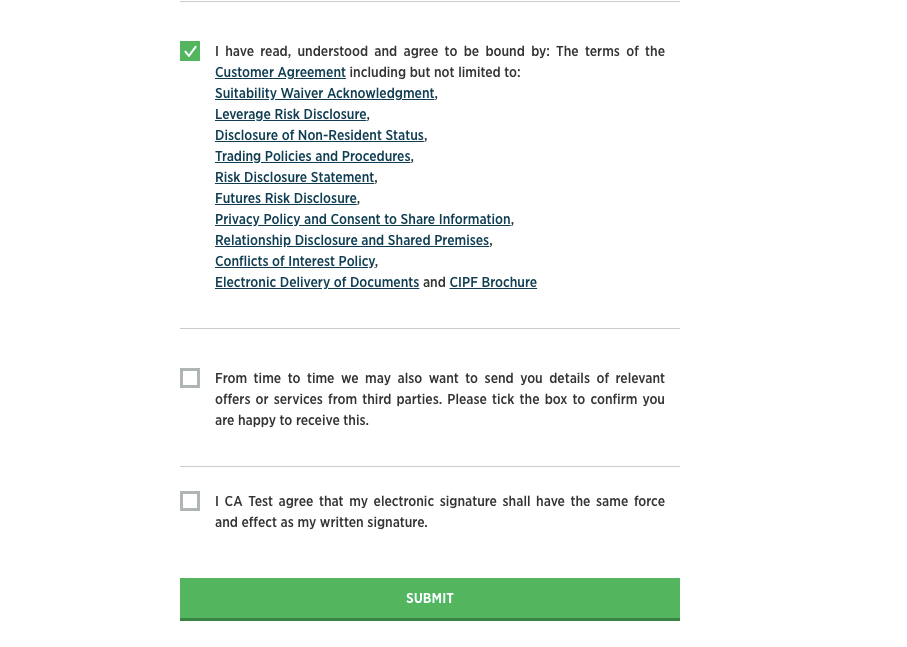

Step 5) Agree to the terms and conditions then click ‘SUBMIT’.

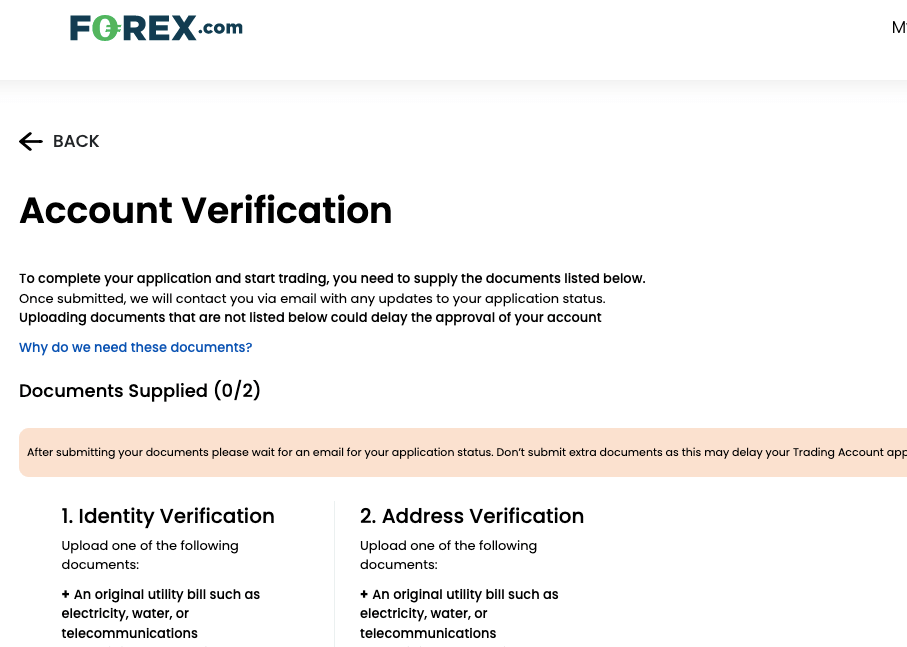

Step 6) Upload the required documents to verify your identity and address so that your account application will be approved.

Note that you will need to verify your account before you can make any deposits, start trading or make withdrawals.

FBS Deposits & Withdrawals

Payment methods supported by Forex.com for deposits and withdrawals are bank transfers and cards. Here is the summary of the deposits and withdrawal options on Forex.com Canada.

Forex.com Deposit Methods

Here is a summary of payment methods accepted by Forex.com for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | Free | 24 hours |

| E-wallets | No | N/A | N/A |

Forex.com Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Forex.com.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Internet Banking/Bank Transfer | Yes | Free | 48 hours |

| Cards | Yes | Free | 24 hours |

| E-wallets | No | N/A | N/A |

What is the minimum deposit for forex com?

The minimum deposit on Forex.com is $100 for cards with a maximum of $10,000 per transaction while deposits via bank wire transfers have no mandatory minimum or maximum deposit amount.

How do I deposit money into Forex.com?

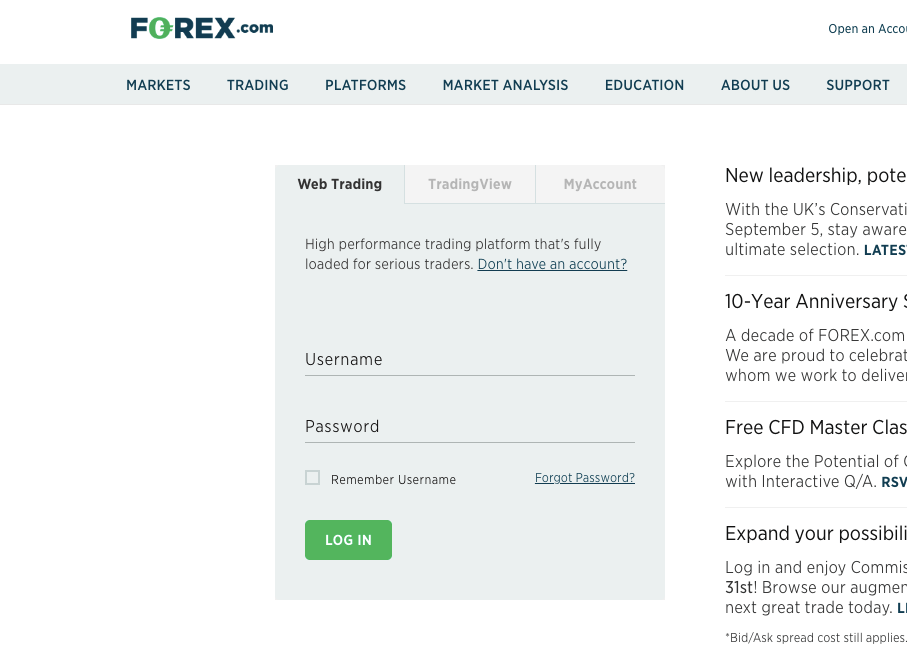

Step 1) log in to your Forex.com dashboard via www.forex.com/en-ca/account-login/

Step 2) Go to the funding page and follow the on-screen instructions to complete your deposit.

What is Forex.com’s minimum withdrawal?

The minimum withdrawal amount on Forex.com is $100 or all the funds in your account, whichever is smaller. This applies to all payment methods and account types.

You can withdraw a maximum of $50,000 to cards and $25,000 to bank accounts per transaction.

How do you withdraw from forex com?

Step 1) log in to your Forex.com dashboard via www.forex.com/en-ca/account-login/

Step 2) Go to the funding page and follow the on-screen instructions to initiate your withdrawal request.

Note that you can only withdraw via a payment method you have used to make a deposit.

Forex.com Trading Instruments

Here is a breakdown of tradable financial instruments on Forex.com.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 82 currency pairs on Forex.com |

| Commodities CFDs | Yes | 6 agriculture commodities on Forex.com (Coffee, soybeans, and others) |

| Energies CFDs | Yes | 2 oils on Forex.com (Natural gas and US Crude Oil) |

| Metals CFDs | Yes | 7 metals on Forex.com (Gold and Silver paired to currencies) |

| Indices CFDs | Yes | 17 indices on Forex.com (UK100, Wall Street, AU200 and others) |

| Shares CFDs | Yes | 66 stocks on Forex.com (Including stocks from US, UK, France and other countries) | ETF CFDs | Yes | 200 ETFs on Forex.com (Including Vanguard IT, iShares MBS and others) |

| Cryptos CFDs | Yes | 8 cryptocurrencies on Forex.com (Including Bitcoin, Litecoin and others) |

Forex.com Trading Platforms

Trading platforms supported by Forex.com are:

1) Forex.com Web Trading: Forex.com uses a proprietary trading platform developed by the broker. The trading platform is available on the web. It is a dynamic trading platform with different features. It has charts, a customizable layout, and options for advanced risk management.

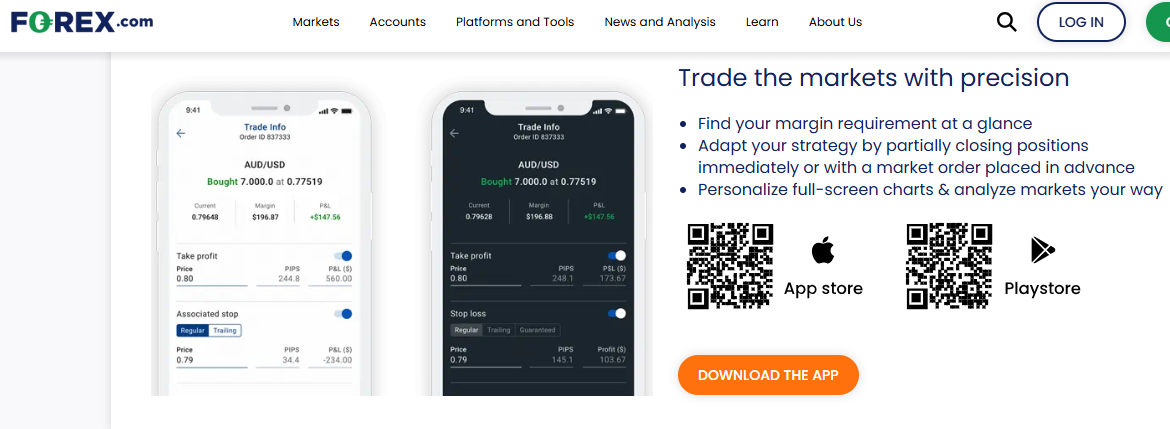

3)Forex.com Trading App: Forex.com also supports a their proprietary trading app. The app has real-time trade and order alerts, TradingView charting, full account management features and fast execution. You can download the app from the Google Play Store or Apple App Store.

3) MetaTrader 4 And MetaTrade 5: Forex.com supports the MT4 and MT5 trading application as platform for trading financial assets. You can access the app on the web, desktop (Windows & macOS), and mobile devices (Android & iOS).

Forex.com Trading Tools

City index have two trading tools. Here is a breakdown:

Trader Sentiment: The trader sentiment lets you know the CFDs that Forex.com’s clients are buying or selling. You will also get to see the by what percentage they are buying or selling. You can combine this tool with technical indicators to determine trend reversal.

Performance Analytics:Performance analytics is like a digital mentor. It contains a variety of tools within it that helps you with discipline, knowledge, and skill. It helps you set realistic trading goals and track them.

This tool has within it four internal tools. There is the trading plan that help you measure and monitor your trading goals. Then there is the playmaker that make sure you stay on track. The next tool, called Review, analyses your trades to help you see how you can improve it.

The final tool is the GamePlan. It reveals the strength and weaknesses in your trade with advanced technology. Performance Analytics is free for city index live clients.

Does Forex.com have a mobile app?

Forex.com have a mobile app that is available on the Google Play Store. It has been downloaded over 100,000 times on Google Play Store. It has 4.0/5 stars from 2,400 reviews. On the App Store, it is rated 4.5/5 stars from over 3,100 reviews.

Forex.com Education and Research

Forex com Canada offers educational resources to traders of all levels. You can use this resources as a new trader, intermediate or expert. Here are some ways you can learn more about Forex trading on Forex.com Canada:

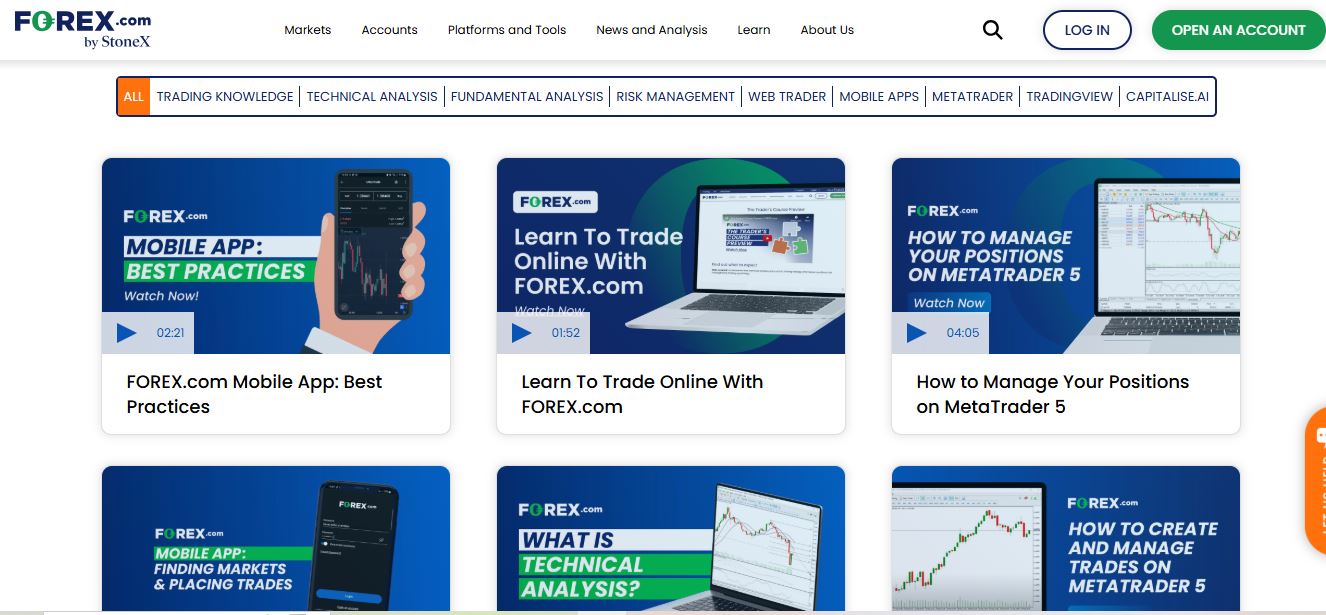

1. Trading Academy: Forex com has an academy that contains lessons on Forex trading to help traders develop their skill. The lessons are mainly in form of interactive articles and you can find lessons for beginners, intermediate and advanced trader. To access the Forex.com trading academy, go the ‘Learn’ tab on their website.

2. Webinar: Forex com hosts webinars periodically to share insights about market event with expert analysis. They host different webinars to cater to different levels of forex traders. The topics for their Forex.com webinars usually range from Strategist Webinars, Beginners Webinars, to Special Webinars.

3. Platform Tutorials: Forex.com has video tutorials on the ‘Learn’ section of their website that you can use to learn about their trading platforms. The videos focus on Forex com Platform Tutorials, designed to help you understand the features of their platform and how to use it.

The tutorial also focus on MT4, MT5, TradingView, and Capitalise.ai. Beyond learning about these platforms, this section also cover extra knowledge on technical analysis, fundamental analysis, and risk management. At the time of this writing, there are over 90 videos in the tutorial section, covering different trading and platform subjects.

Forex.com Canada Customer Service

Forex.com offers 24/5 customer support via live chat, email, and phone to traders.

1) Live chat support: Forex.com Live chat is available 24 hours from 10:00 AM on Sunday to 5:00 PM Friday ET and can be accessed via their website. When you start the chat, you will be required to submit your name and email address.

When our team tested the live chat, the wait time was about 1 minute before an agent was connected. The live chat responses were fast and the answers to our questions were relevant.

2) Email support: Forex.com offers email support to clients that is available 24/5. The Forex.com email address is [email protected]. When our team tested the email support, we got an auto-response immediately acknowledging receipt of your enquiry.

A customer representative replied to our email within 10 minutes and the answers to our questions were relevant.

3) Phone support: Forex.com offers toll-free phone support to clients in Canada which is available on business days. The Forex.com phone number in Canada is 1 855 317 9242.

Do we Recommend Forex.com Canada?

Based on the safety of clients’ funds, Forex.com is trustworthy because they are regulated in Canada by CIRO and other Top-Tier financial regulators in the UK, Australia, and Europe.

Forex.com fees are fair, as they offer commission-free trading with the Standard Account, zero charges for deposits and withdrawals, and competitive spreads. Although the broker charges inactive account fees after 12 months.

The customer support of Forex.com is good, as they are available 24 hours five days a week and respond promptly, which means you can easily resolve issues with your account. They also have an FAQ section with answers to many questions.

Forex.com’s maximum leverage of 1:33 will help in avoiding risk, although the broker offers relatively few tradable instruments and does not have negative balance protection.

Overall, we recommend that you check out their website to see if the platform is right for you and if they have the instrument pairs you would like to trade.

Forex.com Canada FAQs

Is Forex.com a good broker for beginners?

Forex.com is considered good for beginners because they have demo accounts for practice, supports more than one trading platform, and offer commission-free trading and free deposits and withdrawals.

A downside to the broker although they have limited leverage to minimise risk, is that there is no negative balance protection and the minimum deposit may be too higher for some beginners.

Can I use forex Com in Canada?

Forex.com is available in Canada. Forex.com is regulated in Canada by IIROC as ‘GAIN Capital – FOREX.com Canada Ltd.’ as an investment dealer and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 38580, issued in 2012.

Is Forex com allowed in Canada?

Yes, Forex com is allowed in Canada as the broker is regulated in Canada by the Canadian Investment Regulatory Organisation (CIRO) as GAIN Capital – FOREX.com Canada Ltd.

Forex.com is also a member of the Canada Investor Protection Fund that will compensate you up to $1 million in the event that you suffer a loss because of a misconduct by the broker.

How long does it take to withdraw from forex.com account?

It takes 24 hours to withdraw funds from Forex.com if you are withdrawing to a card and up to 48 hours for withdrawals via bank transfers.

Is there a withdrawal fee on Forex.com?

Forex.com does not charge any fees when you withdraw funds from the platform or deposit funds to your account. However, your financial institution may charge an independent fee.

Note: Your capital is at risk