FXCM has been operating since 1999 and has made a name for itself in the forex and CFD brokerage space. This broker offers currency pairs, indices, cryptocurrencies, commodities, and shares for trading purposes.

In Canada, FXCM has partnered with Friedberg Direct to offer its services to residents of Canada. This partnership allows Canadian traders to gain exposure to FXCM’s suite of products while maintaining the safety and accountability offered by Friedberg Direct which is a Canada-based company.

FXCM’s operations in Canada are overseen by the IIROC of Canada, which is the relevant regulatory authority in the company. Friedberg Direct is an esteemed member of the IIROC. Further, FXCM’s group entities are regulated in the UK, in Australia, in Cyprus, and in Bermuda.

In this review, we’ll talk about everything Canadian traders need to know about FXCM and its services including pros and cons, overall fees, customer support, trading instruments, and more.

| FXCM Review Summary | |

|---|---|

| 🏢 Broker Name | Friedberg Mercantile Group Ltd. |

| 📅 Establishment Date | 1999 |

| 🌐 Website | https://www.fxcm.com/ca/ |

| 🏢 Address | Friedberg Direct, 220 Bay Street, Suite 600, Toronto, Ontario, M5J 2W4, Canada |

| 🏦 Minimum Deposit | CAD 50 |

| ⚙️ Maximum Leverage | 1:400 |

| 📋 Regulation | IIROC, FCA, ASIC, CySEC, The Bahamas |

| 💻 Trading Platforms | MT4, Trading Station |

| Visit FXCM | |

FXCM Pros

- Fast execution

- Authorised by Top-Tier Regulators

- Offers commission-free trading

- Offers negative balance protection

- Supports multiple trading platforms and EAs

- Does not charge any fees for deposits

FXCM Cons

- Does not offer cryptocurrencies

- Do not have 24/7 customer support

- Slow processing of deposits and withdrawals

Is FXCM safe for traders from Canada?

Yes, FXCM is considered to be safe for traders from Canada. This is largely because of their partnership with Friedberg Direct. Friedberg Direct is a member of the IIROC which is the relevant financial authority of Canada overseeing financial services in the country.

Further, FXCM’s group entities are also regulated by the tier-1 financial authorities Financial Conduct Authority of the UK and the Australian Securities and Investment Commission of Australia.

They also implement safety practices for traders such as negative balance protection and segregation of funds.

Here is a breakdown of the licenses held by FXCM and its group entities:

1) Canadian Investment Regulatory Organization (CIRO): FXCM in partnership with Friedberg Direct (Friedberg Mercantile Group Ltd.) is a member of the IIROC of Canada. Hence, they are regulated and licensed to operate in Canada. They are held accountable by this regulatory body and any grievance can be legally redressed. The Investment Industry Regulatory Organization of Canada (IIROC) is now known as CIRO.

FXCM through Friedberg Direct is a member of the Canadian Investor Protection Fund (CIPF) that compensates traders in the event of a loss that is as a result of the broker’s misconduct or even when the broker is bankrupt.

2) Financial Conduct Authority (FCA): Forex Capital Markets Limited is regulated by the Financial Conduct Authority (FCA) of the United Kingdom (UK) and holds the license number 217689 which was issued in 2003.

3) Australian Investment and Securities Commission (ASIC): FXCM Australia Pty Limited is regulated by the Australian Investment and Securities Commission (ASIC) of Australia and has held the license number 121934432 since 2016.

4) Cyprus Securities and Exchange Commission (CySEC): FXCM EU Limited is regulated by the Cyprus Securities and Exchange Commission (CySEC) and has held the license number 392/20 since 2020.

5) Bermuda Registrar of Companies: FXCM Markets Limited is regulated in Bermuda and has been incorporated since 2012.

FXCM Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Canada | $1,000,000 | Canadian Investment Regulatory Organisation (CIRO) | Friedberg Mercantile Group Ltd. |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | FXCM Australia Pty. Limited |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | FXCM EU Ltd |

| UK | £85,000 | Financial Conduct Authority (FCA) | Forex Capital Markets Limited |

FXCM Leverage

The leverage offered by FXCM depends on the instrument being traded and the type of trading account held by the trader. The maximum leverage offered by FXCM is 1:400. When trading currency pairs through the Active Trader account, the maximum leverage is 1:200.

A leverage of 1:400 means that a trader can make a trade worth $400,000 while only utilizing $1,000 of their own funds (the money they have deposited into their trading account).

You should keep in mind that using leverage greatly increases the risk associated with your trade and you can lose all your money. Even though it magnifies profits, it also magnifies losses.

FXCM Account Types

FXCM primarily offers only two types of accounts; these are the Retail account and the Active Trader account. The Retail account is meant for beginners and individual traders while the Active Trader account is meant for high-volume traders and institutional traders.

Further, FXCM also offers Islamic account for traders of the Islamic faith and the Demo account for beginners to practice trading.

Here is a breakdown of each of these types of accounts:

1) Retail Account: The Retail account is a spread-only account which does not charge a commission. The Retail account can be opened with a minimum deposit of CAD 50. The minimum trade size is 1 Micro Lot and the maximum leverage is 1:400.

This account can be accessed using the MetaTrader 4 platform or the Trading Station platform. Traders can gain exposure to currency pairs, indices, commodities, cryptocurrencies, shares, and more.

The average spread is 1.3 pips which is decent compared to other similar brokers.

2) Active Trader Account: The Active Trader Account is meant for advanced high-volume traders and for institutional traders. This type of account charges a tight spread along with a commission per lot per trade.

An Active Trader account can only be opened if the trader has a notional trading volume of over CAD 10 million. This trading volume is calculated based on the funds deposited into the trading account and the notional value of the open trades on the platform.

An Active Trader account comes with a dedicated account manager along with priority customer support. Traders also have access to exclusive market data which can be used to inform trades.

3) Islamic Accounts: The Islamic account is also known as a swap-free account because FXCM does not charge any swap fees to traders using such an account. This is because paying any form of interest is forbidden under Islamic law.

An Islamic account can only be opened by Muslims who follow the Islamic faith. You can have your Retail account or your Active Trader account converted into an Islamic account (with the same trading conditions except no swap fees and higher spreads) by making an application to customer support.

4) Demo Account: A demo account, as the name suggests, is not a real trading account but it mimics the trading conditions of a real account. A demo account can be used to practice trading without risking real money and also get a feel of FXCM’s trading services and learn the trading platform.

FXCM Base Account Currency

You can choose from 2 currencies as your account base currency on FXCM. They are Canadian Dollar – CAD and United States Dollar – USD.

All your trades, deposits/withdrawals will be measured in your base account currency.

FXCM Overall Fees

FXCM charges trading and non-trading fees. They are detailed below:

Trading fees

1) Average Spreads: All trades on FXCM involve a spread (even if you’re using the Active Trader account). The spread is charged as the difference between the Bid price and the Ask price.

The average spread for trading the benchmark EUR/USD currency pair through the Retail account is 1.3 pips and the through the Active Trader account is 0.3 pips.

| Instrument/Pair | Standard Retail Accounts | Active Trader Accounts |

|---|---|---|

| EUR/USD | 1.3 pips | 0.3 pips |

| GBP/USD | 2 pips | 0.8 pips |

| EUR/GBP | 2.6 pips | 0.6 pips |

| Gold | 0.45 pips | 0.45 pip |

2) Average Commissions: FXCM charges a commission on every trade through the Active Trader account. Traders using the Retail account do not need to pay a commission. The commission is fixed and the same commission applies regardless of the instrument being traded.

Commissions start from $0.07 per side of 1,000 lot, $0.70 per side of 10,000 lot, $7 per side of 100,000, and $70 per side of 1,000,000 lot, which applies to major forex pairs. Others have commissions starting from $0.09 per side lot and up to $90 per side.

3) Swap Fees: FXCM charges a swap fee if the trader holds an open position overnight. This fee is charged if a trade is not closed by 5 PM. Traders using an Islamic account do not need to pay any swap fees but they will be charged higher spreads on every trade.

Non-trading fees

1) No Deposit Fees: FXCM does not charge any deposit fees. However, the payment service provider may charge a fee for executing the fund transfer.

2) Low Withdrawal Fees: FXCM charges a withdrawal fee of CAD 40 when withdrawing through a wire transfer to any bank account outside of the United States or the United Kingdom. They do not charge a withdrawal fee if withdrawing through cards or through a payment wallet.

3) Low Inactivity Fees: FXCM charges an inactivity fee of CAD 50 per year if you do not make any trades through your account for a period of more than one year.

FXCM Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | CAD 50 per year |

| Deposit fee | Free |

| Withdrawal fee | CAD 40 for wire transfers |

*Note that your payment processing company may charge some independent transaction fee.

How to Open FXCM Account in Canada?

Follow these steps to open a trading account on FXCM.

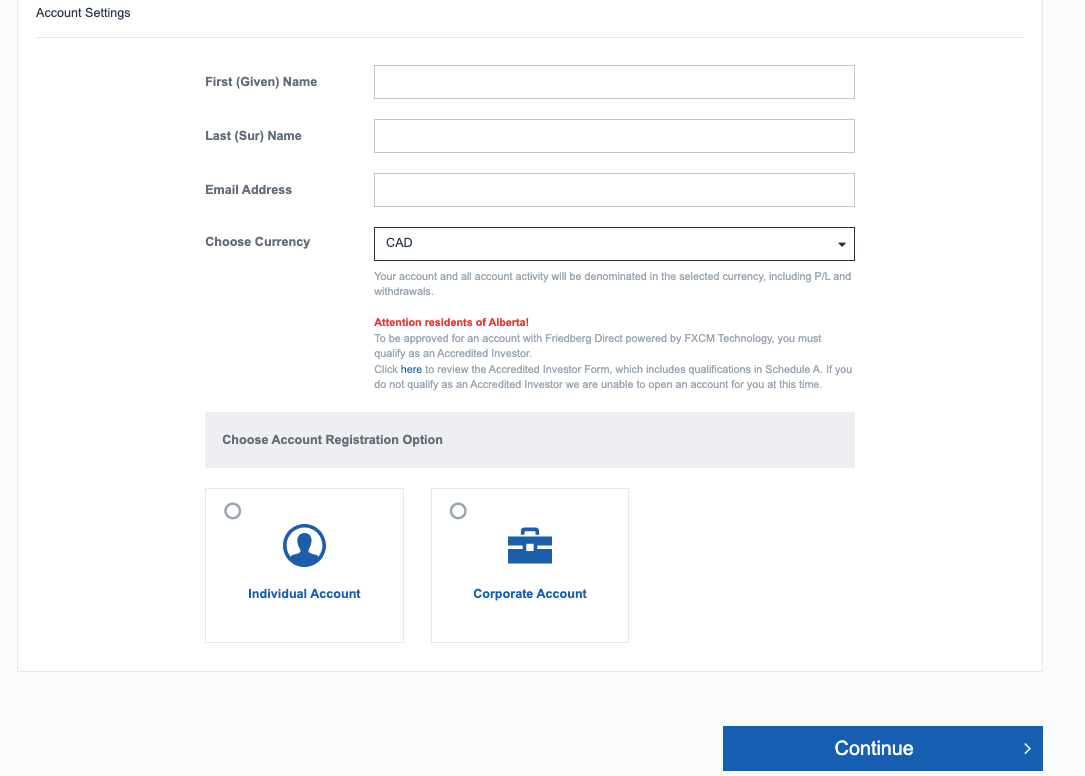

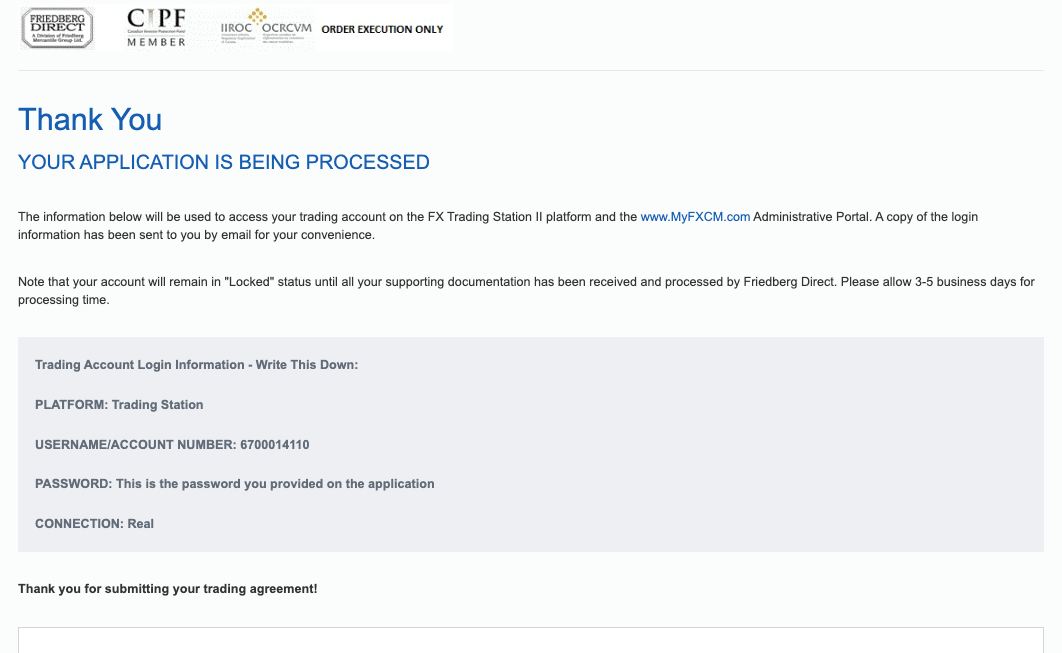

Step 1) Go to the FXCM website at www.fxcm.com and click on ‘OPEN AN ACCOUNT’. On the page that loads, select the trading platform you would like to use.

Step 2) Provide your name and email address, choose your preferred account currency and whether you are opening a corporate or individual account, then click ‘Continue’.

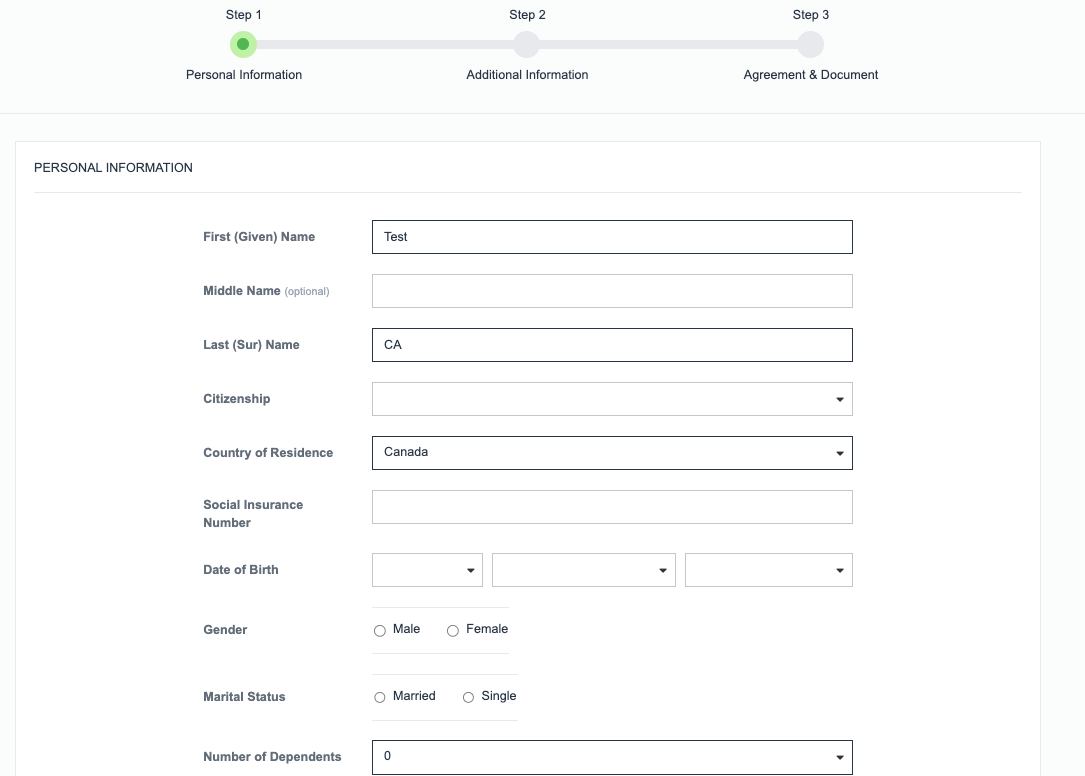

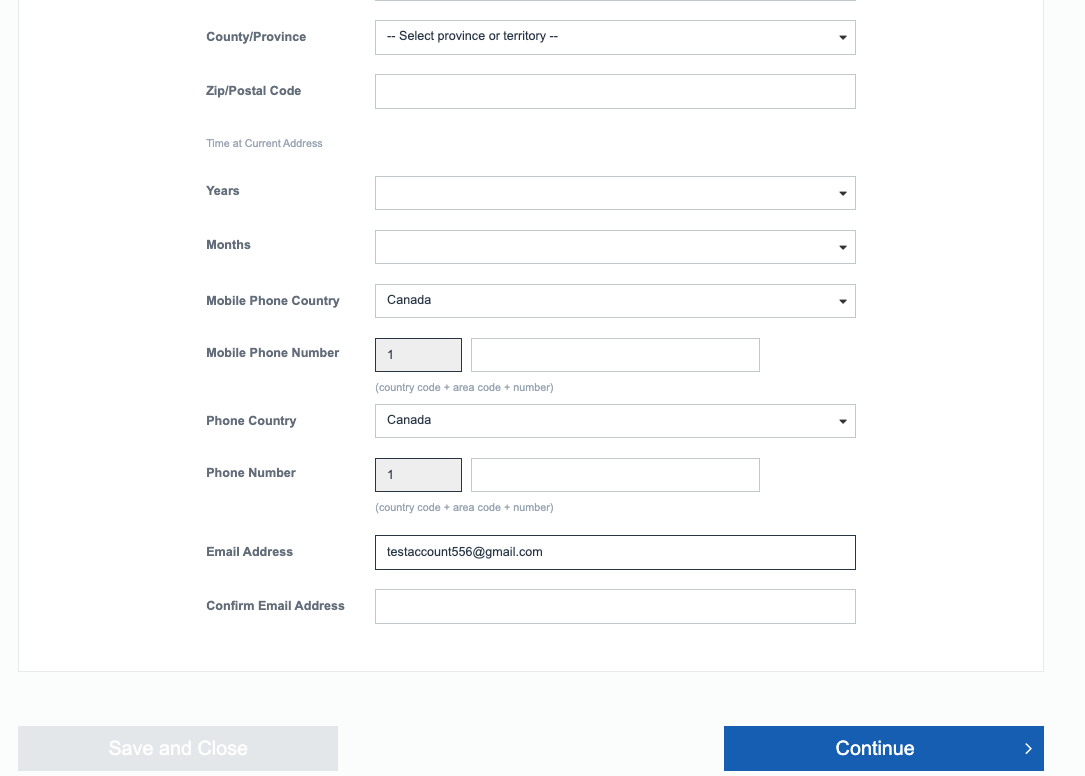

Step 3) Provide your Social Insurance Number, address, phone number and answer other personal questions, then click ‘Continue’.

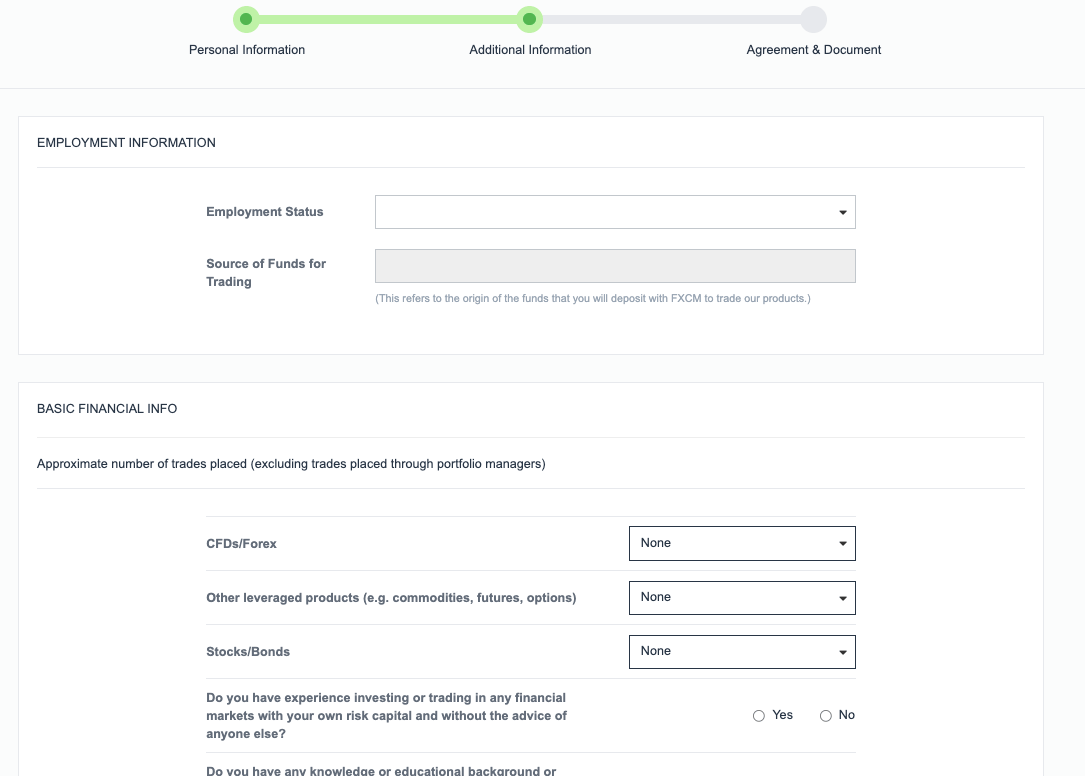

Step 4) Answer questions about your employment and trading experience then click ‘Continue’.

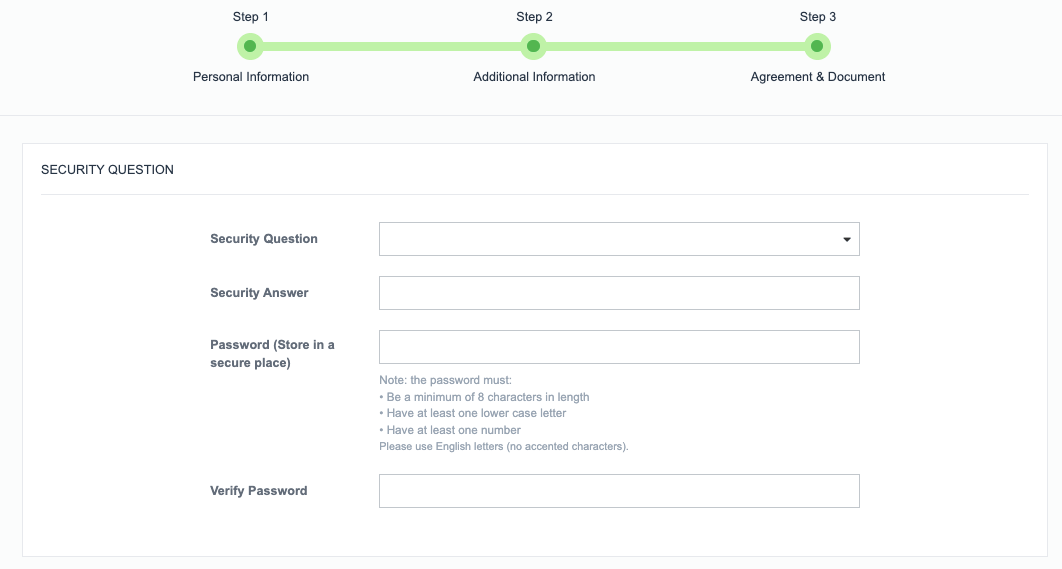

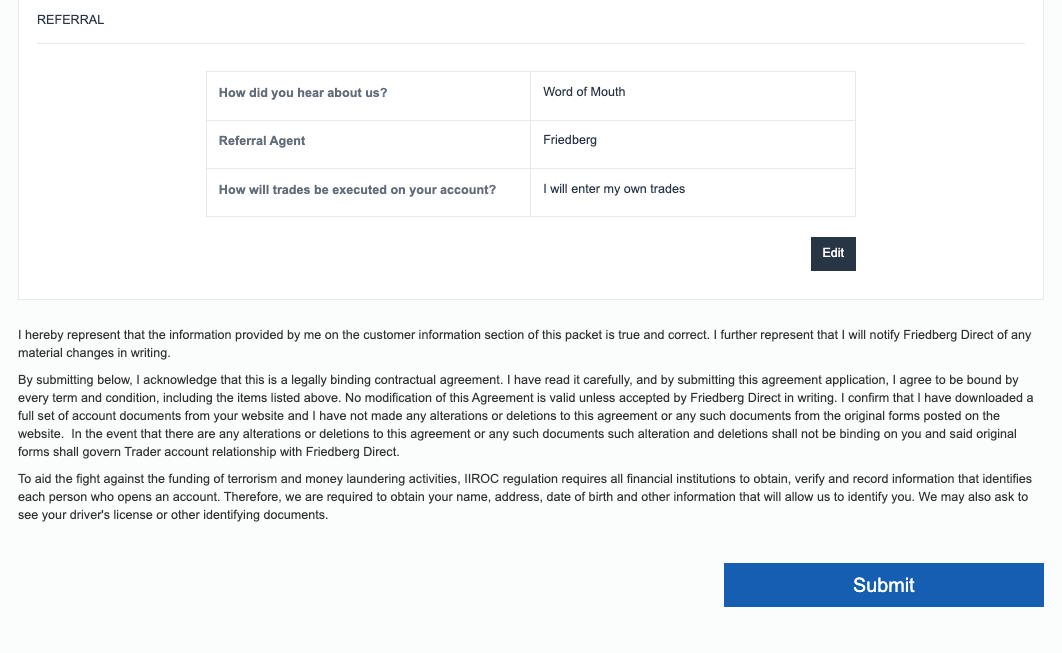

Step 5) Set a password for your account, check the boxes to accept the terms and condition then click ‘Continue’. Next review the information you have provided and click ‘Submit’.

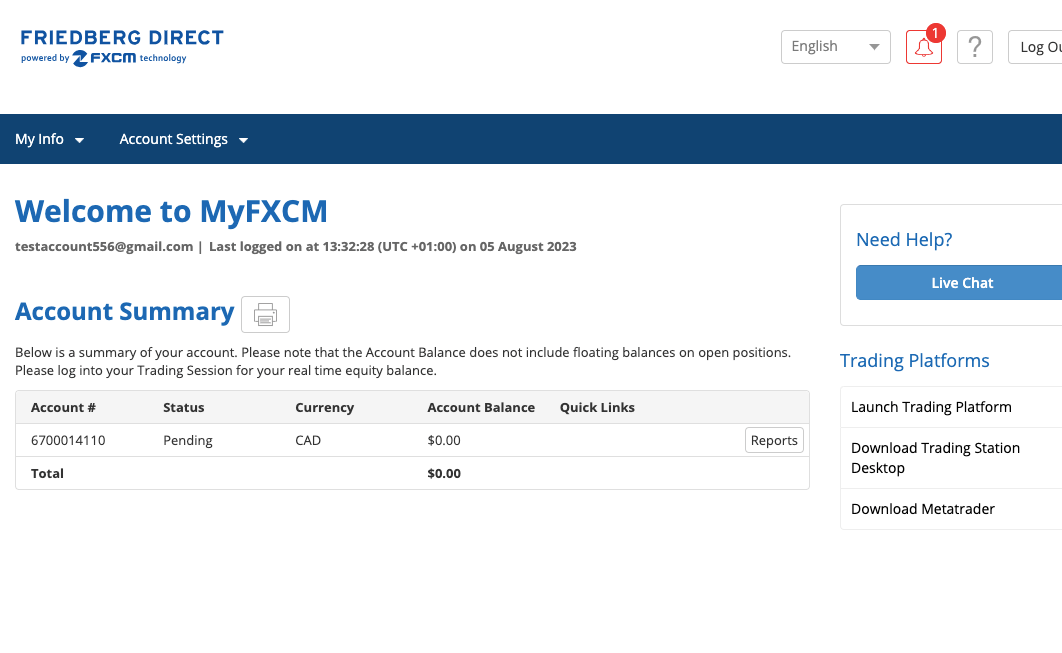

Step 6) After the application is submitted, click the www.MyFXCM.com to login to your account and continue the setup.

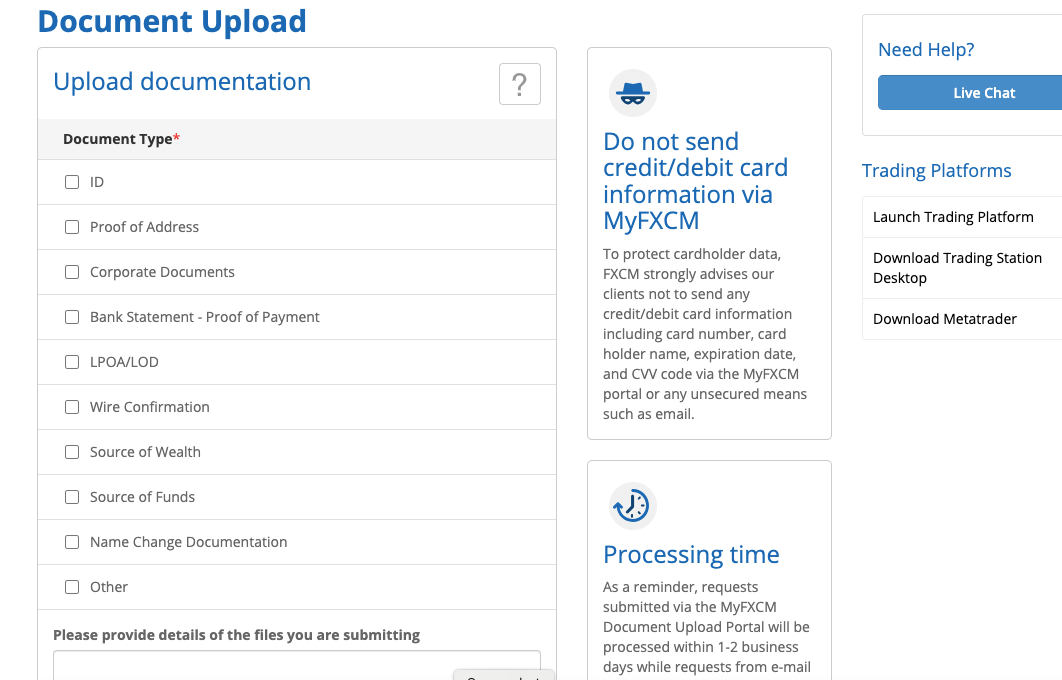

Step 7) Once logged in, you will be required to upload identity and proof of address documents to verify your account. They are processed in 1-2 business days.

After verifying your account, you can now deposit funds and start trading.

FXCM Deposits & Withdrawals

FXCM offers deposits and withdrawals to Canadian residents through the following means:

FXCM Deposit Methods

Here is a summary of payment methods accepted by FXCM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 2 to 5 business days |

| Cards | Yes | Free | Instant and up to 2 hours |

| E-wallet | No | N/A | N/A |

FXCM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FXCM.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | Free | up to 5 business days |

| E-wallets | No | N/A | N/A |

What is FXCM minimum deposit?

FXCM requires a minimum deposit of CAD 50 at the time of account opening. This deposit can be used for trading.

What is FXCM minimum withdrawal?

There is no mandatory minimum withdrawal amount. A trader can withdraw even CAD 1 from their trading account.

FXCM Trading Instruments

You can trade over the following financial instruments on FXCM:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 42 currency pairs on FXCM (7 Majors, 21 Minors, and 14 Exotics) |

| Forex Baskets CFDs | Yes | 3 Forex Baskets on FXCM |

| Commodities CFDs | Yes | 9 commodities on FXCM (Oil, Agriculture and Metals) |

| Indices CFDs | Yes | 12 indices on FXCM |

| Index Baskets CFDs | Yes | 1 Index Basket on FXCM (USEquities) |

| Stocks CFDs | Yes | 204 shares on FXCM (UK, US, Hong Kong, German, France, and Australia shares) |

| Stock Baskets CFDs | Yes | 16 stock baskets on FXCM |

| Treasury (Bonds) CFDs | Yes | 9 Treasury Bonds on FXCM (BUND, 10USnote, and others) |

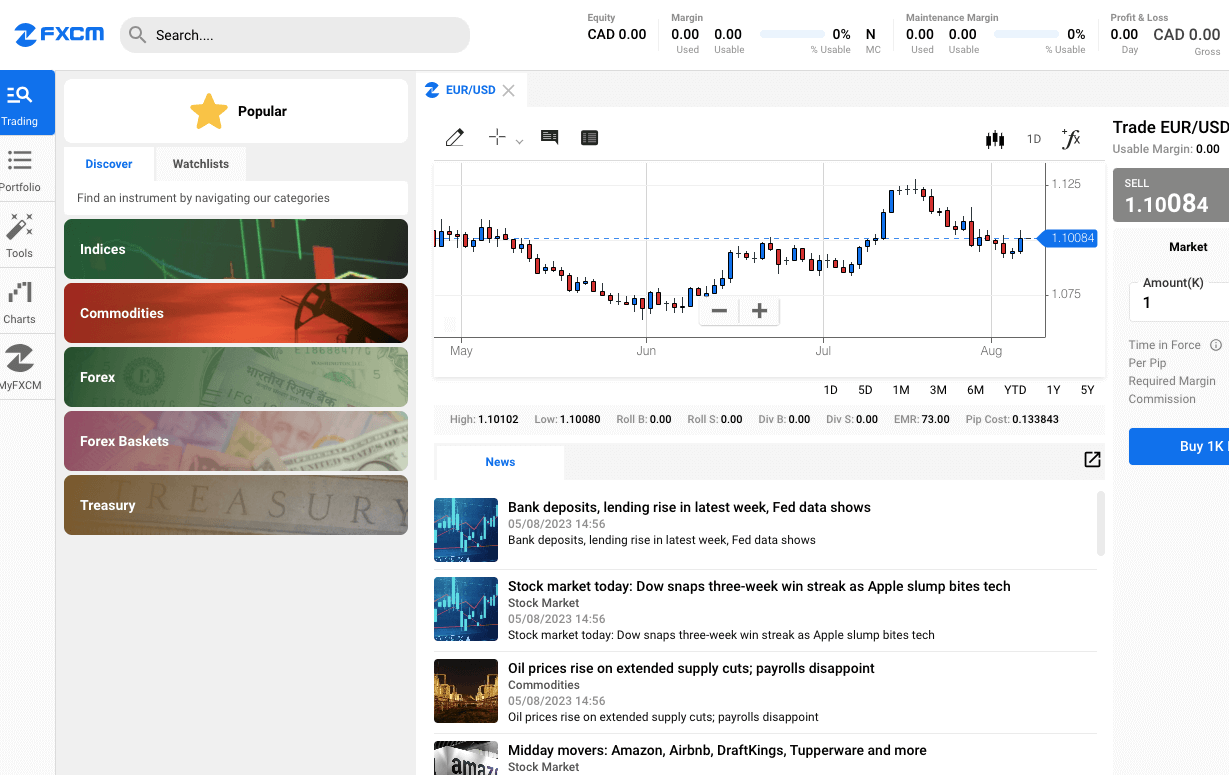

FXCM Trading Platforms

FXCM offers two trading platforms to traders from Canada:

1) MetaTrader 4: This is the most popular and commonly used trading platform in the world. It is quite simple and easy to use and boasts a host of attractive features. This platform can be used through Windows, MacOS, Android, and iOS devices. You can also access it directly through any web browser.

2) FXCM Trading Stations: This is FXCM’s proprietary trading platform which is not available anywhere else. This platform offers advanced charting tools and analytical features. It can be used as a mobile app or through a web browser. It also provides a window into the latest news and research.

Traders should note that MetaTrader 5 is not offered by FXCM.

FXCM Trading Tools

These trading tools can be found on FXCM’s Trading Station.

1) Dynamic Charts: You can trade directly from the charts. The charts are dynamic and you can customize them to your preferred display. You can also customize the periodicity. The indicators are pre-loaded but they are just a few dozens.

Another exciting feature of the charts is that you can overlay the prices of two CFDs so you can compare them better. You can set price alerts as well.

2) Automated trading: You can take advantage of automated trading to reduce the human factor in your trading. You can use forex strategy backtesting to see how you can improve your trades. There is also the strategy optimization tool to help you adjust your code.

3) The Speculative Sentiment Index (SSI): The SSI is a proprietary indicator created by FXCM. It is a contrarian indicator that helps you monitor trending markets. It gives you a ratio that lets you know to what degree a CFD is being bought or sold.

Does FXCM have a mobile app?

Yes, FXCM has a mobile app called trading station mobile. It has over 500,000 downloads on the Google Play Store with 3.8/5 starts from 1000 reviews. It also available on the Apple App Store.

FXCM Canada Customer Service

FXCM offers customer support through live chat, phone call, and email.

Live Chat: Their live chat function is available on their website and displayed prominently on the bottom right corner. It takes around five minutes to connect to a human customer support agent. Their responses are timely and helpful. Active Trader account holders can gain access to priority customer support. The live chat option is available at all times during weekdays but not during weekends.

Email Support: FXCM has a dedicated email helpline that can be contacted for customer support issues. This email is available on their website in the “contact us” page. We received and automated response when we contacted them and a live agent reached out to us within one hour. Our issue was resolved and our query was answered without any hassle. The email helpline is also only available during weekdays and not weekends.

Phone Support: Traders can reach FXCM through phone call as well. Their phone line number is available on the Canadian website of FXCM. The number is not toll-free as far as we were able to ascertain. The phone call option is only available during weekdays.

Overall, we found that FXCM provides good customer support and their team is conversant in English and quite helpful and responsive.

Is FXCM a Prime Broker?

FXCM provides prime brokerage services to institutional clients who require access to market data and execution across multiple trading venues with settlements managed through a centralized source.

FXCM Prime offers various services to clients such as high-frequency trading firms, hedge funds, proprietary trading firms, and small regional and emerging market banks.

These services include centralized clearing, risk management solutions, and access to multiple trading venues. However, to use FXCM Prime’s services, customers must maintain a minimum balance of more than $250,000.

Do we Recommend FXCM to Traders from Canada?

FXCM has a partnership with renowned Canadian brand Friedberg Direct which is a member of the esteemed IIROC. FXCM’s group entities are also regulated by the FCA of the UK and the ASIC of Australia. This makes them a safe option for traders from Canada.

Further, FXCM’s fees are quite reasonable. They offer different account types for different types of traders, while not offering too many account types which can be confusing for the trader.

Their website is quite well-made and provides all the relevant about their services and their customer support team can be reached quickly in case of any queries.

There are some drawbacks to trading through FXCM as well.

FXCM does not offer cryptocurrencies and they do not offer customer support during weekends. Their phone line is not toll-free and they may charge a withdrawal fee for bank transfers.

Overall, we recommend that you go to the broker’s website and chat with their customer support and see other offerings they have to know if you would like to trade with them.

FXCM Canada FAQs

Is FXCM a good broker?

Yes, FXCM is a good and reputed broker. They are safe for traders from Canada and their fees is quite reasonable. They offer a decent range of trading instruments and their trading platform can be used by anyone.

How long does it take to withdraw money from FXCM?

When you initiate a withdrawal, the accounts department processes it within 1-3 days. It can take up to 5 business days for you to receive the funds, depending on your card processor or e-wallet.

How much does FXCM charge per trade?

FXCM charges spreads per trade that start from 1.3 pips per trade on major pairs like EUR/USD and no commissions are charged per trade for retail and professional traders.

However, if you are an Active Trader on FXCM, you pay commission fees of £25 per million value traded and spreads are lower. The exact fee depends on the type of account held by the trader, the type of instrument being traded, the timing of the trade, amongst other factors.

What type of accounts does FXCM offer?

FXCM offers a variety of account types to suit different needs and experience levels. These include Standard Retail Accounts, Professional Account and Demo Accounts that beginners can use to get familiar with the platform practicing with virtual money before putting in their real money.

Is FXCM good for beginners?

Yes, FXCM is considered good for beginners in Canada, because the broker offers demo accounts beginners can use to get familiar with the trading platform with virtual money before in their real money.

The broker also offer negative balance protection to ensure you do not lose more than the capital invested. FXCM is also a member of Canadian Investor Protection Fund (CIPF), which is good sign for beginners to show the broker’s to following laid down regulation in protecting client fund.

What deposit methods does FXCM offer?

FXCM offers a variety of deposit methods, including bank transfer, credit/debit card, and e-wallets like PayPal and Skrill. The deposits are instant for cards and e-wallets and up to 2 business days.

Note: Your capital is at risk