| XM Minimum Deposit Summary | |

|---|---|

| XM Minimum Deposit | $5 (MYR 23) |

| Deposit Methods | Bank Transfer, E-wallets, Credit/Debit Cards |

| Account Types | Micro Account, Standard Account, Ultra Low Standard Account, and Shares Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR |

| Withdrawal Fees | No Fees (except for bank transfers below US$200) |

| Visit XM | |

XM minimum deposit in Malaysia is $5 (MYR 23). That is all you need to open an account with XM Trading.

This article is a breakdown of XM minimum deposit requirements, payment methods, processing time for deposits and other important info you should know about funding your trading account with XM in Malaysia.

What is the minimum deposit for XM?

XM offers four trading accounts. Micro Account, Standard Account, Ultra Low Standard Account, and Shares Account.

You need $5 to open any of the accounts except for the Shares Account.

Though this is the the minimum deposit required, it is recommended that you fund your account with more money. This will help you cover the margin costs of your trades.

Let us look into XM’s trading accounts briefly.

1) Standard Account

Minimum deposit is also $5 (MYR 23) but 1 lot size here is the standard 100,000 units in terms of contract size. The minimum spread is 1 pip.

XM charge no extra commission per standard lot on this account as well and the minimum trade volume is 0.01. Per ticket, you will be restricted to 50 lots. You cannot exceed this figure.

The Standard Account has the same base currencies as the Micro Account.

2) Ultra Low Standard Account

This account is divided into Ultra Low Standard Account and Ultra Low Micro Account. The minimum deposit is $5 but for both sub-divisions.

However, they vary in contract size. 1 lot size is 1000 units of currency for Ultra Low Micro Account. while the same lot size is 100,000 units for Ultra Low Standard Account.

They also vary for minimum trade volumes. For Ultra Low Micro Account, it is 0.1 lots. For Ultra Low Standard Account, the minimum volume is 0.01 lots

The account has the lowest spread beginning from 0.6 pips. All base currencies for the account are EUR, USD, GBP, AUD, ZAR, SGD.

3) Shares Account

This account is specifically for trading shares CFDs. The only base currency for this account is USD and the minimum deposit is $10,000. You will pay a commission per standard lot traded.

Minimum trading volume is 1 lot so this account is for high volume traders.

4) Islamic Account

XM’s Islamic Account is swap free to accommodate traders that do not want to pay or receive interest. The Micro, Standard, Ultra Low Standard Account, and Shares Account all have an Islamic Account option.

The minimum deposit and all trading conditions are the same except for payments of swap.

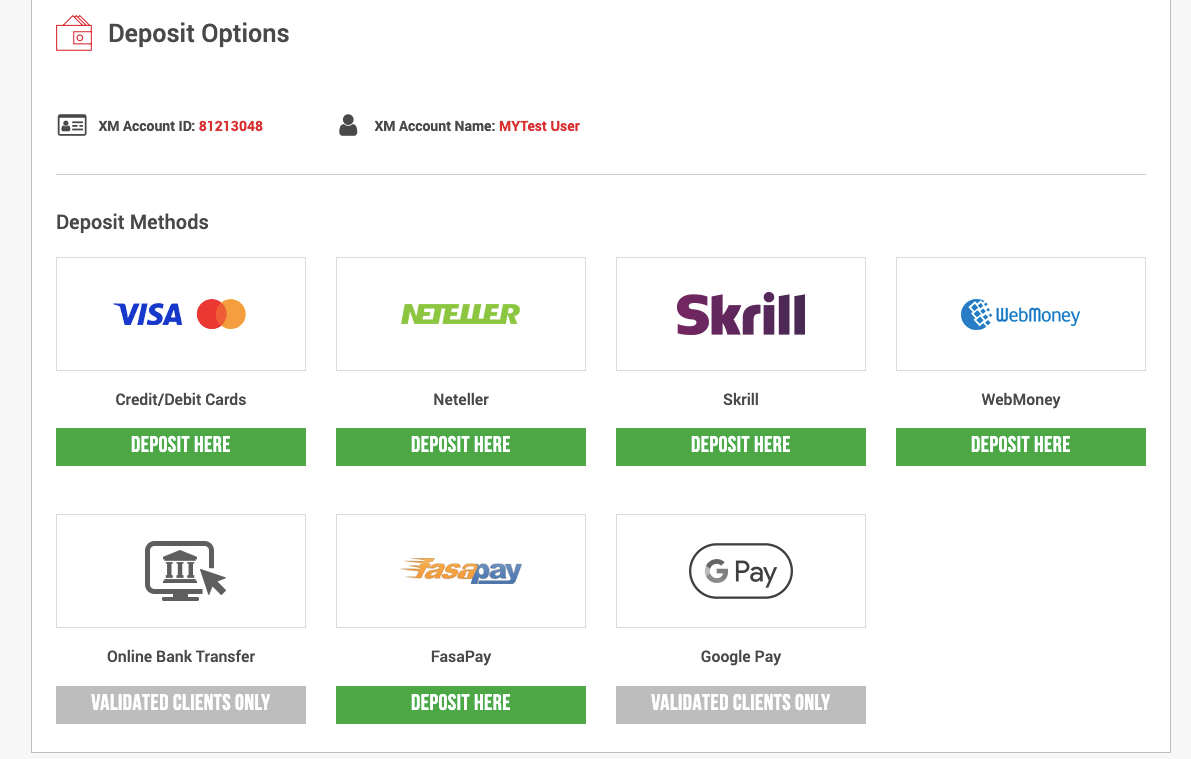

Accepted Deposit Methods on XM Trading

XM offers different funding methods for forex traders in Malaysia:

Cards: XM accepts cards from Visa, MasterCard, and Maestro. Processing time is instant without any extra charges

Bank Transfer: You can fund your account via bank transfer. Transaction processing can take 2-5 business days. Bank transfer deposits is free. If your deposit is below $200, you will be charged $15 (MYR 69)

E-wallets: XM accepts webmoney, fasapay, Neteller, and Skrill for traders in Malaysia. XM does not charge extra fees for e-wallets. Processing time is instant.

Note: Though XM might not charge any fees for some deposit methods, your card/e-wallet providers or bank might charge you a fee when you fund your account.

Note: CFD trading is risky

XM Trading Deposit Rules

1) XM does not accept third-party payments. All payments made must come from accounts, cards, or e-wallets that bear your name.

2) XM does not charge fees for deposits but your payment providers might charge.

3) All withdrawals must be made to the original source before you can change your deposit methods. This means if you fund your account with an e-wallet, you have to withdraw via the same method.

4) You can transfer funds between trading accounts that belong to you. You cannot transfer funds to another client’s trading account.

5) If you’ve fund your account using a debit or credit card, you can only withdraw an amount equal the amount you deposited back to the same card.

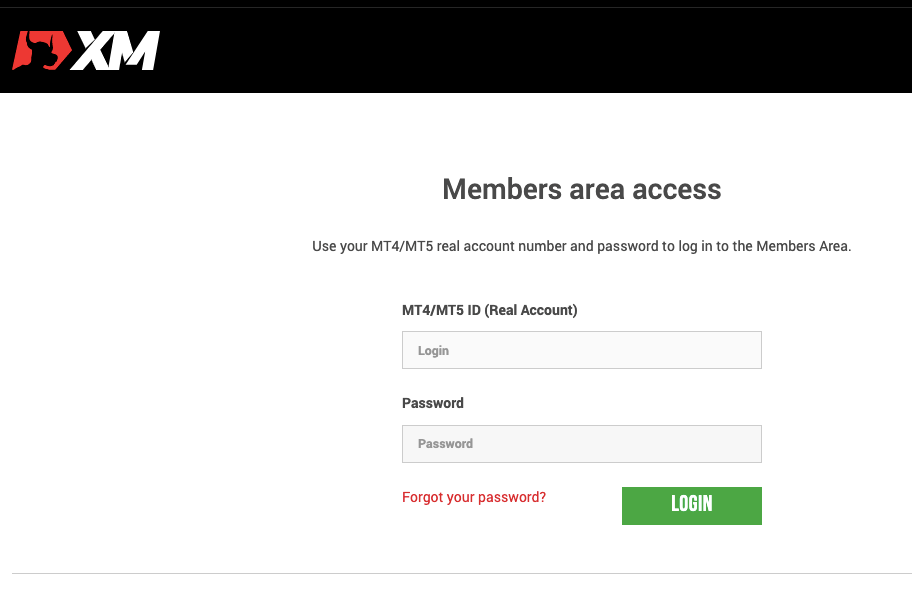

How Do I Deposit Money into my XM Account?

1) Log in to your XM Memeber Area through the XM website.

2) Click on ‘DEPOSIT FUNDS’ and choose the funding method you prefer.

3) Enter the amount you want to pay and click deposit.

Comparison Of XM Minimum Deposit With Other Brokers

Here is how XM’s minimum deposit compares with select brokers in Malaysia.

| Broker | Minimum Deposit |

|---|---|

| XM | $5 (MYR 23) |

| Plus500 | RM500 |

| AvaTrade | RM 473 ($100) |

| Octa | RM100 |

| AxiTrader | RM0 ($0) |

Note: CFD trading is risky

What base currencies are accepted by XM?

XM accounts are denominated in USD. Any currency you deposit in will be converted to USD. It will be the equivalent of the currency you deposit with.

XM Minimum Deposit FAQs

How much is an XM minimum deposit?

XM Minimum deposit is $5. In Malaysia, that will be MYR 23.

Is XM regulated in Malaysia?

XM is not locally regulated in Malaysia. XM registers Malaysian traders under their FSC license in Belize.

Is XM good for beginners?

Yes, XM has a good research and learning center that beginners can maximize. They have webinars, tutorials, and educational videos.

Does XM charge inactivity fee?

XM charges dormancy fee when there is no trading activity, deposits, or withdrawals on your account in a 90-day period.

Which country own XM?

XM is the trading name of Trading Points Holdings Limited. The company is incoporated in Cyprus.

Note: Your capital is at risk