Pepperstone is a forex and CFD broker that offers trading services for currency pairs and CFDs on shares, indices, ETFs, commodities, cryptocurrencies and currency indices.

Pepperstone was founded in 2010 in Melbourne, Australia and is licensed in the UK, Dubai, Europe and Africa to offer financial services.

Our review of Pepperstone will inform you of the broker’s regulations, deposit/withdrawal options, customer support, tradable instruments, trading platforms, trading fees, account types and how to create a Pepperstone Account in Malaysia.

| Pepperstone Review Summary | |

|---|---|

| 🏢 Broker Name | Pepperstone Markets Limited |

| 📅 Establishment Date | 2010 |

| 🌐 Website | www.pepperstone.com |

| 🏢 Address | Pepperstone Markets Limited, Sea Sky Lane, B201 Sandyport, Nassau New Providence, The Bahamas |

| 🏦 Minimum Deposit | $10 (MYR 45) |

| ⚙️ Maximum Leverage | 1:200 |

| 📋 Regulation | SCB, FCA, ASIC, CySEC, DFSA |

| 💻 Trading Platforms | MT4, MT5, Trading View and cTrader for PC, Mac, Web, Android & iOS |

| Visit Pepperstone | |

Pepperstone Pros

- Pepperstone is licensed in many countries

- No dormant account fee

- You can deposit and withdraw your funds via local banks

- Pepperstone supports multiple trading platforms.

- Offers negative balance protection

Pepperstone Cons

- Pepperstone charges commission per standard lot round turn with Razor Account

- No guaranteed stop loss order

Pepperstone Video Review

Regulation and Safety of Funds

Pepperstone is licensed in multiple jurisdictions by Tier-1 and Tier-2 financial regulators. Here is a list of the regulations of Pepperstone in various countries.

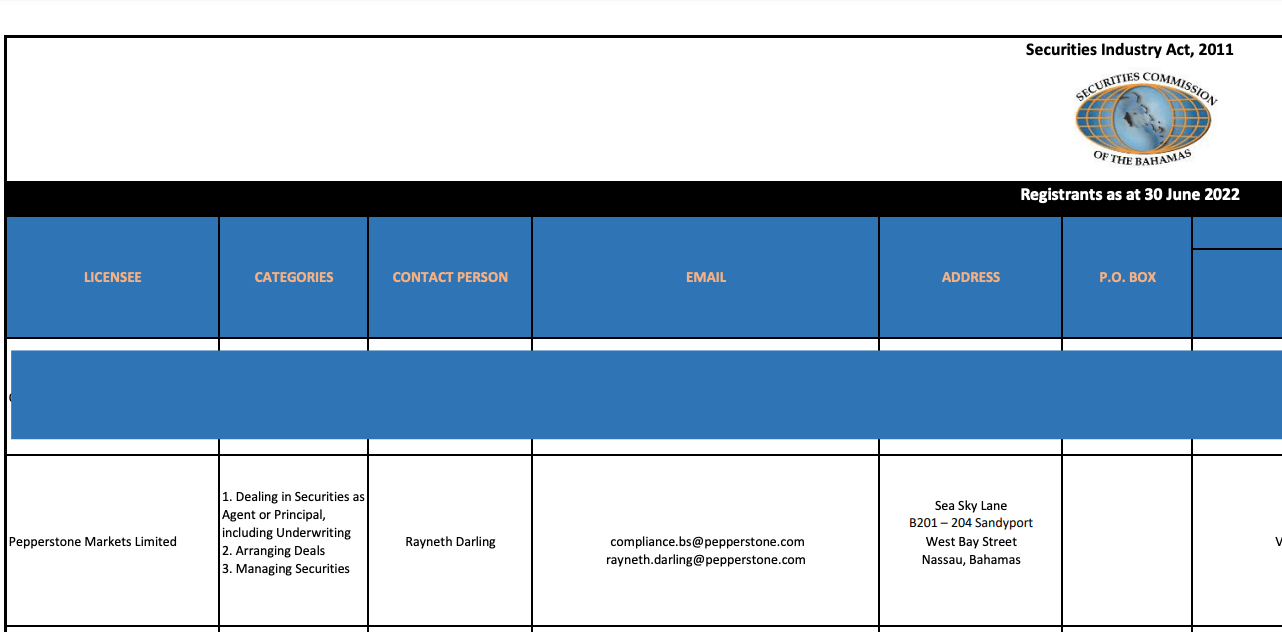

1) Securities Commission of The Bahamas (SCB): Pepperstone is regulated as an SIA company under the name Pepperstone Markets Limited in the Bahamas, by the SCB. Their license number is 177174 B/SIA-F217. Traders in Malaysia are registered under this regulation.

Bear in mind that because forex is not regulated in Malaysia, traders in Malaysian are trading at their own risk as the offshore regulations consumer protection may not cover Malaysian traders.

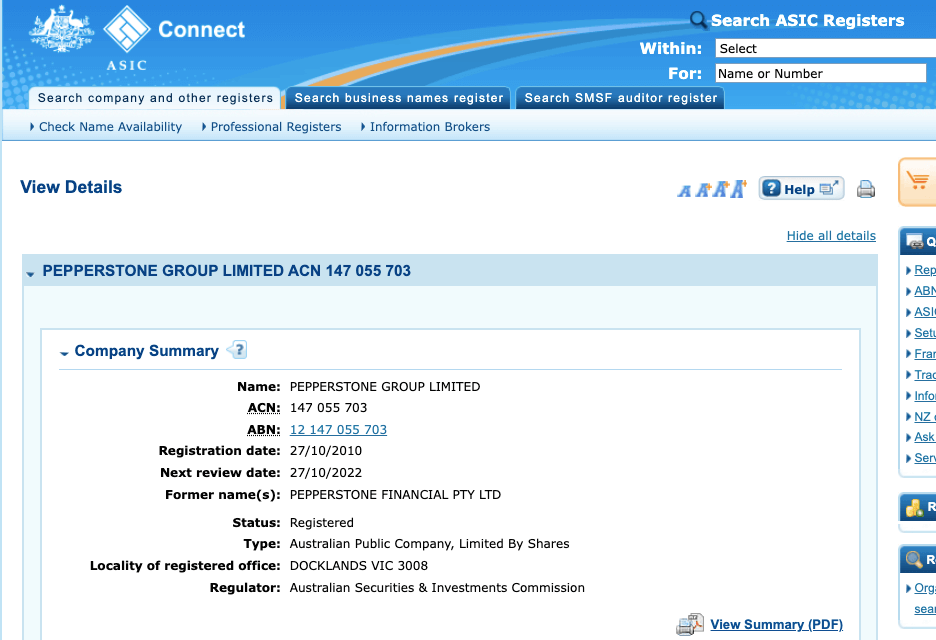

2) Australian Securities & Investment Commission (ASIC): Pepperstone is regulated in Australia by ASIC as Pepperstone Group Limited. ASIC issues all financial service providers Australian Financial Services License (AFSL) Number. 414530 is Pepperstone’s AFSL number, issued in 2010.

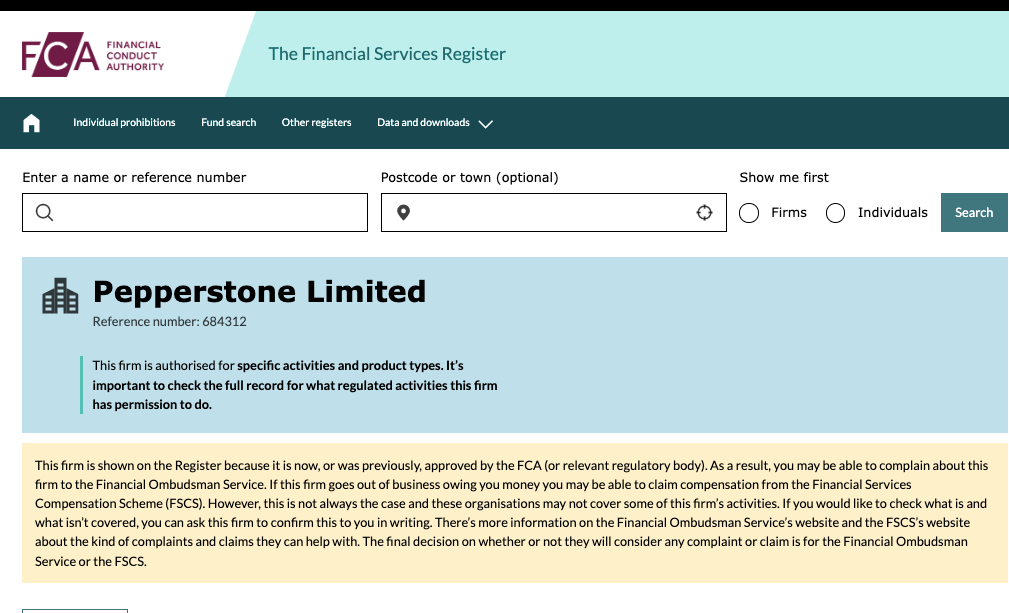

3) Financial Conduct Authority (FCA), United Kingdom: Pepperstone is regulated by the FCA as Peperstone (UK) Limited. Their FCA reference number is 648312, issued in 2015.

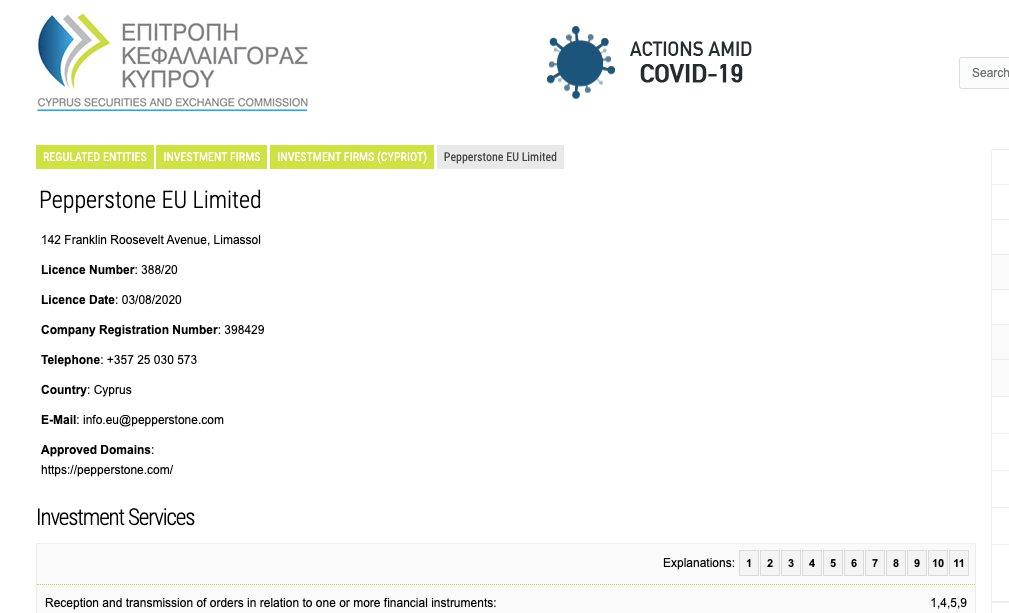

4) Cyprus Securities and Exchange Commission CySec: Pepperstone is regulated with Cysec as Pepperstone (EU) Limited. Their company registration number is 398429 with license number 388/20, issued in 2020. Pepperstone registers traders from other European Union regions under this regulator.

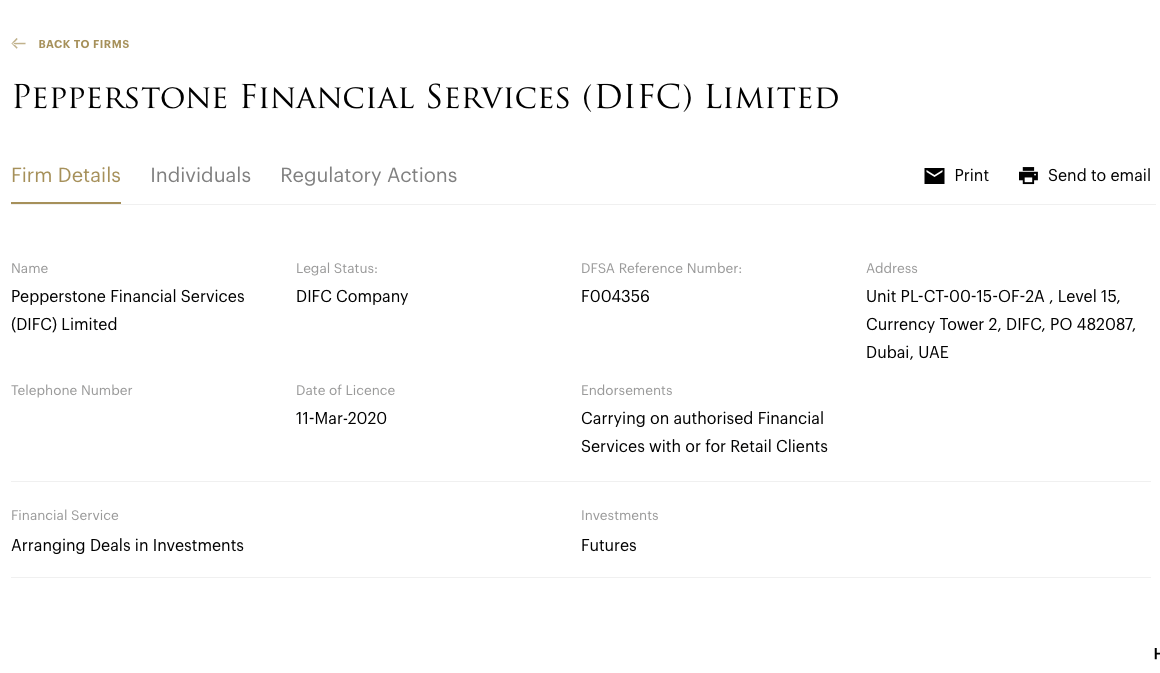

5) Dubai Financial Services Authority (DFSA): Pepperstone is regulated by the DFSA as Pepperstone Financial Services Limited with license number F004356, issued in 2020.

Pepperstone Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | Peperstone (UK) Limited |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | Pepperstone (EU) Limited |

| Kenya | Ksh 50,000 | Capital Markets Authority (CMA) | Pepperstone Markets Kenya Limited |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | Pepperstone Group Limited |

| Malaysia | No protection | Securities Commission of The Bahamas (SCB) | Pepperstone Markets Limited |

Pepperstone Leverage

Leverage on Pepperstone depends on the instrument you are trading and whether you are a retail trader or professional trader. The maximum leverage on Pepperstone is 1:200 for retail clients, which means that you can open a trade position worth up to 200 times the value of your deposit. The leverage breakdown per instrument is Up to

-1:200 for Gold, Silver and most FX pairs – not referring to TRY pairs

– 1:200 for major Indices

– 1:100 for minor indices

– 1:20 for Share CFDs

– 1:50 for Soft Commodities and

– 1:10 for Cryptocurrencies

For example, with a deposit of $1000, you can open a trade position worth up to $200,000 to increase your profit potential. Note that it also exposes you to more risk.

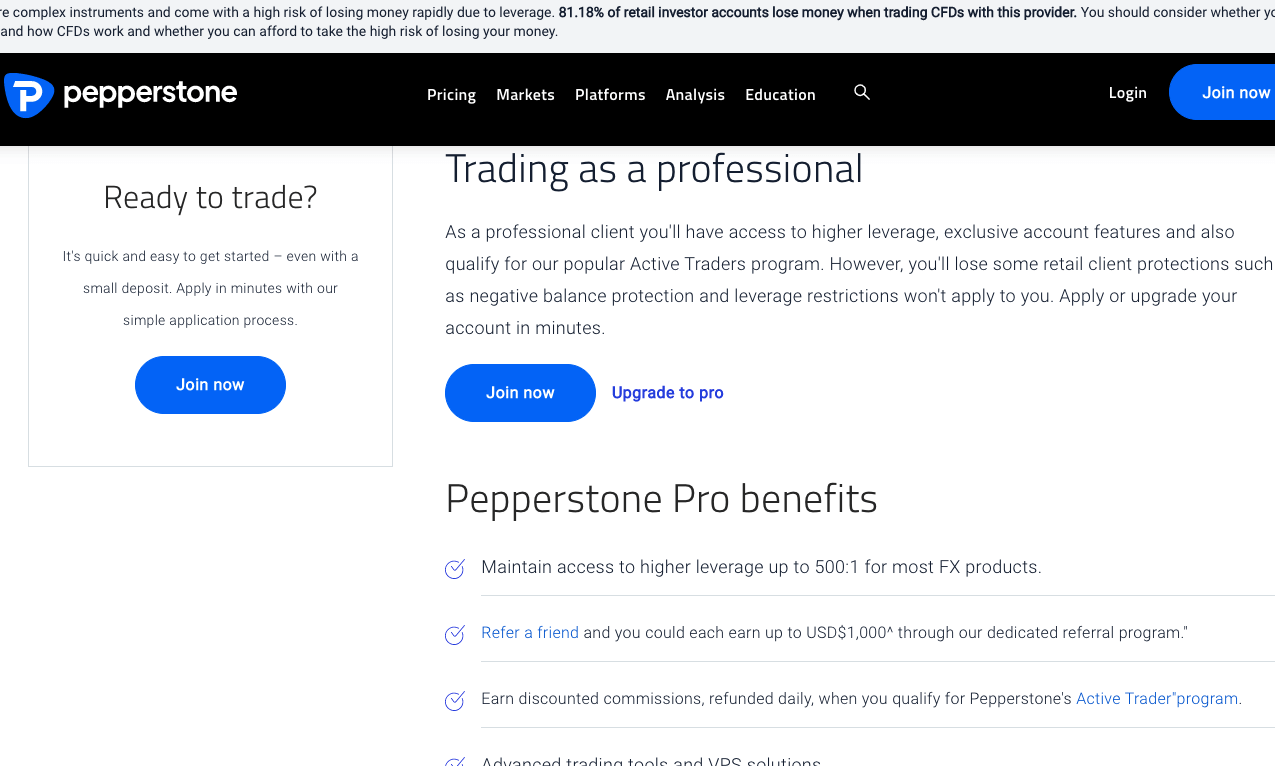

Professional traders can access higher leverage up to 1:500. The maximum leverage of 1:200 and 1:500 are for forex majors, other instruments have lower leverage limits.

Note that trading leveraged products are risky, and you can lose your money. It is best to avoid it. Only trade if you have experience or understand them.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81.7% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

Pepperstone Account Types

Pepperstone has three account types, Standard Account, Razor Account, and Managed Account. You can open either of the two accounts as a retail client or a professional client.

They also offer swap-free accounts, demo accounts for beginners and active trader status to accounts. You can open an account as an individual, partnership (joint account), or as a company (corporate account).

Here’s an overview of the account types on Pepperstone.

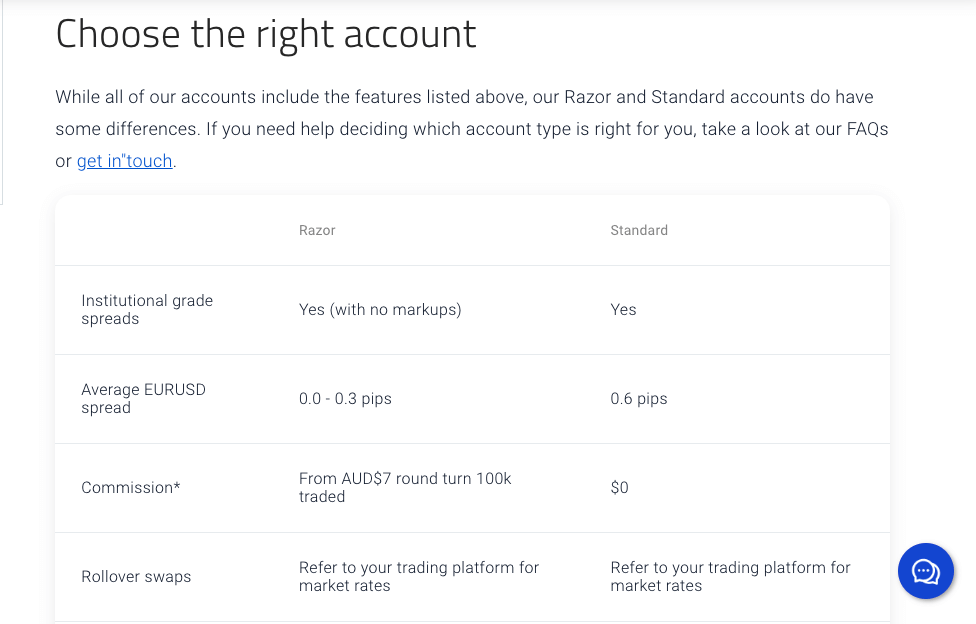

1) EDGE Standard Account: The Pepperstone Standard Account is designed for new traders who want a simple account. You can trade Forex pairs and CFDs on shares, indices, ETFs, commodities, cryptocurrencies and currency indices.

Pepperstone does not charge an extra commission per standard lot on this account, which means you will not pay any fees for opening and closing trade positions. Spreads start from 0.6 pips for major pairs like EURUSD and you pay swap fees if you keep a trade position open past the market closing time.

The recommended minimum deposit for this account is $200 (MYR 900), with a required minimum trade size of 0.01 lot. This account has a leverage limit of 1:200 for retail clients and you have negative balance protection, which means you cannot lose more than the money in your trading account when you suffer a loss on a trade position.

2) EDGE Razor Account: The Pepperstone Razor Account is designed for experienced traders and scalpers who want to trade large volumes of financial instruments and use EAs (Expert Advisors) trading robots. You can trade Forex pairs and CFDs on shares, indices, ETFs, commodities, cryptocurrencies and currency indices with this account. The account is accessible on MetaTrader, TradingView and cTrader.

This account pays commission fees on forex per standard lot (100,000 lots) traded starting from US$0.08 and up to US$7 (MYR 31.4) on MetaTrader and TradingView platform, when trading on cTrader, you pay commission of $6 (MYR 27) round turn. Spreads start from 0.0 pips for major pairs like EURUSD and you pay swap fees if you keep a trade position open past the market closing time.

The recommended minimum deposit for this account is $200 (MYR 900), with a required minimum trade size of 0.01 lot. This account has a maximum leverage limit of 1:200 for retail clients and you have negative balance protection, which means you cannot lose more than the money in your trading account when you suffer a loss on a trade position.

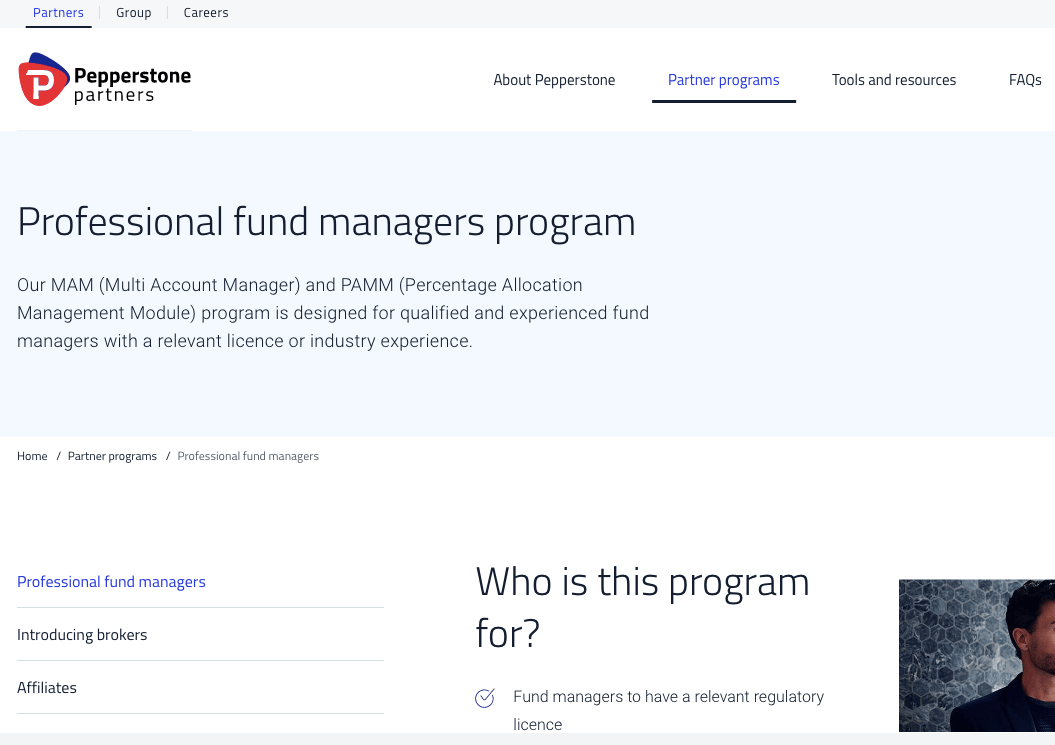

3) Managed Account: The Pepperstone Managed Account is designed for fund managers who have a relevant license and want to open many sub-accounts to manage funds for their clients. This is under the Pepperstone Fund Managers Program, and you can open as many accounts as you want as a Professional Fund Manager.

To get this account you will have to contact customer support and submit the relevant documents.

4) Professional Account: The Pepperstone Professional Account is designed for more experienced traders who trade large volumes of financial instruments and want to access leverage. You can trade Forex pairs and CFDs on shares, indices, ETFs, commodities, cryptocurrencies and currency indices with this account.

You can upgrade your retail Standard and Razor Accounts after meeting at least 2 of the required conditions below:

- You have a trading portfolio and cash deposits of more than US$500,000 (MYR 22,44,000)

- You have experience trading Over The Counter (OTC) or leveraged products

- You have experience working in the financials services sector

You will also need to take a short quiz on the client portal to demonstrate your trading knowledge.

As Professional Client on Pepperstone, you do not have negative balance protection, which means that you can lose more than the money in your account and will be required to deposit more money to clear any negative balance that accrues from an unsuccessful trade position.

The required minimum trade size of 0.01 lot with maximum leverage of 1:500. You pay commission fees and spreads depending on whether you had a Razor or Standard Account before the upgrade.

To get a professional account on Pepperstone, first, create a retail Razor or Standard Account, then contact customer support if you meet the requirement to upgrade your account status. You will be required to submit additional documents to verify your claim. When your application is approved, you will receive an email informing you of the upgrade.

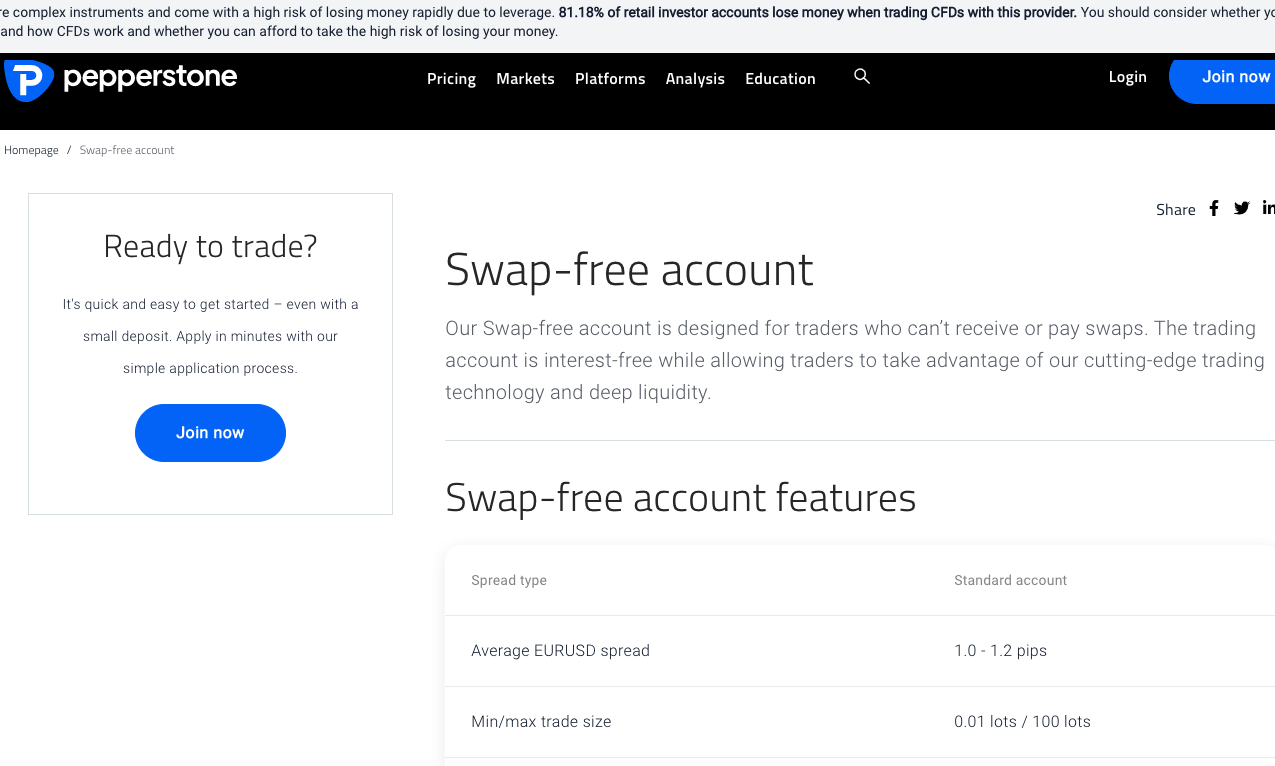

5) Swap-free Account: The Swap-free Islamic Account is designed for Muslim traders and others who do not want to pay swap fees or interests on trade. With this account, you do not pay swap fees for keeping a trade position past the market’s closing during the grace period.

Pepperstone gives a grace period of 10 days during which Swap-free Accounts are not required to pay any swap fees. After the grace period, you will pay a daily fixed admin fee starting from US$1.5 (MYR 6.7)for commodities and up to US$50 (MYR 230) for FX per standard lot that is open, depending on the instrument you are trading and the leverage.

You can convert your retail Standard Account to Swap-free status by sending a message via email or live chat to customer support. Spreads start from 1.2 pips on this account with zero commission charges and max trade lots of 100.

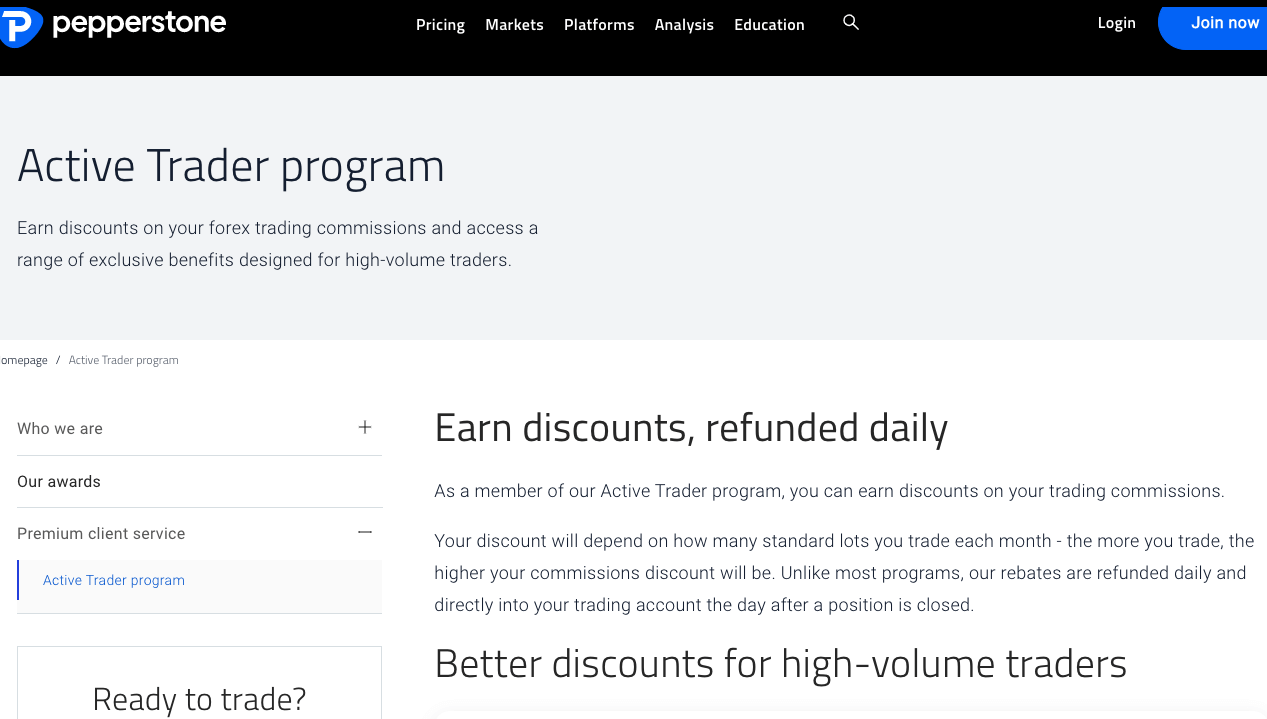

6) Active Trader: The Pepperstone Active Trader status is a Premium Account service offered to both retail and professional clients who trade large volumes of financial assets on the platform.

As an Active Trader on Pepperstone, you get discounts on commission fees of up to $3 (MYR 13.5) on commissions and a 30% spread reduction. You also get priority support, advanced market insights, VPS hosting for Pro Clients and invitation to Pepperstone VIP webinars and other events.

To become a Premium Client on Pepperstone and be classified as an Active Trader, you must have a notional trade value of US$15 million (MYR 6,73,20,000) per month for 2 consecutive quarters. Once you meet this requirement, contact Pepperstone customer support via email at [email protected] to request an account upgrade.

Pepperstone Base Account Currency

Account base currencies available on Pepperstone are British Pound sterling – GBP, Euros – EUR, United States Dollars – USD, Swiss Franc -CHF, Japanese Yen – JPY, Canadian Dollar – CAD, New Zealand Dollar – NZD, Australian Dollar – AUD, Honk Kong Dollar – HKD, and Singapore Dollar -SGD.

You are required to select one when opening an account and all your deposits, trades, withdrawals, and fees are measured in your Pepperstone account currency.

Pepperstone Fees

Fees on Pepperstone depend on the account type you have, the instruments you are trading, and whether you are a retail or professional client. Here is a summary of the broker’s trading and non-trading fees:

1) Spread: Pepperstone offer charges spread whenever you trade financial instruments on the platforms. Spreads are the difference between the bid (buy) and ask (sell) price. Spreads vary based on the instrument being trading and the account type of the trader. Find a summary of average spreads for major instrument pairs on the table below:

2) Commissions: Pepperstone only charge commissions on the Razor Account when you trade forex, which means you will pay fees for opening and closing trade positions. The commission differs based on the trading platform you choose. If you are using MT4/MT5, you pay a commission of about US$3.5 (MYR 15.7) per standard lot. This means your round-turn commission is $7 (MYR 31.4).

On the other hand, the commission on cTrader is $3 (MYR 13.5) per standard lot ($6 round-turn).

Pepperstone Trading fees Table

Here is a summary of the average spread fees and commission Pepperstone charges on some instruments:

| CFD instrument | Spread (Standard Account) | Commission (Razor Account) |

|---|---|---|

| EUR/USD | 1.1 pips | US$3.5 |

| GBP/USD | 1.4 pips | US$3.5 |

| EUR/GBP | 1.4 pips | US$3.5 |

| XAU/USD (Gold) | 0.15 pips | None |

| Crude oil | 2.5 pips | None |

| UK 100 | 1.0 pips | None |

| US 30 | 2.0 pips | None |

*Commission stated here are for MT4 and MT5 platforms. Other platforms have different commission charges.

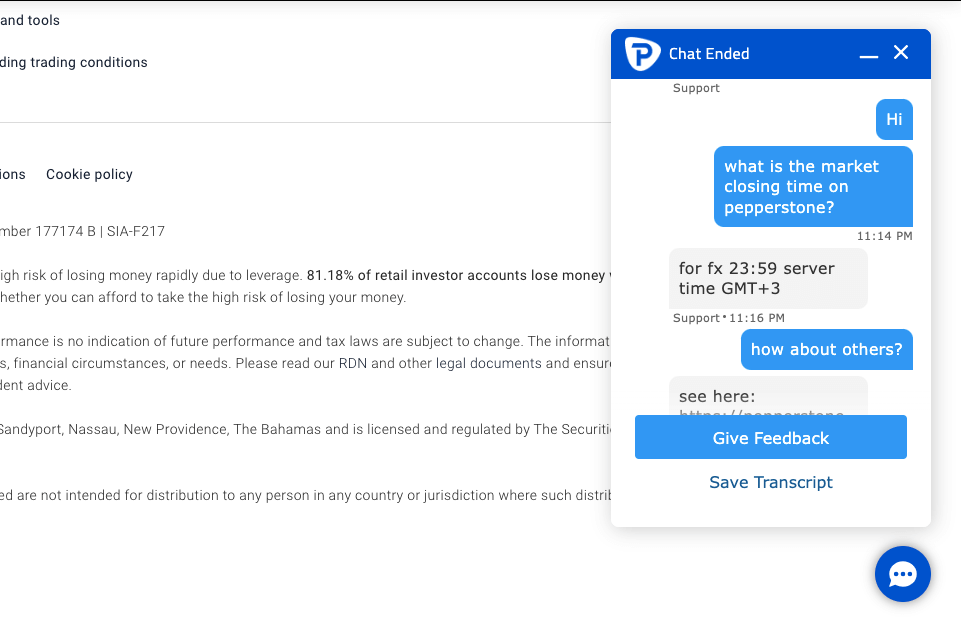

2) Swap fees: The market closing time for trade on Pepperstone is 23:59 server time GMT+3. If you keep a trade position open past the closing time, you incur rollover fees (overnight funding costs) also call swap fees. The fee is calculated based on your trade volume, leverage, spread, and whether your trade position was a long swap (buy) or a short swap (sell). Note that some instruments have different market closing times.

3) Non-Trading Fees: Non-trading fees refer to funding fees, withdrawal fees, and inactivity charges. Pepperstone charges low non-trading fees. See details below:

| Deposit fees | Withdrawal fees | Inactivity charges |

| No* | No* | No |

*Note that your payment processing company may charge some independent transaction fee.

How to Open a Trading Account with Pepperstone in Malaysia

You need a live account before you can start trading. Here are the basic steps for signing up with Pepperstone:

Step 1) Go to Pepperstone’s website at www.pepperstone.com and click on the ‘Trade now’ button.

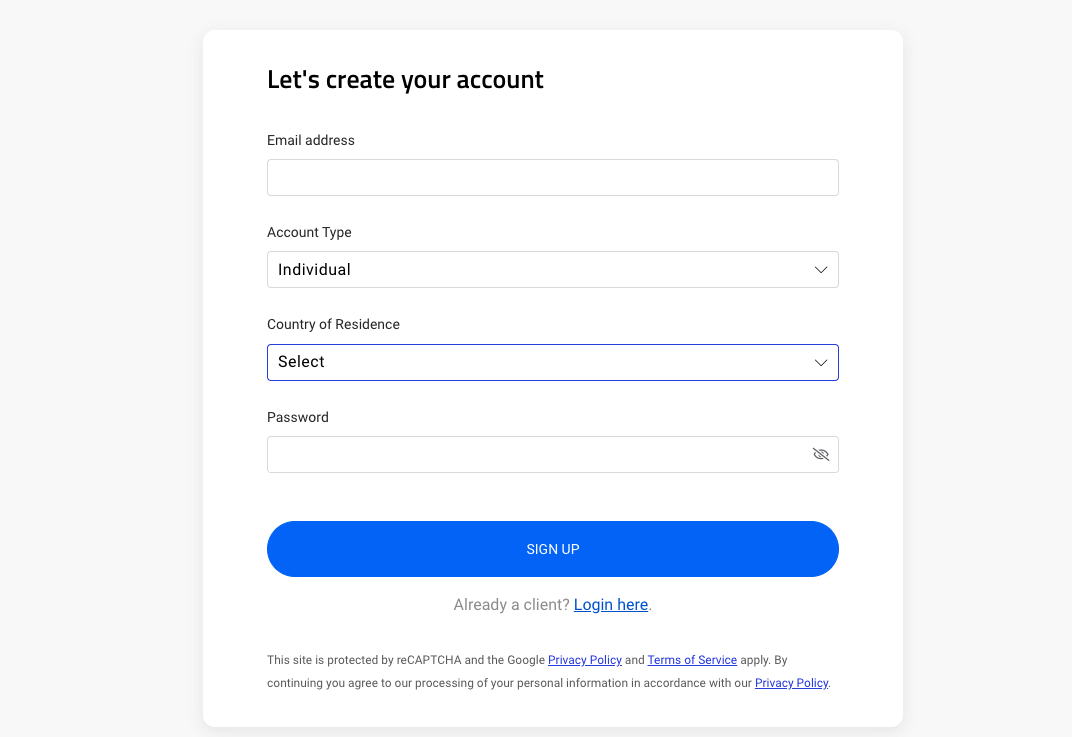

Step 2) Enter your email address, select the account you want to open, select your country residence, and create a password, then click ‘SIGN UP’.

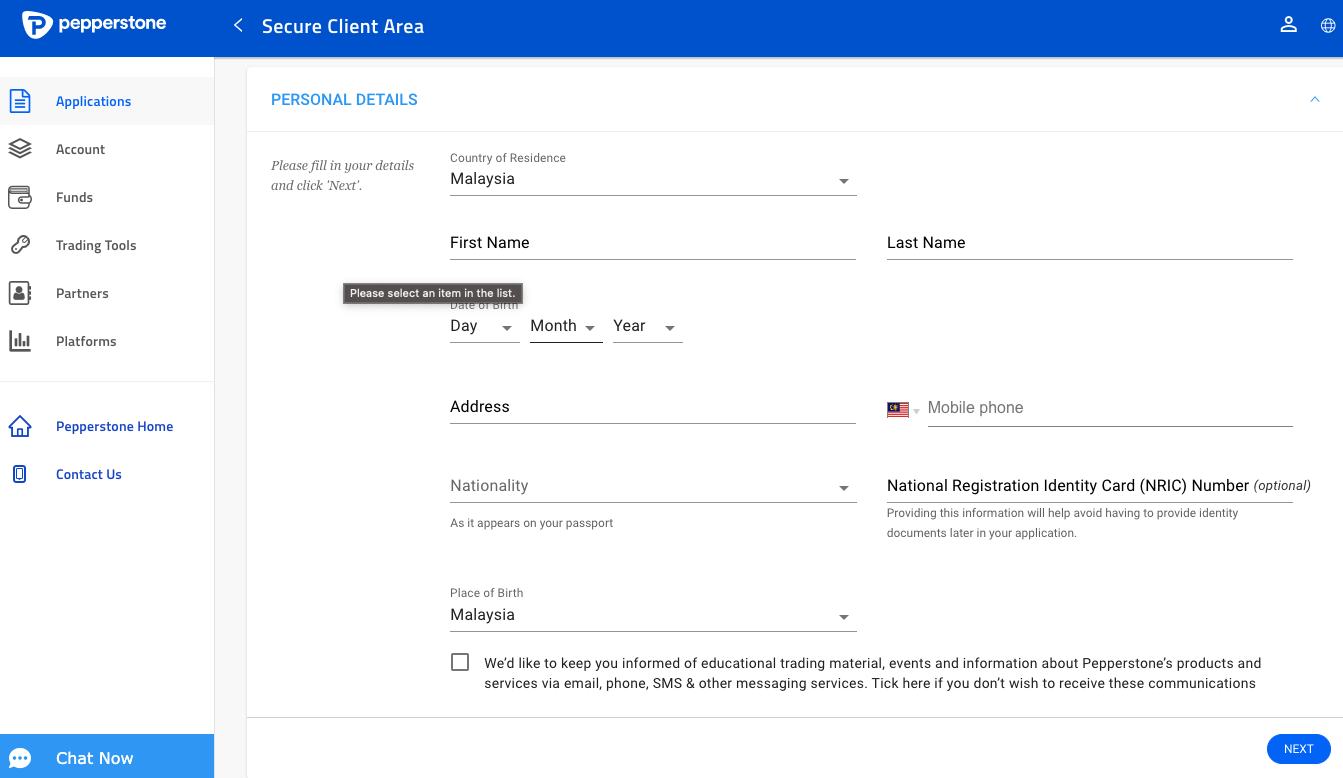

Step 3) Provide your full name, address, date of birth and phone number. Select your nationality and place of birth, enter your National Registration Identity Card (NRIC) number, and then click ‘NEXT’.

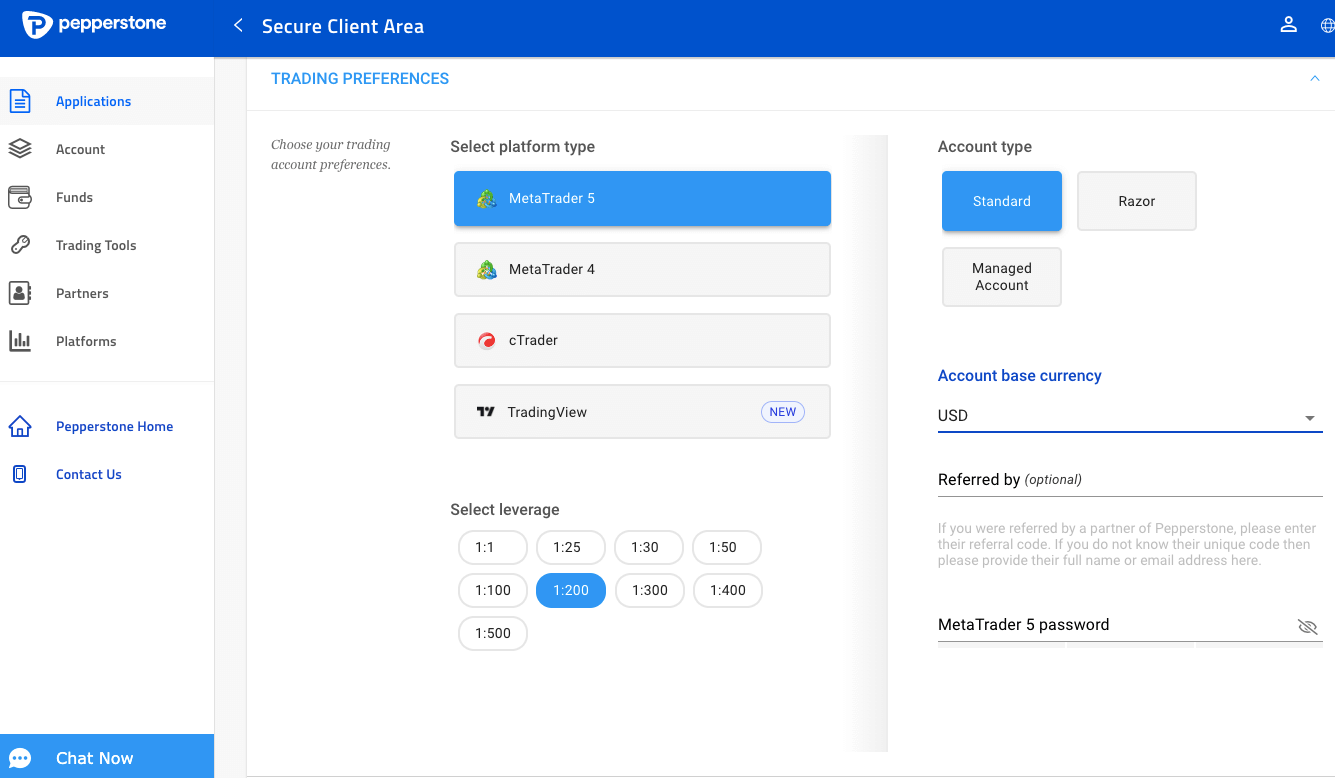

Step 4) Select your preferred trading platform, account type, trading account currency, set your maximum leverage and create a password for your chosen platform then click ‘NEXT’.

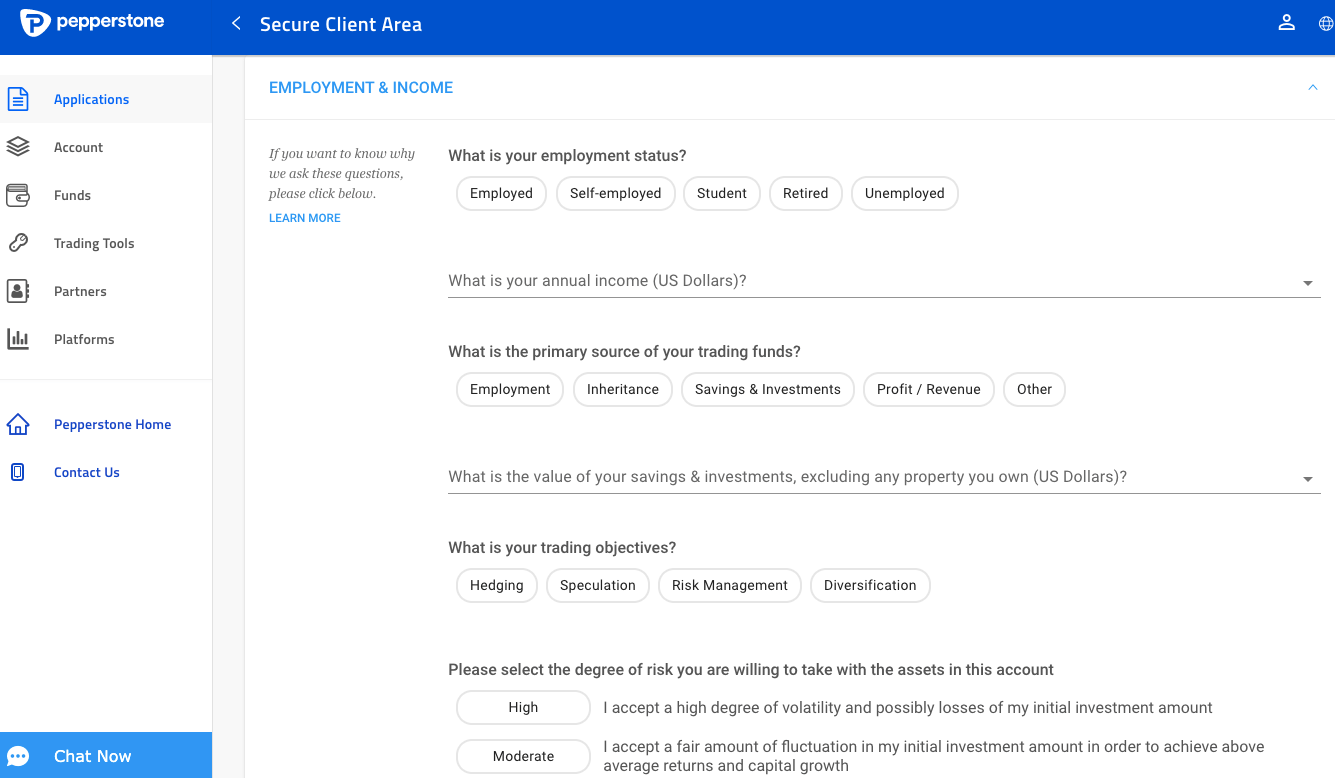

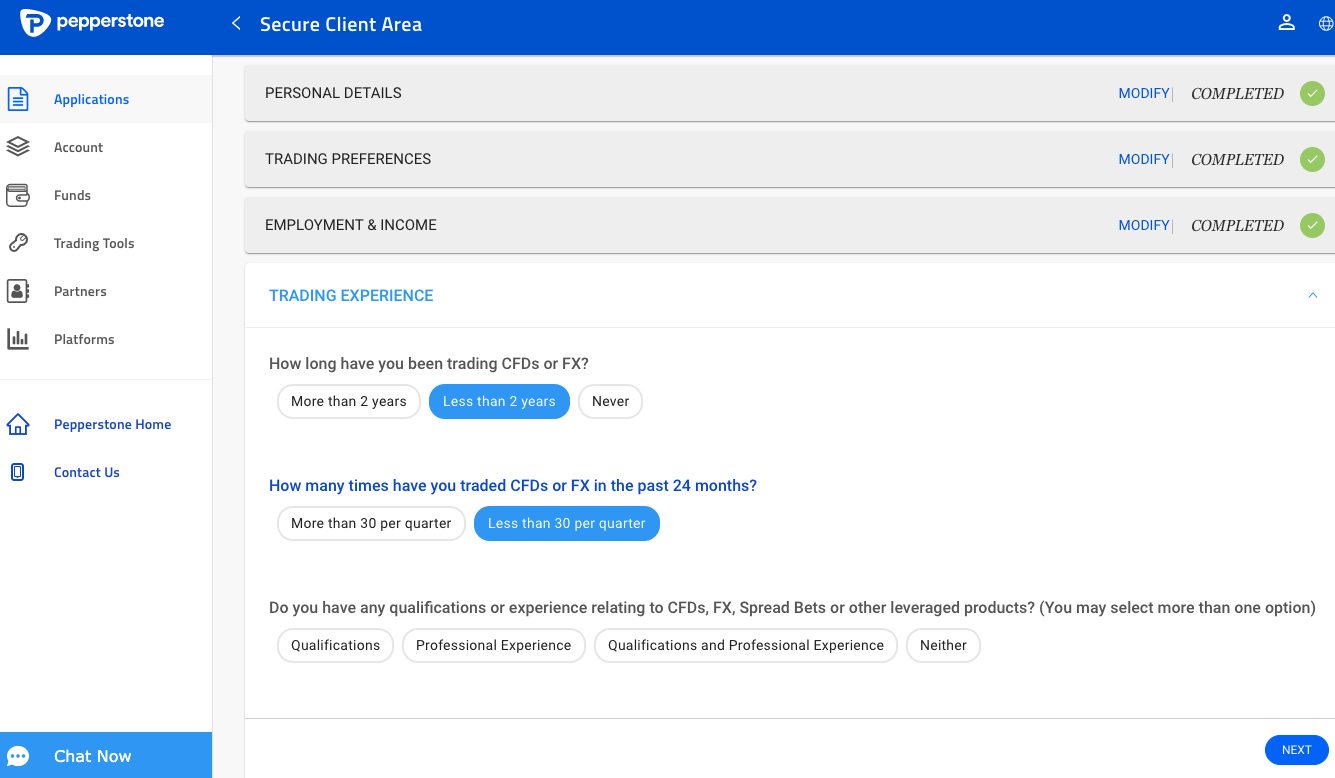

Step 5) Answer questions about your employment, financial status and trading experience, then click ‘NEXT’.

Step 6) Check the box to agree to the Terms and Conditions then click ‘NEXT’.

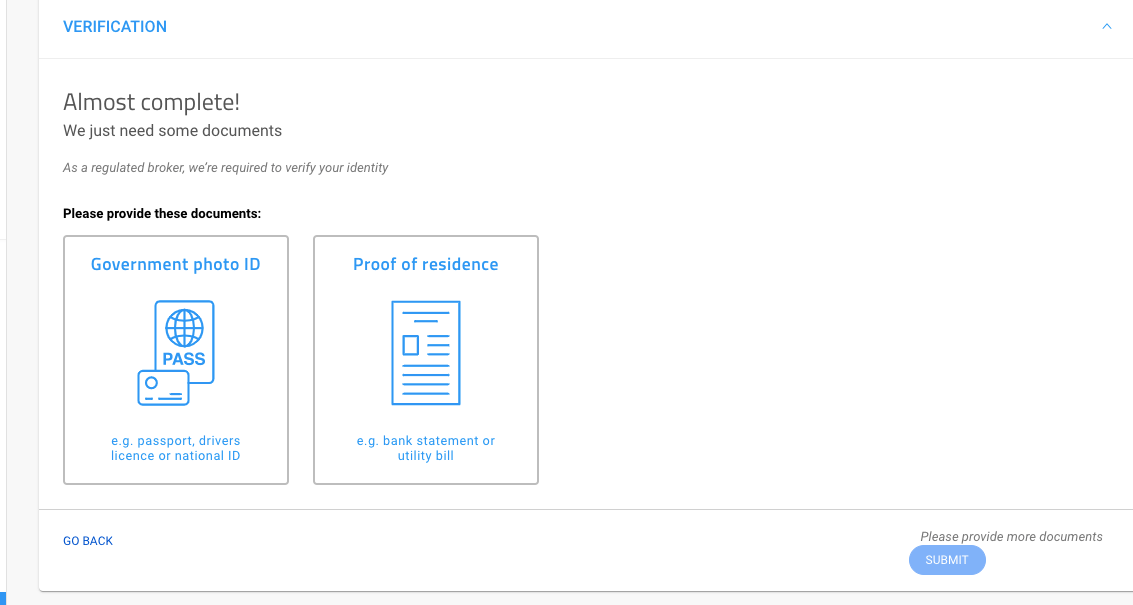

Go to your email inbox and click on the verification link sent to verify your email and also verify your phone number.

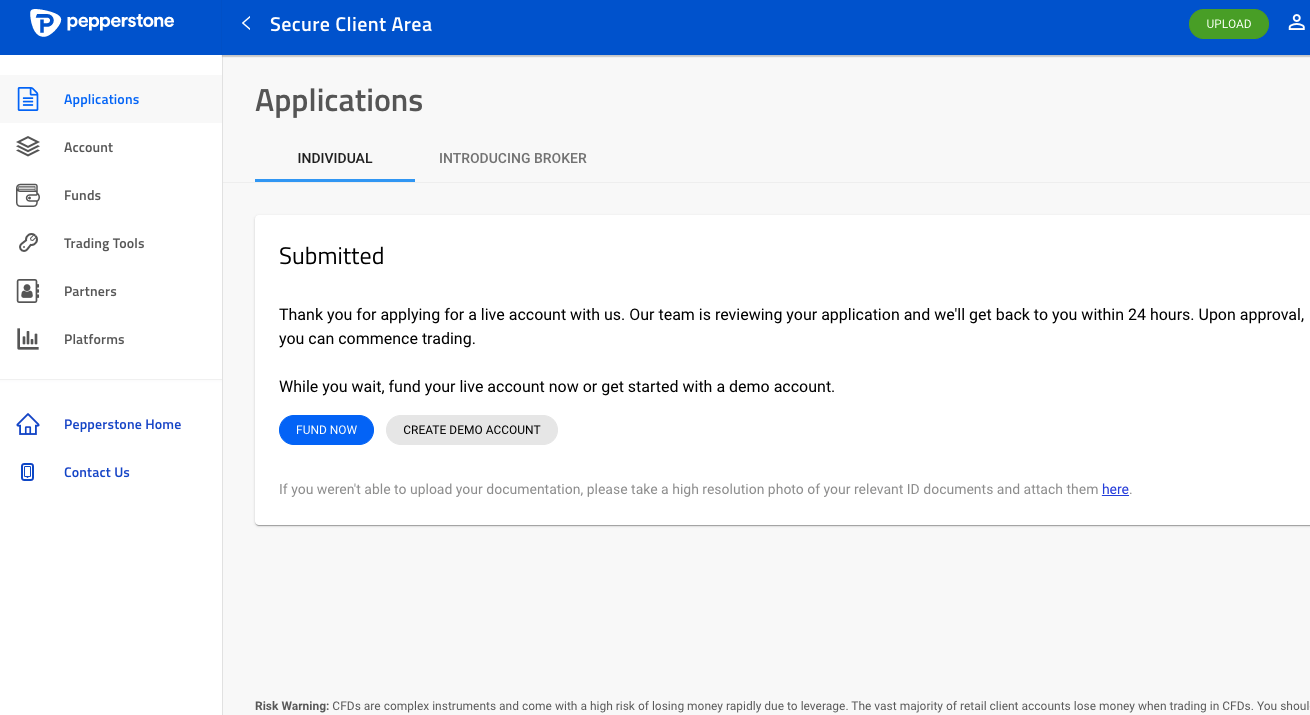

You can choose to ignore those and simply upload a government-issued ID to prove your identity or a bank statement to prove your address then click ‘SUBMIT’, then wait for your account to be approved, which usually takes about 24 hours.

You can decide to deposit funds into your account before the approval.

Pepperstone Deposits & Withdrawals

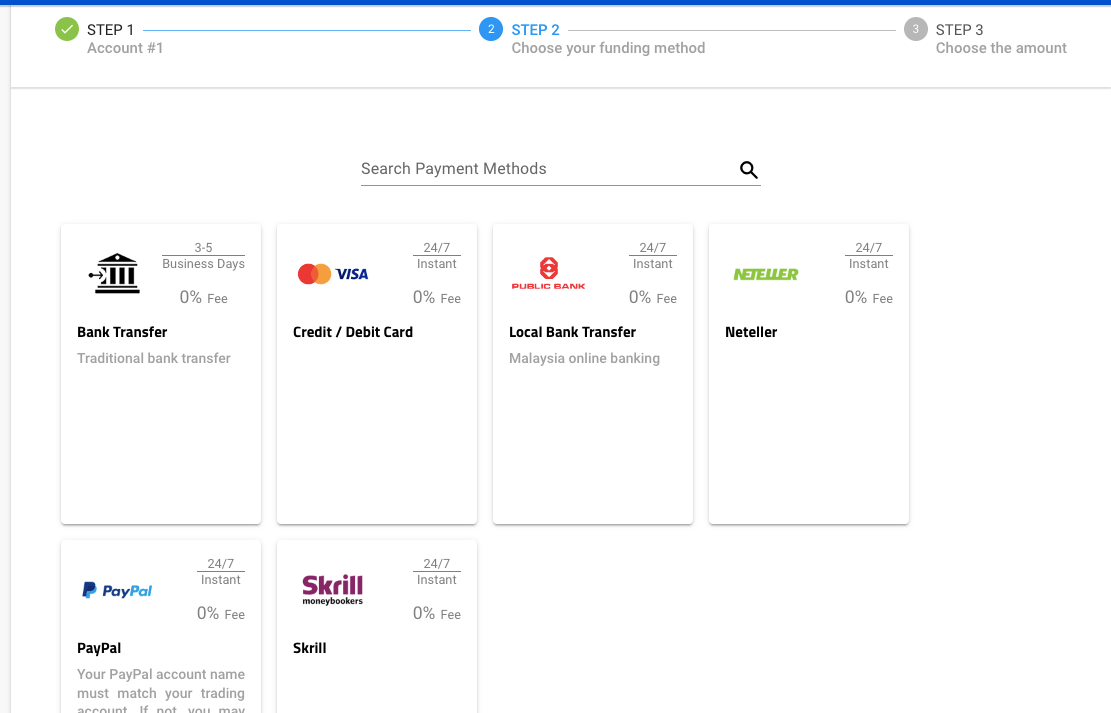

Payment methods accepted on Pepperstone for deposits and withdrawals are cards (credit/debit), local bank transfers (Malaysia online banking), traditional bank transfers and e-wallets (Skrill, Neteller, and PayPal).

Third-party accounts are not allowed for transactions, the bank/e-wallets accounts and cards must bear the same name as the one on your trading account. Find a summary of the deposits and withdrawal options for traders in Malaysia below.

Pepperstone Deposit Methods

Here is a summary of payment methods accepted by Pepperstone for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 3-5 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes | Free | Instant |

Pepperstone Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on Pepperstone.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 3-5 business days |

| Cards | Yes | Free | 3-5 business days |

| E-wallets | Yes | Free | 3-5 business days |

What is the Pepperstone Minimum Deposit?

The minimum deposit on Pepperstone depends on the payment method you are using. While Malaysia’s online bank transfer requires a minimum of US$20 (MYR 90), cards and e-wallets have a minimum deposit amount of US$10 (MYR 45). Although the broker recommends a minimum deposit of $200 (MYR 900) because it will allow you to open a sizeable trade lot.

Local banks supported in Malaysia for payments on Pepperstone are Maybank, RHB, CIMB, Public Bank, and HongLeong Bank

How do I add money to my Pepperstone account?

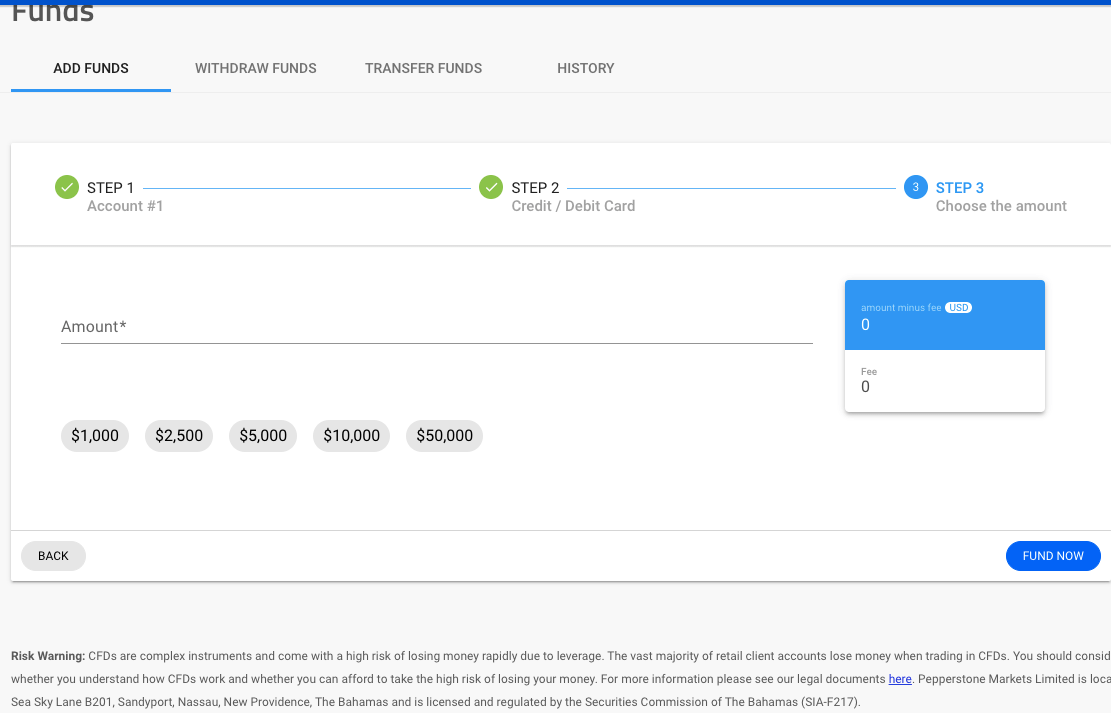

Follow these steps to deposit funds into your Pepperstone trading account:

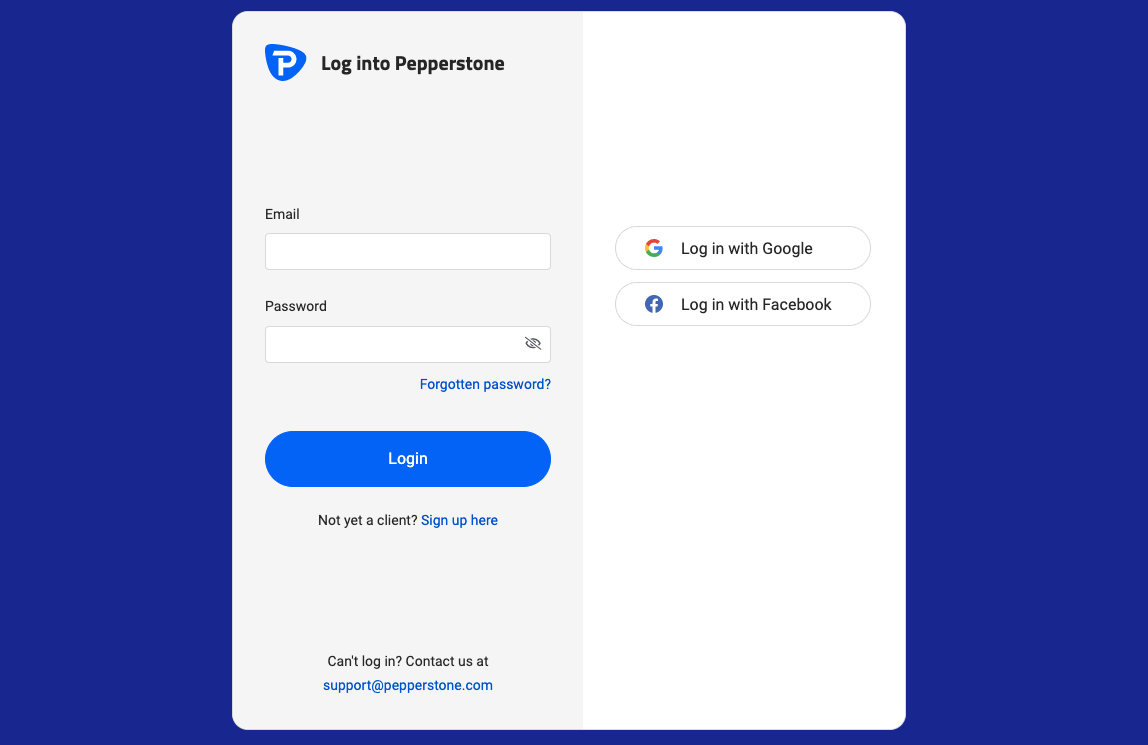

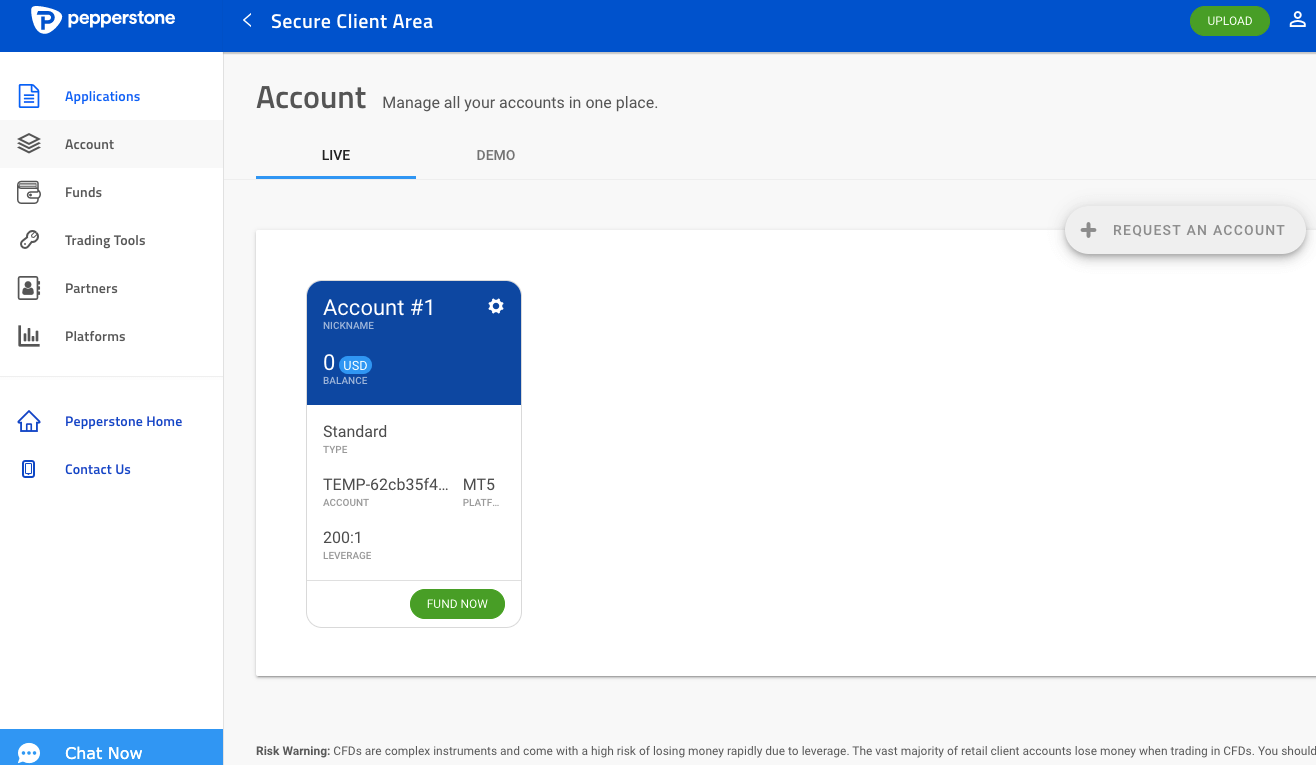

Step 1) Log in to your Pepperstone Account via auth.pepperstone.com/login/ and click on the ‘Funds’ tab.

Step 2) Under the ‘Add Funds’ section select the trading account you want to deposit funds into and click ‘CONTINUE’.

Step 3) Choose a payment method and click ‘CONTINUE’.

Step 4) Enter the amount you want to deposit and click ‘FUND NOW’.

What is the Pepperstone Minimum Withdrawal?

There is no specific minimum withdrawal. It depends on your preferred withdrawal method. Withdrawals initiated before 07:00 (AEST) are processed the same day, while those received later are processed on the next business day.

How do I withdraw from Pepperstone?

Follow these steps to withdraw money from your Pepperstone account:

Step 1) Log in to your Pepperstone Account via auth.pepperstone.com/login/.

Step 2) Click on the ‘Funds’ tab and under the ‘Withdraw’ section select the trading account you want to withdraw funds from and click ‘CONTINUE’.

Step 3) Choose a payment method and follow the on-screen instructions to complete the withdrawal.

Trading Instruments at Pepperstone

Pepperstone offers over 1,200 trading instruments. All instruments are offered as CFDs. You can find their classification in the table below:

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 62 currency pairs on Pepperstone (including, majors, minors, and exotics) |

| Indices CFDs | Yes | 23 Indices on Pepperstone (US500, Germany 40, Australia 200) |

| Commodities CFDs | Yes | 32 commodities on Pepperstone (4 oil, 12 metals and 16 agriculture) |

| ETFs CFDs | Yes | 97 ETFs on Pepperstone (Vanguard Util ETF, Bonds, and others) |

| Shares CFDs | Yes | 600+ shares on Pepperstone (US, UK, DE, shares and others) |

| Cryptocurrencies CFDs | Yes | 21 crypto assets pairs on Pepperstone (Bitcoin, Dash, Litecoin and others) |

| Currency Index CFDs | Yes | 3 currency index on Pepperstone (USD, EUR, JPY) |

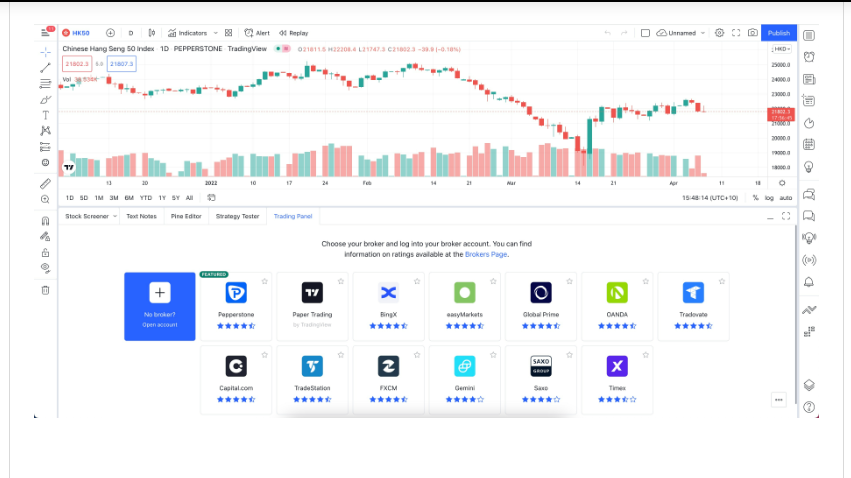

Pepperstone Trading Platforms

Pepperstone does not have a proprietary trading platform. They support third party platforms in MT4, MT5, cTrader, and TradingView.

1) Pepperstone MT4: With this platform, you can customise the way you trade. It allows automated trading and you can your Expert Advisors using MQL4. It also comes with Autochartist, Smart Trader tools, and 85 pre-installed indicators. The downside, however, is that shares CFDs are not offered on it. Pepperstone MT4 is available on Android, iOS, and desktops.

2) Pepperstone MT5: Pepperstone MT5 is advanced and is available on Android, iOS, Windows, and Mac devices. Coding is easier in MQL5 and analysis is deeper with 21 timeframes. It has Autochartist and Smart Trader tools too. And shares CFDs are available on it.

3) cTrader cTrader is growing in popularity among traders. Pepperstone cTrader is optimised for indicators and EAs. You can customise your trades via cTrader Automate and enjoy advanced risk management. Pepperstone cTrader is available on iOS, Android, and Windows. It is not available on Mac.

4) TradingView: TradingView is a third-party platform with advanced drawing and technical tools. You can connect your trading account to the platform and trade directly from there. Only Razor Accounts can get connected. TradingView is available on desktops and mobile devices.

4) Pepperstone platform: This is the broker’s proprietary trading platform. You can easily search for instruments, use a demo account, and build customised watchlist. The platform is available as a mobile app only.

Does Pepperstone have a mobile app?

Yes, Pepperstone has an in-house trading app built for forex traders. It is available on Android and iOS.

On the Play Store, from 365 reviews, it has 3.9 stars and has been downloaded over 100,000 times. On the App Store, it is rated three stars with over 100,000 download.

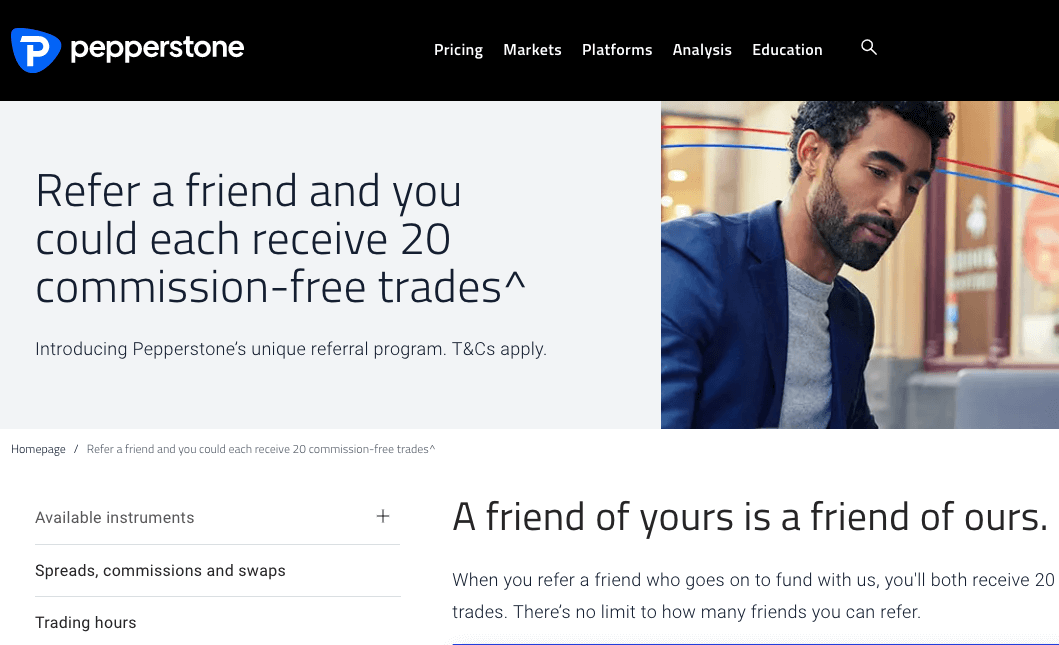

Pepperstone Promotion

1) Referral Bonus: Pepperstone Referral Program rewards both retail and professional clients who refer friends to the platform with 20 commission-free trades.

The person you refer must input your registered email address in the ‘How did you hear of us’ section when opening their account. They are also required to deposit a minimum of US$1,000 (MYR 4,500) within 90 days of signing up, and then both you and the person you referred get 20 trades without commission charges.

2) Active Trader Discounts: This promotion is for Active Traders who trade at least US$15 million (MYR 6,73,20,000) worth of portfolios every month. They get discounts on commission fees of up to $3 and spreads reduction of up to 30%.

The higher your volume of trade, the higher the discounts you get.

Pepperstone Social Trading

Pepperstone partners with 3 social trading platforms; DupliTrade, MetaTrader Signals and Myfxbook, to allow new traders to copy the trades of experts and experienced traders. You need to first open a Pepperstone account to participate.

Pepperstone Trading Tools

While Pepperstone offers popular tools like MetaTrader platforms and calculators, they also provide advanced options for experienced traders that you can use, some of them are:

1) Capitalise.ai: This free tool for Pepperstone customers allows automated trading strategies without coding. You can use its drag-and-drop interface to build custom bots based on indicators, signals, and risk management parameters. Perfect for automating repetitive tasks and testing strategies.

2) Smart Trader Tools: This suite of add-ons for MetaTrader 4 and 5 includes features you can use like:

a) Mini Terminal: Manage all your trades from a single, powerful terminal.

b) Smart Lines: Draw trend lines and other technical annotations with ease.

c) Correlation Matrix: Master the art of trading non-correlated currency pairs.

d) Volume Profile: Analyze market depth and identify potential support and resistance levels.

3) Autochartist: This automated technical analysis tool scans the markets and identifies potential trading opportunities based on user-defined parameters.

Pepperstone Malaysia Customer Service

Pepperstone has good customer support service. If you are a trader based in Malaysia, you can reach Pepperstone via

1) Live chat: Pepperstone gives fast replies on their live chat. Their chatbot named Pepper offers some menu-based support, and you can transfer to a live customer representative.

We tested this and got a reply after four minutes. You do not need to open an account before you can use Pepperstone’s live chat. You only need to fill in your name and email. The Pepperstone live chat is available 24 hours during market hours.

2) Phone number support: Pepperstone have an international phone number support for traders in Malaysia. The number is +1786 628 1209. These numbers are available 24/7 during trading hours. They are off during public holidays.

3) Email Support: Email support is available on [email protected]. Response from Pepperstone’s email support is not as fast as the live chat. We got a response 23 minutes after we sent in an inquiry. The answers given were straight to the point and relevant to what we asked.

How Does Pepperstone Make Money?

Pepperstone make their money through spreads and commissions. If your account is in USD, then your commission per standard lot is US$3.5. This applies to MT4/MT5 only. On cTrader, the commission is $3. On other platforms like TradingView and the Pepperstone platform, it is $3.5.

Which Country Owns Pepperstone?

Pepperstone was founded in Melbourne, Australia in the year 2010 by a team of advanced and experienced traders.

Is Pepperstone Good for Beginners?

Pepperstone is good for beginners in a number of ways. First, they have one of the simplest account and fee structures. Their accounts and trading fees are easy to understand.

They also provide educational materials so you can learn to trade. Webinars, blog articles, market-specific trainings etc.

Furthermore, they allow you to start trading with little money. Though they recommend a $200 (884 MYR) minimum deposit, you can start with as little as $10 (44.20 MYR)

Can I buy stocks on Pepperstone?

No, you cannot buy and own physical stocks through Pepperstone. They are not an investment platforms. However, you can trade stock CFDs by going long or short on publicly traded companies.

In addition, owning stocks does not require leverage. To trade stock CFDs, you will need leverage.

Does Pepperstone have a Demo Account?

Yes, Pepperstone has a demo account. However, the experience is not the same across all of their trading platforms.

On MT4 and MT5, your demo account expires after 60 days unless you fund your live account. After funding your live account, you can request for a non-expiry demo account.

On cTrader, your demo account will not expire as long as you log in at least once every 30 days. Demo account on TradingView does not expire.

Is Pepperstone Good for Scalping?

Pepperstone is a good broker for scalping. Their Razor account allows scalping and this account charges tight spreads on major forex pairs, offers fast trade execution, and has TradingView which offers advanced charting tools and technical indicators for technical analysis.

Scalpers who use Pepperstone can also automate their trading activities using cTrader or MT4 and MT5 by building or buying trading robots.

Do we Recommend Pepperstone for Malaysian Traders?

Pepperstone is regulated in multiple jurisdictions by Top-Tier financial regulators including the UK FCA, Australia ASIC, EU CySEC and UAE, DFSA. This means that the broker has taken steps to ensure the safety of the deposited clients’ funds.

They offer a variety of accounts including swap-free and professional accounts to clients. They also have promotional programs and social trading to encourage clients to trade. It is also important to note that a relatively high number of retail account holders, up 81% lose money on this platform.

The fees on Pepperstone are moderate, as they have a spread-only account which is commission-free and Razor Account in which the spreads are low & the commission per lot is moderate. They do not enforce a minimum deposit, they offer negative balance protection, free deposits and withdrawals, and no inactive account fees are charged.

Based on our review, we recommend that you go to the broker’s website to find more information and chat with the customer support to help you decide if they are right for you.

FAQs on Pepperstone Malaysia

What is pepperstone leverage?

The maximum leverage on Pepperstone for traders in Malaysia is 1:200 for retail clients, which means that you can open a trade position worth up to 200 times the value of your deposit.

Professional traders can access higher leverage of up to 1:500. The maximum leverage of 1:200 and 1:500 are for forex majors, other instruments have lower leverage limits..

What is the minimum amount to trade with Pepperstone?

The minimum deposit amount for traders in Malaysia is 10 USD for cards and e-wallets (PayPal, Skrill, and Netller) while Malaysia online bank transfer requires a minimum deposit of 20 USD.

What are Pepperstone fees?

Fees charged by Pepperstone are spreads starting from 0.3 pips and apply to all accounts, commissions that start from $7 per round turn and apply to only the Razor Account. Pepperstone also charges swap fees if you keep a trade position open pas the market’s closing.

Not that the broker offers Swap-free Islamic Accounts, which are exempt from pay swap fees for a grace period of 10 days.

How long do Pepperstone withdrawals take?

Withdrawals initiated before 07:00 (AEST) are processed the same day, while those received later are processed in the next business day. Bank wire transfers take about 3-5 days to be processed.

Is Pepperstone a trusted broker?

Yes, Pepperstone can be trusted by traders from Malaysia. They are a credible broker with a strong track record. They are licensed by tier-1 regulators like the FCA of the UK and the ASIC of Australia. Pepperstone also provides safety practices such as negative balance protection and segregation of funds.

Note: Your capital is at risk