| FXTM Minimum Deposit Summary | |

|---|---|

| FXTM Minimum Deposit | $200 (896 MYR) |

| Deposit Methods | Credit/Debit Cards, e-Wallets, Online Banking Transfer |

| Account Types | Advantage Stocks Account, Advantage Account, Advantage Plus Account |

| Deposit Fees | No Fees |

| Account Base Currencies | USD |

| Withdrawal Fees | Yes (Commission for some withdrawal methods) |

| Visit FXTM | |

FXTM’s minimum deposit is $200 (896 MYR). FXTM has just two trading accounts. They used to have a Micro Account that has a lower minimum deposit.

In this short guide, we will be covering these accounts in greater detail. We will also show you how to fund your FXTM trading account, the funding methods available and how much they cost.

How Much is FXTM’s Minimum Deposit in Malaysia?

Now we go deeper into FXTM’s trading accounts.

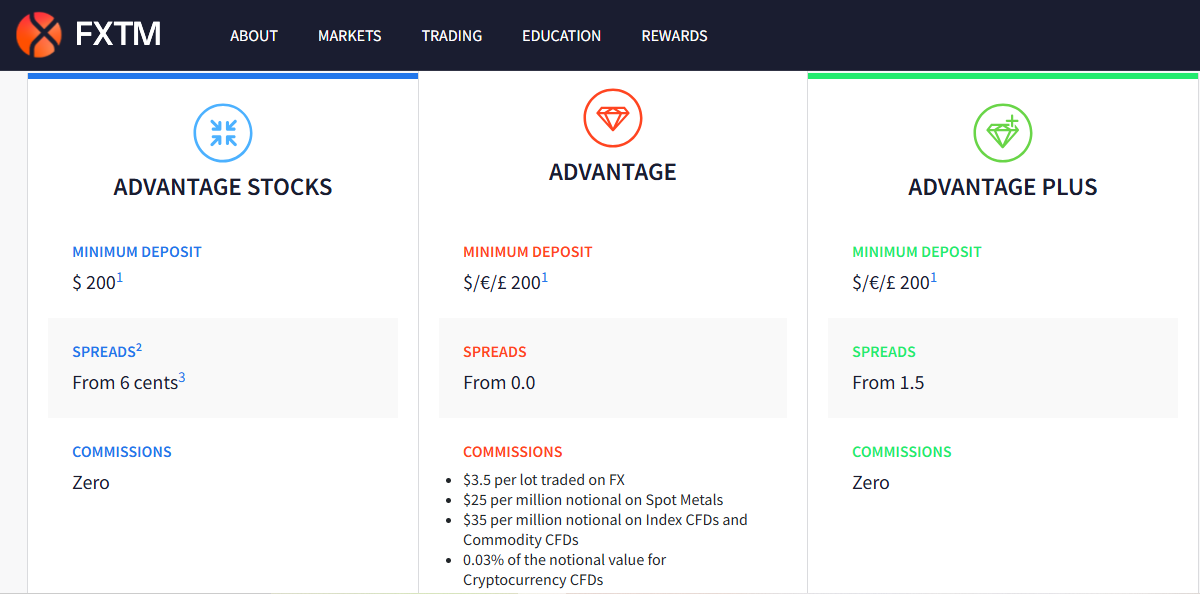

1) Advantage Stocks Account

The minimum deposit for FXTM’s Advantage Stocks Account is $200 (896 MYR). The spreads are a bit high beginning from 6 cents. It is designed for traders who prefer stock CFDs only..

No extra commission. But if you keep your positions open overnight, you will pay rollover charges (swap).

2) The Advantage Account

The minimum deposit for FXTM’s Advantage Account is $200 (896 MYR). The spreads for CFDs are low beginning from 0.0 pips. The instruments offered are forex pairs, metals, commodities, stock CFDs and indices CFDs.

Trading on this account also attracts a commission. You will pay a $25 simple flat commission rate per million notional on FX, metals, and CFDs. You will also pay overnight charges if your have trades open past official trading hours.

The Advantage Account is available on MT4 and MT5 trading platform.

The maximum number of orders is unlimited. You can open as many orders as possible. However, the minimum order (lot) size is 0.01.

3) The Advantage Plus Account

The minimum deposit for FXTM’s Advantage Account is $200 (896 MYR). The spreads are higher than that of the Advantage Account. They begin from 1.5 pips.

You will pay zero commission on FX, metals, and CFDs and the account is available on MT4 only. However, you will pay trading fees in form of swap if you have positions open overnight.

The account offer unlimited orders with a 0.01 minimum lot size on MT4 and MT5. No other third-party trading platform is available.

Read more on on FXTM accounts in our FXTM review.

4) Swap-Free Account

It is possible there are traders that cannot pay or receive interests on their trading account. This could be because of culture or religious beliefs.

If you fall into this category, FXTM’s swap-free account is designed for you. It is an Islamic account that complies with Shariah.

The account operates a no-riba policy. This means you will not pay or receive swap/interests on your trading account. However, if you hold your trades beyond seven days, you will start to pay swap-free daily fee.

FXTM’s swap-free account is available on all account types with exact same trading conditions. Only the swap fee is different.

Note: CFD trading is risky

FXTM Minimum Deposit Methods and Required Fees

FXTM has varying funding methods for traders resident in Malaysia. FXTM does not have a Malaysian Ringgit (MYR) account but you can fund your account in MYR via Online banking. Your money will then be converted to your account’s base currency.

Here are FXTM’s funding method.

1) Credit/Debit Cards: FXTM accepts cards from Visa, MasterCard, and Maestro without extra charges. Any fee you incur in deposits will be from your bank provider. Processing time is 2 hours

2) E-wallets: You can fund your FXTM Account via electronic wallets like Skrill and Neteller. No deposit fee from FXTM but these payment providers may charge service fee. It takes 2 hours for your money to show in your account.

3) Online Banking Transfer: You can deposit funds through your online banks. Transaction time can take about 30 minutes.

Note: FXTM charges no deposit fees. However, they charge a commission for some withdrawal methods.

FXTM Deposit Terms

1) FXTM does not accept third party payments for all deposit methods. Make sure that your funds come from wallets, bank accounts, and cards that bear your name.

2) For card deposits, a scanned coloured copy of both the front and back pages of your card is required. For security purposes, cover your CVV code and all digits on your card except the last four.

3) You may be required to provide an authorization code for card deposits. Card statement or screenshot from your online banking might also be required.

4) There might be a delay in deposit if the card processor or FXTM cannot verify your information.

5) All card requests will come from FXTM official emails only. Contact [email protected] if you receive any suspicious request.

6) If your card is prepaid, you will need provide proof as regards to your source of funds.

7) Use the same email you registered your e-wallet with for your FXTM trading account. It will make the processing of your transaction easier. The same applies to your address.

8) Deposit fees charged by your bank or payment provider will be deducted from the amount you deposit.

Refer to FXTM’s policies for all terms and conditions for deposits. All funding methods have unique terms. Click any of them for all the information you need.

How to Deposit Money Into Your FXTM Account

1) Login to MyFXTM via your FXTM dashboard.

2) Select your preferred funding method and click ‘Deposit’

3) Choose the trading account you wish to fund.

4) Check your deposit details to see if they are correct.

5)Complete your transaction.

Comparison Of FXTM Minimum Deposit With Other Brokers

Here is how FXTM’s minimum deposit compares with that of a select few forex brokers that operate in Malaysia.

| Broker | Minimum Deposit |

|---|---|

| FXTM | $200 (896 MYR) |

| IC Markets | $200 (896 MYR) |

| Tickmill | $200 (448 MYR) |

| Plus500 | 500 MYR |

| AvaTrade | $100 (448 MYR) |

| OANDA | $0 (0 MYR) |

Note: CFD trading is risky

What base currencies are accepted by FXTM?

FXTM accepts the following base currencies: EUR, GBP, USD, IDR, PLN, NGN, and CZK.

Frequently Asked Questions

How long does it take to withdraw from FXTM?

Withdrawal processing time depends on the method you use. Online banking has the shortest processing time at 30 minutes. Other funding methods might have longer processing time.

Is FXTM good for beginners?

FXTM use to offer a Micro Account that allows beginners trade with little money. You can also access their beginners guide to Forex Trading for free.

How legit is FXTM?

FXTM operates legally in Malaysia. They are not regulated locally by Malaysia’s SCM. However, they accept Malaysian traders via their FSC license in Mauritius.

What are the cons of FXTM?

FXTM charges inactivity fees after 6 months of inactivity. They charge withdrawal fees for cards and bank transfer. And customer support is not available round the clock.

Note: Your capital is at risk