| AxiTrader Minimum Deposit Summary | |

|---|---|

| AxiTrader Minimum Deposit | $5 (MYR 21) |

| Deposit Methods | Bank Transfer |

| Account Types | 3 Accounts |

| Deposit Fees | No Fees |

| Account Base Currencies | USD |

| Withdrawal Fees | Withdrawals are free if they are above US$50 or for the full balance of your Account. |

| Visit AxiTrader | |

AxiTrader has different minimum deposits for their accounts in Malaysia. According to their website, the minimum deposit for AxiTrader is $5 (MYR 21). This figure is for Axi’s Standard Account. If you choose another account, it is higher than this

Apart from a demo account, there a four live trading accounts you can open with Axi. They all come with varying minimum deposits and trading conditions.

We researched these accounts and here is a summary of what we found.

How Much is Axi’s Minimum Deposit in Malaysia?

Here is where we breakdown the account types, a summary of their trading conditions, and the minimum deposits.

Let’s go.

1) Standard Account

This is Axi’s first account. The minimum deposit for Axi’s Standard Account is $5 (MYR 21). Also, there is no fee required to set up the account.

In terms of trading fees, they are low for this account. You will pay a spread on every trade and that is all there is. The spread begins from 0.9 pips. The account is commission free so there will be no extra charges for every standard lot you trade.

Your lowest lot size is 0.01 and you can trade 140+ FX pairs, metals, indices, and Shares CFDs. There are over 260 CFDs available in total.

2) Pro Account

The minimum deposit for Axi’s Pro Account is $5 (MYR 21). Do not mistake this account for a professional account. It is just another retail trading account for retail traders.

The spread for this account is low, starting at 0.0 pips. The main trading fee for this account is the extra commission for every standard lot you trade. The commission is $3.5 per trip which brings your commission to $7 round trip.

You can trade 140+ FX pairs, metals, indices, and Shares CFDs on a 0.01 minimum lot size. There are over 260 CFDs available in total as well.

3) Elite Account

The elite account is a proper professional account. It is designed for wholesale clients, seasoned professionals, and high volume traders. The minimum deposit is $25,000 (MYR 118,300). You can also choose from other base currencies like EUR, GBP, and AUD

Spreads begin from 0.0 pips with $3.50 round-turn commission which is 50% less than the Pro Account. You get access to exclusive services like free VPS hosting, local language customer support, and webinars for highly advanced trading strategies.

4) Islamic Trading Account

As per our AxiTrader review, Axi’s Standard and Pro Accounts are also available as swap-free accounts. The minimum deposit remains the same.

You might not find it on their website. But as you go through the account application process, you will find the option of a swap-free account. Axi decided if they will say yes to your application at their discretion.

This account is for those who cannot pay or receive interest due to religious or cultural beliefs. Axi can revoke the swap-free status of your account. So make sure not to misuse the account or trade suspiciously.

Note: CFD trading is risky

5) MT4 Demo Account

This is an account you can use to practise trading without any risk. This account is 100% free and it only lasts for thirty days.

There is no minimum deposit for this account. Rather, Axi will give you virtual money in your demo account to trade a replica of live trading conditions.

If you do opt for a demo account, you get $50,000 as your virtual deposit.

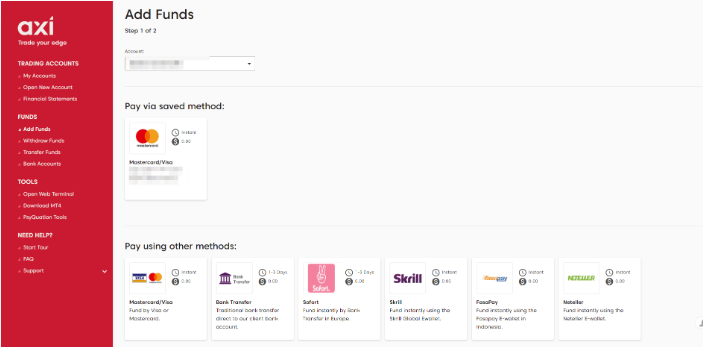

Axi Deposit Methods and Required Fees

Traders resident in Australia can fund their account in different ways. You might pay a fee or nothing for using these methods. It all depends on you meeting simple terms and conditions.

Any fee you have to pay can come from your bank or financial institution. Axi does not charge any fees for funding.

Let us have a look at the local methods available for Malaysians.

1) Credit/Debit cards: Axi accepts cards from Visa and MasterCard only. There is no extra fee when you fund your account through this method. Your money reflects in your trading account instantly.

2) International Bank Transfer: International bank transfer can also be an easy means of funding your trading account. Axi charge no fees for using this method.

3) Local Bank Transfer: Malaysia-based traders can fund their trading account via their local bank. This allows you make payment in Malaysian Ringgit (MYR).

4) E-wallets: You can fund your account with different e-wallets like Skrill, Neteller, fasapay, and Astropay. They all support payment in USD.

5) Crypto: Crypto payment is also supported by Axi. You can deposit money into your account via BTC, ETH, LTC, XRP, XLM, USDT (TRC20), and USDT (ERC20).

Note: All of these payment methods have their minimum deposits. These minimum deposits are not from Axi but from the payment service providers. Also, you can withdraw your funds using any of these channels.

Axi Deposit Rules

1) Axi does not accept third party payments. If they suspect a third party payment, they reserve the right to return the funds to the remitter and retain the balance in your account, pending verification/proof of identity.

If Identity cannot be proven Axi reserves the right to retain the balance in your Account and you will not be permitted to withdraw the balance in your Account.

2) If funding exceeds monthly limits of $50,000 for card payments and other methods, Axi may charge a 3% fee. Only bank transfer is exempted from this rule because there is no monthly limit.

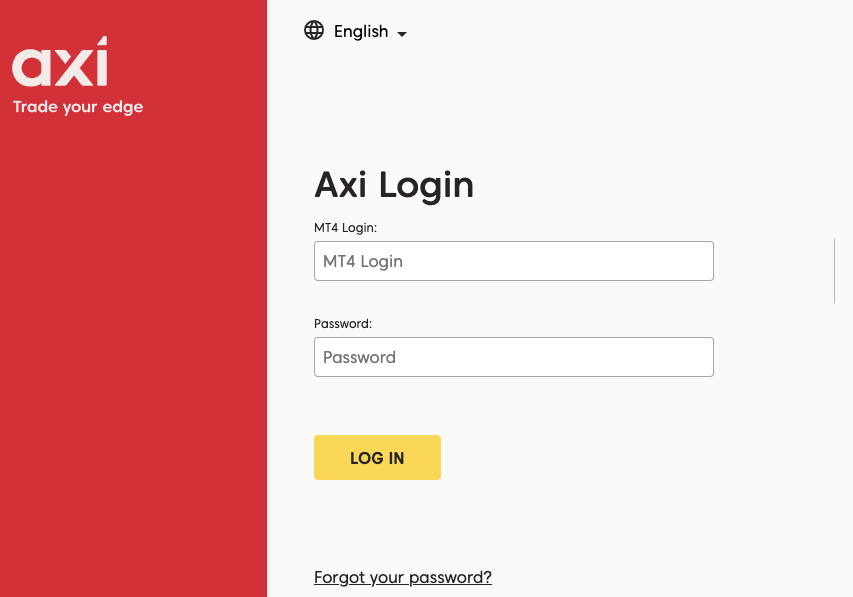

How to Deposit Funds Into Your Axi Account

1) Log in to your personal client area.

2) Click the ‘Deposit’ or ‘Funding menu’

3) Choose your preferred payment method

4) Provide necessary information and complete funding to your trading account.

Comparison Of Axi Minimum Deposit With Other Brokers

Here is how Axi’s minimum deposit compares with a select UK brokers in the industry.

| Broker | Minimum Deposit |

|---|---|

| Axi | $5 (MYR 21) |

| FBS | $5 (MYR 24) |

| OANDA | $0 (MYR 0) |

| FxPro | $100 (MYR 473) |

| FXCM | $50 (MYR 280) |

| IG Markets | $50 (MYR 280) |

Note: CFD trading is risky

What base currencies are accepted by Axi?

Axi accepts the following base currencies: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD

Frequently Asked Questions

How much is the Axi deposit fee?

Axi does not charge any fees for deposit. However, there is a 3% commission if you exceed a $50,000 monthly transaction for limit for some payment methods.

How long does it take to withdraw money from Axitrader?

It depends on the payment method you use. Credit/debit cards and e-wallets is instant. Other methods like bank transfer take 1-3 business days.

What is the minimum withdrawal from Axi?

There is no specific minimum withdrawal. Your payment method determines what your minimum withdrawal will be. If you are using a local bank it is MYR 30,000 and $50,000 (MYR 236,600) for credit/debit cards.

Note: Your capital is at risk