IG Markets is an online provider of services for shares trading and CFDs (Contract for Differences) trading. IG offers expert traders as well as beginners an accessible platform on which you can trade in financial markets such as forex, indices, commodities, ETFs, bonds, cryptocurrencies, and shares.

IG Markets was founded in 1974 in London and is authorized in Singapore, Australia, the United Kingdom, Europe, America, and Africa.

In our review of IG Markets, we examine the broker’s trading conditions, fees, account types and features, account opening process, trading platforms, tradable instruments deposit/withdrawal, and customer support.

| IG Markets Review Summary | |

|---|---|

| Broker Name | IG Asia Pte Ltd |

| Establishment Date | 1974 |

| Website | www.ig.com |

| Address | IG Asia Pte Ltd., 9 Battery Road #01-02 MYP Centre Singapore 049910 |

| Minimum Deposit | S$450 |

| Maximum Leverage | 1:20 |

| Regulation | MAS, ASIC, FCA, FSCA, BaFin |

| Trading Platforms | ProRealTime, L2 Dealer, IG Trader, and MT4 available on PC, Mac, Web, Android, & iOS |

| Visit IG Markets | |

IG Markets Pros

- Regulated by MAS

- Supports MT4 platform

- Offers commission-free trading

- Free deposits and withdrawals

- Offers a wide range of instruments

- No mandatory minimum deposit for bank transfers

IG Markets Cons

- Customer support is not responsive

- Charges inactive account fees

- Charges currency conversion fees

- Does not support MT5 platform

Is IG A good broker?

IG Markets is considered safe for traders and scores low on the risk of funds because they are regulated in Singapore and other jurisdictions by Top-Tier financial regulators.

Here are the various regulations of the trading IG Markets in different countries:

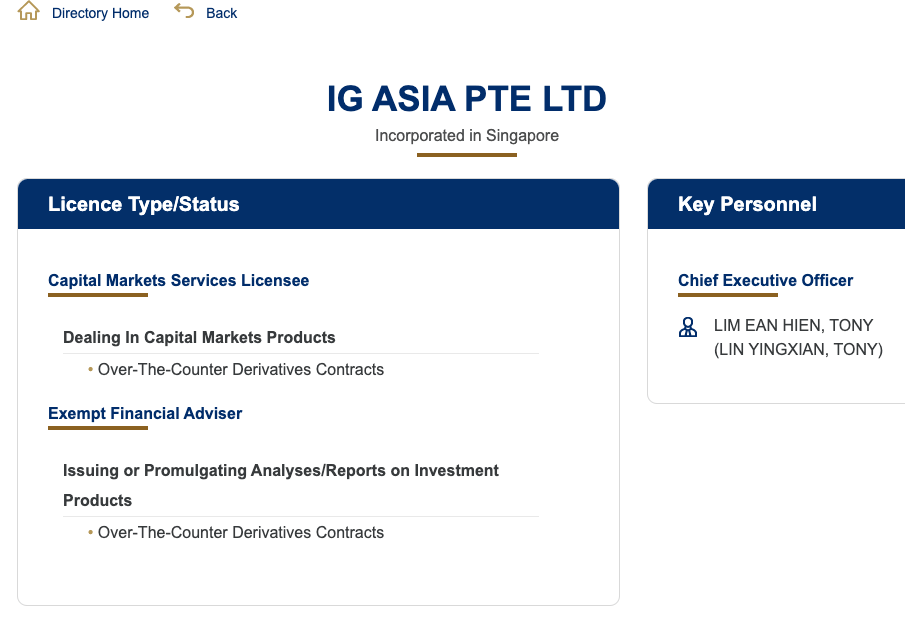

1) Monetary Authority of Singapore (MAS): IG Asia Pte Ltd is registered in Singapore as a financial institution and authorized to deal in capital markets products.

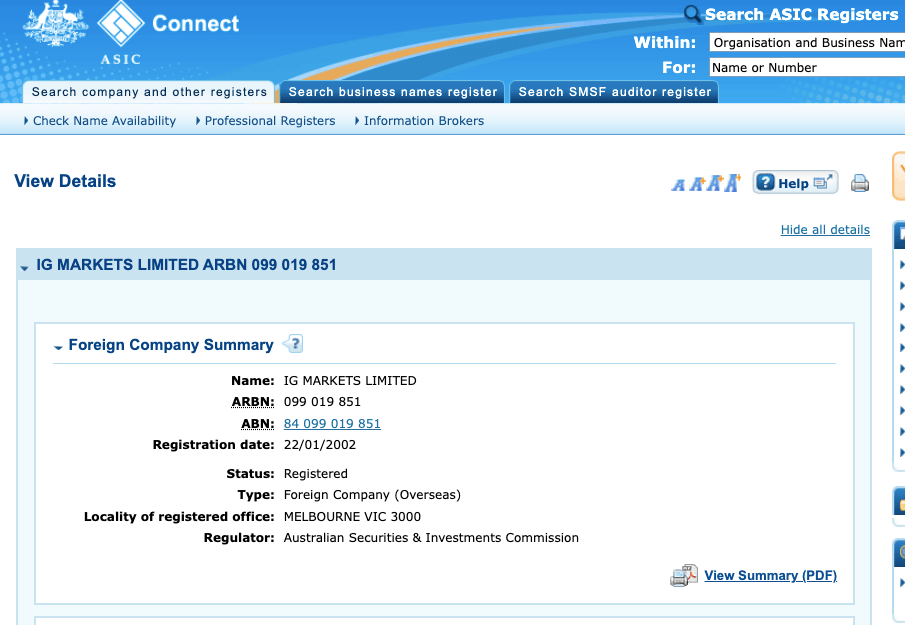

2) Australian Securities & Investments Commission (ASIC): IG Markets Limited is registered in Australia by ASIC and licensed to offer financial services, with ARBN (Australian Registered Body Number) 099019851, issued in 2002.

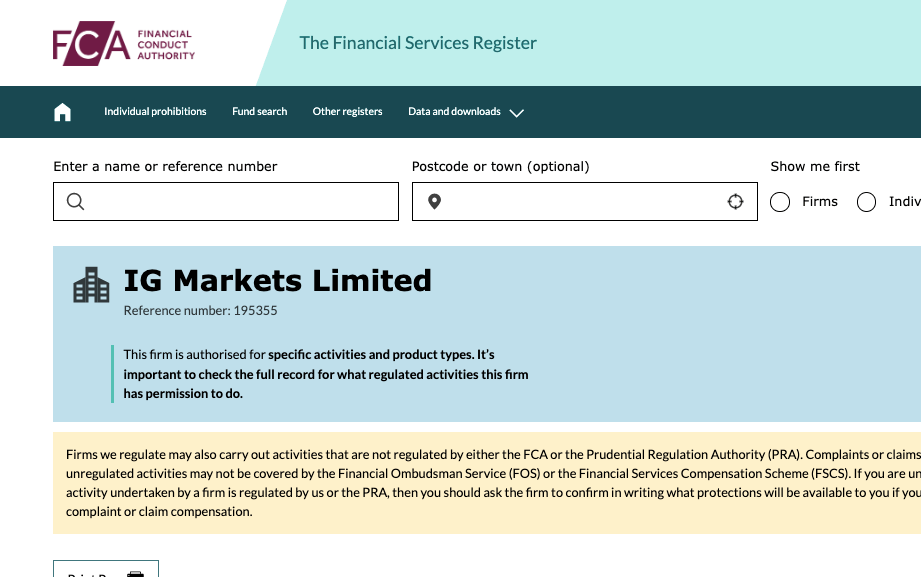

3) Financial Conduct Authority (FCA): IG Markets Limited is regulated by the FCA and authorized to offer financial services in the UK, with reference number 195355, issued in 2001.

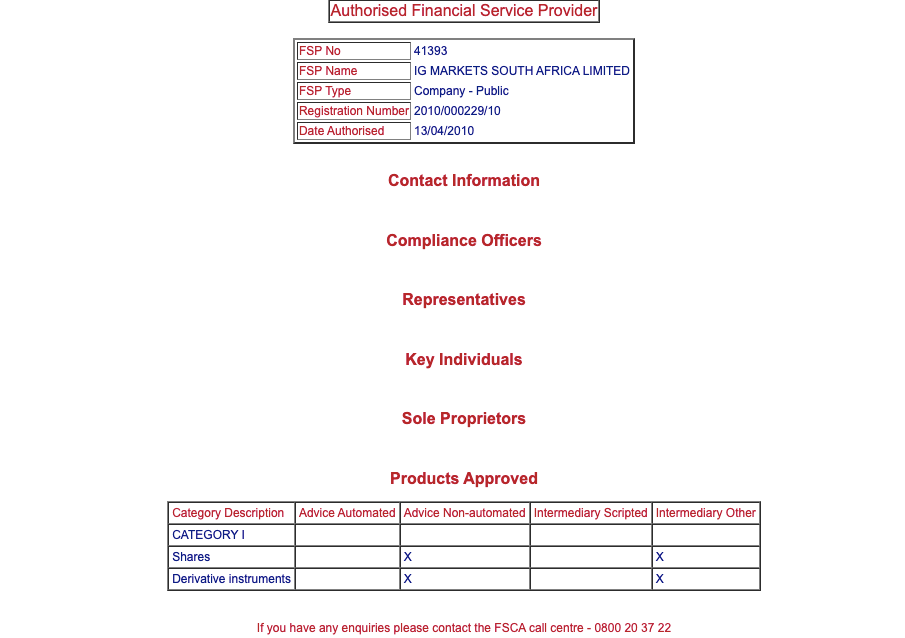

4) Financial Sector Conduct Authority (FSCA), South Africa: IG Markets South Africa Limited is authorized by the FSCA to provide financial services in South Africa, with FSP (Financial Services Provider) Number 41393, issued in 2010.

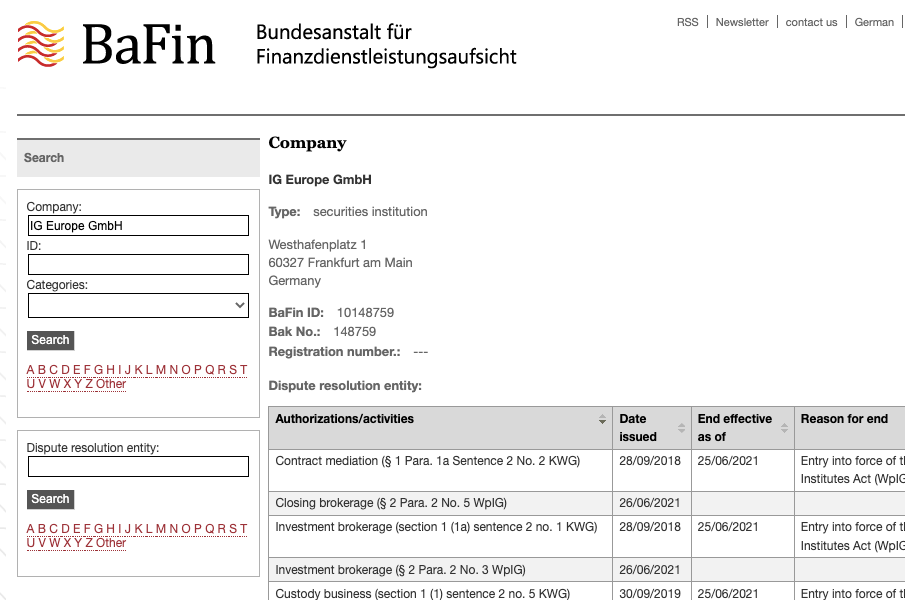

5) Federal Financial Supervisory Authority, Germany: IG Markets is authorized in Germany as ‘IG Europe GmbH’, with an office in Frankfurt. IG Markets serve European clients through this license in the EEA.

IG Markets Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Singapore | No fixed compensation | Monetary Authority of Singapore (MAS) | IG Asia Pte Ltd |

| UK | £85,000 | Financial Conduct Authority (FCA) | IG Markets Limited |

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | IG Markets Limited |

| South Africa | No Protection | Financial Service Conduct Authority (FSCA) | IG Markets South Africa Limited |

IG Markets Leverage

The maximum leverage on IG Markets is 1:20 for retail traders. This means that you can place a trade worth 20 times the size of your deposit.

For example, if you deposit $1,000, you can open a trade position worth $20,000. Although this maximum leverage applies to forex and other instruments have lower leverages.

IG Markets’ maximum leverage for professional clients (Accredited Investors) is 1:50.

It is best to avoid trading leveraged products as you can lose your capital in the process. Only engage in trading if you understand how they work and have experience. It is recommended that you do not use all the leverage available as it increased the risk of losing your capital.

IG Markets Account Types

IG Markets offer two account types, the Standard Account and Accredited Investor Account. Your account type determines the instruments you can trade, fees, and leverage you can access. You can open a personal account as an individual, a joint account with a partner or an institutional account as a corporate entity.

IG Markets Does not offer Islamic Accounts, although you can create a demo account to practice with virtual money before putting your real money.

Here is an overview of the account types on IG Markets:

1) Standard Account: The IG Markets Standard Trading Account is designed for retail clients and can be accessed on the MT4 trading platform. It is the default account you are assigned when you first signup and can trade CFDs on forex, indices, shares, cryptocurrencies and commodities with this account.

Spreads on this account start from 0.6 pips for major pairs like EURUSD and you do not pay any commission fees on your trades except when trading shares. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of S$450. If you don’t use your account for 24 months, there’s a S$25 monthly charge that applies. IG Markets does not have negative balance protection which means you can lose more money than you deposited if your trade position is unsuccessful.

The leverage on this account is 1:20 for forex pairs and indices, 1:10 for shares, 1:5 for commodities (metals and oil), and 1:2 for cryptocurrencies.

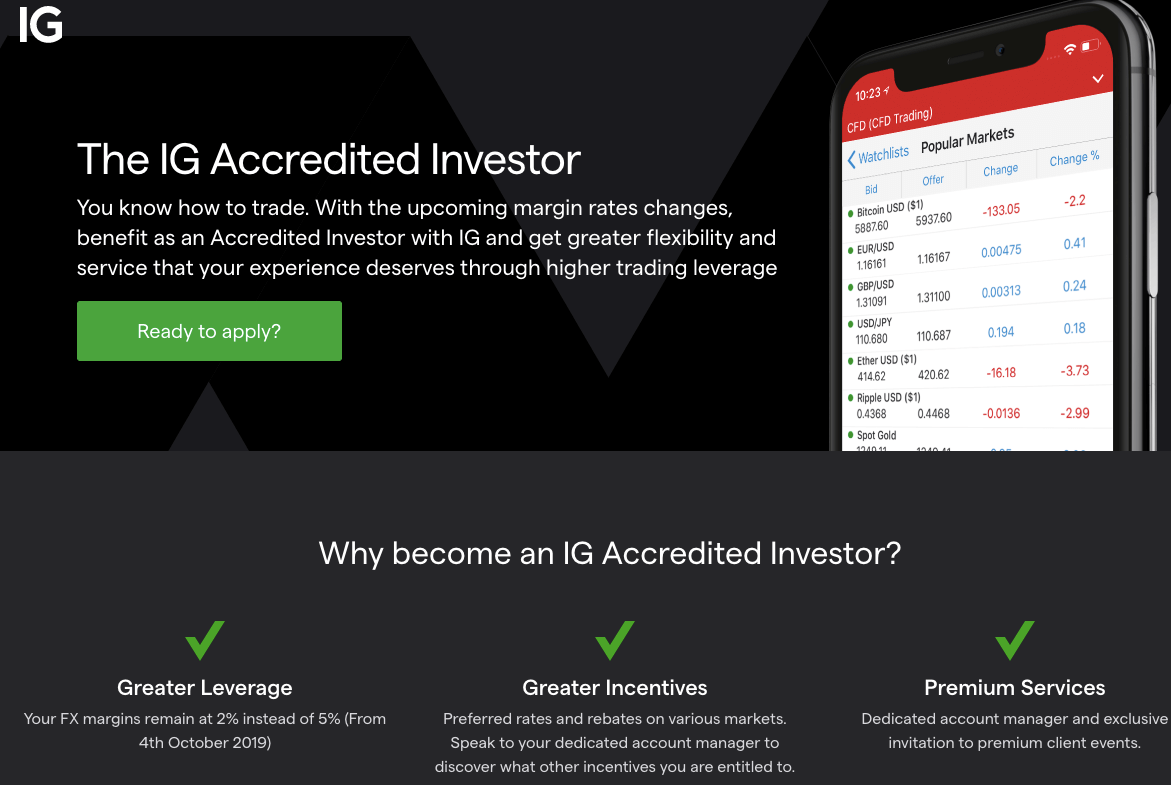

2) IG Accredited Investor Account: This account is designed for professional and experienced CFD traders who trade large sizes of financial markets. You can access the account on the MT4 trading application and trade CFDs on forex, indices, cryptocurrencies, and commodities.

Spread fees on this account also start from 0.6 pips for major pairs like EURUSD and you only pay commission fees when trading shares. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of $450 and account inactivity fees apply after 24 months. The IG Professional Account does not have negative balance protection. If your trade is unsuccessful, you can lose more than your deposit and will need to deposit more funds to clear the negative balance.

As an Accredited Investor on IG Markets Singapore, you get a dedicated account manager and invitations to premium clients’ events. You also have access to higher leverage of up to 1:50 for forex pairs, while other instruments’ leverage is 1:20 for indices, 1:10 for shares, 1:5 for commodities (metals and oil), and 1:2 for cryptocurrencies.

You can apply to become an IG Markets Accredited investor after meeting at least one of the following criteria:

- You have net personal assets of more than S$2 million; or

- You have an annual income of more than S$300,000 in the past year; or

- You have more than $1 million in net financial assets

To get the Accredited Investor Account, first create a Standard Account, If you meet the criteria, contact support via email at [email protected] and fill out the application form. Once your account is approved, you will get an email notification.

IG Markets Base Account Currency

When you create an on IG Markets, by default you are assigned the Singapore Dollar – SGD as your account base currency. You can decide to change this and choose from 5 other base account currencies on IG Markets which are British Pound sterling – GBP, Euros – EUR, United States Dollar – USD, Australian Dollar – AUD, and Hong Kong Dollar – HKD.

Your trades, fees, and deposits/withdrawals are measured in the base currency of your account.

IG Markets Fees

Fees on IG Markets depend on the instruments you are trading, the size of the trading, your account type, and how long you keep the trade open. Find an overview of the trading and non-trading fees on IG Markets below:

Trading fees

1) Spreads: You pay spread fees on IG Markets whenever you place a trade. The spread is the difference between the bid and asks prices, called pips, and this varies based on the instrument you are trading and market movement. Spread fees apply to all CFD trades except when you trade shares.

You do not pay spread on shares CFDs trade, you pay commission fees instead. Find the average spreads of major instruments with the IG Standard Account below:

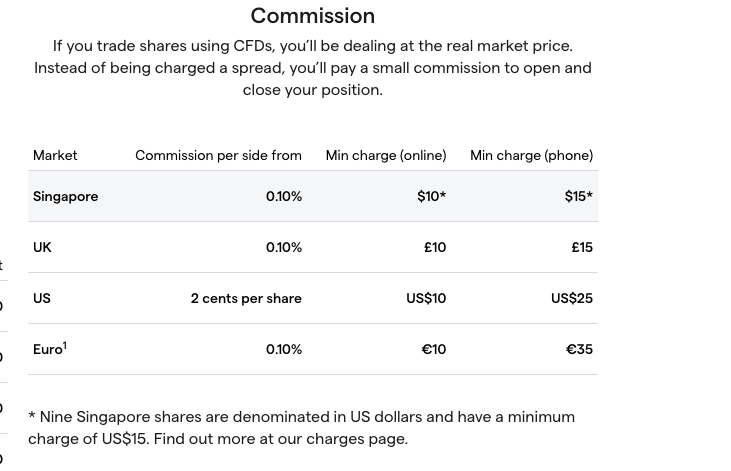

2) Commission fees: IG Markets offers commission-free trading for all instruments except shares. This means that you do not have to pay commissions for opening or closing trade positions on most instruments.

Only shares or shares CFDs trades incur commission fees and no spreads are charged on them. The commission fees on shares vary based on the country whose shares you are trading and whether you are using a mobile trading app or web.

For Singapore shares, the fee starts from 0.1% per side or a minimum of S$10 per round turn for web CFDs shares trading and S$15 for shares trading on mobile.

IG Markets Trading fees Table

Here is a summary of the average fees IG Markets charges on some instruments:

| CFD instrument | Spread | Commission |

|---|---|---|

| EUR/USD | 1.04 pips | None |

| GBP/USD | 1.83 pips | None |

| EUR/GBP | 1.89 pips | None |

| XAU/USD (Gold) | 0.3 pips | None |

| Crude oil (Brent) | 2.8 pips | None |

| Wall street | 2.4 pips | None |

| US 500 | 1.5 pips | None |

3) Swap fees: Whenever you keep a trading position open past the closing time of the market, which is 10 PM UK time (5 AM Singapore Time), you incur an overnight funding cost also called swap fees or rollover fees. This fee is based on the size of your trade and whether your position is long (buy) or short (sell).

The swap fees are added to your profit or loss when you close the trade. In some cases, if you are holding a long position open, you gain interest instead of a fee.

4) Currency Conversion fees: Whenever you make a CFD trade in a currency other than the base currency of your account, IG Markets will charge a currency conversion fee.

For example, if your account base currency is SGD and you place a trade on GBP/USD, IG Markets will charge a currency conversion fee of 0.7% of the transaction value.

Non-trading fees

1) Deposit and Withdrawal fees: IG Markets offers free deposits and withdrawals for internet bank transfers (FAST Payments), while cards incur a deposit fee of 2% (levied by the processor). Deposits via cheques also have deposit costs levied by the clearing house. Withdrawals are free on IG Markets.

Note that your payment processor may charge an independent transaction fee.

2) Account Inactivity charges: If you do not place any trade with your IG Markets Account for 2 years, you will be charged a dormant account fee of S$25 every month, which will be deducted from any money in your account.

If you do not have any money in your account, you will not be charged, thus the account will not accrue a negative balance.

IG Markets Non-trading fees

| Fee | Amount |

|---|---|

| Inactivity fee | S$25 per month |

| Deposit fee | Free* |

| Withdrawal fee | Free* |

How to Open IG Markets Account in Singapore?

Follow these steps to open a trading account on IG Markets.

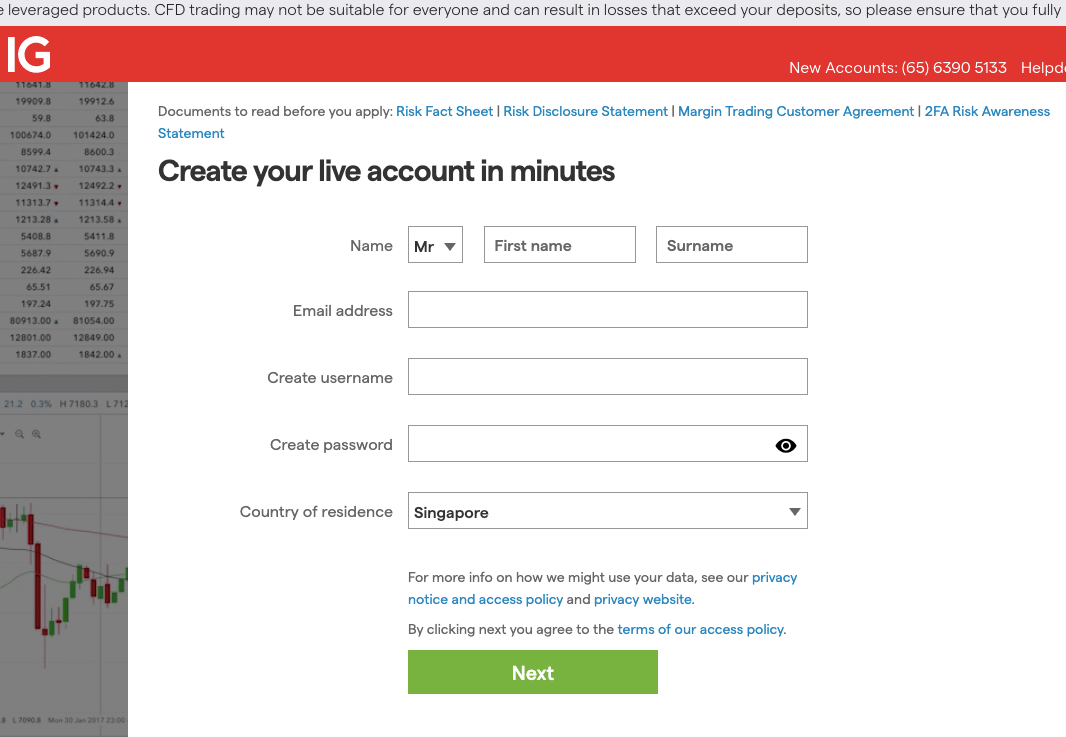

Step 1) Go to the IG Markets website at www.ig.com and click on ‘Create live account’.

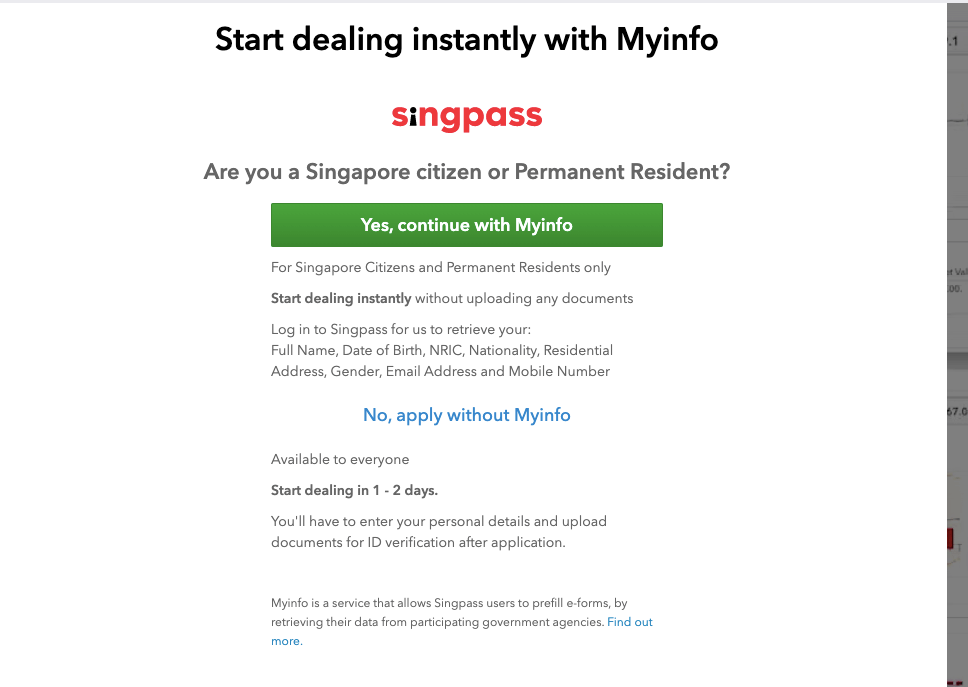

Step 2) On the form that appears, fill out your name and email, create a username and password, select your country of residence (Singapore will be selected by default), and then click on ‘Next’. You can also choose to fill this out with Myinfo by Singpass

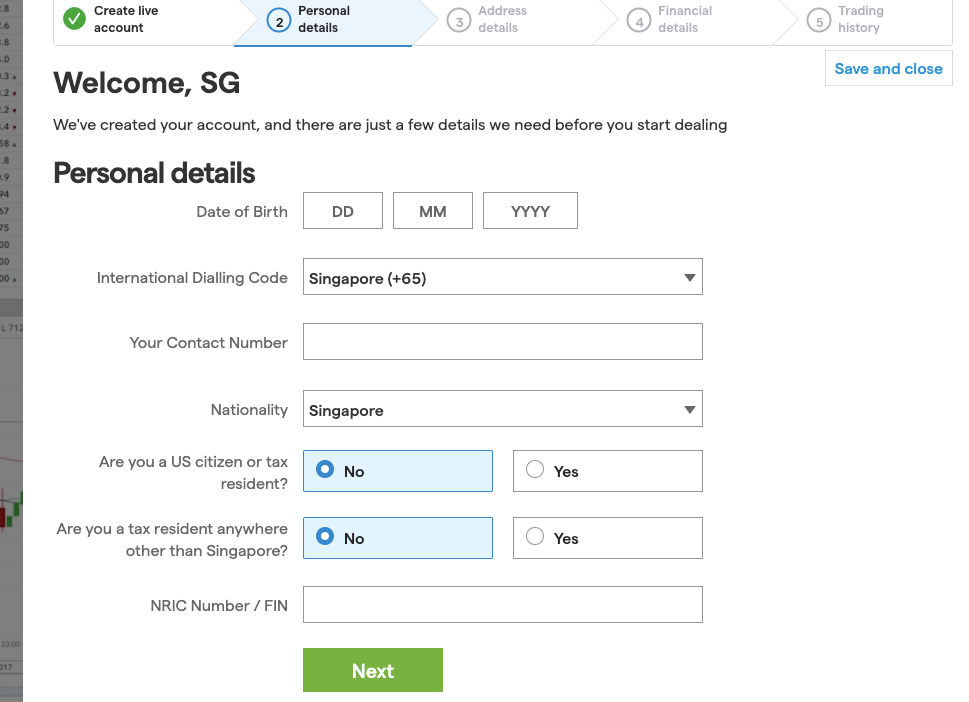

Step 3) Supply your date of birth, phone number, select nationality, check the box to indicate you are not a US citizen and provide your NRIC Number or FIN then click ‘Next’.

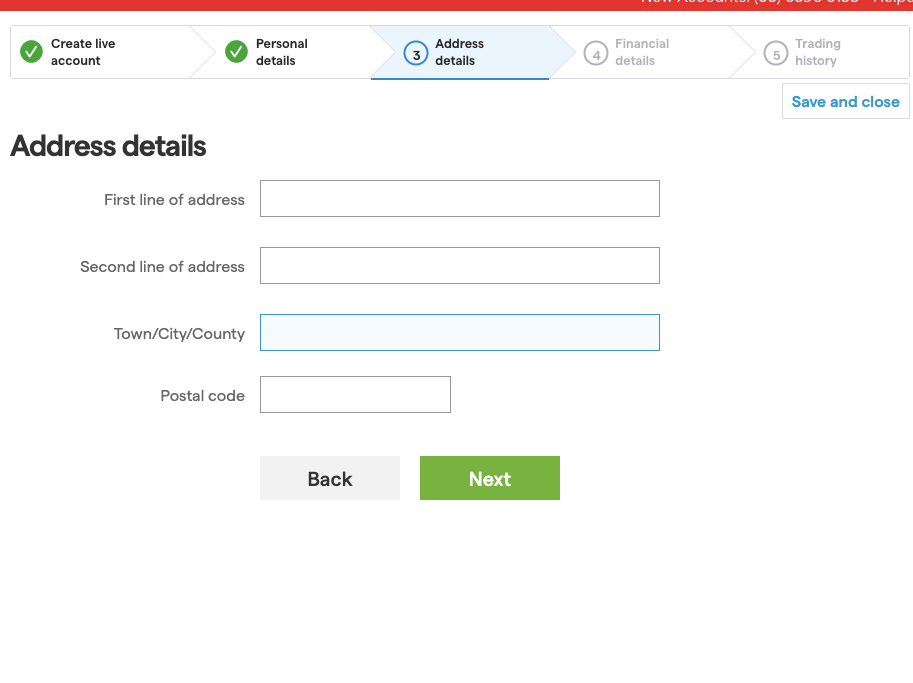

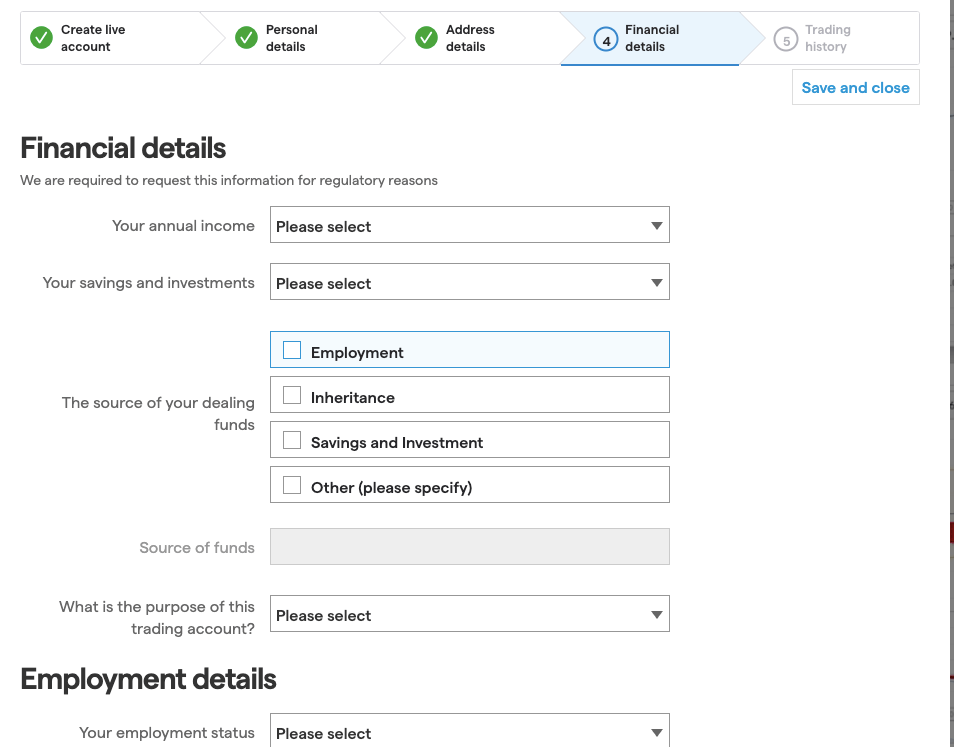

Step 4) Provide your address and click ‘Next’.

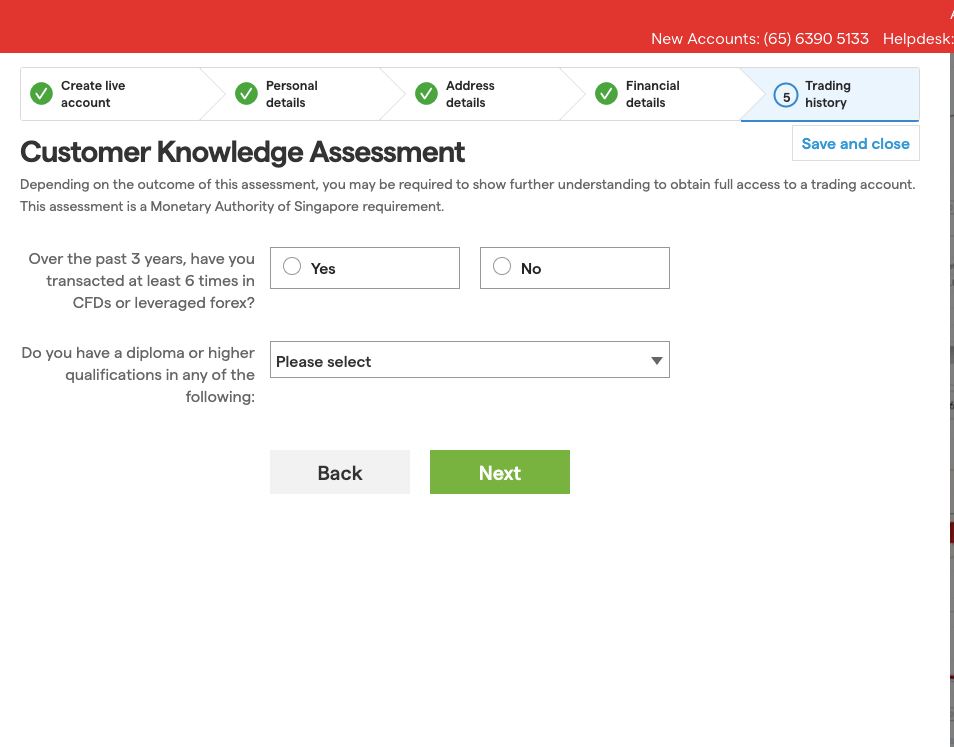

Step 5) Answer questions relating to your employment, financial status, trading experience and knowledge, then click ‘Next’.

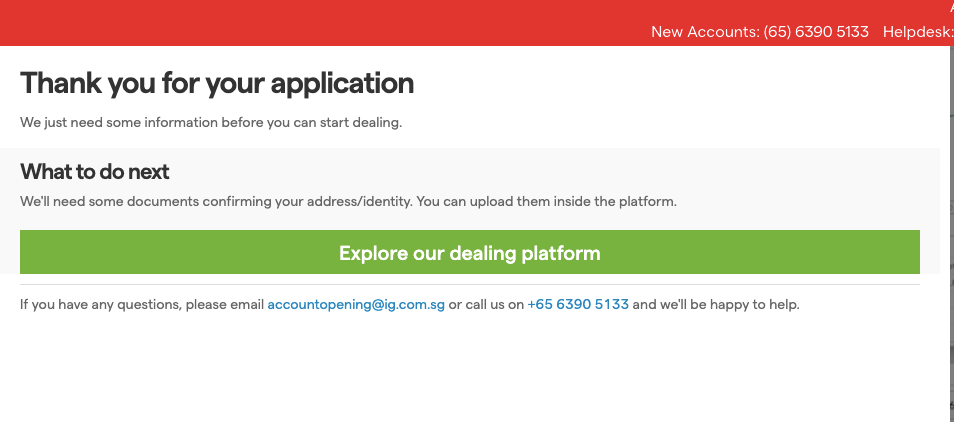

Step 6) Check the box to agree to the terms and conditions and click ‘Finish’, on the page that appears then click the ‘Explore our dealing platform’ button and you will be redirected to the IG Markets dashboard to continue with your registration.

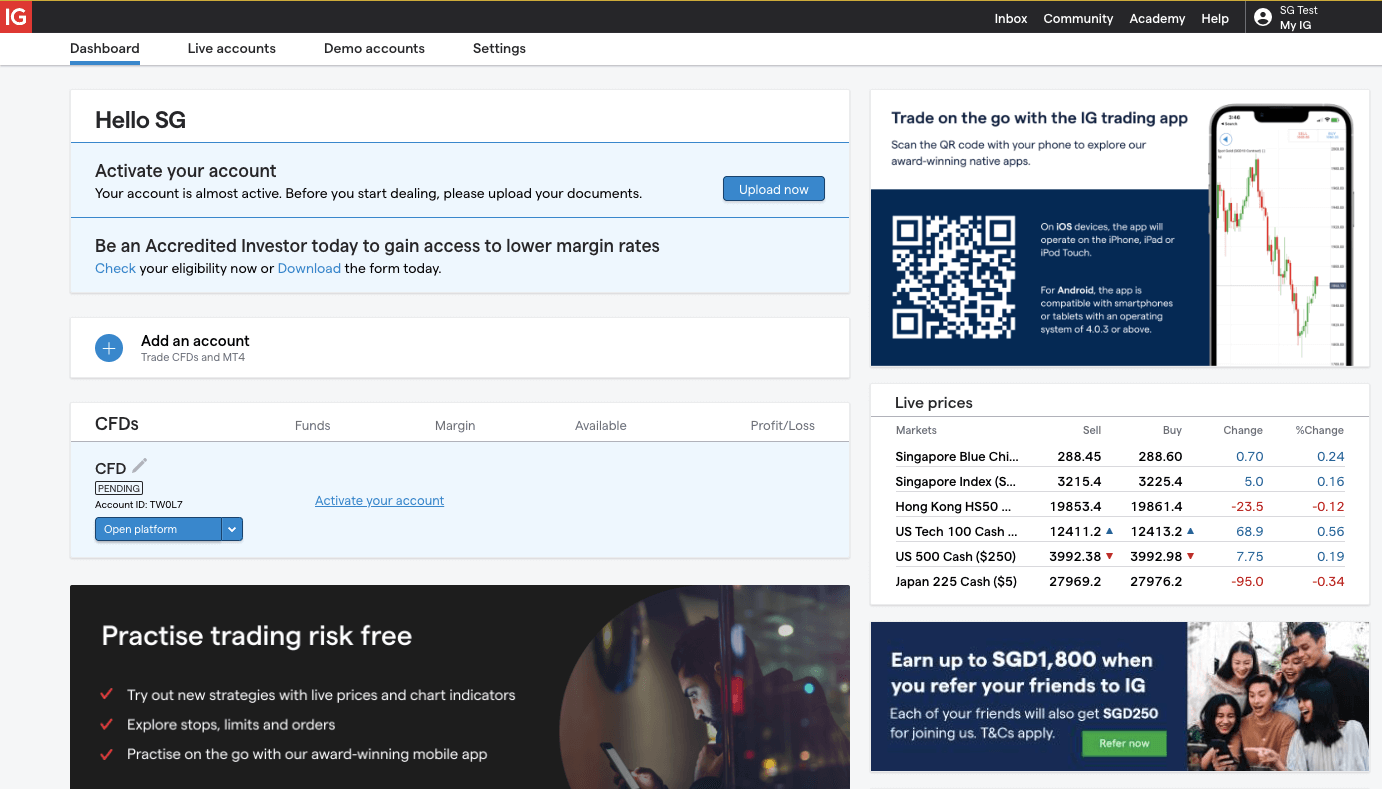

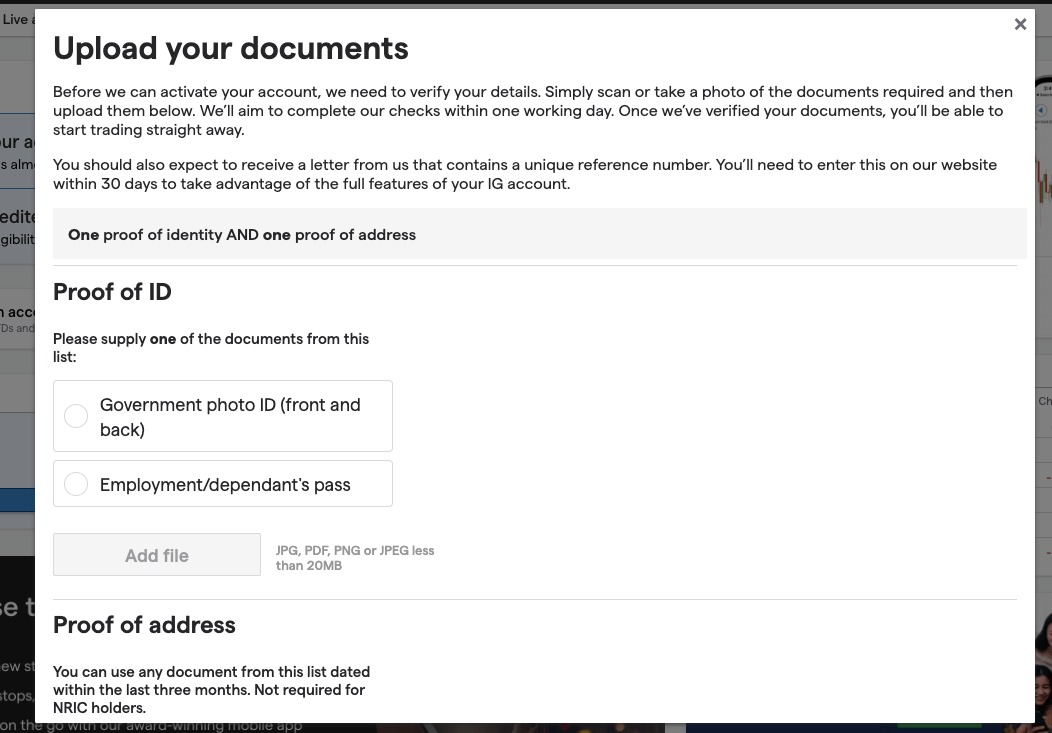

Step 7) On the dashboard, click on ‘Upload now’ to activate your account and upload the required verification documents.

After your account is activated, you can make deposits, place trades and withdraw funds from it.

IG Markets Deposits & Withdrawals

Payment Methods accepted on IG Markets are bank transfers (FAST Payments), PayNow (UEN payments), cards (credit/debit), and cheques. Find details about deposits and withdrawals on IG Markets below:

IG Markets Deposit Methods

Here is a summary of payment methods accepted by IG Markets for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 1 business day |

| Cards | Yes | 2% per transaction | Instant |

| E-wallet | Yes (Bill payments, PayNow) | Free | 1 business day |

IG Markets Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on IG Markets.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 24 hours |

| Cards | Yes | N/A | Up to 5 business days |

| E-wallets | No | N/A | N/A |

What is the minimum deposit for IG Markets?

The minimum deposit on IG Markets is S$450 using cards and Bank transfers and cheques have no mandatory minimum deposit amount.

The maximum deposit per transaction is S$50,000 per transaction for bank transfers, and S$300,000 for PayNow while cheques have no maximum amount, the maximum deposit amount for cards is determined by the processor.

It takes up to 3 working days for deposits via cheques to be credited to your account. You can send your proof of payment to customer support to fast-track the process.

How do I add money to my IG trading account?

Follow these steps to deposit funds into your IG Markets trading account:

Step 1) Log in to your IG Markets Account via www.ig.com/sg/login.

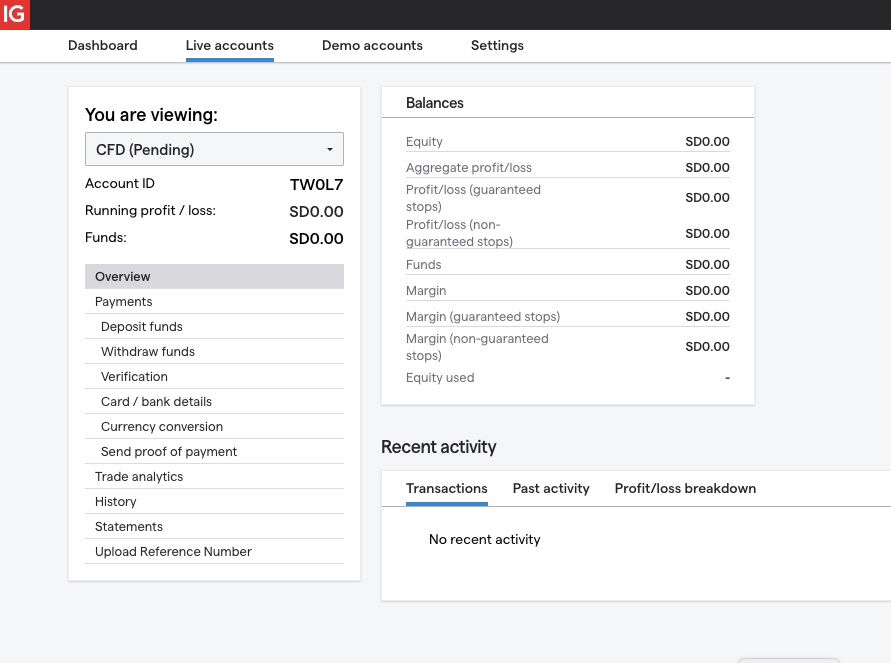

Step 2) Click on the ‘Live Accounts’ tab and select the trading account you want to deposit funds into.

Step 3) Select ‘Deposit funds’, choose a payment method and follow the on-screen instructions to complete your deposit.

IG Markets Minimum Withdrawal

The minimum withdrawal on IG Markets is S$200 for PayNow and bank transfers. Although if your account balance is less than $200, you can withdraw the available amount.

You can only withdraw a maximum of S$35,000 per day to cards while EFT (Electronic Funds Transfer), cheques and bank transfers have no maximum withdrawal amount.

How do I withdraw money from IG trading?

Follow these steps to withdraw money from your IG Markets:

Step 1) Log in to your IG Markets Account.

Step 2) Click on the ‘Live Accounts’ tab and select the trading account you want to withdraw money from.

Step 3) Select ‘Withdraw funds’, choose a withdrawal method and follow the on-screen instructions to complete your withdrawal.

How long do IG withdrawals take?

The time it takes to receive funds after requesting withdrawals on IG Markets depends on your payment method. Withdrawals to bank accounts are received the same day if you submit your request before mid-day Singapore Time, otherwise, you get it on the next business day.

While PayNow withdrawals are received instantly or within 1 business day, card withdrawals take 3-5 business days for you to receive the funds.

IG Markets Trading Instruments

You can trade over 16,000 financial instruments on IG Markets, find a breakdown of the instruments below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 99 currency pairs on IG Markets |

| Energy | Yes | 8 Energies on IG Markets |

| Metals | Yes | 5 Metals on IG Markets |

| Commodities | Yes | 21 soft (agriculture) commodities on IG Markets |

| Indices | Yes | 34 indices on IG Markets |

| Shares | Yes | 16,000+ shares on IG Markets |

| Bonds | Yes | 12 Bonds on IG Markets | ETFs | Yes | 17 ETFs on IG Markets | Cryptocurrencies | Yes | 13 Cryptocurrencies on IG Markets |

IG Markets Trading Platforms

Trading platforms supported by IG Markets are:

1) MetaTrader 4: You can trade financial markets with IG Markets on the MT4 trading application which is available on the web, desktop (macOS & Windows), and mobile devices (Android & iOS).

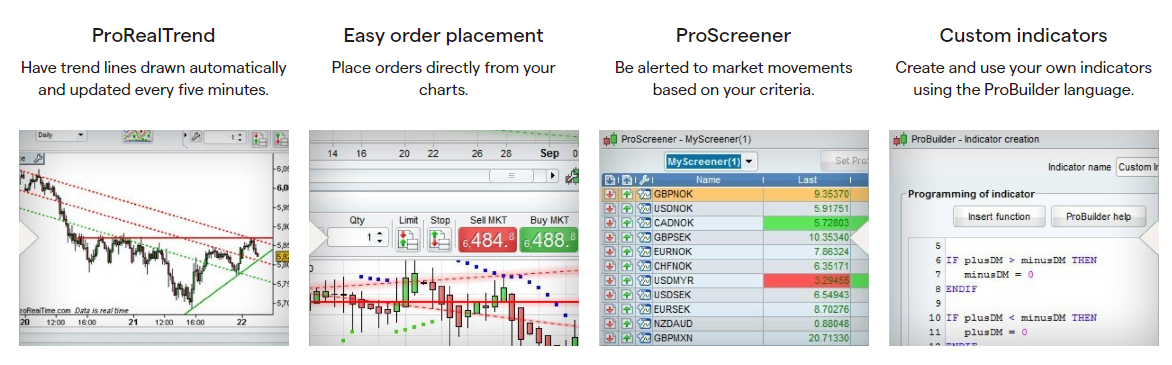

2) ProRealTime: You can also access IG Markets trades via the ProRealTime trading application which is only available for web-based trading. ProRealTime is an advanced charting software useful for technical analysis and trading. It is integrated with IG’s platform so you do not need to use it separately.

ProRealTime lets you use advanced technical analysis via 100 indicators and unlimited timeframes. You can also automate your dealings by building your algorithm. The algorithm can run for 24 hours on its own.

3) IG Trader (Progressive Web App): IG Markets has a proprietary trading application Progressive Web App (PWA) which is accessible on the web and has a mobile trading app as well available for mobile devices (Android & iOS).

IG Markets Trading Signals

Trading excellently consumes a lot of time. Picking the CFDs to trade, carrying out your analysis, and monitoring your trades can be quite demanding. If you want to trade without having to go through the hassle, you can try IG trading signals.

These signals are buy and sell suggestions based on emerging chart patterns and fundamental analysis. With this service, you will see key support zones, key resistance zones, and entry/exit points. You will also see the provider’s confidence level in the signal so you can decide if you are willing to take the risk.

IG’s trading signals are provided by Autochartist and PIA-First. Autochartist provides automated chart pattern recognition. PIA-First has been in the service of providing trading strategies for over 45 years. There seasoned professionals analyzes charts and set signals in a more fundamental context.

Also, you won’t be paying any fees to access these services. IG Trading signal is free.

IG Financial Freedom Hub

Financial Freedom Hub is an initiative by IG to help traders with financial literacy. There is no financial freedom without knowing how to manage and invest your money. Other than trading CFDs, you can also take advantage of IG’s financial freedom hub to learn about personal finance and how to invest.

The hub is divided into three sections as displayed below

If you click ‘learn more’, you can take a deep dive into all the lessons in the three sections. IG does not charge extra fees for access to the hub. It is free of charge.

IG Markets Execution Policy

According to their execution policy document, IG is a market maker. They act as a principal and execute your trades on your behalf. This means IG is the sole execution venue for clients orders. In other words, traders will deal directly with IG and not the underlying market.

Like every market maker, IG has their own in-house dealing desk and price book. This is major challenge traders have with market makers. However, IG has a system to ensure fair prices are offered to traders. They pay due regard to the market price for the underlying reference CFDs you want to trade. IG has access to different data sources for pricing. With this, they are able to maintain an unbiased view of the bid/ask prices for the CFDs they offer.

Finally, IG has different order execution revenues. They regularly assess these venues to make sure their costs and execution policy is best for their clients. Also, IG aims to reduce transaction costs by hedging their risks for all trades in the underlying markets.

IG Markets Singapore Customer Service

IG Markets Singapore offers 24/5 online customer support to traders via the following channels:

1) Email support: IG Markets offers email support to both existing and new clients which is available from 9 PM on Sunday to 10 PM on Friday. The IG Markets email address for support is [email protected].

When our team tested the email support, we did not get any response after several hours.

2) Phone support: IG Markets offers phone support to traders in Singapore. IG Markets’ phone number is +65 6390 5133 and is available during working hours on business days.

Do we Recommend IG Markets Singapore?

IG Markets is considered trustworthy and clients’ funds are safe because of their regulation by the Monetary Authority of Singapore and other Top-Tier financial regulators. They also offer a wide range of instruments to choose from.

Trading fees on IG Markets are moderate, as they offer commission-free trading on all instruments except shares, and offer shares trading without the spreads. The spreads on IG Markets are competitive. Although the broker charges deposit fees on multiple methods, you can avoid this by using methods that are free of charge.

Although it takes about 2 years before they start charging dormant account fees, they charge currency conversion fees and there are brokers regulated in Singapore who do not charge such fees. The minimum deposit of SGD450 is relatively high. Note that the broker does not offer negative balance protection

IG Markets customer support is not good as there is no live chat support in Singapore, and email support is not responsive. This means that it will take longer to make enquiries and resolve any issues you might have with your account.

With the overview we provided in this review, we recommend you can visit the broker’s website to see more information and compare it with others regulated in Singapore to choose the platform that is best for you.

IG Markets Singpore FAQs

Is IG market good for beginners?

IG Markets is not the best for new traders, because, although you can signup on IG Markets Demo accounts to get familiar with trading and the platform before putting your real money, the broker does not offer negative balance protection which means you can lose more than your deposit which is not beginners want.

The minimum deposit of S$450 might be too high for some beginners. The broker has some educational materials for beginners and you can only contact support via email or phone to resolve any issues you might have. We recommend beginners should signup with a broker that has negative balance protection and has a relatively lower minimum deposit.

What markets does IG offer?

You can trade over 16,000 financial market instruments on IG Markets including forex, indices, stocks, bonds, cryptocurrencies and ETFs.

How much does IG charge per trade?

IG Markets charge commission fees of up to S$10 per trade for Singapore shares which applies to web traders, mobile traders pay about S$8 dollars per trade.

Note that commission fees apply only when you trade shares, other instruments are commission-free.

Is IG Markets regulated in Singapore?

IG Markets is regulated in Singapore as ‘IG Asia Pte Ltd’, registered a financial institution and authorized to deal in capital markets products by the Monetary Authority of Singapore (MAS).

What is the minimum deposit on IG trading?

The minimum deposit to start trading on IG Markets is S$450. You can use local bank transfers, cards, cheques or PayNow to make this deposit.

Note: Your capital is at risk