City Index is a forex broker & CFD broker that offers trading of CFDs (contract for differences) on indices, shares, forex, oil, commodities, metals, and bonds. Apart from trading CFDs, City Index also offers spread betting on these instruments.

City Index is licensed in Singapore along with multiple Tier-1 & Tier-2 financial regulatory bodies. City Index was founded in 1983, the company is listed on a stock exchange and offers their services to clients from various countries.

Our review of City Index Singapore will cover the account types, leverage, tradable instruments, trading/non-trading fees, deposits and withdrawals options and other features of the broker.

| City Index Review Summary | |

|---|---|

| 🏢 Broker Name | StoneX Financial Pte. Ltd. |

| 📅 Establishment Date | 1983 |

| 🌐 Website | https://www.cityindex.com/en-sg/ |

| 🏢 Address | StoneX Financial Pte. Ltd., 1 Raffles Place, #12-62 One Raffles Place – Tower 2, Singapore 048616. |

| 🏦 Minimum Deposit | SGD 150 |

| ⚙️ Maximum Leverage | 1:400 |

| 📋 Regulation | MAS, ASIC, CIMA, CySEC, and FCA |

| 💻 Trading Platforms | MT4, Webtrader, City Index Mobile App |

| Start Trading with City Index | |

City Index Pros

- Regulated in Singapore

- Local bank transfer options available

- Negative balance protection

- City Index supports MT4 trading platform.

- Customer service is available 24/5

- Available on all devices, web, desktop, android, and iOS

City Index Cons

- City index charges account inactivity fee.

- Customer service is not available 24/7

- The forex broker does not offer MT5.

- Limited CFD range on MT4.

City Index Video Review

Is City Index Legit?

City Index is legit and considered a low-risk broker because of their regulation in multiple jurisdictions including Singapore. A forex broker with multiple tier-1 regulations has a considerably lower risk of default.

City Index Singapore is is a subsidiary of their parent company, StoneX Group, which is listed on NASDAQ.

Here is a closer review of City Index’s various regulations and licenses.

1) Monetary Authority of Singapore (MAS): City Index is incorporated in Singapore as StoneX Financial Pte. Ltd, and registered with MAS as a financial institution and authorized to deal in capital markets products.

2) ASIC: City Index is licensed with ASIC as Sotnex Financial Pty.Ltd. All financial services providers in Australia are issued an Australian Financial Services License (AFSL) Number. City Index’s AFSL number as seen on ASIC’s website is 345646.

3) FCA: The Financial Conduct Authority (FCA) is the United Kingdom’s financial services regulator.City Index is licensed with the FCA as Stonex Financial Limited. Their FCA reference number is 446717.

4) CySec: CySec is Cyprus Securities and Exchange Commission. City Index is regulated with CySec as StoneX Europe Ltd. The company registration number is 409708 with license number 400/21.

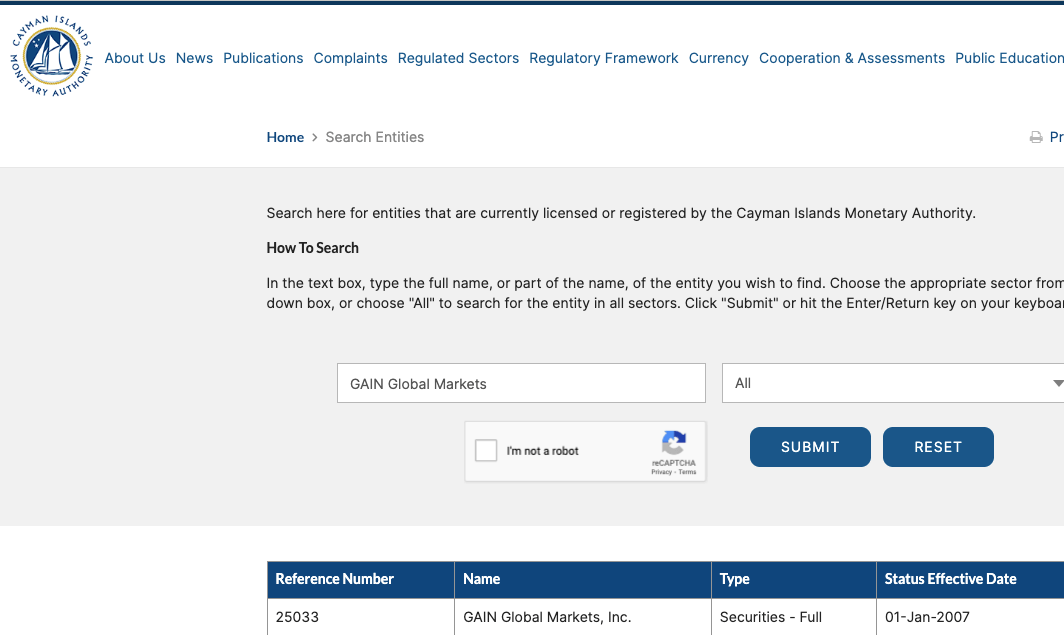

5) CIMA: City Index is licensed by the Cayman Islands Monetary Authority as GAIN Global Markets, Inc. with the trading name Forex.com. The broker was licensed in 2007 with reference number 25033.

City Index Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Singapore | No compensation | Monetary Authority of Singapore (MAS) | StoneX Financial Pte. Ltd. |

| United Kingdom | £85,000 | Financial Conduct Authority (FCA) | StoneX Financial Limited |

| Cyprus (EU) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | StoneX Europe Ltd |

| Other countries | No protection | Cayman Islands Monetary Authority (CIMA) | GAIN Global Markets, Inc. |

City Index Leverage

Leverage on City Index depends on the type of client you are, either retail or professional, the instrument you are trading an your trade size. The maximum leverage on City Index is 1:20 for retail clients and 1:50 for professional clients (accredited investor).

These maximum leverage applies to major forex pairs and indices, other instruments have lower leverage limits, such as Commodities/Minor Indices 5:1, Stocks 10:1, Crypto currencies 4:1.

The leverage of 1:20 for trading means that you can place a trade worth 20 times the value of your deposit. For example, if you deposit $100, you can open a trade position worth $2,000.

Keep in mind that the maximum leverage on City Index reduces as the size of your trade becomes bigger. For CFDs stake size of 0-1,000 – 1:20, 1,000-10,000 – 1:10, 10,000-50,000 – 1:66, and 50,000+ 1:25.

Note that trading leveraged products are risky, and you can lose your money. It is best to avoid it. Only trade if you have experience or understand them.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

It is important that you do not trade with all the leverage available, because this will increase your risk and you can lose all your money.

City Index Account Types

City Index offers four primary types of accounts to traders from Singapore and a professional account for accredited investors. Find a summary of the account types below:

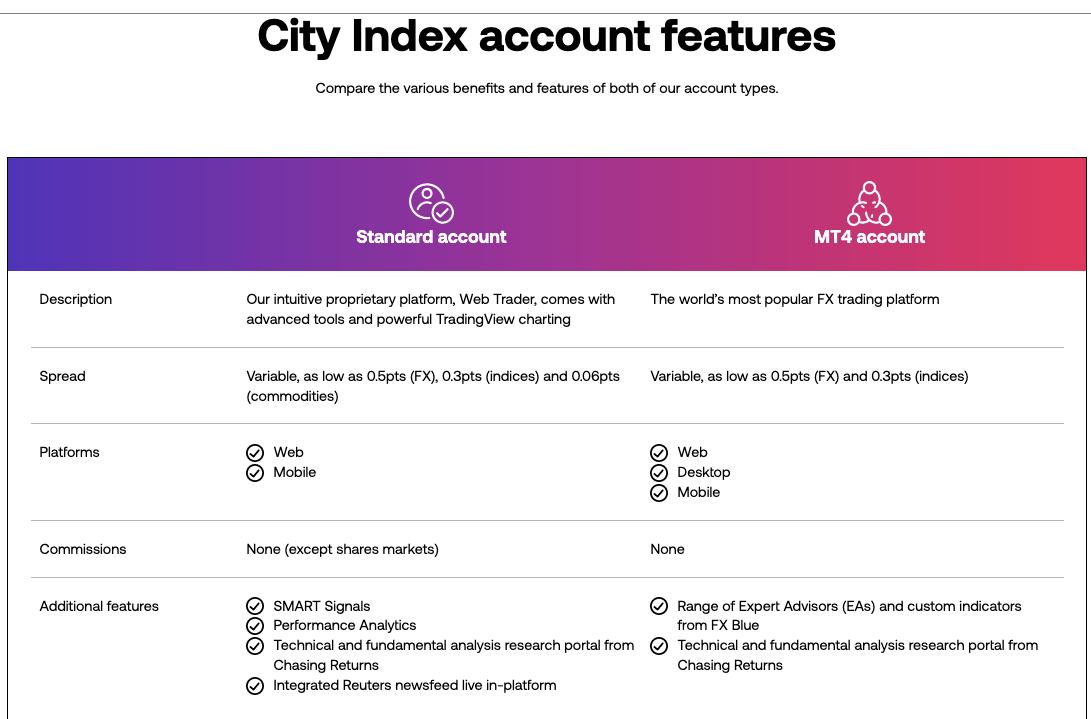

1) Standard Account – The Standard account is the most basic type of account offered by City Index.

The City Index Standard Account is designed for retail clients and can be accessed on the City Index proprietary trading platform on the web and mobile devices. The trading platform has features such as SMART Signals, performance analytics, research portal for fundamental and technical analysis, integrated news feed within trading platform.

Spreads on this account start from 0.5 pips for major pairs and you do not pay any commission fees on your trades except when trading shares from 0.05% to 0.15%. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of S$150. If you don’t use your account for 24 months, there’s a S$15 monthly charge that applies. City Index does not have negative balance protection which means you can lose more money than you deposited if your trade position is unsuccessful.

2) MT4 Account – The MT4 account is best suited for those looking to trade only currency pairs and indices. This account comes with several expert advisors to help you make trading decisions along with research material for both fundamental and technical analysis.

The City Index MT4 Account is on the MetaTrader trading platform on the web, desktop and mobile devices.

Spreads on this account start from 0.5 pips for major pairs and you do not pay any commission fees for trades. You also pay swap fees for keeping a position open past the closing time of the market.

This account requires a minimum deposit of S$150. If you don’t use your account for 24 months, there’s a S$15 monthly charge that applies. City Index does not have negative balance protection which means you can lose more money than you deposited if your trade position is unsuccessful.

3) Corporate Account – The Corporate Account is meant for corporations, as the name suggests. You can add multiple users to the same trading account for collaborative trading. This account provides access to more than 6000 markets.

4) DMA Account – The DMA Account stands for Direct Market Access. The trading prices under this account are sourced directly from liquidity providers, so the costs are lower. The commissions are also lower if you make more trades through this account.

The City Index DMA Account is designed for clients who trade large volumes of instruments and requires a minimum deposit of S$25,000.

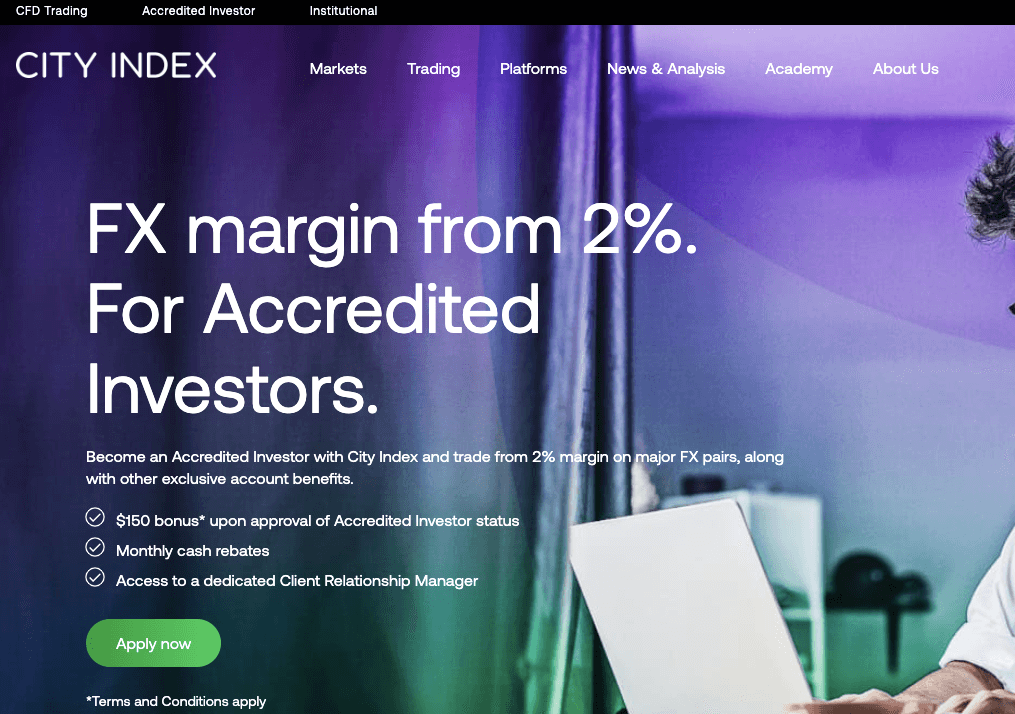

5) Accredited Investor (AI) Account: an Accredited Investor Account allows traders to be classified as an Elective Professional client which comes with a range of benefits.

Some of the benefits of this account is that it gives you access to higher leverage of up 1:50, you can skip the annual suitability checks by the broker, you can trade more products, get early access to new products and features, and you also get exclusive access to private equity products.

To be classified as an Accredited Investor on City Index, you need to first open a standard account, then apply by filling an online form and submitting some verification documents after meeting one of the following conditions.

- You have net financial assets of more than SGD 1 million; or

- You have net personal assets of more than SGD 2 million; or

- You have an annual income of at least SGD 300,000 in the last 12 months

City Index Fees

Singapore traders can find City Index’s spread, commissions, and other non-trading charges on their website. Here is a simplified view of their charges:

1) Spread: City Index offers the same spreads for their CFD Trading Accounts. The minimum spread for major currency pairs on City Index are shown below.

2) Commission: City Index does not charge a commission when trading through their Standard account or their MT4 Account. However, they charge a commission of at least 0.05% and up to 15% when trading share CFDs, depending on the country’s shares you are trading.

City Index Trading fees Table

Here is a summary of the minimum spread fees and commission City Index charges on some instruments on the Standard Account:

| CFD instrument | Spread (Standard Account) | Commission |

|---|---|---|

| EUR/USD | 0.7 pips | None |

| GBP/USD | 1.1 pips | None |

| EUR/GBP | 1.1 pips | None |

| XAU/USD (Gold) | 0.3 pips | None |

| Crude oil | 2.5 pips | None |

| UK 100 | 2.0 pips | None |

| US Tech 100 | 1.0 pips | None |

3) Swaps: Whenever you keep a trade position open past the market closing time, you pay swap fees, which is calculated based on the trade size, leverage, spread and how long the position is kept open.

3) Non-trading Fees: City Index does not charge a deposit or withdrawal fee (however, the payment service provider may charge a fee, like cards processor charge 2% per transaction). They do charge a small inactivity fee in case your account has been lying dormant for a prolonged period of time.

| Deposit fees | Withdrawal fees | Inactivity charges | GSLO Fees | Currency Conversion Fees |

| No* | No* | Yes | Yes | Yes |

*Note that your payment processing company may charge some independent transaction fee.

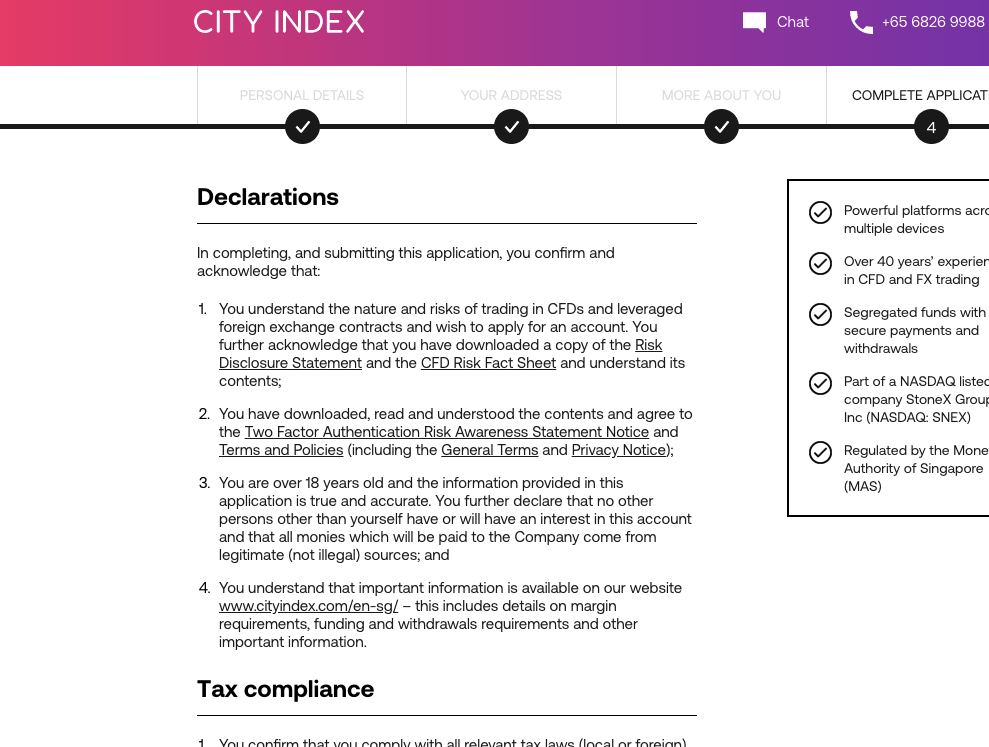

How to Open an Account with City Index?

Here is how to sign up with City Index in basic steps:

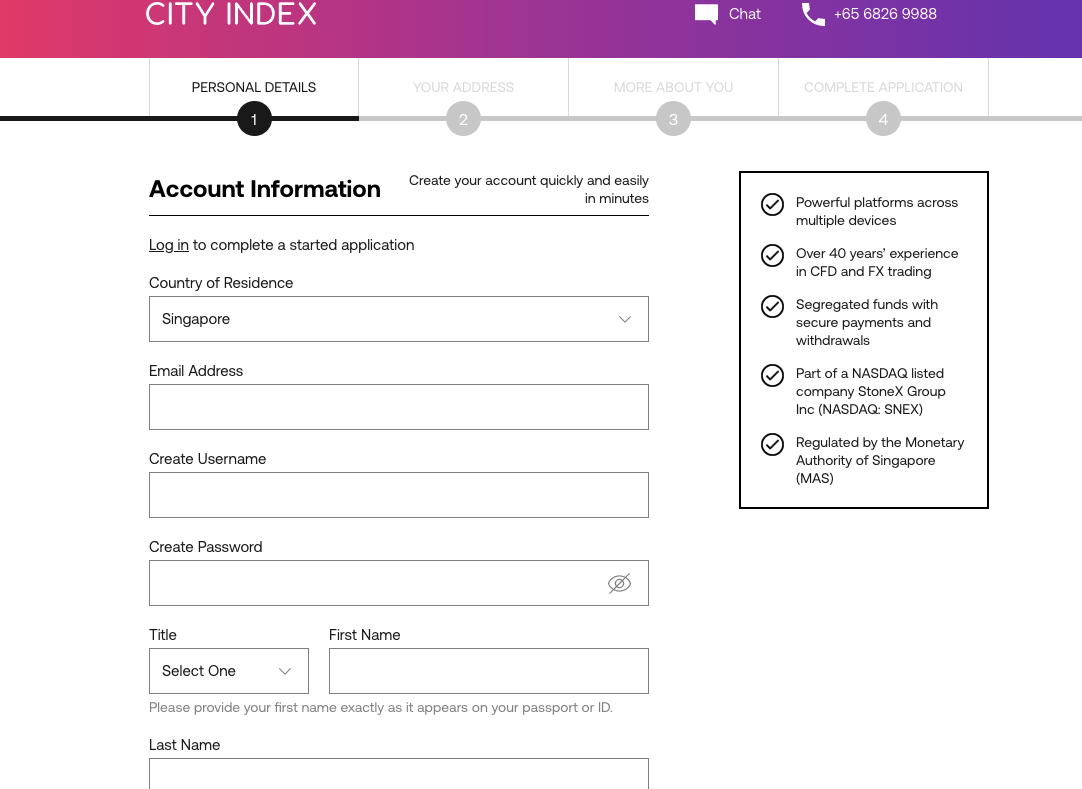

Step 1) Go to City Index’s website at https://www.cityindex.com/en-sg/ and click on the ‘Open Account’ button.

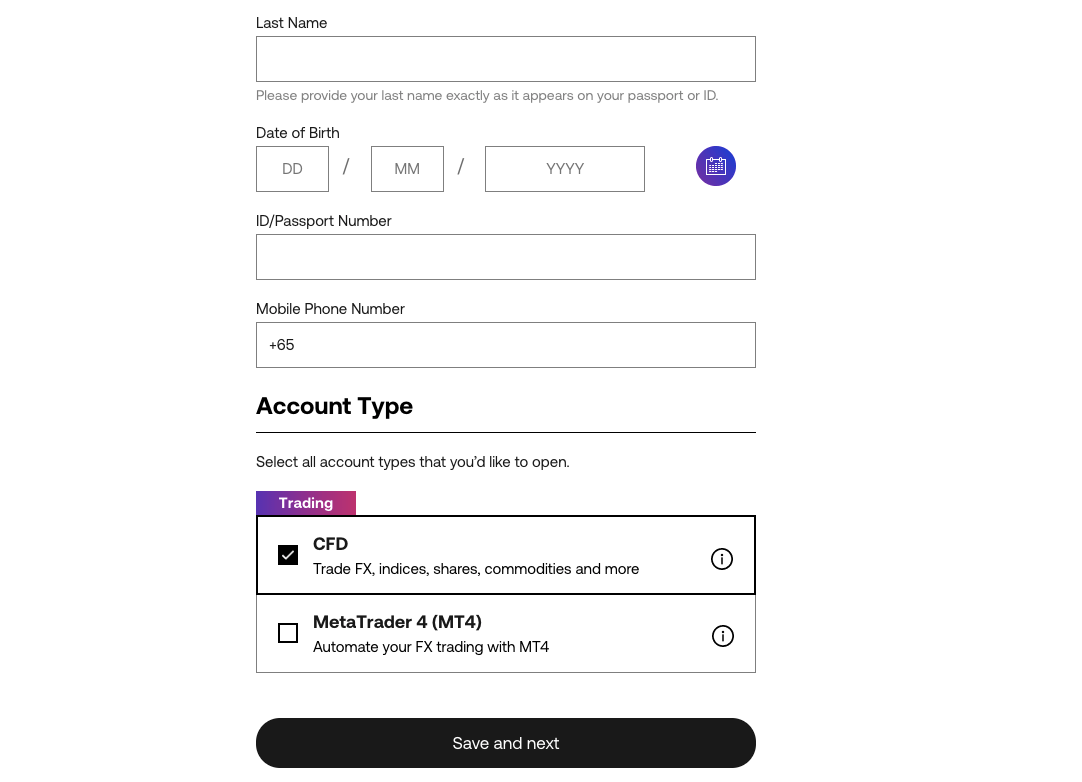

Step 2) Fill in your personal details, email, country of residence, etc. More importantly, you will have to choose your account type and set a login password. When you have filled in your details, click on ‘save and next’.

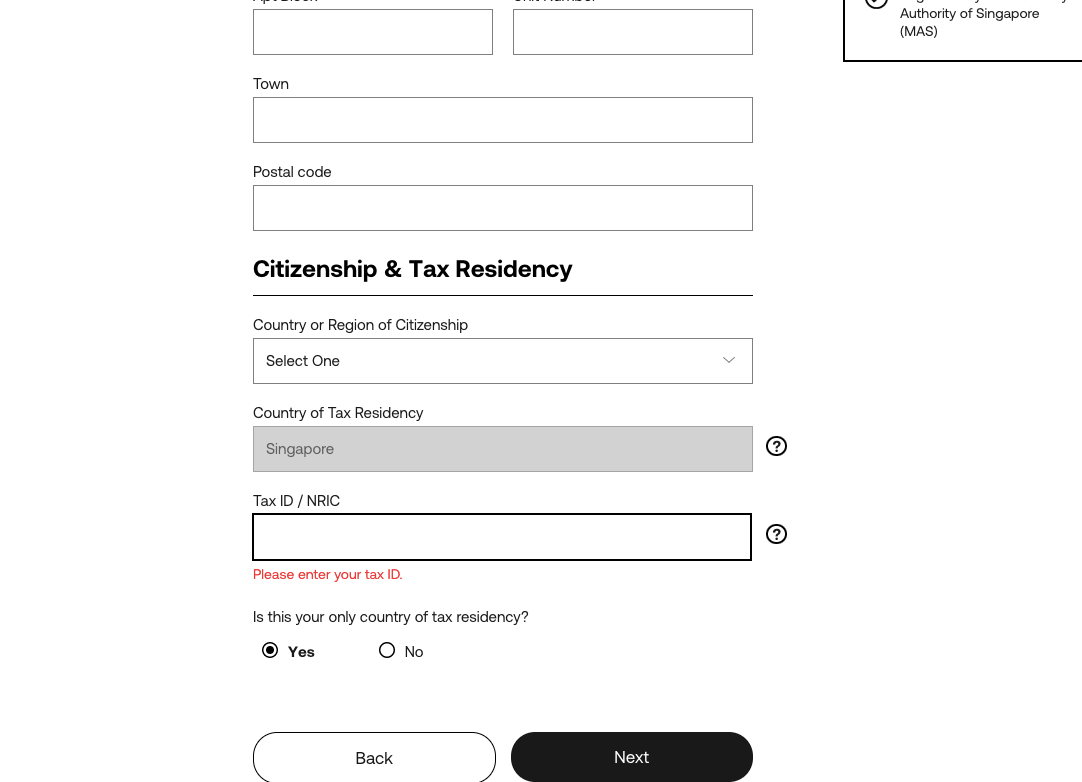

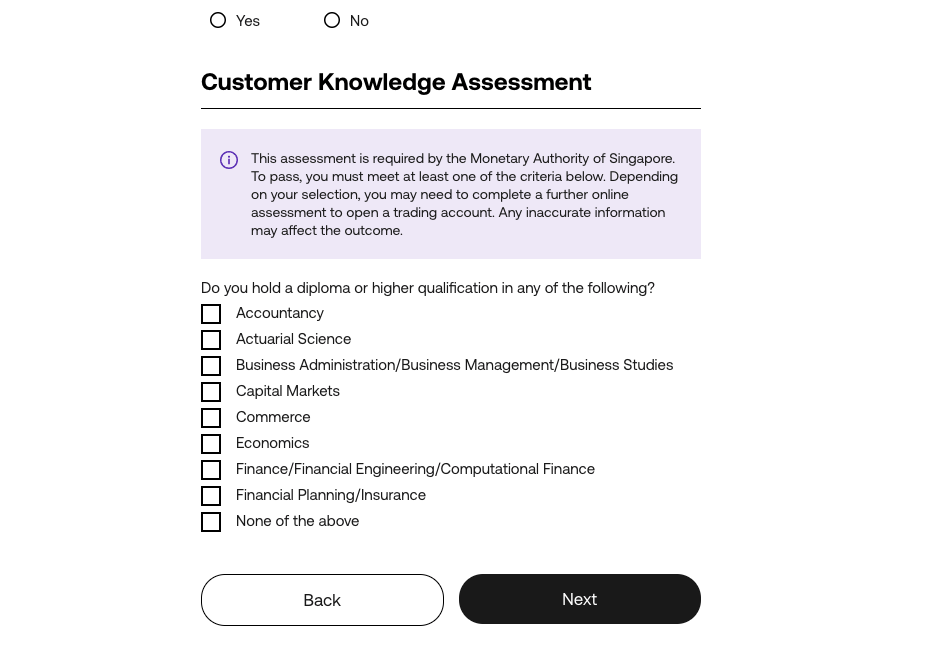

Step 3) On the next page, you will be entering your address, the region, you were born, and more personal details.

Step 4) At this point, City Index will be going deeper into what they want to know. Your employment details, your trading experience, and your annual income are key details required at this point.

Step 6) For the next step, you will basically be asked questions about your understanding of the risks attached to trading CFDs and Spread Betting. You will also choose your means of communication (email, SMS, phone call, or mail). Finally, you agree to the terms and conditions and click on ‘submit application’. It will take about 30 seconds for your application to be approved.

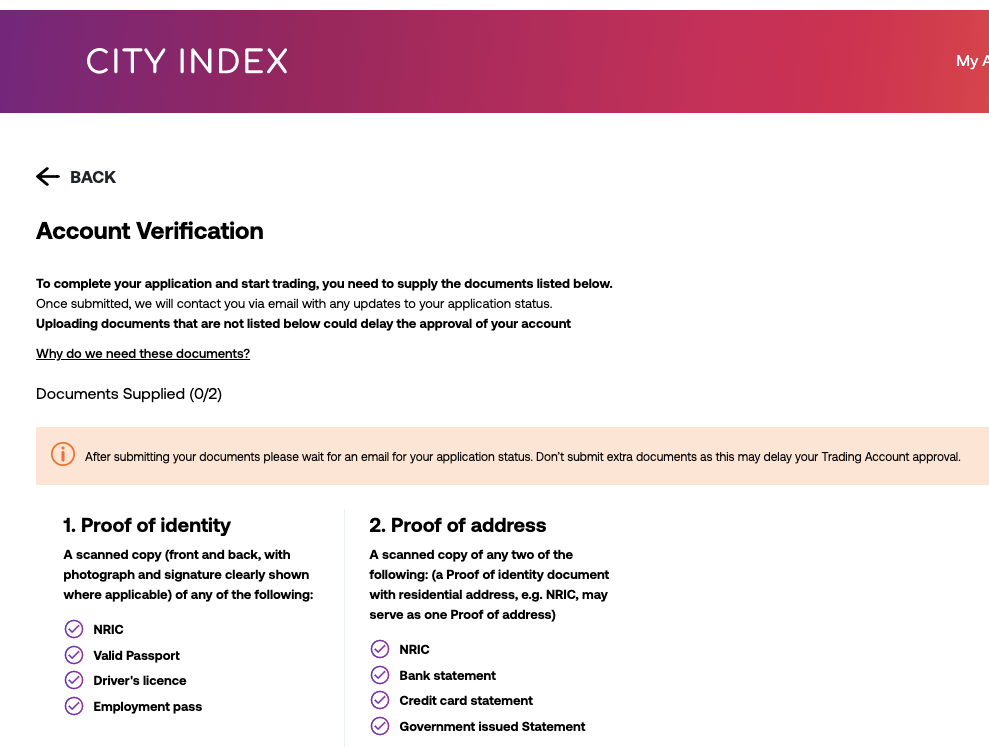

Step 7) The final step is the KYC. You will submit documents to verify your nationality, identity, and address. Once your account is verified and approved after you submit the documents, you can begin your trading with City Index.

City Index Deposits and Withdrawals

There are several ways in which a trader from Singapore can make a deposit into their trading account:

City Index Deposit Methods

Here is a summary of payment methods accepted by City Index for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | 2% per transaction | Instant |

| E-wallet | Yes (FAST, PayNow)d> | Free | Instant |

City Index Trading Platforms

MetaTrader 4: City Index supports MetaTrader 4. It is one of their third-party trading platforms. They even have an account dedicated to MT4 only. City Index MT4 is available as web trader, on desktop, and mobile phones (Android and iOS)

TradingView: TradingView is City Index’s second third-party platform. TradingView allows you to integrate your trading account with their platform. In addition, it comes with some of the best drawing tools in the industry.

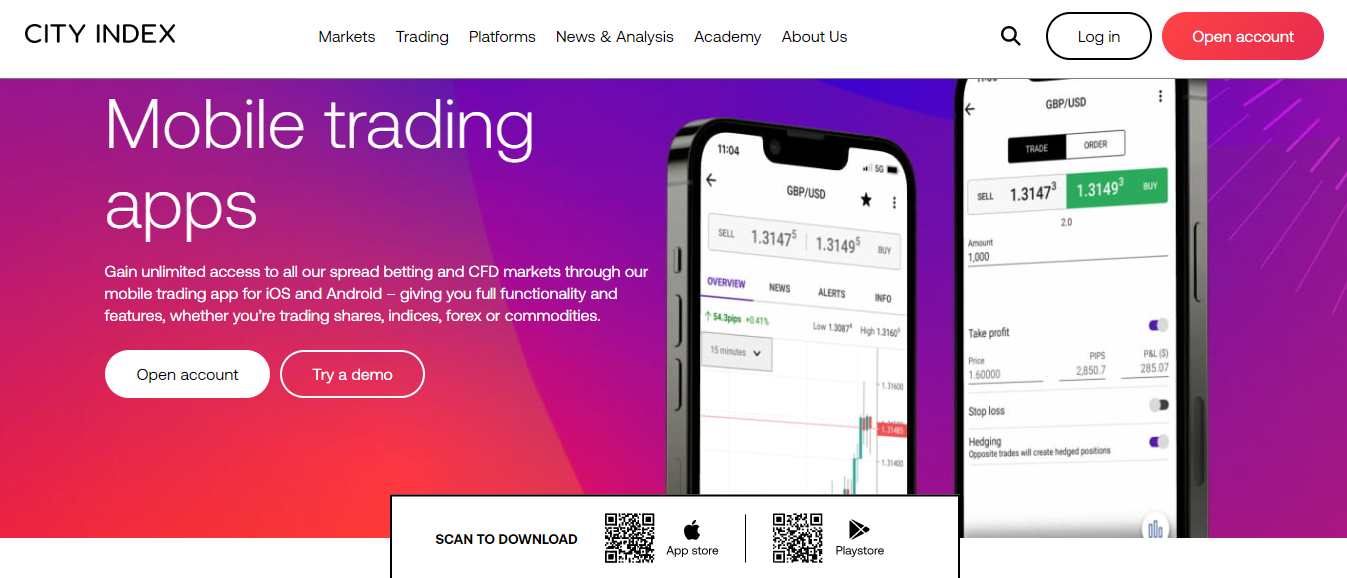

Does City Index have a mobile app

City index has a proprietary mobile trading app. If you prefer City Index’s proprietary platform, you can use their mobile trading app or web trader. The web trader has 14 timeframes with advanced drawing tools. SMART signals and performance analytics make up a kit of the platform’s intelligent trading tools.

City Index mobile app is available on iOS and Android phones. It has 3/5 stars from 263 views on Google Play Store with over 10,000 downloads. On the App Store, it has 3.8/5 stars from 118 reviews.

City Index Trading Tools

City index have two trading tools. Here is a breakdown:

Economic Calendar: The economic calendar lets you monitor news and release that can move the prices of CFDs. Not all news move prices the same way. So there is a filter that allows you focus on only the most impactful news.

Performance Analytics: Performance analytics is like a digital mentor. It contains a variety of tools within it that helps you with discipline, knowledge, and skill. It helps you set realistic trading goals and track them.

This tool has within it four internal tools. There is the trading plan that help you measure and monitor your trading goals. Then there is the playmaker that make sure you stay on track. The next tool, called Review, analyses your trades to help you see how you can improve it.

The final tool is the GamePlan. It reveals the strength and weaknesses in your trade with advanced technology. Performance Analytics is free for city index live clients.

City Index Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on City Index.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Bank Wire Transfer | Yes | Free | Up to 3 business days |

| Cards | Yes | Free | Up to 10 business days |

| E-wallets | No | N/A | N/A |

What is the City Index Minimum deposit?

The minimum deposit on City Index is S$150 for bank transfers and S$250 for cards, although the recommended minimum deposit is SG$ 2,500 for all payment methods which applies to the Standard and MT4 Accounts. DMA require a minimum deposit of SG$ 25,000.

What is the City Index Minimum withdrawal?

The minimum withdrawal on City Index in Singapore is SG $150.

You can initiate deposits and withdrawals by logging into your account, and on the City Index area or dashboard, click on deposit or withdrawal on the left side menu.

Saxo traders can only withdraw money from their Saxo trading account directly into their bank account. Their website contains detailed information on how to withdraw funds from your trading account to your bank account. A withdrawal fee of SGD 50 may be applied in case you use the manual form for processing your withdrawal.

City Index Trading Instruments

City Index provides a very wide range of trading instruments to traders from Singapore. They offer a selection of over 12000 instruments, depending on the type of trading account being used by the trader. Below is a breakdown of the various instruments offered by the broker.

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 84 currency pairs on City Index |

| Indices | Yes | 21 Indices on City Index |

| Commodities | Yes | 25 commodities on City Index (oil, coffee, and other agriculture instruments) |

| Metals | Yes | 2 metals on City Index (Gold and Silver) |

| Stocks | Yes | 4,500+ shares on City Index (US, UK, Europe and other shares) |

They do not offer cryptocurrency trading instruments.

City Index Educational Materials and Research

On City Index’s homepage, you can find the different ways to learn under ‘Academy’. Here are the channels of learning with City Index.

1. Demo Account: City Index offers a demo account for retail traders. The only issue is the account expires in 30 days. Traders can re-apply for another demo account. However, the account will be as good as new. All settings will go back to default and you might not be able to track how well you are doing in the long term.

2. Courses: City Index’ courses are divided into basic, intermediate, and advanced levels. Each level has different courses and each course contains at least 3-4 lessons. The lessons are in text form and can take up to 5 minutes to read. There is also a progress bar that helps you track how far you have gone with the courses.

3. Glossary: Glossaries are good for getting the definition of terms quickly. City Index has a glossary for definition of terms and some financial instruments. In addition, the glossary is easy to navigate and arranged in alphabetical order. This saves you time and helps you search quickly.

4. News: This section covers economic events and information that traders can use for research. Events or information that affects forex, commodities, shares, and indices are shared and analyzed by top professionals and market analysts.

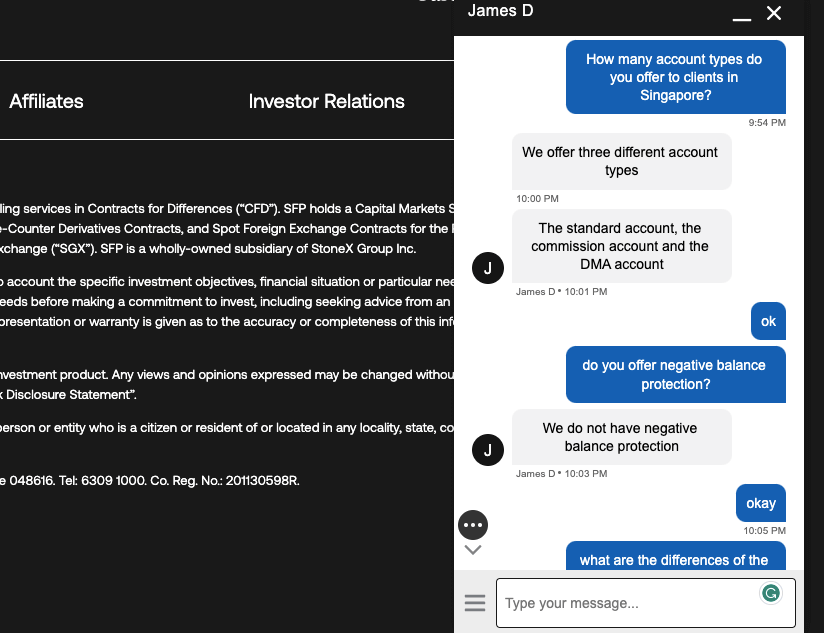

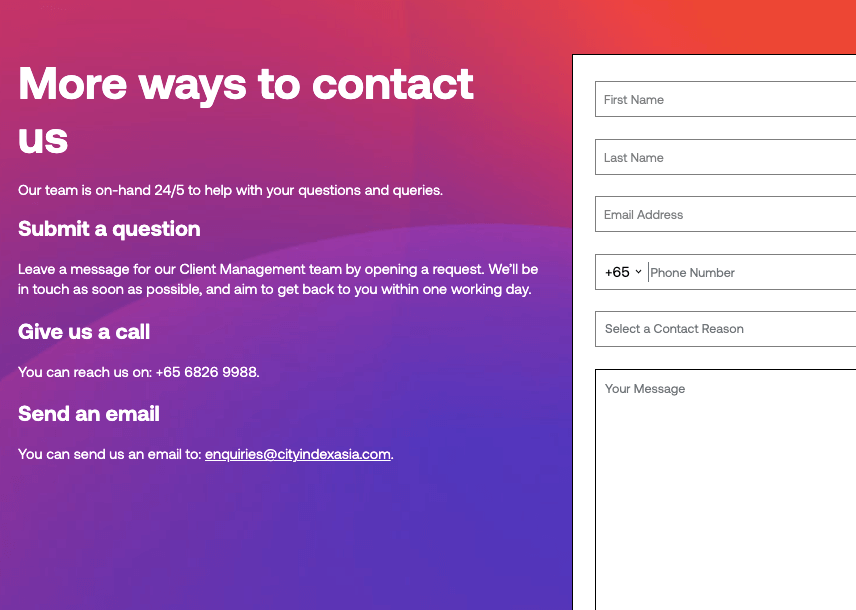

City Index Customer Support

The support at City Index is good & we found it easy to talk to them via chat.

Good customer service is important. As a trader choosing a forex broker, you might have questions and inquiries. This is why we have reviewed City Index’s customer support in Singapore.

1) Good Live chat: City Index has a live chat that is available 24/5. The chatbot is the first to respond to you on the live chat it will ask for name and email address before transferring you to a live agent.

When we got connected to the customer service representative, we had a few seconds of holding time. We got quick responses to our answers (within two minutes). The answers were simple and relevant to our questions.

2) Phone number support: City Index have a phone number on their website. It is under their ‘contact us section so clients change t support by calling this number – +65 6826 9988.

3) Email Support: The City Index Email address for support and inquiries is [email protected], when we sent an enquiry, we didn’t get feedback after several hours.

Is City Index a market Marker?

Yes, City index is a market maker. This means that City Index takes the opposite side of your trade, when you buy, City Index sells to you and when you sell, they buy from you.

As a market maker, City Index profits from the difference in the bid/ask price. On City Index trading platforms, you may notice that the ask price is always higher than the bid price. For example, they may display the bid/ask price of Tesla shares as 250/250.5

This means that City Index will buy Tesla shares at 250 from sellers but sell at 250.5 to buyers.

Do We Recommend City Index for Traders from Singapore?

Overall, yes.

City Index has a local office in Singapore and is regulated by the local regulatory authority MAS of Singapore. This makes City Index a low-risk broker for traders from Singapore due to legal accountability and oversight.

City Index also has a dedicated website meant for traders from Singapore, which makes it much easier for traders to understand the services offered in Singapore.

Further, City Index’s range of trading instruments and customer support are one of the best-in-class making City Index one of the best brokers for residents of Singapore.

However, there are a couple of downsides to trading through City Index as well. Their overall fees are slightly higher than average. Further, the leverage that they offer is quite limited (this can be good if you want to trade while minimizing risk).

City Index Singapore FAQs

What leverage does City Index offer?

To traders from Singapore, City Index offers maximum leverage of 1:20. This means that the maximum margin is 5%. This leverage is in accordance with rules prescribed by the MAS.

Is City Index regulated by MAS?

City Index is incorporated in Singapore as StoneX Financial Pte. Ltd, registered with MAS as a financial institution and authorized to deal in capital markets products.

What Does CFD Mean in Stocks?

City Index offers CFD trading services. CFDs are trading instruments that can be bought and sold without actually owning the underlying asset (currency pairs, stocks, commodities, indices, etc.) The primary advantage of trading CFDs is that you can take advantage of the leverage offered by brokers to increase your profit margins from a successful trade. However, trading CFDs can be highly risky and is only recommended for informed traders.

Is City Index a good broker?

City Index is a popular CFD broker in Singapore and are regulated by the MAS. They provide CFD trading service on various instruments and with zero commission for currency pairs on the Standard Account.

City Index offers negative balance protection to ensure as a trader, you do not lose more than the money you have deposited.

How can I trade in Singapore?

Traders from Singapore can trade through a CFD and forex broker such as City Index. Traders should only trade through reputed and credible brokers that are licensed by the MAS.

Note: Your capital is at risk