Best Forex Brokers Singapore

The right forex broker is one that is regulated in Singapore by MAS, provides easy funding and quick withdrawals at low fees, offers wide range of CFD instruments and has low trading fees.

Editor

|

Singapore traders can trade forex via the Monetary Authority of Singapore (MAS) regulated forex and CFD brokers. It is best to trade with only regulated forex brokers as they are mandated to protect funds deposited by the customer/traders. They can legally accept forex traders in Singapore.

In this review, we have compared forex brokers that are regulated by the MAS. Our comparison is based on safety, fees, and other trading conditions.

| Broker | MAS License No | EUR/USD Spread (Pips) | Min. Deposit | Visit |

|---|---|---|---|---|

| City Index | 201130598R |

0.7

|

SGD 215

|

Visit Broker |

| CMC Markets | 200605050E |

0.7

|

No minimum deposit

|

Visit Broker |

|

201422211Z

|

1.1

|

SGD 200

|

Visit Broker | |

|

200704926K

|

1

|

No minimum deposit

|

Visit Broker | |

|

200601141M

|

0.7

|

SGD 3,000

|

Visit Broker | |

|

200510021k

|

1.04

|

SGD 250

|

Visit Broker |

Note: The spread and minimum deposit is as per information on these brokers’ websites in June 2024. Please see our methodology below.

Here is our list of Best Forex Brokers in Singapore that we have reviewed:

City Index is regulated with the MAS as StoneX Financial Pte. Ltd. Their registration number is 201130598R.

Total Fees: Low typical spread for major pairs. There is no extra commission per lot except for shares CFDs. In addition, there are fees for credit/debit card deposits, GSLOs, inactivity fees (SGD 21), and swaps. Overall, total fees are not too high.

Trading conditions

Account types: City Index offers three accounts.

CFD Account – for indices, forex, commodities, and other CFDs

MT4 Account – for indices and forex only

DMA Account – for forex only

Further, you can practice trading and check out their services using a demo account.

Instruments: 17 indices CFDs, 84 currency pairs, 6,000+ shares CFDs, 7 pairs of metals CFDs, and 10 commodities (agriculture and oil) CFDs are available. All the CFDs are available on the CFD account alone.

Leverage: Here is the leverage for City Index’s CFDs

| Instruments (CFDs) | Leverage |

|---|---|

| Currency Pairs | 20:1 |

| Indices | 20:1 |

| Shares | 10:1 |

| Metals | 5:1 |

| Commodities | 5:1 |

Platforms: The City Index proprietary trading platform is a WebTrader. They also support TradingView, MT4 and City Index mobile CFD trading app. The MT4 platform is available on smartphones as well.

Risk management: City Index offers guaranteed stop loss order but no negative balance protection. Hence, it can be quite risky to trade through them using leverage. You may lose more than your trading account balance on a loss-making trade.

Funding/withdrawals: Funding is easy via internet banking, PayNow, credit/debit cards, cheque, bill payment, and bank wire transfer. All deposit transactions are instant or take up to a day except cheque and wire transfer.

Withdrawals are free but there is a 2% levy fee for credit/debit cards deposit transactions.

Customer Support: Singapore traders can get 24/5 support via email, local mobile phone number, and live chat. Speaking with their live chat support, we had a 7-minute holding time before a response. We got an email response after several hours.

City Index Pros

City Index Cons

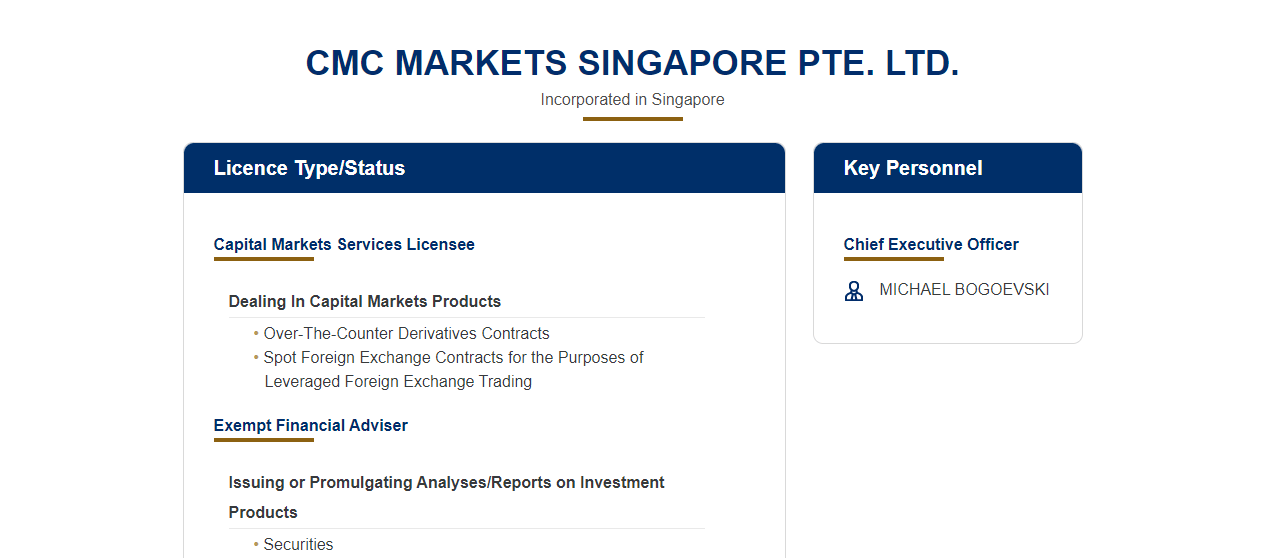

CMC Markets are regulated with the MAS as CMC Markets Singapore Pte. Ltd. They hold a capital markets services license with registration number UEN200605050E. They have been in operation for over 30 years.

Total Fees: There are no commissions for forex and no inactivity fees. There is a minimum $10 (SGD 14) commission for shares CFDs. There is a fee for guaranteed stop-loss orders and certain deposit methods. Overall, fees are low.

Trading conditions

Account type: CMC Markets offers two account types – CFD and Corporate Accounts.

Instruments: CMC Markets offer the following CFDs: 339 forex pairs, 95 indices, 111 commodities (agriculture, oil, metals), 9451 shares, 46 treasuries and 8 cryptocurrencies.

Leverage: Here is the leverage for retail traders:

| Instruments (CFDs) | Leverage |

|---|---|

| Forex | 20:1 |

| Indices | 20:1 |

| Commodities | 5:1 |

| Shares | 10:1 |

| Treasuries | 5:1 |

| Cryptocurrencies | 2:1 |

Platforms: CMC Markets support MT4 and their proprietary Next Generation trading application that is available as WebTrader and on mobile applications.

Risk management: You can use guaranteed stop loss orders. However, there is no negative balance protection.

Funding/withdrawal: There are up to nine deposit channels if you are depositing funds in SGD. CMC Markets charge a 2% levy when you deposit with credit/debit cards. They charge no fees for other deposit methods.

In addition, the withdrawal of funds is free.

Customer support: You can get 24/5 support via live chat, email and a mobile number on their website. We tested the email support and got a response within 12 minutes. Live is not so good, as it has delays.

CMC Markets Pros

CMC Markets Cons

Plus500 holds a license to offer capital Market Services by the MAS. Their registered company name is Plus500SG Pte. Ltd. with registration number UEN 201422211Z.

Total fees: There is no extra commission per lot and the spread for major pairs is low. Additional charges include swaps, currency conversion fees, and account inactivity fees ($10). Also, there are no deposit and withdrawal charges.

Trading conditions

Account type: Plus500 offers one trading account.

Instruments: Plus500 offers 66 currency pairs, 22 commodities (metals, oil, agriculture), 96 ETFs, 27 indices, 1,655 shares, 356 options and 19 cryptocurrencies. All instruments are CFDs.

Leverage: Leverage for retail traders are shown below

| Instruments (CFDs) | Leverage |

|---|---|

| Forex | 20:1 |

| Indices | 20:1 |

| Commodities | 5:1 |

| Shares | 10:1 |

| ETFs | 5:1 |

| Options | 5:1 |

| Cryptocurrencies | 2:1 |

Platforms: No MetaTrader, cTrader or any other known third-party platform. Only Plus500 proprietary trading platform is available to customers as WebTrader and also available on mobile devices. You can try their demo account to see if their trading app suits your needs.

Risk management: Plus500 offers guaranteed stop-loss order and negative balance protection for Singapore traders. This makes them a relatively safe broker to trade through.

Funding/withdrawal: You can deposit your funds via credit/debit card, ApplePay, PayPal, bank wire transfer, and PayNow. Funding your account is easy with these conventional methods. Plus500 does not charge extra fees for deposits or withdrawals.

Customer Support: A local mobile number is available for support. You can also get support via email and live chat with is available 24/7. We tested their email, getting a response after 12 minutes so overall support is good.

Plus500 Pros

Plus500 Cons

Oanda is regulated with the MAS as OANDA Asia Pacific Pte. Ltd. Their registration number is 200704926K. They hold a license for capital markets services in Singapore.

Total Fees: No extra commission per lot, low spread for majors, and no deposit fees. You may incur a fee for some withdrawal methods. There is also an inactivity fee of SGD 10 and a premium fee for guaranteed stop-loss orders. Overall, total fees are low.

Trading conditions

Account types: OANDA offers Standard and Premium Accounts.

Instruments: 68 forex pairs, 18 indices CFDs, 21 metal CFDs, 6 commodities CFDs (oil, metals, agriculture), 4 cryptocurrency CFDs, and 5 bonds CFDs are available.

Leverage: Here is the leverage per CFD instrument for retail traders.

| Instruments(CFDs) | Leverage |

|---|---|

| Forex | 20:1 |

| Indices | 20:1 |

| Metals | 5:1 |

| Commodities | 5:1 |

| Bonds | 5:1 |

| Cryptocurrencies | 2:1 |

Platforms: You can trade with OANDA’s customizable proprietary platform (OANDA Trader). It is available as a webtrader, desktop platform, and mobile/tablet app. Metatrader 4 and TradingView are available too.

Risk management: OANDA offers guaranteed stop loss orders. No negative balance protection so your loss can exceed your deposit.

Funding/withdrawals: You can deposit your funds easily with PayNow, DBS, PayPal, cheques, bank wire transfer, and internet banking transfer. Withdrawals can be carried out through PayPal, cheques, bank wire transfer, and internet banking transfer only. There are no extra fees except for certain withdrawal methods.

Customer Support: Oanda offers 24/5 support via email and live chat. After speaking with their live support, we discovered they give quick responses with no holding time. We got no response from their email. Overall, customer support is good.

OANDA Pros

OANDA Cons

Saxo Markets are regulated with the MAS as Saxo Capital Markets Pte. Ltd. with registration number 200601141M. The CFD broker is a subsidiary of Saxo Bank A/S so they are less risky.

Total Fees: Total fees are high. There are commissions for CFDs, US stocks, commodities, options, and US ETFs. No inactivity fee but you can incur withdrawal fees and currency conversion charges. Swaps are charged based on Singapore Overnight Rates (SORA).

Trading conditions

Account types: Saxo Markets offers 5 accounts: Bronze, Silver, Gold, Platinum and Diamond Accounts.

Instruments: Saxo Markets offer Forex CFDs, Index CFDs, Stock CFDs, Commodity CFDs (metals, oil), Bond CFDs, Crypto FX and Options CFDs. Total number of CFDs is over 19,000.

| Instruments(CFDs) | Leverage |

|---|---|

| Forex | 20:1 |

| Indices | 20:1 |

| Stocks | 10:1 |

| Commodities | 5:1 |

| Bonds | 5:1 |

| Options | 5:1 |

| Cryptocurrencies | 2:1 |

Platforms: Saxo Markets offer 3 trading platforms: Saxo Investor for web, SaxoTraderGO for mobile and SaxoTraderPRO for desktop. The SaxoTraderPRO is available for only traders with Gold, Platinum and Diamond Accounts.

Risk management: No guaranteed stop loss order and you can lose more than your trading capital.

Funding/withdrawals: You can fund your account via MEPS, PayNowUEN, and PayNow QR code. You can also use your HSBC account if you have one or bank cards. You can choose your preferred withdrawal method when you open your trading account.

Customer support: Singapore traders can get support via live chat, email, and phone calls to the CFD broker.

Saxo Markets Pros

Saxo Markets Cons

The CFD broker is regulated with the MAS as IG Asia Pte. Ltd. IG Markets are licensed to operate in Singapore. Their license number is 200510021K.

Total fees: Total fees are considerably high. There is inactivity fee (SGD 25), ProRealTime Charts fee (SGD 60), an account documentation fee for US stocks (SGD 72) , and 0.5% currency conversion charges (for trading in other currencies other than your account base currency).

Trading conditions

Account type: IG offers just one trading account

Instruments: 99 forex CFDs, 34 indices CFDs, 35 commodity CFDs (metals, energies, agriculture), 13 cryptocurrency CFDs, 12 bonds, 17 ETFs and 16000+ shares CFDs are available with IG Markets.

Leverage: The following leverage is available for retail traders

| Instruments(CFDs) | Leverage |

|---|---|

| Forex | 20:1 |

| Indices | 20:1 |

| Shares | 10:1 |

| Commodities | 5:1 |

| Cryptocurrencies | 2:1 |

Platform: IG Markets offer a proprietary online trading platform with a mobile trading app and progressive web trader. The broker also supports L2 Dealer, ProRealTime, and MT4 trading platforms.

Risk management: GSLOs are available but have no negative balance protection.

Funding/withdrawal: Funding is convenient via internet bank transfer, credit/debit cards, cheques, and bill payments. You can also withdraw funds via bank transfer and credit/debit cards. IG Markets charge no extra fees for funding or withdrawals. Your bank or card issuer might charge you though.

Customer support: IG Markets offers support to clients via email and live chat available 24/5. When we tested the live chat, we got a response in under 5 minutes. We tested their email but got no response after several hours. Customer support is fair.

IG Markets Pros

IG Markets Cons

Here are few factors you should consider:

To do this, search for the CFD broker’s regulation statement at the footnote of their website. Here is an example below with CMC Markets.

After this, go to https://eservices.mas.gov.sg/fid. Enter the CFD broker’s name in the search box and click on search. You will arrive at the picture below with the broker’s details on the MAS website.

If you scroll down the page, you will also find their Singapore office address.

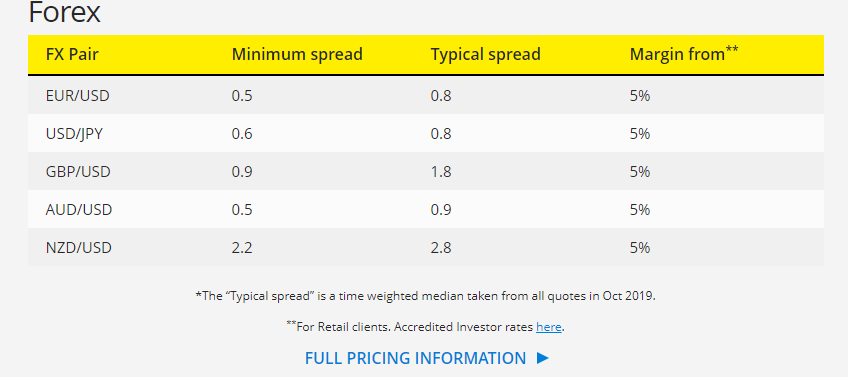

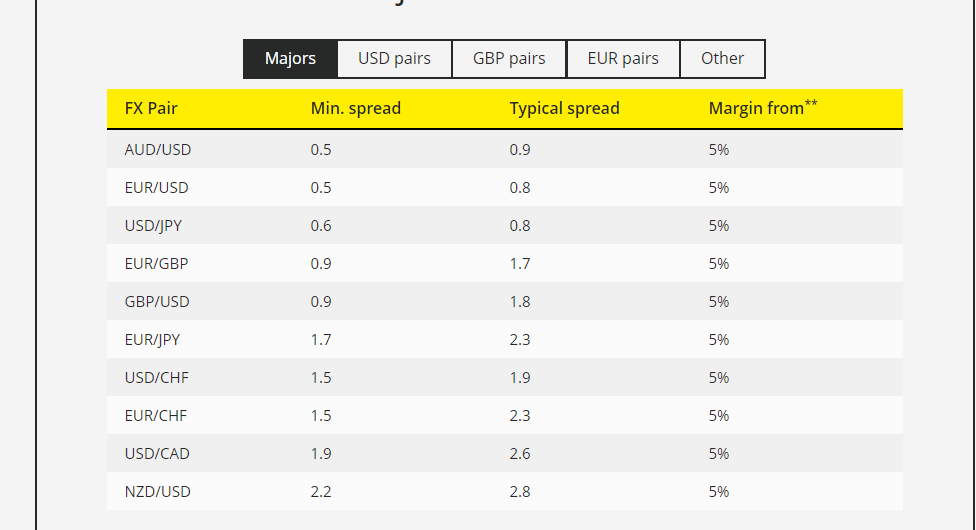

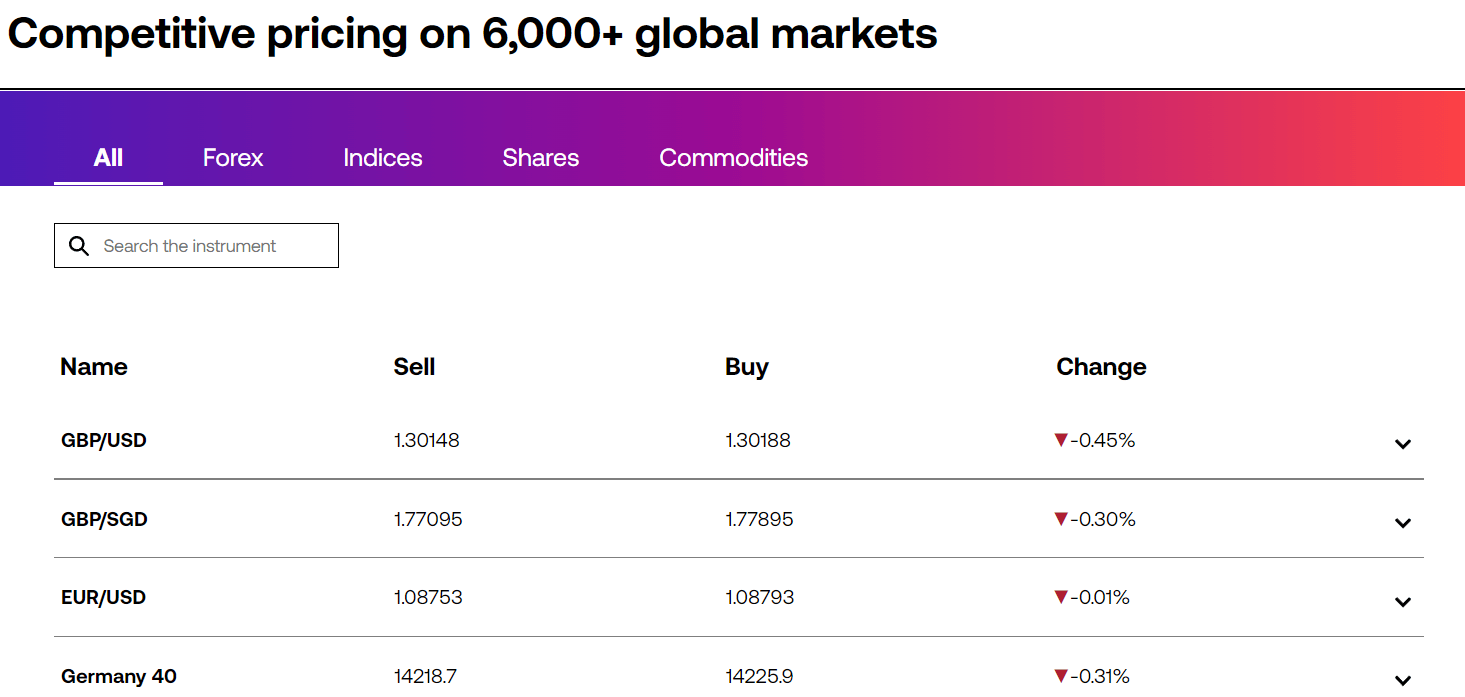

Spreads and commissions determine your total trading fees. You want to check if these fees are high or low. So, how do you go about this? We will use City Index as an example. Visit their website at cityindex.com.sg, and click on forex.

You will see the page as the screenshot below. Scroll down and click on full pricing information.

Similarly, you can compare the spreads of each of the broker. Compare the overall fees for the instruments that you want to trade.

Some CFD brokers charge low spreads, but they charge commissions instead. If you see near zero spreads on the broker’s pricing page, then it is likely that they charge commissions.

To know more about commissions, you can speak to your preferred CFD broker.

You should be able to deposit/withdraw funds easily and quickly. These depend on the funding methods supported by your CFD broker. Contact them to know their deposit/withdrawal methods so you can have an idea.

The forex market is volatile and not all CFDs can be traded every time. This is why you need many options so you can switch between markets. From currency pairs to indices, shares, and commodities, your CFD broker should have them all.

Most CFD brokers have pages on their website where you can find the list of available instruments. For example, City Index claims to offer CFD trading on 1000s of instruments & you can search these instruments from their ‘Pricing’ page which looks like the screenshot below.

On their pricing page they have a search box which you can use to check if your desired instrument is available or not. And what will be the fees charged.

According to our review, CMC Markets have the most currency pairs (339)

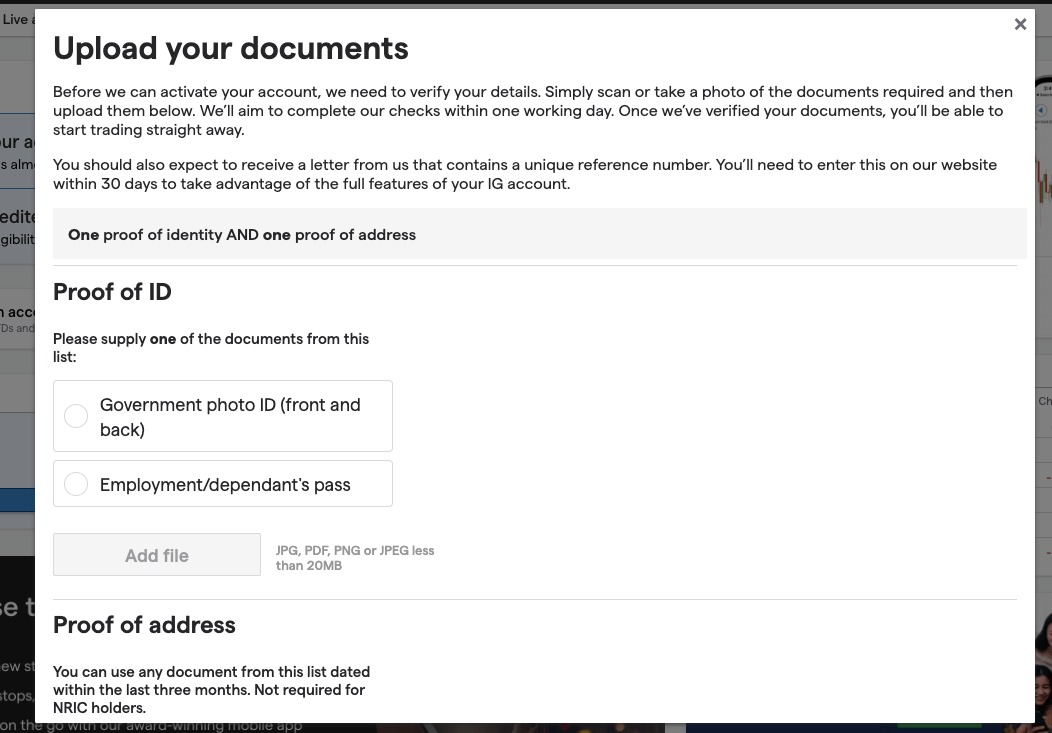

Opening a trading account should not take too long. Documents required for your KYC process should be basic like a driver’s license, passport, or identity card.

Normally, most forex & CFD brokers complete this process in 48 hours. You should receive a notification from your broker about the process involved once you complete their form to signup for a trading account.

To start trading, you need to open a live trading account with a forex broker.

Follow the steps below to open an account with a forex broker in Singapore, where we will use IG Markets as an example. Generally, the steps involved are the same with each broker, so you can follow these generic steps as references

Step 1) Go to the IG Markets website at www.ig.com and click on ‘Create live account’.

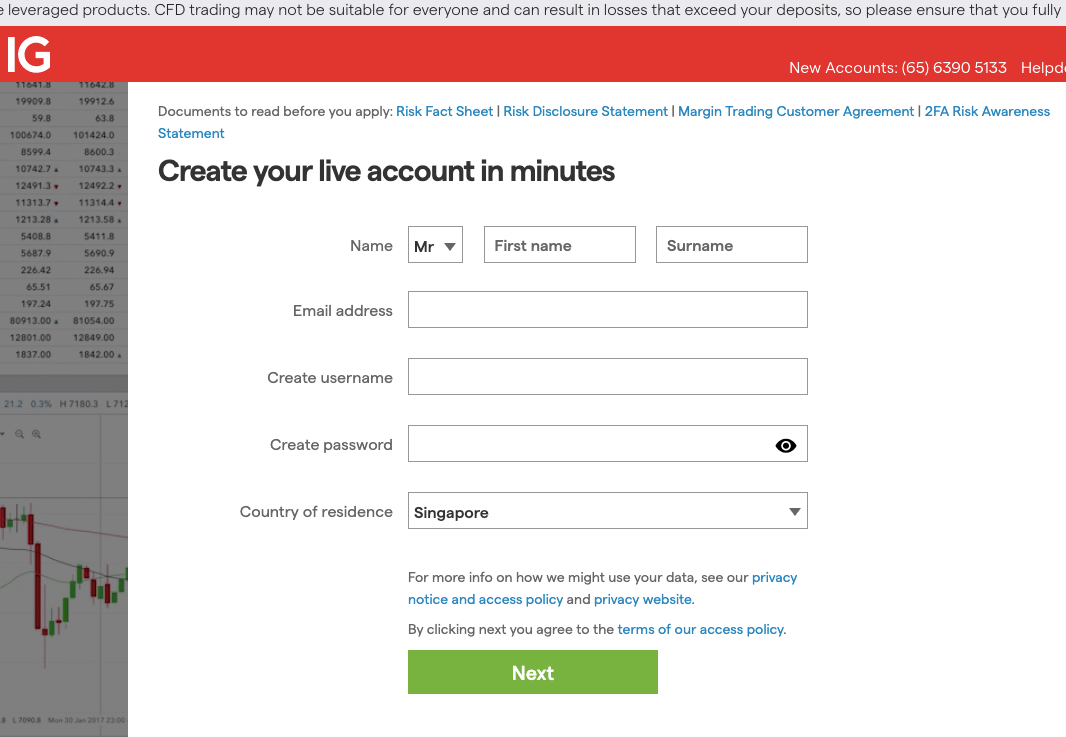

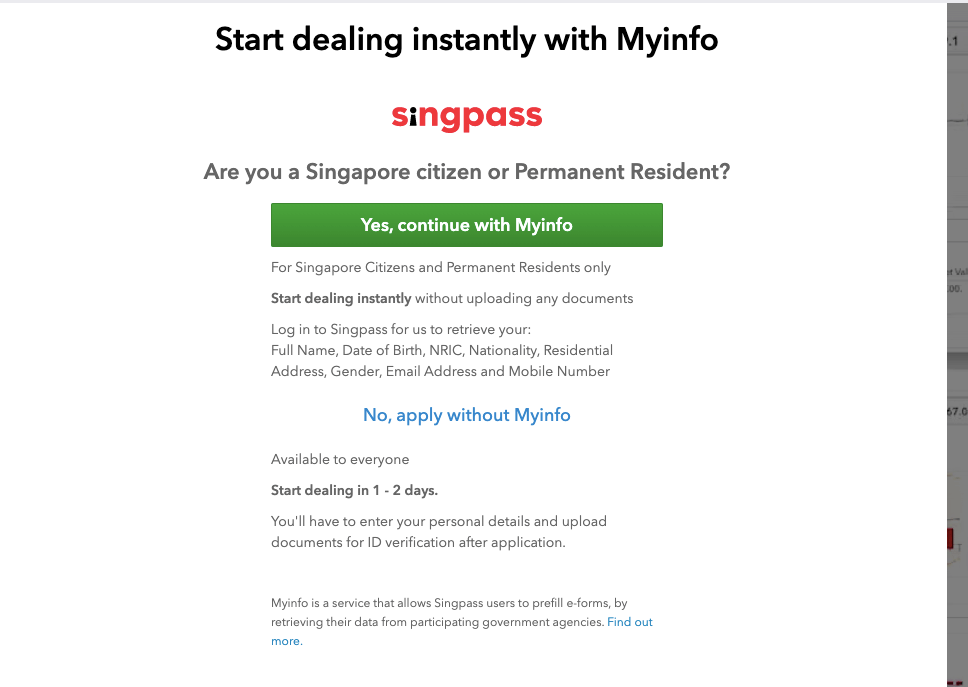

Step 2) On the form that appears, fill out your name and email, create a username and password, select your country of residence (Singapore will be selected by default), and then click on ‘Next’. You can also choose to fill this out with Myinfo by Singpass

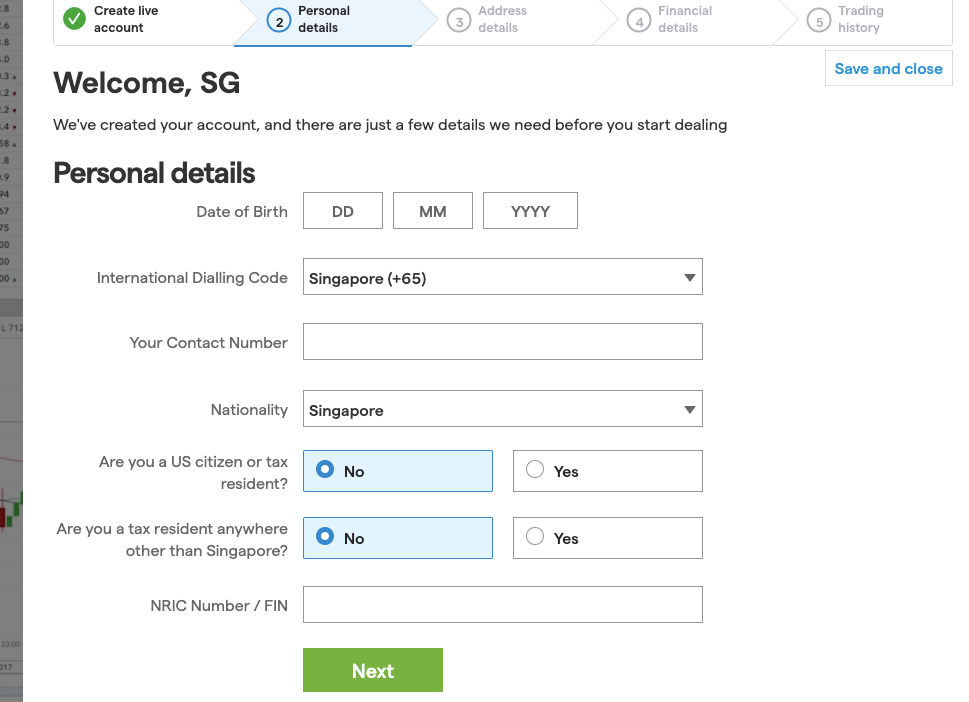

Step 3) Supply your date of birth, phone number, select nationality, check the box to indicate you are not a US citizen and provide your NRIC Number or FIN then click ‘Next’.

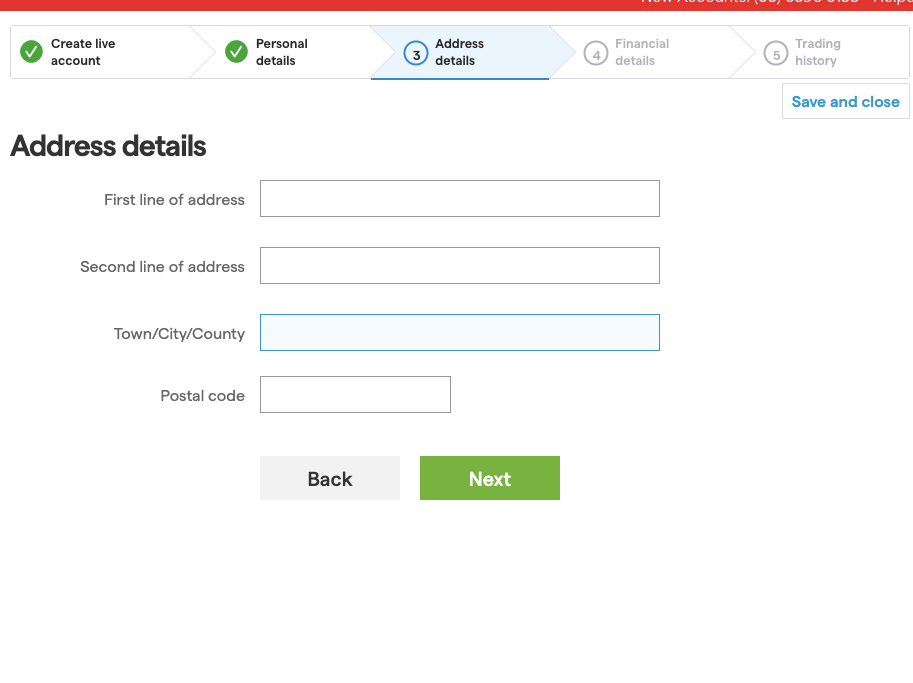

Step 4) Provide your address and click ‘Next’.

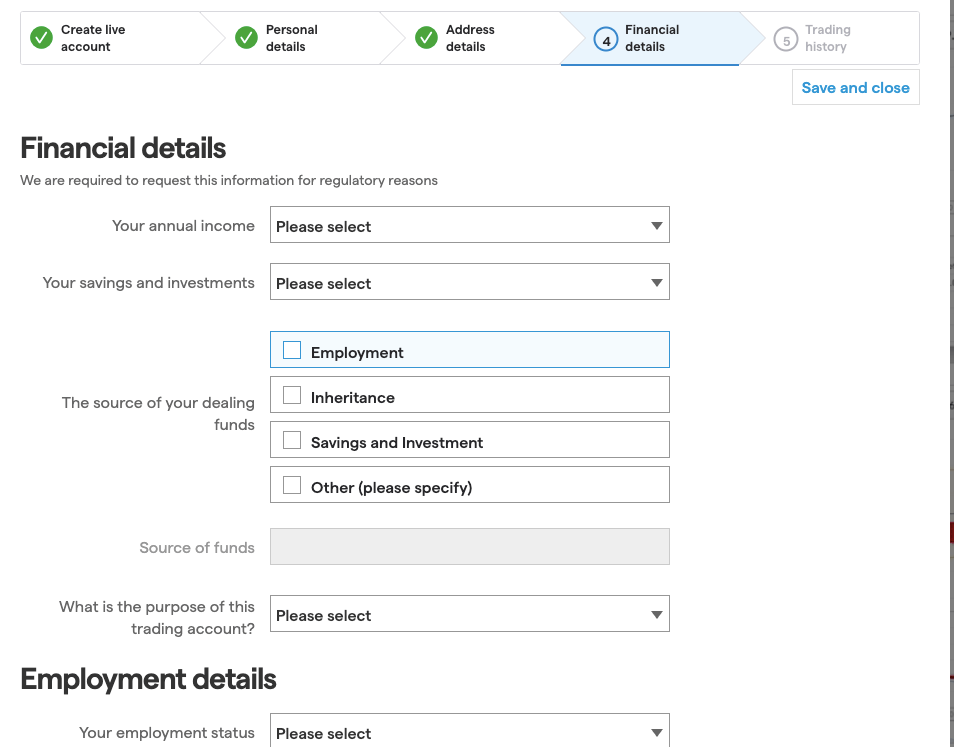

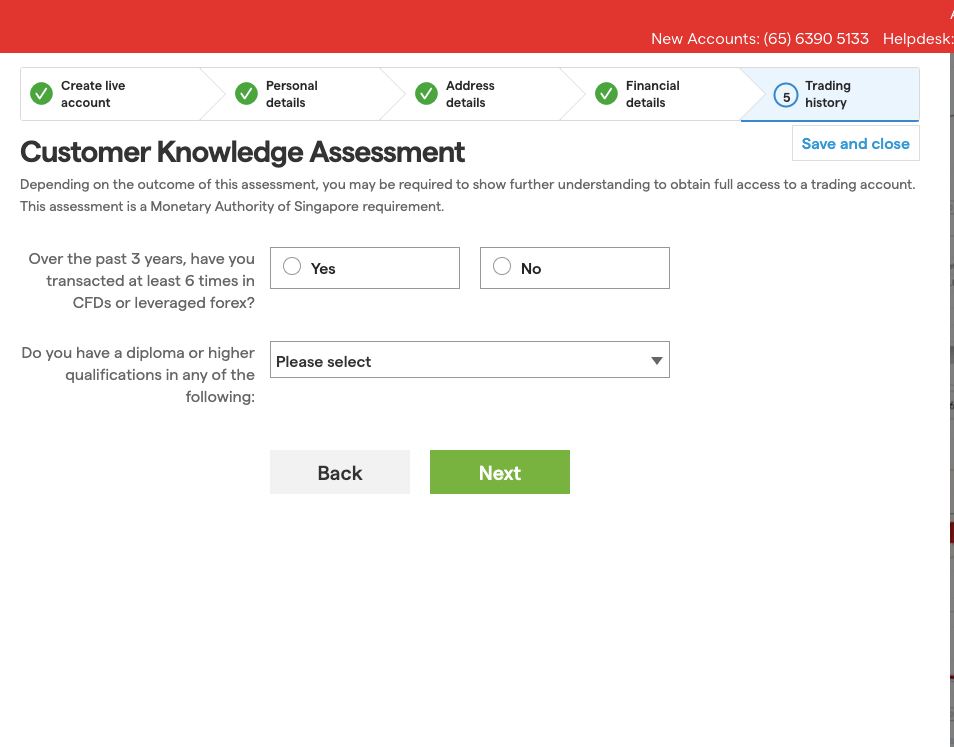

Step 5) Answer questions relating to your employment, financial status, trading experience and knowledge, then click ‘Next’.

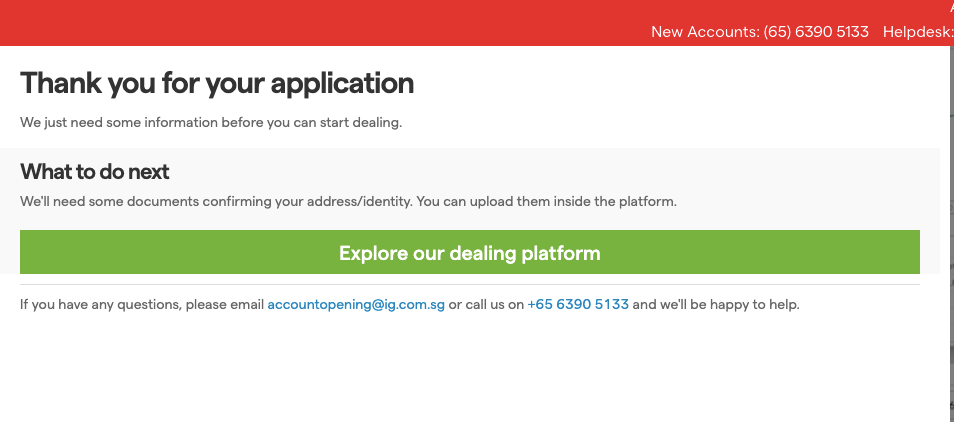

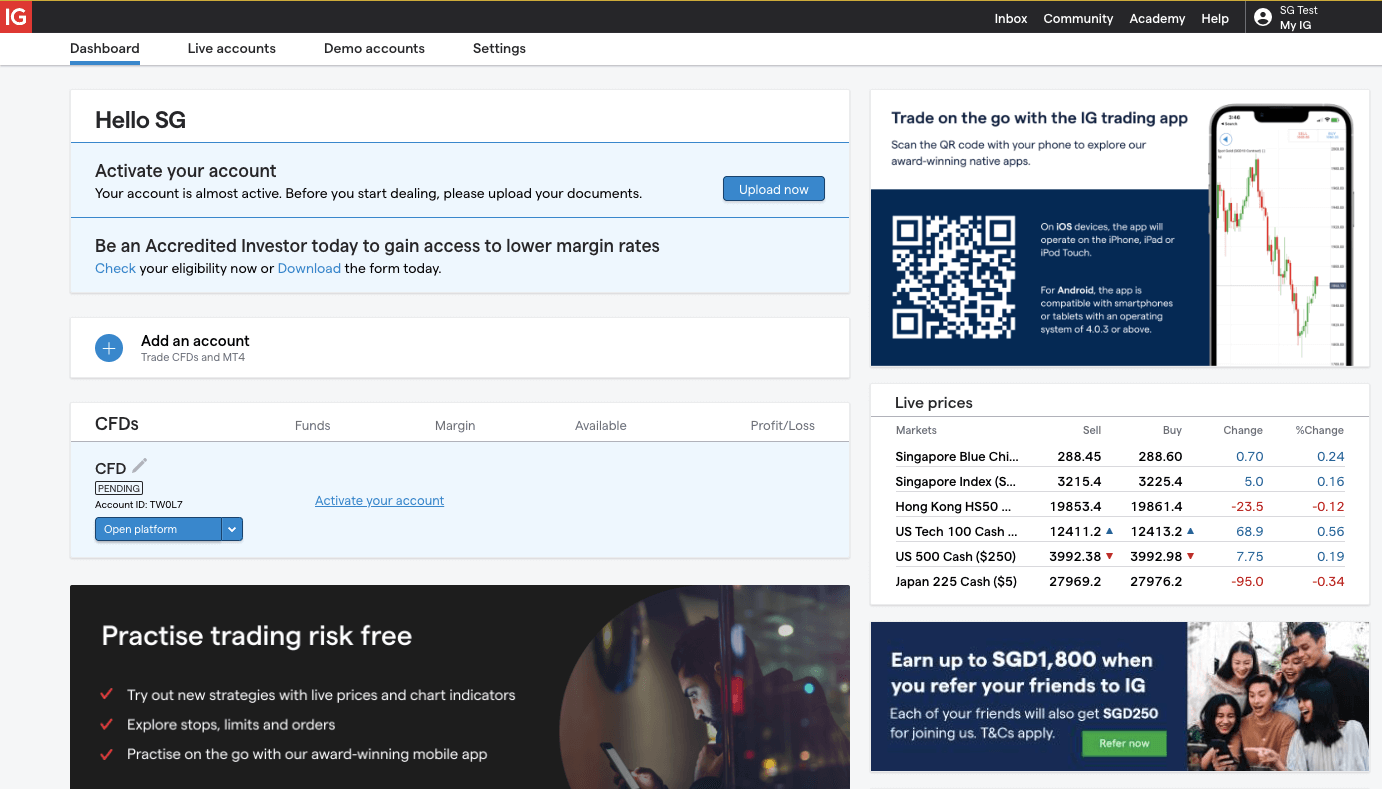

Step 6) Check the box to agree to the terms and conditions and click ‘Finish’, on the page that appears then click the ‘Explore our dealing platform’ button and you will be redirected to the IG Markets dashboard to continue with your registration.

Step 7) On the dashboard, click on ‘Upload now’ to activate your account and upload the required verification documents.

After your account is activated, you can make deposits, place trades and withdraw funds from it.

A Forex broker, also known as a foreign exchange broker or FX broker, acts as a middleman between you and the massive, global market for trading currencies.

Here’s what they do:

They provide access to the Forex market:

Think of them as your gateway to buying and selling different currencies.

They offer trading platforms where you can execute your trades and monitor currency prices.

They facilitate currency exchange:

You don’t directly interact with other traders. The broker matches your buy orders with sell orders from other clients or directly fulfills them (depending on the broker type).

They ensure smooth and secure transactions, eliminating the need to worry about counterparty risk.

They make money through fees:

They typically charge spreads (the difference between the buy and sell price of a currency pair) or commissions on your trades.

Yes, you generally need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the vast interbank market where currencies are actually traded. Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market. Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

IG Markets, Saxo, Plus500, and CMC Markets are regarded as having good trading platform. However, the best forex trading platform in Singapore will depend on your trading preferences. Here is a summary of features on their trading platforms.

1. IG Markets: This broker offer a range of platforms you can use to trade, including their own proprietary IG Markets trading platform. They also integrate with MetaTrader 4, and ProRealTime. Key features of their platform include research and educational resources, and competitive pricing (commission-free trading).

2. CMC Markets: This broker also offers their own proprietary trading platform known as Next Generation and also integrate with MT4 trading application. Key features include GSLO function, market analysis and education resources.

3. City Index: This brokers offers a proprietary WebTrader platform and can integrate with MetaTrade 4 trading application and Trading View. Key features on City Index platform are GSLO (Guaranteed Stop Loss Order) functionality and Supports algorithmic trading via Expert Advisors on MT4.

4. Plus500: This broker offers only their proprietary trading platform, the Plus500 Trader that is available on web and mobile devices.The key features are Guaranteed stop-loss orders to manage risk as well as negative balance protection to ensure you never lose more money than you deposited.

Overall, the best trading platform is platform that offers risk management tools/features and educational resources, is available on different devices (web, mobile for android and iOS), and integrates with other platform.

Its best to trade with forex brokers that offer some form of safety for your funds. Here are some red flags to avoid when choosing a forex broker:

1) Unregulated Brokers: Do not trade with forex brokers that are not regulated.

2) Hidden Fees: Another sign to avoid a broker is high fees or commissions.

There is no specific amount that applies to every trader or forex brokers. The minimum deposit for forex trading is a decentralized phenomenon. No regulatory body enforces minimum deposit. It all depends on how each broker wants to operate. This is the first factor.

Some brokers have trading accounts with no minimum deposit. There could also be accounts with low minimum deposits requirement like SGD 50. There are a few brokers with minimum deposits as high as SGD 500 or more. So when it comes to the money you need to begin trading, your forex broker is a key factor.

The second factor is you. You need to consider your risk tolerance, trading goals, and financial state. How much are you willing to lose trading? How much is your gross monthly income? Why am I trading? These are pivotal questions you need to ask yourself. The answers to these questions will affect how much you put in your trading account.

How do you choose the amount to begin forex trading? A good consideration of the two factors above will help you make the right choice. After determining how much you are willing to risk in trading, then you need to choose your ideal broker.

If your risk tolerance is low, then you might have to choose brokers with zero minimum deposit account or low minimum deposit account like SGD 5-SGD 10. Though this little money, you can trade more positions with it using leverage. However, you should note that you can lose all of your money with leveraged CFD trading.

Even if your risk tolerance is high or you have enough money to trade CFDs, we caution that you do not put too much money in CFD trading because it is very risky.

In theory there are offshore brokers that give high leverage to Singapore based traders, but you should never put your money with these ‘high leverage’ brokers.

Note that the max. leverage on forex is 1:20 at MAS regulated forex brokers. That means for a deposit of SGD 1000, you can trade a position up to SGD 20,000 or approx. equivalent of 1.5 Mini Lots (15,000 Units) on EUR/USD.

You may want to choose a foreign forex broker in order to bypass these rules, but these rules are put in place for protection of retail traders.

There are many offshore brokers that try to attract traders by advertising high leverage, but they are high risk & illegal.

While some of these brokers are regulated with with foreign tier-1 regulators like ASIC, but if you signup with them they don’t create your account under their tier-1 regulated entity. Instead these brokers sign up traders under their offshore entities like on Bahamas or Belize etc. where they don’t have to follow any strict regulations or leverage restrictions.

That way these brokers are able to bypass the regulatory restrictions set by MAS in this case.

You should avoid any forex brokers that does not open your account under their MAS licensed company, and report any such broker to MAS. Any legal forex broker will have a valid license for Capital Markets products to offer ‘Over-The-Counter Derivatives Contracts’.

Regulated brokers in Singapore have very strict compliance requirements for protection of Client’s Money including ‘segregated client bank accounts’ as mandated by MAS’s rules, no hedging using client funds, strict cap on leverage on CFD instruments etc.

Not all forex brokers operate the same way. There might be few similarities in some things. But when it comes to business models, the differences are usually clear.

Here are the most common forex business models:

DD: DD means dealing desk brokers. They are also known as market makers. This means they are counterparties to your trades. In other words, they take the opposite side of your trading positions. DD brokers can have different pricing models, some are fixed spread brokers, while others have variable spreads.

Also, some market market maker brokers offer instant order execution, but there may be slippage if the price is moving fast.

NDD: NDD means non-dealing desk brokers. Unlike DD brokers, NDD brokers are mediators. They connect their clients to interbank markets. Instead of a dealing desk, your trades are sent straight to banks and liquidity providers.

The direct market access offered by NDD brokers prevents requoting because prices are updated in real time. NDD brokers are further divided into ECN and STP brokers.

Here is a breakdown of the two:

ECN: ECN means Electronic Communication Network. ECN brokers are a liquidity hub. They have different liquidity providers, banks , and hedge funds that are connected. Your trades are sent electronically into this hub. There is no price manipulation and every participant has access to the price feed.

STP: STP means Straight-Through-Processing. STP brokers route your trades directly to liquidity providers who act as counterparties to your trades. STP brokers also add a mark up to spreads received by liquidity providers. That is one of the ways they make their money.

For beginners, you need to prioritize education and simple account structure. The following brokers are the best forex brokers for beginners in Malaysia: XM, Octa, HFM, Tickmill, FXTM, and AvaTrade.

These brokers have account structures that are easy to understand. They also have FAQs that will answer common questions. Furthermore, they have educational materials in written and video form for you to learn forex trading.

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

The issue of the best trading platform for beginners is a subjective matter. Forex traders differ in preference and opinions as to what they want in a trading platform.

However, some general criteria can help you if you are beginner. Here are some of them.

License: Your trading platform should be well regulated. The MAS regulates brokers in Malaysia but the license is not top-tier. So, focus on brokers that have a top-tier regulation with the FCA in the UK or ASIC in Australia plus the local MAS license.

SGD-base Account: Choosing a trading platform with your local currency account is good. As a beginner, you want to avoid excess charges like conversion fees. If you want to go the conventional way, you can open a USD trading account.

Singapore friendly payment methods: Bank wire transfers and debit/credit cards should be supported. More payment options like Skrill, Neteller, and other e-wallets help lets you enjoy a degree of flexibility. E-wallets are not available everywhere especially if you prefer a certain company.

So, the bare minimum is payment via your bank and your cards.

Diverse account types:A forex broker will likely have at least two trading accounts. There is usually a Standard Account, and an ECN Account. Not all account types are suitable for beginners. A Standard Account might be a good place to start.

Free Demo account: Beginner traders need a demo account. An unlimited demo account that does not expire is preferable. This is helpful for practice of trading strategies. You are also able to trade objectively since there is no fear or greed to make money.

The forex market is open 24 hours for 5 days in a week. This is possible due to a global network of trading centers. The market does not operate on Saturday and Sundays. There might be some partial operations on Sundays but there is usually not enough liquidity in the market.

The forex market opens at the beginning of every week in the Asian region and closes in the North American region. This allows you to take advantage of trading opportunities across different trading sessions.

Here are the most common trading sessions:

Asian session: The Asian session is also called the Tokyo session. This session kicks off trading for the day. Trading starts in Sydney (Australia) at 10 PM GMT (6 AM SGT, next day)). Tokyo opens for trading next by 12 AM GMT (8 AM SGT). Liquidity is very low during the Asian session. You can maximize this session by trading AUD and JPY pairs.

European Session: This session is also known as the London session. It opens 8 AM GMT (4 PM SGT) and has the most liquidity because it overlaps with the Asian and North American session. Volatility is also very high. EUR, CHF, and GBP pairs are the best to trade in this session.

North American Session: Popularly known as the New York session, trading begins here at 1 PM GMT (9 PM SGT). It overlaps with the London session between 1 PM (9 PM SGT) and 5 PM GMT (1 AM SGT, next day). These four hours are usually very active because of the session going at once. The New York session is the best time to trade USD pairs.

Most strategic traders prefer to trade when there is a Tokyo-London or London-New York session.

N.B: There are other minor sessions within the sessions above. For example, Frankfurt session in Germany opens before London within the European session. However, these are the sessions discussed above are the most popular ones that traders work with.

According to the Inland Revenue Authority of Singapore, forex trading is subjected to taxation. However, not all forex traders are taxed. Only traders whose main income source is forex trading are taxed. So, if you are a professional trader, you have to declare your profits from forex trading as income.

So, how much will you pay as taxes? Well, it depends on your income. If you earn less than $20,000, your income tax rate of 0%. Its 22% if you earn over $320,000 and 24% for those earning over $1,000,000.

Speak to a tax expert to ensure that you are tax compliant according to the law of the country.

The MAS regulates Forex & CFD brokers in Singapore. Visit the ‘Financial Institutions Directory’ on their website at https://eservices.mas.gov.sg/fid to verify your preferred broker’s regulation.

Although the answer to this is relative and depends on individual trader. Generally, if a CFD broker is regulated with the MAS, they are low-risk and you can open an account with them. You should then compare the overall fees, no. of CFD instruments, platforms, ease of withdrawals, trading conditions mainly, risk management, and negative balance protection. Based on our research, the best forex brokers in Singpore with good trading conditions are Plus500, IG Markets, City Index, CMC Markets and Oanda.

According to our research, Saxo Markets have the most CFD instruments. They offer over 19,000 CFD instruments.

Based on our research and comparison, CMC Markets has one of the lowest spreads for trading forex pairs, with an average of 0.7 pips for majors like EURUSD. The broker also offers commission-free trading for forex.

Yes, forex trading is legal in Singapore. Make sure that you trade through a broker that is regulated by the Monetary Authority of Singapore (MAS).