Forex Trading in Malaysia

Online Forex Trading is not regulated in Malaysia. So the retail traders trading forex are doing so at their own risk. Read our guide to understand how forex trading works & the risks involved.

Editor

|

Forex trading is not regulated in Malaysia yet. Hence, every forex broker that accepts traders from Malaysia is unregulated by the SCM (Securities Commission Malaysia).

The Securities Commission Malaysia (SCM) is the statutory regulatory body that oversees financial markets in Malaysia, however, they have not allowed & regulated any retail forex brokers operating in the country.

For ensuring that your funds are safe, retail traders from Malaysia should not trade forex online till there is a local regulation.

But the traders who trade currently should only trade through forex brokers that are regulated by top-tier foreign financial regulators such as the FCA of the UK and the ASIC of Australia and the CySEC of Cyprus.

The more heavily regulated the broker is, the better it is for Malaysian traders. Hence, you should always check the licenses held by the broker before trading with them.

Also, it is important to understand that forex & CFD trading is very risky, and almost 70-80% of retail traders lose their money when trading at different CFD brokers in Malaysia. Hence, if you are thinking about trading forex, then you must learn about the risks as well.

Below are the some of the points that you need to know for learning everything about forex trading:

In this guide, we will mostly discuss from the point of view of retail traders in the forex market. We will try to cover some of the topics that can help you decide if you should trade, and learn about the risks involved. Or simply learn about forex trading.

| Broker | Regulation | EUR/USD Spread (pips) | Min. Deposit | Visit |

|---|---|---|---|---|

| OctaFX | St. Vincent & Grenadine FSA, CySEC |

0.9

|

MYR 100 | Visit Broker |

| HF Markets | SVG FSA, FCA, DFSA, FSCA, CMA |

1.4

|

MYR 50 | Visit Broker |

| Pepperstone | SCB, FCA, ASIC, DFSA |

1.0

|

MYR 45 ($10) | Visit Broker |

| Oanda | FSC BVI, MAS, IIROC, FCA, Malta FSA, Japanese FSA, ASIC |

1.1

|

MYR 0 | Visit Broker |

| FXTM | FSC Mauritius, FSCA, FCA, CySEC, CMA |

1.9

|

MYR 2,374 ($500) | Visit Broker |

Note: The spread data & minimum deposit is the typical/minimum spread as per information on these brokers’ websites in March 2024. Please see our methodology below.

The foreign exchange market alias forex or FX market is a global, online over-the-counter (OTC) market where currencies of about 170 countries are bought and sold. It is open 24 hours a day. It is the biggest financial market in the world and has very high liquidity. The forex market participants include multinational businesses, banks, speculators, financial institutions, etc.

Most of the trading is from banks, multinational corporations, and institutional investors. Some of the trade in the forex market is speculative in nature, and a part of it is from retail traders. Retail traders are individual and independent traders who trade with their own money. Retail traders come to the forex market to speculate, hedge against currency and interest rate risk, etc.

The activities that take place in the forex market are what determine the exchange rate of any currency pair. The higher the demand for a currency, the higher its exchange rate. This means that a currency which is being bought more than it is being sold will witness a rise in its value against other currencies.

The forex market ecosystem teems with a lot of participants. Let us discuss some of them.

The forex broker is a regulated participant who acts as a bridge between the forex trader and the market.

The broker is a middleman who places buy and sell orders for retail traders and some brokers also offer research services as well if required by the trader. The forex broker charges a fee for their services.

That being said, retail traders need to pass through a forex broker that accepts retail traders if they are to access the market. There are several forex brokers in Malaysia to choose from.

However, traders from Malaysia should check the licenses held by forex brokers to avoid patronizing fraudulent/scam brokerages. Traders should only trade with brokers who have tier-1 (such as FCA or ASIC) or tier-2 (such as CySEC) licenses.

Retail forex traders are individual investors who wish to trade in the forex market for personal gain. They don’t trade on behalf of an organization or company. They account for an estimated 5.5% of the global forex market as per BIS data.

Retail traders are in the market mostly for speculative reasons. They hope to profit from differences in exchange rates between currencies.

Their presence in the forex market is to create policies that can affect the currency, intervene and stabilize the currency through increasing or decreasing interest rates, performing Open market operations in some situations etc.

Central banks can also devalue their currency to make exports of their country more competitive to international buyers. In short, the Central bank plays a major role in deciding the value of a currency.

Commercial Banks make up the interbank market where they trade forex with other banks in very large volumes. These volumes are large enough to dictate the bid and ask prices for any currency. They trade on behalf of themselves and their customers.

Big companies that operate in different parts of the world have to trade in the forex market to hedge risk and also for business purposes.

A company hoping to buy raw materials from another part of the world may need to convert its currency to be able to pay the supplier at the other end.

Big companies that have business operations in other parts of the world may also want to convert and repatriate their profits in a stronger currency to hedge against the risk of currency depreciation.

The forex market operates in four different time zones-

Depending on the currency that you want to trade, some sessions can be better than others. Most of the trading is carried out in the London & New York sessions.

The best time to trade the majors is when some of the major sessions overlap. At this time, market participation and liquidity are high, and spreads are at their lowest.

For example, the ideal time to trade the EUR/USD currency pair is during the London & New York sessions, because at that time liquidity in the market is highest.

If you are trading JPY-based pairs, then you will also find liquidity during the Asian session.

As a trader from Malaysia, it is recommended that you trade currency pairs involving AUD and other Asian currencies like JPY during the day, and trade currency pairs involving USD and EUR currencies during the night.

All the countries participate in the forex market and their currencies are represented as three-letter codes.

However, we will focus on the popular currencies here. The popular currencies and their codes are listed below:

Forex currencies are traded in pairs written as Base Currency/Quote Currency – GBP/USD

Currency pairs could be major, minor, or exotic. Let us discuss them below.

The major currency pairs quote the USD alongside another major currency. The USD is part of 90% of all trades in the forex market.

They usually have the USD on one side of the quote either as the base or quote currency. Examples in order of popularity are:

These are currency pairs of strong economies that do not contain the USD. Examples are

These are currency pairs involving a major currency and a currency of a smaller economy. Examples are

Forex currencies are traded in pairs written as Base Currency/Quote Currency i.e. GBP/USD

The base currency is the currency being bought while the quote currency is the currency used to pay for the base currency.

Currencies are always traded in pairs at an exchange rate. The exchange rate is how much of the quote currency is required to buy the base currency.

Assume the GBP/USD exchange rate = 1.2

This means that it will take $1.2 to buy one GBP and vice versa.

While trading forex, we use one currency to buy another hence we can also quote the currencies in terms of BID/ASK prices

The Bid price is the highest price a forex trader is willing to pay to buy the base currency from the broker.

The Ask price is the lowest price the forex broker is willing to sell the currency.

Certain terms are widely used in forex trading and understanding is very important. We shall discuss some common terms below.

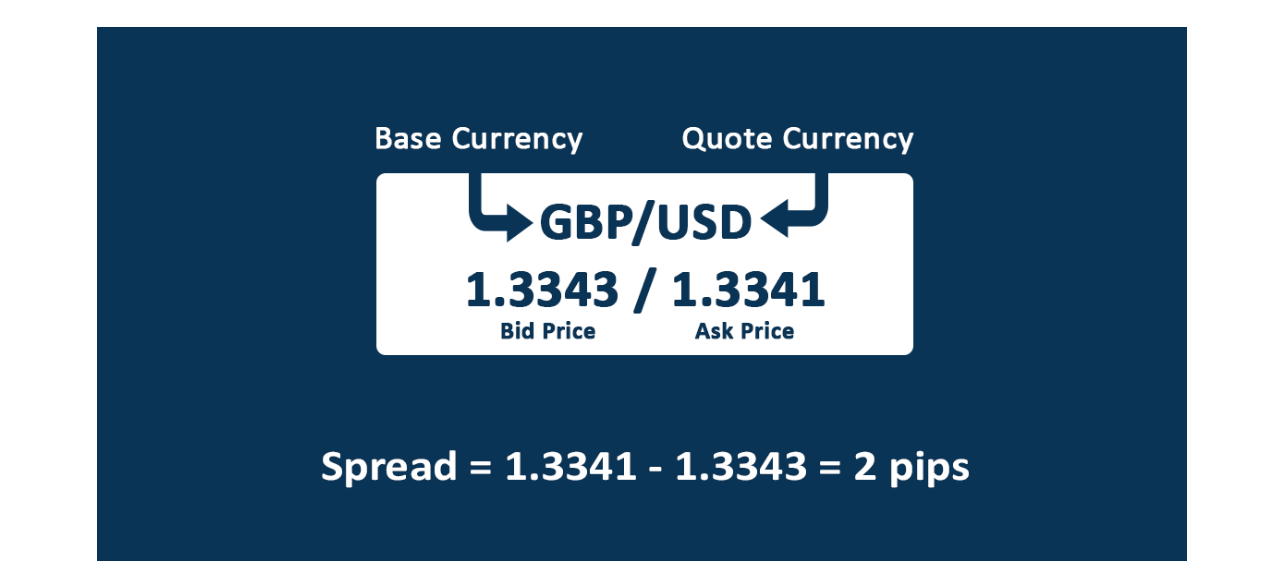

Spread is the difference between the bid price and the Ask price of a currency pair.

As seen in the image above the GBP/USD currency pair with a Bid/Ask price of 1.3089/1.3091 has a spread of 1.3089-1.3091 = 0.0002

Your forex broker may not always charge you a commission but makes their profit from the spread.

A spread of 0.0002 means if you are trading in a standard lot of 100,000 units of GBP/USD currency, the forex broker makes $20 on every standard lot traded i.e. 0.0002 x 100,000

Percentage in point alias “pips” is the unit of measurement for the spread.

As seen in the example above, if the spread is 0.0002 it is conventionally expressed as 2 pips. This is for a currency up to the fourth decimal.

Forex currency pairs are traded in lots at forex brokers.

Since the currencies don’t move by a lot, the traders tend to trade a higher number of units. Remember, the higher the traded volume, the larger the profit and the loss.

Currency pairs are divided into various lots as seen in the table below.

| Lot | Number of units of currency |

|---|---|

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

Standard lot example:

For a GBP/USD currency pair with details below-

Exchange rate = $1.36

Standard lot = 100,000 units

The margin needed for trading 1 standard lot will be $136,000 (i.e., $1.36 x 100,000)

Mini lot example:

For a GBP/USD currency pair with details below-

Exchange rate = $1.36

Mini lot = 10,000 units

The balance required for trading a Mini lot will be $13,600 (i.e. $1.36 x 10,000)

So, the margin that you need to trade depends on the total lots or units that you are trading. If you are trading 2.5 Mini Lots, this means that you are trading 25,000 units of a currency.

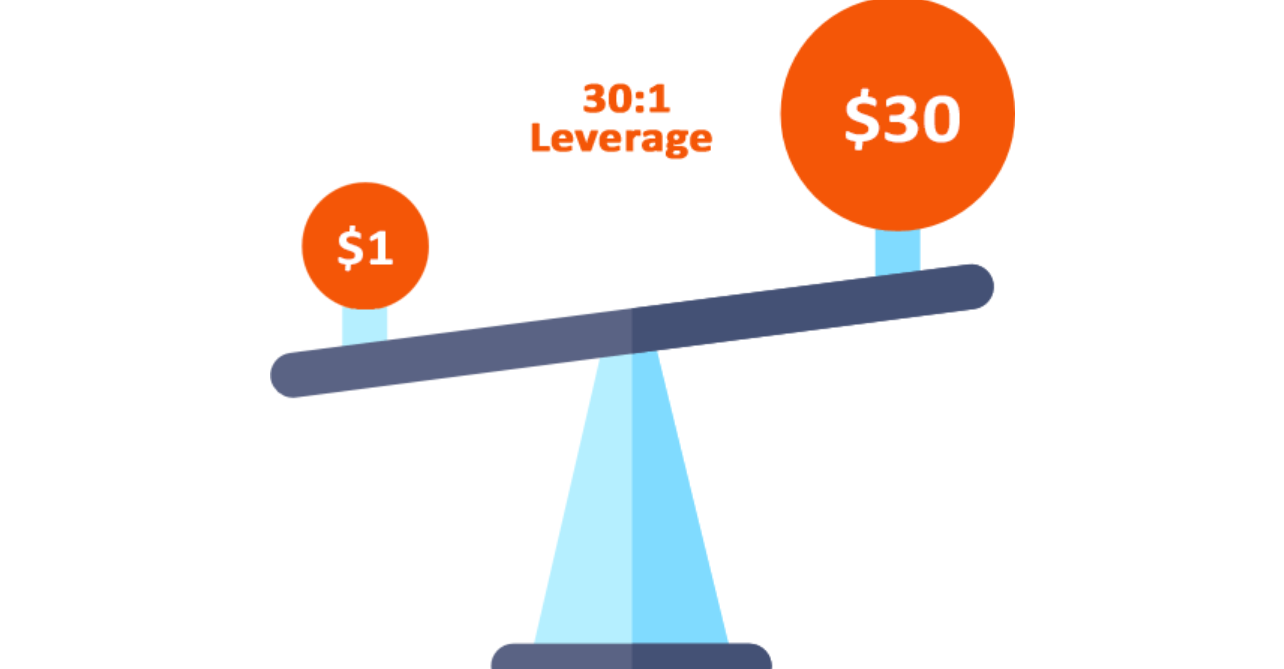

Leverage in forex trading is essentially taking a loan from your forex broker to trade most lots. The loan is repaid after you sell and make a profit or a loss.

Leverage of 1:30 means for every $1 a forex trader can trade up to $30 position using margin money.

Leverage is inversely proportional to margin.

Example:

If margin is 3.33%, then leverage is 1/3.33 = 30 (also expressed as 1:30)

Since leveraging means taking a loan, it is a double-edged sword. Even though leverage allows you to make higher profits, the loss can also be higher.

For example, if you lose big on a trade, and if the forex broker does not have Negative balance protection in place, the trader may have to repay more than the initial capital if the losses exceed capital.

You should remember that forex trading is not regulated in Malaysia. Hence, forex brokers operating in Malaysia can offer very high leverages to traders from Malaysia (for example, some brokers offer as high as 1:2000 leverage).

Trading with such high leverage is very risky and should be avoided. Ideally, you should not trade with more than 1:30 leverage for forex (as capped by major regulators such as the FCA, ESMA & ASIC).

This is a good faith deposit a trader must keep in his trading account. It is expressed as a percentage and is inversely proportional to leverage.

Margin % = 1/Leverage

For leverage of 30:1, the margin is 1/30 = 3.33%

Example:

If a forex trader uses leverage to place a buy order of 1 standard lot of GBP/USD currency pair

GBP/USD Exchange rate = $1.33

Margin = 3%

Required deposit without margin = $133,000 (i.e. 100,000 units x $1.33)

Required deposit with 3.33% margin= $4428.9 (i.e. 3.33% of $133,000)

After the forex trader deposits $4,428.9 in his or her account, then the 1 standard lot trade on GBP/USD can be placed.

Similar to leverage, the margin requirement is also not regulated in Malaysia. Brokers can offer extremely low margins which may not be in the best interest of traders. You should not trade with margins lower than 3.33% (as recommended by the FCA).

This is a system put in place by forex brokers to ensure your account doesn’t go into negative when the market moves against you quickly.

Once you lose the deposits in your CFD trading account, the brokerage system automatically closes all your positions.

It limits your loss to just your capital and ensures that the forex broker does not take the risk of your position. Negative balance protection is offered to only retail traders and not institutional traders.

You should remember that forex trading is not regulated in Malaysia. Hence, it is not legally necessary for CFD & forex brokers to offer negative balance protection to traders from Malaysia. This can mean that traders from Malaysia can lose more money than they have in their trading accounts.

Hence, you should only trade through brokers that offer negative balance protection to Malaysian traders.

The best way to confirm this is to visit the broker’s website and contact their customer support team. You should ask them whether they offer negative balance protection to traders from Malaysia. If they don’t, then you should not open an account with them.

As you can see, we contacted the customer support team at XM and asked them the same question. Their response was affirmative.

CFDs (Contracts for Differences) are derivatives, and these are contracts between the broker & the trader. Derivatives are complex financial instruments that derive their value from another underlying asset such as stocks, currencies, commodities like oil, precious metals, etc.

When trading CFDs, a trader does not own the underlying asset and is only speculating on the price of the instrument. This allows the trader to profit (or loss) from changes in the value of the underlying asset.

Hedging is a way to manage risk.

Traders sometimes trade derivative instruments such as currency futures and currency options to hedge against currency and interest rate fluctuation risk.

This is a trader who opens and closes trading positions on the same day.

Day traders are usually speculators and use derivative products like CFDs to try to profit from the rise or fall of the price of an asset.

Swing trading is a long-term trading strategy. Swing traders combine fundamental and technical analysis before opening a trading position. They can hold their trade for some days. Some can even keep positions open for months.

Slippage is the difference between the requested price of your order and the price it is executed by your broker. Slippage is can be caused by poor internet connection on your end, rapid price movement in the market, or your broker’s system. To know how your broker handles slippage, make sure you read their rider execution policy and other related official documents. They are usually available on the broker’s websites.

A forex order is simply how you enter and exit the market. They are the offers you send to your broker from trading platforms. There are different types of orders you can place in the market. Here are the common ones:

Buy Order: This involves placing an order to purchase a currency pair. This order is instant. However, it has two variations called the buy stop and buy limit orders. A buy stop is when you set your entry price above the current market price. If the price rises to the level you have set, your buy order is triggered.

On the other hand, a buy limit means setting your entry price below the current market price in hope that the price will fall to that level. If it does, your buy order will be triggered.

Sell Order: It involves placing a trade to short (sell) a currency pair. A sell order is instant but has two variations too – the sell stop and sell limit orders. For a sell stop, you place your order at a price below the market price with the hope that the price will fall further from that point. If the price falls to the point you have set, your sell order will be activated.

For the sell limit, you place your sell order at an entry price above the current price, with the hope that the price will fall from there. If the price rises to the point you have set, your sell order will be activated.

The buy limit, buy stop, sell limit, and sell stop are generally referred to as pending orders.

Take Profit: It literally means what the name suggests. It is that price you set for your broker to close your trades and lock in your profits. The order is usually executed automatically on the trading platform. You can also execute it manually.

Stop Loss: If a trade goes against you, you are losing money. There is a limit to losses that you can take as a trader. This is why the stop loss order is important. It is that price you set for your broker to close your trade to reduce losses. It can be executed automatically or manually.

There is an advanced form of the stop loss order called the guaranteed stop loss order (GSLO). This order makes sure that your stop loss order is executed at the exact price you choose so you don’t lose more money. That is, your stop loss order is not subjected to slippage. A premium fee is usually charged for GSLO. Though it is not offered by all brokers, GSLO can be very key to your risk management strategy.

Trailing Stop: The trailing stop is similar to the stop loss because it automatically closes your trade if price movement is unfavorable. Also, it does this within a specified distance. But they differ in one crucial way.

When price moves in your favor, it moves the trailing stop along with it. Trailing stop allows you to capitalize on favorable market movement while managing your risk effectively.

To open a forex trading account, you need to first choose a reputed broker that is regulated by top-tier regulators such as the FCA, ASIC, or CySEC. This is especially important since forex brokers are not regulated in Malaysia. There are many brokers that are regulated by top-tier foreign regulators, so you should compare factors like the safety of funds, fees, platforms, instruments, support, ease of withdrawals, etc.

Once you have decided on the forex broker that you want to choose, then you should proceed with opening your trading account. We will take Pepperstone as an example. The steps involved are generally the same for all forex brokers.

Step 1) Compare the Forex Brokers: This step is basically checking the regulation, fees (spreads and commission), available trading instruments, trading platforms, and other factors.

After you have done your research on the broker that you want to trade with then proceed to the next step.

As a Malaysian, you should check whether the broker offers their services in Melayu, whether they have a dedicated website for Malaysian traders, and whether they offer convenient deposit and withdrawal options to Malaysian traders via local banks.

Step 2) Open your Trading Account: Go to the website of the broker that you want to signup with.

On the website on the broker, go to the “Open Account” section, and complete the signup process.

Step 3) Submit your documents for KYC: All regulated brokers are required to complete the KYC of trading clients.

You will be required to submit details like your ID proof & Address Proof. The brokers generally verify it in 48 hours i.e. 2 working days.

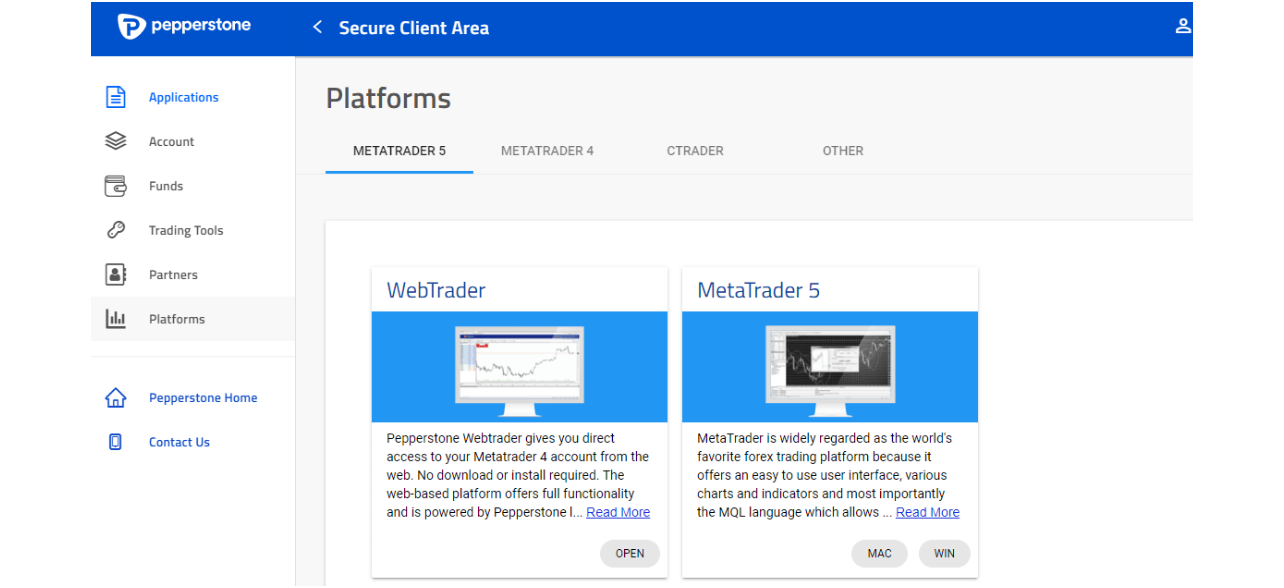

Step 4) Download the Platform: All brokers offer platforms like MetaTrader or their own proprietary platforms. Most forex brokers offer multiple platforms. You can use these platforms through your desktop, laptop, web browser, tablet, or smartphone.

You will generally get an email from the broker regarding the details on how to download a login to your platform.

Step 5) Deposit Funds: You can choose methods like a card or bank transfer for depositing. Watch out for brokers that charge extra fees during deposits.

A lot of brokers offer the option of bank transfer to Malaysian traders. This means that you can directly deposit your funds through a bank transfer to your bank account. Otherwise, you can also deposit funds using your debit or credit bank. You should always check the deposit and withdrawal methods available with a broker to see if it’s suitable for your needs.

Also, avoid any brokers that charge excessive withdrawal fees. Some brokers claim to charge low trading fees while charging excessive charges on withdrawals & deposits, making their overall fees very high.

The forex market is very liquid and this liquidity has caused a lot of traders to throw caution to the wind and even become greedy.

Most retail traders trade forex because of leverage, and this can cause losses to escalate very quickly.

Let us discuss some risks.

As mentioned earlier, retail online forex brokers are not regulated by the SCM in Malaysia. This means that the popular forex brokers that operate in Malaysia are operating without any oversight & don’t have to follow strict regulatory standards.

Hence, traders who register with foreign forex brokers are doing so at their own risk. These brokers can, technically, scam you and you would have no legal recourse against them in any Malaysian court.

Hence, you should at least be very careful of trading only through reputed forex brokers who are regulated by top-tier foreign forex regulators like the FCA of the UK, the ASIC of Australia, and the CySEC of Cyprus.

There are lots of unlicensed brokers who lure unsuspecting traders with promises of huge returns with low investments.

Some of them claim to hold licenses from regulators in countries that are not known for strong regulatory supervision.

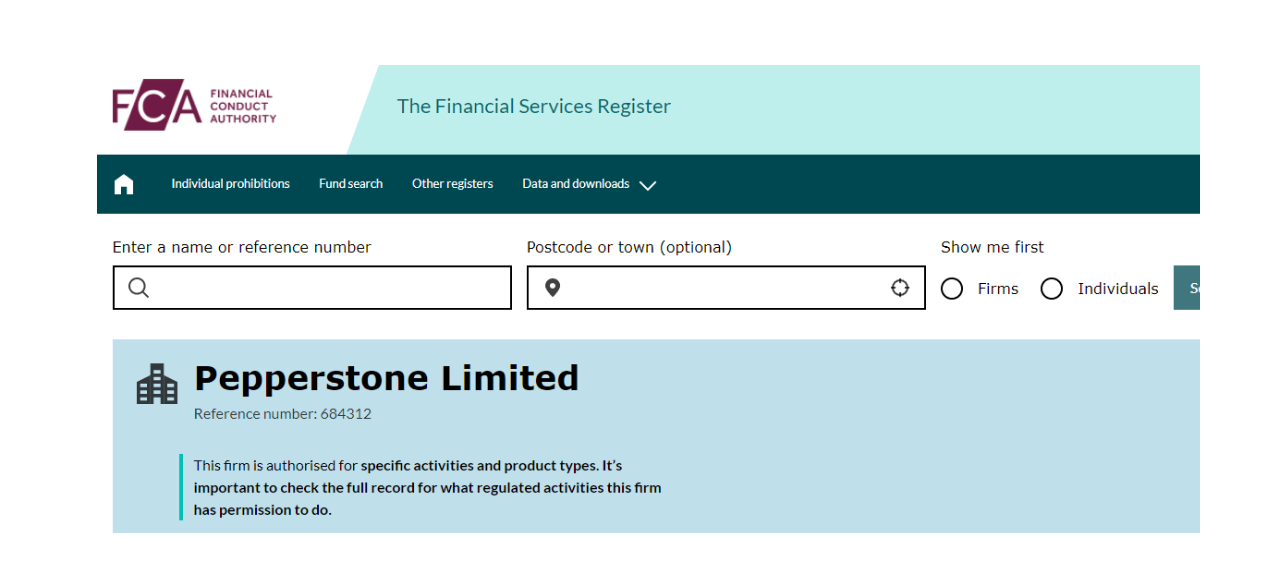

Forex traders from Malaysia should only trade with brokers regulated by top-tier financial regulators. Traders should go to the regulator’s website and check if their broker is on the list of licensed forex brokers. For example, suppose a broker website claims that they are regulated by the FCA. Then, traders should cross-check the information and license number by visiting the FCA’s website. We’ve used Pepperstone in this example.

You should cross-check the license number provided on the broker’s website with the license number (or reference number) provided on the regulator’s website.

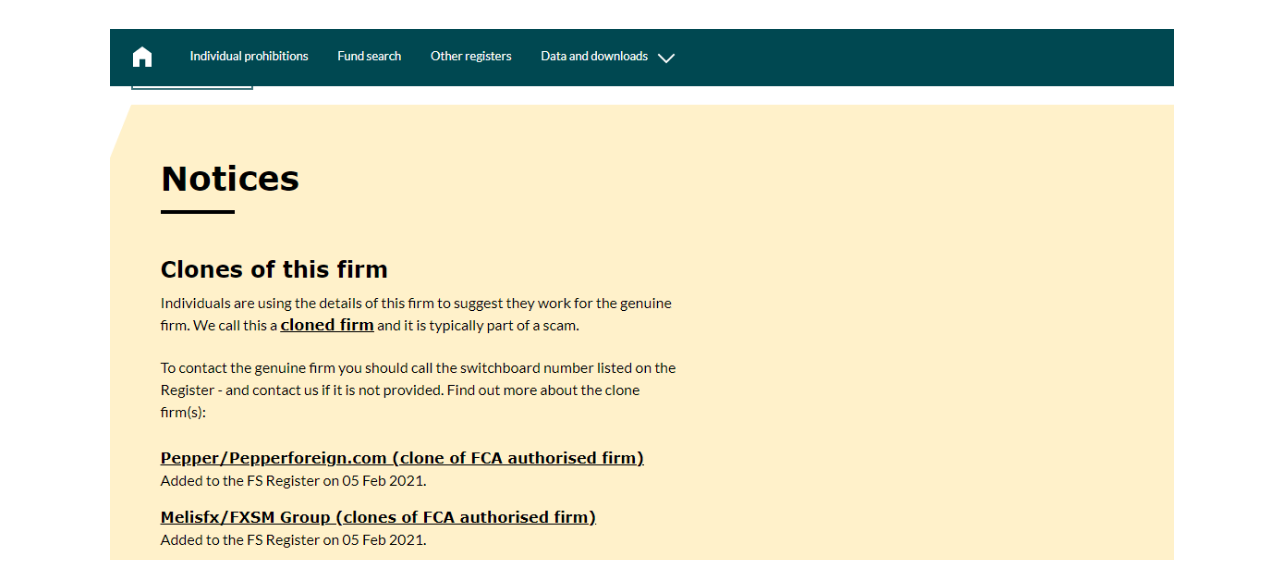

Some scam forex brokers go ahead and clone other licensed brokers.

They go as far as hosting websites with logos and registration numbers to deceive unsuspecting targets. The image below shows the FCA issuing a notice to the UK public about a cloned Pepperstone forex broker website.

Forex traders must be watchful and look out for red flags such as little differences in the broker name as can be seen in the image above (pepperforeign instead of pepperstone). Forex traders should also report any cloned page they come across to the regulator.

Scam brokers do exist so you should be wary of them and report anyone you come across to the regulator.

The first two risks that we discussed are associated with the risk due to a third party I.e. your broker. We will now talk about the risks that you face with actual trading.

Reports state that even with the leverage restrictions, 70 to 80% of retail forex traders lose money. The actual percentage differs with different brokers.

This is mainly because of over-leveraging a position. Traders must avoid using more than 1:10 leverage on any forex trade.

For example, let’s say you place a buy order on EUR/USD at 1.1000 targeting 1.1100, which is 100 pips. You have $10,000 in your trading account & you decide to use 1:10 leverage to place 1 Standard lot trade.

If the price does go in your direction, then you can make a profit of $1000 on this trade. But if the price goes against you by let’s say 100 pips, then you would lose $1000, which is 10% of your capital. If you had used 1:30 leverage, then the losses would have been $3000, which is 30% of your capital on a single trade.

Hence, you must remember that trading with excessive leverage can cause big losses.

The use of leverage should be done responsibly as it amplifies both gains and losses. You should find out if your broker offers negative balance protection so as to stop your account from going negative.

You can also use Stop Loss orders to automatically exit a position if the loss exceeds a certain level. Stop-loss orders are automated instructions a trader gives the broker to exit his trading position once the price goes below a predetermined amount. Stop-loss orders could be used to manage risk.

The forex market is very volatile and should be approached with caution. For example, it is not uncommon for some currency pairs to move 4%-5% in a day.

Normally, even majors like EUR/USD can move 1-2% in a single day. If you are risking too much on a single trade, then you can lose very quickly.

In fact, most of the retail traders trading in the forex market lose their money. It is really hard to be profitable with forex trading, mostly because traders trade with gamblers’ nature of risking excessively.

It is really important to practice risk management on a demo account for some months before going live. Also do not risk more than 2% of your trading capital on one trade. Further, don’t use too much leverage. The recommended amount of leverage is 1:30.

In the world of forex trading, there are two major types of analysis — fundamental and technical analysis. Technical analysis focuses on price patterns (present and historical), indicators, use of drawing tools, etc. On the other hand, fundamental analysis has to so with how political and economic factors affect the value of currencies.

In this section, we will be breaking down both methods to help you understand them better.

1. Fundamental Analysis: The health of an economy is crucial to the strength of its currency. The aim of fundamental analysis is to determine how the health of an economy affects the value of its currency. There are different components of fundamental analysis that can help you determine the direction of price for a currency pair.

Here are some of them.

Economic indicators and releases: Economic indicators are quantitative and objective. They usually have a numerical value that helps to determine the strength of a currency. Examples include GDP, interest rate, unemployment rate, non-farm payroll, etc.

Economic releases are qualitative and their interpretations can be subjective. Examples include a speech from the President of the ECB.

Geopolitical Events:Diplomatic tensions, wars, trade disputes, and policy changes can affect the value of a currency. Fundamental analysis considers these factors and their potential impact on a country’s economy and currency.

The forex market is deeply connected with these events and increase/decrease in demand of other currencies. For example, if a major economy or even the global economy falls into a crisis, it will lead to an increase in demand for safe haven currencies.

Market Sentiment: Traders’ perceptions and sentiments about a country’s economic prospects can increase/decrease currency prices. Positive sentiment can lead to increase in demand for a currency. Some forex brokers have market sentiment plug-in. It allows you to know where traders lean (bullish or bearish) on the market.

Political Stability: A country with a stable political atmosphere will mostly have a strong currency. Furthermore, stable politics in a country attracts investors. Increase in investors will lead to an increase in the demand for a country’s currency, making it stronger in the process.

You can find the data you need for fundamental analysis. But most forex brokers have them on their websites or third-party trading platforms. It is usually called the Economic Calendar.

It is important to note that economic analysis requires a deep knowledge and understanding of economic concepts. You also have to monitor global events consistently. It takes time for economic factors to affect the price of currency pairs. So if you prefer fundamental analysis, you need to be patient and have a long-term perspective.

2. Technical Analysis: Technical analysis studies the historical price behaviour of CFDs. It could be a currency pair, a stock CFDs, crypto CFDs, etc. Unlike fundamental analysis, technical analysis focuses on what your trading charts might be saying.

That is, technical analysis is founded on the notion that you can speculate the future price of a CFD based on its historical price movement and patterns.

To become efficient in technical analysis, you need to understand price patterns. However, you cannot understand price patterns without learning to read forex trading charts.

There are three types of forex trading charts that you will find on popular forex trading platforms like MT4 and MT5. They are line charts, bar charts, and the Japanese candlestick charts.

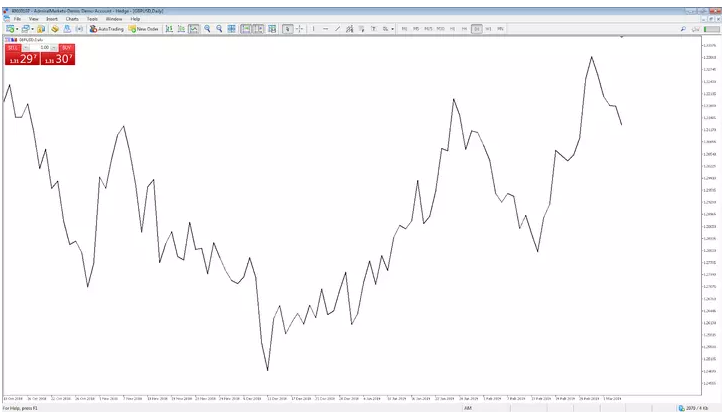

Line charts: These charts are the least popular of the three charts. Line charts connect the closing prices of a CFD. It can vary depending on the timeframe you are using. If you are on the 4 hours timeframe, then the chart connects the closing price of the CFD every four hours.

Here is an illustration of a line chart:

The sharp edges show the closing prices.

Bar charts: Also known as the OHLC bar charts shows a bar for every time period that you select. For example, if you are viewing EURUSD on the daily timeframe, a bar represents a day’s worth of trading.

Beyond closing prices, the bar chart also shows you the open, high, low, and close (OHLC) prices of the bar. The dash on the left shows the opening price and the dash on the right shows the closing price.

The high of the bar is the highest price the market traded while the low of the bar is the lowest price the market traded. All of these is shown on every single bar for the time period you select.

Candlestick charts: Candlestick charts are the most popular type of forex trading chart. Homma Munehisa developed the concept of candlestick charting. Like bar charts, they also show the OHLC.

The difference between them is that candlestick charts have a ‘body’. The ‘body’ of a candlestick is a rectangular box between the open and close prices.

In analyzing the forex market, understanding chart patterns are crucial. You can use them to determine where the price will go, and whether a trend will continue or end.

However, there are some terms you need to know before moving to price patterns. They are support, resistance, breakout, and retracement.

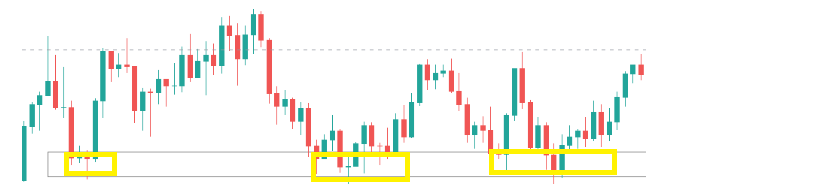

Support: When supply exceeds demand in the forex market, the price begins to fall. This fall in price continues to a point where demand slowly exceeds supply. Consequently, the price stops falling. This is support.

Here is a pictorial illustration of support (see the areas with yellow boxes).

Resistance:Resistance is the opposite of support. The price of a currency will continue to rise as demands exceed supply. However, a point comes in the market where supply exceeds demand and the price stop rising. This is resistance.

Here is a pictorial illustration resistance (see the areas with yellow boxes).

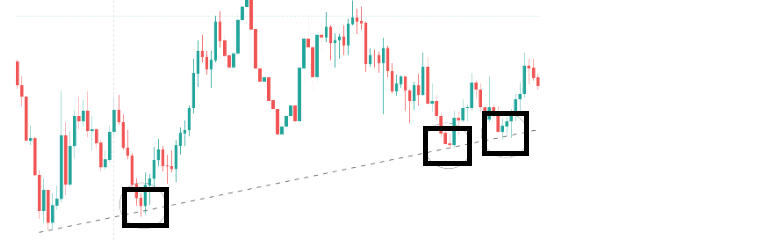

Support and resistance can also occur diagonally on a trend line. They do not occur horizontally alone. Here is a pictorial illustration of diagonal support (see the areas with black boxes).

Support/resistance can be a single price or a zone. Typically, price reverse when they get to these zones. That is, price tend to start rising from a support zones and tend to fall at resistance zones.

This is not the case every time. Anytime there is no price reversal at support or resistance, what happens is a breakout.

Breakout: Understanding a breakout is simple. Imagine you are in huge crowd outside a stadium waiting for a concert to start. The main gate is locked and the huge crowd is pushing forward and putting pressure on the main gate.

The gate is strong and holds up, preventing the crowd from coming in. Suddenly, the pressure increased beyond the strength of the gate. It falls and you and the crowd rush into the stadium.

This is what a breakout look like in forex trading. Sometimes, price can be trapped between support/resistance zones. Thus can happen in an uptrend, a downtrend or a range. When price breaks out of this zone, then a breakout has happened.

Here is an example of a breakout within a range

A breakout could signify that a current trend might end or continue. That is, it could be a sign that a buy/sell trend will end or continue. It could be a point that a range trend will end or continue.

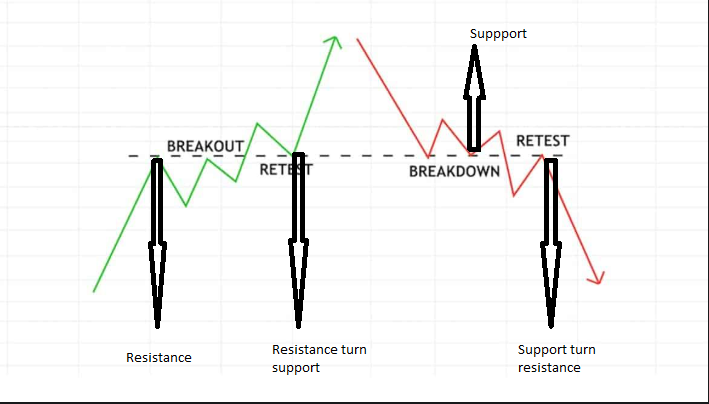

To confirm that a breakout is real, you need to wait for a support or resistance level to be retested. This is where retracement comes in.

Retracement: Another word for retracement is retest. This occurs when a price breaks out of a support/resistance zone before reversing to test that same zone.

When a support is retested, it becomes resistance and when a resistance is retested, it becomes a support.

Why is retracement important? Traders use retracement to confirm if a breakout is real or not.

Sometimes, when a breakout level is retested, especially in an uptrend or downtrend, it could tell future price direction.

Candlestick Patterns: Finally, we look at candlestick patterns. It is important you under this before we consider chart patterns. Candlestick patterns can be likened to the language of the market. Every candle is saying something about market activity.

Learning about candlestick patterns combined with support/resistance within certain chart patterns can help you find profitable trade set up. A candlestick pattern could be bullish (signal price might go up), bearish (signal price might go down) or continuation (that a trend will continue)

Here are some popular candlestick patterns you should know:

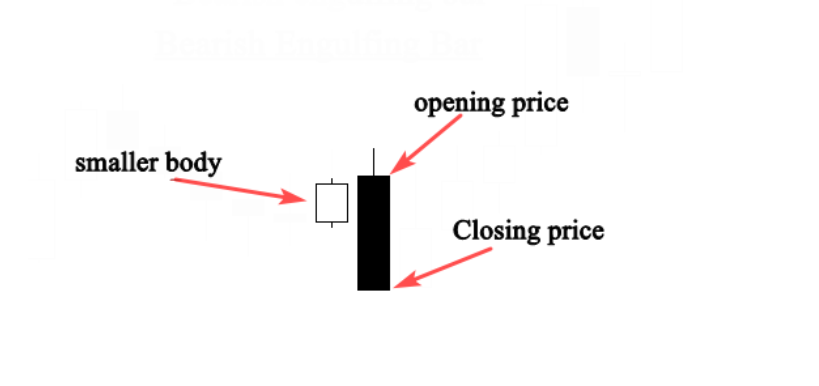

1)Engulfing bar: This is formed when a candle fully engulfs the candle formed before it. The engulfing bar can engulf more than one previous candle, but to be considered an engulfing bar, at least one candle must be fully engulfed.

The engulfing bar consists of two bodies. The first body is smaller than the second one, in other words, the second body engulfs the previous one. Here is an illustration below:

When this pattern occurs at the end of an uptrend, this indicates that buyers have overwhelmed sellers and a downtrend might start. The opposite applies when it is formed at the end of a downtrend.

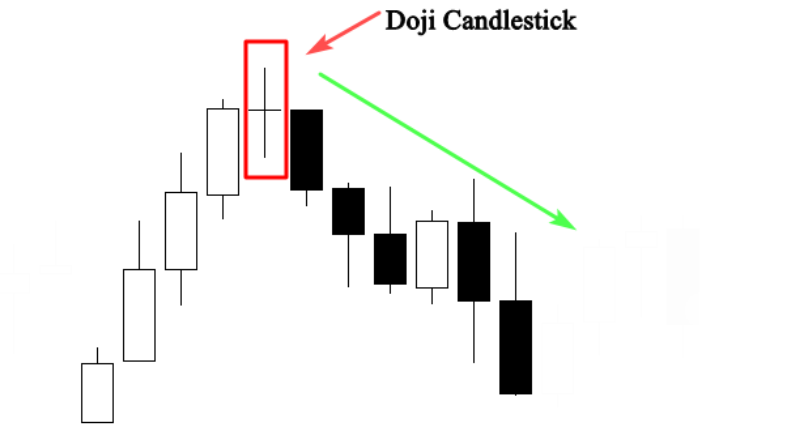

2)Doji: The Doji signifies equality in the market. It is formed when the market opens and closes at the same price. It shows that neither the buyers nor the sellers are in control of the market. This means there is indecision between buyers and sellers in terms of price direction

When the Doji is found at the bottom or at the top of a trend, it is considered as a sign that a prior trend is losing its strengths. The picture below is a good illustration.

As you can see, the price was going up till the Doji was formed. Once it is formed, price reversed and started going down.

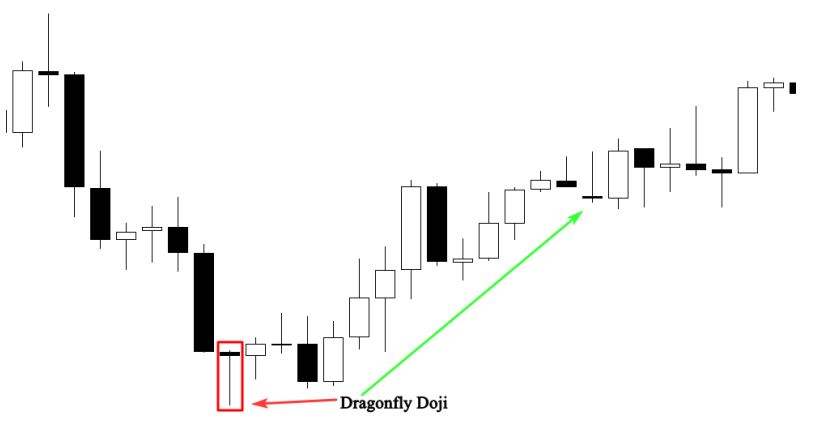

There are two variations to the standard Doji candlestick. They are the Dragonfly Doji and the Gravestone Doji. The Dragonfly Doji is a bullish pattern. You will see this candle on your chart when the opening an closing price are about the same price. It is characterized by a long lower tail that shows buyers attempt to push prices up.

In the chart below, you can see a Dragonfly Doji form as price was falling. This shows there was a price rejection leading to the Dragonfly Doji (the red box). After the candle, you can see that the price went up (the green arrow).

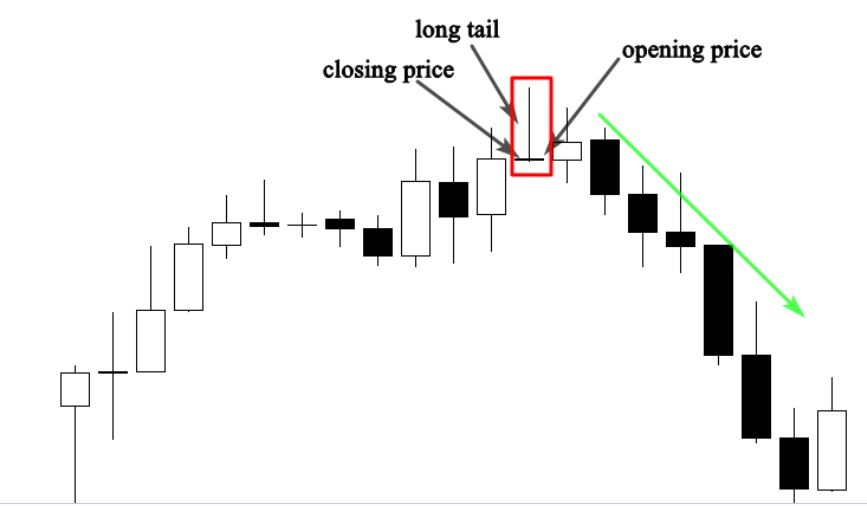

The Gravestone Doji is the opposite of the Dragonfly Doji. It is a bearish price formation. Opening and closing price are close as usual. The major difference is that the gravestone has a long upper tail that shows sellers attempting to push prices down.

Here is an illustration below. It shows the gravestone forming as price was going up (red box). The appearance of the gravestone in this condition is a sign that price will likely go down(green arrow).

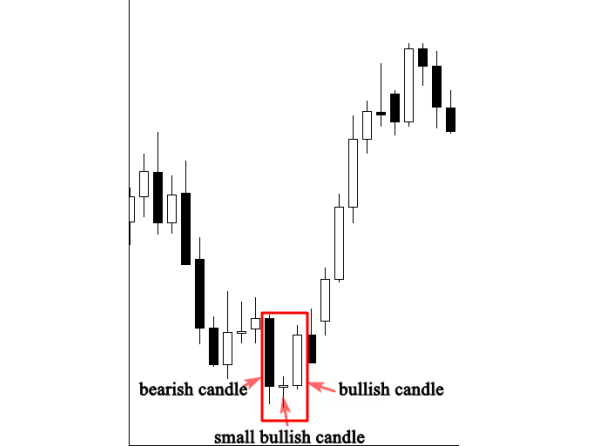

3)Morning star: The morning star: This pattern is considered a bullish reversal. This means it occurs at the bottom of a downtrend, indicating buyers (the bulls) are about to take over the market. The morning star pattern typically has three candles:

-the first candlestick is bearish showing that the bears (sellers) are overpowering buyers in the market.

-the second candle is small and can be bullish or bearish. It shows seller are in control but could not drive price lower. It points to a likely equilibrium of power between buyers and sellers.

-the third candle is a bullish candlestick and closes above the midpoint of the first candle.

When you see this pattern at the end of a downtrend near a strong support zone, it is a good signal that the market is about to reverse. Here is an illustration of the candlestick pattern below:

Whether forex trading is halal depends on the specific practices involved and how they align with Islamic financial principles. Here’s a breakdown:

Prohibited elements in forex trading:

1) Riba (interest): Traditional forex trading often involves rollover fees or interest charges on overnight positions, which are strictly prohibited in Islam.

2) Maysir (gambling): Excessive speculation and high leverage can be seen as gambling, also forbidden in Islam.

3) Gharar (excessive uncertainty): Trading on margin involves borrowing money with a guaranteed return to the broker, which could be considered as an unfair exchange.

Compatible practices for halal forex trading:

1) Swap-free accounts: These accounts avoid rollover fees by closing open positions at the end of each trading day, eliminating interest-based charges.

2) Fixed fees: Some brokers offer fixed fees for each trade, removing the element of uncertainty associated with variable spreads and commissions.

3) Profit-sharing: Profit-sharing agreements between traders and brokers can replace interest-based income with a Sharia-compliant revenue model.

4) Limited leverage: Reducing leverage minimizes the risk of excessive speculation and debt.

Popular options for halal forex trading:

1) Islamic forex accounts: Many online forex brokers offer specific accounts that comply with Sharia law, often incorporating swap-free trading, fixed fees, or profit-sharing structures. Such forex brokers include HF Markets, Octa, AvaTrade, and XM Trading among others.

Things to consider:

1)Not all forex brokers offer halal alternatives. Ensure the platform and account structure adhere to Sharia principles.

2)Fees and structures may vary. Compare different brokers to find one that offers competitive fees and a Sharia-compliant structure that aligns with your preferences.

A no deposit bonus is a promotional offer in which forex brokers give out a certain amount of money to new clients for signing up on their platform and verifying their accounts.

The amount of bonus varies from broker-to-broker, but it typically starts from $5 and can be up to $100. These bonuses are risk free as you can use it to trade real forex currency pairs on the live market without depositing any of your own money.

Not all forex brokers give no deposit bonuses, and even for those that give, it may not apply to all their account types.

Some of the forex brokers that give no deposit bonus for forex trading in Malaysia are HF Markets – $30, Tickmill – $30, Octa – $30, and FBS – $70.

How no deposit bonus in forex work:

1) Find a forex broker that offers no deposit bonuses, read reviews about them check out the terms and conditions for the bonus then select your preferred broker.

2) Create an account with the broker and verify it by submitting identity and address verification documents like government issued ID card and utility bill or bank statement.

3) Upon successful verification, your trading account will be credited with the deposit bonus.

4) You can trade financial instruments on the live market with the bonus received. There may be limits to how you can use the bonus for trading.

5) While you cannot withdraw no deposit bonuses, most brokers allow you to with any profits you made while using the bonus to trade. The withdrawal is usually conditional and you have to meet certain requirement in trade volume or other detail.

If you want to know more about no-deposit bonus, read our detailed review on No Deposit Bonus Forex Brokers In Malaysia

Forex trading is still unregulated in Malaysia. This means that the SCM (or Securities Commission of Malaysia) has not provided any rules or guidelines which forex brokers need to follow when they operate in Malaysia. Hence, even though Malaysian traders can legally trade through foreign forex brokers, they do so at their own risk since there is no legal protection.

There are several online forex brokers that offer their services to Malaysian traders. Some of these brokers include XM, OctaFX, and Pepperstone. To start trading forex in Malaysia, check out the various brokers and select your preferred broker, then create a live trading account, fund it and start trading.

Forex trading involves buying and selling currency pairs like EUR/USD, GBP/USD, EUR/GBP etc. A forex trader speculates on the prices of currencies. For example, if a trader thinks that the USD is going to be weaker in the next few weeks against the GBP, then that trader can buy GBP, that is the GBP/USD pair.

If the trader is right and the USD becomes weaker, the trader makes profits from the difference. Forex trading generally involves leverage, which is very risky as we explained in our guide.

Forex trading involves a lot of risk and inexperienced people can lose all their money. Beginners who are new traders are advised to first create a demo account and practice trading with virtual money before putting their real money.

It is also best and safest to trade with a broker that is well-regulated by Tier-1 and Tier-2 financial regulators, that offers negative balance protection, and requires little deposit. As a beginner, you should also not use high leverage as it will increase your risk and potential losses.

There are several good forex brokers that offer their services to Malaysian traders. You should do your own research before registering with a broker. Some of the factors that you need to consider are whether they have a dedicated Malaysian website and whether they offer convenient deposit and withdrawal options. A few of the best forex brokers for Malaysian traders are HF Markets, XM Trading, Pepperstone, AvaTrade, and OctaFX.