It’s not easy finding a forex broker that suits your needs. There are numerous fraudulent forex brokers out there, so a trader needs to be very careful. Further, forex brokers are not regulated in Malaysia, which means that traders need to find reputable foreign forex brokers that are properly regulated overseas.

Further, there are several factors that you need to consider before signing up with a broker. These factors include safety, overall fees, trading conditions, and customer support. It is challenging to find a good forex broker that offers fair Islamic accounts.

In this article, we’ll cover four of the best Islamic forex brokers that traders from Malaysia can trade through. We’ll also talk about Islamic forex brokers and how to open an account with one of them.

Comparison of Islamic Forex Brokers in Malaysia

| Broker | Regulation | EUR/USD Spread (pips) | Min. Deposit | Visit |

|---|---|---|---|---|

| HF Markets |

FSA SVG, FCA, DFSA, FSCA

|

1.4

|

MYR 50

|

Visit Broker |

| Octa |

FSA SVG, CySEC

|

0.9

|

MYR 100

|

Visit Broker |

| XM |

FSC, CySEC,ASIC & FCA

|

1.6

|

MYR 23

|

Visit Broker |

| AvaTrade |

CBI, PFSA, BVI, ASIC, CySec, FSRA, FSCA, and ISA

|

0.9

|

MYR 450

|

Visit Broker |

Best Islamic Forex Brokers in Malaysia

Here are our 4 Best Islamic Forex Brokers for traders in Malaysia that have good trading conditions based on our research & editorial review

- HF Markets – Best Broker Overall

- Octa – Best Customer Support

- XM – Wide Range of Trading Instruments

- AvaTrade – Best Trading Platforms

Here are four of the best brokers that you should consider before registering with a broker.

#1 HF Markets – Best Broker Overall

HF Markets has been operating since 2010 and caters to millions of traders around the world.

HF Markets offers six different types of accounts: For main accounts which are Premium, Zero, Pro and Cent Accounts. They also offer 2 investing accounts which are PAMM and HFCopy Accounts. Out of these account types, four can be converted into an Islamic account (With the exception of HFCopy and PAMM).

To convert an account into an Islamic Account, a trader must first open any of the account types listed above and then apply for an Islamic Account by contacting the customer support team in order to get it converted from a regular account to an Islamic account.

The spread is increased on Islamic Accounts, however, they do not charge any rollover interest or swap fees for the grace period of 7 days for selected instruments. If you keep a position open for more than 7 days, you will incur carry charges.

All the trading instruments that are available to other accounts are also available for Islamic traders. They offer market execution with maximum leverage of 1:2,000. You can also only use Islamic Account on MT4 and HFM WebTrader and App.

HF Markets offers customer support via email and live chat that is available 24/5.

#2 Octa – Best Customer Support

Octa was founded in 2011 and caters to more than 6.6 million trading accounts.

Octa received the “Best Islamic FX Account 2020” award from World Finance.

Octa offers swap-free trading on all accounts which means you automatically get an Islamic trading account when you signup on to Octa. They do not charge any commission for trading through an Islamic account.

All two of Octa’s account types (MT4 Account and MT5 Account) allow you to trade all the available instruments with maximum leverage of 1:500. Octa offers 24/7 customer support via live chat and email.

#3 XM – Wide Range of Trading Instruments

XM has been operating since 2009 and has grown into one of the most widely recognized brokers in the world.

XM offers Islamic accounts to all traders following the Muslim faith. Any of their trading accounts can be converted into Islamic accounts. Once you have registered a trading account, you can request for it to be converted into an Islamic account.

The key advantage of opening an Islamic account through XM is that they do not charge any other kind of fee to compensate for the swap-free nature of the account. They do not widen your spreads and they do not charge any other type of additional fee. They also do not charge any commission or any hidden fees.

The leverage can be up to 1:1,000. There is no time limit for how long an open position can be held. They offer dedicated customer support 24/7 that is available in various languages including Malay (available mostly during working hours).

#4 AvaTrade – Best Trading Platforms

EUR/USD Benchmark:

Trading Platforms:

Account Minimum:

AvaTrade was founded in 2006 and offers a wide range of trading platforms to choose from. The company is headquartered in Dublin, Ireland.

AvaTrade was founded in 2006 and offers a wide range of trading platforms to choose from. The company is headquartered in Dublin, Ireland.

AvaTrade offers a convenient way to turn your trading account into an Islamic trading account. You can fund a trading account, and then request to have the account converted into an Islamic account. The entire process usually takes up to 48 hours.

AvaTrade does not charge any rollover interest or swap fees through Islamic Accounts. However, they do charge an additional daily administration fee. This fee is intended to compensate the broker for not charging any swap fees.

Cryptocurrency trading is not available through Islamic accounts with AvaTrade. Further, certain currency pairs are also not available.

While trading forex, Islamic account holders may be subject to wider spreads in certain cases.

Maximum leverage on AvaTrade is 1:400 and the broker has email and live chat support 24/5.

What is an Islamic Forex Broker?

The forex markets are open 24 hours a day. Most forex traders only keep their positions open for a few hours before closing them and booking their profit or loss (they are known as day traders). However, sometimes it may become necessary to keep an open position held overnight. This means that you have bought or sold security, and then held that trade without closing it on the same day.

When an open position is held overnight, brokers charge an additional amount from the trader known as a swap fee or a rollover interest. This fee is in the form of an interest charged by the broker for the facility of holding an overnight position.

However, charging interest is forbidden under Sharia law or Islamic law. Muslim traders are forbidden by their faith to pay any form of interest.

To solve this issue, forex brokers have come up with the concept of “Islamic trading accounts”. An Islamic trading account is completely compliant with Shariah law and can only be opened by a person who is of the Muslim faith.

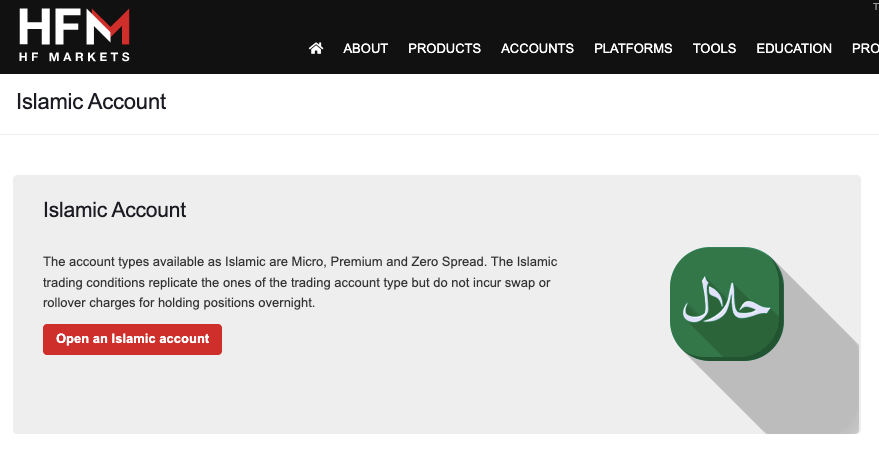

For example, as mentioned above, HF Markets offers Islamic accounts. Here is a screenshot of their Islamic accounts page.

Brokers do not charge any rollover fees or swap fees through an Islamic account. Instead, they may charge an additional fee in other forms to make compensation for not charging such interest. There are some brokers that do not charge any kind of additional fee.

Brokers that offer such Islamic accounts are known as Islamic forex brokers.

What is an Islmamic Trading Account?

An Islamic trading account, also known as a Sharia-compliant trading account, is a specialized account offered by some forex and CFD brokers that adheres to the principles of Islamic law which governs Islamic finance.

Traditional forex and CFD trading practices often involve rollover fees or interest charges on overnight positions that are considered Riba (usury) and are prohibited in Islam.

Islamic trading accounts offer alternative structures that comply with Sharia law, allowing Muslim traders to participate in financial markets while adhering to their religious beliefs.

Here are some key features of Islamic trading accounts:

1) No interest charges: Islamic accounts avoid interest-based charges like rollover fees or swaps on overnight positions. This is achieved through alternative fee structures, such as:

2) Fixed fees: A fixed fee is charged for each trade, regardless of the holding period.

3) Profit-sharing: Instead of interest, the platform or broker may share a portion of the profits generated from copied trades.

4) Mark-up fee: A small markup is added to the spread on trades to generate revenue.

5) Sharia-compliant instruments: Islamic accounts typically offer access to instruments that are deemed permissible under Sharia law, such as spot forex, certain commodities, and Sharia-compliant stocks and ETFs.

6) Transparency and fairness: Islamic accounts prioritize transparency in fees and charges and aim to provide fair trading conditions for all participants.

Things to consider:

1) Not all forex and CFD brokers offer Islamic accounts. Be sure to check with the broker before opening an account.

2) Fees and structures may vary. Compare different platforms to find one that offers competitive fees and a Sharia-compliant structure that aligns with your preferences.

3) Copy trading involves risk. Past performance is not indicative of future results, and even successful traders can experience losses.

How to Open Islamic Trading Account with Forex Broker?

The first step before opening such an account is that you must check that the broker offers Islamic trading accounts. If a broker offers such an account, then it will be prominently displayed on their website.

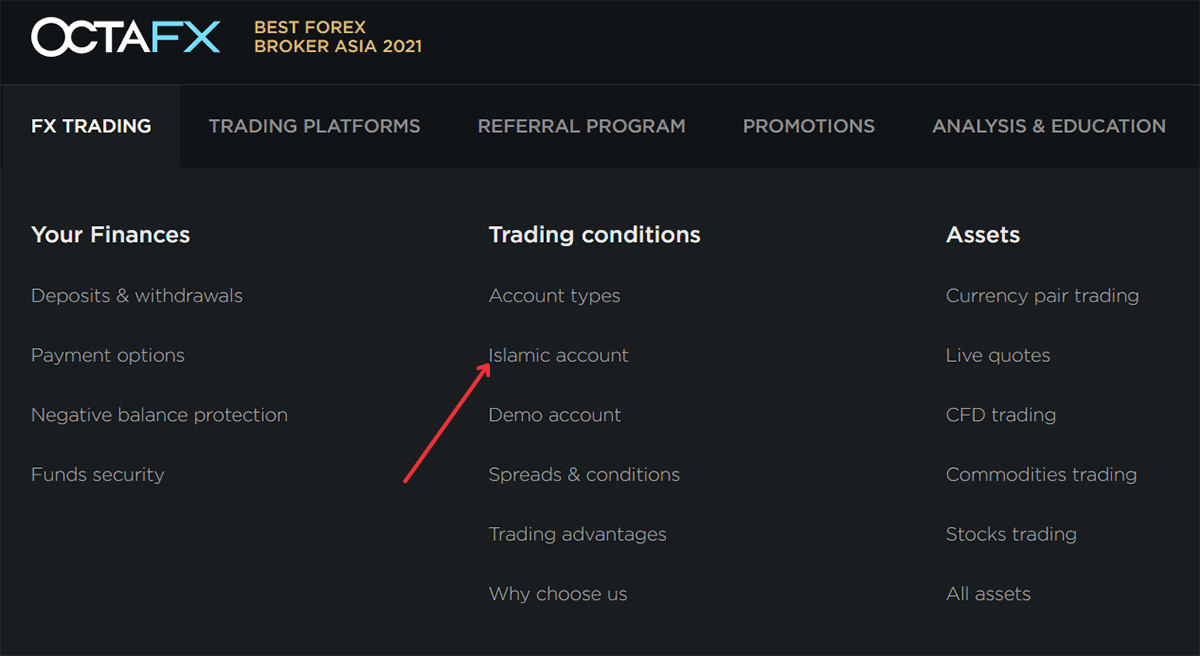

For example, let us look at Octa. We can see that Octa offers Islamic accounts through one of the options available on their home page.

The process of opening an Islamic account through any broker is quite simple. Usually, the process is the same, so we’ll be taking the example of Octa to take you through it.

Once you’ve ascertained that a broker offers Islamic accounts, you must first open a regular account with them.

You will be asked to provide some basic personal information about yourself. You will also need to submit certain documents. Essentially, they will ask you about your residential information, contact information, financial information, and identification information. Fill in the forms and then you’re good to go.

It may take around 24 hours for an executive to view your application and open your account.

Once you’ve signed up for a regular account, you can apply to the broker to convert it into an Islamic account. You will be asked to submit documentation that proves that you follow the Islamic faith.

Note that all Octa accounts are automatically swap-free (Islamic Accounts) and you do not need any other application.

Lastly, they will take between one and two days to review your application. If everything is in order, your account will be converted into an Islamic Account status. You can then proceed to fund your account and start trading.

It is important for you to note that trading forex involves risk and you can lose all your money, only engage in forex trading if you understand it and have experience.

Is there Islamic forex trading?

Yes, there is Islamic forex trading, also known as halal forex trading. It allows Muslims to participate in the forex market while adhering to Islamic principles set forth in Sharia law. Here is a breakdown of what it entails.

Why might forex trading be considered not halal?

Traditional forex trading often involves earning or paying interest (riba), which is prohibited in Islam.

How does Islamic forex trading work?

Some brokers offer Islamic accounts that eliminate riba. This is achieved through a concept called “spot contracts.” Essentially, you are buying and selling currencies or other financial instruments for immediate ownership, not borrowing or lending them. There are two main ways Islamic forex accounts make this happen:

1) Eliminating swap fees (rollover cost): In traditional forex trading, trade positions that are held overnight incur swap fees (overnight funding cost), which can be seen as a form of interest. Islamic accounts eliminate these fees. They may charge a small administration charge instead, usually proportional to the size of your trade.

2) Short-term trades: Islamic forex trading encourages short-term trades to avoid overnight positions and eliminate the need for swap fees. You can practice this with some forex brokers that do not have Islamic Account options.

Important note: While Islamic forex accounts address riba, forex trading still carries inherent risks. It’s important to be aware of these risks and conduct your own research before trading.

What types of trades are not allowed in Islamic accounts?

Islamic accounts follow the Sharia law, which disallows certain financial transactions. Here’s a breakdown of trades typically not allowed in Islamic accounts:

1) Interest-based transactions (riba): This is the primary issue of sharia law with forex trading. Any instrument or transactions involving interest payments is strictly prohibited under sharia law. This includes:

a) Swaps: Overnight charges that are incurred on leveraged positions for keeping it open past the market closing time. Since they essentially represent interest on borrowed funds to hold a position, they are not allowed on Islamic Accounts.

b)Forward contracts: These contracts can involve built-in interest charges depending on the structure and the broker offering it.

c) Any instruments with embedded interest: This includes certain exotic currency pairs/options or complex derivatives that indirectly involve interest. They are are not allowed when trading with Islamic Accounts, its why forex brokers do not offer exotic pairs to Islamic Account holders.

2) Margin trading: Leverage is a major feature of traditional forex CFDs trading that is offered by all brokers, but this is not permissible in Sharia Law and by extension not used in Islamic accounts. Leverage involves borrowing funds from the broker to increase your trading capital and size of trade. Because borrowing normally involves interest, it’s disallowed in accordance with Sharia principles.

3) Companies with Questionable Business Practice: Sharia compliance does not permit investment in companies whose business activities are forbidden (haram). Examples of such companies include alcohol beverage companies, tobacco companies, gambling/betting companies, pork-related products, etc.

To spot these type of companies, you can use halal screening if your broker has such a tool.

If your brokers does not have the tool, it is possible they offer it through partnership with a third-party. Ensure you speak with your broker for more clarity on this.

To make Islamic Accounts comply with Sharia principles, forex brokers offer the following options which are the basis for Islamic Accounts:

1) Spot forex trading: This has to do with buying and selling currencies pairs for immediate delivery, without any overnight/swap charges.

2) Profit/loss sharing agreements: This is basically a financing structure where the forex broker and forex trader share profits and losses on any trade according to an agreed ratio. No interests are charged or paid, but profits or losses are shared based on the performance of the trades.

How To Choose The Best Islamic Forex Brokers:

When selecting a Forex broker, there are some essential factors you should look out for to ensure your trading is safe, reliable, and profitable. Based on our experience, here are some key things to look out for:

Broker’s Regulation: To ensure safe trading, you should always ensure the broker is regulated. You can find out if a broker is regulated by going to the footer of their website, it is usually indicated there.

It is best to pick a broker that is regulated by at least one Tier-1 financial regulator such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investment Commission (ASIC).

Having Tier-1 regulation indicates the broker has taken steps to act in the best interest of traders since those regulators will mandate them to abide by some strict rules.

Swap-free rate: Although Islamic accounts are swap-free and do not charge overnight funding or rollover fees, in our review of several brokers, we noticed that some brokers offer a higher rate of free swap.

Usually, with swap-free Islamic Accounts, you get a swap-free grace period before they charge administrative fees. Some brokers offer 3 days grace period while some offer up to 7 days.

You should check this out before creating an account to be sure that you won’t be overpaying on trades. You can confirm this by the information on their website or reach out to their customer support.

Extra Fees: Islamic Accounts are sometimes charged a fixed administrative fee in place of swap fees. Other times the spread on Islamic Accounts is higher to make up for the income the broker is not making int swap fees.

You should check this out to know if there are any additional fees that the broker charges on Islamic Accounts to be sure you are comfortable with them before creating an account.

FAQs on Islamic Forex Brokers in Malaysia

Does Islam Allow Forex?

Yes, trading forex is allowed under Sharia law. However, you can only trade through an Islamic account. A lot of brokers offer Islamic Accounts for Islamic traders, and four of them are mentioned in this article. The difference between a regular account and an Islamic Account is that the broker does not charge any interest (for holding an open position overnight) under Islamic Accounts.

Which broker is halal?

Any broker that offers Islamic accounts and does not charge swap fees is halal. You will need to ensure that you’re trading through an Islamic trading account for your activity to be considered halal. You can do so by registering for an Islamic trading account with a reputable broker. Some of the brokers that offer Islamic Accounts in Malaysia are HF Markets, Octa, XM Trading, and AvaTrade.

Is Forex haram or halal Malaysia?

Traditional forex trading practices that charge swap fees, which is considered riba (interest) is haram in Islam. However, some forex brokers offer Islamic Account options that allow you to trade without paying any interest (swap fees), trading forex with such brokers is halal.

Which platform is halal for trading?

Octa, HF Markets, XM Trading and AvaTrade are forex trading platforms that are considered halal because they offer Islamic Accounts that do not charge swap fees (interest/riba) on trades.

Is OctaFX an Islamic broker?

Yes, Octa allows Islamic traders to open Islamic trading accounts. Octa trading accounts does not charge any rollover interest (swap-fees) which means that it is safe for Islamic traders to use.

Does Octafx have Islamic account?

Yes, Octa allows Islamic traders to open Islamic trading accounts. An Islamic trading account does not charge any rollover interest which means that it is safe for Islamic traders to use them. You can find out more about Octa in this article above.