MetaTrader 4 (MT4) was and is loved by several traders across the globe, and today MetaTrader 5 (MT5) has taken the place of MT4 because many traders prefer it.

MT5 is a web-based trading platform used for trading stocks, futures, indices, forex, etc. It can be used on desktops and mobile phones too. One of the outstanding features of MT5 that makes it dear to the heart of traders is the use of trading robots.

These robots are known as Expert Advisors (EA). They can execute traders and monitor market activity without the trader’s attention. MT5 has other features which we have discussed in this article. However, we have streamlined this article to the best MT5 Broker in Canada.

Comparison of Best MetaTrader 5 Brokers

| Broker | IIROC Regulation | MT5 | Range of CFDs | Visit |

|---|---|---|---|---|

| AvaTrade |

Yes

|

Yes

|

Forex, Commodities, Indices, Stock, Options

|

Visit Broker |

| Admiral Markets |

Yes

|

Yes

|

Forex, Commodities, Indices, Stock, Cryptocurrencies, ETFs

|

Visit Broker |

| FP Markets |

No

|

Yes

|

Forex, Commodities, Indices, Stock, Cryptocurrencies, Bonds, ETFs

|

Visit Broker |

Warning: Trading CFDs is risky and can result in the loss of your capital. Always trade with caution.

Best MT5 Forex Brokers in Canada

Here is the list of best MT5 forex brokers in Canada as per our research:

- AvaTrade – MT5 Broker Regulated in Canada

- Admiral Markets – MT5 Broker with Multiple Accounts

- FP Markets – ECN Broker with MT5

#1 AvaTrade – MT5 Broker Regulated in Canada

AvaTrade is regulated by the IIROC via Friedberg Direct, which is a division of Friedberg Mercantile limited. This means your funds are protected under the Canadian Investor Protection Fund. We consider them low-risk for traders based in Canada.

Avatrade has only one account. With CAD $100, you can open your trading account. AvaTrade does not charge extra commissions so fees are low overall. Here is why we chose AvaTrade as one of Canada’s best MT5 brokers:

First, it is user friendly and available on Web, iOS, Android, and Window. You can use it on multiple devices. MetaTrader 5 on Avatrade offers its users access to: technical tools, copy trading, scripts, customer indicator, auto trading tools, timeframes, libraries, access to micro lots, news streaming, EA functionality, to mention but a few.

With their multi-threaded strategy tester, you can test your stategies to determine their success rates. Scripts help you carry out funtions faster. For example, you can use a script to program a function to insert or remove indicators. If you are into automated trading, EAs are available on AvaTrade’s MT5 so you can use trading bots.

All of these and many kore usefultools come with the trading platform. Finally, deposits and withdrawals are convienient via debit/credit cards and local bank transfer.

Read our in-depth review of AvaTrade for more on this broker.

AvaTrade Pros

- Good research tools

- Free deposit and withdrawal methods

- User friendly interface

- It is easy to open an avatrade account

- IIROC Regulation

AvaTrade Cons

- No multiple accounts

- Inactivity fee

#2 Admiral Markets – MT5 Broker with Multiple Accounts

Admiral Markets is a multiple account CFD broker with low risk. They are regulated by the IIROC a Admiral Markets Canada Limited. They also hold top-tier licenses with the FCA and ASIC so you can consider them low-risk.

Admiral Markets offer three accounts if you are using their MetaTrader 5 – Trade.MT5, Zero.MT5, Invest.MT5. None of these accounts have CAD as the base currency.

Not all CFDs are available on these accounts. All CFDs are available on Zero.MT5 Account only. They include: Currencies (40), Metal CFDs (5), Energy CFDs (3), Agriculture CFDs (7) Index Futures CFD (24), Commodity Futures (11) Cash Index CFDs (19), Stock CFDs (over 3350), ETF CFDs (over 300), and Bonds CFDs (2)

There is no commission for forex except for the Zero.MT5 account. This commission depends on your trading volume. The more you trade, the more you pay. It ranges from $1.0 to $3.0.

Hedging is available on all accounts except Invest.MT5. Also, there is the MetaTrader Supreme Edition add-on. It contains trade alerts, an economic calendar, and a market analysis tool.

Admiral markets MT5 is available on Windows, Mac, Android, and iOS.

Admiral Markets Pros

- Multiple accounts

- Low minimum deposit on Invest.MT5 account ($1)

- Low commission

- There is an add-on with helpful tools

- Good education

Admiral Markets Cons

- All accounts do not have all CFDs

- No CAD base account

#3 FP Markets– ECN Broker with MT5

FP markets is an Australian forex broker. They are not regulated in Canada so there is high risk trading with them. However, they accept traders from Canada except for Ontario and British Columbia regions. In addition, Fp Markets register Canadian traders under an offshore regulator which makes trading with them more risky.

FP Markets just two accounts – Raw and Standard. The two accounts are available on FP Markets MT5.

With CAD $100, you can trade forex, shares, metals, commodities, indices, and bonds. FP Markets offer more than 10,000 shares CFDs. However, only 1000+ are available on their MT5.

The trading fees include $3.00 round turn commission for forex trading with high swaps. For example, the overnight charges for USD/CAD are -2.89 (long position) and -3.77 (short position). This is for their Raw Account only.

You can use the platform as WebTrader and on multiple devices (Mac, iOS, Android, and Windows). Hedging, scalping, and automated trading are supported as well. Also, execution is fast with FP Market’s ECN pricing model.

Finally, there are multiple funding and withdrawal methods like debit/credit cards, Skrill, Neteller, etc.

FP Markets Pros

- Tier-1 regulation with ASIC

- Multiple funding methods

- ECN pricng model

- Hedging and Scalping is allowed

- Automated trading is supported

FP Markets Cons

- No extra add-ins

- No IIROC regulation

- Canada traders are registered under an offshore regulator

What is MetaTrader 5?

MT5 is the latest version of MetaQuotes popular trading software. It was released in 2010. MT5 allows forex traders access to the forex market through brokerage firms. An advantage it has over MT4 is that stock CFDs and futures are available on it.

Because of this, brokers are able to take on more traders, especially those that prefer to trade shares CFDs. This is why most brokers now support both MT4 and MT5. Some even replace MT4 with MT5 completely.

MQL5 is MT5’s script language. It is more advanced and efficient than MT4’s MQL4. In addition, the MT5 has more advanced charting tools, more technical indicators, and more timeframes (12). It also has an in-built economic calendar so you can track events that impact the market without an external website.

Finally, MT5 has an embedded chat system that is linked to MQL5.com. The chat system is a community of traders that can be of real benefit.

Whhat are MT5’s Best Features?

MT5 is an improvement on MT4. It is much better that some forex brokers only support MT5, ditching MT4. The same applies to traders as well. So why are traders and brokers moving towards MT5? What is the reason for this shift? Here are some answers we were able to gather.

Trading tools: MetaTrader 5 comes with analytical tools that improve your trading. You can view historic price movement on 21 different timeframes. On these timeframes, you can use more than 80 technical indicators and graphic objects to analyze the market.

If you prefer, you can build custom-made indicators c=via MT5’s Freelance Service. Here, you get programmers that can help you make these indicators.

Algorithm trading: Algo trading is an essential feature of MT5. With the improved MetaQuotes Language 5 (MQL5), you can use Expert Advisors (EAs) with programmed instructions to execute your trades. This is possible because of the optimal development provided by MT5.

In addition, there is a development assistant that can be helpful for inexperienced traders. The assistant allows you to put together simple trading robots. Skilled software developers can also take advantage of the C++ pregaming language on MQL5. They can use it to build advanced Expert Advisors and trading robots.

Advanced traders can use complex mathematical computations to get a more precise analysis. If you want to shorten your learning time, you can use the robot copy on MT5. The only downside is that it is not free.

Economic calendar: As a trader, it is crucial that you are able to monitor key economic and industrial indicators. These indicators can affect the direction and the volatility of different CFDs. With MT5’s economic calendar, you have access to different open sources for these indicators.

Important data connected to these indicators are sent directly to your MT5. You can then proceed to analyze them and make trading decisions.

Copy trading: If you do not have the time to manually analyze the market, you can subscribe to MT5’s copy trading service. After subscription, MT5 will replicate another person’s trade on your account. However, you will carry the responsibility of selecting the level of risks you want to take. Once you set this, the platform will automatically create buy and sell orders on your trading account.

A quick one; this service is not free so make sure you have enough money in your account for subscription fees.

Strategy tester: You can use MetaQuotes’ MQL5 to build trading software. However, it is risky to run the software on your live account without any test.

This is where MT5’s strategy tester comes in. You can use it to optimize any software built with MQL5. In addition, you can use it to also test any expert advisor from the MT5 community before you purchase it.

How to Choose the Best MetaTrader 5 Broker

There are important criteria you need to consider before signing up with an MT5 broker. A forex broker may support the platform with conditons that are not suitable for you. We have compiled these factors for you. They can be used as your checklist.

1. IIROC Regulation: This factor is crucial because of the safety of your funds. Brokers that operate in Canada are regulated with the IIROC. However, some brokers are regulated indirectly. These brokers operate in Canada via a division of Friedberg Mercantile Limited called Friedberg Direct. They have the same license as other IIROC regulated brokers.

In addition, some brokers are able to accept traders from Canada without IIROC regulation, For these kind of brokers, you want to check of they hold a tier-1 license with bodies such as the Financial Conduct Authority (FCA) or Australian Securities and Investments Commission (ASIC). With these regulations, your fund is at low risk of fraud.

By all means, avoid brokers that register Canadian traders under offshore regulators. If it is not AISC or the FCA, you might fall victim of fraudulent activites. With all of these complexitieis, it is crucial you speak with your broker’s customer support to know how their regulation in Canada works.

2.Range of CFDs: Currency pairs are the most popular CFDs. However, your MetaTrader 5 broker should offer beyond them. Indices, commodities, shares, and precious metals are all important too. The number of these CFDs should not be too limited so you can have a variety of choices to trade.

You should pay attention to account types as well. With Admiral Markets, for example, though all accounts are on MT5, all CFDs are not on all accounts

3. Trading Fees: MT5 brokers do not structure their fees the same way. For trading fees, all brokers charge spreads and swaps. It is only with commissions that they vary. Some brokers with ECN Accounts charge low spreads with an extra commission. On Standard Accounts, the spreads are usually high with no commission.

This why it is to crucial to not only choose MT5, but also the right account with a low fee structure.

4. Slippage: This is when your orders are not filled at your desired price and the solution is speedy execution. Though most brokers say they have fast execution, you should check their pricing model to verify. ECN pricing and non-dealing desk model enable quick execution. Dealing desk brokers execute trades manually which usually lead to slippage.

5. Hedging: Your MetaTrader 5 broker should enable hedging. Hedging is a popular risk management strategy with retail and professional traders. If your chosen broker allows hedging on their MetaTrader 5, it will be stated clearly under the platform details.

6. Demo Account: Demo accounts are practice account. Most brokers offer them to traders. However, when it comes to platform-based reviews, you cannot assume anything. What are we saying here? It is that a broker might offer a demo account but not make it available on MT5.

This could be for a number of reasons. Because when it comes to this part of trading, brokers do have an autonomy on how they choose to operate. A broker can independently decide to not have a MT5 demo account. Without an MT5 demo account, you cannot practice, test new features and indicators, etc.

So when you are choosing an MT5 broker, verify if they support a demo account on their MT5.

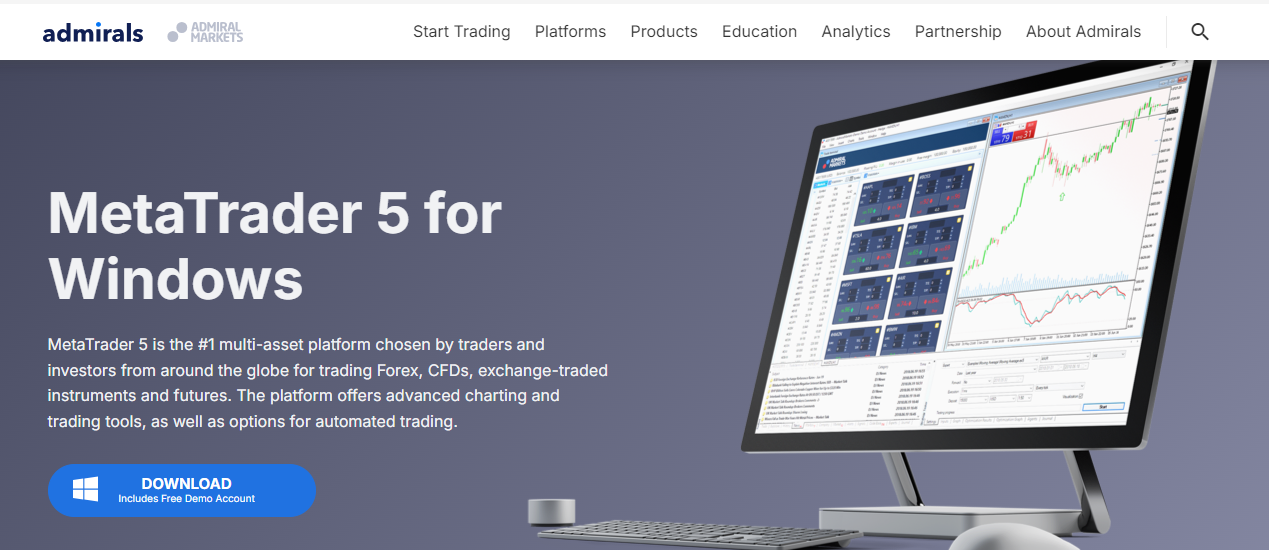

The image above is from Admiral Markets MT5 page. Can you see that it comes with a free demo account?

Some key MT5 features

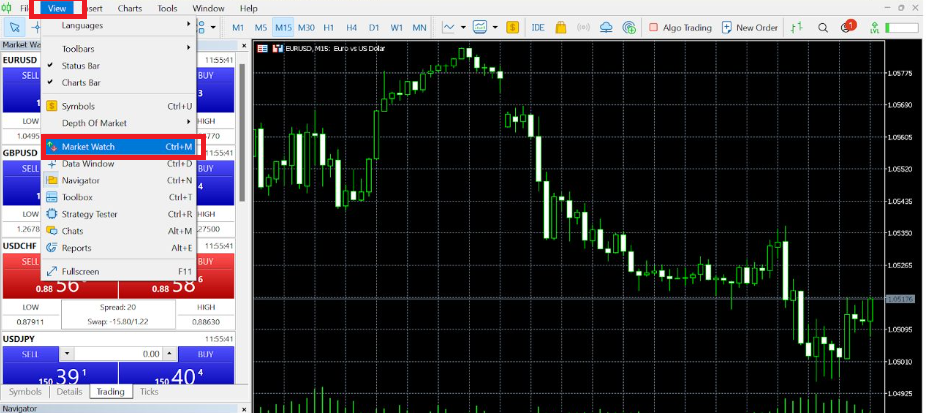

Market watch: This is where you gain access to all CFD instruments. Forex pairs, stock, indices, all of it. It displays real time quotes (bid/ask price) and gives you quick access to charts. You can also find the order window quickly through the market watch.

If you double click an instrument on the market watch, it shows you a real time tick chart of its price movement. You can also customize the market watch to display only the CFDs you want. You can add and remove CFDs from the list as you please.

To open the market watch window, click ‘View’ on your MT5. A tab will show up as displayed below

Click ‘Market’ Watch on the tab. Here is what you should see.

Navigator: The MT5 navigator is like a control center. It gives you access to different personal settings and customization. From the navigator, you can manage your accounts. You can switch between demo account and live accounts.

It is also from the navigator you get access to built in indicators like the relative strength index, stochastics, fractals, moving averages, Bollinger bands, and other indicators. Finally, is through the navigator that you run your Expert Advisors (RAs) and trading scripts.

Can I use MetaTrader 5 without a broker?

No, you cannot use MT5 without a forex broker. You need a live account provided by a reputable broker to trade with real funds. You can try MT5’s default demo account from MetaQuotes but it is limited. You will not be able to trade with real money or get live price updates from the market.

If you connect your demo account to a broker, this will not be the case. You will have a simulation of real trading conditions with real price updates. Can you see that using a broker has its own advantages?

So when choosing a broker, you should carry out a little research to know more about the broker. Their price structure, account type, and range of CFDs. Here is our extensive review of Canada’s best brokers. It will help you when making your choice.

Is MT5 good for beginners?

MT5 has more advanced functionalities than MT4. MT5 has more order types, timeframes, 44 graphical objects, and a better strategy tester.

Though these differences are significant, they do not matter hugely to a beginner. In fact, it is easy to miss these differences if you are a fresh trader.

Therefore, your priority as a trader is to consume a lot of educational content. Get familiar with trading, trading platforms, and trading terminologies.

Your understanding and use of MT5 will increase as you improve your knowledge.

Does MT5 have automated trading?

Yes, MT5 supports automated trading. You can use automated trading on MT5 through copy trading available on the platform. Also, you can utilize expert advisors (EA) to create your own automated trading system.

How does MetaTrader make money?

You do not have to pay any money to download MetaTrader 5. MetaQuotes developed MT5 and they make money by licensing it to forex brokers. This allows forex brokers to offer MT5 to their clients. This license also allows forex brokers to connect their server to MT5.

Only forex brokers pay a fee. You do not have to pay any fee to use MT5.

FAQs on Best MetaTrader 5 Brokers

Can You Use MT5 In Canada??

Yes, you can use MT5 in Canada. Forex brokers like AvaTrade, Admiral Markets, and FP Markets offer MT5 trading platforms.

Can I use MetaTrader 5 without a broker?

No, you cannot use MT5 without a broker. However, before choosing a broker, you may want to diligently research about them.

Is forex allowed in Canada?

Forex trading is legal in Canada. Only make sure you trade with IIROC regulated brokers or brokers with top-tier regulations (FCA and ASIC)