CFD (Contract for difference) trading is betting on the price movements of financial instruments. You can take a position that the price will fall or rise, if your prediction happens, then you make a profit from the difference, if not, you suffer a loss. CFD brokers offer platforms for CFDs trading.

With CFDs, you trade financial instruments without owning them. You are betting on the assets using leverage—borrowing money from the broker to place your trade/bet.

Leverage allows you to make more trades with less deposit than you have available. This increases your chances of making profits as well as losses.

Over 60% of traders lose money trading CFDs, so it’s advisable that you have adequate knowledge/experience before trading and apply caution.

Choosing the right broker is one of the crucial factors in your trading success. This post will help you understand which brokers are best for trading in Singapore by assessing their regulatory status and safety, fees, customer support, trading platforms and available instruments.

Comparison of Best CFD Brokers Singapore

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| City Index |

MAS, FCA |

1:20

|

SGD 250

|

Visit Broker |

| Plus500 |

MAS, CySEC |

1:20

|

SGD 200

|

Visit Broker |

| CMC Markets |

MAS, ASIC |

1:20

|

No minimum deposit

|

Visit Broker |

| Oanda |

MAS, FCA |

1:20

|

No minimum deposit

|

Visit Broker |

| IG Markets |

MAS, ASIC |

1:20

|

SGD 450

|

Visit Broker |

Best CFD Brokers in Singapore

The following is a list of the best CFD brokers for traders based in Singapore, according to our research.

- City Index – CFD broker with low trading fees

- Plus500 – Best CFD Broker with commission-free trading

- CMC Markets – CFD broker with free deposit and withdrawal

- Oanda – Good CFD Broker with fast funding methods

- IG Markets – Reputed CFD Broker with best trading platform

Let’s take a closer look at the best CFD brokers and summary of their regulations, fees, customer support, deposit and withdrawal options and other features.

#1 City Index – Best CFD broker with low trading fees

City Index was founded in 1983 and is licensed in Singapore. The broker offers commission-free trading on all instruments except shares.

Regulation: City Index is regulated in Singapore as StoneX Financial Pte. Ltd and licensed to offer Capital Markets Services. The broker is also authorised by other Top-Tier financial regulators in the UK, Australia, and Europe.

Minimum deposit: The minimum deposit on City Index is SGD 150 for bank transfers. Although cards deposits on City Index require a minimum amount of SGD 250

Spread for major pairs: Spreads start from 0.7 pips on City Index depending on the instrument you are trading. Spreads for major pairs on the City Index Standard Account start from 0.7 pips for EURUSD and 1.1 pips for EURGBP.

Trading Fees: Trading fees charged by City Index are spreads and swap fees for keeping a trade open past the market’s closing time, starting from 2.5% plus or minus SONIA (Sterling Overnight Index Average). City Index does not charge commission fees for opening and closing trades on all instruments except shares (equities). Commissions start from 0.08% for Singapore shares and 1.5 cents for US shares.

Non-Trading Fees: City Index charges no deposit fee, although the card processor will charge a 2% fee per transaction, bank deposit and other payment methods have no fees. While City Index does not charge withdrawal fees, the broker charges an inactive account fee of $15 (SGD 21) per month if you do not place a trade for 24 months.

Range of market: You can trade over 6,000 financial instruments on City Index Singapore including CFDs on 84 forex currencies pairs, 6,000+ shares, 17 indices, 10 commodities, and 2 metals (gold and silver).

Leverage for forex: The Maximum leverage on City Index for Retail Clients is 1:20 (5% margin) while Accredited Investors (Professional Clients) have a maximum leverage of 1:50 (2% margin). Note that this maximum applies to major forex pairs, other instruments have lower leverage limits.

Deposit: City Index allows deposits via credit/debit cards and bank wire transfers. Card deposits on City Index are credited instantly or within a few hours while it may take 2-3 days for deposits via wire transfers to be credited to your trading account. The minimum deposit on City Index is S$250.

Withdrawal: City Index allows deposits and withdrawals via credit/debit cards and bank wire transfers and requires a minimum withdrawal amount of $150. While all withdrawal requests are processed within 3 working days by the broker, it may take 3 business days for you to receive funds withdrawn to bank accounts and up to 10 working days for withdrawals to cards.

Customer Support: City Index offers 24/5 support via live chat, phone, and email.

Trading Platform: Trading platforms supported by City Index are MT4, City Index Webtrader, and City Index Mobile App available on both iOS and Android devices.

#2 Plus500 – Best CFD Broker with commission-free trading

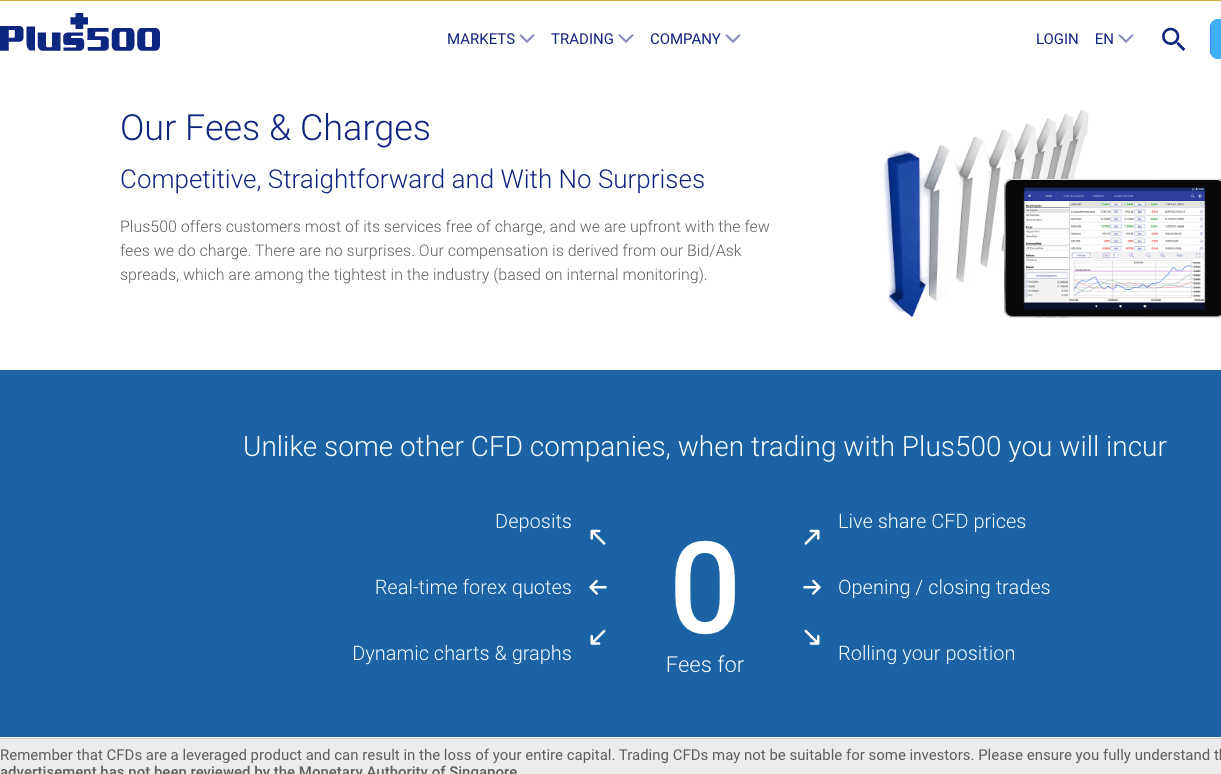

Plus500 was established in 2008 and is listed on the London Stock Exchange. The broker offers commission-free trading for all instruments and free deposits and withdrawals.

Regulation: Plus500 is regulated in Singapore as Plus500SG Pte Ltd and licensed to offer Capital Markets Services. Plus500 is also authorised by other Top-Tier financial regulators in the UK, South Africa, Australia, and Europe.

Minimum deposit: The minimum deposit on Plus500 is SGD 200 for cards and e-wallets (ApplePay and PayPal) while bank transfers and PayNow require a minimum of SGD 500.

Spread for major pairs: Spreads start from 0.6 pips on Plus500 depending on the instrument you are trading. Spreads for major pairs on the Plus500 start from 1.2 pips for EURUSD and 1.5 pips for EURGBP.

Trading Fees: Trading fees charged by Plus500 are spreads and swap fees for keeping a trade open past the market’s closing time. Although Plus500 does not charge commission fees for opening and closing trades on all instruments, the broker charges currency conversion fees for trading an instrument denominated in a currency order than your base account currency.

Non-Trading Fees: Plus500 does not charge any deposit fee for adding funds to your account or withdrawal fee for withdrawing money from your account, although the broker charges a monthly inactive account fee of US$10 (SGD 14) my month if you do not log into your trading account for 3 months.

Range of market: Tradable financial instruments on Plus500 Singapore are CFDs on 66 forex currency pairs, 1,655 shares, 27 indices, 22 commodities, 19 cryptocurrencies, 356 options, and 96 ETFs.

Leverage for forex: The Maximum leverage on Plus500 is 1:20 for major forex pairs, other instruments have lower leverage limits. This leverage is for retail clients as Plus500 does not offer professional accounts or accredited investor accounts to clients in Singapore.

Deposit: Plus500 allows deposits via cards (credit/debit), e-wallets (PayPal, PayNow) and bank wire transfers. Cards and e-wallets deposits are credited instantly while it may take 5 business days for deposits via wire transfers to be credited to your trading account. Plus500 requires a minimum deposit of SGD 200 for cards and e-wallets while bank transfers reauire a minimum of SGD 500.

Withdrawal: Withdrawal methods on Plus500 are cards and bank transfers which require a minimum of SGD 100 for cards and bank transfers, while e-wallets have a minimum withdrawal amount of SGD 70. All withdrawal requests are normally processed by Plus500 within 1-3 business days before being sent out, however, it may take a few additional days to receive funds depending on the payment method you are using.

Customer Support: Plus500 has 24/7 support via live chat, phone call, WhatsApp and email.

Trading Platform: Plus500 Trader is a proprietary trading application of Plus500 and is available for PC, Mac, Web, Android, & iOS.

#3 CMC Markets – Best CFD broker with no minimum deposit

CMC Markets was established in 1989 and is listed on the London Stock Exchange. The broker offers commission-free trading on most instruments.

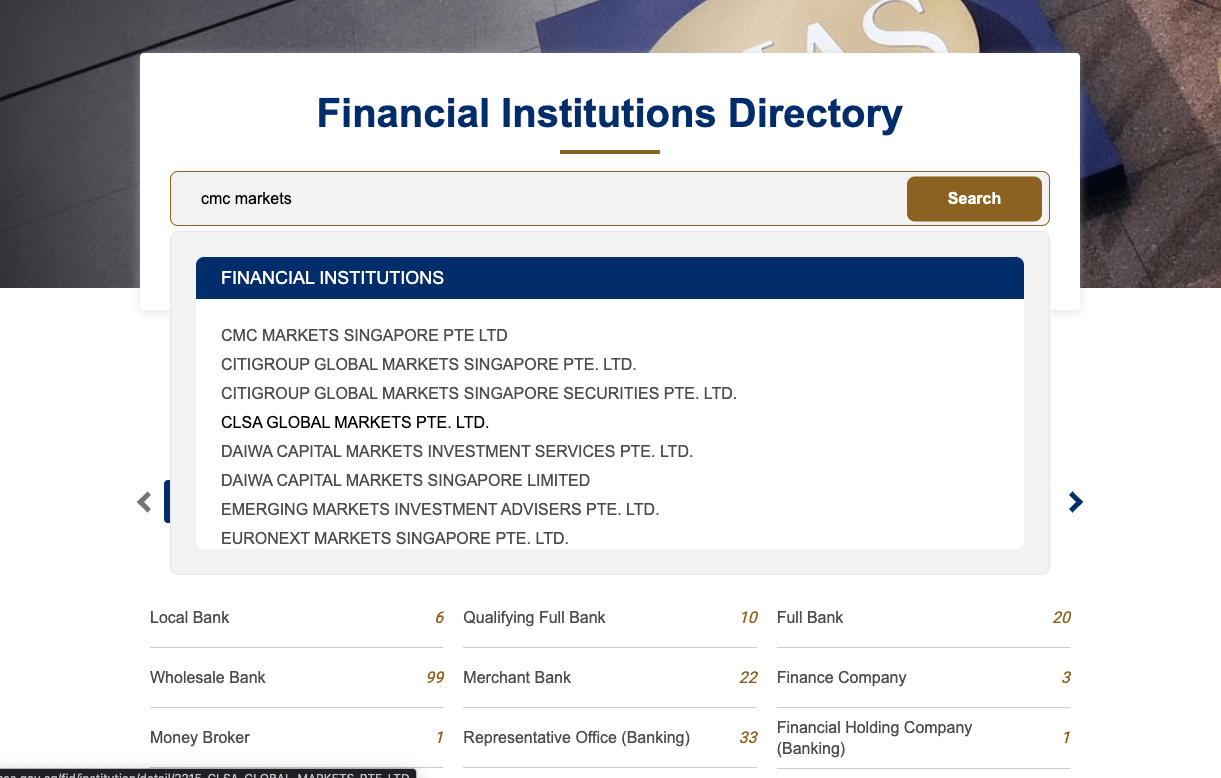

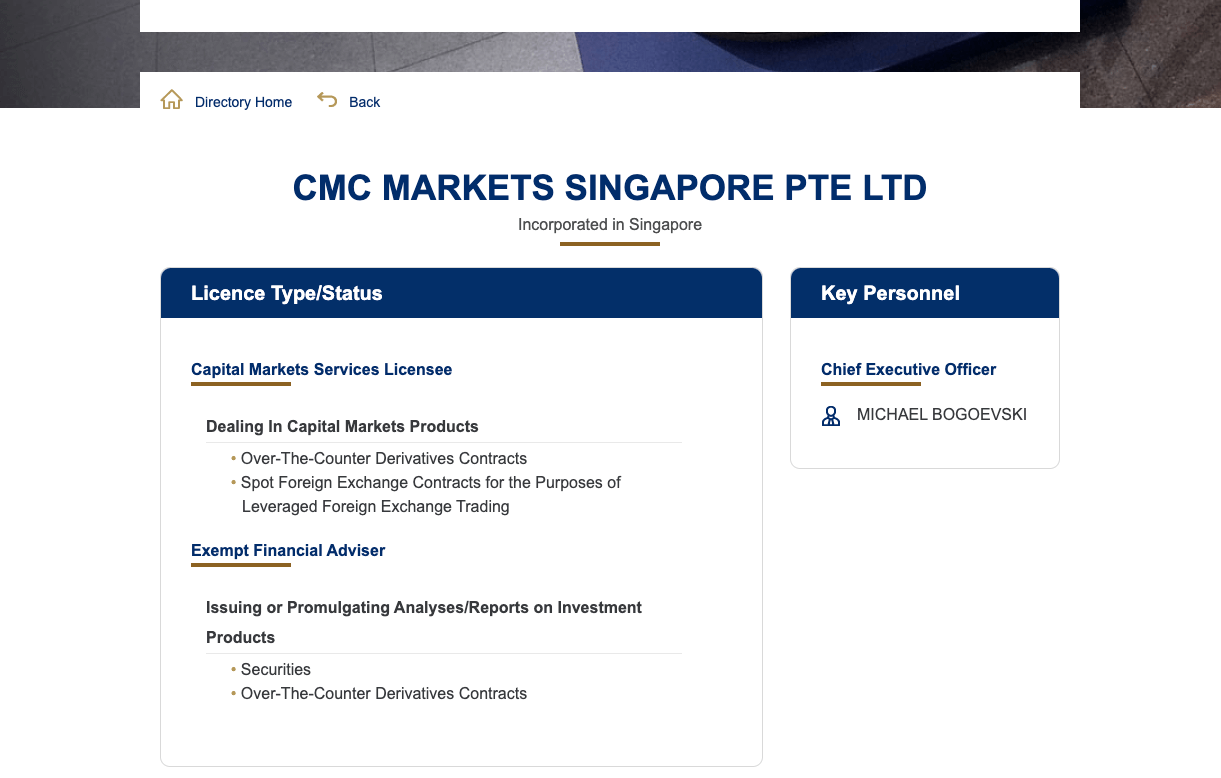

Regulation: CMC Markets is regulated in Singapore as CMC Markets Singapore Pte. Ltd and licensed to offer Capital Markets Services. CMC Markets is also authorised by other Top-Tier financial regulators in the UK, Australia, and Europe.

Minimum deposit: The minimum deposit can start from US$1 (SGD 1.4) as CMC Markets does not have any mandatory minimum deposit amount.

Spread for major pairs: Spreads start from 0.0 pips on CMC Markets depending on the instrument you are trading and your account type. Spreads for major pairs on CMC Markets start from 0.7 pips for EURUSD and 1.1 pips for EURGBP.

Trading Fees: Trading fees charged by CMC Markets are spreads and swap fees for keeping a trade open past the market’s closing time. CMC Markets does not charge commission fees for opening and closing trades on all instruments except shares. Commissions start from 0.1% and minimum charge of SGD 10 depending on the country whose shares you are trading.

Non-Trading Fees: CMC does not charge any deposit fees on all payment methods except cards which attract a 2% merchant fee. Withdrawals on CMC Markets are free for all payment methods. An account inactivity fee of SGD 15 per month applies if you do not log in or place any trade for 12 months.

Range of market: The financial instruments on CMC Markets Singapore are CFDs on 339 forex currency pairs, 9,451 shares, 95 indices, 111 commodities, 8 cryptocurrencies, and 46 treasuries (bonds).

Leverage for forex: The Maximum leverage on CMC Markets for Retail Clients is 1:20 (5% margin) while Accredited Investors (Professional Clients) have a maximum leverage of 1:50 (2% margin). Note that this maximum applies to major forex pairs and other instruments have lower leverage limits.

Deposit: Deposit methods supported by CMC Markets are card deposits, which are credited instantly and attract a deposit fee of 2% of the transaction value. PayNow and Bank transfers are credited within 2 hours or the next business day and have no fees. There is no mandatory minimum deposit required, you can deposit any amount you want.

Withdrawal: CMC Markets Supports withdrawals to bank accounts and it takes about 1-2 working days for you to receive funds. No mandatory minimum withdrawal amount as well.

Customer Support: CMC Markets offers 24/5 support via live chat, phone and email.

Trading Platform: Trading platforms supported by CMC Markets are MT4 and CMC Markets Trader (Next Generation Platform) available on PC, Mac, Web, Android, & iOS.

#4 Oanda – CFD Broker with fast funding methods

Onda was established in 1996. The broker processes deposits and withdrawals quickly and supports multiple platforms.

Regulation: Oanda is regulated in Singapore as OANDA Asia Pacific Pte Ltd and licensed to offer Capital Markets Services. The broker is also authorised by other Top-Tier financial regulators in the UK, Australia, and Europe.

Minimum deposit: Oanda does not have a mandatory minimum deposit. You can deposit any amount you want.

Spread for major pairs: Spreads on Oanda start from 0.0 pips depending on the instrument you are trading and your account type. Spreads for major pairs on the Oanda Spread-only Account start from 0.6 pips for EURUSD and 0.8 pips for EURGBP.

Trading Fees: Trading fees charged by Oanda are spreads, swap fees (financing cost) for keeping a trade open past the market’s closing time and currency conversion whenever you trade a financial instrument in a currency different from your account base currency. Oanda does not charge commission fees for opening and closing trades if you choose the spread-only pricing method but the core-pricing method charges commissions of $50 per 1 million trade.

Non-Trading Fees: Oanda does not charge deposit fees for cards, PayNow, DBS, and bank wire transfers, although your bank may charge an independent fee. PayPal deposits attract a 6% processing fee. While withdrawals to cards and PayPal are free of charge, bank transfers incur a withdrawal fee of US$20 (SGD 28) per transaction. Oanda also charges an inactive account fee of US$10 (SGD 14) per month if 12 months pass without trading activity.

Range of market: You can trade the following instruments on Oanda Singapore; CFDs on 68 forex currency pairs, 6 bonds, 19 indices, 10 commodities, 228 shares, 4 cryptocurrencies and 21 precious metals pairs.

Leverage for forex: The Maximum leverage on Oanda for Retail Clients is 1:20 (5% margin) while Accredited Investors (Professional Clients) have a maximum leverage of 1:50 (2% margin). Note that this maximum applies to major forex pairs and other instruments that have lower leverage limits.

Deposit: Oanda allows deposits via cheques, e-wallets(PayNow, NETs, PayPal, etc) and bank wire transfers. All deposits have varying times for funds to be credited, ranging from 1-5 business days. No mandatory minimum deposit amount is required on Oanda.

Withdrawal: There is no compulsory minimum withdrawal on Oanda. Withdrawals to PayPal take one business, Cheques and bank accounts are processed within 2-3 business days and it may take up to 5 business days. There is no compulsory minimum withdrawal amount by the broker.

Customer Support: Oanda offers 24 hours support starting from 4 AM SGT Monday to 6 AM SGT Saturday via live chat, phone and email.

Trading Platform: Trading platforms supported by Oanda are MT4, Trading View and OANDA Trader available on PC, Mac, Web, and mobile devices (Android, & iOS).

#5 IG Markets- Reputed CFD Broker with best trading platform

IG Markets was founded in 1974. The broker offers commission-free trading.

Regulation: IG Markets is regulated in Singapore as IG Asia Pte Ltd and licensed to offer Capital Markets Services. The broker is also authorised by other Top-Tier financial regulators in the UK, Australia, South Africa and Europe.

Minimum deposit: The minimum deposit for IG Markets Singapore is SGD 450 for card payments.

Spread for major pairs: Spreads start from 0.6 pips on IG Markets depending on the instrument you are trading. Average spreads for major pairs on IG Markets Standard Account are 1.04 pips for EURUSD and 1.89 pips for EURGBP.

Trading Fees: Trading fees charged by IG Markets are spreads and swap fees for keeping a trade open past the market’s closing time. City Index does not charge commission fees for opening and closing trades on all instruments except shares which start from 0.10%. They also charge currency conversion fees whenever you place a trade on an instrument that is in a currency different from the currency of your base account.

Non-Trading Fees: Deposits via cards on IG Markets attract a 2.3% deposit fee per transaction (charged by card processor) while bank deposits have no fees and no withdrawal fees are charged. If you do not use your trading account for 2 years, you will incur a monthly fee of SGD 25.

Range of market: Available financial instruments on IG Markets Singapore includes CFDs on 99 forex currencies pairs, 16,000+ shares, 34 indices, 21 soft commodities, 8 energies, 17 ETFs, 12 bonds, 13 cryptocurrencies and 5 metals pairs.

Leverage for forex: The Maximum leverage on IG Markets for Retail Clients is 1:20 (5% margin) while Accredited Investors (Professional Clients) have a maximum leverage of 1:50 (2% margin). Note that this maximum applies to major forex pairs and other instruments that have lower leverage limits.

Deposit: IG Markets allows deposits via cards and bank wire transfers. Card deposits on IG Markets are credited instantly and 1 business day for deposits via wire transfers. The minimum deposit on IG Markets is SGD 450.

Withdrawal: IG Markets withdrawal requests to bank accounts are received within 24 hours while it takes up to 5 business days to receive withdrawals to cards on IG Markets. The minimum withdrawal on IG Markets is S$200.

Customer Support: IG Markets offer 24-hour support from 9 AM on Sunday to 10 PM on Friday via phone and email. They also have a community where you can post questions for other customers to answer. IG Markets also has a menu-based live chat feature.

Trading Platform: Trading platforms supported by IG Markets are ProRealTime web-trader, L2 Dealer and MT4 available on PC, Mac, Web, and mobile apps (available on App Store and Play Store).

What is CFD Trading?

CFD trading is buying or selling financial assets at a certain open price and speculating that the price will rise or fall.

If the closing price is according to your speculation (prediction), then the difference between the opening and closing price is your profit, if the closing price is not according to your prediction, the difference will be your loss.

When you buy or sell CFD instruments, you do not own the underlying assets as you have only placed a bet on them based on speculation.

In CFDs trading, you can use leverage, which is basically borrowing money from the broker to enable you to place higher bets. If your trade position is successful, you make all the profits, if your position is unsuccessful, you suffer all the loss.

For example, if you deposit SGD 700 and decide to open a EURUSD trade position using a leverage of 1:10 which is 10 times your deposit, you can open a trade worth $7,000.

Example of a CFD Trade

For example, you place a trade on EURUSD, predicting that the open trade price of 1.3591 will close at 1.5687 or more, so you buy EURUSD. If the price closes at 1.6587, then the difference of 0.2996 is your profit, if the price closes at say 1.2678, then the difference of 0.0913 is your loss.

How to Choose a CFD Broker in Singapore

When choosing a forex broker, it’s important to consider a variety of factors as they will affect your trading succes. Here, we will help you find the best CFD broker by answering some common questions.

1) Is the CFD Broker Regulated by the Monetary Authority of Singapore (MAS)?

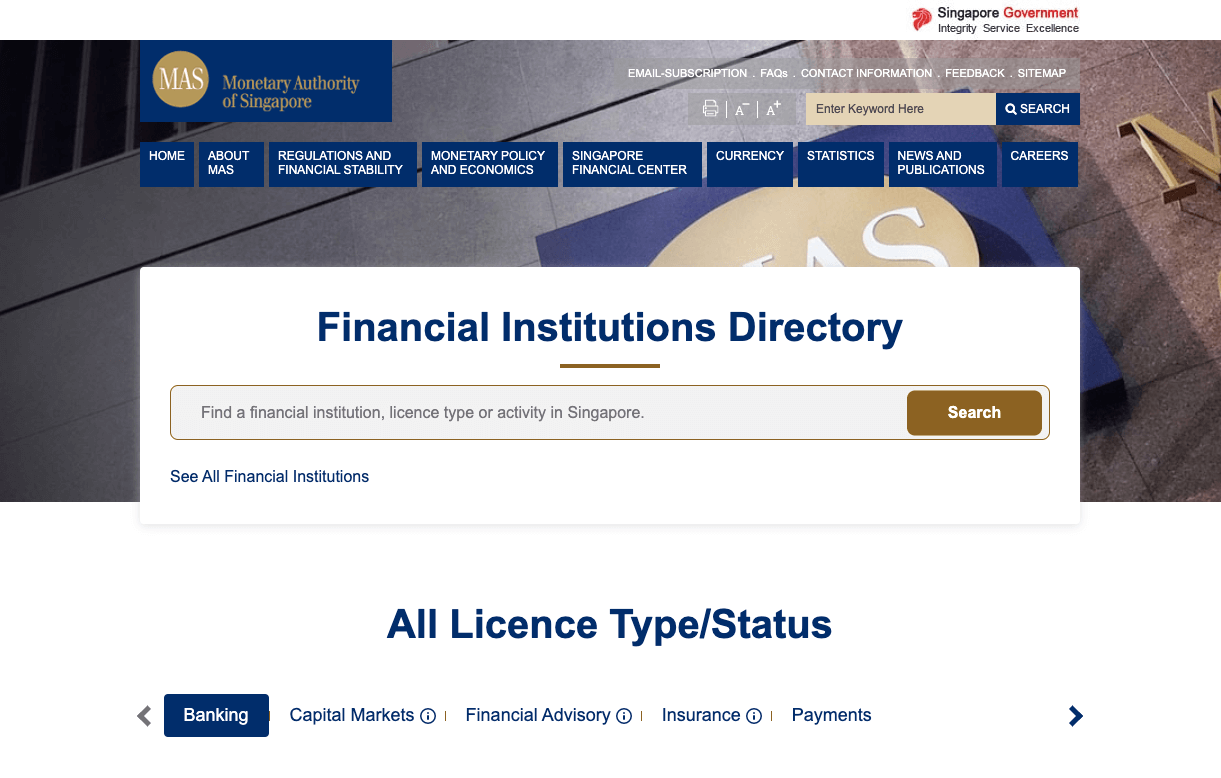

When choosing a broker, be sure to ask whether they are regulated. The MAS regulates CFD brokers to ensure the safety of clients’ funds and protect investors. You can verify if a broker is licensed in Singapore on the MAS website. See how below:

We will use CMC Markets for the example:

To verify their license in Singapore.

Step 1) Go to the MAS website at eservices.mas.gov.sg/fid/.

Step 2) Type in the name of the broker in the search box.

Step 3) Select the broker name to see details about their license..

Note that some brokers are regulated by name different from their trading name. You can go the broker’s website to find out the name they are regulated under then go to the MAS website to verify.

2) What are their Charges?

The next question to ask about the broker’s fees. There are trading and non-trading fees.

Trading entails all the fees that are charged for trading a financial instrument. They range from spreads, commissions, currency conversion fees and swap fees. Trading fees usually vary for brokers that have more than one account type. The fees can also vary based on the instrument you are trading.

Note that spreads are charged by all brokers (although some brokers spreads can be higher or lower), some brokers do not charge commission and currency conversion fees, while all brokers also charge swap fees (except they offer a swap-free account).

Non-trading fees are charges that are not directly related to trading activities, they include deposit fees, withdrawal fees, and dormant account fees. While some brokers waive these fees all together, others may charge all or some.

It is important for you check out the fees of a broker before you signup to help you decide which broker to choose. You can find the fees on their websites (usually on the account types page or a page dedicated to fees), if its not easily accessible, you can contact support to find out about all fees to avoid any hidden charges.

3) Ease of Deposits and Withdrawals

Another question to ask when choosing a broker is about their deposits and withdrawal options.

What methods do they support?

How fast are the deposits and withdrawals processed?

What charges, if any, do the different payment methods attract?

The best CFD brokers are those that offer multiple payment methods including local bank transfers, charge little or no fees and process withdrawals and deposits quickly.

To see the supported payment methods for deposits and withdrawals, the required minimum deposit and withdrawal as well as the time it takes to receive your money, simply go to the deposits/withdrawals section of the broker’s websites. Alternatively, you can go to the FAQs page or ask customer support via live chat, email and phone call.

4) Available Trading Platforms

When choosing a forex broker, you should consider the trading application platforms they support. You should also check if they support web trading, desktop versions, as well as mobile versions. Is their mobile app available for iOS and Android devices?

The best brokers support more than one trading platform as it makes trading easier. With multiple trading platforms, you can trade on the go (with mobile devices) and easily take opportunities or close your trading positions to stop a loss.

While some brokers develop their own proprietary trading applications, others use trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, and some brokers use both a proprietary platform and popular ones. Each trading application comes with some functionalities and tools.

5) Customer Support

Another important factor when choosing a CFDs broker is their customer support. Responsive customer services for traders means that you can easily resolve any issues you encounter during trading or using the platform.

The best brokers offer support via multiple platforms, including live chat, phone, FAQs, and email, and they are available 24 hours every day or on business days only.

What are the Risks of CFD Trading?

1) Risk of leverage

Leverage can make or mar your account. You can make more profit as much as more loss trading with leverage. See a practical example below

Let us assume you have a trading account with SGD 200 and 1:1 leverage (no leverage). If you buy Gold CFD (0.01 which is 10 cents per point) at the entry price of 1817.89 but the price falls and triggers your stop loss at 30 pips from entry (1817.59). Your loss is a paltry SGD 3.

If you take this same trade on an SGD 200 trading account with (1:5) leverage. The implication of this is that your account is 5 times stronger (SGD 1,000). You will be able to control more trade volume for a small margin.

So, you placed a buy trade on Gold CFD at 1817.89, with the same stop loss. This time, you can trade at 0.1 (SGD 1 per point) lot size because of your leverage. The trade goes against you but your loss is calculated as 1 x 30 = SGD 30.

The 1:5 leverage multiplied your loss 10 times the time you used no leverage. This is why CFDs are risky and should be left to professional traders.

2) You can lose your entire trading capital

This can happen if you over leverage your account and trade volatile instruments. If you do not have enough money in your account to meet up with margin requirement, you will not be able to trade. Negative balance protection ensures you do not lose more than your capital. However, it is possible to lose all of your trading capital

3) Risk of Fraud

There is a risk of trading with unregulated CFD brokers. These brokers can register you under loosely regulated entities and can defraud you. Also, there is no form of insurance if your money is lost. You can mitigate this risk by signing up with MAS regulated brokers only.

Another area the risk of fraud can affect you is clone firms. Clone firms try to deceive traders by trying to use similar names to MAS regulated brokers. Some even try to use a similar website name with licensed forex brokers. To avoid these clone firms, make sure to check the list of the clones of your preferred broker. This is the best way to avoid being a victim of fraud.

4) Gapping Risks

The reason you are able to open a contract (buy or sell) on a CFD is because of liquidity. Liquidity is when there is enough money volume involved in the trading of a CFD. However, there are rare occasions where your contract can become illiquid because of a low volume of money.

Illiquidity, coupled with volatility in the markets can cause your trade to be executed at unfavorable prices. In other words, the price of a CFD can drop before your trade is executed at your preferred price. This phenomenon is known as Gapping.

If gapping occurs when you have a trade open, it will negatively affect your profits.

5) Holding costs

Some CFD trades can take up days or weeks to reach your exit point. The longer you hold a trade, the more the holding costs you procure. Holding costs accumulated over a long period will make you pay a lot to your broker. For every day you do not close a trade, you will pay a swap for that day.

On specific days, the holding cost might be twice the normal fee (double swap). Holding costs can reduce your profit or amplify your loss when they accumulate.

How to open a CFD Trading Account in Singapore

Creating a CFD trading account with a broker in Singapore is simple. We will use Plus500 as an example to explain the steps involved.

Step 1) Go to the broker website homepage, in this case, the Plus500 website is via www.plus500.com and Click the button labelled ‘Start Trading’ on the top right side of this page, or ‘Start Trading Now’ at the page center.

Step 2) Input your email and create a password on the form that appears then click ‘Create Account’. You will be redirected to the Plus500 WebTrader.

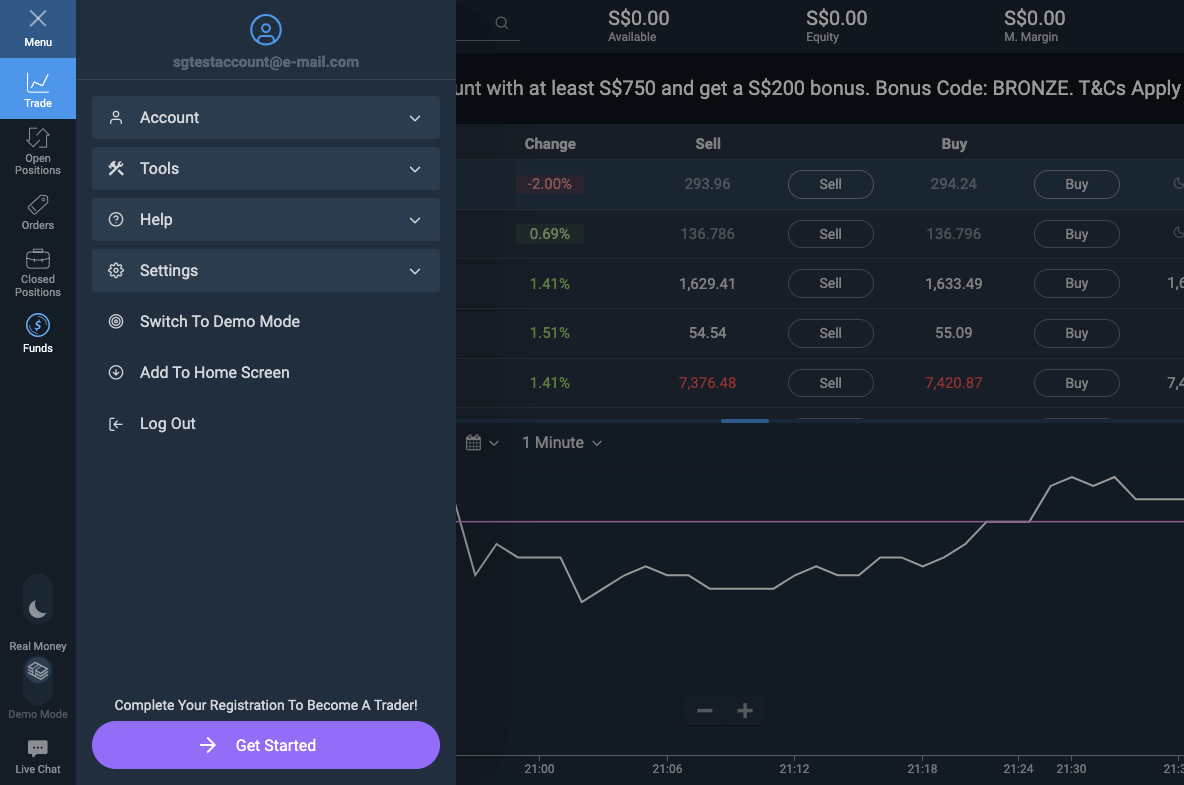

Step 3) To complete your registration, click on the three bars on the left side of the WebTrader, then follow the ‘Get Started’ link.

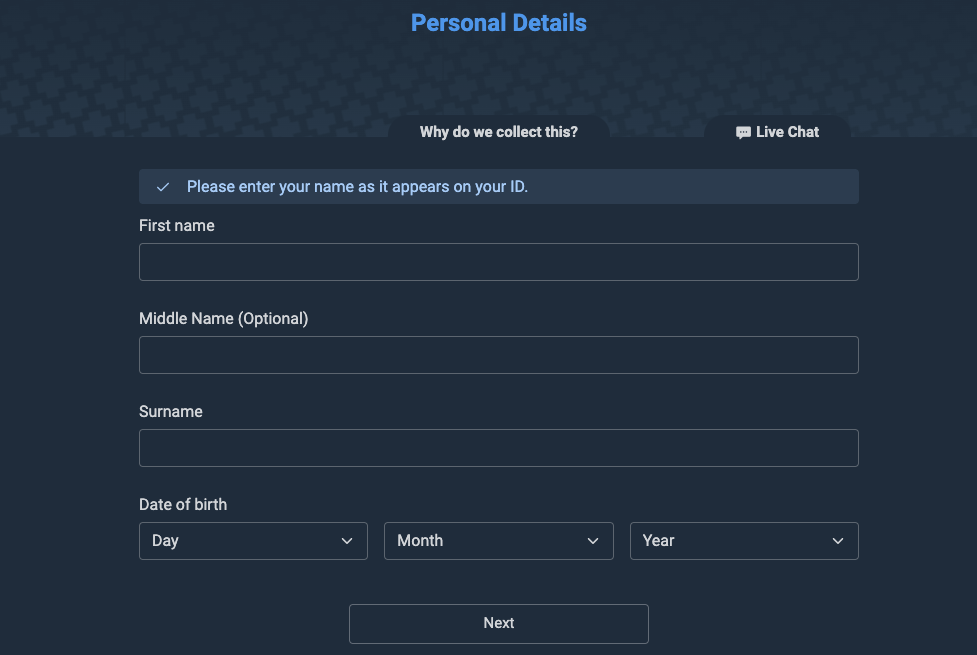

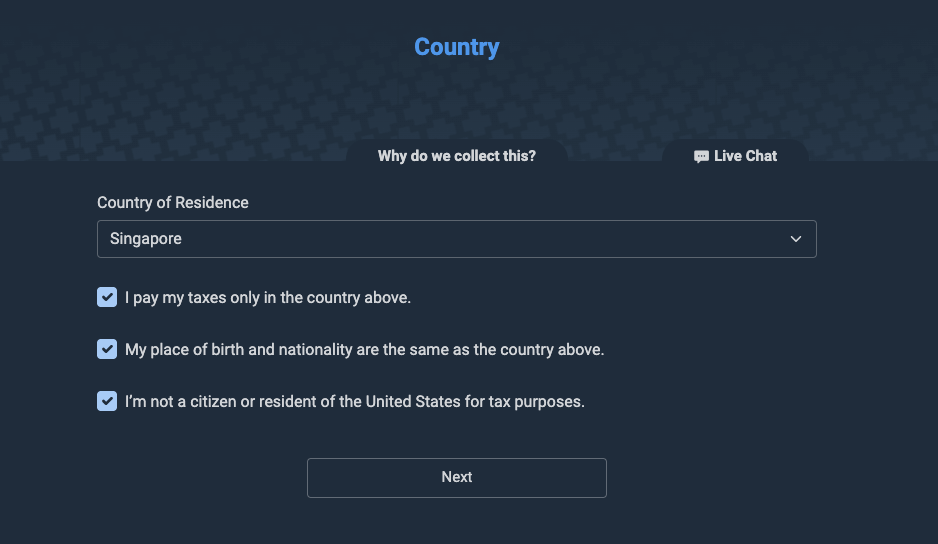

Step 4) Type your full name and date of birth on the personal details form provided, then click Next. Fill out the address information and provide your NRIC or FIN number then click ‘NEXT’.

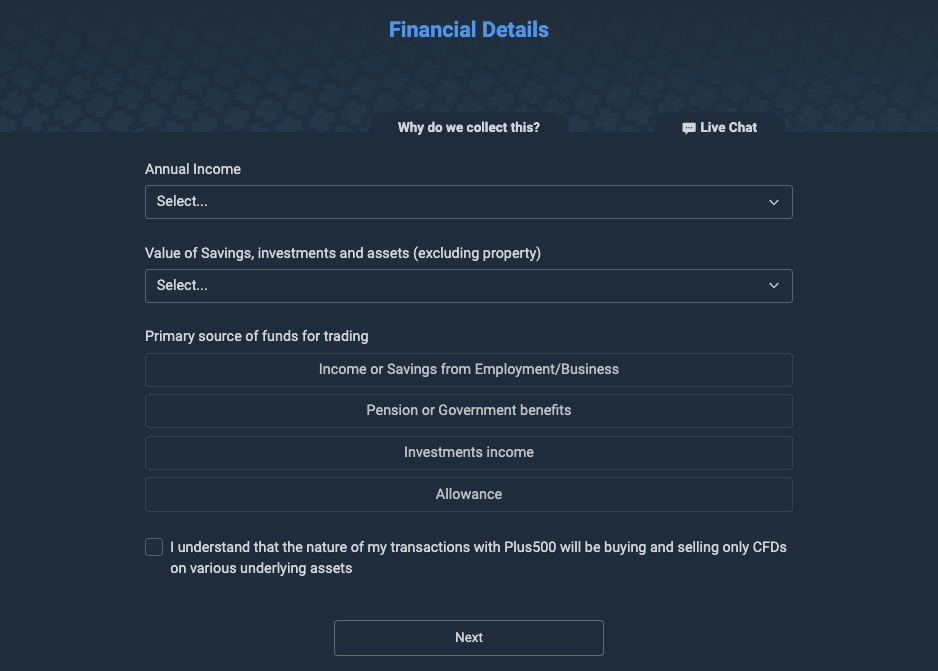

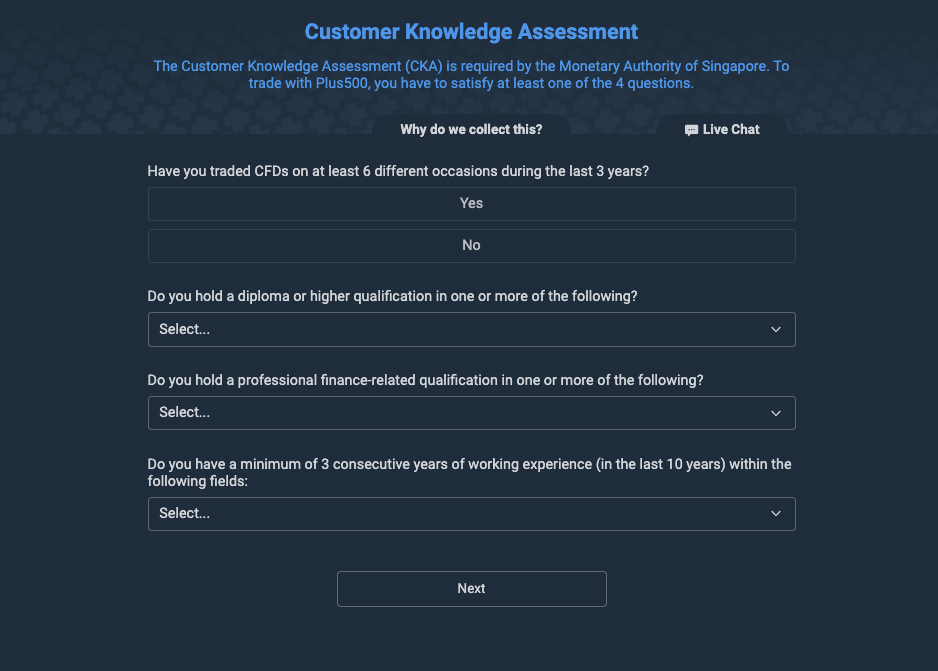

Step 5) Answer questions about your employment, financial status, CFDs trading experience, and knowledge of trading, then click ‘NEXT’

After that, check the boxes to agree to the terms and conditions and accept the risk disclosure warning.

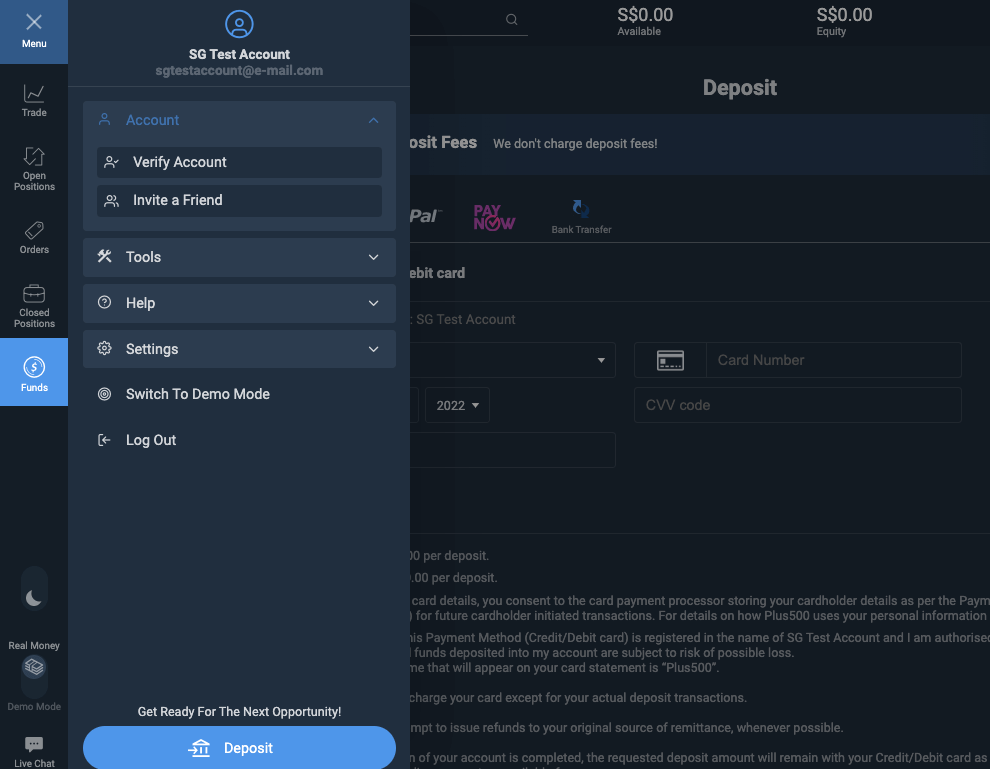

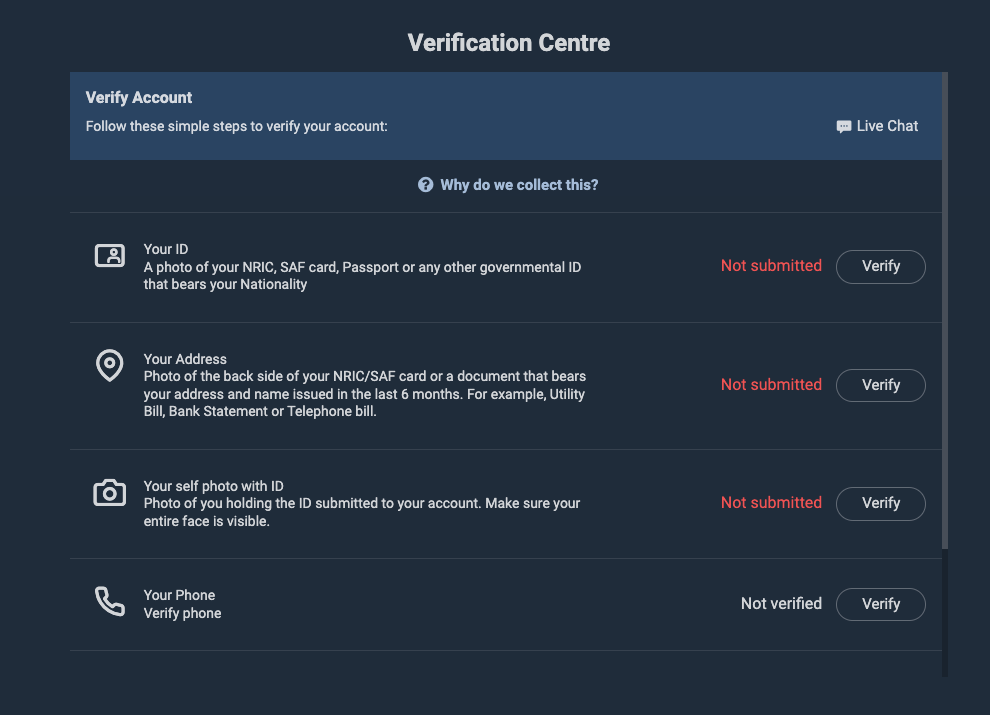

Step 6) To verify your account, click on the menu (three bars) on the left, then select ‘Account’ and click on ‘Verify Account’. You will be required to upload some documents to verify your identity and address.

After your account is verified, you can make deposits, trade, and withdraw funds.

What is CFD leverage in Singapore?

1:20 is the maximum leverage for CFDs trading in Singapore, this limit is mandated by the Monetary Authority of Singapore (MAS) and all regulated forex brokers are required to follow this when dealing with retail forex traders.

The leverage limit of 1:20 means that you can borrow up to 20 times the amount of your deposit to enter a trade. If you deposit S$150, you can open a trade position worth S$3,000.

However, if you are an experienced forex trader that trade large volumes and want to access leverage for trading CFDs in Singapore, you can apply for the accredited investor account (professional account). Accredited investors account holders can access leverage of up to 1:50.

Note that the maximum leverage of 1:20 for retail traders and 1:50 for accredited investors apply to some forex instruments and indices. Other instruments have lower leverage limit.

For retail clients, other instruments leverage limits are 1:10 for shares, 1:5 for commodities (metals and oil), and 1:2 for cryptocurrencies.

For accredited investors, other instruments leverage limits are 1:20 for indices, 1:10 for shares, 1:5 for commodities (metals and oil), and 1:2 for cryptocurrencies.

It is best that you do not use all the leverage available as this increases your risk and you can lose your money.

Can you lose money with CFD?

Yes, CFD trading involves using leverage to trade financial instruments, trading leveraged CFDs products involves risk and you can lose all your money. It is best to avoid trading leveraged products unless you understand how they work and have experience.

How Do CFD Brokers Make Money?

CFD Brokers make money through different means like spreads, fees, and overnight financing. Though fee structures may differ per broker, all CFD brokers combine these various means to generate revenue.

The spread is the difference between the buying (ask) and selling (bid) prices of a CFD. Brokers typically charge traders this spread, and they make money regardless of your trade result (profit or loss). Some brokers may offer fixed spreads, while others provide variable spreads that can change based on market volatility.

Other than spreads, brokers may also charge commissions and inactivity fees.

Another fee charged by CFD brokers is overnight financing also known as swap. When you hold a trade overnight, a fee is charge that reflects the cost of maintaining your trade overnight.

In essence, you can say that CFD brokers have multiple streams of making money. However, it is important for you to research your broker’s fees structure. For example, some brokers do not charge inactivity fees. So it is important always that you do your research.

Is CFD trading profitable?

Yes, CFD trading can be profitable. Some traders (retail or professional) can make money sometime. However, 70-80% of forex traders lose their capital trading CFDs. This is due to the risk that comes with CFD trading. CFDs are leveraged products which further increases the risk of losses.

This is why CFD brokers licensed with tier-1 regulators are required to reveal potential risk disclosures to their clients. Brokers regulated in the UK will give you the exact percentage of their clients that lose their money. They also update this data as it changes.

CFD brokers in other jurisdictions might just let you know that your capital is at risk without any data. CFD trading is not a get-rich-quick-scheme. You need to have a clear trading strategy combined with risk management. This helps minimize your losses but that is still no guarantee.

Is CFD trading good for beginners?

CFD trading might not be the best for a beginner. There is an extra risk that comes CFD trading because of leverage. Leverage increases the potential for profit and loss. It goes both ways. This is why CFD trading is different from traditional investing.

If you want to go into CFD trading as a beginner, a demo account might be the best for you. With this account, you get virtual money that gets you acquainted with the CFD market. You can trade different instruments without losing real money.

If you have practiced long enough and have confidence in your strategy, you can then move to a real account. Otherwise, it is better to avoid the risk entirely.

What is the Difference between CFD Trading and Forex Trading?

CFDs are derivatives. In CFD trading, traders do not own the assets they buy. However, the derivative derives its value from the assets. So if you want to trade EURUSD for example, you will not hold the currency as yours. In forex trading, you will own the currency pair you are trading. You own the assets.

What is the Difference between Trading and Investing?

Trading involves speculating the price of a financial instrument using technical and fundamental analysis. When you are investing, you own a part of the total value of an asset. For example, you can trade a stock as CFD. If you do this, you are only speculating if the price of the stock will rise or fall. Usually, this is suitable for short-term traders.

When you invest in a stock, you are owning that stock with the hope that it will rise in value in the long-term.

Are all CFD brokers regulated?

Every forex broker has one regulation or the other. However, regulations are in tiers. Tier-1 regulators like ASIC and the FCA have a regulatory framework that protects traders. However, CFD brokers are banned in certain countries like the USA.

How to Reduce Risks in CFD Trading?

Reduce leverage: In Australia, the maximum leverage for retail traders is 30:1. However, you might be able to choose an even lower leverage. A lower leverage reduces the amount of losses.

Diversified trading: Trade more than a class of CFDs. Trade different financial instruments. Incorporate multiple timeframes into your strategy. This can minimize your risk exposure.

Smaller lot size: In a bid to make money, some traders tend to trade huge lot sizes. This can lead to margin call and loses. Instead, trade smaller lot sizes especially if you are new. It helps you control your emotions in trading.

FAQs on Best CFD Brokers in Singapore

Are CFDs legal in Singapore?

CFD Trading is legal in Singapore. Singapore traders are allowed to trade forex, stocks, ETFs as CFDs, and cryptocurrencies. CFDs trading is regulated by the Monetary Authority of Singapore (MAS).

Which broker is best for CFD?

Although deciding the best broker depends on different factors, some of the best brokers in Singapore are City Index, Plus500, CMC Markets, Oanda and IG Markets, based on our research which you can read above.

Safety is one of the most important factors to consider. Do not trade with a broker that is not regulated by the Monetary Authority of Singapore, in addition, the platform should also support local deposits and withdrawals.

Can CFDs make you rich?

CFD trading is risky. More than 70% of CFD traders lose their money. In addition, CFDs are leveraged product. Leverage amplifies your losses if a trade goes against you. This is why you should not trade CFDs if you are not a professional.

How do I open a CFD account in Singapore?

You can follow our step-by-step guide above to open a CFD account in Singapore.

Is CFD trading risky?

CFD trading is very risky. Over 70% of retail traders lose all of their trading capital. CFD products are leveraged products. Trading with leverage increases projected profit and loss. This is why CFD trading is for professional traders. Professional traders are experienced in trading leveraged products.

Who are CFD brokers?

CFD brokers are middlemen. CFD brokers provide a platform for trading financial instruments that allows traders to trade derivatives on various instruments. The profit or loss are cash settled in an account opened with the CFD broker.