Best MT4 Brokers in New Zealand

5 Best MT4 Brokers in New Zealand

Editor

|

MT4 is one of the most popular trading platforms across the globe, with more than 14 million users as of 2014.

Unlike a broker’s proprietary trading platform, MT4 does not belong to a broker; however, to use MT4, you need a broker.

Thankfully, seeing that a good number of traders prefer to use MT4 rather than the broker’s proprietary trading platform, several brokers have included MT4 as one of their trading platforms.

If you are someone who prefers trading with MT4, it is important that you don’t get carried away with your desire to trade with a broker that offers MT4 and overlook other important factors. Your preferred broker should be regulated by the New Zealand Financial Market Authority (FMA).

To help you make an informed decision, we have created this list of the best MT4 Forex brokers in New Zealand.

| Forex Broker | FMA Regulation | Currency Pair | Maximum Leverage | |

|---|---|---|---|---|

| IG Market |

Yes

|

80+

|

1:200

|

IG Market app, ProRealTime, L2 Dealer

|

| Tickmill |

No

|

60+

|

1:500

|

MT5, Tickmill trading app

|

| CMC Market |

Yes

|

330+

|

1:500

|

Next Generation

|

| Black Bull Market |

Yes

|

65+

|

1:500

|

MT5, TradingView

|

| HFM |

No

|

50+

|

1:200

|

MT5, HFM Platform

|

Here are the five brokers that made our list of best MT4 brokers in New Zealand for 2023:

Now we’ll go ahead and review these MT4 brokers in detail.

IG Market is an online broker that was established in 1974 and is listed on the London Stock Exchange. They also make up the FTSE 250 Index and have up to 313,000+ clients.

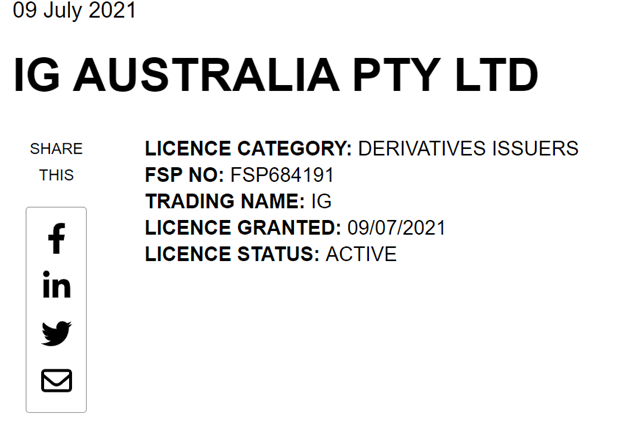

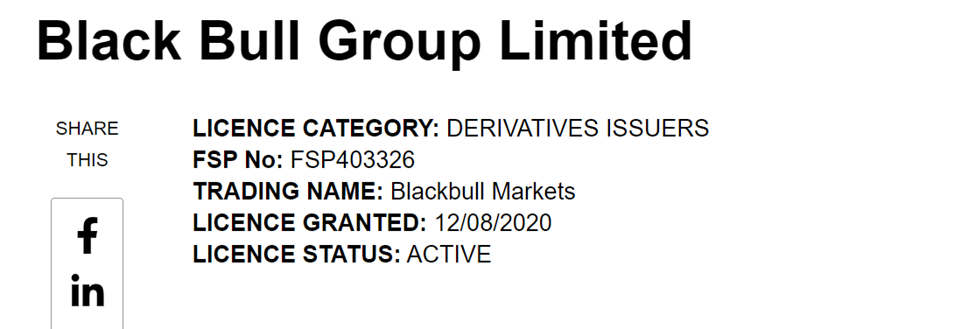

Regulation: IG Market is regulated by the New Zealand Financial Market Authority (FMA) as a derivative issuer. They are also regulated abroad by bodies like FCA, ASIC, FSCA, JFSA, DFSA, etc. You can trade over 15,000 assets on the IG market.

MT4 Features: IG Market MT4 is an advanced trading platform that gives you access to automate trades, build trading algorithms, and even customize your trading experience.

MT4 is available on mobile, web, and desktop, which makes it a readily accessible platform for trading.

IG Market prides itself on the claim that they have 99+% uptime with no third-party bridges. The trading platform also comes with 18 free add-ons and indicators, customizable charts, and a minimum trade size of 0.01 lots.

Other Trading Platforms Aside from MT4, IG Market has about four other trading platforms you can trade on. Here are some of their features:

IG Market App

ProRealTime

L2 Trader

Trading Conditions

Tickmill was established in 2014 and currently operates as a privately held company that is not listed on any stock exchange.

Regulation: They have up to 668,000 registered traders but do not have FMA licenses. However, Tickmill is regulated by the Financial Conduct Authority (FCA) UK, which is a tier 1 regulatory body.

They also have regulations from FSA Seychelles, DFSA, CySEC, etc. You can trade over 500 assets on Tickmill.

MT4 Features: Tickmill MT4 is available on mobile, desktop, and web. This trading platform gives you access to automate trading with expert advisors, and you can execute orders with no partial fills.

MT4 also gives you access to up to 30 in-built indicators, and 24 graphic tools. You also have access to one-click trading, which makes it possible for you to execute several trades quickly.

Tickmill MT4 also enables you to turn on alerts, so that when the price hits the bid or ask price you wish to trade with, you can get an alert. Alert also works for other things you wish to monitor.

Professional traders can also make use of the MT4 trading platform to monitor multiple trading accounts.

Other Trading Platforms There are two other trading platforms that you can trade with on Tickmill.

MT5

Tickmill Trading App

Trading Conditions

CMC Market is a financial service provider that was established in 1989. They are listed on the London Stock Exchange and make up the FTSE 250 Index.

Regulation: CMC Market has up to 300,000 traders from several countries in the world, including New Zealand. They are regulated by the FMA. They are also regulated by the FCA UK, BaFin, ASIC, and IIROC. You can trade over 12,000 assets with CMC Market.

MT4 Features: Trading with the CMC Market MT4 platform gives you access to thousands of indicators and signals. This customizable trading platform gives you access to a wide range of chart types and tools.

CMC Market allows you to automate your trading using expert advisors and trading robots, without the use of codes.

The minimum trade size when trading on the CMC market on MT4 is 0.01 lot. You also get access to monitor market sentiment.

Other Trading Platforms CMC Market has just one more trading app. Here are some features:

Next Generation

Trading Conditions

Black Bull is a local Forex trader that was established in 2014 in New Zealand. They are a privately held company.

Regulation: You can trade up to 26,000 assets on Black Bull, and they are regulated by the Financial Market Authority (FMA).They are also regulated by the FSA Seychelles.

MT4 Features: Blackbull MT4 is available on mobile, desktop, and web, and it gives you the opportunity to trade Blackbull’s wide range of assets using expert advisors and tools for price analysis and trading signals.

Other Trading Platforms Here are some features of the other available trading platforms:

MT5

Trading Conditions

HF Market is a privately held Forex broker that was established in 2010.

Regulation: Although they are not regulated by the FMA, they are incorporated in Saint Vincent and The Grenadines as an international business company.

HF Market is also regulated by the FCA UK, FSCA, CMA, DFSA, etc. Over 2.5 client accounts have been opened with HFM, and you can trade more than 1200 assets with them.

MT4 Features: HFM MT4 comes with ultra-fast trade execution, 30 indicators and tools, 9 timeframes, and one-click trading.

The trading interface is also easy to navigate and suitable for both novice and expert traders. Trading on MT4 with HFM also gives you access to pre-programmed analytical tools, market execution, and 4 pending orders.

Other Trading Platforms Here are the features of other trading platforms:

MT5

HFM Platform

Trading Conditions

MetaQuotes developed the MetaTrader 4 in 2005. It is designed for futures and Forex trading. MetaTrader 4 allows a trader to analyze the financial markets and use expert advisors. It also supports copy trading.

The platform has a good trading system that supports instant execution and market orders. It also supports buy limit orders, sell limit orders, sell stop orders, buy stop orders, 2 stop orders, and trailing stop loss. The combination of these functions allows you to be flexible with your trading strategies.

MetaTrader 4 also supports tools that help your technical analysis. These tools, which include 30 indicators and 24 graphic objects, are built-in. You do not need to install them, Moving averages, relative strength index, stochastic, trendlines, Fibonacci tools, and more are available for thorough technical analysis.

Most MT4 brokers offer a trading platform across different devices and operating systems. You can download your broker’s MT4 platform and install it on your PC. You can also use the platform on your mobile phone (android or iOS). In addition to these, there is also the MT4 web trading platform that you can access via your broker’s website.

As we have earlier stated, online Forex trading in New Zealand is regulated by the Financial Market Authority (FMA).

It is advisable that, when choosing a broker, you consider one that is regulated by the FMA. This is the only way the government of New Zealand can protect your trading rights as a trader.

However, in the case where your preferred broker is not regulated by the FMA, you may want to consider ensuring that they are regulated by a top-tier regulatory body like the FCA.

Aside from this, you should ensure that non FMA regulated brokers do not open your trading account with offshore regulators. These offshore regulators have less strict rules and may not provide enough protection for you. Rather, your account should be opened with an onshore regulator.

All brokers charge fees because that’s how they make money, and when it comes to fees, no broker is perfect, you just have to choose what suits your trading style best.

Spread and commission are two of the most common fees that brokers charge. It is advisable that you go for brokers who charge a tight spread and low commissions.

Other fees included deposit and withdrawal fees, inactivity fees, and swaps. Not all brokers charge these fees, so they can be avoided. All in all, let your trading style guide you when choosing a broker as it relates to fees.

A good Forex broker should have trading platforms that are easily accessible on all devices.

Any broker that offers MT4 has a trading platform that is available on mobile, desktop, and the web. This makes MT4 a versatile platform.

It is important to choose a broker whose trading app is compatible with all types of devices, as it gives you the chance to change devices at any time without worrying about difficulties in using your trading platform.

You may want to consider brokers who offer a wide range of tradable assets. This enables you to hedge your open positions and trade several assets with one broker.

Another thing to ensure is that the tradable instruments your broker offers are assets that you have an interest in trading.

A good broker should have customer service that is available at any time of the day and reachable through various means.

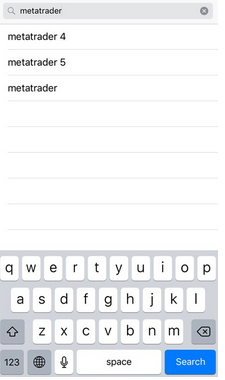

MT4 was removed from the Apple App store on September 23,2022. According to the company the app did not comply with review guidelines. After about six months, MT4 was reinstated on the App Store March 6, 2023. Now you can get MT4 on your iphone now that the ban is no longer in place.

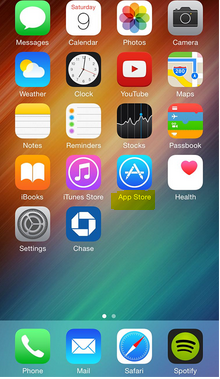

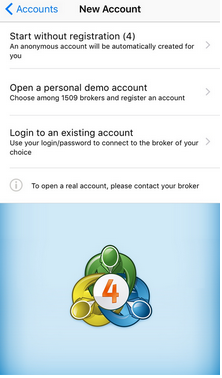

1. Go to App store on your phone by clicking on the App store icon. (highlighted yellow)

2. Search for MetaTrader 4 in the search window. The App store will give show you an option to click.

3. When you click the option, you will arrive at the MT4 page. It will look like the image below. Note the image and the logo of MT4. In addition, the name of the company is important. In the image, you can see the manufacturer’s name which is MetaQuotes Software Corp. Download the app by clicking ‘GET’.

5. When the download is complete, install the app on your iPhone.

6. Open the app when installation is complete. Find your broker’s server and enter log in details if you have an existing trading account. If you don’t have one, you can open a default MT4 demo account or a demo account from your broker.

7. If you follow this process, then you are ready to start using MT4 and trading CFDs. You can customize the colors and display on the chart if you want.

Yes, you need a forex broker to access live market rates and updates on MT4. If you download MT4 on your mobile phone, you can access a demo account offered by MetaQuotes. It is automatic and you do not need a broker for this demo account.

However, it is better that you sign up with a broker instead. This allows you open a demo account from your broker and assess their trading conditions. Then you can proceed to open a live account by searching for your broker’s server and entering your log in details.

For a more easy process, it is advisable that you download MT4 from your broker’s website. It will likely be customized and made for your broker. You will not have to carry out a long search to find your broker’s server.

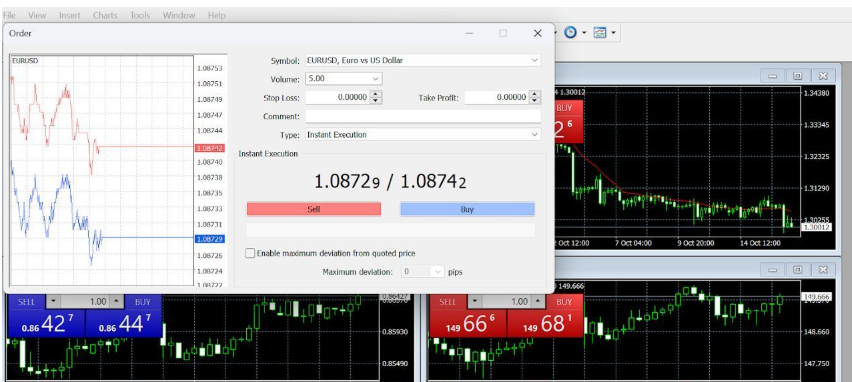

Here is how you go about placing your first trade on MT4.

1) Open the chart of a any trading instrument by right-clicking in the Market Watch window.

2) Click New Order to bring up the trading window. Here is what the trading window looks like.

3) On the window, select your order type and set other parameters like take profit or stop loss. After this, click Buy or Sell.

MT4 is provided for free by forex brokers to their clients. This makes the trading platform easily accessible. You will not pay any fees. Rather, your broker pays the licensing cost to use the software to the developer (MetaQuotes).

While your use of MT4 is free, your trading is not. Depending on the broker you choose, you will incur charges for trading CFDs. These fee are not charged by MT4 or MetaQuotes but by your broker. These fees could be in form of spreads, commissions, and rollover charges (a fee charged when you hold a position overnight).

Furthermore, you might incur more charges if you want to use third-party tools and services. These tools include Expert Advisors (EAs), customized indicators, data feeds, and VPS.

Yes, MT4 has risk management tools. Stop loss and take profit orders are the most common. You us them to exit a trade at a profitable or losing position. All you need to do is set them when placing your trades.

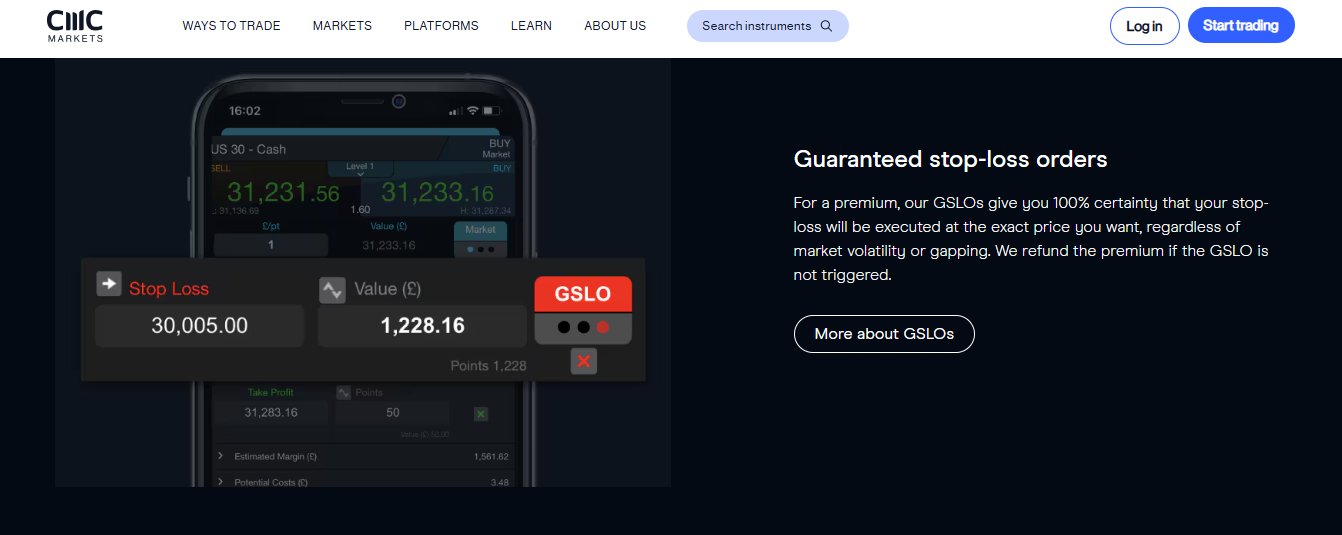

It is possible for a stop-loss order to fail. This means you might lose more money than you calculated. Forex brokers offer guaranteed stop loss order(GSLO); an advanced risk management tool to mitigate this risk.

We reviewed CMC Markets in this research. They are one of the brokers with GSLO.

Trailing stop and margin alerts are also part of MT4’s risk management tools. Trailing stops adjust your stop-loss level as the market moves in the favor of your position. This ensures you secure your gains are protected. Margin alerts lets you know when your open positions are at risk due to insufficient margin.

Backtesting is a crucial tool for forex traders. Traders use it to assess their trading strategy by using historical data. MT4 supports two type of backtesting — manual and automatic. Automatic backtesting is not enabled as a default setting on MT4. You have to enable it from the”View” sub-menu. Once you do this, you can test your EAs or indicators.

IG Market, CMC Market, HF Market, Black Bull, and Tickmill are some of the best MT4 brokers in New Zealand.

Yes, there are claims that a broker can manipulate MT4.

They can do this by causing slippage, fake spikes, or anything else to help them make more profit. This is why there is a strong emphasis on trading with a well-regulated broker, whose reputation and license will be at stake if they try to manipulate trading platforms.

Yes, you can trade Forex in New Zealand, as trading Forex is legal and locally regulated. However, ensure that you trade with FMA-regulated brokers.

No, you cannot use MT4 without a broker. If MT4 is your preferred trading platform, compare brokers’ offerings and choose one that suits your trading style.