BlackBull Markets is a CFD broker that was founded in 2014. This broker is based in New Zealand and accepts traders from New Zealand. They offer a very wide range of trading instruments that includes more than 26,000+ CFDs, currency pairs, commodities, and equities.

With BlackBull Markets, you can use the popular MetaTrader 4 or MetaTrader 5 trading platforms. You also have the option of trading through their popular proprietary trading platform which is called BlackBull Markets Shares.

BlackBull Markets offers ECN brokerage services, which means that there is no conflict of interest between the trader and the broker.

In this review, we’ll talk about how safe BlackBull Markets is for traders from New Zealand, how much they charge their traders, how good their customer support is, and provide a breakdown of their pros and cons.

| BlackBull Markets Review Summary | |

|---|---|

| Broker Name | Black Bull Group Limited |

| Establishment Date | 2014 |

| Website | www.blackbull.com |

| Address | Level 20, 188 Quay Street, Auckland Central, 1010, Auckland, New Zealand |

| Minimum Deposit | NZD 0 |

| Maximum Leverage | 1:500 |

| Regulation | FMA and FSA Seychelles |

| Trading Platforms | MetaTrader 4, MetaTrader 5, TradingView, Blackbull Shares |

| Visit BlackBull Markets | |

BlackBull Markets Pros

- Regulated in New Zealand

- Offers negative balance protection to all clients.

- Has NZD account currency

- Offers commission-free trading on Standard account

- Does not charge any fees for deposits.

BlackBull Markets Cons

- High commission charges for the prime account.

- Has high leverage which increases capital risk.

- Live support is not available 24/7.

- Charges withdrawal fees on some methods.

Is BlackBull Markets trusted?

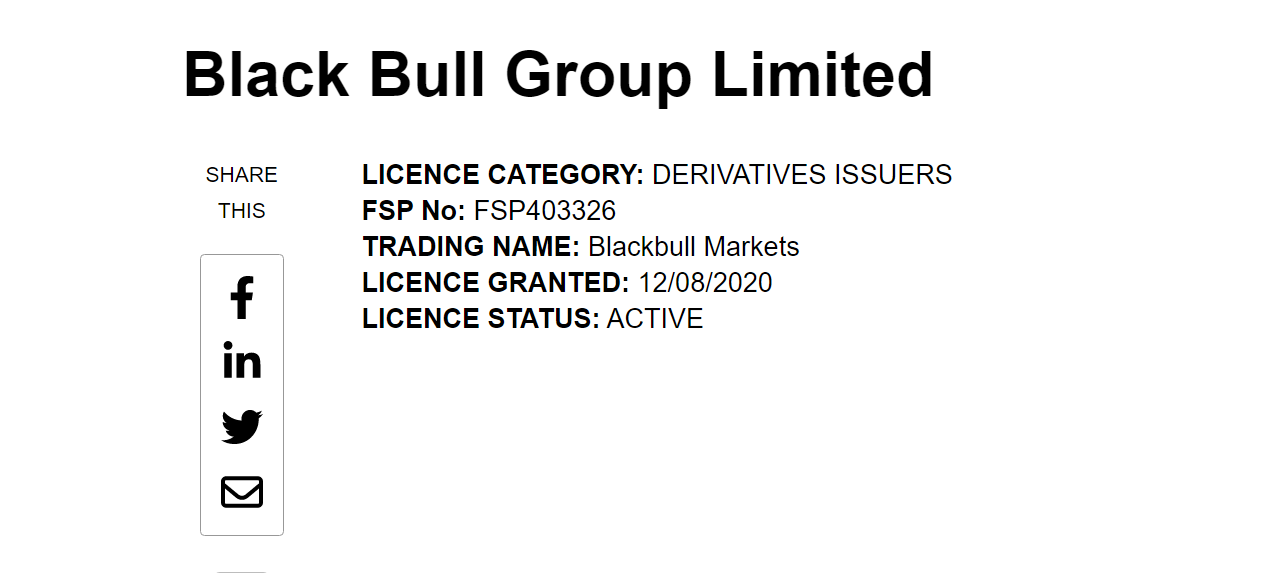

BlackBull Markets is regulated by the Financial Markets Authority (FMA) of New Zealand. The FMA is the financial regulatory body of the government of New Zealand.

Being locally regulated means that the broker is held legally accountable in the country. The broker is required to follow all the regulations and safety practices dictated by the FMA, which means traders from New Zealand interests are protected by the FMA.

Here is a breakdown of the licenses held by BlackBull Markets:

1) Financial Markets Authority: Black Bull Group Limited is regulated by the Financial Markets Authority of New Zealand and holds the license number FSP403326 as a Financial Services Provider, issued in 2020.

2) Financial Services Authority: BBG Limited (with trading name BlackBull Markets) is regulated by the Financial Services Authority of Seychelles and holds the license number SD045 as a Securities Dealer.

Traders from New Zealand are automatically registered under the FMA’s regulation so that their interests are protected under New Zealand law. Further, BlackBull Markets also implements safety practices such as segregation of funds (so that trader’s funds are kept separate from the broker’s funds) and negative balance protection (which means that a trader’s funds cannot go below zero).

BlackBull Markets Leverage

BlackBull Markets offers different leverage depending on the trading instrument being used. The maximum leverage offered by BlackBull Markets is 1:500 regardless of the type of account held by the trader (Standard, Prime, or Institutional).

This means that you can trade securities worth $500,000 by using $1,000 of your own money. The higher the leverage, the greater your profit (or loss).

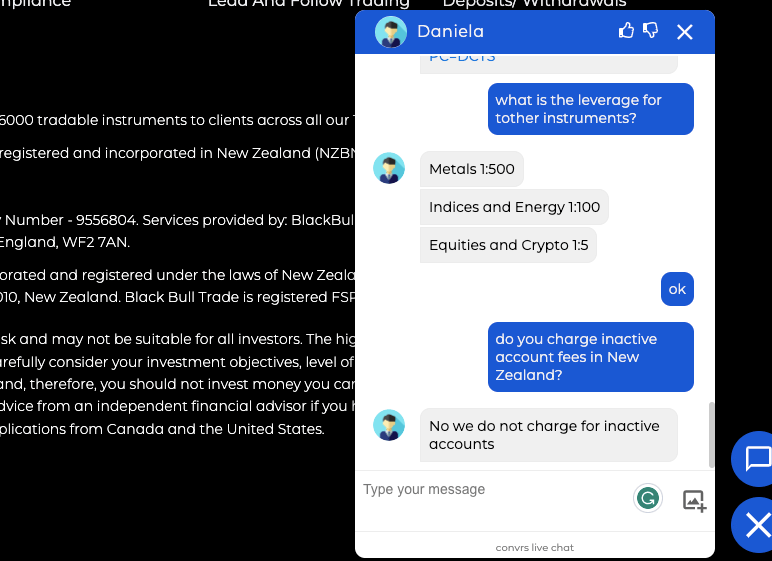

Note that the maximum leverage of 1:500 applies to major forex pairs, other instruments have lower margins such as metals 1:500, indices and energy 1:100, and equities and crypto 1:5.

We recommend that traders do not use leverage more than 1:40 so that the risk associated with each trade is lower, especially for new traders. Traders can select the amount of leverage they want to use for each trade (subject to the maximum offered by BlackBull Markets.)

It is best that you avoid forex trading if you do not understand it or have experience because of the risk involved. You can lose all your money trading leveraged products and CFDs.

BlackBull Markets Account Types

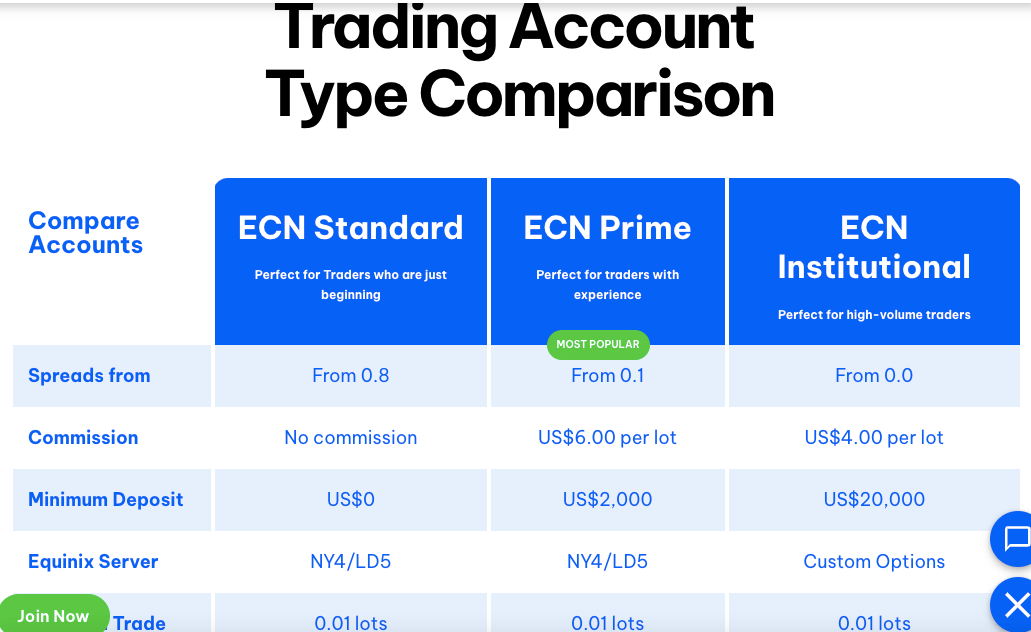

BlackBull Markets offers three primary types of accounts to its users. These accounts are called Standard, Prime, and Institutional. The trading conditions offered by BlackBull Markets depend on the type of account being used by the trader.

Further, BlackBull Markets also offers Islamic accounts for traders from the Islamic faith and demo accounts (where you can practice trading without using real money) for beginners and people looking to try out their services.

Here is a breakdown of each account type offered by BlackBull Markets:

1) Standard account: The Standard account is an ECN account which does not have a minimum deposit requirement. This account is most suitable for beginners. They do not charge a commission per trade. Instead, they charge a reasonable spread. Their minimum spread is 0.8 pips.

You can take advantage of leverage up to 1:500. The minimum lot size is 0.01 (the lowest amount that you can trade).

2) Prime account: The Prime account is meant for more experienced traders. The minimum deposit to open such an account is USD 2,000 (NZD 3,300).

When trading through a Prime account, traders will need to pay a commission per lot per trade of USD 6 (NZD 10). However, the spreads are much tighter when compared to the Standard account and start at 0.1 pips.

The Prime account also offers leverage up to 1:500 and the minimum lot size is 0.01.

3) Institutional account: As the name suggests, the Institutional account is meant for institutional traders. This account should only be used if you’re trading on behalf of an institution such as a hedge fund or a bank.

The minimum deposit required to open such an account is USD 20,000 (NZD 33,100). The spreads are very tight and start from 0 pips. However, they do charge a commission which is negotiable. The minimum commission that they charge is $15 per million.

The maximum leverage under this type of account is 1:500 and the minimum lot size is 0.01.

4) Islamic account: Both the Standard and Prime accounts can be converted into Islamic accounts with similar trading conditions. The primary benefit of an Islamic account is that it is swap-free. This means that you won’t be charged a rollover interest when you hold an open position overnight.

An Islamic account can be opened by applying to the customer support team at BlackBull Markets. An Islamic account can only be held by a person of the Islamic faith.

What are the base currencies offered by BlackBull Markets?

BlackBull Markets offers several base currencies which can be used by traders including the New Zealand Dollar. The other currencies offered as a base currency include the USD, GBP, EUR, AUD, SGD, CAD, JPY, and ZAR.

A base currency means that currency in which you will hold money in your trading account. You will be trading instruments through this base currency and any money that you earn will be denominated in your base currency.

Since NZD is offered as a base currency by BlackBull Markets, it makes it easier for residents of New Zealand to deposit and withdraw funds without having to pay currency conversion fees.

BlackBull Markets Overall Fees

Here is a breakdown of the trading and non-trading fees charged by BlackBull Markets.

1) Spreads: The spread charged by BlackBull Markets depends on the type of account held by the trader, the instrument being trader, and the timing of the trade. The spread can be as low as 0 pips if you have an Institutional trading account.

Under the Standard account, the minimum spread is 0.8 pips for trading the benchmark EURUSD currency pair.

The spread charged is generally lower is you’re paying a commission, this is why spreads under the Prime and Institutional accounts are much lower when compared to the Standard account.

Below is a breakdown of the typical spreads charges on the major instrument pairs:

| Instrument/Pair | BlackBull Markets Typical Spread |

|---|---|

| EUR/USD | 1.4 pips |

| GBP/USD | 1.5 pips |

| EUR/GBP | 17 pips |

| Gold | 2.4 pips |

Note that the spreads change daily and the information shown were obtained from Blackbull Markets website on 05 September 2023.

2) Commission: BlackBull Markets charges a commission when trading through the Prime or Institutional account.

When trading through the Prime account, you can expect to pay a commission of USD 6 (NZD 10).

When trading through the Institution account, you can negotiate your commission with BlackBull Markets depending on the kind of volume that you intend to trade. However, the minimum commission is USD 15 (NZD 25) per million.

3) Swap Fees: BlackBull Markets charges a swap fee (also called overnight rollover interest) when a trader holds an open position overnight. The swap fee charged by BlackBull Markets depends on a variety of factors such as the size of the trade and the leverage used by the trader.

BlackBull Markets does not charge a swap fee if you’re trading through an Islamic account. Only followers of the Islamic faith can convert their Standard or Prime account into an Islamic (swap-free) account.

4) Deposit and Withdrawal Fees: BlackBull Markets does not charge a deposit fee when you’re transferring funds into your trading account. However, you may be charged a fee by your payment service provider such as your bank.

However, BlackBull Markets does charge a withdrawal fee of NZD 5 when withdrawing money through credit or debit cards or through electronic wallets. They charge a withdrawal fee of NZD 20 when withdrawing through an international bank transfer (however, this fee won’t apply to traders based in New Zealand).

Further, there is a fee of 5% in case a trader deposits the fee and then withdraws the amount without making any trade.

5) Inactive Account Fees: BlackBull Markets does not charge any account inactivity fee if you do not log into your account for any period of time.

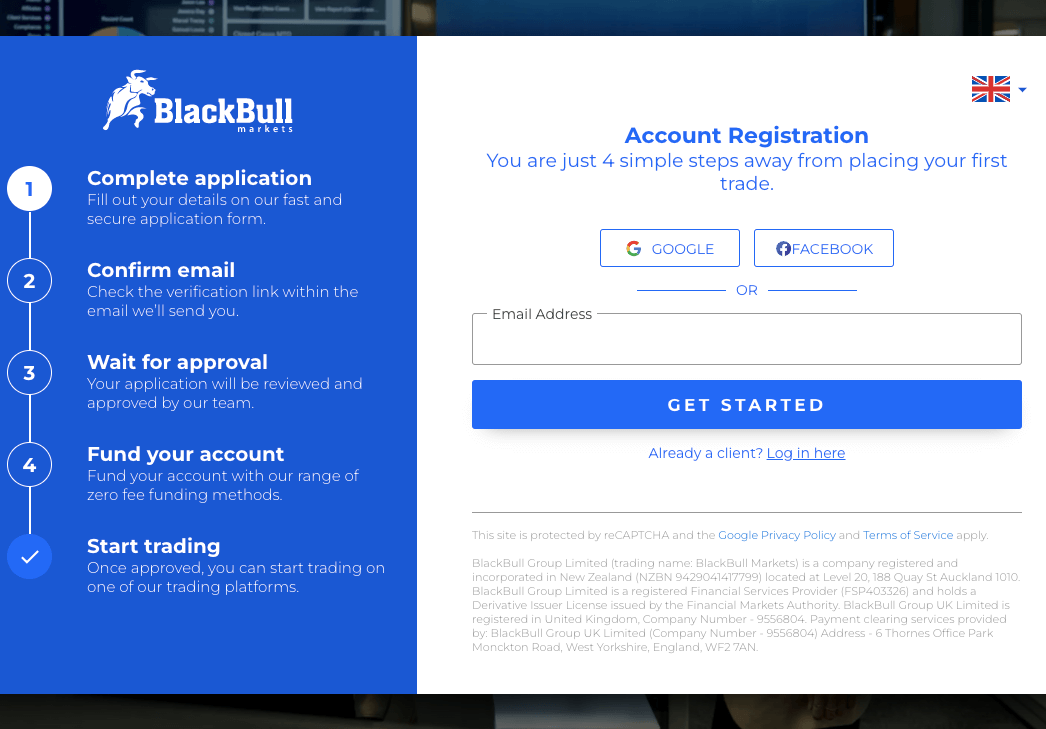

How to Open BlackBull Markets Account in New Zealand?

To start trading with BlackBull Markets, follow the steps below to create a BlackBull trading account.

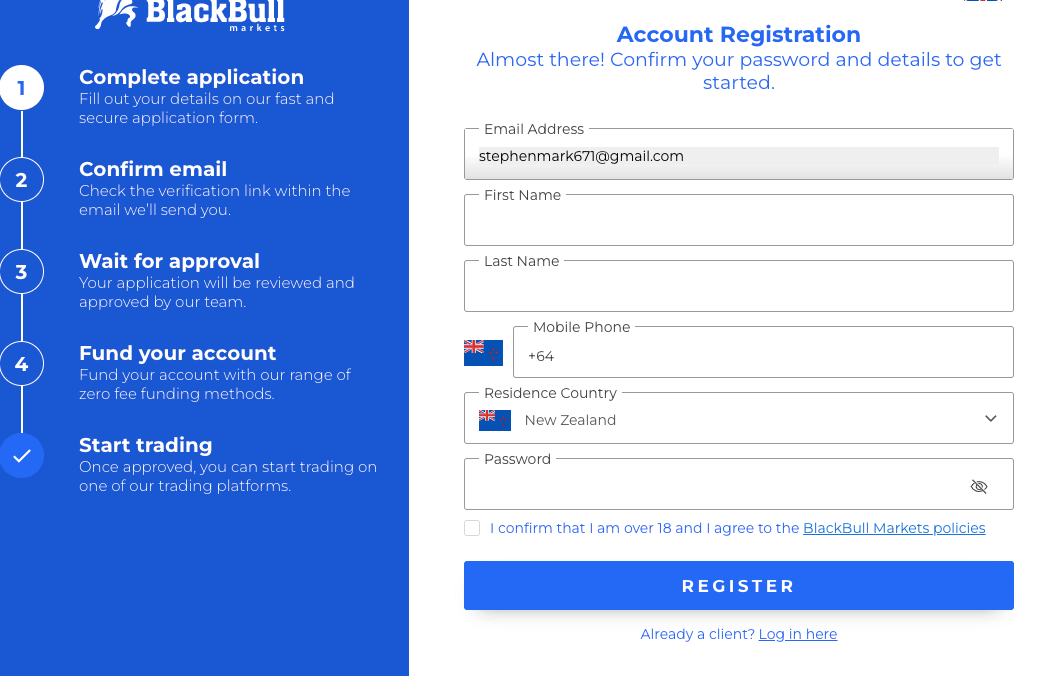

Step 1) Go to the BlackBull website homepage via www.blackbullmarkets.com and Click the ‘Join Now’ button.

Step 2) Input your email and click ‘GET STARTED’. You will be required to verify your email address.

Step 3) Provide your full name and phone number, check the box to confirm you are above 18 years old then create a password and click ‘REGISTER’. You will be redirected to the BlackBull Markets Dashboard.

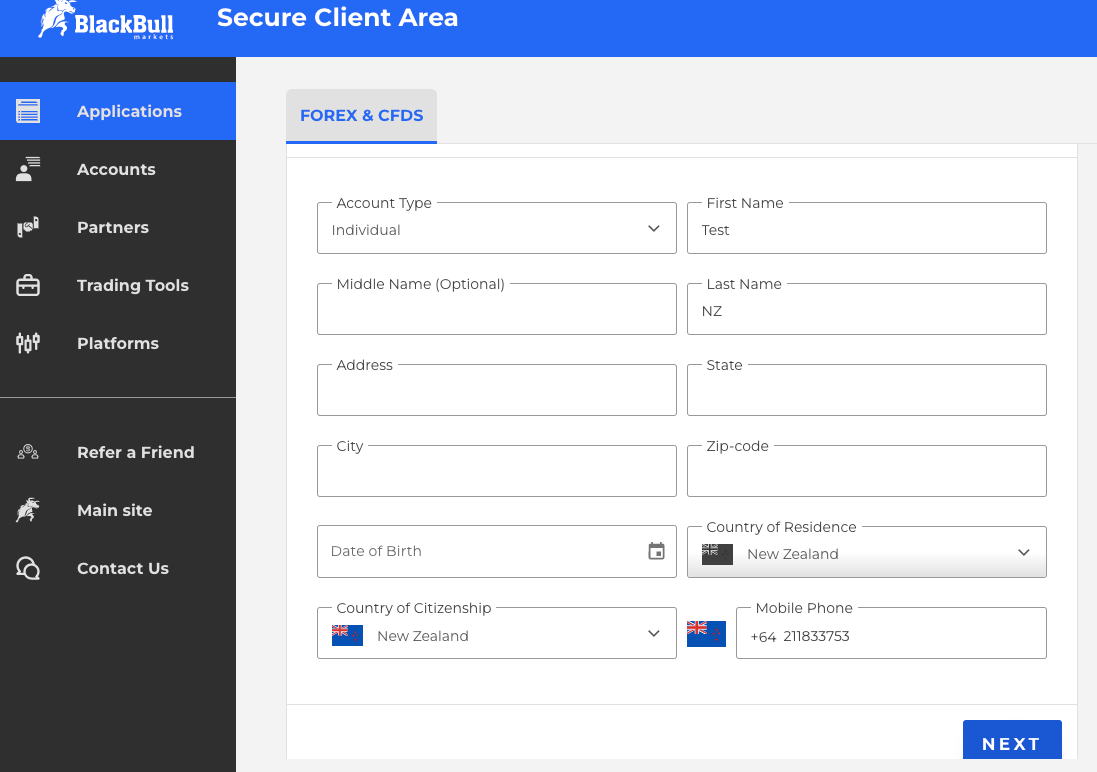

Step 4) Select an account type, provide your date of birth, fill out the address information and click ‘NEXT’.

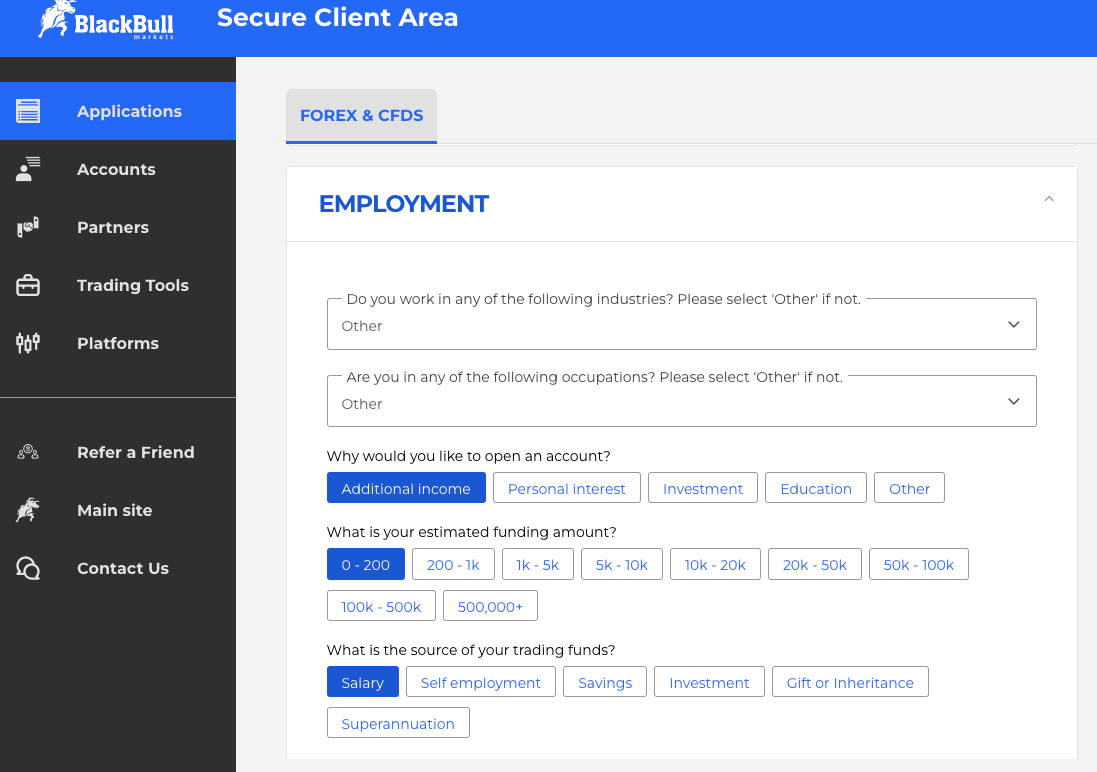

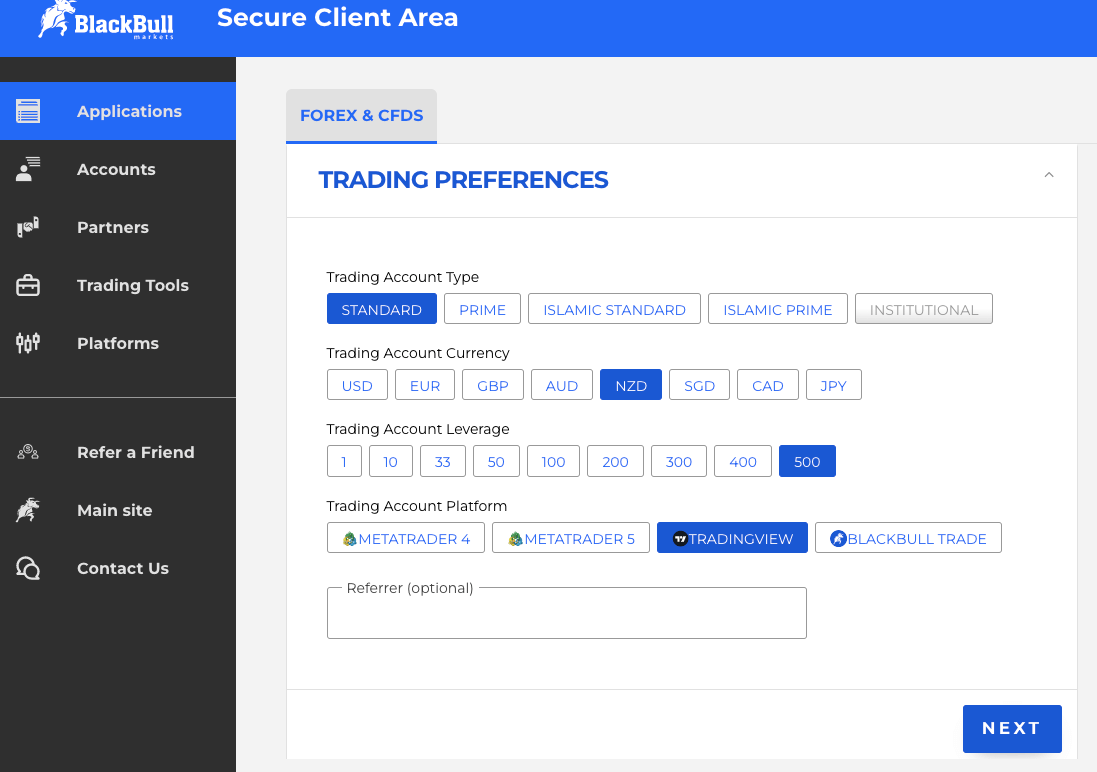

Step 5) Select your preferred account type, account base currencies, trading platform and maximum leverage then click ‘NEXT’. Answer questions about your employment and trading experience then click ‘NEXT’.

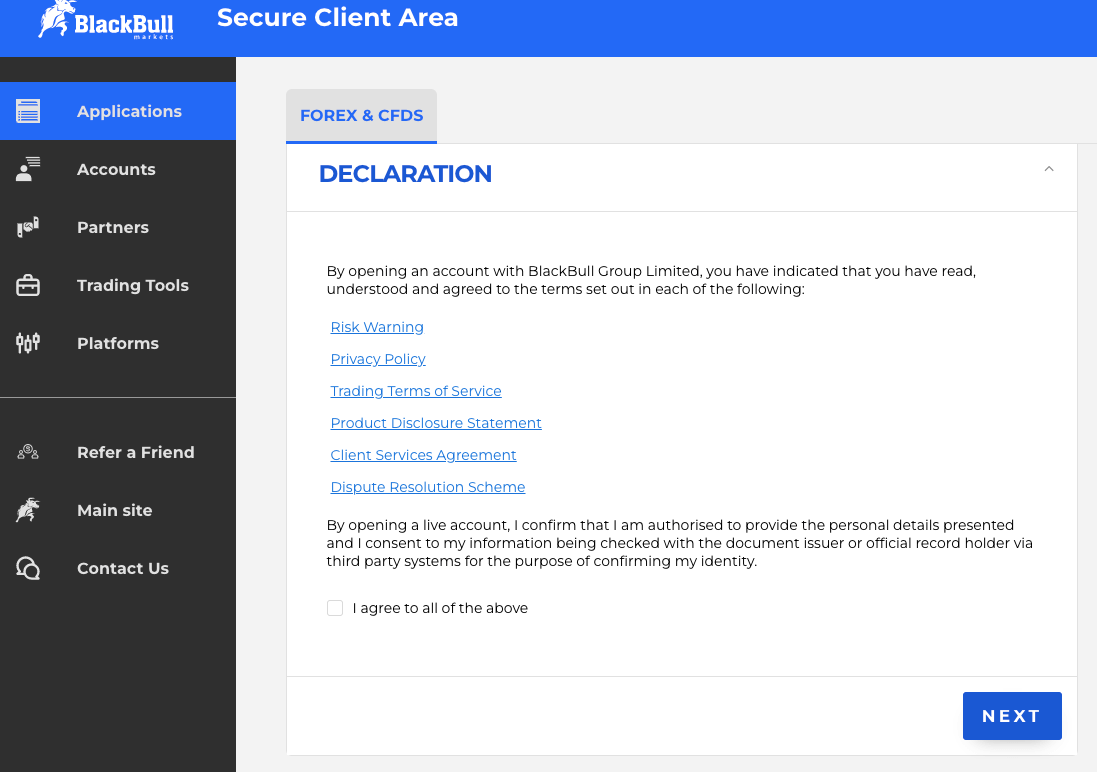

Step 6) Take the suitability test then agree to the terms and condition and click ‘NEXT’

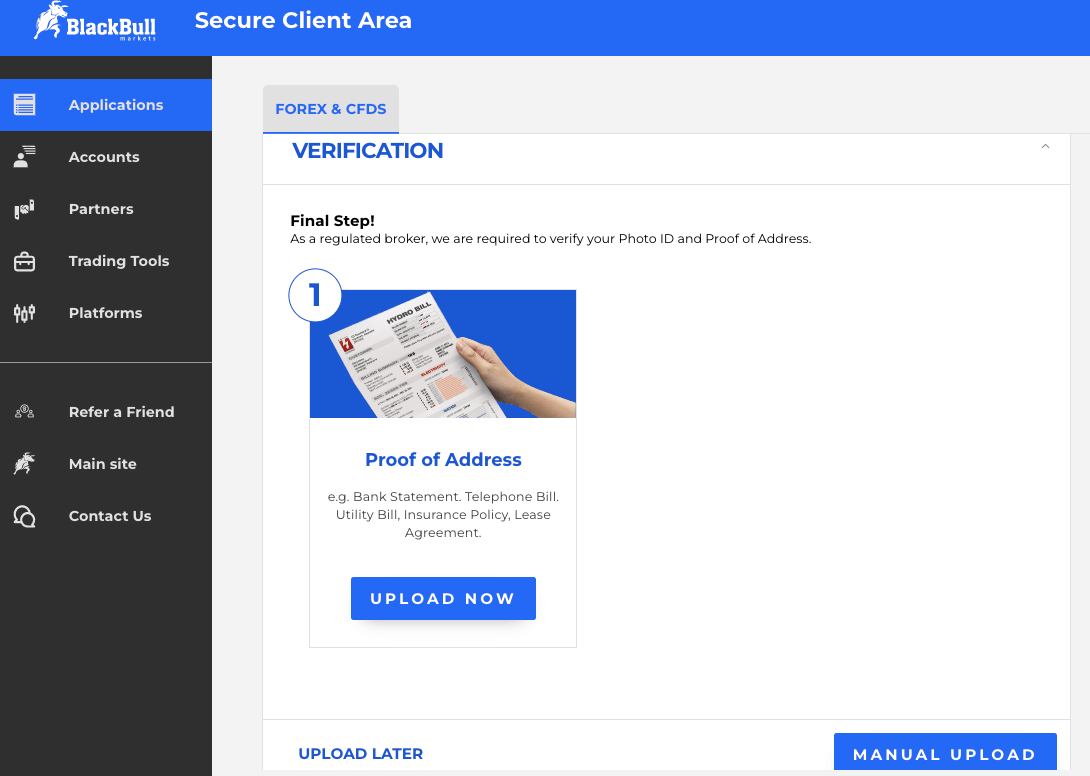

Step 7) Upload documents to verify your identity and address. After your account is verified, you can make deposits, trade, and withdraw funds.

BlackBull Markets Deposits & Withdrawals

BlackBull Markets offers several different ways in which to deposit (and withdraw) funds to traders from New Zealand.

BlackBull Deposit Methods

Here is a summary of payment methods accepted by BlackBull for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1 to 3 business days |

| Cards | Yes | Free | Instant |

| E-wallet | Yes (Skrill, Neteller) | Free | Instant |

BlackBull Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on BlackBull.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Transfer | Yes | Free | 1 to 3 business days |

| Cards | Yes | NZ$5 | Within 24 hours |

| E-wallets | Yes (Skrill, Netller) | NZ$5 | Within 24 hours |

What is BlackBull Markets Minimum deposit?

At the time of opening your trading account, brokers ask for a minimum deposit. The minimum deposit required by BlackBull Markets depends on the type of trading account that the trader has opened.

For a Standard account, there is no minimum deposit requirement.

For a Prime account, there is a minimum deposit requirement of USD 2,000 (NZD 3,100).

For an Institutional account, the minimum deposit needs to be USD 20,000 (NZD 33,100.

What is BlackBull Markets Minimum Withdrawal?

There is no mandatory minimum withdrawal amount on BlackBull in New Zealand.

To deposit or withdraw funds on BlackBull Markets NZ, go to the client area (account dashboard), click the ‘My Wallet’ tab on the left-hand side of the client area, Select ‘Add Funds’ or ‘Withdraw Funds’ and follow the onscreen instruction to complete your deposit or withdrawal.

BlackBull Markets Trading Instruments

BlackBull Markets offers a wide variety of trading instruments. The instruments offered by BlackBull Markets can be classified into CFDs and shares.

| Instrument | Availability | Number |

|---|---|---|

| Forex CFDs | Yes | 70 currency pairs on BlackBulll (majors, minors, exotic) |

| Indices CFDs | Yes | 10 spot indices on BlackBulll |

| Futures CFDs | Yes | 2,020 futures on BlackBulll |

| Commodities CFDs | Yes | 8 Agriculture commodities on BlackBulll (Soybean, coffee, and others) |

| Energy CFDs | Yes | 5 oils on BlackBulll (Brent, NGAS, and others) |

| Metals CFDs | Yes | 9 metals on BlackBulll (Gold, Silver and others) |

| Shares CFDs | Yes | 26,000+ equities on BlackBull (AU, US, NZ equities) |

| Crypto CFDs | Yes | 10 Cryptocurrencies on BlackBull (BTC, LTC, and others) |

Overall, we consider the variety of trading instruments offered by BlackBull Markets to be adequate for most traders (including beginners and more advanced traders).

BlackBull Markets Trading Platforms

BlackBull Markets provides several trading platform options for traders to choose from.

1) MetaTrader 4: The MetaTrader 4 is the classic forex and CFD trading platform used by traders around the world. It is one of the most popular trading platforms thanks to its simplicity and effectiveness. This platform can be used on Windows, MacOS, web browsers, Android, and iOS.

2) MetaTrader 5: The MetaTrader 5 is a more advanced version of the MetaTrader 4. It is suitable for traders who need more sophisticated technical analysis tools, when compared with the MetaTrader 4. The compatibility of the MT5 is the same as that of the MT4.

3) TradingView: TradingView is another highly popular trading platform offered by BlackBull Markets. This platform is perfect for technical analysis as well as social trading.

4) Blackbull Shares: Blackbull Shares is BlackBull’s proprietary trading platform that provides access to more than 26,000 shares for trading. This is a mobile-native app which can be downloaded in Android as well as iOS.

BlackBull Markets Education and Research

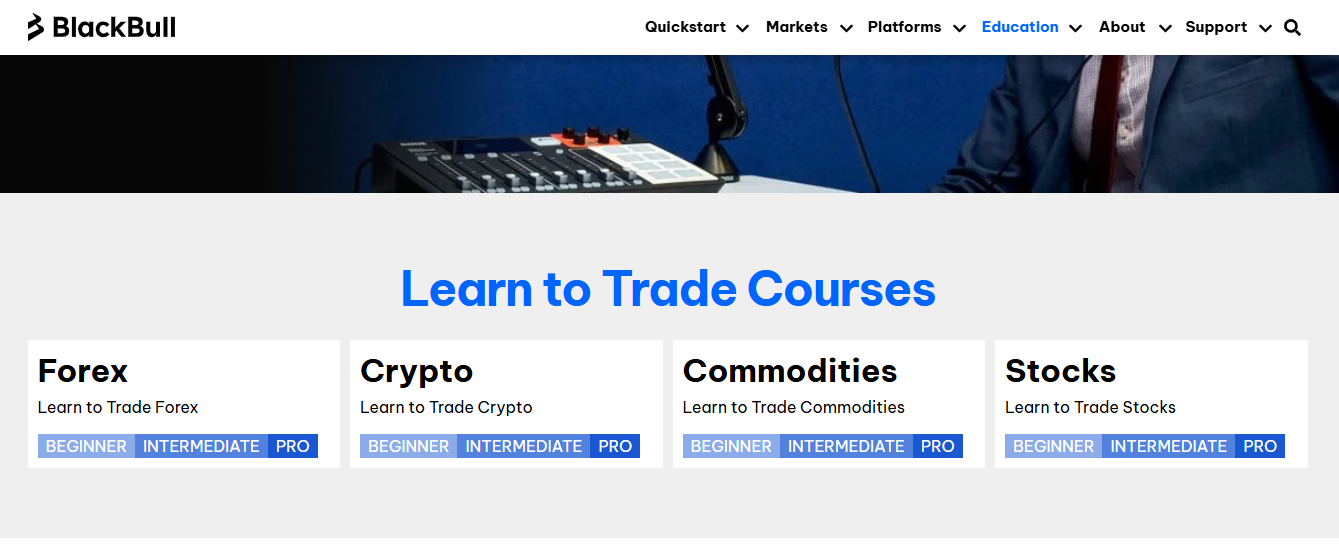

1) Education Hub: The hub contains courses on how to trade. The good thing is that it is not generic. It contains trading courses on forex, crypto, commodities, and stock. The courses cater to you regardless of your trading experience. Beginners, intermediates, and pros can take the trading courses.

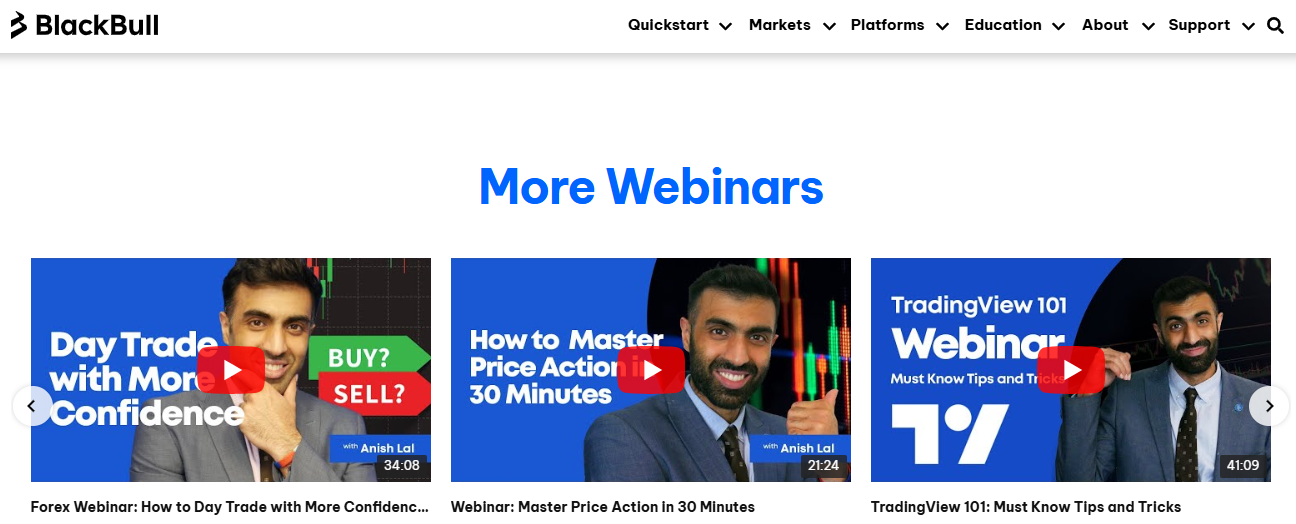

2) Webinars: BlackBull Markets hosts live webinars where you can learn from experts. They cover topics like price action and fundamental analysis. You will also find sessions that cover platform tutorials helpful. For example, if you are new to using TradingView, you can learn the basics via BlackBull Markets’ webinars.

If you miss a live session, you can watch it at your own time. Previous webinars are available for free.

3) Research Hub: You can sign up for investment research emails for free. You can also read article analyzing the effects of some events on the forex market. The research hub covers analysis on stocks and CFDs separately. So you can focus on any of the researched knowledge you prefer.

img class=”aligncenter size-full wp-image-465″ style=”border: 1px solid #ececec; padding: 10px; box-shadow: 0 0 30px rgba(0,0,0,.05);” src=”https://safeforexbrokers.com/nz/wp-content/uploads/2022/09/blackbull-markets-research.png” alt=”Research Hub” width=”1097″ height=”772″ class=”aligncenter size-full wp-image-217″ />

BlackBull Markets New Zealand Customer Service

BlackBull Markets provides customer support through live chat, local phone calls, and email. Since they have an office in Auckland, they can be physically contacted by residents of New Zealand as well.

1) Live Chat: The live chat option allows you to get a quick response to basic queries. The live chat option is a good first step for both new and existing users and it is available 24/6 from Monday to Saturday. We reached out to them through live chat and received a response within four minutes, and the response was helpful.

2) Phone Call: Traders from New Zealand can contact BlackBull Markets on their customer support helpline. You will be redirected to a human agent once you answer a few questions on the IVR. The BlackBull phone number for support is +64 (0)9 558 5142. The line is available 24/6.

3) Email: For more detailed and prolonged queries, traders can get in touch with BlackBull Markets through their customer support email ID which is available 24/6. The email address of BlackBull Markets in New Zealand is [email protected]. When our team tested it, we go feedback from a live agent after one hour and the answers to our questions were satisfactory.

Do we Recommend BlackBull Markets New Zealand?

BlackBull Markets has its headquarters in Auckland and is a broker that is native to New Zealand. The broker is also licensed by the FMA of New Zealand and other top tier financial regulators.

Further, they charge reasonable fees and they have different types of accounts meant to cater to the needs of different kinds of users. They also offer a wide variety of instruments.

There are some drawbacks to trading through BlackBull Markets as well. They charge a high withdrawal fee every time you withdraw money from your trading account. Further, they do not offer cryptocurrencies or ETFs for trading purposes. Their customer support service is not available on weekends.

The main reasons to trade through BlackBull Markets is safety (they are regulated in New Zealand) and low trading fees.

We recommend that you check out the BlackBull Markets website and read up on their offerings and trading conditions. You can even chat with an agent to answer any questions you may have to help you decide if you want to trade with them.

BlackBull Markets New Zealand FAQs

Is BlackBull Markets Markets Legit?

Yes, BlackBull Markets is a legitimate CFDs broker. They offer genuine brokerage services in New Zealand and around the world. They also provide negative balance protection and segregation of funds for the safety of their users.

Is BlackBull Markets Regulated?

Yes, BlackBull Markets is regulated by the FMA of New Zealand and the FSA of the Seychelles.

What is the withdrawal fee on BlackBull Markets?

BlackBull Markets New Zealand charges a withdrawal fee of $5 per transaction. This applies to withdrawals to cards and e-wallets as well as international transfers.

Is BlackBull Markets Markets cheap?

BlackBull Markets offers affordable trading services and their spreads are relatively less than average and they do not charge a commission through their Standard account. Further, the commission that they charge through their Prime or Institutional accounts are also quite low and the spread is even tighter.

Note: Your capital is at risk