If you want to trade forex in South Africa, you will come across many options for forex brokers. So which one do you choose? Finding the right broker is important as it can affect how your trades go and save you money in the long run.

It is important for you to choose a broker regulated in South Africa with the FSCA to protect your funds against scam brokers & bad practices.

To help you find the right broker we have tested 50+ brokers that various top-tier financial regulators license based on their safety of funds, trading fees (commission, spread, and other charges), trading platforms, ease of withdrawal, and have compiled this review to help you choose a reputed broker in South Africa. We’ve compared the top forex brokers below:

Show More

Comparison Table of Best Forex Brokers in South Africa

| Broker |

Regulations |

EUR/USD Spread (pips) |

Min. Deposit |

Visit |

|

|

FSCA, FCA, CySEC

|

1.2

|

$5 or R100

|

Visit Broker

|

|

|

FSCA, FCA, CySEC

|

1

|

$10

|

Visit Broker

|

|

|

FSCA, FSA, FSC, ASIC

|

0.9

|

$100 or R1,750

|

Visit Broker

|

|

|

FSCA, CySEC, FCA, FSA

|

0.1

|

$100

|

Visit Broker

|

|

|

FSCA, FCA, CySEC

|

1.9

|

$10

|

Visit Broker

|

XM Trading

|

FSCA, ASIC, FCA, CySEC, FSC Belize

|

1.6

|

$5

|

Visit Broker

|

Best South African Forex Brokers

Here are the 10 best forex brokers reviewed as per our research for trading in South Africa.

- HF Markets – Overall Best Forex Broker in South Africa

- Exness – Regulated Forex Broker with Low Spread

- AvaTrade – Fixed Spread Forex Broker

- Tickmill – South African Regulated Forex Broker with Local Deposit

- FXTM – Regulated Forex Broker in South Africa

- XM Trading – Forex Broker with Zero Commission & Low Spread

- IC Markets – ECN Type Broker with Low Fees

- Plus500 – Good Forex Trading Platform

- Blackstone Futures – Local Forex broker in South Africa

- FBS – Forex Broker with multiple account types

For more detail, you can read the reviews of all the above-listed hosting providers which helps you to choose the best one.

#1 HF Markets – Overall Best Forex Broker in South Africa

EUR/USD Benchmark:

1.2 pips on average with Premium Account

Trading Platforms:

MT4, MT5, HFM App

Account Minimum:

R100 or $5

HF Markets was Established in 2010 as HotForex. HF Markets is a popular Forex and CFD Broker in South Africa.

Regulation: HF Markets is regulated by the FSCA (Financial Sector Conduct Authority) in South Africa as HF MARKETS SA (PTY) LTD. They are also regulated by other top-tier regulators FCA, FSC, and CySEC.

Account Types: HF Markets offers four account types tailored to meet different categories of traders and their investment needs. These are the Pro, Premium, Zero, and Cent accounts. The broker also gives a swap-free Islamic Account option.

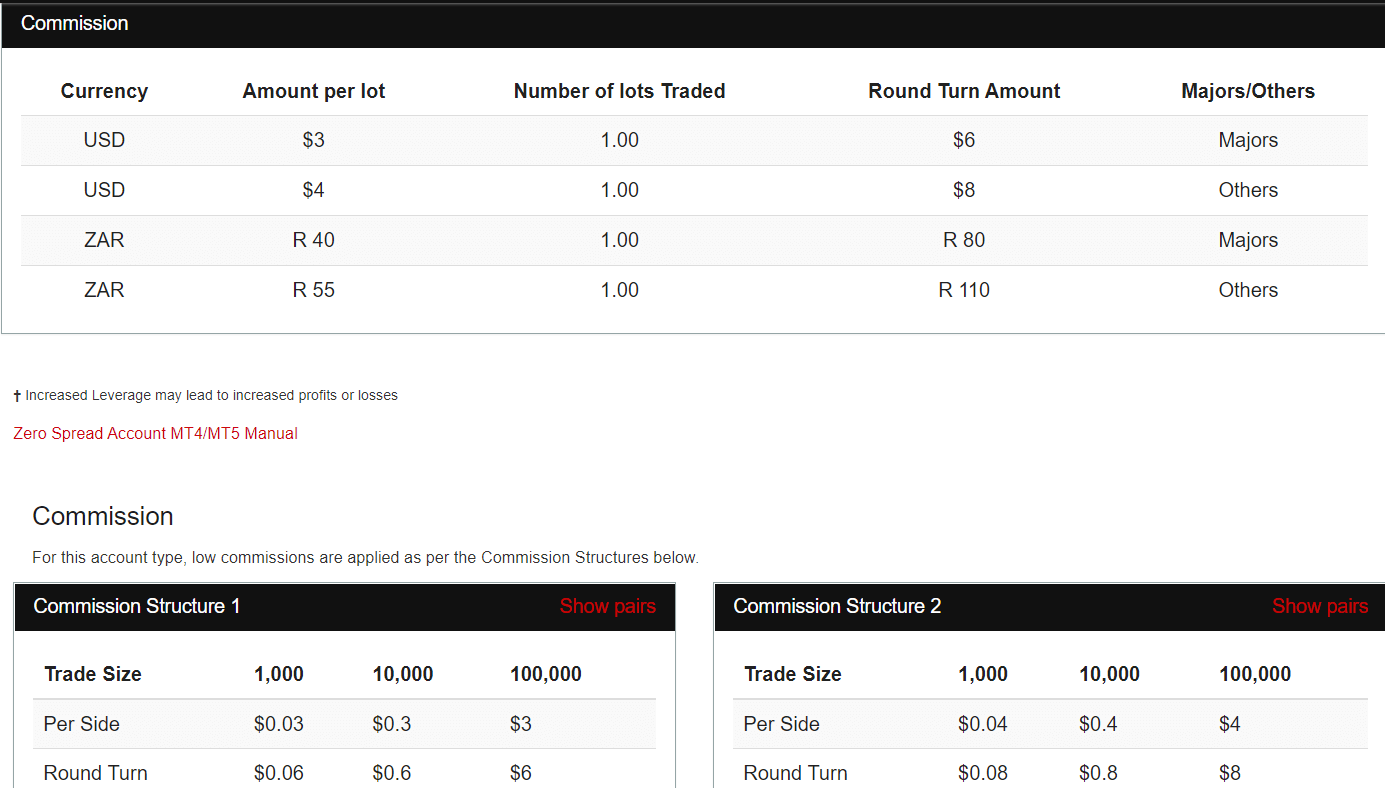

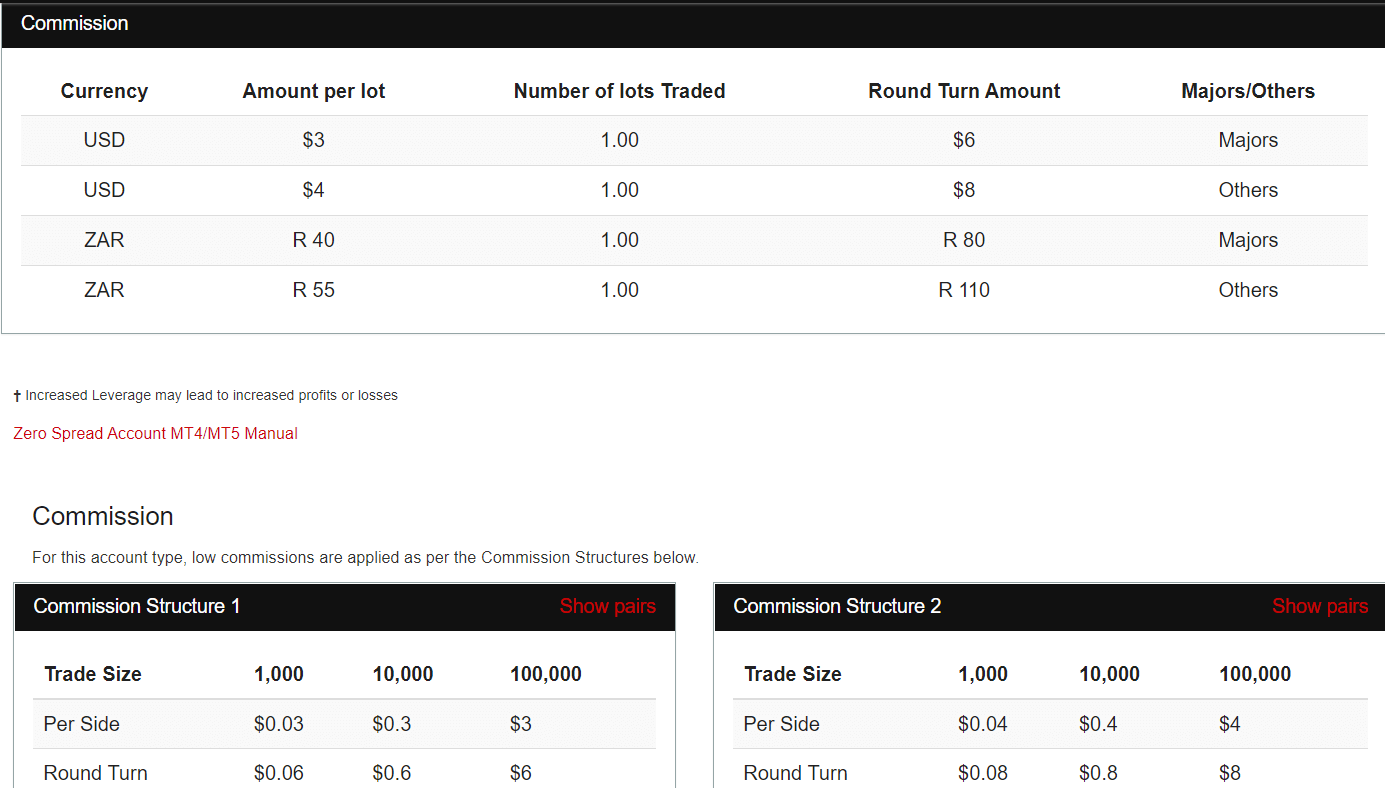

Fees: HF Markets offers commission-free trading on the Pro, Cent and Premium Accounts with spreads starting from 1 pip. The Zero Account has spreads starting from 0.1 pips but incurs commission fees starting from $3 or R40 per side.

HF Markets does not charge clients for deposits and withdrawals, although local banks might do so. HF Markets charges $5 per month as dormant account fees after 6 months of inactivity.

Trading Conditions: Leverage varies on HF Markets and can range from 1:5 to 1:1,000 depending on the account type and instrument traded.

The minimum amount for a deposit is R100 or $5. HF Markets offers ZAR trading account currency and supports online deposits/withdrawals using South African banks.

Tradable Instruments: HF Markets provides the platform to trade about 53 currency pairs CFDs, and over 100 CFDs on metals, shares, indices, and commodities at a quick execution rate.

Trading Platforms: HF Markets supports MT4 and MT5 platforms which are adaptable on all devices. They also offer the proprietary HFM App which is available on the web and mobile devices.

Customer Support: HF Markets maintains an active online customer support system via email, phone calls, and live chat that is available 24/5. They also have an office in South Africa that clients can visit to know more about the firm and its offerings. Aside from these, HF Markets also provides educational support for traders to improve their knowledge of the industry.

Read our well researched HF Markets Review for more on this broker.

HF Markets Pros

- HF Markets is licensed in SA by FSCA

- Accepts deposits from South African banks

- Allows withdrawals of funds to South African banks

- HF Markets has ZAR as a base currency for accounts

- Has a physical office in South Africa

- Has responsive 24/5 customer support via email, local phone call,s and live chat

HF Markets Cons

- Customer service is not available 24/7

- Charges dormant account fee

#2 Exness – Regulated Forex Broker with Low Spread

EUR/USD Benchmark:

1 pip on Standard Account

Trading Platforms:

MT4, MT5, Exness Trader

Exness is a forex broker that offers Forex & CFD trading to South African traders and is regulated with the FSCA.

Regulation: Exness was founded in 2008, as a forex broker. In South Africa, Exness is registered and regulated by the FSCA as Exness ZA (PTY) Ltd with license number 51024 as a Financial Service Provider. It is also registered and regulated by other top-tier regulators like Cyprus’ CySEC and Britain’s FCA.

Account Types: Exness offers two main classes of account types for their customers. The Standard Accounts and the Professional Accounts. The Standard Account is sub-divided into Standard and Standard Accounts, while the Professional Account is sub-divided into Raw Spread, Zero, and Pro Accounts, making it 5 account types in total. You can also request an Islamic Account on Exness.

Fees: There are no commission fees for trading with the Standard Account while that of the Zero (Professional) Account can be up to $3.5 per side. The spread for the Exness Standard Account is 1 pip on average for a major pair like EUR/USD, while that of the Exness Zero Account is 0 pips.

Exness offers free deposits and withdrawals and does not charge any account inactivity fees.

Trading Conditions: Leverage on Exness varies based on the instrument you are trading, equity, and the account type, with a maximum of 1:2,000.

The minimum deposit for Exness is $10 and sometimes varies based on the payment method. Exness offers ZAR as account currency and South African traders can make ZAR deposits using South African local banks.

Tradable Instruments: The instruments traded include about 99 currency pairs CFDs, and over 100 CFDs on metals, stocks, energies, indices, and cryptocurrencies.

Trading Platforms: Exness supports MT4 and MT5 trading platforms which are compatible with all devices. Exness also offers the Exness WebTrader and Exness App for mobile devices.

Customer Support: Exness offers support to South African traders in English. Exness customer support system is available 24/7. They offer support via live chat, international phone line, and email. Although there is no local phone number for South Africans.

Exness also has an FAQs section to answer likely complaints or questions that are common from traders. There are articles answering potential customer questions as well.

Read our in-depth review Exness Review for more.

Exness Pros

- Regulated by the FSCA and other top-tier international regulators.

- Accepts deposit and withdrawals using local banks

- Exness has ZAR as account currency

- Very low spread for Standard and Professional Accounts

- No inactive account fees

- 24/7 live chat support

Exness Cons

- Charges commission for professional accounts

- Email support response time is slow

- Has unlimited leverage option

#3 AvaTrade – Fixed Spread Forex Broker

EUR/USD Benchmark:

0.9 pips Fixed Spread

Trading Platforms:

MT4, MT5, AvaTrade WebTrader, AvaTradeGO

Account Minimum:

R1,750 or $100

AvaTrade is a CFDs and Forex broker. Ava Trade offers various trading platforms like AvaTradeGo, MT5, and MT4.

Regulation: AvaTrade is a Forex broker founded in 2006. Ava Trade is registered and regulated by reputable international regulators. In South Africa, Ava Trade is regulated by the FSCA under the name AVA CAPITAL MARKETS (PTY) LTD as a Financial Service Provider with license number 45984.

Account Types: AvaTrade offers only one type of account to traders, which is the Real Account. They also offer a no-swap Islamic account option upon request.

Fees: AvaTrade does not charge any commission fees on trades, while spreads start from 0.9 pips for major pairs like EURUSD.

There are no fees on deposits and withdrawals, but AvaTrade charges around $50 per month for inactivity after three months and $100 after a year of inactivity.

Trading Conditions: The maximum leverage on AvaTrade is 1:400 and can be smaller depending on the instrument you trade.

Ava Trade’s minimum amount of deposit is $100 or ZAR1,750. The broker has ZAR as account currency and you can make deposits/withdrawals via local banks in SA.

Tradable Instruments: AvaTrade offers over 500 instruments including CFDs on 55 currency pairs, major stocks, cryptocurrencies, indices, FX options, and commodities.

Trading Platforms: AvaTrade trading platform is available on MT4 and MT5 and is compatible with tablets, Windows, Mac, Android, and iOS devices. The broker also has a proprietary AvaTrade WebTrader and AvaTradeGo App available on mobile devices.

Customer Support: AvaTrade provides 24/5 customer support via email support and live chat, while phone support is available during working hours on business days. They also provide trading education and demo account for inexperienced traders.

Read more about AvaTrade here.

AvaTrade Pros

- Has ZAR account currency option

- Registered with FSCA

- Deposit and withdrawals can be made local banks

- Offers commission-free trading

- Does not charge any fees for deposits or Withdrawals

AvaTrade Cons

- Charges inactive account fees

- Do not have 24/7 customer support

- Slow processing of deposits and withdrawals

#4 Tickmill – South African Regulated Forex Broker with Local Deposit

EUR/USD Benchmark:

From 0.1 pips with Pro Account

Trading Platforms:

MT4, MT5, Tickmill App

Tickmill is a CFDs & Forex Broker that is regulated with multiple regulators. They offer low spreads and good trading conditions.

Regulation: Tickmill was established around 2014. Tickmill is registered in South Africa as TICKMILL SOUTH AFRICA (PTY) LTD, a Financial Service Provider by the FSCA with FSP number 49464.

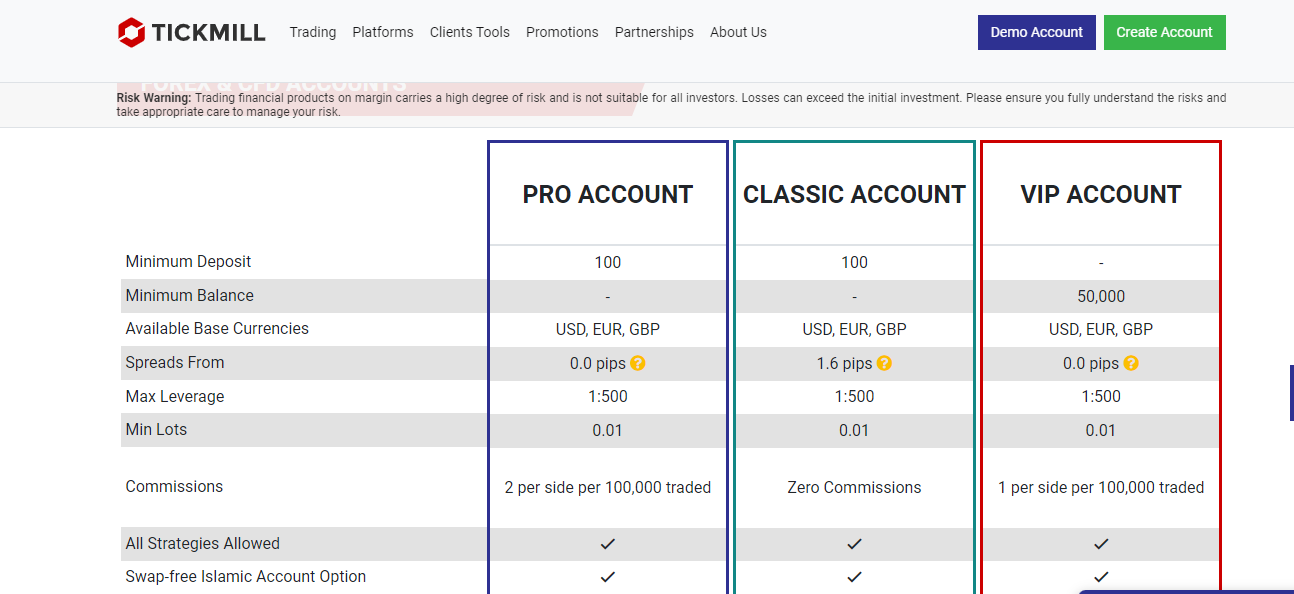

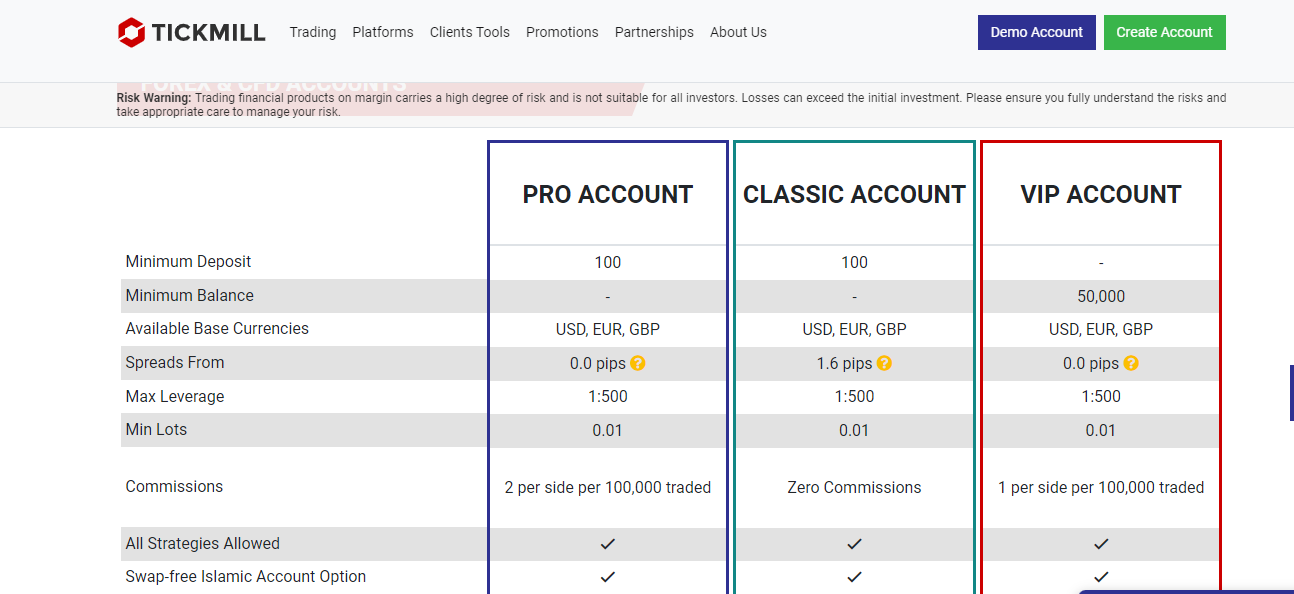

Account Types: Tickmill offers three different account types excluding the demo account. They have Classic, VIP, and Pro Accounts. They also have an Islamic (Swap-Free) Account option for Muslim traders.

Fees: Typical spreads on Tickmill is 0.1 pips with Pro Accounts for majors like EURUSD and the account has commissions of $2 per side. VIP Accounts have commissions of $1 per side with spreads starting from 0.0 pips, while the Classic Account has spreads starting from 1.6 pips and does not have any commission fees.

There are no deposit and withdrawal charges on Tickmill, and no inactive account fees are charged.

Trading Conditions: Maximum leverage stands at 1:500 and can be lower based on the instruments you are trading.

The minimum deposit on Tickmill is pegged at $100. Tickmill does not provide local currency accounts i.e there is no ZAR account currency, although, the firm allows for deposits using local banks.

Tradable Instruments: Tickmill provides a variety of instruments for clients to trade. These include CFDs on 62 currency pairs, and CFDs on cryptos, major stocks, and commodities such as oil and precious metals.

Trading Platforms: Tickmill operates the MT4 and MT5 trading platforms. It also has the meta trader for the web and Mac. Tickmill also has a proprietary application, Tickmill Mobile App, for mobile devices (iOS and Android).

Customer Support: Tickmill customer support is available via live chat (9 AM GMT +3 to 10 PM GMT +3 on working days), email (24/5), and phone (during working hours on business days).

Tickmill Pros

- Authorised by FSCA and other Top-Tier regulators

- Does not charge dormant account fees

- Low trading fees with tight spreads

- Supports bank transfer in South Africa

Tickmill Cons

- Charges commission on trading

- No ZAR account currency

- Live chat not available for 24 hours

#5 FXTM – Regulated Forex Broker in South Africa

EUR/USD Benchmark:

1.9 pips with Micro Account

Trading Platforms:

MT4, MT5, FXTM Trader

FXTM offers deposits in ZAR for South African Traders. And offering multiple Trading resources.

Regulation: FXTM was founded in 2011 and registered as an FSP with the FSCA as FOREXTIME LTD with registration number 46614.

Account Types: FXTM offers three account types. The Micro, Advantage, and Advantage Plus Accounts. The broker also offers an Islamic Account upon request.

Fees: FXTM has a high spread of about 1.9 pips on average for majors like EURUSD with their Micro account. While there are no trading commissions for its Micro and Advantage Plus Accounts, FXTM charges up to 4.88 USD as commission for its Advantage Account.

FXTM doesn’t charge any fee for deposits, however, it charges around 1.5% on some withdrawal methods. For example, for withdrawals in ZAR via bank, they charge a flat $1 per withdrawal and $3 for cards. FXTM also charges inactive account fees of $5 per month after 6 months.

Trading Conditions: Leverage on FXTM ranges from 1:3 to 1:2,000 depending on your account type and the instrument you are trading.

The minimum deposit stands at $10. FXTM does not have ZAR account currency, although the broker allows deposits in local ZAR for South African traders which is converted to USD.

Tradable Instruments: FXTM offers a wide variety of instruments for clients to trade on. There are around 57 currency pairs CFDs, and CFDs on 100s of cryptos, stocks, commodities, indices, and metals.

Trading Platforms: The MT4 and MT5 trading platforms are available on FXTM. They also have a proprietary FXTM WebTrader and FXTM App for mobile.

Customer Support: FXTM customer support is available 24/5 on business days via live chat, email, and call. They however do not have a local South African number to call.

FXTM Pros

- FXTM is regulated in South Africa

- FXTM has negative balance protection

- You can make deposits via South African local bank accounts

- FXTM has bonus offerings

- Fast processing of deposits and withdrawals

- The customer care support of FXTM is good and available 24/5

FXTM Cons

- FXTM charges dormant account fees after 6 months of inactivity

- FXTM charges withdrawal fees on some payment methods

- FXTM customer support is not available 24/7

- FXTM does not have ZAR account currency

- FXTM does not support withdrawals to South African bank account

#6 XM Trading – Forex Broker with Zero Commission & Low spread

EUR/USD Benchmark:

1.6 pips with Standard Account

Trading Platforms:

MT4, MT5, XM App

XM Trading offers a wide range of trading instruments including forex. Negative balance protection is available to traders.

Regulation: XM Trading was founded in 2009 and is headquartered in Cyprus. XM is registered and regulated with the FSCA as KEY WAY FINANCIAL (PTY) LTD. with FSP number 49976. In addition, they are registered and regulated by CySEC and IFSC Belize.

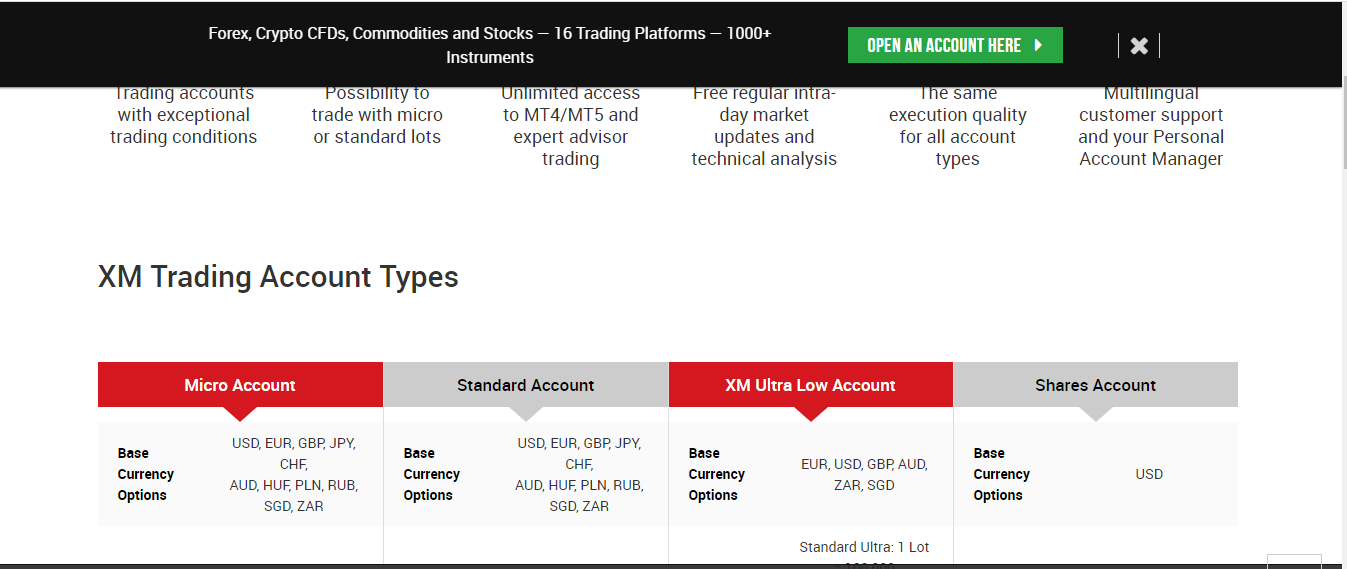

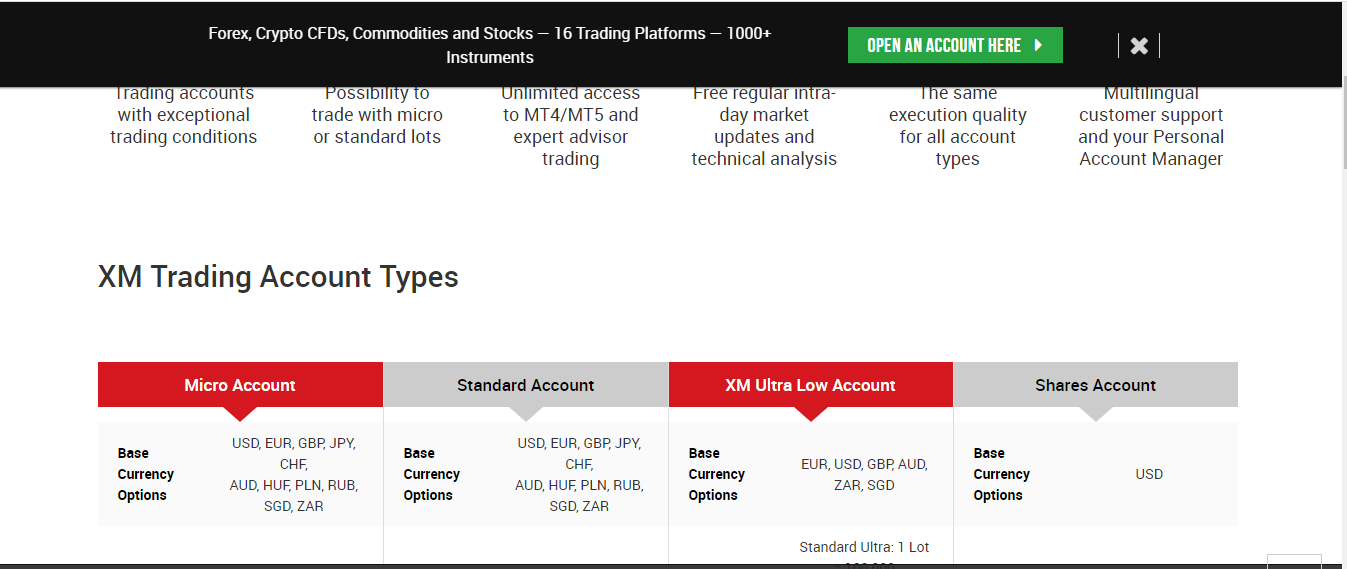

Account Types: XM offers 4 account types. The Micro, Standard, Ultra-Low, and Shares Accounts. All accounts have the provision for ZAR as the base currency except for the Shares Account.

Fees: The spread is around 0.1 pip. It doesn’t charge commission on all accounts except the shares account, which has commission fees of $5 per trade. XM also doesn’t charge fees for withdrawals and deposits. The broker charges dormant account fees of $5 monthly after 90 days.

Trading Conditions: The maximum leverage on offer from XM is 1:1,000. The minimum deposit on all accounts is $5 except the shares account which has a minimum deposit of $10,000.

XM allows deposits in ZAR and also offers ZAR as an account base currency.

Tradable Instruments: FXTM offers a wide variety of instruments for clients to trade on. There are around 55 currency pairs CFDs, shares CFDs, and CFDs on cryptos, commodities, stocks, energies, indices, and metals.

Trading Platforms: The MT4 and MT5 trading platforms are supported by XM for trading. They also have a proprietary XM WebTrader and XM App for mobile devices.

Customer Support: The customer support on XM Broker is via live chat and email. South African traders do not have a phone line to call, they only have an international number.

XM Trading Pros

- Regulated in South Africa

- Fast Processing of deposit and withdrawals

- Offers commission-free trading

- Has ZAR as account currency

- Customer support is available 24/7

XM Trading Cons

- Charges dormant account fees

- Few tradable instruments available

#7 IC Markets – ECN Type Broker with Low Fees

EUR/USD Benchmark:

0.6 pips with Standard Account

Trading Platforms:

MT4, MT5, cTrader

Based in Australia, IC Markets holds an FSCA licens. This makes it possible for them to accept and provide financial services for South African traders.

Regulation: IC Markets is headquartered in Australia. In 2021, their license was authorised by the FSCA under the name International Capital Markets (Pty) Limited. Their FSP number is 50715

Account Types: XM offers 2 account types. There is a Standard Account and a Raw Spread Account. The Raw Spread Account can be opened for MT4 and cTrader with varying trading conditions. The two accounts are not available in ZAR.

Fees: Commissions are charged only on IC Market’s Raw Spread Account. It is $3.50 per standard lot on MT4. On cTrader, you pay $3.00 as commission for a standard lot. Spreads begin from 0.6 pips for Standard Account. There also overnight charges.

Trading Conditions: The maximum leverage on offer is 1:1000. The minimum deposit on all accounts is $200. You cannot fund your account in ZAR.

Tradable Instruments: IC Markets has a wide market range that includes 61 currency pairs, and indices, commodities, bonds, shares CFDs, cryptos, and futures.

Trading Platforms: IC Markets supports MT4, MT5, and cTrader. No proprietary trading platform.

Customer Support: You can reach IC Markets via email and live chat. IC Markets have emails for different purposes (client relations, support, and accounts). Make sure you send your inquiries to the relvant department.

IC Markets Pros

- Regulated in South Africa

- No commissions on Standard Account

- ECN raw spread account

- Supports cTrader

- Good customer support

IC Markets Cons

- No ZAR-based Account

- No deposit/withdrawal in ZAR

What is a Forex Broker?

A forex broker offers brokerage services to retail and professional traders who want to speculate on currency pairs & other markets as CFDs, by going long (buy) or short (sell). Through a forex broker, your profit or loss from trading CFDs is cash settled in a brokerage account you have opened with the broker.

A forex broker could be a market maker which means they could be taking the opposite sides of your trades. A market maker also stands to makeprofit when you lose a trade so there is a little conflict of interest. A forex broker could also be a no-dealing desk broker that connects you to buyers/sellers through their liquidity providers via computerized networks.

How to choose Best Forex Broker in South Africa

Forex traders in South Africa face a dilemma over the choice of a brokerage firm to trade with. Although getting started in Forex trading is easy as one just needs to register and fund an account with a broker. What constitutes a problem is finding the right broker.

For ease in trading, the brokerage firm should accept deposits and quick withdrawals in ZAR at zero to low fees. A forex trader should look out for such when deciding on the choice of broker.

Probably the most important of all factors to consider is trading fees. Some brokers charge high charges for almost every transaction carried out by the trader. Such numerous and exorbitant trading fees can eat into a trader’s profit or even his capital. A trader must choose a broker that has low or minimal trading fees.

That being said, the above list of the best brokers in South Africa was created using the criteria listed below.

1. Consider the Regulation in South Africa

For forex traders in South Africa, the Financial Sector Conduct Authority (FSCA)- which is the apex regulatory authority has warned and advised forex traders in South Africa to avoid brokers who are not registered and regulated as Financial Service Providers (FSP) in the country. The warning is hinged on the idea that in the event of misappropriation of funds, it is difficult or impossible to bring the broker to book.

The FSCA regulates forex brokers & only the brokers that are authorized by them are considered relatively safe for trading in SA in terms of deposited client funds.

FSCA carries out its activities by issuing a unique FSP number to all authorized Financial Services Providers. It is important as a forex trader in South Africa you check whether your chosen broker is registered as an FSP on their website.

This is done by confirming the FSCA registration number on the broker’s website with that on the FSCA website. You can also check using the broker’s name.

It is also important for traders to check whether their brokers can offer derivative instruments to clients. This can be done in four simple steps.

-

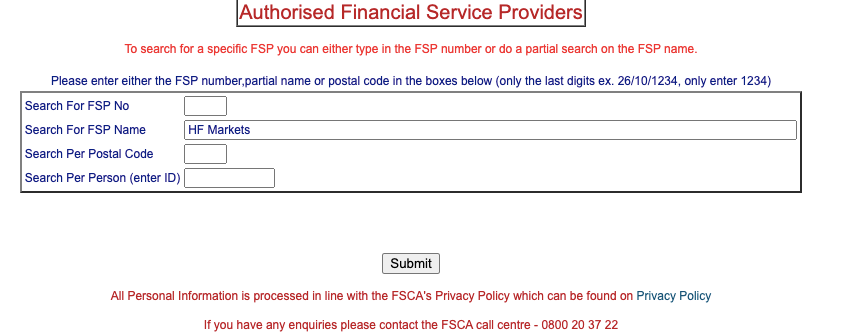

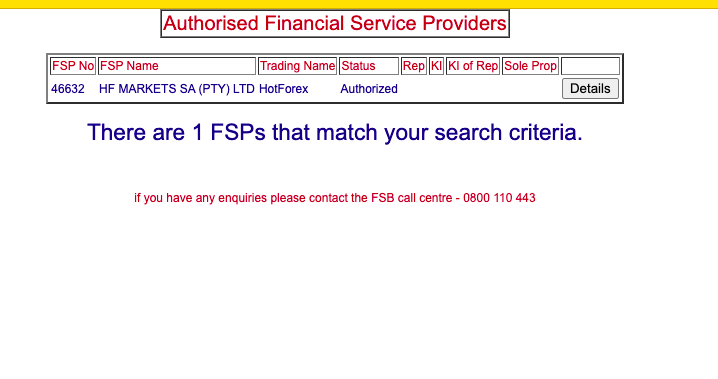

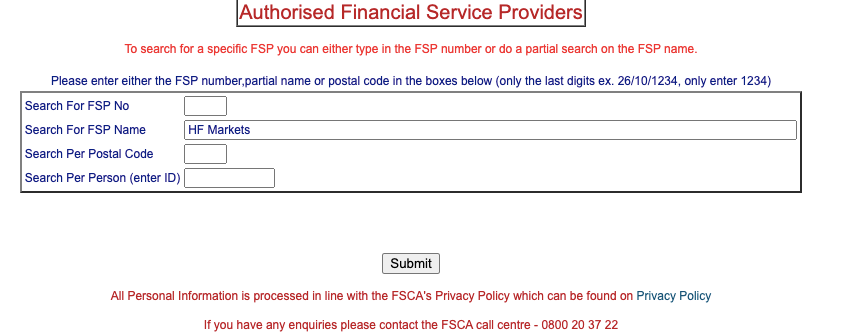

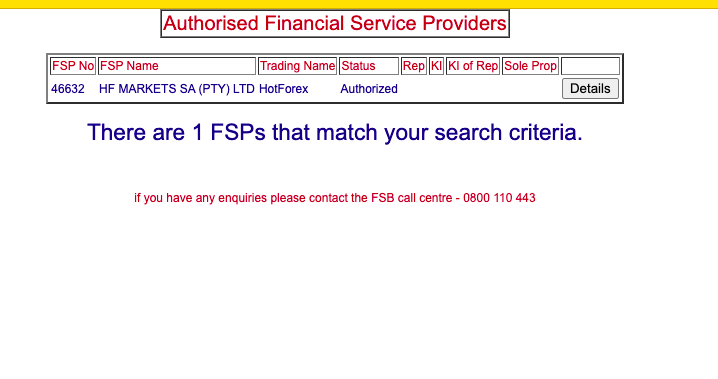

Firstly, the client checks if the broker is registered by the FSCA as an FSP by searching the broker’s name on the FSCA’s public search platform. We use HF Markets as an example for this search.

-

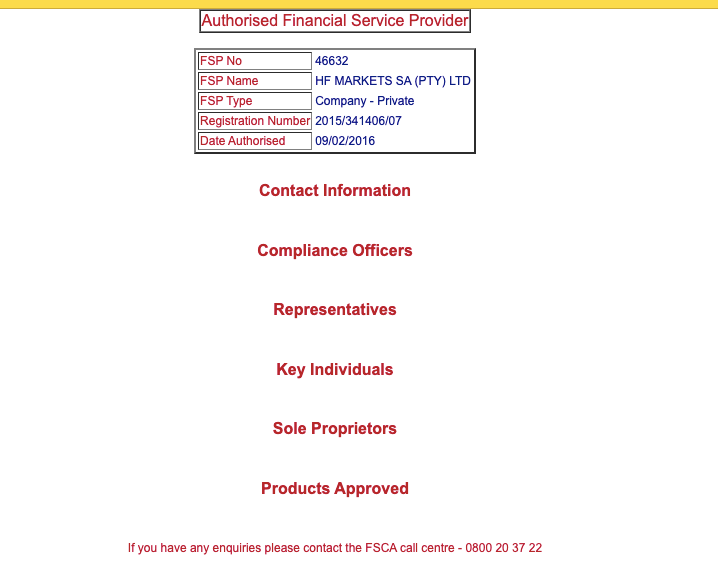

On confirmation, verify the name and number on the FSCA website with that on the broker’s website.

-

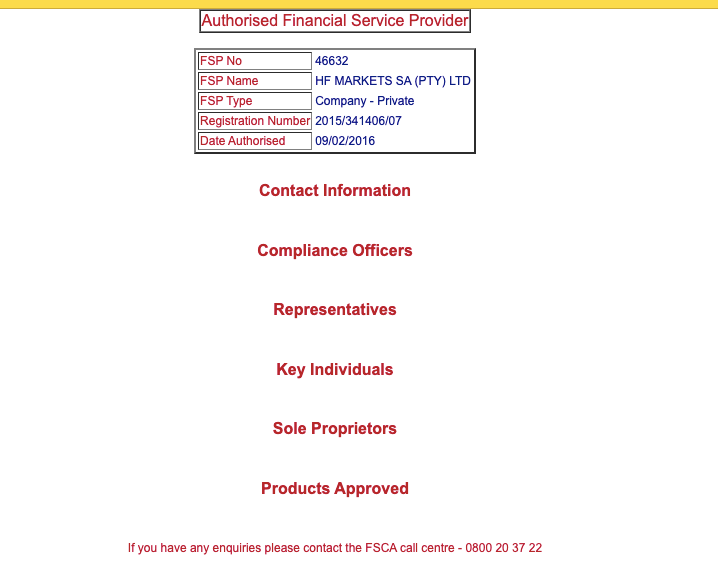

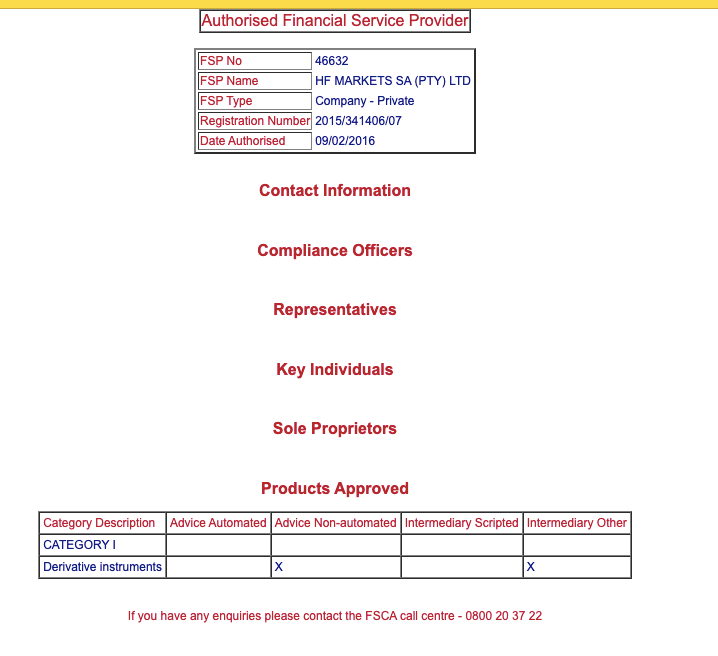

Thirdly, click on ‘Details’ of the broker’s registration.

-

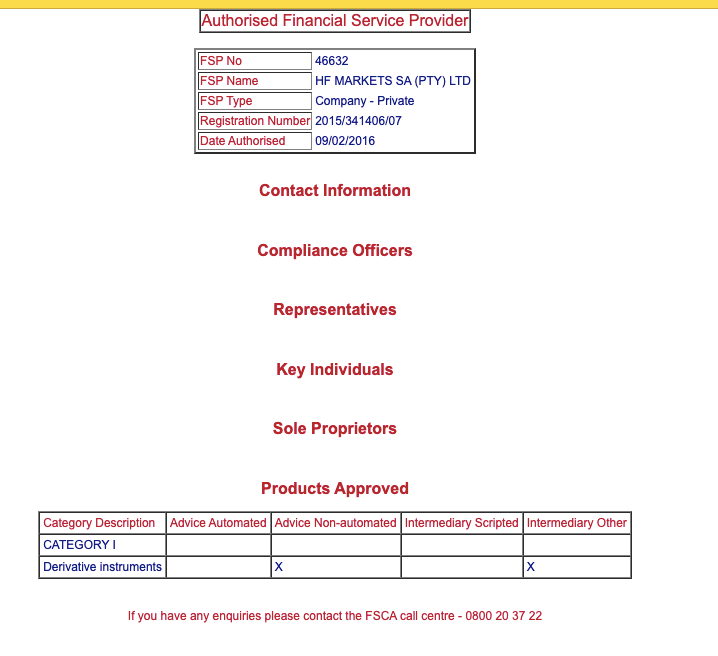

Lastly, click on products approved. You’ll see derivatives and other instruments approved by the broker.

However, not all brokers will be registered with the FSCA. It is also advised a trader avoids brokers that are registered with low-tier regulators also called Offshore regulators such as IFSC Belize, FSC Mauritius, etc. Trading with offshore brokers means there is no protection in case the broker is a scam or use bad practices like delayed withdrawals, widening of spreads, etc.

The brokers registered with Tier-1 regulators such as FCA in the UK and ASIC in Australia can be considered if they are not registered by FSCA. These brokers are low-risk compared to offshore brokers.

However, it is advised that SA traders should stick to only brokers registered by the FSCA as it is easier to get protection from one’s home country than from foreign counterparts.

Also, you should check if the forex broker is authorized to offer the products that you want to trade. For example, CFD brokers are also required to get licensed as an ODP to offer derivatives, so their status must be “Approved” on FSCA’s ODP search, which allows you to search the entities approved to offer over-the-counter Derivatives.

2. Overall Trading Fees

It is also important a trader is well informed about the trading fees and commissions a broker charges before choosing to with them. This is important since some brokers charge excessively and exorbitantly. These fees can eat deep into one’s profit or even capital. Some brokers also charge for the inactivity of accounts.

1. Spread: The main fee brokers charge is the spread. The higher the spread means the higher fees you are paying to trade.

What is spread? It is the difference between the bid & the ask price. For example, if the bid price of EUR/USD is 1.1103 & the Ask price is 1.1100, this means the spread is 3 pips. You will only start to make a profit from your trade once the price goes up/down by 3 pips (depending on your position).

Spreads should be put into consideration when deciding on the choice of broker. Brokers usually charge higher spreads when they offer no commission trading.

2. Commission: Some forex brokers offer zero spread or Raw spread accounts, but in turn make money from commissions per trade. It is common for ECN-type brokers to have Pro accounts.

Let’s take HF Markets for example. They have a Zero Spread Account, with which they charge very low spreads from zero pips, but they have commissions of R80/lot round-turn for majors.

Let’s take EUR/USD as an example, HF Markets charges 0.1 pips spread on average on their Zero Account & the commission is $6/lot. So, if you are trading 1 mini lot, then the commission + spread for this trade will be 0.6 + 0.1 i.e. $0.7 for 1 mini lot trade.

This is lower when you compare it with their Premium account which has a spread of 1.3 pips on average for trading EUR/USD. So for the same trade, you will be paying $1.3 in trading fees with the Premium account compared to $0.7 in trading fees with Zero Account.

It is important to note that like most forex brokers, HF Markets has variable spreads. So, the overall trading fees can vary in the example above.

Still, on fees, some brokers do charge conversion fees when one’s home currency is different from the base currency. It is advised one chooses a broker that offers accounts in your local currency.

3. Trading Instruments

The number of tradable instruments on offer should also be a factor when choosing a broker. Most Forex brokers offer around 50 to 100 currency pairs. These are grouped into major, minor and exotic currency pairs.

Also, some brokers offer contracts for difference (CFDs) on currency pairs, cryptos, stocks, and commodities. These are important considerations since one’s choice of trade might not be on offer or one’s preferred group of instruments might not be offered by a broker. So it is important to check this yourself.

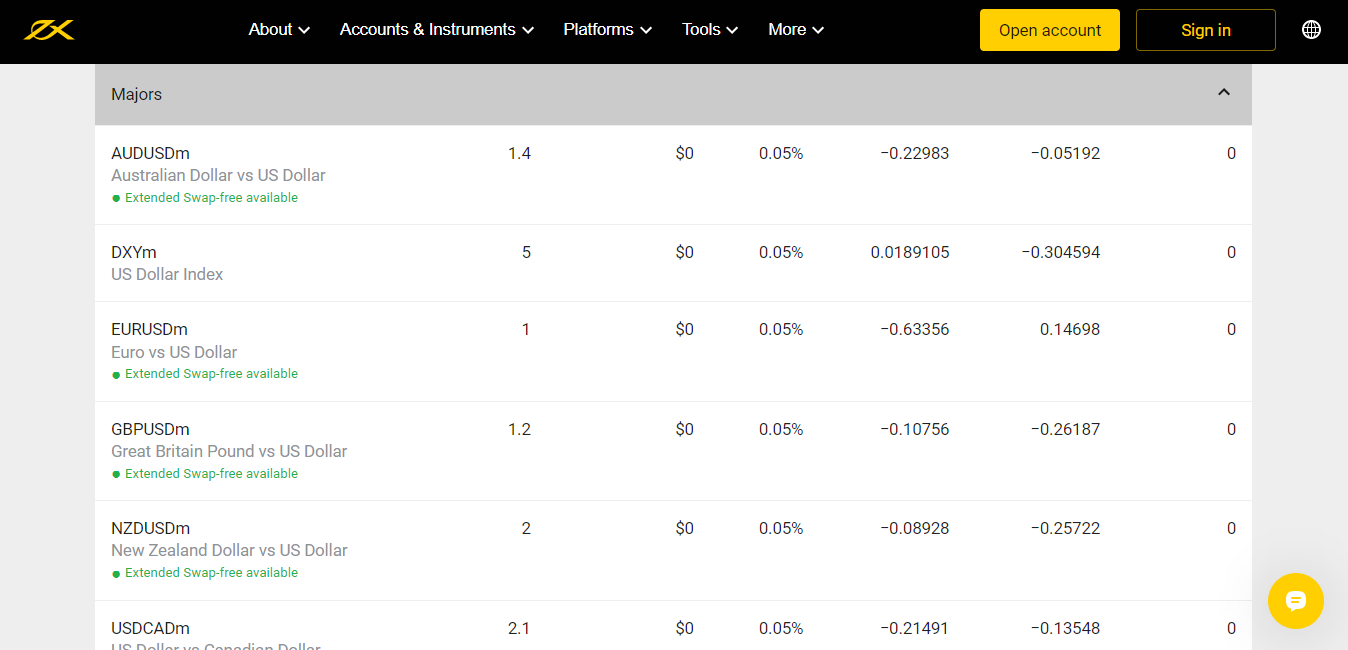

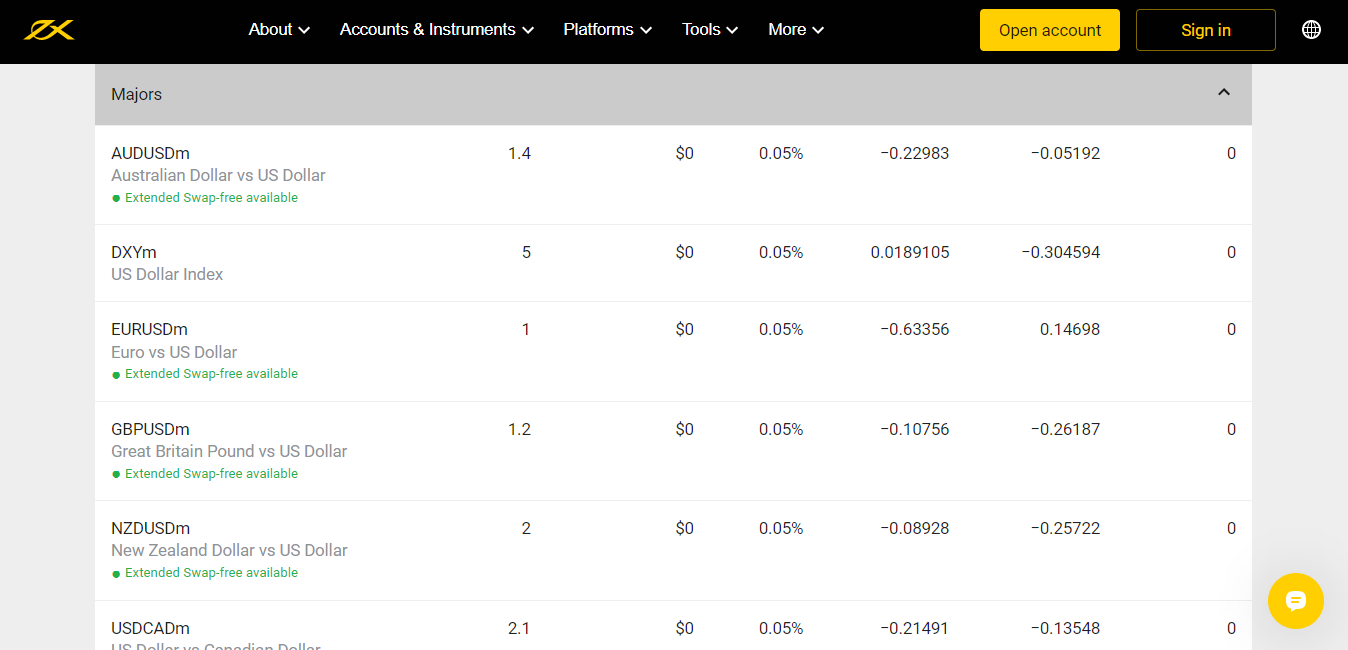

Here is how you can go about it with Exness as our example. On Exness’s homepage, click on ‘Accounts and Instruments. You’ll see a dropdown that lists all CFDs offered by Exness.

You only need to click on any CFD class to know more about them (including spreads and swaps). The image below displays what your search result will look like.

4. Account Types

Perhaps one of the most important factors a trader should consider before choosing a broker is the type of account on offer. The features of the different accounts such as commissions and spreads should be properly understood.

One unique account that clients should know about is the ECN-type account. Some brokers do offer ECN accounts on their platforms. ECN stands for Electronic Communication Network. This type of account allows traders to trade without a middleman or link. FXTM, Exness, and HF Markets all offer ECN accounts on their platform.

Having multiple account types can offer you the flexibility to trade, and generally, brokers have different fee structures for different account types.

Let’s understand this with an example. Forex brokers generally have Pro accounts (for Professional traders) & Standard Accounts (for Retail traders). The difference can be in terms of leverage & lower fees for large-volume traders.

Standard accounts are basic account types with standard fee structures, generally as spreads. Although some brokers also have Standard accounts with low spreads, some commission is involved for each trade (depending on your lot size).

Here is a screenshot from Tickmill’s website showing their different account types.

You can see that minimum spreads and commissions vary per account though they have the same maximum leverage. With these options, you can select the account that suits you in terms of trading fees.

5. Availability of Local Funding

It is easier to trade on a platform that allows one to fund his account through his local bank. A trader will find it difficult to make deposits and withdrawals when the broker’s platform doesn’t allow local funding and withdrawal.

Hence it is important one verifies this when choosing a broker. Many regulated Forex brokers in South Africa allow ZAR funding and withdrawal.

Examples include Tickmill, HF Markets, Exness, etc. These do not charge fees for deposits and withdrawals. However, a local bank might charge some form of processing fee. FXTM does charge for deposits and withdrawals.

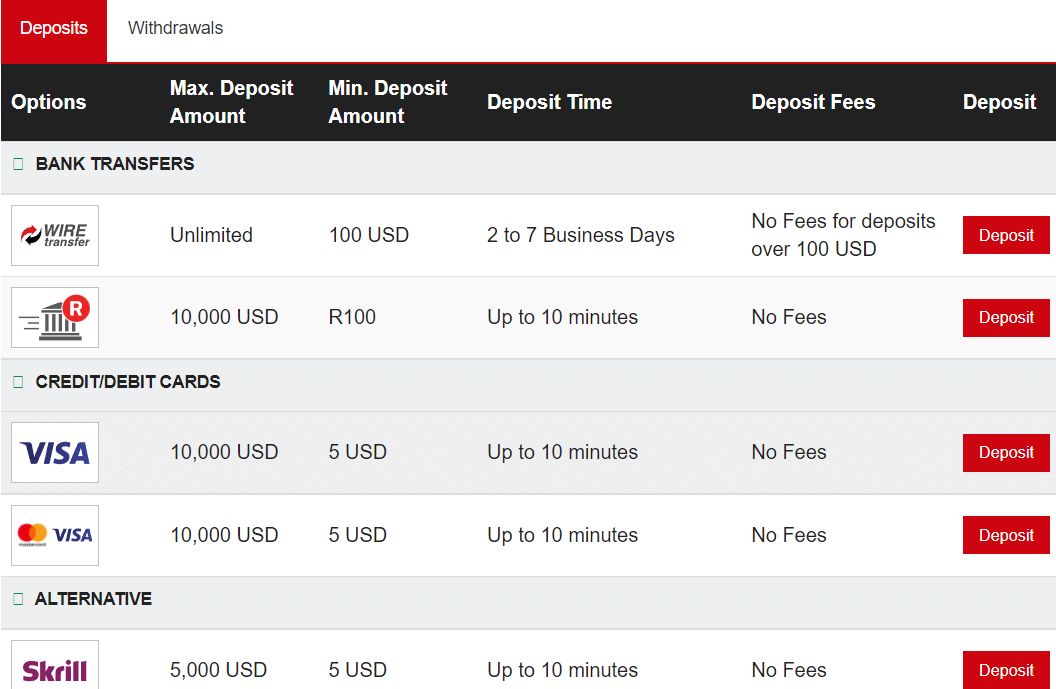

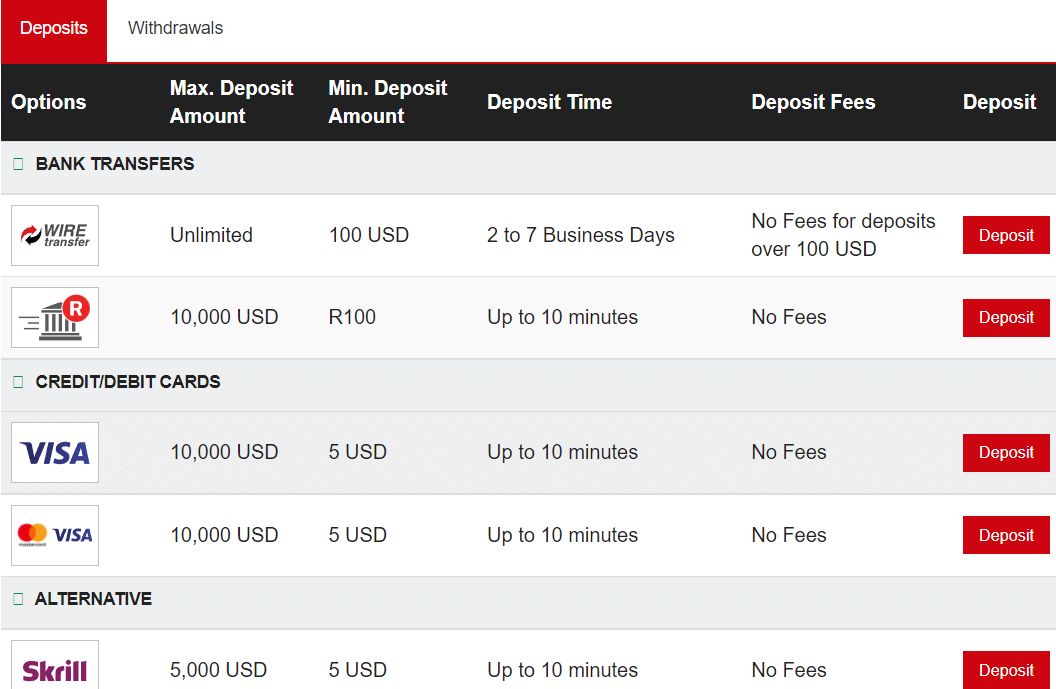

You can check the available local funding option in your client panel or the broker’s website. Let’s take the example of HF Markets.

They have mentioned the minimum deposit in ZAR for each payment method, including local bank transfers. The deposit time is around 10 minutes, and there are no extra fees for funding via bank transfer or EFT in ZAR.

Similarly, other brokers mention the deposit requirements, time & fees for the local bank transfer in South Africa. You must check & compare it to ensure that you are not paying anything extra for local funding & withdrawals.

6. Percentage of Losing Traders

Though forex trading is regulated in South Africa, ZA forex brokers are not required to reveal the percentage of traders that lose money trading with them. However, if you choose a South African broker that is also regulated in the UK, you can check the percentage of traders that lose with the broker.

This factor is important because there is an industry benchmark of around 75% for losing traders. If a forex broker has a percentage higher than this, then something could be wrong. So, how do you check it? Go to the UK version of the broker’s website. You will find the percentage in the header of the website. That is where most brokers display it.

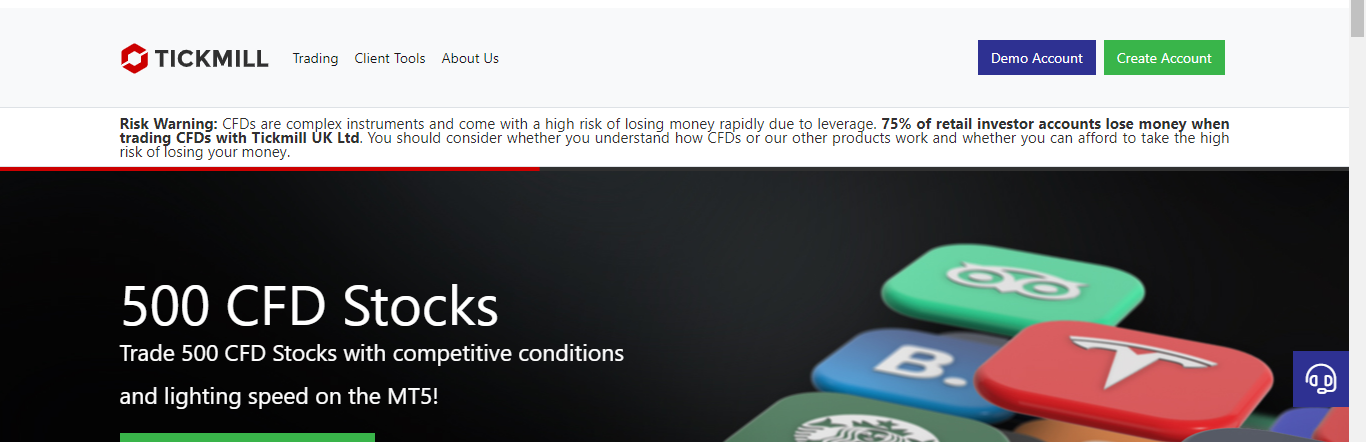

If you don’t find it there, then scroll down to the footer. Brokers like AvaTrade display it at the footer. The screenshot below is from Tickmill’s UK website.

According to the data from April 2023, 75% of traders lose their money when they trade with Tickmill. This figure may be high or low depending on the broker you are checking.

7. Account Base Currency

To prevent oneself from going through the hassle of converting from local currency to base currency if one’s local currency is not the base currency for his trading account, a trader should look for a broker who doesn’t charge conversion fees.

Alternatively, a trader might decide to fund his account in the currency one trades in. Then there won’t be any need for conversion before the trade and conversion after the trade. These conversions in some cases do come with fees. These conversion charges are usually 2-3 percent of the overall deposit.

Some regulated Forex brokers in South Africa do have the ZAR as their base currency. Examples are HF Markets, Exness, and XM do have ZAR as the base currency account option.

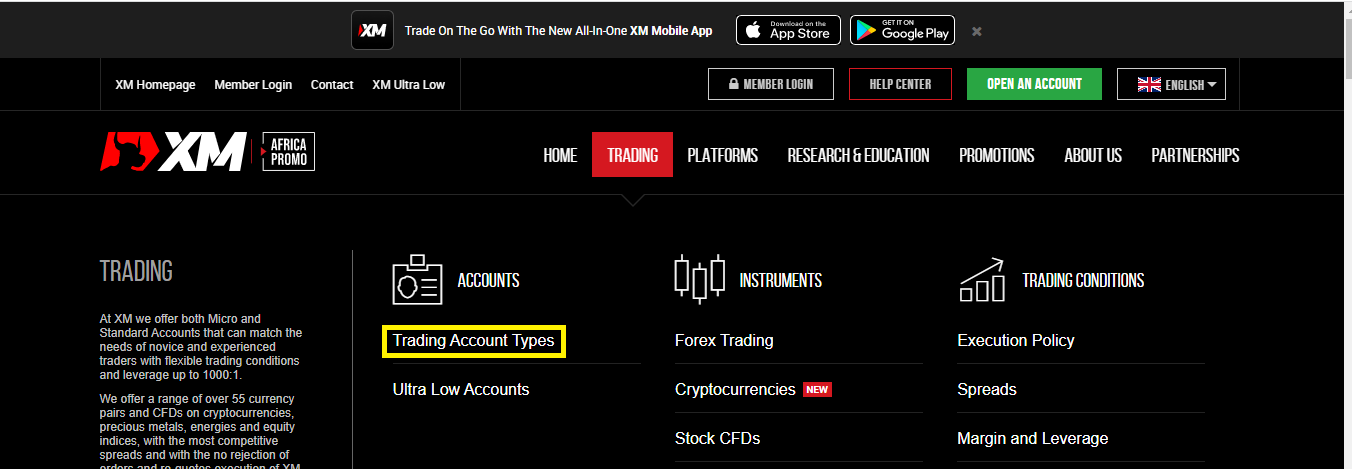

Here is how you can check if your broker has a ZAR account. We will use XM as our example. This is quite easy. Go to XM’s website and click on ‘Trading’. From the dropdown, click on ‘Trading Account Types’. Here is the illustration below

When you click on ‘Trading Account Types’ and scroll down, you will find the page below showing the base currencies available per account.

From the image above, you can see from the second row that you can trade in ZAR on all accounts except for the Shares Account. You can repeat these steps for most brokers. If you find it difficult, you can speak to your broker’s support.

8. Choice of trading platforms

Metatrader 4 (MT4) and Metatrader 5 (MT5) are the most popular trading platforms. Not all brokers have them though. What you want to pay attention to here are platform-specific features.

Some brokers have more instruments on their MT4 platform than MT5. There could even be differences in swaps and commissions across the two platforms. So make sure to look this up on the broker’s website. In addition, the platforms should be multi-device. Mobile trading apps are handy for on-the-go trading. Desktop versions/web traders give you a better view of the price.

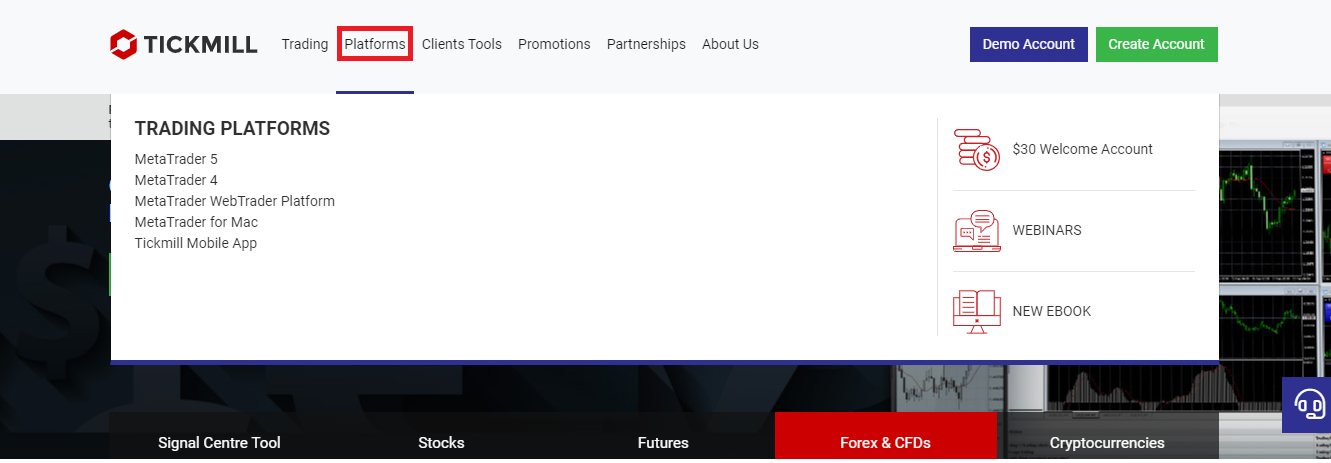

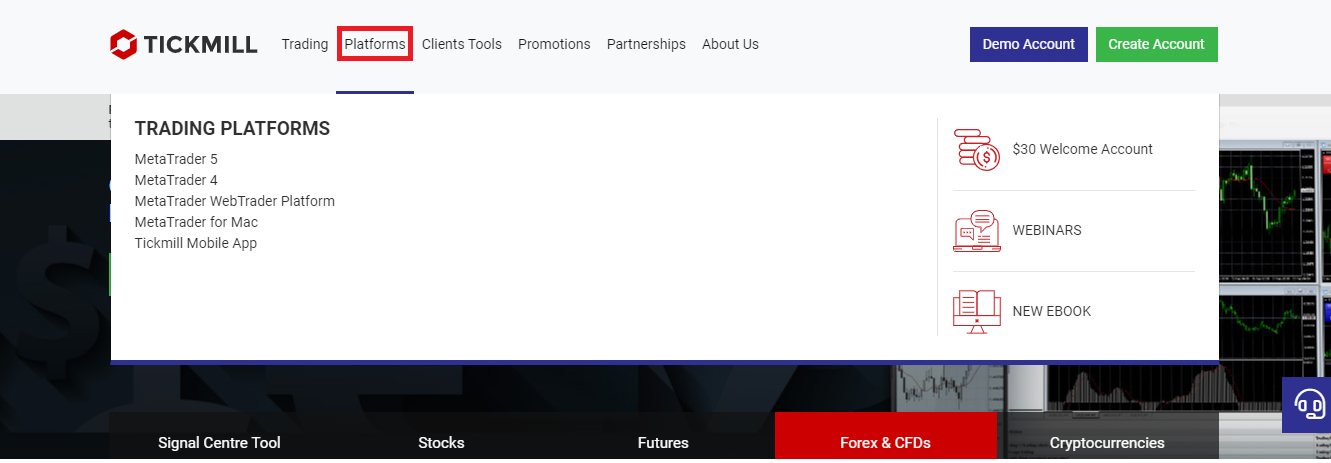

You will need to combine these devices for effective trading so make sure you check. Here is how we checked with Tickmill for example. On their homepage, click ‘PLATFORMS’

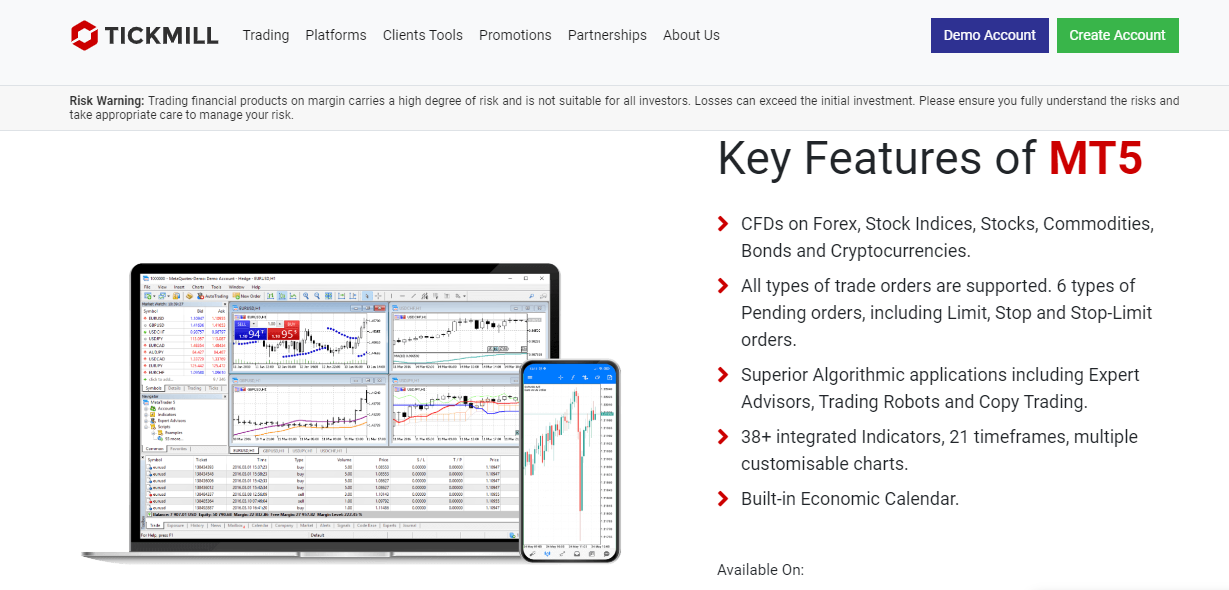

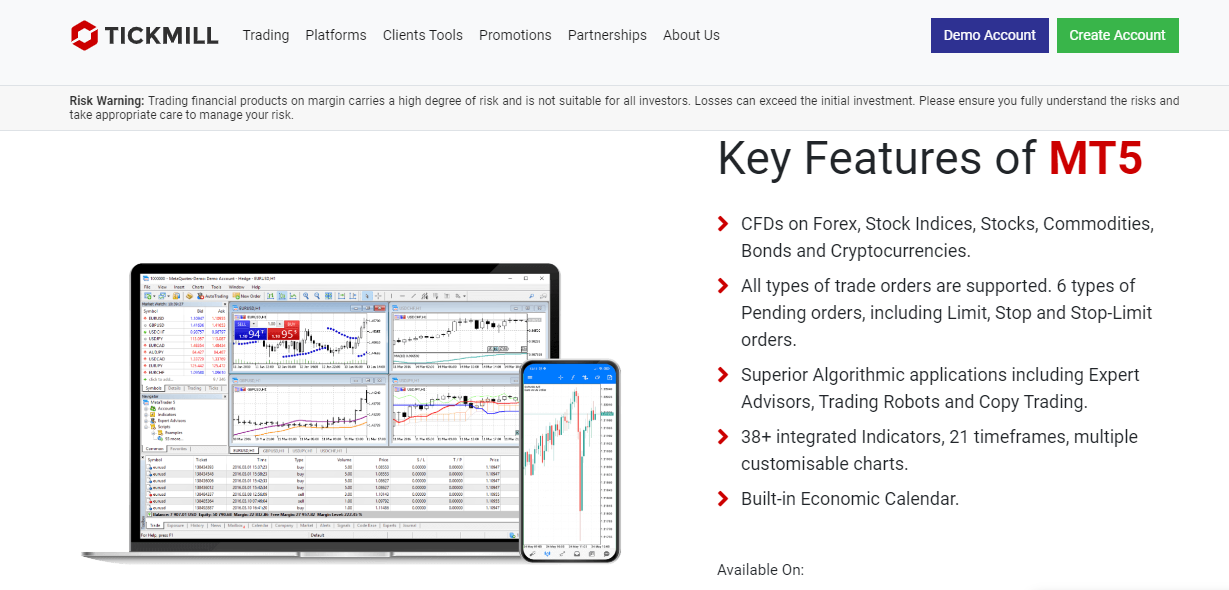

From their website, Tickmill has MT4, MT5, and Tickmill mobile apps. You can look through each trading platform for more information about their features. If you click on MT5 for example, you will find the details below

From the image, you can see the features of Tickmill’s MT5 and its availability on multiple devices.

Some forex brokers might also support a proprietary trading platform. These platforms are not usually linked to a third party developer like the MT4, MT5, and cTrader. They are owned by your broker and in some cases might even be named after your broker. HFM Platform, Exness Trading App, Exness Terminal, and Tickmill Mobile App are examples.

Traders favor MT4 and MT5. However, it is possible your broker’s platform has some features, indicators or trading tools that might not be on MT4/MT5. So you might want to give your broker’s platform a try. The only downside is that your broker’s platform might not be available on all devices.

For example, Tickmill, FXTM, and HF Markets only support trading apps. On the other hand, Exness supports their trading app and a trading terminal for desktop users.

The availability of copy trading is another important thing to check. You will find this on the broker’s website if it is available.

9. Other trading conditions

a. Order types: Varying order types help give you options in the market. Limit and stop orders can come in handy in entering the market at the right time and price. Your chosen broker must have these orders available on their platform.

Guaranteed stop-loss orders close your trades at specified prices. This order is executed regardless of market conditions. It is important your broker has this service in place because it is key for risk management. In addition, GSLOs are not free. So check with your broker to know if they have it, and much they charge for it.

b. Negative balance protection: Without negative balance protection, you can lose more than the funds in your trading account. This is why the FSCA required that brokers protect traders from experiencing this.

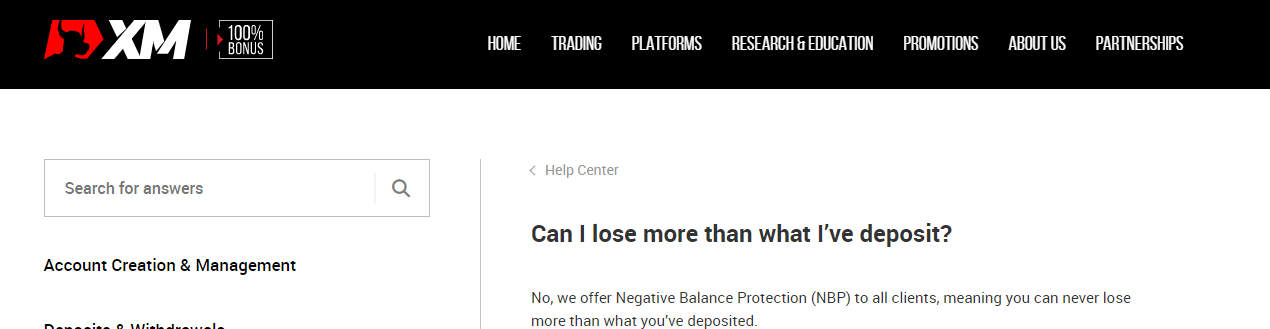

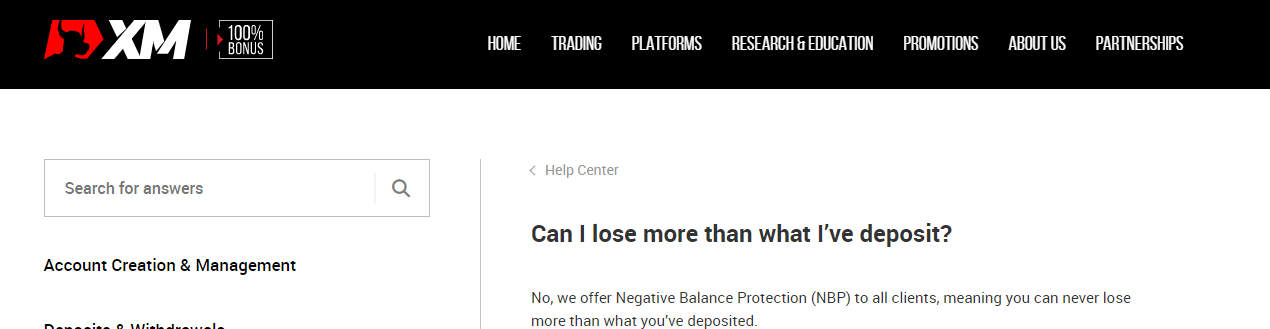

If your chosen broker is regulated with the FSCA, you can be sure that they offer negative balance protection. Can you see why trading with a regulated broker is important? You can even confirm with your broker if they provide negative balance protection. By contacting their support, you can verify. However, some brokers have FAQs on their websites. You can use it to verify if they have this risk management tool without waiting for an email or live chat response.

Here is an example on XM’s website.

Finally, forex brokers are not mandated to provide negative balance protection if you are a professional trader. However, retail traders are guaranteed to get it.

c. Education: Education is key. A forex broker should be friendly to beginners. Structured online courses, webinars, articles, and free research tools a forex broker should offer. These should be offered free of charge without extra costs.

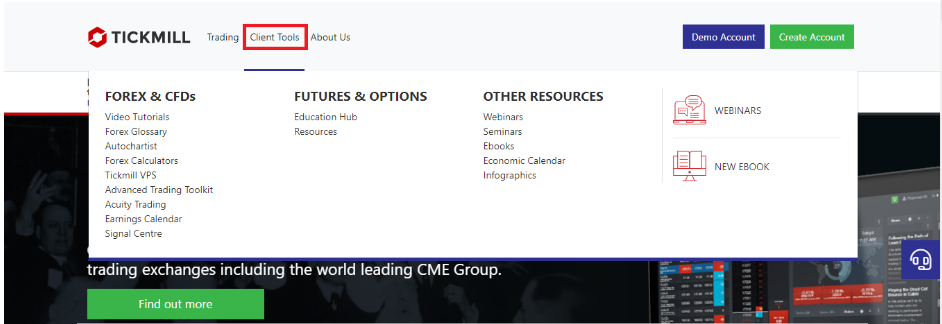

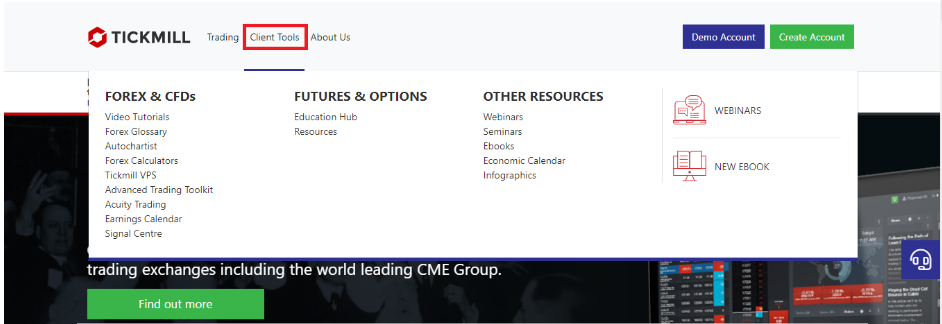

Finding a broker’s education is easy. It is usually on their homepage. With a few clicks, you can access quality courses for your learning. Let us show you how you can do this (Tickmill is our example). On Tickmill’s homepage, click on ‘Client Tools’ (in the red box). Here is an illustration below.

From the image, you can see that Tickmill has webinars, seminars, e-books, infographics, etc. You can use any of these tools to expand your knowledge about forex and CFD trading.

d. Customer support: Customer support is enjoyable with quick responses. A live chat feature and a South African mobile number are also key. To know how quickly a broker responds to enquiry, send their customer support email.

In addition, you chat with them if they are on WhatsApp. Carrying out this test gives you good knowledge about a broker’s customer support.

Do I need a broker for Forex Trading in UK?

Yes, you need a forex broker to trade in the foreign exchange market. They act as an intermediary between you and the interbank market where currencies are actually traded.

Here’s why:

1) Access to the Market: Retail traders like you and me can’t directly access the interbank market.

Forex brokers have the licenses and relationships to do so, and they provide you with a platform to place your buy and sell orders. For example, on the backend, the access different providers to get the prices.

2) Order Execution: Your broker takes your order and finds a counterparty to match it with on the interbank market. They handle the execution of the trade, ensuring it’s done efficiently and at the best available price.

You can see this process play out on their forex trading platforms.

The brokers have access to liquidity providers, or a market maker may act as the counterparty themselves to your trades.

Let’s understand through an example. Let’s assume that you want to buy GBP/USD. First of all you need quote (Bid & Ask prices), which you can check on the broker’s platform. When you place a ‘market order’, the broker finds the fill for you by send it to their liquidity providers or directly acting as the counterparty.

All of this happens in real time within a few micro seconds. Without a broker, retail or professional traders cannot trade currencies directly.

FAQs on Best Forex Brokers in South Africa

Which Broker is Good for Beginners in South Africa?

HF Markets is a good choice for new traders in South Africa based on our research because they offer customers negative balance protection, have free demo accounts, moderate fees, offer spread-only trading accounts (Micro & Premium), and has the South African Rand (ZAR) as a base account currency.

HF Markets is regulated by FSCA and other top-tier regulators and allows the deposit/withdrawal of funds via bank transfer or EFT in South Africa. The broker also has responsive customer support channels from Mondays to Fridays as per our tests.

Which forex brokers has ZAR as Account Currency?

Which Forex Brokers are best for MT4?

As per our research HF Markets, Exness & Tickmill are the best forex brokers for trading via MetaTrader 4. Almost all the regulated forex brokers in South Africa offer the MetaTrader platform, but the good brokers have lower fees, good support & trading conditions.

Which broker has NAS100?

All the brokers in this review have NAS100 but it might have different names per broker. You can read our review of the best NAS100 brokers in South Africa.

Which forex brokers accept deposit in ZAR?

Exness, HF Markets, Tickmill, AvaTrade & a few other forex brokers accept deposits in ZAR via local bank transfer or EFT in South Africa and support withdrawals in ZAR to South African bank accounts.