FXCM is a Forex and CFDs broker offering CFDs trading on foreign exchange currencies pairs, commodities, indices, cryptocurrencies and shares. FXCM was established in 1999, is regulated by ASIC and has offices in Australia, the UK, South Africa and Cyprus.

In our review of FXCM, we examine the safety of funds with the broker, deposit/withdrawal options, fees, account types, opening account process, leverage information, tradeable instruments and trading conditions.

| FXCM Review Summary | |

|---|---|

| Broker Name | FXCM Australia Pty. Limited |

| Establishment Date | 1999 |

| Website | www.fxcm.com |

| Address | FXCM Australia Pty. Limited, Suite 214,480 Collins Street, Melbourne VIC 3000, Australia |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:30 |

| Regulation | ASIC, FCA, CySEC, FSCA |

| Trading Platforms | MT4, FXCM Trading Station, and NinjaTrade8 available on PC, Mac, Web, Android, & iOS |

| Visit FXCM | |

FXCM Pros

- Regulated in Australia by ASIC

- Fast processing of deposits

- Offers commission-free trading

- Easy account opening process

- Supports multiple trading platforms

- User-friendly website

FXCM Cons

- Does not offer 24/7 customer support

- Charges dormant account fees after 1 year

- Has few tradeable instruments

- Charges withdrawal fees for bank wire transfer

Can FXCM be trusted?

FXCM is the trading name of Forex Capital Markets, a company owned by Leucadia Investments/Jefferies Financial Group.

The FXCM Group is regulated in various jurisdictions under different names. The multiple regulations of the FXCM Group make them have a low-risk score and are considered safe for traders in Australia. Find a list of the regulations of FXCM below:

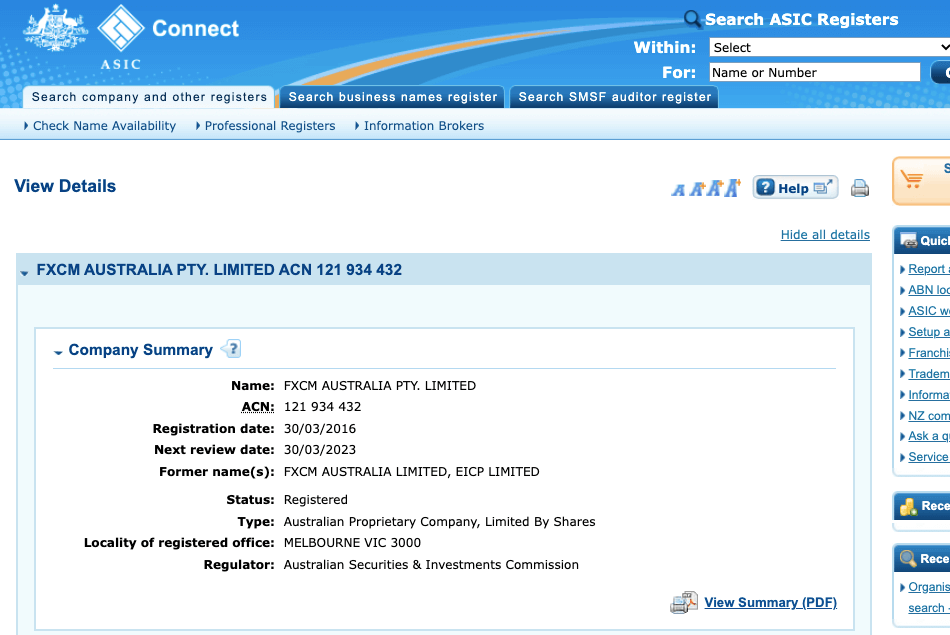

1) Australian Securities & Investments Commission (ASIC): FXCM is regulated in Australia by the ASIC as ‘FXCM Australia Pty. Limited’ and licensed to offer financial services, with ACN (Australia Company Number) 121 934 432, issued in 2016.

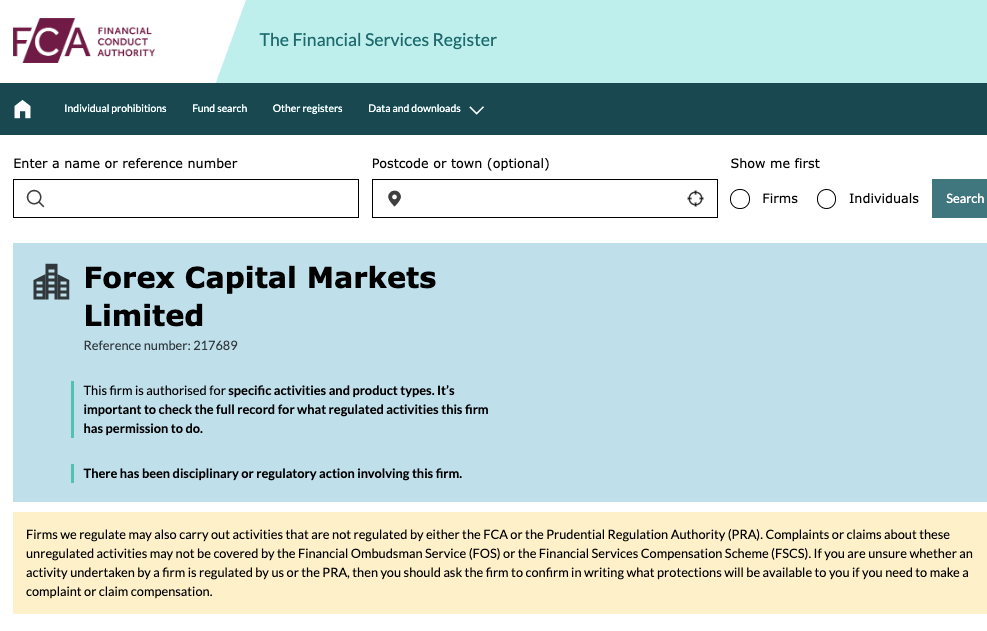

2) Financial Conduct Authority (FCA): FXCM is regulated by the FCA as ‘Forex Capital Markets Limited’ and authorised to offer financial services in the UK, with reference number 217689, issued in 2003.

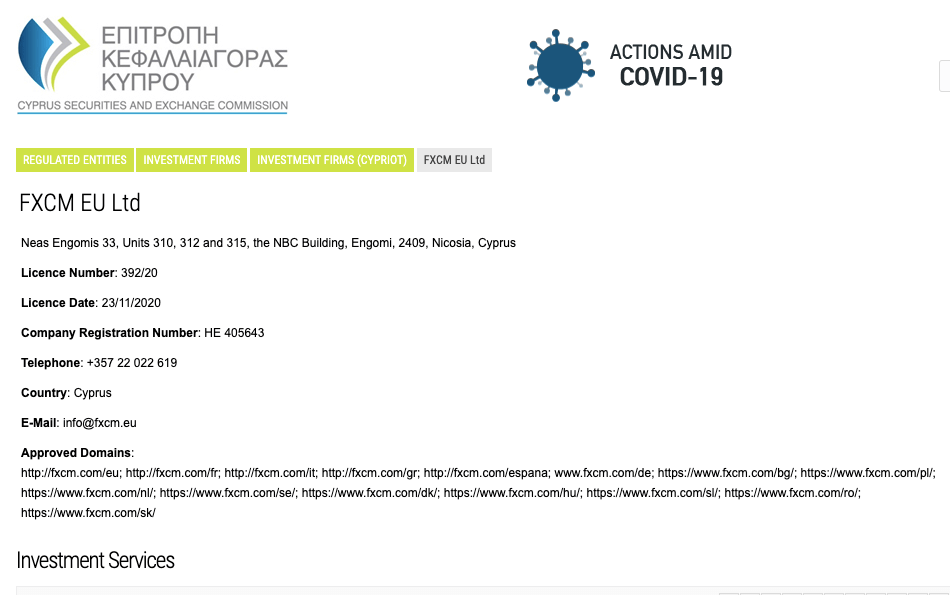

3) Cyprus Securities and Exchange Commission (CySEC): FXCM is regulated in Europe as ‘FXCM EU Ltd’ by the CySEC and licensed to offer investment services with license number 392/20, issued in 2020.

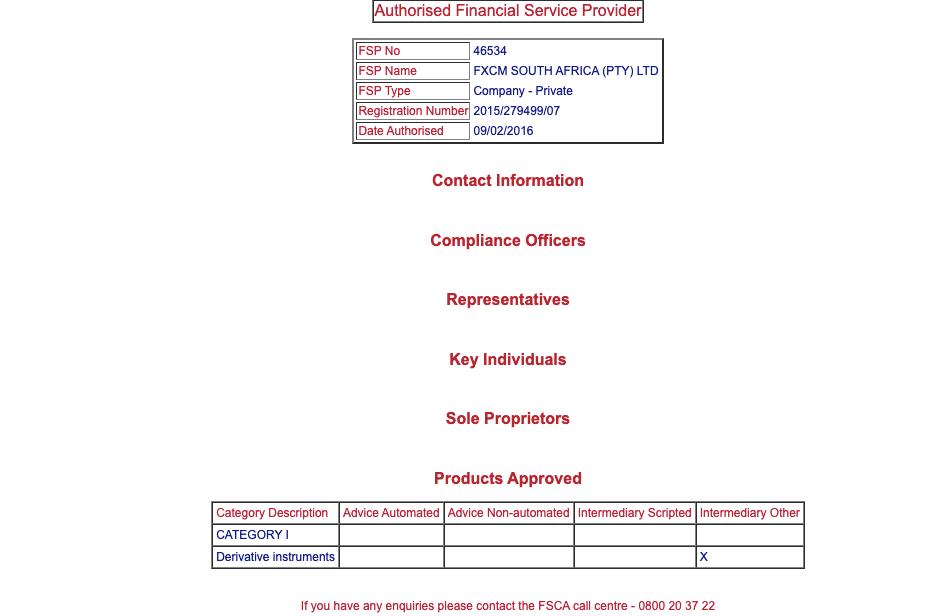

4) Financial Sector Conduct Authority (FSCA), South Africa: FXCM is regulated in South Africa by FSCA as ‘FXCM South Africa (Pty) Ltd’ and authorized to provide financial services, with FSP (Financial Services Provider) number 46534, issued in 2016.

5) Investment Industry Regulatory Organization of Canada (IIROC): FXCM is authorised to operate in Canada. However, they operate indirectly via Friedberg Direct. Friedberg Direct is a division of Friedberg Direct Mercantile Group Limited which is regulated by the IIROC. They are also a member of the Canadian Investor Protection Fund.

FXCM Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| Australia | $20,000 | Australian Securities & Investments Commission (ASIC) | FXCM Australia Pty. Limited |

| Canada | $1,000,000 | Canadian Investment Regulatory Organisation (CIRO) | Friedberg Mercantile Group Ltd. |

| Cyprus (European Union Area) | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | FXCM EU Ltd |

| UK | £85,000 | Financial Conduct Authority (FCA) | Forex Capital Markets Limited |

FXCM Leverage

Leverage on FXCM depends on the instrument you are trading and whether you are a retail or professional trader. Retail clients have a maximum leverage of 1:30. This means that you can open a trade position worth up to 30 times the value of your deposit. For example, with a £1,000 deposit, you can open a trade position of £30,000.

The maximum leverage of 1:30 is for major currency pairs. Leverage for other instruments is 1:20 for minor currency pairs, major indices, and gold; 1:10 for other commodities, and minor indices; 1:5 for shares; and 1:2 for crypto assets.

The maximum leverage on FXCM for professional clients is 1:200 for major forex pairs. The leverage is lower for other instruments.

FXCM Account Types

FXCM has only one account type for retail traders which is the Retail Account. FXCM also offers Professional Account status for more experienced traders and Active Trader account status to clients who trade large volumes of financial instruments.

FXCM offers interest-free Islamic Accounts to Muslim traders as well as demo accounts for new traders. Find an overview of the account types on FXCM below:

1) Retail Account: The FXCM Retail Account is designed for retail clients and can be accessed with the MT4 trading application. You can engage in CFD trading with this account and trade the available markets of forex pairs, indices, commodities, cryptocurrencies, and shares.

You do not pay any commission fees with this account. Spread fees start from an average of 1.3 pips for major pairs like the EURUSD and you pay swap fees whenever your trade position is kept open and it rolls over to the next trading day.

You need to deposit a minimum of $50 to start trading, with a required minimum trade size of 1 micro lot and maximum leverage of 1:30. Retail Accounts on FXCM have negative balance protection, which means that you cannot lose more than the money you deposited if a trade is unsuccessful and you have a loss.

2) Professional Account: The FXCM Professional Account is designed for experienced traders who trade large volumes of financial assets and use higher leverage. You can engage CFDs trading with this account and trade the available markets of forex pairs, indices, commodities, shares, and cryptocurrencies.

With this account, you can access higher leverage of up to 1:200. This account has no negative balance protection, which means that you can lose more than the money in your account if your trade position is unsuccessful and will be required to deposit more money to clear the negative balance.

You do not pay any commission fees for trading. Spread fees start from an average of 1.3 pips for major pairs like the EURUSD and you pay swap fees whenever your trade position is kept open and it rolls over to the next trading day.

To get a Professional Account on FXCM, you need to pass the tests below:

1) Wealth Test:

You must meet at least one of these 2 criteria to pass.

- You have AU$2.5 million in net assets;

- You have had an annual gross income of at least AU$250,000 for the last 2 years.

2) Sophisticated Investor Test:

You also have to qualify as a sophisticated trader by meeting at least one of these 2 criteria to pass:

- Proof of at least 1 year of working experience in the financial services sector with the relevant knowledge of leveraged trading. You will be required to take an online test to demonstrate your knowledge.

- Show proof of placing at least 10 trades each quarter over the last 3 years (12 quarters) with a notional value of AU$1,000,000. You will also be required to take an online test to demonstrate your knowledge of financial markets trading

Once you have the requirement, after opening a Retail Account, you then apply for an account upgrade by contacting customer support.

3) Islamic Account: FXCM offers Islamic Accounts to Muslim Traders which is in compliance with the sharia law of no-riba. Islamic Accounts on FXCM are interest-free, which means that you will not pay any overnight funding fees if you keep a trade position open past the closing time of the market.

You can have an Islamic Account as a retail trader or professional trader. To get your Retail or Professional Account converted to Islamic Account status, send a message to customer support. You will be required to fill out an application form and submit additional documentation before your application is approved.

Note that the spread fees for Islamic Accounts are higher because they pay no interest.

4) Active Trader: The FXCM Active Trader Account is an account status accorded to professional traders who trade large volumes of financial instruments and have a minimum notional trade volume of US$10 million. The equity is calculated as your deposit plus the floating profits of your open trade positions.

As an Active Trader on FXCM, you are assigned a dedicated account manager and receive priority customer support. You will also pay lower spreads on trades and gain access to exclusive market data.

With this account status, you get cash rebates when your trades exceed US$10 million in a month and receive up to $10,000 in rebates depending on the instruments you traded and the notional value of the trade.

FXCM Base Account Currency

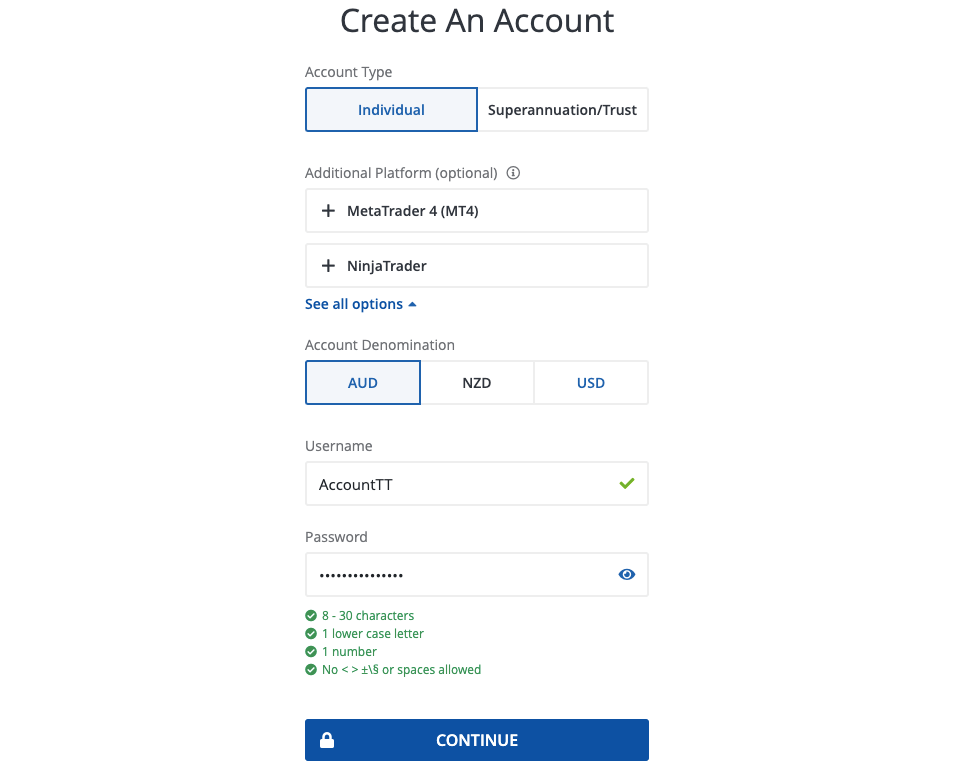

While creating an account, you can choose from 3 currencies to serve as your account base currency on FXCM. They are the Australian Dollar – AUD, New Zealand Dollar – NZD, and the United States Dollar – USD.

All your trades, deposits/withdrawals will be measured in your base account currency.

FXCM Overall Fees

Fees on FXCM depend on your account type, the instrument you are trading and the size of your trade. Find an overview of trading and non-trading fees on FXCM.

Trading fees

1) Spread: Whenever you trade an instrument on FXCM, you pay a spread fee which is the difference between the bid and ask price of the instrument. Find the average spreads charges on FXCM for major instrument pairs on the table below:

| Instrument/Pair | Standard Retail/Professional Accounts | Active Trader Accounts |

|---|---|---|

| EUR/USD | 1.3 pips | 0.3 pips |

| GBP/USD | 2 pips | 0.8 pips |

| EUR/GBP | 2.6 pips | 0.6 pips |

| Gold | 0.45 pips | 0.45 pip |

2) Commission fees: FXCM offers commission-free trading for all instruments on all account types, except for Active Traders. This means that whenever you open or close a trade position, you will not be required to pay any commission fees.

Active Traders pay commission fees of $50 to $60 round turn per million worth of trade.

3) Swap fees: Whenever you keep a trade position open past the closing time of the market, which is 5 PM EST, you incur a rollover cost or swap fees. This cost is added to your profit or loss when you close the trade and is calculated based on the size of your trade, the number of days for which it was open, and whether it was a short (sell) or long (buy) position.

Islamic Accounts are swap-free (interest-free) and do not pay any swap fees whenever they keep a position open beyond the market closing time.

FXCM also offers clients in Australia Interest-free trading on selected indices and commodities. The FXCM No Rollover Fee Trading is automatic for all clients and is limited to a trade value of US$200,000, after which any funds above the threshold will be charged a rollover fee.

Non-trading fees

1) Deposit and Withdrawal fees: FXCM does not charge any fees for depositing funds into your account. When withdrawing funds from your account, withdrawals via cards and e-wallets are free of charge, while local bank wire transfers attract a cost of AU$15 per withdrawal and AU$30 for international transfers.

2) Account Inactivity charges: If you do not place any trade with your FXCM for one year, you will be charged an inactive account fee every year of $50, which will be deducted from any balance in your account.

If you do not have any funds in the account, your account will not be debited and you will not accumulate any negative balance.

FXCM Non-Trading fees Table

| Fee | Amount |

|---|---|

| Inactivity fee | AUD 50 per year |

| Deposit fee | Free |

| Withdrawal fee | AUD 15 for wire transfers |

*Note that your payment processing company may charge some independent transaction fee.

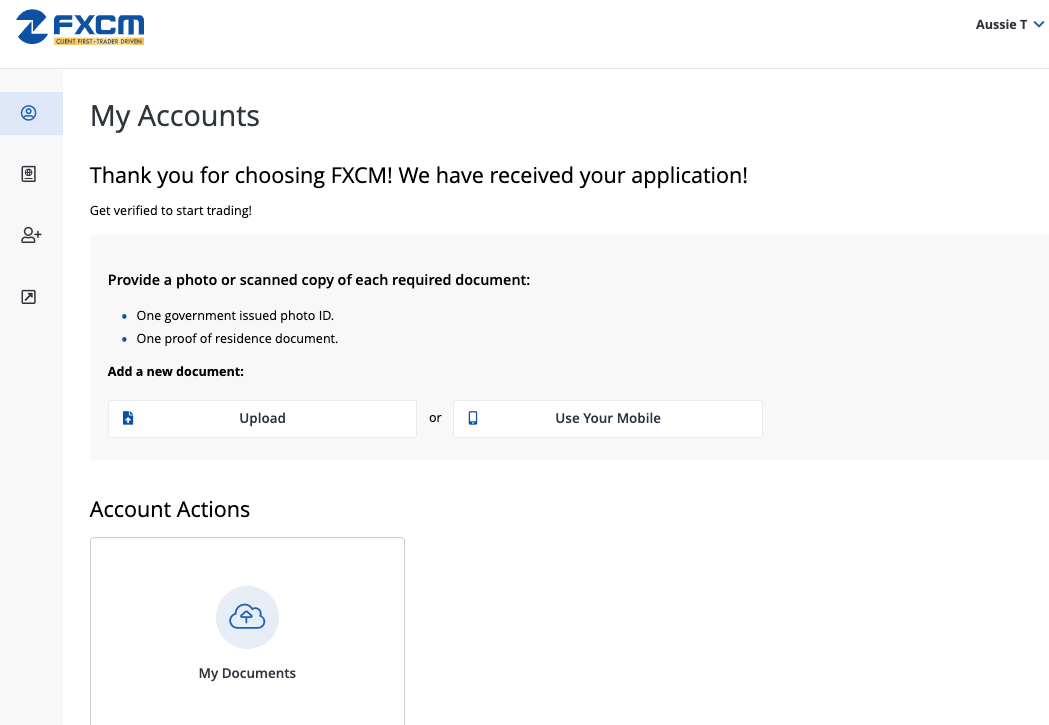

How to Open FXCM Account in Australia?

Follow these steps to open a trading account on FXCM.

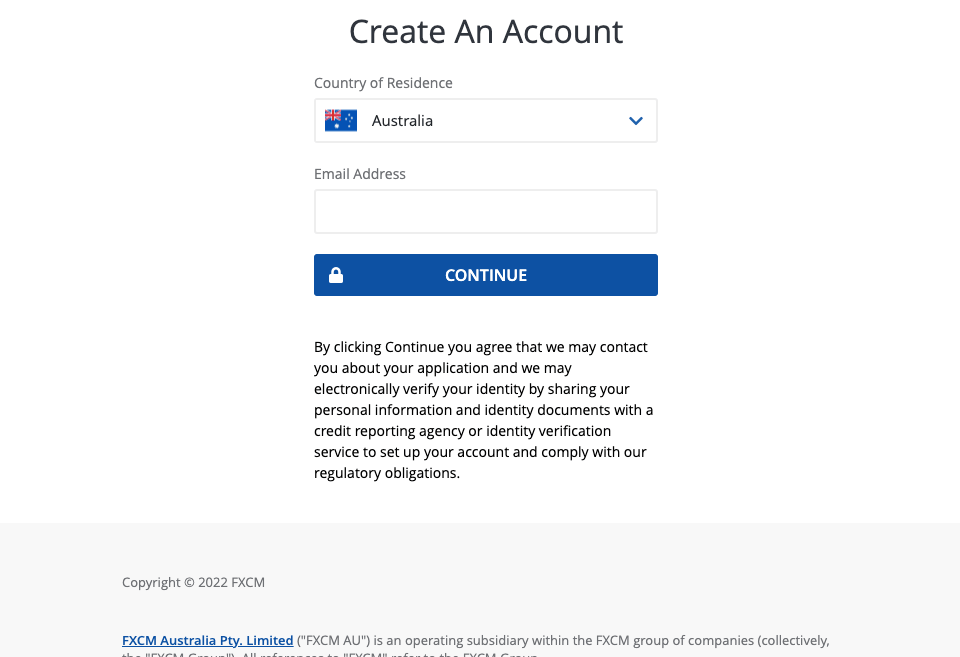

Step 1) Go to the FXCM Australia website at www.fxcm.com and click on ‘OPEN ACCOUNT’.

Step 2) Type in your email address and click ‘CONTINUE’.

Step 3) Choose your preferred trading platform and account currency, create a username and password, and then click ‘CONTINUE’.

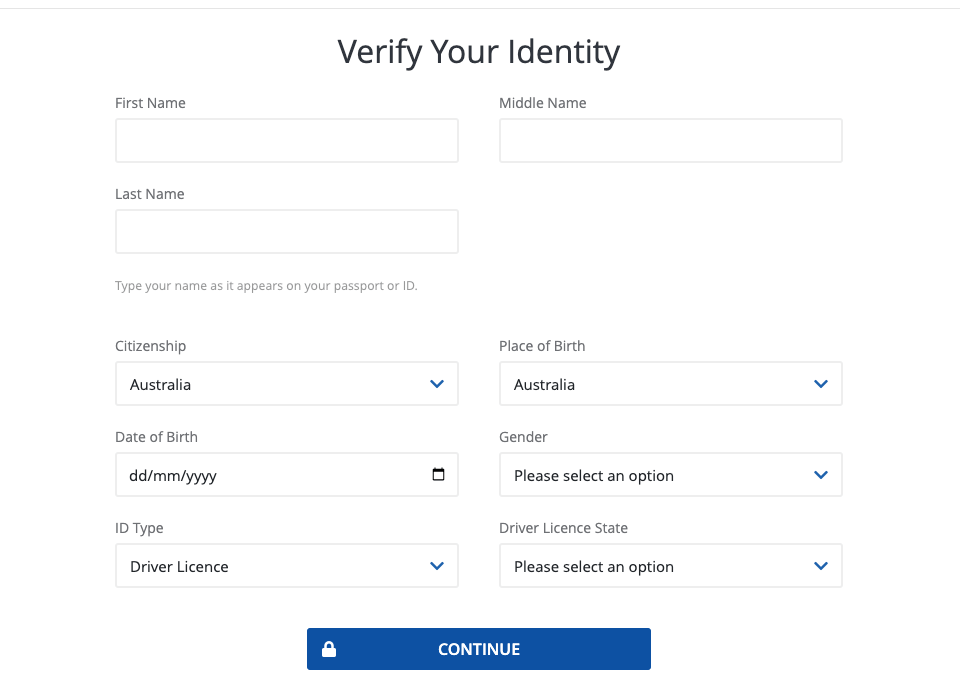

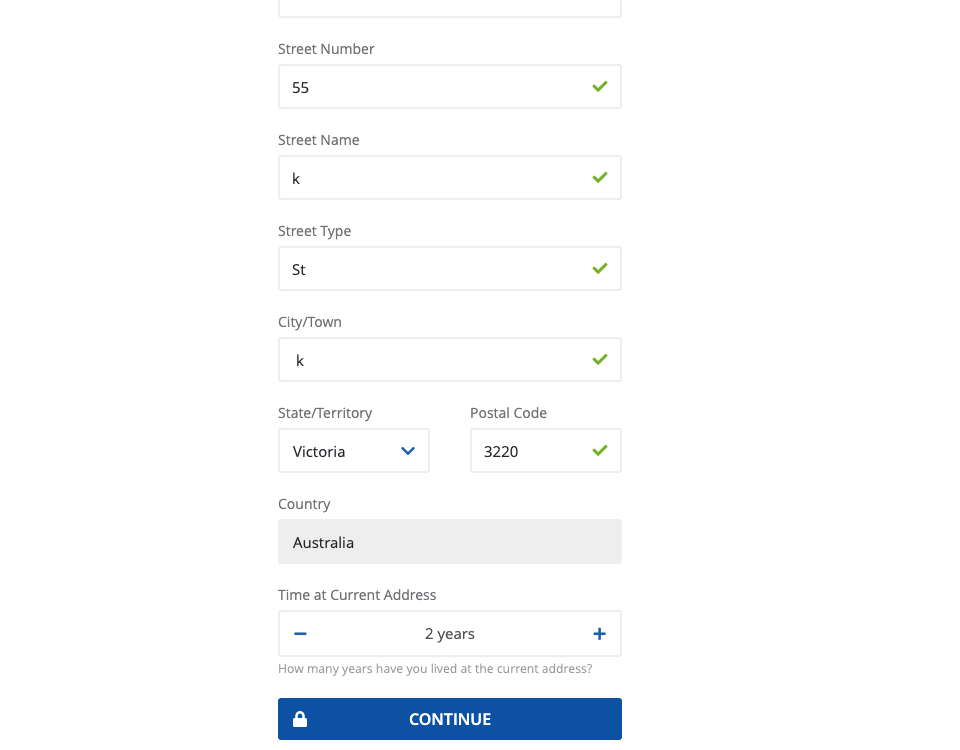

Step 4) Provide your full name, date of birth, ID number, phone number, and address, then click ‘CONTINUE’.

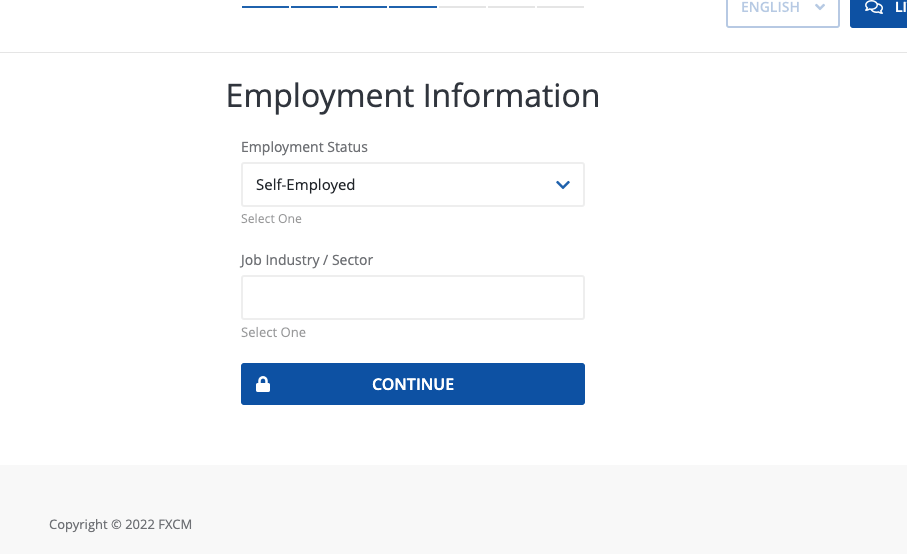

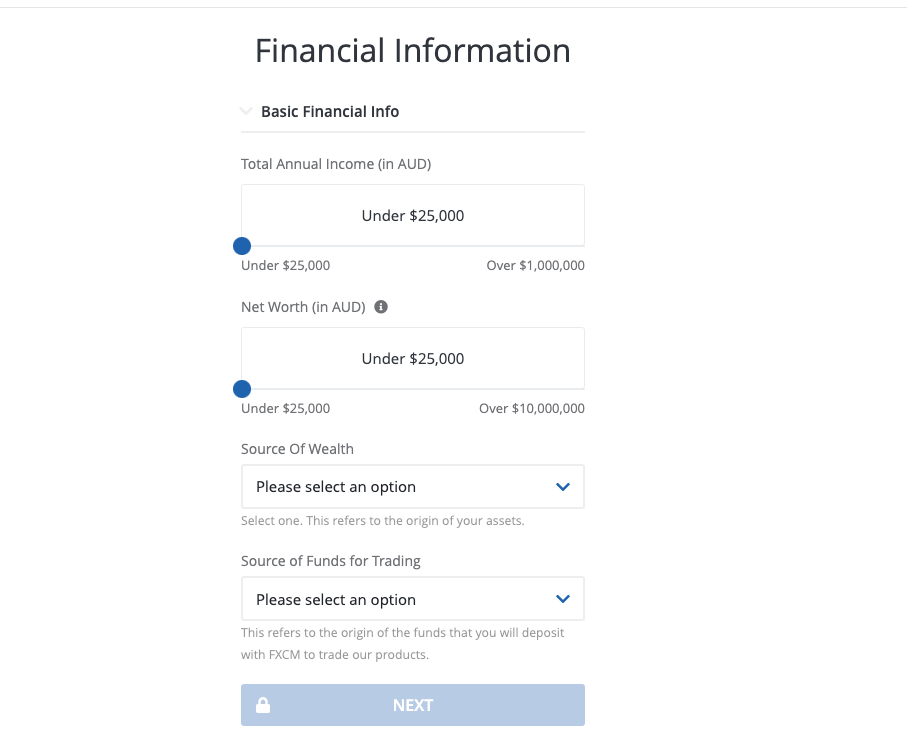

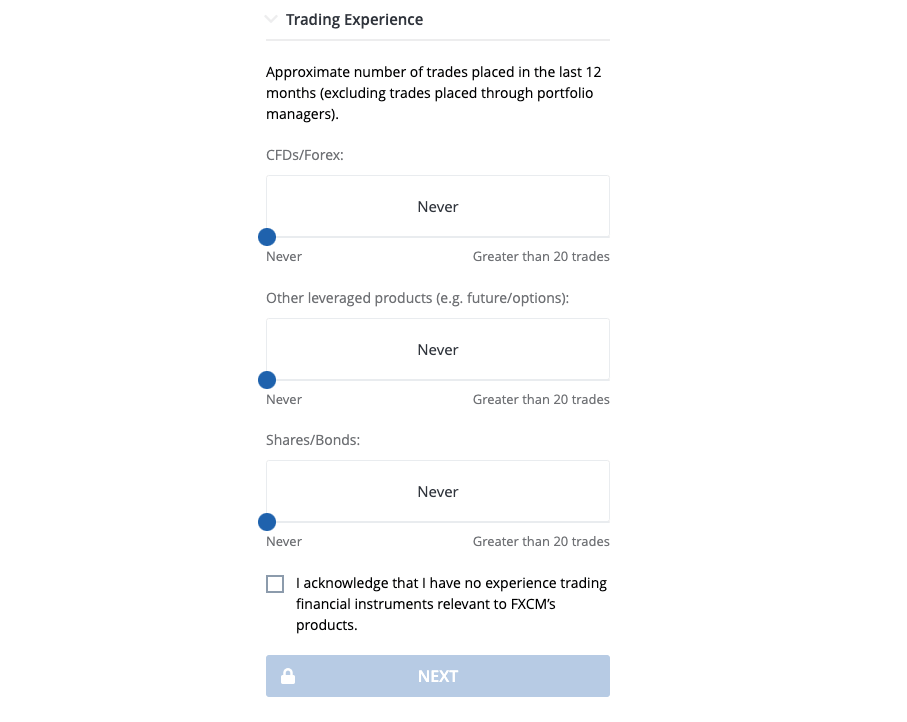

Step 5) Answer questions about your employment, financial status, trading experience, and intentions for trading then click ‘NEXT’.

Step 6) After answering the questions, you will be taken to the dashboard to continue with the registration and verify your account.

If you are considered unqualified to trade with a live account based on your trading experience and answers to some questions, you will be recommended to open a demo account.

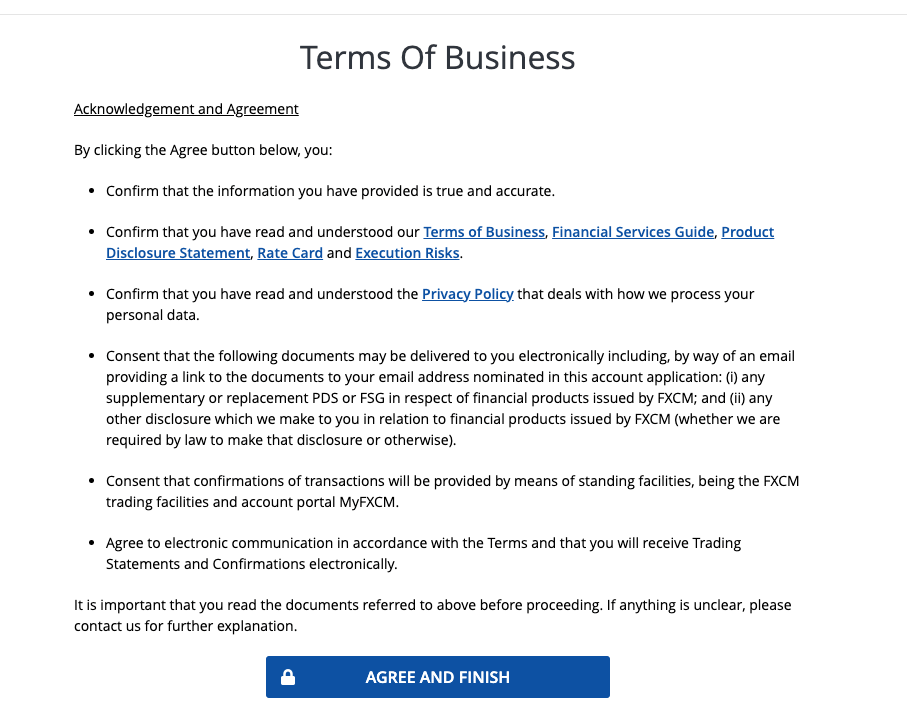

Agree to the terms of business of FXCM to continue with your account registration.

Step 7) Upload an ID Card or utility bill to verify your identity and address to verify your account.

After verifying your account, you can now deposit funds and start trading.

FXCM Deposits & Withdrawals

FXCM offers deposits and withdrawals to Canadian residents through the following means:

FXCM Deposit Methods

Here is a summary of payment methods accepted by FXCM for deposits.

| Deposit Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 1 to 2 business days |

| Cards | Yes | Free | Instant and up to 2 hours |

| E-wallet | Yes (Skrill, Neteller) | Free | Instant |

FXCM Withdrawal Methods

Here is a summary of payment methods for withdrawals accepted on FXCM.

| Withdrawal Methods | Availability | Charges | Processing time |

|---|---|---|---|

| Local Bank Wire Transfer | Yes | Free | 1-2 business days |

| Cards | Yes | $15 per withdrawal | up to 5 business days |

| E-wallets | Yes (Skrill, Neteller) | Free | 3-5 business days |

What is the FXCM Minimum deposit?

The minimum deposit on FXCM is $50 for all account types for all payment methods. Cards and e-wallets deposits on FXCM are credited immediately while local transfers take up to 2 business days for the funds to be credited to your trading account.

How do I deposit money into FXCM?

To deposit funds on FXCM, log in to your account, then click on Funds and select Deposit Funds. Choose a deposit method and follow the on-screen instructions to complete your deposit.

What is the FXCM Minimum withdrawal?

There is no mandatory minimum withdrawal amount on FXCM. All withdrawals are processed within 1-3 days by the accounts department. It can take up to 5 business days for you to receive the funds, depending on your bank, card processor, or e-wallet.

How do I withdraw money from FXCM?

To withdraw funds from FXCM, log in to your account, then click on Funds and select Withdraw. Choose a withdrawal method, enter the amount you want to withdraw and follow the on-screen instructions to complete your withdrawal.

FXCM Trading Instruments

You can trade over the following financial instruments on FXCM:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 42 currency pairs on FXCM (7 Majors, 21 Minors, and 14 Exotics) |

| Forex Baskets | Yes | 3 Forex Baskets on FXCM |

| Commodities | Yes | 12 commodities on FXCM (Oil, Agriculture and Metals) |

| Indices | Yes | 15 indices on FXCM |

| Index Baskets | Yes | 1 Index Basket on FXCM (USEquities) |

| Stocks | Yes | 204 shares on FXCM (UK, US, Hong Kong, German, France, and Australia shares) |

| Stock Baskets | Yes | 16 stock baskets on FXCM |

| Treasury (Bonds) | Yes | 1 Treasury Bond on FXCM (BUND) |

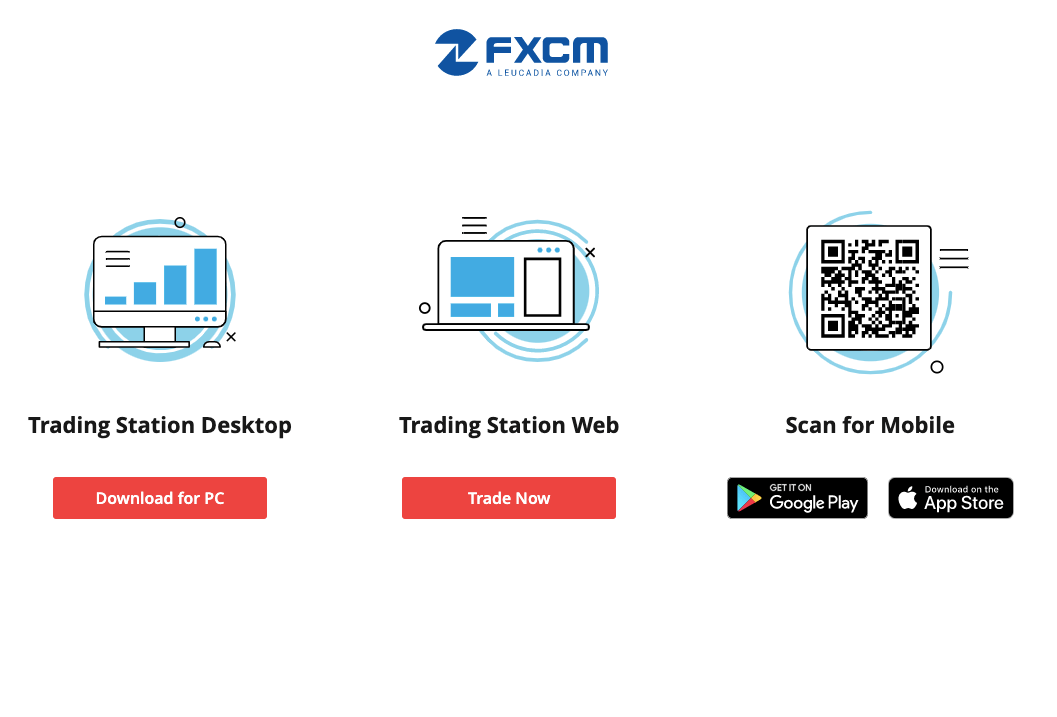

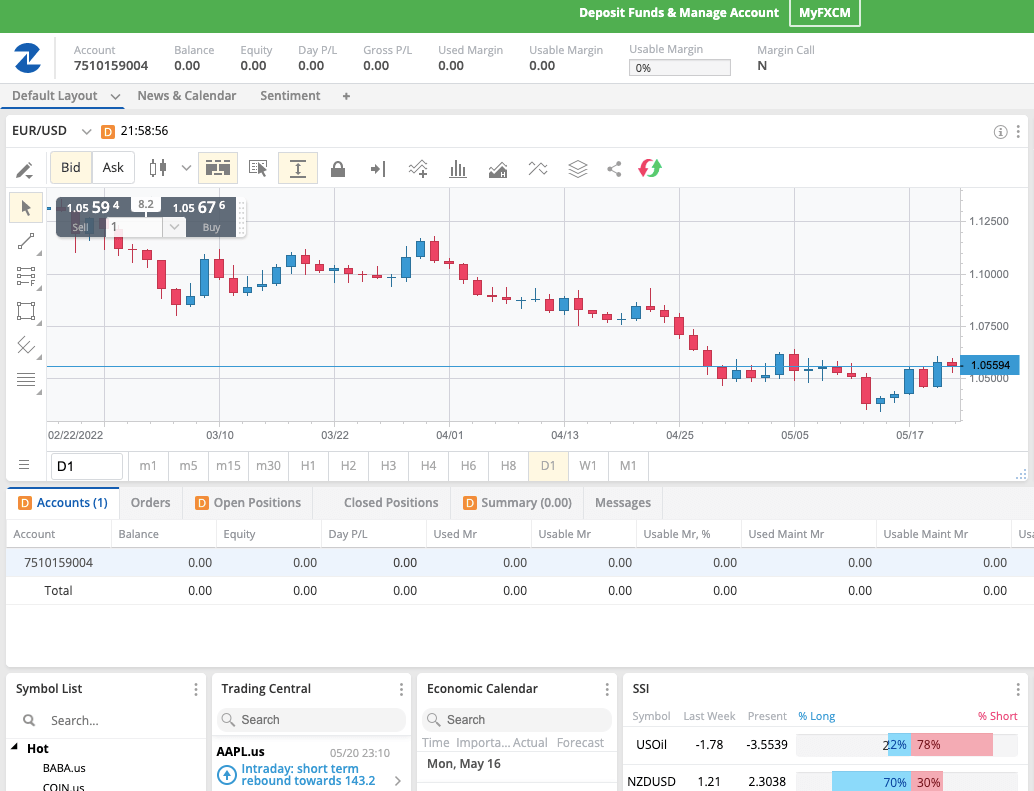

FXCM Markets Trading Platforms

Trading platforms supported by FXCM are:

1) MetaTrader 4: You can trade FXCM financial markets on the MT4 trading application, available on the web, desktop (Windows and macOS), and mobile devices (Android & iOS).

2) FXCM Trading Station: This is a proprietary trading platform developed by FXCM and can be accessed on the web, desktop, or download mobile versions on Apple App Store or Google Play Store.

3) Capitalise AI: Capitalise AI is a platform that lets you plan your trade as a human, but trade like a machine. In other words, it is automated trading but without you writing any codes. Instead of typing codes, you type your trade ideas. The platform goes on to execute your trade.

You can also set trading conditions based on price movement and news data. This allows you to trade the news without tracking it yourself. The machine does the tracking based on previous, actual, and forecast data and executes your trades accordingly.

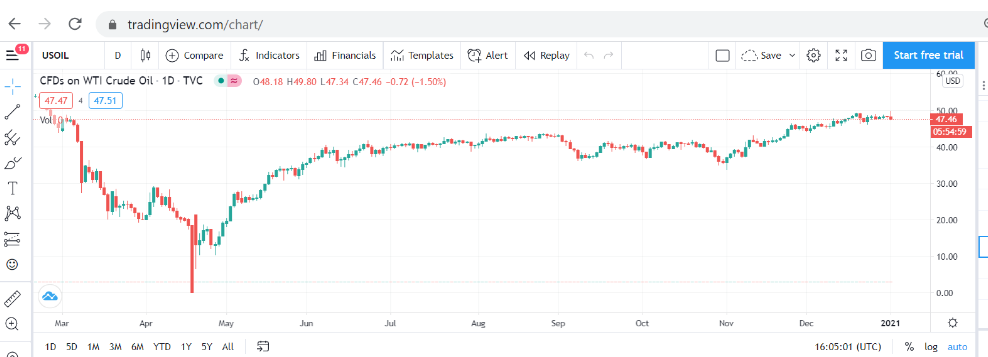

4) TradingView: TradingView is a third party trading platform. Beyond this, it is also a social network for CFD traders. You get live quotes for currency pairs, stock CFDs, futures, and other tradeable CFDs. The network of traders also gives you access to expert ideas.

No platform or its perks guarantees gains so you are bear responsibility for any losses. However, TradingView does come with advanced charting features that are very beneficial to your analysis. Furthermore, you can integrate your FXCM account with TradingView so you can trade directly from your charts.

FXCM Free Forex Trading Signals

FXCM provides actionable ideas that you can execute in the market. These signals are created from technical or fundamental analysis. Sometimes, they are created by combining both approach. It does not matter if you are a beginner or an advanced trader, anyone can use trading signals. You can use them as your sole strategy but it might be too risky. So it is advisable you use them as a complement to your strategy.

To test FXCM’s trading signals, you can access them on trial for 14 days. The signals cover 40 currency pairs so you will always get trade ideas. After your 14-day trial is over, you will continue to have free access if you open a live account. FXCM live account holders have guaranteed free access.

Trading signals are not financial/investment advice. You act on them at your own risk.

FXCM UK Education and Research

We rate FXCM highly in terms of education and research. Their learning section is loaded with useful guides and information that will make you a better trader. Let us break them down. You will find all of this under the ‘Learn To Trade’ tab.

Education: This section contains webinars and text content. Upcoming webinars are scheduled so you know when it is happening live. You can also access the recording of previous webinars. At the time of this writing, there are recordings on FXCM’s website. The name of the speakers is also revealed so you can check if they are experts in the topics they speak on.

The text content is all about forex trading and is very good for beginners. It is well structured and covers the basics of forex trading including the definition of commonly used terms.

Research: This section is divided into three: economic calendar, market volatility, and market news. The economic calendar helps you track events that could have a significant impact on the market. You can

filter the calendar to make sure you see only the important news and events. The market news functions closely with the economic calendar.

The market is always moving. However, it is important to know what is causing the movements. This what trading volatility helps you achieve. Videos are released daily by FXCM discussing factors moving the market, and trading ideas.

Trading Guides: FXCM’s trade guides is comprised of three sections. The first section is called learn forex trading. It contains text content with some images. The topics covered include:

-What is forex? and why trade it?

-Putting your ideas into action

-Reading a quote and making a trade

-Pips, profit, leverage and loss

-How to develop a strategy

The second section is a downloadable trading guide for beginners. Summarily, it is all of the first section in a book that you can read without having to visit FXCM UK’s website. Clients and non-clients can download the e-book after submitting their email and country.

The last section is about the traits of successful traders. Though more percentage of traders lose their money, there are a few traders who are successful in the industry. The third section helps you learn the habits and rules of these traders. If you imbibe them, then you increase your chances of being a successful trader too.

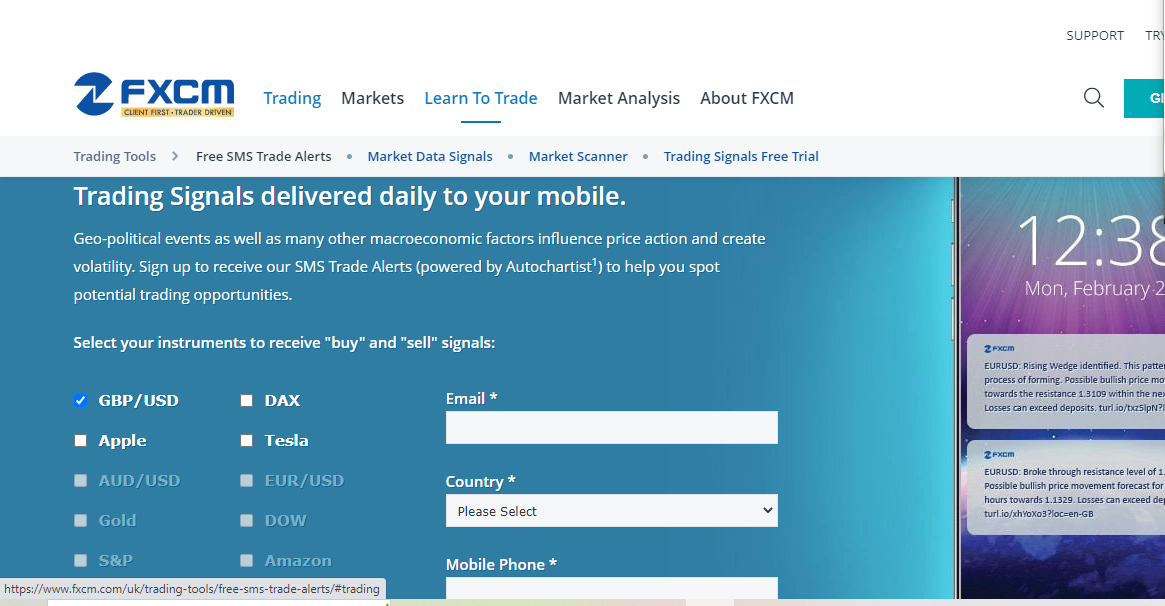

Trading Tools: There are a few trading tools offered by FXCM that can make you a better trader. The first is the Free SMS Trade Alert powered by AutoChartist. This tool sends trading signals directly to your mobile phone. You can even choose the instruments you want to receive trading signals for. FXCM does not charge any fee for this tool. However, network charges may apply.

Another tool that can be very useful for you is the Market Scanner. With this tool, you can utilize technical indicators set to your own parameters to analyze forex pairs and CFDs. After this, you can then scan the market. FXCM will deliver the five strongest signals to you when the scan is over.

Become a Better Trader: Like most brokers, FXCM also have a webinar. The unique thing about FXCM’s webinar is that it is divided into two sections. There is Morning Market Review where a senior market specialist discusses the sentiments for the DAX and Euro Stoxx open. Technical analysis is also carried out on their charts. Key support and resistance levels are marked to help you trade better.

FXCM Australia Customer Service

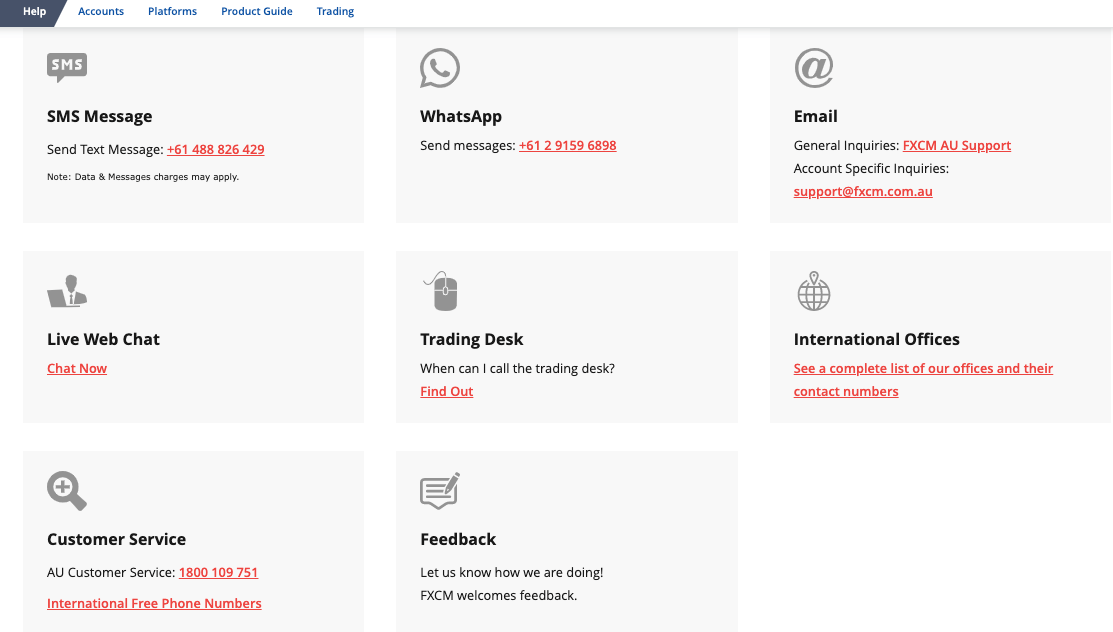

FXCM offers 24/5 customer support to traders via the following channels:

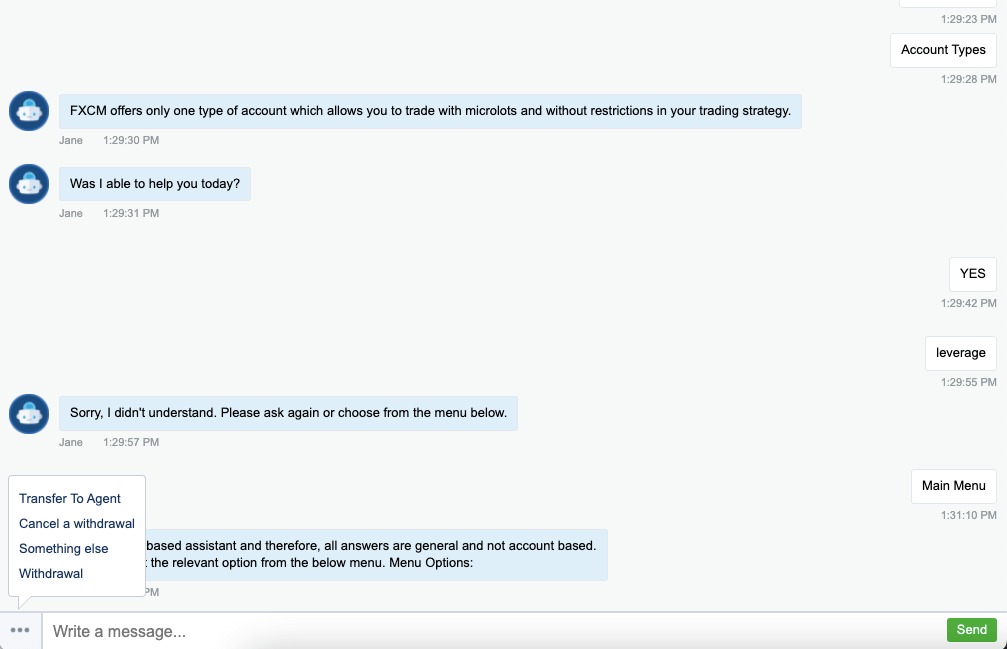

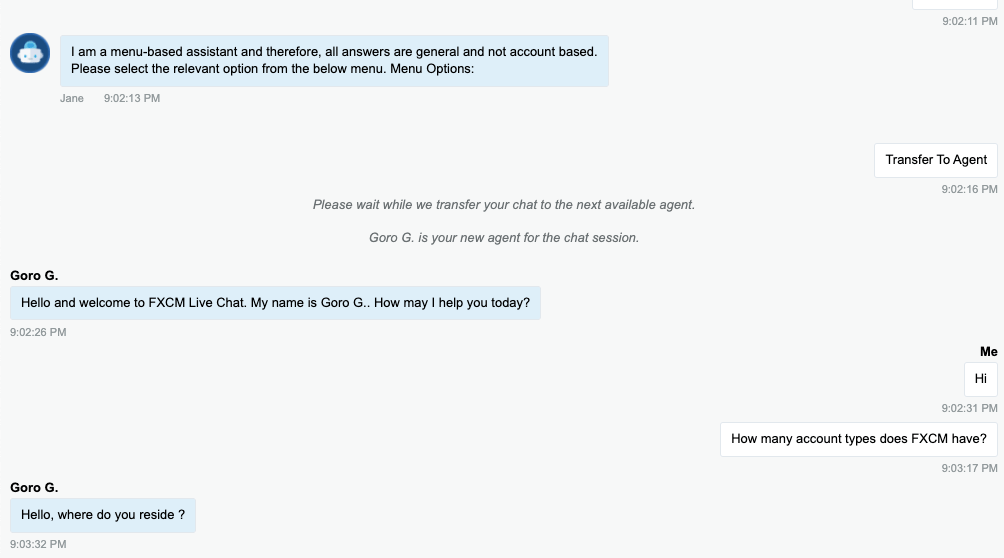

1) Live chat support: FXCM offers live chat support to traders, which can be accessed on their website. The chatbot is available 24/7, while live chat agents are available 24/5.

When our team tested, we got a response from a live agent within 2 minutes and the answers to our questions were relevant. When you first initiate a chat, you will be required to submit your name and email, then the chatbot will offer menu-based answers to questions on various topics.

You will have to click the 3 dots and select ‘Transfer To Agent’ beside the chat to talk to a live agent.

2) Email support: FXCM also offers email support for customers that is available 24/5. When our team tested, we got an autogenerated reply immediately but no live agent responded after several hours. The FXCM email address is [email protected].

3) Phone support: FXCM offers phone support to traders as well. You can call the FXCM phone number during business hours on working days. The FXCM phone number for support is 1800 109 751. You can also reach FXCM WhatsApp Support via +61 2 9159 6898 or send a text message to +61 488 826 429.

Is FXCM a Prime Broker?

FXCM provides prime brokerage services to institutional clients who require access to market data and execution across multiple trading venues with settlements managed through a centralized source.

FXCM Prime offers various services to clients such as high-frequency trading firms, hedge funds, proprietary trading firms, and small regional and emerging market banks.

Their services include centralized clearing, risk management solutions, and access to multiple trading venues. However, to use FXCM Prime’s services, customers must maintain a minimum balance of more than $250,000.

Do we Recommend FXCM Australia?

FXCM is regulated in Australia by the ASIC and other Top-Tier financial regulators, which makes them trustworthy because they are compliant with the regulations.

The fees on FXCM are moderate because you do not pay commission for trades, inactive account fees start after 1 year, and you can have lower spreads if you trade large volumes and become an active trader. You can also get a professional account if you want more leverage or an interest-free account for Muslim traders.

FXCM is also good for beginners because you can open a demo account and access educational materials to boost your knowledge. Retail clients also have negative balance protection and cannot lose more than the money in their accounts. FXCM also supports multiple platforms for trading although they offer relatively fewer instruments.

The customer service on FXCM is fair, live chat agents are available 24/5 and respond promptly. Although there are other brokers whose customer support is more responsive and available 24/7.

We recommend that you read up more on the FXCM website and probably chat with the customer to ask any questions you may have to help you decide if they are right for you.

FXCM Australia FAQs

What is the minimum deposit for FXCM Australi?

The minimum deposit at FXCM Australia is $50 for all payment methods and account types. The accepted payment methods are local bank transfer, e-wallets, and cards.

Is FXCM regulated in Australia?

FXCM is regulated in Australia by the Australian Securities and Investments Commission (ASIC) as ‘FXCM Australia Pty. Limited’ and licensed to offer financial services, with ACN (Australia Company Number) 121 934 432, issued in 2016.

Can I use FXCM in Australia?

Yes, FXCM is available in Australia and you can create an account on their platform and start trading financial instruments. FXCM is regulated the Australia by ASIC

How much does FXCM charge per trade?

FXCM charges spreads per trade that start from 1.3 pips per trade on major pairs like EUR/USD and no commissions are charged per trade for retail and professional traders.

However, if you are an Active Trader on FXCM, you pay commission fees of £25 per million value traded and spreads are lower. The exact fee depends on the type of account held by the trader, the type of instrument being traded, the timing of the trade, amongst other factors.

What type of accounts does FXCM offer?

FXCM offers a variety of account types to suit different needs and experience levels. These include Standard Retail Accounts, Professional Account and Demo Accounts that beginners can use to get familiar with the platform practicing with virtual money before putting in their real money.

How long does it take to withdraw money from FXCM?

When you initiate a withdrawal, the accounts department processes it within 1-3 days. It can take up to 5 business days for you to receive the funds, depending on your payment processor/institution.

Who owns FXCM?

FXCM is owned by Leucadia Investments, the investment banking arm of Jefferies Financial Group, which is listed on the New York Stock Exchange.

Note: Your capital is at risk