Canadian traders can trade forex through CIRO-regulated brokers. These brokers offer MT4, MT5, and cTrader trading platforms. They might also offer their own proprietary trading platform.

The Canadian Investment Regulatory Organization (CIRO) which was formerly called Investment Industry Regulatory Organization of Canada (IIROC) regulates Forex trading platforms in Canada. Only CIRO-regulated forex trading platforms are safe for you. Do not trade with an unregulated forex trading platform. It is not safe and the chances of losing all your money are very high.

Comparison of Best Forex Trading Platforms Canada

| Forex Broker | Regulation | Maximum Leverage | Minimum Deposit | |

|---|---|---|---|---|

| OANDA |

CIRO, FCA

|

1:50

|

$0

|

Visit Broker |

| Forex.com |

CIRO, ASIC

|

1:33

|

$100

|

Visit Broker |

| CMC Markets |

CIRO, CySEC

|

1:33

|

$0

|

Visit Broker |

| Fortrade |

CIRO, ASIC

|

1:50

|

CAD 250

|

Visit Broker |

| Interactive Brokers |

CIRO, FCA

|

1:43

|

$0

|

Visit Broker |

| AvaTRade |

CIRO, ASIC

|

1:33

|

C$300

|

Visit Broker |

6 Best Forex Trading Platforms Canada for 2022

Forex trading platforms are a dime a dozen. We have gathered for you the best of them in Canada.

- OANDA -Best Forex Trading Platform with Zero commissions

- Forex.com – Platform with free deposits and withdrawals

- CMC Markets – Forex Platform with wide range of tradable instruments

- Fortrade – Forex Trading Platform with swap-free account

- Interactive Brokers – Forex Broker with Low fees on Proprietary Trading Platform

- AvaTrade – Forex broker with Multiple Trading Platforms

Now a brief description of all the above-listed best Forex Trading Platforms in Canada.

#1 OANDA – Best Forex Trading Platform with Zero commissions

OANDA is regulated By the CIRO as ‘OANDA (Canada) Corporation ULC’

Regulation: OANDA is regulated in Canada as an investment dealer by the CIRO and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 24590, issued in 2011. The platform is considered safe for trading because of this regulation.

Trading Fees: Trading fees charged by OANDA are spreads starting from 1 pip for major pairs, currency conversion fees for trading an instrument not denominated in your account currency and swap fees for keeping a trade open past the market’s closing time. OANDA does not charge any commission fees for opening or closing trading positions, this applies to all instruments and account types.

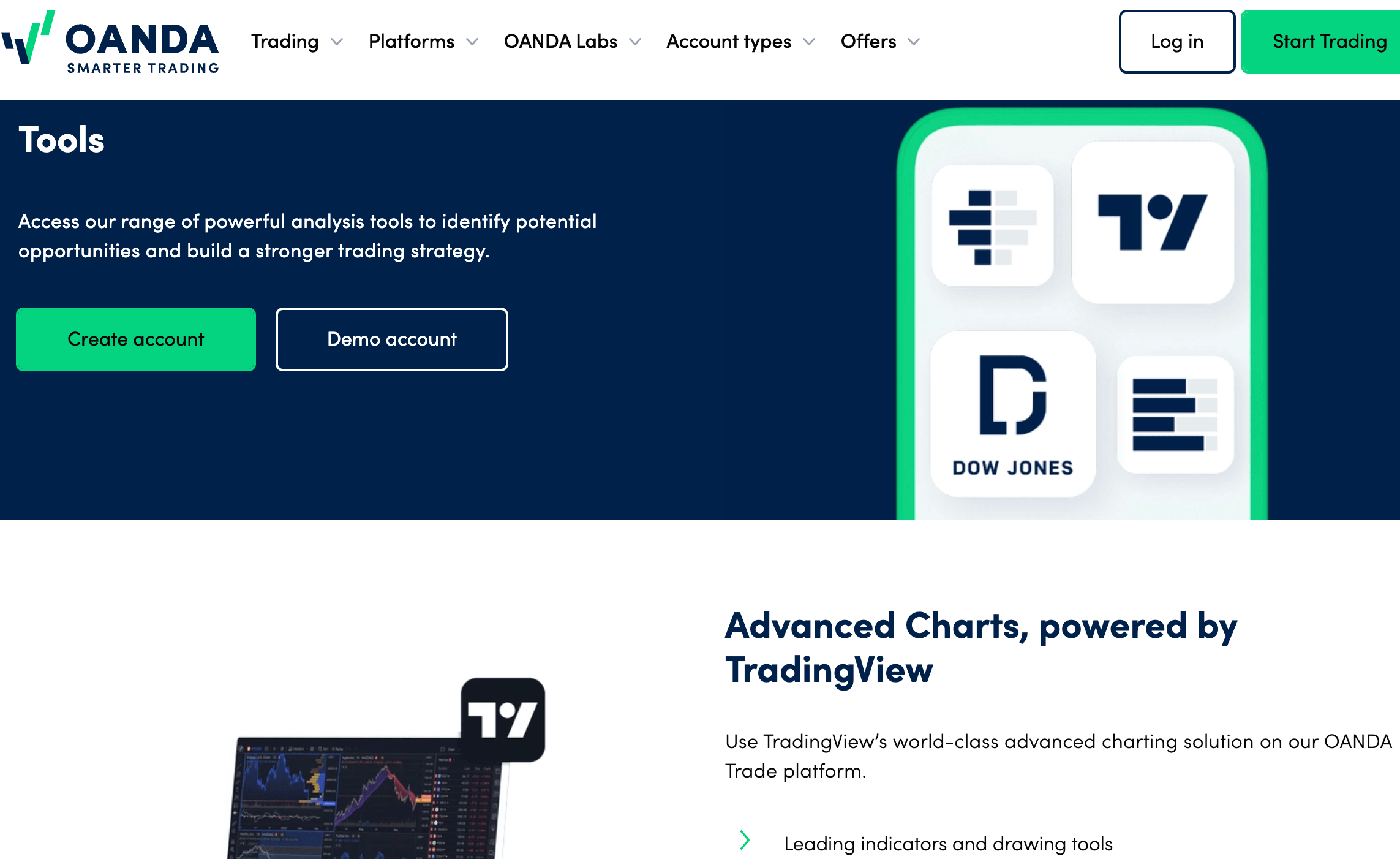

Available platforms: OANDA supports the MetaTrader 4 trading application and offers their own proprietary OANDA Trader application – Trading View. Both platforms can be accessed via the web, desktop, or mobile devices ( Android and iOS).

Tradable Instruments: Financial instruments you can trade on OANDA are forex and CFDs on indices, bonds, metals, oil, and agricultural commodities.

Funding/withdrawals: Payment methods for deposits and withdrawals on OANDA Canada are cards, internet bank wire transfers, and e-wallet (PayPal). All deposits on OANDA are free of charge, and card deposits are credited instantly, 1-3 business days for bank transfers and 5-7 business days for PayPal.

Withdrawals to cards take 1-3 business days and are free of charge, 1 business day for PayPal and free as well, while bank transfers take 2-5 business days and attract a charge of $20 on the first withdrawal in a month and $40 on subsequent withdrawals.

Customer support: OANDA offers 24/7 customer support via live chat, email and phone number. When we tested, the OANDA live chat (OANDA Assistant) response time was under 1 minute and the email response was after 20 minutes.

OANDA Pros

- Regulated by CIRO

- Offers commission-free trading for all accounts

- No mandatory minimum deposit

- Simple account opening process

- Offers free deposits and processes them quickly

- Has responsive customer support

OANDA Cons

- Has few tradable instruments

- Charges dormant account fees

- No negative balance protection

- Does not support MT5 trading application

#2 Forex.com – Platform with free deposits and withdrawals

Forex.com is regulated by CIRO as ‘GAIN Capital – FOREX.com Canada Ltd.’

Regulation: Forex.com is regulated in Canada by CIRO as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 38580, issued in 2012.

Trading Fees: Trading fees charged by Forex.com are spreads starting from 1.3 pip for major pairs and swap fees for keeping a trade open past the market’s closing time. Forex.com charges a commission whenever you open and close trades on shares while other instruments are commission-free. The commissions charged by Forex.com on shares start from $80 per USD million traded and can be lower if your trade volume increases.

Available platforms: Forex.com supports the MetaTrader 4 trading application accessible on the web, desktop and mobile devices as well as the Forex.com Trading application for Android and iOS and the Forex.com Web Trading platform.

Tradable Instruments: Financial instruments you can trade on Forex.com are forex, indices, metals, oil, agriculture commodities and stocks.

Funding/withdrawals: Payment methods accepted for deposits and withdrawals on Forex.com Canada are cards and internet bank wire transfers. Deposits via cards are credited within 24 hours while it takes 1-2 business days for bank transfers deposits to be credited.

Withdrawals take 24 and 48 hours for cards and internet bank transfers respectively. Forex.com does not charge any deposit or withdrawal fees.

Customer support: Forex.com has 24/5 (10:00 AM on Sunday to 5:00 PM Friday ET ) customer support via live chat, email and phone number. When we tested, the Forex.com live chat response time was under 1 minute and we got a response to our email enquiry after 10 minutes.

Forex.com Pros

- Regulated in Canada

- No deposit and withdrawal fees

- Has responsive customer support

- Offers commission-free trading

- Supports MT4 trading platform

- Fast execution

Forex.com Cons

- Does not offer negative balance protection

- Does not support MT5 platform

- Does not offer deposits/withdrawals via e-wallets

- Charges inactive account fees.

- Customer support is not available 24/7.

#3 CMC Markets – Forex Platform with wide range of tradable instruments

CMC Markets is regulated by CIRO as ‘CMC Markets Canada Inc.’

Regulation: CMC Markets is regulated in Canada by CIRO as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 12570, issued in 2009.

Trading Fees: CMC Markets trading fees are spreads starting from 0.7 pips for major pairs and swap fees for keeping a trade open past the market’s closing time. CMC Markets charges a commission of $8 per round whenever you open and close trades on shares. CMC Markets offers commission-free trading for other instruments asides from shares.

Available platforms: CMC Markets supports the MetaTrader 4 trading application and CMC Markets Trader, Next Generation, which are accessible on the web, desktop and mobile devices.

Tradable Instruments: Financial instruments you can trade on CMC Markets are forex, shares, indices, ETFs, bonds and commodities (metals, energies, agriculture).

Funding/withdrawals: CMC Markets accepts only internet bank wire transfers and e-wallets (EFTs and Online Bill Payment) for deposits and withdrawals. Deposits via bank transfers are credited within 24 hours and attract a charge of $15 per transaction while it takes about 3 business days for e-wallet deposits to be credited and is free.

All withdrawals on CMC Markets are processed within 1-2 business days. While bank transfers attract a withdrawal fee of $10 per transaction, e-wallet transactions are free.

Customer support: CMC Markets offers 24/5 customer support via live chat, email and phone number. When we tested, the CMC Markets live chat had no response and we got a response to our email enquiry after 6 hours.

CMC Markets Pros

- Regulated by CIRO

- Offers a wide range of tradable instruments

- User friendly website and trader

- Fast processing of deposits and withdrawals

- No mandatory minimum deposit or withdrawal

- Offers commission-free trading for most instruments

CMC Markets Cons

- Customer support is not available 24/7

- Charges commission fees for shares trading

- Charges dormant account fees

- Does not support MT5 platform

- Does not payments with cards

#4 Fortrade – Forex Trading Platform with swap-free account

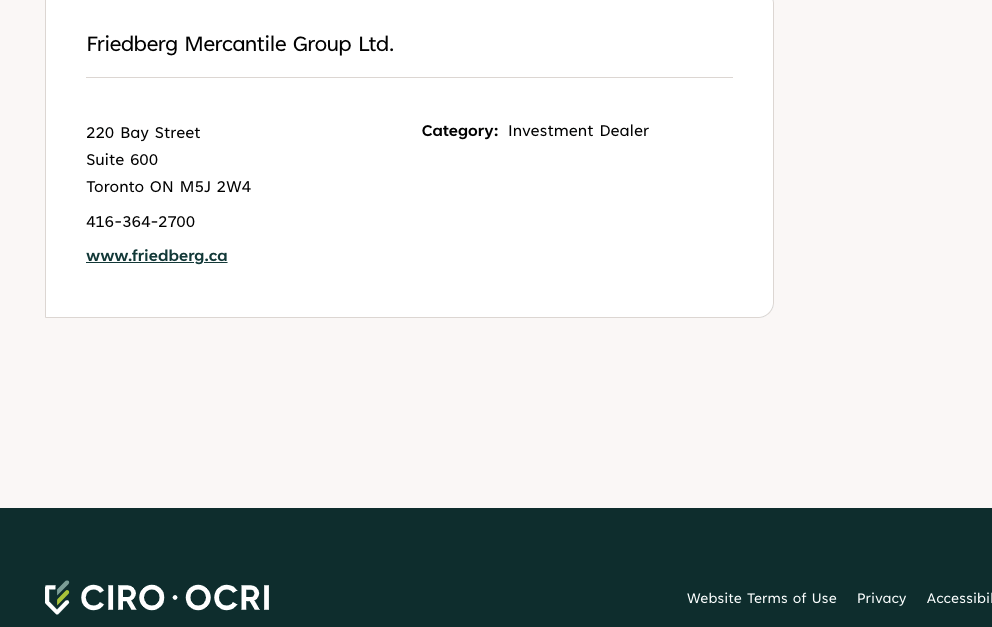

Fortrade is regulated By the CIRO as ‘Fortrade Canada Limited’

Regulation: Fortrade is regulated in Canada by CIRO as an investment dealer and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 63670, issued in 2020.

Trading Fees: Fortrade trading fees are spreads starting from 1.5 pips for major pairs and swap fees for keeping a trade open past the market’s closing time. Fortrade does not charge any commissions for opening and closing trade positions on the platform.

Available platforms: Fortrade supports the MetaTrader 4 trading application available in web, desktop and mobile versions. Fortrade has its own proprietary trading application – Fortrader, which has the web version (Web Fortrader) and you can download it from Google Play Store or Apple App Store.

Tradable Instruments: Financial instruments you can trade on Fortrade are forex currency pairs, indices stocks, precious metals, energies, agriculture commodities, and US treasuries.

Funding/withdrawals: Fortrade accepts internet bank transfers, cards and e-wallets (Skrill, Neteller) for deposits and withdrawals. Deposits via bank transfers are credited within 7 days and attract a charge of $15 per transaction while it takes about 3 business days for e-wallet deposits to be credited and is free.

It takes about 5 business days for you to receive funds withdrawn to bank accounts and about 15 business days for withdrawals to cards. While the broker charges no fees for deposits and withdrawals, your payment processor may charge a fee.

Customer support: Fortrade offers customer service to clients during working hours on business days via live chat, email and phone.

Fortrade Pros

- Regulated by CIRO

- Offers commission-free trading for all accounts

- Offers free deposits and withdrawals

- Offers swap free accounts

Fortrade Cons

- Customer support not available for 24 hours

- Charges dormant account fees

- Slow processing of deposits and withdrawals

- Does not support MT5 platform

- High minimum deposit

#5 Interactive Brokers – Forex Broker with Low fees on Proprietary Trading Platform

Interactive Brokers is regulated by the CIRO as ‘Interactive Brokers Canada Inc.’

Regulation: Interactive Brokers is regulated in Canada by CIRO as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 11890, issued in 2009.

Trading Fees: Interactive Brokers spreads starting from 0.2 pips for major pairs and swap fees for keeping a trade open past the market’s closing time. CMC Markets charges a commission of $2 per round turn whenever you open and close trades on the platform and can reduce to $1 if your trading volume increases.

Available platforms: Interactive Brokers offers only their proprietary trading application platform which has web version (Client Portal), desktop version (Trader Workstation), and mobile versions (IBKR Mobile on Android and iOS).

Tradable Instruments: Financial instruments you can trade on Interactive Brokers are stocks, forex pairs, options, bonds, futures, and hedge funds.

Funding/withdrawals: Interactive Brokers accept deposits and withdrawals via EFTs, bank wire transfers, and Online Bill Pay. While Bank transfers are credited within 1 business day with fees depending on your bank, it takes 4 business days for EFTs without any fees and 1-6 days for Online Bill Pay without any fees as well.

Withdrawals are allowed to bank accounts and via EFTs. All withdrawals are processed within 1 business day but may take longer for you to receive the funds depending on your bank or payment processor and charges may apply.

Customer support: Interactive Brokers offers 24/5 customer support on business days via live chat, email and phone number. When we tested, the Interactive Brokers live chat had no wait time.

Interactive Brokers Pros

- Regulated by CIRO

- Responsive customer support

- Has low spreads

- No mandatory minimum deposit

- Does not charge inactive account fees

- Has a wide range of instruments

Interactive Brokers Cons

- Customer support not available 24/7

- Does not support MetaTrader

- Slow processing of deposits

- Does not support card as a payment method

- Website is not user friendly and account opening is complicated

#6 AvaTrade – Forex broker with Multiple Trading Platforms

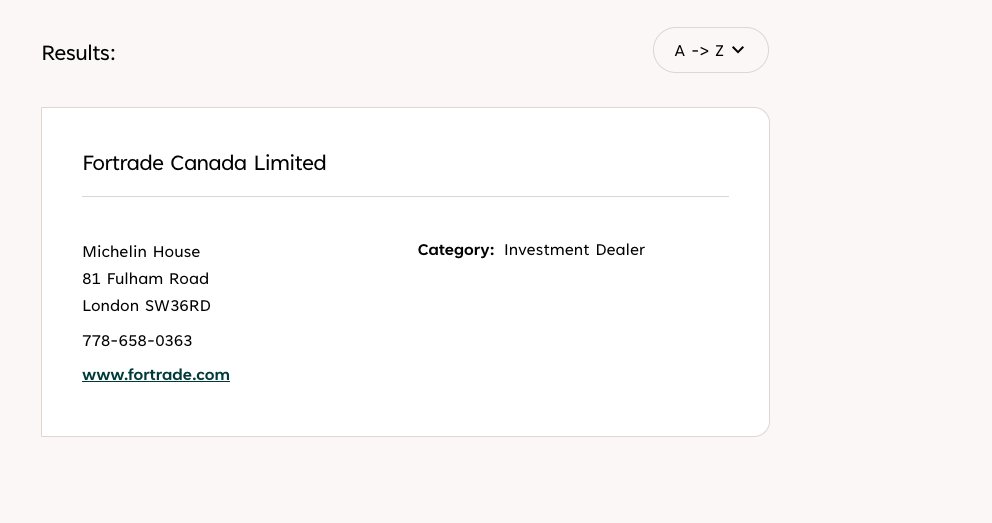

AvaTrade is regulated by CIRO through ‘Friedberg Mercantile Group Ltd.’ which operates as Friedberg Direct

Regulation: Friedberg Mercantile Group Ltd is regulated in Canada by CIRO as an investment dealer, and is registered with Canada Securities Administrators (CSA) with NRD (National Registration Database) Number 1310, issued in 2009.

Trading Fees: AvaTrade charges spreads starting from 0.6 pips for major pairs and swap fees for keeping a trade open past the market’s closing time. AvaTrade does not charge any commissions when you open or trade any instrument on the platform.

Available platforms: AvaTrade supports the MetaTrader 4 and MetaTrader 5 for trading which is available on web, desktop and mobile versions. AvaTrade also has a proprietary trading platform AvaOptions that can be accessed on web (WebTrader) or downloaded to the desktop and AvaTradeGo for mobile trading is available on Android Play Store and iOS App Store.

Tradable Instruments: Financial instruments you can trade on AvaTrade are forex pairs, stocks, bonds, indices, commodities (metals, oil, agriculture), and FX options.

Funding/withdrawals: AvaTrade supports cards and bank transfers for deposits and withdrawals on the platform. While deposits via cards are credited instantly, deposits via bank transfers can take up to 10 business days to be credited. AvaTrade does not charge deposit a fee on any method.

Card withdrawals on AvaTrade Canada take 5 business days to receive funds and up to 10 business days for the withdrawal to bank transfers without fees as well.

Customer support: AvaTrade offers customer support via live chat, email and phone number during business days (Monday – Friday 5:00 – 21:00 GMT). When we tested, the AvaTrade live chat had no wait time.

AvaTrade Pros

- Regulated by CIRO

- Offers commission-free trading

- Supports MT4 & MT5 trading platform

- Offers free deposits and withdrawals

- Has low trading fees

AvaTrade Cons

- Slow processing of withdrawals and bank transfers deposit

- Charges dormant account fees after 3 months

- Customer support is not available 24/7

More on Forex Trading Platforms

A forex trading platform begins with regulated brokerage companies. These companies have a system of accepting traders and connecting them to the forex market. A Trading platform is a major way forex brokers let traders access the markets.

Once you are registered and your trading account is activated, you can then use the trading platforms to trade forex. Trading platforms are broadly divided into two — third-party platforms and proprietary platforms. The former is developed by other companies for forex brokers. Examples of third-party platforms include MT4/MT5 (from MetaQuotes) and cTrader (from Spotware Systems).

On the other hand, proprietary platforms are developed by brokerage companies. They are designed and built by brokerage companies. eToro, FxPro, and City Index are examples of brokers with their own platforms. Some brokers support both types of trading platforms. However, there are a few brokers like Interactive Brokers who only support their proprietary platforms.

What is the Difference Between Dealing Desk and Non-Dealing Desk Platforms

Forex trading platforms can be divided into dealing desk and non-dealing desk (NDD) platforms. Dealing desk platforms are market makers. They take the opposite sides of your trades. In simple terms, when you buy a currency pair, they are selling it to you and vice-versa.

Most dealing desk brokers usually have an in-house price book so they set the price of trading instruments. Because of this, there’s likely to be a conflict of interest where the broker stands to benefit from your trades. This does not mean dealing desk brokers should be avoided. You can review their legal documents to see how they deal with conflicts of interest.

NDD brokers, on the other hand, do not take opposite sides of your trades. They have no dealing desk and in-house price book. an NDD broker could be an ECN or STP broker. ECN brokers give direct market access. They connect you directly to buyers and sellers in their market.

STP brokers connect you to buyers/sellers through their liquidity pools which could be banks or other financial institutions.

Finally, there are hybrid brokers that combine the features discussed above. The important point is to know how they handle conflict of interest. You can ask your forex trading platform for their conflict of interest document to know how they handle it.

How to Choose the Best Forex Trading Platform

We considered some criteria when assessing forex trading platforms. To know if a forex trading platform is the best for you, there are certain things you must check and verify. Here is what you check and how you go about it.

Is the forex trading platform regulated?

The Canadian Investment Regulatory Organization (CIRO) regulates forex trading platforms in Canada. Do not trade with unregulated forex trading platforms. You could lose all of your money to fraud.

Registering with an CIRO-regulated broker would offer you protection as an investor in case the regulated broker goes out of business. All brokers are required to register with the Canadian Investor Protection Fund (CIPF) which protects your investments and will work to ensure the broker pays whatever is owed to you in the event of insolvency, up to $1 million.

How do you know if a broker is regulated by CIRO?

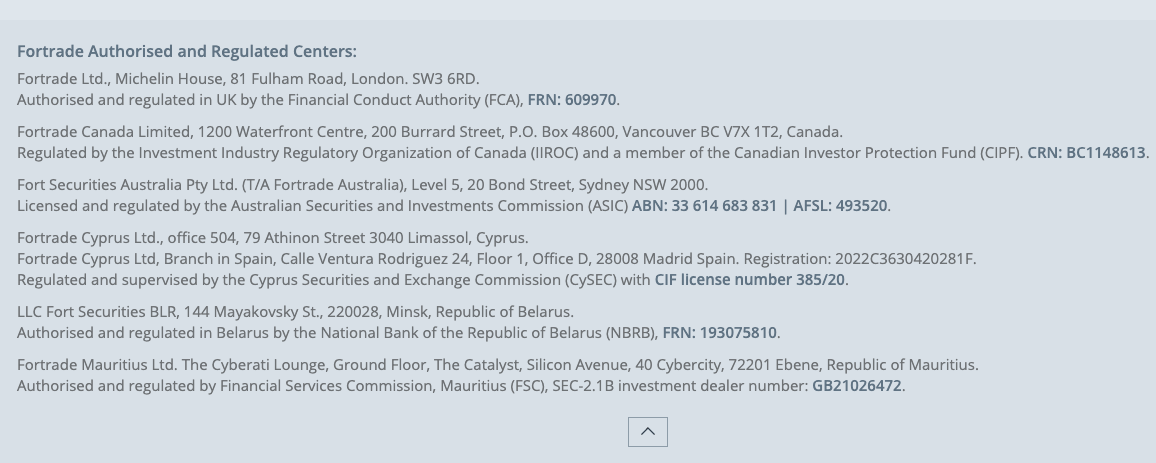

Step 1) Go to the broker’s website and scroll down to the footer. You will find their regulations clearly stated. Here is a picture from the Fortrade website.

You can see the name with which they are regulated in various jurisdictions. Should you stop here? No.

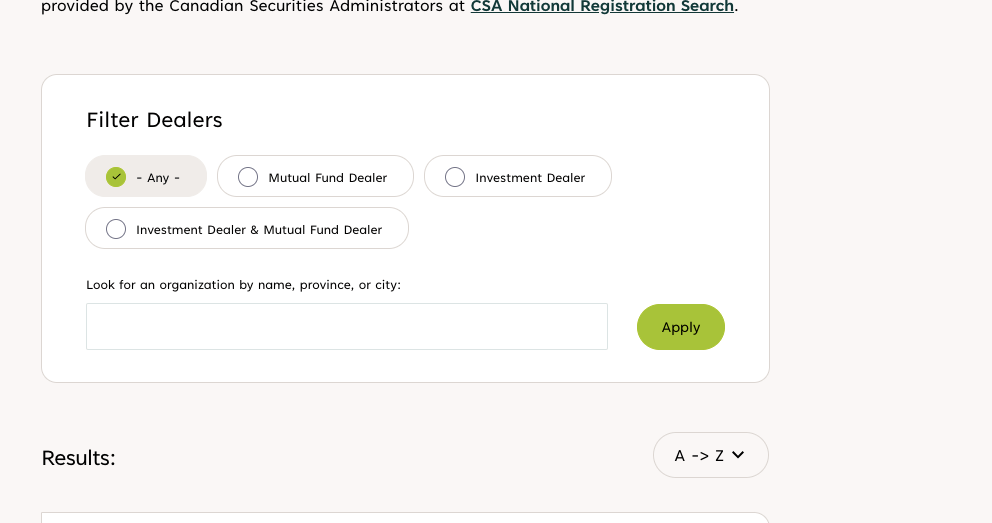

Step 2) You have to go further to verify the information on the broker’s website. You have to check if it is the same on the CIRO website. Go to https://www.ciro.ca/office-investor/dealers-we-regulate. Scroll down until you arrive at the area shown below.

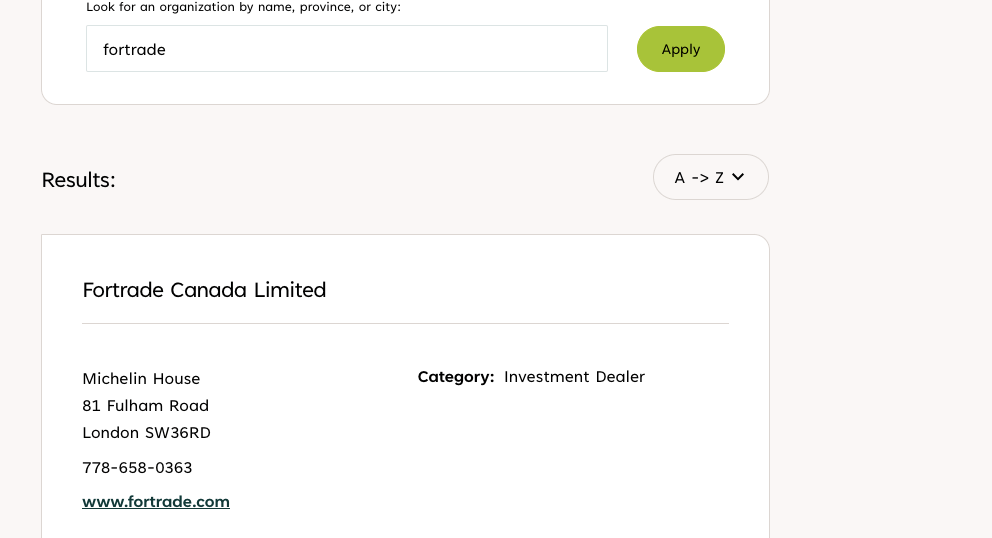

Step 3) Enter the broker’s name and click ‘APPLY’. Using Fortrade for example, your search result should look like this:

The registration name on the two websites match. Once you can confirm this, you know a forex trading platform is regulated on CIRO and safe.

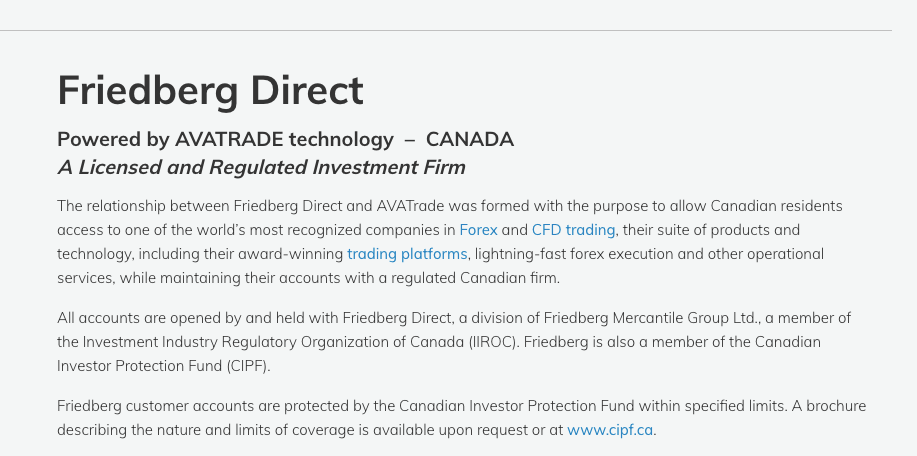

Furthermore, on regulation, some forex trading platforms operate under a subsidiary, thus they have a different trading name from the name with which they are regulated. An example of such a platform is AvaTrade in Canada, which operates through the Friedberg Direct subsidiary of Friedberg Mercantile Group Ltd.

The subsidiary brokers usually state it on their website, here is a confirmation below:

Finally, check that the website is authorized. Never open an account on a website that is not authorized. You can check this as well. On the CIRO page of the broke, you will find the authorised website

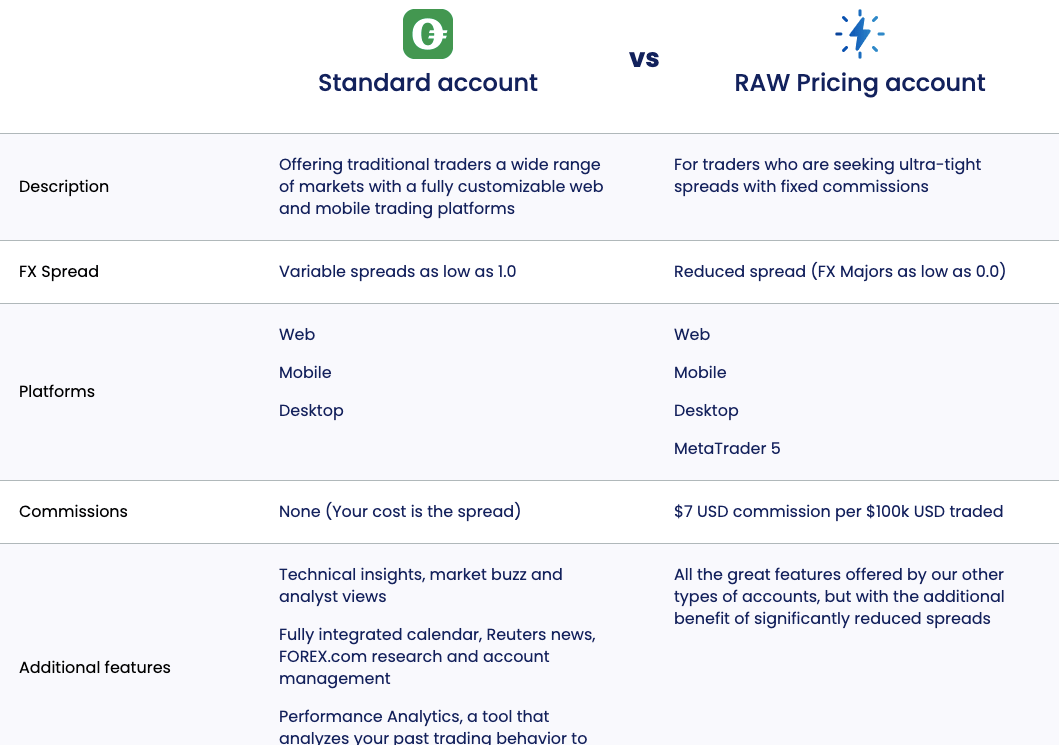

Is there more than one account?

Forex trading platforms usually have more than one account. You should consider this factor because it helps you with pricing flexibility. Usually, forex brokers will have a standard trading account. This account will have high average spreads with zero commissions per standard lot.

The other account(s) have a low typical spread but you are charged a round-turn commission on your trades. Because account types affect the structure of trading fees, it is better you go for a trading platform with at least two accounts.

In addition, account types might also affect your minimum deposit. A forex broker may have an account with no fixed minimum deposit. This allows you to trade with little money. However, some accounts do have a specific minimum deposit. Do you see why you have to consider a platform with multiple accounts?

Here is an overview of Forex.com trading accounts comparison for example.

Forex.com have several account types. You can see from the image that the trading conditions in the accounts are different. Spreads, available instruments for trading, commissions, etc. all vary per account.

Do you see why you need to compare trading accounts? If your broker offers more than a single trading account, you have to compare them to choose the best trading conditions.

Are overall fees low?

Your overall fees as a trader is a combination of trading and non-trading fees. Trading fees include spreads, commissions, and overnight charges. Non-trading fees include inactivity fees, deposit/withdrawal charges, or currency conversion charges.

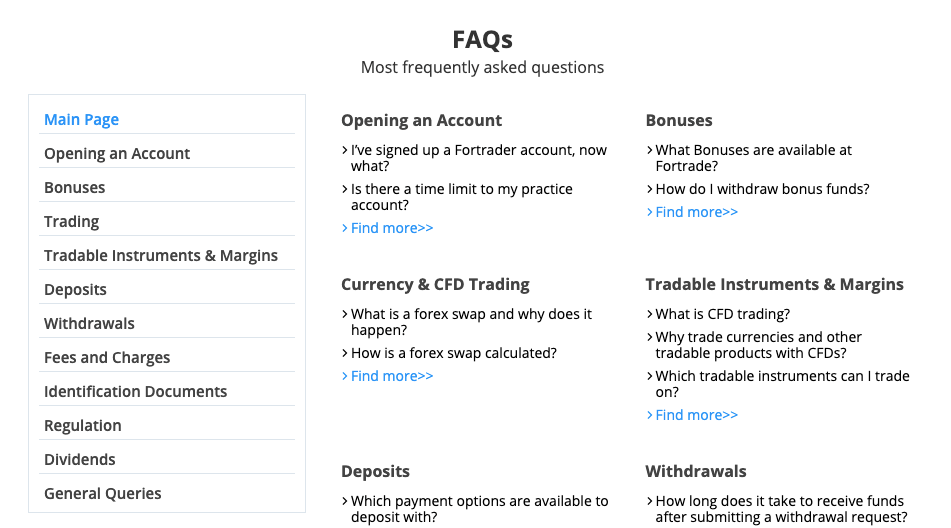

It is important to know if the overall fees are low or high. Overall fees affect your profit or loss cumulatively so make sure to check them out. They are usually found under the forex broker’s fees or pricing located in the trading bar or FAQs.

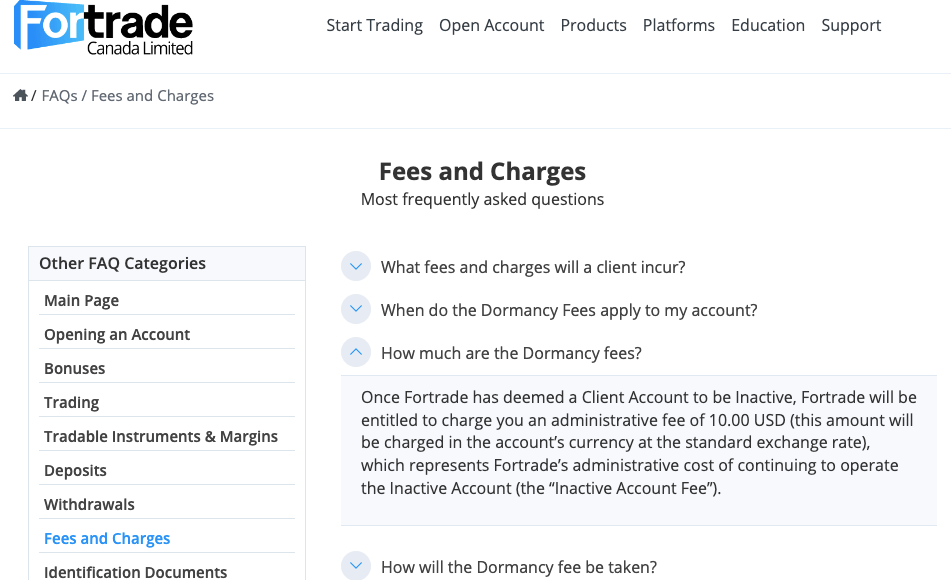

You can also ask customer support via charts for applicable fees. Here is a screenshot of how to check Fortrade fees on their FAQs section:

Is their platform multi-device?

MT4, MT5, and cTrader platforms are prominent with traders. You want to make sure your chosen forex trading platform supports them. They should also be available on multiple devices.

This is important because all devices do not give you the same experience. Mobile apps allow you to monitor your trades on the go. Desktop versions give you a detailed and concise view that is lacking in mobile apps.

Forex trading platforms usually state their platforms and the device or devices they are available on. All you need to do is go to their website and click on platforms or trading platforms.

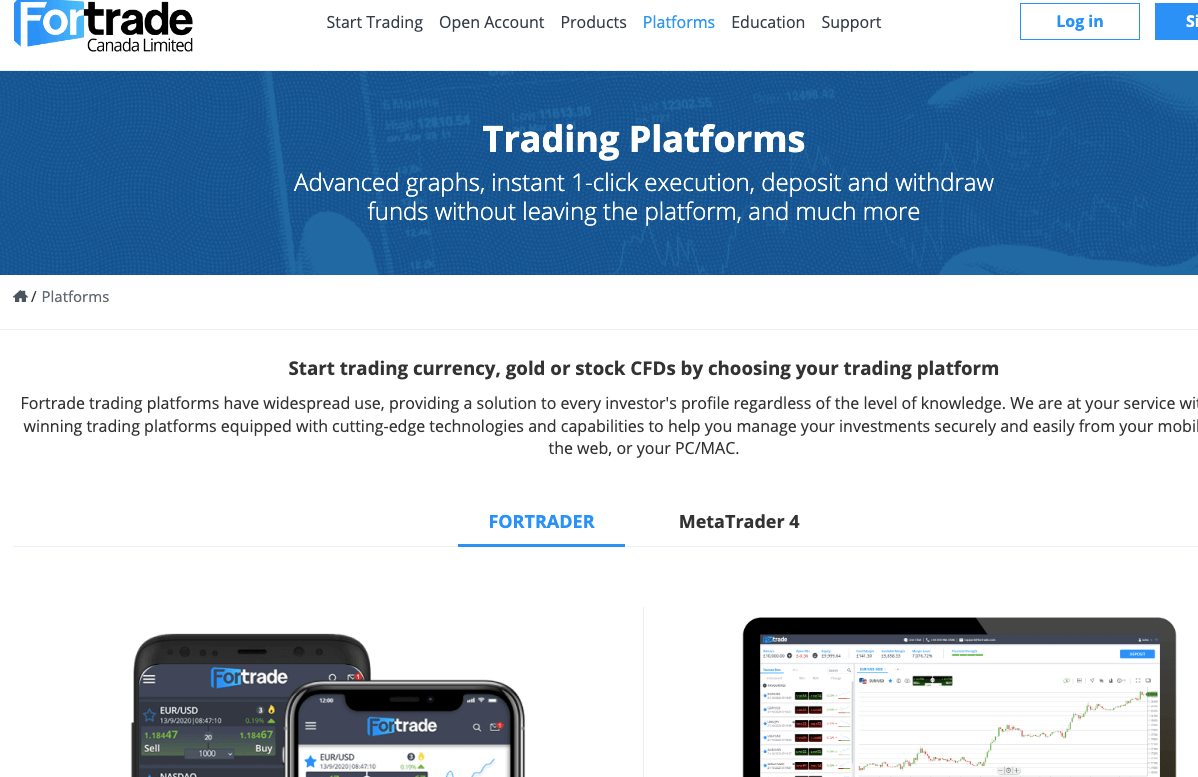

Here is a screenshot of Fortrade Trading platforms. You can see how it is available on multiple devices and functional on different operating systems.

Is customer support quick?

To know if the customer support is quick, you have to test it yourself. This way, you get first-hand experience. You can use the live chat feature or send an email. You can grade the speed of the customer support this way.

Is it easy to withdraw funds?

You should be able to withdraw your money easily at any time. What you need to check are the withdrawal methods, how instant they are processed, the fees if any, and when the money shows in your account. You can find this by going to the funding and withdrawal section.

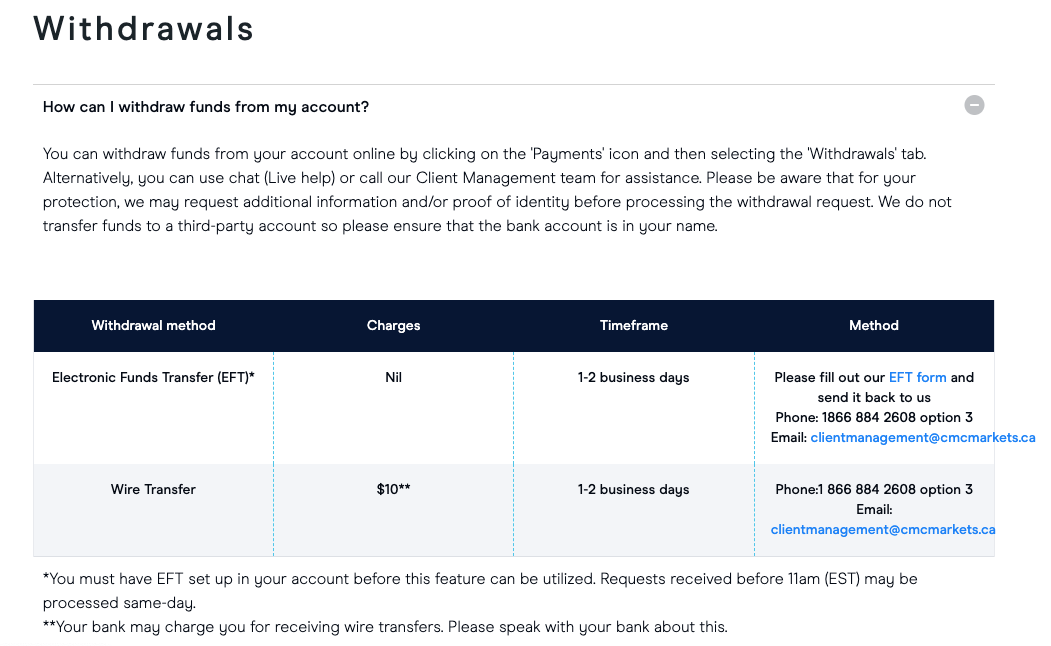

For CMC Markets as an example, go to the FAQs section and click on funding and withdrawal.

Does the platform have key features?

When choosing a forex trading platform, there are some key features you want to look for that will make trading smoother and efficient. First, check if the platform has customisable charting tools. You will want the ability to personalise your charts with different indicators, and timelines.

If they have chart types like candlestick or Renko, even better. From experience, advanced tools like Fibonacci retracements and moving averages help you make technical analysis.

Another thing to look out for is Fast order execution, this is important as it helps you avoid slippage, and having various order types—like market, limit, and stop orders—gives you more control over your trades. A good platform will typically also offer research tools, such as an economic calendar to track key events as well as fundamental analysis for market news and company reports.

If you are serious about strategy, make sure to choose a platform that allows you to backtest your trades using historical data. Finally, if you are interested in social trading, then choose a platform with copy trading features that let you follow and replicate successful traders’ moves.

Do they have comprehensive educational resources?

Starting a successful forex trading journey often depends on having the right knowledge. A good trading platform should offer the tools and resources you need to learn the ropes, improve your skills, and experience. So, make sure to choose a trading platform with comprehensive educational resources such as:

-

Tutorials and Guides: A good platform should break down forex trading concepts in a way that’s easy to understand, especially for beginners; and

-

Webinars and Seminars: Live webinars and seminars hosted by experienced traders or analysts can provide real-time insights and strategies. Good trading platforms usually host these sessions and they are great for learning from the pros and staying up-to-date with market trends.

What is the Difference Between Trading Tools and Technical Indicators?

Trading tools help forex traders make trading decisions. It could be any form of technology or application. Beyond trading decisions, these tools also aid forex traders in portfolio management. These tools could be as simple as tutorials and videos for trading education.

However, they could also be complex tools for backtesting your strategies, optimizing your portfolio, analyzing your portfolio, etc. Trading tools also might also include risk management tools.

You might confuse trading tools with technical indicators but they are not the same. Technical indicators are used to identify bullish or bearish trends. You can use them to identify how strong these trends are and how far with they might last.

These indicators are not perfect. However, traders tend to integrate two or more of these indicators to confirm their analysis. The most common indicators include the relative strength index (RSI), stochastic, moving average convergence divergence (MACD), fractals, Fibonacci retracements, etc.

FAQs on Best Forex Trading Platforms Canada

Which forex trading platforms are regulated in Canada?

As per our research, OANDA, CMC Markets, Fortrade, Interactive Brokers, Forex.com, and AvaTrade are some of the brokers regulated trading platforms in Canada.

Any forex trading platform that is authorised by CIRO is regulated in Canada. So, check if the platform you are choosing is authorized in Canada by checking their Registered name on the CIRO and CSA database. Only this would ensure that your funds are protected.

Which forex trading platforms have the lowest spreads??

Interactive Brokaers, AvaTrade, and CMC Markets are some of the forex trading platforms with low spreads. Look for brokers that offer ECN type accounts with Raw spreads if you are looking to trade with very low spreads.

Best forex trading platforms in Canada for beginners?

OANDA is the best platform for beginners as per our review. Their offering is clear, with competitive spread, Metatrader platform, low deposit, fair trading conditions, simple account opening, commissin-free trading, and 24/7 support.

Which is the best platform for forex trading?

MetaTrader 4 and 5 are the most popular trading platforms. They have good charting tools that is ideal for trading. cTrader follows them closely and is growing in popularity too. Althogh some brokers’ proprietary trading platforms are good as well