FxPro is an online broker that provides trading services for CFDs on forex pairs, indices, metals, stocks, energies, and futures via the MT4, MT5, and cTrader trading applications.

FxPro was established in 2006 and is regulated in the UK by the FCA (Financial Conduct Authority) and other Top-Tier financial regulators like CySEC (Cyprus Securities & Exchange Commission) and FSCA (Financial Services Conduct Authority) in South Africa.

In our review of FxPro, we examine the fees, deposits/withdrawal options, trading conditions, account types, account opening process, tradeable instruments, and customer support of the broker.

| FxPro Review Summary | |

|---|---|

| Broker Name | FxPro Australia |

| Establishment Date | 2006 |

| Website | www.fxpro.com |

| Address | FxPro Global Markets Ltd, Albany Financial Center, South Ocean Boulevard, New Providence, The Bahamas |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:200 |

| Regulation | FCA, CySEC,FSCA, SCB |

| Trading Platforms | MT4, MT5, cTrader, and FxPro Edge available on PC, Mac, Web, Android, & iOS |

| Visit FxPro | |

FxPro Pros

- Offers 24/7 customer support

- Supports multiple trading platforms

- Offers commission-free trading accounts

- Fast and simple account opening process

- Free deposits and withdrawals

- Fast deposits processing

FxPro Cons

- Charges dormant account fees

- Has relatively fewer instruments to trade

- Not regulated in Australia

Is FxPro a good forex broker?

FxPro is a good broker because they are regulated in multiple jurisdictions by Tier 1 and Tier 2 financial regulators. This means that clients’ funds are safer and the risk of fraud is lower because they have to comply with the regulations.

FxPro is not regulated in Australia currently. Traders in Australia are registered under FxPro Global Markets Ltd, which is regulated by the Securities Commission of The Bahamas (SCB) as a securities dealer.

Find other regulations of FxPro in different countries below:

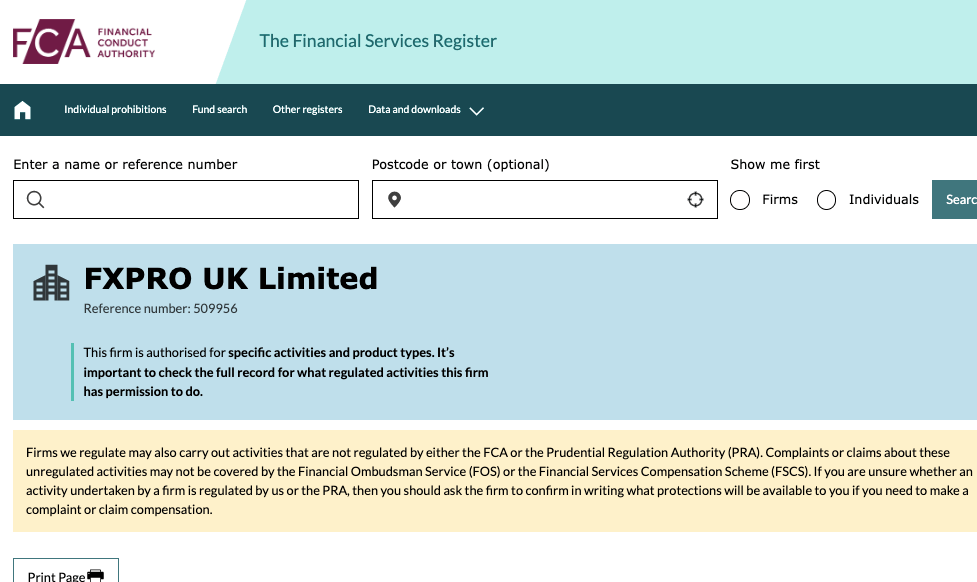

1) Financial Conduct Authority (FCA): FxPro is regulated by the FCA as ‘FxPro UK Limited’ and authorized to offer financial services in the UK, with reference number 509956, issued in 2010.

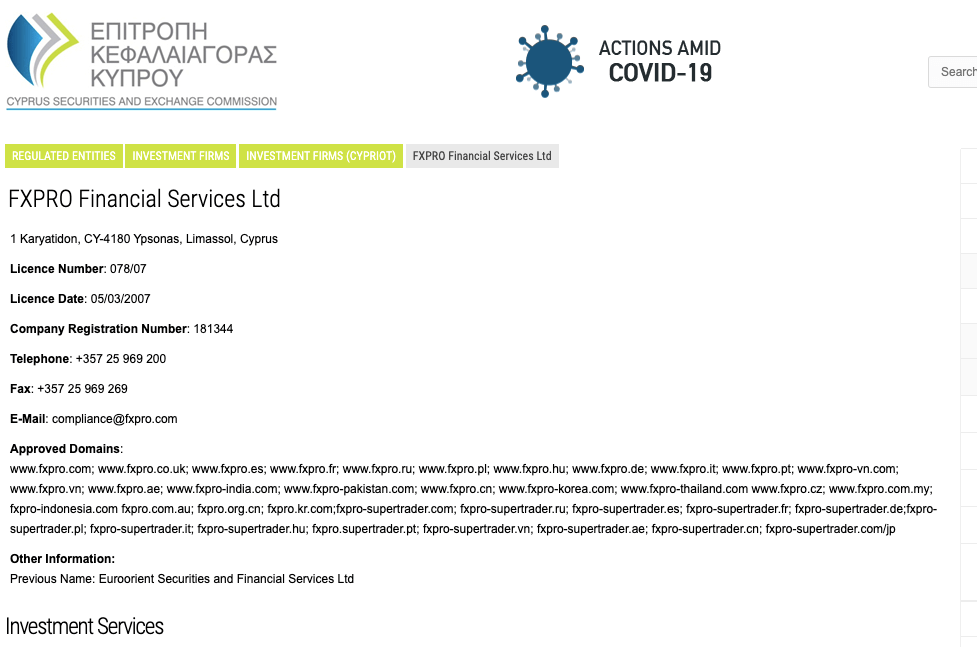

2) Cyprus Securities and Exchange Commission (CySEC): FxPro is regulated by CySEC as ‘FXPRO Financial Services Ltd’ and licensed to offer investment services in Cyprus and other European Union countries, with license number 078/07, issued in 2007. FxPro serves clients in EEA (European Economic Area) with this license.

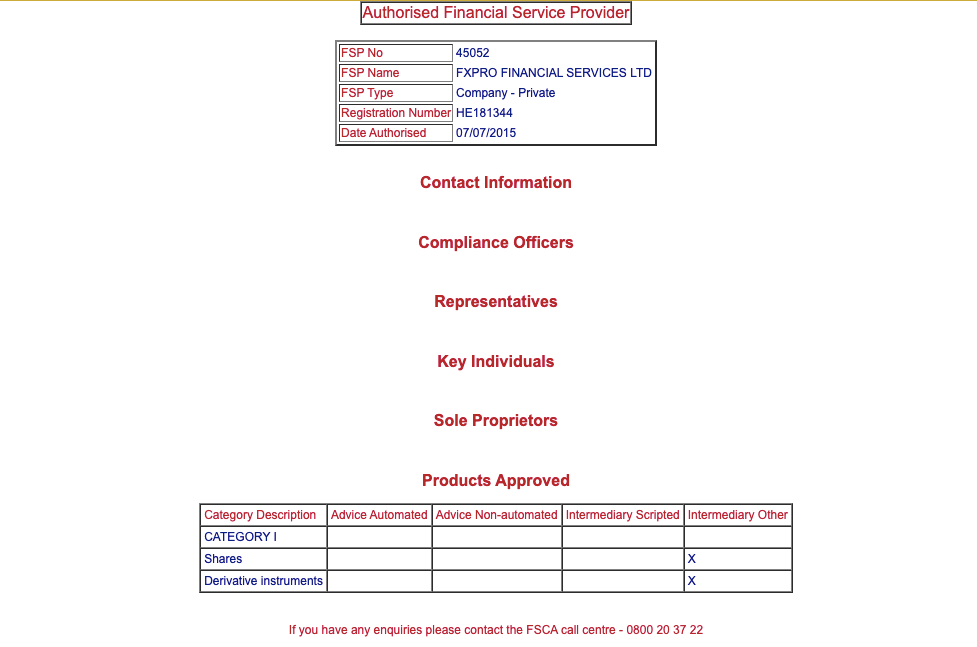

3) Financial Sector Conduct Authority (FSCA), South Africa: FxPro is authorized in South Africa by the FSCA as ‘FxPro Financial Services Ltd’ and licensed as a financial services provider (FSP), with FSP number 45052, issued in 2015.

4) Securities Commission of The Bahamas (SCB): FxPro is authorized and licensed in The Bahamas by the SCB. They are registered as FxPro Global Markets Ltd under the Securities Investment Act, making the broker an SIA registrant. Their SIA license number is SIA-F184

FxPro Investor Protection

| Client Country | Protection | Regulator | Legal name |

|---|---|---|---|

| UK | £85,000 | Financial Conduct Authority (FCA) | FxPro UK Limited |

| EEA Countries | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | FxPro Financial Services Ltd |

| South Africa | No Protection | Financial Sector Conduct Authority (FSCA) | FxPro Financial Services Ltd |

| The Bahamas | No Protection | Securities Commission of The Bahamas (SCB) | FxPro Global Markets Ltd |

With FxPro, you cannot lose more than your initial deposit. Negative balance protection is provided for all UK clients. In addition, UK clients can have their money protected up to £85,000 via the Financial Services Compensation Scheme (FSCS). This means your money is protected should FxPro go bankrupt.

Australian clients are registered under FxPro’s regulation in the Bahamas. There is no compensation fund arrangement with the SCB. However, negative balance protection is provided in accordance to the SCB rule book for CFDs. It says “the liability of a retail client for all CFDs connected to the retail client’s account is limited to the funds in that account.” Simply put, you cannot lose more than the money you have in your account.

FxPro Leverage

FxPro operates a variable leverage system, and the leverage on FxPro depends on the instrument you are trading and whether you are a retail or professional client.

Retail clients on FxPro have a maximum leverage of 1:200 for forex pairs, gold, silver, spot indices major and energies; 1:100 for spot indices minor; 1:50 for futures indices, platinum, palladium and other commodities; 1:25 for shares; and 1:20 for crypto assets.

The maximum leverage on FxPro for Professional clients is 1:500, which is for major forex pairs, other instruments have lower leverages.

FxPro Account Types

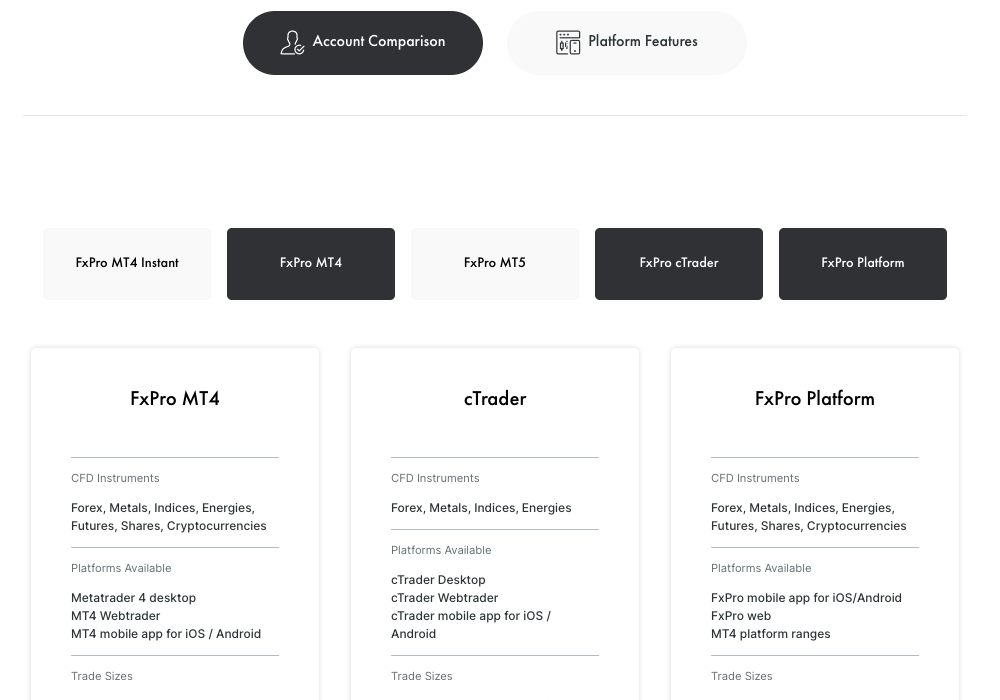

FxPro offers five main account types to retail clients, each based on the trading platform that you access the account through, fees, and the order execution type. FxPro Edge CFD, CTrader, MT4, MT4 Instant, and MT5. You can open an individual account on FxPro or as a corporate body.

FxPro also offers Professional Account and VIP Account status to some clients. Swap-free Islamic Accounts are available for Muslim traders, and beginners can open demo accounts to practice trading before putting real money on the line.

Find an overview of the various account types on FxPro below:

1) MT4 Account: The FxPro MT4 Account is designed for retail traders and is based on the MT4 trading application. You can trade forex pairs, indices, futures, metals, energies, and shares.

This account is spread only and you do not pay any commissions when you open or close trade positions. Spreads start from 1 pip for major forex pairs and you pay swap fees whenever you keep a trade position open past the closing time of the market.

This account requires a minimum deposit of $1,000, the minimum trade size is 0.01 micro-lots, and uses market order execution type for trades.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account if a trade position is unsuccessful.

2) MT4 Instant Account: The FxPro MT4 Instant Account is also a retail trading account type based on the MT4 trading application. It allows you to trade currency pairs, indices, futures, metals, energies, and shares.

This account doesn’t charge commissions when you open or close trade positions. The spread on this account starts at 1 pip for major forex pairs, and you’ll pay a swap fee whenever you keep a trade position open past the closing time of the market.

This account requires a minimum deposit of $1,000, the minimum trade size is 0.01 micro-lots and uses an instant execution type for trades.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account if a trade position is unsuccessful.

3) MT5 Account: The FxPro MT5 Account is also designed for retail traders and is based on the MT5 trading application. It allows you to trade currency pairs, indices, futures, metals, energies, and shares.

You pay no commission fees when you open or close trade positions with this account. Spreads start from 1 pip for major forex pairs, and you pay swap fees when you keep a trade position open past the closing time of the market.

This account requires a minimum deposit of $1,000, the minimum trade size is 0.01 micro-lots with market order execution.

You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account if a trade position is unsuccessful.

4) cTrader Account: The FxPro cTrader Account is also designed for retail traders and is based on the cTrader trading platform. With this account, you can trade currency pairs, indices, futures, metals, energies, and shares.

With the cTrader Account, you pay commission fees for trading forex and metals, while other instruments are commission-free. You pay lower spreads with this account with no minimum spreads. You also pay swap fees when you keep a trade position open past the closing time of the market.

This trading account requires a minimum deposit of $1,000 to start trading. The minimum trade size is 0.01 micro-lots, and a market order execution model is used for trades.

This account type also has negative balance protection, which means you cannot lose more than the amount of money in your trading account.

5) FxPro Edge Account: FxPro’s Edge Account is designed for retail traders and accessed on the FxPro trading platform. You can trade currency pairs, indices, futures, metals, energies, and shares with this account.

There are no commission fees when you open or close trade positions with this account. Spreads start at 1 pip for major forex pairs with this account, and swap fees apply when you keep a trade position open past the closing time of the market.

This account requires a minimum deposit of $1,000, and the minimum trade size is 0.01 micro-lots with market order execution. You have negative balance protection with this account, which means you cannot lose more than the amount of money in your trading account.

6) Professional Account: FxPro offers experienced traders Professional Account status, which enables you to trade financial markets with higher leverage of up to 1:500. You can trade forex, indices, energies, metals, futures, cryptocurrencies, and shares.

This account type can be based on any of the trading platforms, depending on your preference, and the regular spread fees and commissions on such platforms will apply.

Professional Accounts on FxPro require a minimum deposit of $1,000 and a minimum trade lot of 0.01. Professional traders do not have guaranteed negative balance protection, which means you can lose more than the money in your account. You will also not be eligible for any financial compensation in the event that the broker cannot pay up their obligations.

To get a professional account, you have to apply in writing to customer support. To qualify for a professional account, you need to meet at least 2 of the 3 criteria below:

- You must have worked in the financial sector for at least 1 year

- You must have carried out a minimum of 10 significant transactions each quarter for the past year

- You must have a financial instruments portfolio exceeding €500,000

Note that as a professional trader you can also apply to be recategorized as a retail client, by writing to customer support to downgrade your account.

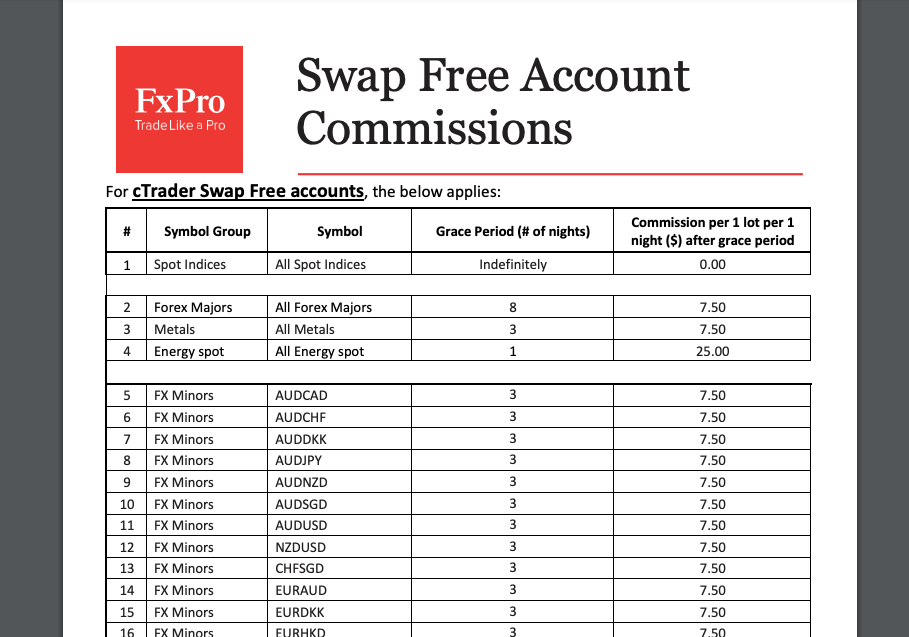

7) Islamic Account: FxPro offers Islamic Accounts to Muslim traders that are in compliance with sharia law. These accounts are swap-free (interest-free), which means they do not pay any rollover fees for keeping a trade position open during the closing time of the market within a grace period.

Although the FxPro Islamic Account is swap-free, you start to pay fixed swap fees per lot each night after keeping a trade position open consecutively past the market closing time beyond the grace period days.

The grace period days vary based on the instrument being traded and start from 1 day for energies spot, 3 days for metals, crypto assets, and minor forex pairs, and can be up to 8 days for major forex pairs.

The fixed swap fees start from $7.50 and can be up to $80 per lot each night. Spot indices, futures, and shares have an indefinite grace period.

You can have a swap-free Islamic Account on FxPro as a retail or professional client by sending an application to customer support via email. You will be required to submit some documents before your application is approved.

Note that a swap-free Islamic Account is not supported with the MT5 Account type.

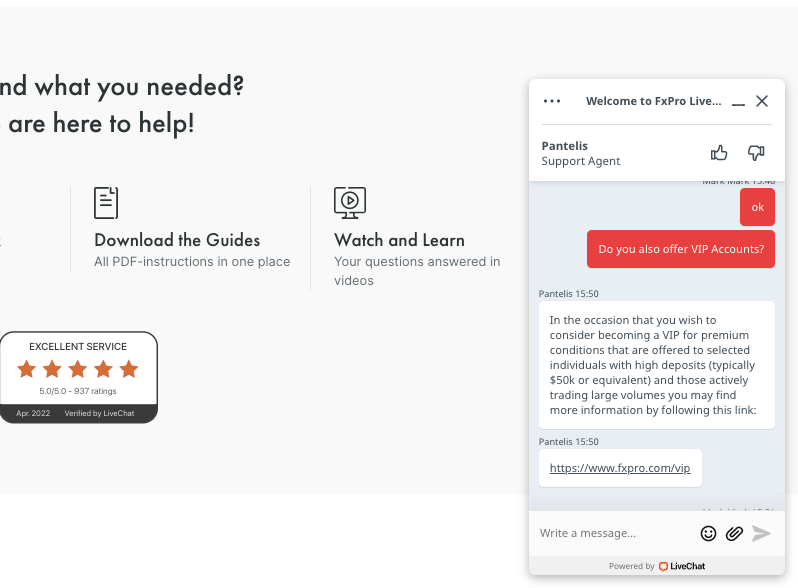

8) VIP Account: FxPro offers VIP Account status to traders who deposit more than $50,000 and actively trade large volumes. This applies to all account types and whether you are a retail or professional client.

Once you meet the requirement, a manager from FxPro will reach out to you to activate your VIP premium account status. You can also submit an Application for FxPro Premium Account if no one reaches out to you automatically.

With the FxPro VIP Account, you get up to 30% discounts on spreads and commissions. You can also use EAs (Expert Advisors) like cBots to trade.

FxPro Base Account Currency

You can choose from 7 currencies when signing up to serve as your account base currency on FxPro. Your trades, deposits, profits, and withdrawals will be measured in your base account currency.

The available currencies are Australian Dollars – AUD, Swiss Franc – CHF, Euros – EUR, British Pound sterling – GBP, Japanese Yen – JPY, Polish Zloty – PLN, and the United States Dollar – USD.

FxPro Overall Fees

FxPro charges different fees depending on the instrument you trade size and whether you are a retail or professional client or have VIP account status. Here’s an overview of the broker’s trading and non-trading fees.

Trading fees

1) Spreads: FxPro charges spread fees whenever you trade a financial instrument on the platform. Spreads are the difference between the ask and bid prices of the tradeable instruments and serve as revenue for the broker. Spreads on FxPro depend on the instrument you are trading and your account type.

The following table shows the average spreads that FxPro charges for major instrument pairs.

| Instrument/Pair | MT4 | MT5 | cTrader |

|---|---|---|---|

| EUR/USD | 1.51 pips | 1.52 pips | 0.27 pips |

| GBP/USD | 1.67 pip | 1.84 pips | 0.38 pips |

| EUR/GBP | 1.69 pips | 1.84 pips | 0.59 pips |

| Gold | 26.48 pips | 27.19 pips | 16.88 pips |

2) Commission fees: FxPro offers commission-free trading for all instruments on all account types except the FxPro cTrader Account. You do not have to pay any commission fees when you enter or exit a trade position.

FxPro charges commissions on the cTrader account when trading FX & Metals. The commission fee is $45 for every $1 million traded upon opening a position and $45 upon closing the position, making it $90 for a round turn.

When trading a volume less than $1 million, the fee is prorated and you pay a fraction of the $45.

3) Swap fees: The market closing time on FxPro is 9:59 PM UK time. If you keep a trade position open past this time, you will incur rollover fees also called swap fees or overnight funding costs. This fee will be added to your profit or loss when you close the position.

Swap fees on FxPro are calculated based on the size of your trade, the spread cost of the trade, the prevailing swap rate, the number of days you keep it open, and whether your position is a buy (long) or sell (short). No swap fees are charged on futures contracts.

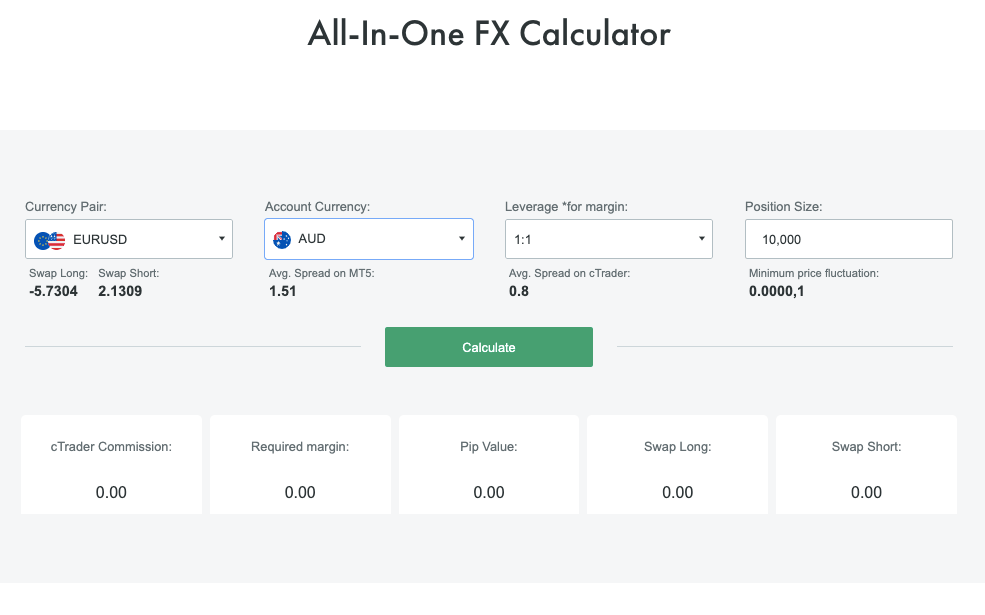

You can calculate the cost of a swap by using the Cost Calculation Tool on the ‘Tools’ page of the FxPro website.

Non-trading fees

1) Deposit and Withdrawal fees: FxPro offers free deposits and withdrawals. You do not pay any fees when you deposit funds to your account or withdraw from it. This applies to all account types and payment methods.

2) Account Inactivity charges: If you do not perform any trade on your account for 6 months, your account will be categorized as inactive and any balance in your account will be charged a one-time fee of $15, then $5 monthly subsequently. If you do not have any funds in your account, no negative will accumulate on the account.

If your account remains inactive for 6 years and the broker is unable to reach you, any funds in the account will no longer be considered clients’ funds and will be given to charity or used for any such thing as the broker deems fit.

| Fee | Amount |

|---|---|

| Inactivity fee | $15 (one-time), $5 (monthly) |

| Deposit fee | None |

| Withdrawal fee | None |

How to Open FxPro Account in Australia?

Follow these steps to open a trading account on FxPro.

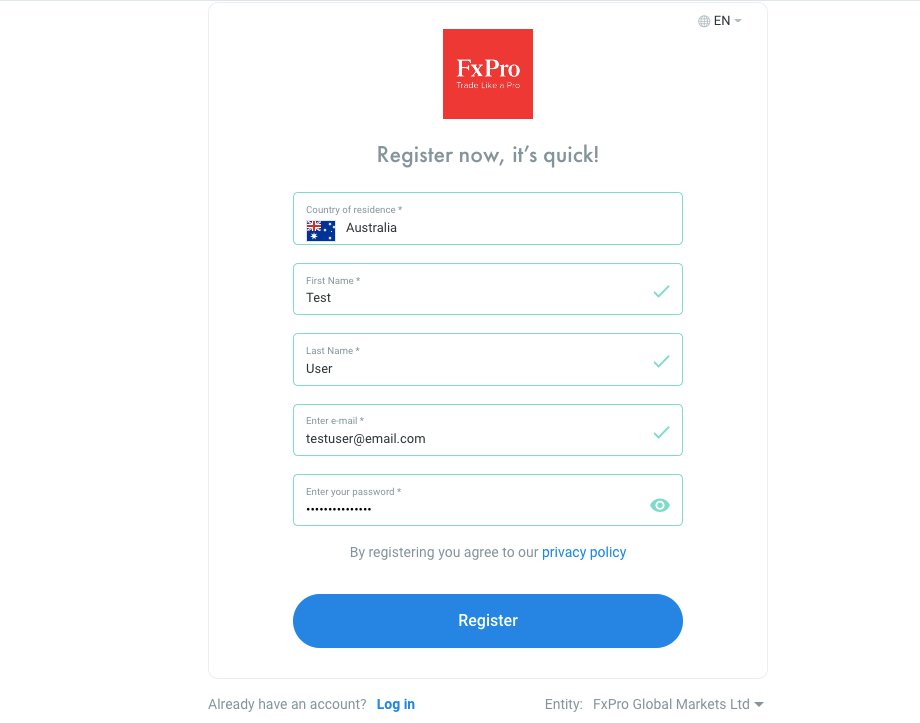

Step 1) Visit the website of Fxpro at www.fxpro.com and click on the ‘Open Trading Account’ or ‘Register’ button.

Step 2) Fill out your name and email, create a password then click on ‘Register’.

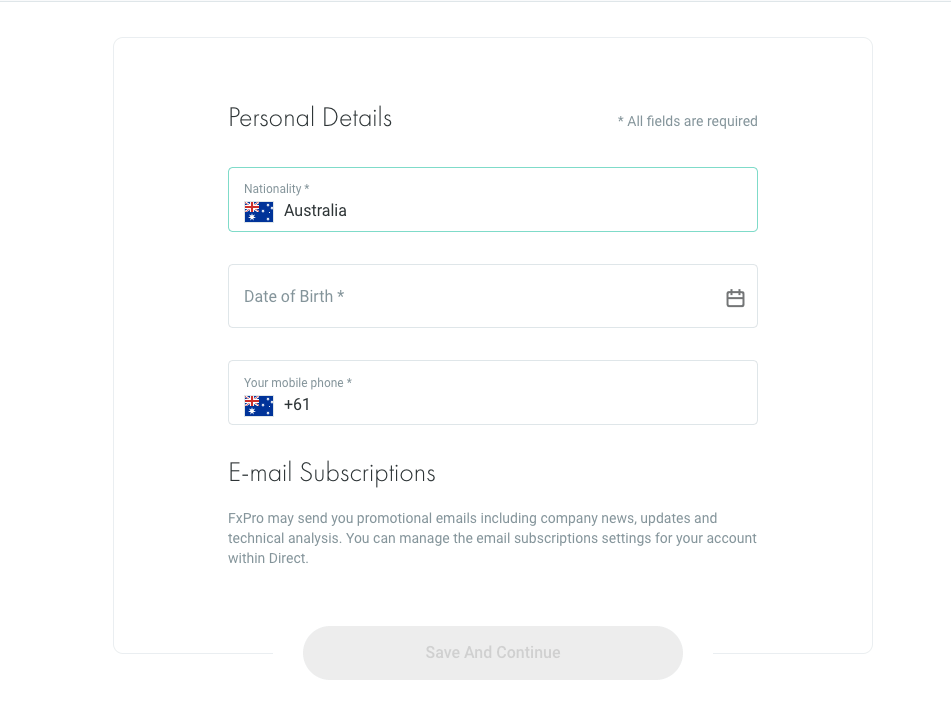

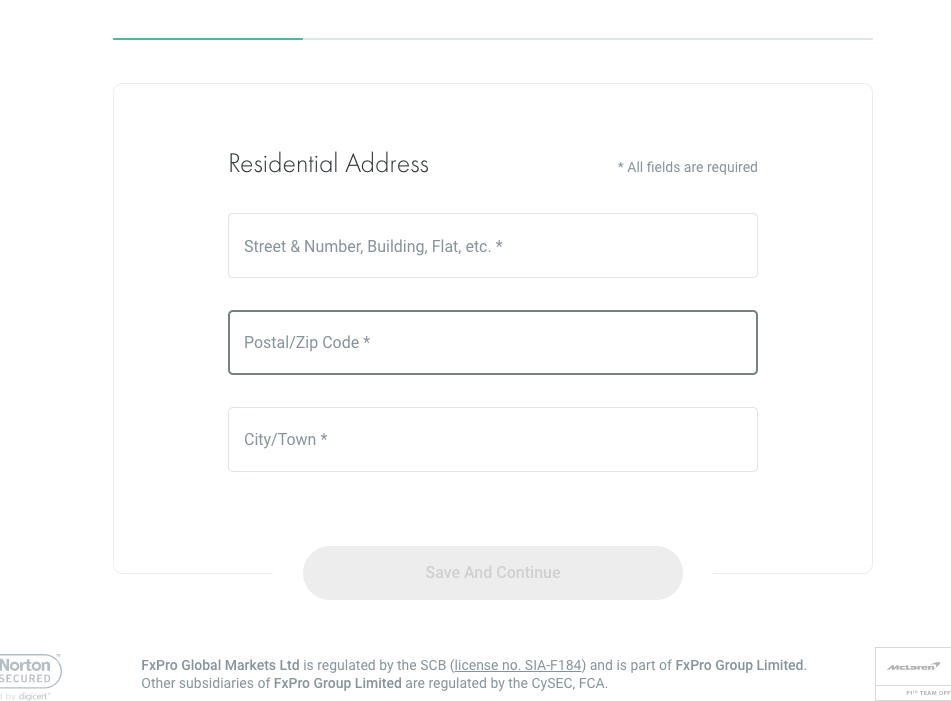

Step 3) Provide your date of birth, phone number, and address then click ‘Save and Continue’.

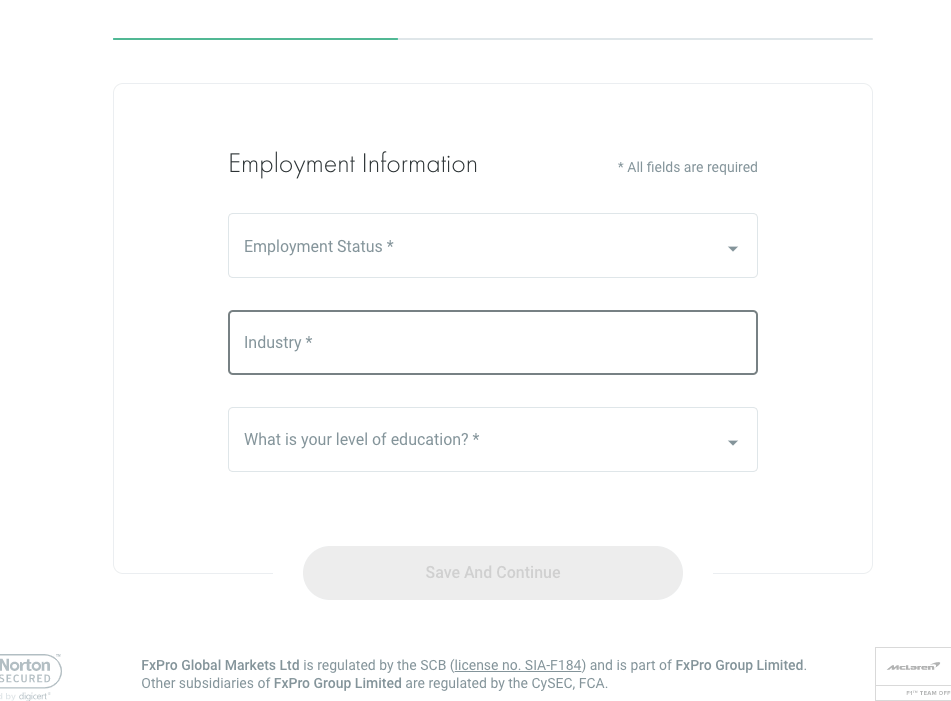

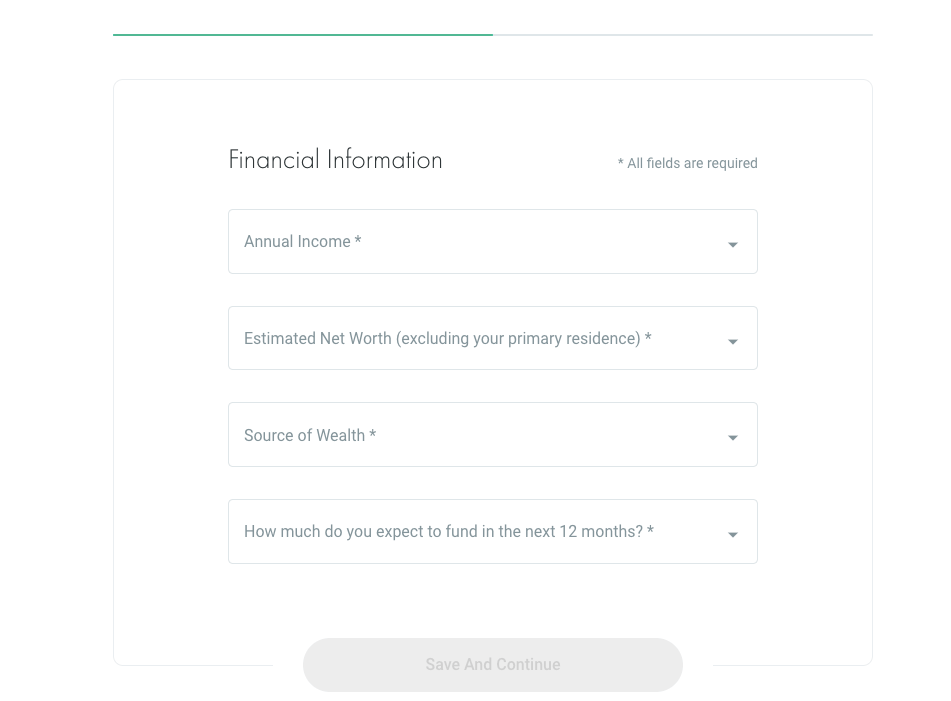

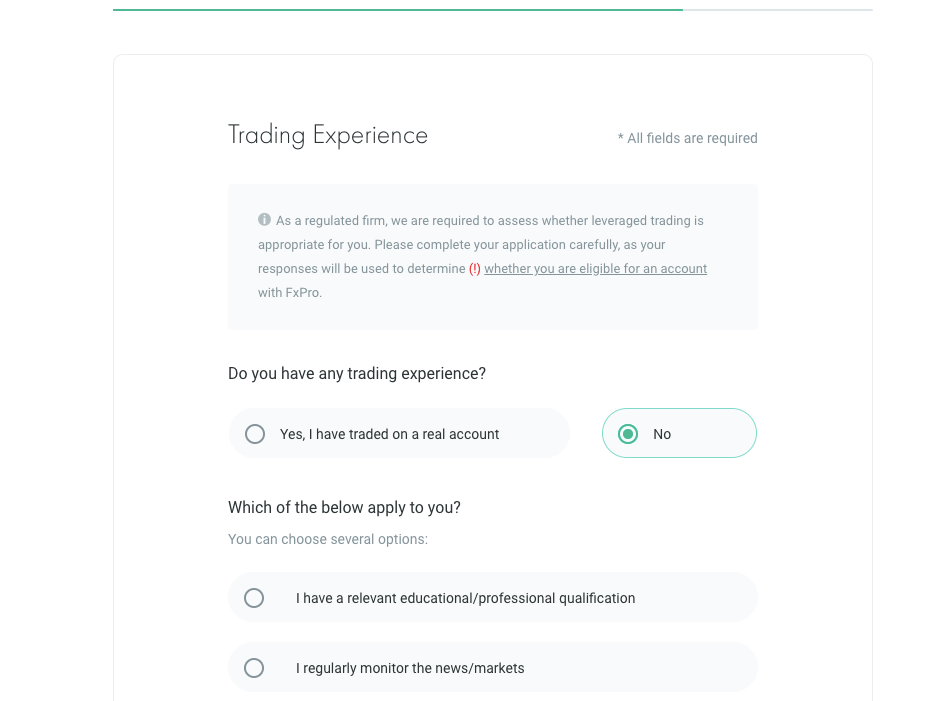

Step 4) Answer some questions about your employment status, education level, financial information, and trading experience.

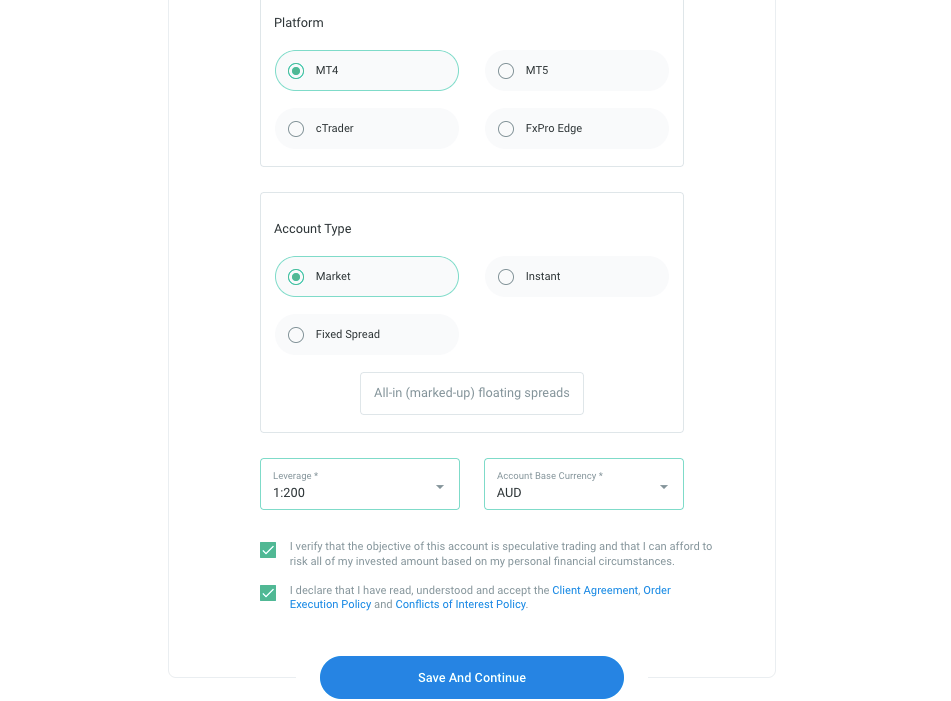

Step 5) Choose your preferred trading platform, set maximum leverage, and select your base account currency, then check the privacy policy and client agreement and ‘Save and Continue’ to proceed with your account registration.

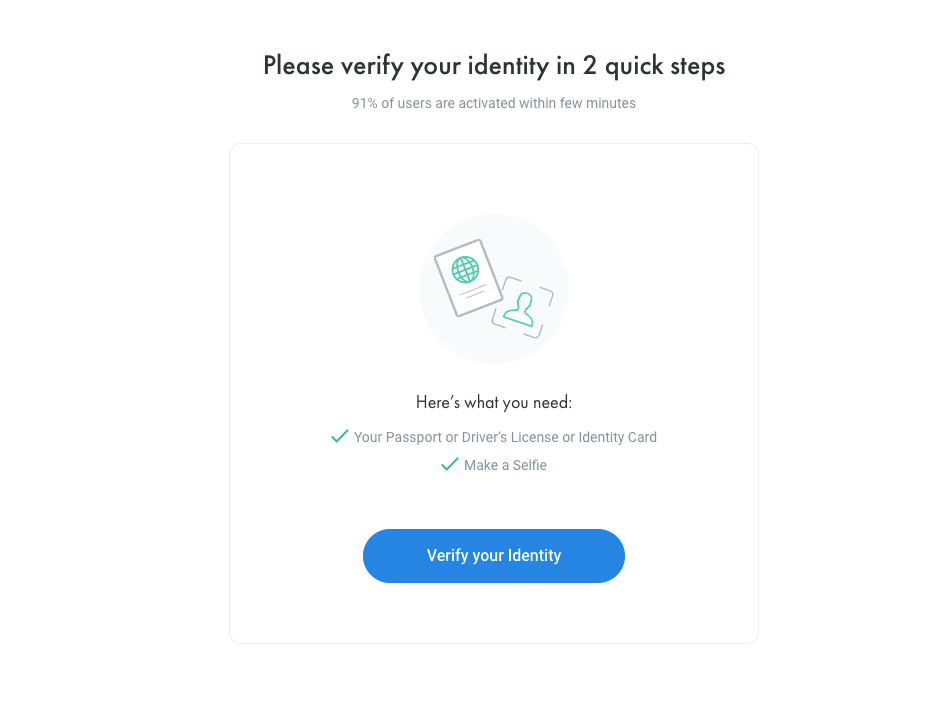

Step 6) Upload verification documents like ID Card for identity and utility bill or bank statements for address. This will enable the broker to verify your account.

FxPro Deposits & Withdrawals

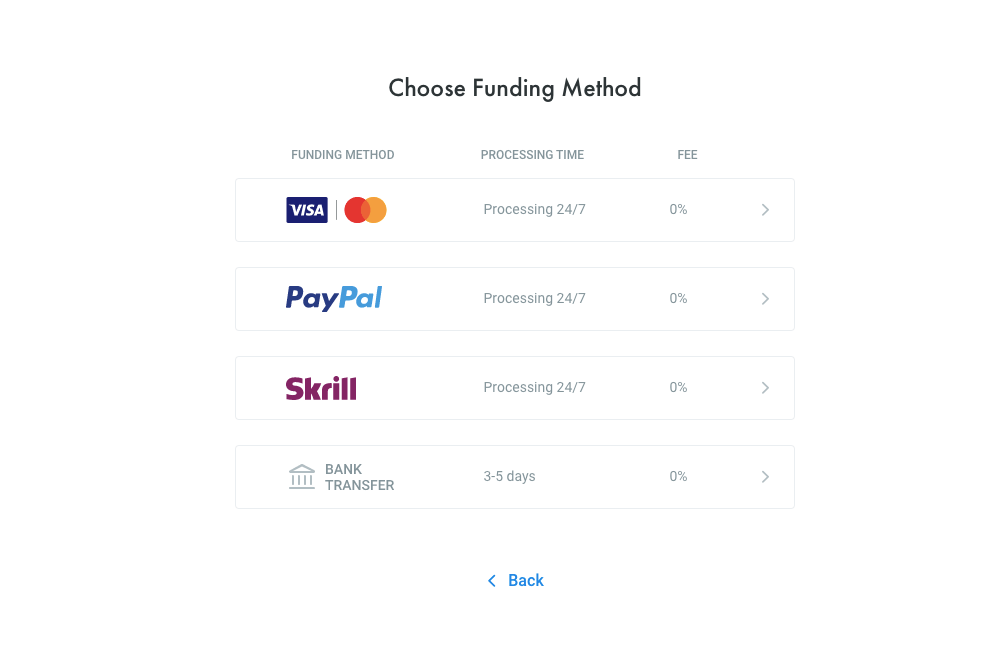

Payment methods accepted on FxPro for deposits and withdrawals are bank transfers, e-wallets like Skrill & PayPal and Credit/Debit cards. Find an overview of deposits and withdrawals on FxPro below:

What is the minimum deposit for FxPro?

The minimum deposit on FxPro is $100. Although the broker recommends a minimum deposit of $1,000 for all account types and both retail and professional clients because it will enable you to open larger trade sizes, you can actually deposit $100 via cards or bank transfers.

Cards and e-wallets deposits are credited to your account within 10 minutes while it can take up to 3 business days for bank transfer deposits to be credited to your account.

Note that you can only deposit a maximum of $20,000 per transaction via card. Bank transfers have no maximum deposit amount.

How do I deposit money into FxPro?

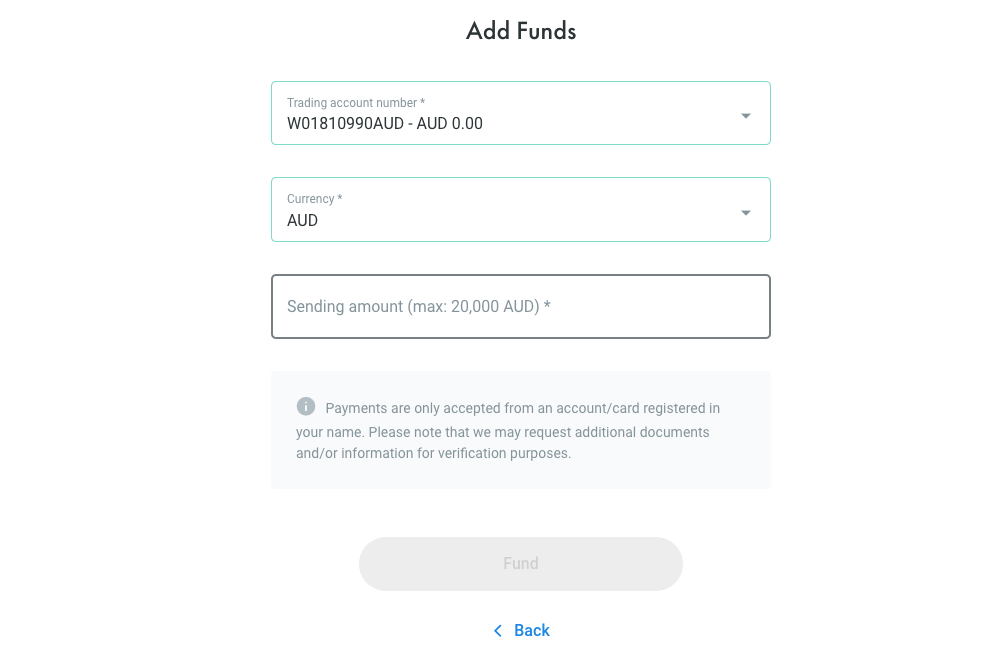

Follow these simple steps to deposit funds into FxPro Account:

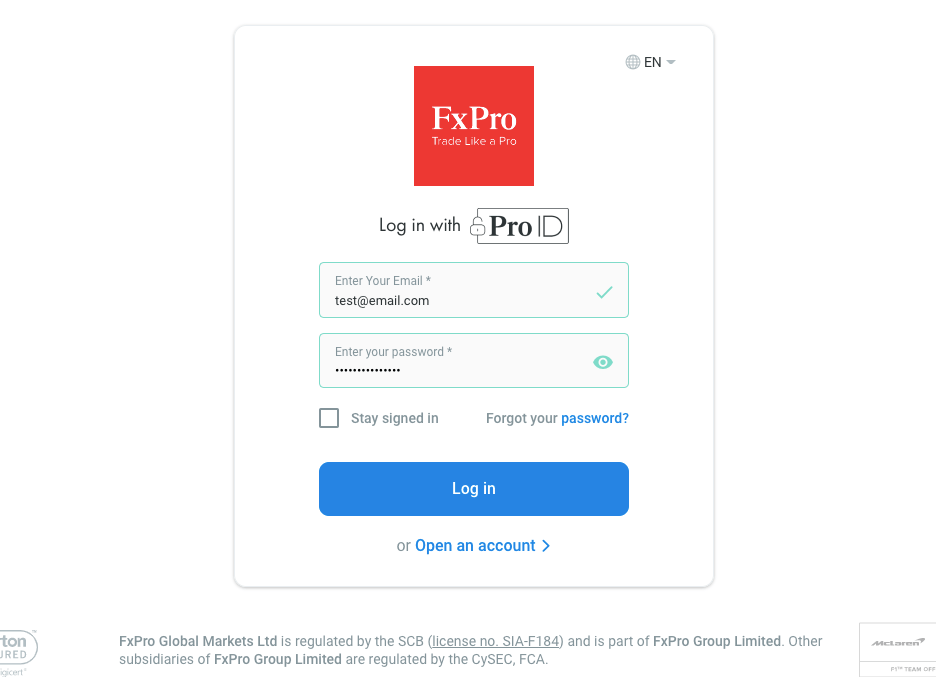

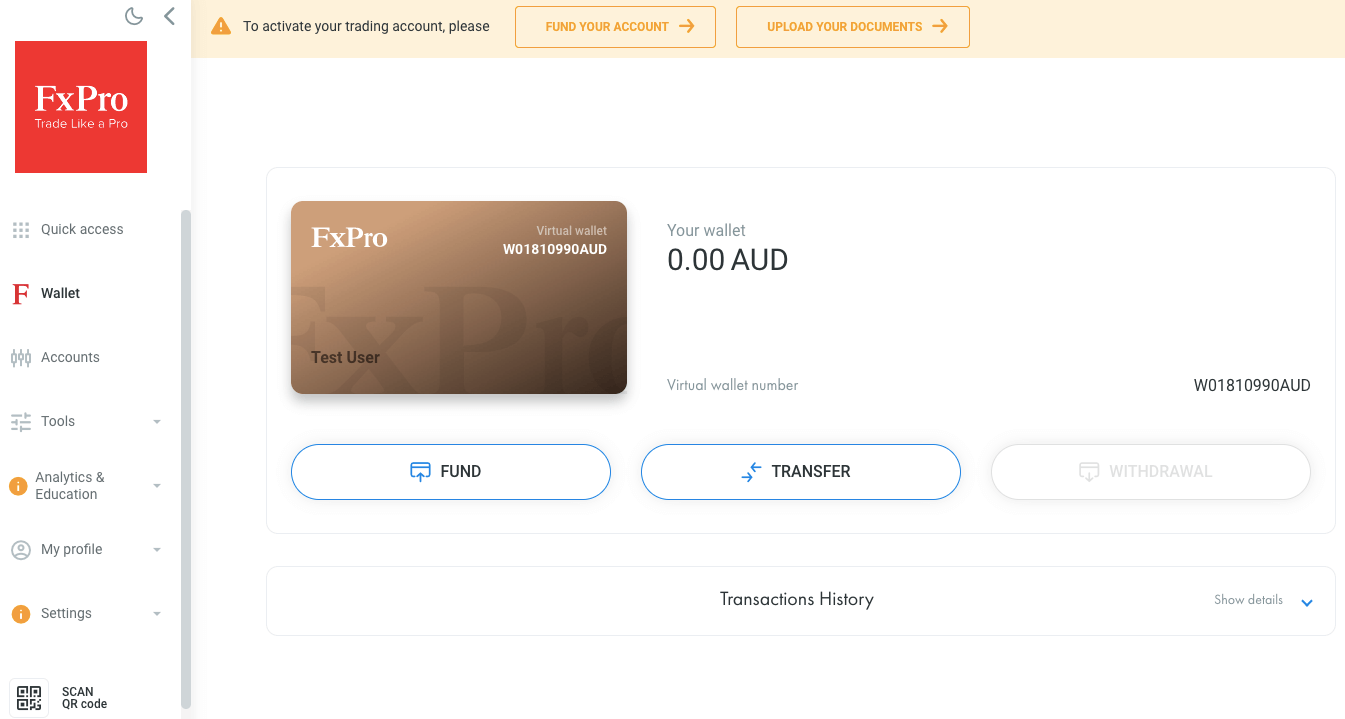

Step 1) Log in to your FxPro dashboard via direct.fxpro.group/en/login.

Step 2) Click on the ‘Wallet’ tab on the left side menu, then select ‘FUND’.

Step 3) Choose a payment method.

Step 4) Select the currency you want to deposit and enter the amount, then click ‘Fund’ and follow the on-screen instructions to complete your deposit.

What is the FxPro Minimum withdrawal?

There is no mandatory minimum withdrawal amount on FxPro. Although if you are withdrawing funds via card, you can only withdraw as much as you have deposited via the card, while withdrawals by bank transfers have no maximum amount.

Withdrawal requests on FxPro are processed within 1 working day and may take up to 3 to 7 days to receive funds for card withdrawal and about 2 working days for withdrawals to local bank accounts.

How to Withdraw Funds from FxPro

Follow these simple steps to withdraw money from your FxPro Account:

Step 1) Log in to your FxPro dashboard.

Step 2) Click on the ‘Wallet’ tab on the left side menu, then select ‘WITHDRAWAL’.

Step 3) Choose a withdrawal method and follow the on-screen instructions to complete your withdrawal.

FxPro Trading Instruments

You can trade over 2,000 financial instruments on FxPro, find a breakdown of the instruments below:

| Instrument | Availability | Number |

|---|---|---|

| Forex | Yes | 70 currency pairs on FxPro (15 majors and 55 minors)) |

| Energies | Yes | 3 spot energies on FxPro (Brent, WTI, and NatGas) |

| Precious Metals | Yes | 8 pairs of Metals on FxPro (including Gold, Palladium and Silver) |

| Indices | Yes | 19 spot indices on FxPro (AUS200, UK100, Germany40, and others) |

| Shares | Yes | 2,126 shares on FxPro (US, UK, French shares and others) |

| Futures | Yes | 21 Futures on FxPro (including some indices, agric commodities, and oil) | Cryptocurrencies | Yes | 29 cryptocurrencies on FxPro |

FxPro Trading Platforms

Trading platforms supported by FxPro are:

1) MetaTrader 4 and MetaTrader 5: FxPro supports the MT4 and MT5 trading applications for trading financial markets. This is available on the web, desktop, and mobile devices (Android & iOS).

2) cTrader: You can also trade financial markets on FxPro with the cTrader platform, which has the web trader, desktop trader, and mobile app versions on Apple App Store and Google Play Store.

3) FxPro Edge: This is the proprietary FxPro trading platform, developed by FxPro for trading financial markets. The FxPro Edge has web trader and mobile app versions for Android and iOS. In partnership with TradingView, the mobile version gives you access to advanced charts, over a hundred indicators, and trading tools.

4) FxPro WebTrader: FxPro’s web-based interface lets you access the market directly from your browser. It has 6 chart types, 15 timeframes, 53 t3chnical indicators, and 13 drawing tools. You can customize the interface and use features like one –click trading.

There are a few downsides that you should know about this platform. First is that it is available in English Language only. There are no other languages.

Secondly, you cannot use the trailing stop order on the platform. Market, limit, and stop loss orders are available. You can also use the Good ‘Til Cancel (GTC) order.

FxPro’s Execution Policy in Australia

FxPro states clearly on their website that they are a not an ECN or STP broker. Based on their execution, they are a non-dealing desk (NDD) broker. Ideally, they are either ECN or STP since they are not a market maker. However, their official statement identifies the as neither.

Like any broker, FxPro’s next execution is based on price, costs, speed, and likelihood of execution. FxPro receives a stream of prices from the world’s leading liquidity and data providers. A price aggregation engine detects and quotes the best bid-ask prices. This ensures that you get competitive prices always. In addition, Fxpro does not enforce price requotes. If you do not consent to a price requote, your order will not be executed.

Costs are minimized because FXPro does not execute trades via multiple execution venues. Because of this, no extra clearing or settlement fees are incurred when they execute your orders. Furthermore, FXPro also minimizes trading costs by placing limits on spreads so you do not receive maximum spreads from the wholesale market.

Speed of execution is also a key part of FXPro’s policy. Execution is fully automated except for minimal manual execution. FxPro has multiple servers hosted globally that help them maintain high-speed connections.

FxPro also has a system in place that increases the likelihood of your order being executed. The broker relies on liquidity providers for the price and volume of trading instruments. This means that the execution of your orders depends on the availability of price and liquidity. Because FXPro has multiple liquidity providers, you can expect most of your orders to be executed.

If liquidity is not available, it is likely because of abnormal market conditions like:

– when the market is just opening

– when news is about to be released

– when a key economic event is about to take place

– extremely high volatility

– insufficient liquidity due to your choice of price and volume

– when FXPro has to regulate internal risk.

Other than these primary factors, FxPro also considers secondary factors like negative instrument prices. This applies to CFDs that can be traded below $0. An example of this is CFs on Oil Futures. If the price of a CFD falls below $0, FxPro will close your trades at $0. In other words, no trading at a negative price.

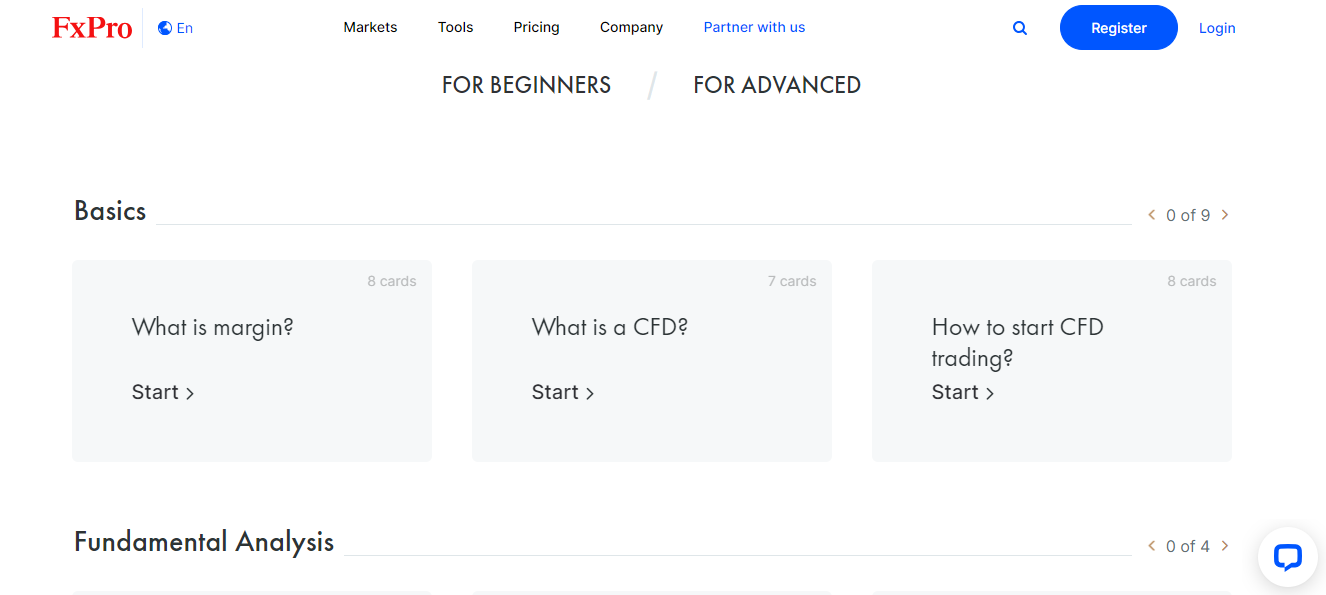

FxPro UK Education and Research

FxPro’s education is not the most comprehensive. However, there are a few things that you can find useful. Here is the breakdown

Trading Education: In this section, FxPro has courses for beginners and advanced traders. For beginners, the topics covered include the basics of trading, fundamental analysis, technical analysis, and trading psychology. The courses are in written form though there are a few videos you can watch.

The advanced courses cover fundamental analysis only. Under it, there are only three sub-sections. If you prefer to trade the news, these courses are for you.

Webinars and Events: You can find the recording of FxPro’s past webinars on their YouTube channel. If there is a live webinar coming up, you will find it on their website.

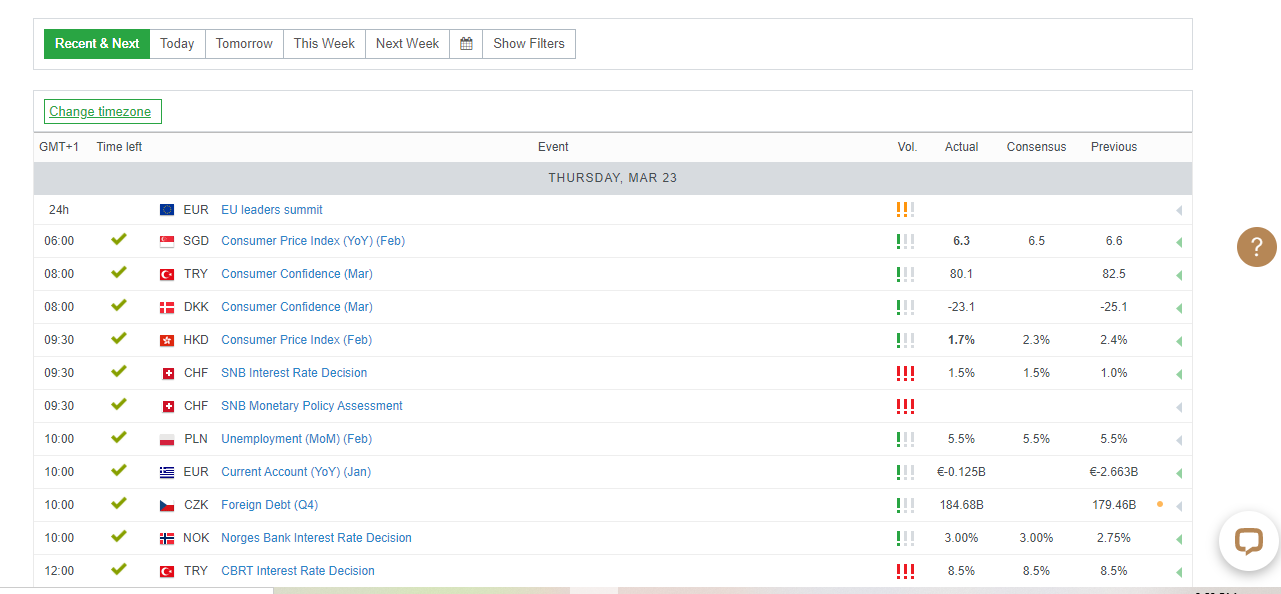

FxPro Economic Calendar: FxPro’s economic calendar is good for your research. This is key if you love to trade the news. You can use filters to select important and high impact news only. It is also automatically localized to your timezone so you do not miss trading opportunities.

Forex Articles: FxPro has number of articles discussing different concepts in forex trading. This section of FxPro’s website has not been updated since 2021. However, you can still find the existing content helpful.

Video Tutorials: FxPro’s video tutorials is mainly for how-to videos. You get to watch how to download trading platforms, verify your profile, start trading, fund your account, etc.

FxPro Australia Customer Service

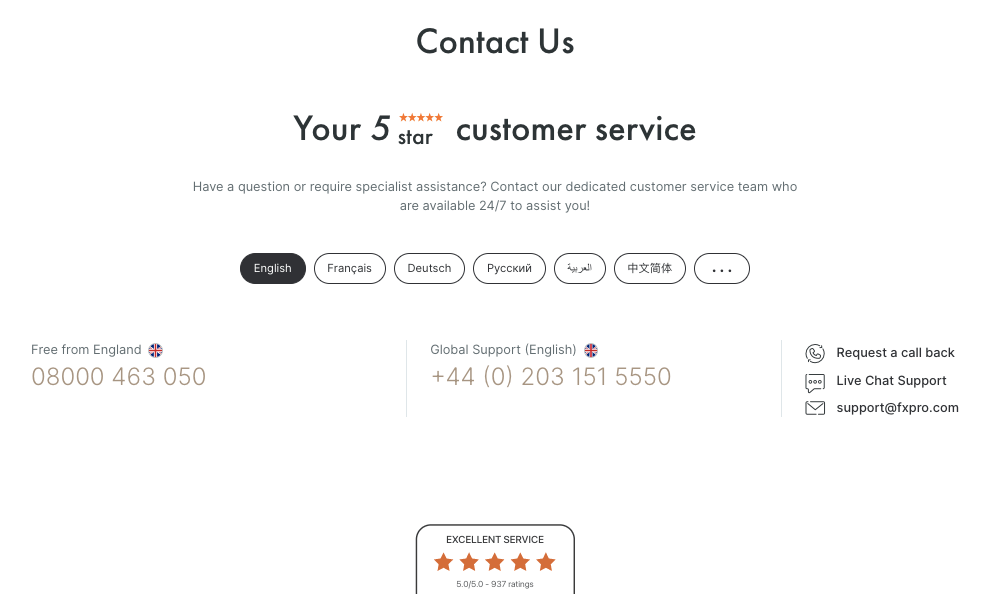

FxPro offers 24/7 online customer support to traders via the following channels:

1) Live chat support: The FxPro live chat can be accessed on the ‘Contact Us’ page of the FxPro website and is available 24/7. When our team tested the online live chat support, we got a response as soon as we started the chat and there was no wait time.

When you start the chat you will be required to provide your email address and name. FxPro uses no chatbot, the live agents respond quickly and the answers to our questions are relevant.

2) Email support: FxPro offers email support to traders. When we tested the FxPro email support, we got an autogenerated reply acknowledging our inquiry and then received a reply from a customer support representative 20 minutes later.

The FxPro email address for inquiries is [email protected].

3) Phone support: FxPro offers phone support to traders, and you can speak with them via the global FxPro phone number +44 (0) 203 151 5550. You can call the FxPro desk 24/7 to ask any questions you may have.

Do we Recommend FxPro Australia?

FxPro is considered safe in terms of clients’ funds because although they are not licensed in Australia, they are regulated by Top-Tier regulators in the UK, Cyprus, and South Africa. Nevertheless, you can find brokers regulated in Australia with fair offerings, if you prefer.

The fees on FxPro are also moderate as you can trade commission-free on all instruments with some account types. If you trade large volumes, you can become a VIP client and have discounts on the fees. You can also apply for a professional account to access more leverage and trade crypto assets.

FxPro’s customer service is responsive on all channels and available 24/7. The account opening process is fast and simple, and the broker’s website is easy to navigate and contains up-to-date information about the company and its trading platforms/conditions.

The broker is also good for beginners as you have negative balance protection, although the minimum deposit of $100 is relatively high compared to some brokers.

We recommend that you try FxPro if you want to start trading financial assets. You can visit their website to read up more about them and chat with a customer support agent to help you make up your mind.

How much does it cost to withdraw money from FxPro?

FxPro does not charge a fee for withdrawal for their withdrawal methods which include bank transfer, broker-to-broker, and credit/debit cards.

However, FxPro will charge a fee if you try to withdraw without trading for some payment methods.

Is FxPro good for beginners?

Yes, FxPro is good for beginners. They have popular trading platforms like MT4, MT5, and cTrader. Their web-based platform is also easy to use.

FxPro also offer a demo account with $10,000 in virtual funds. This is crucial for beginners who want to practice trading without any risk. Their customer team are also on hand to answer any question you might have.

The only downside for beginners is that FxPro has a complex trading account and trading fees structure. They require focus to understand them well.

Is FxPro a scam?

FxPro is not a scam. They are regulated in the UK with the Financial Conduct Authority (FCA). They also hold a license with CySEC but hold no ASIC regulation.

Ensure you research about the suitability of any broker before you open an account with them.

Which country is FxPro from?

FxPro was founded in Cyprus in the year 2002. They have offices in Cyprus, Monaco, and the Bahamas. However, their headquarters is in London.

FxPro Australia FAQs

How long is FxPro withdrawal?

Withdrawal requests on FxPro are processed within 1 working day and may take 3 to 7 days to receive funds for card withdrawal and about 2 working days for withdrawals to local bank accounts.

Is FxPro regulated in Australia?

FxPro is not regulated with local regulator ASIC in Australia. But they are regulated with other regulatories like FCA, CySEC. So we consider them as a moderate risk forex broker for Australian Traders.

How do I trade on FxPro?

To trade on FxPro, you need to open a live trading account. Visit the website of Fxpro at www.fxpro.com and click on the ‘Open Trading Account’ or ‘Register’ button.

Scroll up to follow our simple step-by-step guide to opening an FxPro trading account.

Can I trade stocks on FxPro?

You can trade over 2,126 stocks on FxPro including US, UK, France, Germany, Portugal, Switzerland, Netherlands, and Belgium stocks.

Note: Your capital is at risk